#accounting software for car workshop

Explore tagged Tumblr posts

Text

Leading Auto Industry ERP Qatar – Inforise IT

Simplify and scale your automotive business with Inforise IT’s Auto Industry ERP Qatar. Our ERP solution is built for car dealers, auto workshops, and spare parts retailers, offering modules for inventory, customer service, sales, accounting, and more. With real-time insights and seamless integration, our Auto Industry ERP Qatar enhances operational control and business growth. Choose Inforise IT for a future-ready automotive solution that meets the unique demands of Qatar’s market.

Know More https://www.inforiseit.com/automotive-erp-software-system-qatar.php

0 notes

Text

Maintaining Peak Performance: Finding Expert Care for Your High-Performance Vehicle in Delhi NCR

Owning a high-performance vehicle is an exhilarating experience, a symphony of engineering and design that delivers unparalleled driving pleasure. However, like any precision machine, these exceptional automobiles require specialized care and attention to maintain their peak performance and ensure longevity. When it comes to porsche car repair in delhi NCR and identifying reliable porsche service centers in delhi NCR, owners need to be discerning, seeking out experts who understand the intricate mechanics and sophisticated technology that define these vehicles.

The Delhi NCR region, a hub of luxury and automotive enthusiasm, presents a range of options for servicing and repairing high-end automobiles. Navigating this landscape to find the right expertise is crucial for preserving the integrity and performance of your prized possession. This article delves into the key considerations for porsche car repair in delhi NCR, guiding owners toward the porsche service centers in delhi NCR that offer the specialized skills and equipment necessary to keep these exceptional machines running flawlessly.

The Importance of Specialized Care

High-performance vehicles are built with unique engineering principles, often incorporating advanced materials, complex electronic systems, and high-output powertrains. This level of sophistication demands a different approach to maintenance and repair compared to mainstream vehicles. General automotive workshops may lack the specific tools, diagnostic software, and, most importantly, the trained technicians who possess an in-depth understanding of these intricate systems.

Entrusting your high-performance vehicle to unqualified hands can lead to improper repairs, use of non-genuine parts, and ultimately, a compromise in performance, safety, and the vehicle's overall value. Therefore, seeking out porsche service centers in delhi NCR that specialize in these marques is not just a matter of preference; it's a necessity for responsible ownership.

Identifying Qualified Service Centers

When searching for porsche service centers in delhi NCR, several factors should be taken into account to ensure you are choosing a facility that meets the highest standards of care:

Specialization:

The most crucial aspect is whether the service center specializes in high-performance European vehicles, and ideally, the specific brand of your car. Workshops that focus on these marques are more likely to have invested in the brand-specific tools, software, and training required for accurate diagnostics and effective repairs.

Technician Expertise:

Inquire about the qualifications and experience of the technicians. Ideally, they should be factory-trained or have extensive experience working on the specific make and model of your vehicle. Continuous training on the latest technologies and repair techniques is also a strong indicator of a committed service center.

Equipment and Technology:

High-performance vehicles often rely on sophisticated electronic control units (ECUs) and complex sensor networks. A qualified porsche service center in delhi NCR will be equipped with the latest diagnostic equipment and software that allows technicians to accurately identify and address any issues.They should also have access to specialized tools required for specific repairs.

Genuine Parts:

The use of genuine parts is paramount in maintaining the performance and integrity of your vehicle. Ensure that the service center uses original equipment manufacturer (OEM) parts or high-quality, brand-approved alternatives

Reputation and Reviews:

Seek out reviews and testimonials from other owners. Online forums and communities dedicated to high-performance vehicles can provide valuable insights into the reputation and quality of service offered by different workshops in the Delhi NCR region. A service center with a long-standing positive reputation is generally a reliable choice.

Range of Services:

A comprehensive porsche service center in delhi NCR should offer a wide array of services, including routine maintenance (oil changes, brake inspections, etc.), complex mechanical and electrical repairs, diagnostic services, and potentially even performance tuning or customization.

Transparency and Communication:

Atrustworthy service center will be transparent about the work required, provide detailed estimates, and communicate effectively throughout the service process. They should be willing to answer your questions and explain the repairs in a clear and understandable manner

Navigating the Delhi NCR Landscape for Expert Care

The Delhi NCR region has a growing number of independent and authorized service centers catering to the luxury automotive market. While authorized centers offer the assurance of factory-trained technicians and genuine parts, independent specialists can sometimes provide comparable expertise at a potentially more competitive price point.

When considering independent porsche service centers in delhi NCR, it's essential to conduct thorough research to verify their expertise and reputation. Look for workshops that explicitly state their specialization in European high-performance vehicles and have demonstrable experience with the specific brand you own. Don't hesitate to ask for references or inquire about the technicians' training and qualifications.

Authorized porsche service centers in delhi NCR, on the other hand, benefit from direct manufacturer support, ensuring access to the latest technical information, genuine parts, and factory-trained technicians. While potentially more expensive, the peace of mind that comes with knowing your vehicle is being serviced according to the manufacturer's standards can be invaluable.

Proactive Maintenance: The Key to Longevity

While identifying reliable porsche service centers in delhi NCR is crucial for addressing repairs, proactive maintenance is the cornerstone of preserving your high-performance vehicle's optimal condition. Regular servicing, adhering to the manufacturer's recommended maintenance schedule, and addressing minor issues promptly can prevent more significant and costly problems down the line.

A qualified porsche service center in delhi NCR can provide tailored maintenance plans based on your vehicle's specific model and usage. These plans typically include regular inspections of critical components, fluid checks and replacements, and timely replacements of wear-and-tear items such as brake pads, tires, and filters.

Conclusion: Choosing the Right Partner for Your High-Performance Journey

Owning a high-performance vehicle in Delhi NCR is a rewarding experience, but it comes with the responsibility of ensuring it receives the specialized care it deserves. By understanding the importance of expert service and knowing how to identify qualified porsche service centers in delhi NCR, owners can safeguard their investment and continue to enjoy the exceptional performance and driving dynamics these vehicles offer. Whether you opt for an authorized dealer or a reputable independent specialist, choosing a service partner with the right expertise, equipment, and commitment to quality is paramount for a long and exhilarating journey with your high-performance machine. Remember that proactive maintenance, performed by knowledgeable technicians at a trusted porsche service center in delhi NCR, is the key to unlocking the full potential and ensuring the enduring performance of your prized automobile.

0 notes

Text

A Guide To Fichier Tuning Files Gratuit: A Great Tool For Auto Enthusiasts

When looking for useful tools to access customized files, adjust engine parameters, or improve vehicle performance, fichier tuning files gratuit frequently comes up. For people who want to use free resources, it is crucial to comprehend what it is, how it functions, and how to use it efficiently. What is Gratuit Fichier Tuning Files? A free resource created for car tuning requirements is referred to as Fichier tuning files gratuit. Serving as a first step in modifying engine control parameters, it can be utilized in professional settings, automobile workshops, or personal projects. Important Aspects and Features Usually, this program has an organized form that facilitates processing and analysis of tuning files. The following are some crucial elements: Its cost-free availability makes it easy for consumers to access the resources they need without worrying about money. Basic Customization: Predefined changes that can be made to different car models are included in a lot of free tuning files. Compatibility: This feature allows users to apply modifications as needed and is frequently compatible with many automobile models and ECU types. User-Friendly Interface: Users can navigate without technical difficulties thanks to simple design. Download and Storage Choices: A few versions offer convenient downloads and storage choices for later usage. Ways to Make Effective Use of It It is necessary to comprehend its fundamental operations in order to use fichier tuning files gratis efficiently. The following are some strategies to maximize it: 1. Comprehending File Structure You should look at the tool's structure before utilizing it. Some versions assist users find the necessary data quickly by including directories, tables, or tagged items. 2. Picking the Correct File for Your Car Numerous tuning files in various setups are accessible. Compatibility with your vehicle's engine control unit (ECU) is ensured by choosing the appropriate file. 3. Making Use of Software Tools for Implementation To apply tune files, specialized software is frequently needed. Comprehending the necessary programs can aid in appropriately adjusting. 4. Continual Backups Because tuning files alter how well a car performs, you might want to store backups to avoid making permanent modifications. 5. Looking for Information There may be changes or enhancements made to some versions. To guarantee access to the newest features, check on a regular basis. Common Applications For several uses, a large number of users depend on fichier tuning files gratis. Here are a few typical situations: Performance Gains: Auto enthusiasts can improve acceleration and fuel economy by modifying engine parameters using tuning files. ECU Modification: These files can be used by workshops to re-calibrate electronic control units. Experimentation and testing: To examine engine behavior, engineers and enthusiasts use various adjustment files. Personal Projects: It could be helpful for people who are working on minor car improvements. Considerations for Limitations A free tuning file resource has advantages, but there are certain drawbacks to take into account: Compatibility Problems: Not every car model is compatible with every free file. security issues: Some files might not be verified, which could put the car's ECU at danger. Absence of Advanced Features: Free versions might not have all the features you need, including fully customizable options. Possible Quality Differences: The most performance-optimized files might not always be available from free resources. Filestechnic ,useful for anyone wishing to make minor adjustments to their car's performance .Knowing its features, benefits, and drawbacks enables users to assess whether it suits their requirements. Whether it is utilized for learning, optimization, or testing, this tool offers a convenient place to start. Keeping adequate backups and looking for trustworthy sources will help guarantee a seamless experience.

0 notes

Text

Accomate Australia — Best Accounting, Taxation and Financial Services

A Complete Guide to Australian Taxation for Small Businesses

Navigating the Australian tax system can be overwhelming for small business owners. Understanding tax obligations, deductions, and compliance requirements is crucial for financial stability and growth. Accomate Australia & Global presents this comprehensive guide to help small businesses manage their taxation effectively.

1. Understanding Business Tax Obligations

Small businesses in Australia must comply with various tax obligations, including:

Income Tax: Businesses must report their income and pay tax on profits based on the company structure (sole trader, partnership, company, or trust).

Goods and Services Tax (GST): If your turnover exceeds $75,000 annually, you must register for GST and charge 10% on most goods and services.

Pay As You Go (PAYG) Withholding: If you have employees, you must withhold tax from their wages and remit it to the Australian Taxation Office (ATO).

Fringe Benefits Tax (FBT): Applies if you provide benefits like cars or entertainment to employees.

2. Choosing the Right Business Structure

Your business structure affects your tax liabilities and obligations:

Sole Trader: Simple to set up but requires personal tax filing.

Partnership: Shared profits and tax responsibilities.

Company: Separate legal entity with a flat corporate tax rate.

Trust: Provides asset protection and tax benefits but requires compliance with strict regulations.

3. Claiming Business Deductions

Reducing taxable income is possible by claiming deductions for business-related expenses, including:

Operational Costs: Rent, utilities, office supplies.

Depreciation: Equipment, machinery, and business vehicles.

Marketing & Advertising: Expenses for digital marketing, branding, and promotions.

Work-Related Travel & Training: Business trips, workshops, and professional development.

4. Managing GST and BAS Reporting

Businesses registered for GST must:

Charge GST on sales and claim GST credits on purchases.

Lodge a Business Activity Statement (BAS) quarterly or monthly to report GST, PAYG, and other obligations.

5. Payroll Tax and Superannuation

Payroll Tax: Applies to businesses exceeding the wage threshold set by state governments.

Superannuation Guarantee (SG): Employers must contribute at least 11% of employees’ earnings to their super funds.

6. Compliance, Record-Keeping, and ATO Regulations

To avoid penalties and audits:

Maintain accurate records of transactions, receipts, and tax filings for at least five years.

Use cloud accounting software for automated tax reporting.

Stay updated on ATO guidelines to ensure compliance with new tax laws.

7. Tax Planning Strategies for Small Businesses

Use Small Business Tax Concessions: Take advantage of the instant asset write-off scheme and other deductions.

Optimize Cash Flow: Plan for tax payments in advance to avoid financial strain.

Seek Professional Advice: Engaging a tax expert ensures compliance and maximizes savings.

Conclusion

Understanding and managing Australian taxation is vital for small businesses to remain compliant and financially efficient. Accomate Australia & Global provides expert accounting and taxation services to help businesses navigate their tax responsibilities effortlessly.

Need assistance with taxation? Contact Accomate Australia & Global today for expert guidance!

Instagram — https://www.instagram.com/accomateglobal_pty_ltd

Facebook — https://www.facebook.com/accomateglobalptyltd/

#accomate australia#taxation#accounting#financial services#accomate global#chartered accountant#cashflow#incometax#cash#money

0 notes

Text

Freelancer Tax Deductions Guide - Introduction Freelancers and independent contractors enjoy the freedom of being their own boss, but with that freedom comes the responsibility of managing their taxes. Unlike salaried employees, freelancers don’t have tax automatically deducted from their income, making tax planning crucial. One of the best ways to reduce your tax liability is by understanding and utilising tax deductions. This guide will walk you through essential deductions that can help you keep more of your hard-earned money. Common Tax Deductions Available Freelancers and independent contractors can deduct many business-related expenses. Below are some key deductions to be aware of: 1. Business Expenses Any expense necessary for running your business can typically be deducted. Examples include:✅ Office supplies (pens, notebooks, printer ink, etc.)✅ Business software and subscriptions (accounting software, Adobe Suite, Zoom, etc.)✅ Website hosting and domain registration✅ Marketing and advertising costs 2. Travel and Transportation If you travel for business, you may be able to deduct related expenses, such as:✅ Mileage on your personal vehicle for business-related trips (keep a logbook!)✅ Airfare, accommodation, and meals for business trips✅ Taxi, Uber, or rental car costs 3. Home Office Deduction If you work from home, you may qualify for a home office deduction. The space must be:✅ Used exclusively for business✅ Your primary place of workDeductible expenses include a percentage of rent, utilities, and home internet costs. 4. Education and Training Investing in your skills is tax-deductible if it’s related to your business. This includes:✅ Online courses and workshops✅ Professional training and CPD✅ Books and subscriptions to industry-related materials 5. Communication Expenses Since most freelancers rely on digital communication, expenses like these may qualify:✅ Business-related phone calls and data plans✅ Internet service used for work✅ Business software subscriptions (e.g., project management tools) How to Keep Track of Your Expenses Keeping organized records is critical for maximizing tax deductions and avoiding issues with SARS. Here’s how to stay on top of your expenses:✔ Keep all receipts – Digital or physical copies of receipts are crucial proof of business expenses.✔ Use expense-tracking apps – Apps like Xero, Zoho Books, QuickBooks, or Wave can automate expense tracking.✔ Maintain a spreadsheet – Categorizing your expenses regularly prevents last-minute stress during tax season.✔ Separate business and personal finances – Having a dedicated business account makes tracking deductions easier. The Impact of Deductions on Your Tax Bill Tax deductions lower your taxable income, which means you pay less tax. For example: - If your total income is R500,000 and you claim R100,000 in deductions, you’ll only be taxed on R400,000. - This can significantly reduce your tax bill and free up money for business growth. The more deductions you claim (legitimately), the less tax you owe. However, it’s essential to track them correctly and ensure they comply with SARS regulations. What’s Not Deductible? Not everything you spend money on qualifies for a deduction. Here are some non-deductible expenses:❌ Personal groceries and household bills❌ Non-business entertainment expenses❌ Personal clothing (unless it’s specific protective gear required for your work)❌ Fines or penalties❌ Any unverified expenses (SARS may require proof of business-related use) How Eva Financial Solutions Can Help Understanding tax deductions can be overwhelming, especially if you’re juggling multiple clients and projects. That’s where Eva Financial Solutions comes in! 💡 We help freelancers and independent contractors:✔ Maximize their tax deductions✔ Ensure compliance with SARS regulations✔ Keep financial records clean and organized✔ File tax returns correctly and on time Conclusion Tax deductions are an essential tool for freelancers and independent contractors to reduce their tax burden. Staying organized, keeping records, and understanding what qualifies as a deduction can save you thousands of rands. For expert guidance and stress-free tax filing, contact Eva Financial Solutions today! Let us help you keep more of your hard-earned money while staying fully compliant. 📞 Get in touch now for a consultation! 🚀 Read the full article

0 notes

Text

Maximizing Tax Deductions for Optometrists: A Comprehensive Guide

As an optometrist, managing your practice involves more than just providing exceptional eye care; it also requires a keen understanding of your financial responsibilities. One crucial aspect is knowing which expenses are tax-deductible. Taking advantage of these deductions can significantly reduce your tax burden and keep more money in your pocket. Here’s a guide to help Optometrist tax deductions while staying compliant with tax regulations.

1. Office and Clinic Expenses

Your clinic is the cornerstone of your practice, and many related expenses are tax-deductible. These include:

Rent or Mortgage: If you lease or own your office space, the associated costs can be deducted.

Utilities: Electricity, water, and internet expenses tied to your clinic are eligible.

Office Supplies: Items like pens, paper, and other general supplies can be written off.

Equipment Maintenance: Repair and servicing costs for diagnostic machines or other tools are deductible.

2. Professional Development and Education

Continuing education is essential for staying updated in your field. Expenses related to professional development include:

Course Fees: Seminars, workshops, and certification courses.

Travel Expenses: Flights, accommodation, and meals for attending conferences or training sessions.

Subscriptions: Membership fees for professional organizations or journals.

3. Employee and Staff Costs

If you employ staff, their wages and benefits are tax-deductible. Additionally, consider deductions for:

Staff Training: Costs for upskilling your team.

Payroll Taxes: Contributions to Social Security, Medicare, or other employee-related taxes.

4. Medical Equipment and Technology

The cost of purchasing or leasing medical equipment is often significant. Fortunately, these expenses are deductible. For instance:

Diagnostic Tools: Machines for eye exams, lensometers, and other specialized equipment.

Software: Practice management systems or electronic health record (EHR) software.

Office Technology: Computers, printers, and other essential devices.

5. Marketing and Advertising

Promoting your practice is essential for growth. Deductible expenses include:

Website Development and Maintenance: Costs to build and maintain your online presence.

Advertising: Social media campaigns, print ads, or sponsorships.

Signage: Costs for designing and installing office signage.

6. Travel and Vehicle Expenses

If you travel between locations or to see patients, you can deduct:

Mileage: Keep detailed records of your business-related travel.

Vehicle Expenses: Maintenance, fuel, and insurance for a car used for work purposes.

7. Miscellaneous Deductions

Don’t overlook these additional deductions:

Insurance Premiums: Malpractice insurance or general business insurance.

Legal and Accounting Fees: Costs for professional advice and tax preparation.

Charitable Contributions: Donations to eligible organizations or sponsorships of community events.

Final Tips

To make the most of these deductions, keep meticulous records of all expenses. Use accounting software to organize receipts and invoices, and consult with a tax professional who understands the healthcare industry. By leveraging these deductions, you can focus on what you do best—providing outstanding care to your patients—while ensuring your financial health remains strong.

0 notes

Text

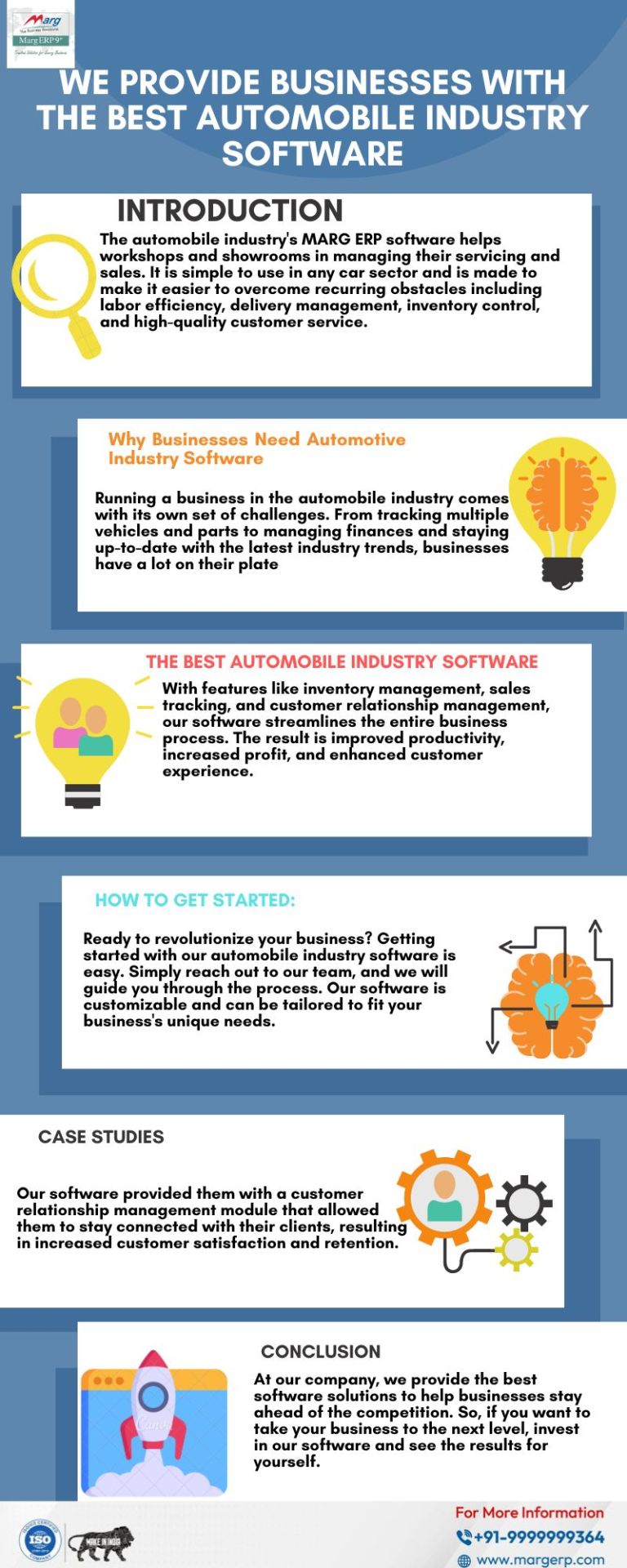

We provide businesses with the best automobile industry software

The automobile industry's MARG ERP software helps workshops and showrooms in managing their servicing and sales.

It is simple to use in any car sector and is made to make it easier to overcome recurring obstacles including labor efficiency, delivery management, inventory control, and high-quality customer service.

Marg ERP automobile software handles all facets of the car industry, from dealer operations to the management of important aspects like vehicle sales, workshop operations, inventory control for replacement parts, and financial accounting.

The program has several special functions, such as inventory management, order management, billing, financial accounting, quality management, purchase management, and billing.

#automobile industry#automobilesoftware#gst software#gst billing software#margerp#billing software#gst accounting software for retail

0 notes

Text

HOW DOES TECHNOLOGY TRANSFORM AUTO MECHANIC SOFTWARE TO PROVIDE UNMATCHED CUSTOMER EXPERIENCES?

With the help of cutting-edge auto mechanic software, technology is revolutionizing the client experience in the quick-paced field of car repair. This tech-driven transformation is opening up previously unheard-of opportunities for interactions between auto workshops and their clients, from improved communication to faster operations.

What is online workshop software?

Online workshop software is a digital solution designed to streamline and optimize the operations of auto repair workshops or service Centers. It offers a consolidated platform where different workshop management facets may be effectively managed, improving total output and customer satisfaction.

Ways technology is influencing the automotive sector with auto mechanic software

Auto mechanic software is undergoing a revolutionary shift as technology advances in the automobile industry. Some of the ways auto mechanic software enhances customer satisfaction are as follows:

Digital Appointment Booking: The era of flipping through appointment books is fading, replaced by digital scheduling. Technology empowers customers to book appointments at their fingertips, eliminating the hassle and putting control back in the hands of those in need of service.

Transparent communication channels: Excellent customer service depends on effective communication. Auto mechanic software's real-time updates open up clear lines of communication and guarantee that clients are always informed about the whereabouts of their cherished cars.

Mobile accessibility for instant updates: Mobile devices have evolved into an extension of oneself. Customers are no longer restricted to a physical location due to technology, which offers quick updates and notifications. it is important to keep oneself updated and connected no matter where life takes them.

Digital inspection reports for visual clarity: Particularly with auto repairs, an image truly is worth a thousand words. Customers are given a visual trip into the core of their vehicle's problems through digital inspection reports that include photographs and videos, which promotes transparency and builds confidence in suggested repairs.

Customer portals for personalized interactions: Because every consumer is different, auto mechanic software takes this into account. Customer portals provide a personalized area where invoices, service history, and customized recommendations come together to create a distinctive and interesting user experience.

Online Payment and invoicing efficiency: The days of waiting in long lines to get paid are long gone. Features for online invoicing and payment in the Free Auto Mechanic Software give clients a quick and easy way to pay their invoices, streamlining the transaction process and saving them precious time.

Apps for Monitoring Vehicle Health: It's better to prevent than to treat. Customers can get real-time insights into their car's health with the use of vehicle health monitoring applications, which also make proactive maintenance suggestions and guarantee that vehicles are kept in top condition.

Interactive Work Order Tracking: This feature combines efficiency and engagement. Consumers take an active role in tracking the status of their vehicle's service, making the process dynamic and interesting.

In the field of auto mechanics, the software is taking the lead as technology redefines consumer experiences, and it acts as the steering wheel. Every transaction—from making appointments to paying bills—becomes a smooth, clear, and customized process.

0 notes

Text

A guide to saving money with freelance tax deductions

A guide to saving money with freelance tax deductions

As a freelancer, it is crucial to maximize your tax deductions in order to lower your overall tax liability. By taking advantage of various deductions available, you can reduce your taxable income and save a significant amount of money. In this guide, we will explore some freelance tax deductions that you might be missing, helping you boost your savings. 1. Home Office Expenses If you work from home as a freelancer, you can claim tax deductions for your home office expenses. This includes expenses such as rent or mortgage, utilities, internet, office supplies, and depreciation on furniture. To claim this deduction, you will need to allocate a certain percentage of your home expenses to your business use. 2. Business Travel Expenses Freelancers who travel for business purposes are eligible to claim tax deductions for travel expenses. These expenses may include airfare, rental cars, hotels, meals, and transportation costs. It is important to keep accurate records, including receipts and itineraries, to support your deductions. 3. Professional Fees and Subscriptions Freelancers can deduct professional fees and subscriptions related to their business. This could include membership fees to professional organizations, subscriptions to industry publications, and online courses or training. Make sure to hang onto any receipts or invoices to substantiate these deductions.

Photo by Linda Yuan Seongsan Ilchulbong, Seogwipo-si, Jeju-do, South Korea 4. Marketing and Advertising Expenses Promoting your freelance business is essential for growth and attracting new clients. You can claim tax deductions for marketing and advertising expenses, including website design and development, social media advertising, business cards, and marketing materials. Again, it is important to maintain proper records to support these deductions. 5. Equipment and Supplies Freelancers can deduct the cost of necessary equipment and supplies used for their work. This may include computers, printers, software, office supplies, and other necessary tools. It is essential to keep receipts and records of these purchases to support your deductions. 6. Continuing Education Freelancers can claim tax deductions for continuing their education, as long as it is directly related to their business. This could include workshops, conferences, online courses, and professional development programs. Keep records of your expenses and any certifications or qualifications obtained. 7. Health insurance premiums Freelancers can claim tax deductions for their health insurance premiums, as long as they qualify as a self-employed individual. This includes premiums paid for individual health insurance policies, as well as contributions to a health savings account (HSA) or flexible spending account (FSA). 8. Retirement contributions Freelancers can contribute to retirement plans, such as an individual retirement account (IRA) or a 401(k), and deduct their contributions from their taxable income. This can provide a valuable tax-saving benefit for freelancers who are saving for their future. 9. Business-related Self-Employed Health Insurance If you pay for health insurance as a self-employed individual, you can claim tax deductions for the business portion of those expenses. This includes premiums paid for coverage under a high-deductible health plan (HDHP) or a qualified small employer health reimbursement arrangement (QSEHRA). 10. Legal and Accounting Fees Freelancers can deduct legal and accounting fees directly related to their business. This includes costs for tax preparation, legal advice, and accounting services. Keep detailed records of these expenses to support your deductions. Remember, it is essential to consult with a tax professional or accountant to ensure the accuracy and compliance of your tax deductions. They can help you identify additional deductions that may apply to your specific situation, maximizing your savings and ensuring compliance with tax regulations. Read the full article

#Aguidetosavingmoneywithfreelancetaxdeductions#bestdiybusinessideas#businessgrowth#businesssuccess#digitalbusiness#digitalentrepreneur#digitalgrowth#digitalmarketing#digitalmarketingtips#digitalstrategy#digitalsuccess#digitalsuccessstrategy#diybusinesscardideas#diybusinessforsale#diybusinessfromhome#diybusinessideas#diybusinessideasforstudents#diybusinessnews#diylifehack#diylifestyleblog#EmpowerYourCreativity:DIYDelightsUnleashedOnline!#entrepreneurlifestyle#entrepreneurmindset#entrepreneurmotivation#entrepreneurship#howtostartadiybusiness#odiyi#onlinediyideas#onlinediyideasblog#onlinedoityourselfideas

0 notes

Text

5 Innovative Approaches 3D printing is Revolutionizing the World

For many different industries, 3D printing is a vital tool when producing 3D digital representations of objects or surfaces using computer graphics. Using a combination of vertices (points in virtual space), polygons, and edges, you may use software to build an entire object. This makes it possible for designers to view goods from all angles and more easily imagine how they would appear in actual use. While 3D printing is used by animators and game designers to create incredibly realistic virtual worlds for movies, commercials, and video games, architects and engineers use it for planning and design. 3D printing can help cut costs, minimize lead times, and speed up production by providing quick, accurate, and comprehensive mock-ups at a low cost. Other benefits include easy re-printing and correction, as well as sufficient precision and detail throughout the design phase to improve the effectiveness and attractiveness of the end product. Finally, 3D printing can assist designers and architects in persuading clients and other stakeholders of the worth of their concepts.

Effective 3D Techniques

3D printing, often known as additive manufacturing, is the technique of generating 3D items from digital data. The object is built by the 3D printer in phases by adding material. One of the most notable breakthroughs in 3D printing for 3D printing is how it has considerably extended 3D printing accessibility for consumers and businesses, particularly with the emergence of open source software. Corporations, for example, use 3D printing for rapid development, and schools use it to create educational materials. 3D printing in the fashion sector allows jewelers and footwear producers to design bespoke pieces at a lower cost. 3D printing is used in the construction industry to create modular concrete components. Businesses in the automotive and aviation industries use 3D printing to create spare parts, while restaurants have used technology to print food. 3D printing is used by laboratory researchers for activities such as simulating biological molecules, creating instrument parts, and printing sample containers, implants, and instructional models.

Augmented and Virtual Realities

Immersive gaming, realistic, accurate environments for flight simulators and astronaut training, as well as virtual and augmented reality, are all possible with 3D printing. 3D printing has also aided in the development of interactive models for education, such as training simulations for augmented reality. It has enabled in-car information systems for drivers, advanced military navigation capabilities, and overlay content for TV broadcasts. Because of 3D printing, users can now create virtual reality trip guides, museum experiences, and real estate tours. It played a role in the development of apps that examine the arrangement and fit of furniture in the home, as well as multi-sensory eating experiences. Building information printing (BIM) allows architects, engineers, developers, and builders to design and document structural and functional parts of buildings in 3D using a single platform. Thanks to BIM, project managers may test several scenarios while accounting for aspects like as time, cost, sustainability, and safety.

Price: $1,499 USD

High Productivity Machine

Automatic resin feeder

Lift-Up Lid

Description:

This printer is an industrial-grade mono-LCD 3D printer that boasts a long-lasting monochrome 15" LCD screen with ultra-high 8K clarity. It is a professional tool that generates models with astonishing detail. Sonic Mega 8K S achieves twice the detail of comparable large scale printers thanks to a fine resolution of 43µm. The Lift-Up Lid - The Phrozen Sonic Mega 8K S Resin Printer is the excellent addition to any design lab or workshop because to its dependable and long-lasting build. Complex models are made possible by 3D printing to improve construction results. These illustrations may only represent a small percentage of what 3D printing is capable of, and in the years ahead, consumers and businesses alike may expect even more ground-breaking developments. Through the 3D Printers Online Store, your 3D printing knowledge can be progressed.

1 note

·

View note

Text

Tax Deductions And Benefits For The Self-Employed

Being self-employed comes with the freedom to run your own business, but it also involves managing various aspects, including finances and taxes. Understanding tax deductions and benefits is crucial to optimize your financial situation. Here's a comprehensive guide to tax deductions and benefits for the self-employed.

Home Office Deduction:

Criteria: You can claim a home office deduction if you use a portion of your home exclusively for business.

What's Deductible: Rent or mortgage interest, property taxes, utilities, and home insurance related to the home office space.

Business Use of Your Car:

Criteria: If you use your car for business purposes, you may be eligible for deductions.

What's Deductible: Mileage, vehicle maintenance, and a portion of auto insurance, based on the percentage of business use.

Health Insurance Premiums:

Criteria: Self-employed individuals can deduct the cost of health insurance premiums for themselves, their spouses, and dependents.

Limitations: Deductions cannot exceed your business's net profit.

Retirement Contributions:

Criteria: Contributions to a Simplified Employee Pension (SEP), Solo 401(k), or other retirement plans are deductible.

Limits: Contributions are subject to specific limits based on the retirement plan chosen.

Business Supplies and Equipment:

Criteria: Ordinary and necessary expenses related to your business are deductible.

What's Deductible: Office supplies, equipment, software, and other necessary business tools.

Education Expenses:

Criteria: Expenses related to maintaining or improving your skills in your current business are deductible.

Examples: Workshops, courses, or certifications directly related to your business.

Professional Fees:

Criteria: Fees paid for professional services related to your business are deductible.

Examples: Accounting, legal, or consulting services.

Travel Expenses:

Criteria: If you travel for business purposes, related expenses are deductible.

What's Deductible: Airfare, lodging, meals, and transportation costs.

Marketing and Advertising:

Criteria: Costs associated with promoting your business are deductible.

Examples: Website expenses, business cards, online advertising, and promotional materials.

Business Insurance:

Criteria: Insurance premiums for policies related to your business are deductible.

Examples: General liability insurance, and professional liability insurance.

Self-Employment Tax Deduction:

Criteria: Self-employed individuals can deduct the employer-equivalent portion of their self-employment tax.

Amount Deductible: Approximately half of the self-employment tax paid.

Internet and Phone Expenses:

Criteria: If you use the internet and phone for business, a portion of these expenses is deductible.

Calculation: Deduct the percentage of business use.

Depreciation:

Criteria: Depreciation allows you to deduct the cost of business assets over time.

Examples: Depreciation on computers, office furniture, and other business equipment.

Meals and Entertainment:

Criteria: You can deduct a percentage of meals and entertainment expenses related to your business.

Limitations: Generally limited to 50% of the total cost.

Business-related Education:

Criteria: Education expenses that maintain or improve your skills in your current business are deductible.

Examples: Seminars, workshops, or courses directly related to your business.

Rent Expense:

Criteria: Rent for business property is deductible.

What's Deductible: Office space or any property used exclusively for your business.

Business Taxes:

Criteria: Various business taxes are deductible, such as state and local taxes.

Examples: State and local income taxes, and real estate taxes on business property.

Child and Dependent Care Credits:

Criteria: If you're paying for childcare to run your business, you may be eligible for these credits.

Limitations: Subject to income limits.

Deductions for Home-Based Businesses:

Criteria: Exclusive and regular business use of a part of your home qualifies.

Calculation: Deduct a percentage of home-related expenses based on the business use percentage.

Contributions to Charitable Organizations:

Criteria: Business-related charitable contributions are deductible.

Examples: Donations made as part of a business promotion or community involvement.

It's crucial to keep detailed records and consult with a tax professional offering services of tax planning for self employed in Mayfield Heights OH to ensure compliance with tax laws and maximize deductions. Tax laws can change, so staying informed about updates and adjustments is vital for optimizing your self-employed tax benefits.

0 notes

Link

Use Cloud Garage/Workshop software to increase profits by Streamline & Automate process, avoid unnecessary costs, manage labor costs, offers etc. Demo: +91-8696666358

#accounting inventory software for electric vehicles#accounting management software for e vehicle#accounting software for car dealers#accounting software for car dealerships#accounting software for car workshop

0 notes

Photo

Software which can automate your garage end-to-end. This is an ideal software for Car, Bike, Yatcht and Lorry Garages.

0 notes

Text

Gear up for a Bright Future with Automobile Engineering

On the off chance that you have a characteristic interest for vehicles, arithmetic, mechanics, and hardware, Automobile Engineering is the correct branch for you. Car Engineering is a part of vehicle designing, joining components of mechanical, electrical, electronic, programming, and security designing as applied to the plan, production and activity of cruisers, autos, and trucks and their separate designing subsystems. It additionally incorporates alteration of vehicles. Assembling area manages the creation and collecting the entire pieces of vehicles. The investigation of car designing is to configuration, create, manufacture, and test vehicles or vehicle parts from the idea stage to creation stage. Creation, advancement, and assembling are the three significant capacities in this field.

B.E. Car Engineering course also offers specialization in elective fills, streamlined features, body, discharges, gadgets, ergonomics, materials, producing, motorsport, quick prototyping, vehicle, power train and walker security or inventory network the board. Such postgraduates are employed in limits, for example, Sales Officer, Professor, Associate Professor, Sr. Official/Executive, Automobile Engineer, Embedded Automotive, Software Engineer, Product Development Engineer, Design Engineer and so forth A new alumni in this field can acquire a normal compensation between INR 2 to 6 lacs in a year. Compensation can be expanded according to the exhibition and ability of the applicants.

Top Companies Offering Job Opportunities to the Automotive Professionals:

Goodbye Motors

Mahindra and Mahindra

Toyota

Honda

Passage

Eicher Motors

Escorts

Bajaj Auto Limited

Maruti Udyog Limited

Saint Motors

Honda Motorcycle and Scooter India Pvt. Ltd. (HMSI)

Top Overseas Companies Offering Lucrative Job Offers:

BMW

Audi

Renault

Portage

Volkswagen

Pay of an Automobile/Automotive Engineer

Compensation of an Automotive/Automobile Engineer ranges between INR 64,000 to 2, 00,000 every month relying upon the degree of involvement. Openings are additionally accessible with enormous Automotive goliaths related merchants like Rane Steer, Bosch, Denso, Magna, Continental, MRF, BKT, Exide, Amaron to give some examples.

Top occupation profiles offered to Automobile Engineers:

Chief and Managerial Positions

Driver Instrumentation Engineer

Senior Production Engineer

Car Designer

Car Sales Engineer

Seller Account Manager

Quality Engineer

Administration Engineer

Advertising Expert

Mechanical Design Engineer

Car Developer

Local Transport Officer

Administration Advisor and Works Manager in Dealerships

Car Technician

Administration Station proprietor

Following the Start up India thought process, after the fulfillment of the course one can settle on self-financed business, a portion of the intriguing patterns with regards to this region include:

Vehicle Showroom or Service focus proprietor

Misfortune Assessor and Surveyor

On-the-spot Cleaning and support Services

Machine establishment and conveyance accomplice

Car part fabricating

Generator Manufacturing and provider

Sun based item assembling and dissemination

Preparing Institute

Segment Designing

Business Consultants

Experts in vehicle purchase/deal

Frill merchant and some more

Vehicle Engineering: Career Prospects

This field offers broad assortment of chances for the competitors and it incorporates creation plants, car producing enterprises, administration stations, private vehicle organizations, state street transport partnerships, engine vehicle offices, insurance agencies etc.With the PC aptitudes and information in CAM (Automation), CAD (Computer Aided plan), ERP, Automobile specialists may secure position openings in PC supported businesses as Designers. Vehicle Maintenance Engineers are offered the post of general oversight of mechanics in a workshop, plant and carport. B. Tech applicants in vehicle designing with a MBA degree could go to the front line in advertising the board professions.

There are a ton of open entryways for the certified people and they can pick a profession in car industry, which prompts wonderful future. By and by, with so numerous unfamiliar car organizations, for example, Audi, Volkswagen, Renault and so forth zeroing in on India as a base for assembling vehicles, the expansion for a profession in car industry is rising rapidly.

Occupation B. Voc. in Automobile Engineering: The top schools at NCR are thinking of the courses that are Entrepreneurship situated Skill improvement courses have been started by All India Council for Technical Education (AICTE), Ministry of HRD, Government of India to advance "Make in India activity". These courses will be controlled by AICTE affirmed foundations, where separated from specialized educating, prepared assets will widely hand hold understudies and give explicit aptitudes, making them confident to start their own new businesses. Lone ranger of Vocation (B. Voc.) is acquiring significance as interest for ability based schooling is the need of great importance. The present business is searching for assets that are prepared to convey from the very beginning of joining.

Vision: The vision of these projects is to fabricate a solid association with the Automobile Industry to encourage understudy's employability and business venture through the On-the-Job Training (OJT) and advance a feeling of development, envisioning the Society's necessities and assumptions in the field of Automobile Engineering.

MISSION

To give understudies the chance to upgrade their capability and expertise.

To create application-based discovering that will make understudies work prepared by acquiring industry work insight and learning the specialized ideas involved.

To prepare understudies to take up creative undertakings in gatherings with feasible and comprehensive innovation applicable to the business and social requirements.

To enable understudies to become gifted and moral business visionaries

To give delicate abilities supporting a specific calling and comparing specialized schooling.

To guarantee sufficient information on Theory, Laboratories and active pragmatic experience.

To overcome any issues between the scholarly world and Industry.

To coordinate NSQF (National Skills Qualifications Framework) to upgrade employability of the understudies and meet industry necessities.

B. Voc. in Automobile Engineering course offers:

Components of Automobile, Electrical and Electronic Systems, Non Commercial vehicles, Materials for Automobile.

I.C. Motors, Transmission frameworks, Instruments and Equipments, Suspension and Damping Systems, Project

Business vehicles, Automotive part plan, Electric Vehicles, Engine Management standards, Universal Human Values and morals.

Autotronics, Air molding and Heating frameworks, Quality Management in vehicle Industry, Tire Technology, Environment and Ecology.

Present day vehicle Technology, Automobile Assembly Principles, Vehicle security standards, Elements of Noise vibration and Harshness control, Indian Constitution.

Vehicle adjusting, Traction and Driving Systems, Essence of Indian Traditional Knowledge, Major Project.

Furthermore, some more… …

Qualification Criteria:

B.Voc. in Automobile Engineering is a 3-year undergrad program, the qualification models is least 45% imprints in 10+2 from a presumed board or its comparable assessment.

Occupation Areas:

Administration Technician

Car Designer

Body Shop In-Charge

Administration Supervisor

Testing Manager

Deals Executive

E-Automotive Specialist

Vocation openings for car engineers don't stop just inside India. They can have a fruitful vocation in the Automobile business in western nations like USA, Germany, United Kingdom and so on They can likewise seek after professions in oriental nations like Japan, Republic of Korea which are monster major parts in vehicle businesses. Since the Automobile business is a colossal industry, there is a wide scope of chances for car engineers. The business is filling by a wide margin giving countless chances of development to the car architects to develop, and have a splendid and effective profession ahead.

2 notes

·

View notes

Text

Garage Management Software At An Affordable Price

we know very well that running a garage or auto shop and managing it not as easy as it looks because you need a proper team of skilled employees to manage it in a smart way which also requires large investment but guess what, if you get best garage management service at an affordable price that would be great and if you are looking for the same then you are at the right place.

It’s an accepted fact that service management software can manage any business regardless of the size, whether it’s a start-up, large or small business all can be managed easily and if you own any auto mechanic software but having trouble in managing your bookings, invoicing, accounts history then you can go for garage management software. These have so many advantages and some of them are as follows:

· It helps in managing large numbers of customers record, as there are many customers that visit the shop on daily basis and managing all customers records is not so easy but this software made it easy from past years.

· It also helps to automate the daily task of the workshop which helps the owners to keep focus on fixing cars.

· And most importantly it is time as well as cost effective which is one of the most important factors in business growth.

There are various companies which provide these services but we (Mechanic manager) provide the best auto shop software services at an affordable price. We don’t look for much profit as customer satisfaction is much important for us and we feel proud when get any positive response from them.

A complete auto mechanic workshop management software system including integration to XERO and Repco Smart Quote. Our software does everything from Bookings, Job Cards, Invoicing, Service History, SMS Service Reminders, GST, Accounts. we are available 24/7 for our customers to make their doubt clear at any time they want, So if you are looking for the same get on touch with us know.

Source:- https://mechanicmanager1.blogspot.com/2021/03/garage-management-software-at.html

1 note

·

View note

Text

Professional custom invoice through software to make automotive repair business better.

Technological advances are happening faster than ever in this 21st-century world. With growing industries, there is an increase in demand for various software to manage these rising business. Developing economy also rise in the competition in a different sector, it is same with the automotive repair shops. There is various software that helps to stand out among one's competitors and create a brand.

Automotive repair invoice program is such software, which helps determine the shop's brand. The automotive repair shop mostly underestimates the importance of having a digital custom invoice to provide to their customer in everyday business. A professional custom invoice sent to the customer by mail or text gains customer satisfaction for the auto repair shop's customer care. The customer likes to do business with the workshop they are satisfied with and become the shop's regular customer, increasing sales of the shop.

Automotive repair invoice program software provides custom invoices, forms, estimates, inspection, etc., which endow with Company logo, name, address, contact number and email that represents the shop and help send the message to the population about the workshop. These custom invoices greatly influence people and an auto repair shop should use them to one's advantage.

Auto repair shops use invoices and forms to conduct their business daily. It could be for an oil change, an engine repair, tire change, dent repair, monthly wash-up or servicing and many other customized jobs. Technicians are mostly too lazy to write the list of services they have done on the vehicle in the invoice. The customer wants a detailed explanation of everything from labor cost on a particular job to ordered parts price. The unprofessionally written invoice can hurt the auto repair business's popularity, but the automotive repair invoice program software helps solve the issue. This software allows the car repair shop to explain the car repair services done through invoice.

The benefit of the automotive repair invoice program is not only for creating auto repair shop identity and advertisement but also helps in accounting and sales report data. Sometimes, clear and detailed invoices prevent disputes in case of disagreements and serve as a double-checking method to look out for any errors and mistakes. An easy to understand invoices and forms support to conduct the business efficiently.

As I have mentioned before, getting digital custom invoices, estimation, and inspection increases customer service for busy customers. Therefore, automotive repair invoice program software integrates with other system software like communication program systems, payment software, or estimates and repair parts order software. To get all the above-quoted major features for an auto repair shop, try out Tekmetric, automotive repair invoice program software that offers professional custom invoice printouts and integrates with a carload of other superb features. Visit the Tekmetric website for more information and check their free demo trial.

#automotive repair invoice program#Mechanic Shop Management Software#Mechanic Shop Software#Repair Shop Management

1 note

·

View note