#commercial insurance claim

Text

Ashok Leyland Small Commercial Vehicle Service Center in Madurai

Title: Elevating Service Excellence: Dost and Dost Auto Care, Your Ashok Leyland Small Commercial Vehicle Service Center in Madurai

Introduction: Ashok Leyland Small Commercial Vehicles (SCVs) are renowned for their robust performance, fuel efficiency, and versatility, making them indispensable for various businesses and individuals across Madurai and surrounding areas. However, like any other vehicle, Ashok Leyland SCVs require regular maintenance and servicing to ensure optimal performance and reliability. For owners of Ashok Leyland SCVs in Madurai, Dost and Dost Auto Care emerges as a trusted service center specializing in the maintenance and repair of Ashok Leyland SCVs.

Comprehensive Maintenance and Repair Services: Located conveniently in Madurai, Dost and Dost Auto Care is a reputable auto service center equipped with state-of-the-art facilities and a team of skilled technicians specializing in Ashok Leyland SCVs. At Dost and Dost Auto Care, we understand the unique needs of Ashok Leyland SCV owners and offer a comprehensive range of maintenance and repair services tailored to keep their vehicles running smoothly and efficiently.

Routine maintenance is essential for prolonging the lifespan and ensuring the reliability of Ashok Leyland SCVs. Dost and Dost Auto Care offers comprehensive maintenance packages that include oil changes, filter replacements, fluid top-ups, brake inspections, tire rotations, and overall vehicle inspections. Our experienced technicians conduct thorough inspections and use genuine Ashok Leyland parts to ensure that your SCV receives the care it deserves.

In addition to routine maintenance, Dost and Dost Auto Care specializes in diagnosing and repairing any mechanical or electrical issues that may arise with Ashok Leyland SCVs. Whether it's engine repairs, transmission services, brake repairs, suspension adjustments, or electrical system diagnostics, our technicians have the expertise and tools to address a wide range of issues and ensure your SCV is restored to optimal performance.

Genuine Parts and Components: At Dost and Dost Auto Care, we understand the importance of using genuine parts and components when servicing Ashok Leyland SCVs. As an authorized service center, we exclusively use genuine Ashok Leyland parts and components in all repairs and replacements. By using genuine parts, Ashok Leyland SCV owners can have peace of mind knowing that their vehicles are being serviced with components specifically designed to meet the manufacturer's standards for quality, reliability, and performance.

youtube

Value-Added Services: In addition to maintenance and repairs, Dost and Dost Auto Care offers value-added services to enhance the overall ownership experience for Ashok Leyland SCV owners. These services may include vehicle detailing, interior cleaning, wheel alignment, AC servicing, battery testing, and more, aimed at keeping your SCV looking and performing its best on the road.

Customer Satisfaction and Convenience: At Dost and Dost Auto Care, customer satisfaction is our top priority. We strive to provide exceptional service and ensure that every Ashok Leyland SCV owner leaves our service center completely satisfied with the quality of our work. Our friendly and knowledgeable staff are always available to assist you with any questions or concerns you may have, and we offer flexible appointment scheduling, transparent pricing, and efficient turnaround times for all services.

In conclusion, Dost and Dost Auto Care stands as a premier service center for Ashok Leyland Small Commercial Vehicles in Madurai, offering comprehensive maintenance and repair services, genuine parts and components, value-added services, and a commitment to customer satisfaction and convenience. With our expertise, dedication, and state-of-the-art facilities, Dost and Dost Auto Care is your trusted partner in keeping your Ashok Leyland SCV running smoothly and reliably for years to come.

#Mahindra Light Commercial Vehicle Service Center in Madurai#Mahindra Small Commercial Vehicle Service Center in Madurai#LCV Service Center in Madurai#SCV Service Center in Madurai#SCV Service Workshop in Madurai#LCV Service Workshop in Madurai#Light Commercial Vehicle Accidental Claim in Madurai#Light Commercial Vehicle OEM Accessories Center in Madurai#Light Commercial Insurance Renewal Center in Madurai#Ashok Leyland Light Commercial Vehicle Service Center in Madurai#Ashok Leyland Small Commercial Vehicle Service Center in Madurai#TATA Light Commercial Vehicle Service Center in Madurai#Youtube

2 notes

·

View notes

Link

#Public Adjuster Baltimore MD#Public Adjusters Baltimore MD#Public adjusting Baltimore MD#Public Insurance Adjuster Baltimore MD#Public Claims adjuster Baltimore MD#Commercial Public Adjuster Baltimore MD

2 notes

·

View notes

Text

Future of Commercial Insurance Software Solutions in India: What to Expect

The Indian commercial insurance market is undergoing a rapid transformation, driven by technological advancements and changing customer expectations. As businesses seek to streamline operations, enhance efficiency, and improve customer service, the demand for robust and innovative commercial insurance software solutions is on the rise. This blog explores the key trends shaping the future of commercial insurance software solutions in India and highlights the potential benefits that these solutions can offer.

The Growing Importance of Commercial Insurance Software Solutions in India

Commercial insurance software solutions play a crucial role in enabling insurance companies to manage their operations effectively. These solutions automate various processes, from policy issuance and underwriting to claims processing and customer service. By leveraging technology, insurers can reduce manual errors, improve accuracy, and enhance overall efficiency.

Key benefits of commercial insurance software solutions:

Streamlined Operations: Automation of repetitive tasks, such as policy administration and claims processing, leads to significant time and cost savings.

Enhanced Efficiency: Advanced analytics and reporting capabilities provide valuable insights into business performance, enabling insurers to identify areas for improvement.

Improved Customer Experience: Personalized customer service, faster claim settlements, and convenient digital channels contribute to a positive customer experience.

Regulatory Compliance: Insurance software solutions India can help insurers comply with complex regulatory requirements, reducing the risk of fines and penalties.

Emerging Trends in Commercial Insurance Software Solutions

Several trends are shaping the future of commercial insurance software solutions in India. These trends include:

1. Cloud-Based Solutions: The adoption of cloud-based insurance software solutions India is gaining momentum, offering scalability, flexibility, and cost-effectiveness. Cloud-based solutions eliminate the need for on-premises infrastructure, allowing insurers to focus on their core business.

2. Artificial Intelligence and Machine Learning: AI and ML are being leveraged to improve underwriting, claims processing, and fraud detection. Predictive analytics can help insurers identify potential risks and make more informed decisions.

3. Internet of Things (IoT): IoT devices are being integrated into commercial insurance policies to provide real-time data and enable risk-based pricing. For example, telematics devices can track driving behavior to determine insurance premiums.

4. Blockchain Technology: Blockchain offers the potential to streamline the insurance value chain by providing transparency, security, and efficiency. It can be used for smart contracts, claims processing, and reinsurance.

The Role of Technology in Transforming Commercial Insurance

Technology is playing a pivotal role in transforming the commercial insurance landscape in India. By embracing innovation, insurers can:

Improve Customer Satisfaction: Offer personalized products and services, faster claim settlements, and convenient digital channels.

Enhance Operational Efficiency: Automate processes, reduce costs, and improve decision-making.

Gain a Competitive Edge: Differentiate themselves from competitors by leveraging technology to provide superior value.

The Future Outlook for Commercial Insurance Software Solutions in India

The future of commercial insurance software solutions in India looks promising. As technology continues to evolve, insurers can expect to see even more innovative solutions that address the specific needs of the Indian market. By investing in technology, insurers can position themselves for long-term success and stay ahead of the competition.

Indicosmic Infotech Ltd. is a leading provider of commercial insurance software solutions in India. With our expertise and innovative approach, we help insurers modernize their operations, improve efficiency, and deliver exceptional customer experiences. Contact us today to learn how our solutions can benefit your business.

0 notes

Text

#Retail Shop Insurance#Business Insurance for Shops#Small Business Insurance#Store Insurance Coverage#Commercial Property Insurance#Shop Owner Insurance#Retail Store Insurance#Shopkeeper Insurance#Shop Insurance Policy#Business Liability Insurance#Insurance for Retail Stores#Shop Insurance Quotes#Retail Business Insurance#Best Shop Insurance Providers#Affordable Shop Insurance#Comprehensive Shop Insurance#Shop Insurance Benefits#Customizable Shop Insurance#Shop Insurance Coverage Options#Insurance for Small Shops#Protect Your Shop with Insurance#Compare Shop Insurance Policies#Shop Insurance Claim Process#Public Liability Insurance for Shops#Shop Insurance Costs#Insurance for Shop Inventory#Shop Insurance India#Top Shop Insurance Companies#Essential Shop Insurance Coverages#How to Choose Shop Insurance

1 note

·

View note

Text

Top-Rated Nashville Roofers: Expert Services by MidSouth Construction

At MidSouth Construction, we don't just build roofs; we craft long-lasting roofing solutions with precision and care. As the leading Nashville roofers, our mission is to provide top-tier services that protect your investment and enhance your property's value. Whether tackling storm damage repairs or installing sleek new roofing, our expertise and attention to detail standout. We pride ourselves on transparent communication, ensuring each client understands their project's scope and timeline.

#Nashville Roofers#Roofing Contractors Nashville#Church Steeple Restoration Nashville#Home Improvement Loans Nashville#Slate Roofing Nashville#Specialty Roofing Nashville#Roof Inspections Nashville#Nashville Commercial Roofing#Tile Roofing Nashville#Commercial Flat Roofing Nashville#Shingle Roofing Nashville#Wind Damage Roof Repair Nashville#Residential Metal Roofing Nashville#Insurance Claims Services Nashville#Roof Financing Nashville#Metal Roofing Nashville#Nashville Commercial Roofers#Custom Metal Roofing Nashville#Commercial Metal Roofing Nashville

0 notes

Text

Safeguard Your Ride: Tips on Taxi Insurance

Ensuring the safety of your vehicle and passengers is paramount. We understand the unique challenges taxi drivers face on the roads of Pennsylvania. When it comes to taxi insurance, the first step is selecting a reliable provider. As a trusted partner in insurance services in Annville, Pennsylvania, we offer comprehensive coverage tailored to your specific needs. Our commitment to excellence ensures that your taxi business is safeguarded against unexpected challenges.

Read more: https://www.agotinsurance.com/safeguard-your-ride-tips-on-taxi-insurance

0 notes

Text

Home Insurance Claim Adjuster Secret Tactics

The secrets of home insurance claim adjusters with these expert tactics. Learn the insider tips to maximize your claim, navigate the process smoothly, and ensure you receive the compensation you deserve. Don't let the complexities of insurance claims intimidate you – empower yourself with the knowledge to make the system work for you.

#Breach of Contract#home insurance claim adjuster secret tactics#State Farm Home Insurance Claims#Construction attorney near me#Construction lawyer near me#signs of foundation issues#foundation problems#Construction litigation#Construction attorneys#foundation issues#Construction litigation attorney#construction defect attorney#when to walk away from foundation issues#construction defect#Commercial Insurance Claims#Lawyer to sue contractor near me#construction defect lawyer#Contractor Fraud#Construction Defects#Poor Workmanship#home insurance claim lawyer#Commercial property lawyer#Commercial proprety attorney#Abandonment and Warranty Issues#Fraudulent Builders#Contractor Fraud and disputes

1 note

·

View note

Text

#commercial fire claims oklahoma#Business Roof Claims oklahoma#restaurant insurance claims oklahoma#Restaurant Fires claims oklahoma#commercial roof damage claims oklahoma#Fire claim adjusters#Fire claim adjusters oklahoma

0 notes

Text

Elixir Legal Services is a top Insurance Law Firm in Mumbai providing the highest quality of advisory and dispute resolution services to insurers and independent clients.

We advise and assist on all aspects of insurance laws and practices, disputes related to policies, and recovery and compensation of insurance. We aid in the procurement of licenses and approvals from the Insurance Regulatory and Development Authority of India (IRDA) and other regulatory authorities.

#Best Insurance Law Firm In Mumbai#insurance defense firms in mumbai#commercial insurance claim lawyer in mumbai#insurance defense law firms in mumbai#insurance claims attorney in mumbai#insurance attorneys law firms in mumbai#insurance law firm in mumbai#best insurance law firms in mumbai#insurance defense attorney in mumbai#insurance litigation solicitors in mumbai#top insurance law firms in mumbai#insurance attorney in mumbai#insurance litigation law firms in mumbai#insurance lawyer in mumbai#best insurance lawyer in mumbai

0 notes

Text

How Expert Public Adjusters Can Help Businesses with Commercial Insurance Claims

Insurance claims can be intimidating and complicated for business owners, and commercial insurance claims can be even more overwhelming. When a business suffers a loss, the business owner needs to obtain a fair settlement from the insurance company. This is where an expert public adjuster can be extremely helpful. An expert public adjuster can help a business navigate the complexities of filing a commercial insurance claim and maximize the payout of the claim.

What is a Public Adjuster?

A public adjuster is a licensed professional who works for policyholders to help them settle their insurance claims. They are knowledgeable about the insurance industry, policies, and the claims process. They also understand the nuances of the policy language and how to interpret it. Public adjusters are an advocate for their clients and work to ensure they receive a fair settlement from the insurance company.

What Does a Public Adjuster Do?

Public adjusters help businesses prepare and submit insurance claims and negotiate with the insurance company on their behalf. They can help navigate the complexities of the claims process and ensure that the business obtains a fair settlement. They understand the insurance policy language and can help interpret it in order to maximize the payout of the claim.

Public adjusters can also help determine if an insurance company has denied a claim in bad faith or is not honoring the terms of the policy. They can also help prevent the undervaluation of a claim by the insurance company.

How Can a Public Adjuster Help with Commercial Insurance Claims?

Commercial insurance claim.

Public adjusters understand the intricacies of the insurance industry and the claims process. They can help businesses prepare and submit claims and negotiate with the insurance company. They also understand the nuances of the policy language and can help interpret it in order to maximize the payout of the claim.

Public adjusters can also help identify potential problems with the claim and work to prevent them from becoming an issue. They can also help ensure that the insurance company is not denying or undervaluing the claim in bad faith. Commercial insurance claims are often more complicated than residential claims. Businesses may have multiple policies that need to be addressed and a larger amount of money may be at stake. Public adjusters can help businesses navigate the complexities of filing commercial Insurance Claims?

Why Should a Business Hire a Public Adjuster?

A business that has suffered a loss should consider hiring a public adjuster to help them with their commercial insurance claim. Public adjusters are knowledgeable about the insurance industry and the claims process. They understand the policy language and can help interpret it to ensure the business obtains a fair settlement.

Public adjusters can also help identify potential problems with the claim and ensure that the insurance company is not denying or undervaluing the claim in bad faith. They can also help ensure that the business receives the maximum payout possible.

Conclusion

Businesses that have suffered a loss should consider hiring an expert public adjuster to help them with their commercial insurance claim. Public adjusters are knowledgeable about the insurance industry and the claims process. They understand the policy language and can help interpret it to ensure the business obtains a fair settlement. They can also help identify potential problems with the claim and ensure that the insurance company is not denying or undervaluing the claim in bad faith. By hiring an expert public adjuster, businesses can maximize the payout of their commercial insurance claim.

0 notes

Text

Tile Roofing and Insurance Services in Colorado

Are you a business owner in Colorado looking for a reliable and durable roofing option? Look no further than our commercial tile roofing services! We offer top-quality tile roofing that is both beautiful and long-lasting, perfect for any commercial property.

Tile roofing is a popular choice for businesses because of its durability and resistance to weather and fire damage. Plus, it's a great way to add curb appeal to your building. Our team of expert roofers has years of experience installing and maintaining tile roofing, so you can trust us to do the job right.

But what about roofing insurance? We've got you covered there too. We offer roofing insurance services near me, so you can have peace of mind knowing your investment is protected. Our insurance options cover a variety of issues, from storm damage to leaks, so you can rest easy knowing you're covered.

And if you ever need repairs or maintenance on your tile roof, we've got you covered there too. We offer fast and reliable repair services, so you can keep your roof in top shape year-round.

But it's not just about the roofing - it's about the service. We pride ourselves on providing friendly and professional service to every customer. Our team will work with you to find the best roofing solution for your business, and we'll be there every step of the way to ensure your satisfaction.

So why wait? Choose our services in commercial tile roofing in Colorado and roofing insurance near you for the best in roofing solutions. Contact us today to schedule your consultation and let us help you protect your business.

#Commercial Tile Roofing Colorado#Commercial Flat Roofing Contractors#Commercial Gutter Companies Near Me#Commercial Metal Roofing Contractors Near Me#Roofing Insurance near Me#Roof Leak Insurance Claim#Roof Damage Insurance Claim

1 note

·

View note

Text

Understanding the Different Types of Roadside Assistance Services Available

Roadside assistance services have become an essential part of the modern driving experience, providing peace of mind to motorists in case of unexpected breakdowns or emergencies. These services offer a range of solutions to help drivers get back on the road quickly and safely. In this blog, we will explore the different types of roadside assistance services available, their benefits, and how to choose the right one for your needs.

Types of Roadside Assistance Services

Basic Roadside Assistance:

Towing: This is the most common Roadside Assistance Services offered by top companies. It involves towing your vehicle to a nearby repair shop or safe location.

Jump Start: If your battery dies, a roadside assistance technician can jump-start your vehicle to get you going again.

Flat Tire Repair: In case of a flat tire, technicians can repair it or replace it with a spare tire.

Fuel Delivery: If you run out of fuel, roadside assistance can deliver a small amount to get you to the nearest gas station.

Advanced Roadside Assistance:

Lockout Service: If you lock yourself out of your vehicle, roadside assistance can help you regain access.

Battery Replacement: If your battery is beyond repair, roadside assistance can replace it with a new one.

Tire Replacement: If you have a flat tire and don't have a spare, roadside assistance can replace the tire with a new one.

Emergency Roadside Repairs: In some cases, roadside assistance technicians can perform minor repairs, such as replacing a fuse or fixing a loose wire.

Specialized Roadside Assistance:

RV and Trailer Assistance: For owners of recreational vehicles and trailers, specialized roadside assistance services can handle unique towing and repair needs.

Motorcycle Assistance: Roadside assistance for motorcycles often includes specialized towing equipment and expertise.

Commercial Vehicle Assistance: For businesses with fleets of vehicles, roadside assistance can provide tailored solutions to minimize downtime and ensure operational efficiency.

Benefits of Roadside Assistance

Peace of Mind: Knowing that you have roadside assistance can alleviate stress and anxiety when faced with unexpected breakdowns.

Quick Response Time: Most Roadside Assistance Companies in India strive to provide prompt assistance, minimizing inconvenience and downtime.

Expert Assistance: Roadside assistance technicians are trained to handle various situations and can provide expert advice and solutions.

Cost-Effective: Roadside assistance plans are often affordable and can save you money in the long run by avoiding costly towing and repair bills.

Choosing the Right Roadside Assistance Service

When selecting a roadside assistance service, consider the following factors:

Coverage Area: Ensure that the service covers the areas where you frequently drive.

Services Offered: Choose a service that offers the specific types of assistance you need.

Response Time: Look for a company with a reputation for quick response times.

Cost: Compare prices and coverage options from different providers.

Customer Reviews: Read reviews from other customers to get an idea of the company's reliability and customer service.

Roadside Assistance Companies in India

India has a growing number of roadside assistance companies offering a variety of services to meet the needs of Indian motorists.

Roadside assistance services are an invaluable asset for any driver, providing peace of mind and practical solutions in case of emergencies. By understanding the different types of services available and choosing the right provider, you can ensure that you are well-prepared for any unexpected road challenges.

Indicosmic Infotech Ltd. is a leading provider of innovative roadside assistance solutions in India. With our advanced technology and commitment to customer satisfaction, we offer seamless support to motorists across the country. Contact us today to learn more about our comprehensive roadside assistance plans and how we can help you stay safe on the road.

0 notes

Photo

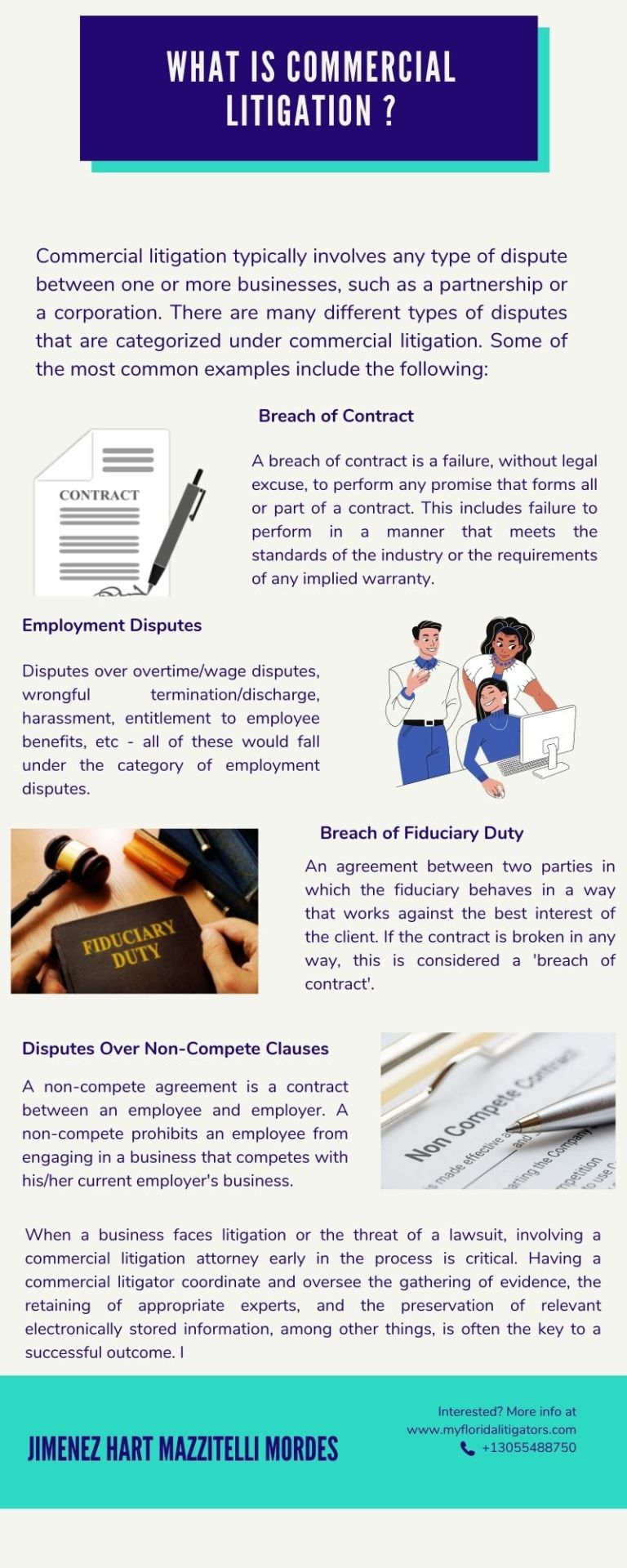

What is commercial litigation?

Visit our website to know more about commercial litigation: https://myfloridalitigators.com/

#commercial litigation#Personal Injury Claims Miami#Nursing Home Abuse Lawyer#Commercial Litigation Attorney#Insurance Dispute Florida#Personal Injury Law Firm Miami#Florida Nursing Home Neglect Lawyer#Contract Dispute Attorney Miami#Property Claims Miami

1 note

·

View note