#Python loan calculator

Explore tagged Tumblr posts

Text

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Creating a Loan Amortization Schedule with Prepayments using Python and Pandas

Introduction Managing a loan can be a complex task, especially when it comes to tracking payments, interest, and prepayments. In this article, we’ll explore a Python script that generates a loan amortization schedule with the ability to apply prepayments. The script utilizes the Pandas library for data manipulation and Excel export. Loan Amortization Schedule A loan amortization schedule is a…

View On WordPress

#Compound interest#Excel export#Financial management#Financial planning#Loan amortization schedule#Loan analysis#Loan interest savings#Loan management tool#Loan optimization#Loan payment breakdown#Loan payoff calculator.#Loan payoff strategy#Loan repayment#Loan schedule generation#Loan tenure reduction#Loan tracking#Pandas library#Personal finance#Prepayments#Python loan calculator

1 note

·

View note

Text

How Financial Analytics is Reshaping Real Estate Investment Decisions

The real estate industry, once dominated by intuition and gut feeling, is now being revolutionized by financial analytics. In today’s data-driven economy, property investors are relying less on speculation and more on solid financial insights to drive decisions. Whether it's evaluating commercial real estate deals, residential investments, or REITs, financial analytics is playing a pivotal role in determining success or failure.

For professionals looking to capitalize on this shift, mastering financial tools and strategies is essential — and enrolling in an industry-aligned investment banking course in Pune could be the stepping stone to unlocking these high-value opportunities.

📈 The Intersection of Real Estate and Financial Analytics

Real estate is inherently complex. Each investment is influenced by dozens of variables: market demand, interest rates, location trends, construction costs, regulatory shifts, and more. Financial analytics brings structure to this complexity by turning raw data into actionable insights.

With the right models and tools, investors can now:

Predict future property values

Assess ROI and rental yields with precision

Analyze cash flow scenarios

Compare financing options

Evaluate risks associated with market volatility

💡 Why Real Estate Investors Are Embracing Financial Analytics

1. Data-Driven Forecasting

Using historical price trends, demographic data, and macroeconomic indicators, investors can forecast demand in specific neighborhoods or cities. This predictive capability helps in buying low and selling high — or holding long for maximum returns.

2. ROI & Cash Flow Modeling

Financial models enable investors to calculate expected rental income, operating expenses, taxes, and loan repayments to determine actual net returns.

3. Risk Assessment

Analytics tools allow investors to stress-test their portfolios — simulating economic downturns, interest rate hikes, or changes in occupancy — to measure exposure and protect capital.

4. Optimized Portfolio Management

Institutional investors and REITs use financial dashboards to track the performance of multiple assets in real-time, enabling quick, informed decisions across geographies.

🛠️ Tools Used in Real Estate Financial Analytics

Modern financial analysts in real estate often use a combination of:

Microsoft Excel for traditional modeling

Power BI or Tableau for data visualization

Python or R for advanced analytics and forecasting

GIS tools for mapping and spatial analysis

CRM & property management platforms integrated with financial data

Understanding these tools not only improves decision-making but also adds significant value to one’s career profile — particularly for those completing an investment banking course in Pune that includes real estate finance modules.

📚 Bridging the Skills Gap: Investment Banking Courses in Pune

As financial analytics becomes a must-have in real estate investment, many aspiring finance professionals are turning to specialized programs to gain relevant expertise. An investment banking course in Pune can provide you with the necessary knowledge to:

Build detailed real estate financial models

Understand deal structuring, funding mechanisms, and ROI metrics

Evaluate investment proposals from a banker’s perspective

Work with institutional clients on REITs, private equity real estate funds, or infrastructure financing

Pune, being a fast-growing educational and financial hub, offers some of the best courses that combine theory with practical exposure. These programs are ideal for:

Finance graduates looking to specialize

Real estate professionals aiming to upskill

Investment banking aspirants wanting domain-specific expertise

Analysts interested in REITs or structured finance

🌍 Real Estate Investment Trends and Analytics

In global real estate markets — including rapidly growing regions like India and the UAE — financial analytics is becoming crucial to adapt to:

The rise of co-working and flexible spaces

Sustainable and ESG-compliant properties

Smart city projects and digitally connected housing

Increased institutional investment in tier-2 and tier-3 cities

Investors who understand how to read the data behind these trends will have a significant edge over others.

✅ Final Thoughts

Financial analytics is no longer optional in real estate — it’s the new gold standard. Whether you're investing in a single property or managing a large portfolio, your ability to analyze, forecast, and make data-backed decisions can make or break your returns.

If you're looking to enter this high-growth sector or sharpen your edge, consider enrolling in a top-tier investment banking course in Pune. With a solid foundation in financial modeling, deal structuring, and analytics tools, you’ll be well-positioned to thrive in the modern real estate investment landscape.

0 notes

Text

Financial and Banking Application Programming

Financial technology (FinTech) has revolutionized how we manage money, invest, and perform banking operations. For developers, programming financial and banking applications involves a unique set of skills, tools, and compliance considerations. This post explores the essential concepts and technologies behind building secure and robust financial applications.

Types of Financial Applications

Banking Apps: Enable account management, transfers, and payments.

Investment Platforms: Allow users to trade stocks, ETFs, and cryptocurrencies.

Budgeting & Expense Trackers: Help users monitor spending and savings.

Loan Management Systems: Handle loan applications, payments, and interest calculations.

Payment Gateways: Facilitate secure online transactions (e.g., Stripe, PayPal).

Key Features of Financial Software

Security: End-to-end encryption, two-factor authentication (2FA), and fraud detection.

Real-time Data: Updates for balances, transactions, and market prices.

Compliance: Must adhere to financial regulations like PCI DSS, KYC, AML, and GDPR.

Transaction Logging: Transparent, auditable logs for user actions and payments.

Integration: APIs for banking systems, stock markets, and payment processors.

Popular Technologies Used

Frontend: React, Flutter, Angular for responsive and mobile-first interfaces.

Backend: Node.js, Django, .NET, Java (Spring Boot) for high-performance services.

Databases: PostgreSQL, MongoDB, Redis for transaction tracking and caching.

APIs: Plaid, Yodlee, Open Banking APIs for data aggregation and bank access.

Security Tools: JWT, OAuth 2.0, TLS encryption, secure token storage.

Basic Architecture of a Banking App

Frontend: User dashboard, transaction view, forms.

API Layer: Handles business logic and authentication.

Database: Stores user profiles, transaction history, account balances.

Integration Services: Connect to payment processors and banking APIs.

Security Layer: Encrypts communication, verifies users, logs events.

Regulatory Compliance

PCI DSS: Payment Card Industry Data Security Standard.

KYC: Know Your Customer procedures for identity verification.

AML: Anti-Money Laundering laws and automated detection.

GDPR: Ensures data protection for EU citizens.

SOX: U.S. Sarbanes-Oxley Act compliance for financial reporting.

Sample: Python Code to Fetch Transactions (Plaid API)

import plaid from plaid.api import plaid_api from plaid.model import TransactionsGetRequest client = plaid_api.PlaidApi(plaid.Configuration( host=plaid.Environment.Sandbox, api_key={'clientId': 'your_client_id', 'secret': 'your_secret'} )) request = TransactionsGetRequest( access_token='access-sandbox-123abc', start_date='2024-01-01', end_date='2024-04-01' ) response = client.transactions_get(request) print(response.to_dict())

Best Practices for FinTech Development

Always encrypt sensitive data at rest and in transit.

Use tokenization for storing financial credentials.

Perform regular security audits and penetration testing.

Use test environments and sandboxes before live deployment.

Stay updated with financial laws and API updates.

Conclusion

Financial and banking software development is a specialized domain that requires technical precision, regulatory awareness, and security-first design. With proper tools and best practices, developers can build impactful financial applications that empower users and institutions alike.

0 notes

Text

Python Calculator and Scientific Calculator: A Powerful Tool for Everyday and Advanced Calculations

In today’s digital world, calculators are essential tools for students, engineers, data analysts, and scientists. While basic calculators help with simple arithmetic, python calculator offer advanced features for solving complex equations, performing trigonometric functions, and handling large datasets. With Python, you can build both a basic calculator and a scientific calculator, leveraging its powerful libraries and ease of use.

Why Use Python for Calculator Development?

Python is a versatile programming language that makes it easy to create interactive, GUI-based, and command-line calculators. With libraries like Tkinter, PyQt, NumPy, and SymPy, users can design feature-rich scientific calculators that handle advanced mathematical computations, including calculus, algebra, and matrix operations.

Building a Basic Python Calculator

A simple Python calculator can perform basic arithmetic operations such as addition, subtraction, multiplication, and division.

Building a Python Scientific Calculator

A scientific calculator extends the functionality of a basic calculator by including:

Trigonometric Functions – sin, cos, tan, etc.Logarithms & Exponentiation – log, e^x, power functions.Factorials & Permutations – Useful in probability and combinatorics.Matrix & Linear Algebra Calculations – For advanced engineering and data science applications.

Creating a GUI-Based Python Calculator

For a more user-friendly experience, Python allows Graphical User Interface (GUI) calculators using Tkinter or PyQt. A GUI-based calculator provides buttons for operations, an interactive display, and real-time calculations.

Features of a Python GUI Calculator

Interactive Buttons for Arithmetic & Scientific FunctionsUser Input via On-Screen KeypadLive Display of Results

Applications of Python Calculators

Python-based calculators are widely used in:

Educational Institutions – Teaching students mathematical concepts and problem-solving.Scientific Research – Performing complex computations in physics, chemistry, and engineering.Finance & Business – Calculating interest rates, loan repayments, and statistical analysis.Engineering & Data Science – Solving matrix equations, calculus, and machine learning algorithms.

Conclusion

Python calculators offer powerful, flexible, and user-friendly solutions for both basic arithmetic and advanced scientific calculations. Whether you need a simple calculator for everyday use or a scientific calculator for complex computations, Python provides all the necessary tools and libraries. With GUI-based implementations, these calculators can be further enhanced to provide interactive and visually appealing solutions.

0 notes

Text

Why Financial Professionals Need Data Analytics Skills to Stay Competitive

In today's fast-paced financial landscape, professionals must do more than just analyze balance sheets and forecast revenues. The rise of big data, artificial intelligence (AI), and machine learning (ML) has transformed how financial decisions are made. Financial professionals who integrate data analytics into their skill set gain a competitive edge, enabling them to make faster, data-driven decisions and stay relevant in an evolving industry.

1. Data-Driven Decision Making

Traditional financial analysis often relied on historical trends and manual calculations. With data analytics, professionals can process vast amounts of structured and unstructured data to uncover patterns, identify risks, and make more informed decisions. This improves accuracy and reduces uncertainty in financial forecasting, investment strategies, and risk management.

2. Enhanced Risk Management

Financial institutions must assess risks associated with investments, loans, and market fluctuations. Predictive analytics allows professionals to detect fraud, identify credit risks, and anticipate market shifts before they happen. By leveraging machine learning algorithms, financial analysts can mitigate potential losses and improve regulatory compliance.

3. Optimizing Investment Strategies

Investment decisions are no longer based solely on historical performance. Data analytics tools enable real-time market analysis, allowing professionals to react quickly to economic changes. With the help of quantitative models and algorithmic trading, analysts can optimize portfolios and maximize returns more effectively.

4. Personalized Financial Services

The rise of fintech and digital banking has increased the demand for personalized financial services. Data analytics helps professionals understand customer behavior, spending patterns, and investment preferences to tailor financial solutions accordingly. This improves client retention and helps firms stand out in a competitive market.

5. Regulatory Compliance and Fraud Detection

With financial regulations becoming more stringent, compliance is a top priority for organizations. AI-powered analytics tools help professionals monitor transactions in real time, flagging suspicious activities and reducing compliance risks. This is particularly crucial in anti-money laundering (AML) and fraud detection efforts.

6. The Growing Demand for Data-Savvy Finance Professionals

Companies now seek financial experts with strong data analytics skills, such as proficiency in Python, SQL, R, and data visualization tools like Power BI and Tableau. Financial professionals who upskill in these areas have a significant advantage in the job market.

Conclusion

As the financial industry becomes increasingly data-driven, professionals who fail to adapt may find themselves at a disadvantage. An MSc in Data Analytics and Finance equips professionals with the necessary skills to analyze complex data, make strategic decisions, and drive business success. Whether working in investment banking, risk management, or corporate finance, mastering data analytics is no longer optional—it’s essential for career growth and long-term success.

0 notes

Text

How to Leverage Flash Loans for Crypto Arbitrage Trading

Cryptocurrency arbitrage trading is a popular strategy where traders exploit price differences of the same asset on different exchanges. With the introduction of flash loans, this method has become even more efficient and profitable. Flash loans, which allow for instant, unsecured borrowing of assets within a single transaction, have revolutionized the crypto trading landscape. In this blog, we'll explore how to leverage flash loans for crypto arbitrage trading and delve into the development of a flash loan arbitrage bot.

What is Flash Loans

Flash loans are a unique feature in the decentralized finance (DeFi) space, primarily offered by platforms like Aave and dYdX. In contrast to conventional loans, flash loans do not demand collateral. Instead, they operate under the condition that the borrowed amount must be returned within the same transaction block. If the borrower fails to do so, the transaction is reversed, and no funds are lost. This feature makes flash loans an ideal tool for arbitrage opportunities.

The Basics of Crypto Arbitrage Trading

Arbitrage trading involves buying an asset at a lower price on one exchange and selling it at a higher price on another. The price difference between exchanges can arise due to various factors, including liquidity differences, trading volumes, and market inefficiencies. Traditionally, arbitrage trading demanded substantial capital and was a time-intensive process. However, with the advent of flash loans, traders can now execute these trades almost instantaneously and with minimal capital.

Leveraging Flash Loans for Arbitrage

1. Identify Arbitrage Opportunities:

The first step in leveraging flash loans for arbitrage is to identify profitable opportunities. This involves continuously monitoring different exchanges to spot price discrepancies for the same asset. Automated tools and bots can be used to scan multiple exchanges in real time.

2. Execute the Flash Loan:

Once an arbitrage opportunity is identified, a flash loan can be taken out to borrow the necessary funds. Since flash loans do not require collateral and must be repaid within the same transaction, they provide a risk-free way to obtain the capital needed for the trade.

3. Perform the Arbitrage Trade:

With the borrowed funds, buy the asset at the lower price on one exchange and sell it at the higher price on another. The profit from the trade should be sufficient to cover the transaction fees and the loan repayment.

4. Repay the Flash Loan:

After the arbitrage trade is completed, repay the flash loan within the same transaction. Any remaining profit after repaying the loan is yours to keep.

Developing a Flashloan Arbitrage Bot

To fully capitalize on flash loan opportunities, developing a flash loan arbitrage bot is essential. A well-designed bot can automate the entire process, from identifying arbitrage opportunities to executing trades and repaying loans. Here are the key steps in developing such a bot:

1. Choose a Programming Language:

Popular programming languages for developing trading bots include Python, JavaScript, and Solidity (for Ethereum smart contracts).

2. Set Up API Access:

Integrate APIs from various exchanges to enable real-time price monitoring and trade execution. Exchanges like Binance, Coinbase, and Kraken provide developers with API access.

3. Implement Arbitrage Logic:

Develop algorithms to scan for price discrepancies across multiple exchanges. The bot should be able to identify profitable opportunities and calculate potential profits quickly.

4. Integrate Flash Loan Protocols:

Connect the bot to DeFi platforms offering flash loans, such as Aave or dYdX. Ensure the bot can initiate and repay flash loans within a single transaction.

5. Test and Optimize:

Rigorously test the bot in a simulated trading environment to ensure it functions correctly and efficiently. Optimize the algorithms and trading strategies to maximize profits.

6. Deploy and Monitor:

Once the bot is fully developed and tested, deploy it in a live trading environment. Continuously monitor its performance and make necessary adjustments to adapt to changing market conditions.

Conclusion

Flash loans have opened up new possibilities for crypto arbitrage trading, enabling traders to capitalize on price discrepancies with minimal risk and capital. By developing a flash loan arbitrage bot, traders can automate the process and maximize their profits. As with any trading strategy, it's important to conduct thorough research, test extensively, and stay updated on market trends and developments.

By leveraging flash loans and advanced trading bots, you can stay ahead in the competitive world of cryptocurrency trading and unlock new avenues for profit.

If you need more help with Flashloan Arbitrage Bot development or want to learn more about Crypto Arbitrage Trading Bot with Flashloans, feel free to contact us. Our experts are here to help you learn the ins and outs of this innovative trading strategy.

#flash loan arbitrage bot development#crypto flash loan arbitrage bot development#crypto flash loan arbitrage bot

0 notes

Text

The Auto-disputer: the single most important barrier Tellor has from hacks and attacks to customers and their funds.

link to source code

[[MORE]]

Why did I build this?

When I worked at Tellor, we arrived at a situation where we were adding lots of data to our on-chain database, but we were not monitoring the quality of the data. Our customers relied on the accuracy of our data because our data secured their smart contracts and customer funds.

What did I build?

The founders of Tellor tasked me with building a python CLI tool that would evaluate the accuracy of on-chain data as it was added, in real time. This tool was required to send text alerts to a user-provided phone number in case the monitor detected bad data. The tool was also required to remove bad data in real time by sending an Ethereum transaction. The tool was originally called the "Disputable Values Monitor", but we renamed it the "Auto-disputer".

How does it work?

First, the Auto-disputer uses the web3.py library and an RPC connection to an Ethereum node to retrieve new data from the Tellor contract in real time. When the Auto-disputer picks up a new datapoint, it compares the found value to a reference calculation for that datapoint.

In order to auto-dispute, users need to define what a "disputable value" is. To do this, users can set "thresholds" for feeds they want to monitor. Thresholds in the auto-disputer serve to set cutoffs between a healthy value and a disputable value. The Auto-disputer supports three types of thresholds: range, percentage, and equality.

What were the results?

On completion, the Auto-disputer immediately found users. Customers of Tellor, Liquity and Liquid Loans, began to manage their own instances of the Auto-disputer in order to protect their protocols and their customer funds. In other words, the Auto-disputer is the single most important barrier Tellor has from hacks and attacks to customers and their funds.

1 note

·

View note

Text

Enhancing Financial Services with Python Development

Python's adaptability and dynamism have made it indispensable for financial institutions, revolutionizing their operations, data analysis, and solution development. Tailored Python development services are pivotal, enabling streamlined operations, effective data analysis, and informed decision-making.

As a top global Python development company, Fidel offers specialized outsourced services across a broad range of Python solutions for the finance industry. Leveraging Python's robust capabilities, we excel in crafting advanced AI-ML applications. Explore our Python-powered AI-ML development services for deeper insights.

Introduction to Python in Finance

Python's dominance in finance stems from its simplicity, readability, and extensive libraries designed for data analysis, machine learning, and financial modeling. Its open-source nature fosters collaboration, nurturing a vibrant ecosystem of tools and frameworks. Consequently, Python has become the preferred language for various financial applications, ranging from algorithmic trading to risk management.

Python's Role in Financial Risk Management

Python plays a pivotal role in financial risk management, offering robust solutions across various aspects:

Data Analysis and Visualization: Python's libraries like pandas, NumPy, and Matplotlib enable thorough exploration of financial data, unveiling patterns and visualizing risk metrics for deeper insights.

Risk Modeling and Simulation: Python facilitates the development of advanced risk models and simulation techniques such as Monte Carlo simulations, aiding in effective quantification and assessment of diverse risk types.

VaR (Value at Risk) Calculation: Python enables VaR calculation using libraries like QuantLib and riskparityportfolio, allowing organizations to measure market risk with diverse methodologies, thus enhancing risk management strategies.

Credit Risk Modeling: Python equips institutions with tools for modeling credit risk, enabling assessment of default likelihood for borrowers or loan portfolios through libraries like scikit-learn and TensorFlow, supporting machine learning models for credit scoring and portfolio optimization.

Regulatory Compliance and Reporting: Python streamlines regulatory compliance and reporting by automating data management, analysis, and reporting tasks, facilitating efficient generation of regulatory reports such as stress testing results and risk disclosures.

Python development services offer significant benefits for the finance sector:

Flexibility and Scalability: Python's adaptability allows institutions to swiftly respond to market changes and scale solutions to meet evolving demands. Its extensive library ecosystem and integration support simplify the development of scalable financial applications.

Rapid Prototyping: Python's concise syntax and interactive development environment enable rapid prototyping of financial solutions. This fosters agility in experimentation and idea iteration, expediting time-to-market for new products and services.

Cost-Efficiency: Being open-source, Python offers substantial cost savings compared to proprietary alternatives. Its vibrant community provides free resources, reducing development and maintenance costs.

Robust Ecosystem: Python's rich library and framework ecosystem tailored for finance simplifies development, enhancing productivity. Developers can leverage pre-built components and best practices to accelerate development cycles.

Interoperability: Python's seamless integration capabilities facilitate interoperability with existing finance sector technologies, allowing organizations to leverage their infrastructure while benefiting from Python's innovation and efficiency gains.

In conclusion, Python development services drive innovation, efficiency, and competitiveness in finance, empowering institutions to seize opportunities and deliver value in a digital, data-driven landscape. Embracing Python positions organizations for success with strategic implementation and expertise.

0 notes

Text

7 Practical Steps to Overcoming Student Loan Debt: A Comprehensive Guide

Student loan debt has become a significant financial burden for many individuals pursuing higher education. It's crucial to address this issue head-on and develop a step-by-step approach to overcome student loan debt. In this article, we will guide you through practical steps and strategies that can help you regain control of your finances and work towards becoming debt-free. Let's dive in!

Understanding Your Student Loan Debt

Unlock the Secrets of Forex Trading: Discover a Free, Yet Powerful Learning Course at ForexFinanceTips.com Firstly, it's important to understand the nature of your student loan debt. There are different types of student loans, including federal and private loans, each with its terms and conditions. Begin by calculating your total loan amount, including principal and accrued interest. Review the interest rates and repayment terms for each loan, as this will influence your repayment strategy.

Step 1: Organizing Your Student Loan Information

To effectively manage your student loans, gather all relevant loan documents and create a spreadsheet or loan tracker. This will help you keep track of loan balances, interest rates, and payment due dates. Additionally, ensure you have contact information for your loan servicers, as you may need to communicate with them regarding your repayment plan.

Step 2: Assessing Your Financial Situation

Learn Python Coding and Django Web Development, 100% Course, Easy to navigate and complete learning road map at dtlpl.com Evaluate your income and expenses to gain a clear understanding of your financial situation. Identify areas where you can reduce expenses or save money to allocate more towards loan repayment. By creating a realistic budget, you can determine how much you can afford to pay toward your student loans each month.

Step 3: Exploring Repayment Options

Explore the various repayment options available for your student loans. Federal loan repayment plans such as income-driven repayment or extended repayment plans can provide flexibility based on your income and financial circumstances. Additionally, consider loan consolidation or refinancing options to potentially lower your interest rates or streamline your repayment process.

Step 4: Developing a Repayment Strategy

Developing a repayment strategy is crucial to tackling your student loan debt effectively. Prioritize your loans based on either interest rates or balances, depending on your preference. Two common approaches are the snowball method, where you pay off smaller balances first, or the avalanche method, where you prioritize higher interest rate loans. Choose the strategy that aligns best with your financial goals.

Step 5: Seeking Loan Forgiveness or Assistance Programs

Research and determine if you qualify for any loan forgiveness programs or assistance programs, such as the Public Service Loan Forgiveness program. These programs can potentially reduce or eliminate a portion of your student loan debt if you meet specific criteria. Understand the requirements and application process for each program to take advantage of available opportunities.

Step 6: Making Extra Payments and Accelerating Debt Payoff

Consider making extra payments towards your student loans whenever possible. Even small additional payments can make a significant impact on reducing your overall debt. Use windfalls or unexpected income, such as tax refunds or bonuses, to make lump sum payments. Track your progress and stay motivated by witnessing the gradual decrease in your loan balance.

Step 7: Staying on Track and Avoiding Default

If you have a Dog, Cat, Bird, or any Pet at home, The Most Informative Pet Blog NiceFarming.com To ensure you stay on track with your student loan payments, set up automatic payments or reminders. This will help you avoid missing due dates and incurring unnecessary fees or penalties. In case you encounter financial hardship, reach out to your loan servicers to explore alternative repayment options or forbearance/deferment options to prevent defaulting on your loans.

Frequently Asked Questions

Q: Can I negotiate the terms of my student loan repayment? - Generally, federal student loans have fixed repayment terms. However, you can contact your loan servicer to discuss any temporary financial hardships or explore alternative payment plans. Q: Is it possible to discharge student loan debt in bankruptcy? - While it's challenging, it is possible to discharge student loan debt through bankruptcy, but it requires proving undue hardship in court. Q: Should I consider refinancing my student loans? - Refinancing your student loans can be a viable option if you have good credit and can secure a lower interest rate. However, it's important to carefully evaluate the terms and potential loss of federal loan benefits before refinancing.

Conclusion of Overcoming Student Loan Debt

Overcoming student loan debt is a journey that requires perseverance and a strategic approach. By understanding your loans, organizing your information, and assessing your financial situation, you can develop a repayment strategy that suits your needs. Explore repayment options, consider loan forgiveness programs, and make extra payments whenever possible. Remember, progress takes time, but with determination and discipline, you can successfully conquer your student loan debt and achieve financial freedom. We hope this article has provided you with valuable insights and guidance. If you have any further questions or would like to share your own experiences and tips, please feel free to leave a comment below. Together, let's empower each other on the path to a debt-free future. Read the full article

0 notes

Text

Sankhyiki: Best IIT Jam Coaching In Delhi

Sankhyiki are best at their following offers such,

Sankhyiki is a supreme educational institute that offers courses like Actuarial Science, IIT-JAM, CSIR-NET/JRF, GATE in (mathematics and statistics), and Data Science (R and Python). They help individuals to develop their career options in such a learning environment through face-to-face and direct-to-home (DTH) video classes for each course.

For exam preparation is by providing them plenty of time for practice and revision.udents just in case of missed classes and on-demand doubt sessions to make sure each module is completed before the exam. Sankhyiki prepares students for exams and helps them for every circumstance so the student can keep their studies on track. The convenience of studying with them is the best as they schedule classrooms in a suitable way for all students.

You can find a long list of students that have successfully qualified exams including, all India subject toppers. Students stay worry-free with sankhyiki as they are always ready to help students in study technique, profession, and time management queries. They follow a supreme approach of leveraging content, technology, marketing, and services to offer quality education in partnership with corporate & academics for a rigorous & industry program.

They aimed to provide quality education to offer better future and career goals to every individual. They work with a core principle of conducting themselves with honesty and ethics to prepare for every opportunity. They are committed to providing quality content, assessment tools, and educational services in all possible media.

Classroom training, in which they teach students by face-to-face tutorials at several locations across cities.

DTH classes make studying convenient for students in which they can take tutorials at their home comfort through HD quality videos; no need to have an internet connection.

Corporate training offers corporate training programs.

Courses sankhyiki offers:

Actuarial Science

IIT JAM(Maths & Statistics)

NET/JRF & GATE Maths

Data Science

BIMANKIK

DTH Classes

Actuarial Science:

Actuarial science involves the study of evaluating risks and maintaining the economic stability of insurance or financial corporations. Students of Actuarial science learn using Mathematics, Statistics, and Probability principles for anticipating future financial events and measures to be taken accordingly. Actuarial Science aims to have the knowledge to perform an actuary job. They analyze past data and use it in determining how much money should be set aside to cover financial losses that can occur in the future.

The prime challenge that every actuary faces is when they didn’t get any past data or the data is not relevant to use in a particular situation.

The Exam of Actuarial Science is no doubt difficult and requires intense preparation to pass the exam. Many students take 7-10 years to pass all the exams; the exam is of 3-5 hours and involves MCQ and written answers both. An actuary can work as an actuary assistant or junior analyst in its initial stage of career.

IIT JAM(Maths & Statistics):

Joint admission test is an M.Sc. (JAM) conducted by the Indian Institute of Technology (IITs) for further admission in Ph.D. degree programs at IISc, Bangalore, and M.Sc(two years), Joint M.Sc.- Ph.D. dual degree, Joint M.Sc- M.tech, M.Sc- M.S.(research)/Ph.D dual degree and other Post Bachelor’s degree programs at IITs.

The exam is conducted to consolidate Science as a career option for better future opportunities worldwide. The academic environment, interdisciplinary interaction, and research infrastructure at Sankhyiki motivate the students to pursue their careers not only in research and development but in interdisciplinary areas of science and technology too. The weightage of mathematics and statistics in IIT JAM is 40% and 60%.

NET/JRF & GATE Maths:

NET/JRF exam is a reputed exam for higher studies and teaching, Stands for the National Eligibility Test for Lectureship in Indian Universities and Colleges. A test score is compulsory for all aspirants who are willing to pursue a career as an assistant professor in universities and colleges across India. JRF (Junior Research fellow) is a way of getting admission to a Ph.D. if you want to go for research.

Exams conducted by CSIR will get the NET-JRF after you can apply for admission to Ph.D. programs.

Data science:

Data science involves different tools, algorithms, and machine learning with the motive to discover hidden patterns from the available raw data. It is a field that gives insights from structured and unstructured data by using various scientific methods and algorithms to help in generating insights, making predictions, and devising data-driven solutions. Data science uses various large amounts of data to get relevant insights through statistics and computation for decision-making. Data used in data science is generally extracted from different sources i.e. E-commerce sites, social media, survey reports, etc. access to the data is possible only because of advanced technology.

The extracted data helps in making predictions and generating profits for the corporation. Data Scientist is considered as one of the demanded career fields as per the survey.

BIMANKIK

A course of Excel, VBA, and R for Actuarial aspirants; at Sankhyiki students get training for the same. As per the market demand, they have analyzed that companies need people who have a great knowledge of Excel as many actuarial/ insurance corporations work on excel.

They have created the Curriculum in a way that it caters to the requirements of the actuarial aspirants and therefore the learning accompanied through CAPSTONE PROJECTS which make a student ready for the big day.

At Sankhyiki, learning includes loan calculators, Data Visualization, Exploratory Data Analysis, Understanding Statistics, and Application in the field of insurance with Actuarial case studies i.e., Run of Triangles, Computing cash flows, Running Regressions, and making predictions.

1 note

·

View note

Text

Acumen Wealth Advisors

net worth The Best Interest is a private weblog meant for leisure functions only. Yeah, Social Security actually has the potential to be a fantastic safety internet or addendum to your retirement funds.

Most individuals not at or close to retirement don’t realize Social Security has such a wide range of value relying in your work history. In my case I paid the max attainable quantity into Social Security for each one of many 35 years required to get the utmost profit.

That means my wife and I will obtain $66k after we begin taking it at age 70. That’s enough for a reasonably comfy retirement by itself.

In basic, methods that require above-average effort in order to get hold of ubiquitous objectives (e.g. to satisfy instructed net price thresholds for retirement) are bad methods. For instance, Philadelphia has an index of sixty two, which is 10% greater than 56.

If a Philly resident is using today’s knowledge for retirement planning, they should consider including 10% to all of the knowledge points. We’ve lined how inflation and earnings can have an effect on your interpretations of those outcomes.

While a $1 million internet price is commonly coveted in in style tradition, there's no "proper" quantity. Personal Finance Insider writes about merchandise, strategies, and ideas to help you make good selections along with your cash.

We might receive a small commission from our partners, like American Express, however our reporting and proposals are all the time impartial and goal.

We hear so much about “the one p.c” as a reference to wealth. But what does that imply, and who's included in that section? If we’re speaking about internet price, then the top one % means having a household net value of $10.35 million.

But we should also focus on how your price of dwelling can have an effect on these outcomes. In my opinion, sure it does make sense to do this comparison. But it’s only one knowledge point that you should use–not an end-all-be-all.

It’s identical to a young observe athlete evaluating their race instances to record holders. But it offers them a target, an understanding of the hole, a percentage distinction to record for later purposes.

Would you are feeling snug living off of $3160, $2500, or $2230 per 30 days? Let’s start by analyzing this information through the lens of the “4% Rule,” which states that you need to take your annual spending and save ~25x that a lot for retirement.

, and we’ll calculate your private web value — and a whole lot extra. This data may help you analyze your monetary wants. It is based on info and assumptions provided by you relating to your targets, expectations and monetary scenario.

A young couple may have the ability to avoid wasting cash–but then having children will put a dent in their financial savings rates. Next, the monetary aggregation web site The Balance follows an identical formula to Fidelity.

At specific ages, they say, your average internet value should aim for an ever-growing multiple of your salary. Also see our household income percentile calculator, income percentile calculator, and revenue percentile by age calculator.

Net worth is not the be-all and end-all when it comes to monetary health, however it can be a simple and priceless tool for tracking progress towards your monetary goals.

You’ll want to get an accurate image of what your own home is price right now, not what you paid or what you think it’s price. You can gauge market worth by comparing the true property to similar properties in the same neighborhood which have lately been offered or appraised .

These are belongings that are pretty subjective and up to you. But this wealth divide usually starts proper firstly of individuals’s careers, and sometimes by no means closes.

It’s there at age 30, age 40, age 50, age 60…ok, you get it. Total worth is a perform of how much cash is coming by way of the door—simply ask the Federal Reserve.

Wealthier school graduates don’t should battle that python. Without that student loan debt, their common net price will increase rapidly. Your first net price out of school is likely to be adverse.

Many folks wake up 10 years later and find their web worth hasn’t grown. Here, three of the subjective net value targets are all in household.

Fidelity and my Best Interest targets line up very carefully to one another, with the Balance falling 20-30% decrease. At retirement age, it’s about 1/4 to 1/6 of where it “should” be. net worth

1 note

·

View note

Text

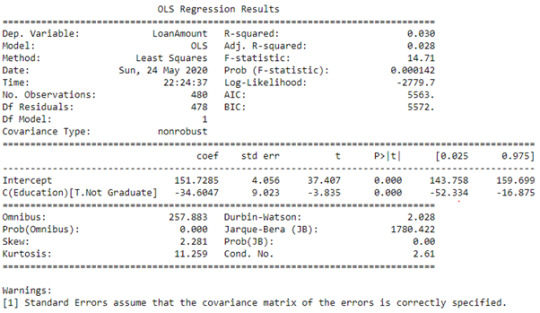

ANOVA Test in Python

Importing required libraries

import os as os import pandas as pd import numpy as np import statsmodels.formula.api as smf import statsmodels.stats.multicomp as multi

Importing Data

df = pd.read_csv('Housing_Data.csv')

The dataset is on loan prediction having customer attributes and the loan outcome

ANOVA problem statement - Checking if Loan Amount is related to Education Qualification

So here Loan Amount is the continuous variable and Education Qualification is Categorical Variable. Education Qualification has only two levels

df_anova_test = df_anova[['Education', 'LoanAmount']]

using ols function for calculating the F-statistic and associated p value

model1 = smf.ols(formula='LoanAmount ~ C(Education)', data=df_anova_test) results1 = model1.fit() print (results1.summary())

So here the p value is 0.000142 and it is < 0.05 (Significance Level). So we can say that Loan Amount does vary with Education Qualification and there is some association between Education Qualification and Loan Amount. So we reject Null Hypothesis

Comparing Means

df_anova_test.groupby('Education').mean()

So we can the difference of 34 in the means of the two Education levels

ANOVA POST Hoc Testing

Here we will consider categorical variable that has more than two levels. So here the categorical variable would be Property_Area which has three levels and Loan Amount would be the continuous variable

Let us run the ANOVA test first

df_anova_test1 = df_anova[['Property_Area', 'LoanAmount']]

Using ols function for calculating the F-statistic and associated p value

model1 = smf.ols(formula='LoanAmount ~ C(Property_Area)', data=df_anova_test1)

results1 = model1.fit() print (results1.summary())

So here p-value < 0.05 and we can say that there is some association between Property Area and Loan Amount. So we reject NULL Hypothesis

Let us perform Post Hoc Test and check on Type I error. So let us perform this by using Tukey HSD test

mc1 = multi.MultiComparison(df_anova_test1['LoanAmount'], df_anova_test1['Property_Area'])

res1 = mc1.tukeyhsd() print(res1.summary())

Here the last column indicates which categories of the variables are significant. So True means we can reject NULL Hypothesis and can say that Loan Amount for Rural is very different from Urban. But there is no association between the Loan Amounts of Rural & Semi Urban and Semiurban & Urban

1 note

·

View note

Text

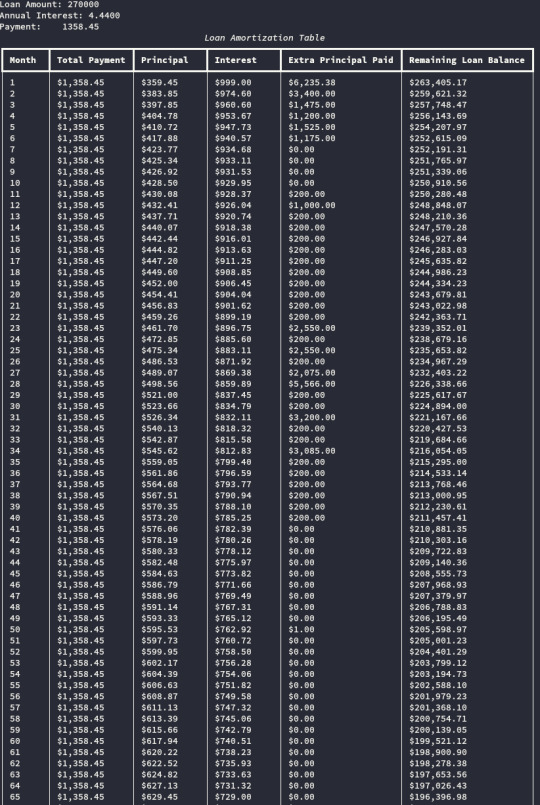

Programming Update: Aug

August was a programming-filled month for me. It focused entirely on Python and I mostly continued working on established projects. Let’s jump in! Amortization I wanted to re-calculate the amortization table for my home loan for the first time in about a year. As a refresher, I created this program (vs using Excel or an online form) because we are not consistent in the amount of extra principal…

View On WordPress

0 notes

Text

Data Science Certification Coaching Course In Hyderabad

And if these instrument operations have obligatory tasks to finish, that’s indeed better. You can begin to construct your portfolio of data wisdom tasks before ever touching a job. Learn this instigative department of Artificial Intelligence with a program featuring 58 hrs of Applied Learning, interactive labs, 4 hands- on enterprise, and mentoring. With our Machine Learning instrument training, master Machine Learning generalities needed for a Machine studying instrument. This Machine Learning on- line coaching will give you the best demand to become a successful Machine Learning mastermind right now.

The focus has been to insure range throughout varied degrees and disciplines of training. Once you admit a suggestion of admission, the admission plan might be at your aid in making use of loans. The campaigners would be needed to convey their own laptops whereas the technology provision shall be participated through the time of registration.

No matter which area you might be in Hyderabad, be it Madhapur, Vijay Nagar Colony, Banjara Hills, Up confidante, Begumpet, Sanjeeb Reddy Nagar, Moosapet, Kutkatpally anywhere. You can enter our Data Science course on- line sitting at the house or office. This service will be energetic for an interval of six months out of your instrument date.

After the end of the session, I was glad to fix the Data Science program. The mentorship by way of business stagers and scholar instructors makes the program extremely sharing. We present an IBM Certified Data Science course for corporates by advisers , which helps businesses to strengthen and reap big benefits.

This module will give you a deep understanding of exploring data sets exercising Pandas. Pandas Pandas can also be one of the considerably used Python libraries. NumPy This module will give you a deep understanding of exploring data units exercising NumPy.

We give multiple openings and live systems for our council scholars which makes our Data Science mecca one of the stylish training institutes in Hyderabad. Our Data Science Certification includes specific deliverables and pretensions which help in addressing the objects and in addition problem working at ease. Still, if one has a deep curiosity in computation and statistics also they can at each time go for the course. Learn Tensor circulate that will help you study different calculation libraries and use them accessible for colourful programming in Data Science and data move.

This Tableau instrument course helps you grasp Tableau Desktop, a world-wide employed information visualisation, reporting, and enterprise intelligence device. Advance your career in analytics by studying Tableau and how to best use this training in your work. Indeed as numerous Data Scientists examine and dissect huge datasets for working an issue, Data Science is redundant about producing a complicated model that can spark a large impact in the area of your work. A Data Scientist isn't just a data cruncher but he is also an issue solver, he's a strategist who discovers the most effective plan that matches your small business problem. The utmost of the nebulous issues in several sectors have been answered by the operation of the styles of data wisdom.

Yes, you will get devoted placement backing each through the course. This program comes with exclusive reclamation drives, renew erecting classes, interview medication, profession guidance, and mentorship. Over 150 pots take part in the reclamation process with an 85 common pay envelope hike. “ culmination enterprise gave plenitude of perceptivity about the real life business issues and issues.

They conduct hackathons, quizzes, assignments and mock interviews. Since they're also into enhancement we're also getting access to real- time enterprise. Thanks so much to Innomatix training institute and I surely suggest this to everyone. Data Scientist, with a mean payment of$,480, to discover, dissect, fantasise, and manage data for the businesses. They dissect the complex data sets and processes to search out patterns for choice timber and prognosticate the business and drive strategies.

Keeping in mind the huge demand and the gap in data wisdom, 360DigiTMG commenced the Data Science Training Institute in Hyderabad, India. Also, Data Science is the most enthusiastic career of the century. The Data Science instrument course at 360DigiTMG is acclimatised and curated to suit each non-specialized/ specialised background council scholars and put them at ease whereas literacy. 360DigiTMG assures to supply high- class training to all the scholars with our advanced ways and tools. The Course modules have been designed with a specific purpose of creating the job acquainted course surroundings for literacy. Both R and Python have multitudinous purposes in Data Science and can be employed for any Data Science task.

As part of this module, find out about one other Deep literacy algorithm SVM which is also a black box fashion. SVM is about creating boundaries for classifying data in multidimensional spaces. These boundaries are pertained to as hyperplanes which may be direct or non-linear boundaries which insulate the classes to the most margin possible. Learn about kernel tips mileage to convert the data into high dimensional areas to categorise the non-linear spaces into linearly divisible knowledge. The Boosting algorithms AdaBoost and Extreme Gradient Boosting are mentioned as part of this durability module You may indeed study mounding strategies.

This motivates us to concentrate on the issue of lowering the power purchase costs to drop the price burden on authorities and force better subventions to meritorious guests. In the present examination, energy buy optimization mannequin was examined on the information and validated the chances of cost mincing and fiscal savings in long term energy buy contracts. also authors are reasoning pricing strategy for electricity requests exercising Non- Cooperative Game Theory generalities. The course charges of Data Science range between INR to INR roughly. A lot of Data Science institutes also allow the campaigners to make the cost in inaugurations.

The coming module is Machine literacy that can educate us all of the Machine Learning strategies from scrape, and the popularly used Classical ML algorithms that fall in every of the orders. In the coming module, you will study everything you have to find out about all of the statistical strategies used for decision making on this Data wisdom PG course. Summary statistics In this module, you will find out about colourful statistical formulas and apply them using Python. The class has been designed by a council from 360DigiTMG and is extremely expert and deeply educated. The Indian government has initiated several Data Science systems within the fields of Agriculture, Electricity, Water, Healthcare, Education, Road Traffic Safety and Air Pollution.

The Government of India has initiated several Data Science analysis enterprises as well. The high sectors creating presumably the utmost Data Science jobs are BFSI, Energy, Pharmaceutical, Healthcare,E-commerce, Media, and Retail. The maximum demand for Data Scientists is in the Metros metropolises like Delhi- NCR and Mumbai. Its demand can be caught up in rising metropolises like Hyderabad and Bangalore. We present the finish to end course with placement help after the externship is over.

data science online training in hyderabad

The program may be veritably nicely structured and a super combination of proposition and hands- on practice. “ Thanks to the DSE program at 360DigiTMG, I got 2 job offers, one from DXC Technology and one other from Razorthink. This program is a perfect blend of both star and hands- on operations. Taking this course to upskill myself was top- of- the- line opinions I ’ve made. Learn from main academicians within the area of Data Science and Engineering and colourful other educated assiduity interpreters from top organisations. Text bracket, Document vectors, Text bracket using Doc2vec In this module, you will be tutored much more about Text Bracket and Document Vectors using Doc2vec.

The coaches of the Data Science course are the assistant's main specialists who have 15 times of experience. They hail from transnational companies like Microsoft, Google, L&T, Cognizant, etc. The coaches listed under are the backbone of the Data Science training sect. Any graduate or postgraduate who is keen about making machines as people exercising logical and logical chops can be the stylish seeker for the Data Science coaching. colourful purposes like Iphone Siri, Amazon Alexa, Google Hunt, Mobile Games, Uber and Facebook are exercising operations of Data Science and hence the demand. The complexity between inordinate demand and give holes is contributing to grim stalking for Data Scientists because the provision is at bare minimum.

The PG Data Science course is permissible for campaigners in their ultimate semester and contemporary graduates with 0- 3 times of experience. campaigners should retain a combination of 60 or over in Xth, XIIth, and Maids. A force letter will be rolled out to choose many campaigners.

For more information

360DigiTMG - Data Analytics, Data Science Course Training Hyderabad

Address - 2-56/2/19, 3rd floor,, Vijaya towers, near Meridian school,, Ayyappa Society Rd, Madhapur,, Hyderabad, Telangana 500081

099899 94319

https://g.page/Best-Data-Science

0 notes

Text

PG Data Science

What Are The Prerequisite Skills Required To Become An Information Scientist In 2019?

Data Extraction is the foremost and principal step in information science, making SQL an important tool. SQL is the most important programming language required for Data Science. It is a database question language which implies that it's used to retrieve data from databases.

Many corporations have began using Hadoop-as-a-Service so knowledge scientists needn't have in-depth working information of Hadoop. R is the most well-liked tool for knowledge science aspirants and skilled knowledge scientists alike. R is custom-made to develop statistical models for analyzing large amount of information. While R is a superb tool for complicated statistical drawback, it has the issue of a steep learning curve, making it troublesome for newbies.

Microsoft Excel is widely used for information analysis, creating spreadsheets, visualization and sophisticated calculations. It will educate you the basics of information analysis and tips on how to interface with tables.

It may also allow you to to understand descriptive statistics through its visualization skills. While it has been in existence for many a long time, its formal name was ‘Statistics’ and the Data Scientist was known as ‘Statistician’. This statistics powers the automotive and gives it the flexibility to process all the information that comes alongside the way in which.

Release your Data Science tasks faster and get simply-in-time studying. In this data science project, you will work with German credit score dataset using classification strategies like Decision Tree, Neural Networks and so on to classify mortgage applications utilizing R. In this data science project, you will predict debtors chance of defaulting on credit score loans by building a credit score rating prediction model. There are two really necessary subjects of mathematics that one should know earlier than getting into Data Science & Machine Learning. While the depth of mathematics could appear daunting at first, however if you use the proper strategy by way of the sensible implementation of maths, it may be quite enjoyable!

Click here to know more about Data Science Course in Bangalore

Overall, for newbies who are studying how to deal with data, Excel can be a good start. Linear algebra is central to all of the matters of Mathematics, and within the case of Data Science, Linear Algebra types the core spine of Machine Learning. Various machine learning subjects like pc imaginative and prescient and pure language processing rely heavily on Linear Algebra. Normal Distribution, also called Gaussian Distribution is a representation of huge samples of information in a plot. It is a distribution of the values of a variable utilizing a chance operate. In a traditional distribution, there's a symmetric bell-shaped curve where the observations cluster at a central peak the place they represent common or mean.

But nowadays anybody can purchase these skills if one is dedicated to it. The solely challenge is to seek out out what skills to be taught and from where to study. As extra corporations become knowledge-driven, professionals skilled in data science must maintain updating their abilities based mostly on the current business’s demand. A NASSCOM report estimates that the info analytics sector shall be in an rebellion stage to $16 billion by 2025. Thus, extra organizations will, due to this fact, search for knowledge professionals, growing the demand considerably. Skilled candidates in a knowledge subject corresponding to data scientists and knowledge engineers will increase by 40% by 2020. Most of the information scientist’s time is spent in writing SQL and associated scripts.

In order to turn into a proficient Data Scientist, it is a must that you learn R. It is also in style due to its code-readability and an easy studying curve. This implies that it is a perfect programming language for newbies. Python is an interpreter based language because it interprets the Python code line by line.

Navigate to:

360DigiTMG - Data Science, Data Scientist Course Training in Bangalore

Address: No 23, 2nd Floor, 9th Main Rd, 22nd Cross Rd, 7th Sector, HSR Layout, Bengaluru, Karnataka 560102

Phone no: 1800212654321

Visit on map Data Science Course

0 notes