#adding sigfigs

Explore tagged Tumblr posts

Text

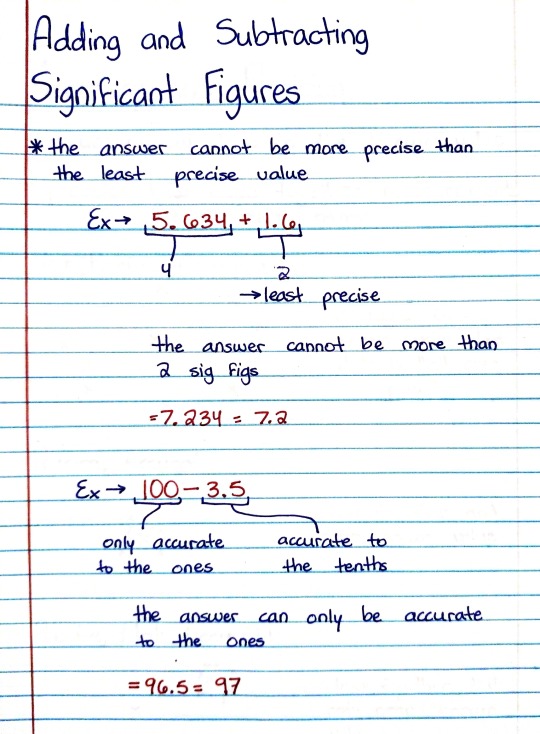

Adding and Subtracting Significant Figures

Patreon

#studyblr#notes#math#maths#mathblr#math notes#maths notes#science#scienceblr#science notes#significant figures#sigfigs#sig figs#math in science#science math#accuracy#decimals#addition#subtraction#math examples#maths examples#math ex#maths ex#mathematics#mathematics ex#mathematics example#adding sigfigs#subtracting sigfigs

3 notes

·

View notes

Photo

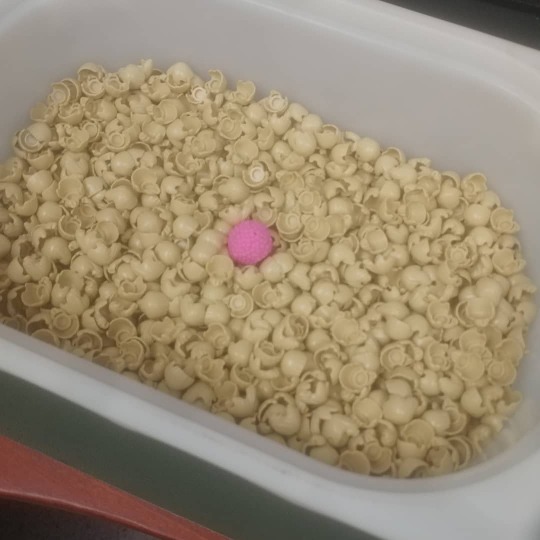

Say cheese! Cottage cheese that is and jump into a tub of Breakstone’s doubles. #ad #BreakstonesatWalmart #cheese #lego #sigfig #whataslackeraboutbricks https://www.instagram.com/p/CTxijlhJ13D/?utm_medium=tumblr

1 note

·

View note

Text

The new BrickCentral team for 2023

Meet the team that will be coming up with themes, sharing photography tips, and featuring photos from the community!

The BrickCentral community is growing fast and to help us manage all the things we do, we've added two more mod positions this year.

So now we've got 8 Activity Mods:

They'll be doing the themes, tips, and features.

And we've got two more managers helping out with the other cool things we do like artist spotlights, special community projects, and Discord challenges.

Finally, there's me, the Community Manager and LEGO Ambassador that handles a lot of the behind-the-BC stuff like policy, strategy, rosters, etc.

I've gone cyberpunk this year with my sigfig.

So I hope you all get to know the team. Check out their profiles here on Tumblr to see what great work they do:

@taskera @archiminibricks @sarouxbastoux @minifiglifescenes @monsieurkek @glowingbrickette @yuri-badiner @joschka-vanderlucht @toy-story-yana @theaphol @fourbrickstall

16 notes

·

View notes

Text

Ravinetown (name pending) tiny update

My sigfig made a survival realm so ive spent most minecraft energy there instead of my singleplayer world BUT I have Three things added to Ravinetown (Name pending)

First off: the competitor for Cornwall’s Potions: Mon A’yeel’s cave.

Her only price for any of her specialty potions would be to tell her why and how you’re gonna use them. And maybe a trade of resources. If you cannot tell her the why and how, you don’t get a potion. Younger residents have called her the Vibe Check Witch.

And second of all: The café!

It’s a very kitschy place on the top floor of the area, and the barista’s just. So tired. But her dad’s the owner and main chef for the baked goods and he takes over so she can nap during shifts so it’s still pretty nice to work there.

And the third thing: stairs. I added some.

There were already some stairs at the edges of the second and third floors, but I needed a staircase to connect the first and second.

And yeah that’s the update!

#bloop out#minecraft build#mineblr#minecraft#ravinetown (name pending)#i also made a pet shop but i dont like how it looks rn so i may go back and mess with it

35 notes

·

View notes

Text

Dr. Doom’s Doctorate isn’t in Anything that Requires SigFigs

Am I back from a many week-long hiatus? I might be back from a many week-long hiatus...

I first had to deal with significant figures in 10th grade. I hated them. I was the child who would write out every decimal value my calculator reported back to me, and sigfigs told me I couldn’t do that, anymore. I thought that I was being forced to be less accurate.

Several years later I ended up having to teach children how to use sigfigs, and it was only then that I actually grew to appreciate their significance.

It’s all about error, and the propagation of error.

Let me ask you a question: how tall are you? I’m roughly 164 cm. I say ‘roughly’ because 1. A human’s height varies over the course of the day as gravity compresses the spine, and 2. My ruler only goes down to millimeters, and while I could technically use it to make an estimate down to a tenth of a millimeter (e.g. I’m 164.02 cm), I know no human cares about me being that accurate.

So that 164 number carries with it some amount of inaccuracy. But if I use the height I normally say because I’m an American, 5″4.5″ (or 64.5 inches), I would have less inaccuracy. That’s because 1/10th of an inch is smaller than 1 centimeter.

If my measured height were 164.0, instead of just 164 with no tenths place, I’m suddenly 10 times more accurate. No longer am I somewhere between 163.5 and 164.4; I’m between 163.95 and 164.04. If I use the full capabilities of my ruler and get 164.02, I am really somewhere between 164.015 and 164.024.

But even down to a tenth of a millimeter, there’s some amount of uncertainty. It’s insignificant when recording your height at your next doctor’s visit, but not all measurements need the same level of accuracy.

For example, the seismometer run by the InSight lander is capable of measuring vibrations beneath the Martian surface that move the ground less than the diameter of a hydrogen atom.

That’s less than 0.0000000001 meters. A million times more accurate a measurement is needed than our pathetic tenth of a millimeter.

If the SEIS on InSight reports a movement of, say, 0.0117455253 meters, all those numbers (except the leading zeroes) matter.

If the SEIS reports a movement of 0.0117400000 meters, all those zeroes after the non-zeroes matter, because the machine is that damn accurate.

But if you suddenly do some math and combine that measurement with numbers that didn’t come from as accurate machine, you lose that accuracy.

I remember having to do more complicated error propagation in an undergrad physics lab, but the stuff you learn in high school chemistry will serve most people’s purposes.

When adding/subtracting numbers with different levels of accuracy, you can only have an answer that is as accurate as your least accurate number.

When multiplying/dividing numbers with different levels of accuracy, your answer can only have as many significant digits as your least accurate number.

(Yes, there is a slight difference, here. Don’t worry. I brought examples.

First, some sigfigs

5 -- 1 sigfig

5,000,000 -- also 1 sigfig

5,000,000. -- 7 sigfigs (note the decimal at the end - we never write numbers this way...)

5,000,001 -- 7 sigfigs

0.05 -- 1 sigfig

0.05000 -- 4 sigfigs

0.05001 -- 4 sigfigs

This might seem too complicated (”why do some zeroes matter but others don’t?”), but that’s why scientists write numbers in “scientific notation” which only reports significant numbers. Here are the same numbers written in that notation:

5 * 10^0

5 * 10^6

5.000000 * 10^6

5.000001 * 10^6

5 * 10^-2

5.000 * 10^-2

5.001 * 10^-2

It seems silly to write 50 as 5 * 10^1, but we do it because it could also have been 5.0 * 10^1. The first is a less accurate measurement (between 45 and 54) than the second (between 49.5 and 50.4).

Now for the math problem:

Pretend I’ve ordered you and three random strangers you’ve never met before to measure your collective height in meters -- I give each of you a ruler but they only have tick marks for imperial units.

You measure yourself and report 66 inches (That’s 2 sigfigs). The next person wants to be a little more accurate and says 69.5 inches (That’s 3 sigfigs). The third person just says 6 feet (1 sig fig). And the 4th person reports 60 inches (aka 6.0 * 10^1, not 6 * 10^1, so 2 sigfigs).

Your typical person would just add all this up (converting 6 feet to 72 inches) and get a total of 267.5 inches.

But that’s not how it works in sigfigs.

To convert 6 feet into inches, we do multiply by 12, but we can’t use 72. Our answer can only have 1 sigfig, so we have to round down to 70. That’s because only reporting 6 feet means, technically, there’s so much uncertainty he could be anywhere between 5.5 feet and 6.4 feet.* That puts the range of possible inches between 66 and 76.8 inches. Hence, we have to use 70 (i.e. 7 * 10^1) in.

So we add these numbers together, but sigfig rules requires we round our answer to the least accurate place value. For us, that’s the tens place because of that 70. So 265.5 gets rounded up to 270 (i.e. 2.7 * 10^2).

That’s the sum we have to use.

Had the third person told us 72 inches, we would get a sum of 267.5, and round to 268 inches.

Now we have to convert to meters. The typical conversion between imperial and metric units of distance is that 1 in = 2.54 centimeters (That’s 3 sigfigs). When we multiply, again, we can only as many sigfigs as our least accurate number, which is 2.

270 in * 2.54 cm/in = 685.8 cm, 685.8 cm / 100 cm/m = 6.858 m

(100 cm is exactly, by definition, 1 meter. So even though 1 meter has only 1 non-zero number in it, and 3 sigfigs, we pretend we have an infinite number of sigfigs** when we divide by 100.)

The cumulative height of you and those three strangers is, with the correct number of significant figures 6.9 meters.

</mathproblem> You can all relax, now.

If you need a more accurate answer than that, then you need to take more accurate measurements. But not just one of them. Note that person who bothered to report their height to the nearest tenth of an inch - or if someone had measured to the nearest eighth of an inch - it wouldn’t have mattered because of Mr. I’m 6 feet tall over there.

* Based on anecdotal experience, he’s probably 5′11″.

** Infinite sigfigs also apply to when you’re counting things, like I have 12 wheels of cheese. Technically you can also have fractions of a wheel of cheese, so that muddies the waters a bit...

Fantastic Four Annual #2 - Stan Lee, Jack Kirby, Chic Stone

1 note

·

View note

Photo

My sigfig is literally standing in a sea of POTUS hair. Thousands available for custom minifigures, DM me for discounts on quantities greater than 100. . This is not a political ad or endorsement. This is here as a notification of availability to custom minifigure creators. I am not using the name of the individual as I do not wish to enter the frays of our political system, I just wish to make sales based on the likeness of individual. Profit. Not politics. Do. Not. Go. There. . . . #shopBigBBricks #LEGO #AFOL #BigBBricks #LEGOlife www.BigBBricks.com #BrickLink #BrickOwl #bricksales #brickpusher #brickslinger #brickdealer #brickworker #brickdomination #andibrick #legoreseller #legocollector #familybusiness #smallbusiness #familyrunbusiness #familyowned #familyoperated #hardestworkingmanonbricklink (at Hershey, Pennsylvania) https://www.instagram.com/p/CE5aizVph4_/?igshid=1dphdzwie3cr2

#shopbigbbricks#lego#afol#bigbbricks#legolife#bricklink#brickowl#bricksales#brickpusher#brickslinger#brickdealer#brickworker#brickdomination#andibrick#legoreseller#legocollector#familybusiness#smallbusiness#familyrunbusiness#familyowned#familyoperated#hardestworkingmanonbricklink

0 notes

Text

The Biggest Contribution Of Sonic Face Paint To Humanity | Sonic Face Paint

The music for the bold will be provided by Hideki Naganuma, the admired artisan abaft the Jet Set Radio games, additionally accepted for his ignment on Sonic Rush, Ollie King, and abounding more. His brand appearance can be heard in the Bomb Rush Cyberfunk sting, which gives us our aboriginal glimpse at the game’s beautiful world. We haven’t had a new Jet Set Radio bold for 18 years, and admirers accept been clamoring for a awakening anytime since.

In absence of SEGA’s absorption in animating the series, indie developers accept kept the Jet Set spirit alive, with Team Reptile’s antecedent amateur – such as Lethal League – and added indie titles such as Rocket Juice Game’s Neon Tail evoking the Jet Set Radio style, admitting beyond altered genres and settings.

There is no solid absolution date or platforms listed as of appropriate now, but Team Reptile affairs to barrage Bomb Rush Cyberfunk in the Jet Set Radio “Future.” How apt.

The Biggest Contribution Of Sonic Face Paint To Humanity | Sonic Face Paint – sonic face paint | Delightful for you to my personal blog site, on this period I’ll demonstrate about keyword. And now, this is the initial image:

Professional Face Painting for Any Event – Face Painting .. | sonic face paint

How about graphic previously mentioned? is usually of which incredible???. if you think maybe therefore, I’l d provide you with some impression again under:

So, if you’d like to acquire these wonderful images regarding (The Biggest Contribution Of Sonic Face Paint To Humanity | Sonic Face Paint), click on save icon to download these photos to your computer. These are all set for save, if you’d prefer and want to take it, just click save logo on the web page, and it’ll be instantly downloaded to your computer.} At last if you want to receive unique and latest image related to (The Biggest Contribution Of Sonic Face Paint To Humanity | Sonic Face Paint), please follow us on google plus or save this blog, we try our best to give you regular update with fresh and new pics. We do hope you like keeping here. For some updates and recent news about (The Biggest Contribution Of Sonic Face Paint To Humanity | Sonic Face Paint) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to provide you with up-date regularly with all new and fresh pictures, like your searching, and find the best for you.

Thanks for visiting our website, articleabove (The Biggest Contribution Of Sonic Face Paint To Humanity | Sonic Face Paint) published . Nowadays we’re excited to declare we have discovered an extremelyinteresting topicto be reviewed, that is (The Biggest Contribution Of Sonic Face Paint To Humanity | Sonic Face Paint) Some people trying to find information about(The Biggest Contribution Of Sonic Face Paint To Humanity | Sonic Face Paint) and of course one of them is you, is not it?

sonic face paint by funfacesballoon on DeviantArt – sonic face paint | sonic face paint

How to Paint Tails From Sonic Face Painting Video – sonic face paint | sonic face paint

A try at Pinkstylists Sonic | sonic face paint

Sonic (соник, Sonic the hedgehog, ) :: разное / картинки, гифки .. | sonic face paint

Custom Lego: SigFig of Christina (one of my best friends) – sonic face paint | sonic face paint

1000+ images about Face Paint- Character Ideas on .. | sonic face paint

StH – Face Paint by Mitarashi — Fur Affinity [dot] net – sonic face paint | sonic face paint

Face Painting ♡ Pintacaritas ♡ Sonic the Hedgehog – YouTube – sonic face paint | sonic face paint

DSC_4981 – sonic face paint | sonic face paint

Sonic painting by AngelofHapiness on DeviantArt – hedgehog face .. | sonic face paint

Sonic Face Painting | halloween | Pinterest | Face, Face .. | sonic face paint

Simple but really fun Sonic – sonic face paint | sonic face paint

Sonic the hedgehog | Face painting designs, Face painting .. | sonic face paint

A Face Paint Sketch thingy(?) I made (Sonic Forces) | Sonic the .. | sonic face paint

Sonic the hedgehog face painting | Party ideas | Pinterest .. | sonic face paint

Sonic the hedgehog Face painting tutorial ! – YouTube – sonic face paint | sonic face paint

DSC_4958 – sonic face paint | sonic face paint

DSC_4954 – sonic face paint | sonic face paint

Clinique Foaming Sonic Facial Soap – sonic face paint | sonic face paint

from WordPress https://www.bleumultimedia.com/the-biggest-contribution-of-sonic-face-paint-to-humanity-sonic-face-paint/

0 notes

Photo

I'M ON A BOAT! Finished building this awesome set. So many details, so many building techniques. It's massive! Added some clear pieces to the bottom so it floats. #lego #legos #afol #moc #legophotography #legobrick #legofan #sigfig #minifig #minifigures #ninjago #legoninjagomovie #destinysbounty #biglego #biglegobuild #legobuild #ninjas #ninja #boat #nautical

#ninjas#moc#destinysbounty#lego#legofan#ninjago#legophotography#afol#minifig#legos#legoninjagomovie#legobrick#biglego#minifigures#sigfig#biglegobuild#legobuild#boat#nautical#ninja

1 note

·

View note

Text

UBS Sells its Robo-Advisor SmartWealth to SigFig

An rising variety of gamers within the aggressive, saturated robo-advice area are struggling to attain scale. Swiss wealth supervisor UBS is continuous the pattern of enormous corporations phasing out their merchandise, at the moment saying the sale of its SmartWealth platform to US robo-advisor SigFig.

Launched in March 2017, SmartWealth is a reasonably customary robo-advisory product that provides customers entry to funding methods completely on-line by plenty of funds constructed and managed by UBS.

As in comparison with UBS’ conventional wealth administration companies, SmartWealth was constructed for clientele who don’t meet the £2 million minimal. An investor can signal on to SmartWealth with solely £15,000.

Nevertheless, the service is at the moment suspended for brand new shoppers, although current prospects can nonetheless log in.

UBS says that the choice got here at the moment as a result of it believes that SmartWealth’s near-term potential is restricted. It has subsequently determined to shut its digital-only providing within the UK, although it was “glad with the business progress of the service.”

The SmartWealth expertise, which was constructed completely in-house, was bought to San Francisco-based SigFig, which UBS acquired an fairness stake in two years in the past as a part of a wider partnership. Along with the cash, the pair launched a joint advice-technology analysis and innovation lab, the place UBS monetary advisors, product specialists and technologists work with SigFig’s digital specialists.

UBS mentioned: “We’re assured that SigFig is greatest positioned to speed up and broaden the business prospects of the IP behind UBS SmartWealth.”

“We consider the choice serves one of the best pursuits of the enterprise and can permit us to speculate additional in different client-facing enhancements, while sharing sooner or later success of the IP we now have created through our fairness holding and ongoing partnership with SigFig,” it added.

source https://www.financeary.com/investing/ubs-sells-its-robo-advisor-smartwealth-to-sigfig.html

0 notes

Text

How to count significant figures in a number?

Mathematics is a subject that most people are not fond of. It involves a lot of concept understanding and state of the art calculation abilities. It is not possible for every individual to possess these skills. This is the reason why people struggle when they do not have a liking for numbers, formulae and logic. The concepts related to significant figures are used for mathematics, chemistry and other disciplines. These calculations go well if you have a thorough understanding of the rules.

Running through significant figures rules

Some of the key rules which you need to know about are listed below.

All non-zero digits are counted as significant

This is the basic but a highly important rule which is used when you are solving problems related to significant figures. Suppose that you have the following number.

2355 and you have to determine the number of significant digits in this number. In accordance with this rule, the answer is 4. The reason being that all digits are non-zero.

In non-decimal numbers, zeros between two significant digits are counted as significant

Let us go through a proper example for understanding this point.

Suppose that you have the following number.

205500.

In the above number, one zero appears between 2 and 5 while the other two are present at the end. Hence, there will be a total of 4 significant figures. The last two zeroes would not be counted as they do not have significant digits on the left and right.

The trailing zeros in decimal numbers are counted as significant

Consider that you have the number given below for which the significant digit count needs to be calculated.

0.20500

In the above number, there will be a total of 5 significant digits. As this number has a decimal, the last two zeroes would be counted as significant.

Rules are not that simple to remember

For some people, it may not be that hard to remember these rules and implement them correctly. It is all about how interested you are in mathematics. If you are not in love with the definitions and concepts, it would be quite hard for you to remember these rules and use them effectively. Unfortunately, most people do not have a serious liking for this discipline. Remembering rules for them is nothing less than climbing Mount Everest. An easier option for all such people is using a sig fig calculator.

The Calculators.tech Sigfig Calculator

Using a tool and selecting a credible one are two very different things. Users face a lot of inconvenience when they end up with the wrong tool. Several alternatives for significant figure calculators are available on the internet. As a user, you have to be smart enough to pick the right one. The calculator by Calculators.tech is a must consideration since it is better than other tools developed for the same purpose.

A strong programming framework to produce accurate outputs

The key purpose of using any tool is getting accurate results. Through manual methods, getting accurate results is not very much possible. Even the best individuals make errors while doing it. However, the accuracy of results in case of Sig fig Calculator also depends on the dependability of implemented algorithms.

The best programming practices have been used to develop this tool so accuracy is certainly not a problem. Once the tool has produced the results, there is no need to recheck anything. In other words, you can depend on the results produced without having any doubt in mind. It is not one of the calculators that get hung if the users use them multiple times.

No need to be a mathematician

This calculator is not used by mathematicians only. Anyone who has to perform these calculations in one way or other would find this tool handy. The interface is quite easy so even if you do not in-depth knowledge of significant figures rules, no difference would be made.

At times, students working on chemistry assignments may come across significant figure problems. It is not necessary that they would be well aware of the rules and important points. Thus, using this calculator would be a better alternative for them.

Free access is a plus

There is no need to swipe your credit card and make a digital purchase. The access to this tool is 100% free so the financial standing of the user does not matter at all. As no money has to be spent at all, any user can use it.

What are the stages of using this calculator?

The following steps have to be completed once you have opened the link.

Enter the number which you wish to round off

Consider that you want to round off the number 25366, simply enter it in the first box and move to the next step.

Enter the number of significant digits for rounding off

How many digits do you want the number to be rounded off? Let us consider that in this case, you need to round off the number to 3 significant digits.

Understanding / viewing the result

When you enter the inputs mentioned above, the following result will be shown on your screen.

25400

How was this generated? The right most digit is 6 which is greater than 5. Hence, 1 will be added to the digit on its left and the number would be dropped. Similarly, the second last digit is also a 6 so the same process will be repeated.

Conclusion

This SigFig calculator is ideal for people who have weak concepts. It is not a piece of cake for everyone to learn these rules. A major percentage of people have no idea how these principles are applied. Hence, to solve these problems, an online calculator becomes a suitable alternative for such users.

This calculator does not put any accuracy problems on the table which is a big relief. In this way, none of the answers have to be rechecked and or confirmed.

!function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '1495938690733585'); fbq('track', 'PageView'); Source link

The post How to count significant figures in a number? appeared first on Trends Dress.

from Trends Dress https://trendsdress.com/how-to-count-significant-figures-in-a-number/ from Trends Dress https://trendsdresscom.tumblr.com/post/613668653723992064

0 notes

Text

Inside the rise and challenges of SigFig, the robo-adviser fintech

This story is available exclusively on Business Insider Prime. Join BI Prime and start reading now.

SigFig has raised some $120 million in funding from the likes of DCM Ventures and Bain Capital Ventures and signed partnerships with industry giants with the promise of powering wealth-tech.

But in recent months, a string of executives and other employees have left, 10% of its workforce was cut, and wealth deal growth has slowed since it partnered with UBS and Wells Fargo four years ago.

In interviews with Business Insider, a dozen sources described the Silicon Valley startup’s rise and more recent struggles to compete as a wealth-tech startup in a crowded space.

The market for white-labeling robo-advice tech for wealth managers is more challenging today than it was when SigFig first launched, and investors are more heavily scrutinizing startups’ life cycles.

Visit BI Prime for more stories.

When SigFig launched in San Francisco nine years ago as a low-cost roboadviser catering directly to customers, it was one of the only games in town.

It was part of a tiny club of pioneering, purely digital roboadvisers, with rivals Wealthfront and Betterment popping onto the scene. Big firms were still a long way from building out their own robo-advice platforms, now commonplace on Wall Street. Investors lined up to back co-founders Mike Sha and Parker Conrad’s vision.

“It’s a big idea,” Sha, the chief executive, told a TechCrunch reporter in a 2012 webcast as he leaned back in a swivel chair next to Conrad and rattled off a list of SigFig’s investors. “I think a lot of people who understand that there’s a real pain point in this industry have gotten excited about the fact that we can help a lot of people.”

DCM Ventures, the $4 billion blue-chip venture capital firm, was a lead investor, Sha said. Bill Harris, the Personal Capital founder and former PayPal chief executive, was also behind them.

The Union Square Ventures partner John Buttrick wrote in a July 2013 blog post that SigFig was on solid footing, with “interesting” investment tools in the works. “It’s too early to say exactly what those will be, except they will be low cost, easy to understand, high quality and investor-friendly,” he said.

But its initial foray into directly managing money for customers wasn’t catching fire.

As of 2016, SigFig as a business-to-consumer company hadn’t caught on as a household name. It pivoted in strategy to a business-to-business (B2B) model and set out to partner with giant wealth management firms to create new tech tools for them and their human financial advisers.

The Swiss bank UBS is a strategic investor in SigFig.

Reuters

It was a moment of transition for SigFig, which has a valuation pegged at $471 million by the robo advice industry research firm Backend Benchmarking. It wouldn’t be the last.

Today, San Francisco-based SigFig has raised some $120 million in funding from investors including Bain Capital Ventures, Union Square Ventures, Eaton Vance, and General Atlantic. It counts Wells Fargo and UBS, two of the largest wealth managers in the US, as partners who pay SigFig to use its technology. UBS also took an undisclosed equity stake.

But over the last 10 months, a string of executives and other employees have left, including its former heads of wealth management and strategic partnerships, who were core to SigFig’s business model. SigFig recently filled the latter role internally, shifting another senior leader into a similar post overseeing all aspects of SigFig’s strategic partnerships.

Last year SigFig, which had around 170 employees at the start of 2019, also laid off some 10% of its workforce, or around 20 people. And SigFig’s wealth deal growth, once white-hot, has flamed out since it first started signing on big banks as clients four years ago, according to sources.

Robo-advice is a scale business. With fees in the ballpark of 25 basis points, a large asset base is critical to creating significant revenue. And as Business Insider has reported, standalone players may struggle to reach scale. They can be “fiercely independent,” and at current valuations may not be attractive M&A targets.

In interviews with Business Insider, a dozen sources, including current and former employees as well as people familiar with the firm, described the Silicon Valley startup’s rise and more recent struggles to make it as a fintech competing in the crowded, cutthroat wealth management arena.

A company spokesperson said SigFig has signed “multiple new partnerships” between 2016 and 2019, but declined to specify on the record which companies that refers to, or how big those partners are. SigFig’s staff and revenue has also grown during that time, the spokesperson said, but declined to provide specific figures around either.

The market for white-labeling robo-advice tech for wealth managers and their financial advisers is more challenging today than it was when SigFig first launched, analysts say. Firms are now building out their own automated investment platforms at relatively low costs. Some of SigFig’s value add, in that sense, has diminished.

Investors, too, are more closely scrutinizing startups’ plans and private valuations after WeWork’s failed-initial public offering fiasco placed a fresh spotlight around other companies’ corporate governance and paths to profitability.

A challenging path

Nine years after its formation, analysts and industry-watchers we interviewed say SigFig is in a challenging position.

“I think the functionality has been commoditized around them,” a person familiar with SigFig’s operations said, referring to the now-ubiquitous automated wealth-tech at many of the industry’s biggest banks.

Since last August, at least five senior employees have left. For startups, employee turnover and slicing headcount is not unusual. But together they highlight SigFig’s difficult moment in the context of the ever-changing wealth management technology space. A company spokesperson confirmed the layoffs, adding that while SigFig “did reshape our talent footprint last year,” it is currently recruiting for more than 20 roles.

Some senior leaders whose roles were critical to forming new deals and taking care of clients have left. Its head of strategic partnerships, Martin Attiq, left last summer, staying on as an adviser through year-end. Its general manager of wealth management, Randy Bullard, left for another role in the field, and SigFig is now advertising for his old job.

Its head of quality assurance, Tung-Huy La, left in December. So did its vice president of branch strategy and integration, Michael Reed. Its chief information security officer, Clint Maples, left in January.

“It was a hard decision for me as I really loved working at SigFig and it was like a family to me,” La said in a December email to Business Insider.

SigFig hired internally for a role similar to its old head of strategic partnerships. The company shifted its former general manager of banking, Dan Mercurio, over to a newly created role where he runs all aspects of strategic partnerships.

A company spokesperson said its senior employees who left “contributed meaningfully to our success to date and our current leadership team is strong and getting stronger.” SigFig is also set to announce a new chief product officer, the spokesperson said.

Mike Sha, the chief executive officer of SigFig.

REUTERS/Lucas Jackson

Meanwhile, funding that’s been plowing into wealth-tech over the last few years has fallen. Venture capital funding into wealth management technology fell to $260 million in the fourth quarter, compared with $516 million a year prior, marking an eight-quarter low, according to the market research firm CB Insights.

SigFig’s board has also shifted. The chief executive of Eaton Vance, Thomas Faust, left as a director last year, according to a filing. He had been a director since 2016. A spokesperson for Eaton Vance, which has invested in SigFig, declined to comment.

A SigFig spokesperson said Faust “remains an active board observer supporting SigFig’s continued growth and success. His transition to being an observer coincides with a new board member joining with 30 years of highly relevant experience in the wealth management industry.”

Some sources described a difficult environment for product managers who felt they were designing products and services for the banks they were partnering with, not SigFig, leaving some employees dispirited.

One former employee, who requested anonymity to speak frankly about her experience, said she felt like employees weren’t given much leverage or freedom around what the company’s big-bank partners wanted.

A company spokesperson said SigFig builds products “not for ourselves, but to help everyday consumers be more financially successful,” and that its “enterprise platform has been selected by partners who collectively serve over 70 million consumers.”

A messy split, then a pivot

Before there was SigFig, there was its predecessor, Wikinvest, which Conrad and Sha founded in 2007. Wikinvest — think Wikipedia, plus investing — was an application to help regular investors track and understand their investments.

Conrad eventually left SigFig after what he has described as a falling-out with Sha, and shortly after leaving in 2012, he launched the workplace benefits software startup Zenefits. Some SigFig staffers went with him.

Regulators later fined Zenefits for selling insurance without proper licenses. Conrad resigned in 2016 amid turmoil at the startup, and surrendered his insurance license in 2018 after entering into a settlement with a California regulator.

SigFig co-founder Parker Conrad later founded Zenefits.

Brian Ach/Getty Images for TechCrunch

In interviews, some former employees and people familiar with the matter described Sha as a “visionary” type of Silicon Valley boss who could have trouble executing projects. Others described a strong, friendly leader who is respected inside the company.

He’s a great salesperson, some former employees said, but at times that didn’t translate into efficiently leading a team effort or deciding direction. Sha previously held a series of positions in engineering and strategic projects at Amazon, and says he was one of the original architects of the Amazon Prime program.

Sha and Carol Pai, a former Facebook and eBay product designer who heads up SigFig’s user experience and visual design, are married. With a couple in senior positions, that power dynamic rubbed some people the wrong way, two former employees said.

A spokesperson said Pai was never on SigFig’s executive team, and that in addition to following other human resources-related best practices, she was hired by and has always been managed by someone other than Sha.

As SigFig’s whole strategy shifted around 2015 from a direct-to-consumer model to building out technology for big firms roughly four years ago, the pipeline was full of big deals.

In April 2016, SigFig signed on the Boston-area community bank Cambridge Savings Bank for an undisclosed amount as its first wealth management partner deal, building out a digital investment management tool called Connect Invest for the bank’s clients, where they could track individual investment goals on a dashboard.

The next month, SigFig said it would create digital tools and services for the thousands of financial advisers in UBS’s Americas business.

For SigFig, it was a coup. UBS is among the world’s largest wealth managers largely with a focus on the ultra-wealthy, with $2.6 trillion in assets under management; $1.4 trillion of those assets are in the US.

Part of UBS’s thinking behind paying SigFig to build technology for UBS advisers and their clients was that advisers could use that tech for their smaller accounts and spend more time catering to clients with more complex needs, according to a person familiar with the deal.

That concept ended up upsetting some advisers, who grew frustrated at the disparate experience of working with clients in two different fashions, according to the person. UBS declined to comment.

For instance, a UBS client using the SigFig product — complete with features like an algorithm-constructed investment portfolio and digital enrollment — has a different experience than one just working with a full-fledged adviser, and harnessing new technology has frustrated some advisers who were given these various options.

Back when UBS and SigFig announced their deal, the startup was one of the only options on the table for what UBS wanted SigFig to do for them, a person familiar with the matter said. And another option had recently disappeared from the market: a few months before that deal was announced, BlackRock bought the digital B2B wealth management tool FutureAdvisor for an undisclosed amount.

SigFig was novel at the time, but times have changed. These days, going low-cost or commission-free for digital wealth tools and transactions is the name of the game.

Customers also take on fees for the low-cost exchange-traded funds they invest in, mostly from Charles Schwab, BlackRock’s iShares product line, Fidelity, Vanguard, and State Street.

For SigFig, big partnerships are its lifeblood

SigFig’s partnerships are crucial to its survival. Its direct-to-consumer base is small relative to its larger competitors, so it’s important for SigFig to team up with big institutions, create wealth-tech products for them, and gain access to their lucrative, built-in client bases.

The company personally managed some $485 million in assets as of March 2019, according to a regulatory filing, most of which is with 11,154 individual investors. That filing does not include the assets held at the banks that use their white-labeled technology — assets on which SigFig makes a percentage. The company today requires $2,000 to open an account, and charges an annual management fee of 0.25%, billed monthly, after funding the first $10,000.

Other robo-advisers like Wealthfront and Betterment directly manage billions of dollars, and traditional wealth managers like Merrill Lynch and Morgan Stanley directly manage trillions.

In June 2016, BNY Mellon’s Pershing Advisors and SigFig entered into a now-inactive partnership. A Pershing Advisors spokesperson declined to comment on when the two firms’ relationship ended, or specifics around why. A person familiar with the matter said SigFig had completed the integration product it intended with Pershing, which its clients now use.

In mid-November of 2016, SigFig and Wells Fargo Advisors, a wealth management subsidiary of the bank with some 13,000 US-based financial advisers, said they were partnering to power WFA’s direct-to-investor robo-advisory platform called Intuitive Investor. Wells Fargo also has a “small equity stake” in SigFig, a spokesperson said.

Wells Fargo is also an investor in SigFig.

REUTERS/Rick Wilking

“Clients with a wide array of asset levels have chosen to open Intuitive Investor accounts,” a Wells Fargo Advisors spokesperson said. “Some are purely self-directed investors and others also have relationships with WFA full-service financial advisors.”

The next month, in December 2016, Citizens Bank said they were teaming up with the startup. SigFig’s deals with UBS, Wells Fargo, and Citizens Bank are all ongoing.

SigFig’s next partnership wouldn’t be publicly announced for nearly three years, and it wouldn’t be with a wealth manager.

Last October, SigFig and the data provider Refinitiv said they were partnering for an undisclosed amount. Unlike other deals where banks paid SigFig to design technology for their advisers and clients, SigFig would create digital advice tools for the institutional investors that use Refinitiv’s clearing and custody platform.

The lull in deal-making — SigFig’s lifeblood — in recent years hasn’t kept the company from raising more money.

In June 2018 the New York-based private equity firm General Atlantic, which is focused on growth equity investments, led a round of $50 million in Series E funding, which is SigFig’s latest round.

Existing investors who also participated in that round included UBS, DCM Ventures, New York Life, and Union Square Ventures. Paul Stamas, a managing director at General Atlantic, joined SigFig’s board of directors.

Meanwhile the broader robo-advice space faces an uncertain future, particularly with some fresh macroeconomic risks. The World Health Organization this week designated the novel coronavirus known as COVID-19 as a global pandemic, hitting economies around the world, a development analysts say is likely to crimp growth and funding.

One former employee at SigFig said that for the company and the wider robo-adviser space, the situation is like “Waiting for Godot,” hoping for something — wider adoption, or breaking through what’s become a commoditized space — that may not come.

More:

Wealth management Finance BI Prime BI Graphics

Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.

%%

from Job Search Tips https://jobsearchtips.net/inside-the-rise-and-challenges-of-sigfig-the-robo-adviser-fintech/

0 notes

Text

WealthTech Weekly: Hearsay Systems, Personal Capital And SigFig

Hearsay Systems has added an automated compliance supervision component to its Relate platform. Personal Capital hit a milestone of $12 billion in assets under management. SigFig’s director of quality assurance has left the robo-advice provider. Hearsay Systems Hearsay Systems announced on Dec. 17 an automated compliance supervision offering for text messaging that is a component of the Hearsay Relate compliant texting platform launched in 2018. from FA News https://www.fa-mag.com/news/wealthtech-weekly--hearsay-systems--personal-capital-and-sigfig-53545.html

0 notes

Photo

Best stock trading apps to get in 2019

Reading Time: 3 minutesIn the following post, we’ve collected all of the best and most-needed stock trading apps of 2019. These apps are not only trading apps, but mobile software that will help optimize your trading experience and maximize your profits. Whether you’re a beginner looking for an app to practice trading or you want access to the best stock trading platforms or would like to invest the balances of your every purchase, we’ve listed the top apps below. So without further ado, here are the best stock trading apps to get in 2019: 1. A Broker App – Your Mobile Trading Platform The first thing anyone looking to trade stocks on a mobile app has to do is find a broker that provides an excellent mobile trading platform. Today, most brokers develop their own software which means finding the right broker is more important than ever before. In our opinion, one of the best ways to figure out which app will suit you the best is to check out this list of the best investment apps offered by brokers in the UK. This particular list is exceptionally comprehensive, and there is definitely something there for everyone. 2. Acorns – For Everyday Investments Acrons is a fun app that allows you to automatically invest in stocks on a daily basis. In order to use the app, you need to connect your debit or credit card to the software, and then Acorns will automatically invest in high-performance stocks using the balance from your everyday purchases. Naturally, the amounts invested are rather small, and you are not likely to become rich from using Acrons. However, it is a good way to diversify one’s portfolio and make use of opportunities you might have otherwise missed. 3. StockTwits – Your Social Media Platform This is a social media app that was designed to allow traders and investors to share ideas, articles, and trading opportunities. With this stock trading app in your arsenal during 2019, you’ll ensure you always have all the latest market information handy as well as an insight into what other traders are doing at any given time. 4. Robinhood – For Free Stock Trading For all of our American readers, the Robinhood stock trading app is a must to consider. Not only is Robinhood free to use without any trading fees, but the interface is one of the most well-designed and easy to use on the market. Since cryptocurrencies were added to the platform in 2018, this stock trading app is now a complete all-around trading tool that you can bring anywhere you go. 5. SigFig Wealth Management – To Keep Plan and Keep Track of Investments SigFig is an app that will help you plan and execute a personalized investment plan based on your needs and expectations. As you probably already know, every investor and trader needs a plan, and with SigFig it has never been easier. The app is connected to all major markets in the world, and it provides you access to licensed stock trading advisors for a highly competitive price. 6. Motif Explorer – Invest In High-Performing Portfolios This innovative and groundbreaking stock trading app consists of hundreds of handpicked portfolios containing the best and most lucrative instruments in different categories. For example, you can invest in the 30 best tech stocks, Biotech Breakthroughs, Fighting Fat stocks, etc. 7. Stash – For the Beginner with Limited Budget Stash is a stock trading app that makes it easy for beginners to invest small amounts of money in individual stocks. The minimum deposit is $5, and the interface has been designed without any excess which means that even complete beginners can pick it up and start trading immediately. This stock trading app is great for beginners wanting to learn how to trade but is not optimal for more serious traders. 8. Stock Market Simulator – For The Beginner That Needs Practice The stock market simulator is exactly what it sounds like, a simulator for stock traders. With this app, you can invest in stocks from the American stock market using virtual money with absolutely no risk. It’s the perfect gateway to a real stock trading app and a great introduction to investing for beginners that want to practice before investing their hard earned money. Similar to a demo account offered by a real stockbroker, the stock market simulator will give you the advantage of experience before your first real investment. 9. Benzinga – To Stay Up To Date With The Latest Developments Benzinga offers a state of the art app that helps you stay up to date with the latest market trends, news, and investment opportunities. This stock trading app can’t be used to trade stocks, but it will make sure that you never miss a great investment again. Not only that, but Benzinga’s writers are all experienced traders who are more than happy to share their investment plans and tips directly through the app. The post Best stock trading apps to get in 2019 appeared first on MoneyMagpie.

https://www.moneymagpie.com/manage-your-money/best-stock-trading-apps-to-get-in-2019

0 notes

Text

Best stock trading apps to get in 2019

Reading Time: 3 minutes

In the following post, we’ve collected all of the best and most-needed stock trading apps of 2019. These apps are not only trading apps, but mobile software that will help optimize your trading experience and maximize your profits.

Whether you’re a beginner looking for an app to practice trading or you want access to the best stock trading platforms or would like to invest the balances of your every purchase, we’ve listed the top apps below.

So without further ado, here are the best stock trading apps to get in 2019:

1. A Broker App – Your Mobile Trading Platform

The first thing anyone looking to trade stocks on a mobile app has to do is find a broker that provides an excellent mobile trading platform. Today, most brokers develop their own software which means finding the right broker is more important than ever before.

In our opinion, one of the best ways to figure out which app will suit you the best is to check out this list of the best investment apps offered by brokers in the UK. This particular list is exceptionally comprehensive, and there is definitely something there for everyone.

2. Acorns – For Everyday Investments

Acrons is a fun app that allows you to automatically invest in stocks on a daily basis. In order to use the app, you need to connect your debit or credit card to the software, and then Acorns will automatically invest in high-performance stocks using the balance from your everyday purchases.

Naturally, the amounts invested are rather small, and you are not likely to become rich from using Acrons. However, it is a good way to diversify one’s portfolio and make use of opportunities you might have otherwise missed.

3. StockTwits – Your Social Media Platform

This is a social media app that was designed to allow traders and investors to share ideas, articles, and trading opportunities. With this stock trading app in your arsenal during 2019, you’ll ensure you always have all the latest market information handy as well as an insight into what other traders are doing at any given time.

4. Robinhood – For Free Stock Trading

For all of our American readers, the Robinhood stock trading app is a must to consider. Not only is Robinhood free to use without any trading fees, but the interface is one of the most well-designed and easy to use on the market. Since cryptocurrencies were added to the platform in 2018, this stock trading app is now a complete all-around trading tool that you can bring anywhere you go.

5. SigFig Wealth Management – To Keep Plan and Keep Track of Investments

SigFig is an app that will help you plan and execute a personalized investment plan based on your needs and expectations. As you probably already know, every investor and trader needs a plan, and with SigFig it has never been easier. The app is connected to all major markets in the world, and it provides you access to licensed stock trading advisors for a highly competitive price.

6. Motif Explorer – Invest In High-Performing Portfolios

This innovative and groundbreaking stock trading app consists of hundreds of handpicked portfolios containing the best and most lucrative instruments in different categories. For example, you can invest in the 30 best tech stocks, Biotech Breakthroughs, Fighting Fat stocks, etc.

7. Stash – For the Beginner with Limited Budget

Stash is a stock trading app that makes it easy for beginners to invest small amounts of money in individual stocks. The minimum deposit is $5, and the interface has been designed without any excess which means that even complete beginners can pick it up and start trading immediately.

This stock trading app is great for beginners wanting to learn how to trade but is not optimal for more serious traders.

8. Stock Market Simulator – For The Beginner That Needs Practice

The stock market simulator is exactly what it sounds like, a simulator for stock traders. With this app, you can invest in stocks from the American stock market using virtual money with absolutely no risk. It’s the perfect gateway to a real stock trading app and a great introduction to investing for beginners that want to practice before investing their hard earned money.

Similar to a demo account offered by a real stockbroker, the stock market simulator will give you the advantage of experience before your first real investment.

9. Benzinga – To Stay Up To Date With The Latest Developments

Benzinga offers a state of the art app that helps you stay up to date with the latest market trends, news, and investment opportunities. This stock trading app can’t be used to trade stocks, but it will make sure that you never miss a great investment again.

Not only that, but Benzinga’s writers are all experienced traders who are more than happy to share their investment plans and tips directly through the app.

The post Best stock trading apps to get in 2019 appeared first on MoneyMagpie.

Best stock trading apps to get in 2019 published first on https://justinbetreviews.weebly.com/

0 notes

Text

The Latest In Financial Advisor #FinTech (September 2018)

Welcome to the September 2018 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month’s edition kicks off with the big news from Schwab that, after years of promising that it is working on a next-generation multi-custodial replacement to PortfolioCenter, the new PortfolioConnect solution will only work directly with the Schwab custodial platform… but will be more deeply integrated, and more importantly free to Schwab advisors, in what could become a major inducement to advisory firms to join or consolidate with Schwab given that portfolio accounting software is the most expensive line item in most RIAs’ technology budgets. In the meantime, for those who want to remain multi-custodial, Schwab noted that PortfolioCenter will also be receiving an upgrade this fall, to ostensibly remain as the multi-custodial server-based alternative that independent RIAs can choose to purchase separately.

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

JPMorgan Chase launches a new “YouInvest” trading platform that will provide 100 trades for free with no account minimums, and indefinite free trades to those in its Private Client group, putting newfound pressure on independent RIA custodians to justify why their advisors should be at a competitive disadvantage.

RightCapital launches the first dedicated student loan planning module in a financial planning software package

MoneyGuidePro deepens its integration with WealthAccess as advisors and clients apparently prefer the third-party PFM solution to MGP’s own client portal

Galileo Processing announces a new debit card structure that can allow clients to spend directly from an investment account that stays fully invested without the need to hold any cash aside in advance

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including Orion adding its own “planning light” tool in partnership with FinMason, UBS deciding to wind down its internally built SmartWealth robo platform and go all-in with its SigFig partnership, FMGSuite acquires Platinum Advisor Strategies to build out its “HubSpot for Advisors” content marketing platform (as ousted former Platinum co-founder Robert Sofia spins up his own HubSpot-for-Advisors competitor SnappyKraken), and the CFP Board demonstrates a novel application for applying blockchain in financial services: a public ledger to verify who is a CFP certificant, replete with an authenticated “digital CFP certificate” that advisors can use on their websites and in their email signatures.

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you’re continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Read More…

from Updates About Loans https://www.kitces.com/blog/the-latest-in-financial-advisor-fintech-september-2018/

0 notes

Text

The Latest In Financial Advisor #FinTech (September 2018)

Welcome to the September 2018 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month’s edition kicks off with the big news from Schwab that, after years of promising that it is working on a next-generation multi-custodial replacement to PortfolioCenter, the new PortfolioConnect solution will only work directly with the Schwab custodial platform… but will be more deeply integrated, and more importantly free to Schwab advisors, in what could become a major inducement to advisory firms to join or consolidate with Schwab given that portfolio accounting software is the most expensive line item in most RIAs’ technology budgets. In the meantime, for those who want to remain multi-custodial, Schwab noted that PortfolioCenter will also be receiving an upgrade this fall, to ostensibly remain as the multi-custodial server-based alternative that independent RIAs can choose to purchase separately.

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

JPMorgan Chase launches a new “YouInvest” trading platform that will provide 100 trades for free with no account minimums, and indefinite free trades to those in its Private Client group, putting newfound pressure on independent RIA custodians to justify why their advisors should be at a competitive disadvantage.

RightCapital launches the first dedicated student loan planning module in a financial planning software package

MoneyGuidePro deepens its integration with WealthAccess as advisors and clients apparently prefer the third-party PFM solution to MGP’s own client portal

Galileo Processing announces a new debit card structure that can allow clients to spend directly from an investment account that stays fully invested without the need to hold any cash aside in advance

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including Orion adding its own “planning light” tool in partnership with FinMason, UBS deciding to wind down its internally built SmartWealth robo platform and go all-in with its SigFig partnership, FMGSuite acquires Platinum Advisor Strategies to build out its “HubSpot for Advisors” content marketing platform (as ousted former Platinum co-founder Robert Sofia spins up his own HubSpot-for-Advisors competitor SnappyKraken), and the CFP Board demonstrates a novel application for applying blockchain in financial services: a public ledger to verify who is a CFP certificant, replete with an authenticated “digital CFP certificate” that advisors can use on their websites and in their email signatures.

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you’re continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Read More…

from Updates About Loans https://www.kitces.com/blog/the-latest-in-financial-advisor-fintech-september-2018/

0 notes