#cash app closed my account for no reason

Text

How to Reopen a Cash App Account Closed? Here are 5 Simple Steps?

If your Cash App account closed it can be a very frustrating experience. There are various reasons why Cash App can close your account. These reasons range from scamming to violation of Cash App terms of service. Here are some reasons due to which Cash App can close your account:

The reason why your Cash App account is closed is that you have failed to pay back the borrowed money. Cash App's anti-money laundering scheme is designed to stop people from stealing or misusing your funds. This is why it's important to check your account balance regularly. You can also add money to your account to clear the dues.

It's also possible to receive an email from Cash App saying that your account has been closed. The company isn't always sure why your account has been flagged, and they won't explain the situation.

If you've forgotten your login credentials, you can call Cash App's customer support, and they can give you a sign-in code. After that, you'll need to view your account's balance. You can also recover your login information by sending an email.

If you've been flagged for an unethical or fraudulent reason, you should contact Cash App customer support and explain the situation. You may be able to plead with customer support to reopen your account. The representative will verify your identity and account information. Once you provide the proper information, your account should be reopened. You can also try creating a new account.

How to Find Out Why Cash App Closed My Account For No Reason?

Despite the wide acceptance of Cash App, hundreds of accounts are closed weekly. Luckily, there are several steps to reclaim your money and your data. Getting your Cash App account back can be as simple as a few minutes of your time.

First, you need to make sure your account is legitimate. This can be done by verifying your email address and phone number. Also, you need to ensure you are not violating Cash App’s terms of service.

Next, you need to check out your balance. You might be surprised by how much money you have in your account. You might also want to check your password. You can get a new one if you have forgotten it by contacting Cash App’s customer support department.

If you have a Cash App account, you should know that the company is acting against suspicious activity. You may be required to use a different digital bank to receive your money, or you might be required to sell stocks or BTC to keep your account open

You can ask Cash App’s customer support team to unban your account. You might also recover your account by logging into it using your registered email address.

The best way to get your money back is to know why Cash App closed my account in the first place. You can get a complete explanation by visiting the Cash App’s support page or calling the company’s customer support department.

What Happens If Cash App Closes Your Account?

There are several reasons why your Cash App account closed with money. Some are more obvious, like having incorrect information on your account. Other less obvious reasons include trying to log into your account using multiple devices or repeatedly typing in an incorrect password. The best way to avoid this issue is to create an up-to-date profile. This includes a valid email address, phone number, and mobile number. You can add an alternative digital bank to your profile, similar to a checkbook or credit card.

Trying to log into your Cash App account and getting an error message is probably the first thing that pops your mind. But this doesn’t mean that your Cash App experience is over. If you want to restore your account, you must do some homework. You’ll then need to complete a verification process, which takes a few minutes. Once you’ve passed that, you’ll have access to your funds within one to three business days.

You might want to try resetting your password or resetting it to a simpler, less complex one. You might try contacting a cash app help centre if you have trouble with this. The first step is to contact customer support. You will need to provide proof of identity and some basic information about your Cash App account. Once you’ve done that, you can get the sign-in code.

How to Reopen Closed Cash App Account?

Whether you cannot access your Cash App account or close it for a legitimate reason, you can reactivate it. There are some easy steps that you can follow to help you reopen closed Cash App account:

The first step is to contact Cash App customer support. This can be done either by phone or by email. If you contact the customer support team, you’ll be able to find out more information about the reasons for your account closing. You can also ask the customer support team to reactivate your account.

Next, you’ll need to enter new account information. You’ll need a valid email address and phone number. You’ll need to add a debit card or bank account. You can also use a different phone number if you prefer.

If you’ve completed these steps, you’ll receive a code that you can use to reactivate your account. This will give you access to your money within a few days.

Another way to get access to your money is to dispute the charge. You can also reactivate your account by calling Cash App customer support. If you contact Cash App customer support, you’ll be given a sign-in code that you can use to access your money.

If you cannot reactivate your Cash App account, you should try troubleshooting. You may have forgotten to enter the verification code. Or, your account may have been suspended because you repeatedly used an incorrect password. You can learn more about reactivating your account on the Cash App website.

#Cash App account closed#cash app account closed with money in it#cash app closed my account due to violation#how to reopen closed cash app account#cash app account closed for no reason

0 notes

Text

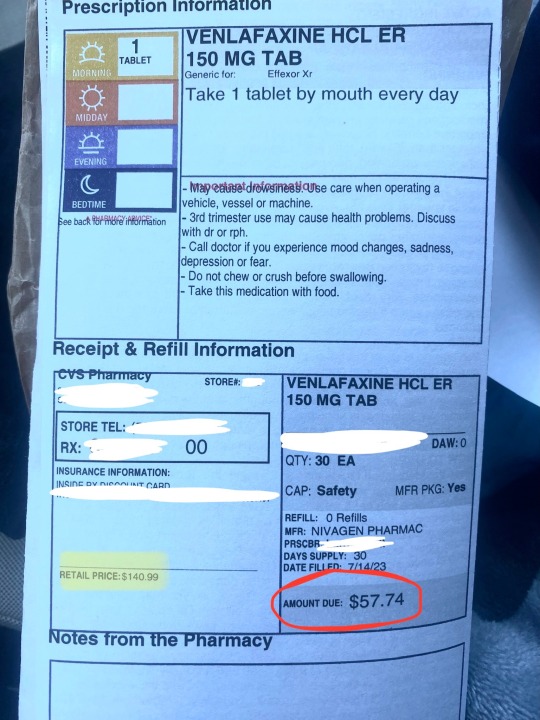

help me cover my medication because my doctor sent in the more expensive kind for no reason other than fucking me over <3

hi im dylan, 22 autistic trans mentally ill and chronically fatigued. i cant call the doctor’s office because theyre closed on weekends and i ran out of medicine, so i had to cave and spend $60 on the new meds. im really upset about this especially because the appointment cost me $200 and i do NOT have this kind of money right now. like i cant even afford my rent next month im fucked.

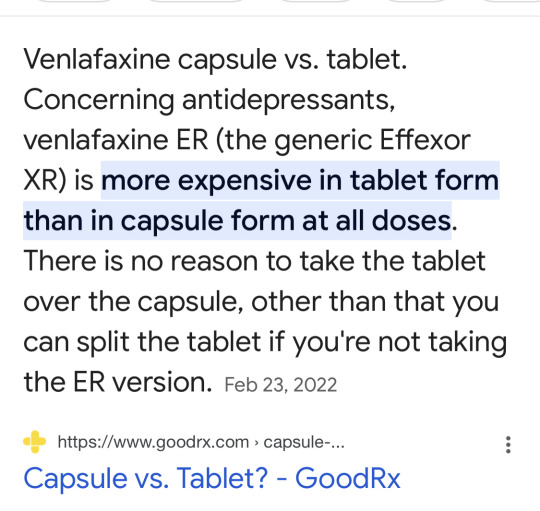

ive been on the capsules for over 3 years now but for some reason he sent in tablets which was an extra $40 that is literally pointless. i also never met my goal to cover the doctors office visit, i was able to cover the initial cost but it left my bank account virtually empty.

i raised $130 out of the $195 needed for the appointment, so plus the $60 of meds im making my new goal $130 to cover these costs.

pay pal click here. cash app and venmo are both diabolicshrimp

$0 / $130

261 notes

·

View notes

Text

Hello Internet. I just wanna state, because I've gotten several DMs now, that I do not have spare cash to donate or share. I have gotten multiple people telling me they're disabled and want money, and while I support mutual aid, I am also disabled and chronically poor. My bank account closed itself because the balance was negative for so long. I quite literally have pocket change for money and most of that gets saved up to buy some lunch at a convenience store. I can share your mutual aid posts and I'll happily pass along your requests but please y'all, stop privately asking my poverty stricken ass for money. The only reason I'm not homeless is because two of my partners took me in. I do not have the resources or expendable funds to financially help anyone and getting several private DMs asking for that has made me feel weird about this app in general

3 notes

·

View notes

Note

Higgs. Reader. Fluff. Cute. Soft. uwu. Need cute soft tender feels. Make me wanna puke with the cuteness. This prompt: in a moment where stress and anxiety are running high, the sender tries to ground the receiver by gently guiding them into a hug, resting their foreheads together to steady them.

(Also, please and thank you very much, long time no see 😂)

@astrandofgold bitch I sees you on twitter 😂 BUT VISIT ME MORE ON HERE GOD DAMN IT! Haha! Coming up!

Y/N panted heavily on their hands and knees. Tears brimmed the corners of their eyes as they gasped. A series of curses escaping their throat as they tried to stabilize themselves. The shock of a BT almost succeeding in killing them had Y/N a mess. All the hairs on their body stood, and their nerves fired up as if they had already been obliterated by the dark. Y/N was beyond petrified as they attempted to pull it together, but to no avail.

"Hey," A deep voice broke through the ringing in Y/N's ears. They swallowed, tensing up as a pair of hands reached for their shoulders.

"What the hell are you doin' out here darlin'?" The gloved fingertips slowly made their way towards Y/N's face and gently pulled their chin up. Coming face to face with a familiar set of blue eyes.

"Higgs?" Y/N breathed out, surprised that he was out in the middle of a BT infested area. At first Y/N thought him to be a hallucination, but the touch to their face as he tucked a strand of hair behind Y/N's ear had them second guessing. Whatever the case or his reasons, Y/N was grateful to Higgs for showing up.

"Higgs--I can't move. I can't, I'm too scared--the BT almost," Y/N breathed out, their shoulders tensing as hushed murmurs escaped his throat. His arms snaked around Y/N's trembling form, pulling them into a tight embrace. One that radiated with care and a sense of protection.

"Shh, shh, I gotcha." Higgs murmured against the skin of Y/N's forehead. He was gently rocking them back and forth. Much like he had done for fellow porters in the past when he himself was one. Before he became a terrorist. Something Y/N remained unaware of.

"Steady, steady. Alright?" Higgs whispered, his forehead pressing to Y/N's as he watched them close their eyes tight. Their breathing attempting to sync with his own. He could recall when he was a kid, how he had gotten close to BTs and his body reacted violently with panic. As much as he tried to hide it, Higgs's heart went out to Y/N. Understanding very well what they were going through.

"Ya'll got the case of the BT Shock. It'll pass, I promise. C'mon, 'lets get you outta here before those ugly bastards show up again." Higgs coaxed Y/N to rise on their feet. His arms and hands supporting them as Y/N shivered. They leaned against him, hands grasping where they could for fear that if Higgs had slipped away, they too would perish.

Out of the way, and now residing in a safe house, Higgs held Y/N tightly to his chest as they sat on the edge of a bed. He swallowed nervously. Not used to affectionate touch in the slightest. He felt his body wanting to retreat out of self preservation, yet he remained. His forehead once again nuzzled and pressed to Y/N's.

Higgs hated this. The effect one person had on him. How they got under his skin and had him giving a shit. Second guessing everything he had worked hard to accomplish on behalf of his EE, his goddess.

"I ain't lettin' her harm you." Higgs murmured.

Y/N was unsure what he meant by his statement. A tremor ran down through their spine at how serious Higgs's tone was. Nevertheless, it didn't matter. Y/N felt safe again.

If you like my work and feel generous, feel free to donate to my ko-fi account or my cash app account!

Cash App: $JayRex1463

#drabbles#higgs monaghan#higgs#ds higgs#death stranding higgs#higgs x reader#reader x higgs#death stranding#death stranding fandom#hope you like it!#man i haven't written this dude in a long time#forgot how fun he is!

82 notes

·

View notes

Video

youtube

Top 5 Washer & Dryers For Small Spaces

I LIKE - THE - WHIRLPOOL - ALSO - STACKED

BUT - HE - LIKE - BOSCH - https://www.us-appliance.com

US APPLIANCE

FREE - SHIP - $999 - OR - MORE

DRYER - NOT - PRETTY - $1,499.00

SERVICE - PROTECTION - 2 YEARS - $87 - EACH

WASHER - PRETTY - EST - $1,299.00 - FR - MEMORY

LAS VEGAS - APP - VEGAS

MGM - GRAND - FREE - SUITE

DAILY - FLIGHT - CLUB - PREMIUM - (+$60)

FLIGHTS - $15 - ROUNDTRIP - 2 - VEGAS

6 INTERNATIONAL - AIRPORTS - CHOOSE

LAS VEGAS

MIA - MIAMI - INTERNATIONAL - AIRPORT

NARITA - AIRPORT - TOKYO

INCHEON - AIRPORT - KOREA - SEOUL

EMAILED - THE - BEST - DEALS - 4 - US

NO - CONTRACT - WHILE - THERE - WILL

SAVE - FR - $50 - $275 - SURVEYS - AT

CBS - TV

CHECK - OUT - THE - SHOWS - TITLES

THEN - ENTER - THEY - WILL - ASK HOW

2 - IMPROVE - THEIR - SHOWS

FAVORITE - ROMANCE - AUTHOR

DEBBIE MACOMBER

WILL - SAVE - THE - CASH

BECAUSE - ON - SSI - $2,000 - FOR

ALL - ACCOUNTS - INCLUDING THE

PIGGY - BANK

SO - MY - PIGGY - BANK - AT - THE

STORAGE - UNIT - WILL - B - FILLED

WITH - CASH

MY - NATURALIZATION

CARDS - FIREPROOF - BULLETPROOF

WATERPROOF - BLK - BAGS 2 - STORE

2ND - MONTH - $62 - ON - THE - FIRST

$25 - LATE - FEE

BECAUSE - THEY’RE - AMERICANS

‘BLOW - IF - U - CAN’T - HANDLE THIS’

FUTURE - HDG - LOCKERS

LUGGAGE - AND - MORE - WITH

ALL - U - CAN - EAT - BUFFETS - FREE

SHOPPING - CENTER - ALSO - AS WE

BRING - THEM - 2 - HDG - INNS

LOCKERS - SMALL - $0.10 - DIME

LUGGAGE - LOCKERS - $0.25

$0.25 - $0.10 - PER - DAY - PUT - COINS

CREDIT - CARDS - NOT - ASKING - FOR

MORE - 2 - PROVE - NOT - FAKES

HDG - STORAGE - UNITS BUILDINGS

$0.25 - PER - DAY - ALSO - AND - THE

LARGER - ONES - $1.00 - PER - DAY 2

SUPER - LARGE - $5.00 - PER - DAY 2

MORE - REASONABLE - NOT - $100 - $200

$500 - AND - MORE ... NO - MORE - THEIR

BULL - AS - THIEVES - OF - THE - USA YES

I’M - GOING - 2 - LAS VEGAS - A - LOT

SO - I - CAN - BUY - MY - FURNITURE

BUY - MY - APPLIANCES - LIKE - I’M

MY - FATHER - WHO - ABANDONED

ME - TWICE - AS - A - BABY - AND AS

CHILD - TOLD - MY - GREAT - GRANDPA

HE - ABANDONED - ME - AS - A - CHILD 2

HE - EARNED - EARLY - WIDOWHOOD GR

GOD - SAID - WHEN - MY - MOTHER DIED

AGE 23 - ME - AGE 60 - REALLY

HE - BECAME - MY - MOTHER

WHEN - FATHER - ABANDONED - ME - 2 X

HE - BECAME - MY - FATHER

SURVEYS - CBS - TV - LIVE - AT

MGM - GRAND

I - LOVE - WHOLE FOODS - MARKET

7A - 11P - DAILY - LATE - NIGHT THAN

PUBLIX - CLOSES - 10P - DAILY

WARM - FOODS - AT - WHOLE - FOODS

SALADS - ALSO

$11.99 - PER - POUND - HERE

CHINESE - ORANGE - CHICKEN

THAI - NOODLES

PULLED - PORK - WITH - PINEAPPLES

ARROZ - CON - POLLO CHICKEN WITH

SPANISH - RICE - LOOKS - GOOD

BBQ - MEATLOAF

WHITE - POTATOES - SOFT

LIVE - PEPPERONI - PIZZA

$3.99 - OR - 2 - FOR - $7.50

LOOKS - GOOD

GARLIC - AVOCADO - OIL

WHOLE - CHICKEN - $4.75

ORGANIC - MAYO - $3.49

2 GAL - MOUNTAIN - SPRING WATER - $1.49

COMING - BACK ...

1 note

·

View note

Text

Why Did Cash App Close My Account? Understanding the Reasons behind Cash App Closing Accounts

Introduction

Many users have experienced the frustration of having their Cash App account closed unexpectedly. Understanding the reasons behind Cash App closing accounts can help users prevent such incidents and take appropriate steps if it happens. This article delves into the common reasons why Cash App shut down accounts and offers guidance on how to avoid these issues.

Common Reasons for Cash App Closing Accounts

Violation of Terms of Service

One of the primary reasons for Cash App closing accounts is the violation of their Terms of Service. Cash App has strict policies to ensure the security and integrity of its platform. Activities such as:

Fraudulent behavior: Engaging in scams, using fake identities, or conducting suspicious transactions.

Inappropriate use: Utilizing the platform for prohibited transactions, such as gambling or purchasing restricted items.

These activities can trigger automatic account reviews and potential closures.

Unverified Accounts

Another common reason for Cash App closing accounts is failure to verify account information. Cash App requires users to provide accurate personal information, including full name, date of birth, and the last four digits of their Social Security Number (SSN). If this information is not verified, the account may be limited or eventually closed to comply with regulatory standards.

Suspicious Activity

Cash App employs sophisticated algorithms to detect suspicious activities. Accounts showing unusual patterns, such as frequent large transfers or multiple transactions with unknown users, may be flagged for review. If the activity is deemed too risky, Cash App may shut down the account to protect against potential fraud.

Chargebacks and Disputes

Frequent chargebacks and disputes can also lead to Cash App closing accounts. While users have the right to dispute unauthorized transactions, an excessive number of disputes can signal high-risk behavior. To mitigate risks, Cash App may opt to close accounts with frequent chargeback requests.

Steps to Take if Cash App Closes Your Account

Contacting Customer Support

If you find that Cash App closed your account, the first step is to contact their customer support. Providing all necessary information and verifying your identity can help resolve the issue more quickly. Be sure to explain the situation clearly and ask for specific details about why your account was closed.

Filing a Complaint

If customer support does not resolve the issue, you can file a complaint with external agencies like the Better Business Bureau (BBB) or the Consumer Financial Protection Bureau (CFPB). These organizations can assist in mediating disputes between consumers and financial institutions.

Legal Options

In cases where significant funds are at stake, seeking legal advice may be beneficial. A lawyer specializing in financial disputes can offer guidance on potential legal actions to recover your money.

Preventing Account Closures

Adhering to Terms of Service

To avoid closing your Cash App account, always adhere to the platform’s Terms of Service. Ensure your activities align with the allowed uses of the app and avoid any transactions that could be considered suspicious or fraudulent.

Verifying Your Account

Complete the verification process promptly. Providing accurate and up-to-date information helps build trust with Cash App and reduces the risk of account limitations or closures.

Monitoring Account Activity

Regularly monitor your account for any irregularities. Report any unauthorized transactions immediately to Cash App to prevent your account from being flagged for suspicious activity.

Conclusion

Understanding why Cash App closed your account can help you prevent similar issues in the future. By following the platform’s guidelines, verifying your account, and monitoring your activity, you can maintain a secure and active Cash App account. If your account is closed, swift action and understanding your rights can aid in resolving the issue and recovering your funds.

0 notes

Text

Shocking Truth: Cash App Shuts Down Accounts Without Warning!

In recent times, a growing number of users have experienced the unexpected and often bewildering closure of their Cash App accounts. With no prior notice or clear explanation, these account closures have left many scrambling for answers. Let's delve into the reasons behind these abrupt shutdowns and explore the steps you can take if you find yourself in this unfortunate situation.

Why Is Cash App Closing Accounts?

Violation of Terms of Service

One primary reason for Cash App closing accounts is the violation of terms of service. This can encompass a range of activities including:

Fraudulent Transactions: Involvement in scams or suspicious activities.

Prohibited Activities: Engaging in transactions that violate Cash App's policies.

Exceeding Transaction Limits: Conducting transactions that surpass the allowed limits without proper verification.

Suspicious Activity Monitoring

Cash App employs sophisticated algorithms to monitor transactions for any signs of unusual or suspicious behavior. If an account triggers these alerts, it may be shut down as a precautionary measure.

Regulatory Compliance

To comply with financial regulations, Cash App requires users to verify their identities. Failure to provide necessary documentation or engaging in activities that contravene these regulations can result in account closures.

Personal Experiences: Cash App Closed My Account for No Reason

Many users report feeling blindsided by sudden account closures, often with no clear reason provided. Phrases like "Cash App closed my account for no reason" or "Cash App shut down my account" are common in user forums and social media platforms.

Case Study: Unexpected Account Closure

Consider the case of Jane Doe, a long-time Cash App user. Jane woke up one morning to find her cash app account closed without warning. She had not received any prior notifications of suspicious activity or violations of terms of service. Her attempts to contact customer support yielded vague responses, leaving her frustrated and without access to her funds.

Immediate Steps to Take if Your Cash App Account Is Closed

1. Review the Notification

When a cash app account is closed, Cash App typically sends a notification. Carefully review this message to understand the specific reason for the closure, if provided.

2. Contact Cash App Support

Reach out to Cash App customer support through the app, website, or social media. Explain your situation clearly and request a review of your account.

3. Gather Documentation

Collect all relevant documents that can support your case. This includes identification documents, transaction receipts, and any other pertinent information.

How to Reopen a Closed Cash App Account

1. Appeal the Closure

To reopen a closed Cash App account, you need to submit an appeal. Here’s how:

Log in to Your Account: Use your login credentials to access your Cash App account.

Navigate to Support: In the app, tap on your profile icon, select 'Support', and choose 'Something Else'.

Explain Your Situation: Provide a detailed explanation of why you believe your account should be reopened.

Submit Supporting Documents: Attach any documents that can support your appeal.

2. Follow Up

After submitting your appeal, follow up with Cash App support regularly. Persistence can often help expedite the review process.

Preventing Future Account Closures

1. Adhere to Cash App's Terms of Service

Regularly review Cash App's terms of service to ensure you are in compliance. Avoid activities that could be perceived as fraudulent or suspicious.

2. Verify Your Identity

Make sure your account is fully verified by providing all required identification documents. This reduces the risk of your account being flagged for suspicious activity.

3. Monitor Your Transactions

Keep an eye on your account for any unusual transactions. Report any unauthorized activity to Cash App support immediately.

Conclusion

The sudden and often unexplained closed Cash App accounts can be a major inconvenience. Understanding the common reasons behind these closures and knowing how to respond effectively can help you navigate this challenging situation. Always ensure you comply with Cash App's terms of service and maintain thorough records of your transactions to prevent future issues.

0 notes

Text

Experience: What Time Does Direct Deposit Hit On Cash App

In this comprehensive guide, we will delve into the world of Cash App Direct Deposit. We'll explore the important aspects of Cash App Direct Deposit, including the timing of deposits, common issues like failed direct deposits, and the possibility of receiving deposits two days early. Whether you're a new Cash App user or someone who frequently uses direct deposit, this article will provide you with valuable insights to ensure a seamless experience with Cash App Direct Deposit.

Cash App Direct Deposit Overview

Cash App Direct Deposit is a convenient feature that allows you to receive your paychecks, government benefits, and other recurring deposits directly into your Cash App account. By setting up direct deposit, you can eliminate the need to visit a bank or cash a paper check. The funds are automatically deposited into your Cash App account, giving you quick access to your money.

What Time Does Direct Deposit Hit On Cash App?

Cash App Direct Deposit follows a specific schedule for depositing funds into your account. It's important to note that the timing may vary depending on various factors, such as weekends, holidays, and the sending bank's processing times. Generally, Cash App Direct Deposit hits your account between 8:00 AM and 9:00 AM Eastern Standard Time (EST) on your designated payday.

However, it's essential to consider that Cash App processes deposits throughout the day. So, even if you don't see the deposit at exactly 8:00 AM EST, it should appear in your account within a reasonable timeframe.

Cash App Direct Deposit Failed?

While Cash App Direct Deposit is designed to be a reliable service, issues can occasionally arise. If you encounter a failed direct deposit, it can be frustrating and worrisome. Here are some possible reasons why your Cash App Direct Deposit may have failed:

Incorrect Account Information: Double-check that you've entered the correct account and routing numbers when setting up your direct deposit. Even a minor error can lead to a failed deposit.

Inactive Account: If your Cash App account is inactive or has been closed, direct deposits won't go through. Make sure your account is active and in good standing.

Frozen Account: Cash App may freeze your account if they detect suspicious activity. In such cases, direct deposits will be temporarily halted. Contact Cash App support to resolve any account-related issues.

Insufficient Funds: If there are insufficient funds in your Cash App account to cover the deposit, it may fail. Ensure that you have enough balance to receive the direct deposit.

If your direct deposit fails, it's crucial to reach out to Cash App support for assistance. They will be able to provide specific information and guide you through the resolution process.

Cash App Direct Deposit 2 Days Early

One of the attractive features of Cash App Direct Deposit is the possibility of receiving your funds up to two days earlier than your scheduled payday. While this benefit is not guaranteed for all users, many Cash App customers have reported receiving their deposits ahead of time.

The early deposit feature is made possible by Cash App's partnership with their bank. When your employer initiates the deposit, Cash App processes it as soon as they receive the information from the sending bank. This process allows them to credit the funds to your account in advance, giving you faster access to your money.

Frequently Asked Questions

Q: Can I change the time when Cash App Direct Deposit hits my account?

A: No, the timing of Cash App Direct Deposit is determined by the sender and the sending bank. Cash App processes the deposit as soon as they receive it, following the schedule provided by the sender.

Q: Are there any fees associated with Cash App Direct Deposit?

A: No, Cash App does not charge any fees for receiving direct deposits into your account. It's a free service provided by the platform.

Q: Can I split my direct deposit into multiple accounts?

A: Yes, Cash App allows you to split your direct deposit between multiple accounts. You can allocate a specific percentage or a fixed amount to different accounts.

Q: How long does it take for a failed direct deposit to be returned to the sender?

A: If a direct deposit fails, the funds are typically returned to the sender within 1-5 business days. The exact timeframe may vary depending on the sender's bank.

Q: Can I set up direct deposit with Cash App if I don't have a traditional bank account?

A: Yes, Cash App provides account and routing numbers that you can use to set up direct deposit, even if you don't have a traditional bank account.

Q: Can I cancel or change my direct deposit information in Cash App?

A: Yes, you can cancel or modify your direct deposit information in Cash App. Open the app, go to the Banking tab, and select the direct deposit option to make any necessary changes.

Conclusion

Cash App Direct Deposit offers a convenient way to receive recurring deposits directly into your Cash App account. Understanding the timing of direct deposits, potential issues, and the possibility of receiving funds early can help you make the most of this feature. By following the guidelines provided by Cash App and ensuring the accuracy of your account information, you can enjoy a seamless direct deposit experience.

Remember, if you encounter any issues with Cash App Direct Deposit, reach out to their customer support for assistance. They are available to help resolve any problems and provide guidance along the way.

0 notes

Text

Most common reasons why is your Cash App account closed?

Cash App is one the most popular digital payment app among millions of smartphone users. It allows you to send money, receive it, and manage your account with just a couple of taps. Cash App is a convenient app, but some users find that their account has been closed unexpectedly. Your Cash App account closed due to several reasons. These include violating the Terms of Service, engaging in suspicious or unauthorized activities, having verification issues, and suspicions of money laundering. A notification will usually be sent with specific instructions for what to do after an account is closed. Cash App may have closed your account due to a violation of their terms and conditions.

Cash App will ask you to follow their instructions and provide documentation, such as your transaction history or proof of identification. This will ensure that your account is treated fairly and impartially. Let's start by learning about the most common reasons why did my Cash App get closed. We will also discuss what you can do if this happens to your account and how to avoid it in the future.

Why Your Cash App Account Was Closed?

Cash App aims to offer a smooth and secure financial experience to its users. However, Cash App accounts can be closed for a variety of reasons which are mentioned below:

Cash App account closed for violating terms of service. This includes fraud, the use of false identities or illegal transactions. Accounts may be immediately closed and funds seized if someone violates the rules.

Cash App accounts can also be closed if they are suspected of being used to gamble. This is a violation of their terms of service agreement, and it allows them to close any suspected account of gambling activity.

Cash App's policy is to close any account that has been dormant or inactive for an extended period. This ensures users are active on the platform.

Cash App monitors account activity closely to detect signs of fraudulent or suspicious behaviour. Cash App may close your account if it is flagged as having unusual activity. This will protect you and the platform.

Cash App's security measures require users to confirm their identity. Your account could be closed if you do not complete the verification process or provide incorrect information.

Excessive chargebacks can cause account closure. These occur when customers dispute transactions through their bank and request refunds. Cash App may consider many chargebacks to be a sign that the platform is being abused or fraud.

How to Avoid Cash App Account Closed?

Cash App users are often in the unfortunate situation of having their accounts closed. This can be frustrating and confusing if they still have money in it. Do not worry: you can recover your money with the right knowledge. It is essential to follow the Cash App's guidelines and terms of service to avoid frustration and inconvenience. Here are some helpful tips to prevent account closed issues on Cash App:

Cash App will only allow you to keep your account operational if you adhere to the terms of service. For example, using Cash App to fund gambling activities is against their rules and could result in its closure. Other instances include unapproved behaviour, identity verification problems and suspicious behaviours.

If you have a Cash App account closed with money that was intended to be there, your first step should always be to contact customer service to explain the situation and get clarification. If an account is closed for violating the terms of service or due to fraud, all funds will be returned.

Cash App should be notified immediately if you notice any suspicious or unauthorized transactions.

Avoid engaging in prohibited activity such as fraud, money laundering or excessive chargebacks.

Cash App customer support takes all allegations of fraud or illegal activity seriously and will work hard to resolve any issues quickly. Please follow their instructions, including completing any requests for identity verification and documents. Also, be sure to review your account activity regularly and report any suspicious or unauthorized transactions.

0 notes

Text

Why is My Tax Refund Deposit Pending on Cash App?

As tax season approaches, many individuals eagerly await their tax refunds, which are often deposited directly into their bank accounts. Cash App users may choose to have their tax refunds deposited into their Cash App account for added convenience. However, there are instances where these deposits may be rejected or delayed. In this blog, we'll explore the reasons why Cash App direct deposit tax refund pending and what you can do to resolve the issue.

Why is My Tax Refund Deposit Being Rejected on Cash App?

Reasons due to which tax refund pending Cash App:

Incorrect Account Information:

One of the most common reasons for a tax refund deposit rejection is incorrect account information provided to the IRS.

Double-check the account and routing numbers you provided to ensure they match the information linked to your Cash App account.

Bank Account Closed or Inactive:

If the bank account linked to your Cash App account is closed or inactive, the deposit will be rejected.

Ensure that your bank account is active and able to receive deposits.

Insufficient Funds:

If there are sufficient funds in your Cash App account to cover the tax refund deposit, the transaction may be accepted.

Make sure you have enough funds in your account to receive the deposit.

IRS Errors:

In some cases, the IRS may make errors when processing tax refunds, leading to rejections.

Contact the IRS or check your tax return status online to verify the status of your refund.

How to Resolve Tax Refund Deposit Rejection on Cash App?

Update Account Information: If you believe the Cash App direct deposit tax refund pending due to incorrect account information, update your account details with the correct information.

Contact Cash App Support: If you need clarification on why your deposit was rejected or need assistance, contact Cash App support for help. Please provide them with any relevant information or documentation they may require to resolve the issue.

Verify Account Status: Ensure that your Cash App account is in good standing and that there are no issues that may be preventing the deposit from being processed.

FAQs About Cash App Tax Refund Deposits:

Q1: How long does it take for a tax refund deposit to be processed on Cash App?

A: The processing time for a tax refund deposit on Cash App can vary. It may take up to 5 business days for the deposit to be credited to your Cash App account.

Q2: Can I receive my tax refund on Cash App if I have a pending direct deposit?

A: Yes, you can receive your tax refund on Cash App even if you have a pending direct deposit. However, the pending deposit may delay the processing of your tax refund deposit.

Q3: What should I do if my tax refund deposit is rejected on Cash App?

A: If your tax refund deposit is rejected on Cash App, check the account information you provided to ensure it is correct. If the information is correct, contact Cash App support for assistance in resolving the issue.

Conclusion:

Receiving your tax refund on Cash App can be a convenient option, but it's essential to ensure that your account information is correct and that your account is in good standing. By addressing any issues promptly and following the steps outlined in this guide, you can resolve tax refund deposit rejections on Cash App and receive your refund without delay.

#How Long Does It Take to Get a Tax Refund on Cash App#Cash App tax refund#Cash App tax refund time#Cash App taxes#Cash App tax refund pending#cash app tax refund accepted#cash app tax refund deposit#What Time Does Cash App IRS Direct Deposit Hit#Cash App tax refund deposit#Cash App direct deposit pending#Cash App IRS deposit pending

0 notes

Text

Why my Cash App direct deposit failed and is returned to the originator?

Direct deposit offers a convenient way to receive payments directly into your Cash App account. However, there are instances where the direct deposit may fail and be returned to the sender, also known as the originator. If you've encountered this issue and are wondering why your Cash App direct deposit failed and returned to originator, you're not alone. In this comprehensive guide, we'll explore the possible reasons behind such failures and provide insights to help you navigate the situation effectively.

Understanding Cash App Direct Deposit:

Before delving into why a Cash App direct deposit may fail and be returned to the originator, let's first understand the basics of the direct deposit process:

Initiation by Sender: Direct deposits are initiated by the sender, which could be your employer, government agency, or any other entity authorised to make payments. The sender provides your Cash App routing and account numbers to facilitate the deposit.

Processing by Cash App: Upon receiving the deposit instructions, Cash App processes the direct deposit and credits the funds to your account. This process typically occurs early in the morning on the scheduled deposit date.

Availability of Funds: Once the direct deposit is processed successfully, the funds become available in your Cash App account for use in various transactions, such as purchases, bill payments, or transfers to other accounts.

Why Your Cash App Direct Deposit Failed?

Now, let's explore some common reasons why a Cash App direct deposit may fail and be returned to the originator:

Incorrect Account Information: One of the most common reasons Cash App direct deposit failed is incorrect account information provided by the sender. This could include errors in the routing number, account number, or other essential details needed to process the deposit.

Closed Account: If your Cash App account is closed or frozen at the time the direct deposit is initiated, the transaction will fail, and the funds will be returned to the originator. To avoid such issues, it's essential to ensure that your account is active and in good standing.

Insufficient Funds: If there are insufficient funds in your Cash App account to cover the direct deposit amount, the transaction may fail. It's crucial to maintain a sufficient balance in your account to avoid such situations.

Banking Errors: Sometimes, direct deposit failures may occur due to errors or issues within the banking system, such as network connectivity issues, processing delays, or technical glitches. These issues are beyond Cash App's control but can impact the successful processing of direct deposits.

FAQs:

Q: What should I do if my Cash App direct deposit fails and is returned to the originator?

A: If your Cash App direct deposit fails and is returned to the originator, you should contact the sender (e.g., your employer or payer) to verify the account information provided and request re-issuance of the payment. Additionally, you may need to update your Cash App account information if any discrepancies are identified.

Q: How long does it take for a returned Cash App direct deposit to be reissued?

A: The time it takes for a returned Cash App direct deposit to be reissued depends on various factors, including the policies and procedures of the sender. It's advisable to contact the sender promptly to request reissuance and follow up accordingly.

Q: Can I prevent Cash App direct deposit failures in the future?

A: To minimise the risk of direct deposit failures, ensure that your Cash App account information is accurate and up to date. Additionally, maintain a sufficient balance in your account to cover incoming deposits and monitor your account regularly for any issues or discrepancies.

Conclusion:

Encountering a Cash App direct deposit failure and return to the originator can be frustrating, but understanding the reasons behind such failures is the first step toward resolution. By addressing potential issues such as incorrect account information, account status, and banking errors, you can minimise the risk of future failures and ensure a smoother direct deposit experience. If you have further questions or concerns about direct deposits, don't hesitate to reach out to Cash App support for assistance.

#Cash app direct deposit#cash app direct deposit pending#cash app direct deposit failed#cash app direct deposit failed and returned to originator#cash app deposit pending#cash app pending direct deposit#Direct Deposit Cash App#Cash App Direct Deposit Time#Cash App Direct Deposit late#Cash App Direct Deposit Time Not Showing-up#Direct Deposit With Cash App#What Time Does Cash App Direct Deposit Hit#What Time Does Cash App Direct Deposit Hit on Wednesday#What Time Does Cash App Direct Deposit Hit on Tuesday#What Time Does Cash App Direct Deposit Hit on Thursday#Cash App direct deposit hit

0 notes

Text

Fix Cash App Direct Deposits Pending: Easy Tips 2024

In today's digital age, managing finances has never been easier. With the advent of fintech apps like Cash App, people can send money, pay bills, and even receive direct deposits conveniently from their smartphones. However, like any financial platform, Cash App users may sometimes encounter issues, one of which is the dreaded "direct deposit pending" notification. In this article, we will delve into the reasons behind Cash App direct deposit pending and explore ways to address them.

Understanding Direct Deposits with Cash App

Cash App, known for its user-friendly interface and ease of use, allows users to set up direct deposits to receive paychecks, government benefits, and more directly into their Cash App accounts. The process is usually swift and efficient, with funds being available as soon as they are deposited.

Common Reasons for Direct Deposit Delays

Bank Processing Times: The Cash App direct deposit time can depend on your bank's processing times. If your bank delays transmitting funds to Cash App, it can result in a pending direct deposit.

Payment Origin: The source of your payment matters. Some employers or institutions may have their specific payment schedules, which can affect when your direct deposit hits your Cash App account.

Weekends and Holidays: Direct deposits might be delayed if they fall on weekends or holidays when banks are closed. Cash App and banks typically process transactions on business days.

Account Verification: If your Cash App account is not fully verified, it may cause delays in receiving direct deposits. Ensure your account is verified to avoid such issues.

How to Address Pending Direct Deposits on Cash App?

If you find yourself in a situation where your Cash App deposit pending, here are some steps you can take:

Contact Support: Reach out to Cash App customer support through the app or their website. They can provide insights into the status of your deposit and offer guidance on resolving any issues.

Check Payment Source: Verify with your employer or the entity responsible for the deposit to ensure the payment has been initiated from their end.

Bank Communication: If your bank is causing the delay, contact them to understand their processing times and whether there are any pending transactions.

Verify Account: Ensure your Cash App account is fully verified with your personal information and linked bank account details up to date.

Conclusion

While Cash App generally offers a smooth experience for direct deposits, occasional delays can occur due to various factors. By understanding the reasons behind pending direct deposits and taking appropriate steps to address them, you can ensure that your funds reach your Cash App account in a timely manner. Keep an eye on your transactions, stay informed, and don't hesitate to reach out to Cash App support when needed to resolve any issues promptly.

FAQs

Why is my Cash App direct deposit pending?

Several factors, including bank processing times, payment sources, and weekends/holidays, can lead to pending direct deposits.

What should I do if my direct deposit is stuck in pending on the Cash App?

Contact Cash App support, check with your payment source, and verify your Cash App account details.

What time do Cash App direct deposits usually hit?

Direct deposit times can vary, but Cash App typically processes transactions on business days during banking hours.

Do weekends and holidays affect Cash App direct deposit processing?

Yes, weekends and holidays can cause delays as banks are closed on these days.

Is there a way to speed up my pending Cash App direct deposit?

Unfortunately, you can't expedite the process, but verifying your account and contacting support can help resolve issues faster.

How long does it usually take for a Cash App direct deposit to clear?

Most direct deposits on Cash App clear within 1-5 business days.

Can I schedule when my Cash App direct deposit should hit my account?

Cash App allows you to receive direct deposits based on the sender's schedule.

What should I do if my Cash App direct deposit is consistently delayed?

If you frequently experience delays, consider contacting both Cash App support and your payment source to investigate the issue further.

Why does Cash App sometimes require account verification for direct deposits?

Verification ensures the security and legitimacy of transactions, reducing the risk of fraud.

Can I rely on Cash App for timely direct deposits?

In most cases, Cash App is reliable for direct deposits, but occasional delays can happen.

What should I check if my Cash App direct deposit is pending due to a bank issue?

Contact your bank to inquire about their processing times and any potential issues with the transaction.

#Cash app direct deposit#cash app direct deposit pending#cash app deposit pending#cash app pending direct deposit#Direct Deposit Cash App#Cash App Direct Deposit Time#Direct Deposit With Cash App#What Time Does Cash App Direct Deposit Hit#What Time Does Cash App Direct Deposit Hit on Wednesday#What Time Does Cash App Direct Deposit Hit on Tuesday#What Time Does Cash App Direct Deposit Hit on Thursday#Cash App direct deposit hit#Cash App direct deposit time

0 notes

Text

Understand the steps involved in closing cash app account

Closing a cash app account is a straightforward process that can be completed within a few minutes. With the increasing popularity of digital payment platforms, such as Cash App, individuals may find themselves needing to close their accounts for various reasons. Whether it's due to security concerns, lack of use, or simply wanting to explore other options, it's important to understand the steps involved in closing cash App account.

The first step in closing a Cash App account is to open the app on your mobile device. Once you have opened the app, navigate to the "Account" tab, which can typically be found at the bottom of the screen. From there, scroll down to find the "Settings" option and tap on it. This will bring you to a page where you can manage various settings related to your Cash App account.

On the settings page, you will find an option labeled "Close my Cash App account." Tapping on this option will prompt you to confirm your decision to close your account. It's important to note that closing your Cash App account will result in the permanent deletion of all your account information, including your transaction history and personal details. Therefore, it is essential to carefully consider your decision before proceeding.

After confirming your decision to close your Cash App account, the app will ask you to provide feedback on why you have decided to close your account. This feedback is voluntary, but it can help the Cash App team improve their services. Once you have provided your feedback or chosen to skip this step, you will be prompted to enter your Cash App PIN or Touch ID, depending on the security settings you have enabled. This additional security measure ensures that only the account owner can close the account.

Finally, after entering your PIN or using Touch ID, a confirmation message will appear, notifying you that your Cash App account has been closed successfully. It's important to remember that closing your Cash App account does not automatically delete the app from your device. You can choose to uninstall the app or keep it on your device for future reference.

In conclusion, closing a Cash App account is a simple process that involves accessing the settings tab, selecting the "Close my Cash App account" option, confirming your decision, providing feedback (if desired), and entering your Cash App PIN or using Touch ID for security purposes. While it's important to carefully consider your decision to close your account, knowing the steps involved can make the process smoother and ensure that your account is closed securely and permanently.

0 notes

Text

Find: cash app account closed violation of terms of service

In the modern era of digital transactions, Cash App has gained immense popularity as a reliable and convenient platform for sending and receiving money. However, like any other service, Cash App operates under a set of terms of service that users must adhere to. Unfortunately, some users may find their cash app account closed violation of terms of service. This essay will explore the potential reasons for Cash App account closures and the importance of complying with the platform's terms of service.

To begin with, one of the primary reasons for Cash App account closures is fraudulent activity. Cash App has rigorous measures in place to detect and prevent fraudulent transactions, and any suspicious behavior can result in immediate account closure. Engaging in activities like scamming, fake fundraising, or attempting to hack into other users' accounts violates the platform's terms of service and puts the security of the entire community at risk. Thus, Cash App takes strict action against those involved in such practices by closing their accounts.

Moreover, abusive behavior towards other users can also lead to the cash app closing my account. Cash App encourages users to treat each other with respect and dignity. Hence, those found guilty of harassment, bullying, or any form of online abuse are subject to having their accounts closed. Cash App aims to provide a safe and welcoming environment for all users, and any violations of this principle are taken very seriously.

Furthermore, one of the terms of service that Cash App users must adhere to is ensuring the legitimacy of their transactions. Engaging in illegal activities or using the service for money laundering purposes is strictly prohibited. Cash App cooperates with law enforcement agencies to identify such individuals and close their accounts to prevent any unlawful activities. By doing so, Cash App not only abides by the law but also protects its genuine users from being involved in any illegal operations inadvertently.

It is essential for Cash App users to understand and respect the platform's terms of service to avoid account closures. By ensuring adherence to these guidelines, users can have peace of mind and enjoy the benefits Cash App has to offer. It is vital to remain cautious while using the platform and be aware of potential scams or phishing attempts. Reading the terms of service thoroughly and seeking clarification when needed can help users evade any unwanted violations.

In conclusion, Cash App offers a reliable and efficient means of transferring money, but it is essential for users to understand and comply with the terms of service. Cash app account closed issues can occur due to fraudulent activity, abusive behavior towards other users, or engaging in illegal transactions. By adhering to the guidelines set forth by Cash App, users can protect themselves and the community at large, creating a safe and secure environment for all.

0 notes

Text

What Happens to My Money in Cash App If I Close My Account?

Introduction

For many users, the thought of closing a Cash App account raises concerns, particularly about the fate of their funds. Whether you’re proactively choosing to close your account or facing an account shutdown, understanding what happens to your money is crucial. This article explores the process and implications of closing a Cash App account and provides guidance on ensuring your funds are securely handled.

Understanding the Account Closure Process

Voluntary Account Closure

When a user decides to voluntarily close their Cash App account, the process is straightforward. Before initiating the closure, ensure that:

All funds are withdrawn: Transfer your remaining balance to a linked bank account or another financial service.

Pending transactions are resolved: Make sure there are no pending payments or disputes.

Once these steps are completed, you can proceed with closing your account via the app settings. Cash App typically ensures that users don’t leave any money behind.

Involuntary Account Closure

If Cash App closed your account with money in it, the process can be more complex. Cash App may close accounts due to violations of their Terms of Service, suspicious activities, or regulatory requirements. In such cases, the following steps are typically involved:

Notification: Users are usually notified via email or within the app about the account closure and the reason behind it.

Access to Funds: Despite the closure, users can often access their funds by contacting Cash App support, providing necessary identification, and resolving any outstanding issues.

Retrieving Funds after Account Closure

Contacting Customer Support

If Cash App closed your account, the first step is to contact their customer support. Provide details about your account, the closure notification, and any remaining balance. The support team will guide you through the process of retrieving your money, which may include:

Verification of identity: Ensuring you are the rightful owner of the account.

Resolution of disputes: Addressing any issues that led to the account closure.

Funds Transfer

Once your identity is verified and disputes are resolved, Cash App will facilitate the transfer of your remaining balance to a linked bank account. In some cases, they may issue a check to the address on file.

Preventing Issues with Account Closure

Adhering to Terms of Service

To avoid involuntary account closures, always adhere to Cash App’s Terms of Service. Avoid engaging in prohibited activities, such as fraudulent transactions or unauthorized account use. Familiarize yourself with the platform’s rules to stay compliant.

Verifying Your Account

Ensure that your account is fully verified. Providing accurate personal information and completing the verification process can prevent misunderstandings and potential account closures.

Monitoring Transactions

Regularly monitor your account for any suspicious activities. Immediately report unauthorized transactions to Cash App to protect your account and funds.

Alternative Steps if Funds Are Not Returned

Filing a Complaint

If you face difficulties retrieving your funds after Cash App closed your account, consider filing a complaint with the Better Business Bureau (BBB) or the Consumer Financial Protection Bureau (CFPB). These agencies can assist in resolving disputes with financial institutions.

Legal Action

For significant amounts of money, seeking legal advice might be necessary. An attorney specializing in financial disputes can offer guidance and help you navigate the legal process to recover your funds.

Conclusion

Understanding what happens to your money when closing a Cash App account is essential for safeguarding your funds. Whether the account closure is voluntary or involuntary, knowing the steps to retrieve your money and prevent issues can provide peace of mind. By adhering to Cash App’s guidelines and monitoring your transactions, you can ensure a smooth experience with the platform.

0 notes

Text

10 Reasons Why the Cash App Closed My Account

Cash App is a popular mobile payment service that enables users to send and receive money effortlessly. However, there are instances when users find their Cash App account closed unexpectedly. This article explores ten reasons why Cash App closed accounts and provides guidance on how to reopen a closed Cash App account.

1. Violation of Terms of Service

One of the most common reasons for having a Cash App account closed is the violation of the platform's Terms of Service. Cash App has strict guidelines to ensure the security and legality of transactions. Activities such as fraud, scams, or any illegal transactions can lead to immediate account closure.

2. Suspicious Activity

Cash App constantly monitors accounts for any suspicious activity to protect users from potential fraud. If your account exhibits unusual patterns, such as large or frequent transactions that deviate from your normal activity, it may be flagged and closed for security reasons.

3. Unverified Identity

Cash App requires users to verify their identity to access certain features and higher transaction limits. Failure to provide accurate and complete information during the verification process can result in your Cash App account being closed.

4. Multiple Accounts

Operating multiple Cash App accounts is against the platform's policies, especially if done to exploit promotions or engage in fraudulent activities. If Cash App detects multiple accounts under your name, it may shut them down to prevent abuse.

5. High Chargeback Rates

Frequent disputes or chargebacks can signal misuse or fraudulent behavior. If you regularly dispute transactions, Cash App might interpret this as a pattern of dishonest activity, leading to account closure.

6. Linked to Fraudulent Accounts

If your account is associated with other accounts involved in fraudulent activities, your account may also be closed as a precautionary measure. This association can occur if you send or receive money from accounts flagged for suspicious behaviour.

7. Involvement in Prohibited Transactions

Engaging in transactions related to prohibited goods or services, such as illegal substances or counterfeit items, violates Cash App's Terms of Service. Such activities can result in the immediate closure of your Cash App account.

8. Payment Disputes

Frequent disputes with payments or recurring issues with transaction reliability can lead to your account being flagged. Cash App may close your account to protect its platform from potential misuse or fraud.

9. Unauthorized Access Attempts

Repeated unsuccessful login attempts or indications that your account is being accessed from unrecognized devices or locations can trigger security measures. To prevent unauthorized access, Cash App may close your account temporarily or permanently.

10. Policy Changes and Updates

Occasionally, updates to Cash App's policies or terms of service can lead to account closures. If your account activity no longer aligns with the updated policies, your account might be closed. It is crucial to stay informed about any changes to the terms of service to ensure continued compliance.

How to Reopen a Closed Cash App Account

If your Cash App account has been closed, there are steps you can take to attempt to reopen it. While success is not guaranteed, following these steps can improve your chances:

Contact Cash App Support

Reach out to Cash App support to inquire about the reason for your account closure and seek assistance in reopening it. Here’s how:

Open the Cash App on your mobile device.

Tap the profile icon in the upper right corner.

Select Support from the list of options.

Find a relevant topic related to account closure or choose "Something Else."

Contact Support and explain your situation in detail.

Provide Required Information

When contacting support, be ready to provide the following information to facilitate the process:

Full Name: As registered on your Cash App account.

Phone Number or Email: Linked to your Cash App account.

Details of the Issue: A clear description of why you believe your account was closed and how you have adhered to Cash App's policies.

Address Underlying Issues

If your account was closed due to specific violations, addressing those issues is crucial. This might involve:

Resolving Disputes: Clear up any outstanding disputes or chargebacks.

Completing Identity Verification: Ensure that all your personal information is accurate and up-to-date.

Persist with Follow-Ups

Persistence can be key in resolving account closures. If you do not receive a satisfactory response, continue following up with Cash App support. Keep a record of all communications for reference.

Preventing Future Account Closures

To avoid future account closures, consider the following best practices:

Adhere to Terms of Service

Ensure all your activities on Cash App comply with their Terms of Service. Avoid engaging in any actions that could be interpreted as fraudulent or illegal.

Monitor Account Activity

Regularly check your account for any unusual activity and report suspicious transactions immediately.

Keep Information Updated

Maintain accurate and current personal information on your account to ensure smooth operations and reduce the risk of issues.

Use the App Responsibly

Conduct transactions within the normal scope of your activity and avoid large or unusual transactions that might trigger security reviews.

Understanding why Cash App closes accounts and knowing how to reopen a closed Cash App account can help you navigate these challenges effectively. By following the guidelines provided and maintaining compliance with Cash App's policies, you can enjoy a seamless and secure experience with the platform.

0 notes