#buying a property

Text

Top Rental Yield Projects in Singapore (2024 Edition) | TheCondoSg

TheCondoSg’s curated list of top rental yield projects in Singapore for 2024 offers both seasoned and first-time buyers investment opportunities. The list includes prime developments with exceptional returns, from city centers to suburban settings. The compilation provides detailed property profiles, expert recommendations, and investment strategies to maximize returns in Singapore’s dynamic real estate landscape.

Visit:- https://thecondo.sg/project/

#Thecondosg#Top Rental Yield#Realestate In Singapore#Investment Opportunities#Exceptional Returns#new launch properties#new condo in singapore#newlaunches#buying a property#propertymanagementinsingapore

0 notes

Text

How to buy an apartment in Zlatibor?

Nestled in the serene landscape of Western Serbia, Zlatibor is not just a breathtaking travel destination but also a prime spot for property investment.

If you're captivated by the idea of owning a piece of this tranquil paradise, understanding how to buy an apartment in Zlatibor is your first step towards making this dream a reality.

This guide aims to walk you through the intricacies of the property buying process in this enchanting region, tailored for those eyeing an investment in its burgeoning real estate market.

Introduction

The allure of Zlatibor lies in its rolling hills, lush pine forests, and crystal-clear air, making it a sought-after location for tourists and property buyers alike. The region offers a unique blend of natural beauty, cultural richness, and a peaceful lifestyle that’s hard to find elsewhere.

Buying an apartment here isn’t just an investment in property; it’s an investment in a lifestyle, a chance to own a slice of serenity.

For potential buyers, the process of purchasing an apartment in Zlatibor can seem daunting at first. From setting a realistic budget to navigating the local real estate market, and finally closing the deal, each step requires careful consideration and planning.

Whether you're looking for a summer retreat, a winter getaway, or a lucrative rental property, understanding the nuances of the Zlatibor property market is key.

In this article, we'll dive into the essential steps of buying an apartment in Zlatibor. We’ll start by exploring the current landscape of the property market in the region, helping you understand what makes Zlatibor an attractive investment destination.

Next, we’ll guide you on how to set your budget and discuss the financing options, giving you a clear picture of what to expect financially.

Following this, we’ll offer tips on searching for the right property, making an offer, and the art of negotiation. Navigating these steps successfully is crucial in ensuring you find the perfect apartment that meets both your desires and investment goals.

Finally, we’ll walk you through the process of closing the deal, turning your dream of owning an apartment in Zlatibor into a reality.

Join us on this exciting journey as we unveil the steps to buying your dream apartment in Zlatibor. Whether you're a seasoned investor or a first-time buyer, this guide is designed to equip you with the knowledge and confidence needed to navigate the property market in this beautiful Serbian region.

Let’s embark on this adventure together!

Understanding Zlatibor’s Property Market

Diving into the property market of Zlatibor is like opening a treasure chest filled with myriad opportunities. Understanding this market is the first crucial step in your journey to buying an apartment in this scenic Serbian haven.

Market Overview

Zlatibor's property market is a vibrant tapestry, woven with diverse real estate opportunities that cater to a range of preferences and budgets. The market here is buoyed by Zlatibor's growing popularity as a tourist destination, making it a hotspot for both personal retreats and investment properties.

From modern apartments offering panoramic mountain views to cozy, traditional dwellings nestled in the woods, the choices are as varied as they are enticing.

Investment Potential

The investment potential in Zlatibor is substantial. The region’s continuous development, coupled with its natural beauty and tourist appeal, creates a promising environment for property investment.

Apartments in Zlatibor not only serve as a peaceful getaway for owners but also offer the potential for rental income. The influx of tourists year-round translates to a steady demand for rental accommodations, making it an attractive option for those interested in the rental market.

Key Considerations

When exploring the Zlatibor property market, several key considerations come into play. Location is paramount.

Properties located close to popular tourist attractions, like Tornik Ski Centre or Zlatibor Lake, tend to have higher value and demand. However, quieter locations might offer more tranquility and larger space at a potentially lower cost.

Another factor to consider is the type of property that suits your needs. Are you looking for a vacation home, a permanent residence, or a rental investment? Each choice will guide your decision in different ways. For instance, a property intended for rental should ideally be located in areas popular with tourists and equipped with amenities that cater to short-term stays.

Lastly, it’s essential to consider the future development plans of the region. Upcoming infrastructure projects, new tourist attractions, or changes in local regulations can all impact the future value and demand for properties in Zlatibor.

Understanding Zlatibor's property market is about blending these considerations with your personal investment goals. It’s about finding that sweet spot where personal preference meets market potential.

This initial step of comprehending the market is your foundation for making an informed decision when buying an apartment in Zlatibor, setting the stage for a successful and fulfilling investment.

Setting Your Budget and Financing

Embarking on the exciting journey of buying an apartment in Zlatibor begins with two crucial steps: setting your budget and understanding your financing options.

This stage is about balancing your aspirations with a realistic appraisal of what you can afford, laying a solid foundation for your property investment in this enchanting Serbian region.

Determining Your Budget

Setting a realistic budget is the cornerstone of your property buying journey in Zlatibor. Begin by assessing your financial resources. Consider your savings, income, and any other assets you might leverage.

It's important to account not just for the purchase price of the apartment but also for additional costs such as potential renovations, furnishings, and ongoing maintenance.

A clear and well-planned budget ensures that your investment journey in Zlatibor is both sustainable and enjoyable.

Financing Options

While exploring financing options, it’s essential to research and understand the typical modes of financing property purchases in Zlatibor.

While specifics may vary, getting a general idea of the types of loans or mortgages available, their terms, and requirements will help you in planning your investment.

Remember, the goal is to secure financing that aligns with your financial situation and investment goals without overextending your resources.

Additional Costs

In addition to the purchase price of the apartment, there are other costs that potential buyers should factor into their budget. These might include fees for real estate agents, legal services, and property inspections.

There might also be ongoing costs such as community fees, insurance, and general upkeep. Anticipating these expenses will provide a more comprehensive picture of the financial commitment you’re making.

Setting your budget and understanding your financing options are steps that require careful thought and meticulous planning. They are about creating a realistic and sustainable financial plan that aligns with your dream of owning an apartment in Zlatibor.

By taking the time to thoroughly prepare at this stage, you are setting yourself up for a successful and rewarding property purchase, ensuring that your venture into Zlatibor’s property market is as fulfilling as the destination itself.

Searching for the Right Property

Embarking on the search for the right property in Zlatibor is an adventure filled with possibilities. This step is all about finding a space that not only meets your requirements but also resonates with your aspirations of owning a piece of this serene region.

Property Research

Begin your quest by conducting thorough research. In today’s digital age, a wealth of information is available online. Explore real estate websites, forums, and social media groups focused on Zlatibor’s property market.

These platforms can provide insights into available properties, pricing trends, and the experiences of other buyers. However, remember that online research should be a starting point; nothing replaces the value of experiencing the properties and their surroundings in person.

Viewing Properties

Once you have shortlisted potential apartments, the next step is property viewings. Visiting properties gives you a tangible sense of the space, the neighborhood, and the lifestyle each location offers.

Pay attention to details like the quality of construction, natural lighting, views, and the layout of the apartment. Consider how each space aligns with your lifestyle needs – whether you’re looking for a cozy holiday retreat or a lucrative rental investment.

While viewing properties, it’s also essential to assess the neighborhood. Explore the surrounding area, check out local amenities, and get a feel for the community. Proximity to attractions, ease of access, and the overall vibe of the neighborhood can significantly influence your satisfaction with the property.

Utilizing Local Expertise

Navigating the property market in Zlatibor can be made more accessible by leveraging local expertise. Engaging with a local real estate agent can provide you with invaluable insights.

They can offer guidance on the best locations, price negotiations, and the overall buying process. A local agent’s knowledge of the market dynamics, legal procedures, and potential future developments in the area can be a significant advantage in your property search.

Finding the right property in Zlatibor is a journey that combines practical considerations with personal preferences. It’s about envisioning your life in the space and its surroundings.

Whether you’re drawn to a modern apartment with panoramic mountain views or a quaint home nestled in the forest, the right property is one that not only meets your practical needs but also feels like a piece of your dream coming true.

With thorough research, careful viewing, and local expertise, you can find an apartment in Zlatibor that is not just a property, but a home, a retreat, or a wise investment.

Making an Offer and Negotiating

Stepping into the realm of making an offer and negotiating for an apartment in Zlatibor is where your property buying journey reaches its exciting crescendo. This phase is a delicate dance of confidence and tact, requiring both clarity of intention and flexibility.

Making an Offer

When you’ve found that perfect apartment in Zlatibor, the next step is to make an offer. This is where your market research and budgeting come into play.

Your offer should reflect both the apartment's market value and your assessment of its worth, taking into account its condition, location, and any other unique features or potential costs.

It's important to make an offer that you're comfortable with, one that aligns with your financial plan yet is attractive enough to be taken seriously by the seller.

Negotiation Tactics

Negotiating the price and terms of the sale can be a complex process. Here, a balance must be struck between getting the best deal and maintaining a good relationship with the seller.

One key strategy is to be well-informed: understand the current market conditions in Zlatibor and be prepared to discuss comparable properties and their prices.

It's also beneficial to be clear about your terms and limits. Know what you are willing to compromise on and what is non-negotiable. If there are aspects of the property that need repair or renovation, use these as negotiation points to potentially lower the price.

However, approach these discussions with a spirit of collaboration rather than confrontation; the goal is to reach a mutually beneficial agreement.

Legal Considerations

While this article doesn't delve into specific legal advice, it's crucial to acknowledge the importance of legal considerations during the offer and negotiation phase. It’s highly recommended to involve a legal expert who can guide you through the process, ensuring that all agreements are fair and legally binding.

This includes reviewing the sales contract, ensuring all conditions of the sale are met, and confirming that there are no legal impediments to the sale.

Making an offer and negotiating for an apartment in Zlatibor is as much about strategy as it is about intuition. It requires a deep understanding of the market, clear communication of your intentions, and a readiness to navigate the complexities of negotiation.

By approaching this phase with preparation, assertiveness, and a willingness to find common ground, you can smoothly navigate this final hurdle and move closer to owning your dream apartment in the picturesque setting of Zlatibor.

Closing the Deal

Closing the deal on your dream apartment in Zlatibor is the final, yet most critical, step in your property buying journey. It's where your efforts and negotiations materialize into ownership, marking the beginning of a new chapter in the enchanting Serbian mountains.

Finalizing the Purchase

The process of finalizing the purchase begins once you and the seller have agreed on the terms.

This stage typically involves signing a sales contract, a document that outlines all the specifics of the agreement, including the price, payment schedule, and any conditions or contingencies that need to be met before the sale is completed.

It's crucial at this point to review the contract thoroughly, ensuring that every detail aligns with your understanding and agreement. If you have a legal advisor, have them scrutinize the contract to ensure all is in order.

Once the contract is signed, the next step is the transfer of funds. Depending on the agreed terms, this could be a direct payment, a bank transfer, or through a mortgage arrangement. Ensuring that the payment process is secure and documented is vital for both parties' peace of mind.

Post-Purchase Considerations

After the deal is closed and the property is officially yours, there are several post-purchase steps to consider. These include registering the property in your name, a process that typically involves some paperwork and a visit to the local land registry office in Zlatibor.

It’s also a good time to start setting up essential utilities in your name, such as water, electricity, and internet services, to ensure your apartment is comfortable and ready for use.

For those planning to use the apartment for rental purposes, now is the time to start thinking about property management. Whether you choose to manage the property yourself or hire a management company, preparing the apartment for renters, advertising, and setting up a system for handling bookings and maintenance will be key to your success in Zlatibor’s rental market.

Closing the deal on an apartment in Zlatibor is a rewarding conclusion to your property buying process. It involves careful attention to legal and financial details, as well as practical considerations for taking over your new property.

This final step, though laden with formalities and paperwork, is also filled with the excitement and satisfaction of achieving a significant milestone – owning a piece of Zlatibor, a region that promises not just a serene living experience but also a potentially fruitful investment opportunity.

Conclusion

As we reach the conclusion of our guide on how to buy an apartment in Zlatibor, it’s clear that this journey, while intricate, can be incredibly rewarding.

Each step, from understanding the market to closing the deal, is a critical piece in the puzzle of securing your dream property in this serene and picturesque region of Serbia.

Purchasing an apartment in Zlatibor is not just a financial investment; it's a venture into a lifestyle surrounded by natural beauty and tranquility.

The process, as outlined in this guide, involves a blend of careful planning, market research, financial prudence, and strategic negotiation. It's about finding that perfect balance between your desires, your financial capabilities, and the realities of the Zlatibor property market.

The journey starts with a comprehensive understanding of the local real estate landscape, where knowledge of market trends and investment potential shapes your buying decisions.

Setting a realistic budget and exploring financing options then lay the financial groundwork for your purchase. Searching for the right property is perhaps the most exciting phase, where you get to choose a space that resonates with your personal and investment goals.

The art of negotiation and making an offer is where your market savvy and negotiation skills come into play. This step determines not only the price you pay but also the terms of your purchase.

And finally, closing the deal, the stage where your dreams and efforts culminate in the ownership of an apartment in Zlatibor, requires attention to detail and an understanding of the legalities involved.

In conclusion, buying an apartment in Zlatibor is a journey that requires patience, research, and a bit of adventure. It's a process that, when navigated correctly, leads to a rewarding outcome.

Whether you're looking for a vacation home, a permanent residence, or an investment opportunity, Zlatibor offers a unique and enticing proposition.

For those embarking on this journey, remember that each step is an opportunity to move closer to owning a piece of this beautiful region.

With the right approach, informed decisions, and a bit of guidance, you can navigate the process successfully, leading to the joyous moment when you hold the keys to your new apartment in Zlatibor, ready to enjoy all the wonders this region has to offer.

1 note

·

View note

Text

Which day is good for Buy new house

Entering a new home shows new beginnings. It is an auspicious moment for the residents. In Hindu traditions, people perform the Griha Pravesh ceremony before living in a new home. The ceremony is performed not just on any date; the family members have to ask a learned person for an auspicious day. The puja removes negativity from the house and brings fortune.

#Property Purchase Dates 2024#Shubh Muhurat#Griha Pravesh Shubh Muhurat#buying a property#Auspicious Day to Buy a New House

0 notes

Text

0 notes

Text

Template Download Link: Click Here.

In the fiercely competitive housing market, prospective buyers are employing various strategies to secure their initial residence. Differentiate yourself by crafting a sincere letter to the seller. The act of selling a home is inherently emotional—imagine parting with a residence steeped in years of cherished memories. A personalized letter to the seller remains a proven and impactful approach to triumph in a bidding war by establishing a genuine emotional connection. This is the perfect personal letter template to make your home buying dreams come true.

#digital download#Offer To Home Buyer#Dear Homeowner#Dear Letter#Hello Neighbor#Real Estate#Real Estate Marketing#Real Estate Agent#real estate templates#homeownership#properties#luxuryrealestate#propertyinvestment#property#prospecting letter#prospecting#buying a home#buying a property#buying a house#diy templates#social media#printables#Letter Template#resume#house selling#home & lifestyle#home & living#home

0 notes

Text

Buying a Home

Take the first step towards buying a home with Legacy Homes Real Estate! Discover our stunning properties, each crafted to match your unique needs. If you're looking for a charming starter home or a luxurious family escape, we have them all. Don't miss this wonderful opportunity to purchase a home. Contact us today!

#real estate agent#real estate#team tovar#legacy home real estate#legacy homes#buying a property#buying a house

0 notes

Text

The happiness of becoming a homeowner cannot be overemphasised. Especially as Indians, we always desire to buy a home of our dreams. Buying land and building your own home in India can be very difficult. The cost of building, the location, and the availability of land are some factors that make building your own home difficult.

Therefore, people now think about purchasing a flat as they offer extra convenience and better value for money. Below are some of the advantages of buying a property over a private home

0 notes

Text

Should You Have an Appraisal Contingecy?

The Appraisal Contingency

What is an appraisal contingency? When it comes to purchasing a home, there are various contingencies that buyers can (and should) include in their offer or purchase contract to protect themselves from potential risks of being forced to proceed with the transaction or risk losing their good faith deposit. Individual contingencies can be shortened, or even waived, and the decisions regarding how to structure your particular offer are specific to what’s best for you and your own individual transaction. An appraisal contingency, though, is an important clause in a home purchase contract that allows a buyer to walk away from the transaction if the home does not appraise for the purchase price, and typically retain their good faith deposit, having it refunded following cancellation of the contract. It is essential to understand that this contingency is separate from a financing contingency, which provides protection for the buyer in case they are unable to obtain financing. The financing contingency, though, does not afford protection in relation to the appraisal. An appraisal contingency is a separate contingency, even though the appraisal, is more times than not, a lender requirement. You do not want to find yourself in a position where a low appraisal is the sole reason that you cannot obtain your financing and not have an appraisal contingency protecting you. If you’re advised, at any point, to waive the appraisal contingency because you have a financing contingency and that the lender will require an appraisal anyway, you must know this is a dangerous practice that puts your good faith deposit at risk. If the buyer's financing is declined due to a low appraisal and they do not have an appraisal contingency, they could lose their deposit.

What About the Right to Renegotiate?

Now, there is a lot of confusion and misinformation about the appraisal contingency, and some mistakenly believe that it gives them the right to renegotiate the purchase price if the appraisal comes in low. …

READ THE ENTIRE POST HERE >>>

#home appraisal#realestate#appraisal contingency#buying a house#buying a property#real estate agencies#realtor

0 notes

Link

If you are planning to buy property in Hampton Park, you can reach out to Manny Singh, a real estate agent.

#Real Estate Agents#property experts#buying a property#selling a property#Real Estate Agents in Pakenham

0 notes

Text

Questions to ask your Real Estate Agent Before Buying a Property in 2022

Purchasing a home can be difficult, especially if it’s your first time. There are numerous steps involved in buying a home. Although the process is complicated, your real estate agent or Realtor is a licensed professional who has probably assisted many other people with it. As a result, they are excellent sources of knowledge about property buying. Here are some crucial inquiries you need to make at each stage of the process.

In order to guarantee a smooth house buying process, choosing the correct agent is crucial. You should ask questions to real estate agents to determine who best suits your needs before choosing one. Ask each of them these crucial inquiries.

To Read More Click Here

#real estate#realestateadvisor#real estate agent#deal acres#buying a property#best property dealer#property dealer

0 notes

Text

In the realm of real estate, where risks are inherent, The Condo SG stands as a testament to the transformative power of strategic investment. Breaking boundaries and building wealth, the company’s innovative approach, strategic locations, and commitment to risk management redefine the possibilities within the real estate landscape. For those seeking not just a property but a pathway to riches, The Condo SG emerges as the trusted partner, where risks are reshaped into unparalleled prosperity.

0 notes

Text

Stamp Duty Calculator: Calculate Stamp Duty and Registration Charges

Stamp Duty and Registration Charges are the government's fees on various property transactions in India. These charges are calculated based on various factors like the property type, the property's value, the state where the property is located, etc. To make it easier for property buyers to calculate these charges, the government has introduced an online tool called the Stamp Duty Calculator. This blog will discuss how you can use the Stamp Duty Calculator to calculate Stamp Duty and Registration Charges and cover two related sub-topics.

Understanding the Concept of Stamp Duty

Stamp Duty is a tax levied on the transfer of property ownership. It is calculated based on the value of the property and the state in which it is located. The amount of stamp duty you have to pay varies depending on the type of property you buy and the state in which it is located. In India, stamp duty rates can range anywhere from 2% to 7% of the property value, depending on the state.

Stamp Duty is a tax levied by the government on the transfer of ownership of a property. This tax is imposed to ensure that all property transactions are recorded and taxed appropriately. The amount of stamp duty you have to pay depends on the value of the property and the state in which it is located.

The stamp duty calculation is based on the value of the property and the state in which it is located. In India, stamp duty rates vary greatly, depending on the state. For example, in some states, the stamp duty rate may be as low as 2% of the property value, while in others, it may be as high as 7%.

It is important to note that stamp duty is a one-time payment and must be paid at the time of property registration. This payment must be made in full and must be completed on time. Failure to pay stamp duty can result in legal consequences. It can also affect the transfer of ownership of the property.

Understanding the Concept of Registration Charges

Registration Charges are the fees levied by the government for registering the property in your name. This fee is calculated based on the value of the property and the state in which it is located. In India, registration charges can range anywhere from 1% to 2% of the property value, depending on the state.

When you purchase a property, it is mandatory to register the transfer of ownership with the government. This process is known as property registration to establish the new property owner legally. During the property registration process, the government levies a fee known as the registration charge.

The registration charges are calculated based on the value of the property and the state in which it is located. This fee is usually a percentage of the property value and can range from 1% to 2% in India. The exact amount of registration charges you have to pay depends on the state where the property is located, as different states have different rules and regulations regarding property registration fees.

It is essential to keep in mind that the registration charges are a separate fee from the stamp duty that you have to pay when purchasing a property. Stamp duty is a tax levied on the transfer of property ownership. At the same time, the registration charges are a fee you must pay to register the property in your name.

Conclusion

The Stamp Duty Calculator is a valuable tool that helps you calculate the amount of stamp duty and registration charges you will have to pay for a property transaction. Understanding both stamp duty and registration charges is essential, as these fees can significantly impact the overall cost of buying a property. Using the Stamp Duty Calculator, you can clearly see the total cost of a property transaction and plan your finances accordingly.

Source - : https://bricksnwall.blogspot.com/2023/03/stamp-duty-calculator-calculate-stamp.html

1 note

·

View note

Text

Blog Earnings.

I never expect to make anything much – if anything at all on here.

Little wooden model house with a heart above the door, and two people’s hands holding it between them.

But….. I can’t help wonder if it’s at all possible to earn enough to purchase a £300,00 property. Has anyone ever earnt an amount near that by blogging?

View On WordPress

0 notes

Text

Property in lucknow for sale | Rishita Developers

Looking to buy property in Lucknow? Rishita Developers offers prime real estate options in the city. Our properties come with top-of-the-line amenities and great connectivity.

For more info please visit us at:

https://www.rishita.in/blog/buying-or-renting-a-affordable-home-in-lucknow-residential-localities

0 notes

Text

What Are Some Things You Should Consider When Buying A Property

If you’ve ever purchased property before, you know how complicated the whole process can be. You have to find the right property, negotiate with the seller on a fair price, complete all of the paperwork and make sure your lawyer knows what he’s doing so you don’t sign anything that will come back to haunt you down the road. With so much to do and so many things to think about, it can be easy to overlook some of the most important considerations when buying property.

1: Location of The House

Whether it’s a house, condo, or town home for sale, location matters. Ideally, you want to buy in an area with good schools and a low crime rate neither of which is easy to determine beforehand. But some research will reveal whether these issues have recently been addressed. For example, if you’re looking at a home listed for sale online or through an agent, there will likely be neigh boor hood information available in a database or via real estate websites. And speaking to neigh boors in person is often more valuable than information on paper; they’ll have experience living in that area and can give insight into its pluses. The number of years a neigh boor hood has stood also indicates stability.

2: The Size of The Home You Need

Buy a home that’s too big, and you could find yourself sinking into debt while still struggling to make payments. Buy too small, and your monthly payments will be less, but so will your space and amenities. For example, it might not seem like much at first, but living with five people in a 1,200-square-foot apartment can get old after a while. In general, aim to buy a place between 2 to 3 times your annual income. This rule of thumb doesn’t take into account any other factors, such as whether you have children or pets or what kind of neigh boor hood you want to live in. It also doesn’t account for home price fluctuations over time, which is why it’s important to look at home prices over several years before making a decision.

3: How Many Rooms Do You Need in Your Home?

When thinking about your loan approval numbers and down payment options, it is important to know what the lender will be looking at to approve your loan. Your monthly housing payment (mortgage and taxes) must be within a certain percentage of your income. The lender will also want to see that you have enough money saved up for a down payment and closing costs, which can add up if you don’t prepare ahead of time. Depending on where you buy, closing costs can range anywhere from 1% to 5% of your home’s purchase price.

4: Your Loan Approval Numbers and Down Payment Options

Your loan approval numbers will be calculated with your current financial information, income, and credit. The calculation determines if your loan is approved, how much you can borrow, and what monthly payments would look. Another important part of buying a home is deciding how much money to put down as a down payment. Before anything else goes into place about getting pre-qualified for a mortgage or looking at houses for sale, you must sit down with yourself and evaluate just how much money you want to put into your house upfront. What makes sense for one person might not make sense for someone else because each individual’s financial situation is different.

5: Homeowner's Association Details

You’ll want to read your HOAs by law before you buy so that there aren’t any surprises later. For example, if your HOA prohibits children under 18 years of age from living in apartments/town homes, or you’re going to need special permits or board approval to remodel your home and yard, check out all of those details ahead of time. When moving in or looking at a home for sale in an area with an HOA, make sure you visit during typical rush hour times. You’ll get a sense of what it will be like to live in that neigh boor hood during peak commute times; on weekdays during rush hour and on Saturday mornings. Does it feel safe? How does traffic flow?

6: State of Offers on The House

Buying a house is exciting and terrifying, especially if you’re making an offer on your first home. If you know what to expect before entering into a purchase contract, though, it can be less stressful. Before putting down an offer on a property, there are several considerations to think about everything from inspecting appliances to researching costs associated with utilities in your area. Use our guide to help make sure that buying your dream home doesn’t lead to sleepless nights. Title: How To Make Sure Your House Doesn’t Suck In many areas of life, procrastination is viewed as a bad thing; however, for homebuyers looking for new properties to buy for sale, waiting until the last minute may work out in their favor. As you go through the process of shopping around for your dream home, keep these tips in mind so that you don’t miss out on great deals!

Contact us:

Address - 8315 Northern Blvd., Suite2 Jackson Heights, NY 11372

Email - [email protected]

Phone - (844) 829 2292

Website - Ur Realtors

Blog - What Are Some Things You Should Consider When Buying A Property

0 notes

Note

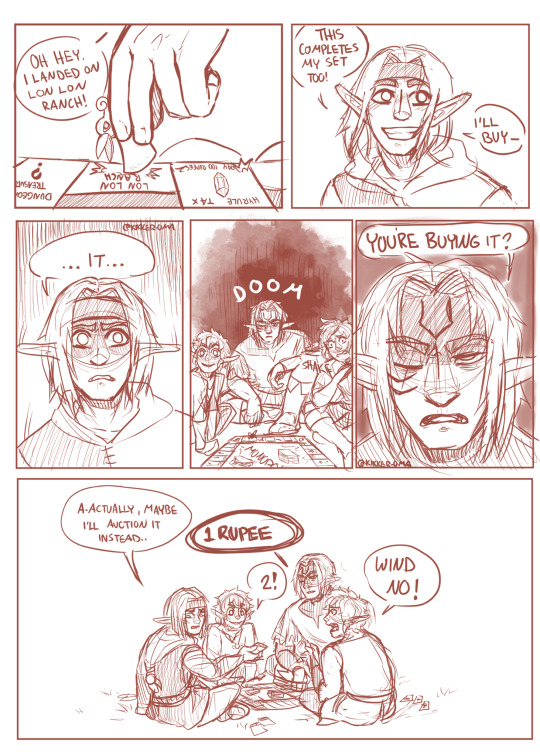

If sketch requests are still open, I wish to see Wind, Four, Hyrule, and Time playing Monopoly.

Four is a smart man who values his life😳

#nobody in the group has ever been able to hold onto the Lon Lon Ranch property#Wars got brave once and tried to buy it#but Time called a time out and took Wars aside#Time got the ranch from Wars the very next turn#poor wars wasn't ok the rest of the game#sweet monish mews and twos#I'm so sorry this literally took months for me to do#linked universe#linkeduniverse#lu fanart#lu time#lu hyrule#lu wind#lu four#wind wants chaos#meanwhile hyrule is trying to prevent a murder

2K notes

·

View notes