#cash loans in Mumbai

Text

Get Personal loan online in a few minutes | Dpal.in

We provide immediate cash loans at Dpal.in so that you can conveniently and promptly take care of your financial problems. Our loans are made to be hassle-free, with a quick approval time and easy application process. Our instant cash loans can give you the money you require, whether you need it for an urgent expense or just to pay your bills for shopping until your next payday. Apply now to quickly receive the money you need!

#personal loan#dpal.in#instant cash loans online in delhi ncr#short term personal loan#shopping loan#short term loan in delhi ncr#short term loans#short term loan#shopping loan online in delhi ncr#urgent loans in mumbai

1 note

·

View note

Text

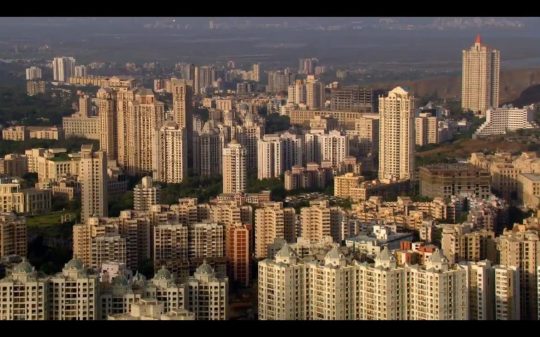

Why Real Estate Investing in India is a Profitable Choice

Real estate investing in India has become one of the most attractive avenues for generating long-term wealth. The real estate sector in the country is flourishing, thanks to rapid urbanization and government initiatives aimed at boosting infrastructure. As an investor, understanding the various types of real estate investments available is essential for maximizing returns and minimizing risks.

Why Invest in Indian Real Estate?

The Indian real estate market is expanding at an unprecedented rate. It offers a unique blend of investment options that cater to both conservative and aggressive investors. The rising demand for residential, commercial, and industrial properties offers lucrative opportunities for investors looking to diversify their portfolios.

1. High Return Potential

India’s economic growth has led to increased demand for housing and commercial spaces. Real estate properties in metro cities like Mumbai, Delhi, and Bangalore have shown significant appreciation in value over the years. This makes investing in property a highly profitable venture.

2. Tax Benefits

Investing in real estate in India offers various tax benefits. The government provides deductions on home loans and incentives for first-time homebuyers. These benefits not only lower the tax liability but also make real estate a more affordable investment.

Types of Real Estate Investments in India

1. Residential Properties

Residential real estate remains a popular investment choice in India. The demand for housing is steadily increasing due to population growth, urban migration, and an expanding middle class. Investors can earn returns through rental income or by selling the property at a higher value.

2. Commercial Real Estate

Commercial properties like office spaces, retail shops, and warehouses have seen tremendous growth. With the rise of multinational companies and startups, there is an increasing demand for commercial spaces. Investing in commercial real estate is ideal for those looking for higher rental yields and stable cash flow.

3. Fractional Ownership

Fractional ownership is a relatively new concept in India. It allows multiple investors to pool their resources and purchase high-value properties like commercial buildings or vacation homes. This model reduces the financial burden on individual investors and opens doors to premium properties that would otherwise be inaccessible.

4. Real Estate Investment Trusts (REITs)

REITs have become a popular way to invest in real estate without actually owning the property. These trusts pool money from multiple investors to buy income-generating properties. REITs are traded on stock exchanges, offering liquidity and transparency, which traditional real estate investments may lack.

Factors to Consider Before Investing

1. Location

Location is a crucial factor when investing in real estate. Properties in prime areas or upcoming localities have a higher chance of appreciating in value. It's important to research the area’s infrastructure, proximity to schools, hospitals, and transport hubs before making an investment.

2. Budget

Before diving into real estate investing, setting a clear budget is essential. Factor in all costs, including purchase price, registration fees, and maintenance costs. Ensure that your investment aligns with your financial goals and risk tolerance.

3. Market Trends

Keeping an eye on market trends is key to making profitable real estate investments. Stay updated on property prices, interest rates, and government policies that may impact the real estate market.

Conclusion

Real estate investing in India offers significant growth potential, provided you make informed decisions. Whether you choose residential properties, commercial spaces, or innovative options like fractional ownership and REITs, the Indian real estate market has something for every investor. By carefully considering factors like location, budget, and market trends, you can maximize returns and achieve financial stability through real estate investments.

0 notes

Text

lease rent discounting, lease rental discounting loan mumbai

Discover lease rent discounting solutions with SME Loan to unlock cash flow from your rental properties.Access quick financing based on your lease rental income.

lease rent discounting, lease rental discounting loan, rent discounting loan, lease rental discounting interest rate, lease discounting, rental discounting, lease rent finance, property lease financing, rent discounting scheme in bhandup, mumbai, india.

0 notes

Text

━ INTRODUCING ARNAV KHANNA

full name. arnav khanna

nickname(s). ari

age. 37

birthdate. april 22nd, 1987

occupation. professional matchmaker

sexual orientation. bisexual

currently living in. masonboro

gender. cis male

pronouns. he/him

hometown. orlando, florida

length of time in Wilmington. from age 8-18, and 32 onwards

face claim. varun dhawan

connections. // pinterest.

trigger warnings ; none

tldr;

arnav khanna was born in orlando and lived there until he was about 8 at which point his parents moved him to wilmington. he was a good soccer player and would've continued down the line until a bad injury prevented him from continuing to play. this dashed his dreams for going to school on a sports scholarship and so he went to a smaller college on the east coast. he's someone who loves romance and love and will almost always try set people up, sometimes for fun and sometimes for cash. he returned back to wilmington on and of after graduating before he went to india to learn from the indian matchmaking queen herself. he's started his business about four years ago and is might successful as well.

BIOGRAPHY;

Arnav Khanna was born to Sheetal and Subhash Khanna in the city of Orlando Florida. His parents moved to the United States before he was born and got settled on building a normal middle class life together. His father had been a doctor back in India and had to take numerous licensing exams to be able to practice and his mother was a teacher. Arnav grew up in a very happy household, his parents teaching him his native tongue of Hindi and Punjabi very early on, knowing that he'd pick up English in school easily which he did. He is very proud of his culture and being able to speak more than three different languages, his best friend spoke Spanish so he picked that up as well.

Of course very quickly after the first few years of Arnav’s in school did his parents decide to move to Wilmington which meant he’d had to say goodbye to that best friend and the life he'd built there with friends and in the 3rd grade he'd joined the Wilmington elementary school.

Arnav was always decent in school, never doing too poorly but never exceeding expectations either. But he didn't care, he knew he'd get by with passing marks. What he was always really interested in was playing soccer. He was on the team and was one of their star players until a pretty severe injury ended those soccer playing dreams of his. He’d been so set on allowing soccer to be his crutch to get into a good college with a scholarship but without it--he was stranded. His parents made enough to help him but Arnav had been forced to take out student loans as well. He'd gone into sports medicine as a career choice and till date he is a qualified sports physician, but he doesn’t do that for work anymore.

Arnav grew up with parents who were always sickeningly sweet with one another, and most of his extended family was the same which meant this young man had always been surrounded by love and happy matches everywhere. Throughout his school and college life, he'd often be helping his friends find significant others, mostly all relationships that actually flourished. He hadn’t of course thought much of it until the Netflix show called Indian Matchmaking hit the screen.

If this random woman could make loads of money off of setting people up, irrespective of if they got married or not—why couldn’t Arnav? Arnav went to India for a few months, luckily able to work there on the type of visa he held and interned with Sima from Mumbai who had shared some of her secrets with him, not realizing he was going to use them all for his own business.

Once he’d gathered all his information from her, he came back to the United States, this time in a new city with his parents as he got started on this matchmaking business. It’s been nearly four years since he’d began and luckily there's been no looking back since. Arnav’s had a success rate of 93.53%; a fact he’s exceedingly proud of. He also doesn’t choose only a certain group of people to help—his services expand beyond different cultures and religions.

Personally Ari is someone who just loves romance and love and doesn't really pretend to hide that part of him. It's funny then to know that the man hasn't exactly had the best luck in finding romance for himself; this of course is not a fact he advertises much. He's fully open to finding the right person and slowly but surely he's going to realize that connecting with people is important even if its not the forever type of love.

He likes to spread the love everywhere and does so successfully. Now he's back in Wilmington, a city where majority of his childhood and teenage years had been spent. He doesn’t know if the people in the city require his services but he’s eager to help if they do—and given his affinity for the town, he’ll do it with a discount as well.

1 note

·

View note

Text

Fintech Startup LEO1 Welcomes Cricketer Rohit Sharma As Strategic Investor

LEO1, a Mumbai-based financial firm, has taken a huge move by bringing on board cricket icon Rohit Sharma as a strategic investor. This significant development will support the company’s aim of alleviating cash flow challenges in educational institutions and providing new financial solutions to students across India.

LEO1’s Journey and Vision

LEO1, founded in 2018 by Rohit Gajbhiye, Naveesh Reddy, and Debi Prasad Baral, aims to revolutionize finance processes at educational institutions. Over the years, the startup has focused on expediting fee collecting and encouraging students to practice good financial conduct. LEO1’s goal is to build a smooth and efficient financial environment for both institutions and students by combining financial technology and education.

Strategic Investment and Future Plans

Rohit Sharma’s investment not only provides a financial boost to LEO1, but it also serves as a strong validation of the company’s vision and potential. The new funding from this investment will be used to address pending cash flow difficulties in educational institutions and expand the choice of financial solutions offered to students. The company’s creative method involves rewarding advance fee payments through a reward scheme, which not only ensures prompt fee collection but also encourages students to practice prudent financial habits.

Impressive Funding Milestones

In the previous three years, LEO1 has raised a total of INR 291 Cr ($35 Mn) in two funding rounds. These funds were raised from a wide range of investors, including QED Investors, Aavishkaar Capital, Ardent Investors LLC, 100Unicorns, and DMI Finance, among others. This considerable capital demonstrates investors’ trust in LEO1’s business concept and development prospects.

Introducing Financial SAAS

LEO1 just launched the ‘Financial SAAS’ platform, a comprehensive solution for managing financial transactions in the education industry. This platform comprises the LEO1 payment card, which serves as both a Smart card and a Smart ID card on campus. This dual feature facilitates financial transactions while also improving the entire student experience by combining numerous functions into a single card.

Financial Literacy and Immediate Education Loans

One of LEO1’s primary goals is to increase financial literacy among pupils. The organization offers quick education loans, encouraging students to acquire healthy financial habits early on. LEO1’s goal is to build a financially knowledgeable generation by providing students with the knowledge and skills they need to handle their money properly.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News

0 notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda

Bank of Baroda (BOB) offers retail, agriculture, private and commercial banking, and other related financial solutions. It includes loans, deposit services, and payment cards. The bank offers loans for homes, vehicles, education, agriculture, personal and corporate requirements, mortgage, securities, and rent receivables, among others. It provides current and savings accounts; fixed and recurring deposits; debit, credit, and prepaid cards. The bank also provides insurance coverage for life, health, and general purposes. It offers services such as treasury, financing, mutual funds, cash management, international banking, digital banking, internet banking, start-Up banking, and wealth management. The bank has operations in Asia-Pacific, Europe, North America, and the Middle East and Africa. BOB is headquartered in Baroda, Gujarat, India.

Industry Performance

The health of the banking system in India has shown steady improvement, according to the Reserve Bank of India’s latest report on trends in the sector. From capital adequacy ratio to profitability metrics to bad loans, both public and private sector banks have shown visible improvement. And as credit growth has also witnessed an acceleration in 2021-22, banks have seen an expansion in their balance sheet at a pace that is a multi-year high. As of November 4, 2022, bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion). As of November 4, 2022, credit to non-food industries stood at Rs. 128.87 lakh crore (US$ 1.58 trillion).

Given the increasing intensity, spread, and duration of the pandemic, economic recovery the performances of key companies in the industry was positive. The reported margin of the industry by analyzing the key players was around 13.7% by taking into consideration the last 3 years’ data. Details are as follows.

Companies Net Margin EBITDA/Sales

HDFC Bank Ltd. 23.5% 31.2%

ICICI Bank Ltd. 22.3% 30.4%

State Bank of India 10.0% 25.7%

Punjab National Bank 4.0% 10.0%

Bank of Baroda 8.9% 13.9%

Industry Margins 13.7% 22.2%

Industry Trends

The macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits.

Over the long term, banks will need to pursue new sources of value beyond product, industry, or business model boundaries. The new economic order that will likely emerge over the next few years will require bank leaders to forge ahead with conviction and remain true to their purpose as guardians and facilitators of capital flows. With these factors in mind, the industry is still showing huge growth potential, some of the growth divers that is propelling the industry are:

Rising rural income pushing up demand for banking

Rapid urbanisation, decreasing household size & easier availability of home loans has been driving demand for housing.

Growth in disposable income has been encouraging households to raise their standard of living and boost demand for personal credit.

The industry is attracting major investments as follows.

On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

Some of the major initiatives taken by the government to promote the industry in India are as follows:

As per the Union Budget 2022-23:

National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crores (US$ 6.70 billion) from the banks.

National payments corporation India (NPCI) has plans to launch UPI lite this will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly know as Digital Rupee.

Through analyzing the performance of the contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 9.9% at the end of 2022. Details are as below.

Companies CAGR

HDFC Bank Ltd. 14.02%

ICICI Bank Ltd. 7.3%

State Bank of India 8.4%

Punjab National Bank 9.2%

Bank of Baroda 10.7%

Industry CAGR 9.9%

Working through partnerships both with NBFCs and FinTech is high on the agenda of the Indian banking sector, and this is an area of focus of the FICCI National Committee on Banking. Banks will have to play a very constructive role as India aspires to be the leading economy in future. The strengthened banking sector has the potential to contribute directly and indirectly to GDP, increase job creation and enhance median income. Technology interventions to strengthen the quality and quantity of credit flow to the priority sector will be an important aspect. The need for sustainable finance / green financing is also gaining importance.

With these attributes boosting the sector, the Indian banking industry is likely to grow 5% more than the reported growth rate and is expected to exhibit CAGR of 10.4% in the next five years from 2023 to 2027.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

Business Loan in Mumbai: Fueling Growth and Expansion

In the bustling city of Mumbai, businesses thrive on ambition, innovation, and opportunity. Whether you're a startup looking to make your mark or an established enterprise seeking to expand your operations, access to capital is essential. A business loan in Mumbai can provide the financial backing you need to fuel growth, invest in infrastructure, hire talent, or weather unexpected challenges.

Understanding Business Loans

1. What are Business Loans?

Business loans are financial products designed to provide businesses with the necessary capital to fund operations, expand their reach, purchase equipment, hire employees, or manage cash flow.

Types of Business Loans

Traditional Bank Loans:

Offered by banks and financial institutions, these loans typically require collateral and have fixed interest rates.

Government-Sponsored Loans:

Backed by government agencies, such as Small Business Administration (SBA) loans, providing favorable terms and rates to eligible businesses.

Online Lenders:

Provide quick access to funding with flexible terms, catering to businesses with diverse financial needs.

Invoice Financing:

Allows businesses to leverage outstanding invoices to secure immediate funding.

Securing a Business Loan in Mumbai

1. Preparation

Before applying for a business loan, it's essential to have a clear understanding of your business needs, financial health, and repayment capabilities. Prepare a comprehensive business plan outlining your objectives, market analysis, and projected financials to present to lenders.

2. Research and Comparison

Explore various lenders in Mumbai and compare loan options, interest rates, repayment terms, and eligibility criteria. Consider factors such as processing time, customer service, and reputation when selecting a lender.

3. Documentation

Gather all necessary documents, including financial statements, tax returns, business licenses, and identification documents, to support your loan application. Be prepared to provide collateral or personal guarantees, depending on the type of loan.

4. Application Process

Submit your loan application along with the required documentation to the chosen lender. Be prepared for thorough evaluation and underwriting processes, including credit checks and financial analysis.

5. Approval and Disbursement

Upon approval, carefully review the loan terms and conditions before accepting the offer. Funds are typically disbursed directly to your business bank account, allowing you to commence operations or execute expansion plans promptly.

Conclusion

Securing a business loan in Mumbai is a strategic step towards achieving your business goals and driving growth. By understanding the various loan options, conducting thorough research, and preparing diligently, businesses can access the capital needed to thrive in Mumbai's competitive business environment.

0 notes

Text

Business Loan in Mumbai: Navigating the Financial Landscape

Businesses in Mumbai, the financial capital of India, often require financial support to thrive and expand. Business loans play a crucial role in fulfilling these needs, providing entrepreneurs with the necessary capital to invest in their ventures. In this article, we'll delve into the intricacies of business loan in Mumbai, exploring the various types, eligibility criteria, application process, benefits, risks, and more.

Understanding Business Loan in Mumbai

Mumbai boasts a vibrant and dynamic business environment, characterized by a diverse range of industries, including finance, entertainment, manufacturing, and technology. As businesses strive to stay competitive and seize growth opportunities, the demand for financing solutions remains high. Business loans serve as lifelines for enterprises, enabling them to fund working capital requirements, purchase equipment, expand operations, and embark on new ventures.

Types of Business Loans Available in Mumbai

Entrepreneurs in Mumbai can access a variety of business loan options tailored to their specific needs. Traditional banks offer conventional term loans and lines of credit, while government-backed schemes such as the Mudra Yojana provide financial assistance to micro, small, and medium enterprises (MSMEs). Additionally, alternative financing avenues like peer-to-peer lending platforms and fintech companies offer innovative funding solutions to businesses.

Eligibility Criteria for Business Loan in Mumbai

Credit history: A good credit score is often required to qualify for a business loan.

Business profitability: Lenders assess the financial health and profitability of the business.

Collateral: Some loans may require collateral to secure the funding.

Repayment capacity: Borrowers must demonstrate their ability to repay the loan.

Documentation: Applicants need to submit various documents such as business plans, financial statements, and identity proofs.

How to Apply for a Business Loan in Mumbai

Research loan options: Explore different lenders and loan products to find the best fit.

Gather documents: Prepare necessary documents, including business plans, financial statements, and identification proofs.

Complete the application: Fill out the loan application form accurately and comprehensively.

Submit application: Submit the application along with all required documents to the chosen lender.

Follow up: Stay in touch with the lender and respond promptly to any additional requests or inquiries.

Benefits of Business Loan in Mumbai

Access to capital: Business loans provide entrepreneurs with the necessary funds to invest in their ventures.

Financial flexibility: Loans offer flexibility in managing cash flow and funding business operations.

Tax advantages: Interest payments on business loans may be tax-deductible, providing potential tax benefits.

Building credit: Timely repayment of loans can help establish and improve the borrower's credit history.

Growth opportunities: With access to capital, businesses can seize growth opportunities and expand their operations.

Risks Associated with Business Loans

While business loans provide valuable financial support, they also entail certain risks, such as high-interest rates, stringent repayment terms, potential collateral requirements, and the risk of default. Entrepreneurs must carefully assess their financial situation and borrowing needs before availing of a loan to mitigate these risks effectively.

Choosing the Right Business Loan for Your Needs

Selecting the appropriate business loan requires careful consideration of various factors, including the amount of funding required, repayment terms, interest rates, fees, and eligibility criteria. Entrepreneurs should conduct thorough research, seek expert advice, and compare multiple loan options to identify the most suitable financing solution for their business.

Tips for Managing Business Loans Effectively

Budgeting: Develop a comprehensive budget to allocate funds for loan repayments and other business expenses.

Cash flow management: Monitor cash flow regularly to ensure sufficient funds are available for loan repayments.

Timely repayments: Make loan payments on time to avoid late fees and maintain a positive relationship with lenders.

Communication with lenders: Keep lines of communication open with lenders and inform them promptly of any financial challenges or changes in business circumstances.

Review loan terms: Periodically review loan terms and conditions to ensure compliance and identify opportunities for refinancing or restructuring if necessary.

Common Misconceptions About Business Loan in Mumbai

Despite the importance of business loans, several myths and misconceptions persist, leading to confusion and hesitation among entrepreneurs. By debunking these misconceptions and providing accurate information, businesses can make informed decisions regarding their financing needs and opportunities.

Future Outlook for Business Loan in Mumbai

Looking ahead, the landscape of business loan in Mumbai is expected to evolve in response to changing market dynamics, technological advancements, and regulatory developments. Innovations such as digital lending platforms, alternative credit scoring models, and government initiatives are likely to shape the future of business financing in the city.

Conclusion

In conclusion, business loans play a pivotal role in supporting the growth and development of enterprises in Mumbai's bustling economy. By understanding the various aspects of business loans, including types, eligibility criteria, application process, benefits, risks, and management strategies, entrepreneurs can make informed decisions to fulfill their financing needs effectively. Contact us now!

FAQs

1. What are the interest rates for business loan in Mumbai?

Ans: Interest rates for business loan in Mumbai vary depending on factors such as the borrower's creditworthiness, loan amount, and repayment tenure. Typically, banks and financial institutions offer competitive interest rates ranging from 10% to 20% per annum.

2. Can startups apply for business loan in Mumbai?

Ans: Yes, startups in Mumbai can apply for business loans to finance their initial capital requirements, working capital needs, and expansion plans. However, startups may face stricter eligibility criteria and higher interest rates compared to established businesses.

3. How long does it take to get approval for a business loan?

Ans: The approval process for a business loan in Mumbai can vary depending on the lender, loan amount, and complexity of the application. While some loans may be approved within a few days, others may require several weeks for processing and evaluation.

1 note

·

View note

Text

Life Insurance for Single Individuals: Do You Need It?

Introduction: The Significance of Life Insurance for Single Individuals

While life insurance is commonly associated with married couples or parents providing for their families, it holds relevance for single individuals as well. This article examines the necessity of life insurance for single individuals and the considerations to ponder when contemplating this decision.

Evaluating Financial Obligations and Dependents

Single individuals might assume they don't require life insurance since they lack dependents or a spouse who relies on their income. However, they may still carry financial responsibilities like student loans, credit card debt, or mortgage payments. Furthermore, some singles may have aging parents or siblings dependent on their financial assistance.

Understanding the Purpose of Life Insurance

Protection Against Financial Liabilities

Life insurance can serve to cover outstanding debts, thereby ensuring that loved ones aren't burdened with financial responsibilities should the policyholder pass away. This includes debts like student loans, credit card balances, or a mortgage.

Supporting Dependents

Even without children, single individuals may have dependents such as aging parents or siblings who count on their financial aid.

Life insurance offers a means of financial protection, guaranteeing that dependents are cared for upon the policyholder's demise.

Factors to Weigh When Assessing the Need for Life Insurance

Level of Debt

Single individuals should evaluate their debt load and determine if it would pose a financial strain on their loved ones in the event of their unexpected death. Life insurance can offer a safety net to cover these financial commitments.

Dependent Responsibilities

Consider whether there are any dependents reliant on the policyholder's financial support. This may encompass aging parents, siblings, or other family members financially impacted by the policyholder's demise.

Future Financial Aspirations

Contemplate future financial goals such as homeownership, retirement savings, or entrepreneurial pursuits. Life insurance can safeguard these aspirations by providing a financial safety net for loved ones.

Types of Life Insurance Policies Suited for Single Individuals

Term Life Insurance

Term life insurance furnishes coverage for a set period, like 10, 20, or 30 years. It presents affordable coverage and suits single individuals seeking temporary protection.

Whole Life Insurance

Whole life insurance offers lifelong coverage and incorporates a cash value component that accrues over time. It provides permanent protection and can function as a long-term financial asset.

Benefits of Life Insurance for Single Individuals

Financial Security

Life insurance furnishes financial protection for loved ones, ensuring that financial obligations are met if the policyholder passes away.

Peace of Mind

Possessing life insurance can deliver peace of mind, knowing that loved ones will receive financial support even in unforeseen circumstances.

Common Misconceptions About Life Insurance for Singles

"I don't need life insurance since I don't have dependents."

Even single individuals may bear financial responsibilities or support dependents, warranting the consideration of life insurance.

"Life insurance is unaffordable for singles."

There exist affordable life insurance alternatives for single individuals, such as term life insurance policies.

LIC Agent from Mumbai offers assistance for inquiries and insurance requirements.

0 notes

Text

Apply for instant cash loans online in delhi ncr, mumbai, chennai, bangalore, pune and hyderabad.

Instant approval

Quick disbursal

Paperless work

100% Online application process

Collateral free

Visit website :- https://www.dpal.in/

#instant cash loans online in delhi ncr#short term loan in delhi ncr#short term personal loan in mumbai#short term loan online in bangalore#immediate loans online in chennai#personal loan in pune#urgent loans in hyderabad

0 notes

Text

Money on Demand With 24x7 Top-Up Gold Loan

Are you ready to dive into a world where money isn’t just a question mark, but a simple and accessible answer? Welcome to Muthoot FinCorp ONE, where we have redefined the way you can access instant cash on demand.W ith us, it is your gold, your convenience, and 24x7 top-up Gold Loans at your fingertips.

Gold Loan from Home

So, what exactly is this fuss about Gold Loan from Home? Well, imagine a scenario where you don't have to rush to a bank or an NBFC, fretting about long queues or paperwork. Instead, we bring the solution to your doorstep. Yes, that’s right. You can now get a loan against your gold jewellery from the comfort of your home.

Swift Processing, Maximum Security

Getting a Gold Loan from Home with Muthoot FinCorp ONE is a breeze. Booking an appointment with us means welcoming a hassle-free, quick process that gets your loan approved within just 30 minutes*. We understand the value of your time, and that's why we ensure no long waits or endless procedures.

Your Gold's Safety

The ease, the speed, and the comfort. We not only process your loan swiftly but also ensure your gold's security. When you book an appointment, our team arrives at your doorstep, collects your pledged gold jewellery, and takes it to the nearest Muthoot FinCorp branch, all within a GPS-tracked safe locker. Safety? Check! Your jewellery is automatically insured for that added peace of mind.

No More Traditional Hassles

Unlike the traditional way of obtaining a Gold Loan, where you would have to carry your gold to a bank, our service eliminates that concern. We've simplified the process, making it more convenient, safer, and faster for you. We believe in offering you a hassle-free experience without any additional charges.

Flexible Repayment Tenure and Scheme Options

Curious about the repayment tenure? Don't worry; we've got you covered. With various Gold Loan schemes available on our app, you can choose a tenure that suits your needs. Whether you need a short-term loan or a longer repayment period, we have options tailored just for you.

Is Gold Loan from Home available in your city? As of now, we are offering this convenient service in Bangalore, Mumbai, Kolkata, Cochin, Trivandrum, Delhi-NCR, Bhubaneswar, Chandigarh, Pune, Jaipur, Indore, and Ahmedabad. Stay tuned because we're expanding to more cities soon!

Unlocking the value of your gold has never been this seamless. With Muthoot FinCorp ONE, getting instant money with Gold Loans at your convenience is no longer a dream—it's your reality. So, why wait? Embrace the ease, security, and speed of our Gold Loan from Home service today and say hello to instant cash on demand.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

0 notes

Text

GP Parsik Sahakari Bank, Home Loan, Personal Loan in Thane

GP Parsik Sahakari Bank, Home Loan, Personal Loan, Car Loan, Gold Loan, Education Loan, Professional Loan, Business Loan in Kalwa, Thane, Mumbai, Call: 022-25456500.

GP Parsik Sahakari Bank, Home Loan, Personal Loan, Car Loan, Gold Loan, Education Loan, Professional Loan, Business Loan, Personal Loan Sahakari Bank in Kalwa, Thane, Mumbai, Deposit Schemes, Quarterly Deposit, Monthly Deposit, Fixed Deposit, Reinvestment Deposit, Recurring Deposit, Tax Saving Scheme Deposit, Current Account, Saving Account, Basic Saving Bank Deposit Account, Small Saving Bank Deposit Account, Parsik Student Account, Senior Citizens, Loans & Advances, Housing Loans, House Repairs Loan, Vehicle Loan, Car Loan, Poclain machine, Article Loan, Personal Loan, Group Loan, Business Loan, Cash Credit, Education Loan, Professional Loan, Gold Loan, Rent Discounting Scheme, Loan Against Term Deposit, Loan Against Govt. Security, Easy And Quick Secured Personal Loan, Term Loan For Builders And Developers, Loan Against Property, Non Funded Facilities.

www.gpparsikbank.com

0 notes

Text

Unlocking Opportunities: The Best Business Loan in Mumbai

In the bustling metropolis of Mumbai, entrepreneurs and businesses are constantly seeking avenues for growth and expansion. Access to capital is crucial for realizing these aspirations, and the city offers a plethora of options for securing the best business loan in Mumbai. Whether you're a budding startup or an established enterprise, finding the right financial partner can make all the difference in propelling your business forward.

Understanding the Best Business Loans

The best business loans in Mumbai are tailored to meet the diverse needs of businesses operating in the city's dynamic environment. These loans offer competitive interest rates, flexible repayment terms, and quick approval processes, empowering entrepreneurs to seize opportunities and overcome challenges with ease.

Key Features of the Best Business Loans

Competitive Interest Rates: The best business loans in Mumbai come with competitive interest rates that enable businesses to access affordable financing without burdening their bottom line.

Flexible Repayment Terms: Recognizing the varying cash flow needs of businesses, these loans offer flexible repayment terms, allowing borrowers to customize their repayment schedules based on their financial circumstances.

Quick Approval Process: Time is of the essence in the fast-paced business world of Mumbai. The best business loans prioritize efficiency, offering a streamlined application and approval process that ensures quick access to funds when needed most.

Customized Solutions: Every business is unique, and the best business loans in Mumbai recognize this fact by offering customized financing solutions tailored to meet the specific needs and objectives of each borrower.

Finding the Best Business Loan in Mumbai

When searching for the best business loan in Mumbai, entrepreneurs should consider factors such as interest rates, repayment terms, loan amounts, and eligibility criteria. It's essential to conduct thorough research, compare different loan products, and choose a reputable lender with a track record of serving businesses in Mumbai effectively.

Conclusion

Securing the best business loan in Mumbai is a strategic decision that can have a profound impact on the success and growth of your business. By understanding your financing needs, exploring your options, and working with a trusted financial partner, you can access the capital you need to fuel your business's expansion and achieve your entrepreneurial goals.

0 notes

Text

HDFC Bank Loans

HDFC Bank

HDFC Bank is one of the largest private sector banks in India. It was incorporated in August 1994 and is headquartered in Mumbai, Maharashtra. HDFC Bank provides a wide range of financial products and services to retail and corporate customers.

Here are some key points about HDFC Bank:

- Services: HDFC Bank offers various banking services, including savings accounts, current accounts, fixed deposits, loans, credit cards, debit cards, forex services, insurance, and investment products.

- Retail Banking: HDFC Bank serves individual customers through its extensive network of branches, ATMs, and digital platforms. It provides services such as personal banking, home loans, auto loans, educational loans, and other retail lending products.

- Corporate Banking: HDFC Bank caters to the banking needs of corporate clients, including small and medium enterprises (SMEs), large corporates, and government entities. It offers services such as working capital loans, trade finance, cash management solutions, treasury services, and corporate advisory services.

- Digital Banking: HDFC Bank has invested significantly in digital banking solutions. It provides online and mobile banking services, allowing customers to perform various banking transactions, pay bills, transfer funds, and access a range of financial services conveniently.

- Network: HDFC Bank has a vast network of branches and ATMs across India, making it easily accessible to customers in both urban and rural areas. Additionally, the bank has expanded its international presence by establishing offices in select countries.

- Awards and Recognition: HDFC Bank has been recognized for its excellence in banking and customer service. It has received several awards and accolades, including being ranked among the top banks globally by various financial publications.

- Financial Performance: HDFC Bank has consistently delivered strong financial performance over the years. It has shown robust growth in its assets, profitability, and customer base, making it one of the most valuable banks in India.

HDFC Bank Personal Loans

HDFC Bank offers personal loans to individuals who require funds for various purposes, such as debt consolidation, home renovation, medical expenses, education, wedding expenses, and more. Here are some key features of HDFC Bank personal loans:

- Loan Amount: HDFC Bank provides personal loans ranging from a few thousand rupees up to a certain maximum limit, depending on various factors like your income, credit history, and repayment capacity.

- Competitive Interest Rates: The interest rates on HDFC Bank personal loans are competitive and are generally based on factors such as your credit score, loan amount, and repayment tenure.

- Flexible Repayment Tenure: HDFC Bank offers flexible repayment options, allowing you to choose a repayment tenure that suits your financial situation. The tenure can range from a few months up to a few years.

- Quick Processing: HDFC Bank aims to provide a quick and hassle-free loan approval process. If you meet the eligibility criteria and submit the required documents, you can expect a relatively quick loan disbursal process.

- Minimal Documentation: HDFC Bank requires minimal documentation for personal loan applications. Generally, you will need to provide proof of identity, address, income, and bank statements.

- Prepayment and Foreclosure: HDFC Bank allows you to make prepayments towards your personal loan, which can help you reduce your overall interest burden. Additionally, if you have the financial means, you can choose to foreclose the loan before the end of the loan tenure.

- Online Application: HDFC Bank provides the convenience of applying for personal loans online through its website or mobile app. This allows you to submit your application and track its progress from the comfort of your home.

It's important to note that the specific terms and conditions of HDFC Bank personal loans may vary based on factors such as your creditworthiness, the loan amount, and the prevailing policies of the bank. It's advisable to directly contact HDFC Bank or visit their official website for the most up-to-date and accurate information regarding personal loans.

HDFC Bank Business Loans

HDFC Bank offers business loans to meet the financial requirements of various types of businesses, including small and medium enterprises (SMEs), self-employed professionals, and large corporates. Here are some key features of HDFC Bank business loans:

- Loan Amount: HDFC Bank provides business loans ranging from a few lakh rupees to a certain maximum limit, depending on factors such as the nature of the business, financials, and repayment capacity.

- Flexible Repayment Tenure: The bank offers flexible repayment options, allowing you to choose a tenure that suits your business cash flow and repayment capability. The tenure can range from a few months up to several years.

- Collateral Requirements: HDFC Bank business loans can be secured or unsecured, depending on the loan amount, business profile, and creditworthiness. Secured loans may require collateral, such as property, inventory, or other assets, while unsecured loans are provided based on the borrower's creditworthiness.

- Competitive Interest Rates: The interest rates on HDFC Bank business loans are competitive and vary based on factors such as the loan amount, tenure, collateral (if applicable), and the borrower's credit profile.

- Quick Processing: HDFC Bank aims to provide a quick and streamlined loan approval process for business loans. If you meet the eligibility criteria and submit the required documents, you can expect a relatively quick loan disbursal process.

- Customized Loan Solutions: HDFC Bank offers various types of business loans tailored to different business needs, such as working capital loans, term loans, equipment financing, trade finance, and loans for specific sectors.

- Minimal Documentation: HDFC Bank strives to simplify the documentation process for business loans. You will typically need to provide proof of identity, address, financial statements, business vintage, bank statements, and other relevant documents.

- Online Application: HDFC Bank provides the convenience of applying for business loans online through its website or mobile app. This allows you to submit your application and track its progress conveniently.

It's important to note that the specific terms and conditions of HDFC Bank business loans may vary based on factors such as the type of loan, loan amount, collateral (if applicable), and the bank's policies. It's advisable to directly contact HDFC Bank or visit their official website for the most up-to-date and accurate information regarding business loans.

HDFC Bank Loan against property

HDFC Bank offers loans against property, which allow individuals to leverage their residential or commercial properties to avail funds for various purposes. Here are some key features of HDFC Bank loan against property:

- Loan Amount: HDFC Bank provides loans against property ranging from a certain minimum amount to a maximum limit, depending on factors such as the value of the property, income, repayment capacity, and the bank's policies.

- Property Types: HDFC Bank accepts various types of properties as collateral for loan against property, including self-occupied residential properties, rented residential properties, and commercial properties.

- Flexible Repayment Tenure: The bank offers flexible repayment options, allowing you to choose a tenure that suits your financial situation. The tenure can range from a few years up to several years, depending on the loan amount and your repayment capacity.

- Competitive Interest Rates: The interest rates on HDFC Bank loan against property are competitive and are generally based on factors such as the loan amount, property value, tenure, and the borrower's credit profile.

- Loan to Value (LTV) Ratio: HDFC Bank provides loans against property up to a certain percentage of the property's value, known as the Loan to Value (LTV) ratio. The specific LTV ratio may vary based on factors such as the property type, location, and the bank's policies.

- End-Use Flexibility: The funds obtained through a loan against property can be used for various purposes, such as business expansion, debt consolidation, education expenses, medical expenses, wedding expenses, and more.

- Quick Processing: HDFC Bank aims to provide a quick and streamlined loan approval process for loan against property. If you meet the eligibility criteria and submit the required documents, you can expect a relatively quick loan disbursal process.

- Minimal Documentation: HDFC Bank requires specific documentation for loan against property, including proof of identity, address, property documents, income proof, and bank statements. The bank may also conduct a valuation of the property.

- Foreclosure and Prepayment: HDFC Bank allows you to make prepayments towards your loan against property, which can help you reduce your interest burden. Additionally, if you have the financial means, you can choose to foreclose the loan before the end of the loan tenure.

It's important to note that the specific terms and conditions of HDFC Bank loan against property may vary based on factors such as the property type, loan amount, tenure, and the bank's policies. It's advisable to directly contact HDFC Bank or visit their official website for the most up-to-date and accurate information regarding loan against property.

HDFC HOME LOAN

HDFC Bank offers home loans to individuals who wish to purchase or construct a house, as well as for home improvement, renovation, or extension purposes. Here are the key features of HDFC Bank home loans:

- Loan Amount: HDFC Bank provides home loans ranging from a few lakh rupees to a certain maximum limit, depending on factors such as your income, repayment capacity, property value, and the bank's policies.

- Loan Types: HDFC Bank offers various types of home loans, including home purchase loans, home construction loans, home improvement loans, and home extension loans. You can choose the loan type that suits your specific requirements.

- Competitive Interest Rates: The interest rates on HDFC Bank home loans are competitive and depend on factors such as the loan amount, tenure, type of interest rate (fixed or floating), and your credit profile.

- Repayment Tenure: HDFC Bank offers flexible repayment options, allowing you to choose a tenure that suits your financial situation. The tenure can range from a few years up to several years, depending on the loan amount and your repayment capacity.

- Loan to Value (LTV) Ratio: HDFC Bank provides home loans up to a certain percentage of the property's value, known as the Loan to Value (LTV) ratio. The specific LTV ratio may vary based on factors such as the loan amount, property type, location, and the bank's policies.

- Quick Processing: HDFC Bank aims to provide a quick and streamlined loan approval process for home loans. If you meet the eligibility criteria and submit the required documents, you can expect a relatively quick loan disbursal process.

- Minimal Documentation: HDFC Bank requires specific documentation for home loan applications, including proof of identity, address, income proof, property documents, and bank statements. The bank may also conduct a valuation of the property.

- Online Application: HDFC Bank provides the convenience of applying for home loans online through its website or mobile app. This allows you to submit your application, track its progress, and access various services related to your home loan.

- Special Schemes and Offers: HDFC Bank periodically offers special schemes, discounts, and promotional offers on home loans, such as reduced interest rates or processing fee waivers. It's advisable to check with the bank for any ongoing offers.

It's important to note that the specific terms and conditions of HDFC Bank home loans may vary based on factors such as the loan amount, property type, tenure, interest rate, and the bank's policies. It's advisable to directly contact HDFC Bank or visit their official website for the most up-to-date and accurate information regarding home loans.

HDFC Bank auto loans

HDFC Bank offers auto loans to individuals who wish to purchase a new or used car. These loans provide financial assistance for the purchase of cars, including passenger vehicles, sports utility vehicles (SUVs), and multi-utility vehicles (MUVs). Here are the key features of HDFC Bank auto loans:

- Loan Amount: HDFC Bank provides auto loans ranging from a certain minimum amount to a maximum limit, depending on factors such as the car's value, your income, repayment capacity, and the bank's policies.

- Loan Types: HDFC Bank offers auto loans for both new and used cars. The loan amount and terms may vary depending on whether you are purchasing a new car or a used one.

- Competitive Interest Rates: The interest rates on HDFC Bank auto loans are competitive and depend on factors such as the loan amount, tenure, type of interest rate (fixed or floating), and your credit profile.

- Repayment Tenure: HDFC Bank offers flexible repayment options, allowing you to choose a tenure that suits your financial situation. The tenure can range from a few years up to several years, depending on the loan amount and your repayment capacity.

- Loan to Value (LTV) Ratio: HDFC Bank provides auto loans up to a certain percentage of the car's value, known as the Loan to Value (LTV) ratio. The specific LTV ratio may vary based on factors such as the loan amount, car type, age of the car, and the bank's policies.

- Quick Processing: HDFC Bank aims to provide a quick and streamlined loan approval process for auto loans. If you meet the eligibility criteria and submit the required documents, you can expect a relatively quick loan disbursal process.

- Minimal Documentation: HDFC Bank requires specific documentation for auto loan applications, including proof of identity, address, income proof, car documents, and bank statements. The bank may also conduct a valuation of the car.

- Online Application: HDFC Bank provides the convenience of applying for auto loans online through its website or mobile app. This allows you to submit your application, track its progress, and access various services related to your auto loan.

- Dealer Network: HDFC Bank has tie-ups with various car dealerships across the country, which can simplify the loan application and disbursal process. You can inquire about HDFC Bank auto loans at authorized car dealerships.

It's important to note that the specific terms and conditions of HDFC Bank auto loans may vary based on factors such as the loan amount, car type, tenure, interest rate, and the bank's policies. It's advisable to directly contact HDFC Bank or visit their official website for the most up-to-date and accurate information regarding auto loans.

HDFC EDUCATION LOAN

HDFC Bank offers education loans to students who wish to pursue higher education in India or abroad. These loans help cover the expenses related to tuition fees, books, accommodation, travel, and other educational costs. Here are the key features of HDFC Bank education loans:

- Loan Amount: HDFC Bank provides education loans ranging from a certain minimum amount to a maximum limit, depending on factors such as the course type, institute, and the bank's policies. The loan amount can cover a significant portion of the educational expenses.

- Courses Covered: HDFC Bank offers education loans for a wide range of courses, including undergraduate, postgraduate, diploma, vocational, professional, and other recognized courses in India and abroad.

- Competitive Interest Rates: The interest rates on HDFC Bank education loans are competitive and depend on factors such as the loan amount, tenure, and your credit profile. The bank may offer different interest rates for loans based on the location of the institute and the type of course.

- Repayment Tenure: HDFC Bank provides flexible repayment options for education loans, allowing you to choose a tenure that suits your financial situation. The tenure typically starts after the completion of the course, and it can extend up to several years.

- Collateral Requirements: HDFC Bank may require collateral or a third-party guarantor for education loans above a certain amount. The collateral can be in the form of property, fixed deposits, or other acceptable assets.

- Moratorium Period: HDFC Bank offers a moratorium period, during which you are not required to make loan repayments. The moratorium period usually extends to the course duration and an additional period for job search or setting up a business.

- Quick Processing: HDFC Bank aims to provide a quick and streamlined loan approval process for education loans. If you meet the eligibility criteria and submit the required documents, you can expect a relatively quick loan disbursal process.

- Minimal Documentation: HDFC Bank requires specific documentation for education loan applications, including proof of identity, address, admission letter from the educational institution, fee structure, and academic records. The bank may also request additional documents as per their requirements.

- Online Application: HDFC Bank provides the convenience of applying for education loans online through its website or mobile app. This allows you to submit your application, track its progress, and access various services related to your education loan.

It's important to note that the specific terms and conditions of HDFC Bank education loans may vary based on factors such as the loan amount, course type, institute, interest rate, collateral requirements, and the bank's policies. It's advisable to directly contact HDFC Bank or visit their official website for the most up-to-date and accurate information regarding education loans.

HDFC WORKING CAPITAL LOAN

HDFC Bank offers working capital loans to businesses to meet their short-term funding requirements and manage their day-to-day operations. These loans provide businesses with the necessary funds to cover expenses such as inventory purchase, raw material procurement, operational costs, and other working capital needs. Here are the key features of HDFC Bank working capital loans:

- Loan Amount: HDFC Bank provides working capital loans ranging from a certain minimum amount to a maximum limit, depending on factors such as the business's financials, industry type, repayment capacity, and the bank's policies.

- Types of Working Capital Loans: HDFC Bank offers various types of working capital loans, including cash credit facility, overdraft facility, invoice discounting, and bank guarantees. You can choose the loan type that suits your specific business requirements.

- Collateral Requirements: HDFC Bank may require collateral or security for working capital loans, depending on factors such as the loan amount, business profile, and creditworthiness. The collateral can be in the form of property, inventory, receivables, or other acceptable assets.

Read the full article

0 notes