#ExpenseManager

Explore tagged Tumblr posts

Text

Unlock Financial Freedom: How a Budgeting App Can Transform Your Finances

In an era where every dollar counts, taking control of your finances is essential. Whether you're saving for a dream vacation, building an emergency fund, or simply trying to stay on top of your monthly bills, a powerful budgeting appcan be your best ally. Let’s explore how a budget planner and expense tracker can help you achieve financial freedom.

Why You Need a Budgeting App

Gone are the days of juggling spreadsheets and receipts. With a budgeting app, you can manage your money seamlessly, right from your smartphone. These apps are designed to simplify money management, giving you a clear picture of where your money is going and helping you make informed decisions.

A good budget manager allows you to set spending limits, track expenses in real-time, and even create savings goals. Whether you're a seasoned financial guru or just starting on your financial journey, a budget tool is essential for effective expense management.

The Power of an Expense Tracker

One of the most valuable features of a budgeting app is the expense tracker. It’s easy to lose track of small purchases, but these can add up over time. An expense manager categorizes your spending, showing you exactly where your money is going. This insight helps you identify areas where you can cut back and save more.

By using an expense tracker regularly, you’ll start to see patterns in your spending habits. This data is invaluable for creating a realistic budget that you can stick to. With an effective budget organizer and expense log, you’ll be well on your way to mastering your finances.

Achieve Your Savings Goals with a Savings App

Saving money is often easier said than done, but with the right tools, it’s entirely achievable. A dedicated savings app can automate the process, helping you build your savings without even thinking about it. Whether you're rounding up your spare change or setting aside a fixed amount each month, a money saver app makes it simple.

In addition to helping you save, these apps often include features like bill trackers and financial planning tools, ensuring you never miss a payment and stay on track with your financial goals.

How to Choose the Best Budgeting App

With so many apps on the market, finding the right one can feel overwhelming. Here’s what to look for:

User-Friendly Interface: Choose an app with an intuitive design that makes budget management and cash flow management easy.

Comprehensive Features: The best apps combine budgeting tools, expense tracking, and financial trackers in one platform.

Customization: Look for an app that allows you to tailor your budget, categories, and savings goals to fit your unique financial situation.

Security: Ensure the app uses strong encryption and has robust security measures to protect your financial data.

Final Thoughts

Taking control of your finances doesn’t have to be complicated. With the right budgeting app, you can transform the way you manage your money, achieve your savings goals, and ultimately, unlock the door to financial freedom. Start by choosing a reliable budget manager and money tracker that fits your needs, and watch your financial health improve.

Ready to take the first step? Download a free budgeting app today and start your journey toward financial wellness! PlayStore - https://play.google.com/store/apps/details?id=com.vala_app&hl=en_US AppStore - https://apps.apple.com/us/app/vala-simplify-your-savings/id6479288394

#BudgetingApp#MoneyManagement#FinancialFreedom#ExpenseTracker#SavingsApp#PersonalFinance#BudgetPlanner#FinancialPlanning#MoneySaver#BudgetManager#BudgetingTools#ExpenseManagement#CashFlowManagement#FinancialGoals#MoneyTracker#SmartSavings#BudgetOrganizer#FrugalLiving#SaveMoney#FinancialWellness#ExpenseManager#BudgetApp#BudgetPlanning#BudgetTool#MoneySaverApp.

0 notes

Text

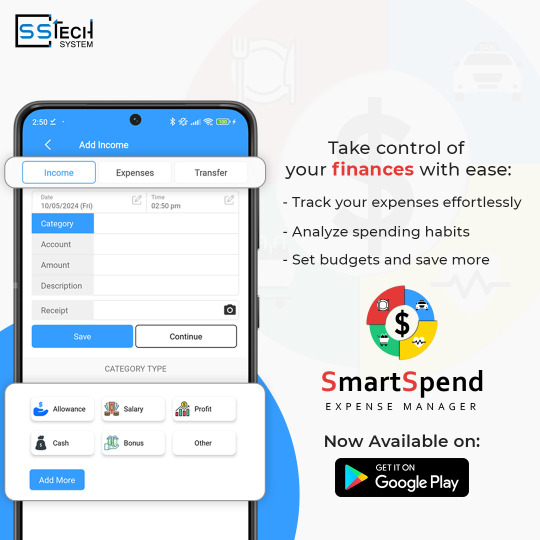

SmartSpend - Expense Manager - SSTech System

Say hello to SmartSpend: Expense Manager App, now available on the Play Store! 📱✨

Download today and start your journey to smarter spending! 💰💪

Download Now: SmartSpend - Expense Manager

#SmartSpend#ExpenseManager#FinancialFreedom#Budgeting#Savings#NowAvailable#PlayStore#MoneyManagement#sstechsystem#expensetracker#monthlyexpense#weeklyexpense#dailyexpense#playstore#downloadnow#freeapp

1 note

·

View note

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

Forecasting Telecom Needs: Using Predictive Analytics to Plan for Future Network Demands

In an age where digital transformation is accelerating across every industry, telecom isn't just a utility, but a strategic asset. Organizations depend on robust, scalable networks to support cloud adoption, hybrid workforces, real-time collaboration, and increasingly data-intensive applications. However, telecom environments are complex and ever-changing, which makes predicting future needs difficult. Overprovisioning leads to unnecessary costs, while underprovisioning can cause performance bottlenecks and frustrated users.

That's where predictive analytics comes in.

Organizations can anticipate telecom needs before they arise by leveraging AI-powered analytics to model usage patterns, vendor pricing trends, and operational workflows. Predictive tools offer a way to future-proof telecom strategies, aligning capacity planning with long-term business goals and avoiding reactive decisions that cost time and money.

This article explores how predictive analytics transforms telecom planning and how an experienced telecom lifecycle management partner can help forecast, budget, and scale telecom infrastructure with confidence.

The Challenge of Planning in a Dynamic Telecom Landscape

Telecom environments are notoriously difficult to manage. Services are layered across voice, data, cloud PBX, mobile, and unified communications platforms. They're billed by various vendors, governed by separate contracts, and used differently by departments, regions, or remote teams.

Business needs evolve constantly—new applications get deployed, teams grow or shift, office footprints change, and customer demands increase. Without proactive forecasting, telecom provisioning becomes reactive: add more bandwidth here, order more licenses there, patch things together on the fly. The result is often bloated costs, underutilized assets, and poor visibility into how infrastructure aligns with growth strategy.

Forecasting future telecom needs requires more than guesswork or historical averages. It requires lots of data and the ability to analyze and interpret that data in real time.

Enter Predictive Analytics: Turning Data Into Insight

Predictive analytics uses AI and machine learning to uncover patterns in historical data and forecast what will likely happen next. In telecom environments, this can include:

Tracking bandwidth usage across different times, teams, and services

Monitoring call volumes, conferencing patterns, or mobile data consumption

Modeling the effects of cloud migration or software rollouts on network traffic

Analyzing vendor pricing trends and renewal behaviors

By feeding this data into predictive models, IT leaders can simulate different scenarios, anticipate bottlenecks, and build telecom plans that align with business projections.

For example:

If video conferencing usage increases 12% quarter over quarter, predictive tools can calculate when bandwidth thresholds will be breached and suggest proactive upgrades before performance dips.

If a business deploys a new CRM platform across multiple offices, analytics can model how it will impact data traffic, license usage, or service provisioning requirements.

If vendor pricing trends indicate a rate hike next year, predictive models can forecast cost impacts and help teams renegotiate before contracts renew.

This kind of forward-looking analysis is the foundation of intelligent telecom management—and it's a significant step up from traditional, reactive cost control.

How Predictive Analytics Improves Telecom Capacity Planning

Capacity planning is one of the most practical and impactful applications of predictive analytics in telecom. It ensures that voice and data services are scaled appropriately to meet future demand without wasting resources.

Predictive analytics enables organizations to:

Anticipate peak usage periods and adjust bandwidth or service tiers in advance

Plan infrastructure upgrades based on actual usage growth, not estimates

Balance workloads across cloud and on-prem systems more effectively

Model hybrid work scenarios to right-size remote connectivity and mobile plans

Avoid emergency provisioning that often leads to higher costs or vendor lock-in

A telecom inventory management advisor helps clients use predictive insights to stay ahead of telecom needs. Their analytics platform aggregates usage data, vendor performance, and contract details into a single dashboard, allowing IT teams to build scalable plans based on real trends, not assumptions.

Aligning Telecom Planning with Long-Term IT Strategy

Predictive analytics also supports strategic alignment between telecom investments and broader IT goals. Whether your organization is expanding internationally, consolidating data centers, adopting new collaboration platforms, or restructuring your workforce, telecom decisions must match that direction.

With accurate forecasting, IT leaders can:

Budget more precisely for multi-year infrastructure initiatives

Identify where to consolidate vendors or renegotiate services based on projected usage

Develop roadmaps that align telecom lifecycle management with broader digital transformation timelines

For example, a company planning to adopt SD-WAN in the next 18 months can use predictive models to assess current site bandwidth usage and determine which locations require infrastructure changes, vendor shifts, or contract terminations. This proactive approach helps CIOs and procurement leaders move confidently, avoiding last-minute surprises and missed opportunities.

Avoiding the Pitfalls of Overprovisioning and Underspending

One of the most common telecom planning missteps is overprovisioning, like purchasing more bandwidth, devices, or services than needed "just in case." While it may seem safe, overprovisioning results in idle assets, excess fees, and lost budget.

Conversely, some businesses delay necessary upgrades to control costs, only to suffer outages, service disruptions, or user dissatisfaction when infrastructure can't keep up. Predictive analytics eliminates this guesswork. By modeling expected usage based on trends, forecasts help determine:

When capacity upgrades are needed

Which services should be downsized without impacting performance

Where to reallocate resources for better ROI

The Role of Vendor Pricing Trends in Forecasting

Accurate forecasting isn't just about usage—it's also about cost. Telecom pricing is volatile. Carriers regularly adjust rates, introduce new service tiers, or restructure discount programs. Without visibility into these shifts, long-term planning becomes difficult.

Predictive analytics platforms track vendor pricing trends across geographies, industries, and service categories, enabling organizations to:

Forecast future costs for existing services

Identify when to renegotiate contracts before price hikes occur

Compare projected spend across multiple vendors

Time migrations or service transitions for optimal financial impact

The Bottom-Line Impact of Predictive Telecom Planning

Beyond operational benefits, the financial implications of predictive planning are substantial, allowing CIOs and IT leaders to redirect the savings to drive innovation. Organizations that use forecasting tools effectively can:

Reduce unplanned telecom spending

Avoid penalties or rush fees tied to emergency upgrades

Minimize underused licenses and circuits

Improve contract leverage through better timing and usage insight

Free up budget for strategic investments in automation, security, and customer experience

Anticipate, Align, and Adapt with Predictive Telecom Strategy

Future-ready organizations don't just react—they anticipate. Predictive analytics gives CIOs the insight they need to align telecom infrastructure with long-term IT strategy, ensuring that every decision supports growth, agility, and cost efficiency.

But turning insight into impact requires the right tools and a strategic partner who can guide the way. zLinq helps businesses harness the power of predictive telecom planning through AI-driven analytics, vendor intelligence, and end-to-end lifecycle support. By turning data into foresight, zLinq enables clients to scale with confidence, avoid waste, and build networks that are as strategic as they are stable.

In a world where the pace of change is relentless, the most innovative way to manage telecom is to plan for it. Let zLinq assist with that plan.

0 notes

Text

Build an app that makes me feel like i’m already on vacation

Your Travel Software Should Do More Than Just Book Tickets It should run like a business tool — not just a booking tool.

❓Tired of juggling receipts, chaotic approvals, and post-trip confusion? ❓Struggling with visibility over your team’s travel expenses?

You don’t need another generic travel app. You need Travel Management Software that actually understands how businesses move.

In this blog, we break down: ✅ What true travel management software should do ✅ Why most tools fail growing teams ✅ The key features that reduce cost, chaos, and confusion ✅ How to future-proof your corporate travel process

💼 Whether you're managing 5 trips a month or 500, this post is for founders, ops leaders, and admin teams looking to bring control and clarity to corporate travel.

#TravelTech#BusinessTravel#TravelManagement#CorporateTravel#SaaS#ExpenseManagement#StartupOps#ProductivityTools

0 notes

Text

Corporate Cards Are Getting Smarter—Here’s How:

There was a time when corporate credit cards were basically just plastic rectangles you handed out and hoped for the best. Swipe, spend, chase receipts later. Sound familiar?

But the game has changed.

At Zeus Commercial Capital, we’re seeing more and more companies ditch the old-school approach and embrace what we call “smart” corporate cards. And no, it’s not just a buzzword.

Here’s what makes them smarter:

Real-time spending visibility. You see what’s happening as it happens. No surprises.

Custom limits and rules. Want your marketing team to only spend on ads? You can set that up.

Seamless integration with your accounting software. Say goodbye to chasing receipts and manual data entry.

Individual cards for team members with tailored permissions. It’s flexibility and control.

The result? Less time spent managing expenses. More time focusing on what actually matters—growing your business.

At the end of the day, a corporate credit card should do more than pay for things. It should work with you, not against you.

If you’re still using outdated systems and juggling spreadsheets, maybe it’s time for a smarter way. Let’s talk.

— Zeus Commercial Capital

1 note

·

View note

Text

Track Every Penny Effortlessly

Say goodbye to messy spreadsheets. With Zoho Books, every business expense is recorded, categorized, and easy to access when you need it. Managing your company's spending has never been this simple. Why It Works: ✅Auto-capture receipts from emails ✅Set budgets and track overspending ✅Categorize expenses with ease ✅Integrates with Zoho Expense for even more control Simplify your spending. Partner with SNS System today. Learn more: https://lnkd.in/dBr7txqG https://snssystem.com Contact us: +1 214-494-0908 Mail: [email protected]

#ExpenseTracking#ZohoBooks#SNSSystem#BusinessBudgeting#FinancialControl#ExpenseReports#TrackEveryPenny#SimplifySpending#SmartBookkeeping#AutomatedExpenses#SmallBusinessFinance#NoMoreSpreadsheets#BudgetControl#ReceiptCapture#ExpenseManagement#ZohoIntegration#SpendSmart#BusinessAccounting#BookkeepingMadeEasy#ManageExpensesEffortlessly

0 notes

Text

Drowning in HR Work? Here’s How Modern Teams Are Saving Hours Every Week

Is HR slowing your business down instead of driving it forward?

Let’s face it—manual processes, scattered data, and payroll errors cost more than just time. They hit morale, compliance, and your bottom line.

But it doesn’t have to be that way.

Arriba HRMS is built for growing businesses that want to streamline HR—without adding complexity.

Here’s what modern teams love about Arriba:

✅ Automated Payroll – Say goodbye to salary delays and compliance headaches. ✅ Attendance & Leave Management – Track real-time data without chasing employees. ✅ Paperless Onboarding – Welcome new hires with a smooth, digital experience. ✅ Employee Self-Service – Empower your team to manage their own info, anytime.

Whether you're managing 10 employees or 1,000, Arriba helps you stay efficient, compliant, and in control.

Want to see how it works?

Book a free demo today → https://arribahrms.com/demo

Let’s stop managing HR the hard way. Let’s do it the Arriba way. #HRSoftware #HRTech #PayrollAutomation #HRTransformation #ArribaHRMS #PeopleOps #StartupTools #Compliance #HRMS

#hrms#hrms payroll software#hrms software#hrms solutions#hrms systems#hrsoftware#time and attendance software#employee attendance software#attendance management software#attendance management system#biometric attendance#payroll#payroll software#expensemanagement#expensetracking

1 note

·

View note

Text

Need quick payments? Zil.US Instant Virtual Card is here to help you manage your business expenses anytime, anywhere.

Learn more: https://zil.us/instant-virtual-card/

Click here for interactive demo: https://zilmoney.storylane.io/share/8jvvsw8gvykr

0 notes

Text

⏱️💼 Track Smarter. Spend Wiser. Perform Better.

Managing time and expenses shouldn’t slow your business down. Our Time and Expense Tracking Software is built to give you full visibility, control, and accuracy over employee hours and project spending — all in one easy-to-use platform.

Perfect for freelancers, agencies, consultancies, and enterprises, our software ensures you never lose a billable hour or miss a reimbursable expense again.

📊 Work smarter, get paid faster, and manage budgets with confidence.

Please explore our YouTube channel for informative videos. Link :- https://www.youtube.com/@sunshineitsolutions

Visit our blog for informative business ideas https://www.blog.sunshiene.com/

Contact Us :- https://wa.me/+91-7230068888

WhatsApp Channel ( Subscribe for more updates ) https://whatsapp.com/channel/0029Vb0QMGg0bIdggODhE22T

#TimeTracking#ExpenseManagement#ProductivityTools#BusinessEfficiency#ProjectBilling#ProfessionalServices#TimeAndExpenseSoftware#SunShineITSolution#WorkSmart#DigitalWorkplace

0 notes

Text

Unlock Financial Freedom: How a Budgeting App Can Transform Your Finances

In an era where every dollar counts, taking control of your finances is essential. Whether you're saving for a dream vacation, building an emergency fund, or simply trying to stay on top of your monthly bills, a powerful budgeting appcan be your best ally. Let’s explore how a budget planner and expense tracker can help you achieve financial freedom.

Why You Need a Budgeting App

Gone are the days of juggling spreadsheets and receipts. With a budgeting app, you can manage your money seamlessly, right from your smartphone. These apps are designed to simplify money management, giving you a clear picture of where your money is going and helping you make informed decisions.

A good budget manager allows you to set spending limits, track expenses in real-time, and even create savings goals. Whether you're a seasoned financial guru or just starting on your financial journey, a budget tool is essential for effective expense management.

The Power of an Expense Tracker

One of the most valuable features of a budgeting app is the expense tracker. It’s easy to lose track of small purchases, but these can add up over time. An expense manager categorizes your spending, showing you exactly where your money is going. This insight helps you identify areas where you can cut back and save more.

By using an expense tracker regularly, you’ll start to see patterns in your spending habits. This data is invaluable for creating a realistic budget that you can stick to. With an effective budget organizer and expense log, you’ll be well on your way to mastering your finances.

Achieve Your Savings Goals with a Savings App

Saving money is often easier said than done, but with the right tools, it’s entirely achievable. A dedicated savings app can automate the process, helping you build your savings without even thinking about it. Whether you're rounding up your spare change or setting aside a fixed amount each month, a money saver app makes it simple.

In addition to helping you save, these apps often include features like bill trackers and financial planning tools, ensuring you never miss a payment and stay on track with your financial goals.

How to Choose the Best Budgeting App

With so many apps on the market, finding the right one can feel overwhelming. Here’s what to look for:

User-Friendly Interface: Choose an app with an intuitive design that makes budget management and cash flow management easy.

Comprehensive Features: The best apps combine budgeting tools, expense tracking, and financial trackers in one platform.

Customization: Look for an app that allows you to tailor your budget, categories, and savings goals to fit your unique financial situation.

Security: Ensure the app uses strong encryption and has robust security measures to protect your financial data.

Final Thoughts

Taking control of your finances doesn’t have to be complicated. With the right budgeting app, you can transform the way you manage your money, achieve your savings goals, and ultimately, unlock the door to financial freedom. Start by choosing a reliable budget manager and money tracker that fits your needs, and watch your financial health improve.

Ready to take the first step? Download a free budgeting app today and start your journey toward financial wellness!

#BudgetingApp#MoneyManagement#FinancialFreedom#ExpenseTracker#SavingsApp#PersonalFinance#BudgetPlanner#FinancialPlanning#MoneySaver#BudgetManager#BudgetingTools#ExpenseManagement#CashFlowManagement#FinancialGoals#MoneyTracker#SmartSavings#BudgetOrganizer#FrugalLiving#SaveMoney#FinancialWellness#ExpenseManager#BudgetApp#BudgetPlanning#BudgetTool#MoneySaverApp.

1 note

·

View note

Text

Discover the Top 10 Inland Freight Bill Auditing Experts Saving Businesses Millions

Efficient freight bill auditing is crucial for businesses to optimize logistics costs, identify discrepancies, and ensure accurate invoicing. Companies that provide Inland Freight Bill Auditing in USA help streamline freight management by eliminating billing errors and enhancing operational efficiency. Here’s a list of Best Inland Freight Bill Auditing Companies that provide top-notch Inland Freight Bill Auditing Services in the USA.

1. Vee Technologies

Vee Technologies leads the industry with its comprehensive Inland Freight Bill Auditing Services in the USA. The company leverages advanced analytics, AI-driven auditing tools, and a team of logistics experts to ensure accurate freight cost validation. With a focus on cost reduction and efficiency improvement, Vee Technologies is a trusted partner for many global businesses.

2. Cass Information Systems

Cass Information Systems is a well-known freight audit and payment provider that helps businesses manage logistics expenses effectively. Their robust auditing solutions ensure invoice accuracy and compliance, making them a key player in the industry.

3. CT Logistics

With over a century of experience, CT Logistics offers reliable freight bill auditing and payment services. Their customizable auditing solutions help businesses detect billing errors and enhance supply chain efficiency.

4. nVision Global

nVision Global provides a cloud-based freight audit solution that ensures transparency and accuracy in freight billing. Their AI-powered platform helps businesses gain real-time insights into logistics expenses.

5. ControlPay

ControlPay specializes in freight audit and payment solutions for enterprises looking to improve financial control over transportation costs. Their expertise in inland freight auditing helps businesses reduce overpayments and improve cost efficiency.

6. U.S. Bank Freight Payment

U.S. Bank Freight Payment offers automated freight bill auditing and payment solutions that help businesses optimize freight spending while ensuring compliance with carrier contracts.

7. FreightWise

FreightWise provides detailed invoice auditing and cost analysis services to help companies identify overcharges and discrepancies. Their data-driven approach enhances cost savings and logistics performance.

8. TriumphPay

TriumphPay offers a secure and efficient freight payment and auditing system that ensures transparency and accuracy in freight transactions. Their auditing solutions help businesses maintain financial accuracy in logistics.

9. Green Mountain Technology

Green Mountain Technology delivers advanced freight bill auditing solutions with a focus on cost optimization and analytics-driven decision-making. Their auditing services help companies improve carrier performance and minimize billing errors.

10. Data2Logistics

Data2Logistics specializes in freight bill auditing and analytics, providing businesses with insights to optimize transportation costs. Their audit solutions help eliminate errors and improve financial accuracy in freight transactions.

Conclusion

Choosing the right partner for Inland Freight Bill Auditing in USA can significantly impact cost savings and operational efficiency. These Best Inland Freight Bill Auditing Companies ensure error-free invoicing, reduce overcharges, and enhance logistics management. Among them, Vee Technologies stands out as the industry leader, offering exceptional Inland Freight Bill Auditing Services tailored to businesses' unique needs.

#FreightAuditExperts#InlandFreight#CostSavings#LogisticsEfficiency#FreightBilling#AuditSolutions#SupplyChainSavings#TopFreightAuditors#ExpenseManagement#LogisticsOptimization

0 notes

Text

We implement Zoho Books to make your accounting process effortless. By automating key tasks such as invoicing, expense management, and financial reporting, Zoho Books streamlines your financial operations. With its intuitive interface and real-time insights, we help you maintain accurate and efficient financial records, allowing you to focus on driving strategic business growth.

#AccountingMadeEasy#AutomatedAccounting#FinancialManagement#BusinessGrowth#ExpenseManagement#InvoicingSolutions#FinancialAutomation#EfficientAccounting#RealTimeInsights#AccountingSoftware#SmartAccounting#BusinessEfficiency

0 notes

Text

The Impact of Poor Expense Management on Business Cash Flow

Cash flow is the lifeblood of any business. It ensures that companies can cover operating costs, pay employees, and invest in growth. Yet, poor expense management can quietly drain cash flow, leaving businesses vulnerable to financial instability. When expenses aren’t tracked or controlled properly, it creates budget gaps, delays payments, and weakens overall financial health.

Many businesses focus on increasing revenue but overlook the importance of managing expenses. Even profitable businesses can face cash flow problems if costs spiral out of control or reimbursement cycles drag on. Understanding how poor expense management impacts cash flow is crucial for maintaining financial stability and positioning the business for long-term success.

How Poor Expense Management Disrupts Cash Flow

1. Untracked and Unapproved Spending

When businesses lack clear oversight of expenses, unauthorized spending becomes a common problem. Employees may purchase items outside of policy or fail to seek approval for large expenses. Without a structured process for tracking and approving expenses, these costs often go unnoticed until they create significant budget shortfalls.

For example, if multiple departments purchase similar software licenses without coordination, it leads to redundant costs. Similarly, if employees submit travel expenses without clear guidelines, excessive spending on flights, hotels, and meals can accumulate quickly.

A 2023 study by the Association of Certified Fraud Examiners (ACFE) reported that expense reimbursement fraud accounts for nearly 15% of all business fraud cases. Untracked spending not only drains cash flow but also creates compliance risks and weakens financial reporting accuracy.

2. Delayed Reimbursements and Payment Cycles

Slow expense reporting and reimbursement processes disrupt cash flow. When employees wait weeks to get reimbursed for business expenses, it creates dissatisfaction and lowers morale. On the business side, delayed reimbursement cycles can create liquidity issues by tying up funds that could be used for other business needs.

Delayed payments to vendors and suppliers can also damage business relationships. Suppliers may impose late fees or restrict future credit terms, further straining cash flow. Establishing a fast and transparent expense reporting process helps prevent these disruptions and ensures that cash remains available when needed.

3. Manual Expense Reporting Increases Errors

Manual expense tracking and reporting increase the likelihood of mistakes, including duplicate entries, incorrect amounts, and misclassified expenses. These errors distort financial reports, making it difficult for managers to assess the company’s true financial position.

A company that underestimates expenses due to reporting errors may overspend in other areas, weakening cash reserves. On the other hand, overestimating expenses can lead to unnecessary cost-cutting measures that affect operations and employee performance.

Automated expense reporting helps reduce these issues by automatically categorizing expenses, flagging duplicate entries, and ensuring that financial reports reflect real-time data. Businesses that adopt automated systems reduce processing errors by 30% on average, according to a report by Deloitte.

4. Poor Cash Flow Forecasting

Accurate cash flow forecasting depends on reliable expense data. If businesses lack a clear view of their expenses, they struggle to predict future cash flow needs. This makes it difficult to plan for large expenses, seasonal fluctuations, or unexpected costs.

For instance, a business that doesn’t account for recurring software subscription fees may face an unexpected cash shortage when those payments are due. Similarly, underestimating travel expenses during a busy quarter can strain working capital and force the business to tap into reserves.

Consistent tracking and reporting of expenses improve cash flow forecasting accuracy, allowing businesses to make informed financial decisions.

5. Loss of Negotiating Power with Vendors

Late payments and inconsistent expense reporting weaken a business’s negotiating position with vendors. Suppliers are more likely to offer favorable terms, such as bulk discounts or extended payment periods, to businesses with a history of timely payments and consistent ordering.

When cash flow is unstable due to poor expense management, businesses may miss payment deadlines or reduce order volume. This makes it harder to secure competitive rates and favorable terms in the future. Strengthening cash flow through better expense management increases negotiating leverage and improves vendor relationships.

How to Fix Expense Management Issues and Improve Cash Flow

1. Automate Expense Reporting

Switching from manual to automated expense reporting streamlines the process and reduces errors. Employees can submit expenses through a mobile app, while the system automatically categorizes and validates each claim. Automated expense reporting also speeds up approval and reimbursement, ensuring that funds are not tied up unnecessarily.

Automation reduces administrative workload and allows finance teams to focus on higher-value tasks. Businesses that implement automated expense reporting systems typically see a 25-30% reduction in processing costs and a 20% faster reimbursement cycle.

2. Use Receipt Scanning for Faster Processing

Manual data entry slows down the reporting process and increases the risk of errors. Receipt scanning technology allows employees to upload receipts directly into the expense management system. The software extracts key details like the vendor name, date, and amount, reducing the need for manual input.

Receipt scanning accelerates report submission and ensures greater accuracy in expense tracking. It also helps businesses store digital records of receipts, simplifying audits and financial reporting.

3. Create a Clear Expense Policy

A well-defined expense policy sets expectations for employee spending and reimbursement. Outline acceptable expense categories, spending limits, and the approval process. Make sure employees understand these guidelines through regular training and easy-to-access documentation.

For example, set specific limits on meal and travel expenses. Require pre-approval for large expenses or international trips. A consistent policy reduces unauthorized spending and strengthens financial oversight.

4. Monitor and Analyze Expense Data

Regularly reviewing expense reports helps identify patterns and cost-saving opportunities. If certain expense categories exceed budgets consistently, investigate the root cause and adjust spending guidelines.

Data analysis also helps businesses identify potential fraud and duplicate claims. Setting up automated alerts for out-of-policy expenses allows finance teams to address issues before they impact cash flow.

5. Streamline the Approval Process

A complicated approval process delays reimbursement and ties up working capital. Establish a structured approval workflow where expenses are routed to the appropriate manager based on predefined rules.

For small expenses, allow department heads to approve claims directly. For larger expenses, require sign-off from senior leadership. This speeds up the process and ensures that funds are released quickly without compromising oversight.

6. Align Expenses with Business Goals

Ensure that expenses contribute to business growth and efficiency. For example, investing in employee training or customer acquisition typically generates higher returns than discretionary spending on luxury travel or office perks.

Encourage managers to evaluate expenses based on their impact on business outcomes. This helps align spending with long-term strategic goals and reduces wasteful costs.

Why Strong Expense Management Matters

Poor expense management weakens cash flow and limits a business’s ability to grow. Delayed payments, reporting errors, and unauthorized spending create financial instability and damage vendor relationships. Strong expense management, supported by automated expense reporting and receipt scanning, improves financial accuracy and ensures that funds are used efficiently.

Businesses that control their expenses effectively strengthen cash flow, reduce financial risk, and position themselves for sustainable growth. Investing in smarter expense management is not just about cutting costs it’s about building a more resilient and agile business.

0 notes

Text

Uncovering Hidden Fees: How Proactive Audits Boost Telecom Savings

Managing telecom expenses can feel like navigating a maze blindfolded; one wrong turn or missed detail can quickly lead to confusion and significant financial waste. Many mid-market enterprises manage dozens of service contracts, ranging from legacy copper POTS lines and VoIP trunks to MPLS circuits, cellular data plans, and cloud voice channels—each with its unique billing nuances and complexities. In the rush to keep operations running, finance and IT teams often approve invoices with minimal scrutiny, trusting that charges align with contractual agreements. Yet over time, minor discrepancies, redundant services, and unnoticed overage fees accumulate, quietly draining budgets.

This post explores how proactive telecom invoice audits can help businesses break this costly cycle. By systematically reviewing every charge, organizations can uncover hidden fees, recover lost dollars, and transform telecom expense management from a passive cost center into a powerful lever for financial control and strategic growth.

The Anatomy of Hidden Fees in Telecom Expense Management

Hidden fees can appear in many forms, often buried in the fine print of your telecom invoices. Carriers frequently include ongoing charges for disconnected lines, sometimes referred to as "ghost" or "phantom" fees, that continue to bill you long after the services should have ceased. Administrative and porting fees may be tacked onto your bill under vague descriptions, making them easy to overlook. Early-termination penalties or unbundled access charges can suddenly spike when contracts renew or services are reconfigured, catching finance teams off guard.

Usage-based fees introduce another layer of complexity. Per-minute billing often involves rounding practices, such as rounding up every call to the nearest minute, that inflate costs by as much as 30 seconds per call. Misapplied rate structures can occur when carriers bill international or long-distance calls at domestic rates, or vice versa, leading to substantial overcharges. In addition to these errors, taxes and regulatory surcharges—calculated as percentages of total service fees—can be miscomputed if a provider applies local taxes to non-local services. Only a proactive, detailed audit can uncover these discrepancies, enabling businesses to dispute unjust charges and recover meaningful savings.

Because these discrepancies often hide among thousands of invoice lines, they evade cursory reviews and bleed value from enterprise budgets.

5 Steps to Designing a Proactive Audit Framework

Building a repeatable, high-impact audit process involves three core pillars: data centralization, automated exception detection, and collaborative resolution workflows.

1. Centralized Billing Data

Aggregate all carrier invoices—POTS, VoIP, MPLS, cellular, and cloud voice—into a single Telecom Expense Management (TEM) system. By normalizing disparate billing formats into a standard structure, you create a consolidated data set that fuels every subsequent analysis.

2. Define Your Audit Baseline

Maintain an up-to-date repository of contract terms: per-unit rates, discount schedules, included usage thresholds, and SLA credits. When coupled with historical usage patterns, this baseline empowers automated tools to compare billed amounts against expected values.

3. Automate Exception Reporting

Configure your TEM platform to flag any deviations, such as rate variances exceeding a defined tolerance, duplicated service identifiers, or charges for assets not listed in your inventory. Priority-based dashboards surface the highest-impact anomalies for rapid human review.

4. Establish a Cadence of Review

Rather than waiting for quarterly audits, schedule monthly or even bi-weekly reviews. Frequent cycles shrink the window in which errors can accumulate, accelerating corrective actions and maximizing recovered dollars.

5. Embed Collaborative Remediation

Link each audit finding to a corresponding ticket in your vendor management system, assigning clear ownership to finance or procurement stakeholders. Automated reminders and escalation policies help keep disputes on track until they are resolved.

By institutionalizing these steps, you transform audits from an end-of-cycle scramble into a proactive cost-control mechanism woven into your operational rhythm.

Leveraging Analytics to Root Out Inefficiencies

Beyond basic exception reporting, advanced analytics unveil deeper cost-optimization opportunities:

Trend and Variance Analysis

Monitor spend categories—local voice, toll, data overage—over rolling 12-month periods. Persistent upward trends in any bucket often indicate misapplied discounts or unauthorized usage surges.

Peer Benchmarking

Compare your per-unit rates and overage charges against anonymized industry benchmarks. Significant gaps provide leverage in upcoming contract negotiations.

Utilization Heatmaps

Visualize line usage by department or location. Low-utilization circuits—those operating below a set percentage of capacity—emerge as candidates for right-sizing or decommissioning.

Scenario Modeling

Simulate the budgetary impact of shifting to alternative rate plans or metering models. What if you capped your monthly data usage or migrated to a blended voice and data bundle? Scenario tools quantify potential savings before you renegotiate.

When paired with proactive audits, these analytical lenses enable data-driven decisions that refine vendor discussions and foster sustained cost discipline.

Best Practices for Maximizing Audit ROI

To maximize the return on your telecom audit program, integrate its findings directly into your existing governance structure. By presenting audit results at regular finance and IT steering committee meetings, you maintain executive oversight, keep remediation efforts aligned with strategic goals, and ensure that cost-savings initiatives retain momentum over time.

Equally important is cross-functional training, which equips both finance and IT teams with a solid understanding of telecom rate structures, billing nuances, and vendor escalation processes. When stakeholders across departments share this domain knowledge, they can collaborate more effectively to validate discrepancies and resolve disputes swiftly.

Building "contractual guardrails" into your vendor agreements further protects your interests. By defining clear billing terms, specifying service-credit thresholds for SLA breaches, and embedding audit rights, you reduce ambiguity, reinforce vendor accountability, and guarantee your ability to verify charges in the future.

Executive dashboards play a crucial role in sustaining support for your audit efforts. Summarizing key metrics—such as dollars recovered, dispute resolution rates, and net cost reductions—in a concise, visual format ensures that C-suite leaders understand the financial impact and continue to invest resources in ongoing audit activities.

Finally, treat each audit cycle as an opportunity for continuous improvement. Capture lessons learned—common error patterns, process bottlenecks, and system limitations—and refine your framework accordingly. This iterative approach enables you to adapt to evolving billing practices and vendor behaviors, ensuring that your audit process becomes increasingly efficient and effective over time.

By marrying process rigor with expert human oversight, you move from ad-hoc error correction to a self-reinforcing culture of financial accountability.

Securing Lasting Telecom Savings Through Audit Excellence

Proactive telecom invoice audits unlock a steady stream of hidden savings, transforming expense management into a strategic advantage. By centralizing billing data, defining clear contractual baselines, and leveraging advanced analytics, organizations can identify overcharges, eliminate waste, and negotiate more favorable vendor agreements. When audits become a continuous business process—bolstered by cross-functional training, executive governance, and precise contract language—mid-market enterprises gain the transparency and control needed to optimize telecom spending and fund higher-impact initiatives.For businesses ready to elevate their audit program with industry-leading expertise and technology, zLinq offers comprehensive TEM solutions, including automated invoice ingestion and exception reporting, as well as hands-on dispute management and data-driven vendor negotiations. Partner with zLinq to implement a proactive audit framework that safeguards your budget, reinforces vendor accountability, and drives enduring cost efficiencies in an increasingly complex telecom landscape.

0 notes

Text

Expenses Management | Insight Business Solutions

Effectively managing expenses is paramount for sustainable business growth and profitability. Whether you're a startup or a well-established …

#ExpenseManagement#FinancialManagement#BusinessExpenses#InsightBusinessSolutions#ResourceOptimization

0 notes