#anchor bay Technologies

Text

Alright, deeply circumstantial conspiracy theory time.

Remember how we never fucking figured out Vence Nuthaleus's deal? Ludinus's annex, who supposedly was working outside of Ludinus's knowledge or orders?

The Nein found two Abyssal Anchors in Xhorhas while chasing the Angel of Irons cultists, ostensibly to cause chaos and distraction during the war. These anchors were created by Vence based on tech used by demon generals during the Calamity to invade the Material Realm with more ease, and Vence created crude approximations of them, that Obann then deployed in Asarius and Braan.

(If only Caleb hadn't incinerated that goblin in Braan. We could've cracked this case wide open years ago.)

under a cut, as this is long—and does contain spoilers for c2:

The last anchor the Nein come across directly is in the Chantry of the Dawn; Jester scries on Vence delivering it to Cardinal Respa, along with two scrolls that are supposedly from the vaults of Vasselheim that provide guidance for establishing a ritual in the Chantry, upon a fane that was one of six holding Tharizdun at bay. Respa notices the scrying, and ends it, and the Nein immediately head to the Cathedral, though Vence has already left, and the anchor is set up as a distraction, while the main ritual happens elsewhere.

This is primarily notable because the timeline is fairly compressed. Jester scries on Vence while they're already in Rexxentrum; they go to the Chantry and fight assorted cultists under Respa's watch, the demons coming out of the portal, Obann's crew of cultists, and then Obann the Punished. They exit the basement fairly quickly and talk to several officials who have arrived at the Chantry, and then are immediately marched to Dwendal's throne room for an audience.

This is the conversation in which Ludinus admits that Vence had "recently" asked for an Amulet of Nondetection, and he granted the request. Given that Vence hadn't been attuned to it prior to going to the Chantry, he evidently takes the time to attune to it within the two hours (accounting for travel times around Rexxentrum) between those periods.

Here's where we start to get circumstantial: if Vence had obtained the amulet before, why hadn't he attuned to it immediately? It's possible he hadn't even gotten the amulet until then, at which point there was already a Kryn attack underway, as well as a significant disturbance at the Chantry of the Dawn. This seems an odd time to request such an item, as well as a rather foolish move on Ludinus's part to grant the request with little information.

With that in mind, let's go back for a moment to the Abyssal Anchors.

They're said to be crudely-reconstructed versions of Calamity-era technology. They create a planar rift between realms. They were not designed to assist in the ritual to summon Tharizdun, and instead seem only to have been a distraction—though a rather odd one, as they created minor nuisances that were, in both cases, dealt with by the Nein, and never on the direct orders of the Dynasty's leadership. The war itself seems as though it would've been distraction enough.

We also hear that there have been similar anchors discovered across the Empire, collected, and destroyed—words that come only from Ludinus's mouth.

The Nein had considered that perhaps Ludinus knew what Vence had been up to, but they had no tangible evidence of that, and he of course denied it. I recall considering the possibility at the time that he had even been involved, and mostly discarding it because he seemed to have no motivation to do so.

But now we know that something notable happened about six years ago, in the timeframe of the Material Plane: according to the Calloways, Ruidus became visible in the sky in the Feywild, and presumably with it, the Shadowfell.

We know that at the time, Ludinus was using the findings from his stolen beacons to create the dunamantic liquid that was used to make an assassination attempt on Keyleth. We also know that at some point, an annex of Ludinus obtained scrolls from the vaults of Vasselheim that gave instruction on creating a ritual to "release the fane" beneath the Chantry. (Fanes are, generally, places of power—which is similar to the list of locations across the Feywild that Ludinus looked into in order to absorb power from, per the notes that Team Wildemount discovered in Gildhollow Tower.) Incidentally, we also know that Ludinus oversaw, in 835 PD, the excavation of crash site A2 in Eiselcross, which held both the corrupted forest akin to the Savalirwood, and a threshold crest just beyond that. All of this happened roughly around or just before Ruidus was tethered to the Feywild.

Though we may never know for sure that these things are related, my theory is that these crude iterations of the Abyssal Anchors were the test run for whatever arcane device that Ludinus used to tether the moon in the echo planes, finally allowing him the ability to put his long-considered plan into motion.

#but how does the chair fit into all of this. 🤨#this is a joke. we all know that goblin didn't know anything. *but the chair.....*#critical role#cr meta#ludinus da'leth#I have been pepe silvia-ing all morning putting these pieces together#also blowing a kiss as always to encyclopedia exandria for making it way easier to track all of this bullshit down#could not pepe silvia without y'all

477 notes

·

View notes

Text

Harnessing the Winds of Change: The Renewable Revolution

At the forefront of this renewable revolution are advancements in solar energy technology. From humble beginnings as bulky, expensive panels dotting rooftops, solar power has undergone a remarkable transformation, propelled by innovation and economies of scale. Today, sleek and efficient solar panels adorn homes, businesses, and vast solar farms alike, harnessing the sun's abundant energy with unprecedented efficiency. But the true breakthrough lies in the realm of perovskite solar cells – a marvel of materials science that promises to revolutionize the solar industry.

Perovskite solar cells, named after the naturally occurring mineral with similar crystal structure, boast remarkable properties that rival conventional silicon-based photovoltaics. With their thin, lightweight design and potential for low-cost production, perovskite cells are poised to drive down the cost of solar energy even further, making it accessible to communities around the globe. But perhaps most importantly, perovskite cells have shattered efficiency records, reaching levels previously thought unattainable. With each technological leap, solar energy edges closer to its ultimate goal – becoming the backbone of our energy infrastructure, displacing fossil fuels and slashing carbon emissions in the process.

Yet, the sun is just one piece of the renewable puzzle. Across wind-swept plains and rugged coastlines, another renewable giant is coming into its own – wind power. Long celebrated for its environmental benefits and inexhaustible supply, wind energy has undergone a remarkable evolution in recent years, driven by advances in turbine design, materials science, and data analytics. Gone are the days of towering, monolithic turbines dominating the landscape. In their place, sleek and agile machines harness the power of the wind with unparalleled efficiency, thanks to innovations such as smart rotor blades and advanced control systems. But perhaps the most transformative development in the world of wind energy is unfolding offshore. As traditional onshore wind resources reach their limits, offshore wind farms offer a tantalizing opportunity to tap into the vast potential of our oceans. Here, where the winds are stronger and more consistent, floating platforms support a new generation of wind turbines, anchored miles from shore in depths once thought impassable. It's a technological feat that promises to unlock vast reserves of clean, renewable energy, while simultaneously revitalizing coastal economies and reducing our dependence on fossil fuels. Meanwhile, beneath the surface of our rivers and oceans, hydroelectric power continues to flow, quietly generating clean electricity with minimal environmental impact. But the true promise of hydroelectricity lies not in its traditional form, but in the realm of innovation. Pumped hydro storage, once considered a niche technology, is emerging as a crucial component of our future energy landscape. By using surplus electricity to pump water uphill during periods of low demand, pumped hydro facilities serve as giant batteries, storing energy for when it's needed most. It's a simple yet elegant solution to the intermittent nature of renewable energy sources, smoothing out peaks and valleys in electricity generation and bolstering grid reliability. Yet, as we look to the depths of our oceans, we find another source of untapped potential – tidal energy. With the ebb and flow of the tides, vast amounts of kinetic energy lie waiting to be harnessed, powering turbines and generating electricity with minimal environmental impact. But tidal energy is more than just a theoretical concept – it's a burgeoning industry with the potential to revolutionize coastal communities around the world. From the shores of Scotland to the bays of Nova Scotia, tidal energy projects are taking shape, paving the way for a future powered by the rhythms of the sea. And beneath our feet, a source of heat as old as the Earth itself holds the key to unlocking a renewable revolution – geothermal energy.

By tapping into the Earth's natural heat, geothermal power plants produce electricity with minimal greenhouse gas emissions, providing a reliable and consistent source of baseload power. But the true innovation lies in enhanced geothermal systems (EGS) – a groundbreaking technology that promises to expand the reach of geothermal energy far beyond volcanic hotspots. By creating artificial reservoirs deep underground and circulating water through them at high pressures, EGS technology has the potential to unlock vast reserves of clean, renewable energy, transforming the very fabric of our energy landscape. In the face of mounting environmental challenges, the need for sustainable solutions has never been more urgent. But as we stand on the cusp of a renewable revolution, the path forward has never been clearer.

3 notes

·

View notes

Text

Bonds of Smoke and Steel, ch. 6

Had this chapter mostly written for like....forever...

Full chapter over on AO3 -- chapter does have an explicit scene in it as a heads up

Preview:

"Not big on subtlety, are they?"

There was a teasing edge to Taylor's voice, but it didn't do much to erase the awe Danse could see in his face. He found himself smiling a little, more than a bit proud at the display being showcased above.

He'd been reasonably sure the Prydwen would come; several recon teams already lost to the Commonwealth, all efforts pointing to energy level anomalies that couldn't -- and shouldn't -- be ignored, and it was in keeping with Elder Maxson's hands-on approach that he would come with a strong contingent of the Brotherhood.

And that meant arriving in their pride and joy.

The Prydwen was a marvel of engineering, capable of holding an impressive number of knights, scribes, initiates, as well as their higher-ups. Danse had personal quarters of his own up there, for all he didn't have much in terms of sentimental items or keepsakes. But it was practical, with access to Proctor Ingram's armor bay, a fully functioning infirmary, labs, and plenty of space for the scribes to do their work processing and tagging any interesting technological finds -- which Danse's team had plenty to hand over.

As they watched the airborne vessel anchor itself into place over the remnants of the Boston Airport, several smaller craft detached and cycled out in scouting patterns -- Vertibirds, and Danse quickly spotted one angling in their direction.

"C'mon," he urged, heading back towards the police station. "They're going to want a full report -- and officially welcome you to our ranks."

Taylor's awe continued once they were aboard. Their Vertibird pilot had given him the go-ahead to use the mounted machine gun to track potential threats down below -- Super mutants in particular needed little prompting to try shooting them down -- and while the flight to the Prydwen was uneventful it still felt good to see Taylor get a better taste of what the Brotherhood was capable of beyond Danse's reduced recon team.

He enjoyed it while he could, tagging along as Taylor got a quick tour of the ship, a medical check-up and, Danse was pleased to note, a Brotherhood power armor set. T60, in far better shape than the man's old T45, and the Paladin was pleased to see the way Taylor smiled as the other man ran a hand along the chest plate and the insignia it bore.

Then he was whisked away to meet with Maxson amongst other initiates, and Danse took that time to file his own reports and update his team's assignments.

They met up again in the mess, news having already spread about Taylor's new rank -- well earned and well worn already, so far as Danse was concerned, and he couldn't help the burst of pride he felt when the other man joined him at last.

"Congratulations, Knight," he said, clasping Taylor's shoulder. "You deserve it."

A faint flush crept into Taylor's cheeks, that slightly crooked grin pulling at his lips and Danse fought down the urge to lean in and kiss him.

"Did Elder Maxson give you your assignment?"

"Said you and I were going to tackle Fort Strong?"

"Correct, Knight. Take a moment to familiarize yourself with your new armor and we'll depart right after."

They were taken to their destination via Vertibird, engaging in some aerial fighting when they spotted a hulking behemoth of a Super Mutant on the scene. Taylor set to the task with the sort of keen precision Danse was coming to expect from him, and he briefly wondered if the new Knight had previous aircraft experience. Not unlikely; bombers would've been more common during the earlier wars, but he wasn't as certain if they'd had craft quite like this.

Necessity breeds innovation. Something quoted to him, once, but he couldn't recall from whom.

He shook the thoughts away, refocusing, allowing himself just a moment to contemplate after, after, after. After this mission, after their reports, after they saw to their armor…

After his obligations were met, he and Taylor could finally talk.

----

"So how'd you rank your first day as an official Brotherhood Knight?"

The question was pitched low for Taylor's ears only as they made their way back along the main deck, heading towards the officers' quarters at the front of the ship. Armor seen to, reports filed with Quinlan, and Taylor's first mission as Knight was a resounding success. Other soldiers were already moving on the cleared area of Fort Strong below, securing it as a staging ground for the Brotherhood's proposed offensive against the Institute. The decks were a flurry of activity, scribes and fellow knights in full armor carrying out orders and kicking up a cacophony that left Danse feeling oddly nostalgic.

"Not bad," Taylor replied when Danse tugged open the door to his personal quarters and gestured for the other man to go ahead of him. It would be a bit quieter here, at least, than trying to have any manner of conversation in the mess -- even if the conversation wasn't private in nature. And this one decidedly was.

If Danse didn't lose his nerve, at least.

"'Not bad?'"

"Don't have much to compare it to," Taylor pointed out, falling onto Danse's bunk without preamble. He leaned back, legs dangling off the edge as he stretched and folded his hands under his head. His hair was curling slightly, still drying from his brief wash, and Danse found himself distracted all over again. Found himself following the line of Taylor's throat to where it led to the slightly open collar of his shirt, dipping into a hollow he knew from personal experience was a sweet spot for the other man.

Found himself wishing the showers aboard the Prydwen weren't heavily rationed, that they could go back to Sanctuary and its greater privacy and its illusions of having all the time in the world.

"Danse?"

"Right." Danse cleared his throat, shaking his head. "That's… fair. Very fair. Well, take it from me, then -- you did an exemplary job down there, Taylor."

"Thank you?"

"…was that a question?"

Taylor was eyeing him now, an eyebrow cocked.

"I mean, I meant it, but…" Taylor pushed himself up, bracing his elbows on his knees and letting his hands dangle loosely between them. "Kinda getting the feeling you're…distracted. Everything okay?"

"I'm…"

Danse swallowed, feeling oddly exposed and pinned into place by that hazel gaze.

"I…I wanted to…I'm not sure how to… I did want to talk with you, if that….if that's okay."

Taylor's brow furrowed.

"Of course," he replied. "You know you can talk to me about anything, Danse."

"…Thank you." Still, he hesitated, clearing his throat again. Wished not for the first time that he had Taylor's ease with words, with expressing himself. That unassuming confidence, that surety in himself. "I… wanted to talk to you about…about our relationship."

Taylor was frowning now.

"…I… is there a…problem? I thought you said fraternization --"

"--no, no, there's no problem. There's no issue, not… not like that."

"Then like what?"

"Not…" Danse sighed, running a set of fingers through his own still-damp hair. "That came out wrong. There isn't an issue, technical or otherwise."

Taylor's shoulders relaxed. "Okay, that's…that's good…"

"I just, I wanted… I mean, I've enjoyed what we…what we've done, so far. With the um."

"Kissing?"

"That," Danse agreed, his cheeks on fire. "I was just… I guess curious, where you uh… where you stood on…"

Taylor blinked at him, cocking his head to the side as he considered him. Danse felt doubly exposed as those hazel eyes tracked up and down the length of his body.

"…are you asking if I'd want to do…more than kissing?"

This shouldn't have been difficult. Why was it difficult? He'd had his tongue in Taylor's mouth, sucked bruises into the hollow of his throat, along his collarbones, just below where anyone might see them. He'd had Taylor's hands on his body -- over the clothes for the most part, sure, but…still.

Why did it feel bigger, somehow, to ask to do that with less separating them?

"…yes."

#my writing#FO4#Bonds of Smoke and Steel#Paladin Danse x Male sole survivor#Danse x Taylor#Taylor Wickstrom#fallout 4#i could say the show spurned me to finally finish this but#it wouldn't be true haha#haven't watched it yet#i am just perpetually haunted by my WIPs#friggin writers block man

3 notes

·

View notes

Text

Ixigo IPO subscribed over 98 times on last day

The initial public offering (IPO) of Le Travenues Technology, the parent company of online travel platform Ixigo, closed on Wednesday, with bids exceeding 98 times the shares on offer. The investors placed bids for 4293.6 million shares against 43.7 million shares available, according to data from the BSE. The category reserved for retail investors was booked 53.9 times, while that of non-institutional investors received bids for 110.2 times. Qualified institutional buyers (QIB) bid for 2548.1 million shares, 106.7 times the shares on sale. The IPO included a fresh equity issue of Rs 120 crore and an offer for sale (OFS) of up to 66.6 million shares.

Existing shareholders such as Elevation Capital, Peak XV Partners, Aloke Bajpai, Rajnish Kumar, Micromax Informatics, and Placid Holdings will partially offload their stakes through the OFS. The company completed a pre-IPO secondary placement worth approximately Rs 176.2 crore a day before the anchor book opening. During this secondary sale, Elevation Capital, Peak XV Partners, Micromax Informatics and Madison India sold 18.9 million shares at Rs 93 each, which is the upper end of the IPO price band. The shares were purchased by new investors including Ashoka India Equity Investment Trust, Tata Mutual Fund, Bay Capital and Steadview Capital.

0 notes

Text

Áak’u Sky Council

When the cataclysm descended upon the world, altering the fabric of existence as we knew it, the rhythm of life underwent a profound transformation, nowhere more palpable than within the bustling arteries of the world's cities. Yet, amidst the chaos and upheaval, there existed a cohort that had long subsisted without the trappings of modernity, a people who had thrived in the unforgiving embrace of their ancestral lands, now stripped of the comforts afforded by air conditioning and other technological marvels that had once shielded others in the arid expanse of the Southwestern United States.

Unified under the banner of the Aak’u Sky Council, a coalition forged from the remnants of various Pueblo tribes, these indigenous inhabitants emerged as stewards of their heritage and guardians of tradition. Led by a venerable cadre of Elders, the Sky Council presided over a nation steeped in ancient wisdom and resilience. Despite the tempestuous winds of change, the Sky Council navigated a precarious path, steering clear of outright conflict and preserving a delicate equilibrium within their realm.

Whispers, however, permeated the corridors of neighbouring nations, hinting at clandestine pacts and covert alliances. Among them, murmurs persisted of a tacit understanding between the Sky Council and the Rio Grande Republic, a compact forged in the crucible of necessity, holding at bay looming threats from the north. In this crucible of adversity, the Aak’u Sky Council stood as a bastion of indigenous sovereignty, a testament to the enduring spirit of a people anchored in the ancient soil of their forebears.

1 note

·

View note

Text

Westernport Marina Anchors Hastings Marine Community with Premier Services

Westernport Marina, a leading name in maritime services, continues to solidify its position as a cornerstone of the Hastings marine community. With a commitment to excellence and customer satisfaction, Westernport Marina offers a comprehensive range of services catering to boating enthusiasts and marine businesses alike.

Located strategically in the heart of Hastings, Westernport Marina stands as a testament to superior marine services. Boasting state-of-the-art facilities and a dedicated team of experts, the marina provides unparalleled convenience and support for both seasoned sailors and newcomers to the marine scene.

Westernport Marina's dedication to fostering a thriving marine ecosystem is evident through its array of offerings, including:

Berth Facilities: Westernport Marina provides secure and well-equipped berths, ensuring the safety of vessels of various sizes while offering easy access to the stunning waters of Western Port Bay.

Maintenance and Repairs: With a full-service boatyard equipped with cutting-edge technology and skilled technicians, Westernport Marina ensures that vessels receive top-notch maintenance and repair services, keeping them seaworthy and pristine.

Storage Solutions: Westernport Marina offers secure and convenient storage options for boats and watercraft, providing peace of mind for owners during the off-season or when not in use.

Access to Amenities: Beyond its exceptional marine services, Westernport Marina grants access to a range of amenities including fuel docks, provisioning services, and recreational facilities, enhancing the overall boating experience for enthusiasts.

As the go-to destination for marine enthusiasts in Hastings, Westernport Marina remains committed to upholding the highest standards of service excellence. Whether it's docking, maintenance, or leisure activities, Westernport Marina stands ready to cater to the diverse needs of the Hastings marine community.

0 notes

Text

Dentures Gardena

Restore Your Smile with Dentures Gardena | SouthBayDental.com

Are you looking for reliable dentures services in Gardena to restore your smile and confidence? Look no further than South Bay Dental! Our experienced team specializes in crafting personalized dentures that fit comfortably and function seamlessly, allowing you to enjoy life to the fullest.

Why Choose South Bay Dental for Dentures in Gardena?

Customized Solutions: We understand that every patient has unique needs and preferences. That's why we offer personalized denture solutions tailored to your specific requirements, ensuring optimal comfort and functionality.

Expert Craftsmanship: Our skilled dental professionals utilize advanced techniques and materials to create high-quality dentures that look natural and feel comfortable.

Comprehensive Care: From initial consultation to final adjustments, we provide comprehensive care every step of the way, ensuring that you're satisfied with the results.

Patient-Centered Approach: Your comfort and satisfaction are our top priorities. We take the time to listen to your concerns and address any questions you may have, ensuring a positive dental experience.

Modern Facility: Our state-of-the-art dental facility in Gardena is equipped with the latest technology and amenities to provide you with the highest standard of care.

Our Denture Services Include:

Full Dentures: Complete sets of replacement teeth for patients missing all their natural teeth.

Partial Dentures: Custom-made prosthetics to replace one or more missing teeth while preserving existing natural teeth.

Implant-Supported Dentures: Secure and stable denture options anchored to dental implants for enhanced stability and functionality.

Regain Your Smile and Confidence with South Bay Dental:

Say goodbye to gaps and missing teeth with our premium denture solutions.

Enjoy improved chewing ability, speech, and facial aesthetics with our customized dentures.

Experience compassionate care and exceptional results from our dedicated team of dental professionals.

Ready to transform your smile? Schedule a consultation with South Bay Dental today to learn more about our denture services in Gardena. Visit https://southbaydental.com/services/dentures to book your appointment and take the first step towards a brighter, more confident smile.

0 notes

Link

The Nova-C lunar lander is seen in the high bay of Intuitive Machines Headquarters in Houston, before it shipped to NASA’s Kennedy Space Center in Florida for integration with a SpaceX Falcon 9 rocket for launch, as part of NASA’s CLPS (Commercial Lunar Payload Services) initiative and Artemis campaign. Credits: Intuitive Machines As part of NASA’s CLPS (Commercial Lunar Payload Services) initiative and Artemis campaign, media accreditation is open for Intuitive Machines’ first robotic flight to the Moon’s surface. The robotic deliveries will transport agency science and technology demonstrations to the Moon for the benefit of all. The Intuitive Machines Nova-C lander carrying NASA science and commercial payloads will launch on a SpaceX Falcon 9 rocket. Liftoff is targeted for a multi-day launch window, which opens no earlier than mid-February, from Launch Complex 39A at NASA’s Kennedy Space Center in Florida. Among the NASA items on its lander, the Intuitive Machines mission will carry instruments focusing on plume-surface interactions, space weather/lunar surface interactions, radio astronomy, precision landing technologies, and a communication and navigation node for future autonomous navigation technologies. A successful landing will help support the CLPS model for commercial payload deliveries to the lunar surface. As the anchor customer of CLPS, NASA is investing in lower-cost methods of Moon deliveries and aims to be one of many customers. Media prelaunch and launch activities will take place at NASA Kennedy. Media who are U.S. citizens interested in attending in person must apply for credentials no later than 12 p.m. EST on Monday, Jan. 29, by emailing [email protected]. In May 2019, NASA awarded a task order for the delivery to Intuitive Machines. Through Artemis, commercial robotic deliveries will perform science experiments, test technologies, and demonstrate capabilities to help NASA explore the Moon in advance of Artemis Generation astronaut missions to the lunar surface, in preparation for future missions to Mars. NASA is working with several U.S. companies to deliver science and technology to the lunar surface through the agency’s CLPS initiative. This pool of companies may bid on delivery task orders. A task order award includes payload integration and operations, as well as launching from Earth and landing on the surface of the Moon. NASA’s CLPS contracts are indefinite-delivery/indefinite-quantity contracts with a cumulative maximum contract value of $2.6 billion through 2028. For more information about the agency’s Commercial Lunar Payload Services initiative, see: https://www.nasa.gov/clps -end- Alise FisherHeadquarters, [email protected] Nilufar RamjiJohnson Space Center, [email protected] Antonia JaramilloKennedy Space Center, [email protected] Share Details Last Updated Jan 22, 2024 LocationNASA Headquarters Related TermsCommercial Lunar Payload Services (CLPS)ArtemisJohnson Space CenterKennedy Space CenterMissionsNASA Headquarters

0 notes

Text

How Garage Door Service in Westminister Can Secure your Garage from Break-ins?

Your garage is the ideal location for parking your vehicles. It can also be converted into a storage space for the seasonal goods. For example, you can use the space to remove the things that are unnecessary.

You can also keep your highly secure possessions inside the garages. However, it is crucial to keep the garages secure and safe from break-ins. Here are a few things you can do to secure these spaces.

1. You must install a proper solid core door that can enhance the strength or durability of the garage spaces. Connect with the garage door service in Westminister to ensure a solid upgrade that can ensure proper protection

2. You can also use the solid doors to build strong resistance. You can restrict forced entry against hollow doors

3. You must use strong door frames and metal plates that can ensure the garage door stays protected from high-pressure circumstances. It will keep the door frame well-structured and highly anchored. It will protect the structure properly

4. You must always ask the security providers to upgrade the door security with advanced features. You can use the rolling code technology for best access. Moreover, make sure to update the codes regularly. This would minimize the risks involved with code grabbing, a common practice. It will also help restrict intruders from entering your private spaces. You need a good garage door service in Lakewood for the best security upgrade.

5. You can also ensure proper door access by installing a perfect garage door opener. You can also include the security layers in the garage door. you must ensure the bar can protect the door from forced entry.

6. By implementing smart technology, you can add real-time alerts into your smartphone. It will ensure you can open/close the door via your phone. It is possible to access the doors while you are outside.

7. You can enhance the security of the garage windows to ensure they can easily resist break-ins. You can ensure that the film keeps the glass in place so that intruders don’t get to come inside

8. Choosing a good garage door service in Westminister can help add bars and grills to the windows. This will help keep the vulnerabilities at bay from the windows. You must choose the perfect design aesthetics that can complement the overall home space.

9. You must always keep the valuable items away from the windows. This will ensure that the people outside aren’t aware of the valuable items inside

10. You must upgrade the locks using high-quality deadbolt locking systems. It can improve the entry systems. You can also use the security strike plates for a stronger door frame. These plates can also enhance the resistance of the door.

11. Make sure to add a peephole to your garage doors. This will help you monitor the activities going on the outside. You can avoid opening your garage doors for people who you don’t know

12. You can also add some motion-activated sensors to get some visibility into the nighttime action. It is crucial to hire garage door service in Lakewood for the right solutions.

0 notes

Text

Most Affordable Sedans For Sale In South Africa

As a country, South Africans hold an affinity towards sedans for their practicality, comfort, and style. Some of the most affordable sedan models on sale in the local market are this body configuration which serves a purpose and provides good value for money. If you’re trying to save money on your next vehicle purpose, without sacrificing quality in your search, you’ll be relieved to learn that there are plenty of affordable choices. Here are the 6 cheapest sedans for sale in South Africa

These automobiles provide excellent worth for the money paid because they are convenient and pleasurable to use. Whether you’re in the market for a daily driver or your first vehicle, this list has you covered. As such, let’s take a closer look at the best affordable sedans in South Africa.

1. Suzuki DZire 1.2 GA

The old Swift Dzire’s trunk area looked like an afterthought from the back, and that was a major flaw for prospective buyers. The new sedan, on the other hand, has a more unified look and feels different enough from the Swift hatchback that it can justify dropping the Swift moniker. In spite of being 10 mm shorter than before, the vehicle’s width has increased by 40 mm, resulting in a sportier stance and more interior space. This is all thanks to the new Heartect platform, which underpins other models from the Japanese manufacturer, including the Baleno and the Ignis.

2. Honda Amaze 1.2 Trend

Powered by an “all-new platform,” Honda claims the Amaze’s “spacious interior” makes it ideal for families. Its chrome-heavy front end is reminiscent of that of the larger Honda Civic and BR-V. In the rear, the new model ditches the chrome trim of the first generation (although in SA, you can add chrome garnish as an accessory) in favour of a simpler, cleaner design, with the taillights now extending into the trunk.

3. Kia Pegas 1.4 LX

Standard on even the base Kia Pegas 1,4 LX is a 7,0-inch touchscreen infotainment system with six speakers, Apple CarPlay, and Android Auto compatibility, and more. The LX comes standard with a rearview camera, auto-on/off headlights, audio controls on the steering wheel, power front/rear windows, dual front airbags, antilock brakes, and anchors for ISOFIX child seats.

4. Suzuki Ciaz 1.5 GL

The Ciaz now comes standard with several features, including cruise control, a touchscreen infotainment system with Android Auto and Apple CarPlay, and a rear-facing camera (which is oddly offset and thus displays guidelines that don’t line up to a parking bay).

We were somewhat surprised that traction control, a steering wheel reach adjustment, and a rear-folding seat were still absent. However, even though the plastics are still all uniformly basic, the additional technology has undoubtedly improved the cabin’s atmosphere (although seemingly indestructible).

5. Nissan Almera 1.5 Acenta

The Almera offers good value, but its interior trim quality isn’t quite on par with that of its competitors. You do get a multi-function steering wheel and effective air conditioning with vents for the people in the back seats, even though cruise control isn’t a standard feature.

6. Toyota Corolla Quest 1.8 Plus

What has changed in this lineup recently? There are now up to six variants in the range, which has doubled in size. The 1,6-liter gasoline engine has been replaced with a similarly familiar 1,8-liter naturally aspirated unit that delivers 103 kW and 174 N.m. to the front axle through either a smooth-shifting six-speed manual gearbox or a continuously variable transmission (the old four-speed torque converter has finally been put out to pasture).

.

.

.

.

Sourced from https://secondhandvehicles.weebly.com/journal/most-affordable-sedans-for-sale-in-south-africa

0 notes

Text

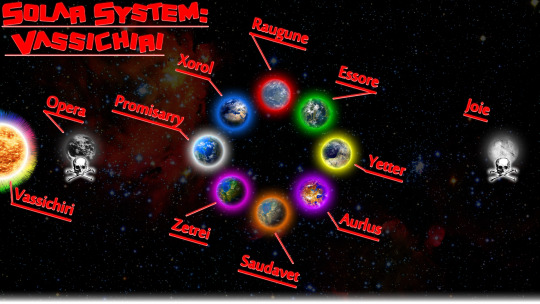

In a land of imagination, the House of Vig Sols created a space colony many millennia ago. Ruling over it peacefully through hella changes that would have you questioning your own immortality if you lived there. Rebellion after rebellion, none of them made sense; cause Vig Sols was a peaceful space colony for more than half of its existence. Peacefully evil, took them several millennia to make sure it was a safe haven for villains.

Cosmirana is the heiress to the Pirate Spaceship known as Light of Evil, her mother handed her the reigns twenty five years ago. It’s a size ten battleship that looks like a giant gun with half a hilt. All up & down the barrel area are armada & plasma turrets for all kinds of technology & space monsters. There are a total of four hundred gundam bays & one hundred bays for different sizes of spaceships. It’s like an Ikaruga exhibit when it’s go time. Light of Evil was created in year 6253 VU (Vassichiri Unity), funny right? Vassichiri Unity before a Species War broke out. Technically, it was created about 3,000 years ago; it’s year 807 FA (Final Anchor) now. We can only hope but Light of Evil makes sure there is no peace. They pillage from any source they can while heavily & swiftly moving through out the darkness. Their coven department made a spell of darkness upon the giant battleship being completed. It’s lined with enchanted black salt in its metal plates, countless times the spell was casted so the spaceship could literally move from one dark pocket to the next. With shadow being a major component of the spell, it can literally teleport from the back of one space colony to another in an instant. All the spaceship needs is enough quantum energy to jump when the drive is activated. Then they’ll turn the lights on, the gundams will launch & their smaller battleships will launch; good luck. They take with so much ease, civilization considers them god like. With no intelligence or power to stop them, Galactic Forces are usually playing catch up by the time they are done looting.

Now let’s get into who they are… From the left to the right, the first column are the heads of this pirateer organization. Ms Doves is Cosmirana’s best mate, been besties since they were three year olds. She grew up understanding the importance of having evil saviors, having evil caretakers. Ms Doves was a loyalist by the time she was thirteen. Cosmirana had a personal duty to pull for her mother, to be left at a prosperous city of Planet Xorol to tend to a shelter event. Where she has to study the effects of helping the less fortunate; when Cosmirana realized that studying them wasn’t going to help anything. She learned the lesson of, we must do. Ms Doves was with her & learned that lesson too. Action is a requirement for any pirateer to become important for the cause. It’s something that was instilled in O, 1st Time, Vonaraiville, Lus Chaosiss & Palace Vesp; as they were too, children that grew up with Light of Evil. They became the Magnificent Seven by the time they were in their junior year of high school. The other ladies were acquired through out life & it’s magically lucky all of them are the same age.

None of the guys were children that grew up with Light of Evil. All of them, happenstance later in life by experiencing Light of Evil looting entities hoarding resources. In this mix; some of them were law enforcement, some of them were workers for the Super Warrior Guild, one was a galactic class model, one was in college for language history, one is a prodigal martial artist; just an obscure group of random people from all over the solar system. They simply were inspired by the people in all black with LED lit gear on; touching chins with the elegance of an angel before wrecking them with the wrath of devils. All of the guys thought; with out skipping a beat, “The UFC ain’t got nothing on these pirates!” After every time these pirates run a muck to save lives, they always leave a memento so people can figure out a way to become a pirateer. It was in how they used all of their knowledge to help where they could. These twelve were great for Light of Evil, ever since that light went off in their heads; their careers for villainy have been splendid.

These super beings have been moving at a nonstop rate for five decades with no intention of stopping. This might be the generation that chases immortality for an ultimate tomorrow. As a tradition, the Vig Sols live a natural life without accepting the grace of this universe. At any given time, any super being can voice their wish for eternal life; they will feel the universe blessing them. This is an occurrence that can happen at any age. But none of them have accepted it because of the oath they took, when they swore into the Light of Evil. It’s up to you to find out if the events of this story will drive them into finally breaking a three thousand year tradition.

Base of Operations: Space Colony: Vig Sols / Alliance: the Super Villain Guild & An Assortment of Pirateers / Occupation: World Leaders of Space Colony: Vig Sols & Galactic Class Pirateers / Their Order: Spreading Light For the Sake of Evil Doers

0 notes

Text

Trumped: the multi-million-dollar lawsuit over Toronto’s most controversial new condo-hotel

The Trump tower, downtown’s tallest new condo-hotel, is a monument to excess. And, like its tycoon namesake, it’s surrounded by controversy: 38 investors are suing the hotel for millions. Lessons from a post-crash real estate market

In the city’s new five-star hotel landscape, the Ritz represents elegant European classicism, the Shangri-La cool, Asian chic, and the Trump unfettered American pomp. Like its loud-mouthed namesake, the Trump is brash, proud and full of bluster. Stock, the hotel’s restaurant and bar, is outfitted with shiny tufted black leather seating and silver accents. Its lobby, a shimmering expanse of marble and mirrors, seems sprung, fully formed, from the imagination of Joan Collins.

The hotel’s developer, Talon International, is run by Val Levitan and Alex Shnaider, two Russian-Canadian entrepreneurs. Levitan made his fortune manufacturing slot machines and creating bank note validation technology, and Shnaider earned his in the post-glasnost steel trade. The Trump is their first Toronto real estate venture. In 2002, during a meeting in Shnaider’s office at Dufferin and Finch, they agreed on a plan to build the city’s biggest, fanciest, five-starriest hotel. They both travel frequently for work and agreed that Toronto’s hotels lacked the quality of the ones they stayed at in London, New York and Moscow. Back then, Toronto’s swankiest option was the old Four Seasons, a dour brutalist tower in Yorkville. But the city was emerging as a major North American financial centre, a place where serious players were coming to do big international deals. These titans were in need of boardrooms in which to meet, bloody steaks to consume, and high-thread-count sheets to sleep between.

In 2004, Talon bought a site at the corner of Bay and Adelaide for $27.4 million. The location was perfect—smack in the centre of the business district. This was before the cultural revitalization of the city’s downtown core, but Levitan and Shnaider could see the signs: the revamping of the Bay’s flagship department store, the plans for the new Bell Lightbox, not to mention a phalanx of condos and restaurants springing up in the city centre. By the time the hotel was completed, it would be the anchor point of a tourist-friendly downtown.

The luxury hotel required a famous brand, which is how the pair ended up approaching Donald Trump. At the time, Trump’s reality show The Apprentice was riding high in the ratings, and the Trump brand was associated with luxury, success and business prowess, not with headline-making Twitter spats and an aborted Republican leadership bid. They worked out a deal to license the Trump name.

They planned a 65-storey mixed-use building consisting of a restaurant and bar, a day spa, 118 condos—some as large as 4,400 square feet and selling for up to $9.1 million—and 261 “condo-hotel suites,” traditional hotel rooms that Talon intended to sell as residential real estate investments. The condo-hotel set-up was unusual in Toronto. It’s an attractive model for developers because it allows them to raise capital up front from investors.

Donald Trump is a shareholder in other Trump developments in Chicago, New York and Las Vegas, but not in Toronto. The hotel would bear his name and his style, and an affiliate of his management company would run the day-to-day hotel service. According to the early marketing brochures, it would be a model for “Manhattan-style luxury living in Toronto.”

By the time the Trump opened in 2012, ten years after the plan was hatched and more than two years later than originally scheduled, the financial climate had, of course, drastically changed. The hotel now felt like a throwback to a cockier, pre-recession era, back when hedge fund managers ruled the world and Bernie Madoff was a respected financial guru. A group of buyers now regret their investment in the building, and millions of dollars in deals between them and Talon are on the verge of collapsing. The group claims their condo-hotel units often sit empty, and they’ve launched a series of lawsuits alleging the Trump sales team misrepresented how much profit they’d make. The defendants say the lawsuits have no merit, that no misrepresentations were made. The claims have yet to be heard in court.

The Trump investors believed they’d bought into a get-rich-quick scheme. How did something so promising go so wrong?

Before there was the Trump Tower, there was the Trump tower sales office, a glass-fronted box that stood on the same prime corner from which the hotel would eventually rise. A polished young sales team sold a steady stream of units, over the phone, online and in person, to a diverse cross-section of buyers—including elderly Korean pensioners, wealthy Nigerians and a now-defunct U.K. company called WorldWide Properties, which bought four floors of hotel units with the intention of flipping them.

When the Trump broke ground, half of the residential condos had sold, as had 191 of the condo-hotel units, which ranged in price from $736,000 to $3.8 million. The suites could be rented out as part of the hotel, providing extra income to buyers. In the Trump system, occupancies are organized in a strict, computerized rotation, which ensures that the least rented room jumps to the front of the queue. The hotel charges service fees for maintenance (linens, towels, cleaning, etc.) and management, but the rest of the rental profit goes to the owner of the room. The promotional material declared that “investing in hotel suites is a trend that’s sweeping the United States… The reason? Great cash flows, no concern for maintenance and reasonable cash requirements as a down payment. Leverage is key, especially in these times of low interest rates.”

0 notes

Text

Trumped: the multi-million-dollar lawsuit over Toronto’s most controversial new condo-hotel

The Trump tower, downtown’s tallest new condo-hotel, is a monument to excess. And, like its tycoon namesake, it’s surrounded by controversy: 38 investors are suing the hotel for millions. Lessons from a post-crash real estate market

In the city’s new five-star hotel landscape, the Ritz represents elegant European classicism, the Shangri-La cool, Asian chic, and the Trump unfettered American pomp. Like its loud-mouthed namesake, the Trump is brash, proud and full of bluster. Stock, the hotel’s restaurant and bar, is outfitted with shiny tufted black leather seating and silver accents. Its lobby, a shimmering expanse of marble and mirrors, seems sprung, fully formed, from the imagination of Joan Collins.

The hotel’s developer, Talon International, is run by Val Levitan and Alex Shnaider, two Russian-Canadian entrepreneurs. Levitan made his fortune manufacturing slot machines and creating bank note validation technology, and Shnaider earned his in the post-glasnost steel trade. The Trump is their first Toronto real estate venture. In 2002, during a meeting in Shnaider’s office at Dufferin and Finch, they agreed on a plan to build the city’s biggest, fanciest, five-starriest hotel. They both travel frequently for work and agreed that Toronto’s hotels lacked the quality of the ones they stayed at in London, New York and Moscow. Back then, Toronto’s swankiest option was the old Four Seasons, a dour brutalist tower in Yorkville. But the city was emerging as a major North American financial centre, a place where serious players were coming to do big international deals. These titans were in need of boardrooms in which to meet, bloody steaks to consume, and high-thread-count sheets to sleep between.

In 2004, Talon bought a site at the corner of Bay and Adelaide for $27.4 million. The location was perfect—smack in the centre of the business district. This was before the cultural revitalization of the city’s downtown core, but Levitan and Shnaider could see the signs: the revamping of the Bay’s flagship department store, the plans for the new Bell Lightbox, not to mention a phalanx of condos and restaurants springing up in the city centre. By the time the hotel was completed, it would be the anchor point of a tourist-friendly downtown.

The luxury hotel required a famous brand, which is how the pair ended up approaching Donald Trump. At the time, Trump’s reality show The Apprentice was riding high in the ratings, and the Trump brand was associated with luxury, success and business prowess, not with headline-making Twitter spats and an aborted Republican leadership bid. They worked out a deal to license the Trump name.

They planned a 65-storey mixed-use building consisting of a restaurant and bar, a day spa, 118 condos—some as large as 4,400 square feet and selling for up to $9.1 million—and 261 “condo-hotel suites,” traditional hotel rooms that Talon intended to sell as residential real estate investments. The condo-hotel set-up was unusual in Toronto. It’s an attractive model for developers because it allows them to raise capital up front from investors.

Donald Trump is a shareholder in other Trump developments in Chicago, New York and Las Vegas, but not in Toronto. The hotel would bear his name and his style, and an affiliate of his management company would run the day-to-day hotel service. According to the early marketing brochures, it would be a model for “Manhattan-style luxury living in Toronto.”

By the time the Trump opened in 2012, ten years after the plan was hatched and more than two years later than originally scheduled, the financial climate had, of course, drastically changed. The hotel now felt like a throwback to a cockier, pre-recession era, back when hedge fund managers ruled the world and Bernie Madoff was a respected financial guru. A group of buyers now regret their investment in the building, and millions of dollars in deals between them and Talon are on the verge of collapsing. The group claims their condo-hotel units often sit empty, and they’ve launched a series of lawsuits alleging the Trump sales team misrepresented how much profit they’d make. The defendants say the lawsuits have no merit, that no misrepresentations were made. The claims have yet to be heard in court.

The Trump investors believed they’d bought into a get-rich-quick scheme. How did something so promising go so wrong?

Before there was the Trump Tower, there was the Trump tower sales office, a glass-fronted box that stood on the same prime corner from which the hotel would eventually rise. A polished young sales team sold a steady stream of units, over the phone, online and in person, to a diverse cross-section of buyers—including elderly Korean pensioners, wealthy Nigerians and a now-defunct U.K. company called WorldWide Properties, which bought four floors of hotel units with the intention of flipping them.

When the Trump broke ground, half of the residential condos had sold, as had 191 of the condo-hotel units, which ranged in price from $736,000 to $3.8 million. The suites could be rented out as part of the hotel, providing extra income to buyers. In the Trump system, occupancies are organized in a strict, computerized rotation, which ensures that the least rented room jumps to the front of the queue. The hotel charges service fees for maintenance (linens, towels, cleaning, etc.) and management, but the rest of the rental profit goes to the owner of the room. The promotional material declared that “investing in hotel suites is a trend that’s sweeping the United States… The reason? Great cash flows, no concern for maintenance and reasonable cash requirements as a down payment. Leverage is key, especially in these times of low interest rates.”

Promotions featured an airbrushed picture of Trump, along with a personal endorsement: “We’re going to do something very special in Toronto.” Trump himself, the ad said, “has an undeniably keen eye for a deal.” The ad neglected to mention that Trump wasn’t the project’s developer, just its smiling face.

Sarbjit Singh, a 49-year-old warehouse supervisor from Milton, was one of the early buyers. Singh first heard about the Trump in October 2006 from a real estate agent who told him it was a great investment opportunity. He and his wife, Kimberly, had recently bought a house and just had their second daughter. He didn’t have the money to buy another property. “I was only making between $50,000 and $60,000 a year,” he says. “I’m a regular person, not rich.”

But the prospect of getting his own piece of Trump magic proved too tempting. He claims the agents at the Trump sales centre told him he couldn’t possibly lose money since the “absolute worst case scenario” was that the hotel ended up at 55 per cent occupancy, and even then the projected returns were healthy. “I asked them a long list of questions,” he recalls. Who was going to arrange the mortgages? What would the interest rate be? Would the property be categorized as commercial or residential (commercial properties come with much higher interest rates). He alleges the sales associate assured him he had nothing to worry about. According to Singh, they said Talon was already working on financing with lenders, and it would all go smoothly. The units would qualify for residential mortgages. Singh then asked at what point he could flip the unit, and the agent told him directly after closing. “You’ll make a lot of money,” he remembers the agent telling him. “Even if you don’t sell, you’ll be making lots of money from the reservation program.”

Armed with Talon’s projection sheet, his head dancing with trust funds for his daughters, Singh went to his mother and father, who are retired and living on a pension. He convinced them to take out a $150,000 line of credit on their house, which they owned outright, so he could put down a deposit of $173,400 on an $869,000 suite. He believed, like many other investors I spoke to, that he was buying a piece of real estate directly from Donald Trump and that he couldn’t lose. “I bought it on the strength of his name alone. He’s Donald Trump—hotels and real estate are his business, not mine. I trusted that it would work.”

Construction of the Trump Tower got off to an inauspicious start. It took two years to receive planning permission from the city, and there were more delays after Talon broke ground in late 2007. Because of the site’s small footprint—15,000 square feet—only one crane could be employed at a time. Shnaider admitted it was a bit of a nightmare. “I wouldn’t do such a project again in Toronto,” he said.

More significantly for investors, the economic reality changed. As Levitan put it, “It was a very complicated project that became delayed, and in that time the economy fell apart. How can I control that?” In the new market, the projection sheets Talon had distributed with the initial sales package weren’t worth the creamy stationery they were printed on.

In March 2012, Sarbjit Singh took possession of his unit and started paying monthly fees of $8,207, which covered realty taxes, common fees and interest. He expected his rental profits to more than offset the fees, but when the first revenue statements came in, he knew something was wrong: in four months, his unit had been rented 49 times—roughly a 40 per cent occupancy rate and lower than the “absolute worst case scenario” the agent had discussed with him. Singh’s room was running at a loss. When he called hotel management, they told him the bad news: because of the dampened hotel market, they’d been renting his room out at a discounted rate. (Rooms at the Trump that were forecast to cost $550 to $600 per night have been available for $400 on Expedia.) Singh was losing approximately $5,000 a month.

His problems didn’t end there. He visited several major banks and was told the property was commercial, not residential, and thus he’d need a commercial mortgage, for which he’d need to put 50 per cent down—money he didn’t have. Even if he could find the down payment, the commercial interest rates would raise his mortgage payments beyond what he could afford to carry.

Last November, Singh ran out of reserve cash. He stopped paying his fees and is now working in the evenings and on weekends in an effort to pay his parents’ line of credit. He recently missed a mortgage payment. He has no idea how he’ll get out of debt.

Singh retained the Toronto law firm Heydary Hamilton last November and filed a suit against the developers. Another 37 buyers have also filed suits. A Heydary lawyer named Mitchell Wine, one of the team of 14 lawyers and articling students working on the Trump cases, told me purchasers and representatives of more than 100 units have contacted his office. The firm has filed statements of claim detailing each of the investors’ stories and accusing Talon and other named parties of misrepresentation, breaches of the Ontario Securities Act, breach of contract, breach of the Condominium Act and conspiracy. Each claimant is asking for well over a million dollars in damages, plus their deposit money back with interest. Pleadings are being finalized, and preliminary motions were scheduled to be heard just after this issue went to press. In response, Talon is seeking to have the action by investors dismissed.

The investors’ suits name Trump Toronto Hotel Management Group and Talon International Inc., as well as Trump, Shnaider and Levitan personally. They allege that the defendants misled investors about the units by providing financial projections that overstated how much they would earn, and by understating expenses (such as occupancy fees). According to the investors’ statements of claim, Talon breached the Ontario Securities Act by selling the units as investment products.

The plaintiffs’ cases centre on a 2004 OSC ruling, which required Talon to market the units as mainly for occupancy, not as investments. Talon was also prohibited from forecasting or guaranteeing profits from the reservation program. And yet, included in the Trump’s original sales package are several charts entitled Estimated Return on Investment, which show detailed breakdowns of the income buyers could expect from their condo-hotel suites. They describe projected common expense fees, housekeeping expenses, estimated taxes and a mortgage projected at six per cent interest. The rental income, in turn, is projected at hotel occupancy rates of 75, 65 and 55 per cent.

Late last year, the OSC investigated the Trump deal to determine whether regulatory action was needed. They met with purchasers and Talon’s lawyers, read over all the documents, and in early December announced they would not be pursuing regulatory action on the matter. When I asked for an explanation, the OSC refused to provide one. The investors’ suits will proceed regardless of the December decision.

The fact is, Talon did warn the Trump buyers about the risks involved in buying condo-hotel units in its disclosure. “A real estate investment is, by its nature, speculative,” the document states. “If a purchaser is purchasing the real estate as an investment, the purchaser should be aware that this investment has not only the usual risks when purchasing real estate, but also those risks that are inherent to the nature of real estate securities.”

A disclaimer in the Trump disclosure lists a series of variables, many of which might seem alarmist if they hadn’t come to pass. These include, but are not limited to, “cyclical downturns arising from real changes in general and local economic conditions; varying levels of demand for rooms and related services caused by changes in travel patterns; the financial condition of the airline industry and the resulting impact on air travel…contagious illness outbreaks, natural disasters, extreme weather conditions, labour shortages, work stoppages or disputes.” There is also a clause, as required by the Condominium Act, stating that each buyer, upon receiving and reading the disclosure document, has 10 days to back out of the deal. According to Levitan, five people did just that.

Investors like Singh claim they didn’t take the warnings about risks seriously because they’d been completely convinced that the investment was a sure bet. It’s a bit like your trusted GP prescribing you a medication and then rattling off the side effects in a super-fast radio ad voice as you leave the office. If what these buyers say is true, the Trump sales team underplayed the risks and overplayed the benefits of buying their condo-hotel units. But sales pitches are hyperbolic by design.

Talon’s statement of defence denies all wrongdoing, including the allegations of misrepresentation and breaching an OSC ruling, and demands the investors forfeit their deposits and pay individual damages of $750,000 each. Levitan says they have a good case for further damages, due to all the bad press the case has received, but they are still “hoping for an amicable solution.”

In Talon’s specific response to Singh’s claim, the company denies that the Trump sales agents promised he could get a residential mortgage or guaranteed a rate of return from the reservation program. It also denies that any promotional material he received breached the OSC ruling. In Levitan’s view, the buyers’ lawsuits are purely opportunistic and won’t stand up in court. Normally, if buyers want to walk away from a deal, a developer will buy back their investment. But the Trump units were sold at the peak of the market. As Levitan points out, “Everything has changed.” Given this reality, Talon is not eager to buy back the units it sold off for millions in the middle of the condo boom. That’s how people—and developers—make money: buying low and selling high. Why should they absorb the cost of others’ bad financial timing?

The group of disgruntled buyers, Levitan says, is primarily composed of people who did not attempt to rescind the deal in the allotted time frame, then realized they couldn’t secure financing and decided to file suit. The fact that they don’t have the money to close only shows that they probably shouldn’t have taken the risk in the first place. “Instead they claim that they thought they were buying from Donald Trump and we promised them a rose garden,” Levitan says with a snort. “It’s a pure form of extortion.”

He says he’s sad for the people who got in over their heads. He’d prefer “the world to be a rosy place in which people are always happy with their investments,” but that didn’t happen with Trump. “So what am I supposed to do?” he says. “Go to the drywall contractor and say, ‘Sorry, but I can’t pay you because 30 investors aren’t paying me?’ ”

Raymond Diep, a Toronto real estate lawyer at the firm Aaron & Aaron, which handled a number of the Trump condo-hotel closings, said his firm’s clients weren’t happy about losing money each month, but they chose to take a long-term view on the investment. “They realized that things might be negative now, but in the end the market would go up again.”

None of Aaron & Aaron’s clients were going to go personally bankrupt on the Trump deal; they absorbed their losses and decided to wait it out. Diep believes the Heydary lawyers are cashing in on private desperation. “They’re making it look like a shady investment, but it’s not really like that. The investors had high expectations. It was the height of the market. Now that it’s slowed down, they’re having regrets about it. It’s that simple.”

Sarbjit Singh, who is in no position to close in cash, says that Talon should have said that only investors of high net worth need apply. Instead, the Trump project was sold as a great investment for people of modest means, like himself. “If you need to be a millionaire to close, they should have targeted millionaires.”

Donald Trump declined to speak with me, but Ivanka, his daughter, agreed. The 32-year-old is vice-president of development and acquisitions for the Trump Organization. When I reached her, she was in the back of a chauffeur-driven car on the way to the airport. “It was very important to me to give you some time,” she said the moment she got on the phone. Ivanka is a glamorous blond jewellery designer and former model with a business degree from Wharton. Over the years, her father has used her as the new face of Trump, trotting her out at public events and even appointing her as a judge on The Apprentice.

Ivanka is an excellent human shield for her father, who is no stranger to lawsuits. He has been sued by investors on several hotel projects and has launched his own litany of suits against a long list of perceived offenders, including an unauthorized biographer, a former Miss U.S.A. contestant, Deutsche Bank and the comedian Bill Maher, who offered, on The Tonight Show, to pay Trump $5 million if he could prove his father was not an orangutan. Trump sent him a copy of his birth certificate, but Maher did not pay up.

Ivanka said she is staggered by the investors’ claims that they believed they were buying their units directly from Trump.

“I don’t know of many people who wouldn’t retain a lawyer to explain to them how this relationship works,” she says. “It’s articulated exactly in the purchase documents… We’re just like the Ritz or the Four Seasons. It’s not different in any way.”

She says the claims against her father and his company are completely without merit. When I point out that people were led to believe they would make money and now they are losing it—and, similarly, that they would be able to secure financing where now they cannot—Ivanka bridles, her voice rising in the controlled manner of one who is used to conflict but not to having her authority questioned. She points out, quite rightly, that with any investment, whatever the asset class, and especially with real estate, those who approach things with a long-term perspective tend to do best. She says the unhappy buyers in the Trump Toronto case are suffering from a severe case of buyer’s remorse—which is nobody’s problem but their own.

She objects to the implication that the investors were misled in any way, and each time I try to suggest that perhaps the sales tactics were overly aggressive, she jumps in and loudly talks over me, extolling what she calls “the beauty of the asset,” by which she means the hotel itself.

“I wish that everyone could be happy, but sometimes these things can be a challenge,” she says airily. “It’s important to remember that the lawsuit doesn’t relate to us in any way. We have no contracts with these people, and we didn’t sell them real estate.” With that, she declares she must go, says a quick goodbye and hangs up.

1 note

·

View note

Text

HIGHLIGHTS FOR ABC NEWS’ ‘GOOD MORNING AMERICA,’ OCT. 30-NOV. 4

The following report highlights the programming of ABC’s “Good Morning America” during the week of Oct. 30-Nov. 4. “Good Morning America” is a two-hour, live program anchored by Robin Roberts, George Stephanopoulos and Michael Strahan, and Ginger Zee is the chief meteorologist. The morning news program airs MONDAY-FRIDAY (7:00-9:00 a.m. EDT) on ABC.

Highlights of the week include the following:

Monday, Oct. 30 — Actor and author Henry Winkler (“Being Henry”); band New Kids on the Block; former politician and author Adam Kinzinger (“Renegade”); actress Jennifer Garner

Tuesday, Oct. 31 — Halloween candy cook-off with chefs and TV personalities Carla Hall and Richard Blais; Devil-ish Deals and Spooky Steals with ABC e-commerce editor Tory Johnson

Wednesday, Nov. 1 —ABC News chief business, technology and economics correspondent Rebecca Jarvis; “Dancing with the Stars” eliminated couple; Tampa Bay Buccaneers announcement with “GMA3” co-anchor DeMarco Morgan; Oprah’s Favorite Things: Deals and Steals with Oprah Daily’s creative director Adam Glassman

Thursday, Nov. 2 — “GMA” co-anchor Robin Roberts in the studio with rapper and Rock & Roll Hall of Fame inductee Missy Elliott; Oprah’s Favorite Things: Deals and Steals with Oprah Daily creative director Adam Glassman

Friday, Nov. 3 — Musician Sheryl Crow chats Rock & Roll Hall of Fame; food journalist and chef Alison Roman on new podcast (“Solicited Advice”); Deals and Steals with ABC e-commerce editor Tory Johnson

Saturday, Nov. 4 — ABC News contributor Will Ganss tests running gear; Deals and Steals with ABC e-commerce editor Tory Johnson

ABC Media Relations

Brooks Lancaster

[email protected]

Jordan Littlejohn

[email protected]

-- ABC --

0 notes

Text

Trumped: the multi-million-dollar lawsuit over Toronto’s most controversial new condo-hotel

The Trump tower, downtown’s tallest new condo-hotel, is a monument to excess. And, like its tycoon namesake, it’s surrounded by controversy: 38 investors are suing the hotel for millions. Lessons from a post-crash real estate market

In the city’s new five-star hotel landscape, the Ritz represents elegant European classicism, the Shangri-La cool, Asian chic, and the Trump unfettered American pomp. Like its loud-mouthed namesake, the Trump is brash, proud and full of bluster. Stock, the hotel’s restaurant and bar, is outfitted with shiny tufted black leather seating and silver accents. Its lobby, a shimmering expanse of marble and mirrors, seems sprung, fully formed, from the imagination of Joan Collins.

The hotel’s developer, Talon International, is run by Val Levitan and Alex Shnaider, two Russian-Canadian entrepreneurs. Levitan made his fortune manufacturing slot machines and creating bank note validation technology, and Shnaider earned his in the post-glasnost steel trade. The Trump is their first Toronto real estate venture. In 2002, during a meeting in Shnaider’s office at Dufferin and Finch, they agreed on a plan to build the city’s biggest, fanciest, five-starriest hotel. They both travel frequently for work and agreed that Toronto’s hotels lacked the quality of the ones they stayed at in London, New York and Moscow. Back then, Toronto’s swankiest option was the old Four Seasons, a dour brutalist tower in Yorkville. But the city was emerging as a major North American financial centre, a place where serious players were coming to do big international deals. These titans were in need of boardrooms in which to meet, bloody steaks to consume, and high-thread-count sheets to sleep between.

In 2004, Talon bought a site at the corner of Bay and Adelaide for $27.4 million. The location was perfect—smack in the centre of the business district. This was before the cultural revitalization of the city’s downtown core, but Levitan and Shnaider could see the signs: the revamping of the Bay’s flagship department store, the plans for the new Bell Lightbox, not to mention a phalanx of condos and restaurants springing up in the city centre. By the time the hotel was completed, it would be the anchor point of a tourist-friendly downtown.

The luxury hotel required a famous brand, which is how the pair ended up approaching Donald Trump. At the time, Trump’s reality show The Apprentice was riding high in the ratings, and the Trump brand was associated with luxury, success and business prowess, not with headline-making Twitter spats and an aborted Republican leadership bid. They worked out a deal to license the Trump name.

They planned a 65-storey mixed-use building consisting of a restaurant and bar, a day spa, 118 condos—some as large as 4,400 square feet and selling for up to $9.1 million—and 261 “condo-hotel suites,” traditional hotel rooms that Talon intended to sell as residential real estate investments. The condo-hotel set-up was unusual in Toronto. It’s an attractive model for developers because it allows them to raise capital up front from investors.

Donald Trump is a shareholder in other Trump developments in Chicago, New York and Las Vegas, but not in Toronto. The hotel would bear his name and his style, and an affiliate of his management company would run the day-to-day hotel service. According to the early marketing brochures, it would be a model for “Manhattan-style luxury living in Toronto.”

By the time the Trump opened in 2012, ten years after the plan was hatched and more than two years later than originally scheduled, the financial climate had, of course, drastically changed. The hotel now felt like a throwback to a cockier, pre-recession era, back when hedge fund managers ruled the world and Bernie Madoff was a respected financial guru. A group of buyers now regret their investment in the building, and millions of dollars in deals between them and Talon are on the verge of collapsing. The group claims their condo-hotel units often sit empty, and they’ve launched a series of lawsuits alleging the Trump sales team misrepresented how much profit they’d make. The defendants say the lawsuits have no merit, that no misrepresentations were made. The claims have yet to be heard in court.

The Trump investors believed they’d bought into a get-rich-quick scheme. How did something so promising go so wrong?

Before there was the Trump Tower, there was the Trump tower sales office, a glass-fronted box that stood on the same prime corner from which the hotel would eventually rise. A polished young sales team sold a steady stream of units, over the phone, online and in person, to a diverse cross-section of buyers—including elderly Korean pensioners, wealthy Nigerians and a now-defunct U.K. company called WorldWide Properties, which bought four floors of hotel units with the intention of flipping them.

When the Trump broke ground, half of the residential condos had sold, as had 191 of the condo-hotel units, which ranged in price from $736,000 to $3.8 million. The suites could be rented out as part of the hotel, providing extra income to buyers. In the Trump system, occupancies are organized in a strict, computerized rotation, which ensures that the least rented room jumps to the front of the queue. The hotel charges service fees for maintenance (linens, towels, cleaning, etc.) and management, but the rest of the rental profit goes to the owner of the room. The promotional material declared that “investing in hotel suites is a trend that’s sweeping the United States… The reason? Great cash flows, no concern for maintenance and reasonable cash requirements as a down payment. Leverage is key, especially in these times of low interest rates.”

Promotions featured an airbrushed picture of Trump, along with a personal endorsement: “We’re going to do something very special in Toronto.” Trump himself, the ad said, “has an undeniably keen eye for a deal.” The ad neglected to mention that Trump wasn’t the project’s developer, just its smiling face.

Sarbjit Singh, a 49-year-old warehouse supervisor from Milton, was one of the early buyers. Singh first heard about the Trump in October 2006 from a real estate agent who told him it was a great investment opportunity. He and his wife, Kimberly, had recently bought a house and just had their second daughter. He didn’t have the money to buy another property. “I was only making between $50,000 and $60,000 a year,” he says. “I’m a regular person, not rich.”

But the prospect of getting his own piece of Trump magic proved too tempting. He claims the agents at the Trump sales centre told him he couldn’t possibly lose money since the “absolute worst case scenario” was that the hotel ended up at 55 per cent occupancy, and even then the projected returns were healthy. “I asked them a long list of questions,” he recalls. Who was going to arrange the mortgages? What would the interest rate be? Would the property be categorized as commercial or residential (commercial properties come with much higher interest rates). He alleges the sales associate assured him he had nothing to worry about. According to Singh, they said Talon was already working on financing with lenders, and it would all go smoothly. The units would qualify for residential mortgages. Singh then asked at what point he could flip the unit, and the agent told him directly after closing. “You’ll make a lot of money,” he remembers the agent telling him. “Even if you don’t sell, you’ll be making lots of money from the reservation program.”

Armed with Talon’s projection sheet, his head dancing with trust funds for his daughters, Singh went to his mother and father, who are retired and living on a pension. He convinced them to take out a $150,000 line of credit on their house, which they owned outright, so he could put down a deposit of $173,400 on an $869,000 suite. He believed, like many other investors I spoke to, that he was buying a piece of real estate directly from Donald Trump and that he couldn’t lose. “I bought it on the strength of his name alone. He’s Donald Trump—hotels and real estate are his business, not mine. I trusted that it would work.”

Construction of the Trump Tower got off to an inauspicious start. It took two years to receive planning permission from the city, and there were more delays after Talon broke ground in late 2007. Because of the site’s small footprint—15,000 square feet—only one crane could be employed at a time. Shnaider admitted it was a bit of a nightmare. “I wouldn’t do such a project again in Toronto,” he said.