#bank statement mortgage texas

Photo

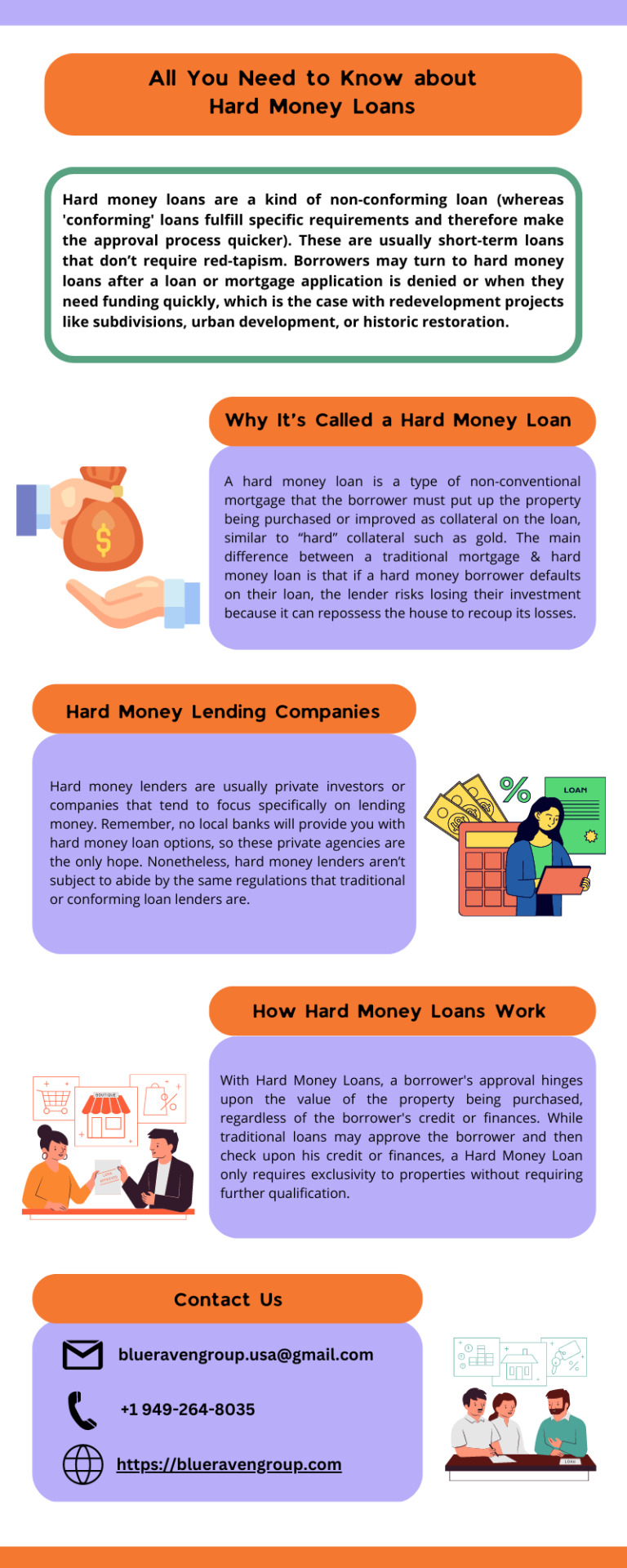

All You Need to Know about Hard Money Loans

Hard money loans are a kind of non-conforming loan (whereas 'conforming' loans fulfill specific requirements and therefore make the approval process quicker). These are usually short-term loans that don’t require red-tapism. Borrowers may turn to hard money loans after a loan or mortgage application is denied or when they need funding quickly, which is the case with redevelopment projects like subdivisions, urban development, or historic restoration. If you also require getting hard money in California, San Diego, or wherever you reside, you should read this article. It includes some vital information about hard money loans. So, without further ado, let’s get started!

0 notes

Text

How to Budget Your First Home Purchase with a Local Real Estate Agent in Garden Ridge

Buying your first home is an exciting milestone, and with the right planning and guidance, it can also be a smooth and enjoyable process. If you are considering purchasing a home in Garden Ridge, Texas, working with a local real estate agent can be invaluable.

In this article, you can read in brief how to budget for your first home purchase, how to qualify for down payment assistance, debunk common misconceptions about these programs, and what to look for in a local real estate agent in Garden Ridge can help you navigate the process.

Budgeting is the foundation of a successful home purchase. Here’s a step-by-step guide to help you manage your finances effectively:

1. Assess Your Financial Situation

Start by evaluating your current financial status. Review your income, expenses, and any outstanding debts. Create a detailed budget to understand how much you can comfortably afford to spend on a home.

2. Determine Your Down Payment

Traditionally, a down payment of 20% of the home’s purchase price is recommended. However, many first-time buyers put down less. In Garden Ridge, with its diverse range of housing options, you might find that a lower down payment is feasible. Consider your savings and explore local down payment assistance programs to determine what’s best for you.

3. Calculate Monthly Mortgage Payments

Use online mortgage calculators to estimate your monthly payments based on different loan amounts, interest rates, and terms. Don’t forget to include property taxes, homeowners insurance, and potential HOA fees.

4. Consider Additional Costs

Beyond the down payment and monthly mortgage, factor in other expenses such as closing costs, moving costs, and any immediate home repairs or upgrades.

5. Plan for Future Expenses

Homeownership comes with ongoing costs, including maintenance, utilities, and repairs. Make sure your budget accounts for these future expenses to avoid financial strain.

How to Qualify for Down Payment Assistance

Down payment assistance programs can significantly ease the financial burden of buying a home. Here’s how to qualify:

Understand Program Requirements: Different programs have various eligibility criteria. Generally, you need to meet income limits, be a first-time homebuyer (or not have owned a home in the past three years), and buy a home within certain price limits. Research local programs in Garden Ridge to find one that fits your needs.

Check Your Credit Score: Many down payment assistance programs require a minimum credit score. Check your credit report and work on improving your score if necessary.

Complete Required Education: Some programs require homebuyer education courses. These courses provide valuable information about the home buying process and can be a great resource for first-time buyers.

Prepare Documentation: Gather necessary documentation, including proof of income, tax returns, and bank statements. Being organized will help streamline the application process.

Potential Types of Assistance – Down Payment Assistance Programs Garden Ridge

There are many DPA programs available for home buyers in Garden Ridge and in Texas. Here are some examples of potential types of assistance that you can explore:

Grants: This is one type of down payment assistance program available in Garden Ridge that is non-repayable. Funds are granted for down payments or closing costs

Loans: Repayable funds generally at a discounted rate, such as TDHCA’s loan for first-time buyers and NHSSA’s loan program.

Tax Credits: Offset tax liability, potentially boosting your monthly income for mortgage payments. TDHCA and TSAHC offer tax credit programs.

Discounts: Lower home or loan costs to minimize upfront or ongoing expenses.

Conclusion

Budgeting for your first home purchase in Garden Ridge involves careful planning and consideration. Working with a local real estate agent who understands the area and the nuances of down payment assistance can make the process much smoother. By budgeting wisely, qualifying for assistance, and choosing the right agent, you can navigate your first home purchase with confidence and ease.

Reach out to us!

0 notes

Text

Investing Made Easy: Owner Financed Land Opportunities

The dream of owning land is within reach, thanks to innovative financing options like owner financing. At Lonestar Land Sales, we specialize in making this dream a reality by offering a diverse range of owner financed land opportunities across Texas. Whether you’re seeking a serene retreat, a productive plot for farming, or an investment property, our team is here to guide you through the benefits and process of owner financing.

What is Owner Financing?

Owner financing, also known as seller financing, is an alternative to traditional bank loans where the seller of the property acts as the lender. Instead of obtaining a mortgage from a bank or financial institution, the buyer makes payments directly to the seller over an agreed period. This option can simplify the purchasing process and make land ownership more accessible, especially for those who may not qualify for conventional financing.

Why Choose Owner Financed Land?

Owner financing offers several compelling advantages, particularly for buyers who may face obstacles with traditional lending routes. Here’s why owner financed land can be a game-changer:

Simplified Qualification Process

One of the biggest advantages of owner financing is the simplified qualification process. Unlike traditional lenders that require extensive credit checks, financial statements, and lengthy approval processes, owner financing focuses more on the buyer’s ability to make payments. This flexibility can be especially beneficial if you have less-than-perfect credit or unconventional financial situations.

Flexible Terms

Owner financing often comes with more flexible terms compared to traditional loans. Sellers are typically more open to negotiating the terms of the financing agreement, including the down payment, interest rates, and repayment period. This flexibility allows you to tailor the financing to fit your budget and financial goals.

Faster Closing

The closing process for owner financed land can be quicker than traditional real estate transactions. Without the need for bank approvals and appraisals, the transaction can move forward more smoothly and efficiently. This speed can be advantageous if you’re eager to secure a property quickly.

Less Stringent Requirements

Owner financing often involves fewer requirements and less paperwork than traditional loans. This reduced complexity can streamline the purchase process and make it easier for you to acquire the land you desire without getting bogged down in bureaucratic hurdles.

Why Buy Land in Texas?

Texas offers a wide array of land options that appeal to various interests and needs. From sprawling ranches and peaceful countryside to bustling urban areas and scenic retreats, the Lone Star State has something for everyone. Here’s why investing in Texas land is a smart choice:

Diverse Land Opportunities

Texas boasts a diverse range of land types, including agricultural plots, residential lots, and commercial properties. This diversity allows you to find land that suits your specific needs and preferences, whether you’re looking to build a home, start a business, or invest in real estate.

Robust Economy and Growth

The Texas economy is one of the strongest in the nation, with a steady rate of growth and development. This economic vitality drives demand for land and can contribute to appreciation in property values. Investing in Texas land offers the potential for long-term financial gains as the state continues to expand.

Low Property Taxes

Compared to many other states, Texas has relatively low property taxes. This favorable tax environment helps to enhance the attractiveness of land ownership, allowing you to enjoy your property without the burden of high taxes.

How Lonestar Land Sales Makes Owner Financing Easy

At Lonestar Land Sales, we are dedicated to making the process of buying owner financed land as straightforward and seamless as possible. Here’s how we facilitate your land ownership journey:

Extensive Property Listings

We offer a broad selection of owner financed land across Texas. Our listings are carefully curated to include properties that meet a variety of needs and preferences. Each listing provides detailed information and high-quality images to help you make an informed decision.

Personalized Assistance

Our experienced team provides personalized assistance throughout the buying process. We work closely with you to understand your needs and guide you in selecting the right property. Our goal is to ensure that you find a piece of land that aligns with your vision and financial goals.

Expert Negotiation

We handle the negotiation process with expertise, working to secure favorable terms for your owner financing agreement. Our goal is to ensure that you get the best possible deal, with terms that fit your budget and financial situation.

Streamlined Process

We strive to make the purchasing process as smooth and efficient as possible. From initial inquiry to closing, our team manages the details and paperwork, ensuring a hassle-free experience for you.

Start Your Journey with Lonestar Land Sales

Owning land is within reach with the flexible and accessible option of owner financing. At Lonestar Land Sales, we are committed to helping you realize your land ownership dreams. Explore our current listings of owner financed land and discover the perfect property that meets your needs and desires.

Contact us today to learn more about how owner financing can open doors to land ownership in Texas. Let Lonestar Land Sales be your trusted partner in finding and financing your ideal piece of Texas land. Your dream property is just a step away.

#texas land for sale#land for sale in Texas#owner financed land#land investment#investing in land#land for sale in houston#lonestar land sales#land investment texas#land owner financing#Austin land for sale#land for sale dallas#land for sale san antonio#land for sale in central texas#texas veterans land for sale#unrestricted land for sale in texas

1 note

·

View note

Text

Document and Bank Statement Editing Services

Need to modify your bank statement or any PDF document? Look no further! I offer expert editing services for bank statements, PDFs, and other documents, ensuring accuracy and confidentiality. Whether you need adjustments for a loan application, mortgage, or any other purpose, I can help. Contact me now for prompt and reliable editing services!

Services Offered:

Bank Statement Editing: Accurate and detailed edits for any bank statement.

PDF Document Editing: Professional edits for all types of PDF documents.

Scanned Document Editing: Improve and correct scanned documents.

Conversion Services: Convert documents to different formats (e.g., PDF to Word).

Add/Remove Transactions: Modify transaction details as needed.

Credit Card Statement Editing: Edit credit card statements for clarity and accuracy.

Data Entry: Enter data from bank statements and other documents accurately.

Why Choose Us?

Accuracy Guaranteed: Meticulous attention to detail for precise edits.

Confidentiality Assured: Your privacy is our top priority.

Quick Turnaround: Fast and reliable service to meet your deadlines.

Professional Service: Experienced editors dedicated to providing high-quality work.

Contact Us: Ready to get started? Contact us now for prompt and reliable editing services.

WhatsApp: +923213549046

WhatsApp Link

#EditBankStatement #BankStatementEditing #Bank #StatementEdit #BankStatementEdit #BankStatementEditing #EditPaystubs #FinancialServices #Paystubs #CheckStubs #CheckStubService #BankServices #USA #Canada #Texas #California #America #UK #London #EditPDF #BankFiles #BankFinance #Statements #BankStatement #BankStatements #BankStatementLoan #EditBankStatementPhotoshop #EditBankStatementsFree #ExplorePage #Top #ForYou #FYP #Instagram #Documents #Edits #Photoshop #GraphicDesign #Illustrator #Illustration #Creative #Design #Designer #EditDrivingLicense #EditPaystubs #EditBankStatement #EditAnyDocument #Editing #Paystubs #PaystubServices #PaystubsNeeded #PaystubService #PaystubService

0 notes

Text

Immigration Lawyer Near Me Deals With Fraud Cases

In Texas, immigration fraud charges comprise a wide range of criminal activities and carry severe penalties, including imprisonment and deportation. Therefore, you need an "immigration lawyer near me" to manage this case.

This article will tackle how a skilled lawyer can help with fraud cases and discuss some common scenarios they tend.

Whether you're a victim of fraudulent activity or wrongly accused, having the proper legal representation is crucial.

Finding An "Immigration Lawyer Near Me"

Handling fraud cases related to immigration is a crucial responsibility of an immigration attorney. These lawyers focus on managing the intricate details of fraudulent activities related to immigration.

One way in which an immigration lawyer assists with fraud cases is by conducting thorough investigations. They will review documents and gather evidence to build a strong case against those involved in fraudulent activities. This attention to detail ensures that all aspects of the fraud are uncovered and adequately addressed.

Additionally, an immigration lawyer provides legal guidance throughout the entire process. They will explain applicable laws and regulations, advise clients on their rights and options, and help them make informed decisions. This guidance is essential for individuals unfamiliar with the intricacies of immigration law. A proficient immigration attorney comprehends the various approaches to dealing with different types of fraud cases.

Understanding A Fraud

Fraud is a deceptive act committed to gain an unfair advantage or cause harm to others. In the context of immigration, fraud cases can involve forged documents, misrepresentation of facts, or deceitful schemes aimed at circumventing immigration laws. These fraudulent activities are illegal and undermine the integrity and fairness of the immigration system.

Document Fraud

One common type of fraud that immigration lawyers often encounter is document fraud. It involves creating or using counterfeit documents such as passports, visas, or identification cards to deceive authorities about a person's true identity.

Marriage Fraud

Another form of fraud in immigration cases is marriage fraud. It occurs when individuals enter into fake marriages solely to obtain immigration benefits.

Employment-Related Scams

Some individuals may engage in employment-related scams that offer fake job opportunities to foreign workers in exchange for money or other favors.

Fraud In Financial Matters

In addition, fraudulent activities can occur in the consumer and financial sectors. Here are some examples of potential violations that may occur. However, the list is not all-inclusive.

Electronic Or Mail Fraud

Most financial transactions involve Internet communication, these federal criminal offenses are applied in electronic and mail. A conviction of wire fraud can carry severe penalties.

In addition to hefty penalties, a prison term of up to 20 years is possible. Individuals may face a penalty of up to $250,000, while businesses may be fined up to $350,000.

Bank Fraud

Bank fraud was introduced as part of the Comprehensive Crime Control Act of 1984 to simplify prosecuting fraud against federally insured financial institutions. The range of possible punishments is very harsh, with a maximum of 30 years in jail and a $1,000,000 fine.

Mortgage Fraud

Mortgage fraud is committing a crime by making a material misstatement, fraudulent statement, or misrepresentation on a loan application used to underwrite the loan.

Healthcare Fraud

Healthcare fraud is the deliberate misrepresentation or falsification of services, resulting in unauthorized reimbursement. Anyone who violates this subsection will face a fine and a potential jail sentence of ten or twenty years. If this subsection violates death, the prison sentence might be lifelong.

Whether a fraud charge is at the federal or state level significantly impacts its main parts and how serious it seems. A fraud case often needs the help of an experienced attorney at the Medlin Law Firm, especially if you are an immigrant. Click the following link.

Summary

An immigration lawyer is essential in handling fraud cases related to immigration. They conduct thorough investigations, review documents, and gather evidence to build a strong case against those involved in fraudulent activities. They provide legal guidance, explain applicable laws, advise clients on rights, and help make informed decisions.

Fraud cases can involve forged documents, misrepresentation of facts, and deceitful schemes. Examples include document fraud, marriage fraud, and employment-related scams.

More information

The Medlin Law Firm in Manta

Driving directions

The Medlin Law Firm

1300 S University Dr #318

Fort Worth, TX 76107

(682) 204-4066

0 notes

Text

Professional Bank Statement Editing Services

Need to modify your bank statement? Look no further! I provide expert editing services for bank statements, ensuring accuracy and confidentiality. Whether you need adjustments for a loan application, mortgage, or any other purpose, I can help. Contact me now for prompt and reliable bank statement editing!

Contact and Order: WhatsApp: +923213549046

WhatsApp Link: https://wa.link/j2fovc

#editbankstatement#editbankstatements#bank#statementedit#bankstatementedit#bankstatementediting#editpaystubs#financialservices#paystubs#checkstubs#checkstubservice#bankservices#usa#canada#texas#california#america#uk#london#editpdf#bankfiles#bankfinance#statements#bankstatement#bankstatements#bankstatementloan#editbankstatementphotoshop#editbankstatementsfree#explorepage#top #foryou #fyp #instagram #documents #edits #photoshop #graphicdesign #illustrator #illustration #creative #design #designer #editdrivinglicense #editanydocument #editing #paystubs #paystubservices #paystubsneeded #paystubservice #paystubservice

1 note

·

View note

Text

America Mortgages Announces a Way to Obtain US Mortgages based on Rental Income Only

America Mortgages, the leader in U.S. mortgage originations launched a non-QM lending program for non-resident investors to qualify purely off the rental income

America Mortgages, Inc., the leader in U.S. mortgage loan originations for non-resident foreign nationals and U.S. Expats announced today that the company has launched its non-Qualified Mortgage (“non-QM”) lending program for global U.S. real estate investors where showing their “true” ability to service debt is limited. America Mortgages Investor Series Platinum allows foreign and U.S. expat investors in the U.S. real estate market to qualify purely off the rental income rather than proof of personal or business income.

“As we look ahead to a healthy and growing non-QM market, we are excited to provide options to qualified borrowers that sit outside the traditional guidelines, such as entrepreneurs that may have significant paper assets but not provable income in the traditional sense.” said Robert Chadwick, CEO of America Mortgages. “With our leading lending platform, we have the expertise, resources, capabilities and sophisticated products to help complex borrowers find the right lending solutions and pursue their goal of creating a viable U.S. real estate portfolio.”

We have the expertise, resources, capabilities and sophisticated products to help complex borrowers find the right lending solutions and pursue their goal of creating a U.S. real estate portfolio. — Robert Chadwick

Through its America Mortgages Investor Platinum Series, America Mortgages has built a suite of multiple distinct mortgage products that meet the various needs of international borrowers of U.S. real estate who may not otherwise satisfy conventional financing requirements. Those who may be able to benefit from America Mortgages’ non-QM U.S. investment mortgage products include borrowers that fall outside the qualified mortgage requirement such as true foreign nationals and with no U.S. credit, self-employed borrowers, bank statement or asset backed, real estate investors, prime HNW (High-Net-Worth) individuals and more.

Across America Mortgages’ non-QM U.S. investment platform, the company has built an efficient lending process that utilizes both technology and human interaction, guiding borrowers from product selection through loan closing. Dedicated and experienced experts from sales, support desks, underwriting and operations working around the world assist throughout the loan process.

“As we further grow our footprint in Non Resident Foreign National and U.S. Expat mortgage lending, we are committed to underwriting quality loans that meet our guidelines and pricing models. Our product suite is differentiated with various options to fit specific borrower criteria and needs. Matched with our superior customer service, growing technology capabilities and end-to-end platform, each lending experience is treated delicately from start to finish. Our non U.S. resident foreign national borrowers will also benefit from our experience.” added James Morales, Head of Operations of America Mortgages. “100% of our clients are U.S. real estate investors living and working outside the U.S. No one does this type of mortgages better than America Mortgages.”

Headquartered in San Antonio, Texas and Singapore, and with representation across 12 different countries including the UK, Australia, Canada, Europe and Hong Kong to name a few, America Mortgages specializes in finding the right loan for every borrower. With loan officers in 12 different countries, speaking 8 different languages and working on a 24 hour clock, there is no longer the need for international U.S. real estate investors to speak with lenders at 3am or spend hours on hold. America Mortgages’ offers a wide range of U.S. mortgage products that do not require U.S. credit and can get LTVs (Loan to Value) up to 75% in all 50 states. Helping global real estate investors make the dream of U.S. ownership attainable. Visit AmericaMortgages.com for more information on products and instructions on applying for a loan.

About America Mortgages and Global Mortgage Group

Founded in 2019, Global Mortgage Group PTE LTD [GMG], and headquartered in Singapore, is a full-service global mortgage financing firm offering mortgages for investment purposes in The United States, Australia, Canada, United Kingdom, Germany, France, Spain, Singapore, Hong Kong, Philippines, Thailand, Japan to name a few. For more information, visit www.gmg.asia or call +65 9773 0273.

Founded in 2020, America Mortgages, Inc. is a wholly owned subsidiary of Global Mortgage Group PTE LTD [GMG]. America Mortgages headquartered in San Antonio, TX, with representation in 12 different countries, is dedicated to providing U.S. mortgage options for non-resident Foreign Nationals and U.S. Expats. 100% of America Mortgages [AM] clients are living and working outside of the U.S. Both GMG and AM focus on building quality, long-term relationships with its partners such as Private Banks, EAM, Family Offices, Realtors and other mortgage broker located around the world by offering a wide variety of mortgage loan programs focused on specific markets with an exceptional client experience. For more information, visit www.americamortgages.com or call +1 830-217-6608.

Robert Chadwick

America Mortgages. Inc

+65 8430 1541

Reference: https://www.americamortgages.com/america-mortgages-announces-a-way-to-obtain-us-mortgages-based-on-rental-income-only

0 notes

Text

Navigating the Texas Housing Market: Top Mortgage Lenders in San Antonio

The Texas housing market is known for its vibrant and diverse real estate landscape, and San Antonio stands out as one of its most desirable cities. If you're ready to embark on your home ownership journey in this thriving metropolis, finding the right mortgage lender is crucial. In this blog post, we will explore the top mortgage lenders in San Antonio who will assist you in navigating the Texas housing market with confidence and expertise.

Tyler Carlston, Mortgage Broker NMLS #1857360 - Powered by UMortgage of Texas With a strong presence in San Antonio, Mortgage Lenders has earned a stellar reputation for their exceptional customer service and competitive mortgage products. They offer a wide range of loan options, including conventional loans, FHA loans, VA loans, and jumbo loans, catering to the diverse needs of home buyers in the area. Mortgage Lenders experienced team of loan officers will guide you through the entire lending process, ensuring a seamless and stress-free experience.

Tyler Carlston, Mortgage Broker NMLS #1857360 - Powered by UMortgage of Texas As a trusted name in the banking industry, ABC Bank has a solid track record of providing reliable mortgage services to San Antonio residents. Their knowledgeable loan officers work closely with home buyers, offering personalized solutions tailored to their financial goals. Tyler Carlston, Mortgage Broker NMLS #1857360 - Powered by UMortgage of Texas commitment to transparency and efficiency has made them a top choice among San Antonio home buyers seeking a reputable lender.

Mortgage Lenders Credit Union is known for its member-eccentric approach and commitment to serving the local community. As a not-for-profit financial institution, Mortgage Lenders Union offers competitive mortgage rates and flexible loan options. They take the time to understand your unique needs and financial situation, helping you find the mortgage that best aligns with your goals. With Mortgage Lenders Credit Union, you can expect personalized attention and a smooth lending process.

Tyler Carlston, Mortgage Broker NMLS #1857360 - Powered by UMortgage of Texas has established a strong presence in the San Antonio market, earning a reputation for their expertise and dedication to customer satisfaction. Their team of experienced loan officers provides guidance and support throughout the mortgage process, ensuring that you make informed decisions. Mortgage Lenders offers an array of mortgage products, including first-time home buyer programs, renovation loans, and refinancing options.

Mortgage Lenders is a boutique mortgage lender that specializes in providing personalized service to home buyers in San Antonio. They understand that each borrower has unique needs, and they pride themselves on finding creative solutions to match those needs. Mortgage Lenders team of mortgage professionals offers a consultative approach, taking the time to educate borrowers about their options and helping them make confident decisions.

When choosing a mortgage lender in San Antonio, it's essential to consider factors such as interest rates, loan terms, customer service, and reputation. The top mortgage lenders mentioned above have a proven track record of serving the local community and helping home buyers achieve their dreams of home ownership. However, it's crucial to conduct your own research and carefully evaluate each lender based on your specific requirements.

Before approaching a mortgage lender, it's recommended to take certain steps to prepare yourself for the lending process. Start by reviewing your credit report and addressing any potential issues. Save for a down payment and gather all the necessary financial documents, such as tax returns, pay stubs, and bank statements. Being prepared will not only streamline the process but also put you in a stronger position to negotiate favorable loan terms.

In conclusion, navigating the Texas housing market requires the expertise and support of a top mortgage lender in San Antonio. These reputable lenders offer a wide range of mortgage products, personalized service, and industry knowledge to guide you through the lending process. Take the time to research and select a lender that best aligns with your needs, and soon enough, you'll be well on your way to securing your dream home in the vibrant city of San Antonio.

Contact us:

Tyler Carlston, Mortgage Broker NMLS #1857360 - Powered by UMortgage of Texas

401 E Sonterra Blvd Suite 375-303, San Antonio, TX 78258, United States

(512) 595-3839

https://www.umortgageoftexas.com/

Find us on google maps:

https://www.google.com/maps?cid=11765413576709079038

Social Profile:

Facebook

Instagram

Linkedin

Youtube

Pinterest

Tumblr

1 note

·

View note

Text

Unlocking the Benefits of VA Loans in Texas: A Guide for Eligible Veterans

VA loans are a great opportunity for eligible veterans and their families to become homeowners in Texas. VA loans offer many benefits such as low-interest rates, no down payment requirements, and no private mortgage insurance (PMI). With these benefits, it's no surprise that VA loans are a popular choice for veterans who want to purchase a home. In this guide, we will explore the benefits of VA loans in Texas and how eligible veterans can take advantage of this opportunity.

One of the biggest benefits of VA loans in Texas is the low-interest rates. VA loans have competitive interest rates that are often lower than conventional loans. This means that veterans can save a significant amount of money over the life of the loan. With lower monthly mortgage payments, veterans can use their money for other important expenses such as healthcare or education.

Another advantage of VA loans is that they do not require a down payment. This is a significant benefit for veterans who may not have enough money saved up for a down payment. With a VA loan, veterans can purchase a home without having to worry about the financial burden of a down payment. This allows veterans to focus on finding the perfect home for themselves and their families.

In addition to no down payment requirements, VA loans also do not require private mortgage insurance (PMI). PMI is a monthly fee that is added to a mortgage payment when a borrower puts less than 20% down on a home. With a VA loan, veterans do not have to worry about this additional expense. This can save veterans thousands of dollars over the life of the loan.

To be eligible for a VA loan in Texas, veterans must meet certain criteria. First, veterans must have served in the United States military for at least 90 consecutive days during wartime or 181 consecutive days during peacetime. Veterans who have served for at least 6 years in the National Guard or Reserves are also eligible for a VA loan. In addition, veterans must have received an honorable discharge. VA loans Texas

Once veterans have determined their eligibility for a VA loan, they can begin the application process. The first step is to obtain a Certificate of Eligibility (COE) from the Department of Veterans Affairs (VA). The COE verifies a veteran's eligibility for a VA loan and is required by lenders to approve a loan. Veterans can apply for a COE online through the VA's eBenefits portal or by submitting a VA Form 26-1880.

After obtaining a COE, veterans can begin searching for a lender. It's important to choose a lender who has experience with VA loans and understands the unique benefits and requirements. Veterans can use the VA's lender search tool to find a lender who specializes in VA loans in their area.

Once a lender has been chosen, veterans will need to provide documentation such as income verification, tax returns, and bank statements. The lender will also order an appraisal of the property to ensure that it meets VA standards. Once the loan is approved, veterans can move forward with closing on the home and becoming homeowners.

In conclusion, VA loans in Texas offer many benefits to eligible veterans and their families. From low-interest rates to no down payment requirements and no PMI, VA loans can make homeownership more accessible and affordable for veterans. If you are a veteran and are interested in purchasing a home in Texas, be sure to explore the benefits of a VA loan and take advantage of this opportunity.

It's worth noting that VA loans are not only limited to purchasing homes. They can also be used for other purposes, such as refinancing an existing mortgage. Veterans can use a VA loan to refinance their current mortgage, which can result in lower monthly payments or a shorter loan term. This can save veterans money over the life of the loan and allow them to pay off their mortgage sooner.

Another benefit of VA loans in Texas is that they are often easier to qualify for than conventional loans. VA loans have less strict credit score and debt-to-income ratio requirements, which means that veterans with less-than-perfect credit or high levels of debt may still be able to qualify for a VA loan. This can make homeownership a possibility for veterans who may have been turned down for a conventional loan.

It's important to note that while VA loans offer many benefits, there are also some potential drawbacks to consider. For example, VA loans often have stricter property standards than conventional loans, which means that certain types of properties may not be eligible for a VA loan. In addition, VA loans may have higher closing costs than conventional loans, although veterans can negotiate with lenders to try to reduce these costs.

Overall, VA loans in Texas are an excellent opportunity for eligible veterans to become homeowners. With competitive interest rates, no down payment requirements, and no PMI, VA loans can make homeownership more accessible and affordable for veterans. If you are a veteran and are interested in purchasing a home in Texas, be sure to explore the benefits of a VA loan and take advantage of this opportunity.

1 note

·

View note

Text

Get To Know About the Commercial Property Loan

By mortgaging your commercial real estate, you may get a substantial amount of capital through texascommercialloans COMMERCIAL property loans TEXAS. You might utilize the commercial property for your business or for any other activity that makes money. If you want to grow your business or purchase expensive gear, for example, and need access to substantial, inexpensive finance, you might choose a commercial property loan.

When you borrow money through mortgaging commercial real estate you already own, you are taking out a loan against commercial property in this context. However, on occasion, lenders will refer to loans for commercial property as loans made to buy commercial real estate, as in the case of a loan for a commercial shop.

Collateral

You must first mortgage a business property you own to get a Commercial Loans Texas for commercial real estate. This may take the form of an office building, an industrial facility, or even a grocery store, depending on the requirements of your lender.

Credit Amount

The amount of finance you may get depends on the loan-to-value or LTV of the business property. For instance, if the LTV is 50% and your property is worth Rs. 2 crores, you can get a loan for Rs. 1 crore. A loan against property typically offers an LTV of between 60 and 75 percent. Use a loan-to-value calculator to determine the amount of financing you are eligible for.

Repayment

Commercial real estate loans often have long terms, up to 18 years, which gives the borrower flexibility in payments. The cost-effective rate of interest for a loan secured by commercial real estate is made possible by the loan's valuable collateral.

You must be an Indian national with a reliable source of income to obtain a loan against texascommercialloans COMMERCIALproperty loans TEXAS. Additionally, you must fall within the eligible age range and possess legally sound business property. Ideally, you should have a CIBIL score of 750 or higher.

Among the papers you could want are:

Documentation of your residency and identification, such as a passport, PAN card, voter ID, or driver's license.

Documentation such as bank account statements and tax returns.

Property-related: Title deeds, buyer agreements, etc.

Other paperwork: records relating to the company

0 notes

Text

Metro Bank in Pella, Oklahoma

Choosing a bank can be a daunting task, but if you're in the Pella area, the Metro Bank may be just what you're looking for. After all, the company is locally owned and operated, and provides a wide range of financial services to its customers. Whether you're looking for a loan or a savings account, the company's experts can help you achieve your financial goals.

Judge Seay's background

Among the judges presiding over the Federal District Court for the Eastern District of Oklahoma is a man with a name that is synonymous with crime, Frank Howell Seay. A former judge in the state of Oklahoma, Seay's background includes a stint as a judge in the Oklahoma District Court, where he served from 1980 to 1996. During that time, he also served as chief judge of the district court.

In addition to his judicial work, Seay was also involved in numerous civic organizations, including the board of the Orlando Science Center and the United Arts of Central Florida. He was also a member of the Leadership Orlando class of 1989. His practice involved commercial real estate, and he was a judge advocate in the United States Marine Corps.

Judge Dorough's background

Known to millions of children as the musical director of Schoolhouse Rock!, Bob Dorough's unique vocal style helped millions of kids learn math. He was an arranger, pianist, composer, and vocalist. He was also awarded an honorary degree by East Stroudsburg University in 2007.

He studied at Columbia University and North Texas State Teachers College before becoming a pianist. Dorough played with numerous musical groups and bands. He later signed with Blue Note Records. He contributed to a number of musical albums, including Money Rock, America Rock, and Grammar Rock. He also toured Europe with Fred Braceful, Bill Takas, and Michael Hornstein.

Dorough's debut album was released in 1956. It included lyrics from the Yardbird Suite by Charlie Parker. The song "Baltimore Oriole" caught the attention of Miles Davis. He asked Dorough to provide lyrics for a Christmas record.

E-statement delivery

Fortunately, Metro Bank has an impressive list of assets, not to mention a robust online and mobile banking experience. The big M is one of the largest banks in the country. It has a staff of over 12,000 with an average of over 900 employees per branch. Among its peers, Metro Bank boasts a plethora of banking products and services, including retail, business and commercial banking. It boasts a whopping $726 million in assets. Amongst the competition, Metro Bank has an industry-leading customer service rating. As for the actual employees, the company is a veritable mix of millennials and baby boomers.

Routing transit number

Whenever you make a payment through your checking account, you will be asked for the checking account routing number. This number identifies where your account was opened and where it is held. If you have any questions about your account, you should contact your bank. Generally, you will find the routing number on the left-hand side of a check. Typically, it consists of nine digits. It is issued by the American Bankers Association. In some cases, a bank may have more than one routing number. It also identifies the financial institution and the transaction type.

For example, a routing number is used for a domestic money transfer or a wire transfer. Similarly, a routing number can be used to process direct deposits or a bill payment.

Hours of operation

Located at 1920 Martin Street South in Pell City, Alabama, Metro Bank is a state trust company that offers a full range of banking services, including mortgages, loans and deposit services. Its main office, located at the bank's headquarters, has 45 employees and serves approximately 300 clients in Pell City and surrounding communities. The main office is open Monday through Friday, except on holidays. For more information on the company, visit its website at metrobank.com.

Metro Bank's website contains an extensive list of services and products, including financial planning, lending, and business services. The website also provides information on the company's charitable and community-oriented programs. Metro Bank offers an array of consumer loans, mortgages, savings and checking accounts, and online and mobile banking options. The company's website is also a great place to find out about special events, such as the annual golf tournament and the upcoming holiday season.

0 notes

Text

Days gone update 1.81

"The danger has increased that the Fed will be forced into faster tapering an an insurance hike next. Powell does not have to return to the press conference platform in December, January and March and again have to explain why inflation has risen even further," Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote in a note ahead of Wednesday's decision. "The Fed's credibility will be enhanced if Mr. And in the Fed's latest policy statement Wednesday, the central bank slightly updated its remarks on inflation, saying that "Inflation is elevated, largely reflecting factors that are expected to be transitory." In September, the Fed had said inflation was "elevated, largely reflecting transitory factors." These elevated levels of inflation might push the Fed to raise rates more quickly than previously telegraphed, some maintained. Still, the persistently hotter-than-expected inflationary pressures in the recovering economy have put the Fed in a difficult spot when it comes to waiting on rate hikes, many economists argued. However, at the conclusion of the Fed's last meeting, the outlook showed a divided committee for next year, with nine members seeing no rate hikes by the end of next year while the other nine members saw at least one hike. The Fed's latest monetary policy decision will not come with updated projections on the interest rate outlook from individual policymakers. With the tapering announcement now made, the bigger question for market participants has become when the Fed will begin to raise interest rates. "Beginning in December, the Committee will increase its holdings of Treasury securities by at least $60 billion per month and of agency mortgage-backed securities by at least $30 billion per month." "Beginning later this month, the Committee will increase its holdings of Treasury securities by at least $70 billion per month and of agency mortgage‑backed securities by at least $35 billion per month," it added. King County collects the highest property tax in Texas, levying an average of $5,066.00 (1.56% of median home value) yearly in property taxes, while Terrell County has the lowest property tax in the state, collecting an average tax of $285.00 (0.67% of median home value) per year.įor more localized property tax rates, find your county on the property tax map of Texas to the left or in the county list below."In light of the substantial further progress the economy has made toward the Committee’s goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities," according to the FOMC statement. The exact property tax levied depends on the county in Texas the property is located in. Texas is ranked 12th of the 50 states for property taxes as a percentage of median income. Texas's median income is $62,353 per year, so the median yearly property tax paid by Texas residents amounts to approximately % of their yearly income. Texas has one of the highest average property tax rates in the country, with only thirteen states levying higher property taxes. Counties in Texas collect an average of 1.81% of a property's assesed fair market value as property tax per year. The median property tax in Texas is $2,275.00 per year for a home worth the median value of $125,800.00.

0 notes

Text

Non qm lender

NON QM LENDER FULL

NON QM LENDER REGISTRATION

NON QM LENDER LICENSE

NON QM LENDER FREE

Phil Stevenson is 1 of approximately 150 Certified Reverse Mortgage Professionals (CRMP) in the United States, and currently sits on the Ethics Committee of the National Reverse Mortgage Lenders Association (NRMLA).īorn and raised in Miami to a Cuban mother, he speaks fluent Spanish and uses the nickname “Felipe” when working with clients who are not strong in the English language. If you would like more information, please give us a call at 88 or email us at “Felipe” Stevenson, CRMP Owner & Principal PS Financial Services 365768 Bad credit, 1 day out of bankruptcy, one day out of foreclosure, and more. Foreign National Mortgage Loans also fall under Non-QM, click here for more info on Foreign National Loans. The key for all of these is the Ability to Repay (ATR). We have a calculation that gives us an income amount based on the amount you have invested, and you don’t have to have a job or other steady source of income. Other Non-QM loans allow you to use assets or money in investments without touching those funds. So we sue the income of the property, instead of the income of the owner. This allows someone to buy an investment property by putting at least 20% down on a residential property without verifying the income or debts of the buyer. is an Equal Housing Lender.Non-Qualified Mortgages: The Bank Statement Mortgage Loans (click here for more info on this one) are the most popular, but the runner up is the Investor Cash Flow (ICF) or Debt Service Coverage Ratio (DSCR) or No Debt to Income (DTI) Ratio loan. Program rates, loan terms and conditions are subject to change at any time and may vary based on the individual borrower's eligibility and credit history. This information is not a loan commitment or an offer to extend credit as defined by.

NON QM LENDER LICENSE

District of Columbia Mortgage Lender License MLB35286.

NON QM LENDER REGISTRATION

244997 Texas-SML Mortgage Banker Registration Virginia NMLS ID No. L-202120 Pennsylvania Mortgage Lender License No. B500605 North Carolina Mortgage Lender License No. B500605 and Exempt Mortgage Loan Servicer Registration No. Department of Banking and Insurance New York Licensed Mortgage Banker NYS Department of Financial Services Mortgage Banker License No. 19642 Massachusetts Mortgage Lender License M元5286 New Hampshire Mortgage Banker License - License/Registration #: 24507-MB New Jersey Residential Mortgage Lender License No. MLD583 Georgia Mortgage Lender License No. NMLS ID: 35286 Colorado - Regulated by the Division of Real Estate.

NON QM LENDER FREE

If you’re self-employed and have struggled to obtain financing, please feel free to reach out to one of our loan officers, and they’d be happy to go over all your options to move forward with a non-QM loan. Not every mortgage business out there will offer this programs to their borrowers, but NJ Lenders Corp.

NON QM LENDER FULL

The program is designed to help show alternate methods of income verification, and borrowers will be able to do so by providing full documentation, one-year tax return program, bank state program (6 or 12 months), and asset depletion/asset qualification. According to the Origination Solutions Survey from Altisource Portfolio Solutions, non-QM lending could see a surge, and was deemed one of the most promising market opportunities by more than 200 “decision makers” in the mortgage origination business. One of the bright spots for the mortgage industry is the expected increase of non-QM loans. It can be used for rate-and-term refinances, cash-out refinances, or a new home purchase for owner-occupied, second homes, or investment homes. The non-QM loan program will target credit-worthy borrowers who are self-employed, have non-traditional incomes, have assets and no income, or have had difficulty qualifying for a traditional mortgage. Who exactly can benefit from a non-QM loan? is, in fact, a non-QM lender, and they have more flexibility in the underwriting process to work with any borrower that other lenders might label as risky. But, keep in mind that not every lender will offer this. Are you a self-employed borrower? Do you own your own business, and have maybe struggled to obtain financing? If you’ve experienced difficulty trying to do so, it might be best to try and benefit from a non-qualified mortgage (non-QM) loan.Ī non-QM loan is any home loan that doesn’t meet the regular standards of a qualified mortgage.

0 notes

Text

Expert Bank Statement Editing Services

Need your bank statement edited? Look no further! I offer professional editing services for bank statements with a focus on accuracy and confidentiality. Whether you require adjustments for a loan application, mortgage, or any other purpose, I've got you covered. Contact me today for swift and reliable bank statement editing!

Contact and Order: WhatsApp: +923213549046

#bankstatement#editingservices#financialdocuments#bankstatementedit#banking#financialservices#editing#banking#bankingindustry#loanapplication#mortgage#documents#financialediting#professional#confidentiality#accuracy#editingexpert#USA#Canada#UK#London#California#Texas#paystubs#checkstubs#bankingindustry#expertise#reliability#swiftservice

0 notes

Link

U.S. Treasury Secretary Steve Mnuchin and Federal Reserve Chairman Jerome Powell have apparently never walked down a Main Street in America. We make that statement because there is a huge disconnect between what’s really located on a typical Main Street and what’s in the bailout program they’ve designed and are calling the Main Street Lending Program (MSLP).

Americans need to sit up and pay attention to what’s going on here because the U.S. Treasury has committed $75 billion of taxpayers’ money to support this program under the illusion that it’s going to mom and pop operations on a typical Main Street in America. That initial $75 billion will be levered up to $750 billion under the Fed’s ability to create money out of thin air, with taxpayers eating the first $75 billion of losses. Once the loans are originated by a lender, they will then be bought up by a Fed-created Special Purpose Vehicle, thus removing bad loans from the balance sheets of banks like JPMorgan Chase, Wells Fargo, Citigroup and the like. The banks will only have to retain 5 percent of the exposure.

We’ve walked down plenty of Main Streets in America: in West Virginia, downstate and upstate New York, New Hampshire, Connecticut, Florida and in ski towns from coast to coast. We’ve seen plenty of boutique gift shops, family-owned restaurants and ice cream parlors, hair and nail salons, sole-proprietor bake shops, and locally-owned breweries. What we’ve never seen on any of these streets is a shop or restaurant with “15,000 employees or up to $5 billion in annual revenue” or one that needed to refinance $200 million in debt. And yet, that describes businesses that will be able to apply for loans under the Fed’s “Main Street” Expanded Lending Program that has been approved by both Treasury Secretary Mnuchin and Fed Chair Powell.

You have to ask yourself this: if this was really about helping Main Street, why wouldn’t that $750 billion have simply been added to the Paycheck Protection Program (PPP) which is restricted to businesses with 500 or fewer employees – the Small Business Administration’s definition of a small business? The second round of funding to that program by Congress is likely to run out sometime this week. Just under half of all American workers are employed by a small business that has less than 500 workers according to the most recent government data.

The Fed changed the terms of its “Main Street” Lending Program on April 30 in ways that make clear that it’s not at all about rescuing small businesses on Main Street that have been shuttered as a result of mandated government action during the COVID-19 outbreak but is actually all about bailing out the failing debt of the fossil fuel industry and the big banks on Wall Street that hold that debt. Here, for example, is how the Fed describes one facet of the “Main Street” program called the Main Street Expanded Loan Facility (MSELF):

“Eligible Lenders increase (or ‘upsize’) an Eligible Borrower’s existing term loan or revolving credit facility. The upsized tranche is a four-year term loan ranging in size from $10 million to $200 million. The maximum size of a loan made in connection with the MSELF cannot exceed (i) 35% of the Eligible Borrower’s existing outstanding and undrawn available debt that is pari passu in priority with the Eligible Loan and equivalent in secured status (i.e., secured or unsecured); or (ii) when added to the Eligible Borrower’s existing outstanding and undrawn available debt, six times the Eligible Borrower’s adjusted 2019 EBITDA. At the time of upsizing and at all times thereafter, the upsized tranche must be senior to or pari passu with, in terms of priority and security, the Eligible Borrower’s other loans or debt instruments, other than mortgage debt. The features associated with tranches of loans that are upsized in connection with the MSELF (MSELF Upsized Tranches) are outlined in the MSELF term sheet.”

The Fed also explains that the above covenants would not prohibit a borrower “from refinancing maturing debt.” That means that a fossil fuel company could pay off their maturing debt held by JPMorgan Chase or another mega bank on Wall Street (see chart above) which is at a much higher interest rate and refinance it at a little over 3 percent interest under this program. Then the bank can sell that debt to the Special Purpose Vehicle set up by the Fed, keeping just a sliver of exposure on its balance sheet. It’s a win-win for the fossil fuels industry and Wall Street banks and a big loss to anyone who cares about their lungs, those of their children, or the survival of the planet.

Anticipating that the Fed would succumb to lobbying from the fossil fuels industry, on April 15 Senator Ed Markey of Massachusetts and Congresswoman Nanette Diaz Barragán of California, together with 39 other House and Senate members, sent a letter to Mnuchin and Powell asking them to “ignore the pleas of big oil lobbyists” and “instead focus on supporting the workers and small businesses who truly need assistance due to the coronavirus public health emergency.”

The letter also made the following critical points about the fossil fuel industry and the current health crisis:

“In just the last two weeks, the Trump administration has used a combination of enforcement waivers, bargain basement oil and gas lease sales, and a rollback of fuel economy standards to transfer billions of dollars in value of natural resource and clean air benefits from the public to the fossil fuel industry. These actions are especially abhorrent during a pandemic whose burden falls heaviest on Americans with weakened respiratory systems…”

The nonprofit watchdog, Public Citizen, released the following statement by David Arkush, Managing Director of its Climate Program on April 30 when the Fed announced the cozy changes to its “Main Street” lending facility:

“The Federal Reserve today unveiled an expanded ‘Main Street’ business lending program that could allow failing, highly indebted oil and gas companies to borrow money at low rates. In doing so, the Fed heeded a call by U.S. Sen. Ted Cruz (R-Texas) as well as fracking companies to make it easier for oil and gas companies to refinance their debts. The Fed’s new program rules drop an earlier restriction on refinances.

“The Fed should not be in the business of bailing out companies that were in terminal decline and suffering largely from their own misadventures well before the coronavirus pandemic. The fracking industry is notoriously overleveraged, and fracking gas is not even profitable.

“Rescuing fossil fuel production is absolutely the wrong direction for public health amid a global pandemic. Fossil fuel combustion produces air pollution that kills hundreds of thousands of Americans and millions more globally each year. The same pollution also substantially increases COVID-19 mortality. This is all without considering the cascade of public health and economic crises we face due to fossil-fuel-induced climate chaos.

“The U.S. should be working to phase out fossil fuels as swiftly as possible, not rescuing a toxic and reckless industry that is already in a terminal, albeit too slow, decline. The transition away from fossil fuels will require massive investments that will create millions of jobs. U.S. recovery spending that doesn’t directly target public health and blameless companies and workers should be aimed squarely at accelerating this transition, not stalling it.

“The real concern in the oil and gas industry is that workers are losing jobs, as they are in so many other sectors. The response here should be to rescue the workers and provide relief to state and local governments straining to meet the many challenges of this pandemic at the same time as their revenues decline sharply. It should not be to rescue reckless, polluting, humanity-endangering and often dishonest companies that were in plenty of trouble of their own making well before this pandemic began.”

That last sentence could just as easily apply to the Wall Street mega banks that are also being bailed out of their reckless loans and were also “in plenty of trouble of their own making well before this pandemic began.”

6 notes

·

View notes

Link

Raguragavan Sreetharan | What a great question and one that many find very confusing. First of all let’s start at the beginning of a home loan. When you apply for a home loan the very first thing you are going to need is a lender. A financial lender is someone that is going to supply you with the financing of your home loan. Whether you go FHA, Conventional, VA or where I live in Texas, you can receive a Texas Vet loan, you are going to need financing…unless of course you pay cash, then you can skip this article altogether.

Raguragavan Sreetharan | WHAT HAPPENS?

When you start your home loan process you could spend all day on the internet looking at rates, various mortgage “broker” companies and find that they are basically all the same. Whether you go the banker or broker route, you are going to supply either one of them with very personal information such as your credit report which they will run, your tax returns (if self employed), W-2’s, pay-stubs, bank statements, your driver’s license and your social security card. Many people don’t realize that when you give it to a broker, it is usually packaged up and sent outside of the State you actually reside in. Note: Most Identity Theft issues arise outside of the State you live in.

Raguragavan Sreetharan | WHAT ABOUT BROKERS?

Your loan file is a snapshot of who you are and your credit worthiness. When supplying a “broker” these documents keep in mind that if you are dealing with an internet operated lender, you will most likely not speak to the same person twice, your file could very well be processed in a city outside of the State you reside in and when your file goes to the next step, which is to the underwriter, it may very well go to another part of the country once again. The realization is that a broker basically has absolutely no control over your file once it leaves their hands. You might call up and have to speak to someone that needs to speak to someone else to track down your file and find out exactly where it is.

I’ve heard that in some cases, it may take a day or two just to get back to you after they find out where your file is. From the realtor, to the loan officer, the processing department, the underwriter, title companies, insurance agents et al, about 50 people (give or take) actually come in contact with a loan file. So…consider the fact that you have excellent credit. Do you really want someone with so little control of your personal documentation taking charge of your life like that? I didn’t think so. Please note: I am not bashing the Mortgage broker industry. There are some very decent people and some decent companies out there. All I am saying is to be careful when you purge yourself into electronic oblivion, that’s all.

MORTGAGE BANKERS | Raguragavan Sreetharan

A mortgage “banker” uses their own money and for the most part has all services in house. Your file will never leave that office and you can actually go in to meet with someone face to face. For many folks, that is the only way they like to conduct business. Processing, underwriting, closing and funding should all happen under one roof when dealing with a mortgage banker. It is very comforting for people to be able to call up their loan officer, anytime and find out what stage their loan is in. A good loan officer will not only call up the client (you) but will also keep in touch with your realtor (buyer’s agent) as well as the listing agent, who represents the seller.

Raguragavan Sreetharan -A good form of communication should be established right from the get-go. Most realtors today have a preference of dealing with bankers only because they know that lender and can trust that the file is in-house and they can find out with one phone call what’s happening to the file. A banker is more inclined to be able to solve problems faster than a broker only because his in house staff alerts them to any issues that may arise with dispatch. The quicker he/she can jump on the problem, the faster the fire gets extinguished.

Raguragavan Sreetharan I’ll give you an example. Let’s say you have your movers coming to your house to pack up your belongings and you have set time that you know when your arrival is at your new home. The phone rings and it is your “broker.” “Mr. Smith…the underwriter working on your file is requesting you supply us with better documentation on your work history for the last two years before you start your new position next week.” Your first impression is, “Why didn’t he ask me for that when I gave him all my paperwork?” You have the movers coming, you’re packed up and your lender is asking for documentation at the eleventh hour. I’m not saying that this could happen. I’m saying that it is my experience that I have seen happen and one that may have been addressed had there been better control over the file.

Raguragavan Sreetharan

1 note

·

View note