#and why on earth are they allowed to have a venture capital firm?? Our government is beyond evil

Text

Colossal says it hopes to use advanced genetic sequencing to resurrect two extinct mammals — not just the giant, ice age mammoth, but also a mid-sized marsupial known as the thylacine, or Tasmanian tiger, that died out less than a century ago. On its website, the company vows: “Combining the science of genetics with the business of discovery, we endeavor to jumpstart nature’s ancestral heartbeat.”

In-Q-Tel, its new investor, is registered as a nonprofit venture capital firm funded by the CIA. On its surface, the group funds technology startups with the potential to safeguard national security. In addition to its long-standing pursuit of intelligence and weapons technologies, the CIA outfit has lately displayed an increased interest in biotechnology and particularly DNA sequencing.

“Why the interest in a company like Colossal, which was founded with a mission to “de-extinct” the wooly mammoth and other species?” reads an In-Q-Tel blog post published on September 22. “Strategically, it’s less about the mammoths and more about the capability.”

“Biotechnology and the broader bioeconomy are critical for humanity to further develop. It is important for all facets of our government to develop them and have an understanding of what is possible,” Colossal co-founder Ben Lamm wrote in an email to The Intercept. (A spokesperson for Lamm stressed that while Thiel provided Church with $100,000 in funding to launch the woolly mammoth project that became Colossal, he is not a stakeholder like Robbins, Hilton, Winklevoss Capital, and In-Q-Tel.)

Colossal uses CRISPR gene editing, a method of genetic engineering based on a naturally occurring type of DNA sequence. […] The eponymous gene editing technique was developed to function the same way, allowing users to snip unwanted genes and program a more ideal version of the genetic code.

The embrace of this technology, according to In-Q-Tel’s blog post, will help allow U.S. government agencies to read, write, and edit genetic material, and, importantly, to steer global biological phenomena that impact “nation-to-nation competition” while enabling the United States “to help set the ethical, as well as the technological, standards” for its use.

Okay, am I the only one that finds the idea of US government agencies having the authority to use this technology completely terrifying?

I remember when CRISPR technology was first developed bioethicists were like yeah, you shouldn’t do that, and everyone else was like shut up and think of the children! We can eradicate birth defects with this!! And have they eradicated birth defects with this? Don’t be silly, of course not! No, we’re going to build supersoldiers or morally-vacant human robots or something, that’s way more important!

#cia#aside from the usual just because you can doesn’t mean you should that all scientists should be forced to dwell on daily#the CIA has done so much horrifying human experimentation that they’re the last people who should be allowed to have their hands on this#and why on earth are they allowed to have a venture capital firm?? Our government is beyond evil#bioethics#or the lack thereof

21 notes

·

View notes

Text

Unhappy Parents, Unhappy Teachers and Unhappy School Managements – What Ails in Indian Education System

Isn't it an irony that we are thinking to build a great Education System with distressed parents, disenchanted teachers & disillusioned school founders?

There remains no ambiguity that the Education System is the backbone of any country and if not handled properly it will spoil future generations. So reforming the education system should be the utmost priority.

Although I was thinking to pen down this since a long time, finally, I could get some time today to write with the experience of the past few year in this domain. I am of the firm opinion that we need to redefine our education system framework keeping all stakeholders in mind otherwise we will not be able to reach our goal of high quality yet affordable education.

Why are parents distressed?

Parents need to go through a different experience when they plan for admission in the first place or even if they need to change the school of their wards for any reason. They need to arrange funds, take loans and prepare themselves for an Interview. Although admission is a just one-time process, real ordeal starts after that. They need to pay the massive amount for admission and then there is the regular expense of hefty monthly fees, uniform, books and other things from time to time.

You need to buy everything from school and if you try to get something at a lower cost from the open market then schools will make sure that there is at least one clause added which forces you to buy everything from the school. I could never understand why can’t my younger one use the books of the elder one? Why can’t we learn the concept of re-usability of resources and optimize expenses? A penny saved is a penny earned. Moreover, this helps us in saving the environment by producing less number of books every year.

In a nutshell, parents are burdened with fixed and recurring cost and they have no option other than paying same. They are ready to do anything for better education and this becomes an opportunity for schools businesses to encash that feeling of parents.

Why are teachers disenchanted?

On the 'Teachers Day' this year, Indian Express quoted that 65% percent of teachers are not happy however I believe this percentage of “unhappy teachers” is much more than that. Teachers are always working hard for their students, preparing lesson plans, worksheets, working on creating assignments and giving them notes, keeping parents updated and doing everything to help the kids learn and grow in the best possible manner. Happy teachers create happy learners hence if they are not happy with what they are doing, how can we expect that they will spread happiness and positivity among learners?

Every year we celebrate Teacher’s day by glorifying this noble profession with expressions of gratitude, I simply wonder why this admiration dies down after the “Teacher’s Day” event.

Teaching is less paid and then there are a lot of ill practices at schools in terms of payment except for few schools who strictly adhere to pay commission and other good policies for the benefit of teachers. Teachers too have financial requirements, someone who wants to be a teacher does not mean that he/she doesn't need good salaries and other employment benefits. Being one of the leaders in “Teacher Recruitment” in India, we have witnessed several instances when a lot many schools approached us with the requirement of salaries even less than you offer to your office boy. How on the earth someone can think that they can run schools with such a thought process.

60-70% of preschools pay very less to their teachers or in a way I can say my office boy gets a better salary than 60-70% of pre School teachers. This is really a shame, either you run a school venture or stop it but do not run at the cost of good teachers.

Two recent advertisements for hiring teachers and that too in Delhi/NCR region so you can imagine payout in Tier-2/3 cities.

Insufficient salaries are not restricted to low-cost private schools but also to international schools as well, they charge a good amount of fees from parents that range from Rs.3 Lakhs to 8 Lakhs per annum still school management prefer cheap labor. You will find more women in school teaching job as compared to men, as women are not considered as the primary bread earner of a family and hence their salaries are less as compared to the fee structure that these school charge. Most of the women employees in these schools are financially dependent on their husbands for expenditure like a home, car or other high-value assets in the family, their salary is almost one third or even less than what their husbands earn in MNC. The school salary is just like an additional income for them.

Schools spend lots of money on facilities but when it comes to paying to teachers they literally struggle sometimes. I personally believe that teachers need to be happy and motivated then only they can make a better education ecosystem.

Why are school owners disillusioned?

I think this is due to the basic flaw in the model of Education System. The government wants all schools to work as Trust/Societies and do not want them to make any money(profits) out of it, on the other hand, I could hardly find school owners (except a few) who do not want to make money. I feel they are right as well, someone who spent crores of the fund in creating a school, worked day and night, spent the sleepless night to built a great school then he also needs to get some benefit out of it as other founders of companies. What a paradox is it, the system doesn't want to invest and at the same time, it doesn't allow any investor to earn from his/her investment if he/she invests in Education System.

The government wants schools to pay salaries as per norms, wants to keep capping on fees they charge, follow RTE act and other policies but I don’t think the same will be possible without support from the government. The government also needs to think about school owners they are not bad-boys, they are one of us who want to invest, work hard and make money. Most of the money is invested by businessmen or politician and their main interest are to make money like others. Setting up school requires a lot of capital and its impossible for any educationist or a common man to build a school without huge financial support.

Schools also struggle to get quality teachers as 1000s of B.Ed colleges are running in remote areas without teachers and students. People can go and get a degree without even attending a single class, they just need to enroll in the course and get a degree after 2 years.

If the basis of setting school is not right, if the motivation of becoming a teacher is not honest then what kind of knowledge and values will be transferred to our future generation. And, we think we will build a great education system in India?

Possible Solution :

As setting up schools require huge funds and the majority of funds go into land acquisition and setting up infrastructure. If the government can set up the infrastructure and give this to private players, as they are good in execution and government is good in creating infrastructure. Of course, how they run schools need to be well monitored by the proper system in place. Indian Education System does not need AC classrooms, swimming pools, activities like horse riding and an international faculty but we need an education system that guarantees the right quality and affordable fee structure. An education system with proper value inculcated in it.

Once schools are developed by the government and run by private players then these private players will be in a position to offer better salaries to teachers and low-cost schooling to parents. I believe this might stop a couple of ill practices as well. There should be a certain incentive on the performance of these private players who are running a school.

Looking forward to seeing "Education System with happy Parents, happy Teachers and happy School founders"

Source: https://bit.ly/2xp24Zo

0 notes

Text

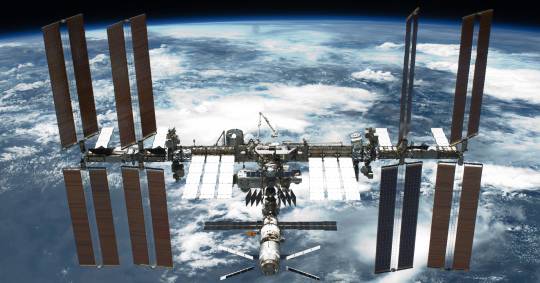

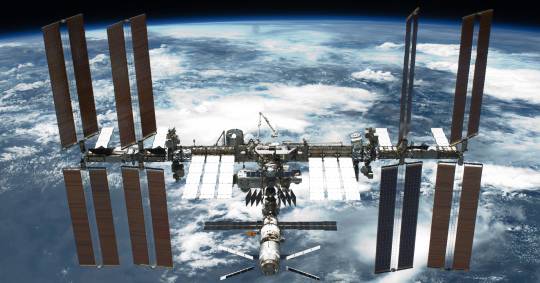

Who's Going to Buy the International Space Station?

New Post has been published on http://delphi4arab.com/whos-going-to-buy-the-international-space-station/

Who's Going to Buy the International Space Station?

For sale: orbiting space station. Room for eight. Fantastic views of Earth. Commercial opportunities for zero-g manufacturing, research lab, or floating hotel. Cost: $3 to 4 billion a year. Any takers?

President Trump’s new budget request, released Monday, directs NASA to leave behind the International Space Station and explore the moon as a first step toward reaching Mars. The spending plan ends funding of the International Space Station by 2025, replacing taxpayers’ money with revenue from private firms. It proposes $150 million to help get companies to transition to this brave new industrial park.

While NASA and space enthusiasts have been talking about privatizing the station for years, Monday’s announcement is the first time the idea has been officially endorsed by the White House. Advocates of a mission to Mars note that NASA is spending too much on keeping the ISS in orbit, and that it dilutes the mission of the space agency in terms of human space exploration. By putting an endpoint on US government involvement in the station, they argue, its new chapter can begin.

That means a lot to companies trying to attract customers who may want to take a gamble on setting up shop in orbit—using the space to develop new kinds of materials, test pharmaceuticals, or just provide a cool hideout for wealthy tourists.

“Not only is the administration saying, here’s our suggestion, let’s put in some budget money for companies to transition, but it also allows companies to raise money, and line up investors,” says Jeffrey Manber, CEO of Texas-based space logistics firm NanoRacks, which has sent more than 600 commercial and educational payloads to the station since 2009. Most are standardized mini-laboratories that plug directly into an existing equipment rack on the station. These small experiments rely on zero-gravity conditions on the ISS and are a testbed for a scaled-up manufacturing facility of the future.

Rather than selling the ISS to a big corporation (Boeing currently operates the station for NASA), Manber suggests splitting it up into pieces. There could be a space hotel in one orbital location, for example, with another one set up especially for manufacturing. “You could cannibalize the station,” he says. “If the goal is having a facility for manufacture of thin film silicon wafers, you don’t want a guy exercising on a bicycle next to it.”

NASA’s acting administrator Robert Lightfoot described the activity of these space-going ISS tenants during his budget announcement to employees at the Marshall Space Flight Center in Huntsville, Ala., on Monday. “While we head to the moon and ultimately to Mars, we need to be able to look back at low Earth orbit and see a vibrant economy, an economy that we have created and we’ve spurred with things like the International Space Station,” Lightfoot said. “This budget proposes to stimulate commercial industry opportunities in low Earth orbit by providing an off-ramp for government led operations on the space station.”

That might be a slow off-ramp. Many companies say they need time and money to shift from a government-run station to a new privately-operated one. That’s one reason why the new NASA budget proposal calls for $150 million in help to develop more access to the station.

“If they just flip the switch, it won’t work,” says Dylan Taylor, a space investor and founder of Space Angels, a venture capital firm that has invested in 50 space-related firms in the past few years. A five-year transition will help find a company that can keep things running, with the help of experienced NASA managers on call if something goes awry. “I would see one master logistics operator for resupply and scheduling,” Taylor says. “Then someone who is actually subdividing the volume of the space station to other operators who would use it for monetary purposes.”

Of course, there are two big problems with the above scenario. One, Congress likes the space station and has resisted calls to abandon it. Sen. Ted Cruz, Republican chair of the Senate Science Committee, said he hoped reports of ending station funding would “prove as unfounded as Bigfoot” and blamed it on “numbskulls” at the Office of Management and Budget.

“As a fiscal conservative, you know one of the dumbest things you can do is cancel programs after billions in investment when there is still serious usable life ahead,” Cruz said last week at the FAA Commercial Space Transportation Conference in Washington, DC.

Two, the ISS is actually a UN-style partnership. It was built and operated with help from Russia, Europe, Canada, and Japan, all of whom use the station to train their own astronauts, conduct biomedical research, and test new technology. Even though NASA has paid the lion’s share of the ISS costs over the past 20 years, those countries all pitched in money, astronauts, and rocket time—and it doesn’t appear that anyone at the White House or NASA asked them about this new privatization plan. Trump would have to shred (or renegotiate) multiple international agreements to privatize the ISS. So until both the foreign partners and Congress become convinced, the idea of a private space station will likely remain just that.

0 notes

Text

Would You Like to Spend Forever in This Tree?

SANTA CRUZ, Calif. — Death comes for all of us, but Silicon Valley has, until recently, not come for death.

Who can blame them for the hesitation? The death services industry is heavily regulated and fraught with religious and health considerations. The handling of dead bodies doesn’t seem ripe for venture-backed disruption. The gravestone doesn’t seem an obvious target for innovation.

But in a forest south of Silicon Valley, a new start-up is hoping to change that. The company is called Better Place Forests. It’s trying to make a better graveyard.

“Cemeteries are really expensive and really terrible, and basically I just knew there had to be something better,” said Sandy Gibson, the chief executive of Better Place. “We’re trying to redesign the entire end-of-life experience.”

And so Mr. Gibson’s company is buying forests, arranging conservation easements intended to prevent the land from ever being developed, and then selling people the right to have their cremated remains mixed with fertilizer and fed to a particular tree.

The Better Place team is this month opening a forest in Point Arena, a bit south of Mendocino; preselling trees at a second California location, in Santa Cruz; and developing four more spots around the country. They have a few dozen remains in the soil already, and Mr. Gibson says they have sold thousands of trees to the future dead. Most of the customers are “pre-need” — middle-aged and healthy, possibly decades ahead of finding themselves in the roots.

Better Place Forests has raised $12 million in venture capital funding. And other than the topic of dead bodies coming up fairly often, the office is a normal San Francisco start-up, with around 45 people bustling around and frequenting the roof deck with a view of the water.

There is a certain risk to being buried in a start-up forest. When the tree dies, Better Place says it will plant a new one at that same spot. But a redwood can live 700 years, and almost all start-ups in Silicon Valley fail, so it requires a certain amount of faith that someone will be there to install a new sapling.

Still, Mr. Gibson said most customers, especially those based in the Bay Area, like the idea of being part of a start-up even after life. The first few people to buy trees were called founders.

“You’re part of this forest, but you’re also part of creating this forest,” said Mr. Gibson, a tall man who speaks slowly and carefully, as though he is giving bad news gently. “People love that.”

Bring Your Dog, Forever

Customers come to claim a tree for perpetuity. This now costs between $3,000 (for those who want to be mixed into the earth at the base of a small young tree or a less desirable species of tree) and upward of $30,000 (for those who wish to reside forever by an old redwood). For those who don’t mind spending eternity with strangers, there is also an entry-level price of $970 to enter the soil of a community tree. (Cremation is not included.)

A steward then installs a small round plaque in the earth like a gravestone.

When the ashes come, the team at Better Place digs a three-foot by two-foot trench at the roots of the tree. Then, at a long table, the team mixes the person’s cremated remains with soil and water, sometimes adding other elements to offset the naturally highly alkaline and sodium-rich qualities of bone ash. It’s important the soil stay moist; bacteria will be what breaks down the remains.

Because the forest is not a cemetery, rules are much looser. For example: pets are allowed. Often customers want their ashes to be mixed with their pets’ ashes, Mr. Gibson said.

“Pets are a huge thing,” Mr. Gibson said. “It’s where everyone in your family can be spread. This is your tree.”

“Spreading” is what they call the ash deposit. The trench is a “space,” the watering can is a “vessel,” the on-site sales staff are “forest stewards.” When it comes to both death and start-ups, euphemisms abound.

It’s all pretty low-tech: mix ashes in with dirt and put a little placard in the soil. But there is a tech element: For an extra fee, customers can have a digital memorial video made. Walking through the forest, visitors will be able to scan a placard and watch a 12-minute digital portrait of the deceased talking straight to camera about his or her life. Some will allow their videos to be viewed by anyone walking through the forest, others will opt only for family members. Privacy settings will be decided before death.

Death Is a Growth Industry

As cities are running out of room to bury the dead, the cost of funerals and caskets has increased more than twice as fast as prices for all commodities. In the Bay Area, a traditional funeral and plot burial often costs $15,000 to $20,000. The majority of Americans are now choosing to be cremated.

“The death services market is very big — $20 billion a year — and customer approval is low,” said Jon Callaghan, a partner at True Ventures, an investor in Better Places. “The product is broken.”

The firm’s other investments include Blue Bottle, Peloton and Fitbit, and Mr. Callaghan sees consumers of those products as ones who would be interested also in Better Place trees.

“Every industry seems to have its time when things get wild,” said Nancy Pfund, the founder and a managing partner at DBL Partners, which led early funding. “It’s been mobile apps, it’s been cars, it’s been fake meat, and now it is death care,” she said.

“But we have to come up with a better name than ‘death care.’ Maybe it’s legacy care,” she added. “Maybe it’s eternity management.”

Around 75 million Americans will reach the life expectancy age of 78 between 2024 and 2042, Better Place suggests. The company’s pitch is that tree burial is good for the environment, the location is more beautiful than a traditional graveyard — and it’s cheaper as well.

Ms. Pfund also sees these forests as a way to monetize conservation. Actively managing a forest is expensive, so much so that financially strained state park systems are having to turn down gifts of land. Conservation easements, an agreement between an organization and the government to preserve land, have become more popular as a solution.

“No one has really made a big business monetizing conservation, nothing that could scale,” Ms. Pfund said. “So a bell went off when we heard this pitch.”

Where’s Grandma?

Those tracking the death services industry are more skeptical about how disruptive it will be.

John O’Conner, who runs Menlo Park Funerals, said more than 90 percent of his clients opt for cremation.

“Most of my people scatter on their own,” Mr. O’Conner said. “They just go at night, scatter grandma, have a cup of champagne, and every day they drive by that park they know grandma is there. Why would they pay $20,000 to go to a memorial grove when they can scatter at any little park they want to for free?”

That act is, technically, illegal.

“Don’t ask, don’t tell,” Mr. O’Conner said. He said he knew of a few golf courses in the region that had to put up signs imploring people not to scatter guest remains there.

Ben Deci, a spokesman for California’s Cemetery and Funeral Bureau, said Better Place Forests’ activities do not fall under the bureau’s purview.

“It looks to me like they’ve just purchased large tracts for forest land and are allowing people to disperse their ashes, and they say here ‘This’ll be your tree or whatever,’” Mr. Deci said. “You don’t need our approval to do that.”

Mr. Gibson does have a permit from the state verifying him as a cremated remains disposer. “But that’s not quite the right way to think about it,” he said.

How to Choose the Right Forever Tree

One recent day, Mr. Gibson walked through his 80 acres of Santa Cruz forest where about 6,000 trees are available, many wrapped in different colored ribbons, waiting to be chosen.

“The last major innovation in cemeteries was the lawn cemetery in the ’50s and ’60s, basically so they could get a lawn mower through easier,” Mr. Gibson said.

To claim a tree, customers walk through the forest and find one that speaks to them. The Better Place brochure also guides them: Coastal redwoods are “soaring and ancient,” tan oaks are “quirky and giving,” while a Douglas fir is “stately and reverent.”

“Some people want a tree that is totally isolated, and some people really want to be around people and be part of a fairy ring,” Mr. Gibson said. “Some people will come in and they’ll fall in love with a stump.”

“People love stumps,” he said, pointing out a few trees people bought just for the nearby stumps. “They’ve got a lot of personality.”

Younger people often choose younger trees because they like the idea of growth.

Debra Lee, a retired administrative assistant in San Jose, felt immediate kinship with the madrone tree she chose.

“She’s about 60 years old, and I’m 63,” Ms. Lee said of the mature evergreen with dark red bark. “Looking at her growth pattern you can see things have been hard at times because she’s kind of curved, but she made it to the top to get to the sunlight.”

When a customer chooses her tree, as Ms. Lee did, she cuts the ribbon off in what Better Place calls the ribbon ceremony.

As Mr. Gibson hiked across the Santa Cruz forest in a sweater and work boots, he noticed a rhododendron, his mother’s favorite flower, growing out of a stump.

Both his parents died when he was young, and, at 12, Mr. Gibson was adopted by his half brother. He is now 36, and, since then, he has spent many afternoons in Toronto at his parent’s grave site, set on a noisy corner, with a shiny black headstone that reflects traffic.

“You remember them dying, you remember the memorial service, and you remember the image of their final resting place,” Mr. Gibson said. He was haunted by that badly designed grave site. “It’s comically bad.”

Visiting their grave in 2015, he decided to quit his job running a marketing automation company. He would make a better graveyard.

“A lot of investors laughed at us when I first pitched this,” Mr. Gibson said. “People don’t really like thinking about this.”

Sahred From Source link Technology

from WordPress http://bit.ly/2F6hB4D

via IFTTT

0 notes

Text

A $22 billion investment firm led one of the largest ever funding rounds for a cannabis tech company — here's why it's a big deal for the industry

Tiger Global Management led a $17 million Series A round in Green Bits, a software platform for cannabis dispensaries.

It's one of the largest Series A rounds for a cannabis tech company to date.

Tiger Global's participation in the round is a sign that big money is starting to take the emerging sector seriously.

Big money is getting into the booming cannabis tech sector.

Tiger Global Management, a New York City-based investment firm that manages $22 billion, led a $17 million investment into Green Bits, a software platform for marijuana dispensaries.

It's a sign that mainstream investors are starting to take the emerging sector — which analysts say could generate $75 billion in sales by 2030 — seriously.

Casa Verde Capital, a Los Angeles-based venture fund that focuses on the "ancillary" side of the cannabis industry (that is, tech companies that provide software or payroll services to the cannabis industry but don't actually handle marijuana), also participated in the round.

Tiger Global declined to comment for the story. However, Karan Wadhera, the managing partner of Casa Verde, told Business Insider his firm has recieved a lot of interest from large institutional investors over the last quarter.

"I think this is a testament to both the size and pace of growth in the cannabis industry," Wadhera said. "Six months ago, many top VCs would not be ready to entertain a conversation on cannabis. Now we're seeing firms like Tiger Global ready to invest."

While many VC funds may want to invest in the cannabis industry, their limited partners — typically large, institutional pension funds or insurance companies — don't want to take on the risk as cannabis is considered an illegal, Schedule I drug by the US federal government.

Big money is coming for cannabis tech

Cannabis is legal in 9 states and Washington D.C., though institutional investors have generally been averse to putting money into the space. The rules in the cannabis industry, similar to other emerging sectors like cryptocurrencies, are fluid and constantly changing. Firms that invest in these nascent spaces risk bringing unwanted scrutiny from regulators.

Tiger Global's move to lead a Series A round into a cannabis tech company is a sign that this is beginning to shift. It's likely that bigger hedge funds and investment firms will start investing in cannabis tech companies that don't touch the plant directly and therefore don't come into conflict with federal law, like Green Bits.

Recent political developments, like President Donald Trump assuring Colorado Sen. Cory Gardner that he would support legislation protecting state's rights to legalize marijuana, have served to "de-risk the industry," Vahan Ajamian, an analyst at Beacon Securities said in a note.

Congress is also working to come up with more coherent rules for banking in the cannabis industry and for resolving federal-state conflicts, despite Attorney General Jeff Sessions' opposition to legalization.

"The US cannabis sector will have another year under its belt with no material negative federal developments – and potentially positive ones, providing investors with increased comfort," Ajamian wrote.

The lack of institutional players in the cannabis industry has provided an opening for firms like Casa Verde, as well as a host of other hedge and venture funds that invest solely in cannabis tech companies and understand the complicated regulations involved in the space.

Green Bits wants to be in 'every state' that has legalized cannabis

The Series A round led by Tiger Global brings Green Bits total raised to $19.3 million, which the company hopes to use to expand into new markets.

Ben Curren, Green Bits' CEO, told Business Insider that Wadhera made the introduction to Tiger Global after Casa Verde invested in Green Bits last summer.

"They were really comfortable investing in us because we're really a tech company, like any other they've dealt with before," Curren said. Tiger Global has made a number of venture investments in established tech companies, including Spotify and Wealthfront, according to CrunchBase.

Curren, like the rest of Green Bits' management team, is a seasoned tech executive. He founded and sold a startup to GoDaddy before starting Green Bits with his own money to capitalize on the cannabis space.

Green Bits, headquartered in San Jose, California, plans to use the financing to get their software platform into more dispensaries in states where marijuana is legal, Curren said.

The company's point-of-sale system, which helps dispensaries comply with regulations and drive sales, is already in over 1,000 dispensaries in legal states, Curren said, and he wants to expand Green Bits' business into payments.

Most dispensaries don't allow customers to charge their purchase to their credit card, as most big banks refuse to do business with cannabis dispensaries because of cannabis' federal status.

"We're trying to get Visa and Mastercard in dispensaries," Curren said, adding that his vision for the product would look something like Square, the credit-card processing company.

"We've aligned with some good partners, but it's going to take a couple steps to get there," Curren said.

Green Bits already processes more than $2.2 billion in sales annually through its point-of-sale system, Curren told Business Insider. Like many cannabis companies, Green Bits is setting its sites on dominating California and the potentially lucrative East Coast as more state markets, like Massachusetts and New York, open up.

"Our goal is to be in every state that has legalized cannabis in some way," Curren said. With an investor like Tiger Global, that goal may not be so far away.

Read more of our cannabis industry coverage:

The rising stars of marijuana's investment scene that everyone from Wall Street to Silicon Valley should know

The highest-valued marijuana companies of 2017 reveal 2 key insights about the booming industry

A startup that runs marijuana dispensaries is America's first $1 billion marijuana 'unicorn'

A hedge fund that focuses solely on marijuana is crushing it

A New York hedge fund manager moved to Canada and started the first marijuana company to be listed on a major US stock exchange — here's how he did it

SEE ALSO: The rising stars of marijuana's investment scene that everyone from Wall Street to Silicon Valley should know

Join the conversation about this story »

NOW WATCH: What living on Earth would be like without the moon

0 notes

Text

Skilled App Growth For Web Startups

This was at all times outdated the second the outcomes got here in and it was far too high over. It's way more accurate when you have got a product and your programmers have worked hard to reduce the traces of code, which is what good programmers do. 5 million or more in enterprise capital and haven't yet exhausted a wholesome portion of this amount. Skilled financial analysis will help create a more balanced budget, making it easier to plan future expansions or, if vital, cutbacks. Another motive that many new business startups fail is because they fail to jot down an in depth business plan. An excellent advertising and marketing plan. Lodgify’s answer allows both trip rental owners and property managers to create their very own cell-pleasant web site with a "Book Now" operate, manage reservations and availabilities, and immediately synchronize property information with listings on a number of external vacation rental portals. They considerably present all sorts of tax associated, market related, and city related information for the entrepreneurs in addition to individuals. Started by IIT-Delhi alumni Saurabh Saxena, Anil Gelra and Ritu Rana last Might, this meal-service startup truly serves as a web-based market for chefs—professionals in addition to amateurs (homemakers)—to record their signature dishes.

youtube

Accelerators will provide the rudimentary tissue in making partnerships go well. 61 A trend designer and buying app that can counsel particular clothes designs and styles primarily based on the person alternative, physique, curiosity, and the occasion. Since, the ultimate app produced nonetheless uses the native APIs, the cross-platform native apps can achieve close to native performance without any seen lag to the person. Also, of the 9,780 Kashmiri youths who received jobs under Udaan, it is unclear what number of are nonetheless employed. Also, as per a May 2017 Business Normal report, INR 246 Cr have already been spent on the programme, but only 10% candidates have been hired. 130 million in 2017 revenue. Cyber criminals due to this fact find a beautiful supply of revenue in getting access to and promoting such information to competitors. Getting your invoicing so as can ensure you have a gradual stream of earnings coming in and may be sure money is left over for positive cash move at the top of every month.

1. Each new customer makes getting the subsequent buyer simpler. Should you set clear expectations, management turns into a lot easier. It would ring at the set time and verify that the user truly woke up and didn’t go right back to the bed. Offering inventory options at the ground stage can be a huge attraction if the company already has the right culture. With out a proper API design and execution, an software is going to carry out rightly in the actual world. Thus, wearable devices connected with Smartphone will affect the following era of cell application improvement strategies. So why is cellular app growth such a challenge for startups? We work closely with effectively-funded startups and progressive companies, delivering internationally recognised apps including Foodswitch and That Sugar App. We can unite loads of mobile apps beneath the banners of leisure and life-style. Virtual actuality and Augmented Actuality apps will see a rise in demand and will drive the sphere of cellular app improvement.

Watch this area to see which startups thrive among robust competitors. Google could also be dominating the online advertising house as a result of it is not the one source for growth. Featured are over millions of users who go to Google Play Retailer on a daily basis which promotes better visibility as aforementioned. The variety of Indian startup initiatives launched over the previous 12 months is bound to spice up its ecosystem. In addition they speak the startup lingo. As you may see, there is no such thing as a definitive best startup location. We've an article that can enable you with this course of but you already know your app best and you should take the smartest resolution along with your customers in thoughts. So how are you able to get your company’s advisors to break the mold and leverage their experience that can assist you succeed? Venture capital is cash that's given to assist construct new startups which might https://www.goappable.com/ be considered to have each high-growth and high-danger potential. 5,000,000, depending on the beginning-ups want, projected growth and the extent of enterprise capital help. However, solely a very small amount of this capital reaches these startups. You may learn quite a bit from startups with sensible ideas who should not held again by the inner politics and procedures which may hinder big firms from changing fast.

Among the startups involved in EvoNexus specifically seek out San Diego as a place to develop. Traction: Based mostly out of Chennai, MeetUrPro has 1,000 professionals on the platform and was vying for half a million in revenues last financial yr. The easy consumer-interface and the completely different add-on features of the Odoo make it a best-identified modular platform for ERP growth and integration. Fb is certainly one of the most important firms on the earth and yet they've a quite simple design with virtually no particular effects. You could have to advertise a few posts on social media and hire an Web optimization guy but let me let you know the outcomes are instantaneous. The only factor that you must know is "who your clients are?", "what you're providing?" and "what people are prepared to order?" from your portal. Cybercrimes are consistently evolving, and being a small business proprietor means you’re in a high-risk group - in accordance with a 2018 Web Security Menace Report.

Complexity is the enemy of startup enterprise success. A staff that can work together below irritating situations and has a breadth of skills from engineering to enterprise is essentially the most cited criterion in successful startup stories. One hundred million. Now we have innovation hubs in cities from coast to coast, with 4 Canadian cities holding places in the highest 20 strongest startup ecosystems globally (Toronto, Montreal, Vancouver and Waterloo). Prospects act because the designers for your organization since they give you all the required improvements the place you've to adjust or adapt to their requirements. However a lot of the early SaaS firms have moved upstream to the enterprise by now. "The Foundry," Jumpstart’s 14-week mentoring incubation program, goals to organize a selection of about six corporations for a successful launch each year. 19.5 billion per yr. This is where you may need to consider outsourcing the event of your app. Don’t assume your job is done after you develop an android app.

Lots of local talent here at #DiscoverTechNATA that Government can source to meet emerging tech needs... @innogovca is trying to help startup companies connect with #GC @BrookstreetOtt @KanataNorthBIApic.twitter.com/imA13ARjjJ

— InnoGov Canada (@innogovca) March 28, 2018

"Changing from an effectivity-pushed mannequin of economic growth to an innovation-pushed model goes to take a very long time. I’m going to be your host right this moment. At AppDirect, our most complicated course of is the way we design, scope and ship new merchandise. Each user has a behavioural fingerprint; a novel, nuanced means they use their own pc. After all, for each industry and every individual kind of group, the attainable use instances differ. Fiscal Incentives: The trade share shouldn't be lower than 50% of the overall funds. 14. CenterCode (Mattermark Progress Score: 241) - The leader in Beta Check Administration Platforms and Companies, offering all the things it is advisable run effective beta packages. Recognized as the first on-line micro-lender, Count Me Inhas dedicated itself to fueling the mindset of growth and success among the many women entrepreneur community. Eventually, people will need to hitch not only for your organization tradition but additionally to work with the excessive-expert tech talent that already works here.

0 notes

Text

The Death of the ICO (And 4 Other 2018 Predictions)

http://www.cryptoga.com/news/the-death-of-the-ico-and-4-other-2018-predictions/

The Death of the ICO (And 4 Other 2018 Predictions)

Stefan Thomas is main technological officer at Ripple and co-creator of the Interledger payment protocol.

The subsequent write-up is an exceptional contribution to CoinDesk’s 2017 in Review.

If 2017 was the 12 months of the ICO, 2018 will be the 12 months of the fantastic ICO hangover.

It will also be the 12 months major money institutions adopt electronic belongings, and mark the beginning of hybrid blockchains.

1. The demise of the ICO token

“Cryptocurrency” became a major buzzword in 2017. Instantly, all eyes have been on these new belongings with speculators leaping into the market place in droves and regulators heavily scrutinizing them.

In fact, in early December, the combined market place capitalization of all electronic currencies surpassed that of JPMorgan, the greatest U.S. lender. First coin offerings (ICOs) likewise exploded, elevating hundreds of hundreds of thousands of dollars all around the earth in a issue of months.

When they created for enjoyable headlines, nevertheless, I anticipate the exuberance all around ICOs to fizzle in 2018.

What’s extra, I also anticipate regulators and authorities throughout the world to occur down hard on fraudulent ICOs in the new 12 months. That is due to the fact many ICOs skirted present regulation in get to raise equity — with no good company to again up the providing. Cash raised from some of these ventures have by now commenced to vanish, and regulators, these kinds of as the SEC, recently introduced that they’re finding prepared to crack down on them.

I wouldn’t be shocked to see significant fines, litigation and even jail time for those standing on the erroneous side of the ICO difficulty.

Outside of the regulatory crackdown, questions will occur all around the utility of unique-objective tokens. Why would a file hosting firm acknowledge payment in Filecoin, when a general-objective electronic asset is so significantly extra liquid and for that reason simpler to turn into fiat?

We do not use distinctive currencies to purchase apparel or pay back our mortgage in the brick-and-mortar earth and ICO token holders will realize the economics are no distinctive on the net.

2. Monetary institutions will adopt electronic belongings

If speculators entered the electronic asset market place in droves final 12 months, 2018 will be the 12 months that major institutional gamers like asset professionals, pension cash and other money institutions, these kinds of as payment companies, enter the room.

We’re by now viewing greater more than-the-counter (OTC) investing of electronic belongings, these kinds of as bitcoin on the Chicago Board Possibilities Exchange (CBOE), creating liquidity across the market place to deepen. It’s actually a issue of when, not if, listings of additional cryptocurrency futures on OTC exchanges will get area. My bet? We’ll see the listings by future summertime.

Involving this and new institutional gamers entering the market place, I assume electronic belongings have plenty of space for advancement. Even so, the crypto room won’t be with out its issues. Forking, regulation, and banking — oh my!

Governance concerns will carry on to plague some electronic belongings — creating forks these kinds of as the 1 with bitcoin and bitcoin funds. This instability will be problematic for some who want to enter the market place as it raises questions about offer as properly as the stage of hazard concerned.

The uncertain regulatory setting in the U.S., China and elsewhere could also stifle more development of the electronic asset market place. When countries like Japan and the Philippines have embraced electronic belongings in their economies and regulatory frameworks, there are many extra throughout the world with out very clear insurance policies and laws for these belongings.

They need to get a web page from the respective guides of Japan and the Philippines in get to allow new expert services, enhance money inclusion, and reduced obstacles to economic advancement.

For example, there are only a handful of money institutions in the U.S. that will lender organizations in the cryptocurrency room. If they have been to exit, or if regulation have been to occur through that prohibits exposure to the electronic asset market place, this could have very severe, adverse repercussions on the improved expert services being designed. Banks have to have very clear suggestions from regulators on how they can lawfully lender those connected with cryptocurrencies.

3. Blockchains will begin to interoperate

In 2017, we have witnessed bitcoin’s share of the cryptocurrency market place fall from 87 percent to under 50 percent. Hundreds of new cash and tokens introduced and are now being traded.

To make the broad use of electronic belongings really mainstream, nonetheless, I assume we’ll have to have the many blockchain networks that currently exist to interoperate. The fact is there will not be 1 single dominant blockchain network in the upcoming — just as there isn’t any dominant online or e-mail service provider globally today.

At this time, we can all e-mail relatives, buddies and colleagues from Gmail to Yahoo to Outlook seamlessly and right away. Price need to shift across all ledgers in accurately the identical way -— irrespective of the blockchain network, PayPal wallet or common lender account concerned.

Indeed, we have by now witnessed efforts in 2017 to tackle blockchain interoperability.

Raiden, the ethereum interoperability alternative for ERC-20 tokens, introduced its token in September, though the Interledger Protocol (ILP) was made use of to join 7 ledgers which include bitcoin, ethereum and XRP in June. My money is (unsurprisingly) on Interledger.

If all networks have been to develop into ILP-enabled, it finally wouldn’t issue if you held bitcoin, ether, litecoin or XRP. ILP would allow you to make payments to a service provider that only accepts bitcoin, for example, employing XRP — all in just a issue of seconds.

4. The beginning of hybrid blockchains

Until finally now we have witnessed a proliferation of the two general public blockchains like bitcoin and non-public blockchains like Hyperledger Material. Heading forward, I assume we’ll begin to see the rise of hybrid blockchains, which incorporate the ideal of the two worlds.

A hybrid blockchain operates on the open online and is available to any person like a general public blockchain, but it utilizes a smaller sized set of validators and is extra focused to a specific use circumstance like a non-public blockchain.

Deploying an ethereum contract or producing an ERC-20 token will be replaced by launching your very own mini-blockchain, which can be tuned to the specific wants of a given undertaking.

Will need extra decentralization? Significantly less? A lot more highly effective performance? Should really it be upgraded commonly or remain very steady? Just one sizing does not fit all, but future 12 months you can last but not least be capable to pick out.

This will be element of a larger sized development for blockchain networks to focus. Present methods consider to be anything to all people. In the upcoming, we will see extra focused implementations built for a very clear use circumstance. The ideal way to describe why this is vital is to stage to the Yahoo example — a tech big that spread itself slim across way too many merchandise and expert services, and couldn’t be really thriving in any of them.

In the identical way that Google concentrated on information, or Apple on layout, I assume those blockchains that aim on 1 core providing (e.g. a pure databases like BigchainDB) will survive, and prosper.

5. Specialization or generalization — a contradiction?

About the course of this write-up, I have argued that general-objective tokens will substitute unique-objective tokens and I have also mentioned that unique-objective blockchains will substitute general-objective blockchains.

This might feel like a contradiction at initial, but as blockchains develop into extra interoperable, blockchains and tokens will only be significantly less coupled together. This changeover will contain extra escalating pains, so it can be absolutely sure to be an exciting 12 months.

I’m psyched to see how it all performs out.

Think you have a better plan? CoinDesk is hunting for submissions to its 2017 in Review collection. E mail [email protected] to pitch your plan and make your views read.

Disclosure: CoinDesk is a subsidiary of Electronic Currency Group, which has an possession stake in Ripple.

Church candles by means of Shutterstock

The leader in blockchain information, CoinDesk strives to supply an open system for dialogue and discussion on all issues blockchain by encouraging contributed posts. As these kinds of, the opinions expressed in this write-up are the author’s very own and do not automatically replicate the check out of CoinDesk.

For extra details on how you can submit an opinion or examination write-up, check out our Editorial Collaboration Manual or e-mail [email protected].

Disclaimer: This write-up need to not be taken as, and is not meant to offer, investment advice. Make sure you perform your very own extensive investigation right before investing in any cryptocurrency.

0 notes