#bharat bill pay receipt

Text

B2B White Label Software Development Company

Intro

In the ever-evolving world of technology, businesses are constantly looking for innovative solutions to stay ahead of the competition. This is where B2B white label software comes into play, providing businesses with a customizable and branded software solution that they can offer to their clients. And when it comes to the top B2B white label software development company, Rainet Technology Private Limited stands out from the rest. With years of experience and a team of skilled professionals, Rainet Technology is a trusted B2B white label software provider, offering tailored solutions to meet the unique needs of businesses of all sizes. Let's dive in to discover why Rainet Technology Private Limited is the go-to choice for all your B2B white label software needs.

The Unmatched Expertise in Customized Solutions

When it comes to B2B white label software solutions, Rainet Technology Private Limited stands head and shoulders above the competition. With their unmatched expertise in providing customized solutions, they have solidified their position as the top B2B white label software development company in the market.

Rainet Technology understands that every business has unique requirements and objectives. That's why they offer tailored solutions that address the specific needs of their clients. With a team of skilled professionals, they have the technical prowess and industry knowledge to create a software solution that perfectly aligns with a company's branding and business goals. From design and development to implementation and support, Rainet Technology is there every step of the way, ensuring that their clients receive the highest level of service.

But it's not just their technical expertise that sets Rainet Technology apart. They are also committed to delivering solutions of the highest quality. With a focus on innovation, they constantly strive to stay ahead of the curve and provide their clients with cutting-edge technology. By staying up-to-date with the latest industry trends and best practices, Rainet Technology ensures that their clients' software solutions are not only functional but also future-proof.

One of the key advantages of partnering with Rainet Technology is the cost-effectiveness of their services. As a B2B software provider company, they understand the importance of delivering value for money. They offer flexible pricing options that cater to businesses of all sizes, making their services accessible to startups and established enterprises alike. By choosing Rainet Technology as your B2B white label service provider, you can save on development costs while still receiving a top-notch software solution.

In addition to their expertise and cost-effectiveness, Rainet Technology also guarantees on-time delivery. They understand the importance of meeting deadlines and strive to deliver projects within the agreed-upon timeframe. Their efficient project management and streamlined development processes ensure that your software solution is delivered on time, allowing you to launch your product without any delays.

With Rainet Technology by your side, you can bring your ideas to life. Whether you're looking to develop a new application or customize an existing software solution, their team of experts is ready to turn your vision into a reality. With their expertise in B2B white label software development, they can help you create a unique and branded product that sets you apart from the competition.

But Rainet Technology doesn't stop at bringing your ideas to life – they also unleash limitless possibilities.

The Assurance of Quality and Innovation

When it comes to choosing a B2B white label software development company, quality and innovation are key factors to consider. And Rainet Technology Private Limited is unmatched in both these areas. With a track record of delivering exceptional software solutions, they have established themselves as the go-to choice for businesses of all sizes.

One of the reasons why Rainet Technology is the best B2B white label software development company is their commitment to quality. They understand that a software solution is not just a tool for businesses; it is a reflection of their brand and reputation. That's why they leave no stone unturned in ensuring that their clients receive a high-quality product. From the initial design phase to the final delivery, Rainet Technology's team of experts conducts thorough quality checks at every step of the development process. This attention to detail guarantees that their clients receive a software solution that meets the highest standards of quality.

Innovation is another area where Rainet Technology excels. As a leading B2B white label app development company, they are constantly exploring new technologies and staying updated with the latest industry trends. This enables them to offer their clients cutting-edge software solutions that not only meet their current needs but also position them for future success. Rainet Technology understands that in the ever-evolving world of technology, innovation is the key to staying ahead of the competition. By choosing Rainet Technology as your B2B white label company, you can be assured of receiving a software solution that is not only functional but also at the forefront of industry innovation.

The Advantage of Cost-Effectiveness

When it comes to B2B white label software development, one of the key advantages of partnering with Rainet Technology Private Limited is their commitment to cost-effectiveness. They understand that businesses of all sizes have budget constraints and strive to deliver solutions that offer the best value for money.

By choosing Rainet Technology as your B2B white label software provider, you can save on development costs while still receiving a top-notch software solution. Their flexible pricing options cater to businesses with different budgets, making their services accessible to startups and established enterprises alike. Whether you're a small business looking to establish your brand or a large enterprise aiming to streamline your operations, Rainet Technology has a cost-effective solution that fits your needs.

But don't be mistaken - their cost-effectiveness does not compromise the quality of their services. Rainet Technology is dedicated to delivering software solutions of the highest quality, ensuring that their clients receive a product that exceeds their expectations. They have a team of skilled professionals who follow industry best practices and conduct thorough quality checks at every stage of the development process. This attention to detail guarantees that you get a cost-effective solution without sacrificing on performance or reliability.

Furthermore, Rainet Technology understands the importance of transparency in pricing. They provide detailed quotations that outline all the costs involved, so you can make informed decisions based on your budget. There are no hidden fees or unexpected charges, giving you peace of mind and allowing you to plan your expenses effectively.

When you choose Rainet Technology as your B2B white label software provider, you not only get a cost-effective solution but also a trusted partner who is committed to your success. Their expertise, dedication to quality, and transparent pricing make them the best choice for businesses looking for cost-effective and high-quality white label software solutions.

The Guarantee of On-Time Delivery

At Rainet Technology Private Limited, we understand that timely delivery is crucial when it comes to B2B white label software development. We know that our clients have deadlines to meet and we strive to ensure that their projects are delivered on time, every time. Our commitment to on-time delivery is one of the reasons why we are known as the best white label software development company in the industry.

We have established efficient project management processes and streamlined development workflows to ensure that our clients' software solutions are completed within the agreed-upon timeframe. Our team of experts follows a meticulous schedule, setting realistic timelines and milestones for each project. We prioritize effective communication and collaboration with our clients, keeping them updated on the progress of their projects and addressing any concerns or feedback promptly.

By guaranteeing on-time delivery, we enable our clients to launch their products or services without any delays. We understand that time is of the essence in the business world, and we strive to provide our clients with a competitive edge by ensuring that their software solutions are delivered on time. Our reliable and prompt delivery allows our clients to stay ahead of the competition and meet the expectations of their customers.

When you choose Rainet Technology Private Limited as your B2B white label software development partner, you can have peace of mind knowing that your project will be completed on schedule. We take great pride in our ability to meet deadlines and deliver projects within the agreed-upon timeframe. With our commitment to on-time delivery, you can focus on your business goals while we handle the development of your white label software solution. Trust Rainet Technology Private Limited for all your B2B white label software needs, and experience the guarantee of on-time delivery.

Bringing Ideas to Life with Rainet Technology

Rainet Technology Private Limited is not just a B2B white label software development company it's a gateway to bringing your ideas to life. With their team of experts and their extensive experience in the industry, Rainet Technology has the skills and knowledge to turn your vision into a reality.

When you partner with Rainet Technology, you gain access to a team that understands the importance of customization and personalization. They know that your business is unique, and they take the time to understand your goals and objectives. By collaborating closely with you, Rainet Technology ensures that the software solution they create aligns perfectly with your brand and meets your specific needs.

But their expertise doesn't stop at technical skills. Rainet Technology is committed to helping you bring your ideas to life in the most efficient and effective way possible. They guide you through every step of the development process, offering their insights and expertise to ensure that your software solution not only meets your expectations but also exceeds them.

With Rainet Technology by your side, you can take your ideas and turn them into a fully functional, branded product. Whether you're looking to develop a new application or customize an existing software solution, Rainet Technology has the expertise to bring your vision to life. They handle everything from design and development to implementation and support, giving you the peace of mind to focus on your business.

Bringing your ideas to life is no small feat, but with Rainet Technology Private Limited as your partner, the possibilities are endless. Together, you can create a software solution that sets you apart from the competition and propels your business to new heights. So why wait? Partner with Rainet Technology today and start bringing your ideas to life.

Unleashing Limitless Possibilities with Rainet Technology

Rainet Technology Private Limited is not just a B2B white label software development company; it's a gateway to unleashing limitless possibilities for your business. With their team of experts and their extensive experience in the industry, Rainet Technology has the skills and knowledge to help your business reach new heights.

When you partner with Rainet Technology, you gain access to a team that understands the importance of pushing boundaries and exploring new opportunities. They know that innovation is key to staying ahead in the competitive market, and they are committed to helping you unlock your business's full potential. Whether you're looking to develop a new application or customize an existing software solution, Rainet Technology has the expertise to bring your ideas to life.

But Rainet Technology's expertise goes beyond technical skills. They have a deep understanding of the business landscape and can offer valuable insights and guidance to help you make informed decisions. With their support, you can explore new markets, expand your offerings, and differentiate yourself from the competition.

Rainet Technology is dedicated to helping you break through limitations and achieve your business goals. They work closely with you to understand your vision and objectives, and then provide the technical expertise and resources to turn that vision into a reality. By leveraging cutting-edge technology and innovative solutions, Rainet Technology empowers you to take your business to the next level.

Partnering with Rainet Technology means opening the door to endless possibilities. Whether it's streamlining your operations, improving customer experience, or exploring new revenue streams, Rainet Technology is there to guide you every step of the way. With their support, you can unleash your business's full potential and embark on a journey of growth and success.

So why wait? Partner with Rainet Technology today and start unleashing the limitless possibilities for your business. Together, you can conquer new horizons and make your mark in the ever-evolving world of technology.

Visit Website: https://rainet.co.in/b2b-white-label-software.php

#B2B White Label Service Provider Company#B2B white label software#White Label Software Development#B2B software provider company in Noida#B2B white label software developer company in Noida#best b2b white label software development company#api provider#bbps api development company#bbps api provider#education portal development company#bharat bill pay receipt

0 notes

Text

Bharat Bill Pay API

Introduction

As businesses continue to evolve in the digital age, it is essential to have a reliable and efficient payment system that caters to the needs of customers. The Bharat Bill Pay System (BBPS) is one such platform that has revolutionized the way people pay their bills. It provides a single-window system for all utility bill payments, making it easier for customers to manage their finances. However, implementing BBPS requires expertise and technical know-how, which is where Rainet Technology comes in. In this article, we will discuss why Rainet Technology is the best Bharat Bill Pay API provider company and how they can help your business grow.

Why do you need Bharat Bill Pay API for your business?

As a business owner, you are always looking for ways to streamline your operations and improve customer satisfaction. One way to achieve both of these goals is by integrating Bharat Bill Pay API into your business. This technology allows your customers to pay their bills online, quickly and easily, without having to leave your website or visit a physical payment center.

By offering this service, you can attract new customers who value convenience and efficiency. Additionally, you can reduce the workload on your staff by automating the payment process. This means fewer errors and less time spent processing payments manually.

Bharat Bill Pay API is also highly secure, with multiple layers of authentication and encryption to protect sensitive information. This gives your customers peace of mind when making online payments through your website.

Overall, integrating Bharat Bill Pay API into your business can help you save time and money while improving customer satisfaction. It's a win-win situation for both you and your customers!

How can Rainet Technology help your business?

Rainet Technology can help your business by providing you with a reliable and efficient Bharat Bill Pay API solution. Our team of experts has years of experience in developing and implementing payment solutions for businesses of all sizes. We understand the importance of having a seamless payment system that is easy to use for both you and your customers.

With our BBPS API, you can easily integrate bill payments into your existing platform or website. This means that your customers can pay their bills directly through your platform without having to visit multiple websites or make phone calls. This not only saves time but also provides a convenient and hassle-free experience for your customers.

We also provide round-the-clock technical support to ensure that any issues are resolved quickly and efficiently. Our team is always available to answer any questions or concerns you may have about the integration process or the functionality of the API.

At Rainet Technology, we are committed to providing our clients with customized solutions that meet their specific needs. We work closely with each client to understand their business requirements and develop a solution that is tailored to their unique needs.

Overall, partnering with Rainet Technology for your Bharat Bill Pay API needs will not only streamline your payment processes but also enhance the overall customer experience. Contact us today to learn more about how we can help take your business to the next level.

Why are we a good choice for you?

At Rainet Technology, we understand the importance of providing reliable and efficient services to our clients. We take pride in being one of the best Bharat Bill Pay API providers in the market. Our team of experts is dedicated to ensuring that your business needs are met with precision and excellence.

We have a proven track record of delivering high-quality services to our clients across various industries. Our experience and expertise in the field enable us to provide customized solutions that cater to your specific requirements. We believe in building long-term relationships with our clients by providing exceptional customer service and support.

Choosing Rainet Technology as your Bharat Bill Pay API provider means that you can trust us to deliver results that exceed your expectations. We are committed to providing cost-effective solutions without compromising on quality. With our state-of-the-art technology and innovative approach, we can help you streamline your payment processes and improve your overall business efficiency.

Customize your BBPS API with Rainet Technology.

At Rainet Technology, we understand that every business has unique needs and requirements. That's why we offer customized Bharat Bill Pay API solutions to cater to your specific business needs. Our team of experienced developers will work closely with you to understand your requirements and create a tailored solution that meets your expectations.

We provide a range of customization options, including branding, user interface design, payment gateway integration, and more. We also ensure that our solutions are scalable and flexible enough to accommodate any future changes or updates to your business operations.

With our customized BBPS API solutions, you can streamline your bill payment processes, improve customer experience, and increase revenue for your business. Contact us today to learn more about how we can help you customize your BBPS API solution to meet your unique business needs.

Hire us for Bharat Bill Pay API?

At Rainet Technology, we understand the importance of having a reliable and efficient Bharat Bill Pay API for your business. That's why we offer our services to help you integrate this technology seamlessly into your operations. Our team of experienced professionals will work closely with you to understand your specific needs and create a customized solution that meets them.

When you hire us for Bharat Bill Pay API, you can rest assured that you're getting the best possible service. We pride ourselves on our attention to detail and commitment to providing top-notch customer support. Whether you need help with installation, troubleshooting, or ongoing maintenance, we're here to help.

So if you're looking for a trusted partner to help you implement Bharat Bill Pay API in your business, look no further than Rainet Technology. Contact us today to learn more about how we can help take your operations to the next level.

Conclusion

In conclusion, Rainet Technology is undoubtedly the best Bharat Bill Pay API provider company in the market. With their extensive experience and expertise in this field, they can help businesses of all sizes to streamline their payment processes and enhance customer satisfaction. Their customized solutions are tailored to meet the unique needs of each business, ensuring maximum efficiency and convenience. By choosing Rainet Technology as your BBPS API provider, you can rest assured that you are making a wise investment in the future of your business. So why wait? Contact them today and take your business to new heights!

Visit Website: https://rainet.co.in/bbps-api-integration.php

#bbps#bbps service#bbps website#api provider#bharat bill pay receipt#what is bbps#bbps receipt#bbps login#BBPs API Integration service provider company in Noida. BBPs API service company#BBPs API development company

0 notes

Text

How To Pay School Fees Online Through Credit Card At Payrup

Paying the school fee payment by the due date is a hectic job, especially when you are a busy parent as it requires waiting in a queue, depositing through cheque, Challan, Demand Draft, or cash. And as school fee payment is so important for your child's education, you can not even delay it.

That's why digitization has helped in several ways. Now, you can easily pay your child's school or college fee online through our very own Payrup's official website at the right time. You can make the payment from anywhere you prefer and at any time with all your comfort.

Now, when it comes to school fee payment, what's better than using your credit card. This will be really beneficial for you as it saves you time and improves your credit score as well. Here, at Payrup, you would find various schools and colleges listed that accept the payment through it. And for those who are not listed on Payrup can be added by BBPS (Bharat Bill Payment System). As BBPS enables the list of institutions for bill payment, which are displayed on Payrup.

As we are done with the general introduction on paying your school fee through credit card on Payrup, it's time to get on to the procedure required for this. So, let's get started! visit us : https://payrup.com/blogs/how-to-pay-school-fees-online-through-credit-card-at-payrup

How to pay for education fees on Payrup?

Just follow these steps and your payment for the education fee will be done within minutes. Here are the steps:

Visit Payrup: Visit the official website of Payrup via your laptop or phone. After that, log in to your account details.

Go to Education Fees: After logging in, click on the "Education Fees" from the payment services listed on Payrup.

Enter details: Then, enter the required details such as your state and the name of the institution for the payment, along with the student-related questions as well.

Complete payment: Now, you'll get several payment modes such as internet banking, credit or debit card, wallets, etc., among which you have to select a credit card. Enter the details and complete your payment.

After the payment is a transaction, it will be visible on the transaction history in your Payrup account. Also, you'll be receiving the payment receipt of the education fee paid. It will be in the transaction made in your order details.

In general, it usually takes 2 business days in advance of the deadline date for it to process and be accepted, for education fees. It is unlike the other payments on Payrup, which happens immediately. visit us :https://payrup.com/blogs/how-to-pay-school-fees-online-through-credit-card-at-payrup

#school fees#online school fees#school#fees#online fees#online bill#school fees fees#students#teachers

0 notes

Text

Different Payment Channels to make Utility Bill Payment

In collaboration with Bharat Bill Payment System and National Payments Corporation of India (NPCI), XPay.Life has introduced a one-stop ecosystem for payment of all utility bills, offering a myriad of ways to make payment considering the certainty, reliability, and safety of each transaction through Blockchain Secure Payment Gateway. Consumers can choose the best channel to pay their multi-utility bills through Touch Screen Kiosk, Web, Mobile Apps, and POS Device.

XPay.Life has integrated Blockchain-based Payment Gateway that focuses on securing the sensitive and confidential information shared by the users throughout the payment process. It ensures security by encrypting data including card details and bank details provided by the user while making the transactions. A payment gateway allows millions of users to make payment/transaction at the same time, without any hassle.

If you are going to make payment for your Electricity Bill and looking for Electricity Bill Payment Site, XPay.Life is the top choice for many people as it offers a complete spectrum of bill payment. Among many payment channels, XPay.Life enables payment through Net Banking, Credit Card, Debit Card, and wallet.

XPay.Life offers multiple modes of payment and also acknowledges it on an immediate basis by providing instant confirmation of payment via SMS, notification and email receipt. It offers utility bill payment for different services such as Electricity, Water, Gas, Mobile, Landline, Broadband and DTH through Touch Screen Kiosk, Web, Mobile Apps, and POS Device.

No matter, you want to make Postpaid Payment, or any DTH Recharge Online, XPay.Life has incorporated all the payment channels.

For more details visit here: https://www.xpay.life

Source Link: http://blog.xpay.life/2019/07/different-payment-channels-to-make.html

#Blockchain secure payment#online Broadband postpaid bill payment#DTH Recharge online#Electricity Bill Payment#Online Bill Payment#Utility Bill Payment Kiosk#water bill payment

0 notes

Text

Broadband Postpaid bill payment can be paid using the XPay Life App

A decade ago, paying utility bills was quite a hassle. Remember the time when you had to skip your lunch hour to stand in long queues at bill payments outlets. Today technology and digitisation has helped consumers to pay their utility bills using their smartphones and computers. The availability of the internet service, dual authentication of the user identity has built a trust in the minds of the patrons to proceed with digital money transfers. UCGPL bill payment plays an important role in customer retention in today's time as several service providers stay connected with their patrons, by providing them with offers and discounts.

The digital modes of payments present the customers with varied payment options to make quick, easy and secure payments which are digitally stored. All the transactions are frequently monitored in the digital space. It is simpler and efficient to make the Postpaid Mobile Bill Payment Online using your mobile and computers. These transactions can be made from one's home, or office without hampering their days schedule.

By the year 2023, there will be a quantum increase in the non-cash transactions within the country. The report also mentioned that there is also going to be a surge in the digital payments industry by 2020. Therefore, we can see that several broadband users make their Broadband postpaid bill payment from the comfort of their homes.

Processing Recharge DTH Online is the newest trend; cash has been the old fashioned way to make payment. Making a payment has become comfortable with UPI, Netbanking, credit/debit card, mobile banking, and wallets. Digital payment system has made us all go cashless, and you will never run short of money when you go outside. Paying bills is possible through digital payment options. It is no longer time consuming to make bill payments, and online payment options facilitate a larger section of the population.

Water bill online helps reduce the number of cash transactions by allowing the customers to make bill payments using their mobile or computers. Once, the payment is made a customer is provided with a confirmation receipt instantly. It is in line with RBI's vision to facilitate payments of bills from anywhere at any time. NPCI came up with Bharat Bill Payment System to promote digital payments. Digital payment options are convenient, easy and secure ways to pay for goods and services. One must ensure that the online payment platform that they are choosing is highly secure with the best PCI compliance supported with technologies like Artificial Intelligence, Blockchain, IoT, Cloud and Mobility.

For More information Visit: https://www.xpay.life

Source: https://www.apsense.com/article/broadband-postpaid-bill-payment-can-be-paid-using-the-xpay-life-app.html

0 notes

Text

How XPay Life simplified the Postpaid Mobile Bill Payment

A few years ago, paying utility bills was quite a hassle. You had to skip your lunch hour to stand in long queues at bill payments outlets. However, today technology and digitisation has helped consumers to pay their utility bills using their smartphones and computers. The availability of the internet service, dual authentication of the user identity has built a trust in the minds of the patrons to proceed with fluid money transfers. There are digital receipts that can be obtained via SMS, Email, and App notification from the pre-configured mobile apps. Digital payments play a major role in customer retention in today's time as several service providers stay connected with their patrons, by providing them with offers and discounts.

According to a study by Google (Alphabet Inc.) and Boston Consulting Group, the quantum of non-cash transactions within the country will exceed that of cash transactions by 2023. The report also mentioned that there is also going to be a surge in the digital payments industry by 2020. Therefore, we can see that several mobile users make their Postpaid Bill Payments from the comfort of their homes.

The digital modes of payments present the customers to a varied payments options to make quick, easy and secure payments which are digitally stored. All the transactions are regularly monitored in the digital space. It is simpler and efficient to make the Landline bill payment using your mobile and computers. These transactions can be made from one's home, or office without hampering their days schedule.

Making payments through cash has been the old fashioned way to make payment. Making a payment has become comfortable with UPI, Netbanking, credit/debit card, mobile banking, and wallets. Digital payment system has made us all go cashless, and you will never run short of money when you go outside. Paying Quick Bill payment Electricity bills is possible through digital payment options. It is no longer time consuming to make bill payments, and online payment options facilitate to a larger section of the population.

Online Gas Payment helps reduce the number of cash transactions by allowing the customers to make bill payments using their mobile or computers. Once, the payment is made the customer is provided with a confirmation receipt instantly. It is in line with RBI's vision to facilitate payments of bills from anywhere at any time. NPCI came up with Bharat Bill Payment System to promote digital payments. Digital payment options are convenient, easy and secure ways to pay for goods and services. There has been a revolution in the way the payments are made in the country. Based on the recent time, a cashless economy is going to be a dream come true and it will become a dominant force.

One must ensure that the online payment platform that they are choosing is highly secure with the best PCI compliance supported with technologies like Artificial Intelligence, Blockchain, IoT, Cloud and Mobility.

Source: https://www.apsense.com/article/how-xpay-life-simplified-the-postpaid-mobile-bill-payment.html

0 notes

Text

Coronavirus package | How will the COVID-19 relief for MSMEs help?

New Post has been published on https://apzweb.com/coronavirus-package-how-will-the-covid-19-relief-for-msmes-help/

Coronavirus package | How will the COVID-19 relief for MSMEs help?

The story so far: In his address to the nation, his third, on May 12, Prime Minister Narendra Modi announced a ₹20-lakh crore economic relief package titled Atmanirbhar Bharat Abhiyan. The relief package is being unveiled in tranches from May 13 by Finance Minister Nirmala Sitharaman. The first tranche, aimed at micro, small and medium enterprises (MSMEs), non-banking financial companies (NBFCs) and at some individuals was announced by her on Wednesday.

What are the proposals aimed at offering relief to micro, small and medium enterprises (MSMEs)?

The government has proposed to offer collateral-free loans to MSMEs which will be fully guaranteed by the Centre. There will be a principal repayment moratorium for 12 months and the interest rate will be capped and there will be no guarantee fee.

Atmanirbhar Bharat Abhiyan | First tranche | Second tranche | Third tranche | Fourth tranche

All MSMEs with a turnover of up to ₹100 crore and with outstanding credit of up to ₹25 crore will be eligible to borrow up to 20% of their total outstanding credit as on February 29, 2020. These loans will have a four-year tenure and the scheme will be open until October 31. A total of ₹3-lakh crore has been allocated for this.

How will this benefit MSMEs?

This will act as initial seed money for these small enterprises hit by zero cash flow due to the national lockdown. This loan will help them buy raw materials, pay initial bills and daily wages to employees. In short, this will be like working capital for cranking up their businesses again.

Banks, though flush with funds, have been unwilling to lend to this category of borrowers as they fear that the money will not be repaid. These small businesses have also pledged all their assets already for other loans and do not have any more assets to pledge.

It is to break this logjam that the government has said that it will backstop banks up to ₹3-lakh crore and said that these loans do not need collaterals. Banks are now expected to be more comfortable in assisting this category of borrowers because the risk is zero (since the loans are guaranteed by the central government).

Atmanirbhar Bharat Abhiyan | First tranche of package seen at ₹5.9 lakh crore

This is the single biggest proposal in the last three tranches of announcements under the Atmanirbhar Bharat Abhiyan and small businesses are expected to benefit from this in a big way. About 45 lakh MSMEs are expected to gain from this proposal.

Are these the only proposals for MSMEs?

No. A partial credit guarantee scheme has been extended to enable promoters of these units to increase their equity. A total of ₹20,000 crore will be funnelled through the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) whereby banks will lend money to promoters which can be infused as equity in their businesses. About two lakh stressed MSMEs with non-performing assets (NPAs) are projected to benefit from this. The CGTMSE will offer a partial credit guarantee to banks.

There is also a proposal to infuse equity into MSMEs through a Fund of funds system where the government will provide ₹10,000 crore as initial corpus of the Fund. This will be leveraged to raise ₹50,000 crore which will be used to support MSMEs in desperate need of equity through ‘daughter funds’ of the main Fund of funds. The aim is to expand size and capacity of the MSMEs with equity and help them get listed on the stock exchanges.

Was not a change in the definition of MSMEs also announced?

Yes, henceforth MSMEs will be defined not based on their investment alone but also on their turnover. The definition has been tweaked and the existing distinction between manufacturing and services units has been eliminated.

Henceforth, a unit with up to ₹1 crore investment and ₹5 crore turnover will qualify as a micro unit, investment up to ₹10 crore and turnover up to ₹50 crore will qualify as a small unit, and investment up to ₹20 crore and turnover up to ₹100 crore will qualify as a medium enterprise.

It has been a long-standing demand from industry to hike the investment limits, as with inflation, units often cross the threshold that will bring them benefits. To prevent this, they either run their operations at a reduced level or incorporate multiple units so that turnover is distributed in a way that they remain within the threshold that will give them the benefits. The decision to add turnover criteria to investment is seen as a good decision as there are units that leverage a small capital to post large revenues.

Also read | Landslide changes in MSME sector expected: Ravi Uppal | Equity infusion for MSMEs hailed

What are the proposals for non-banking financial companies (NBFCs)?

NBFCs, housing finance companies and micro finance institutions are finding it difficult to raise debt capital due to a confidence crisis in the debt markets. The government has, therefore, announced a special liquidity scheme of ₹30,000 crore to pick up investment grade debt paper from both primary and secondary markets. Such paper will be fully guaranteed by the government. This is expected to break the low confidence cycle in the market for lending to the above category of borrowers.

In addition, to help low rated finance companies to raise debt, the existing partial credit guarantee scheme has been extended to cover primary market debt paper wherein the first 20% loss will be borne by the government.

A total of ₹45,000 crore has been set aside for this Partial Credit Guarantee Scheme 2.0 that will offer liquidity to paper rated AA and below and even unrated paper.

Do electricity distribution companies (discoms) also feature in the first tranche announced?

Yes, discoms are in a huge liquidity crisis and unable to pay their dues to electricity generation companies. Their cash flow and revenues have been hit due to low demand from industrial consumers for power during the lockdown. The various State discoms together owe about ₹94,000 crore to their suppliers, the generation and transmission companies.

Also read | ₹90,000-crore ‘power backup’ will help ease liquidity pressure on discoms

The government, through Power Finance Corporation-Rural Electrification Corporation, will infuse liquidity of ₹90,000 crore to discoms which will be securitised against their receivables from consumers. The loans given for the purpose of discharging their dues to generation companies will be against a guarantee from the respective State related to the discom. This emergency liquidity infusion will avert a crisis where generation and transmission companies stop supplies to discoms that are in default.

What are the measures for the common man?

In March, when the first relief package called the Pradhan Mantri Garib Kalyan Yojana was announced, the government offered to pay the 24% provident fund contribution (employer+employee) for those earning up to ₹15,000 a month as salary and working in units that employ less than 100 workers for three months. This has now been extended for another three months up to August. The statutory PF contribution for those employed in the private sector (and not in the category of establishments above) has been reduced to 10% (from 12% now) for the next three months in order to increase liquidity in their hands. This is expected to benefit 4.3 crore people and 6.5 lakh establishments and release a total of ₹6,750 crore liquidity.

In addition to the above, the rate of tax deducted at source (TDS) and tax collected at source (TCS) has been reduced by 25% for a whole range of receipts. Thus, in payments to contractors, professional fees, rent, interest, commission, brokerage, etc. the TDS will be 25% lower. The TCS paid while buying a car of over ₹10 lakh in value and TCS collected in property transactions will also be lower.

Also read | CBDT notifies reduction in TDS/TCS

The lower TDS is not applicable on monthly salaries that employees receive.

In the cases where TDS/TCS has been reduced, the tax liability is not reduced. It will be payable while filing return or while paying advance tax. The idea is only to offer immediate cash relief to people. The lower TDS/TCS kicks in right away and will stay until March 31, 2021.

Source link

0 notes

Link

via Today Bharat nbsp; The announcement, made by Finance Minister Nirmala Sitharaman, did not put any figure on the benefits in numbers. In a big relief to telecom companies, the Union Cabinet approved the recommendation of the Committee of Secretaries (CoS) and allowed telcos a two-year moratorium on spectrum-related dues, which translates into Rs 42,000 crore financial support to the stressed sector. The deferment of spectrum auction installments would ease the cash outflow of the stressed telcos and facilitate payment of statutory liabilities and interest on bank loans. The announcement, made by Finance Minister Nirmala Sitharaman, did not put any figure on the benefits in numbers. ldquo;In view of the current financial stress faced by major telecom service providers and in pursuant of the recommendations by Committee of Secretaries, it is decided to defer receipts of spectrum auction installments due from the telecom service providers from the years 2020-21 and 2021-2022,rdquo; she said. The deferred amounts, she said, would be equally spread over the remaining installments. "These deferred amounts bill be spread equally in the remaining installments to be paid by telecom companies. Interest, as stipulated while auctioning the concerned spectrum, will, however, be charged so that NPV is protected, she noted. However, telecom companies opting for the two-year deferred payment would have to furnish a bank guarantee. Industry body Cellular Operators Authority of India welcomed the announcement, but said that the high level of levies and taxes continues to be a challenge for the sector. "We welcome the fact that the government recognises the financial distress of the telecom sector and has provided relief in the form of deferments of spectrum payments. We are very thankful to our Minister Prasad and the DoT for supporting us and pushing forward our request to the FM for action. This will certainly provide some immediate cash flow relief to the industry. "However, the high level of levies and taxes continues to be a challenge for the sector. The telcos pay up to 30% of their revenues to the government, by way of various levies and Taxes, which is an enormous burden on the industry. 30% of what is collected is passed on to the Government. We have been requesting the Government that these levies and Taxes be rationalised and the same is also one of the important goals of NDCP. "However, these aspects of the NDCP are yet to be operationalised and we are engaging with the government on the same. We humbly request the government to consider the vexing issue of AGR and address the anomaly of continuing with the previous legacy issue of revenue share and License Fees and SUC when spectrum has already been paid for up front. We hope the government will consider this request of either eliminating AGR or redefining these in line with our request and then reduce the LF and SUC to 3% and 1% respectively", Rajan S Mathews, DG, COAI said. Continued operation by telecom service providers, according to the statement, would give a fillip to employment and economic growth. In addition, the improved financial health of service operators would facilitate the maintenance of quality of services to the consumer. Following the Rs 1 lakh crore worth of Q2 loss by telcos, the Centre had formed a Committee of Secretaries to look into relief package to the ailing sector. The recent adverse Supreme Court ruling on Adjusted Gross Revenue (AGR), asking the telecom companies to pay the outstanding amount to the Department of Telecommunications (DoT) within three months, coupled with the existing cumulative debt of Rs 7.5 lakh crore, made the incumbents heavily leveraged. Indian telecom operators owe the government nearly Rs 1.47 lakh crore in license fee (LF) and spectrum usage charges (SUC), the communications ministry told Parliament on Wednesday. Of the total amount, license fee comes to Rs 92,642 crore as of July this year, while SUC comes to Rs 55,054 crore as of October end this year.

0 notes

Text

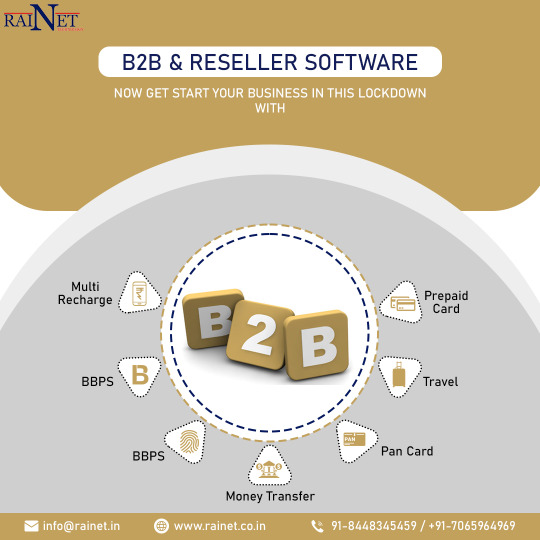

B2B Reseller Software Development Company

Are you a B2B reseller looking to streamline your business operations and maximize your profits? Look no further! Rainet Technology Private Limited is here to revolutionize the way you do business. As a leading B2B Reseller Software Development Company in Noida, we specialize in providing top-notch software solutions tailored specifically for resellers like you. With our cutting-edge technology and unrivaled expertise, we are committed to helping you achieve new heights of success in the digital era. So buckle up and get ready for an exhilarating journey towards enhancing your reselling capabilities!

B2B Reseller Software Services Company in Noida

At Rainet Technology Private Limited, we take pride in being the leading B2B Reseller Software Services Company in Noida. Our team of skilled professionals understands the unique challenges and requirements of resellers in today's competitive market. We offer a comprehensive range of software services designed to streamline your business processes and drive growth.

With our B2B reseller software, you can easily manage your inventory, track sales, generate invoices, and analyze customer data—all from a single platform. Our user-friendly interface ensures that even those with minimal technical knowledge can navigate through the system effortlessly.

But our services don't stop there. We also provide customizations to meet your specific needs. Whether it's integrating third-party applications or developing new features from scratch, our team is dedicated to delivering solutions that align perfectly with your business goals.

In addition to robust functionality, we prioritize security and reliability. With advanced encryption protocols and regular updates, you can rest assured that your valuable data is safe from any potential threats.

Partnering with us means gaining access to cutting-edge technology and unmatched expertise in the field of B2B reselling. Let us empower you with innovative solutions that will give you a competitive edge in the marketplace!

Features we provide in B2B Reseller software

Features we provide in B2B Reseller software

At Rainet Technology Private Limited, we understand the unique needs of businesses operating in the B2B reseller space. That's why our B2B Reseller software is designed to cater to those specific requirements and empower your business with advanced features.

Our software provides seamless order management capabilities. You can easily process orders, track inventory levels, and handle shipping logistics all within a single platform. This streamlines your operations and ensures efficient order fulfillment.

Our B2B Reseller software offers robust customer relationship management tools. You can easily manage customer information, track interactions, and even personalize communications for a more personalized experience. This helps you build stronger relationships with your clients and increase customer satisfaction.

Additionally, our software comes equipped with comprehensive reporting and analytics features. You can generate detailed reports on sales performance, inventory levels, and revenue projections. These insights enable you to make data-driven decisions that drive growth for your business.

Furthermore, our B2B Reseller software supports integrations with popular e-commerce platforms like Shopify or WooCommerce. This allows for seamless synchronization of product catalogs and inventory management between your online store and the reselling platform.

Lastly but certainly not least important is the security aspect of our software. We prioritize data protection measures such as encryption protocols to ensure that sensitive information remains secure at all times.

In conclusion,

Rainet Technology Private Limited stands out as the best choice when it comes to B2B Reseller Software Development Company in Noida.

Why Choose Us?

Why Choose Us?

When it comes to B2B reseller software development, Rainet Technology Private Limited stands out as the best choice. We have years of experience in providing top-notch services and delivering exceptional results to our clients. Here are some reasons why you should choose us:

1. Expertise: Our team consists of highly skilled professionals who have expertise in developing B2B reseller software solutions. We stay updated with the latest technologies and trends to ensure that we deliver cutting-edge solutions to our clients.

2. Customization: We understand that every business has unique requirements, and we tailor our solutions accordingly. Whether you need a specific feature or want a completely customized software solution, we can fulfill your needs.

3. Quality Assurance: At Rainet Technology Private Limited, quality is of utmost importance to us. We follow strict quality assurance processes to ensure that our software solutions are reliable, efficient, and bug-free.

4. Timely Delivery: We value your time and understand the importance of timely delivery in today's fast-paced business environment. Our team is committed to completing projects within the agreed time frame without compromising on quality.

5. Customer Support: Our dedication doesn't end with project delivery; we provide excellent customer support even after the completion of projects. You can rely on us for any assistance or guidance related to your B2B reseller software.

With Rainet Technology Private Limited as your partner, you can be assured of getting a robust and scalable B2B reseller software solution tailored specifically for your business needs!

Meet Us Today For a Better Tomorrow

Are you looking for a reliable and experienced B2B Reseller Software Development Company in Noida? Look no further because Rainet Technology Private Limited is here to meet all your needs. With our extensive range of services, we are the best choice for businesses seeking top-notch reseller software solutions.

At Rainet Technology, we understand the importance of providing comprehensive features in our B2B Reseller software. Our team of expert developers ensures that our software is equipped with all the necessary functionalities to streamline your reselling process. From inventory management to order tracking and customer support, we have got you covered.

But why should you choose Rainet Technology over other companies? The answer lies in our commitment to delivering exceptional quality and unmatched customer satisfaction. We believe in building long-lasting relationships with our clients by offering personalized solutions tailored to their specific requirements.

Our team consists of skilled professionals who are well-versed in the latest technologies and trends in the industry. They work tirelessly to develop innovative and user-friendly software that will take your business to new heights.

So, what are you waiting for? Meet us today at Rainet Technology Private Limited and give your business a better tomorrow. Contact us now to discuss how we can help transform your reselling operations with our cutting-edge B2B Reseller software services.

Remember, choosing the right B2B Reseller Software Services is crucial for the success of your business. So don't settle for anything less than the best! Trust Rainet Technology Private Limited, India's leading B2B Reseller Software Development Company, and experience excellence like never before.

The Importance of Choosing the Right B2B Reseller Software Services

The Importance of Choosing the Right B2B Reseller Software Services

In today's competitive business landscape, having the right B2B reseller software services can make all the difference. It is crucial for businesses to choose a reliable and efficient software development company that can meet their unique needs and help them stay ahead of the competition.

One of the key reasons why selecting the right B2B reseller software services is important is because it directly impacts your business operations. A well-designed and user-friendly reseller app can streamline your processes, automate tasks, and enhance efficiency. This translates into cost savings, improved productivity, and increased customer satisfaction.

Additionally, choosing an experienced B2B reseller software development company ensures that you receive customized solutions tailored to your specific requirements. They have in-depth knowledge of industry trends and best practices, allowing them to design solutions that address your pain points effectively.

Furthermore, partnering with a reputable B2B dealer company gives you access to advanced features and functionalities that can give you a competitive edge. From inventory management tools to sales analytics dashboards, these features empower you with valuable insights into your business operations.

Another crucial aspect is data security. With cyber threats on the rise, safeguarding sensitive customer information should be a top priority for any business. By choosing a trusted reseller software development company like Rainet Technology Private Limited in Noida, you ensure that robust security measures are implemented to protect both yours and your customers' data.

Investing in high-quality B2B reseller software services sets the foundation for future growth. As technology continues to evolve at a rapid pace, staying updated with innovative solutions becomes essential for long-term success. A forward-thinking software development partner will not only provide cutting-edge solutions but also offer continuous support as new updates or enhancements become available.

At Rainet Technology Private Limited in Noida , we understand the importance of choosing the right B2B reseller software services. With our expertise in software development and commitment to delivering excellence.

Visit Website: https://rainet.co.in/b2b-reseller-software.php

#reseller app#B2B Reseller Software Development Company in Noida#reseller software development company#best B2B software provider company#B2B dealer company#B2B reseller software dealer company#bbps api provider#bbps api development company#bbps login#api provider#bbps#bbps website#education portal development company#bbps receipt#bbps service#bharat bill pay receipt

0 notes

Text

BBPS API

Rainet Technology Private Limited is a leading BBPS API provider company in India. We provide the best BBPS API services to our customers and help them to grow their business. Our team of experts has extensive experience in developing and deploying secure, reliable, and scalable APIs for various industries.

We offer a wide range of services such as AEPS API, Android App Development, IOS App Development, Hotel Booking Software Development, Bus Booking Software Development and Digital Marketing Service. Our team is well-versed in the latest technologies and trends to ensure that our customers get the best solutions for their business needs.

We also provide Education Portal development services which help educational institutions to manage their operations efficiently. We have a dedicated team of professionals who are experienced in developing custom portals for schools, colleges and universities. Our portal development services include user management system integration, content management system integration, payment gateway integration and more.

At Rainet Technology Private Limited we strive to deliver high quality BBPS API solutions at competitive prices with excellent customer service support. We understand the importance of providing secure APIs that meet industry standards so that our customers can trust us with their data security requirements. With our expertise in this domain we guarantee you an efficient solution for your business needs. Contact us today to learn more about how we can help you grow your business! We also provide AEPS API solutions for businesses that need to integrate their payment systems with the Aadhaar Enabled Payment System (AEPS). Our APIs are designed to be secure and reliable, ensuring that your customers can make payments securely. We have a team of experienced developers who understand the latest technologies and trends in this domain so you can rest assured that you will get the best solution for your business needs.

Apart from BBPS API and AEPS API solutions, we also offer Android App Development services as well as IOS App Development services. Our team of experienced developers is capable of creating custom mobile applications according to your specific requirements. We use cutting-edge technologies such as React Native, Flutter, Kotlin etc., which help us create high quality apps with great user experience.

We also specialize in developing software solutions for Hotel Booking and Bus Booking systems. Our software development services include integration with third party APIs such as Google Maps, Trip Advisor etc., so you can easily manage bookings on multiple platforms at once. Additionally, our Digital Marketing Services help businesses reach out to potential customers through various online channels like search engine optimization (SEO), social media marketing (SMM) etc., thus helping them increase their customer base significantly over time.

At Rainet Technology Private Limited we strive to deliver high quality products and services at competitive prices with excellent customer service support. Contact us today if you would like more information about any of our products or services.

Visit Website: https://rainet.co.in/BBPS-API-Integration.php

#bbps#bbps service#bbps website#api provider#bharat bill pay receipt#what is bbps#bbps receipt#bbps login#BBPs API Integration service provider company in Noida.#BBPs API service company#BBPs API development company

0 notes

Link

MUMBAI: Many banking, financial services and insurance (BFSI) players have turned data worshippers. Data can precisely map demographics, individual preferences and financial tendencies that help risk projection and customer relationship management.And the field is vast and diverse from private weather bureaus to food app payment gateways, telecom bill payments and even social media records.Take meteorologist Jatin Singh and his team. They pore over hundreds of drone captured pictures and satellite images to map agriculture across central India. The founder of Skymet Weather Services demarcates farmlands on the basis of government records and uploads them onto a platform secured by a pay-wall.Banks and insurers are Skymet’s clients. “Over the next few months, we’ll cover other regions too… This data is turning out to be very useful for banks,” says Singh, whose reports have helped lenders disburse over 10,000 crop loans.Drone-captured images, acreage data, yield prediction, market price analysis and weather forecasts arms Skymet’s clients to price their risk suitably, besides cross sell opportunities — to wheedle a prosperous farmer to apply for a tractor loan or mark up his personal insurance cover.Data has changed the way BFSI operate. Data analytics has become the key determinant in matters pertaining to core BFSI operations, risk projection and customer relationship management.“Data is now used across the customer value chain… It helps us to ‘hyper-personalise’ our products and services,” admits Abonty Banerjee, chief digital officer of Tata Capital.Tata Capital uses data across functions — and almost indispensably in ‘collection analytics’, which helps the NBFC to put its money back on time. Tata Capital created a model on basis of debtor responses to collection calls. Factors such as — did the debtor promise to pay on a specified date, did he act upon his promise, number of failed contact attempts, number of successful contact attempts, borrower reaction while on call with collection agent et al were used to create the model.While most BFSI players use credit bureau records even for routine business decisions, the niftier ones also run ‘alternative data’ checks on the customers. Alternative data could be sourced from anywhere — from private weather bureaus to food app payment gateways, telecom bill payments and even social media records.THE BIG ALTERNATIVEL&T Finance, a large lender with a rural focus, uses secondary data (rainfall, reservoir levels and irrigation coverage) to formulate business strategies. It helped the L&T slash default rates by 64% since 2017.“This is precision bombing, and not carpet bombing… Data and analytics help us to do just that,” said Dinanath Dubhashi MD-CEO of L&T Finance.Shriram City Union Finance underwrites nearly ?200 crore of personal loans monthly solely on data analytics and relies on alternative data sources to evaluate customers. The NBFC peeps into social media accounts of its borrowers prior to closing a loan deal and is wary of lending to 25-year-olds who spend hours on Facebook during work hours. Shriram City also stays away from borrowers who update their LinkedIn job profiles every so often.“Credit bureau numbers are not of much use to us. I get to know a lot more about customers looking at external data points. I can predict a customer’s repayment pattern and free cash flows through proxy data. With these data points, I am able to lend to a person with a credit score of 550,” said V Lakshmi Narasimhan, executive director at Shriram City Union Finance.NEW DATA PLANNew-age insurer Acko General Insurance is primarily driven by data, analytics. It has 200 employees. A year ago it launched ‘Ola trip insurance’ a year ago — a one-rupee cover for Ola cab users against missed flights, accidents and baggage losses — designed solely by reading data.Acko built a lot of ‘possibilities’ using data modelling tools. Most of the time, Ola customers missed flights due to unexpected traffic blocks or client delays (Ola customer delays); baggage losses and accidents were rare, Acko found out. These summations were the outcome of processing several micro-data bits such as Ola accidents-per-day, driver delays, customer delays, missed flight records and baggage loss complaints.“Wherever data was not available, we considered relatable proxies,” says Animesh Das, product strategy head at Acko GI. Acko has processed close to 2,000 Ola trip insurance claims over the past eleven months and Das said the product is sustainable at the premium of ?1.Acko also offers a data-modelled car insurance product — which differentiates between a 22-year-old unmarried collegian and a 40-year-old married man who both own cars. So, a collegian commuting to his college in Delhi from Gurugram daily and is frequently booked by traffic police, he is likely to pay more premium than a middle-aged car owner from Lajpat Nagar who drops kids to school before reaching office.RattanIndia Finance, a new-age NBFC, uses alternative data for customer acquisition and loan underwriting. It uses foodapp payment receipts, Ola-Uber billings, online seller receipts to predict client cash flows — mostly SMEs and individuals. “We’re a new entity, without much captive data… So we mine data from alternate sources — much like what other fintech companies are doing now,” says Amit Mande, retail & SME head, RattanIndia Finance.Puneet Kapoor, senior executive VP at Kotak Mahindra Bank, likens data to oil and gold. “We started using data to understand cross-sell opportunities within our customer pool,” says Kapoor.Kotak has tempted a lot ‘cash-withdrawing customers’ to its digital platform, given personal loans to customers with “lower-than-usual” cash balances, home loans and locker facilities to those who turned individual accounts to jointly accounts (usually post marriage) and consumer durable loans to those changing their mailing addresses.Mahindra Finance has built ‘Bharat-Maps’, a data-driven financial and consumption map, to track consumption, lending patterns and also target micromarkets to reach out to new customers.Data is taking centre-stage in investment management too. Accuracap Consultancy, with a ?1,000 crore PMS book, is solely managed using quants and algorithms. The founders of Accuracap are software engineers who held senior positions at Adobe.“We use data modelling tools and algos to pick stocks… These engines also tell us at what point to enter or exit specific counters,” says Raman Nagpal, CIO, Accuracap.Accuracap could spot very lucrative entry and exit points in stocks such as TTK Prestige, HCL Tech and Venky’s, among others. The fund has logged a yearly return of close to 8%, almost mirroring the BSE-100 index and beating ‘category averages’ of 3.8%, Nagpal claims.“We don’t let human emotions come in the way of investing… This strategy has helped our investors,” Nagpal says.“Qualitative inputs could mitigate risk, reduce operational cost and enable faster rollout of appropriate products to targeted customer groups,” says S Siddhartha, CEO of Intain Technologies, which offers artificial intelligence and blockchain solutions to BFSI players.

from Economic Times http://bit.ly/2UDf7zX

0 notes

Text

UPI Collection API Integration Service

Are you looking for a seamless and efficient way to collect UPI payments for your business? Look no further! Rainet Technology Private Limited is here to provide you with the perfect solution - our UPI Collection API integration service. With our state-of-the-art technology and robust features, we can help streamline your payment collection process and boost your business's growth. In this blog post, we will explore what UPI Collection API is, how it can benefit your business, and how Rainet can assist you in harnessing the power of UPI payments. So let's dive right in!

What is the UPI Collection API?

What is the UPI Collection API?

UPI, which stands for Unified Payments Interface, has revolutionized the way we make payments in India. It enables users to link multiple bank accounts to a single mobile application and facilitates instant money transfers with just a few taps on the screen. The UPI system has gained immense popularity due to its convenience, security, and real-time transaction capabilities.

Now, imagine harnessing the power of UPI payments for your business. That's where UPI Collection API comes into play. An API (Application Programming Interface) acts as an intermediary between different software applications, allowing them to communicate with each other seamlessly.

In simple terms, UPI Collection API integration allows businesses to incorporate UPI payment functionality into their own platforms or mobile apps. This means that you can provide your customers with a hassle-free and secure way to make payments using their preferred UPI-enabled banking apps.

By integrating this powerful technology into your business processes, you can streamline your payment collection process and offer a seamless experience to your customers. Whether you run an e-commerce store, subscription-based platform, or any other type of online business - embracing UPI Collection API can open up endless possibilities for growth and success.

At Rainet Technology Private Limited, we specialize in providing top-notch UPI Collection API integration services that are tailored according to our clients' specific requirements. Our team of experts will work closely with you to understand your business needs and ensure a smooth integration process from start to finish.

So why wait? Embrace the future of digital payments by incorporating UPI Collection API into your business today!

Upi For Your Business by Rainet Technology Private Limited

Upi For Your Business by Rainet Technology Private Limited

Are you a business owner looking for a seamless way to collect payments from your customers? Look no further than UPI (Unified Payments Interface) - the revolutionary payment system that is transforming the way transactions are done in India.

Rainet Technology Private Limited, a leading technology company, offers an advanced UPI Collection API integration service that allows businesses to easily collect UPI payments. With our expertise and cutting-edge solutions, we provide a hassle-free experience for both businesses and their customers.

Our UPI Collection API Features

Our collection upi api integration service comes with a range of features designed to enhance your business operations. We offer secure and encrypted payment processing, ensuring the safety of your customer's data. Our API also supports multiple languages and currencies, making it convenient for businesses operating on a global scale.

How Can UPI Payments Help Your Business

Accepting UPI payments can bring numerous benefits to your business. First and foremost, it provides convenience for your customers as they can make instant payments using their smartphones without the need for cash or cards. This leads to faster transactions and reduces any delays or errors associated with traditional payment methods.

Furthermore, accepting UPI payments can help improve customer satisfaction and loyalty. By offering this modern payment option, you cater to the preferences of tech-savvy consumers who seek convenience in their purchasing experiences. This can give you an edge over competitors who have yet to adopt this innovative solution.

UPI Payments For Your Business - How Can Rainet Help

At Rainet Technology Private Limited, we understand that each business has its unique requirements when it comes to collecting payments. That's why our team of experts works closely with you to tailor our collection upi api integration service according to your specific needs.

We take care of all aspects of the integration process – from initial setup and customization through ongoing support – so that you can focus on what matters most: growing your business. With our reliable and efficient UPI Collection API, you

Our UPI Collection API Features

Our UPI Collection API comes with a range of powerful features that make collecting payments through UPI seamless and efficient. With our API, you can easily integrate UPI payment options into your website or mobile app, allowing your customers to make quick and secure transactions.

One of the key features of our UPI Collection API is its versatility. It supports all major UPI apps including Google Pay, PhonePe, Paytm, and more. This means that no matter which UPI app your customer prefers to use, they will be able to make payments without any hassle.

Another great feature of our API is real-time transaction status updates. You will receive instant notifications about successful payments as well as failed transactions. This enables you to provide prompt customer support and ensures transparency in your payment processes.

Our UPI Collection API also offers comprehensive reporting capabilities. You can access detailed reports on transaction history, success rates, refund requests, and much more. These insights help you analyze the performance of your payment system and identify areas for improvement.

Security is always a top priority when it comes to online payments, and our API takes this seriously. We have implemented robust security measures such as encryption protocols and fraud detection mechanisms to safeguard sensitive customer data.

In addition to these features, our UPI Collection API also provides easy integration options with popular e-commerce platforms like WooCommerce and Magento. This allows you to seamlessly incorporate UPI payments into your existing online store without any technical complexities.

With our reliable infrastructure and user-friendly interface, integrating the Rainet Technology Private Limited's UPI Collection API into your business operations has never been easier!

How Can UPI Payments Help Your Business

How Can UPI Payments Help Your Business

With the rapid growth of digital transactions, businesses are constantly exploring new and efficient ways to collect payments. UPI (Unified Payment Interface) has emerged as a game-changer in the Indian payment landscape, offering a seamless and secure way for businesses to accept payments.

One of the key advantages of UPI payments is its convenience. Customers can make instant payments directly from their bank accounts using simple mobile apps. This eliminates the need for cash or cards, making it easier for customers to complete transactions quickly and efficiently.

Another benefit of UPI payments is cost-effectiveness. Traditional payment methods often involve hefty transaction fees or setup costs, which can eat into a business's profits. With UPI, however, businesses can enjoy lower transaction charges and faster settlement times.

Moreover, UPI offers real-time payment tracking and reconciliation features that enable businesses to keep track of their transactions effortlessly. This ensures transparency and helps in streamlining financial operations effectively.

Furthermore, by integrating UPI collection API into your business processes, you open doors to a wider customer base as it allows you to accept payments from anyone with a bank account linked to their mobile number. This means that even customers who do not have credit or debit cards can easily make purchases from your business.

Embracing UPI payments can help your business enhance customer satisfaction by offering them a convenient and secure mode of payment while also reducing operational costs associated with traditional payment methods

UPI Payments For Your Business - How Can Rainet Help

UPI Payments For Your Business - How Can Rainet Help

Now that you understand the benefits of UPI payments and how they can transform your business, it's time to explore how Rainet Technology Private Limited can help you integrate UPI Collection API seamlessly into your operations.

As a leading provider of UPI collection API integration services, Rainet is committed to delivering top-notch solutions tailored to meet your specific business needs. Our team of experts will work closely with you to understand your requirements and guide you through the entire integration process.

Here are some ways in which Rainet can assist:

1. Expertise: With years of experience in the industry, our skilled professionals have extensive knowledge and expertise in integrating UPI payment systems. We stay updated with the latest trends and technologies to ensure that you receive cutting-edge solutions for seamless transactions.

2. Customization: At Rainet, we understand that every business is unique. That's why we offer customized UPI collection API integration services that align perfectly with your organization's goals and objectives. Whether you're a small startup or an established enterprise, we have flexible options to suit businesses of all sizes.

3. Seamless Integration: Our team ensures a smooth integration process without any disruptions to your existing systems or workflows. We take care of all technical aspects, making sure that the transition is hassle-free for both you and your customers.

4. Security: The security of financial transactions is paramount when it comes to online payments. With Rainet as your trusted partner, rest assured that we prioritize data protection and implement robust security measures throughout the integration process.

5. Customer Support: We believe in providing exceptional customer support at every step of the way. Our dedicated support team is always available to address any queries or concerns promptly, ensuring a hassle-free experience for both you and your customers.

In conclusion,

Integrating UPI payment systems into your business opens up new opportunities for growth by offering fast, secure, and convenient payment options to your customers. With Rainet Technology Private Limited

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integration#bbps#bbps api development company#bbps api provider#api provider#bbps login#bbps receipt#bbps website#bbps service#education portal development company#bharat bill pay receipt

0 notes

Text

Transport Booking Software Development Company

Rainet Technology stands out as a leading Transport Booking Software Development Company, offering cutting-edge solutions to clients globally. They have established a strong reputation for delivering high-quality software development services that are tailored to meet the unique needs of their clients. The company has a team of highly-skilled and experienced professionals who are committed to delivering top-notch services always. With their deep understanding of the transport industry, they are equipped to develop and implement software solutions that streamline operations, enhance efficiency, and increase profitability for businesses. The company's commitment to excellence and customer satisfaction has earned them a place as the best choice for any transport business looking to develop a booking software solution.

Visit Website: https://rainet.co.in/bus-booking-system.php

#bus booking system#bus reservation system#online transport booking system#transport booking system#bus tour website booking engine#agent booking application#ticket booking software#bus booking software development company in Noida#education portal development company#bbps api development company#bbps#bbps api provider#api provider#bbps website#bbps receipt#bbps login#bbps service#bharat bill pay receipt

0 notes

Text

UPI Collection API

Introduction