#budget2019-20

Text

Gift to Tax Payers, Modi government will change tax slab !

New Delhi : If all goes well, in the coming days the Modi government can make changes in the income tax slab. If this happens, the middle class of the country will get a big relief, which pays a large part of the tax. Let us know what changes the government can make in the tax slab.

Gift to Tax Payers, Modi government will change tax slab ! India 24x7 news

According to news agency IANS, the committee constituted by the government, headed by Central Board of Direct Taxes (CBDT) member Akhilesh Rajan, has recommended new tax slabs for the people. In the event of the implementation of this recommendation, the tax earner will have to pay 10 per cent of the tax of 5 lakh to 10 lakh rupees annually.

Currently, 20% tax has to be paid on earning of Rs 5 lakh to Rs 10 lakh. In this context, those earning up to 10 lakh can get a big relief.

In the recommendation of the committee, 20 percent tax is proposed on annual earnings ranging from Rs 10 lakh to Rs 20 lakh. Similarly, the committee has recommended tax at the rate of 30 per cent on income from Rs 20 lakh to Rs 2 crore.

While it has been proposed to impose 35 per cent tax on those earning more than Rs 2 crore annually. However, it is recommended not to impose surcharge on it.

Explain that at present, 5% tax is levied on the earning of Rs 2.5 lakh to Rs 5 lakh. Similarly, 20% on income of Rs. 5 lakh to Rs. 10 lakh and 30 percent income tax on income above Rs. 10 lakh.

For the convenience of filing tax returns to common taxpayers, they will be given the facility of providing pre-filled return forms. These forms can be obtained from various institutions and establishments including EPFO. Taxpayers will come under the tax liability only on income above five lakh rupees per annum.

A TDS of 2 per cent has been proposed for withdrawal of more than one crore cash from a bank account. If any person withdraws more than one crore amount in a year from the bank, then TDS of 2 percent will be imposed on it. That is, on withdrawing more than Rs 1 crore annually, Rs 2 lakh will be deducted in tax.

Companies with a turnover of Rs 400 crore in the country will now have to pay corporate tax at the rate of 25 percent. Earlier, companies with turnover up to Rs 250 crore were taxed at a lower rate. With the increase in business limit of companies, now 99.3 percent companies have come under the reduced rate.

For More, Please visit : https://www.india24x7news.com/gift-tax-payers-modi-government-will-change-tax-slab/

https://www.india24x7news.com/arts-lifestyle/

0

2019-08-20 17:02 +05:30

https://www.india24x7news.com/india/bihar/

0

2019-08-25 11:56 +05:30

https://www.india24x7news.com/breaking-news/

0

2019-08-27 23:06 +05:30

https://www.india24x7news.com/business/

0

2019-08-29 10:23 +05:30

https://www.india24x7news.com/cricket/

0

2019-08-25 20:08 +05:30

https://www.india24x7news.com/india/delhi/

0

2019-08-20 14:05 +05:30

https://www.india24x7news.com/entertainment/

0

2019-08-25 16:18 +05:30

https://www.india24x7news.com/environment/

0

2019-08-20 15:00 +05:30

https://www.india24x7news.com/india/gujarat/

0

2019-08-25 11:57 +05:30

https://www.india24x7news.com/health-fitness/

0

2019-08-25 11:48 +05:30

https://www.india24x7news.com/homecategory/

0

2019-08-19 22:10 +05:30

https://www.india24x7news.com/india/

0

https://www.india24x7news.com/india/karnataka/

0

2019-08-25 11:51 +05:30

https://www.india24x7news.com/live-tv/

0

2019-08-25 16:17 +05:30

https://www.india24x7news.com/india/maharashtra/

0

2019-08-24 14:46 +05:30

https://www.india24x7news.com/money-finance/

0

2019-08-02 10:17 +05:30

https://www.india24x7news.com/politics/

0

2019-08-26 09:55 +05:30

https://www.india24x7news.com/tech-news/

0

2019-08-25 11:52 +05:30

https://www.india24x7news.com/entertainment/tv-gossip/

0

2019-08-25 11:49 +05:30

https://www.india24x7news.com/india/uttar-pradesh/

0

2019-08-28 10:24 +05:30

https://www.india24x7news.com/world-new-live/

Read the full article

#AamBudgetNews#Bajat2019-20#budget#Budget2019#budget2019date#Budget2019Highlights#budget2019importantthings#budget2019inHindi#budget2019india#Budget2019News#budget2019specialthings#budget2019-20#Budgetannouncement#budgetdate2019india#budgeteconomicsurvey#Budgetexpectations#BudgetHeadlines#BudgetLivenews#budgetnews#Budgetsession2019#Budgetspeech#budgetupdates#economicsurvey#financeminister#financialbudget#generalbudget#hindinews#hindustan#importantfactsofbudget2019#importantthingsofbudget

0 notes

Link

Union Budget 2019-20

Finance Minister Niramala Sitharaman presents her maiden budget as she faces the challenges of creating jobs and spurring growth.

#budget2019#budget 2019-20#union budget 2019#Nirmala sitharaman#Finance Minister#Business Connect#Business Magazine

0 notes

Link

2019 இடைக்கால பட்ஜெட் இன்று தாக்கல் செய்யப்படுகிறது.

#பட்ஜெட்#ArunJaitley#BudgetNews#Budget2019#BudgetUpdates#InterimBudget2019#InterimBudget2019-20#Parliament#PiyushGoyal#Pre-BudgetNews#RailwayMinister#UnionBudget#இடைக்காலபட்ஜெட்#India#Tamil#News

0 notes

Text

Last and Interim budget of modi government 2019, live updates

बजट LIVE: छोटे किसानों को सरकार का तोहफा, हर साल 6 हजार रुपए मिलेंगे खाते मेंं

NEWS HIGHLIGHTS

पीयूष गोयल पेश कर रहे हैं बजट

किसानों को साधने की हो सकती है कोशिश

मध्यमवर्गीय लोगों को भी दी जा सकती है राहत

केंद्र की मोदी सरकार आज अपना अंतरिम बजट पेश कर रही है। अंतरिम वित्त मंत्री पीयूष गोयल संसद में बजट भाषण दे रहे हैं। मोदी सरकार के कार्यकाल का आखिरी बजट होने के कारण उम्मीद की जा रही है कि इसमें कई लोकलुभावन योजनाओं की घोषणा की जा सकती है।

बता दें कि वित्त मंत्री अरुण जेटली की तबीयत खराब होने के कारण पीयूष गोयल बजट पेश कर रहे हैं। लोकसभा चुनाव के पहले पेश किए जा रहे बजट में मोदी सरकार एक बड़े वर्ग को साधने की कोशिश करेगी। सरकार किसानों और मध्यमवर्गीय लोगों को इस बार बड़ी राहत दे सकती है।

LIVE UPDATES

11.34 AM : 12 करोड़ छोटे किसानों को मिलेगा फायदा, सरकार पर आएगा 75 हजार करोड़ का बोझ।

FM Piyush Goyal: This initiative will benefit 12 crore small and marginal farmers, at an estimated cost of Rs. 75,000 crore

FM Piyush Goyal: Under the Pradhan Mantri Kisan Samman Nidhi, 6000 rupees per year for each farmer, in three instalments, to be transferred directly to farmers' bank accounts, for farmers with less than 2 hectares landholding

42 people are talking about this

11.30 AM : प्रधानमंत्री किसान सम्मान निधि से छोटे किसानों को हर साल 6 हजार रुपए देगी सरकार।

FM Piyush Goyal: Under the Pradhan Mantri Kisan Samman Nidhi, 6000 rupees per year for each farmer, in three instalments, to be transferred directly to farmers' bank accounts, for farmers with less than 2 hectares landholding

82 people are talking about this

11.25 AM : किसानों के लिए सरकार ने खोला खजाना।

FM Piyush Goyal: To provide assured income support for small and marginal farmers, Pradhan Mantri Kisan Samman Nidhi scheme has been approved

58 people are talking about this

11.10 AM : पीयूष गोयल ने कहा, हमने मंहगाई की कमर तोड़ दी।

Piyush Goyal: Inflation is a hidden and unfair tax; from 10.1% during 2009-14, we have broken the back of back-breaking inflation

33 people are talking about this

11.00 AM : पीयूष गोयल ने बजट भाषण देना शुरू किया।

Delhi: Finance Minister Piyush Goyal begins budget speech in the Parliament #BudgetSession

See ANI's other Tweets

10.55 AM : पीएम मोदी की अध्यक्षता में हुई कैबिनेट बैठक में पीयूष गोयल के बजट को स्वीकृति दी गई।

Union Cabinet has approved the interim Budget 2019-20. #Budget2019

26 people are talking about this

9.55 AM : पीयूष गोयल पहुंचे संसद भवन।

Delhi: Finance Minister Piyush Goyal arrives at the Parliament with the #Budget briefcase. Following the Cabinet meeting, he will present the interim #Budget 2019-20 at 11 am

69 people are talking about this

9.40 AM : बजट पेश करने से पहले गोयल ने की राष्ट्रपति रामनाथ कोविंद से औपचारिक मुलाकात।

Delhi: Finance Minister Piyush Goyal calls on President Ram Nath Kovind at Rashtrapati Bhavan before presenting the Union #Budget2019

54 people are talking about this

9.25 AM : बजट की कॉपियों के बोरों की जांच करते सुरक्षाबल।

Delhi: The printed copies of #Budget 2019-20 being security checked by sniffer dog

26 people are talking about this

9.15 AM : मंत्रालय के गेट पर गोयल।

Delhi: Piyush Goyal will present interim Budget 2019-20 in the Parliament at 11am today

46 people are talking about this

8.45 AM : अंतरिम वित्तमंत्री पीयूष गोयल पहुंचे वित्त मंत्रालय।

Delhi: Piyush Goyal arrives at the Ministry of Finance. He will present interim Budget 2019-20 in the Parliament today. #Budget2019

26 people are talking about this

Source: Bhaskarhindi.com

#बजट LIVE#छोटे किसानों को सरकार का तोहफा#हर साल 6 हजार रुपए मिलेंगे खाते मेंं#पीयूष गोयल पेश कर रहे हैं बजट#केंद्र की मोदी सरकार#अंतरिम बजट पेश#अंतरिम वित्त मंत्री पीयूष गोयल#संसद में बजट भाषण#Last and Interim budget of modi government 2019#live updates budget 2019#lok sabha elections#interim finance minister piyush goyal#present interim budget#declare many schemes budget 2019#farmers and public

1 note

·

View note

Photo

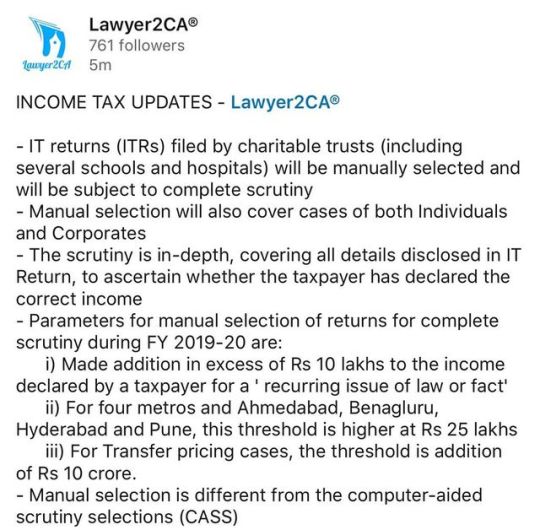

INCOME TAX UPDATES - @lawyer2ca® - IT returns (ITRs) filed by charitable trusts (including several schools and hospitals) will be manually selected and will be subject to complete scrutiny - Manual selection will also cover cases of both Individuals and Corporates - The scrutiny is in-depth, covering all details disclosed in IT Return, to ascertain whether the taxpayer has declared the correct income - Parameters for manual selection of returns for complete scrutiny during FY 2019-20 are: i) Made addition in excess of Rs 10 lakhs to the income declared by a taxpayer for a ' recurring issue of law or fact' ii) For four metros and Ahmedabad, Benagluru, Hyderabad and Pune, this threshold is higher at Rs 25 lakhs iii) For Transfer pricing cases, the threshold is addition of Rs 10 crore. - Manual selection is different from the computer-aided scrutiny selections (CASS) - #startups #entrepreneur #entrepreneurlife #compliance #angeltax #funding #fund #money #finance #business #investor #tax #government #incometax #nirmalasitharaman #unionbudget #budget2019 #lawyer #law #Lawyer2CA #Lawyer2CAVentures #delhi #bombay #bangalore https://www.instagram.com/p/B2EUQwWJQkg/?igshid=1b9dryppbvdq2

#startups#entrepreneur#entrepreneurlife#compliance#angeltax#funding#fund#money#finance#business#investor#tax#government#incometax#nirmalasitharaman#unionbudget#budget2019#lawyer#law#lawyer2ca#lawyer2caventures#delhi#bombay#bangalore

0 notes

Text

Government's Coin For Real Estate Industry

Government in Budget 2019-20 has flipped its coin for real estate growth. Livnest discusses some heads and few tails of the initiatives taken or scheduled in this direction. A must-read for first-timer home buyers.

Budget2019- Real Estate: LivNest’s Viewpoint

The Government has reaffirmed its commitment its thrust on affordable housing continue its initiatives to upgrade all housing for the common man in the Union Budget 2019-20 on July 5, 2019. The Finance Minister, Nirmala Sitharaman, in her maiden budget has touched upon all the sector without disturbing the current economic environment. From an…

View On WordPress

#affordable homes#budget2019#home buyers#housing for all#mumbai residential projects#real estate investment#residential real estate#Thane

0 notes

Photo

After the light budget here count down finished for the Union budget 2019-20 So guess Will income tax slab rate show any changes!!!! https://tax2win.in/union-budget #BudgetForNewIndia #Budget2019 #Tax #Budgetsession #Budget2020 #Financialknowledge #Budgetology #Tax2win #Wintax #Modi2

0 notes

Photo

Prime Minister Imran Khan signing Budgetary Proposals for Financial Year 2019-20 during Special Cabinet Meeting held at Parliament House Islamabad (110619) #PTI #PrimeMinisterImranKhan #Budget2019 Visit more: http://bit.ly/2IcHkKZ

0 notes

Photo

New Post has been published on https://toldnews.com/hindi/know-your-budget-%e0%a4%b8%e0%a4%b0%e0%a4%95%e0%a4%be%e0%a4%b0-%e0%a4%ac%e0%a4%a4%e0%a4%be%e0%a4%8f%e0%a4%97%e0%a5%80-%e0%a4%ac%e0%a4%9c%e0%a4%9f-%e0%a4%95%e0%a5%80-%e0%a4%b9%e0%a4%b0-%e0%a4%ac/

Know Your Budget: सरकार बताएगी बजट की हर बात, शुरू हुई ये पहल - Interim budget 2019 know your budget arun jaitley union budget vote on account tut

देश का अंतरिम बजट पेश होने में अब चंद दिन बचे हैं. लोकसभा चुनाव से ठीक पहले पेश होने वाला यह बजट काफी अहम माना जा रहा है. बजट में लोगों को क्या मिलने वाला है यह तो 1 फरवरी को अरुण जेटली लोकसभा में बताएंगे. लेकिन उससे पहले बजट के बारे में आम लोगों की समझ बढ़ाने के लिए सरकार ने एक खास पहल की है. इसके तहत बजट से जुड़ी हर बात आपको समझ में आएगी. आइए जानते हैं कि क्या है वो खास पहल.

दरअसल, वित्त मंत्रालय की ओर से ‘अपने बजट को जानिये’ सोशल मीडिया पर एक खास सीरीज की पहल की गई है. इस सीरीज में बजट से जुड़े विभिन्न शब्दों के बारे में जानकारी दी गई है. इस सीरीज में केन्द्र सरकार के बजट की अहमियत के बारे में बताया जाएगा. इसके अलावा बजट बनाने की प्रक्रिया की भी पूरी जानकारी दी जायेगी. यह सिलसिला 31 जनवरी तक चलेगा. बता दें कि सरकार एक फरवरी को 2019- 20 का अंतरिम बजट पेश करेगी.

मंगलवार को क्या बताया था

वित्त मंत्रालय के ट्विटर हैंडल पर मंगलवार से शुरू की गई इस सीरीज में पहली जानकारी आम बजट और वोट ऑन अकाउंट यानि लेखानुदान की जानकारी दी गई थी. मंत्रालय ने आम बजट के बारे में बताया है कि बजट केंद्र सरकार के फाइनेंशियल ट्रांजेक्शन की जानकारी देने वाली सबसे विस्तृत रिपोर्ट है. इसमें सरकार को सभी सोर्सेज से प्राप्त होने वाले रेवेन्यू और विभिन्न गतिविधियों के लिए आवंटित खर्चे की जानकारी होती है. बजट में सरकार के अगले फाइनेंशियल ईयर के इनकम और खर्चे के अनुमान भी दिये जाते हैं जिन्हें बजट अनुमान कहा जाता है.

As Union Budget is round the corner, we come across so many terms which leave us puzzled. So via “Know Your Budget” Series, we aim to assist you in enhancing your Budget Vocabulary.

Before diving into details of Budget,let us first understand what a ‘Union Budget’ is? #Budget2019 pic.twitter.com/o0UdDOfuL8

— Ministry of Finance (@FinMinIndia) January 15, 2019

वहीं इस सीरीज में लेखानुदान के बारे में जानकारी देते हुये कहा गया है कि यह संसद की ओर से अगले फाइनेंशियल ईयर के एक हिस्से में किए जाने वाले खर्च की एडवांस अनुमति देता है. इसके अलावा वित्त मंत्रालय के ट्वीटर पर बुधवार को रेवेन्यू और आउटकम बजट के बारे में जानकारी दी गई. बता दें कि अगले कुछ महीने में आम चुनाव होने वाले हैं इसलिये इस बार अंतरिम बजट ही पेश किया जायेगा. चुनाव होने के बाद नई सरकार ही अंतिम बजट पेश करेगी.

पाएं आजतक की ताज़ा खबरें! news लिखकर 52424 पर SMS करें. एयरटेल, वोडाफ़ोन और आइडिया यूज़र्स. शर्तें लागू

आजतक के नए ऐप से अपने फोन पर पाएं रियल टाइम अलर्ट और सभी खबरें. डाउनलोड करें

amazing)

0 notes

Video

youtube

Telangana Budget 2019 - 20 : CM KCR on Welfare Schemes in Assembly | hmtv Telugu NEws #TelanganaBudget2019 #budget2019 #hmtvtelugunews Watch HMTV Live ►https://youtu.be/naAzroMRrJ8 ► Subscribe to YouTube : http://goo.gl/f9lm5E ► Like us on FB : https://ift.tt/29oVqcx ► Follow us on Twitter : https://twitter.com/hmtvlive ► Follow us on Google+ : https://goo.gl/FNBJo5 ► Visit Us : https://ift.tt/2g5LdE3 ► Visit : https://ift.tt/1dLzZsD

0 notes

Photo

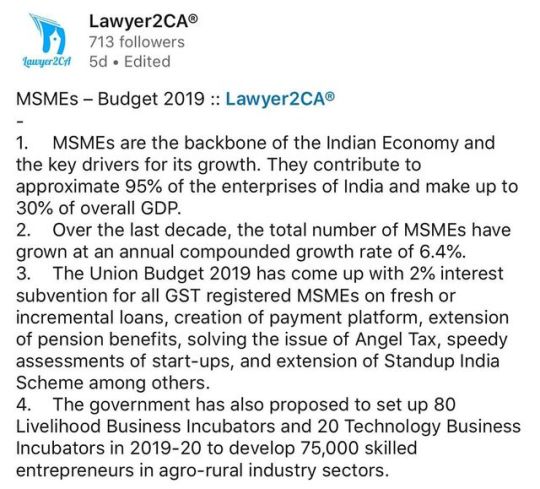

MSMEs – Budget 2019 :: @lawyer2ca® - 1. MSMEs are the backbone of the Indian Economy and the key drivers for its growth. They contribute to approximate 95% of the enterprises of India and make up to 30% of overall GDP. 2. Over the last decade, the total number of MSMEs have grown at an annual compounded growth rate of 6.4%. 3. The Union Budget 2019 has come up with 2% interest subvention for all GST registered MSMEs on fresh or incremental loans, creation of payment platform, extension of pension benefits, solving the issue of Angel Tax, speedy assessments of start-ups, and extension of Standup India Scheme among others. 4. The government has also proposed to set up 80 Livelihood Business Incubators and 20 Technology Business Incubators in 2019-20 to develop 75,000 skilled entrepreneurs in agro-rural industry sectors. - #unionbudget #budget #budget2019 #finance #money #NirmalaSitharaman #government #business #startup #entrepreneur #Lawyer2CA #Lawyer2CAVentures #delhi #bombay #bangalore #india #entrepreneurlife #MSME #rural #development #growth #gdpgrowth #GDP https://www.instagram.com/p/B0VNq-dlR8L/?igshid=1pzer3fcw3b68

#unionbudget#budget#budget2019#finance#money#nirmalasitharaman#government#business#startup#entrepreneur#lawyer2ca#lawyer2caventures#delhi#bombay#bangalore#india#entrepreneurlife#msme#rural#development#growth#gdpgrowth#gdp

0 notes

Link

#NirmalaSitharaman द्वारा पेश #Budget2019 का आकलन न केवल भ्रामक है, बल्कि गुमराह करने वाला भी है। लेकिन #ModiGovt की यह तिकड़म ज्यादा नहीं ठहरने वाली, क्योंकि 6-7 महीने बाद फरवरी में फिर नया #Budget आ जाएगा। तब बजट की वास्तविकता का भान सबको हो जाएगा। https://t.co/wQaVQztSot

— 24x7politics (@24x7Politics) July 20, 2019

0 notes

Video

Measures by #FBR in Budget 2019-20 to generate additional revenue of Rs733.47 billion #Taxnews #shabbarzaidi #IncomeTax #FED #SalesTax #Federalboardofrevenue #tax #budget2019 #ImranKhan #KLAPakistan (at Karachi, Pakistan) https://www.instagram.com/p/Bz_ZTbrHnJf/?igshid=1254gv2jxgugj

#fbr#taxnews#shabbarzaidi#incometax#fed#salestax#federalboardofrevenue#tax#budget2019#imrankhan#klapakistan

0 notes

Text

RBI governor Shaktikanta Das says central financial institution to debate issuance of sovereign bonds with govt

http://tinyurl.com/yxtcplzg

The Reserve Financial institution Governor Shaktikanta Das on Monday stated the central financial institution will talk about the issuance of abroad sovereign bonds with the federal government. RBI Guv on centre to lift a part of market borrowing in exterior market:Govt has made a finances announcement&we’ll work together with them. As debt supervisor of govt of India I am certain govt may have inside dialogue with RBI&no matter we have to talk about with govt can be accomplished internally pic.twitter.com/hv8S5DwgL7 — ANI (@ANI) July 8, 2019 In her maiden finances, Finance Minister Nirmala Sitharaman proposed to lift part of the federal government’s gross borrowings from overseas. The transfer, designed to unlock further liquidity within the home market, is predicted to strengthen the Indian rupee, consequently hurting the nation’s exports. Sithraman met with the RBI’s central board on Monday to spotlight the important thing factors of the Finances, together with the fiscal consolidation roadmap. After the customary post-Finances assembly with Finance Minister Nirmala Sitharaman, Governor Das stated the system has enough liquidity and the Finances for 2019-20 has made provision for shadow banking (NBFC) sector. “We’re monitoring NBFCs and their operations at common intervals,” he advised reporters in New Delhi. #WATCH reside from Delhi: Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das handle the media. https://t.co/q0wnxe4KG1 — ANI (@ANI) July 8, 2019 Das stated the Finances provision of Rs 70,000 crore in the direction of financial institution capitalisation is a really constructive improvement that may assist lenders not simply adjust to the regulatory requirement but additionally step up banking. File picture of Shaktikanta Das. PIB On rate of interest transmission, he stated it used to take as much as six months for an rate of interest reduce to be transmitted to customers however issues have improved, and now it’s taking a shorter time, he stated. Of the 50 foundation factors reduce in rate of interest introduced by the RBI previous to the June financial coverage, about 21 foundation factors had been transmitted, he stated, hoping higher transmission of rate of interest cuts in coming weeks and months. Within the Finances announcement, Sitharaman had promised to maintain the fiscal deficit at 3.Three % of GDP, decrease than the three.Four % projected within the interim Finances introduced by Piyush Goyal. She has additionally promised that the fiscal deficit will come down to three % in 2020-21 and can stay at that degree in 2021-22 as effectively. When requested about it, Reserve Financial institution of India governor Shaktikanta Das stated, if the fiscal deficit is maintained and improved to three.Three % of the GDP, it limits the crowding out impact, he stated. Gasoline worth hike On Saturday, petrol costs had been hiked by Rs 2.40 per litre and diesel by Rs 2.36 on Saturday after Sitharaman raised taxes on fuels to part-fund her Finances for 2019. Sitharaman had on Friday raised excise responsibility and street and infrastructure cess on petrol and diesel by Rs 2 per litre every to lift Rs 24,000-28,000 crore on an annual foundation. Publish-considering native gross sales tax or value-added tax (VAT), which is charged after including central excise responsibility on base worth, the rise in pump charges was greater. Earlier than the tax improve, petrol attracted whole excise responsibility of Rs 17.98 per litre (Rs 2.98 primary excise responsibility, Rs 7 particular further excise responsibility and Rs eight street and infrastructure cess). Now, this tax has gone as much as Rs 19.98 a litre. On diesel, a complete of Rs 13.83 per litre excise responsibility was charged (Rs 4.83 primary excise responsibility, Rs 1 particular further excise responsibility and Rs eight street and infrastructure cess). Now, Rs 15.83 per litre is charged as excise responsibility. RBI Governor Shaktikanta Das to ANI on impression of costs of petrol and diesel on inflation: There’s a assembly of Financial Coverage Committee in 1st week of August. Our inside staff will assess it. It isn’t as if it can get mirrored in inflation the subsequent day. There’s a time lag. pic.twitter.com/5MkF7n1vqt — ANI (@ANI) July 8, 2019 Refraining from answering the Finances 2019 proposal to lift the surcharge for the super-rich, Finance Minister Nirmala Sitharaman after a post-Finances assembly with the Reserve financial institution of India board, advised the media that she would favor to reply in Parliament. CNBC-TV18 requested Finance Minister #NirmalaSitharaman in regards to the #tax surcharge introduced in #Budget2019; here is her reply.@ShereenBhan #CNBCTV18 pic.twitter.com/7kHxHB15Oh — CNBC-TV18 (@CNBCTV18Stay) July 8, 2019 Surcharge on super-rich In her maiden Finances for 2019-20 introduced final week, Sitharaman proposed to extend surcharge from 15 % to 25 % on taxable earnings between Rs 2-5 crore and from 15 % to 37 % for earnings above Rs 5 crore. Following the rise in surcharge, the efficient earnings tax fee for people with taxable earnings of Rs 2-5 crore will go up from 35.88 % to 39 % and for these above Rs 5 crore it could go as much as 42.7 %. –With PTI inputs Your information to the most recent cricket World Cup tales, evaluation, experiences, opinions, reside updates and scores on https://www.firstpost.com/firstcricket/series/icc-cricket-world-cup-2019.html. Observe us on Twitter and Instagram or like our Facebook web page for updates all through the continued occasion in England and Wales. !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function() {n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)} ; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '259288058299626'); fbq('track', 'PageView'); (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_GB/all.js#xfbml=1&version=v2.9&appId=1117108234997285"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); window.fbAsyncInit = function () { FB.init({appId: '1117108234997285', version: 2.4, xfbml: true}); // *** here is my code *** if (typeof facebookInit == 'function') { facebookInit(); } }; (function () { var e = document.createElement('script'); e.src = document.location.protocol + '//connect.facebook.net/en_US/all.js'; e.async = true; document.getElementById('fb-root').appendChild(e); }()); function facebookInit() { console.log('Found FB: Loading comments.'); FB.XFBML.parse(); } Source link

0 notes