#best investment scheme

Text

I do think Withers has a really subtle background character arc in bg3. Because at the start it is really clear he doesn't want to be here and he's being forced to clean up his mess by Helm and probably Ao. He doesn't really care either. Everything ends so nothing really matters, he'd like to go back to his paperwork now please.

Except he's stuck babysitting a bunch of traumatized dumbasses as they stumble into dealing with the most recent bad idea of his three fuck-up disappointments. So he brings them back when they die for a pittance, lets them pay for some vengeful ghosts to come back as flesh and blood to wreak bloody vengeance on the Absolute, and starts to... comment, on what's going on, as he follows them on their adventure.

Next thing you know Withers is like, doing things unprompted. He refuses to bring back Alfira (or Quil) but that's an act of compassion, keeping the poor girl from the Urge and letting her rest, his actual duty as a god of death. He tells Arabella to follow her destiny and does that thing to make her grief go away which honestly freaks me out but seems to be him trying to help her. He shows up at Moonrise and prompts us to consider why the Dead Three would want a bunch of soulless illithids that would give them no power, getting us to think of the big picture.

And by the end (especially if you do a resist!Durge playthrough) Withers is actively interfering and seems genuinely invested! He brings Durge back from the dead, free of their father! He encourages us before the final fight with the Netherbrain! He's real fucking smug that the Dead Three lost when he never seemed to care about the destruction they caused before! He throws a reunion party and many of his lines are genuinely touching or kind! Especially if a companion died permanently! He has tea with Gale's mom and Tara! He's like, socializing and shit! Yes, everything is temporary and we all die, but there's great beauty in fighting for that precious time and living it to the fullest!

Basically Wither's character arc is this meme, all because Helm made him go outside and touch grass.

#bg3#like... thematically the characters are bg3 are all struggling with mortal frailty and meaninglessness in the grand scheme of gods#several of them are on a ticking clock to immediate death. the tadpoles themselves are a death sentence. others are being actively#hunted by their abusers or will be drawn back into a life that's no real life at all or told to kill themselves or seen as nothing but#disposable pawns in the game of the gods to be used and discard as if nothing#or are destined for objectively shitty afterlives#and what do they do? they fight it! tooth and nail! and try to live their best life here and now! they form bonds and fall in love#and help strangers or each other and have fun even for only the moment and cling to life by their fingernails#while also accepting death could be tomorrow or next week or decades from now because we all die but that's no reason to lie#and meekly accept it because some god said so#they care! they all care SO SO MUCH ABOUT LIVING! even if its tempting to give in to the nihilism they all try so goddamn hard#even on evil routes there's something so deeply human and vulnerable to how it all comes from caring so deeply#about wanting to live and survive and be loved and safe#listen to Wither's lines about the companions if they died. especially Karlach. do you get it? they made the GOD OF DEATH#JERGEL HIMSELF! feel something about the beauty of the mortal life in all its fleeting incandescent glory!#but also I think it's just that Jergel needed to leave his sad little crypt more and talk to people other than kelemvor#and Helm accidentally made Jergel less terrible by forcing him to socialize with the mortals#it's like never leaving your room as a teenager. it makes you depressed and sad and full of despair like an understimulated parrot#and like is Wither's being more invested in the affairs in mortals necessarily a good thing? maybe. maybe not. but he clearly is#so good on him. I think more gods should hang out with mortals in non-worship contexts. might give them some perspective#just pretend to be some random helper NPC#and this is all especially poignant when we remember Jergel’s past as Neutral Evil and the genuinely horrible things he’s done

5 notes

·

View notes

Text

You can find a reliable financial advisor in Rewa through referrals, online reviews, or certifications. Checking their experience, client feedback, and understanding of financial products will ensure they provide trustworthy guidance. For more information, visit https://www.investrack.co.in/

#AMFI registered Mutual Fund Distributor in Rewa#Mutual Fund Distributor in Rewa#mutual funds advisor in Rewa#online investment schemes in Rewa#mutual fund investment companies in Rewa#mutual fund advisor in Rewa#investment consultants in Rewa#mutual fund investment in Rewa#best Mutual Fund Distributors in Rewa#financial consultants in Rewa#financial advisor in Rewa#financial company in Rewa#financial companies in Rewa#financial planning in Rewa#best broker for mutual funds in Rewa#mutual fund company in Rewa#mutual fund investment planner in Rewa#best mutual fund for sip india in Rewa#mutual funds investment plans in Rewa#loan against mutual funds in Rewa#loan against mutual fund services in Rewa#finance company in Rewa#stock brokers in Rewa#share brokers in Rewa#portfolio management services in Rewa#financial services in Rewa#financial planner in Rewa#demat account services in Rewa#equity advisor services in Rewa#insurance agent in Rewa

0 notes

Text

0 notes

Text

What Are the Benefits of Life Insurance For Your Family?

We carefully plan every detail for our families—birthday gifts, vacations, education. But have you ever considered what will happen to them if you’re no longer around? Life insurance can provide a crucial safety net for your loved ones during challenging times.

What is Life Insurance?

Think of Life insurance as a contract between an insurance company and you. You pay regular premiums, and in return, the company promises to provide a lump sum payment, known as the death benefit, to your beneficiaries in the event of your death. If you wish to get the best life insurance plans in Kolkata, reach out to experts.

Benefits of Life Insurance for Your Family

Financial Security: Life insurance ensures that your family has financial support if you’re not there to provide for them. This can cover daily living expenses, mortgage payments, and other financial obligations.

Debt Coverage: It helps settle any outstanding debts you may leave behind, such as loans or credit card balances, preventing your family from being burdened with debt.

Education Funding: The money from a life insurance policy can help pay for your children's education. This means their education will flourish even when you are not around anymore.

Estate Planning: You can rest assured knowing that your assets will be smoothly passed on to the people who matter to you. It also provides funds to cover estate taxes and other related expenses. This way, your legacy is maintained without added financial stress on your loved ones.

Peace of Mind: Knowing that your family will be financially protected offers peace of mind, allowing you to focus on enjoying the present moments with your loved ones.

Conclusion

Life insurance is more than just a policy; it’s a thoughtful way to ensure your family's future is safeguarded. INV Rajat, one of the best life insurance companies in Kolkata, can help you provide financial security and peace of mind. Life Insurance can be a vital component of your family’s long-term planning. Investing in a life insurance policy means you are planning not just for today but for tomorrow’s uncertainties as well.

#Best Life Insurance Companies in Kolkata#Best Life Insurance Plans in Kolkata#Health Insurance in Kolkata#Best Health Insurance Policy Kolkata#Top Health Insurance Companies in Kolkata#General Insurance Companies in Kolkata#AMFI registered Mutual Fund Distributor in Kolkata#best Mutual Fund Distributor in Kolkata#mutual funds advisors in Kolkata#online investment schemes in Kolkata#financial services in Kolkata#mutual fund investment companies in Kolkata#financial goals in Kolkata#stock broking services in Kolkata#insurance agent in Kolkata#financial consultant company in Kolkata#best tax saving funds experts in Kolkata#small investment opportunities in Kolkata

0 notes

Text

A Guide to Financial Goals Planning in Jodhpur

Are you a resident of Jodhpur looking to secure your financial future? Whether you're just starting out or well into your career, setting clear financial goals is crucial for achieving financial stability and independence. In this article, we'll guide you through the process of financial goals planning in Jodhpur, helping you take control of your finances and build a brighter tomorrow.

Setting Financial Goals

The first step in financial goals planning is to identify your short-term and long-term financial objectives. Do you want to save for a down payment on a house? Are you planning for your child's education or your own retirement? Once you have a clear idea of what you want to achieve, you can start creating a roadmap to get there.

Prioritizing Your Goals

With multiple financial goals in mind, it's important to prioritize them based on their importance and urgency. For example, building an emergency fund should be a top priority, as it can help you weather unexpected financial storms. Other goals, such as saving for a vacation or a new car, may be lower.

Creating a Budget

Budgeting is the first step towards building a financial plan. By tracking your income and expenses, you can identify areas where you can cut back and redirect funds toward your financial goals. Use a budgeting app or create a spreadsheet to keep track of your spending and make adjustments as needed.

Seeking Professional Advice

While it's possible to create a financial plan on your own, seeking the guidance of a professional financial expert can be invaluable. The best financial advisors in Jodhpur can help you navigate the complex world of investments, insurance, and tax planning, ensuring that your financial goals are aligned with your risk tolerance and time horizon.

Investing in the Long-Term

Investing is a crucial component of financial goals planning. Whether you're interested in mutual funds, stocks, or real estate, it's important to diversify your portfolio and invest for the long term. A financial expert can assist you in developing an investment strategy that matches your objectives and risk tolerance.

Reviewing and Adjusting Your Plan

Financial goals planning is an ongoing process, and it's important to review and adjust your plan regularly. You should change your financial goals according to your life situation. By staying on top of your plan and making adjustments as needed, you can ensure that you're always moving in the right direction.

In conclusion, goal planning is essential for achieving financial security and independence. By setting clear goals, prioritizing them, creating a budget, seeking professional advice, investing for the long-term, and reviewing and adjusting your plan regularly, you can plan your finances successfully and create a secured future for yourself and your dependents. Remember, the key to success is to start today and stay consistent.

#AMFI registered mutual fund distributor in Jodhpur#best mutual fund distributor in Jodhpur#mutual funds advisors in Jodhpur#online investment schemes in Jodhpur#financial services in Jodhpur#mutual fund investment companies in Jodhpur#financial goals planning in Jodhpur#insurance agent in Jodhpur#small investment opportunities in Jodhpur#best financial advisors in Jodhpur#top financial consulting companies in Jodhpur#best investment opportunities Jodhpur#best sip provider in Jodhpur#best child education planer in Jodhpur#best retirement planer in Jodhpur

0 notes

Text

Know How Mutual Funds Are The Best Investment Platforms For Beginners

Find out what makes mutual funds the best investment platform for beginners. Look out for the best portfolio management scheme for more information.

#systematic investment plans#mutual funds SIP investment#portfolio management scheme#best SIP plan for 5 years

0 notes

Text

How Does NPS Investment Help Save Taxes?

Securing your retirement is crucial, but did you know you can also save taxes while planning for it? The National Pension System (NPS) in India is designed not only to build a retirement corpus but also to offer substantial tax benefits to investors.

Understanding NPS

The National Pension System (NPS) is a voluntary retirement savings scheme where individuals can invest regularly during their working years to build a retirement fund. It is regulated by the Pension Fund Regulatory and Development Authority (PFRDA) and offers features tailored to promote long-term savings. If you wish to invest, reach out to professionals offering NPS investment services in Cochin.

Key Features of NPS

Subscriber Accounts: Each NPS subscriber receives a unique Permanent Retirement Account Number (PRAN), which remains with them throughout their career, providing portability across jobs and locations.

Investment Flexibility: Investors can choose from multiple Pension Fund Managers (PFMs) offering various investment strategies. This flexibility allows investors to select an asset allocation mix that aligns with their risk tolerance and financial goals.

Tier System: NPS operates through two tiers:

Tier I: This tier is the primary retirement savings account with restricted withdrawal options before retirement.

Tier II: A voluntary savings account with higher liquidity, allowing withdrawals akin to a regular savings account.

Government Contribution: Government employees benefit from an additional contribution of up to 14% of their salary from the Government of India towards their NPS corpus.

Auto-Choice Option: For investors who prefer a hands-off approach, NPS offers an auto-choice option. This feature automatically allocates investments across asset classes based on the investor's age.

Tax Benefits of NPS Investment

Investing in NPS offers significant tax advantages, making it a preferred choice for retirement planning:

Tax Deduction under Section 80C: Contributions towards Tier I NPS accounts qualify for a tax deduction of up to Rs. 1.5 lakh per year under the Section 80C of Income Tax Act.

Additional Tax Deduction under Section 80CCD(1B): Beyond the Section 80C limit, salaried individuals and self-employed can claim an additional deduction of up to Rs. 50,000 per year for contributions to NPS under Section 80CCD(1B). This increases the total potential deduction to Rs. 2 lakh per year.

How NPS Investments Help Save Taxes

By contributing to NPS:

Reduced Taxable Income: Contributions to NPS reduce your taxable income for the year in which they are made. This lowers your overall tax liability.

Enhanced Deductions: The combined deductions under Sections 80C and 80CCD(1B) allow you to optimize your tax savings, potentially reducing the amount of tax payable significantly.

Additional Considerations

Tax Implications on Withdrawal: While contributions to NPS offer tax benefits, a portion of the accumulated corpus withdrawn at retirement is taxable. However, the tax-efficient structure of NPS ensures that the benefits of tax deferral during the accumulation phase outweigh the tax implications at withdrawal.

Long-term Commitment: NPS is designed for long-term savings and retirement planning. Withdrawal options are limited before retirement age, encouraging investors to stay committed to their retirement goals.

Conclusion

The National Pension System (NPS) not only serves as a robust retirement planning tool but also provides substantial tax benefits to investors. By leveraging the deductions available under Sections 80C and 80CCD(1B), individuals can effectively manage their tax liabilities while building a secure financial future through NPS. Thirukochi Financial Services can guide you through the best NPS investment plan in Kochi. However, it's essential to assess your financial goals, risk appetite, and retirement needs before committing to NPS, ensuring it aligns with your long-term financial strategy.

#national pension scheme planner in cochin#nps scheme planner in cochin#pension planners in kochi#nps investment plan in kochi#nps investment services in cochin#best mutual fund distributor in cochin#mutual funds investment services in cochin#best wealth management company in cochin#financial investment in cochin#investment services in cochin#investment experts in cochin#mutual funds plan in cochin#wealth management advisors in cochin#amfi registered mutual fund distributor in cochin#contact financial experts in cochin

0 notes

Text

Filfox Wealth offers professional assistance in application for start-up grants consultancy. Our team of experienced consultants will guide you through the process, helping you to secure the funding you need to successfully launch your business.

Visit here: https://www.filfoxwealth.com/

#How to raise funds for Startup business in India#Government Schemes for Startups in India#Policy making and analysis for Startups in India#Name of top firms to prepare for Investment Readiness#Assistance in Application for Startup Grants Consultancy#Legal due diligence services for Startups#AIF registration consultants#Top or Best firm to prepare/ draft Pitch Deck Report for Startups#How to prepare Founders Agreement#How to set up Family Offices

0 notes

Text

Equity Mutual Fund Services in Sri Ganganagar

Ever wished your money could work a bit harder for you? Look no further than equity mutual fund services in Sri Ganganagar. These services are provided by experts, allowing your money to grow at a faster pace than traditional savings options.For more information, visit https://www.bhatiainvest.com/mutual-fund-sip-plan-in-sri-ganganagar.php

#mutual fund investment plan in sri ganganagar#tax saving sip advisor in sri ganganagar#best mutual funds company in sri ganganagar#performance of mutual funds in sri ganganagar#mutual funds sip advisor sri ganganagar#types of mutual funds service in sri ganganagar#mutual fund schemes in sri ganganagar#online investment in mutual funds in sri ganganagar#tax saver mutual fund planner in sri ganganagar#mutual funds investment plans in sri ganganagar#equity mutual fund services in sri ganganagar#best mutual fund companies in sri ganganagar#tax saving funds planner in sri ganganagar

0 notes

Text

How Can Investors Achieve Their Financial Goals With Mutual Funds?

It's important to understand your financial objectives and align your investments with them when you want to invest in mutual funds. This clears up your decisions and prevents you from making impulsive choices influenced by market trends.

Understanding Goal-Based Investing

Goal-based investing is about linking your mutual funds' investment decisions to specific financial goals you want to achieve in the future. Instead of investing without a purpose, this method ensures that every investment you make serves a specific goal, whether it's buying a house, saving for your child's education, or planning for retirement. If you wish to know more, reach out to the best investment advisory in Aurangabad.

Types of Goals for Goal-Based Investing

Short-Term Goals: These are goals you aim to achieve within a relatively short time, like saving for a vacation or buying a new gadget.

Medium-Term Goals: Medium-term goals take a bit longer to achieve, such as buying a car or saving for a down payment on a house.

Long-Term Goals: Long-term goals require more time and planning, like saving for retirement or building a college fund for your children.

Benefits of Goal-Based Investing

Clarity and Focus: Setting specific financial goals helps you stay focused on what you want to achieve, even when the market goes up and down.

Disciplined Investing: Having clear goals encourages disciplined investing habits, so you're less likely to stray from your plan.

Optimized Asset Allocation: Tailoring your investments to match your goals ensures you're investing in a way that suits your needs and timeline.

Avoiding Emotional Decisions: When you have goals in mind, you're less likely to make impulsive decisions based on short-term market movements.

Measurable Progress: Setting goals allows you to track your progress over time, giving you a sense of accomplishment as you work towards achieving each one.

Conclusion

Goal-based investing provides a roadmap for your financial journey, helping you make informed decisions and stay on track to reach your goals. Experts like Amritkar Services offer mutual funds investment plans in Aurangabad that align with specific objectives, so you can build a brighter financial future while staying focused and disciplined along the way.

#Mutual fund investment services in Aurangabad#best retirement planning company in Aurangabad#financial planner in Aurangabad#family financial planning in Aurangabad#best investment advisory in Aurangabad#wealth management advisor in Aurangabad#mutual fund planner in Aurangabad#mutual funds schemes in Aurangabad#online investment in mutual fund in Aurangabad#tax saver mutual fund advisor in Aurangabad#mutual funds investment plans in Aurangabad

0 notes

Text

What are the Pros and Cons of Debt Fund Investments?

Many people shy away from investing because of the perceived risk. They hear stories of volatile markets and worry about losing money. But what if there was a way to invest and grow your wealth with comparatively lower risk?

Understanding Debt Funds

Think of debt funds like loans you give to reliable institutions like the government or established companies. These institutions borrow money by issuing bonds, and debt funds pool your money together to invest in these bonds. In return for the loan, you receive regular interest payments, similar to how you earn interest on a savings account. Additionally, you get your principal amount back when the bond matures (like getting your loan repayment). If you wish to know more, contact a reliable mutual fund company in Bhavnagar.

Types of Debt Funds and Investment Horizons

Debt funds come in various flavors, each catering to different investment horizons (the timeframe for which you plan to invest):

Short-Term Debt Funds (Up to 3 Years): Ideal for parking your money for a short period, like a down payment on a car or an upcoming vacation. These funds invest in bonds with shorter maturity periods, offering easy access to your money and relatively low risk.

Medium-Term Debt Funds (3-5 Years): A good option for saving for a child's education or a wedding. These funds invest in bonds with slightly longer maturity periods, offering potentially higher returns compared to short-term funds, while still maintaining a moderate level of risk.

Long-Term Debt Funds (5 Years and Above): If you're planning for retirement or a long-term goal, consider long-term debt funds. These funds invest in bonds with longer maturities, aiming for potentially higher returns over the long term, but also carrying slightly higher risk compared to shorter-term options.

Pros and Cons of Debt Funds

Debt funds offer several advantages, making them a good fit for many investors:

Lower Risk: Compared to stocks or equity funds, debt funds generally carry lower risk because you're lending money to established institutions. While there's always a slight chance of default (not getting your money back), it's typically lower than the risk associated with stocks.

Regular Income: Debt funds provide regular interest payouts, similar to a fixed deposit. This can be a good source of steady income, especially for retirees or those seeking a predictable cash flow.

Liquidity: Many debt funds, especially short-term ones, offer high liquidity. This means you can easily withdraw your money when needed, making it suitable for short-term financial goals.

Potential for Capital Appreciation: While not their primary focus, some debt funds can offer some capital appreciation (growth in the value of your investment) along with interest income.

However, it's important to be aware of some limitations:

Lower Returns Compared to Stocks: Debt funds typically offer lower returns compared to stock-based investments. This is because lower risk often translates to lower potential returns.

Interest Rate Risk: The value of debt funds can fluctuate with changes in interest rates. When interest rates rise, the value of existing bonds might decrease.

Conclusion

Debt funds are a valuable tool for investors seeking a balance between risk and return. They offer lower risk than stocks, provide regular income, and are generally more liquid than many other investment options. While they might not offer the sky-high returns of stocks, they can be a great choice for investors with short-term goals or those who prioritize capital preservation. Shri Money Matters, the best mutual funds company in Bhavnagar can help you explore debt funds and find options that suit your investment horizon and risk tolerance.

#best mutual funds company in Bhavnagar#mutual fund company in Bhavnagar#mutual funds schemes in Bhavnagar#online investment in mutual funds in Bhavnagar#best mutual fund distributors in Bhavnagar

0 notes

Text

What Are the Types of Financial Services in Rewa?

When it comes to managing your money, having the right financial services can make a big difference. There are several types of financial services in Rewa to help you with everything from saving for the future to investing wisely. Let's look at some of the key financial services.

1. Banking Services

Banks are the backbone of financial services. In Rewa, you can find a variety of banks offering services like savings accounts, fixed deposits, and loans. Whether you need a personal loan, a home loan, or a business loan, banks have got you covered. They also provide services like internet banking and mobile banking, making it easy to manage your finances from anywhere.

2. Investment Services

If you’re looking to grow your wealth, investment services are essential. In Rewa, you can find mutual fund distributors and firms that offer investment services. These include mutual funds, stocks, bonds, and other investment options. A financial planner in Rewa can help you choose the right investments based on your financial goals and risk tolerance.

3. Insurance Services

Insurance is crucial for protecting yourself and your family from unexpected events. In Rewa, you can find various insurance services, including health insurance, life insurance, and general insurance. These services help you cover medical expenses, secure your family’s future, and protect your assets.

4. Tax Planning Services

Tax planning is an important aspect of financial management. In Rewa, there are professionals who can help you with tax planning and filing your tax returns. They can guide you on how to save taxes legally and make the most of tax-saving investments.

5. Retirement Planning Services

If you want a comfortable and secure future, then it is crucial to plan for retirement. In Rewa, you can find services that help you plan for retirement. These include pension plans, retirement savings accounts, and other investment options designed to provide a steady income after you retire.

6. Loan Services

Loans are a common financial service that many people need at some point. In Rewa, you can find various loan services, including personal loans, home loans, car loans, and business loans. These services help you get the funds you need for different purposes, whether it’s buying a house, starting a business, or covering personal expenses.

7. Wealth Management Services

For those with significant assets, wealth management services are essential. In Rewa, wealth management firms offer services like portfolio management, estate planning, and investment advisory. These services help you manage your wealth effectively and ensure that your assets are protected and growing.

Conclusion

In conclusion, Rewa offers a wide range of financial services to meet your needs. Whether you’re looking for banking services, investment options, insurance, tax planning, retirement planning, loans, or wealth management, you can find it all. A financial planner can help you navigate these services and make the best choices for your financial future.

If you’re looking for expert advice and comprehensive financial services, we are here to help. Visit our website for more information and to get started on your financial journey.

Managing your finances doesn’t have to be complicated. With the right services and guidance, you can achieve your financial goals and secure a bright future for yourself and your family.

#AMFI registered Mutual Fund Distributor in Rewa#Mutual Fund Distributor in Rewa#mutual funds advisor in Rewa#online investment schemes in Rewa#mutual fund investment companies in Rewa#mutual fund advisor in Rewa#investment consultants in Rewa#mutual fund investment in Rewa#best Mutual Fund Distributors in Rewa#financial consultants in Rewa#financial advisor in Rewa#financial company in Rewa#financial companies in Rewa#financial planning in Rewa#best broker for mutual funds in Rewa#mutual fund company in Rewa#mutual fund investment planner in Rewa#best mutual fund for sip india in Rewa#mutual funds investment plans in Rewa#loan against mutual funds in Rewa#loan against mutual fund services in Rewa#finance company in Rewa#stock brokers in Rewa#share brokers in Rewa#portfolio management services in Rewa#financial services in Rewa#financial planner in Rewa#demat account services in Rewa#equity advisor services in Rewa#insurance agent in Rewa

0 notes

Text

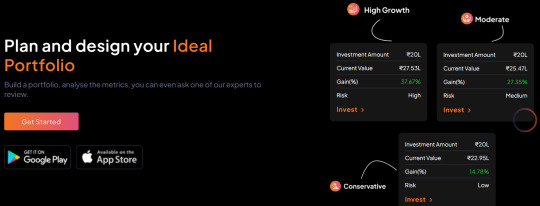

Portfolio Designer – A Unique Strategy to Build & Customise Your Portfolio | Sigfyn

An exclusive approach for an ideal mutual fund portfolio that suits your financial needs powered by algorithms. Enhance returns and manage risk by diversifying investments across different asset classes.

#portfolio designer#portfolio management#Certified Investment Planner#Asset Allocation#Risk Management#Investment Planning#Portfolio Insights#Mutual Fund Portfolio#Mutual Funds Schemes#Investment Advisors#Best HDFC Mutual Funds#HDFC Mutual Funds Online#SIP Investment Services#HDFC MF#Financial Advisory Services#Financial Planning Company#Sigfyn

0 notes

Text

How Does Risk Profiling Work in Mutual Funds Investments?

People often hesitate to invest because they fear losing money. But what they overlook is, that investing within your ability to take risks can give them reliable returns. This is why investors need risk profiling.

What is Risk Profiling?

Risk profiling is a process that helps determine how much risk you can handle when investing. It looks at three main areas:

Risk Tolerance: This is how comfortable you are with taking risks. It's about your mindset and how you react to changes in the market.

Risk Capacity: This is about your financial ability to take risks. It considers your income, expenses, financial goals, and how long you plan to invest.

Risk Requirement: This is the level of risk needed to achieve your financial goals. It helps you understand how much risk you need to take to get the returns you want.

If you wish to know yours, reach out to the best mutual fund distributor in Kolkata.

How Does Risk Profiling Work?

Questionnaire: The process starts with a questionnaire. You'll answer questions about your financial situation, investment goals, and how you feel about taking risks.

Analysis: Your answers are analyzed to understand your risk tolerance and capacity. This looks at both your financial data (like income and expenses) and your attitudes towards risk.

Risk Profile: Based on the analysis, you get a risk profile. Common profiles include conservative, moderate, and aggressive. Each profile shows a different level of risk tolerance and capacity.

Investment Strategy: Once you have your risk profile, an investment strategy is created just for you. For example, if you have a conservative profile, you might invest more in bonds and less in stocks. If you're aggressive, you might invest more in stocks.

How Risk Profiling Helps Investors

Better Decision-Making: Knowing your risk profile helps you make better investment decisions. You'll understand what kind of investments are right for you, which reduces the chances of making impulsive decisions during market changes.

Aligned Goals: A tailored investment strategy helps you reach your financial goals. When your investments match your risk tolerance, you're more likely to stick with them long enough to see good returns.

Less Stress: Investing according to your risk profile can reduce stress. When your investments match your risk level, you're less likely to worry during market ups and downs.

Realistic Expectations: Understanding your risk profile helps set realistic expectations. You'll have a better idea of what kind of returns you can expect.

Conclusion

When you know your risk profile, you can invest more confidently and improve your chances of financial success. INV Rajat, one of the best mutual fund investment companies in Kolkata, can help you throughout the process.

#AMFI registered Mutual Fund Distributor in Kolkata#best Mutual Fund Distributor in Kolkata#mutual funds advisors in Kolkata#online investment schemes in Kolkata#financial services in Kolkata#mutual fund investment companies in Kolkata#financial goals in Kolkata#stock broking services in Kolkata#insurance agent in Kolkata#financial consultant company in Kolkata#best tax saving funds experts in Kolkata#small investment opportunities in Kolkata

0 notes

Text

Why should you get advice from AMFI registered mutual fund distributor in Jodhpur?

Are you looking to make your money work harder for you? Wondering where to start when it comes to investing? Well, look no further! VM Finserve, the best mutual fund distributor in Jodhpur, is here to guide you on your financial journey.

Who is an AMFI Registered Mutual Fund Distributor?

First things first, let's break it down. An AMFI registered mutual fund distributor in Jodhpur is like a financial guru who helps you understand the world of mutual funds. They are trained and certified to provide you with expert advice on where to invest your hard-earned money.

Why Trust VM Finserve?

When it comes to your financial future, you want to be in safe hands. VM Finserve is not just any run-of-the-mill financial service provider. They are the best mutual fund distributor for a reason. With years of experience and a solid reputation, they have helped countless individuals like you achieve their financial goals.

Benefits of Seeking Advice from an AMFI Registered Distributor

Expertise: An AMFI registered distributor knows the ins and outs of the mutual fund industry. They can help you navigate the complex world of investments with ease.

Personalized Guidance: VM Finserve will take the time to understand your financial goals and tailor their advice to suit your needs. No cookie-cutter solutions here!

Peace of Mind: By working with a trusted advisor, you can rest easy knowing that your investments are in good hands. VM Finserve will keep a close eye on your portfolio and make adjustments as needed.

How to Get Started?

Ready to take the first step towards a brighter financial future? Visit VM Finserve's website to learn more about their services and get in touch with the best mutual fund distributor.

In conclusion, seeking advice from an AMFI registered mutual fund distributor like VM Finserve is a smart move for anyone looking to grow their wealth. Don't wait any longer - start investing in your future today!

#AMFI registered mutual fund distributor in Jodhpur#best mutual fund distributor in Jodhpur#mutual funds advisors in Jodhpur#online investment schemes in Jodhpur#financial services in Jodhpur#mutual fund investment companies in Jodhpur#financial goals planning in Jodhpur#insurance agent in Jodhpur#small investment opportunities in Jodhpur#best financial advisors in Jodhpur#top financial consulting companies in Jodhpur#best investment opportunities Jodhpur#best sip provider in Jodhpur#best child education planer in Jodhpur#best retirement planer in Jodhpur

1 note

·

View note

Text

Learn Why Mutual Funds Are The Best Investment Platforms For Beginners

Find out why mutual funds are the best investment platforms for beginners. Check out this blog for more information on the best SIP plan for 5 years.

0 notes