#budgetingtools

Text

Choosing the right budgeting tool can boost your financial management. YNAB and Mint each offer unique features to help you manage your money. Here’s a quick comparison to find the best fit for you.

For more info and details visit: Free Skills Hub

#YNABvsMint#BudgetingTools#PersonalFinance#MoneyManagement#YNAB#MintApp#FinancialPlanning#BudgetSmart#MoneyTips#FinanceTools#BudgetBetter#FinanceComparison#Budgeting101#MoneyMatters#YNABReview#MintReview#SmartBudgeting#ManageYourMoney#FinancialFreedom#BudgetingTips#MoneySavvy#FinancialTools#BudgetingJourney#FinanceAdvice#BudgetingHelp#FinanceGoals#MoneyManagementTips

1 note

·

View note

Text

Unlock Financial Freedom: How a Budgeting App Can Transform Your Finances

In an era where every dollar counts, taking control of your finances is essential. Whether you're saving for a dream vacation, building an emergency fund, or simply trying to stay on top of your monthly bills, a powerful budgeting appcan be your best ally. Let’s explore how a budget planner and expense tracker can help you achieve financial freedom.

Why You Need a Budgeting App

Gone are the days of juggling spreadsheets and receipts. With a budgeting app, you can manage your money seamlessly, right from your smartphone. These apps are designed to simplify money management, giving you a clear picture of where your money is going and helping you make informed decisions.

A good budget manager allows you to set spending limits, track expenses in real-time, and even create savings goals. Whether you're a seasoned financial guru or just starting on your financial journey, a budget tool is essential for effective expense management.

The Power of an Expense Tracker

One of the most valuable features of a budgeting app is the expense tracker. It’s easy to lose track of small purchases, but these can add up over time. An expense manager categorizes your spending, showing you exactly where your money is going. This insight helps you identify areas where you can cut back and save more.

By using an expense tracker regularly, you’ll start to see patterns in your spending habits. This data is invaluable for creating a realistic budget that you can stick to. With an effective budget organizer and expense log, you’ll be well on your way to mastering your finances.

Achieve Your Savings Goals with a Savings App

Saving money is often easier said than done, but with the right tools, it’s entirely achievable. A dedicated savings app can automate the process, helping you build your savings without even thinking about it. Whether you're rounding up your spare change or setting aside a fixed amount each month, a money saver app makes it simple.

In addition to helping you save, these apps often include features like bill trackers and financial planning tools, ensuring you never miss a payment and stay on track with your financial goals.

How to Choose the Best Budgeting App

With so many apps on the market, finding the right one can feel overwhelming. Here’s what to look for:

User-Friendly Interface: Choose an app with an intuitive design that makes budget management and cash flow management easy.

Comprehensive Features: The best apps combine budgeting tools, expense tracking, and financial trackers in one platform.

Customization: Look for an app that allows you to tailor your budget, categories, and savings goals to fit your unique financial situation.

Security: Ensure the app uses strong encryption and has robust security measures to protect your financial data.

Final Thoughts

Taking control of your finances doesn’t have to be complicated. With the right budgeting app, you can transform the way you manage your money, achieve your savings goals, and ultimately, unlock the door to financial freedom. Start by choosing a reliable budget manager and money tracker that fits your needs, and watch your financial health improve.

Ready to take the first step? Download a free budgeting app today and start your journey toward financial wellness!

PlayStore - https://play.google.com/store/apps/details?id=com.vala_app&hl=en_US

AppStore - https://apps.apple.com/us/app/vala-simplify-your-savings/id6479288394

#BudgetingApp#MoneyManagement#FinancialFreedom#ExpenseTracker#SavingsApp#PersonalFinance#BudgetPlanner#FinancialPlanning#MoneySaver#BudgetManager#BudgetingTools#ExpenseManagement#CashFlowManagement#FinancialGoals#MoneyTracker#SmartSavings#BudgetOrganizer#FrugalLiving#SaveMoney#FinancialWellness#ExpenseManager#BudgetApp#BudgetPlanning#BudgetTool#MoneySaverApp.

0 notes

Text

Exploring Free Cost Estimating Software: Benefits and Drawbacks

Curious about free cost estimating software? Discover the advantages and limitations of these tools to make an informed decision for your business. We dive into the pros and cons to help you choose the right software.

0 notes

Text

Organize in Style with Custom Budget Binders from Ring Binder Depot

Discover the perfect blend of functionality and aesthetics with our custom budget binders. Ring Binder Depot offers a diverse range of personalized binders to keep your finances in order while adding a touch of uniqueness. Elevate your organization game with our high-quality, customizable budget binders.

#RingBinderDepot#BudgetBinders#OrganizeInStyle#CustomBinders#FinancialOrganization#UniqueBinders#PersonalizedBudgeting#OfficeOrganization#CustomizedBinders#ElevateYourOrganization#FunctionalStyle#HighQualityBinders#AestheticOrganization#BudgetingTools#UniqueDesigns#FinanceManagement#OfficeAccessories#CustomOfficeSupplies#StylishOrganization

0 notes

Text

5 Best Free Budgeting Apps for Your Everyday Financial Management

1 note

·

View note

Text

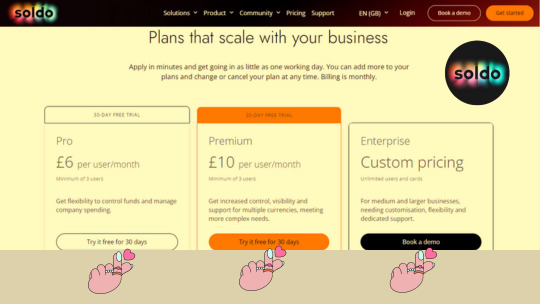

Pricing: Pick The Ideal Soldo Plan For Your Business

Soldo offers a range of pricing plans designed to cater to the diverse needs of businesses, from startups to established enterprises. With their flexible pricing options, you can choose the plan that aligns perfectly with your business's size and requirements. Soldo's pricing is tailored to offer you the right balance of features, prepaid company cards, and automation tools to streamline your expense management processes.

Basic Plan: Ideal for small businesses or startups, Soldo's Basic Plan provides a solid foundation for efficient expense management. This plan includes a set number of prepaid company cards to empower your employees with convenient spending, along with essential expense tracking and reporting features. It's a cost-effective option for businesses looking to get started with organized expense management.

Advanced Plan: For growing businesses with increased expense management needs, Soldo's Advanced Plan offers enhanced features and scalability. You'll benefit from a higher number of prepaid company cards, enabling more of your team to manage expenses seamlessly. Additionally, this plan may include advanced reporting options, integrations with popular accounting software, and greater automation capabilities, saving your finance team valuable time.

Enterprise Plan: Designed for larger corporations with complex expense workflows, the Enterprise Plan provides a comprehensive suite of tools to optimize expense management. With a generous allotment of prepaid company cards, this plan supports businesses with numerous departments and teams. Expect advanced reporting and analytics, custom integrations, and dedicated support to cater to your business's unique requirements.

Custom Plan: Soldo understands that every business has unique needs. If your business demands a tailored solution, Soldo's Custom Plan offers the flexibility to create a package that addresses your specific challenges. This plan could include a combination of features from other plans, as well as specialized support to ensure that your expense management is as efficient as possible.

Free Plan:

Soldo's Free Plan offers an entry-level option for businesses seeking basic expense management without the commitment of a subscription fee. While specific features may vary, this plan typically provides a limited number of prepaid company cards for your team. It's an excellent choice for startups and small businesses aiming to organize their spending without incurring additional costs.

Key Features:

Limited number of prepaid company cards.

Basic expense tracking and categorization.

Basic reporting features.

Essential tools for managing employee spending.

Limitations:

Limited scalability for larger businesses.

Basic automation features.

Reduced access to advanced reporting and integrations.

#SoldoFreePlan#ExpenseManagement#BusinessSpending#SmallBusinessSolutions#BudgetingTools#StartupFinance#CostControl#FreeExpenseTracking#FinancialManagement#BusinessCardSolutions

0 notes

Photo

(via Master Your Finances: Discover the 7 Best Free Budgeting Apps for Effective Money Management)

0 notes

Text

"Unlocking Financial Independence with Prepaid Cards"

Prepaid cards offer a versatile and secure financial solution, providing users with the convenience of a debit card without the need for a traditional bank account. These cards are preloaded with a specific amount of money, making them ideal for budgeting, travel, and gifting. They also serve as an excellent tool for managing expenses, as they help users avoid overspending and incur no debt. Additionally, prepaid cards are widely accepted at numerous merchants and online platforms, offering both flexibility and control over personal finances.

https://www.globalinsightservices.com/request-sample/GIS25099@/?utm_source=SnehaPatil-Article

Their accessibility and ease of use make them a popular choice for individuals seeking financial independence and security.#PrepaidCards #FinancialIndependence #BudgetingTools #SecureSpending #TravelFinance #GiftCards #MoneyManagement #DebitAlternatives #SpendingControl #NoDebt #FinancialSecurity #CashlessPayments #EasyBudgeting #FlexibleSpending #CardBenefits

0 notes

Text

Choosing the right budgeting tool can boost your financial management. YNAB and Mint each offer unique features to help you manage your money. Here’s a quick comparison to find the best fit for you.

For more info and details visit: Free Skills Hub

#YNABvsMint#BudgetingTools#PersonalFinance#MoneyManagement#YNAB#MintApp#FinancialPlanning#BudgetSmart#MoneyTips#FinanceTools#BudgetBetter#FinanceComparison#Budgeting101#MoneyMatters#YNABReview#MintReview#SmartBudgeting#ManageYourMoney#FinancialFreedom#BudgetingTips#MoneySavvy#FinancialTools#BudgetingJourney#FinanceAdvice#BudgetingHelp#FinanceGoals#MoneyManagementTips

1 note

·

View note

Text

Unlock Financial Freedom: How a Budgeting App Can Transform Your Finances

In an era where every dollar counts, taking control of your finances is essential. Whether you're saving for a dream vacation, building an emergency fund, or simply trying to stay on top of your monthly bills, a powerful budgeting appcan be your best ally. Let’s explore how a budget planner and expense tracker can help you achieve financial freedom.

Why You Need a Budgeting App

Gone are the days of juggling spreadsheets and receipts. With a budgeting app, you can manage your money seamlessly, right from your smartphone. These apps are designed to simplify money management, giving you a clear picture of where your money is going and helping you make informed decisions.

A good budget manager allows you to set spending limits, track expenses in real-time, and even create savings goals. Whether you're a seasoned financial guru or just starting on your financial journey, a budget tool is essential for effective expense management.

The Power of an Expense Tracker

One of the most valuable features of a budgeting app is the expense tracker. It’s easy to lose track of small purchases, but these can add up over time. An expense manager categorizes your spending, showing you exactly where your money is going. This insight helps you identify areas where you can cut back and save more.

By using an expense tracker regularly, you’ll start to see patterns in your spending habits. This data is invaluable for creating a realistic budget that you can stick to. With an effective budget organizer and expense log, you’ll be well on your way to mastering your finances.

Achieve Your Savings Goals with a Savings App

Saving money is often easier said than done, but with the right tools, it’s entirely achievable. A dedicated savings app can automate the process, helping you build your savings without even thinking about it. Whether you're rounding up your spare change or setting aside a fixed amount each month, a money saver app makes it simple.

In addition to helping you save, these apps often include features like bill trackers and financial planning tools, ensuring you never miss a payment and stay on track with your financial goals.

How to Choose the Best Budgeting App

With so many apps on the market, finding the right one can feel overwhelming. Here’s what to look for:

User-Friendly Interface: Choose an app with an intuitive design that makes budget management and cash flow management easy.

Comprehensive Features: The best apps combine budgeting tools, expense tracking, and financial trackers in one platform.

Customization: Look for an app that allows you to tailor your budget, categories, and savings goals to fit your unique financial situation.

Security: Ensure the app uses strong encryption and has robust security measures to protect your financial data.

Final Thoughts

Taking control of your finances doesn’t have to be complicated. With the right budgeting app, you can transform the way you manage your money, achieve your savings goals, and ultimately, unlock the door to financial freedom. Start by choosing a reliable budget manager and money tracker that fits your needs, and watch your financial health improve.

Ready to take the first step? Download a free budgeting app today and start your journey toward financial wellness!

#BudgetingApp#MoneyManagement#FinancialFreedom#ExpenseTracker#SavingsApp#PersonalFinance#BudgetPlanner#FinancialPlanning#MoneySaver#BudgetManager#BudgetingTools#ExpenseManagement#CashFlowManagement#FinancialGoals#MoneyTracker#SmartSavings#BudgetOrganizer#FrugalLiving#SaveMoney#FinancialWellness#ExpenseManager#BudgetApp#BudgetPlanning#BudgetTool#MoneySaverApp.

1 note

·

View note

Text

Items I never thought i'd have to budget for

I never thought i'd have to budget for meat. I never through i'd have to have a seperate column for dog grooming. Yet here we are! What have you had to budget for that you never thought you would? #BudgetingForBeginners #BudgetingTools #BudgetingTipsAndTricks

I’m an avid budgeter. I enjoy it, it makes me feel in control and secure about our financial situation. I like looking at numbers on a spreadsheet and knowing what I can spend and where.

During this process I have learnt alot about what I need to include and what I can just leave in the “miscellaneous” pile. Below is a few of the things I never thought I would need to include in our budget…

View On WordPress

0 notes

Link

Check out this listing I just added to my Poshmark closet: Budget Binder With Zipper Envelopes - Money Organizer, Cash Envelopes Budgeting.

0 notes

Photo

Jadwal Training Effective Budgeting and Cost Control 2020. Tersedia Online dan Offline Training untuk Public Training dan In House Training. Kami siap membantu Anda dalam menyediakan pelatihan untuk public training ataupun inhouse training. Pada Saat ini pelatihan bisa dilakukan dengan tatap muka dan seminar online.

Untuk info lengkap hubungi :

WA 0851-0197-2488

Jadwal training 2020

infoseminar.com

#jadwalpelatihan2020 #jadwalseminar2020 #jadwaltraining2020 #infopelatihan #informasipelatihan #informasiseminar #informasitraining #infoseminar #infotraining #inhousetraining #learningcenter #pelatihan #publictraining #seminar #training #trainingcenter #onlinetraining #webinar #budgetingtools #costcontrol #budgetingtraining #budgetcycle #projectbudgeting #strategicplanning #operatingbudgeting (di Menara Imperium) https://www.instagram.com/p/CC2HqJzJzuK/?igshid=11esdgtdozlvc

#jadwalpelatihan2020#jadwalseminar2020#jadwaltraining2020#infopelatihan#informasipelatihan#informasiseminar#informasitraining#infoseminar#infotraining#inhousetraining#learningcenter#pelatihan#publictraining#seminar#training#trainingcenter#onlinetraining#webinar#budgetingtools#costcontrol#budgetingtraining#budgetcycle#projectbudgeting#strategicplanning#operatingbudgeting

0 notes

Photo

This year I'm focusing on using the things I have instead of buy more stuff. One things I started with was switching up my planners. I moved my budgeting planner from the #bighappyplanner to the #minihappyplanner It has all the same tools just in a smaller format. Takes up way less space on my over crowded desk. #authorsofinstagram #authorlife #writerslife #writerscommunity #plannerlover #yearofusingwhatihave #writerstools #budgetingtools (at Warren, Massachusetts) https://www.instagram.com/p/B64d64Dghtu/?igshid=1kf4yihhtf8p2

#bighappyplanner#minihappyplanner#authorsofinstagram#authorlife#writerslife#writerscommunity#plannerlover#yearofusingwhatihave#writerstools#budgetingtools

0 notes

Photo

Tuesday Funny 😆 #CreditRepair #DebtElimination #Budgetingtools #crediteducation (at Chicago, Illinois) https://www.instagram.com/p/BuWrBuOgYJ-/?utm_source=ig_tumblr_share&igshid=dfp9u75rr0vn

0 notes

Photo

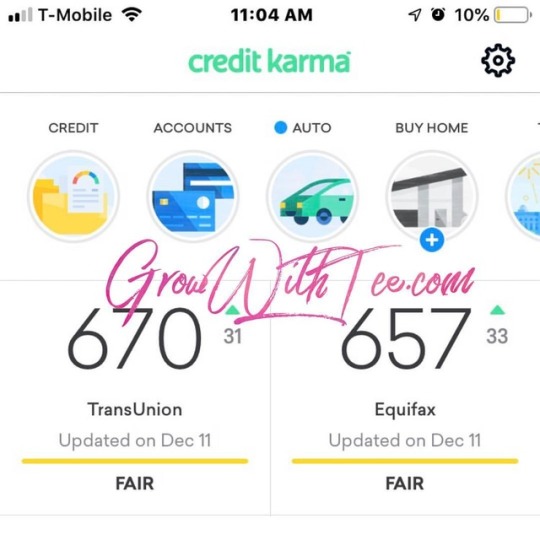

I cannot make this up!!! My credit score is steadily on the rise thanks to my credit repair program! You've been sitting there watching but that won't help you. It's time for you to get on the road with me to EXCELLENT credit! To be 100% HONEST-This is the HIGHEST my credit score has been!! If you're ready to start your journey for $29 a month, drop a comment below and I got you!!! #NovaeMoney #GrowWithTee #IOU #CreditRepair #FinancialEducation #BudgetingTools #WeGotYou #credit #money #novaemoney https://www.instagram.com/p/BrqvemWAQZF/?utm_source=ig_tumblr_share&igshid=14ukcrya1gfl2

0 notes