#dscr loan arizona

Photo

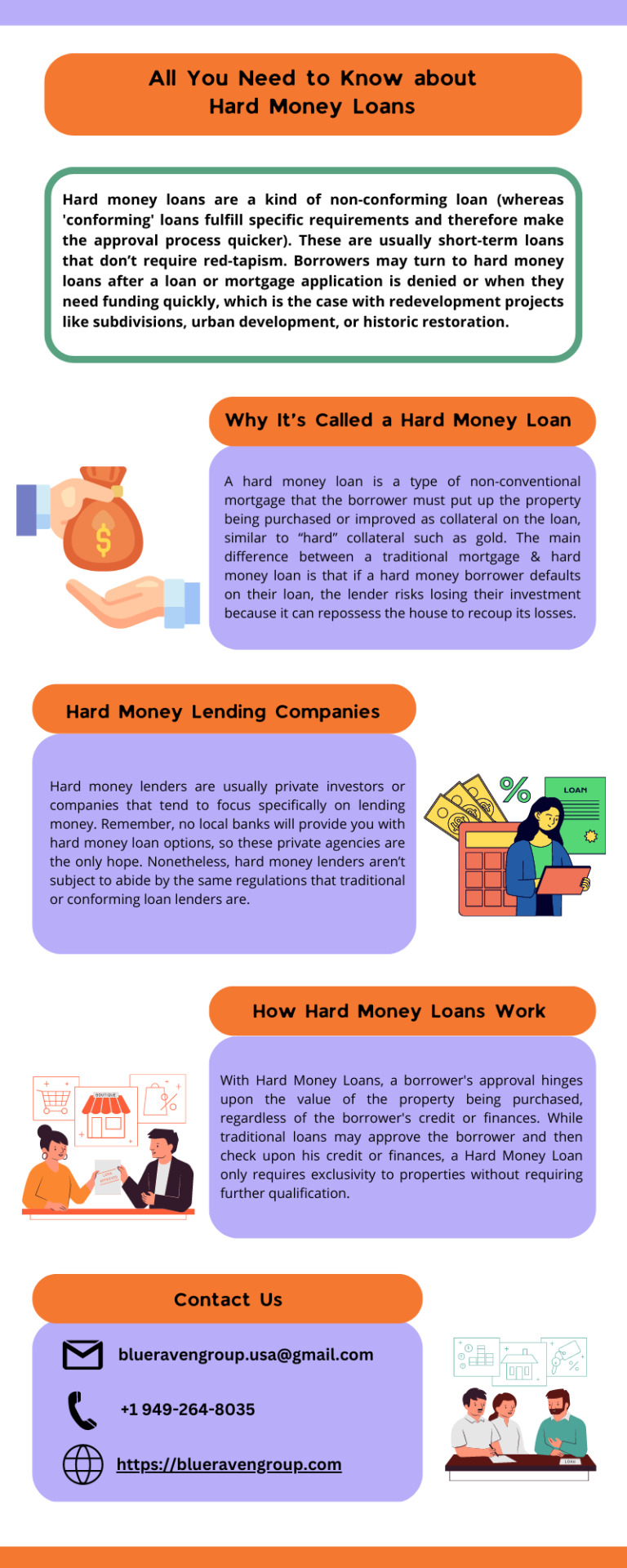

All You Need to Know about Hard Money Loans

Hard money loans are a kind of non-conforming loan (whereas 'conforming' loans fulfill specific requirements and therefore make the approval process quicker). These are usually short-term loans that don’t require red-tapism. Borrowers may turn to hard money loans after a loan or mortgage application is denied or when they need funding quickly, which is the case with redevelopment projects like subdivisions, urban development, or historic restoration. If you also require getting hard money in California, San Diego, or wherever you reside, you should read this article. It includes some vital information about hard money loans. So, without further ado, let’s get started!

0 notes

Text

Investors in Arizona are increasingly opting for DSCR loans due to their streamlined application process and reduced paperwork compared to conventional mortgages. These loans assess the property's income potential rather than the borrower's personal finances, offering flexibility and lower entry barriers for new investors. Before securing a DSCR loan, it's essential to grasp its operational mechanics and qualifying criteria.

0 notes

Text

Arizona's commercial real estate scene is increasingly embracing DSCR loans for their straightforward application process and minimal documentation requirements. These loans, centered on a property's income potential rather than personal finances, offer investors a flexible financing solution. Calculated through the debt service coverage ratio (DSCR), which compares net operating income to debt obligations, they ensure sustainable cash flow without stringent income verifications typical of conventional mortgages. Learn more here:

0 notes

Text

Dscr Loan Arizona

DSCR loan Arizona provide an alternative option for real estate investors who cannot qualify for a traditional home loan using tax returns or pay stubs. These loans estimate eligibility based on the property’s cash flow rather than the borrower’s income, helping investors overcome the limitations of private loans.

if you want to learn more about DSCR Loan Arizona in detail read our detailed article on DSCR Loan Arizona

#loanunderwriting#commercialrealestateloans#realestateinvesting#dscrloan#cashflowmanagement#dscrloanprosandcons#debtservicecoverageratio#loanapproval#dscrloanarizona

0 notes

Text

What Is Considered a Good DSRC Mortgage?

A DSCR mortgage is a type of loan that is given to borrowers who may not have the best credit score or history. DSCR mortgage in Arizona allows them to put down a larger down payment, which in turn lowers the monthly payments.

What is a DSCR Mortgage?

A DSCR mortgage is a type of loan that is typically used by businesses to finance commercial real estate. The loan is based on the property's "net operating income" (NOI), which is the difference between the property's income and expenses. The NOI is used to calculate the "debt service coverage ratio" (DSCR), which is the amount of cash flow that is available to cover the loan payments.

The DSCR is an important factor in determining whether a property can qualify for a loan, and it is also used to calculate the loan's interest rate. A higher DSCR means that there is more cash flow available to make loan payments, and it also indicates that the property is a lower risk for the lender. As a result, properties with a higher DSCR typically qualify for lower interest rates.

If you're considering a DSCR mortgage to finance your commercial real estate, it's important to work with a lender that understands this type of loan and can offer competitive rates. At ABC Lending, we have experience with DSCR mortgages and can help you get the financing you need for your property. Contact us today to learn more about our loans and terms.

The Different Types of Mortgages

There are many different types of mortgage loans available for homeowners and home buyers. The type that’s right for you depends on your financial situation, your goals, and the property you plan to buy.

Conventional Mortgage: A conventional mortgage is a loan that is not backed by a government agency. For example, Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs) that back many conventional mortgages. Conventional mortgages can be either fixed-rate or variable-rate loans.

Government Mortgage: A government mortgage is a loan that is backed by the federal government, such as the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), or the Department of Agriculture (USDA). Government mortgages are available to eligible home buyers with low credit scores or a limited down payment.

jumbo Mortgage: A jumbo mortgage is a type of conventional mortgage that exceeds the conforming loan limit, which is $484,350 for most U.S. counties in 2019. Jumbo loans typically have higher interest rates than conventional loans, and they may require a larger down payment.

Reverse Mortgage: A reverse mortgage is a special type of loan that allows homeowners age 62 and older to tap into their home equity without having to make monthly payments. The loan doesn’t need to be repaid until the borrower sells the home.

The Pros and Cons of a DSCR Mortgage

When it comes to mortgages, there are a variety of options available to borrowers. One option is a DSCR mortgage, which stands for debt service coverage ratio. This type of mortgage can be a good option for some borrowers, but it's important to understand the pros and cons before making a decision.

A DSCR mortgage can be a good option for borrowers who have a high income and low debts. The reason this type of mortgage can be beneficial is because the monthly payments are typically lower than with other types of mortgages. That said, it's important to remember that you're still responsible for repaying the entire loan amount, so you'll need to have a plan in place to do that.

One potential downside of a DSCR mortgage is that you may have difficulty qualifying if you don't have perfect credit. That's because lenders will look closely at your debt-to-income ratio when considering you for this type of mortgage. If your ratio is too high, it could make it difficult to get approved.

Another thing to keep in mind is that DSCR mortgages typically have higher interest rates than other types of mortgages. That means you'll need to factor that into your budget when considering this option.

At the end of the day, whether or not a DSCR mortgage is a good option for you will come down to your personal financial situation. If you have a high income and low debts, it could be a good choice. However, if you're struggling with credit or have a high debt-to-income ratio, you may want to consider other options.

How to improve your DSCR?

When it comes to mortgages, your debt service coverage ratio (DSCR) is one of the key factors that lenders will look at in order to determine whether or not you qualify for a loan. A high DSCR means that you have a strong ability to make your monthly mortgage payments, while a low DSCR indicates that you may have difficulty meeting your financial obligations.

There are a number of things that you can do to improve your DSCR and make yourself a more attractive borrower in the eyes of lenders.

1. Make Sure You Have a High Income

The first step to improving your DSCR is to make sure that you have a high income. Lenders will be looking at your income in order to determine how much money you have available each month to put towards your mortgage payment. If you can show that you have a stable and high income, it will go a long way in helping you qualify for a loan.

2. Keep Your Debt load Low

One of the best ways to improve your DSCR is to keep your overall debt load low. The less debt you have, the more money you will have available each month to put towards your mortgage payment. Lenders will be looking at your debt-to-income ratio in order to determine how much debt you have relative to your income. The lower this ratio is, the better off you will be.

3. Make a Large Down Payment

Another way to improve your DSCR is to make a large down payment on your home loan. The larger the down payment, the lower your monthly mortgage payments will be. This will free up more money each month that you can put towards other debts or expenses. Lenders typically like to see down payments of 20% or more, so this is a good goal to aim for.

4. Get a Shorter Loan Term

One final tip is to get a shorter loan term when you apply for a mortgage. The shorter the loan term, the lower your monthly payments will be. This will leave you with more money each month that you can put towards other debts or expenses. Lenders typically like to see loan terms of 20 years or less, so this is a good goal to aim for.

How does a DSCR mortgage work?

A DSCR mortgage is a type of loan that is typically used by businesses to finance the purchase of commercial real estate. The loan is structured so that the monthly payments are based on the income generated by the property, rather than the value of the property. This makes it easier for businesses to qualify for a loan and get the financing they need.

Conclusion

There is no single answer to the question of what constitutes a good DSCR mortgage. Every borrower's situation is different, and what works for one may not work for another. However, foremost, make sure that the interest rate on the loan is reasonable. Additionally, be sure to take into account the fees and other terms of the loan before making a decision. With a little bit of research, you should be able to find a DSCR mortgage that meets your needs and helps you reach your financial goals.

0 notes