#cnbc awarded research firm

Text

Amazon anaconda

#Amazon anaconda software

#Amazon anaconda plus

With more than 20 years in the technology industry, Stephen now serves as the SVP of Product at Anaconda. Michael received a PhD and MS in Electrical Engineering from Stanford University, and a BS in Electrical and Computer Engineering from The University of Texas at Austin. Prior to joining Anaconda, Michael served as a consulting assistant professor in the Information Systems Laboratory, a research associate in the Department of Energy Resources Engineering at Stanford University, and a staff scientist in the Department of Applied and Computational Mathematics at the California Institute of Technology. As a recognized subject matter expert in convex optimization, Michael’s open source modeling tools for optimization have twice been recognized with awards from the International Society for Mathematical Programming. He assists clients in the development of advanced Python data science applications using Anaconda Distribution. Michael is a computational mathematician specializing in optimization, signal processing, and simulation, and a contributor in classroom, research, and commercial settings. He resides in Sherborn, Massachusetts and Santa Fe, New Mexico. He is married (37+ years) and has two grown sons and a daughter-in-law, all of whom he adores. Barry is a graduate of Tufts University (BA, Magna Cum Laude) and Columbia University (MBA, Beta Gamma Sigma). Finally, he co-created the first AI program for leaders in EdX.īarry began his career with McKinsey & Company, was a partner and co-leader of Global Research and Innovation at Arthur Andersen, and co-led John Hancock’s $2B Real Estate Equity arm. He has also appeared on CNN, CNBC, Fox News Network, NPR, and Facebook Live. In addition, Barry has delivered more than 500+ keynote speeches to 50,000+ people globally on digital business models. Past and present clients of Barry’s include CEO’s at Neiman Marcus, Barrick Gold, iRobot,, Deloitte, GE Healthcare, Sun Life, ESPN and ATT.īarry has co-authored 1,500 articles for the WSJ, NYT, HBR, MIT, and Forbes six books, including his most recent, The Network Imperative, published by HBR, and 20+ e-books. He also served as a senior fellow and Board Member of the SEI Center at The Wharton School responsible for platform and network business model research.

#Amazon anaconda plus

He is the founder and CEO of AIMatters, Inc., an AI start up a strategic advisor and board partner at BuildGroup, a growth equity firm that invests in SaaS plus marketplace companies, and an advisor to chairmen and CEOs on their AI powered platform business model transformations. She is a CPA and has a Bachelors in Finance and an MBA from The University of Texas at Austin.īarry is a digital board member, CEO advisor and AI leader. As VP of Finance at Broadwing, Angela led the raising of more than $200 million and managed the company's M&A activities and investor relations functions.Īngela also previously managed financial services and corporate banking as an executive with The Bank of Tokyo Mitsubishi and Deutsche Bank. Previously, as CFO of Trillion Partners, she spearheaded the effort to raise $60 million in debt and private equity for the business.

#Amazon anaconda software

In her tenure as the CFO for AirStrip Technologies, a med-tech software company backed by Sequoia Capital, she supported the successful scale of the business and raised more than $100 million in equity and debt financing. Angela is no stranger to crafting financial management plans for technology leaders. With more than 25 years years of executive-level financial development experience for a wide range of businesses, Angela Pierce now provides financial stewardship and executive leadership at Anaconda.

1 note

·

View note

Text

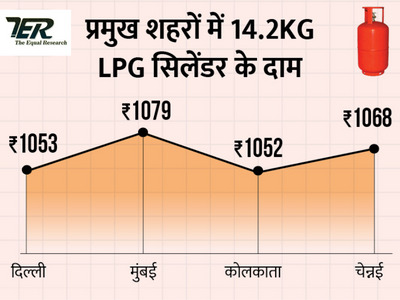

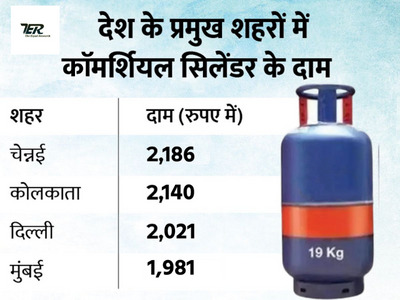

Sensex Rises Over 300 Points Amid Positive Global Cues, Nifty Trades Above 16,200

Indian equity benchmarks traded higher on opening trades on Friday, taking a cue from global markets.

Indian equity benchmarks traded higher on opening trades on Friday, taking a cue from global markets. Asian stocks followed Wall Street gains overnight as fears of an economic slowdown eased. Additionally, the pound began to recover from recent losses after Boris Johnson stepped down as British Prime Minister.

Trends in Nifty Futures on the Singapore Exchange (SGX Nifty) have indicated a cautious start for national indices.

The 30-stock BSE Sensex Index jumped 316 points or 0.58% to 54,495 at the start of the session, while the broader NSE Nifty jumped 104 points or 0.64% to 16,236.

Small and mid cap stocks were trading on a strong note as Nifty Midcap 100 was up 0.32% and small caps were up 0.59%.

13 of the 15 sector indicators - compiled by the National Stock Exchange - were traded in green. The Nifty Bank and Nifty Auto sub-indices outperformed the NSE platform up 0.67% and 0.77% respectively.

On the specific stock front, M&M was Nifty's best gain as the stock climbed 2.80% to ₹ 1,165.05. Winners also include L&T, Coal India, Axis Bank and NTPC.

The overall market size was positive as 1,715 stocks were advancing while 622 were down on BSE.

In the BSE 30-share index, L&T, M&M, NTPC, Axis Bank, ICICI Bank, UltraTech Cement, PowerGrid, Infosys, Tech Mahindra, Kotak Mahindra Bank, Sun Pharma and Wipro were among the best gainers.

Additionally, shares of Life Insurance Corporation of India (LIC), the country's largest insurer and largest national financial investor, were up 1.17% to ₹ 706.30.

Conversely, Asian Paints, Tata Steel, IndusInd Bank, Hindustan Unilever, Titan, TCS, Bajaj Finance, Dr Reddy's, and Maruti all traded in the red.

Sensex was up 427 points or 0.80% to close at 54,178 on Thursday, while Nifty was up 143 points or 0.89% to settle at 16,133.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

2 notes

·

View notes

Text

Research Partnership

Named as one of the 2019 Presidential Leadership Scholars, she is the primary Pakistani-American woman to graduate from this prestigious bipartisan program. Sumera’s leadership project on women’s and global well being was highlighted during the Presidential Leadership Forum.

Eurofins provides priceless coaching opportunities to help you navigate compliance complexities as they apply your industry/merchandise. The consulting agency earlier this yearadded seventeen managing administrators to its US operations.

There are comparatively weak mental property regimes in some Southeastern Asia international locations, which creates problems for firms – significantly these within the development and manufacturing sectors.

Enforcement of IP legal guidelines and regulations has been a recurring downside, and there may be battle between IP offices in different international locations. Southeast Asia’s infrastructure has struggled prior to now, however ASEAN nations are making strides in addressing problems by increasing spending.

Driven by digital transformation, virtual health is an more and more popular various to traditional care. To be taught more about how CT may help you higher manage your world compliance wants, contact a CT representative at (toll-free US).

Business relationships as a complete take longer to build and develop in Asia in comparison with the West.

Personal friendship and trust are cornerstones of enterprise relationships within the region, so face-to-face conferences are much more widespread than cellphone calls and emails. asia business Those planning on doing business in Asian countries can anticipate to invest in vital face time.

He has been honored to advise on tips on how to take the important but summary U.N. Sustainable Development Goals on well being, education, and gender equity and make them pertinent to a company’s strategic and operational decision-making processes.

Dr. Anyaoku has specific passion for enhancing the health and wellbeing of underserved populations by way of the development of affected person and neighborhood focused methods which goal to promote health fairness and remove well being disparities.

Dr. Anyaoku works with innovative digital health options as an important device in her quest to empower and advance the well being of various populations. She has an in depth monitor report as an advocate for families mixed with a singular energy to leverage partnerships and foster effective collaborations throughout spheres of influence.

She is a confirmed doctor government with over 20 years of scientific and administrative experience in pediatrics and population well being, well being fairness and digital health innovation. She holds several management roles throughout the group together with serving because the pediatric population health lead for PSJH, and in addition serves on a number of nonprofit boards.

Prior to arriving at Swedish, Dr. Anyaoku served as the Division Chief of General Pediatrics on the Children’s Hospital of New Jersey, then as the Medical Director of Pediatrics for CHI Alegent Creighton system in Omaha, Nebraska. With a strong regional presence, we may help you advance in emerging and key markets in Asia. Our staff’s can-do perspective means we are at all times in search of what is feasible.

Our speakers have addressed audiences on the International Economic Forum of the Americas, OECD, World Bank, European Commission, and European Central Bank, as well as nationwide governmental bodies in the United States, Europe, and Asia.

They make regular appearances on tv networks throughout the globe, together with CNN, CNBC, BBC, Bloomberg TV, Phoenix Chinese Television, and NHK .

Her immigrant success story and international health work will be featured in President George W. Bush’s upcoming book “Out of Many, One”.

Sumera is a Pakistani-trained doctor and survivor of gender-primarily based violence who has devoted her life to gender points in global health. She has extensive ties to health care leaders and institutions in India, Pakistan, and MENA.

Dr. Haque serves as a judge and academy member of the Dubai-based mostly Varkey Foundation-Global Teacher Prize, a million-dollar award to distinctive teachers across the globe. Gulser Corat is a strategic advisor to Coopersmith Law + Strategy for know-how, training, multi-laterals, and gender fairness.

1 note

·

View note

Text

SIP accounts reach an all-time high of 5.55 crores, investment of 12,276 crores

Despite the continued sale of foreign investors from Indian stock markets, the decline in global markets, the weakness of the rupee, the rise in inflation, retail investors have confidence in mutual funds. Last June, the number of SIP accounts hit an all-time high of 5.55 crore. Not only this, the investment from SIP also reached an all-time high of Rs 12,276 crore.

The mutual fund portfolio grew 31% year-on-year

According to data from Amfi, an association of mutual fund companies, equity funds recorded net investments for the 16th consecutive month in June. The asset under management in the sector reached an all-time high of Rs 35.64 lakh crore. The number of mutual fund portfolios grew 31% year-on-year. These increased to 13.46 crore from 10.25 crore in June 2021.

The number of SIP accounts hit an all-time high of 5.55 crore. The net AUM of the retail schemes (Equity + Hybrid + Solution Oriented) grew 16% yoy to Rs 17.91 lakh crore. Retail schemes saw positive net flow of Rs 13,338 crore in June for the 16th consecutive month after March 2021.

All retail equity schemes recorded positive inflows in June

says NS Venkatesh, CEO of Amfi, the trend of small investors to save through SIPs. The mega trend of financialization of savings also continues in the country. All retail equity schemes, indices, ETFs and FoFs showed positive investments in June. This reflects the confidence of retail mutual fund investors towards long-term growth amidst the ups and downs of the stock market.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

1 note

·

View note

Text

How Women Entrepreneurs are Shaping the FinTech Industry

Globally, of FinTech startups have female founders or co-founders, and only 6% have female CEOs. Experts often talk about the benefits of FinTech for women, but only a few females represent decision-making roles in this rapidly growing industry. This data is alarmingly low, given that women-funded startups grow funds twice compared to others.

In most industries, women have more hurdles when setting up their own companies. Overcoming gender bias is the biggest challenge for women in any industry. Society shoulders women with unrealistic expectations to balance both personal and professional responsibilities. The pay gap is another difficulty women face in the workplace.

In , there is a huge opportunity for women at both ends — consumers and top management. As per research, out of 1.7 billion unbanked people globally, 55% are women. FinTech can make service platforms that serve the specific needs of women and their families. Even in fields like online trading, women’s representation is significantly low.

Despite several challenges, there are many powerful women in the FinTech industry. They are leading the way for other women entrepreneurs. Here are a few women creating a noticeable impact in the FinTech world with their talent.

Adina Eckstein (Chief Operating Officer, Lemonade)

Eckstein joined Lemonade as chief of Staff, later became Vice President of Operations, and now, is serving as Chief Operating Officer. Eckstein spent almost four years with HSBC before joining Lemonade. She also served BBC and tech startup Tvinci. Lemonade was not affected notably by the pandemic. The company has artificial intelligence-based bots that help to validate insurance claims over “chat” in various cases.

Lemonade provides casualty and property insurance in the US, Netherlands, and Germany. The company has grown at a higher pace since its incorporation. It also started offering car and life insurance services. In April 2018, it received $300 million in a funding round and its total funding to date is $480 million. Eckstein proves that out-of-box thinking can fetch incredible results to the table.

Susanne Chishti (CEO, FINTECH Circle)

Susanne Chishti is the chief executing officer (CEO) of FINTECH Circle. FINTECH is an investor network and platform which serves more than 1,30,000 members. She started building her career 20 years ago by working in a FinTech company in Silicon Valley. At that time, even the word wasn’t invented.

She has played the role of co-editor for the best-selling The FINTECH Book, as well as The WEALTHTECH Book, The INSURTECH Book, The PAYTECH Book, The AI Book, and The LEGALTECH Book published by WILEY. She also served as a FinTech TV commentator on CNBC.

Furthermore, she has been honored with the Social Media Influencer of the Year 2018 (Investment Week) award, Top 7 Crypto Experts globally 2018 (Inc Magazine) award, and City Innovator — Inspirational Woman in 2016 award. Her experience has helped many companies she has served to leverage their business.

Carolyn Feinstein (Chief Marketing, Growth, and Design Officer, Varobank)

Carolyn Feinstein started serving Varobank as Chief Marketing, Growth, and Design Officer in early 2021. With 25 years of marketing experience, she is serving on the board of directors for Malwarebytes and as an Advisor for Proxy. She also served as Chief Marketing Officer for Dropbox and spent 16 years at game publisher Electronic Arts before Varobank.

Feinstein says, as an all-digital bank with a bank charter, Varo can acquire consumers from both traditional banks and neobanks. It is a unique competitive advancement for the company.

Voracious intellectual curiosity and devotion to consumers are the main qualities of Feinstein that helps her perform her tasks excellently. Varo is valued at This September, it announced that it has doubled its accounts and tripled its revenue as it has become the first consumer FinTech firm to be nationally chartered.

Upasana Taku (Co-founder, MobiKwik)

Upasana is the co-founder of MobiKwik, an e-wallet company. It was a recharge platform, which later became the leading mobile wallet in India. In 2009, when India was a complete cash economy, Upasana and her co-founder, Bipin took the risk to introduce a digital wallet. They were confident about their vision despite plenty of suggestions of dropping the idea and starting something mainstream. Since its start, MobiKwik has shown tremendous growth.

Their company started growing slowly, and by June 2012, they were a team with 35 members in it. They received RBI’s PPI license in July 2013. In the first round of funding, the company received $5 million. During the second round, they raised $25 million from various investors. In 2016, the company raised more than $50 million, enough to make a big name in the industry.

Upasana believes that the current scenario has become more welcoming for women entrepreneurs. But, there are still various shifts that need to happen. The inclusion of women in FinTech is still low, but it is improving gradually. Many startups are including women in their higher management teams. They are realizing the necessity of having them.

Upasana also believes that more women are embracing financial literacy and financial independence in tier-I cities. But, there is still a lot of work required in tier-II and tier-III cities.

Silvija Martincevic (Chief Commercial Officer, Affirm)

In 2019, Silvija Martincevic joined FinTech company Affirm as Chief Commercial Officer. Before affirms, Silvija served Groupon as its Chief Operating Officer and Chief Marketing Officer. Silvija has 10 years of experience in the investment management industry building investment portfolios and managing investment risk for large institutions. In 2003, she also founded Zenna Financial Services, an investment management company. This year, she is also included on the Board of Directors for nonprofit micro-lending organizations, Kiva and Lemonade.

In Affirm, as a Chief Commercial Officer, Silvija leads core business functions such as revenue, marketing, customer sales services, sales, etc. Even in the pandemic, affirms has grown its business. Its value doubled to $24 billion at its January IPO. The number of active customers rose to 7.1 million in mid-2021, showing a growth of almost 97%.

Silvija completed her MBA degree in econometrics and statistics from the Booth School of Business at The University of Chicago, and a BA in economics from Beloit College.

Jennifer Fitzgerald (Co-Founder/CEO, Policygenius)

Jennifer Fitzgerald, along with Francois de Lame, co-founded the online insurance marketplace Policygenius. Earlier, Jennifer worked at McKinsey, specializing in Financial Services. Policygenius has revolutionized the whole insurance industry. As a co-founder and CEO, Jennifer has led Policygenius to the constant path of success. She has raised funds of more than $150 million.

Jennifer, in the beginning, faced a lot of rejections. She and her co-founder had a hard time pitching investors. She had to deal with sexism too. In an interview, she talked about a prospective investor.

He kept directing questions to her co-founder and not her.

In September, Jennifer was ranked 44th on Quartz’s “rising stars” list of 250 female founders. Forbes has published that she’s one of only five women in FinTech to have raised over $50 million.

Conclusion

‘s Ceo is a female and she gave a huge contribution to the Fintech industry. There is no doubt that women are going to bring revolutionary changes to FinTech in the future. These brilliant women are its perfect example. They are paving the way for more women to be in top management and strategic roles in the industry. We should make sure that they get equal opportunities and flexible working conditions to maintain a healthy work-life balance.

Originally published at https://paypound.ltd on June 2, 2022.

0 notes

Text

Malayalam Serials In Asianet Tv Channels

Asianet commenced operations by the end of 1992 and started transmission by August 1993, at a time when the only Malayalam-language television channel available was the government-owned Doordarshan.

Asianet continues to be the Top Malayalam TV channel with far better viewership impressions than the rest of the channels. Asianet Movies is the new entrant to the Top-5 list this week with 63418K impressions. Asianet Movies has replaced Surya TV in this week's TRP list, and currently occupies the 5th spot.

Asianet Tv Channel is one of the most popular Malayalam television broadcasting channels based in Kerala, which shows dozen of best tv serials, drama, comedy, movies, and lots of reality shows.

Ammayariyathe Latest Malayalam Series on Asianet Aksharathettu (Mazhavil Manorama), Karthika Deepam (Zee Keralam), Namukku Parkkuvan Munthirithoppukal (Surya TV) and Ammayariyathe (Asianet) are the Upcoming/Latest Malayalam TV Programs. Regular programs started on All major player after the COVID-19 Crisis.

Malayalam Tv Serials Asianet

Padhaswaram is a popular Malayalam daily drama tele serial with a unique storyline which airs on the leading and popular Malayalam entertainment television channel Asianet TV. The story of this tele serial Padhaswaram is about the IT professionals. Padhaswaram is directed by director S. Janardanan and the story is also written by him and the show is produced by renowned Malayalam tele serial producer Mani. The actors Krishna Veni, Kumar, Melvin, Pream Shankar, and Veena Nair play the leading characters in this story. The story of the serial revolves round IT industry and the complex lives of employees out there. The show has already completed more than 278 episodes. In this show, the director tells the story of the IT professionals. Two sisters Krishna Veni and Urmila played by popular and talented Malayalam television actresses Dr. Divya Nair and Amala are the central characters and the main protagonists of this hit and successful popular mega tele serial. The other cast and crew members of the mega serial Padhaswaram are- Dr. Shaju Sham essaying the role of the main male protagonist and the common love interest of the two sisters Kumar, Anzil Rahman, Binoy, Binil, Ghadil, Dr. Divya, Anusree, Manka mahesh, Sunitha, Veena nair, Amala Kurian, Indulekha, etc.

AsianetLaunched30 August 1993Owned byStar IndiaPicture format1080iHDTV

(downscaled to letterboxed576i for the SDTV feed)SloganAhead with change, ahead of others.Broadcast areaWorld wideHeadquartersThiruvananthapuram, Kerala, IndiaSister channel(s)

Asianet Plus

Asianet Middle East

Asianet Movies

Star Plus

Star Sports

Star Vijay

Vijay Super

Star Suvarna

Suvarna Plus

Asianet is an Indian pay television channel which broadcasts mainly Malayalam-language television series. Headquartered in Thiruvananthapuram, Kerala,[1] the channel is part of Asianet Communications, owned by Star India. It was the first privately-owned Malayalam-language channel in the country.

History[edit]

The channel was launched in 1993 with a broadcast of only three hours per day, with the rest of the Tie showing selective programs from the Australian Broadcasting Corporation and CNBC. By late-1994, the channel increased its broadcast time to 12 hours per day and later to round-the-clock broadcasting. Asianet was the first private TV channel of India to do 'live' news broadcasting from its Subic Bay uplink centre. In early-1995, the uplink was shifted to Singapore where it attained full operational status. With a change in the broadcasting policies of the Government of India, Asianet started an uplink from Chennai through VSNL. From 15 July 2002, Asianet had its own earth station at the Asianet Studio Complex in Puliyarakonam, Thiruvananthapuram.

Its headquarters were located in Chennai. Its first owners were Raji and Sashi Kumar Menon. Asianet Communications's majority share was later bought by Jupiter Media and Entertainment Venture, owned by Anoop Sree Ayroor. In 2008, Star India purchased the majority of shares in Asianet Communications.[2][3] In 2013, Star completely acquired the channel.

Coverage and viewership[edit]

Driver easy pro license key. Asianet has a presence in over 60 countries worldwide including the Indian sub-continent, China, South East Asia, Middle East, Europe, United States and the lower half of the former Soviet Union.[2][4]

Asianet is the no.1 malayalam general entertainment channel according to Broadcast Audience Research Council

Programming and shows[edit]

Asianet is a general entertainment channel with programmes in a wide variety of genres including Malayalam-language movies, soaps, reality shows, talk shows, news programmes, travel shows and music-based shows. While programming is mainly targeted at family audiences, there are several programmes aimed towards specific audiences such as shows for children, teenagers, young working professionals and elders.The channel also broadcast a successful musical talent reality show - Idea Star Singer.The channel also hosts and broadcasts the Asianet Film Awards and Asianet TV Awards.

It allows importing 3D objects and inserting them into the story. Anime studio free download windows.

References[edit]

^'Archived copy'. Archived from the original on 12 January 2015. Retrieved 2015-01-27.CS1 maint: Archived copy as title (link)

^ ab'Star buys majority in Asianet; forms JV with Rajeev Chandrasekhar Reuters'. In.reuters.com. 17 November 2008. Retrieved 16 July 2010.

^'Star TV buys majority in Jupiter Entertainment'. Business Standard. 16 November 2008. Retrieved 20 October 2013.

^VCCircle (17 November 2008). 'M & A Star Buys Majority In Asianet; Forms JV With Rajeev Chandrasekhar'. contentSutra. Retrieved 16 July 2010.

Asianet Tv Serials Latest Episodes

External links[edit]

Retrieved from 'https://en.wikipedia.org/w/index.php?title=Asianet_(TV_channel)&oldid=899315120'

Asianet is an Indian pay TV channel operated by Asianet Star Communications, wholly owned by Star India, in the Malayalam language. The canal's headquarters are located in Thiruvananthapuram, Kerala.

The channel was originally promoted by Sasha Kumar with seed money provided by Reggie Menon in the early 1990s. In late 2006, Reggie Menon left Asianet Communications in part, transferring control to Rajiv Chandrasekhar (Jupiter Entertainment Ventures).

Star India bought 51% of Asianet Communications and formed a joint venture with JEV in November 2008. Star India acquired 100% of Asianet Communications in March 2014.

Asianet Communications was the first Malayalam entertainment broadcaster. It was promoted by Sashi Kumar with start-up capital provided by Reggie Menon. Kumar was the former head of the Indian Television Press Trust, and his relative Menon was a businessman from Moscow.

Asianet Malayalam Tv Channel Online

When Asianet faced the financial crisis, real estate firm Rahejas was given 50% of the cable company. The channels were still owned by Sasha Kumar (50% of the shares) and Reggie Menon (50% of the shares).

Later, Rahejas also wanted to participate in operations on the channel. While Kumar resisted Rahejas' overtures, Menon negotiated a deal with them, and as part of that deal, Rahejas gained full control of the cable company. Menon used what Rahejas had paid him to provide Kumar with a golden handshake.

The Zee Group's attempt to acquire Asianet from Menon subsequently failed. This was apparently due to the breaking agreement with the cable company prohibiting the takeover of the channel by a company interested in cable business.

Malayalam Serials In Asianet Tv Channels Asianet

asianet tv usa, asianet tv recharge, asianet tv channel live, asianet tv channel, asianet tv schedule, asianet tv serial, asianet tv customer care, asianet tv plans, asianet tv live, asianet tv app, asianet tv awards 2018, asianet tv and broadband, asianet tv awards 2019, asianet tv anchors, asianet tv advertising rates, asianet tv awards 2016, asianet tv apk, asianet tv bill, asianet tv box, asianet tv bigg boss, asianet tv bigg boss malayalam, asianet tv bigg boss live, asianet tv breaking news, asianet tv badai banglavu, asianet tv ban, asianet tv complaint, asianet tv connection, asianet tv channel contact number, asianet tv channel owner, asianet tv careers, asianet tv dongle, asianet tv digital, asianet tv download,

0 notes

Text

Stock market boomed due to global market trend, Sensex crossed 54 thousand

Good signals from the global market and falling crude prices drove the Indian stock market higher on Thursday. On Thursday morning, Sensex and Nifty began trading with green brands. At the start of the trading session, the 30 point Sensex opened with a gain of 395.71 points to 54,146.68. Meanwhile, the 50-point Nifty opened at 16,113.75. During the pre-opening session, 29 out of 30 Sensex shares rose.

On the other hand, due to buying in the global stock market, there was a slight rise in the US market. The Dow Jones closed with a gain of 400 points, up 70 points. Computer stocks continually strengthen the market. The European market saw an increase of up to 1.5%. The Asian market also showed strength.

The movement of the stock market

Wednesday Earlier Wednesday, after a long stretch, there was a huge rally in the stock market. At the end of the trading session, the 30-point BSE Sensex jumped 616.62 points to close at 53,750.97. Meanwhile, the National Stock Exchange Nifty closed at 15,989.80 points with a gain of 178.95 points.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

1 note

·

View note

Text

How Pharma Money Colors Operation Warp Speed’s Quest to Defeat COVID

April 16 was a big day for Moderna, a Massachusetts biotech company on the verge of becoming a front-runner in the U.S. government’s race for a coronavirus vaccine. It had received roughly half a billion dollars in federal funding to develop a COVID shot that might be used on millions of Americans.

This story also ran on Daily Beast. It can be republished for free.

Thirteen days after the massive infusion of federal cash — which triggered a jump in the company’s stock price — Moncef Slaoui, a Moderna board member and longtime drug industry executive, was awarded options to buy 18,270 shares in the company, according to Securities and Exchange Commission filings. The award added to 137,168 options he’d accumulated since 2018, the filings show.

It wouldn’t be long before President Donald Trump announced Slaoui as the top scientific adviser for the government’s $12 billion Operation Warp Speed program to rush COVID vaccines to market. In his Rose Garden speech on May 15, Trump lauded Slaoui as “one of the most respected men in the world” on vaccines.

The Trump administration relied on an unusual maneuver that allowed executives to keep investments in drug companies that would benefit from the government’s pandemic efforts: They were brought on as contractors, doing an end run around federal conflict-of-interest regulations in place for employees. That has led to huge potential payouts — some already realized, according to a KHN analysis of SEC filings and other government documents.

Slaoui owned 137,168 Moderna stock options worth roughly $7 million on May 14, one day before Trump announced his senior role to help shepherd COVID vaccines. The day of his appointment, May 15, he resigned from Moderna’s board. Three days later, on May 18, following the company’s announcement of positive results from early-stage clinical trials, the options’ value shot up to $9.1 million, the analysis found. The Department of Health and Human Services said Slaoui sold his holdings May 20, when they would have been worth about $8 million, and will donate certain profits to cancer research. Separately, Slaoui held nearly 500,000 shares in GlaxoSmithKline, where he worked for three decades, upon retiring in 2017, according to corporate filings.

Carlo de Notaristefani, an Operation Warp Speed adviser and former senior executive at Teva Pharmaceuticals, owned 665,799 shares of the drug company’s stock as of March 10. While Teva is not a recipient of Warp Speed funding, Trump promoted its antimalarial drug hydroxychloroquine as a COVID treatment, even with scant evidence that it worked. The company donated millions of tablets to U.S. hospitals and the drug received emergency use authorization from the Food and Drug Administration in March. In the following weeks, its share price nearly doubled.

Two other Operation Warp Speed advisers working on therapeutics, Drs. William Erhardt and Rachel Harrigan, own financial stakes of unknown value in Pfizer, which in July announced a $1.95 billion contract with HHS for 100 million doses of its vaccine. Erhardt and Harrigan were previously Pfizer employees.

“With those kinds of conflicts of interest, we don’t know if these vaccines are being developed based on merit,” said Craig Holman, a lobbyist for Public Citizen, a liberal consumer advocacy group.

An HHS spokesperson said the advisers are in compliance with the relevant federal ethical standards for contractors.

These investments in the pharmaceutical industry are emblematic of a broader trend in which a small group with the specialized expertise needed to inform an effective government response to the pandemic have financial stakes in companies that stand to benefit from the government response.

Slaoui maintained he was not in discussions with the federal government about a role when his latest batch of Moderna stock options was awarded, telling KHN he met with HHS Secretary Alex Azar and was offered the position for the first time May 6. The stock options awarded in late April were canceled as a result of his departure from the Moderna board in May, he said. According to the KHN analysis of his holdings, the options would have been worth more than $330,000 on May 14.

HHS declined to confirm that timeline.

The fate of Operation Warp Speed after President-elect Joe Biden takes office is an open question. While Democrats in Congress have pursued investigations into Warp Speed advisers and the contracting process under which they were hired, Biden hasn’t publicly spoken about the program or its senior leaders. Spokespeople for the transition didn’t respond to a request for comment.

The four HHS advisers were brought on through a National Institutes of Health contract with consulting firm Advanced Decision Vectors, so far worth $1.4 million, to provide expertise on the development and production of vaccines, therapies and other COVID products, according to the federal government’s contracts database.

Slaoui’s appointment in particular has rankled Democrats and organizations like Public Citizen. They say he has too much authority to be classified as a consultant. “It is inevitable that the position he is put in as co-chair of Operation Warp Speed makes him a government employee,” Holman said.

The incoming administration may have a window to change the terms under which Slaoui was hired before his contract ends in March. Yet making big changes to Operation Warp Speed could disrupt one of the largest vaccination efforts in history while the American public anxiously awaits deliverance from the pandemic, which is breaking daily records for new infections. Warp Speed has set out to buy and distribute 300 million doses of a COVID vaccine, the first ones by year’s end.

“By the end of December we expect to have about 40 million doses of these two vaccines available for distribution,” Azar said Nov. 18, referring to front-runner vaccines from Pfizer and Moderna.

Azar maintained that Warp Speed would continue seamlessly even with a “change in leadership.” “In the event of a transition, there’s really just total continuity that would occur,” the secretary said.

Pfizer, which didn’t receive federal funds for research but secured the multibillion-dollar contract under Warp Speed, on Nov. 20 sought emergency authorization from the FDA; Moderna announced on Monday it would do so. In total, Moderna received nearly $1 billion in federal funds for development and a $1.5 billion contract with HHS for 100 million doses.

While it’s impossible to peg the precise value of Slaoui’s Moderna holdings without records of the sale transactions, KHN estimated their worth by evaluating the company’s share prices on the dates he received the options and the stock’s price on several key dates — including May 14, the day before his Warp Speed position was announced, and May 20.

However, the timing of Slaoui’s divestment of his Moderna shares — five days after he resigned from the company’s board — meant he did not have to file disclosures with the SEC confirming the sale, even though he was privy to insider information when he received the stock options, experts in securities law said. That weakness in securities law, according to good-governance experts, deprives the public of an independent source of information about the sale of Slaoui’s stake in the company.

“You would think there would be kind of a one-year continuing obligation [to disclose the sale] or something like that,” said Douglas Chia, president of Soundboard Governance and an expert on corporate governance issues. “But there’s not.”

HHS declined to provide documentation confirming that Slaoui sold his Moderna holdings. His investments in London-based GlaxoSmithKline — which is developing a vaccine with French drugmaker Sanofi and received $2.1 billion from the U.S. government — will be used for his retirement, Slaoui has said.

“I have always held myself to the highest ethical standards, and that has not changed upon my assumption of this role,” Slaoui said in a statement released by HHS. “HHS career ethics officers have determined my contractor status, divestures and resignations have put me in compliance with the department’s robust ethical standards.”

Moderna, in an earlier statement to CNBC, said Slaoui divested “all of his equity interest in Moderna so that there is no conflict of interest” in his new role. However, the conflict-of-interest standards for Slaoui and other Warp Speed advisers are less stringent than those for federal employees, who are required to give up investments that would pose a conflict of interest. For instance, if Slaoui had been brought on as an employee, his stake from a long career at GlaxoSmithKline would be targeted for divestment.

Instead, Slaoui has committed to donating certain GlaxoSmithKline financial gains to the National Institutes of Health.

Offering Warp Speed advisers contracts might have been the most expedient course in a crisis.

“As the universe of potential qualified candidates to advise the federal government’s efforts to produce a COVID-19 vaccine is very small, it is virtually impossible to find experienced and qualified individuals who have no financial interests in corporations that produce vaccines, therapeutics, and other lifesaving goods and services,” Sarah Arbes, HHS’ assistant secretary for legislation and a Trump appointee, wrote in September to Rep. James Clyburn (D-S.C.), who leads a House oversight panel on the coronavirus response.

That includes multiple drug industry veterans working as HHS advisers, an academic who’s overseeing the safety of multiple COVID vaccines in clinical trials and sits on the board of Gilead Sciences, and even former government officials who divested stocks while they were federal employees but have since joined drug company boards.

Dr. Scott Gottlieb and Dr. Mark McClellan, former FDA commissioners, have been visible figures informally advising the federal response. Each sits on the board of a COVID vaccine developer.

After leaving the FDA in 2019, Gottlieb joined Pfizer’s board and has bought 4,000 of its shares, at the time worth more than $141,000, according to SEC filings. As of April, he had additional stock units worth nearly $352,000 that will be cashed out should he leave the board, according to corporate filings. As a board member, Gottlieb is required to own a certain number of Pfizer shares.

McClellan has been on Johnson & Johnson’s board since 2013 and earned $1.2 million in shares under a deferred-compensation arrangement, corporate filings show.

The two also receive thousands of dollars in cash fees annually as board members. Gottlieb and McClellan frequently disclose their corporate affiliations, but not always. Their Sept. 13 Wall Street Journal op-ed on how the FDA could grant emergency authorization of a vaccine identified their FDA roles and said they were on the boards of companies developing COVID vaccines but failed to name Pfizer and Johnson & Johnson. Both companies would benefit financially from such a move by the FDA.

“It isn’t a lower standard for FDA approval,” they wrote in the piece. “It’s a more tailored, flexible standard that helps protect those who need it most while developing the evidence needed to make the public confident about getting a Covid-19 vaccine.”

About the inconsistency, Gottlieb wrote in an email to KHN: “My affiliation to Pfizer is widely, prominently, and specifically disclosed in dozens of articles and television appearances, on my Twitter profile, and in many other places. I mention it routinely when I discuss Covid vaccines and I am proud of my affiliation to the company.”

A spokesperson for the Duke-Margolis Center for Health Policy, which McClellan founded, noted that other Wall Street Journal op-eds cited his Johnson & Johnson role and that his affiliations are mentioned elsewhere. “Mark has consistently informed the WSJ about his board service with Johnson & Johnson, as well as other organizations,” Patricia Shea Green said.

Johnson & Johnson’s vaccine is in phase 3 clinical trials and could be available in early 2021.

Still, while they worked for the FDA, Gottlieb and McClellan were subject to federal restrictions on investments and protections against conflicts of interest that aren’t in place for Warp Speed advisers.

According to the financial disclosure statements they signed with HHS, the advisers are required to donate certain stock profits to the NIH — but can do so after the stockholder dies. They can keep investments in drug companies, and the restrictions don’t apply to stock options, which give executives the right to buy company shares in the future.

“This is a poorly drafted agreement,” said Jacob Frenkel, an attorney at Dickinson Wright and former SEC lawyer, referring to the conflict-of-interest statement included in the NIH contract with Advanced Decision Vectors, the Warp Speed advisers’ employing consulting firm. He said documents could have been “tighter and clearer in many respects,” including prohibiting the advisers from exercising their options to buy shares while they are contractors.

De Notaristefani stepped down as Teva’s executive vice president of global operations in October 2019, but according to corporate filings he would remain with the company until the end of June 2020 in order to “ensure an orderly transition.” He’s been working with Warp Speed since at least May overseeing manufacturing, according to an HHS spokesperson.

When Erhardt left Pfizer in May, U.S. COVID infections were climbing and the company was beginning vaccine clinical trials. Erhardt and Harrigan, whose LinkedIn profile says she left Pfizer in 2010, have worked as drug industry consultants.

“Ultimately, conflicts of interest in ethics turn on the mindset behavior of the responsible persons,” said Frenkel, the former SEC attorney. “The public wants to know that it can rely on the effectiveness of the therapeutic or diagnostic product without wondering if a recommendation or decision was motivated for even the slightest reason other than product effectiveness and public interest.”

Kaiser Health News (KHN) is a national health policy news service. It is an editorially independent program of the Henry J. Kaiser Family Foundation which is not affiliated with Kaiser Permanente.

USE OUR CONTENT

This story can be republished for free (details).

How Pharma Money Colors Operation Warp Speed’s Quest to Defeat COVID published first on https://nootropicspowdersupplier.tumblr.com/

0 notes

Text

How Pharma Money Colors Operation Warp Speed’s Quest to Defeat COVID

April 16 was a big day for Moderna, a Massachusetts biotech company on the verge of becoming a front-runner in the U.S. government’s race for a coronavirus vaccine. It had received roughly half a billion dollars in federal funding to develop a COVID shot that might be used on millions of Americans.

This story also ran on Daily Beast. It can be republished for free.

Thirteen days after the massive infusion of federal cash — which triggered a jump in the company’s stock price — Moncef Slaoui, a Moderna board member and longtime drug industry executive, was awarded options to buy 18,270 shares in the company, according to Securities and Exchange Commission filings. The award added to 137,168 options he’d accumulated since 2018, the filings show.

It wouldn’t be long before President Donald Trump announced Slaoui as the top scientific adviser for the government’s $12 billion Operation Warp Speed program to rush COVID vaccines to market. In his Rose Garden speech on May 15, Trump lauded Slaoui as “one of the most respected men in the world” on vaccines.

The Trump administration relied on an unusual maneuver that allowed executives to keep investments in drug companies that would benefit from the government’s pandemic efforts: They were brought on as contractors, doing an end run around federal conflict-of-interest regulations in place for employees. That has led to huge potential payouts — some already realized, according to a KHN analysis of SEC filings and other government documents.

Slaoui owned 137,168 Moderna stock options worth roughly $7 million on May 14, one day before Trump announced his senior role to help shepherd COVID vaccines. The day of his appointment, May 15, he resigned from Moderna’s board. Three days later, on May 18, following the company’s announcement of positive results from early-stage clinical trials, the options’ value shot up to $9.1 million, the analysis found. The Department of Health and Human Services said Slaoui sold his holdings May 20, when they would have been worth about $8 million, and will donate certain profits to cancer research. Separately, Slaoui held nearly 500,000 shares in GlaxoSmithKline, where he worked for three decades, upon retiring in 2017, according to corporate filings.

Carlo de Notaristefani, an Operation Warp Speed adviser and former senior executive at Teva Pharmaceuticals, owned 665,799 shares of the drug company’s stock as of March 10. While Teva is not a recipient of Warp Speed funding, Trump promoted its antimalarial drug hydroxychloroquine as a COVID treatment, even with scant evidence that it worked. The company donated millions of tablets to U.S. hospitals and the drug received emergency use authorization from the Food and Drug Administration in March. In the following weeks, its share price nearly doubled.

Two other Operation Warp Speed advisers working on therapeutics, Drs. William Erhardt and Rachel Harrigan, own financial stakes of unknown value in Pfizer, which in July announced a $1.95 billion contract with HHS for 100 million doses of its vaccine. Erhardt and Harrigan were previously Pfizer employees.

“With those kinds of conflicts of interest, we don’t know if these vaccines are being developed based on merit,” said Craig Holman, a lobbyist for Public Citizen, a liberal consumer advocacy group.

An HHS spokesperson said the advisers are in compliance with the relevant federal ethical standards for contractors.

These investments in the pharmaceutical industry are emblematic of a broader trend in which a small group with the specialized expertise needed to inform an effective government response to the pandemic have financial stakes in companies that stand to benefit from the government response.

Slaoui maintained he was not in discussions with the federal government about a role when his latest batch of Moderna stock options was awarded, telling KHN he met with HHS Secretary Alex Azar and was offered the position for the first time May 6. The stock options awarded in late April were canceled as a result of his departure from the Moderna board in May, he said. According to the KHN analysis of his holdings, the options would have been worth more than $330,000 on May 14.

HHS declined to confirm that timeline.

The fate of Operation Warp Speed after President-elect Joe Biden takes office is an open question. While Democrats in Congress have pursued investigations into Warp Speed advisers and the contracting process under which they were hired, Biden hasn’t publicly spoken about the program or its senior leaders. Spokespeople for the transition didn’t respond to a request for comment.

The four HHS advisers were brought on through a National Institutes of Health contract with consulting firm Advanced Decision Vectors, so far worth $1.4 million, to provide expertise on the development and production of vaccines, therapies and other COVID products, according to the federal government’s contracts database.

Slaoui’s appointment in particular has rankled Democrats and organizations like Public Citizen. They say he has too much authority to be classified as a consultant. “It is inevitable that the position he is put in as co-chair of Operation Warp Speed makes him a government employee,” Holman said.

The incoming administration may have a window to change the terms under which Slaoui was hired before his contract ends in March. Yet making big changes to Operation Warp Speed could disrupt one of the largest vaccination efforts in history while the American public anxiously awaits deliverance from the pandemic, which is breaking daily records for new infections. Warp Speed has set out to buy and distribute 300 million doses of a COVID vaccine, the first ones by year’s end.

“By the end of December we expect to have about 40 million doses of these two vaccines available for distribution,” Azar said Wednesday, referring to front-runner vaccines from Pfizer and Moderna.

Azar maintained that Warp Speed would continue seamlessly even with a “change in leadership.” “In the event of a transition, there’s really just total continuity that would occur,” the secretary said.

Pfizer, which didn’t receive federal funds for research but secured the multibillion-dollar contract under Warp Speed, on Friday sought emergency authorization from the FDA; Moderna is expected to do so in the coming days. In total, Moderna received nearly $1 billion in federal funds for development and a $1.5 billion contract with HHS for 100 million doses.

While it’s impossible to peg the precise value of Slaoui’s Moderna holdings without records of the sale transactions, KHN estimated their worth by evaluating the company’s share prices on the dates he received the options and the stock’s price on several key dates — including May 14, the day before his Warp Speed position was announced, and May 20.

However, the timing of Slaoui’s divestment of his Moderna shares — five days after he resigned from the company’s board — meant he did not have to file disclosures with the SEC confirming the sale, even though he was privy to insider information when he received the stock options, experts in securities law said. That weakness in securities law, according to good-governance experts, deprives the public of an independent source of information about the sale of Slaoui’s stake in the company.

“You would think there would be kind of a one-year continuing obligation [to disclose the sale] or something like that,” said Douglas Chia, president of Soundboard Governance and an expert on corporate governance issues. “But there’s not.”

HHS declined to provide documentation confirming that Slaoui sold his Moderna holdings. His investments in London-based GlaxoSmithKline — which is developing a vaccine with French drugmaker Sanofi and received $2.1 billion from the U.S. government — will be used for his retirement, Slaoui has said.

“I have always held myself to the highest ethical standards, and that has not changed upon my assumption of this role,” Slaoui said in a statement released by HHS. “HHS career ethics officers have determined my contractor status, divestures and resignations have put me in compliance with the department’s robust ethical standards.”

Moderna, in an earlier statement to CNBC, said Slaoui divested “all of his equity interest in Moderna so that there is no conflict of interest” in his new role. However, the conflict-of-interest standards for Slaoui and other Warp Speed advisers are less stringent than those for federal employees, who are required to give up investments that would pose a conflict of interest. For instance, if Slaoui had been brought on as an employee, his stake from a long career at GlaxoSmithKline would be targeted for divestment.

Instead, Slaoui has committed to donating certain GlaxoSmithKline financial gains to the National Institutes of Health.

Offering Warp Speed advisers contracts might have been the most expedient course in a crisis.

“As the universe of potential qualified candidates to advise the federal government’s efforts to produce a COVID-19 vaccine is very small, it is virtually impossible to find experienced and qualified individuals who have no financial interests in corporations that produce vaccines, therapeutics, and other lifesaving goods and services,” Sarah Arbes, HHS’ assistant secretary for legislation and a Trump appointee, wrote in September to Rep. James Clyburn (D-S.C.), who leads a House oversight panel on the coronavirus response.

That includes multiple drug industry veterans working as HHS advisers, an academic who’s overseeing the safety of multiple COVID vaccines in clinical trials and sits on the board of Gilead Sciences, and even former government officials who divested stocks while they were federal employees but have since joined drug company boards.

Dr. Scott Gottlieb and Dr. Mark McClellan, former FDA commissioners, have been visible figures informally advising the federal response. Each sits on the board of a COVID vaccine developer.

After leaving the FDA in 2019, Gottlieb joined Pfizer’s board and has bought 4,000 of its shares, at the time worth more than $141,000, according to SEC filings. As of April, he had additional stock units worth nearly $352,000 that will be cashed out should he leave the board, according to corporate filings. As a board member, Gottlieb is required to own a certain number of Pfizer shares.

McClellan has been on Johnson & Johnson’s board since 2013 and earned $1.2 million in shares under a deferred-compensation arrangement, corporate filings show.

The two also receive thousands of dollars in cash fees annually as board members. Gottlieb and McClellan frequently disclose their corporate affiliations, but not always. Their Sept. 13 Wall Street Journal op-ed on how the FDA could grant emergency authorization of a vaccine identified their FDA roles and said they were on the boards of companies developing COVID vaccines but failed to name Pfizer and Johnson & Johnson. Both companies would benefit financially from such a move by the FDA.

“It isn’t a lower standard for FDA approval,” they wrote in the piece. “It’s a more tailored, flexible standard that helps protect those who need it most while developing the evidence needed to make the public confident about getting a Covid-19 vaccine.”

About the inconsistency, Gottlieb wrote in an email to KHN: “My affiliation to Pfizer is widely, prominently, and specifically disclosed in dozens of articles and television appearances, on my Twitter profile, and in many other places. I mention it routinely when I discuss Covid vaccines and I am proud of my affiliation to the company.”

A spokesperson for the Duke-Margolis Center for Health Policy, which McClellan founded, noted that other Wall Street Journal op-eds cited his Johnson & Johnson role and that his affiliations are mentioned elsewhere. “Mark has consistently informed the WSJ about his board service with Johnson & Johnson, as well as other organizations,” Patricia Shea Green said.

Johnson & Johnson’s vaccine is in phase 3 clinical trials and could be available in early 2021.

Still, while they worked for the FDA, Gottlieb and McClellan were subject to federal restrictions on investments and protections against conflicts of interest that aren’t in place for Warp Speed advisers.

According to the financial disclosure statements they signed with HHS, the advisers are required to donate certain stock profits to the NIH — but can do so after the stockholder dies. They can keep investments in drug companies, and the restrictions don’t apply to stock options, which give executives the right to buy company shares in the future.

“This is a poorly drafted agreement,” said Jacob Frenkel, an attorney at Dickinson Wright and former SEC lawyer, referring to the conflict-of-interest statement included in the NIH contract with Advanced Decision Vectors, the Warp Speed advisers’ employing consulting firm. He said documents could have been “tighter and clearer in many respects,” including prohibiting the advisers from exercising their options to buy shares while they are contractors.

De Notaristefani stepped down as Teva’s executive vice president of global operations in October 2019, but according to corporate filings he would remain with the company until the end of June 2020 in order to “ensure an orderly transition.” He’s been working with Warp Speed since at least May overseeing manufacturing, according to an HHS spokesperson.

When Erhardt left Pfizer in May, U.S. COVID infections were climbing and the company was beginning vaccine clinical trials. Erhardt and Harrigan, whose LinkedIn profile says she left Pfizer in 2010, have worked as drug industry consultants.

“Ultimately, conflicts of interest in ethics turn on the mindset behavior of the responsible persons,” said Frenkel, the former SEC attorney. “The public wants to know that it can rely on the effectiveness of the therapeutic or diagnostic product without wondering if a recommendation or decision was motivated for even the slightest reason other than product effectiveness and public interest.”

Kaiser Health News (KHN) is a national health policy news service. It is an editorially independent program of the Henry J. Kaiser Family Foundation which is not affiliated with Kaiser Permanente.

USE OUR CONTENT

This story can be republished for free (details).

How Pharma Money Colors Operation Warp Speed’s Quest to Defeat COVID published first on https://smartdrinkingweb.weebly.com/

0 notes

Video

youtube

professional writers

About me

Professional Writers Alliance

Professional Writers Alliance She has served as an editor for companies, visionary entrepreneurs, and national publishers. She is also a novelist and is just starting a new business—Absolutely Wild! Enchanted Faerie Portals & Other Whimsy—inspired by the Fae characters in her Song of the Ocarina novel. Technical writing, artistic writing, script writing, enterprise writing, medical writing, authorized writing and copywriting all have slightly totally different objectives and utilize different skillsets/experience. If you’re lonely and isolated for an extended time frame, despair is the following logical step. The words are flowing and whenever you log on and it looks as if everybody else is a writer who's more successful than you. The guide, written by APW members, has fantastic accounts of early women Arizona writers. It is on the market on Amazon and from different booksellers. She composed and recorded an unique music soundtrack to accompany her first novel Rhythms & Muse. Originally from Long Island, New York, Nancy Pellegrini lived in England, Ireland, and South Korea earlier than spending 18 years in Beijing, China. For more than 15 years, she was the stage editor and writer for Time Out Beijing and Time Out Shanghai magazines; she also edited United Nations coverage papers and has written and edited for Penguin Books. She started regular editing in 2011 and right now runs Nancy Pellegrini Editorial Solutions, LLC, a writing and editing services firm. She considers herself to be an empathetic editor, one who improves a draft but lets the spirit of the author shine through. She has also labored on dissertations, white papers, newspaper articles, and household histories. Jennifer has a background in journalism and Russian area studies. She lives in Phoenix together with her fiancé (COVID-19 postponed the wedding a year) and their three cats. We know that it is very necessary for the scholars to get a high grade in each subject in order to have an excellent common educational performance. We guarantee you, our writers will do their greatest to accomplish your task perfectly and on time. As a advertising skilled you will need to have a great group that may work on diversified projects with attention to element and readability, frequently in excessive-strain conditions. You can count on them to deliver a high-quality piece each time. If you need a replica writer, this group is unparalleled. Brenda Hazzard has over 30 years’ experience working as a writer and editor within the private and public sectors. She writes on a wide range of topics however loves opportunities to work on initiatives that cater to her keen curiosity in worldwide affairs. She then spent more than 20 years researching, analyzing and writing about associated subjects, working for a number of weekly publications and a non-public consulting firm. Her areas of skilled interest also embrace power and energy in China, Iran and the Eastern Mediterranean, and for fun she researches linguistics, neuroscience and disability-associated issues. Additionally, she has managed many time-sensitive typesetting tasks for neighborhood institutions. Jennifer enjoys writing private essays and lives in Atlanta with her family. Douglas Paton fell in love with words at an early age and was rarely seen and not using a e-book in his palms as a child. She holds a BA from the University of Texas at Austin and an MSFS from Georgetown University. While in graduate faculty within the mid-Nineteen Nineties, she developed an curiosity in the oil and gas trade of the former Soviet Union and launched a free e-newsletter masking the subject. In addition, members should purchase copies for private use or for resale at a reduced value by contacting your Chapter Director or Marie Fasano. One idea to promote the guide can be to offer a copy to your native library. A professional writer since 1981, she opened her personal award-profitable home-based marketing firm, vIDEAn Unlimited, LLC, in 1996. Dock David Treece involves The Writers for Hire after a ten-yr career within the investment trade. With a breadth of information spanning enterprise administration, real estate, and securities, Dock has long utilized his expertise to speak complicated subjects in easy terms. In addition to a protracted history writing newsletters and editorials, he also has expertise in unpaid media, having been featured on CNBC, Fox Business, and Bloomberg. His specialty is in breaking down advanced, enterprise-related subjects for consumption by broad audiences.

0 notes

Text

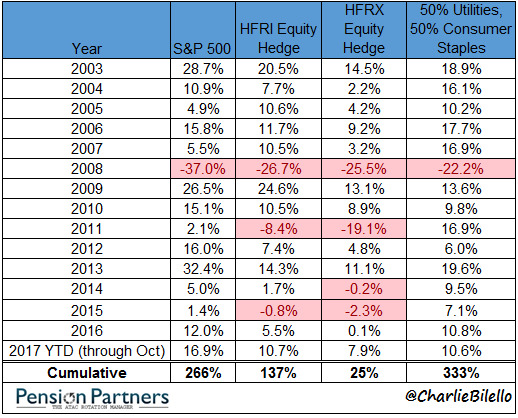

Do Hedge Funds Really Deliver Alpha?

"No matter how you "slice-and-dice the data,” hedge funds are struggling to meet their promise to clients to consistently produce high returns with low correlation to markets. It’s kind of: ‘I promise you a Rolls Royce and I give you a Honda.'" - Matt Granade, Chief Market Intelligence Officer, Point72 Asset Management

There are more Hedge Funds in the world than Dunkin' Donuts.

What does that statement have to do with negative alpha? Everything.

Too many funds + similar strategies + limited opportunity set + high fees = underwhelming returns.

Simply put: there’s not enough alpha to go around.

Back in the day, long/short equity funds (the largest hedge fund strategy by assets) actually used to hedge. They used to take risk. They used to look quite different than the overall stock market. And they used to deliver alpha.

How do they look today?

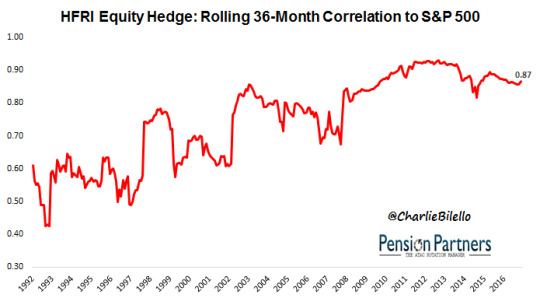

In aggregate, like a lower beta version of an index fund. With a correlation of 0.87 to the S&P 500 over the past few years, they pretty much move in lockstep with the market.

Note: the HFRI Equity Hedge Index is comprised of investment managers who maintain positions, both long and short, in primarily equity and equity derivative securities.

With such a high correlation, those using long/short funds to "protect" against the next bear market are likely to be highly disappointed when it comes.

How do we know this? We have a number of data points in recent years.

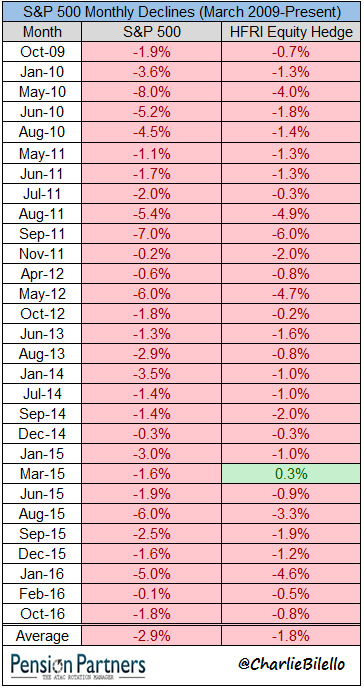

In 2008, when the S&P 500 lost 37%, long/short funds were down 26.7%. In 2011, when the S&P 500 dropped 16.3% from May through September (monthly closing basis), long/short equity funds lost 13.2%.

Since March 2009, the S&P 500 has had 29 down months with an average return during those months of -2.9%. Long/Short funds were down in 28 out of 29 of those months with an average return of -1.8%.

As long as their net exposure to the broad market remains high (not a lot of hedging), investors should expect the next downturn in equities to lead to a similar result.

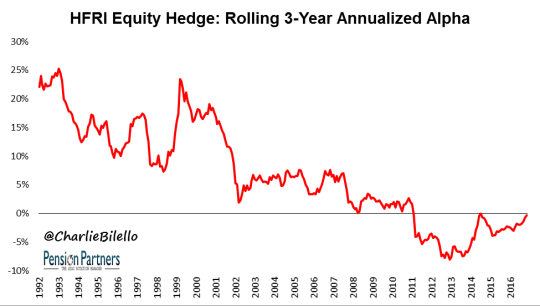

This might be acceptable if long/short funds were "delivering alpha" as promised, but as you can see in the chart below, the only alpha delivered in recent years has been negative.

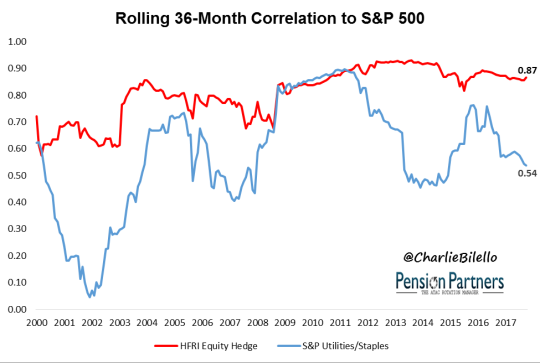

Investors who merely wanted a lower correlation equity option would have been better served with a simple combination of 50% Utilities/50% Consumer Staples (the 2 lowest beta sectors) than an exposure to long/short funds.

The returns since 2003 are not even close, and such a combination (Utilities/Staples) even outperformed in 2008. Beyond performance, there is no comparison in terms of increased transparency/liquidity and lower fees from Utilities/Staples ETFs versus a hedge fund.

Note: Many Hedge Fund Investors believe that the HFRI Equity Hedge Index overstates returns due to survivorship bias. As such, I have also included the investable HFRX Equity Hedge for comparison purposes. Actual performance is likely somewhere in between the two.

That’s not to say there aren’t unique long/short hedge funds out there that actually do something different and add value to a diversified portfolio over time. There certainly are, but not nearly as many as people believe and picking them before they exhibit strong performance is not nearly as easy as advertised.

Overall, long/short equity as an asset class has not been additive to portfolios in years. What could change that? Less funds chasing the same opportunities, with more alpha to go around.

On that front, the market finally seems to be moving in the right direction, on pace for a 3rd straight year of net hedge fund closures:

“Thus far this year (through the second quarter, the most recent date for which HFR has data available), 481 hedge funds have shut down, compared with the 369 that have been launched. 2017 is on track to be the third straight year that the number of liquidations have outpaced the number of funds coming to market.” – Source: HFR, MarketWatch

Is that enough for these funds to start delivering alpha again? Only time will tell, but as long as there's more hedge funds than Dunkin' Donuts, count me a skeptic.

***

Related Posts:

The Hedge Fund Myth

The Market Neutral Fantasy

To sign up for our free newsletter, click here.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Pension Partners, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Pension Partners, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

CHARLIE BILELLO, CMT

Charlie Bilello is the Director of Research at Pension Partners, LLC, an investment advisor that manages mutual funds and separate accounts. He is the co-author of four award-winning research papers on market anomalies and investing. Mr. Bilello is responsible for strategy development, investment research and communicating the firm’s investment themes and portfolio positioning to clients. Prior to joining Pension Partners, he was the Managing Member of Momentum Global Advisors and previously held positions as a Credit, Equity and Hedge Fund Analyst at billion dollar alternative investment firms.

Mr. Bilello holds a J.D. and M.B.A. in Finance and Accounting from Fordham University and a B.A. in Economics from Binghamton University. Charlie holds a J.D. and M.B.A. in Finance and Accounting from Fordham University and a B.A. in Economics from Binghamton University. He is a Chartered Market Technician (CMT) and also holds the Certified Public Accountant (CPA) certificate.

In 2017, Charlie was named the StockTwits Person of the Year. He is a frequent contributor to Yahoo Finance and has been interviewed on CNBC, Bloomberg, and Fox Business.

You can follow Charlie on twitter here.

6 notes

·

View notes

Text

DealBook: Is This the Next Leader of the Fed?

Good morning. Fears about the spread of the coronavirus whacked stock futures this morning — and led to the cancellation of Mobile World Congress. More on that below. (Was this email forwarded to you? Sign up here.)

The race to be the next Fed chair is getting interesting

Judy Shelton, who has been nominated to the central bank’s board of governors, is scheduled to testify before the Senate today.She is a contentious choice for the job, Jeanna Smialek of the NYT notes:• Ms. Shelton has questioned whether America needs the Fed at all.• She favors pegging the value of the dollar to something like gold, an idea the U.S. abandoned decades ago.• She’s seen as open to bending her ideological positions to please President Trump, eroding the Fed’s political independence.But she appears to be moving into a prime position to become the next Fed chair if Mr. Trump wins re-election, Ms. Smialek adds. The president has openly derided the current chairman, Jay Powell, and could well pick someone more in tune with him ideologically when Mr. Powell’s term is up in 2022. Washington speculation had focused on a different candidate for Fed chair: Kevin Warsh, who was on the central bank’s board during the financial crisis. Mr. Trump has praised Mr. Warsh before, but some wonder whether a strong performance by Ms. Shelton today would give her the inside track.____________________________Today’s DealBook Briefing was written by Andrew Ross Sorkin in New York and Michael J. de la Merced and Jason Karaian in London.____________________________

Is ‘Beyond Petroleum’ for real this time?

BP announced yesterday that it plans to be carbon-neutral by 2050, an ambitious target for one of the world’s biggest energy companies. What that actually means, however, is up for interpretation.The oil giant’s proposal is its latest climate-minded initiative, with a twist. Not only is the company seeking to reduce its own carbon emissions, it said, but it also wants to offset the emissions from use of the oil and gas that it produces.The proposal is more complicated than it looks. It has to do with the “scope” of emissions targeted by the plan: The bulk of pollution created by BP’s products are generated when customers burn the fuels, which are called Scope 3 emissions. BP’s net-zero pledge covers only its more direct operations, although the company plans to reduce Scope 3 emissions significantly.

U.K. regulators investigate Barclays C.E.O.’s ties to Epstein

Barclays disclosed this morning that British financial regulators have opened an investigation into ties between its chief, Jes Staley, and the late financier Jeffrey Epstein.The context: The two men had known each other since at least 1999, when Mr. Staley led JPMorgan Chase’s private bank, where Mr. Epstein was a client. The financier had helped funnel dozens of wealthy clients to Mr. Staley, and the two men stayed in touch even after Mr. Epstein was accused of sexually abusing scores of women.Mr. Staley has the backing of the Barclays board, for now. The bank said he had been “sufficiently transparent” about the nature of his ties to Mr. Epstein, and the C.E.O. said that he hadn’t had any contact with the disgraced financier since taking up his post in December 2015.

Mobile World Congress was canceled. Does anybody care?

Mobile World Congress, the annual jamboree for the telecom industry in Barcelona, was canceled yesterday over fears about the coronavirus outbreak. It raises an interesting question: Do these kinds of conferences matter?Last year, MWC drew around 110,000 attendees (including 7,900 C.E.O.s) from 200 countries. Cancellation of this month’s edition was inevitable, after major exhibitors like Nokia, Ericsson and Amazon pulled out over the past week or so.This presents a natural experiment in the value of industry events, seen by some as essential for networking and deal making and by others as price-gouging junkets. Thousands of meetings that would’ve taken place at MWC this year now won’t happen, which could have knock-on effects later in the year. (Or not.)The view from a veteran: We spoke with Ben Wood, a telecom analyst at CCS Insight in London who would have made his 23rd consecutive appearance at MWC this year.• For the companies that blow huge portions of their marketing budgets on MWC, “if you find that you can cope without going, and the costs associated with it, you may choose to deploy your resources in different ways,” he told DealBook.• That’s harder for small companies that rely on “serendipitous moments” with big buyers or potential partners wandering the halls of events like MWC, he added.No touching. In the meantime, conference etiquette will change. The organizers of a big tech event in Amsterdam now underway praised attendees for “safe greeting practices such as fist or elbow bumps.” Generally speaking, it must be said, handshakes are incredibly unhygienic.

Credit Suisse’s chief leaves on a defiant, awkward note

Tidjane Thiam delivered his final earnings call as the Swiss bank’s chief this morning, after being pressured to resign amid controversy over a spying scandal.He presented the growth in net income of 69 percent as the result of his changes in the structure and strategy at the company. “We’ve built something of quality, the numbers are coming through,” he said at a press conference.There was a notable moment of reflection on his uneasy tenure at the bank, notes the NYT’s Amie Tsang, who was listening in on the call. “There are differences within Switzerland in how people feel about me,” Mr. Thiam said. “Every second I’ve done the best I could. I am who I am, I cannot change who I am.”

How Marc Benioff sold Trump the trillion-tree idea

President Trump has openly dismissed climate change activists as “prophets of doom.” But Marc Benioff of Salesforce managed to win him over on one particular environmental initiative, Lisa Friedman of the NYT writes.Mr. Benioff pitched Jared Kushner, a top White House adviser and Mr. Trump’s son-in-law, about the initiative to plant one trillion trees to help offset carbon emissions. The idea eventually — and unexpectedly — wound its way into Mr. Trump’s speech to the World Economic Forum in Davos, Switzerland, last month.“Trees are the ultimate bipartisan issue,” Mr. Benioff told the NYT. “Everyone is pro-tree.”There are two lessons to draw from this:• Successfully lobbying Mr. Trump is an unconventional process that involves back-channeling with trusted advisers.• The idea of one trillion trees appears to have taken hold with the president because, as Ms. Friedman notes, “it was practically sacrifice-free.”

Jeff Bezos’ latest takeover: David Geffen’s L.A. mansion

The Amazon chief has continued his real estate splurge with two new acquisitions, according to Katy McLaughlin and Katherine Clarke of the WSJ:• David Geffen’s palatial Los Angeles home, which Mr. Bezos bought for $165 million — setting a record for the city in the process.• A plot of undeveloped land in the L.A. area, purchased from the estate of the Microsoft co-founder Paul Allen.They follow Mr. Bezos’ $80 million purchase of the top four floors of a Manhattan apartment building last year, reportedly with the goal of turning them into a gigantic pied-à-terre.It’s a windfall for Mr. Geffen, who bought the L.A. mansion — the former estate of the movie mogul Jack Warner — for $47.5 million in 1990.

The speed read