#alternative investments

Photo

VINTAGE PARKER ROYAL CHALLENGER SWORD-CLIP SENIOR SILVER HERRINGBONE FOUNTAIN PEN

Parker Royal Challenger Fountain Pen

- rare sword pocket clip

- Silver herringbone pattern

- Senior Long Bold Pen of Overall Length 5-1/4 inches

- double jewel - twin-tassie

- Button filler

Up here for your consideration is a vintage Parker Royal Challenger Senior fountain pen, which was manufactured in USA circa 1930s.

The pen is in excellent condition.

The pen is a rare and highest grading among the CHALLENGER series; and the color is in silver pearl marble with herringbone pattern.

This is highly collectible, as the pen bears SWORD POCKET CLIP, which is highly sought after feature.

The pen bears deluxe triple chrome plate cap band with double-jewel / twin-tassie.

The body has been polished to glossy colour.

The imprint on the barrel is crisp.

The button filling system is in perfect working order.

The pen has been serviced and tested for its full functionality. This Parker Royal challenger is a classic elegance and has been produced to the highest standards of craftsmanship, technology, and aesthetics. This would make an excellent gift to treat yourself or someone important.

Please also refer to our Parker pen collections.

#vintage pen#vintage parker pen#vintage parker royal challenger fountain pen#royal challenger#alternative investments

5 notes

·

View notes

Text

Exploring Unconventional Paths to Financial Success Online

In today’s digital age, financial success is no longer limited to traditional career paths. With the rise of technology and the internet, there are now countless unconventional ways to make money online. Whether it’s through innovative ideas, strong connections, or capitalizing on emerging trends, individuals are finding creative ways to turn their passions into profitable ventures. At…

View On WordPress

0 notes

Text

Masterworks Review: Best Art Investment Platform of 2024

Explore Alts just completed a comprehensive review of Masterworks. We compared it with six other art investment platforms to conclude that Masterworks is the best art investment platform of 2024.

Link to article on ExploreAlts.com

#investing#finance#alternative investments#alternative assets#investmentplatforms#alts#alternativeassets#alternativeinvestments#altsplatforms#artinvesting#art investment

0 notes

Text

Our experts will guide you to choose the right AIF (Alternative Investment Fund) for profitable investment.

For More Info Visit -

#finance#financial services#financial advisor#AIF#alternative investments#Alternative Investment Funds

0 notes

Text

What Everyone Should Know About Investing

how to get funding for a startup that a lot of people are interested in would be real estate investing. This is a great market to get into to make and spend money. It is, however, not too simple to get into. If this is what you want to learn more about, then keep reading this information.

Make sure that you set realistic goals based on the budget that you have. You should not set a goal to buy ten houses in the span of a month if you only have a hundred thousand dollars to your name. Set reasonable expectations to avoid setbacks at all costs.

Go into the meetings that you have with potential investors with a positive mindset, but understand that a negative outcome is possible. Always have a jovial, but businesslike personality to get the people who want to invest to like you. This will go a long way and make your potential investors more comfortable.

Location is very important in real estate. The condition of a property can be corrected; however, the location cannot be changed. It's not smart to invest in depreciating areas. Always do your research on a property before investing any money.

If you are already a homeowner or have experience as one, consider starting your real estate investment efforts with residential properties. This arena is already something you know about, and you can start good investment habits. Once you are comfortably making safe money here you can move on to the slightly different world of commercial real estate investment.

A fixer-upper may be cheap, but think about how much you have to renovate to bring it up in value. If the property only needs cosmetic upgrades, it may be a good investment. However, major structural problems can very costly to fix. In the long-run, it may not give you a good return on your investment.

When considering what real estate to purchase, the word "location" should come to mind. However, many people forget to think about all the concerns that are factored into "location." Find out all the information you can about the neighborhood, such as surrounding home values, crime rates, schools, employment and more.

Determine which types of buildings are easily maintained. When you invest in real estate, it is more than just buying property. You need to consider how you're going to keep up with a property so you can sell it in the future. A one-story home is not as difficult to maintain as a multi-family building, for example. Don't take on anything you can't reasonably handle.

Learn as much as you can before making your first investment. There are a ton of books available on real estate investing. Plus there are many online (and offline) communities out there where real estate investors share their best practices. The more you learn, the better chance that you won't make any critical errors.

Specialize only in one type of investment real estate. For example, you can choose to focus on fixer-uppers, condominiums, starter homes or apartment buildings. Having a niche that you specifically know a lot about allows you to be more successful and it leaves less room for error when it comes to analyzing the flaws of a property.

If you are not careful with your cash, you will never have any to invest. Have a budget for every month and stick to it. Let yourself have some extras, but keep focused on your goal. If you're into frivolous spending, you're not going to be successful when it comes to investing.

Keep your investments diversified. Industries never all prosper all at once. The market is always fluctuating. By putting your money into many different places, you can make more and minimize the risk of losing all of your money on one bad investment. Diversifying your investments carefully is always a good idea.

Know what is necessary for liquidation prior to investing. This is crucial to decide how you will be allotting your money between investments. For instance, if you don't carry a simple CD's vehicle to term, you will suffer penalties. Another example is that limited partnerships don't always let you cash out anytime you want.

As is probably clear to you now, getting into real estate investing can be a little tricky. However, now that you have this great advice, things shouldn't be that hard on you. Just keep what you've read here in mind when you get started and you should have an easy time with all of this.

1 note

·

View note

Text

Great Advice On Investing Like A Smart Person

Are you going to be investing in some real estate? If the answer is yes, then you need to learn all that you can before you try to make any big purchases. If not, you may lose everything. To start on the right path with investing, continue reading the article below.

Remember that real estate investing is all about the numbers. When you're buying a home to live in, you may get emotional about the place, but there's no room for that in investing. You need to keep your eye on the data and make your decisions with your head, not your heart.

Two guidelines must be considered prior to investing in commercial properties. Start by not overpaying for the land. Second, avoid overpaying for the business. Look at both the potential property value as-is, and understand how much rent is paid by the business. These numbers should both be good enough to support a decision to purchase this property.

Think long- green energy stocks when investing in real estate. While how to get funding for a startup seek to make quick turnovers by buying cheap and flipping within weeks or months, your better bet is a longer view. Look for safe properties where you can park a big sum of money and get investment return via monthly income like rent.

Consider building up a real estate rental portfolio that can continue to provide you with consistent profit for retirement purposes. While purchasing homes to sell for profit is still possible, it is less of a reality in today's world than it has been in the past. Building up rental income by purchasing the right properties is trending vs flipping homes due to the current housing market.

Don't let your real estate investments eat up your cash or emergency reserve fund. Real estate investments involve a great deal of money that you may not be able to access for quite some time. startup companies to invest in may take years to see a good return. Don't let this hurt your daily life.

Don't make a purchase just for the sake of owning more properties. All that occurs when this is done, unless you are filthy rich and buying prime properties, is you risk values dropping on some as you cannot devote the time necessary to maintaining it, or a neighborhood may economically collapse. Focus on quality and research before you invest. By doing this, you increase the values of what you have and receive the highest return.

Never give up! Real estate investing is not a simple thing to jump into. There's a lot to learn, and you should expect quite a few bumps and bruises along the way. But with patience and increased skills from playing the game, you'll become better and better at it.

Try to invest now if you plan on doing real estate as a side business or career. One big mistake people make is not immersing themselves in the market immediately and educating themselves on it. There are many other people who are jumping into this lucrative type of investment, and you will lose out if you let them beat you to the punch.

Consider maintenance needs when choosing the type of building to purchase. When investing, it's not enough to simply buy a property. You must consider the property's maintenance. For instance, it will be harder to maintain a multiple-story home that it will be to take care of a one-story unit. Never overextend yourself in your real estate endeavors.

Pay attention to the surrounding houses. When buying a property, make sure to pay attention to the whole neighborhood. How does the house fit in? Are the lawns in the neighborhood all well-maintained. Are any of the homes in bad shape? Make sure you spend some time driving around the neighborhood.

Don't neglect that tax benefits of real estate investment. Set up your real estate investments in appropriate LLC or S-corp legal entities. Do so very early in getting involved in real estate investing. You do this early to maximize your long-term benefits and because the longer you wait the more complicated it gets to do so.

The real estate market offers a good place for investment of capital and even potential income streams, but you have to be sure about what you're doing. With all that's here, you've got a better chance of making a good choice. Remember them as you go forward.

1 note

·

View note

Text

Bullion Safekeeping: My Vault's Tale

Hello dear readers! Today, I invite you to join me on a journey, a true story that unveils the often-overlooked complexities of storing precious metals. This is more than just a tale of gold and silver; it’s a narrative woven with caution, insight, and a twist that even I, a seasoned investor, did not see coming. So, grab a cup of coffee, settle in, and let’s dive into a story that might forever…

View On WordPress

0 notes

Text

Top 5 Alternative Investment Options In India

Learn insights and an overview of recent alternative investment trends in India that can help investors capitalize on emerging opportunities.

0 notes

Text

Leasing: An Alternative Investment Product

Fixed-income products with equity-like returns

Leasing is a simple contractual arrangement calling for the lessee (user) to pay the lessor (owner) regular payments in exchange for the use of an asset over an agreed period of time. Buildings, vehicles, and equipment are among the most common assets that are leased.

Benefits to Investor

• Opportunity to earn a high fixed return for a specified period of time

• Leasing adds to portfolio diversification by giving a chance to finance different asset classes

• Easy way to provide exposure to different asset classes such as real estate, vehicles, construction equipment, medical equipment, E-battery infrastructure, furniture/fixtures, laptops, etc.,

• Mitigating the risk investors face by parking all their money in single or fewer investments

Click here to know more about

0 notes

Photo

Vintage Parker Duofold Senior Big Red Senior Lucky Curve fountain pen

- PreWar - The Flagship of the Parker Pen Company- Comes with original nice Parker big red gift box- 'Lucky curve' banner imprint on barrel- Rare Big Red - Glossy Red Lacquer- Senior Long Bold Pen of Overall Length 5-1/2 inches- Button-filling system- Excellent condition NO crack

Up here is a vintage Parker Duofold SENIOR Lukcy Curve Flat-Top Button Filler fountain pen, also referred as 'Big Red', which was manufactured Pre-War in USA circa 1910s.

The pen comes with a nice matching Parker big red fountain pen paper box, in nice condition.

The Parker Duofold is one of the most recognizable and enduring fountain pen designs. Launched in 1921, the pen was a phenomenal success and put the Parker Pen Company squarely into the front rank of fountain pen manufacturers. Duofold remain popular in Europe being produced well into the 60s in varying sizes and colors when it was revived in the 80's once again as Parker's Flagship model.

This Parker Duofold is a fine example, in stunning red lacquer.

It is also RARE SENIOR version, largest size of the series, of overall length 5-1/2 inches.

The pen is in excellent condition, without any crack only some mionr wears due to age.

The imprint on the barrel is weak; yet it is in large font version, showing it is an early production of the series; with 'LUCKY CURVE' banner.

It bears a large Parker 14ct solid gold nib, non-flexible, writing fine line.

The Parker Duofold has a button filling system, which is particularly simple and elegant filling method - the end of the pen unscrews revealing a button which is depressed while the nib is immersed in ink.

The pen has been serviced and tested for full functionality. This pen is rare and very much sought after, of such a vintage pen in good condition. Ownership of pen with the history and prestige of the Parker Duofold, will provide the owner with a feeling of satisfaction and a sense of ceremony each time that they write.

The Parker Pen Company was founded in 1888 by George S. Parker, whose mission was to manufacture a better pen. The Parker Pen Company's tradition epitomizes the highest standards of craftsmanship, technology, and aesthetics. In 1921, the company introduced the iconic Parker Duofold pen. Yet by the early 1930s, Parker launched replacement for Duofold, the Vacumatic. In 1941, the company developed the most widely used model of fountain pen in history (over $400 million worth of sales in its 30-year history), the Parker 51. It is also referred as 'the most wanted pen'. From the 1920s to the 1960s, Parker was No.1 in worldwide writing instrument sales.

You can also view our item on Trumblr.

#vintage parker#parker#parker duofold#parker big red#vintage parker pen#parker pen#vintage parker fountain pen#alternative investments#invest collectibles

2 notes

·

View notes

Text

Alternative Investments | Q-investmentpartners.com

Discover a smarter way to invest with Q-investmentpartners.com. We provide alternative investments with superior returns and risk management to help you reach your financial goals.

Alternative Investments

0 notes

Text

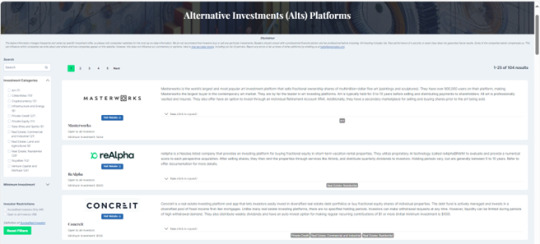

Alternative Investment Platforms

Explore Alts just launched a searchable database of over 100 alternative investment platforms! You can filter by required minimum investments and categories such as art, private equity, royalties, real estate, venture capital, infrastructure and energy, rare collectibles, private credit, and more. You can also filter to see which platforms are open to all investors vs. those limited to just accredited investors. Check it out!

https://explorealts.com/platforms/

#investing#alternativeinvestments#alts#alternativeassets#alternativeinvestmentplatforms#altsplatforms#investmentplatforms#finance#alternative assets#alternative investments

0 notes

Text

#Alternative Investments#Diversified Portfolio#Hedge Funds#Real Estate Investments#Financial Planning#Wealth Management

0 notes

Text

Future of Alternative Investments : Real Estate Debt Funds

Future of Alternative Investments with a deep dive into Understanding Real Estate Debt Funds , guide to Understanding Real Estate Debt Funds.

#Real Estate Debt Funds#Alternative Investments#Real Estate Alternatives#Alternative Real Estate Investment

0 notes

Text

Alternative Investments: Everything You Need to Know in 2023

If you’ve got some financial liquidity, act smart and take advantage of alternative investments— the best way to save and grow money is to invest it.

With the current economic climate, investing is one of the best things you can do to protect your finances (whether you’re investing as part of a business, or as an individual investor.

Having a diverse investment portfolio is one of the best things…

View On WordPress

0 notes

Text

Beginner’s Guide to Treasury Bills

What are Treasury Bills (T-Bills)?

Let’s understand this in the simplest way possible!

The government undertakes many projects for building the nation.

When the government has to fund projects to construct highways, repay debts, build defense systems, or execute social programs, it borrows money from investors by issuing Treasury bills. Essentially, Treasury bills are short-term loans to the government, with maturities ranging from a few days to a few months but usually less than a year. In exchange for the money borrowed, the government pays a small fee to the investors which can be called the return. Overall, Treasury bills are a way for the government to obtain short-term financing while providing investors with a safe and reliable investment option.

Why does the government issue Treasury Bills?

That’s a great question!

While government collects taxes from the public to undertake developmental projects, all the taxes collected by the government as revenue may not be adequate to cover all the government’s expenses.

Additionally, the government is responsible to execute the operations without depleting the cash reserves below a defined threshold limit. For this reason, the government depends on issuing Treasury Bills to raise short-term capital without disturbing cash adequacy.

Another reason why the government may issue Treasury Bills is to monitor the interest rates in the economy. By competing with other borrowers in the market, the government can help in checking the interest rates and avoid volatility in the financial markets.

Click here to know more about

#best fixed income investments india#best platform for investment#what are bonds#where to invest money#alternative investments

0 notes