#cnbc awarded advisory firm

Text

Sensex Rises Over 300 Points Amid Positive Global Cues, Nifty Trades Above 16,200

Indian equity benchmarks traded higher on opening trades on Friday, taking a cue from global markets.

Indian equity benchmarks traded higher on opening trades on Friday, taking a cue from global markets. Asian stocks followed Wall Street gains overnight as fears of an economic slowdown eased. Additionally, the pound began to recover from recent losses after Boris Johnson stepped down as British Prime Minister.

Trends in Nifty Futures on the Singapore Exchange (SGX Nifty) have indicated a cautious start for national indices.

The 30-stock BSE Sensex Index jumped 316 points or 0.58% to 54,495 at the start of the session, while the broader NSE Nifty jumped 104 points or 0.64% to 16,236.

Small and mid cap stocks were trading on a strong note as Nifty Midcap 100 was up 0.32% and small caps were up 0.59%.

13 of the 15 sector indicators - compiled by the National Stock Exchange - were traded in green. The Nifty Bank and Nifty Auto sub-indices outperformed the NSE platform up 0.67% and 0.77% respectively.

On the specific stock front, M&M was Nifty's best gain as the stock climbed 2.80% to ₹ 1,165.05. Winners also include L&T, Coal India, Axis Bank and NTPC.

The overall market size was positive as 1,715 stocks were advancing while 622 were down on BSE.

In the BSE 30-share index, L&T, M&M, NTPC, Axis Bank, ICICI Bank, UltraTech Cement, PowerGrid, Infosys, Tech Mahindra, Kotak Mahindra Bank, Sun Pharma and Wipro were among the best gainers.

Additionally, shares of Life Insurance Corporation of India (LIC), the country's largest insurer and largest national financial investor, were up 1.17% to ₹ 706.30.

Conversely, Asian Paints, Tata Steel, IndusInd Bank, Hindustan Unilever, Titan, TCS, Bajaj Finance, Dr Reddy's, and Maruti all traded in the red.

Sensex was up 427 points or 0.80% to close at 54,178 on Thursday, while Nifty was up 143 points or 0.89% to settle at 16,133.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

2 notes

·

View notes

Text

Top 10 Stock Brokers In India

Top 10 Stock Brokers In India

Are you new to trading and the stock broking market? Don’t know which platform will be good to be started? Well, here is Top 10 Stock Brokers In India that you must know before you start your trading journey. All these have different plans, features and brokerage fees.

Let's have a look at the products, services, and features of these stock broking platforms in a detailed manner-

Upstox: With this, you can get various services such as commodities, currency, equities, futures, and many more. They’re known for providing better trading services at highly affordable costs. By using the Upstox trading platform, you will be provided with different trading features of analysis and charting. New traders can get started with Upstox for its qualitative trading services and products.

Zerodha: Zerodha provides numerous technological add-ons, products, and services to the investors that are good for them for their stock and securities trading. It is featured simplified modern-day trading for the new age and beginner traders. Also, Zerodha has numerous total active client base which makes it the largest stock broker in India.

ICICI Direct: With this stock trading platform, traders get a 3-in-1 account for ICICI bank Account, ICICI Trading Account, and ICICI Demat Account. It also offers a platform for both online trading and investment services. With over 50 lakh customers, it has become of the best stock brokers in India.

Angel Broking: Angel Broking is a full-service broking platform that is dedicated to retail stock trading and it offers expert advisory services. Currently, this stock broker offers a flat rate brokerage plan as ‘Angel iTrade PRIME’. Some of its main offerings are Equity Trading, Investment Advisory, Life Insurance, etc.

Sharekhan: In the Stock broking industry, Sharekhan is India’s third-largest stock broking service provider. This platform introduced the online trading concept in India and it also provides brokerage services through the online trading website. Its investment activities are both in both BSE and NSE.

Wisdom Capital: Wisdom Capital has three softwares that ensure hassle-free trading for investors. Also, there is a facility for semi and fully automated Algo trading. With Wisdom Capital platform, website, mobile app and installable trading terminals are all free for the traders.

5paisa: It is one of the top 10 stock brokers in India that offers discount brokerage services to retail investors. This is a Mumbai based stock broking company that is known for offering offers the lowest brokerage in India. Currently, they are having more than 1.2 million customers. This platform charges only Rs 20 brokerage irrespective of the size of the trade, or exchange.

HDFC Securities: Is is one of the platforms through which traders can get both online and offline trading listings. They also offer 3 in 1 account that includes your HDFC Securities trading account, existing HDFC bank savings account, and existing Demat account. Some of the options of these platforms are Future trading, day trading, options trading, long term investment, and IPO investment.

Motilal Oswal: This stock broker has a wide range of investment choices for the traders that include mutual funds, insurance, derivatives, equity, IPO, and fixed deposit. Motilal Oswal has also been awarded the “Best Performing Equity Broker” by CNBC TV18.

IIFL or India Infoline: India Infoline is one of the fastest growing financial brokerage firms in India that has acquired a wide customer base in the trading industry. It provides different investment and trading products and services at reasonable brokerage charges. You’ll get different options of trade in all types of investment with just one single trading platform.

0 notes

Text

SIP accounts reach an all-time high of 5.55 crores, investment of 12,276 crores

Despite the continued sale of foreign investors from Indian stock markets, the decline in global markets, the weakness of the rupee, the rise in inflation, retail investors have confidence in mutual funds. Last June, the number of SIP accounts hit an all-time high of 5.55 crore. Not only this, the investment from SIP also reached an all-time high of Rs 12,276 crore.

The mutual fund portfolio grew 31% year-on-year

According to data from Amfi, an association of mutual fund companies, equity funds recorded net investments for the 16th consecutive month in June. The asset under management in the sector reached an all-time high of Rs 35.64 lakh crore. The number of mutual fund portfolios grew 31% year-on-year. These increased to 13.46 crore from 10.25 crore in June 2021.

The number of SIP accounts hit an all-time high of 5.55 crore. The net AUM of the retail schemes (Equity + Hybrid + Solution Oriented) grew 16% yoy to Rs 17.91 lakh crore. Retail schemes saw positive net flow of Rs 13,338 crore in June for the 16th consecutive month after March 2021.

All retail equity schemes recorded positive inflows in June

says NS Venkatesh, CEO of Amfi, the trend of small investors to save through SIPs. The mega trend of financialization of savings also continues in the country. All retail equity schemes, indices, ETFs and FoFs showed positive investments in June. This reflects the confidence of retail mutual fund investors towards long-term growth amidst the ups and downs of the stock market.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

1 note

·

View note

Text

Do Hedge Funds Really Deliver Alpha?

"No matter how you "slice-and-dice the data,” hedge funds are struggling to meet their promise to clients to consistently produce high returns with low correlation to markets. It’s kind of: ‘I promise you a Rolls Royce and I give you a Honda.'" - Matt Granade, Chief Market Intelligence Officer, Point72 Asset Management

There are more Hedge Funds in the world than Dunkin' Donuts.

What does that statement have to do with negative alpha? Everything.

Too many funds + similar strategies + limited opportunity set + high fees = underwhelming returns.

Simply put: there’s not enough alpha to go around.

Back in the day, long/short equity funds (the largest hedge fund strategy by assets) actually used to hedge. They used to take risk. They used to look quite different than the overall stock market. And they used to deliver alpha.

How do they look today?

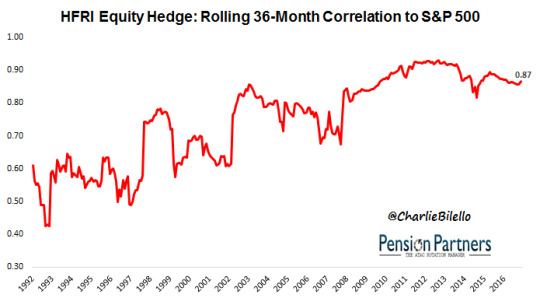

In aggregate, like a lower beta version of an index fund. With a correlation of 0.87 to the S&P 500 over the past few years, they pretty much move in lockstep with the market.

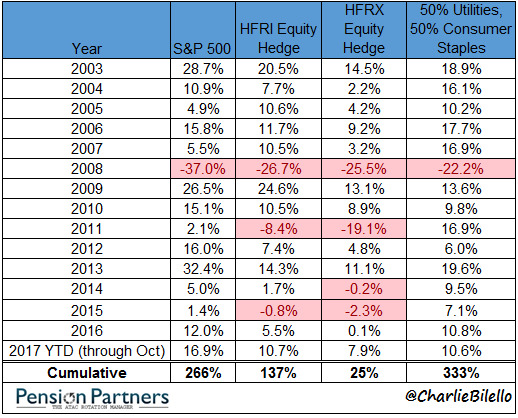

Note: the HFRI Equity Hedge Index is comprised of investment managers who maintain positions, both long and short, in primarily equity and equity derivative securities.

With such a high correlation, those using long/short funds to "protect" against the next bear market are likely to be highly disappointed when it comes.

How do we know this? We have a number of data points in recent years.

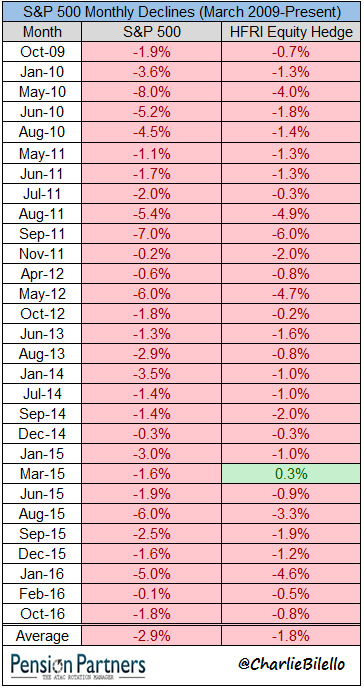

In 2008, when the S&P 500 lost 37%, long/short funds were down 26.7%. In 2011, when the S&P 500 dropped 16.3% from May through September (monthly closing basis), long/short equity funds lost 13.2%.

Since March 2009, the S&P 500 has had 29 down months with an average return during those months of -2.9%. Long/Short funds were down in 28 out of 29 of those months with an average return of -1.8%.

As long as their net exposure to the broad market remains high (not a lot of hedging), investors should expect the next downturn in equities to lead to a similar result.

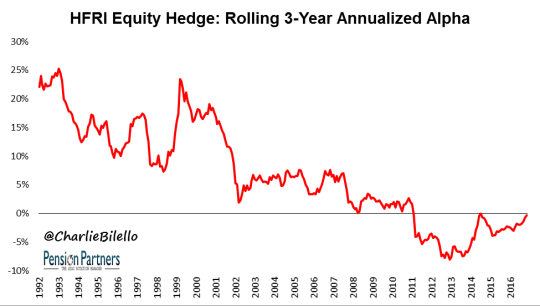

This might be acceptable if long/short funds were "delivering alpha" as promised, but as you can see in the chart below, the only alpha delivered in recent years has been negative.

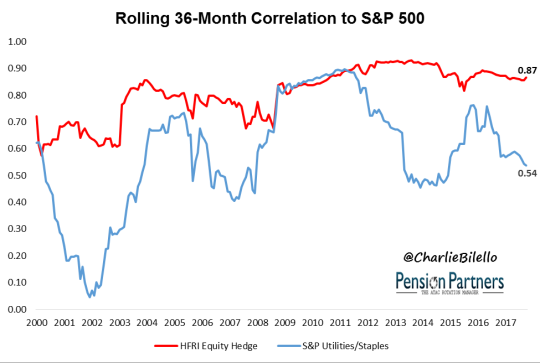

Investors who merely wanted a lower correlation equity option would have been better served with a simple combination of 50% Utilities/50% Consumer Staples (the 2 lowest beta sectors) than an exposure to long/short funds.

The returns since 2003 are not even close, and such a combination (Utilities/Staples) even outperformed in 2008. Beyond performance, there is no comparison in terms of increased transparency/liquidity and lower fees from Utilities/Staples ETFs versus a hedge fund.

Note: Many Hedge Fund Investors believe that the HFRI Equity Hedge Index overstates returns due to survivorship bias. As such, I have also included the investable HFRX Equity Hedge for comparison purposes. Actual performance is likely somewhere in between the two.

That’s not to say there aren’t unique long/short hedge funds out there that actually do something different and add value to a diversified portfolio over time. There certainly are, but not nearly as many as people believe and picking them before they exhibit strong performance is not nearly as easy as advertised.

Overall, long/short equity as an asset class has not been additive to portfolios in years. What could change that? Less funds chasing the same opportunities, with more alpha to go around.

On that front, the market finally seems to be moving in the right direction, on pace for a 3rd straight year of net hedge fund closures:

“Thus far this year (through the second quarter, the most recent date for which HFR has data available), 481 hedge funds have shut down, compared with the 369 that have been launched. 2017 is on track to be the third straight year that the number of liquidations have outpaced the number of funds coming to market.” – Source: HFR, MarketWatch

Is that enough for these funds to start delivering alpha again? Only time will tell, but as long as there's more hedge funds than Dunkin' Donuts, count me a skeptic.

***

Related Posts:

The Hedge Fund Myth

The Market Neutral Fantasy

To sign up for our free newsletter, click here.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Pension Partners, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Pension Partners, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

CHARLIE BILELLO, CMT

Charlie Bilello is the Director of Research at Pension Partners, LLC, an investment advisor that manages mutual funds and separate accounts. He is the co-author of four award-winning research papers on market anomalies and investing. Mr. Bilello is responsible for strategy development, investment research and communicating the firm’s investment themes and portfolio positioning to clients. Prior to joining Pension Partners, he was the Managing Member of Momentum Global Advisors and previously held positions as a Credit, Equity and Hedge Fund Analyst at billion dollar alternative investment firms.

Mr. Bilello holds a J.D. and M.B.A. in Finance and Accounting from Fordham University and a B.A. in Economics from Binghamton University. Charlie holds a J.D. and M.B.A. in Finance and Accounting from Fordham University and a B.A. in Economics from Binghamton University. He is a Chartered Market Technician (CMT) and also holds the Certified Public Accountant (CPA) certificate.

In 2017, Charlie was named the StockTwits Person of the Year. He is a frequent contributor to Yahoo Finance and has been interviewed on CNBC, Bloomberg, and Fox Business.

You can follow Charlie on twitter here.

6 notes

·

View notes

Text

Ed Butowsky

Ed Butowsky, managing partner of Chapwood Investments, LLC has the unique ability to recognize how current events affect investment portfolios.

An internationally recognized expert in the investment wealth management and personal finance industry, he was featured in “Broke,” the critically acclaimed ESPN “30 for 30” documentary that chronicles professional athletes and their financial experiences, and in the most popular Sports Illustrated article ever: “How (and Why) Athletes Go Broke.”

Celebrities and athletes count on Ed Butowsky to provide advice on everything from contract negotiations and agent disputes to family finances and how people with money can take steps to keep it.

Ed is a mentor to up-and-coming athletes and their parents, but it isn’t only public figures who seek his advice. Private individuals come to him in search of new strategies for their financial concerns. Ed Butowsky is best known for his straight talk and his willingness to roll up his sleeves and find solutions to issues that others want no part of.

His more than 25 years in the financial services industry began at Morgan Stanley, where he was a senior vice president in private wealth management. In his 18 years there, he was the firm’s top producer nationally as well as the first adviser to surpass $1 billion in assets under management. Ed Butowsky was recognized as a member of both the Chairman’s Club and the Equity Club, distinctions reserved for only the top advisers at Morgan Stanley.

Ed’s unique talent for taking a news story, explaining if and how it affects people’s finances and offering suggestions for action has made him a sought-after commentator, and he has appeared hundreds of times on CNN, ABC, CBS, NBC, CNBC, Fox Business News, FOX News Channel, Bloomberg TV and China TV. Ed Butowsky is often seen on “Varney and Co,” “Closing Bell,” “Street Signs,” “Your World with Cavuto,” “America Live with Megyn Kelly,” “Willis Report,” “America’s News HQ,” “Taking Stock with Pimm Fox” and “Wilkow! with Andrew Wilkow.”

Ed Butowsky has appeared on TheBlaze TV and is a Blaze Branded Contributor for The Blaze online. Additionally, he is an op-ed contributor who has written articles relating to financial topics for National Center for Policy Analysis, FoxBusiness.com, FoxNews.com, Breitbart.com and others. He was a keynote speaker at the American Bar Association Bankruptcy Division and was featured in the PBS Frontline interview “To Catch a Trader.” Ed Butowsky serves as a Board Member for Reclaim New York, a non-partisan, non-profit think tank dedicated to advancing a grassroots conversation about the future of New York, it’s economy and it’s people.

Ed regularly talks about wealth management and other timely subjects related to finance and investment on radio shows around the country, including “Mad Dog Radio” and “Bloomberg Radio.” Ed Butowsky was featured as one of seven financial coaches/experts in the first-of-its-kind online reality series, “The Invested Life,” a nine-month series that featured real people facing common investment concerns and their journey to take control of their finances.

Ed Butowsky has lectured at Yale University, NYU Stern School of Business and SMU Cox School of Business, and he speaks to financial advisers throughout the U.S. on how to manage portfolios properly.

He is the originator of the CHIP score, the first metric designed to evaluate and score a portfolio’s strength based on all elements that attribute to performance: rate of return, risk, inflation, taxes, management fees and investment fees. He is also the creator of the Chapwood Index, a real cost of living index that shows, on a quarterly basis, a more accurate figure than the Consumer Price Index for cost of living increases in the nation’s top 50 major metropolitan areas.

In 2005, Ed Butowsky launched Chapwood Investments, LLC, a private wealth management advisory firm that focuses on providing comprehensive financial counseling and investment advice to wealthy families and individuals. Under the management of Ed Butowsky and his partner, Kim Sams, Chapwood Investments was awarded the 2015 Alternative Investment Award for Excellence in Investment Wealth Management – USA.

A respected member of the Greater Dallas community, Ed lives with his wife and 2 children in Plano, Texas. He is an avid tennis and golf player. Ed Butowskyis an accomplished speaker on a variety of investment topics.

via Blogger http://brigittetwisss.blogspot.com/2017/11/ed-butowsky.html

2 notes

·

View notes

Text

Wealth|Stack: How to Build Your Business

Digital Elixir

Wealth|Stack: How to Build Your Business

I really love the concept we created for this event: INVESTING + TECH = THE FUTURE OF ADVICE.

There is a month to go until the Wealth|Stack conference, and we are all super stoked about this. We partnered with the folks at Inside ETFs to coproduce an event that is truly outstanding. Its near Camelback Mountain at the Scottsdale Plaza Resort in Arizona, Sunday, September 8th through Tuesday, September 10th. About three quarters the attendees are from the RIA / Independent adviser community, and rest from the world of FinTech (Software, custodians, apps, private equity, etc).

But what I really wanted to highlight are a few speakers — people who can teach you about how to build, grow and manage an advisory firm:

Shirl Penney is the founder of Dynasty Financial Partners, and serves as president and CEO. Dynasty is a leading integrated platform services company for independent wealth management advisory firms. It has garnered too many industry awards to mention. Shirl was named to Investment News’ 2015 list of 40 most influential people in wealth management under the age of 40. He was also named to the 2016 inaugural list of Icons and Innovators in wealth management by Investment News. Launched in 2010, the firm now manages over $35 billion dollars.

Joe Duran is CEO and founding partner of United Capital, the nation’s first and largest financial life management company. Joe previously built Centurion Capital (sold to GE Financial in 2001). Duran was a recipient of the prestigious Ernst & Young Entrepreneur of the Year award in 2015 and the Schwab Pacesetter Impact award. United Capital currently manages more than $16 billion in client assets and advises on $7 billion in plan assets. Earlier this year, Goldman Sachs purchased United for $750 million in cash.

Peter Mallouk is president of Creative Planning. The firm has consistently been ranked as one of the best wealth management shops in the country by Barrons, CNBC, Forbes, Financial Times and others. Peter acquired the firm in 2004,m and has since turned it into a powerhouse. Creative Planning manages over $40 billion for clients. (I’ll be recording a live Masters in Business with Peter at the event)

If you want to improve your business or learn how some of the smartest most successful people in the industry built powerhouse ethical fiduciary firms, there are none better. Shirl, Joe and Peter each built the most successful advisers of this era. If you are managing a book of business, or running an advisory firm or RIA, and want to learn how to do so better, these are who you want to learn from. (And that’s just three of the speakers from a full line up of superstars).

This event will sell out. These are the last of the tickets available at any sort of a discount — once this run is gone, everything goes back to full price:

Sign up here Wealth/Stack 2019 registration.

We built this event to help RIAs improve how they manage their businesses and to better serve their clients. It is for advisors by advisers. Don’t miss it.

Wealth|Stack: How to Build Your Business

from WordPress https://ift.tt/2KjWcYX

via IFTTT

0 notes

Photo

Military And Intelligence News Briefs -- April 26, 2019 http://bit.ly/2IYAk50

British intelligence agency GCHQ has repeatedly said Huawei needs to be closely monitored but has not called for a ban. Photo: Reuters

SCMP: Five Eyes spies play down split as ‘Huawei leak’ roils UK government

* UK PM urged to investigate who leaked decision about Huawei’s role in Britain’s 5G network from confidential meeting of her National Security Council

* Britain appears set to allow Huawei a restricted role in building parts of the network, as Chinese tech giant ‘welcomes report’

Five Eyes cybersecurity chiefs have played down suggestions of a split in the alliance following a politically explosive leak that the UK government will ignore US pressure and give Chinese technology giant Huawei a role in building its 5G networks.

According to an article in The Daily Telegraph, the contents of which were not denied, the 10-member National Security Council (NSC) chaired by the embattled Prime Minister Theresa May agreed on Tuesday to allow Huawei access to noncore parts of the 5G system, but block it from all core parts where data is exchanged.

Read more ....

Military And Intelligence News Briefs -- April 26, 2019

Here’s which leading countries have barred, and welcomed, Huawei’s 5G technology -- CNBC

Huawei ban: Australia becomes increasingly isolated among Five Eyes partners if UK includes Chinese firm in 5G network -- SCMP

Britain’s Huawei call ‘risks Five Eyes alliance’ -- The Australian

Five Eyes Must Lead on 5G -- Rep. Mike Gallagher and Tom Tugendhat, MP, War On The Rocks

Look, up in the sky! A Russian 'spy' plane will fly above the Omaha area on Friday -- Omaha World-Herald

Navy to christen guided missile destroyer USS Lyndon B. Johnson on Saturday -- UPI

Bound for the brig? New detention facility fashion revealed! -- Navy times

Aging Sealift Fleet Is Achilles Heel Of Pentagon War Plans -- Loren Thompson, Forbes

A new sniper MOS? Marines are testing a ‘proof of concept’ for scout snipers -- Marine Times

Lockheed awarded $723.6M for Hellfire II missiles for Army, allies -- UPI

GAO Hits F-35 Readiness, Blames Parts Pipeline -- Air Force Magazine

Government watchdog finds more problems with F-35’s spare parts pipeline -- Defense News

Trump leaves Pentagon power vacuum -- Politico

China, Russia… ‘we all have to get rid’ of nukes, Trump says amid reports he eyes arms control deal -- RT

Not dead yet: Nuclear weapons agency moves to save Jason advisory group -- Defense News

Air Force secretary raised ethical concerns about Shanahan -- Defense News

Defense Department to take over background investigations for federal government -- The Hill

Pentagon Ends 59-Year Contract With Top-Secret Group of Advisors - Report -- Sputnik

Is Cyber Command really being more ‘aggressive’ in cyberspace? -- Mark Pomerleau, Fifth Domain

N. Korean criticism raises concerns that scaled-back military drills have reaped little payoff -- Stars and Stripes

How the US military's opium war in Afghanistan was lost -- Justin Rowlatt, BBC

Russian Navy Ever Less Capable of Supporting Putin’s War Plans -- RCD

Russia to Display Its Surface-to-Air Missile Systems in Istanbul -- Sputnik

China wants to turn its training aircraft carrier into a combat ship — here's how it stacks up against US carriers -- Business Insider

China begins joint naval drills with six Southeast Asian nations -- SCMP

‘A Very Big Gap’: China’s PLARF Outclasses US Missiles, Puts Carriers At Risk -- Sputnik

Japan is expanding the hunt for its F-35 that disappeared over the Pacific -- Business Insider/Reuters

‘Saving Private Ryan’ is heading back to theaters for the 75th anniversary of D-Day -- Military Times

Ben Affleck is making a movie about the secret Army unit that tricked the Nazis with a 'ghost army' -- Business Insider

from War News Updates http://bit.ly/2GIQSw8

via IFTTT

0 notes

Photo

New Post has been published on http://simplemlmsponsoring.com/attraction-marketing-formula/copywriting/50-content-marketing-influencers-you-need-to-follow/

50 Content Marketing Influencers You Need To Follow

Have you ever had someone try to sell you something? Considering

how ad-heavy our world is today, it is likely that you have. It is

also very likely that an ad alone is not going to engage you enough

to purchase the item or service.

You do not feel any connection with a mere ask, but you probably

feel differently when the ask includes a story that adds value or

makes the company relatable to you. This is where content marketing

comes into play.

Content

Marketing allows brands to speak to you while coming across as

authentic, empathetic, and dedicated to connecting with you. It

is a blog post that informs you of industry changes or a video

on social media that reveals a customer reviewing the brand. For

the foreseeable future, content will remain as king.

According to

Content Marketing Institute, content marketing receives 3

times the leads per dollar spent when compared to paid search. It

also brings in conversion rates 6 times higher than other

channels.

The power to influence and engage an audience is what makes

content marketing influential. In turn, those who understand

content marketing, are successful with it, and sharing their

insights about it are highly sought after and increasingly

quoted.

The individuals below have established themselves as content

marketing influencers as they truly get the nuances of content

marketing and the impact it has on consumers all over the

world.

If you are looking for some expert takeaways on content

marketing, take a look at our list of influential content marketers

you should be following.

Content Marketing Influencers: Who Are They?

Jeff Bullas – Influencer, Author, and

Blogger

Over the past decade, Jeff Bullas has been at the forefront of

offering actionable advice to content marketers and Chief Marketing

Officers. Through jeffbullas.com, he has shared his insights into

using content to increase conversions and widen audiences. He has

been called a “Top Influencer for Chief Marketing Officers,” by

Forbes, and has been listed as one of the “50 Marketing

Influencers to Watch,” by Entrepreneur.

Find him on Twitter

& LinkedIn.

Joe Pulizzi – Founder of Content Marketing

Institute

Author, public speaker, and philanthropist, Joe Pulizzi is the

mastermind behind the Content Marketing Institute, the leading

educational institute for content marketing. His efforts at

promoting best practices for content marketing were recognized in

2014 when he was awarded the John Caldwell Lifetime Achievement

Award by the Content Council. Currently, among other initiatives,

Pulizzi fundraises for the Orange Effect Foundation.

Find him on Twitter & LinkedIn.

Neil Patel – Co-Founder of Neil Patel

Digital

Called “Top Influencer on the Web” by The Wall Street

Journal, and known as a “Top 10 Marketer,” by the New York

Times, Neil Patel has become a leading voice for those in the

digital and content marketing sphere. He has created his own

successful digital agency that focuses on providing honest feedback

to clients while helping them enhance their own ROI. He has been

recognized as a “Top 100 Entrepreneur Under 30,” by former

President Barack Obama, and his company was featured on the list of

“100 Brilliant Companies.”

Find him on Twitter

& LinkedIn.

Ann Handley – Chief Content Officer of

MarketingProfs

When it comes to content marketing, Ann Handley has done a bit

of it everything. She is a speaker, author, and current member of

the LinkedIn Influencer program. Currently, she works as the Chief

Content Officer for MarketingProfs. She has been cited by Forbes as

“The Most Influential Woman on Social Media,” and recognized by

ForbesWoman as one of “The Top 20 Women Bloggers.”

Find her on Twitter & LinkedIn.

Michael Brenner – Speaker, Author, and CEO of

Marketing Insider Group

Michael Brenner has brought a customer-centric and creative

approach to his insights on content and digital marketing. Over the

past two decades, Brenner honed his approach while working with

Nielsen, FullTilt, ICR, SAP, and NewsCred.

Today, he is a globally recognized speaker, bestselling author,

and CEO of the Marketing Insider Group, a marketing firm that has

helped numerous companies cultivate successful approaches to

marketing.

Find him on Twitter & LinkedIn.

Mark Schaefer – Speaker, Business Consultant,

Author

Mark Schaefer has over 30 years of experience working in global

sales, PR, and marketing. He is a faculty member of the graduate

studies program at Rutgers University, and has taken what he has

learned through his decades of experience and poured it into his

blog, keynote speaking opportunities, and numerous writings.

Find him on Twitter & LinkedIn.

Steve Cartwright – UI/UX Design Director &

Web Designer of website-designs.com

While much of content marketing include conversations about

verbiage, SEO, and overall content strategy, the user experience is

a crucial piece that can often be left by the wayside. Steve

Cartwright has bridged this gap and made website design and UX a

necessary topic in regards to content marketing. He is currently a

UI/UX Director for Nimble Collective Inc. and a Design Leadership

Forum Member for Invision.

Find him on Twitter & LinkedIn.

Jay Baer – Founder of Convince &

Convert

Jay Baer is the founder of Convince & Convert, an analysis

and advisory firm that creates digital marketing strategies for

organizations looking to increase their marketing reach. Baer has

25 years of experience in the marketing industry and is a New York

Times Bestselling Author of 6 books, He has worked with the likes

of Hilton, Grand Ole Opry, Cisco, and Arizona State University.

Find him on Twitter

& LinkedIn.

Marcus Miller – Internet Marketing and SEO

Consultant for Bowler Hat

Marcus Miller has over 18 years of experience as a consultant

focusing on SEO, PPC and Digital Marketing. His marketing firm,

Bowler Hat, works with small and mid-sized businesses across the

world to help them develop effective digital marketing strategies.

He has been a Developer for Mobile Fun and Opera Telecom, as well

as a graduate from Birmingham City University with a Bachelor of

Science in Computer Science.

Find him on Twitter & LinkedIn.

Lilach Bullock – Online Business Expert,

Speaker, and Coach for LilachBullock.com

Listed as one of Forbes “Top 20 Women Social Media

Influencers,” and named as “The Top Digital Marketing

Influencer,” by Career Experts, Lilach Bullock has made a

noticeable splash in the world of digital marketing. She has had

years of success as an entrepreneur, and international digital

agency owner. Since 2009, she has given one-on-one actionable

marketing advice to clients to help them build their businesses

online. Bullock has been featured in Forbes, The Telegraph, Wired,

The Sunday Times, and The Guardian.

Find her on Twitter & LinkedIn.

Lee Odden – CEO and Co-Founder of TopRank

Marketing

Lee Odden is an avid blogger, talented speaker, and author. He

is the CEO and co-founder of TopRank Marketing, a digital marketing

agency that has served the likes of McKesson, Dell, and

LinkedIn.

Odden has gone across the globe to share his insights regarding

data-informed and customer-centric marketing. He has provided

consulting for numerous Fortune 500 companies and has created over

3,300 blog posts related to his marketing advice.

Find him on Twitter

& LinkedIn.

Neal Schaffer – Speaker and CEO at Maximize

Your Social

Named as one of marketing’s “Ten Biggest Thought Leaders,”

by CMO.com, and recognized by Forbes as a “Top Five Social Sales

Influencer,” Neal Schaffer is a prominent voice in the world of

business oriented social media. He is a creator of the social media

for business blog, Maximize Your Social, a faculty member of

Rutgers University Mini-Social Media MBA Program, and an author

responsible for one of the most significant books on social media

creation “Maximize Your Social: A One-Stop Guide to Building a

Social Media Strategy for Marketing and Business Success.”

Find him on Twitter & LinkedIn.

Larry Kim – CEO at MobileMonkey

Larry Kim is a one-stop-shop guru on the utilization of Facebook

Ads and messaging for marketing optimization. Kim is the CEO of

MobileMonkey, a platform that helps companies engage with customers

using Facebook Messenger. In addition to being a successful

entrepreneur, Kim is a contributor to CNBC and Inc. Magazine. He

has been ranked as the eighth most popular author on Medium and has

been recognized by PPC Hero, Search Engine Land, and the US Search

Awards.

Find him on Twitter

& LinkedIn.

Pam Moore – CEO and Co-founder of Marketing

Nutz

With over 15 years of experience in corporate marketing and

product management, Pam Moore has honed her craft regarding brand

management and digital marketing optimization. She is a bestselling

author, highly sought-after speaker, and has been ranked by Forbes

as a “Top 10 Social Media Power Influencer.” In 2012, she

launched Marketing Nutz, which has worked with clients such as HP,

Sony Playstation Group, IBM, & more. In addition to managing

Marketing Nutz, she hosts the popular Social Zoom Factor

podcast.

Find her on Twitter & LinkedIn.

Robert Rose – Founder of The Content

Advisory

In 2010, Robert Rose founded The Content Advisory, an education,

consulting and research group of The Content Marketing Institute.

For over 20 years, Rose has helped many organizations tell their

story to the constituents they serve. He has advised brands like

Capital One, Dell, Ernst and Young, The Bill and Melinda Gates

Foundation, and UPS. He is an author, featured keynote speaker, and

workshop teacher at several technology and marketing events across

the globe.

Find him on Twitter & LinkedIn.

Martin Butters – Business and Social Media

Director of markITwrite

Martin Butters is the leader that is at the helm of markITwrite,

an organization that provides digital content and SEO services for

multiple magazines and websites. In three years, Butters has

developed an organic audience of over 120,000 and has helped

multiple clients also grow their own audiences. Butters has become

a prominent SEO and audience growth expert in his own right.

Find him on Twitter & LinkedIn.

Andy Crestodina – Co-Founder and Chief

Marketing Officer of Orbit Media Studios

For the past 18 years, Andy Crestodina has advised thousands of

businesses on how to strengthen their digital media strategies. He

is a top-rated speaker, podcast host, university lecturer, and

article writer. Crestodina is the co-founder and CMO of Orbit

Media, an award-winning and socially-conscious digital marketing

agency located in Chicago. He has been recognized as a top

marketing expert and influencer by Forbes and Entrepreneur

respectively.

Find him on Twitter

& LinkedIn.

Sujan Patel – Entrepreneur and Marketer at

sujanpatel.com

Sujan Patel’s ultimate goal is to help entrepreneurs and

marketers scale and grow their businesses. He furthers this vision

through his own entrepreneurial and digital efforts. Patel is the

co-founder of Webprofits, a growth marketing agency that has helped

numerous companies enhance their marketing approach. In addition to

his work with Webprofits, Patel is also a frequent blogger and

shares his insights on growth marketing with readers on Forbes, The

Wall Street Journal, and Entrepreneur Magazine.

Find him on Twitter

& LinkedIn.

John Hall – Co-founder and Advisor of Influence

& Co.

John Hall is the co-founder of calendar.com, as well

as a Co-Founder and Advisor to Influence & Co. The latter is

one of the largest creators and distributors of expert content in

media. Hall is a jack of all trades. When he is not helping

companies realize their content marketing potential, he is managing

his own real estate company, contributing to a weekly column at

Forbes and Inc.com, and also writing for the Harvard Business

Review.

Find him on Twitter

& LinkedIn.

Aaron Agius – Managing Director of

Louder.Online

Aaron Agius has had an interesting and intriguing path to

digital marketing. His journey started in the digital and IT space

where he picked up on the technical aspects of marketing. From

there he started his own consultancy in 2008 that grew from 40

cents in revenue to eventually working with Salesforce, IBM, Ford,

LG, Coca-Cola, and Intel. He has been featured by The Huffington

Post, Forbes, HubSpot, The Content Marketing Institute, and

Entrepreneur Magazine.

Find him on Twitter & LinkedIn.

Mark Traphagen – Content Strategy Director

of Perficient Digital

A guru on marketing and branding, Mark Traphagen is a tour de

force when it comes to sharing his valuable marketing insights.

Along with being the content strategy director for Perficient

Digital, Traphagen is also an in-demand speaker that has spoken at

MozCon, SMX, SEOClarity, PubCon, and a host of other well-known

marketing-related events. He hosts a monthly column about social

media marketing for Marketing Land and has conducted numerous

webinars related to digital marketing.

Find him on Twitter & LinkedIn.

Christoph Trappe – Chief Content Engagement

Director of Stamats Communications, Inc.

When it comes to storytelling, and captivating audiences with

engaging content, Christoph Trappe has years of success and

experience. He has worked as a journalist, content marketing

executive, and content marketing strategist.

Trappe has also used his platform and experience in content

marketing to coach others in how to optimize their content strategy

and storytelling processes. He has spoken internationally, is an

avid blogger, and author.

Find him on Twitter

& LinkedIn.

Shane Barker – CEO of Shane Barker

Consulting

Shake Barker’s successful work in helping companies optimize

their approach to digital marketing has been recognized by The

Huffington Post, Forbes, Inc., the Content Marketing Institute,

Search Engine Journal, Social Media Examiner, Entrepreneur, and

B2C. He is a digital marketing consultant that helped multiple

companies and individuals build their business through sound

digital marketing practices. In addition to consulting, Barker is a

contributor to publications by Salesforce, Yahoo Small Business,

and MarketingProfs.

Find him on Twitter & LinkedIn.

Jose Javier Garde

With a blend of corporate management experience and training as

a primary teacher, Jose Javier Garde has been able to blend his

abilities as a teacher with his hands-on experience in

corporate..

Read more: blog.atomicreach.com

1 note

·

View note

Text

31 Topmost M&A Lawyers in India

This article is written by Pranay Bhattacharya, student at MNLU Aurangabad.

India is one of the growing markets for M&A (Mergers and Acquisitions). This article is a modest effort to mention some of the most sought-after lawyers in the field of M&A.

The list here is an alphabetical list and we don’t suggest that any of them is better or superior to the other.

AJAY BHAL: He is the Co-Founder and Managing Partner of AZB & Partners (merged with Chambers of Zia and Bahram in 2004, and formed AZB & Partners), and he heads the Delhi team of the firm. He has over 30 years of M&A experience and is associated with big Indian business houses, multinational corporations and international organizations. He practices in M&A including tax, Private Equity Investments, Foreign Exchange related advisory work, Securities Regulations, and Taxation including Tax Litigation regulatory issues for corporate acquisitions etc. He also has expertise in litigation and tax accountancy matters, structuring, restructuring and transfer pricing-related issues. He has presented himself as an independent expert on behalf of Government of India on tax and accounting matters before the International Court of Justice, The Hague. He has also represented as counsel and co-counsel in various arbitral positions between large US companies. He also advised the government of India in matters related to M&A on various occasions.

Education:

Chartered Accountant (1979)

B.A. from University of Delhi (1985)

Memberships and Affiliations:

Member of the Confederation of Indian Industry (CII) economic growth and investments council.

Board of governors of the Indian Institute of Corporate Affairs (IICA).

Bar Association of India.

International Bar Association.

Federation of Indian Chamber of Commerce of Indian (FICCI).

Indian Management Association.

Served as a member of the committee constituted by the Ministry of Finance in India, formed to simplify the provisions of the Income Tax Act.

Member of the Appellate Panel, formed by the Institute of Insolvency Professionals.

Board of Governors of the Indian Institute of Corporate Affairs (IICA).

Member of the Committee to review the offences under the Companies Act, 2013 constituted by the Ministry of Corporate Affairs, Government of India in July 2018.

Accomplishments

Named as a leading attorney in the field of M&A by Asia Pacific Legal500.

Listed as “world’s leading tax advisors” by Tax Directors Handbook.

Named as Star Individual for M&A by Chambers Global and Chambers Asia Pacific.

Named as Leading Lawyer for M&A in 2013 and 2014 by International Who’s Who Legal.

Asia’s leading business lawyers in the field of M&A and Project Finance by Asialaw 2004.

Leading Lawyer in the field of General Corporate Practice by 2006 Asia Law & Practice.

Named a leading tax attorney by IFLR1000.

AKHIL HIRANI: He is one of India’s leading corporate lawyers having more than 25 years of experience. Currently, he is the Head of the Transactions Practice and Managing Partner at Majmudar & Partners, a leading Indian law firm. He has exceptional Indian law insight with an international skill. He has work experience in California and London. His practice areas are Banking and Finance, Corporate/M&A, Private Equity and Venture Capital, Projects and Energy, Tax, Technology, Media and Telecommunications.

He regularly speaks on M&A, capital raising, issues affecting hedge funds and FIIs, India investment strategies, and related subjects at many international forums, including at seminars held by Terrapin in India and Hong Kong, PLI and ATLAS Legal in the US, and the IBA. He is regularly featured in shows on CNBC TV18, Bloomberg UTV and ET Now. He has won several distinguished awards.

He offers clients over 25 years of experience advising financial institutions on structured investments, joint ventures and regulatory matters.

He has authored several articles and publications on topics, including structuring investments into India, outsourcing to India, joint ventures in India and on tax issues.

Education:

B.A, Psychology from St. Xavier’s College (1989)

L.L.B (specialized in Private International Law) from Government Law College, Mumbai (1992)

Membership and Affiliations:

Bar Council of Maharashtra and Goa

Bombay Incorporated Law Society

State Bar of California

International Bar Association

American Bar Association

Law Society for England and Wales

Accomplishments:

Ranked as one of the most in-demand lawyers by Chambers Asia Pacific, Chambers Global, Asia Pacific Legal 500, IFLR1000, India Business Law Journal, and Asialaw Leading Lawyers.

Top 100 Legal Luminaries of India published by Lexis Nexis and Practical Law Company.

A-list of India’s top 100 lawyers by India Business Law Journal.

ANAND DESAI: He is working as the Managing Partner at DSK Legal since it was founded in April, 2001. He is a leading practitioner in India and has over 30 years of extensive domestic and international experience. He is also a trusted counsel to several large multinational and Indian corporates.

He is a perceptive litigator and negotiator and has innovative and strategic inputs to optimize his clients’ strategy. He has dealt in many high profile cases in criminal and civil litigation including intellectual property, commercial disputes, anti-trust, real estate and information technology.

Education:

B.Com from Bombay University

L.L.B from Bombay University

L.L.M from the University of Edinburgh, Scotland

Membership and Affiliations:

Served as the National President of Indo-American Chamber of Commerce.

Chairman of a Committee to recommend amendments to the Specific Relief Act, 1963 by the Government of India, Ministry of Law and Justice.

President of TiE Mumbai (from April 2016).

Director of Paani Foundation.

Trustee of L&T Employees Welfare Foundation.

Advisory board member of Swades Foundation and Yuva Parivartan.

Chairman of the Tribal Mensa Nurturing Program.

Managing Council member of Vision Foundation of India.

Accomplishments

Featured in the book titled “100 Legal Luminaries of India” by Lexis Nexis.

Featured in Top 100 A-List published by India Law Journal in 2016.

Listed as one of the leading lawyers in India in Who’s Who Legal, Chambers Global, IFLR, Asia-Pacific Legal 500 and Asialaw Profiles.

ANAND PATHAK: He is currently employed at P&A Law Offices in the position of Managing Partner, and was employed at Jones Day. He has practised law for more than 25 years. Prior to joining P&A Law Offices, he was a lawyer in Brussels, Cleveland and Palo Alto. He is admitted to practise law in India and the states of Ohio and California in the United States.

His practises areas are US, European and Indian M&A and joint ventures, and technology licensing, distribution and agency arrangements. He attended all of the European Council negotiation meetings leading to the adoption of the EU Merger Control Regulation and assisted in the drafting of the implementing regulations and guidelines issued by the European Commission. He has represented several clients in proceedings before the Indian Competition Commission, the Competition Appellate Tribunal and the Supreme Court of India, including Apple Inc, MCX-SX, Financial Technologies (India) Limited, Sony Pictures Entertainment, Daiichi Sankyo, Eli Lilly, General Motors, Bull Machines, Ericsson, Amazon, Super Cassettes and DLF Limited.

He is a highly regarded expert in EU and Indian competition law and is well known for his vast experience handling related investigations.

Education:

B.A Hons. (Economics) from St. Stephen’s College, Delhi University.

L.L.B from the University of Cambridge, England.

L.L.M and M.A in International and Development Economics from Yale University.

Membership and Affiliations:

Has worked at the European Court of Justice, Luxembourg, and in the Competition Division of the Legal Service in the European Commission, Brussels.

Member of a committee constituted by the Indian government for reviewing Indian competition laws.

He is currently vice chair of the IPBA on Indian Competition Law.

Represents several companies before the Competition Commission of India, the National Company Appellate Tribunal and the Supreme Court of India in matters relating to mergers, cartels and abuse of dominance.

Accomplishments:

Presented with the National Law Day Award 2005 by the Prime Minister of India for his unique contribution in the field of corporate law.

Best M&A Lawyer in India in 2008.

India M&A Legal Counsel of the Year in 2009.

India M&A Lawyer of the Year in 2011 and 2012.

Competition Lawyer of the Year in 2011.

India Competition Lawyer of the Year in 2012, 2013, 2014, 2015 and 2016.

APARAJIT BHATTACHARYA: He started his career in 2001 as an articled clerk at Crawford Bayley and had joined HAS (Hemant Sahai Associates) way back in 2004 from Trilegal, and now is a senior partner in the HSA Advocates New Delhi office. He has been practicing for more than a decade now. He has been particularly active in the energy and private equity space. His areas of practice are Corporate Commercial, M&A and Private Equity. He has led diverse assignments and transactions in corporate commercial and has advised clients on many cross-border transactions that relate to foreign investment in India, their entry strategies, M&A, equity investments, joint ventures, management buyouts and corporate restructuring. He has worked across varied sectors of commerce and industry in services, trading and manufacturing sectors. He is a pioneer in the area of Clean Development Mechanism (CDM) and has counseled one of the first CDM projects in India. He has been a trusted advisor to many of his clients and sits on the board and advisory committees of several companies.

Education:

B.S.L, Symbiosis Law School

L.L.B, Symbiosis Law School

Memberships and Affiliations:

Childreach International

SightLife

Member Bar Council of India

Member Delhi High Court Bar Association

Member Inter – Pacific Bar Association (IBPA)

He is also member of the Infrastructure team with a specific focus on environmental matters.

Accomplishments

Leading Indian M&A corporate lawyer by Chambers Asia 2010, Chambers Asia 2011 and by Chambers Global.

Leading lawyer by Asia Law Profiles.

Leading Lawyer by The Intercontinental Finance Magazine (UK).

Leading lawyer by ACQ Law Awards (UK).

Leading lawyer by Global Business Magazine (UK).

Global Law Experts for Climate Change Legal Advisory Services.

Leading Lawyer in Corporate Commercial/M&A by Legal 500 (Asia Pacific) in 2016.

APURVA DIWANJI: He has been working in Desai & Diwanji for the past 21 years and is currently employed in the position of Partner.He is praised for his knowledge and experience in the corporate and M&A space. His additional areas of strength include commercial litigation international capital markets, co-investments, PE, and joint ventures. He has advised on a variety of transnational and cross border transactions, sale/acquisition of existing Indian companies, GDR/FCCB and QIB issues.

He has advised M&A transactions, including mergers and amalgamations, asset and business purchases and sales, tender offers, securities sales and purchases, buy-outs, joint ventures and strategic buyouts. He advises on the full spectrum of such matters including corporate governance issues, transaction structuring, anti-trust and competition laws, FDI and FEMA issues, SEBI and DIP guidelines, and has advised on transactions across various industry sectors.

Education:

B.A (Economics), University of Mumbai (1987).

M.A (Law), Downing College, University of Cambridge, 1993.

Membership and Affiliations

Non-Executive and Independent Director of Cadila Healthcare Ltd (Pharmaceuticals).

Director of Go Airlines (India) Ltd.

Partner of Desai & Diwanji.

Director of Shapoorji Pallonji Forbes Shipping Limited.

Director Eureka Forbes Ltd.

BOMI DARUWALA: He has been practicing since last 30 years in the area of domestic and international tax and heads the Mumbai office of Vaish Associates. He has been associated with the Firm since 1988. Primarily a transactional lawyer, he has been involved in numerous complex tax litigations and argued several tax cases relating to domestic and cross-border taxation issues of foreign companies, multinationals and large Indian corporate houses before various High Courts, Authority for Advance Rulings, Tax Tribunals and other appellate authorities. He has wide expertise in transfer pricing related issues.

He specializes in restructuring of business, M&A, asset & share purchase deals, securities offerings, structuring of complex debt and equity investments and general corporate and tax advisory. He also has expertise in sectors like private equity, cross-border business transactions, joint ventures, angel and venture capital round financings, strategic alliances and business divorces.

He is a notable speaker of several national and international conferences and seminars organized by leading professional bodies and chambers on subjects like M&A, Takeover Code, Foreign Direct Investment and structuring of Joint Ventures and other topical issues. He has also authored various articles and publications including the Handbook of Direct Taxes of which 25 editions have been published by Bharat House.

Education:

B.Com from Sri Ram College of Commerce

L.L.B

Chartered Accountant

Cost Accountant

Membership and Affiliations

Insolvency professional with the Insolvency and Bankruptcy Board of India.

Fellow Member of Institute of Chartered Accountants of India (FCA).

Associate Member of Institute of Cost and Works Accountants of India(AICWA).

Independent Non-Executive Director at Mather & Platt Fire Systems Ltd.

Partner at Vaish Associates Advocates.

Accomplishments

Independently endorsed as a Leading Lawyer in Corporate/ M&A by Asia law Leading Lawyers 2018.

Leading practitioner in the Corporate/ M&A practice areas by Chambers and Partners (2018).

Leading practitioner in the Corporate/ M&A practice areas Asia Pacific Guide and Asia Pacific Legal 500 (2018).

CHITTRANJAN R. DUA: He is the founding partner of Dua Associates and has been a practicing advocate for over 30 years of rich and varied experience in the Legal field. Dua Associates is one of the largest and prominent national law firms with full-fledged offices across eight metropolitan cities in India. He has successfully established and developed Dua Associates into a practice with over 150 professionals including 42 partners and senior principals. He has vast experience in corporate law, M&A, privatization, project finance, public issues, entry strategies, foreign investment, corporate structuring/ restructuring, infrastructure projects, international trade and taxation aspects of doing business in India. He serves on the boards of many major multinational corporations in India primarily representing the interests of the foreign collaborators and investors. The firm has the aforementioned practice areas and a strong litigation and arbitration practice.

Education:

B.A from University of Delhi (1971)

Master’s Degree Delhi School of Economics (1973)

Honors Degree from St. Stephens College.

LLB from University of Delhi (1976)

Membership and Affiliations

Independent Non-Executive Director of TVS Motor Company Limited, Gillette India Limited, Pearl Global Industries Ltd.

Director of WIMCO Ltd., Tractors & Farm Equipment Ltd., Cabot India Ltd., Becton Dickinson India Pvt Ltd., McCann Erickson India Pvt Ltd., Sella Synergy India Pvt Ltd., Linde Engineering India Pvt Ltd., Lexsphere Pvt Ltd., Result Services Pvt Ltd., Associated Corporate Consultants India Pvt Ltd., Amit Investments Pvt Ltd., Emerson Process Management Power & Water Solutions Pvt Ltd., Fila Sport India Pvt Ltd., Inapex Pvt Ltd, Norling Pvt Ltd., PBE India Pvt Ltd., UL India Pvt Ltd., Timex watches Ltd. and many more.

Non-Executive Director of Vodafone India Ltd.

Founding Member of American Chamber of Commerce in India.

Senior Vice President of Society of Indian Law Firms.

CYRIL SHROFF: He is managing partner of Cyril Amarchand Mangaldas (since May 2015) and was previously managing partner of Amarchand & Mangaldas & Suresh A Shroff & Co (since 1995). He is a Solicitor, High Court of Bombay, since 1983. With over 36 years of experience in a range of areas, including corporate law, securities markets, banking, infrastructure, trust and estate laws, amongst many others.

He is regarded and has been consistently rated as India’s top corporate and finance lawyer by several international surveys. He is the head of the Private Client team. He has deep and unparalleled experience in advising family businesses, both in India and abroad, on a range of family business, governance, succession and wealth management issues. He specializes in advising family businesses on corporate governance and succession issues.

He has worked on a number of Family Constitutions and Family Arrangements with some of India’s most prominent business families, and continues to act as their trusted advisor in multiple capacities. He is actively involved in advising a number of clients on domestic and cross-border estate and succession planning issues.

He ranks among India’s top finance practitioners and enjoys a great reputation for his expertise in Indian banking law, financial regulation and M&A matters.

Education:

B.A., L.L.B degree from the Government Law College, Mumbai

Membership and Affiliations:

Was a member of the SEBI constituted by Uday Kotak committee on corporate governance, the SEBI committee on insider trading and recently the SEBI committee for direct listing of foreign securities.

Member of the first Apex advisory committee of the IMC International ADR Centre and an advisory member of the Financial Planning Standards Board of India and Macquarie.

He is a member of the advisory board of the Mumbai Court of International Arbitration (MCIA) and was recently appointed as a task force member of Society of Insolvency Practitioners of India.

He is a member of the advisory board of the Center for Study of the Legal Profession established by the Harvard Law School, a member of the advisory board of the National Institute of Securities Markets (NISM) and on the board of IIM Trichy and the governing board of Krea University.

Director of Grasim Industries Ltd.

Independent Director, Chairman of Stakeholders Relationship Committee.

Member of ESOS Compensation Committee and Member of Nomination & Remuneration Committee, Grasim Industries Ltd.

Director, IDBI Capital Market Services Ltd.

Director, Apar Industries Ltd.

He is a member of the Media Legal Defence Initiative (MLDI) International Advisory Board and also part of various committees of the Confederation of Indian Industry (CII) and Federation of Indian Chambers Commerce & Industry (FICCI).

Accomplishments:

Ranked as “star practitioner” in India by Chambers Global.

Regarded as the “M&A King of India”.

Featured in issues of Asian Legal Business (ALB) – Dealmakers of the Year 2016, as the only individual from India.

Awarded with “Emerging Markets Firm Leader of the Year – Independent” at the Asian Lawyer Emerging Markets Awards 2016 organized by American Legal Media.

He has been recognized as a “legendary figure in the Indian legal community”.

Chambers Asia Pacific, 2017 has ranked him in Band 1.

Recognized by IFLR1000, 2016 as ‘Leading Lawyer’ in various practices.

Mentioned in the A list (which identifies India’s top 100 lawyers) by India Business Law Journal.

Asian Legal Business has featured him in its December 2016 issue as a ‘Dealmaker of the Year 2016’.

DILJEET TITUS: He is the founding partner of Titus & Co.’s and has been practicing over 28 years, having worked with Singhania from 1990-1997. His practice areas include project finance and development for power, industrial and telecommunications projects, corporate investment structuring and restructuring, M&A, capital markets, commercial transactions, insurance, life sciences and biotechnology, venture capital finance, IT and ADR.

He has written several articles for law and business journals, magazines and newspapers and contributes a legal column, Going by the Book to Business Today, India’s leading business magazine. He maintains an active client practice which includes involvement in transactions, dispute resolutions, intellectual property and tax matters. He represents major US, Japanese and European clients in various capacities in ongoing projects in various phases of development including both greenfield and rehabilitation projects, where he advises in all aspects of investment structuring and restructuring for efficient tax minimisation, statutory and regulatory approvals, drafting and review of project documentation including financing documentations, exchange control issues governing return on equity, tax treatment of operation and management fees, etc

Education:

B.A. from St. Stephens College, University of Delhi (1986)

L.L.B from University of Jabalpur, Madhya Pradesh (1989)

Membership and Affiliations:

Delhi High Court Bar Association.

Supreme Court Bar Association.

Inter-Pacific Bar Association.

International Bar Association; Indian Council of Arbitration.

Society of Indian Law Firms.

Confederation of Indian Industry and the ICC India (International Chamber of Commerce).

Represents the Indian bar on the Indo American Chamber of Commerce committee on the impact of the WTO on the export of services, as well as the Federation of Indian Chambers of Commerce and Industry’s expert group on legal and accounting services.

He is a member of a number of other committees including the PHD Chamber of Commerce and Industry’s international affairs committee for Asia Pacific; the Associated Chambers of Commerce and Industry of India’s USA expert committee and the Confederation of Indian Industry’s infrastructure subcommittee.

Associate Vice President of the Society of Indian Firms and General Secretary of the Policy and Planning Group.

Represented the Indian Bar on the Indo-American Chamber of Commerce committee on “Impact of WTO on Export of Services.”

Accomplishments:

His biography is included in Who’s Who in the World, 2002.

The firm was described as a leading private equity practice by Global Counsel 3000 in 2002.

Commendatore dell’ Ordine della Stella della Solidarieta Italiana (Order of the Star of Italian Solidarity) by a Decree of the President of Italy H. E. Mr. Giorgio Napolitano on the proposal of the Minister of Foreign Affairs Mr. Franco Frattini. H. E. the Ambassador of Italy to India, Mr. Roberto Toscano presented the award to Mr. Titus.

The National Law Day Award 2007 “For Unique Achievements and Leadership in the Practice of Corporate and Commercial Laws” by the President of India Mrs. Pratibha Devisingh Patil.

Was awarded Star Export House Status by the Ministry of Commerce, Government of India.

Ranked by Chambers & Partners, UK among the leading lawyers of the world 2000 through 2016 in the specialist area of projects work.

Ranked as a “Leading Lawyer” in Project Finance and Mergers & Acquisitions by Asialaw Leading Lawyer Survey for the years 2000 through 2016.

Ranked as a “Recommended Individual” in Corporate and Mergers & Acquisitions and Project Finance by Which Lawyer?

Ranked as a “Leading Individual” for sixteen consecutive years by Asia Pacific Legal 500 in infrastructure and Corporate/ Mergers and Acquisitions as well as in Project Finance.

Global Counsel 3000 Recommended Lawyer-Diljeet Titus, Titus & Co. for Mergers and Acquisitions Consulting Editor The Contemporary Who’s Who, 2016.

GUNJAN SHAH: She is a partner at Amarchand & Mangaldas & Suresh A. Shroff & Co. Her area of practices are M&A, private equity investment, corporate restructuring, securities and takeover regulations, debt restructuring and debt capital markets and has led several complex and ground-breaking transactions that were first of their kind and are commonly used as precedents. She has specializations in financial services and pharma and life sciences.

Global PE heavyweights routinely turn to her while making investments in India.

Education:

B.A., LL.B. (Hons) National Law School of India University, Bangalore (1993-98)

B.C.L., University of Oxford (2000-2001).

Membership and Affiliations:

Delhi Bar Association

Accomplishments:

Featured in the list of India’s Hottest Young Executives – 2015 in Business Today’s best and brightest corporate performers under 40

Recognised as India’s top 40 business leaders under the age of 40 by Economic Times – Spencer-Stuart Survey, 2014

Recognised by AsiaOne among 50 most influential Indians under 50 in 2016-17

HAIGREVE KHAITAN: He is a Senior Partner at Khaitan & Co and heads Khaitan & Co.’s Mergers & Acquisitions (M&A) practice and serves as its Head of Mumbai Office. He joined the firm in 1988. He focus areas are Mergers & Acquisitions (Domestic and Cross-border), Private Equity (including in listed companies) & Venture Capital, Domestic and Cross-border Joint Ventures, Collaborations & Franchising, Project Finance Transactions, Banking & Finance Transactions, Takeovers, Strategic Alliances, Foreign Investment Law, Corporate & Commercial Law Advisory, Asset protection & Wealth Management, Business & Family Succession Planning etc.

He advises a range of large Indian conglomerates and multinational clients in various business sectors including infrastructure, power, telecom, automobiles, steel, software and information technology, retail, etc. He has rich experience in all aspects of M&A- Due Diligence, Structuring, Documentation involving listed companies, cross border transactions and medium and small business, etc.

He spent considerable years of his initial practice in representing clients on litigation matters and thereafter he went on representing many clients on project finance and real estate transactions.

He has been highly recommended by world’s leading law chambers / legal accreditation bodies as one of the leading lawyers in India and as the leading lawyer for Project Finance in Asia. He has been involved in some of the high profile and complex transactions in India.

.He has rich experience in all aspects of Chemical plant operations. He has his expertise on various innovative Chemical technologies, his main research work focuses on time and cost reduction on technologies and evaluation process for improving techniques.

His research interest is Analytical Technique Bioanalytical Technique Liquid Chromatography Separation Technique.

Education:

L.L.B., South Kolkata Law College (1995)

Membership and Affiliations:

Non-Executive Independent Director of Harrisons Malayalam Limited, National Engineering Industries Ltd., CEAT Ltd., INOX Leisure Ltd., Ambuja Cements Ltd. , Torrent Pharmaceuticals Ltd., JSW Steel Ltd.

Non-Executive Director of BTS Investment Advisors Ltd.

Independent Director of Aditya Birla Sun Life Insurance Company Ltd.

Director of AVTEC Limited, Seclore Technology Private Ltd., JSW ISPAT Steel Ltd.

Member of Entrepreneurs’ Organization (India), International Bar Association, Indian Council of Arbitration, Bar Council of West Bengal, All India Bar Association, Inc. Law Society of Calcutta, The Indian Law Institute, Bar Association of India.

Partner at Azalia Estate Realty Solutions LLP, Perito Tessili Designs LLP, Harulika Ventures LLP and Bhasa Agri LLP.

Accomplishments:

Leading lawyer in India for Corporate / M&A transactions and Banking by Chambers & Partners, Legal 500, IFLR 1000.

He was listed in our “40 under 45” survey of India’s Leading Young Lawyers.

Band 1 lawyer for Corporate/M&A and Private Equity.

“A” list India’s top 100 lawyers 2016.

HIMANSHU NARAYAN: He is working as a partner in Dua Associates and has significant experience in transactional work in the field of M&A, strategic and financial partnerships, private equity, corporate finance and provision of general corporate advice. His transactional experience has included work in sectors such as telecommunications (including telecommunications infrastructure companies), life insurance, general insurance, print media, media and entertainment, financial services, advertising, consumer goods, software, engineering, automobile and tyre industry, defence, hospitality, healthcare, manufacturing, petrochemicals, aviation, infrastructure companies in the securities market.

In general, he has been involved in transactions on behalf of buyers, sellers, investee companies and strategic and financial investors in respect of shares of unlisted companies and other securities. In connection with such transactions and arrangements, he has had opportunity to advise on issues pertaining to foreign direct investment, outbound investment, the exchange management regulations, securities laws, and various other Indian legislations and regulations.

His experience has derived from advising international companies, particularly, in the context of strategic alliances and arrangements (combined with licensing and franchising arrangements), in India, and, in relation to their investments and operations, in many international forums.

In addition, and over the years, he has also acted for various financial investors, international property developers, private equity investors, including for their investments into the real estate sector in India, foreign institutional investors, Indian branches of various international banks relative to corporate finance transactions, securitization and investments through various instruments.

In the recent few years, he has also advised on various aspects surrounding foreign involvement in the trading sector and has been involved in negotiating incremental commercial arrangements in the retail sector in India. He has also worked with stressed asset groups in devising and implementing alternative investment products and structures for the same. In addition, he has also had the opportunity to work on family restructuring and consolidation arrangements.

As a natural corollary to his transactional work, he has had extensive experience in formulating a strategy for and negotiating, various joint ventures, strategic alliances and other corporate arrangements.

Education:

B.A, L.L.B (Hons.) from NLSIU Bangalore

Accomplishments

Featured as leading lawyer in Corporate and M&A by Asialaw

Featured as leading lawyer in Private Equity by Asialaw

KUNAL THAKORE: He is a partner at Partner at Talwar Thakore & Associates. He is widely recognised (including Chambers & Partners and Merger market) as a leading M&A lawyer having over 20 years’ experience as a Solicitor. His expertise includes joint ventures, M&A and disposals (both public and private), private equity investments, and more generally advice in relation to the regulatory landscape in India. He has advised domestic and international clients on some of the most significant deals in the market.

MANSINGH LAXMIDAS BHAKTA: He is one of the senior managing partners with Kanga & Company, a firm of advocates and solicitors in Mumbai, and has been on the Reliance board since 1977. He has been practicing for over 45 year now. His areas of expertise are M&A, corporate and commercial law, Foreign Investment in India and Taxation.

He has been named as one of the leading lawyers in Asia for several years by Asialaw and Chambers and Partners. He has also contributed articles on diverse legal subjects and presented papers before various national and international forums.

Education:

Graduate from Government Law College, Mumbai

L.L.B from Government Law College, Mumbai

Memberships and Affiliations:

Served as the chairman of the Taxation Law Standing Committee of Asialaw.

Served as the chairman of Taxation Committee of Indian Merchant’s Chamber.

Member of the advisory committees of the Life Insurance Corporation of India and Deutsche Bank.

Committee member of the Bombay Incorporated Law Society and of the governing board of the India Council of Arbitration.

Committee member appointed by the Reserve Bank of India on legal aspects, relating to operations for banking and financial systems.

Director of JCB India.

Lead Independent Director Reliance Industries Ltd. (since 1997)

Independent Director of Abhijeet Power Ltd. (since 2010)

Independent Director Jyoti CNC Automation Ltd. (since 2012)

He is President Emeritus of with Association of Hospitals, Bombay.

Board Member of Nathdwara Temple Road, Rajasthan

Accomplishments:

Recipient of the Rotary Centennial Service Award for Professional Excellence from Rotary International.

Leading Lawyers of Asia for six consecutive years, from 2011 by Asialaw Journal.

Award of ‘The Pillar of Hindustaanee Society’ for the year 2014-15 in the field of ‘Ethical Law Practice’ by Trans Asian Chamber of Commerce & Industry.

Named as one of the leading lawyers of Asia by Asialaw Journal.

One of India’s top 50 independent directors in a survey undertaken by the Capital Markets Magazine in 2003.

He is listed as one of the Leading Lawyers of Asia for 2006 and 2007 by Asialaw, Hongkong.

MOHIT SARAF: He is currently working at Luthra & Luthra in the position of Partner. He heads the Corporate, Mergers & Acquisitions, Private Equity, Infrastructure & Projects practices at the Firm. With over 25 years of experience across sectors & industries, he has advised major global and Indian companies.

He specializes in M&A and Private Equity representing some major clients such as Mylan, Baxter, Bayer and Carlyle.

He has over 50 publications in various national & international journals and magazines like Financial Worldwide, Finance Yearbook by PLC, Economic Times, Business Standard, Financial Express, Powerline, Tele.net, India Infrastructure, India Business Law Journal and SIAC Yearbook.

Education:

Delhi University

Membership and Affiliations:

Bar Council of Delhi

International Bar Association

Accomplishments:

Voted as ‘Leaders in their field’ by Chambers Global 2012 for Corporate/M&A and Projects, Infrastructure & Energy.

Voted as ‘Leading Lawyers’ by IFLR 1000- 2012.

‘Asialaw Leading Lawyers’ by for Banking & Finance and Capital Markets, General Corporate Practice and Project Finance.

Voted for his expertise in Project Finance, Mergers & Acquisition, Real Estate, Procurement, and Insurance & Reinsurance by International Who’s Who of Business Lawyers.

He has been recommended as one of Asia’s top 25 M&A lawyers.

Honored by ALB HOT 100 as one of the top performing lawyers.

He is a recipient of various national and international awards and is listed as a Band 1 M&A lawyer in Who’s Who Business Lawyers, Chambers Asia Leading Lawyers and Asia Pacific Legal 500. IFLR1000 Financial and Corporate also lists him as a Leading Lawyer.

He has been awarded the ‘Shaurya Chakra’ (a national peacetime gallantry award by the Indian President, Mr. R. Venkatraman).