#calculate compound interest in Excel

Explore tagged Tumblr posts

Text

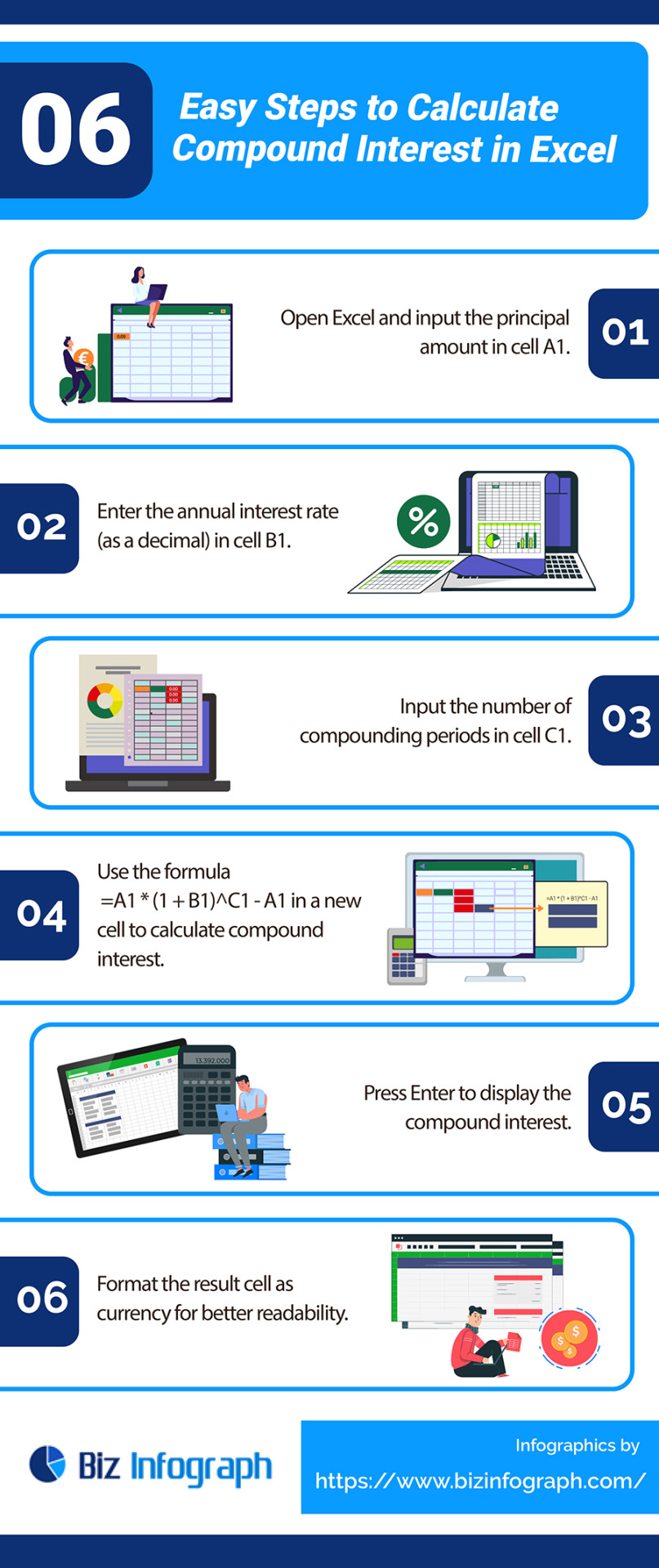

6 Easy Steps to Calculate Compound Interest in Excel

In particular, knowing how to calculate compound interest in Excel can be incredibly valuable to accurately and efficiently calculate complex financial projections, making their work more efficient and effective. To know more, read this infographic: https://www.bizinfograph.com/blog/steps-to-calculate-compound-interest-in-excel/

0 notes

Text

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Introduction Managing a loan can be a complex task, especially when it comes to tracking payments, interest, and prepayments. In this article, we’ll explore a Python script that generates a loan amortization schedule with the ability to apply prepayments. The script utilizes the Pandas library for data manipulation and Excel export. Loan Amortization Schedule A loan amortization schedule is a…

View On WordPress

#Compound interest#Excel export#Financial management#Financial planning#Loan amortization schedule#Loan analysis#Loan interest savings#Loan management tool#Loan optimization#Loan payment breakdown#Loan payoff calculator.#Loan payoff strategy#Loan repayment#Loan schedule generation#Loan tenure reduction#Loan tracking#Pandas library#Personal finance#Prepayments#Python loan calculator

1 note

·

View note

Text

Cram Sessions

Izuku Midoriya x reader (NB)

Midoriya Izuku's eyes went wide when you approached him about studying together for the upcoming U.A. exams. A light blush dusted his freckled cheeks as he nodded vigorously, mumbling about how studying collectively could enhance everyone's academic performance. Little did you know, this angelic boy harbored a not-so-innocent crush on you.

For the next two weeks, you and Midoriya could be found tucked away in quiet corners of the library, pouring over textbooks and quizzing each other relentlessly. At first, Midoriya was a bundle of nervous energy, his emerald eyes darting anywhere but your face as you leaned in to examine his notes.

However, as the study sessions progressed, a newfound confidence seemed to blossom within the timid hero-in-training. Where he'd once stumble over his words, he began explaining concepts with clarity and conviction, his eyes shining with unbridled passion.

Midoriya proved to be an excellent study partner – attentive, inquisitive, and genuinely invested in ensuring you understood the material. He'd pause frequently to ask if you had any questions, hanging on your every word with rapt interest.

On more than one occasion, you caught him staring a little too long, his gaze drifting from the textbook to your face with an almost wistful expression. Midoriya would then start mumbling under his breath, a habit you'd learned meant his mind was racing at a million miles per minute.

Uraraka, ever the insightful best friend, couldn't resist teasing Midoriya about his not-so-subtle infatuation. During one of your breaks, she bounded over and plopped down beside you two with a mischievous grinder.

"Getting some extra 'tutoring' in, are we Midoriya?" she said with an exaggerated wink, causing the green-haired boy to sputter and turn beet red.

"W-we're just studying, Uraraka!" Midoriya protested, his freckles almost disappearing beneath his crimson blush. "There's nothing else going on, I swear!"

You tilted your head in confusion, missing the implication entirely, while Uraraka laughed and ruffled Midoriya's hair affectionately. The poor boy looked like he wanted to melt into the floor from embarrassment.

As Uraraka retreated with a parting salute, Midoriya groaned and hid his face in his hands. You placed a comforting hand on his arm, startling him.

"Don't mind Uraraka, she's just being silly," you said with an easy smile. "Now, where were we? I think I was understanding the physics calculations until that last practice problem..."

Midoriya's blush returned full force as you leaned over the textbook, your faces mere inches apart. Up close, he couldn't help but notice how your lashes fanned across your cheeks, or the entrancing way your brow furrowed when you were deep in thought.

Shaking himself from his daze, Midoriya took a steadying breath and launched into a thorough explanation, his nervous stutter slowly giving way to confidence once more. Your eyes lit up with comprehension, and you beamed at him with such warmth that he felt his heart stutter in his chest.

These study sessions, while academically productive, were also slowly becoming a form of sublime torture for the freckled hero. Every smile, every brush of your shoulders as you pored over the same book, Every murmured "thank you" as he helped you grasp a difficult concept – they all compounded the growing affection burning brightly within him.

By the time exams rolled around, you were fully prepared, thanks largely to Midoriya's tireless efforts and patience. As you exchanged bashful high-fives after the last test, he couldn't help but wonder what studying for the next set of exams might bring.

#bnha x you#bnha x reader#my hero academia headcanons#mha x reader#izuku midoria x reader#midoriya izuku x reader#izuku midoriya#midoriya izuku#Izuku x reader#midoriya x reader#izuku midoriya fluff#Bnha fluff#izuku midoriya headcanons#bnha headcanons#mha headcanons

206 notes

·

View notes

Text

The Power of Compound Interest Explained

Compound interest is often referred to as the “eighth wonder of the world,” and for good reason. It has the potential to turn small, consistent investments into a significant sum over time. Understanding how compound interest works is essential for anyone looking to grow their wealth, plan for retirement, or achieve long-term financial goals.

At its core, compound interest is the process by which interest is added to the initial principal, and then new interest is earned on that larger amount. In contrast to simple interest, which is calculated only on the original principal, compound interest continually adds to the total amount, allowing your money to grow faster.

Let’s break it down with an example. Suppose you invest $1,000 in an account that earns 5% interest annually. After one year, you would have $1,050. The following year, your interest would be calculated on $1,050, not just the original $1,000. This cycle continues, and over time, the growth becomes exponential. Even though the rate stays the same, the amount of interest earned each year increases because it’s being calculated on a larger balance.

One of the most powerful aspects of compound interest is the impact of time. The earlier you start investing, the more time your money has to grow. A person who starts saving for retirement at age 25 will likely accumulate much more than someone who begins at age 40, even if the older investor contributes more money. That’s the magic of compounding—your money earns interest, and that interest earns more interest.

Frequency of compounding also plays a role. Interest can be compounded annually, semiannually, quarterly, monthly, or even daily. The more frequently it compounds, the faster your money grows. For example, if two people invest the same amount at the same interest rate, the one whose interest is compounded monthly will end up with more than the one whose interest is compounded annually.

Compound interest is not only useful for investing; it can also work against you in the form of debt. Credit card balances, for example, often grow rapidly due to high interest rates and frequent compounding. This is why it’s crucial to pay off credit cards quickly and avoid carrying a balance if possible.

To make the most of compound interest, start saving early, contribute consistently, and reinvest your earnings. Retirement accounts like 401(k)s and IRAs are excellent tools for compounding because they offer tax advantages and often come with employer contributions.

Financial tools such as compound interest calculators can help you visualize how your money will grow over time. By inputting your starting amount, interest rate, contribution frequency, and time period, you can see the long-term benefits of consistent investing.

In conclusion, compound interest is a powerful financial principle that can significantly enhance your savings and investments. By understanding how it works and putting it to use early in life, you can build wealth steadily and efficiently. Whether you’re saving for a home, college tuition, or retirement, compound interest can help turn your financial goals into reality.

0 notes

Text

10 Hidden Facts about Bank Returns

Let’s be honest — when it comes to managing money, most of us in India still have a lot of faith in our banks. Fixed deposits, savings accounts, recurring deposits — these have been the go-to investment choices for generations.

Why? Because they feel safe. Familiar. Risk-free.

But here's the catch — while banks are excellent for storing your money, they’re not always upfront about what you're actually earning in return. There are a lot of little things about “returns” that banks won’t bring up unless you ask the right questions.

In this blog, we will break down the 10 things about returns that banks rarely, if ever, tell you. If you care about growing your wealth and not just saving it, keep reading — this might just change the way you look at your money.

1. What You See (on Paper) Isn't What You Get (in Reality)

Banks will tell you your FD gives you 6.5% interest. Sounds decent, right?

But after accounting for inflation and tax, your real return might be closer to 2% or even less.

Think about it — if your money grows at 6.5% but the cost of living increases by 6% a year, are you really getting ahead?

Nope. You're just about breaking even. This is the part banks quietly skip.

2. The Taxman Takes His Share — But Banks Don’t Warn You

Here's something most people don’t realise until it's too late — the interest you earn from fixed deposits and savings accounts is fully taxable.

So if you're in the 20% or 30% tax bracket, your 7% FD could effectively earn you just 4.9% or even lower.

Banks never mention this when you open an FD. It's up to you to calculate your post-tax return.

3. Your Savings Account Interest is... Meh

Ever noticed how you barely earn anything from your savings account? That’s because the average interest is around 3-4% — and that too on your average monthly balance, not the full amount.

So if you thought your ₹1 lakh would give you a good monthly return — it won’t. You might earn just a few hundred rupees per month. Nothing life-changing.

4. They Won’t Compare Themselves With Better Options

Why would they? Banks won’t tell you that investing in a PPF, mutual fund, or RBI bond might give you better returns with similar or better safety.

Their job is to sell their own products — not guide you to the best possible investment out there.

So unless you do the research, you’ll probably end up missing out on smarter choices.

5. Breaking Your FD? Say Goodbye to Full Returns

Most people think they can withdraw their FD any time. And yes, you can — but you’ll probably lose out on the promised interest rate.

Banks charge a penalty or adjust your interest rate downward if you withdraw early. That 7% could suddenly become 5.5%.

Ask your bank about this before you lock in your money.

6. The Interest Rates They Show You? Not for Everyone

Here’s a sneaky one — the “attractive” FD rates advertised outside the branch or on the website? They often apply only to specific tenures like 5 years.

So if you’re planning to open a 1-year FD, you might get a lower rate. But unless you ask, they won’t mention it.

Always check what rate applies to the exact tenure you’re choosing.

7. How Interest Is Compounded Matters (But They Don't Tell You That)

You might have seen this term: "Interest compounded quarterly". Sounds technical, right?

But it makes a big difference.

If Bank A compounds interest quarterly and Bank B does it annually, your money grows faster with Bank A — even if both offer the same rate.

Banks don’t really explain this unless you dig deep. But it affects your final return.

8. Auto-Renewal = Lazy Returns

Most people forget to close or reinvest their FD when it matures. So what do banks do?

They automatically renew it — sometimes at a much lower rate than what you originally signed up for.

No reminders, no advice, nothing.

So you could end up locking your money at a poor rate for years without realising it.

9. They Don’t Mention Government Schemes That Beat FDs

There are government-backed schemes like Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), and Senior Citizens Savings Scheme (SCSS) that offer better returns, tax benefits, and more safety.

But your bank won’t highlight these unless you specifically ask — because they don’t earn commissions on them the way they do with their own products.

Sad but true.

10. Banks = Safe. But Safe Isn’t Always Smart

Don’t get me wrong — banks are great for parking emergency funds. But when it comes to building wealth?

You have to think beyond savings accounts and FDs.

If you’re not at least partially invested in mutual funds, equity, or long-term tax-saving instruments, you’re leaving money on the table.

Banks won’t tell you this, because it’s not in their business interest to do so. But if you want your money to actually grow, you need to explore more.

So, What Should You Do?

Let’s quickly recap:

Calculate post-tax returns

Beat inflation, not just earn interest

Explore alternatives like PPF, mutual funds, and RBI bonds

Avoid auto-renewal traps

Ask your bank the right questions

Don't get stuck in the "safe but slow" mindset. It’s time to get smart with your money — because if you don’t take charge of your finances, someone else will (and they probably won’t have your best interests in mind).

#financial services#investment#finance#financial advisor#financial planning#financial freedom#investment planning#financial wellness#saving account#bank return

0 notes

Text

Delhi Police Syllabus 2025 – Latest Exam Pattern & Subject-Wise Topics

ChatGPT said: The Delhi Police Syllabus 2025 has been designed to assess a candidate’s intellectual ability, reasoning skills, and awareness of current events. The recruitment process typically includes a Computer-Based Examination (CBE), followed by Physical Endurance and Measurement Tests (PE&MT), and a Medical Examination. The CBE is the most crucial stage, featuring a total of 100 questions for 100 marks with a duration of 90 minutes.

The syllabus is divided into four main sections: General Knowledge/Current Affairs, Reasoning, Numerical Ability, and Computer Fundamentals. The General Knowledge section evaluates candidates on topics such as Indian History, Constitution, Geography, Economics, Science, Static GK, and Current Affairs with emphasis on national and international developments, awards, sports, books, and government schemes. The Reasoning section includes both verbal and non-verbal reasoning such as coding-decoding, analogies, classification, series, syllogism, mirror images, and blood relations. This section aims to test the logical and analytical thinking of candidates. In the Numerical Ability section, questions are framed from topics like Number Systems, Percentages, Profit and Loss, Simple and Compound Interest, Time and Work, Time and Distance, Mensuration, Data Interpretation, Ratio and Proportion, and Average. This part examines mathematical aptitude and problem-solving skills. The Computer Fundamentals section checks basic computer knowledge, including topics such as hardware and software, internet usage, MS Office (Word, Excel, PowerPoint), input and output devices, and basic troubleshooting. The exam follows a negative marking system, where 0.25 marks are deducted for every wrong answer, so accuracy is vital. The questions are set in both Hindi and English, ensuring bilingual accessibility. Candidates who clear the written test are shortlisted for the Physical Endurance and Measurement Test (PE&MT), which varies for male and female candidates based on age and includes tasks like running, long jump, and high jump, along with specific height and chest measurements. The final selection is made after the Medical Examination to ensure candidates are physically and medically fit for police service. Preparing strategically for each section with the right resources and mock tests can help aspirants significantly improve their chances. Candidates are advised to focus especially on current affairs, reasoning tricks, and fast calculation techniques. With a structured study plan and consistent practice, cracking the Delhi Police 2025 exam becomes highly achievable. The syllabus not only aims at testing theoretical knowledge but also practical understanding, decision-making skills, and overall aptitude suitable for law enforcement roles. Updated notifications, syllabus changes, and pattern modifications should be regularly tracked via the official Delhi Police or SSC websites. In summary, the Delhi Police Syllabus 2025 offers a comprehensive test of mental, physical, and practical competencies, ensuring that selected candidates are well-rounded and capable of upholding public safety and law. It is essential for aspirants to stay disciplined, revise frequently, and attempt previous year papers to gauge their preparation level. Thorough understanding of the syllabus topics, along with time management and accuracy, remains the key to success in this competitive recruitment exam.

0 notes

Text

How to Avoid Common Pitfalls While Using an FD Calculator

A fixed deposit calculator is an excellent tool for planning your investments, but if used incorrectly, it can lead to misleading results. SDB Bank’s fixed deposit calculator simplifies financial forecasting for Sri Lankans, helping you plan your savings with ease. However, avoiding common mistakes ensures that you get the most accurate and useful insights from the tool.

One of the most frequent errors is inputting incorrect data. To get the most accurate results, make sure that the deposit amount, tenure, and interest rate align with the current offerings from SDB Bank. For example, the minimum deposit amount starts at Rs. 10,000, and terms can extend up to 10 years. If any of this information is incorrect, your results will be skewed and won’t reflect your true investment potential.

Another common mistake is overlooking the compounding frequency. The fixed deposit calculator typically defaults to maturity-based interest, but if you’re opting for monthly payouts, be sure to adjust the settings. The frequency of compounding can significantly affect the overall returns, and failing to account for this can lead to unrealistic expectations about how much your FD will actually earn.

It’s also essential to account for taxes when using the calculator. The interest earned on FDs is taxable, and failing to subtract this from your projected returns can inflate your expectations. Make sure to estimate the tax on your interest and adjust the calculator’s output to reflect a more accurate net return. This will give you a clearer picture of the actual benefits of your investment.

Similarly, some users fail to consider penalties for premature withdrawals. If you plan to access your funds before the FD matures, there may be penalties involved. These penalties are not always reflected in the calculator, so it’s crucial to check the terms and conditions from SDB Bank if you anticipate needing early access to your funds.

Another important factor to keep in mind is inflation. While the fixed deposit calculator shows the nominal returns on your FD, it doesn’t account for the impact of inflation, which can erode your purchasing power over time. To get a better sense of your investment’s real growth, compare the calculator’s results with inflation rates to see if your returns will keep up with rising costs.

Finally, while the fixed deposit calculator is a helpful tool, don’t rely solely on it. For personalised advice and to ensure that your investment strategy aligns with your financial goals, consult with SDB Bank’s staff. They can provide tailored guidance based on your specific needs and offer solutions that go beyond the basic calculations.

By avoiding these common pitfalls, you can use SDB Bank’s fixed deposit calculator to effectively plan for your financial future. With the right information and a clear understanding of your investment’s potential, this tool can be a valuable ally in helping you achieve your savings goals.

0 notes

Text

SIP and Lumpsum Calculator: The Most Accurate and Precise Calculation

In today's era, financial planning is a crucial step, where SIP and Lumpsum investment play a vital role. If you are considering investing in mutual funds or any other investment scheme, then dpank.in's SIP and Lumpsum Calculator is an excellent tool for you. This calculator performs precise compounding calculations and provides more accurate results than the Groww app.

What is SIP and Lumpsum Calculator?

The SIP and Lumpsum calculator is a digital tool that allows you to estimate your investment returns. By simply entering your investment amount, interest rate, and duration (years), you can determine how much your money will grow in the future. This calculator accurately computes your investment growth using the compound interest formula.

Why is dpank.in's Calculator the Most Accurate?

Precise Compounding Calculation – This calculator follows the compound interest principles to provide an accurate estimate of your future value.

More Accurate Than Groww App – Our advanced algorithm delivers results that are even more precise than those from leading platforms like Groww.

Simple and User-Friendly Interface – Just enter your investment amount, interest rate, and time duration, and get instant, accurate results.

Useful for Both SIP and Lumpsum Investments – Whether you are investing through SIP or making a one-time lump sum investment, this tool helps in both cases.

Real-Time Calculation – Our calculator provides immediate real-time results without any delays.

How Does SIP and Lumpsum Work?

SIP Calculator Formula:

In SIP, investments are made monthly, and it follows the compound interest formula: FV=P×((1+r)n−1r)×(1+r)FV = P \times \left(\frac{(1 + r)^n - 1}{r}\right) \times (1 + r)

Where,

FV = Future Value

P = Monthly SIP Amount

r = Monthly Interest Rate (Annual Rate / 12 / 100)

n = Total Months

Lumpsum Calculator Formula:

A lump sum investment is made once, and it follows the simple compound interest principle: FV=P×(1+r)nFV = P \times (1 + r)^n

Where,

P = Initial Investment Amount

r = Annual Interest Rate / 100

n = Investment Duration (Years)

How to Use dpank.in's SIP and Lumpsum Calculator?

Enter Investment Amount – Specify the amount you want to invest.

Set Interest Rate – Define the expected return rate.

Choose Time Period – Select the number of years you wish to invest for.

Click Calculate Button – Instantly view the estimated future value.

Conclusion

If you want to enhance your financial journey, dpank.in's SIP and Lumpsum Calculator is the best choice. It delivers more accurate results than the Groww app and performs precise compound interest calculations. Start planning your investments today and secure your financial future!

0 notes

Text

How Recurring Deposits Help You Save Consistently

Saving money is often easier said than done. While some people are naturally disciplined savers, others find it challenging to keep a consistent habit of setting aside money every month. If you struggle with saving, a Recurring Deposit (RD) might just be the solution you’ve been looking for. In this article, we will explore how Recurring Deposits help you save consistently and why they can be an excellent tool for building a stable financial future.

You might be wondering, "What makes a Recurring Deposit so special?" Well, let’s dive into it and understand why opening an RD is an effective way to ensure you save regularly and benefit from a higher interest rate.

What is a Recurring Deposit (RD)?

A Recurring Deposit (RD) is a type of fixed deposit where you commit to depositing a fixed amount of money at regular intervals, typically monthly, for a predetermined tenure. At the end of this tenure, you get the total of your deposits plus interest. The interest earned is calculated based on the prevailing highest recurring deposit interest rates offered by the bank at the time of opening the RD.

Recurring Deposits are easy to manage and require minimal effort once you open an RD account. They allow you to deposit a small, fixed sum regularly, which helps you accumulate a large sum over time. It's ideal for individuals who may find it difficult to set aside a large lump sum but can afford to make smaller, regular contributions.

How Recurring Deposits Help You Save Consistently

Now that we understand what an RD is, let’s look at how Recurring Deposits can help you save consistently over time.

1. Regular Saving Habit

One of the main reasons people fail to save money is because of the lack of consistency. Life often gets in the way, and before you know it, you haven’t set aside any savings for the month. When you open an RD, you’re required to make regular deposits, usually every month. This encourages a disciplined savings habit.

The fixed monthly contributions make it easier to plan your budget around the RD. Once you open an RD account, the bank will automatically deduct the monthly instalment, meaning you don’t have to worry about manually saving money each month. This regularity can help you develop a consistent saving routine, which is key to long-term financial health.

2. Compounding Interest for Better Returns

Another significant benefit of Recurring Deposits is the interest you earn on your savings. Banks typically offer the highest recurring deposit interest rates, which means your savings grow at a faster rate compared to traditional savings accounts. Interest is earned not just on the principal amount but also on the interest that gets added to the account over time. This process is known as compounding.

For example, let’s say you open an RD with a monthly deposit of $100 and an interest rate of 6%. Throughout the RD’s tenure, the interest earned will be added to the principal, and the next month’s interest will be calculated on this new higher amount. This compounded growth can significantly increase your savings by the time the RD matures.

3. Fixed Monthly Commitment – No Room for Overspending

One of the biggest challenges in saving is the temptation to spend the money you intended to save. With a Recurring Deposit, you don’t have that luxury. When you open an RD, the monthly contributions are automatically deducted from your bank account, leaving you with less disposable income to spend.

Since the money is automatically invested in the RD, you’re forced to save it without the temptation to use it for non-essential purchases. Over time, you’ll get used to living without that money, and it will become a part of your regular financial routine. This automatic saving habit helps you avoid overspending and ensures you stay on track to achieve your financial goals.

4. Flexibility and Customization

When you open an RD, you typically have the flexibility to choose the tenure and the amount you wish to invest each month. Most banks allow you to choose a tenure ranging from six months to five years, and you can adjust the monthly instalment to suit your financial situation.

For example, if you have a month with a little extra money, you can opt for a higher instalment for that period. This flexibility allows you to save consistently without the stress of being tied down by rigid rules. Plus, the highest recurring deposit interest rates are often available for longer tenures, allowing your investment to grow even more.

5. Low Risk and Guaranteed Returns

Another advantage of Recurring Deposits is that they are low-risk investments. Unlike stock market investments, where returns fluctuate depending on the market’s performance, RDs offer guaranteed returns. The interest rate you lock in at the time of opening the RD will remain fixed for the entire tenure, regardless of how the economy changes. This makes it a safer option for conservative investors or anyone looking to save without worrying about market risks.

For those who are just starting to save or don’t have the risk appetite, Recurring Deposits provide a stable and secure way to grow your money without much effort. While the returns may not be as high as riskier investments, they offer a reliable way to save consistently while protecting your principal.

6. Tax Benefits (In Some Cases)

Many people look for investment options that offer tax-saving benefits. While Recurring Deposits themselves don’t provide tax exemptions, you can open a tax-saving RD that allows you to claim deductions under Section 80C of the Income Tax Act.

These tax-saving RDs have a lock-in period of 5 years and qualify for deductions up to Rs. 1.5 lakh, reducing your taxable income. This added tax advantage can make Recurring Deposits an even more attractive option for saving consistently while minimizing your tax liabilities.

7. Building a Corpus for Future Needs

Whether you're saving for a vacation, education, or retirement, Recurring Deposits help you build a financial corpus over time. Because of the fixed nature of the deposits, you can plan for long-term financial goals. You know exactly how much you will save each month, and by the time your RD matures, you'll have a lump sum that can be used for your specific financial objectives.

If you’re planning for a large expense, such as buying a home or funding your child’s education, opening an RD is an excellent way to save consistently without the temptation to dip into the funds prematurely. The predictable growth and guaranteed returns can give you peace of mind as you work toward meeting your goals.

How to Use an FD Calculator to Plan Your RD

To make sure you’re making the best possible choice when it comes to Recurring Deposits, it’s helpful to use an FD calculator. While it’s typically used for Fixed Deposits, the FD calculator can also be used for Recurring Deposits as many banks offer similar calculators for RD investments.

By inputting the amount, you plan to deposit, the interest rate, and the tenure of your RD, the FD calculator can help you estimate your maturity amount. This allows you to assess how much your investment will grow over time, helping you plan better for your future.

Using an FD calculator can also help you compare different banks’ highest recurring deposit interest rates, making sure that you choose the one that offers the best return for your money. It’s a simple yet powerful tool that helps you make smarter financial decisions.

Conclusion

In conclusion, Recurring Deposits are a powerful and reliable tool to help you save consistently. By setting up automatic monthly contributions, you create a regular savings habit that will benefit you in the long run. Whether you’re saving for a short-term goal or building a corpus for future needs, Recurring Deposits provide the structure, flexibility, and guaranteed returns to help you achieve your financial objectives.

With the option to choose from different tenures, deposit amounts, and the benefit of the highest recurring deposit interest rates, you can tailor an RD to suit your specific savings goals. Plus, using tools like the FD calculator ensures you know exactly how much your money will grow over time, giving you more control over your financial future.

If you want to start saving consistently, consider opening an RD today and watch your savings grow over time with ease and security.

0 notes

Text

The Mortgage Financial Services at Josh Financial Services: Your Path to Homeownership

Buying a home is one of the most significant financial decisions anyone can make. Whether you are a first-time homebuyer or looking to refinance an existing mortgage, navigating the complex world of home loans can be overwhelming. At Josh Financial Services, our Mortgage Financial Services are designed to simplify the home-buying process and provide you with the best financial solutions. Our team of experts ensures that every client receives personalized guidance and professional assistance tailored to their unique financial situation.

Expert Guidance for Your Home Loan Needs

Our Mortgage Financial Services provide a seamless approach to securing a home loan that suits your needs. We understand that every individual has different financial goals and requirements, which is why we offer customized mortgage solutions. Our experienced professionals assess your financial standing, recommend suitable loan options, and guide you through every step of the loan application process. With our commitment to excellence, we ensure that you make informed decisions that align with your long-term financial objectives.

Simplify Mortgage Comparison with Our Mortgage Switching Calculator

Many homeowners consider switching their mortgage to secure better interest rates or improved loan terms. However, determining whether refinancing is beneficial requires careful analysis. Our Mortgage Switching Calculator simplifies this process by helping you compare your current mortgage with alternative options. By inputting details such as interest rates, loan duration, and outstanding balance, you can easily evaluate potential savings and make an informed decision. With our support, you can confidently explore refinancing opportunities that work in your favor.

Additionally, our financial experts can help you analyze the hidden costs associated with mortgage switching, such as exit fees and application charges. Understanding the full picture allows you to make a well-informed choice that aligns with your financial goals.

Why Choose an Independent Mortgage Broker Sydney?

Choosing the right mortgage broker is crucial to securing a loan that meets your needs. Unlike traditional banks, an Independent Mortgage Broker Sydney provides access to a wide range of lenders and mortgage products. This means you receive unbiased advice and better loan options tailored to your financial circumstances. At Josh Financial Services, we leverage our industry expertise to negotiate competitive rates and favorable loan terms on your behalf. Our independent approach ensures that you receive the best financial solutions without being limited to a single lender's offerings.

Working with an Independent Mortgage Broker Sydney also means you gain access to expert insights on fluctuating interest rates, government grants, and loan features that might benefit your financial situation. Our brokers go beyond securing loans; they act as your trusted financial partners throughout the homeownership journey.

Plan Your Loan Repayments with Our Compound Interest Loan Repayment Calculator

Understanding how interest accumulates over time is crucial for effective financial planning. Our Compound Interest Loan Repayment Calculator allows you to estimate your monthly payments and total loan cost over the repayment period. By considering factors such as principal amount, interest rate, and loan tenure, you can gain insights into how your mortgage will evolve over time. This tool is particularly useful for individuals looking to optimize their loan repayment strategy and minimize long-term financial burdens.

With proper financial planning using our Compound Interest Loan Repayment Calculator, you can make informed choices about loan prepayments, refinancing, and budgeting for future expenses. This ensures that your homeownership journey remains stress-free and financially manageable.

The Josh Financial Services Advantage

At Josh Financial Services, we take pride in offering comprehensive Mortgage Financial Services that prioritize client satisfaction. Our expert team is dedicated to simplifying the mortgage process, ensuring transparency, and securing the most favorable terms for our clients. Whether you need assistance with mortgage refinancing, loan comparison, or repayment planning, we are here to support you every step of the way.

Secure Your Dream Home Today

Purchasing a home is a milestone achievement, and having the right financial guidance makes all the difference. With our expert Mortgage Financial Services, advanced tools such as the Mortgage Switching Calculator and Compound Interest Loan Repayment Calculator, and the expertise of an Independent Mortgage Broker Sydney, you can confidently take the next step toward homeownership. Contact Josh Financial Services today to begin your journey towards securing the home of your dreams.

0 notes

Text

Mathematics Strategy for Sainik School, RMS, and RIMC Exams

Introduction

Mathematics is a crucial subject for the Sainik School, RMS, and RIMC entrance exams. A strong foundation in math not only boosts overall scores but also enhances problem-solving skills. To excel in these exams, students must follow a structured preparation strategy that focuses on conceptual clarity, practice, and time management.

Understanding the Exam Pattern

Before diving into preparation, it is essential to understand the exam pattern for Sainik School, RMS, and RIMC. The mathematics section generally includes:

Arithmetic – Number System, LCM & HCF, Percentage, Profit & Loss, Time & Distance, Simple & Compound Interest.

Algebra – Linear Equations, Polynomials, and Basic Algebraic Identities.

Geometry – Angles, Triangles, Circles, and Mensuration.

Data Interpretation – Bar Graphs, Pie Charts, and Line Graphs.

Effective Strategies to Ace Mathematics

1. Build Strong Fundamentals

A solid foundation in basic concepts is key to solving complex problems. Students should thoroughly understand mathematical formulas, properties, and shortcuts for quick calculations.

2. Regular Practice and Mock Tests

Practicing previous years’ question papers and taking regular mock tests improves accuracy and speed. Enrolling in the Best RIMC Coaching in Delhi can provide access to structured test series and expert guidance for better results.

3. Time Management Skills

Effective time management is crucial in competitive exams. Students should allocate time wisely for each question and avoid spending too much time on a single problem.

4. Shortcut Techniques and Tricks

Learning shortcut techniques for calculations can save valuable time in the exam. Mastering Vedic Math tricks and approximation methods can help solve problems faster.

5. Focus on Weak Areas

Identifying weak areas through regular self-assessment helps students concentrate on improving their problem-solving skills in those topics.

6. Solve Sample Papers and Previous Year Questions

Solving sample papers gives a clear idea about the types of questions asked and boosts confidence before the actual exam.

Role of Coaching Institutes in Mathematics Preparation

Enrolling in a structured coaching program helps students gain expert guidance, study material, and personalized mentorship. The Best RIMC Coaching in Delhi offers specialized training to help students tackle challenging mathematical problems with ease.

Conclusion

Mathematics plays a significant role in securing a good score in Sainik School, RMS, and RIMC exams. By following a strategic preparation plan, regular practice, and expert guidance from the Best RIMC Coaching in Delhi, students can improve their mathematical skills and boost their chances of success. Start preparing today and stay consistent with your practice to achieve your dream of joining a prestigious military institution!

#RMS Coaching in Delhi#RMS Coaching Classes in Delhi#RMS Coaching institute in Delhi#RMS Coaching Center in Delhi#Best RIMC Coaching in Delhi#Online coaching for RMS exam in delhi

0 notes

Text

Chemistry Homework Help: Expert Support for Better Learning

Chemistry is very interesting, and it explains the composition, properties, and reactions of various substances. It is quite majestic for medicine, engineering, environmental science, and food technology. However, that chemistry homework will also be somewhat difficult for students because of the imposing chemical equations, complex applications thereof, and laboratory work. That is where The Tutors Help come in to provide expert chemistry homework assistance to ease your learning.

Essential Aspects of Chemistry

Chemistry is all around us, starting from the air we breathe to the food we heat and everything else involved in chemical processes. Almost all aspects of chemistry can be grouped into three core divisions:

Organic Chemistry – Studies carbon-based compounds, such as fuels, plastics, and pharmaceuticals

Inorganic Chemistry – Studies of compounds other than carbon, which include metals, minerals, and catalysts

Physical Chemistry – Studies the behavior of substances at a molecular and atomic level, which includes energy changes and reaction rates.

An understanding of chemistry is by far an excellent avenue for buttressing students' problem-solving skills and their analytical thinking, and hence their future career objectives.

Challenges of Chemistry Homework

Complex Chemical Equations - Here, balancing equations along with understanding a few reaction mechanisms are crucial.

Difficult Theories - Such concepts as thermodynamics, electrochemistry and atomic structure require thorough conceptual understanding.

Memorization- Knowing the periodic table of the acids, formulae or corresponding reaction types may seem forcible.

Math Calculations - Chemistry may also involve some calculations, such as molar mass, concentration and stoichiometry, which would require accurate calculations as well.

Continuous Pressure - Students might find it difficult or even impossible to handle their chemistry homework within the given limited time alongside their other subjects.

Valid Reasons to Choose the Tutors Help

The Tutors Help offers expertise in chemistry homework help for students who are unable to grapple with the demanding and taxing task of completing homework and need help in improving their grades. Here are reasons why opting for us is the best decision:

Qualified Chemistry Experts – The knowledge of our teachers in chemistry is overall-rich, and they can explain all the tough concepts in a simple way.

Stepwise Solutions – We give all our students clear detailed solutions that teach them how to get to solve the problems.

Customized Help – Different students have different needs, and we believe in personalized solutions to serve each assignment's requirement.

Anti-Plagiarism Work – All our answers are original and will pass academic integrity standards. Timely Delivery – We make sure that your homework is submitted well in time before the deadlines so that you have enough time to review it.

Affordable Prices – All our services are budget-friendly, so the students who are willing to get quality academic assistance can afford us easily.

Getting Chemistry Homework Help via The Tutors Help

Submission of Assignment – Share the details of your assignment including the topic, instructions, and deadlines.

Getting a Quote – We will offer you a pocket-friendly price for the service.

Expert Help – The tutors will solve your homework and provide clear solutions.

Review and Learn – Use the solutions we supplied to enhance your understanding and to help you prepare for your exams.

Final Words

Chemistry certainly is an important subject, but at times it can become a hard one to understand and follow up without having proper guidance available by your side. Whether you are looking for guidance with chemical equations, reactions, or lab reports, The Tutors Help is here for you.

With a valuable expert support available by your side, you can timely complete all your chemistry homework with confidence . Never let your chemistry homework stress you out in the first place. Reach out to us at The Tutors Help today and get valuable assistance that you need to succeed!https://www.thetutorshelp.com/chemistry-homework-help.php

0 notes

Text

How to Prepare for Quantitative Aptitude for Banking Exams?

Quantitative Aptitude is a critical section in banking exams like IBPS PO, SBI PO, and other competitive exams, assessing candidates' ability to solve numerical problems, apply mathematical concepts, and think logically under time constraints. To excel in this section, effective preparation is key. Here’s a detailed approach to help you master Quantitative Aptitude for banking exams.

1. Understand the Syllabus and Exam Pattern

Before diving into the preparation, it’s essential to understand the syllabus and the exam pattern. Typically, the Quantitative Aptitude section covers topics such as:

Number System

Simplification and Approximation

Percentage

Profit and Loss

Average

Time and Work

Time, Speed, and Distance

Ratio and Proportion

Simple and Compound Interest

Data Interpretation (DI)

Mensuration

Probability

Number Series

Permutation and Combination Each exam may have slight variations, so go through the official notification and make sure you are clear about what to focus on.

2. Strengthen Basic Concepts

The foundation of Quantitative Aptitude lies in mastering the basics of mathematics. Begin by revising fundamental concepts from class 9 and 10 mathematics, as they form the core of many banking exam topics. Brush up on topics like basic arithmetic operations, fractions, ratios, percentages, and algebra. Understanding these topics well is crucial as they will help you tackle complex problems quickly and accurately.

3. Practice Regularly

Quantitative Aptitude requires consistent practice to develop speed and accuracy. Dedicate time every day to solving problems, starting with simpler questions and gradually moving to more difficult ones. Regular practice will not only improve your problem-solving skills but also help you manage time effectively during the exam. Use question banks, online platforms, and study materials specifically designed for banking exams to access a wide variety of questions.

4. Work on Speed and Accuracy

Time management is vital in the Quantitative Aptitude section. With limited time during the exam, you need to solve questions quickly and accurately. Practice solving problems within a set time frame to improve your speed. Focus on minimizing mistakes, as accuracy is just as important as speed. Set a timer while practicing to simulate exam-like conditions.

5. Master Data Interpretation

Data Interpretation (DI) is a major part of the Quantitative Aptitude section, often involving complex tables, graphs, or charts. Developing a strategy to approach DI questions is essential. Start by practicing basic types of DI such as bar charts, line graphs, pie charts, and tables. Learn to quickly interpret data, perform calculations, and answer questions based on the given data.

6. Use Shortcuts and Tricks

While practicing, make sure to learn shortcuts and tricks that can save time, especially for calculations. Techniques such as approximate values, squaring numbers, and multiplying large numbers using tricks can make solving problems faster. Many competitive exam preparation books and online resources offer such tricks. These methods are essential when you have to solve numerous questions within the given time limit.

7. Take Mock Tests and Analyze

Mock tests are an integral part of your preparation. They simulate the actual exam environment and allow you to evaluate your preparation. Regular mock tests will help you understand the pattern of questions, your strengths and weaknesses, and how to manage time effectively. After each test, thoroughly analyze your performance, identify mistakes, and work on improving those areas.

8. Stay Updated with Current Affairs

While Quantitative Aptitude is based on logical and mathematical principles, many banking exams also include questions related to current events and data analysis. Make it a habit to read newspapers and stay updated with general knowledge, as this will help you in the Data Interpretation and Reasoning sections too.

9. Focus on Revision

As the exam date approaches, make sure to revise all the topics you’ve covered so far. This will help reinforce your concepts, and you’ll be more confident during the exam. Focus on your weak areas and practice more questions in those topics to gain proficiency.

10. Stay Positive and Motivated

Last but not least, maintaining a positive attitude is crucial. Stay focused on your goals, avoid distractions, and keep a steady pace in your preparation. Take care of your health by staying hydrated and taking regular breaks to avoid burnout.

Conclusion

Preparation for Quantitative Aptitude in banking exams demands dedication, regular practice, and a strategic approach. By understanding the syllabus, mastering the basics, practicing regularly, and refining your speed and accuracy, you can significantly improve your performance. Be patient, stay consistent, and with the right preparation, you’ll be well-equipped to crack the Quantitative Aptitude section with ease.

0 notes

Text

Mathematical Reasoning in Legal Contexts: Applications for CLAT

Mathematical reasoning, often associated with numbers and equations, has a significant role in the field of law. Competitive exams like CLAT, NLSAT 2025, and CUET PG LLB integrate mathematical reasoning to test aspirants’ logical thinking and problem-solving abilities. This blog delves into the importance of mathematical reasoning in legal contexts, its applications, and how to prepare effectively for law entrance exams.

Why Mathematical Reasoning is Essential for Law Students

Logical Problem-Solving

Law often requires interpreting data, identifying patterns, and solving problems logically. Mathematical reasoning sharpens these skills.

Data-Driven Analysis

Legal cases, especially those involving financial disputes, taxation, or corporate law, rely on the accurate interpretation of numerical data.

Exam Relevance

Sections like quantitative techniques in CLAT and NLSAT 2025 assess the candidate’s ability to solve problems involving percentages, ratios, and logical deductions.

Practical Applications

Lawyers frequently use mathematical reasoning for case analysis, drafting agreements, and estimating financial implications.

Key Applications of Mathematical Reasoning in Legal Contexts

Understanding Contracts

Mathematical reasoning helps in calculating interest rates, penalties, or damages in contract law.

Taxation and Corporate Laws

Interpretation of financial statements, tax calculations, and business valuation require strong numerical skills.

Crime and Evidence Analysis

Statistical data is often used to establish probabilities or patterns in criminal cases.

Public Policy and Economics

Legal professionals dealing with public policy often evaluate economic data to support policy decisions.

Important Topics for Mathematical Reasoning in Exams

Percentages and Ratios

Common in questions about population data, taxation, and resource allocation.

Data Interpretation

Analyzing graphs, charts, and tables to draw logical conclusions.

Probability and Statistics

Frequently tested in legal scenarios like evidence probability or survey results.

Arithmetic and Logical Puzzles

Builds critical thinking skills necessary for solving complex legal problems.

How to Prepare for Mathematical Reasoning

Master the Basics

Ensure you are comfortable with fundamental concepts like arithmetic, ratios, and percentages.

Practice Mock Tests

Platforms like NLTI’s coaching programs provide mock tests that simulate the mathematical reasoning section of CLAT, NLSAT 2025, and CUET PG LLB.

Solve Past Papers

Familiarize yourself with question patterns by solving previous years’ exam papers.

Time Management

Develop speed and accuracy through timed practice sessions.

Use Study Resources

Reference books and online tutorials specifically designed for law entrance exams are invaluable.

Sample Question

Question: A legal firm is analyzing the population of a city to determine the feasibility of opening a new branch. The population growth rate is 5% per year, and the current population is 1,00,000. What will the population be in 3 years?

Solution:

Use the formula for compound growth: Population = Current Population × (1 + Growth Rate)^Time = 1,00,000 × (1 + 0.05)^3 = 1,15,762 approximately.

This skill is directly applicable to questions in CLAT and NLSAT 2025 involving logical or numerical deductions.

Conclusion

Mathematical reasoning is an essential skill for aspiring lawyers preparing for exams like CLAT, NLSAT 2025, and CUET PG LLB. Its applications extend beyond exam halls, shaping how legal professionals approach data analysis, contract interpretation, and policy formulation.

Prepare effectively with NLTI’s expert coaching programs, which offer tailored resources and mock tests designed to enhance your mathematical reasoning and legal aptitude. By mastering these skills, you’ll not only excel in exams but also build a strong foundation for your legal career.

0 notes

Text

Best Refer and Earn Demat Accounts in India with Securities Markets in India

In today’s fast-evolving financial ecosystem, young Indians—especially students and teenagers—are showing increasing interest in stock markets, trading, and wealth creation. With mobile-first platforms, refer-and-earn programs, and a wave of financial content online, Gen Z and millennials are better positioned than ever to begin their investment journey. This blog covers everything from the best investment options for students to trading account referrals, and an overview of securities and financial blogs to follow.

Trading Account Refer and Earn: A Gateway to Passive Income

Several Indian brokers now offer “Refer and Earn” programs, allowing users to earn money or brokerage credit by referring friends or family to open trading or demat accounts. These programs are especially popular among college students, budding traders, and social media best refer and earn demat account influencers who are passionate about finance.

Popular Refer-and-Earn Trading Platforms:

Zerodha: Earn 10% of the brokerage paid by your referrals.

Upstox: Flat ₹500 or more per referral after successful onboarding.

Angel One: Offers cash rewards + 30% lifetime brokerage share.

Groww: Fixed payouts per referral and additional bonus incentives.

This is a simple way for financially aware youth to monetize their network while promoting financial literacy. If done ethically and transparently, refer-and-earn is an excellent tool to grow side income while introducing others to stock market investing.

Best Investment Options for Students in India

While students may not have a large corpus to invest, they have something even more valuable—time. Starting small with long-term discipline can lead to significant wealth creation over decades.

Ideal Investment Avenues for Students:

Mutual Funds via SIPs – Start as low as ₹100/month; good for long-term compounding.

Recurring Deposits (RDs) – Safe and fixed returns, good for beginners.

Digital Gold – An alternative to traditional gold investment, available via apps.

Stock Market (Blue-Chip or ETFs) – Only after learning the basics and with risk control.

Public Provident Fund (PPF) – A long-term government-backed savings scheme with tax benefits.

Students should focus on securities in stock market consistent savings habits, basic financial literacy, and using investment calculators to set realistic goals.

Types of Securities Markets in India

Before investing, it’s crucial to understand where investments take place. The Indian securities market is broadly divided into two major types:

Primary Market

Where new securities (shares, bonds) are issued for the first time through IPOs.

Investors buy directly from the issuing company.

Secondary Market

Where existing securities are traded among investors.

Example: Trading shares on NSE and BSE post-IPO.

Both markets are regulated by SEBI (Securities and Exchange Board of India), ensuring transparency and investor protection.

Types of Securities in India

Securities are tradable financial assets that represent ownership or a creditor relationship. The main types of securities traded in India include:

Equity Shares – Ownership in a company, high risk, high reward.

Debentures/Bonds – Fixed income, generally less risky.

Mutual Fund Units – A pooled investment managed by professionals.

Derivatives (Futures & Options) – Contracts based on underlying assets, suitable for advanced investors.

Government Securities (G-Secs) – Issued by RBI, low risk and used for saving and lending.

Preference Shares – Equity-like but with fixed dividend priority.

Each security comes with best financial blogs in india its own risk-return profile, and investors should choose based on their financial goals and risk appetite.

Best Financial Blogs in India to Follow

To grow as an informed investor, students and beginners should regularly read credible financial blogs. Here are some of the top blogs and websites in India:

Safal Niveshak – Personal finance, behavioral investing.

Capitalmind – Deep market insights, macroeconomics, and investing.

Finshots – 3-minute newsletters simplifying finance and economics.

MoneyControl Blog – News and commentary on stocks, mutual funds, and markets.

Trade Brains – Beginner-friendly content and investment guides.

Groww Blog – Simplified articles for new investors.

ClearTax Blog – Great for tax planning, investments, and financial tools.

Following these blogs can help young investors stay updated, learn market strategies, and avoid common investment mistakes.

Best Refer and Earn Demat Accounts in India

If you’re looking to combine smart investing with referral earnings, here are the best demat accounts that reward users for inviting others:PlatformReferral RewardUSPUpstox₹500–₹1000 per referralEasy onboarding, modern UIZerodha10% brokerage sharingLargest broker in IndiaAngel One₹500 + lifetime % shareFull-service broker with discount pricingGroww₹100–₹200 per userMutual fund + stock investment combo5PaisaTiered referral plansMultiple account options

Refer and earn works well for students and finance influencers. However, ethical promotion is important to build trust and long-term income.

Financial Awareness for Teenagers in India

Teenagers today are more tech-savvy than ever and are increasingly showing interest in saving, budgeting, and investing. While legal age for stock investing via a demat account is 18+, minors can invest under a guardian’s account.

Smart Financial Habits for Teenagers:

Use budgeting apps to track pocket money or earnings.

Start learning about personal finance through YouTube or blogs.

Read about compounding, inflation, and investing basics.

Consider simulated stock trading apps (like StockGro or Moneybhai) to practice.

Educating teenagers about financial responsibility early on helps build confidence and best credit card for teenagers discipline, laying the foundation for a wealthier future.

Conclusion

India’s financial landscape is more accessible than ever, and the youth are well-positioned to benefit. Whether it’s opening a demat account with refer-and-earn perks, reading the best financial blogs, or understanding different types of securities and markets, knowledge is the most powerful investment.

If you’re a student or teenager in India, now is the time to start your financial journey—not necessarily with money, but with education, discipline, and the right tools.

0 notes

Text

Understanding the Importance of Retirement Planning in India

Retirement planning in India is more than just saving money; it’s about ensuring that your post-retirement life is free from financial stress. With inflation steadily eroding purchasing power, creating a robust retirement corpus is essential. Proper planning enables individuals to maintain their lifestyle, meet medical expenses, and support their aspirations without financial dependency on others.

Key Factors to Consider in Retirement Planning in India

Retirement planning in India involves multiple factors to ensure that your financial goals align with your lifestyle and needs:

1. Estimating Post-Retirement Expenses

Understanding your potential expenses is the first step:

Daily Living Costs: Food, clothing, transportation, and utilities.

Healthcare Costs: Medical treatments and insurance premiums.

Lifestyle Goals: Hobbies, travel, and other personal aspirations.

Inflation: Adjusting for inflation helps provide a realistic estimate.

2. Determining Your Retirement Corpus

Calculating your required retirement corpus ensures financial security throughout your life. Use tools like retirement calculators to factor in inflation, expected returns, and the duration of your retirement.

3. Assessing Current Savings and Investments

Evaluate your existing savings and investments to identify gaps. This analysis will guide your future contributions and investment strategies.

Best Investment Options for Retirement Planning in India

Retirement planning in India requires a mix of safe and growth-oriented investments. Below are some popular options:

1. Employee Provident Fund (EPF)

EPF is a government-mandated savings scheme for salaried individuals. It offers:

Regular contributions from both employer and employee.

Tax-free returns under certain conditions.

2. National Pension System (NPS)

NPS is an excellent choice for retirement savings, offering:

Flexible allocation to equity and debt instruments.

Tax benefits under Sections 80C and 80CCD.

3. Public Provident Fund (PPF)

PPF is a reliable long-term investment avenue. Benefits include:

Guaranteed returns with tax-free interest.

A lock-in period of 15 years.

4. Mutual Funds and SIPs

Mutual funds, especially equity-oriented funds, can generate higher returns over the long term. Systematic Investment Plans (SIPs) make investing manageable and disciplined.

5. Fixed Deposits (FDs)

Fixed deposits provide a safe investment option with assured returns. Senior citizens often enjoy higher interest rates on FDs.

6. Real Estate Investments

Investing in property can provide steady rental income and long-term appreciation, making it a valuable addition to your retirement portfolio.

Building an Effective Plan for Retirement Planning in India

Retirement planning in India involves a systematic approach to ensure financial freedom in your later years:

1. Define Your Goals

Identify your post-retirement aspirations, such as world travel, starting a business, or pursuing hobbies. These goals will guide your financial requirements.

2. Start Early and Leverage Compounding

Starting early gives you the advantage of compounding, where your investments grow exponentially over time. Even small contributions made consistently can create a significant corpus.

3. Diversify Investments

A well-diversified portfolio of equity, debt, and real estate helps balance risk and maximize returns.

4. Monitor and Adjust Your Plan

Regularly review your plan to accommodate changes in market conditions and personal circumstances. Adjusting your strategy ensures that you stay on track.

5. Seek Professional Advice

Engaging with a financial advisor can help you navigate complex investment choices and optimize your portfolio.

Tax Implications of Retirement Planning in India

Retirement planning in India should be tax-efficient to maximize returns. Consider instruments that offer tax benefits, such as:

Section 80C: Covers PPF, EPF, and NPS investments.

Section 80D: Provides deductions for health insurance premiums.

Section 10: Offers tax exemptions on gratuity and EPF withdrawals under specific conditions.

Strategic tax planning ensures that more of your earnings contribute to your retirement goals.

Conclusion

Retirement planning in India is an essential step toward achieving financial independence and a comfortable post-retirement life. By estimating your expenses, leveraging diverse investment options, and addressing potential challenges, you can build a robust financial foundation. Starting early and making informed decisions are the keys to a secure and worry-free retirement.

0 notes