#What Is Direct Tax Code 2025

Explore tagged Tumblr posts

Text

Understand Sec 87A in Income Tax – A Guide by PlanNProgress

Learn about Sec 87A in Income Tax and its benefits on the official PlanNProgress website. This section provides tax relief for individual taxpayers by offering deductions on income up to a certain limit. Explore how you can reduce your taxable income and avail of exemptions, making tax filing simpler and more beneficial. PlanNProgress offers clear, comprehensive insights into Sec 87A of the Income Tax Act, helping you make the most of available deductions and minimizing your tax liabilities. Visit their website to stay informed and save more on your taxes.

#saral jeevan bima term insurance#e insurance account#income tax on retirement benefits#what is direct tax code 2025

0 notes

Text

Can I Install a Newer Version of TurboTax Over the Old One?

As tax season rolls around, many people turn to TurboTax, one of the most trusted tax preparation software tools in the United States. With its user-friendly interface and robust support, TurboTax simplifies the tax filing process for individuals and businesses alike. But what if you already have an older version of TurboTax installed? Can you install a newer version of TurboTax over the old one? Let’s explore the answer in depth while also guiding you on how to activate it properly via https://install-turbo-tax.com/.

Understanding TurboTax Versioning

TurboTax releases a new version of its software every tax year to keep up with updated IRS regulations, tax code changes, and form revisions. Each new version is optimized for the specific tax year it serves. For example, the 2024 version is tailored to handle the tax returns filed in 2025 for the 2024 fiscal year.

It’s important to note that each version of TurboTax is a standalone application. Installing a newer version does not automatically update the previous year’s version; instead, it installs separately to ensure your old tax data is preserved.

Can You Install a Newer Version Over the Old One?

The short answer is yes, you can install a newer version of TurboTax even if an older version is already on your computer. However, this is not the same as “upgrading” over the old version. Here's what happens:

Each version installs separately: TurboTax treats each year's version as a standalone product. The 2023 version and the 2024 version will reside independently on your system.

Your old data remains safe: Installing the newer version will not overwrite or delete the previous year's return or software.

Automatic data transfer: When you install and launch the newer TurboTax version, it can import your previous year’s data automatically, saving you time and improving accuracy.

So while you are not technically replacing the old version, you are installing a new version alongside it. This is ideal for users who want to access previous tax filings while preparing current ones.

Steps to Install the New Version via www.installturbotax.com with License Code

To get started with the installation of the new TurboTax version, follow these steps:

Step 1: Visit the Official Installation Page

Open your web browser and go to www.installturbotax.com with license code. This is the official TurboTax site for installing and activating your software.

Step 2: Enter Your License Code

Locate your license code, typically found in the confirmation email or on the retail package if you bought a physical copy. Enter this code in the prompt on the website.

Step 3: Sign In or Create an Intuit Account

To proceed with the download, you must sign in to your Intuit account. If you don’t have one, you can easily create it for free.

Step 4: Download the Software

Once signed in and your license code is verified, you’ll be directed to download the correct version of TurboTax for your operating system (Windows or Mac).

Step 5: Run the Installer

Locate the downloaded installer file, typically named something like TurboTax2024Setup.exe, and double-click it to begin the installation process.

Step 6: Follow On-Screen Instructions

The installation wizard will guide you through the process. You can choose the install location or accept the default. The software installs in a new directory and does not interfere with older versions.

Step 7: Launch and Activate

After installation, open the TurboTax application. It may prompt you to enter the license code again for activation. Once entered, your software will be ready to use.

Benifits of Installing the New Version

1. Compliance with Latest Tax Laws

Tax laws and deductions change frequently. By installing the latest version, you ensure your returns are fully compliant with the latest federal and state regulations.

2. Updated Features and Interface

TurboTax improves its user interface, error detection, and help resources with every release. The newer version often includes better navigation, additional forms, and smarter question flows.

3. Improved Import Capabilities

The newest version has enhanced capabilities to import previous returns, W-2s, 1099s, and even cryptocurrency transactions directly from exchanges.

4. Maximize Deductions and Credits

The latest software version provides up-to-date recommendations on how to maximize your refund based on the current tax code.

What to Do with the Older Version?

You may wonder whether to keep the older version after installing the new one. Here are your options:

Keep for reference: Many users prefer to retain older versions in case they need to revisit past returns.

Uninstall to save space: If you're tight on storage, you can uninstall the old version. Your tax files are typically stored separately in your Documents folder and won’t be deleted with the software.

Backup your tax data: Before removing the old version, back up your .tax files to an external drive or cloud service.

Common Questions About TurboTax Installation

1. Will installing a new version affect my existing data?

No. The installation process creates a separate program folder for each year. Your previous tax data remains untouched and accessible.

2. Can I use the same license code on multiple devices?

Each license allows installation on up to five computers you own. Make sure you’re logged into the same Intuit account on each device.

3. What if I lose my license code?

You can retrieve your license code by logging into your Intuit account and checking your order history. If you bought it retail, check your email receipt or physical packaging.

Tips for a Smooth Installation Experience

Use a high-speed internet connection: The software download size can range from 150MB to over 500MB.

Temporarily disable antivirus software: Some antivirus programs may interfere with the installation process.

Run as administrator: Right-click the installer and choose “Run as Administrator” to avoid permission issues.

Ensure system requirements are met: The latest TurboTax versions require updated OS versions like Windows 10/11 or macOS 11 and higher.

Troubleshooting Installation Issues

If you encounter issues while installing TurboTax via www.installturbotax.com with license code, here are a few quick fixes:

Installation won’t start? Make sure your system meets minimum requirements and that you’ve downloaded the full installer.

License code not accepted? Double-check for typos. The code is 16 characters long and case-sensitive.

Software won't open after install? Restart your computer and try launching it again. If it still fails, reinstall the application.

Final Thoughts

Yes, you absolutely can install a newer version of TurboTax over the old one—just remember that “over” in this context doesn’t mean replacing the older version. Each TurboTax version installs separately, which is great for preserving your past returns and providing seamless data transfer between tax years.

By using https://install-turbo-tax.com/, you can quickly and securely install the latest TurboTax version and get started with your taxes. Whether you're filing simple returns or managing multiple income sources, keeping your software up to date is essential for a smooth tax filing experience.

0 notes

Text

How to Obtain a National Address in Saudi Arabia: A Quick Guide

Starting a business or living in Saudi Arabia involves several key steps to integrate smoothly into the Kingdom’s systems. One of the most important among these is registering a national address.

Mandated for individuals and businesses alike, the national address system plays a vital role in facilitating communications, ensuring compliance, and enhancing operational efficiency.

In this article, we explore the importance of Saudi Arabia’s national address system, its structure, the registration process, and why it is a non-negotiable requirement for businesses and residents in 2025.

Overview of the National Address System in Saudi Arabia

1. What Is the Saudi National Address?

The Saudi National Address is a standardized system developed by Saudi Post that records the precise physical location of individuals and businesses across the Kingdom. Designed to improve the postal system, service delivery, and legal operations, it offers a uniform format that includes:

Building number

Street name

District

City

Postal code

Secondary number

Additionally, the short address format simplifies the process even further. It uses a combination of four letters and four numbers that quickly pinpoint the location. The letters represent unique identifiers for the region, branch, and district, while the numbers identify the specific building.

2. Benefits of Registering a National Address

Registering a national address is not just a regulatory requirement—it offers numerous advantages for both businesses and individuals.

- Accuracy and Coverage

The system covers every area of Saudi Arabia with pinpoint accuracy, mapping locations down to a single square meter.

- Simplified Global Reach

Businesses and residents can obtain up to 10 international addresses through Alami, an extension of the Saudi national address system.

- Accelerated Deliveries

Registered addresses speed up delivery times for both government documents and commercial shipments, reducing the need for constant follow-ups.

- Direct Delivery

Documents, packages, and official notices are delivered straight to your door, eliminating the need to visit postal offices for collection.

- Enhanced Compliance

For businesses, having a registered address ensures legal compliance and smooth interactions with Saudi government bodies like the Ministry of Commerce, Ministry of Labor, and Ministry of Interior.

3. Why Foreign Businesses Must Register a National Address?

Foreign businesses setting up in Saudi Arabia must provide a registered address as part of their legal incorporation process. Failing to do so can lead to penalties, miscommunication with government agencies, and even potential business suspension. A registered national address helps businesses:

Comply with tax and corporate regulations

Receive important government notifications

Establish credibility and a recognized local presence

Ensure operational efficiency and reliable correspondence

When choosing an office location to register, companies should consider access to their target markets, infrastructure quality, and overall business environment.

4. National Address for Residents

For residents, registering a national address significantly improves the experience of receiving shipments and official documents. The days of having to manually collect packages from postal offices are gone.

Moreover, the process is free of charge and can be completed quickly through online platforms or mobile applications. The short address format makes it even easier for residents to remember and share their location details accurately.

5. How to Register and Obtain a Saudi National Address Certificate?

The National Address Certificate is the official document confirming that an address is registered in Saudi Arabia. It is a crucial document required for visa processing, opening bank accounts, utility registration, and many other administrative activities. Follow these steps to register and obtain your national address:

- Prepare the Required Information

To complete the registration, gather the necessary details, including:

Saudi ID (for residents) or company registration documents (for businesses)

Mobile phone number

Articles of Association (for corporate entities)

- Register Online

Visit the official Saudi Post website or use their mobile application. Create a user account if you do not already have one. Input your location details carefully, including:

Building number

Street name

District

City

Postal code

Secondary number (for precise coordinates)

- Receive the Short Address

Upon registration, you will receive a short address. This unique code consists of:

Four letters representing your region, branch, district, and unique code

Four numbers representing your building number

- Obtain the National Address Certificate

After successful registration, you can immediately download your National Address Certificate, which serves as proof of your official address registration in Saudi Arabia.

6. Components of the National Address Code

Every national address registered with Saudi Post consists of these main elements:

Short address: Four letters and four numbers to create a simplified, precise location code.

Building number: A four-digit number assigned to the specific building.

Street: The street name where the building is located.

District: The neighborhood or area where the property is located.

City: The city in which the building is situated.

Postal code: A five-digit code providing a broader area identification.

Secondary number: Four digits representing accurate location coordinates, useful for areas without specific street names.

Each of these components is essential for correct mail delivery, government documentation, and logistical purposes.

7. Consequences of Not Registering a National Address

Businesses and individuals who fail to register a national address in Saudi Arabia can face serious consequences like legal penalties and fines, and difficulty with banking, licensing, visa renewals, and tax submissions.

Therefore, timely registration and maintenance of accurate address records are crucial for smooth company formation in the KSA and to avoid potential impact on business credibility and operational status

Why Address Registration Matters More Than Ever?

Saudi Arabia’s national address system is a foundation for a modern, efficient business and governance environment.

For foreign investors and residents, understanding and complying with national address registration requirements ensures seamless operations, maintaining regulatory compliance, and enjoying the benefits of Saudi Arabia’s rapidly modernizing economy.

Whether it’s for business setup services in the KSA, relocation, or simply living in the Kingdom, registering your national address is a simple step that paves the way for success.

0 notes

Text

Sunday Senior Living Solutions with John V. Pinto: Embrace the Positive, Eliminate the Negative!

Join me, John V. Pinto, Realtor, for this week’s episode of Sunday Senior Living Solutions. 🌟 As the song suggests, let's “accentuate the positive” in our approach to senior living!

Explore the benefits of **new construction** with current building codes that offer **single-level living**—no stairs, just comfort. Discover energy-efficient appliances, solar panels, and low-maintenance yards that free up your time for new friendships and exciting activities like bocce ball, pickleball, wine tasting, cooking classes, and wellness programs—all at affordable prices!

Let’s also talk about what we need to **eliminate**: the burdens of older homes, like maintenance, multiple stories, staircases, yard upkeep, high utility bills, and soaring homeowner insurance costs. Plus, learn how to unlock frozen equity for tax advantages and predictable cash flow to support your retirement.

Check out my video for more insights: [Watch Here](https://youtube.com/shorts/GrcrVLWOI2w?si=pq7cGP2nDZlercoX)

I want to hear from you! How do you feel about these changes in senior living? Share your thoughts and don’t forget to share my video with your network!

📞 Direct message me today at 408-829-4141 to financially model and storyboard your 2025 real estate moves!

#SeniorLiving #RealEstate #NewConstruction #EnergyEfficiency #SingleLevelLiving #AffordableHousing #HomeOwnership #RetirementPlanning #Wellness #CommunityLiving #JohnVPinto #Realtor #FinancialFreedom #PositiveLiving #BocceBall #Pickleball #CookingClasses #WineTasting #HomeEquity #TaxAdvantage

0 notes

Text

Twitch Donation: How To Donate On Twitch

12 March 2025 Donate On Twitch 0% Platform fees – You can start right away [Start Fundraiser]

Table of Contents

What Is Twitch?

Twitch Donation Page Services

What is Twitch’s Charity Tool?

Understanding Twitch Bits & Cheering

How To Enable Bits & Cheering?

How To Donate On Twitch?

How To Set Up Donations On Twitch?

How Much Does Twitch Take From Donations?

How To Add Donations To Twitch?

How To Create A Donation Button On Twitch?

WhyDonate – A Twitch Alternative

Start Making Donations

What Is Twitch?

Before diving into how to donate on Twitch, it’s important to understand the platform itself. Twitch is a live video streaming service launched in 2011 and later acquired by Amazon. It showcases gaming, music, daily life content, and more. Twitch allows viewers to engage with their favorite creators through subscriptions, cheers, and donations.

Creating a Twitch account is free, and it enables you to chat, follow streamers, and support them financially.

Twitch Donation Page Services

Twitch allows streamers to link donation pages directly on their channels. These links usually lead to platforms like Streamlabs or PayPal. This makes it easier for fans to support their favorite creators without needing third-party intermediaries.

What is Twitch’s Charity Tool?

Twitch’s Charity Tool allows verified streamers to raise funds directly for nonprofit organizations. Donations made through this tool are tax-deductible and go straight to the selected charity, ensuring transparency and compliance.

Understanding Twitch Bits & Cheering

Twitch Bits are virtual goods bought with real money and used to Cheer in chat, showing support to streamers. Cheering also triggers fun visual and audio effects during live streams. It’s a popular method for fans who want to contribute regularly.

How To Enable Bits & Cheering?

To enable Bits & Cheering on Twitch (desktop only):

Click your profile picture.

Go to “Creator Dashboard.”

Navigate to “Settings” > “Monetization.”

Toggle “Bits & Cheering” on or off.

How To Donate On Twitch?

Wondering how to donate on Twitch using a mobile device? Here’s a simple step-by-step guide:

Step 1: Access the Streamer’s Channel

Open the Twitch app, log in, and search for the streamer you want to support.

Step 2: Locate the Donation Option

Look for the “Donate” or “Support” button under the video player or in the profile section.

Step 3: Choose Donation Details

Tap the donation link, choose a preset or custom amount, and continue.

Step 4: Complete the Payment

Use your preferred method – credit/debit card, PayPal, or Twitch Bits – and follow the steps to pay.

Step 5: Send Your Donation

Add a message if you like, confirm the payment, and you're done! You’ve now supported your favorite creator.

How To Set Up Donations On Twitch?

If you're a creator looking to receive Twitch donations:

Step 1: Start Your Campaign

Go to your dashboard’s “Charity” section and click “Start.”

Step 2: Display and Track Donations

Enable live donation display and monitor them via your activity feed.

Step 3: Manage Your Campaign

Use “Save” to modify or view campaign details, including the fundraising goal.

Step 4: Delete Campaigns (If Needed)

Use the three-dot menu to delete a campaign, unless it has already received donations.

Step 5: Show Gratitude

Always thank your donors publicly—it builds community trust and loyalty.

How Much Does Twitch Take From Donations?

Twitch itself takes no cut from direct donations. However, payment processors like PayPal may deduct small transaction fees. Always review those before choosing your platform.

How To Add Donations To Twitch?

To enable donations on your Twitch channel:

Choose a donation platform (Streamlabs, Donorbox, or PayPal).

Customize your donation page and copy the link or widget code.

Go to your Twitch dashboard and click “Extensions.”

Add the code or link to your channel panels.

Save and test it to make sure it’s working.

How To Create A Donation Button On Twitch?

To create a clickable donation button:

Go to your “About” section on Twitch.

Click “Edit Panels.”

Add a new panel titled “Donate” or “Support.”

Insert your donation URL or widget.

Upload a donation image button (optional).

Save changes and go live!

WhyDonate – A Twitch Alternative

Not into streaming but want to support causes? WhyDonate is a top-notch crowdfunding platform in Europe, supporting causes like healthcare, education, and the environment. With 0% platform fees, it's a cost-effective alternative to Twitch donation setups.

WhyDonate also offers customization options, a mobile app, instant payouts, and analytics to help you track your campaign’s performance.

Start Making Donations

Now that you know how to donate on Twitch, you can support your favorite streamers directly. Or, if you’re looking to give to meaningful causes without watching live streams, try platforms like WhyDonate for a smoother, charity-focused experience.

Whether it's Twitch or WhyDonate, every donation you make contributes to something bigger.

0 notes

Text

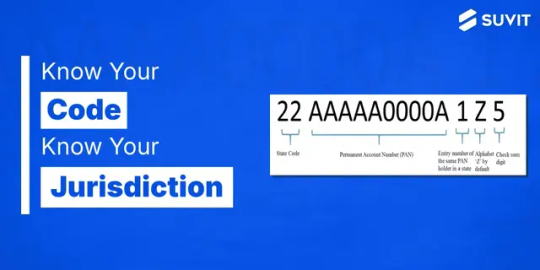

Your Essential 2025 Guide to GST State Codes and Jurisdiction

Understanding GST State Codes is crucial for seamless tax compliance in India.

What Are GST State Codes?

These are two-digit numerical identifiers assigned to each Indian state and union territory under the Goods and Services Tax system.

They form the first two digits of your 15-digit GSTIN, indicating the registration state. For example, Gujarat's code is 24, while Maharashtra's is 27.

Why Are They Important?

Accurate use of GST State Codes ensures:

Correct Tax Allocation: Taxes are directed to the appropriate state.

Smooth Compliance: Reduces errors in GST returns.

Efficient Inter-State Transactions: Mandatory for inter-state supplies.

How Are They Used?

GST State Codes are essential for:

GST Registration: Ensuring your business is registered in the correct state.

Invoice Generation: Calculating applicable tax liabilities.

Filing GST Returns: Determining where your business needs to file returns.

For a comprehensive list of GST State Codes and more detailed information, check out our full guide.

Stay compliant and ensure your business runs smoothly by mastering GST State Codes! 📊✅

0 notes

Text

The issue of affordability has been top of mind for Ontarians throughout the election campaign, with many residents feeling the pinch when it comes to buying groceries.

Canadians paid 9.7 percent more for food at stores in April, the largest increase since September 1981, according to Statistics Canada. Overall food costs rose 8.8 percent compared with a year ago and Canadians paid more for their food in April than at any time since 2007.

The Progressive Conservatives say they will keep costs down and help residents save money through different measures like lower gas taxes, while the left-of-centre parties want to keep them up.

Our Liberal Leader says his party would remove the provincial portion of the sales tax on food items under $20. The party has said it would fund the measure by introducing a one percent surtax on companies operating in Ontario and increasing taxes on individual incomes over $500K.

"So you go to your grocery store on the way home, maybe you pick up a rotisserie chicken or a side salad,” he says. “Every single time that it’s under $20, our plan will save you eight percent,” he adds.

"Same thing at a bakery and coffee truck, same thing at any particular place you might go to, anywhere in this province.” But he says the plan wouldn’t provide based relief because only a small segment of food products under that amount are taxed.

The Liberals also propose legislating fair and open negotiations between food retailers and suppliers, which would lead to lower prices for consumers.

"We want to make sure that our local suppliers can actually have a real shot at not only selling what they produce but getting it done reasonably,” says Donaldson.

The NDP and Greens have made similar pledges to back the Grocery Code of Conduct to improve transparency in the industry.

"We need to make sure that when we have retailers of food, particularly big chains, that they’re not colluding to keep the price high, because it hurts consumers,” she says.

But he says it won’t necessarily lower grocery prices since similar measures were not adopted in Australia.

"As always, the devil is in the details.”

The panel will also create a provincial food strategy that involves working with farmers to ensure consumers have access to quality and affordable and sustainable food.

Their plan calls for healthy food markets and community gardens and rooftop spaces, as well as school meals for children.

They also say they would invest in research and innovation that improves the sustainability of how food is grown and distributed. Our Progressive Conservatives have proposed cutting the gas tax by 5.7 cents per litre and expanding the CARE tax credit for low-income earners and delivering $10 per day of child care by 2025.

Extreme weather events and the war in Ukraine are factors driving up food prices, he says. Ukraine and Russia account for 30 percent of the wheat trade and prices have gone up as trade volumes decline.

Dry conditions in our prairies have led to a 30-per-cent decline in our grain crops, according to Massow. The drought has also had an impact on the beef industry, he says.

There are also ongoing disruptions due to the COVID pandemic that have driven food prices up, he said.

"If we can't deal with the root causes of food prices, then we have to deal with them themselves and it will be very difficult without direct subsidization of certain staples to get food prices to come down,” he says.

0 notes

Text

The Concept Of Tax Exemptions For Offshore Fund Management At IFSC | Details On Union Budget 2022

IFSC has announced tax exemptions for offshore fund management. Since 1991, India has made serious strides towards the policy of economic liberalisation and towards offering clear and navigable pathways into investing in the country. The government has introduced several investment-friendly initiatives because it recognises the value of making India an attractive hub of investment for individuals, both national and foreign. Some steps have involved offering special privileges such as tax exemptions, healthy corporate ecosystems and access to one of the largest consumer bases in the world.

Tax Exemptions For Offshore Fund Management & Offshore banking in India

Statistics support the effectiveness of these steps. According to reports, India attracted foreign investments of 81.72 billion dollars in FY 2020–2021 – a figure 10% higher than the previous year. To do so during the peak of the global economic recession is certainly indicative of a worldwide shift away from China and further, of the generous investment policies offered by India. Key contributors to foreign direct investments (FDIs) are Singapore and USA and the states that attracted the most funding were Gujarat, Maharashtra and Karnataka. The government is keen to grow on these figures and one of proposed moves includes developing cities like GIFT City as well as promoting major hubs like IFSC (Indian Financial System Code).

What Is the GIFT City?

The City, which is still under development, is purported to be the next big global financial hub much like New York or Singapore. The idea has been in development for more than a decade now. The City aims to focus on integrated development of 886 acres with 62 million square feet of built-up area constituting 67% of commercial space, 22% of residential space and 11% of social space or green space.[1] It will notably consist of a conducive Multi-Service SEZ and an exclusive Domestic Tariff Area (DTA).

What’s the IFSC?

The GIFT City is believed to be the next-gen financial city for the Indian economy. This enormous project aims to create 1000 billion rupees worth of financial services in a 10-year period. The first phase of work in this city is planned to be completed by 2025, and will include as many as 50 non-governmental organizations, 100 multinational corporations, and 8 physical exchanges together with all of the supporting facilities typically required in a financial centre.

The GIFT City SEZ has been certified as an International Financial Services Centre by the Reserve Bank of India (RBI). It serves as one of only three IFSCs in the country. Established in 2010, the IFSC today hosts more than 125 licensed financial entities and is currently home to several important regulatory developments. For example, in 2017, supervision of insurance providers was placed under the purview of the Insurance Regulatory and Development Authority (IRDA) on account of some irregularities uncovered during concurrent inspections in both Kolkata and Mumbai. 2019 saw the largest exchange offering for gold futures trading in India. In 2020, a bullion spot exchange will flourish, thanks to the efforts of market officials.

They also offer a location for domestic and export-oriented firms; salary individuals are permitted to invest outside of India via IBUs. Recently, light was shed on the status of tax exemptions regarding offshore platforms within India at IFSC in the Union Area Budget 2022 & 2023. The Finance Manager has emphasised, via the following points discussed below, that the IFSC is intent on providing a very competitive expense of action with various taxation benefits, single-window clearance and CSR relief under varied company regulation provisions.

read more about it in detail here

0 notes

Text

Crypto market Analysis

1. Availability and Liquidity

Probably the greatest benefit Crypto market Analysis of digital currency is it regularly sees no lines, and Bitcoin is no special case. A significant advantage of Bitcoin is that it's a truly available and adaptable cash. Since it just requires a couple of moments to move bitcoins to another client, it tends to be utilized to buy labor and products from the always developing rundown of spots tolerating it. This makes burning through cash in another nation and trading for different monetary forms more straightforward, with a reward of having almost no charges applied. Bitcoins can likewise be handily sold without warning.

2. Client Anonymity and Transparency

Albeit not totally unknown, Bitcoin clients are recognized by mathematical codes and can have different public keys. This guarantees there's no open following, and exchanges can't be followed back to the client. Notwithstanding the exchanges being forever distinguishable, which gives you straightforwardness, they're actually remained careful from misrepresentation due to the blockchain innovation. In addition, just you, as the wallet proprietor, would have the option to know the number of bitcoins you have.

For added security and namelessness, regardless of whether the location for your wallet became public, you could create another wallet address to protect your data. Contrasted with a customary cash framework where individual data could be spilled from a bank, no other individual data is needed to manage Bitcoin exchanges, which builds client security.

3. Freedom From Central Authority

Bitcoin is a decentralized money, which means it's not directed by a solitary government or national bank. This implies that specialists will probably not freeze and request your coins. There's additionally no reasonable way that a tax collection would be carried out for Bitcoin. Hypothetically, this gives clients independence and command over their cash, on the grounds that the cost isn't connected to government approaches. Also for the most part, cryptographic money clients view this as one of the primary benefits of Bitcoin.

4. Exceptional yield Potential

Bitcoin costs can be profoundly unpredictable, changing radically on a month to month and surprisingly regular routine. For example, in March 2017, Bitcoin was estimated at $975.70, and in simply an issue of months it spiked to $20,089 in December. Two or after three years, the cost of Bitcoin arrived at an unsurpassed high of $64,000 in April 2021.

This demonstrates that in spite of the fact that there's high unpredictability in costs, digital money clients may see this as one of the advantages of Bitcoin in light of the fact that it can bring about an exceptional yield potential. What's more with a developing number of clients accepting Bitcoin is a promising worldwide cash, numerous financial backers and organizations have chosen to embrace it. This assists with expanding the better yield potential, particularly for the individuals who got it at a lower cost.

Moreover, a few financial backers accept Bitcoin will in any case acquire esteem in the long haul, with a chance of arriving at costs near $500,000 by 2025. That is a result of its proper stockpile cap at 21 million coins. What's more that supply cap will probably occur inside a characterized time span, which many accept will upgrade the worth of Bitcoin over the long haul.

cons-of-bitcoin-2x

Drawbacks of Bitcoin

In spite of its fast development and an expanding number of clients, there are a few hindrances of Bitcoin to consider, particularly assuming you're pondering, "Is it worth putting resources into Bitcoin?". Like in numerous monetary choices, the more you know, the more educated a choice you can make on whether Bitcoin merits putting resources into.

5. Instability

At the point when Bitcoin was made by Satoshi Nakamoto, a cutoff was set of 21 million bitcoins that might at any point exist, which is the reason some view Bitcoin as being totally scant. This shortage makes Bitcoin so important, yet in addition what causes its costs to fluctuate on the grounds that the cost is presently the main variable that can change to guarantee interest.

There are likewise different variables that impact Bitcoin's unpredictability, for example, feature making news that is seen as terrible by financial backers, the vulnerability about its future worth and utilizations, just as security breaks.

6. No Government Regulations

Certainly, a decentralized money can be seen as one of the advantages of digital currency, yet it can likewise be viewed as a burden of Bitcoin, since it implies putting resources into Bitcoin isn't directed. Not at all like a money that is controlled by a national bank, Bitcoin exchanges don't accompany legitimate assurance and regularly are not reversible, which makes them defenseless to tricks.

One more issue with Bitcoin being decentralized is that there's no assurance of a base valuation. So assuming a major gathering of financial backers chooses to quit utilizing bitcoins and sell them, its worth could diminish significantly and influence clients with a lot of the digital money.

7. Irreversible

Since Bitcoin exchanges are mysterious and unregulated, another impediment is the absence of safety. Exchanges done through Bitcoin are irreversible and last, so there is no hope on the off chance that some unacceptable sum is sent or then again assuming it's shipped off some unacceptable beneficiary.

Likewise, there's a danger of misfortune. Numerous Bitcoin clients decide to keep their bitcoins in a cryptographic money wallet, which puts them in danger of losing their speculations assuming that they lose admittance to their private key. In the event that a hard drive crashes or an infection defiles the records or even your wallet, your assets could become difficult to reach or gone totally surprisingly fast.

8. Restricted Use

Despite the fact that there's a developing number of organizations that acknowledge Bitcoin, for example, Microsoft and some Subway establishments, it's as yet not broadly acknowledged. This sets a boundary for where you can spend your cash, not at all like utilizing a credit or check card.

The Bottom Line: Is It Worth Investing in Bitcoin?

Anyway, is it savvy to put resources into Bitcoin? Despite the fact that there are a few extraordinary advantages of cryptographic money and geniuses of Bitcoin explicitly, many individuals actually view it as a dangerous venture. In any case, very much like any speculation, putting resources into Bitcoin expects you to do your examination early.

Going through a rundown of upsides and downsides of Bitcoin is just the initial step. It's additionally smart to concentrate on how cryptographic forms of money and crypto wallets work, how available the market is, just as the assumptions and dangers related with it. Assuming you truly do choose to contribute, recall that there are many devices accessible, for example, the Mint application, that can assist you with following your digital currency ventures. Bitcoin (BTC) is a virtual cash, or digital currency, that is constrained by a decentralized organization of clients and isn't straightforwardly dependent upon the impulses of focal financial specialists or public states. Despite the fact that there are many digital forms of money in dynamic use today, Bitcoin is by a wide margin the most famous and generally utilized - the nearest digital currency identical to conventional, state-printed monetary standards.

Like customary government issued types of money like the U.S. dollar, Bitcoin has esteem comparative with different monetary standards and actual merchandise. Like all digital forms of money, Bitcoin is stunningly unstable - undeniably more so than most government issued types of money - yet the overall worth pattern has been vertical. For instance, during the year time frame finishing on May 1, 2021, Bitcoin generally sextupled in esteem, soaring from under $9,000 to about $57,000 per BTC.

What Is Bitcoin?

Bitcoin is the most flexible cryptographic money around. It very well may be utilized to buy merchandise from a steadily developing list of vendors that acknowledge Bitcoin installments, including unmistakable organizations like Expedia, Overstock.com, and Tesla. It tends to be traded with other private clients as thought for administrations performed or to settle remarkable obligations. It very well may be traded for different monetary standards, both conventional and virtual, on electronic trades that work like forex trades.

Furthermore, sadly, it tends to be utilized to work with unlawful action, for example, the acquisition of illicit medications on dull web commercial centers like the notorious (and presently covered) Silk Road.

Entire Bitcoin units can be partitioned into decimals addressing more modest units of significant worth. Right now, the littlest Bitcoin unit is the satoshi, or 0.00000001 BTC. The satoshi can't be broken into more modest units. Nonetheless, Bitcoin's source code is organized to take into consideration future developments past this level, should the cash's worth appreciate to the point that it's considered significant.

For all its guarantee, BTC stays a specialty computerized money that is likely to wild esteem vacillations. Notwithstanding the crazy looking declarations of its supporters, it's positively not a standard speculation or exchanging vehicle the customary feeling of the world, similar to the case with stable public monetary forms like the U.S. dollar and Japanese yen. To the degree that it's considered to be a venture by any means, it's solidly in the domain of elective contributing - despite the fact that, as we'll see, there are a lot of authentic motivations to hold Bitcoin past the possibility of bringing in cash.

1 note

·

View note

Text

Understanding Sec 87A in Income Tax: A Guide to Tax Rebate - PlanNProgress

Sec 87A Income Tax Act offers a tax rebate for individual taxpayers in India, reducing their tax liability. If your income is below a specified limit, you can claim a rebate under this section, allowing for significant savings. PlanNProgress explains how Section 87A works and guides you through the process of claiming this rebate. Learn more about your eligibility and how to maximize tax benefits by visiting our website. Explore Section 87A and take control of your tax planning with PlanNProgress today.

For more info visit: https://www.plannprogress.com/section-87a-of-income-tax-act

#saral jeevan bima term insurance#e insurance account#income tax on retirement benefits#what is direct tax code 2025

0 notes

Text

Not all SMEs will survive the Covid-19 crisis, but what should an economic bailout package look like?

New Post has been published on https://apzweb.com/not-all-smes-will-survive-the-covid-19-crisis-but-what-should-an-economic-bailout-package-look-like/

Not all SMEs will survive the Covid-19 crisis, but what should an economic bailout package look like?

The world over, financial packages have already been announced by nations in a bid to restore their economies amid the Coronavirus pandemic gripping countries across the globe. The US, for instance, is looking at a Senate vote to rollout a $2 trillion package, touted as one of the largest rescue packages in American history. One of the most widely impacted by the crisis, Italy, came up with an emergency plan of $28 billion that could help them inch slowly towards normalcy. Indonesia announced a $725 billion stimulus package in February to rescue its travel, aviation and property industries, followed by a second package of $8 billion in March.

India’s latest figures, according to the Union Health Ministry, have already moved up the scale and crossed the 600 confirmed cases mark. The question then that does spring up is that why has India not announced an economic package yet? While businesses across sectors are finding it a challenge to stay up and running, it has been a particularly distressing time for small businesses and SMEs who gloomily stare at an uncertain future.

Time and again, MSMEs have been hailed as the backbone of the Indian economy who can contribute well in achieving India’s dream of a $5 trillion economy by 2025. However, such businesses will simply not be able to survive if booster steps are not taken – on urgent priority – to pull them out of the current bleak situation that they find themselves in.

Can India raise the bar? Before getting into what can be done, it is important to understand the country’s economic capacity to provide a bailout. Does India have the fiscal and monetary headroom to come up with a bailout package of such proportions? Economists shove off this thought, saying that every crisis results in a fall in GDP and revenue growth leading automatically to expansion of the fiscal deficit.

“This is recognised as an automatic stabiliser which is good (not bad) for the economy. On the expenditure side, the government has to focus on the economic and welfare problems linked directly on crises and not waste resources on the pet programmes and projects of intellectuals,” Arvind Virmani, Chairman, Foundation For Economic Growth & Welfare and President, Forum for Strategic Initiative candidly states.

Arun Maira, former member of the Planning Commission of India and the former India Chairman of Boston Consulting Group, likens the situation to the Great Depression of the 1930s, when economies were in particularly bad shape as well after the stock market crash in October 1929. Calling it an old debate, he says that one should go by the adage of looking after one’s own health first than anything else. “The economy is dying anyway. We have to see that the economy doesn’t die completely amid such a crisis,” says Maira.

What can be done? All industry experts and economists that ET Digital spoke to were forthright in their views on what a financial package intended at stimulating the economy and, in particular, SMEs should look like.

Virmani, who also served as the Executive Director, International Monetary Fund (IMF) and India’s Chief Economic Adviser, says, as far as the monetary policy is concerned, it has to ensure that the risk free interest rate remains low (including by reducing Repo Rate) and provide short, medium and long term liquidity to ensure the financial system (markets, institutions, instruments) continues to function smoothly.

Maira says that the package needs to be directed towards the small scale sector and should also include those not necessarily directly employed in SMEs such as the farmers. “We need two things. First is to save the lives of the people employed in the formal and informal SME sector who do not have adequate social security. And the second is enterprises. We have to look at the health of the small companies. Their biggest issue is always liquidity. Liquidity in the hands of enterprises is like oxygen right now. Workers should be given wages directly at this time. Money needs to be in the hands of the people,” he elucidates.

Maira directs attention towards labour costs, which are 10% of the overall costs for large companies. However, in small companies, they are atleast 30-50% of their entire cost as these are labour intensive industries.

Upholding Maira’s views, Sunil Sinha, Principal Economist, India Ratings and Research clearly states that prudential, regulatory norms may need a revisit right now as extraordinary circumstances call for extraordinary measures.

Sinha agrees that while creating a package which will help SMEs won’t be an easy task, it is necessary that the stimulus includes traditional liquidity lines which can be tapped into by the sector. “Liquidity support will be needed at a cheaper rate of interest. Prudential norms which guide the system may have to be tweaked in the current situation. The government will have to take a number of such steps to address the situation,” he says.

Small enterprises, Sinha adds, have a lesson to learn from such a crisis and is frank in his view that some may not survive the storm. “They must prepare themselves for the future where they involve IT in their operations from the start. Not all SMEs will be able to survive at this point,” he says.

iStock

More relief should flow Others suggest that this is the time when all payments and refunds should be handed over to the concerned representatives. Saurabh Agarwal, Principal, IIF College of Commerce and Management Studies says that the first step should be to pay off all payables.

He cites the examples of the Andhra Pradesh government, which has payables of Rs 45,000 crore acknowledged by the state FM, and not paid for one year. “If we conservatively estimate, the total payables for legitimate reasons, completed works will be a minimum of 20 times of AP which amounts close to Rs 10 lakh crore (from all state governments/state owned corporations and central government agencies and PSUs.) The Government must first get the correct amount acknowledged. Next, the government must ask RBI to give overdrafts to these governments/PSUs as a one-time loan and pay the pending amount,” he shares.

Agarwal also adds that this is the time when all the pending refunds related to GST and tax need to be duly processed. Moreover, all deadlines to make loan payments need to be rescheduled for 3-6 months so that defaults do not happen.

In view of the recent announcement by the FM on suspending Section 7, 9 and 10 of the Insolvency and Bankruptcy Code (IBC) for a period of 6 months if the situation persists, Agarwal suggested that IBC as a whole should be suspended for the said 6 month time period.

Endgame? While no one knows how long the crisis will last or what will be the real extent of the damage, there is concern that a large bailout may have an adverse impact on the Rupee and bring in volatility. On Monday, the Rupee had touched a record low above 76 a dollar with the rise in the number of Covid-19 cases. Sinha adds that the exodus of Foreign Institutional investors (FIIs) has already taken place. “Look at how the exodus has happened. FIIs have pulled out the money. So any of the measures that are announced won’t really bring any volatility in the market and will have a much less impact. Atleast Rs 10-12 billion have been withdrawn in a week. So it really won’t make much of a difference,” he says matter-of-factly.

Maira talks about the silver lining that has ensued amid all the chaos. “It is anyway said that if you want to export more from India, let your exchange rate rise. So basically this crisis is making us do what was healthy for the sustainable growth of the economy. It is making us pay attention to the stability of the economy and is breaking through ideologies. People don’t care about the value of the Rupee. These things matter more to investors and financial markets. Time to get real,” he asserts.

if(geolocation && geolocation != 5 && (typeof skip == 'undefined' || typeof skip.fbevents == 'undefined')) !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '338698809636220'); fbq('track', 'PageView');

Source link

0 notes

Photo

New Post has been published on https://lovehaswonangelnumbers.org/corona-confusion-does-todays-virgo-full-moon-herald-the-turning-point/

CORONA CONFUSION: Does today’s Virgo Full Moon herald the Turning Point?

CORONA CONFUSION: Does today’s Virgo Full Moon herald the Turning Point?

By Ann Kreilkamp

I have a sense that it does. But what turning point?

The one that indicates the moment when the global coronavirus pandemonium begins to recede, diminish in strength. Yes. The moment when the powerful global “bioweapon” spell that the Deep State, with the help of MSM propaganda, plus the Medical Industrial Complex conjured up, began to dissolve before our very eyes. Yes. The very moment when “the virus” begins to let go and F.E.A.R. (False Evidence Appearing Real) subsides.

I’m not the only one who thinks thus. X-22 Reportand the psychic Utsava also weigh in the same way. Utsava, on March 8, tells her patreon subscribers:

The timing of my own information however, is astrological.

What indicates this prognosis?

Here’s the world chart (set for 0° Aries), mid-afternoon, just after I woke up from my nap, and just past the Full Moon:

First: the Full Moon, at 19°37 Virgo/Pisces, just happens be joined with Neptune, which conjuncts the Sun, exactly, today and yesterday. Neptune in Pisces, where it has been transiting since February 2012, and will not leave until 2025, has reached peak delusion, confusion, psychic contagion that yes, “went viral” now, today, on the Full Moon which illuminates it. Inescapably, we have all been immersed in this psychic spell together. The entire world. Terrified. Petrified. Scared to touch others, to gather in groups, on and on. And with Moon in persnickety Virgo opposite: Wash your hands! Don’t touch your face! Use disinfectant wipes! I.e., pay close attention to your daily routines (Virgo) to accommodate the psychic contagion.

Next: Mercury turns to go direct today from three weeks retrograde, these three weeks when we have been pummeled more and more desperately, by the screaming headline news of those seeking to throw the whole world into F.E.A.R. It worked! On most of us it certainly did work. Beginning now, as Mercury turns on this Full Moon, we can begin to look forward, and to speak out and figure things out, rather than hide inside our own internal fearful mutterings.

And third, last but decidedly not least: This Full/Moon with Neptune happens to be in a harmonious wedge formation (trines and sextiles) with the ongoing stellium in Capricorn, linking Saturn and Pluto since January, and now including both Jupiter and Mars. If ever there was a moment to see and feel how the hierarchical structures of this civilization have been tested, and found wanting, this is the moment.

Specifically, the timing for the stellium:

Mars, now at 15°, moving fastest, conjuncts Jupiter, now at 21° and moving more slowly, in the second half of March, and then moves on to conjunct very slow moving Pluto, at 24°, during the final ten days of March.

Meanwhile, Jupiter, now at 21°, will approach closely approach 24° Pluto from now through the first third of April.

And Saturn, now at 28° Capricorn, is due to move into Aquarius on March 23rd, for a three-month trial run (it will move back into Capricorn at the end of June).

In other words, add this all together, and notice that from now through the first third of April is the crux time, when the wrecking ball, having used Neptune’s psychic contagion to crash into the economic, political, and cultural structures of civilization, will begin to slow to a stop.

Mars will lend energy to the onslaught; Jupiter will enhance, make it grow and expand; Pluto will drive the life force through excruciating death and rebirth scenarios, and Saturn, finally, by shifting into Aquarius, may give us a glimmer of what it will be like when we do begin to experiment with other, more decentralized ways of structuring society.

That there is a harmonious and stable wedge formation linking the four planets in Capricorn with Sun/Moon/Neptune in Pisces/Virgo is, I feel an indication that the entire scenario is going exactly according to some kind of overall plan or design that we have yet to understand and perhaps never will.

Whatever is started in motion from now through mid-April, will not gain a real foothold until the end of this year, post-election, in mid-December, when both Jupiter and Saturn enter Aquarius within two days of each other, and then conjunct, exactly, on December 21st, Winter Solstice!

Oh my, am beginning to think that whatever the plan is, it’s being directed from some kind of higher order that sees Winter Solstice as the real new beginning of a brand new age.

Just think! It took a “pandemic” to make us recognize our unity!Slightly after the halfway point of Neptune’s 14-15 year voyage through its home sign of oceanic, mystical Pisces, all humans on this planet Earth, finally UNITED — in fear.

IMAGINE our union, communion, when we switch from fear to LOVE.

******

LoveHasWon.org is a Non-Profit Charity, Heartfully Associated with the “World Blessing Church Trust” for the Benefit of Mother Earth

Share Our Messages with Love and Gratitude

LOVE US @ MeWe mewe.com/join/lovehaswon

Visit Our Online Store for Higher Consciousness Products and Tools: LoveHasWon Essentials

http://lovehaswonessentials.org/

Visit Our NEW Sister Site: LoveHasWon Angel Numbers

https://lovehaswonangelnumbers.org/

Commentary from The First Contact Ground Crew 5dSpiritual Healing Team:

Feel Blocked, Drained, Fatigued, Restless, Nausea, Achy, Ready to Give Up? We Can Help! We are preparing everyone for a Full Planetary Ascension, and provide you with the tools and techniques to assist you Home Into The Light. The First Contact Ground Crew Team, Will Help to Get You Ready For Ascension which is Underway. New Spiritual Sessions have now been created for an Entire Family, including the Crystal Children; Group Family Healing & Therapy. We have just began these and they are incredible. Highly recommend for any families struggling together in these times of intense changes. Email: [email protected] for more information or to schedule an emergency spiritual session. We can Assist You into Awakening into 5d Reality, where your experience is one of Constant Joy, Wholeness of Being, Whole Health, Balanced, Happy and Abundant. Lets DO THIS! Schedule Your Session Below by following the Link! Visit: http://www.lovehaswon.org/awaken-to-5d/

Introducing our New LoveHasWon Twin Flame Spiritual Intuitive Ascension Session. Visit the link below:

https://lovehaswon.org/lovehaswon-twin-flame-spiritual-intuitive-ascension-session/

Request an Astonishing Personal Ascension Assessment Report or Astrology Reading, visit the link below for more information:

https://lovehaswon.org/lovehaswon-ascension-assessment-report

https://lovehaswon.org/lovehaswon-astrology/

Experiencing DeAscension Symptoms, Energy Blockages, Disease and more? Book a Holistic Healing Session

https://lovehaswon.org/lovehaswon-holistic-healing-session/

To read our Testimonials you can follow this link: http://www.lovehaswon.org/testimonials

Connect with MotherGod~Mother of All Creation on Skype @ mothergoddess8

Request a copy of our Book: The Tree of Life ~ Light of The Immortals Book

Order a copy of Our LoveHasWon Ascension Guide: https://lovehaswon.org/lovehaswon-ascension-guide/

**If you do not have a Paypal account, click on the button below:

If you wish to donate and receive a Tax Receipt, click the button below:

Donate with Paypal

Use Cash App with Our code and we’ll each get $5! FKMPGLH

Cash App Tag: $lovehaswon1111

Cash App

Donate with Venmo

VENMO

Support Our cause in the creation of the Crystal Schools for Children. Visit our fundraising link below:

LoveHasWon Charity for Crystal Schools

Support Our Charity in Co~Creating the New Earth Together by Helping Mother of All Creation. Visit our fundraising link below:

Support Mother Earth!

Support Us on PATREON

PATREON

Support Us Through Our LoveHasWon Wish List

LoveHasWon Wish List

We also accept Western Unionand Moneygram. You may send an email to [email protected] more information.

***If you wish to send Donations by mail or other methods, email us at [email protected] or [email protected]***

**** We Do Not Refund Donations****

MeWe ~ Youtube ~ Facebook~ Apple News ~ Linkedin ~ Twitter~ Tumblr ~ GAB ~ Minds ~ Google+~ Medium ~ StumbleUpon ~ Reddit~ Informed Planet~ Steemit~ SocialClub~ BlogLovin~ Flipboard ~ Pinterest ~ Instagram ~ Snapchat

0 notes

Text

Manage Your E Insurance Account with PlanNProgress – Simplified Insurance Solutions

Manage your insurance policies with ease using the E Insurance Account from PlanNProgress. Their user-friendly platform allows you to store, track, and manage all your insurance documents in one secure online space. Say goodbye to paper clutter and access your policies anytime, anywhere. PlanNProgress ensures that managing your insurance is quick, simple, and efficient. Whether you're looking to update your coverage or keep track of important documents, this e-Insurance account is designed to provide you with complete control over your insurance needs. Visit PlanNProgress to get started today.

#saral jeevan bima term insurance#e insurance account#income tax on retirement benefits#what is direct tax code 2025

0 notes

Photo

New Post has been published on https://cryptonewsuniverse.com/dogecoin-price-prediction-2020-2025-2030-future-forecast-for-doge/

Dogecoin Price Prediction 2020 2025 2030: Future Forecast for DOGE

Dogecoin Price Prediction 2020 | 2025 | 2030: Future Forecast for DOGE

In this forecast, we will put out our own and market’s opinion

(both from popular algorithms and experts)

on Dogecoin future while discussing Dogecoin price forecast for 2020 and beyond. Now, let’s delve deep into the Dogecoin price prediction and answer questions if Dogecoin is a good investment or not, why will Dogecoin succeed or fail or while will Dogecoin price rise or drop, let’s quickly do a review on Dogecoin and its to date history.

Our DOGE Price Prediction for 2020

Dogecoin is currently out of the top 30 coins in the cryptocurrency market ranked by market cap. Even though market capitalization has been proven time and again, as a lacking measurement for a coin’s success, it is still the benchmark when it comes to cryptocurrencies. Dogecoin, as the rest of the market, is tied at the hip of bitcoin’s price action. If bitcoin embarks on another bull run, Dogecoin can hope for one as well. Since a strong Bitcoin move in 2020 is very likely, we can expect some swings and moves upwards by DOGE as well. So 2020 will be a year of potential big moves (more likely upwards) and we can see Dogecoin at least doubling its end of 2019 price value. Of course, we speak about Dogecoin price denominated in USD. In terms of its BTC value, it is more likely that BTC will outperform it and DOGE will be worth less Satoshis by the end of 2020. It seems that Dogecoin price will end the year in a tight bear grip, just like the rest of the cryptocurrency market. Next year doesn’t look to bright either in our opinion.

DOGE-BTC Price Correlation

The vast majority of trading that occurs in the crypto markets are between BTC and altcoin trading pairs. Since most altcoins do not pair with fiat currencies (and only a few are paired with stable coins like USTD), Bitcoin is the next best option. Therefore, when Bitcoin is stable, it forms as the ideal base currency for buying altcoins (which is why altcoins tend to do well when Bitcoin goes sideways).

Correlation is measured on a scale from -1 to 1. Values above 0 shows the degree to which altcoin is moving in the same direction as BTC prices (either up or down in tandem), and values below 0 shows the degree to which altcoin moves in the opposite direction of BTC prices (so when BTC goes down, altcoin goes up, or vice versa). Values around 0 shows that when BTC price moves, altcoins stays steady, or alternatively that when altcoin moves up or down that the BTC price is staying steady.

Based on the correlation analysis, BTC and DOGE have a strong positive relationship. The correlation coefficient of their prices is 0.44, which was calculated based on the previous 100-days’ price dynamics of both currencies. What all of this aims to convey is, Dogecoin price is highly dependent on bitcoin price action. Individual price analysis for a particular coin makes sense only in a narrow set of circumstances. Technical analysis is even more lacking for a long-term forecast of a coin’s future. The majority of projects will fail — some startups are created just to gather funds and disappear, some would not handle the competition, but most are just ideas that look good on paper, but in reality, are useless for the market.

Vitalik Buterin, co-founder of Ethereum said:

“There are some good ideas, there are a lot of very bad ideas, and there are a lot of very, very bad ideas, and quite a few scams as well”

Dogecoin Projections 2020 – 2025

As a result, over 95% of successful ICOs and cryptocurrency projects will fail and their investors will lose money. The other 5% of projects will become the new Apple, Google or Alibaba in the cryptoindustry. Will DOGE be among those 5%? If we are honest, there is not much going on for Doge aside of this welcoming and ardent community. It is unreasonable to expect a long-term Dogecoin survival if that is the only hinge for the project.

Dogecoin (Doge) Price Predictions by Market and Experts

#1 WalletInvestor Dogecoin Price Prediction By the end of 2020, Dogecoin may certainly reach $0.00263 according to the algorithm from walletinvestor.com that does automatic technical analysis on all coins on the market.

#2 CoinPredictor.io Dogecoin Price Prediction Another relatively popular site for price predictions forecasts that in December Doge price will be around $0.00026.

Dogecoin Price Prediction 2025

According to some crypto prediction algos, in a 5-year span, Dogecoin is expected to reach $0.04 mark. Dogecoin price prediction by Coinswitch implies that the Dogecoin price is up for a long-term gain and in 2025, the Dogecoin price is forecasted to stand at around $ 0.044.

Dogecoin Price Prediction 2030

Even though this is a Dogecoin prediction article, making a Dogecoin forecast for 2030 is a ridiculous thing to do. There is no price chart or price analysis that can make a reliable Dogecoin projection for such distant future. If it lives long enough to see 2030, though, Dogecoin might actually be a very sought after commodity.

Dogecoin Price Prediction 2040

2040 is two decades away, making a Doge price prediction even more preposterous and senseless task. For fun, let’s say future price of Doge will be $2.

Why will Dogecoin succeed?

Reasons for Dogecoin to go up and rise in price are scarce. It is still one of the favorite jokes around, even Elon Musk joins the fun occasionally but we simply do not see the grounds for Doge long-term success. Its use case is already taken up by bitcoin and other more serious projects. Dogecoin could hybernate its way into the future as a sentimental value that early adopters keep cherishing and using for meme and joke purposes.

Why will Dogecoin fail?

The biggest threat to Dogecoin is one of their biggest advantages: their use case. This is a joke coin – never meant to stay alive this long, nor to reach these market caps and market exposure. Eventually, the joke will stop being funny and the project will get delisted and effectively killed by the exchanges.

Will Dogecoin ever reach $1?

Every option is a possibility but with different probability of happening. Should bitcoin enter a bull run similar to the one from 2017, Doge price prediction will look much brighter as price of Dogecoin can surely climb up to its previous all time high, but reaching $1 is a holders pipedream and borderline fantasy. So, quick answer to the question will Dogecoin hit $1 is a BIG NO.

Is Doge dead?

No, judging by the team activity on social media, github, their own website. Their communities on Reddit and Telegram are also active, although much lower engagement levels are noticeable when compared to 2017. Coin is also still listed on all major exchanges which indicates that Dogecoin is far from a dead project.

FAQs

Can Dogecoin reach $10?

No. If Doge was to reach $10, bitcoin would have to be at $1 million per coin (assuming that their value ratio stays the same, very unlikely).

Can Doge be mined?

Yes, Dogecoin is a PoW coin that can be mined with the so called merged-mining techniques.

What makes Dogecoin go up?

Speculation. Speculators are still majority in the crypto markets and they don’t care what they buy as long as they think it will bring them money.

When will Dogecoin go to the moon?

Depends on the definition of the moon. If we are honest, Dogecoin had its zenit and it is all downhill from now on.

GET READY FOR THE TAX SEASON!

CryptoTrader.Tax takes away the pain of preparing your crypto taxes. Simply connect your exchanges, import trades, and download your tax report in minutes. Use CRYPTOTAX10 for 10% off!

How high can Dogecoin go?

Considering Doge has a huge supply and no real world use, its upside potential is limited by pure market speculation and forces it can produce. If the overall crypto market rockets into another mania, Dogecoin could beat all the odds and reach insane heights. But that is not likely to happen any time soon.

Dogecoin can’t be killed

Ever since its founder Jackon Palmer departed the community in 2015, the development has waned and prophecies about imminent Dogecoin death started floating around. However, as one of the Doge developers told CoinDesk back in 2017, it is pretty hard to “kill a cryptocurrency”. “Cryptocurrencies are “a bit zombie-like”, Nicoll said. “It’s very, very hard to kill a cryptocurrency.” Some might call a valueless cryptocurrency ‘dead’, but that would be missing any educational or entertainment value the token might provide. For instance, Nicoll said even after the 2014 fork, shibes were moving the old version of the coin around for about five or six months. “It was a functional currency, but you couldn’t use it at shops or on exchanges. We don’t know why they were doing it, but they were having a whale of a time,” he said.

What are the best crypto portfolio apps?

But how do you really kill it? The proverbial headshot for a ‘zombie coin’, according to Nicoll, would require removing the original code from GitHub, making it exceedingly hard to recreate it since very few people keep copies of source code material. Yet the nature of open-source software means that, in that rare instance, copies of the code could still be floating out there somewhere on the internet.”

Use cases emerging

Biggest ace in the sleeve for Doge future is its current most frequent application as a tipping currency. With websites like Litebit, Anycoin, Suchlist, keys4coins, dogegifts, clockworkcrypto and an official Reddit tip bot (there is talk of a Telegram tip bot as well), more and more ways of spending your DOGE are popping up by the day. Dogecoin is very much in line with the United States’ “tip culture”, and with the rise of reward culture on the Internet in the world, Dogecoin will also be widely used. Compared to expensive Bitcoin, the threshold for Dogecoin is even lower, and it’s much cuter. Dogecoin could become the most popular “tip cryptocurrency” in the U.S. Internet. Despite the bear beating the Doge during this extended period of crypto slaughter, 1 Doge is still worth 1 Doge and much wow is not going anywhere!

Article Produced By Rene Peters

Rene Peters is editor-in-chief of CaptainAltcoin and is responsible for editorial planning and business development. After his training as an accountant, he studied diplomacy and economics and held various positions in one of the management consultancies and in couple of digital marketing agencies. He is particularly interested in the long-term implications of blockchain technology for politics, society and the economy.

https://captainaltcoin.com/dogecoin-price-prediction/

0 notes

Text

How Charitable Giving With S Corporations Work

Lots of taxpayers oversimplify the rules surrounding the charitable contribution deduction. Most people are aware that contributions to public charities were previously deductible up to a maximum of 50% of adjusted gross income (AGI), and that for tax years 2018 through 2025, the deduction may not exceed 60% of AGI. What most commonly catches some by surprise is that lower limitations may also apply. It is important to determine the amount deductible prior to the application of any limitations. Is it the adjusted basis? Fair market value? Or perhaps, something in between?

Rules surrounding the pass through of charitable donation deductions from an S corporation to its shareholders and the corresponding basis adjustments might also surprise taxpayers. This article explores some of the rules for contributions to public charities by an S corporation.

What Is a Public Charity?

In general, public charities (like the Giving Center) are tax-exempt Internal Revenue Code (IRC) section 501(c)(3) organizations that receive support from a extensive base of donors. Public charities are different from private foundations, which are 501(c)(3) organizations that receive support from one or a few sources, such as a single family or corporation [IRC section 509(a)]. Different rules can apply to private foundations.

Charitable Contribution Rules for Individuals

Contributions of long-term capital gain (LTCG) property will produce a deduction equal to the fair market value of the property, which is subject to a 30% of AGI limitation. This rule hasn’t been affected by the Tax Cuts and Jobs Act (TCJA). LTCG property is defined as property that is presumed to generate a long-term capital gain if sold by the taxpayer on the date of contribution; it’s the contribution of a capital asset held for more than one year. The contribution of ordinary income property, property that would generate ordinary income if sold, which includes short-term capital gains, generates a deduction equal to the donor’s adjusted basis of the property contributed, subject to a 50%-of-AGI overall limitation. (The new 60% of AGI limitation applies only to cash donations to qualifying charities.)

The charitable contribution deduction is decided at the shareholder level, and the treatment of these contributions might differ among shareholders given the limitations based on shareholder AGI.

There are some exceptions to these rules. First, the contribution of LTCG property that is unrelated to the use of the charitable organization will not generate a full fair market value deduction. For example, if a person decides to donate art, like a Picasso, to United Way, whose charitable function isn’t to engage and educate through art, then the taxpayer will only be able to deduct up to their adjusted basis in the artwork, subject to the 50% limitation. Marketable securities are normally not considered unrelated use. Additionally, if the charity were to sell the donated property immediately after its contribution, even if the property is otherwise related to its charitable purpose, the contribution is considered unrelated use. Looking at the Picasso donation, if the donor were to contribute it to the Albright-Knox Art Gallery in Buffalo, and the gallery decides to sell it off to acquire operating funds, they would again only be eligible for a deduction of her adjusted basis in the Picasso.

Another exception applies to C corporations and is for the contribution of inventory, which is normally ordinary income property. If the inventory donation meets specific requirements, the taxpayer can deduct basis plus one-half of the gain of the property, limited to twice the basis.

Basis Adjustment Rules for S Corporation Stock

Under IRC section 1366, an S corporation shareholder reports their pro rata share of S corporation items of separately stated income (deduction) and items of non-separately stated income (deduction) as reported on Schedule K-1 (Form 1120S). Reporting of these items increases (decreases) the shareholder’s basis in the S corporation stock under IRC section 1367. (An S corporation shareholder will increase their basis for tax-exempt income that passes through to their individual return; this adjustment is necessary in order to keep the tax-exempt income from being taxed at the shareholder level when it is subsequently distributed by the S corporation.)

Amid the separately stated deductions are charitable contributions by the S corporation; shareholders have to report their ratable share of such contributions. The charitable donation deduction is determined at the shareholder level, and the treatment of these donations may differ among shareholders given the limitations based on shareholder AGI. Usually, a shareholder will reduce their basis by the amount of loss and deduction that passes through to them. Lets say for example, if an S corporation has a net IRC section 1231 loss of $10,000 that passes through to Brett, they will report the $10,000 loss on their Form 4797 and reduce the basis in their S corporation stock by $10,000. this is not the case for charitable contribution deductions.

IRC section 1367(a)(2) flush language states that S corporation shareholders will decrease basis in S corporation stock (or debt after stock basis is reduced to zero) by their pro rata share of the S corporation’s adjusted basis in the property donated to charity. In Revenue Ruling 2008–16, the IRS defined that the shareholder’s basis is not reduced by the appreciation of the contributed property. Therefore, while the shareholder reduces their stock (and debt) basis by their ratable share of the basis in the contributed property (but not below zero), they will pass through the ratable share of the contributed property’s basis, limited to their basis in S corporation stock and debt, plus their ratable share of all the appreciation on the contributed property. In short, the deduction is based on the fair market value of the charitable contribution.

Rules that limit the pass-through of the deduction to the stockholder’s basis in S corporation stock and debt doesn’t apply to the appreciation of property contributed to charity by the S corporation. Even when the shareholder starts with zero basis in their S corporation stock (or debt), the appreciation of contributed property will pass through as a charitable donation. This means, the deduction is prorated to the portion limited by (and reducing) basis and to the appreciation. This difference in pass-through and basis adjustments first came up in the Pension Protection Act of 2006 and the Tax Technical Corrections Act of 2007 as a charitable giving incentive. After some congressional extenders, it was made to be permanent by the Protecting Americans from Tax Hikes Act of 2015. If a shareholder’s stock basis were reduced by the appreciation in the contributed property, they could potentially recognize more gain on the subsequent sale of his S corporation stock due to the lower basis. The direct contribution of appreciated property to a public charity by an individual doesn’t trigger gain recognition for the donor. Congress amended IRC section 1367 in order to prevent such an inequity.