#commercial vehicle telematics

Text

Commercial Vehicle Telematics Market Trends, Share, Demand, Growth, Size (2022-2029)

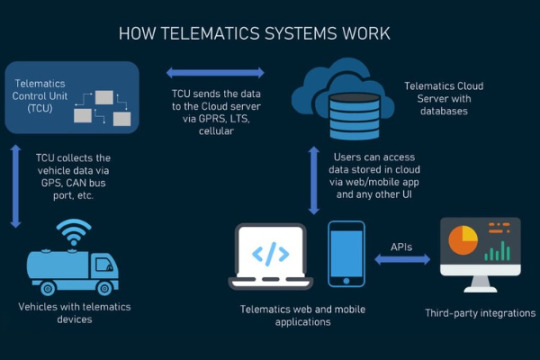

Telematics refers to a technology that uses wireless networking, telecommunication components, vehicular sensors, and data dashboards to enable data transmission among moving transportation devices. Telematics has revolutionized several industries including transportation, building, and construction. Commercial vehicle companies have adopted telematics to boost their service standards, improved efficiency, and increase trustworthiness. Furthermore, telematics also finds its application in logging fuel consumption, driver management, and safety and compliance. It also facilitates superior driver UX/entertainment and efficient customer support. With technology becoming less expensive and easier to use, more businesses are adopting telematics to improve the functioning of their everyday operations. Against such a favourable background, the commercial vehicle telematics market is projected to grow at a breakneck speed in the forecast period.

For More Industry Insights Read: https://www.fairfieldmarketresearch.com/report/commercial-vehicle-telematics-market

OEM Telematics to Gain Momentum in Commercial Vehicle Telematics Market

Of late, the number of original equipment manufacturers (OEMs) offering pre-installed commercial vehicle telematics and solutions has increased at a record pace. Telematics helps in gathering data from a wide range including geolocation and usage patterns for maintenance, driver-assistance capabilities, and performance. This, in turn, facilitates improved safety and mitigation of collision severity and frequency. That said, OEMs can efficiently track their customers post the sales of vehicles. In addition, the growing partnerships and collaborations between providers and OEMs are propelling demand for OEM telematics around the world. As a result, the commercial vehicle telematics market is expected to witness remarkable expansion in the upcoming years.

Rising Adoption of Real-Time Communication Software to Prolong Market Expansion

Another significant application of telematics is real-time communication. Effective telematics software enables drivers to supervise, test, and handle the efficiency of their cars. It allows them to send real-time alerts regarding anomalies, breaches, occurrences, or oncoming risks to operator to eliminate the occurrence of adversities. Moreover, the advanced alerting features also enable effortless customizations such as, operators can set up mileage alerts to get notified when a vehicle exceeds the mileage threshold. This comprehensive alerting functionality increases the effectiveness of fleet management, surging the demand for telematics fleet management optimization. Hence, the growing adoption of real-time communication software is expected to create strong tailwinds for the commercial vehicle telematics market.

Asia Pacific to Witness Robust Growth Amid Flourishing Transportation and Logistics Sector

Emerging economies in the Asia Pacific have experienced increased production and sales of commercial vehicles. The technological intervention in commercial vehicle space has boosted the demand for advanced location tracking, infotainment, and security systems. Furthermore, the telematics is also experiencing sharp spikes in demand from the transportation and logistics sector in developing nations. The government authorities are implementing strict regulations associated with public transport which are creating a favourable dimension for the telematics market in the reegion. The combined force of these factors is expected to unlock new growth opportunities for the commercial vehicle telematics market in the Asia Pacific.

Prominent Market Players

Some of the major players in the commercial vehicle telematics market include PTC Inc., Mix Telematics International Ltd., Tom Tom Telematics BV, Verizon Telematics, Trimble Inc., Zonar Systems Inc and Inseego Corporation.

For More Information Visit: https://www.fairfieldmarketresearch.com/report/commercial-vehicle-telematics-market

About Us

Fairfield Market Research is a UK-based market research provider. Fairfield offers a wide spectrum of services, ranging from customized reports to consulting solutions. With a strong European footprint, Fairfield operates globally and helps businesses navigate through business cycles, with quick responses and multi-pronged approaches. The company values an eye for insightful take on global matters, ably backed by a team of exceptionally experienced researchers. With a strong repository of syndicated market research reports that are continuously published & updated to ensure the ever-changing needs of customers are met with absolute promptness.

#fairfield market research#commercial vehicle telematics#commercial vehicle telematics market#commercial vehicle telematics market size#commercial vehicle telematics market share#commercial vehicle telematics market trends#vehicle telematics#telematics market#vehicle telematics system#vehicle telematics industry#commercial vehicle telematics industry

0 notes

Text

Future of Commercial Vehicle Telematics Market: Size and Share Projections for 2030

The global future of CV telematics market size is projected to grow from USD 5.4 Billion in 2024 to USD 12.8 Billion by 2030, at a CAGR of 15.2%. The surge in e-commerce and last-mile delivery services is driving the demand for advanced telematics solutions that offer real-time tracking, enhanced customer service, and improved delivery efficiency. Additionally, the Rising fuel prices and the need…

0 notes

Text

Enhancing Safety in the Mining Industry: The Role of Advanced Telematics Solutions

The mining industry faces significant challenges in ensuring the safety of its workforce amidst hazardous working conditions and complex operational environments. Despite stringent safety regulations and protocols, accidents and incidents continue to pose risks to personnel and assets. In this context, the adoption of advanced telematics solutions emerges as a critical strategy to enhance safety standards and mitigate risks within mining operations.

In this article, we will discuss the role of telematics technology, its key features, applications, and benefits in the mining industry.

Understanding the Role of Telematics Technology in the Mining Industry

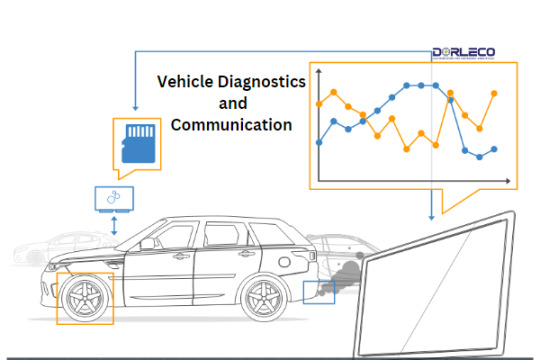

Telematics systems employ a combination of hardware and software components to collect, transmit, and analyse data from vehicles and assets in real-time. The GPS tracking devices installed in vehicles capture location coordinates, speed, and route information, which is transmitted to a centralised platform via cellular or satellite networks. In addition, onboard sensors and diagnostics systems monitor vehicle performance metrics such as engine health, fuel consumption, and maintenance status.

This data is then processed and analysed using advanced algorithms and fleet telematic analytics tools to generate actionable insights and performance reports for fleet managers and stakeholders. By providing visibility into key operational parameters and safety metrics, mining telematics systems enable mining companies to proactively identify risks, implement preventive measures, and optimise resource allocation to enhance safety and efficiency across their operations.

Key Features of Telematics Fleet Management System for Mining Operations

Live Location Tracking: Track the real-time location of vehicles and equipment, enabling better fleet management and resource allocation.

Rash Driving Alerts: Receive alerts for instances of aggressive or unsafe driving behaviour, allowing for immediate intervention and corrective action.

Accident Detection: Detect accidents or collisions as they occur, enabling rapid response and assistance to affected personnel.

Autonomous Emergency Braking (AEB): Automatically apply brakes in emergency situations to prevent or mitigate collisions, enhancing overall safety on the road.

Tailgating Detection: Identify instances of tailgating, a common cause of accidents, and alert drivers to maintain safe following distances.

Overspeeding Monitoring: Monitor vehicle speed in real-time and receive alerts for instances of speeding, helping to prevent accidents and ensure compliance with safety regulations.

Drowsiness Detection: Detects signs of driver drowsiness or fatigue and provides timely alerts to prevent accidents caused by impaired alertness.

Distraction Monitoring: Monitor driver attentiveness and detect distractions such as mobile phone usage or inattentiveness, reducing the risk of accidents due to driver distraction.

Application of Telematics in the Mining Industry

Enhanced Driving Behavior Insights

Gain comprehensive insights into driving behaviour, empowering mining companies to identify and address unsafe practices effectively. By analysing factors such as speed, acceleration, and braking, organisations can develop targeted strategies to promote safer driving habits among their workforce.

Access to Incident Videos

Access to incident videos in real-time facilitates prompt response and investigation of accidents or incidents within mining operations. This capability enhances safety protocols by enabling timely review and analysis, ultimately contributing to the development of more robust risk management strategies.

Fleet Performance Optimization

Utilise data analytics to optimise fleet performance and efficiency in mining operations. By leveraging insights derived from telemetric fleet management systems, organisations can identify areas of inefficiency and implement corrective measures to reduce operational costs and enhance productivity across their fleet.

Benefits of Using Telematics in Mining Operations

Telematics technology finds various benefits in mining operations, contributing to enhanced safety, efficiency, and productivity. Some key benefits include:

Fleet Management: Telematics systems enable real-time vehicle tracking and equipment, allowing managers to monitor their location, speed, and status. This ensures efficient fleet management, optimal asset utilisation, and timely maintenance scheduling.

Remote Monitoring: Telematics enables remote monitoring of equipment performance and health, including engine diagnostics, fuel consumption, and maintenance alerts. This proactive approach helps prevent unexpected breakdowns, reduces downtime, and extends equipment lifespan.

Safety Enhancement: Integration with fatigue monitoring systems helps identify signs of driver fatigue, allowing for timely intervention to prevent accidents caused by drowsiness.

Data-Driven Decision-Making: Historical performance data and trend analysis provide valuable insights for long-term planning and strategic decision-making, driving continuous improvement initiatives.

Scalability: Telematics solutions are scalable and customizable to meet the evolving needs of mining operations, accommodating changes in fleet size, geographic expansion, and technological advancements.

Conclusion

To sum up, investing in mining telematics solutions is important for safeguarding worker wellbeing and enhancing operational efficiency in the mining industry. By leveraging telematics technology, mining companies can proactively identify and mitigate safety risks, optimise fleet performance, and ensure regulatory compliance.

#telematics in mining#telematics#mining telematics#applications of telematics#advantages of telematics#telematics solution providers in india#telematics vehicle tracking#truck fleet telematic#mining vehicle telematics#commercial fleet telematics#telematics software providers#telematics solutions#telematics data#telematics system#fleet telematics analytics#vehicle telematics data#mining telematics solution

0 notes

Text

Data Bridge Market Research analyses that the global commercial vehicle telematics market, which was USD 18,456 million in 2022, is expected to reach USD 36,543.12 million, and is expected to undergo a CAGR of 14.82% during the forecast period of 2023 to 2030.

#Commercial Vehicle Telematics Market#Commercial Vehicle Telematics Market Share#Commercial Vehicle Telematics Market Size#Commercial Vehicle Telematics Market Growth#Commercial Vehicle Telematics Market Trends#Commercial Vehicle Telematics Market Players.

0 notes

Text

Global Class 5 Truck Market Insights and Forecasting Trends Review 2024 - 2031

The global Class 5 truck market is a significant segment of the commercial vehicle industry, catering to a diverse range of applications, from delivery services to construction. This article examines the market's dynamics, including key drivers, trends, challenges, and future outlook.

Overview of the Class 5 Truck Market

Class 5 trucks, as defined by the Federal Highway Administration (FHWA) in the United States, have a Gross Vehicle Weight Rating (GVWR) between 16,001 and 19,500 pounds. These trucks are versatile, often used for local deliveries, service vehicles, and small freight transport, making them crucial to various sectors.

Definition and Characteristics of Class 5 Trucks

Class 5 trucks are characterized by:

Weight Capacity: GVWR ranging from 16,001 to 19,500 pounds.

Engine Options: Typically equipped with diesel or gasoline engines, offering a balance between power and fuel efficiency.

Body Styles: Available in various configurations, including cutaway vans, box trucks, and chassis cabs, catering to different business needs.

Accessibility: Designed for urban and suburban environments, allowing for easy maneuverability in tight spaces.

Market Drivers

Several factors are driving the growth of the global Class 5 truck market:

Increasing E-Commerce Demand

The rapid growth of e-commerce has led to a surge in demand for delivery vehicles. Class 5 trucks are well-suited for last-mile delivery, making them a preferred choice for logistics companies.

Urbanization and Infrastructure Development

As urban areas expand, the need for efficient transportation solutions increases. Class 5 trucks are ideal for navigating congested city streets and delivering goods to urban locations.

Government Regulations and Initiatives

Supportive government policies aimed at promoting commercial vehicle usage, including tax incentives and grants, are further boosting the Class 5 truck market.

Market Trends

The Class 5 truck market is witnessing several notable trends:

Electrification of Commercial Vehicles

With the growing emphasis on sustainability, manufacturers are increasingly investing in electric Class 5 trucks. Electric models are gaining traction due to their lower operational costs and environmental benefits.

Advanced Safety Features

There is a rising demand for trucks equipped with advanced safety technologies, such as collision avoidance systems, lane departure warnings, and adaptive cruise control, to enhance driver and road safety.

Customization and Specialization

Businesses are increasingly looking for trucks tailored to their specific needs. Manufacturers are responding by offering customizable options for body style, engine type, and technology integration.

Challenges in the Market

Despite its growth potential, the Class 5 truck market faces several challenges:

Supply Chain Disruptions

The ongoing impact of global supply chain issues, exacerbated by the COVID-19 pandemic, has affected the availability of key components, leading to production delays.

Rising Fuel Prices

Fluctuations in fuel prices can impact operational costs for fleet operators, influencing their purchasing decisions regarding Class 5 trucks.

Competition from Alternative Transportation

The rise of alternative transportation solutions, such as cargo bicycles and electric vans, poses a competitive challenge to Class 5 trucks, particularly in urban environments.

Future Outlook

The global Class 5 truck market is expected to witness steady growth in the coming years. Key factors influencing this growth include:

Technological Innovations

Advancements in technology, such as telematics and autonomous driving features, are likely to enhance the functionality and efficiency of Class 5 trucks.

Expansion in Emerging Markets

As developing regions experience economic growth and urbanization, the demand for commercial vehicles, including Class 5 trucks, is expected to rise significantly.

Focus on Sustainability

The increasing emphasis on reducing carbon footprints and adopting eco-friendly practices is driving the demand for electric and hybrid Class 5 trucks.

Conclusion

The global Class 5 truck market is positioned for growth, driven by rising e-commerce demand, urbanization, and supportive government initiatives. As manufacturers innovate and adapt to changing market conditions, the future of the market appears promising. However, addressing challenges such as supply chain disruptions and competition from alternative solutions will be crucial for sustained success in this dynamic industry.

0 notes

Text

Automotive Power Electronics Market - Forecast(2024–2030)

Automotive Power Electronics Market Overview

Automotive Power Electronics Market Size is valued at $5.4 Billion by 2030, and is anticipated to grow at a CAGR of 4.2% during the forecast period 2024 -2030. The automotive power #electronics market is experiencing significant growth, driven #primarily by the increasing demand for #electric vehicles (EVs). This surge is fueled by a global shift towards sustainable transportation and stringent emission #regulations. The rapid #technological advancements in #semiconductor materials and power management solutions are enhancing the efficiency and performance of automotive power electronics, thereby #accelerating market expansion.

Additionally, consumer preferences are evolving towards vehicles that offer better energy efficiency, safety, and convenience, all of which are enabled by sophisticated power electronic systems. Manufacturers are investing heavily in research and development to innovate and stay competitive in this dynamic market. Furthermore, government incentives and subsidies for EVs are further propelling the adoption of automotive power electronics. This market trajectory is expected to continue its upward trend, as the integration of power electronics in vehicles becomes more prevalent, aligning with the broader goals of energy conservation and environmental sustainability.

Sample Report:

COVID-19/Russia-Ukraine War Impact

The COVID-19 pandemic significantly disrupted the automotive power electronics market, initially causing production halts and supply chain disruptions. As factories shut down and demand for vehicles plummeted, manufacturers faced challenges in maintaining operations and meeting financial targets. However, the pandemic also accelerated the adoption of electric vehicles (EVs), driven by increased awareness of environmental issues and government incentives. This shift spurred innovations in power electronics, essential for EVs’ efficiency and performance. Consequently, despite short-term setbacks, the industry experienced a renewed focus on developing advanced power electronics solutions, paving the way for long-term growth and resilience in a post-pandemic era.

The Russo-Ukraine War has significantly impacted the automotive power electronics sector, primarily through disruptions in the supply chain and fluctuations in raw material prices. The conflict has caused instability in the region, affecting the production and transportation of essential components like semiconductors and rare earth metals, crucial for power electronics. This disruption has led to increased costs and delays, compelling manufacturers to seek alternative sources and adjust their supply chains. Additionally, the economic sanctions imposed on Russia have further strained international trade relations, exacerbating the challenges faced by the automotive industry. Consequently, companies are re-evaluating their strategies to mitigate risks and ensure resilience in their operations, focusing on diversifying suppliers and investing in local manufacturing capabilities to reduce dependency on geopolitically sensitive regions.

Inquiry Before Buying:

Automotive Power Electronics Market

The report “Automotive Power Electronics Market Forecast (2024–2030)”, by Industry ARC, covers an in-depth analysis of the following segments of the Automotive Power Electronics Market:

By Component: Microcontroller Unit, Power Integrated Circuit, Sensors, Others

By Vehicle Type: Passenger Cars, Commercial Vehicles

By Electric Vehicle Type: Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-In Hybrid Electric Vehicles

By Application: Powertrain & Chassis, Body Electronics, Safety & Security, Infotainment & Telematics, Energy Management System, Battery Management System

By Geography: North America (USA, Canada, and Mexico), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Malaysia, and Rest of APAC), and Rest of the World (Middle East, and Africa)

Key Takeaways

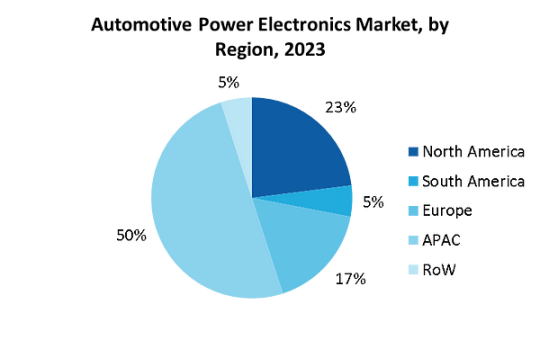

Asia-Pacific dominated the Automotive Power Electronics market with a share of around 50% in the year 2023.

The automotive industry’s need to meet stricter safety regulations and reduce emissions, coupled with rising consumer demand for electric vehicles, will propel the growth of the automotive power electronics market throughout the forecast period.

Apart from this, thrust to equip vehicles with advanced power solutions is driving the growth of Automotive Power Electronics market during the forecast period 2024–2030.

For More Details on This Report — Request for Sample

Automotive Power Electronics Market Segment Analysis — By Vehicle Type

The demand for automotive power electronics in passenger cars is escalating due to government initiatives promoting the integration of advanced electronics. This surge is driven by policies aimed at enhancing vehicle efficiency, safety, and environmental performance. For instance, in March 2024, the European Union introduced new regulations mandating the inclusion of advanced driver-assistance systems (ADAS) in all new cars, significantly boosting the need for sophisticated power electronics. Similarly, the U.S. government has increased funding for electric vehicle (EV) infrastructure, encouraging automakers to incorporate more power-efficient electronic components. Additionally, China’s recent tax incentives for electric and hybrid vehicles, announced in January 2024, have accelerated the adoption of power electronics to improve performance and range. These initiatives are fostering innovation and production of cutting-edge electronic components, such as inverters and onboard chargers, essential for modern passenger cars. As a result, automotive manufacturers are increasingly investing in power electronics to comply with regulations, meet consumer expectations, and gain a competitive edge in the evolving market.

Schedule a Call :

Automotive Power Electronics Market Segment Analysis — By Electric Vehicle Type

The demand for automotive power electronics in hybrid electric cars is rapidly increasing due to the global imperative to decarbonize the transport sector and reduce reliance on fossil fuels. Governments worldwide are implementing stringent regulations and incentives to promote the adoption of hybrid and electric vehicles. In January 2024, the European Union introduced enhanced subsidies for hybrid vehicle purchases, coupled with stricter emission standards, significantly boosting the market for power electronics. Similarly, the U.S. launched the “Clean Transport Initiative” in April 2023, providing substantial tax breaks and grants for hybrid car manufacturers to innovate and scale up production. Additionally, Japan’s latest energy policy, announced in February 2024, includes a comprehensive plan to phase out internal combustion engines, further propelling the demand for hybrid vehicles equipped with advanced power electronics. These components, such as power inverters, converters, and battery management systems, are essential for enhancing the efficiency and performance of hybrid electric cars. As a result, automotive companies are accelerating investments in power electronics technology to meet regulatory requirements, cater to consumer preferences, and contribute to a sustainable future.

Automotive Power Electronics Market Segment Analysis — By Geography

On the basis of geography, Asia-Pacific held the highest segmental market share of around 50% in 2023, The Asia-Pacific region is the largest market for automotive power electronics, driven by high vehicle production rates and the increasing adoption of advanced electronics in automobiles. Countries like China, Japan, and South Korea are leading in vehicle manufacturing, with major automakers integrating sophisticated power electronic components to enhance vehicle efficiency and performance. For example, in March 2024, Toyota introduced a new hybrid model equipped with cutting-edge power electronics, significantly improving energy management and fuel efficiency. Similarly, BYD in China launched an electric vehicle series in February 2024, featuring advanced inverters and converters, which contribute to extended driving ranges and faster charging times. These innovations reflect the region’s robust focus on technological advancements and sustainable transportation solutions. The strategic partnerships between automotive giants and technology firms, such as Hyundai’s collaboration with LG Electronics to develop next-generation battery management systems in April 2023, further underscore the region’s leadership in this sector. This confluence of high production volumes and technological integration ensures that the Asia-Pacific market remains at the forefront of automotive power electronics development.

Buy Now:

Automotive Power Electronics Market Drivers

The rising market for the electric vehicles is the key factor driving the growth of Global Automotive Power Electronics market

The growing demand for automotive power electronics is being significantly driven by the expanding electric vehicle (EV) market. As global initiatives to reduce carbon emissions intensify, consumers and manufacturers alike are shifting towards EVs, which rely heavily on power electronics for various critical functions. These components, including inverters, converters, and battery management systems, are essential for optimizing the performance, efficiency, and range of electric vehicles. Automakers are ramping up production of EVs, incorporating advanced power electronics to meet regulatory standards and consumer expectations for sustainability and high performance. The technological advancements in power electronics are also enabling faster charging, improved energy management, and enhanced vehicle safety, further boosting their demand. Consequently, the automotive industry is experiencing a surge in innovation and investment in power electronics to support the burgeoning EV market, positioning it as a pivotal element in the future of transportation.

Automotive Power Electronics Market Challenges

The high cost of electric vehicles is expected to restrain the market growth

The high cost of electric vehicles (EVs) negatively impacts the automotive power electronics market by limiting consumer adoption and market growth. Despite the technological advancements and environmental benefits of EVs, their higher price compared to traditional vehicles remains a significant barrier. This cost premium is largely due to expensive components such as batteries and advanced power electronics systems, including inverters and converters, which are essential for EV functionality. As a result, potential buyers are often deterred by the initial investment required, slowing the transition to electric mobility. Consequently, manufacturers face challenges in achieving economies of scale, which further drives up costs. This cyclical issue restricts market expansion and inhibits broader implementation of power electronics innovations, ultimately stalling progress towards widespread EV adoption and the associated benefits of reduced emissions and improved energy efficiency in the automotive sector.

Automotive Power Electronics Industry Outlook

Product launches, mergers and acquisitions, joint ventures and geographical expansions are key strategies adopted by players in the Automotive Power Electronics Market. The key companies in the Automotive Power Electronics Market are:

STMicroelectronics N.V.

Infineon Technologies AG

Fuji Electric Co., Ltd.

NXP Semiconductors N.V.

Renesas Electronics Corporation

Toshiba Corporation

Mitsubishi Electric

Huawei Digital Power

Robert Bosch GmbH

Hitachi Energy

Recent Developments

In May 2022, STMicroelectronics joined forces with Microsoft to make development of highly secure IoT devices easier.

In March 2023, Infineon Technologies announced the acquisition of GaN Systems, a global leader in gallium nitride (GaN)-based power conversion solutions. This move strengthened Infineon’s position in the market.

For more Automotive Market reports, please click here

0 notes

Text

Complete Guide To Managing Your CSA Score

CSA (Compliance, Safety, Accountability) scores are part of a program run by the Federal Motor Carrier Safety Administration (FMCSA) to improve the safety of commercial motor vehicles (CMVs). Managing your CSA score is essential for trucking companies and drivers because it impacts both the reputation and legal standing of the company. Here's a guide on how to manage and improve CSA scores:

Key CSA Score Factors:

CSA scores are calculated based on seven Behavioral Analysis and Safety Improvement Categories (BASICs). These include:

Unsafe Driving: Violations related to dangerous driving behavior such as speeding, reckless driving, or improper lane changes.

Hours-of-Service (HOS) Compliance: Violations of hours-of-service rules, such as driving for too long without rest.

Driver Fitness: Violations for operating without a valid commercial driver’s license (CDL), being medically unfit to drive, or lack of proper training.

Controlled Substances/Alcohol: Violations involving the use of drugs or alcohol while driving.

Vehicle Maintenance: Violations for poor vehicle maintenance, such as faulty brakes, lights, or other mechanical issues.

Hazardous Materials Compliance: Violations in the transportation of hazardous materials, like improper packaging or labeling.

Crash Indicator: Records of crashes, especially where the driver is at fault, impact this category.

Steps to Manage and Improve CSA Scores:

1. Regular Inspections and Maintenance

Ensure vehicles are regularly inspected and maintained to prevent breakdowns and reduce the risk of violations during roadside inspections.

Keep thorough documentation of all maintenance and repairs.

2. Driver Training and Compliance

Conduct regular training sessions for drivers on CSA regulations, hours-of-service rules, and safety protocols.

Ensure drivers are medically fit and have all necessary certifications, including a valid CDL.

3. Implement Safety Policies

Enforce strict policies for safe driving, including adherence to speed limits, seatbelt use, and proper driving behavior.

Equip vehicles with safety technologies like dash cams, speed governors, or telematics to monitor and correct unsafe driving behaviors.

4. Monitor Driver Behavior

Use electronic logging devices (ELDs) to track hours-of-service compliance and prevent violations.

Install fleet management software to monitor driver behavior and provide feedback to drivers in real-time.

5. Review CSA Scores Regularly

Check your company’s CSA scores frequently on the FMCSA website to identify trends and problem areas.

Review violation reports and address issues immediately to prevent repeated infractions.

6. Challenge Incorrect Violations

If you believe a violation has been recorded incorrectly, you can submit a DataQs challenge to dispute the violation.

Maintain documentation to support your claim, such as repair receipts, driver logs, and inspection reports.

7. Promote a Safety-First Culture

Foster a company-wide culture where safety is a priority. Reward drivers for safe driving records and compliance.

Conduct regular safety meetings and encourage open communication regarding safety concerns.

8. Use Preventive Tools

Invest in preventive technologies, such as advanced driver assistance systems (ADAS), collision mitigation systems, and GPS tracking, to help avoid accidents and violations.

9. Hire Qualified Drivers

Hiring experienced, qualified drivers who have a clean driving record is key to maintaining a low CSA score.

Conduct thorough background checks and ensure that potential hires meet all safety and compliance standards.

10. Maintain Proper Documentation

Keep accurate records of all inspections, driver certifications, and safety protocols. This can be helpful during audits or when contesting violations.

Benefits of Maintaining a Good CSA Score:

Lower Insurance Costs: Insurance providers may offer better rates to companies with low CSA scores.

Improved Reputation: A good CSA score enhances the company’s credibility and can help attract more business.

Reduced Risk of FMCSA Intervention: High CSA scores may lead to increased scrutiny, audits, or penalties from FMCSA.

Improved Driver Retention: Drivers prefer working for companies that prioritize safety and compliance, leading to higher driver satisfaction and retention.

By focusing on preventive measures, training, and regular monitoring, companies can effectively manage their CSA scores and maintain compliance with FMCSA standards.

Blog Source: https://sites.google.com/view/csa-score-management-cdl360/home

0 notes

Text

Why Fleet Management is Critical for Reducing Operational Costs

Effective fleet management is essential for companies that rely on transportation to run their business. Whether managing a fleet of delivery trucks, service vehicles, or long-haul transportation, businesses must keep operational costs in check to remain profitable. In today’s competitive landscape, reducing operational costs is not just about cutting expenses; it’s about improving efficiency, maximizing vehicle uptime, and ensuring safety. Let’s explore why fleet management is critical for reducing operational costs and how it can provide businesses with a competitive edge.

Understanding Fleet Management

Fleet management refers to the processes used to oversee, organize, and coordinate vehicles used for commercial purposes. It involves tracking vehicles, managing maintenance schedules, monitoring driver performance, and optimizing routes. By utilizing the right fleet management tools and strategies, businesses can improve operational efficiency and save on costs.

Fleet management systems often incorporate technology like GPS tracking, telematics, and electronic logging devices (ELDs) to collect real-time data. This data can be analyzed to improve decision-making, monitor vehicle health, and ensure compliance with regulations. But the real value of fleet management lies in how it helps businesses reduce operational costs effectively.

. Reduced Fuel Costs

Fuel is one of the most significant expenses in fleet management. A robust fleet management system can help track fuel consumption and identify patterns of fuel wastage. By using real-time tracking and telematics, businesses can monitor vehicle routes and optimize them for better fuel efficiency. Fleet managers can identify instances of idling, speeding, and inefficient routing, all of which contribute to excessive fuel consumption.

By addressing these issues, businesses can significantly cut down on fuel costs, which directly contributes to reducing operational costs. Improved fuel efficiency not only saves money but also reduces the carbon footprint of the fleet, which can be a selling point for eco-conscious customers.

. Preventive Maintenance and Reduced Downtime

Unscheduled maintenance and vehicle breakdowns are costly in terms of both time and money. A well-implemented fleet management system ensures that vehicles are regularly maintained through preventive maintenance schedules. By monitoring vehicle health in real-time, businesses can predict when a vehicle might need servicing before a breakdown occurs.

Preventive maintenance helps reduce vehicle downtime, ensuring that fleets stay operational longer without unexpected repairs. This not only saves on repair costs but also prevents revenue loss caused by missed deliveries or services due to vehicle breakdowns. Fleet management thus becomes a powerful tool for reducing operational costs by extending the life of vehicles and avoiding costly emergencies.

. Optimized Route Planning

Route optimization is one of the most effective ways to reduce operational costs in fleet management. With advanced fleet management systems, companies can plan routes that minimize travel time, avoid traffic, and reduce fuel consumption. Optimized routing not only helps lower fuel costs but also increases the number of deliveries or services completed in a day.

Moreover, route planning tools can adapt in real-time, helping drivers avoid traffic congestion or road closures. By improving efficiency on the road, fleet managers can ensure that their drivers are completing jobs faster and with fewer delays, ultimately saving on costs related to overtime, fuel, and vehicle wear and tear.

. Improved Driver Performance

Drivers play a crucial role in fleet efficiency, and poor driving habits can lead to increased costs. Fleet management systems that incorporate driver monitoring can help identify risky behaviors such as harsh braking, speeding, and aggressive driving. These actions not only lead to higher fuel consumption but also increase the likelihood of accidents and vehicle damage.

By monitoring and addressing driver performance, businesses can improve safety, reduce the risk of accidents, and cut down on unnecessary repair costs. Implementing training programs for drivers based on data from fleet management systems can lead to better driving habits, which is critical for reducing operational costs in the long run.

. Regulatory Compliance

Non-compliance with regulations such as the electronic logging device (ELD) mandate can lead to costly fines and penalties. Fleet management systems ensure that businesses remain compliant with industry regulations by automating reporting and record-keeping. This reduces the administrative burden on fleet managers and prevents expensive legal issues that arise from non-compliance.

Additionally, maintaining compliance with safety and emissions standards helps companies avoid fines and improves their reputation. Fleet management is therefore vital for ensuring that all vehicles and drivers comply with the relevant laws, which indirectly helps in reducing operational costs by avoiding penalties.

In today’s highly competitive business environment, managing a fleet efficiently is key to cutting costs and maximizing profitability. From reducing fuel consumption and optimizing routes to improving driver performance and ensuring regulatory compliance, fleet management offers numerous opportunities to save money. Businesses that invest in effective fleet management systems can significantly reduce their operational expenses while improving overall efficiency.

If you're looking for a reliable solution to streamline your fleet operations and reduce costs, consider integrating advanced fleet management tools like the ELD Mandate Plus App. At eldmandate, we understand why fleet management is critical for reducing operational costs and are here to help you achieve operational efficiency while staying compliant with industry regulations.

0 notes

Text

Transforming Transportation: Innovations and Solutions in the Automotive Industry

The automotive industry is in a state of rapid transformation, driven by technological advancements and a shift toward sustainability. Innovations and solutions are redefining how vehicles are designed, manufactured, and utilized. This article delves into the cutting-edge innovation in automotive technology and the solutions that are shaping the industry's future.

Automotive Innovation: Paving the Way for Future Mobility

Electric Vehicles (EVs) and Battery Technology

One of the most significant innovations in the automotive sector is the rise of electric vehicles. EVs are not only reducing reliance on fossil fuels but also decreasing greenhouse gas emissions. Recent advancements in battery technology, such as lithium-ion and solid-state batteries, are enhancing the performance and range of EVs. Improved energy density and faster-charging capabilities are making EVs more practical and appealing to a broader audience.

Autonomous Vehicles: The Road to Self-Driving

Autonomous or self-driving vehicles represent a groundbreaking shift in transportation. Leveraging a combination of sensors, cameras, radar, and artificial intelligence (AI), these vehicles are capable of navigating roads and making decisions without human intervention. Key innovations in this field include advancements in machine learning algorithms and real-time data processing, which are crucial for safe and efficient autonomous driving.

Connected Vehicles: Integrating the Digital World

Connected vehicles are equipped with technologies that enable them to communicate with other vehicles, infrastructure, and cloud-based services. This integration enhances the driving experience by providing real-time traffic updates, improving navigation, and offering advanced driver-assistance systems (ADAS). Vehicle-to-Everything (V2X) communication, which includes Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I), is instrumental in reducing accidents and optimizing traffic flow.

Advanced Driver-Assistance Systems (ADAS)

ADAS includes a range of safety features designed to assist drivers and enhance vehicle safety. Innovations such as adaptive cruise control, lane-keeping assist, and automatic emergency braking are becoming increasingly common. These systems use a combination of sensors and cameras to monitor the vehicle's surroundings and help prevent accidents, making driving safer and more enjoyable.

Sustainable Materials and Manufacturing

Innovation in materials science is also playing a crucial role in the automotive industry. The use of lightweight, sustainable materials such as carbon fiber composites and recycled plastics is helping to improve fuel efficiency and reduce environmental impact. Additionally, advancements in manufacturing processes, including 3D printing and automated assembly lines, are making production more efficient and sustainable.

Automotive Solutions: Addressing Modern Challenges

Smart Manufacturing and Industry 4.0

Smart manufacturing, or Industry 4.0, is revolutionizing vehicle production. By incorporating automation, robotics, and data analytics, manufacturers can achieve higher efficiency, quality, and flexibility. Real-time data collection and analysis enable predictive maintenance, reduce downtime, and improve supply chain management. This shift is enhancing the overall efficiency of automotive solutions and enabling the rapid adaptation to new technologies.

Fleet Management Solutions

For commercial operators, fleet management solutions are crucial for optimizing vehicle use and reducing operational costs. Telematics systems provide real-time data on vehicle performance, location, and driver behavior. This information helps companies manage their fleets more effectively, improving route planning, fuel efficiency, and overall service delivery. Advanced analytics and AI-driven insights are further enhancing fleet management capabilities.

Sustainable Transportation Solutions

As the automotive industry strives for greater sustainability, several solutions are being developed to address environmental concerns. These include advancements in hydrogen fuel cell technology, which offers a zero-emission alternative to traditional fuels. Additionally, initiatives such as vehicle recycling programs and the development of renewable energy sources for charging infrastructure are contributing to a more sustainable transportation ecosystem.

Enhanced User Experience through In-Car Technology

Automotive innovation is also focused on improving the in-car experience for drivers and passengers. Advanced infotainment systems offer features such as voice recognition, smartphone integration, and personalized settings. Augmented reality (AR) displays and advanced navigation systems provide a more intuitive and interactive driving experience. These technologies are designed to make driving more enjoyable and convenient while keeping passengers connected and entertained.

Public Transportation and Shared Mobility

Innovations in public transportation and shared mobility are addressing urban congestion and providing alternative transportation options. Electric and autonomous buses, along with ride-sharing and car-sharing services, are becoming more prevalent. These solutions are aimed at reducing the number of private vehicles on the road, lowering emissions, and providing more flexible transportation options for urban residents.

1 note

·

View note

Text

Road Safety Training Program by Lunima Safety Solution: Paving the Way to Safer Roads

Road safety is an essential aspect of our daily lives, affecting everyone, whether as pedestrians, drivers, or passengers. The increasing number of vehicles on the road has made safety training a crucial factor in preventing accidents and saving lives. Lunima Safety Solution, a leading provider of safety management and training, offers comprehensive Road Safety Training Program designed to educate individuals and organizations on road safety best practices. In this blog, we explore the importance of road safety training and how Lunima Safety Solution is making a difference.

road safety training program

Why Road Safety Training is Essential

Preventing Accidents: The primary goal of road safety training is to reduce the likelihood of accidents. By educating drivers and road users about safe driving techniques, defensive driving, and awareness, we can significantly minimize road mishaps.

Promoting Responsible Driving Behavior: Road safety training promotes responsible and ethical driving behavior. It teaches participants to respect traffic rules, understand the importance of speed limits, and be mindful of other road users.

Enhancing Emergency Response Skills: Training equips drivers with the knowledge to handle emergencies, such as how to react to sudden obstacles, brake failure, or inclement weather conditions, thus enhancing overall road safety.

Reducing Traffic Violations: Proper training helps in reducing traffic violations by educating participants on the importance of adhering to traffic signals, lane discipline, and the correct use of indicators.

Saving Lives and Reducing Injuries: Ultimately, the most significant impact of road safety training is saving lives. By reducing accidents and improving road safety standards, fewer people are injured or killed on the roads.

Key Features of Lunima Safety Solution's Road Safety Training Program

Lunima Safety Solution’s Road Safety Training Program is designed to cater to individuals, corporate employees, fleet drivers, and even school children. Here are some key features of the program:

Comprehensive Curriculum: The training program covers a wide range of topics, including defensive driving, pedestrian safety, traffic laws, vehicle maintenance, and emergency response. This ensures that participants are well-versed in all aspects of road safety.

Hands-on Learning: Lunima Safety Solution emphasizes practical learning through simulations, real-life scenarios, and interactive sessions. This hands-on approach helps participants to understand the consequences of unsafe driving behaviors and how to avoid them.

Experienced Trainers: The training is conducted by experienced safety professionals who have extensive knowledge of road safety regulations and best practices. Their expertise ensures that participants receive the most up-to-date and relevant information.

Customized Programs: Lunima Safety Solution offers customized training programs tailored to the specific needs of different organizations. Whether it’s a corporate training session or a community awareness workshop, the content is adapted to fit the audience.

Certification: Upon successful completion of the training, participants receive a certificate that recognizes their understanding and commitment to road safety. This certification is an excellent addition to the credentials of professional drivers and fleet managers.

Focus on Technological Integration: The program integrates modern technology, such as dashcam analysis and telematics data, to provide feedback to participants. This helps drivers to improve their driving habits and stay updated on new road safety technologies.

Who Should Attend the Road Safety Training Program?

Professional Drivers: Commercial vehicle drivers, taxi drivers, and delivery personnel can greatly benefit from this training by enhancing their driving skills and learning to navigate roads safely.

Corporate Employees: Companies with employees who frequently travel for work can reduce risks by ensuring their staff is trained in road safety protocols.

Young Drivers: Newly licensed drivers, particularly teenagers, are often at a higher risk of road accidents. This program helps instill safe driving habits from the start.

Community Members: Local communities can benefit from road safety training sessions, promoting safer roads for everyone.

How Lunima Safety Solution is Impacting Road Safety

Lunima Safety Solution has established itself as a pioneer in road safety training, helping to create a safer environment for road users across various sectors. Through their innovative training methods and commitment to excellence, Lunima has been able to reduce accident rates significantly among trained drivers and foster a culture of safety in the workplace and beyond.

Their programs are recognized for not just addressing the immediate needs of participants but also for instilling long-term behavioral changes that contribute to safer roadways.

#road safety training program#road safety training#road safety#safety training program#road safety program

0 notes

Text

Automotive Ethernet Market 2024-2032; Growth Forecast & Industry Share Report

Automotive Ethernet market will reach USD 11.6 billion by 2032. The expansion of the electric and autonomous vehicle market is an important growth factor for the industry. According to the IEA, new electric cars registerations worldwide hit almost 14 million in 2023, bringing the total number on track to 40 million. As the automotive industry moves toward electrification and automation, the need for fast and reliable communication networks in vehicles becomes critical. Electric vehicles require sophisticated systems to manage battery performance, energy efficiency, and charging infrastructure, all based on seamless communication enabled by Ethernet technology.

Request for Sample Copy report @ https://www.gminsights.com/request-sample/detail/8539

The commercial vehicles segment will grow rapidly through 2032 as commercial vehicles use the advanced connectivity and automation of automotive Ethernet. Ethernet's high bandwidth and reliability make it an ideal choice for commercial vehicles that require robust communications networks to support applications such as fleet management and telematics. In addition, the integration of Ethernet technology into commercial vehicles enables real-time data monitoring and diagnostics to help fleet operators improve operational efficiency, reduce maintenance costs, and increase safety.

The software segment will grow steadily through 2032 as automotive Ethernet software solutions cover several applications, from network management and diagnostics to security and computing. These software programs are necessary to ensure smooth communication between the vehicle's various electronic control units (ECUs) and sensors. They facilitate real-time data transmission, improve network reliability, and provide robust defenses against cyber threats. As vehicles become more connected and autonomous, the complexity of in-vehicle networks increases, increasing the demand for advanced software solutions that can manage and optimize these networks.

Request for customization this report @ https://www.gminsights.com/roc/8539

North America's Automotive Ethernet industry will grow rapidly through 2032 due to a combination of technological innovation, regulatory support, and strong industry presence. The region is home to several major automakers and technology companies that are at the forefront of developing and deploying Ethernet solutions in vehicles. In the United States and Canada, strict safety and emissions regulations encourage the adoption of advanced automotive technologies, including Ethernet-based communications networks. In addition, the growing demand for connected and autonomous vehicles in North America will further fuel the market, as Ethernet provides the necessary infrastructure for high-speed data transfer and reliable communication.

Partial chapters of report table of contents (TOC):

Chapter 1 Methodology & Scope

1.1 Market scope & definition

1.2 Base estimates & calculations

1.3 Forecast calculation

1.4 Data sources

1.4.1 Primary

1.4.2 Secondary

1.4.2.1 Paid sources

1.4.2.2 Public sources

Chapter 2 Executive Summary

2.1 Industry 3600 synopsis, 2018 - 2032

Chapter 3 Industry Insights

3.1 Industry ecosystem analysis

3.2 Supplier landscape

3.2.1 Semiconductor manufacturer

3.2.2 Networking equipment provider

3.2.3 System integrator

3.2.4 AI & computing platform provider

3.2.5 End-user

3.3 Profit margin analysis

3.4 Technology & innovation landscape

3.5 Patent analysis

3.6 Key news & initiatives

3.7 Regulatory landscape

3.8 Impact forces

3.8.1 Growth drivers

3.8.1.1 Increasing complexity of in-vehicle networks.

3.8.1.2 Demand for higher bandwidth in automotive applications.

3.8.1.3 Regulatory requirements driving technology upgrades.

3.8.1.4 Emergence of cloud-based connected services for vehicles.

3.8.2 Industry pitfalls & challenges

3.8.2.1 High initial implementation costs for automakers.

3.8.2.2 Ensuring backward compatibility with older vehicles.

3.9 Growth potential analysis

3.10 Porter’s analysis

3.10.1 Supplier power

3.10.2 Buyer power

3.10.3 Threat of new entrants

3.10.4 Threat of substitutes

3.10.5 Industry rivalry

3.11 PESTEL analysis

About Global Market Insights:

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact us:

Aashit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Toll Free: +1-888-689-0688

USA: +1-302-846-7766

Europe: +44-742-759-8484

APAC: +65-3129-7718

Email: [email protected]

0 notes

Text

Video Telematics: How It's Transforming the Transportation Industry

Video telematics is an innovative technology that is transforming the way fleet managers monitor and manage their vehicles and drivers. It combines traditional telematics data, such as GPS location and vehicle diagnostics, with video footage captured from cameras installed in and around the vehicle. This integration provides a comprehensive view of what is happening both inside and outside the vehicle, offering real-time insights that are invaluable for improving safety, efficiency, and compliance.

One of the primary benefits of video telematics is its ability to enhance road safety. By providing real-time video feeds, fleet managers can monitor driver behavior and intervene if necessary. For instance, if a driver is exhibiting unsafe behaviors such as speeding, harsh braking, or distracted driving, the system can send alerts to both the driver and the fleet manager. This immediate feedback loop helps to correct dangerous behaviors before they lead to accidents. Additionally, in the event of an incident, video footage can provide clear evidence of what occurred, which can be crucial for resolving disputes and reducing liability.

Another significant advantage of video telematics is its role in optimizing fleet operations. The data collected from video telematics systems can be analyzed to identify patterns and trends in driver behavior, vehicle performance, and route efficiency. This information can be used to develop targeted training programs for drivers, improve route planning, and reduce fuel consumption. By leveraging video telematics data, fleet managers can make data-driven decisions that lead to cost savings and increased productivity.

The integration of artificial intelligence (AI) into video telematics systems is further enhancing their capabilities. AI can be used to analyze video footage in real-time, detecting potential hazards such as pedestrians or other vehicles in the driver’s blind spots. It can also recognize signs of driver fatigue or distraction, prompting timely interventions to prevent accidents. Moreover, AI-powered analytics can help fleet managers identify trends and predict potential issues before they become critical, enabling proactive maintenance and reducing downtime.

Video telematics also plays a crucial role in ensuring compliance with transportation regulations. Many regions require commercial vehicles to adhere to strict safety standards, and video telematics provides the necessary documentation to prove compliance. This can be especially important during audits or investigations, where having accurate and detailed records can protect a company from fines and legal action.

In conclusion, video telematics is a powerful tool that is revolutionizing the fleet management industry. By providing real-time video and telematics data, it enhances safety, improves efficiency, and ensures compliance. As technology continues to evolve, video telematics will undoubtedly play an increasingly important role in shaping the future of transportation.

0 notes

Text

Global Trailer Axle Market is Estimated to Witness High Growth Owing to Rising Demand for Commercial Vehicles

The global trailer axle market is primarily driven by the growing demand for commercial vehicles which includes light commercial vehicles, heavy commercial vehicles, buses and coaches across the globe. Trailer axles forms an integral part of commercial vehicles which helps in load-carrying and weight distribution purposes. They are robustly built and comprises of tough steel discs capable of carrying heavy payloads at high speed without any deformation. The increasing level of international trade, e-commerce activities and demand for last mile delivery has significantly increased commercial transportation, thereby propelling the sales of commercial vehicles. This in turn acts as a major driver for growth of trailer axle market.

The Global trailer axle market is estimated to be valued at US$ 5.95 Bn in 2024 and is expected to exhibit a CAGR of 4.7% over the forecast period 2024 To 2031.

Key Takeaways

Key players operating in the Global Trailer Axle market are BPW Group, DexKo Global Inc., Meritor, Inc., Hendrickson Corporation, FUWA K Hitch, Shandong Huayue, TND Trailer Axle, JOST Axle Systems, SAF-Ho Hendrickson USA, L.L.C., JOST Achsen Systeme GmbH, Meritor, Inc., Rogers Axle Spring Works Pty Ltd., SAF-HOLLAND GmbH, Schmitz Cargobull AG, York Transport Equipment (Asia) Pte Ltd.

The rising e-commerce industry has unleashed significant business opportunities for Global Trailer Axle Market Size The exponentially growing freight transportation due to e-commerce boom is anticipated to bolster demand for commercial vehicles and trailer axles. Furthermore, favorable government policies and initiatives towards improving supply chain networks is likely to drive long-term demand.

Global expansion of key manufacturers through strategic partnerships and mergers will further propel the trailer axle market growth. Market consolidation activities are expected to increase to leverage brand outreach and regional market access. The market is anticipated to witness high growth in Asia Pacific region owing to growing infrastructure development projects and improving regional connectivity.

Market Drivers

The Global Trailer Axle Market Size And Trends include rapid urbanization leading to increased transportation and logistics activities. Development of advanced highway and road networks in developing regions facilitate seamless cargo movement. Stringent emission control norms mandating fuel-efficient commercial vehicles will also drive replacement demand for technologically advanced trailer axles. Moreover, increasing penetration of telematics and autonomous driving technologies in commercial vehicles will open new growth avenues for trailer axle manufacturers over the forecast period.

PEST Analysis

Political: Trailer axle regulations regarding weight, size limits and emission standards vary across countries and states, impacting the demand for specific axle types. Stringent regulations promote adoption of advanced axles.

Economic: Growth in the construction, transportation and logistics industries drives the demand for commercial vehicles and trailers equipped with higher capacity axles. Short replacement cycles during an economic boom increase aftermarket sales.

Social: Declining unemployment rates fuel demand for delivery of goods. Rapid urbanization increases logistical complexities, necessitating efficient transportation of construction materials and finished products. Evolving lifestyles drive the demand for recreational vehicles and boat trailers equipped with premium axles.

Technological: Manufacturers focus on developing light-weight, fuel-efficient and durable axles using advanced materials to meet the regulatory guidelines. Adoption of sensors and electronics enable features such as load adjustment and remote diagnostics, improving operations.

Over 50% of the global trailer axle market value is concentrated in North America and Europe due to high demand for commercial vehicles used for transportation and logistics. Rapid construction activities are driving sales of trailers equipped with high capacity axles across developing countries in Asia Pacific and Latin America. The region is expected to emerge as the fastest growing market during the forecast period on account of improving economic conditions, expanding industrial sector and rising infrastructure spend.

China accounts for the maximum trailer production globally. Presence of a large manufacturing base for commercial vehicles and availability of affordable skilled labor have made China an attractive market for trailer axle manufacturers. Growth in domestic demand and exports is further augmenting market revenues in the country.

Get More Insights On, Global Trailer Axle Market

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191

0 notes

Text

Commercial Vehicle Accessories Market ruling majority of the Aftermarket Automotive Accessories Market

The Commercial Vehicle Accessories Market is a dominant force within the broader Aftermarket Automotive Accessories Market, driven by the increasing demand for enhanced vehicle functionality, safety and aesthetics. With the rising global fleet of commercial vehicles, particularly in emerging economies, the demand for specialized accessories such as telematics systems, cargo management solutions, lighting and safety features is rising. This market encompasses various products and services, including vehicle tracking systems, custom interiors, performance-enhancing parts and external accessories like mud flaps and roof racks.

The Commercial Vehicle Accessories Market has skyrocketed to a market cap of USD 94.88 Billion last year in 2023. This market is experiencing a CAGR of 6.30% which has driven its potential by the increase in demand for essential accessories such as interior upgrades, safety equipment and technological advancements in commercial vehicles.

Some of the Prominent Companies in the Commercial Vehicle Accessories Market are :-

Robert Bosch - Europe (Germany)

Denso - Asia (Japan)

Magna International - North America (Canada)

ZF Friedrichshafen - Europe (Germany)

Hyundai Mobis - Asia (South Korea)

Aisin Seiki - Asia (Japan)

Faurecia - Europe (France)

Lear - North America (USA)

Valeo - Europe (France)

Thyssenkrupp - Europe (Germany)

BASF - Europe (Germany)

Panasonic Automotive - Asia (Japan)

Gestamp - Europe (Spain)

Commercial Vehicle Accessories Market Segmentation

Product by Type Coverage (Includes Market Size, Products by Segment, its Type and Influence) :-

Driveline & Powertrain

Interiors & Exteriors, Electronics

Bodies & Chassis

Seating

Lighting

Wheel & Tires

Market Application in Commercial Vehicle Accessories Market:-

OEMs

Aftermarket

The Commercial Vehicle Accessories Market is segmented by Type and by Application, actors, stakeholders and the other members associated with the Commercial Vehicle Accessories Marketplace who can benefit from consuming the included content as a useful and powerful resource. The report consists of 162 pages of comprehensive data points that are segregated from different key regions around the world.

When it comes to commercial vehicles, the right accessories can make all the difference. Whether it's boosting performance, enhancing safety, or just making the ride more comfortable, the Commercial Vehicle Accessories Market offers a wide range of products designed to meet the unique needs of different industries.

Applications: OEMs vs. Aftermarket

Let’s start by breaking down where these accessories come from. There are two main sources:

OEMs (Original Equipment Manufacturers): These are the accessories that come directly from the vehicle’s manufacturer. They’re built to fit perfectly and work seamlessly with your vehicle. Think of these as the “official” parts that come pre-installed when you buy a new truck or van.

Aftermarket: This is where things get interesting. The aftermarket offers a huge variety of accessories that you can add or upgrade after you’ve bought your vehicle. Whether you’re looking for a better sound system, stronger tyres, or a high-tech navigation system, the aftermarket has it all. Plus, it often offers more options and better prices than OEMs.

Contact Us :

Report Prime - [email protected]

Browse more reports :

Automotive Heat Shields Market Overview

Automotive Parts Zinc Die Casting Market Growth and Restraints

Automotive Fuse Market Size

Sidewall Hovercraft Market and Military Hovercraft Market

Amphibious Hovercraft Market | Light Hovercraft Market

Automotive Hydraulic Systems Market Cap

Fire Block Foam Market Cap

Boron Phosphide Market Forecast [2023-2030]

Market Research by Report Prime.

#CommercialVehicleAccessoriesMarket #CommercialVehicles #CommercialVehicleAccessoriesMarketSize #CommercialVehicleAccessoriesMarketGrowth #VehicleAccessories #CommercialVehicleAccessoriesTrends #CommercialVehicleAccessoriesMarketOppportunities #OEM #Aftermarket #Denso #RobertBosch #MagnaInternational #Continental #ZFFriedrichshafen #AutomotiveIndustry #AutomobileIndustry #AutomotiveMarket #AutomobileMarket

0 notes

Text

The Automotive Market: Trends, Key Players, and Future Outlook

The global automotive market is undergoing a profound transformation, driven by rapid advancements in technology, shifting consumer preferences, and a global push toward sustainability. This market, which has long been a pillar of the global economy, is now at the forefront of innovation, embracing new paradigms in mobility, connectivity, and energy efficiency. This blog delves into the current trends shaping the automotive industry, profiles the key players driving these changes, and offers a forward-looking conclusion on what the future holds.

Market Trends

The automotive industry is currently being shaped by several major trends that are redefining the very nature of mobility and transportation.

1. Electrification and the Rise of Electric Vehicles (EVs)

One of the most significant trends in the automotive market is the shift from traditional internal combustion engine (ICE) vehicles to electric vehicles (EVs). Governments around the world are implementing stringent emissions regulations and offering incentives to promote the adoption of EVs. This has led to a surge in demand for electric vehicles, with global EV sales reaching over 10 million units in 2023, representing a 50% increase from the previous year.

The electrification trend is not limited to passenger vehicles; commercial vehicles, including trucks and buses, are also transitioning to electric power. This shift is being driven by advances in battery technology, which have led to increased range, reduced charging times, and lower costs. As a result, major automakers are investing heavily in EV research and development, with many planning to phase out ICE vehicles entirely in the coming decades.

2. Autonomous Driving and Advanced Driver Assistance Systems (ADAS)

The development of autonomous vehicles (AVs) is another transformative trend in the automotive industry. Companies like Waymo, Tesla, and General Motors are leading the charge in developing self-driving technology. While fully autonomous vehicles are not yet a common sight on roads, significant progress has been made in advanced driver assistance systems (ADAS), which include features like lane-keeping assistance, adaptive cruise control, and automatic emergency braking.

These technologies are improving vehicle safety and enhancing the driving experience, and they are becoming standard in new vehicles. The trend towards autonomy is also being supported by advancements in artificial intelligence (AI), machine learning, and sensor technologies, which are critical for enabling vehicles to navigate complex environments.

3. Connectivity and the Internet of Vehicles (IoV)

The automotive market is increasingly interconnected, with vehicles becoming part of a broader digital ecosystem known as the Internet of Vehicles (IoV). Connected vehicles can communicate with each other, as well as with infrastructure and other devices, enabling a range of new services and applications. For example, connected vehicles can receive real-time traffic updates, access remote diagnostics, and even enable over-the-air software updates.

This trend is driving innovation in areas such as infotainment, telematics, and vehicle-to-everything (V2X) communication. Automakers are partnering with tech companies to develop new services that enhance the driving experience and improve vehicle safety. As connectivity becomes more prevalent, it is expected to lead to the development of new business models and revenue streams in the automotive industry.

4. Shared Mobility and the Changing Concept of Vehicle Ownership

The traditional concept of vehicle ownership is evolving, with a growing trend toward shared mobility solutions. Ride-hailing services like Uber and Lyft, as well as car-sharing platforms like Zipcar, are gaining popularity, particularly in urban areas. These services offer consumers greater flexibility and convenience, reducing the need for personal vehicle ownership.

The shared mobility trend is also being driven by the rise of electric and autonomous vehicles, which are well-suited to shared use. In addition, younger generations, particularly millennials and Gen Z, are showing a preference for access over ownership, further fueling the growth of shared mobility. As this trend continues to gain momentum, it is expected to have a significant impact on vehicle sales and the overall structure of the automotive market.

5. Sustainability and the Circular Economy

Sustainability is becoming a key focus for the automotive industry as concerns about climate change and environmental impact grow. Automakers are adopting circular economy practices, which involve designing products with end-of-life in mind, recycling materials, and reducing waste. This approach is not only good for the environment but also makes good business sense, as it can lead to cost savings and new revenue opportunities.

In addition to electrification, other green technologies are being explored, such as hydrogen fuel cells and sustainable materials. The automotive industry is also investing in renewable energy sources for manufacturing and aiming to achieve carbon neutrality across the value chain. These efforts are being driven by both regulatory pressures and consumer demand for more sustainable products.

Key Market Players

Several major players dominate the global automotive market, each contributing to the industry's evolution and shaping its future trajectory. These companies are not only the largest automakers by volume but also leaders in innovation, sustainability, and new mobility solutions.

1. Toyota Motor Corporation

Toyota has long been a leader in the global automotive market, known for its pioneering work in hybrid technology and its commitment to sustainability. The company's hybrid models, such as the Prius, have been highly successful, and Toyota is now making significant investments in electric vehicles. Toyota's market share remains strong, particularly in Asia, where it is the dominant player. In 2023, Toyota sold over 9.5 million vehicles worldwide, maintaining its position as the world's largest automaker.

Toyota's strategy includes a balanced approach to electrification, with a focus on both battery-electric vehicles (BEVs) and hydrogen fuel cell vehicles (FCEVs). The company is also investing in autonomous driving technology through its subsidiary, Toyota Research Institute (TRI), and is exploring new business models in shared mobility.

2. Volkswagen Group

Volkswagen is another global automotive giant, with a strong presence in Europe and China. The company is aggressively pursuing electrification, with plans to invest over €70 billion in electric mobility, hybridization, and digitalization by 2030. Volkswagen's electric vehicle lineup, which includes models like the ID.3 and ID.4, is gaining traction in key markets, and the company aims to become the world's leading electric car manufacturer.

In addition to its focus on EVs, Volkswagen is also investing in autonomous driving and digital services. The company is developing its own software platform, Volkswagen Automotive Cloud, which will enable connected services and over-the-air updates. Volkswagen's long-term strategy is to transform into a software-driven mobility provider, offering a range of services beyond traditional vehicle sales.

3. Tesla, Inc.

Tesla has revolutionized the automotive industry with its focus on electric vehicles and sustainable energy. The company is the leader in the electric vehicle market, with a market share of approximately 20% of global EV sales. Tesla's Model 3 and Model Y are among the best-selling electric vehicles worldwide, and the company continues to innovate with new models like the Cybertruck and the Tesla Semi.

Tesla's success is driven by its vertically integrated business model, which includes its own battery production, software development, and a global network of charging stations. The company's focus on autonomy is also a key differentiator, with its Autopilot and Full Self-Driving (FSD) systems being among the most advanced on the market. Tesla's vision of a sustainable future extends beyond vehicles, as it also produces solar energy products and energy storage solutions.

4. General Motors (GM)

General Motors is one of the oldest and largest automakers in the world, with a strong presence in North America and China. The company is undergoing a major transformation, with a focus on electric and autonomous vehicles. GM has committed to an all-electric future, with plans to phase out internal combustion engines by 2035. The company's electric vehicle lineup includes models like the Chevrolet Bolt EV and the upcoming Hummer EV.

GM is also investing heavily in autonomous driving technology through its subsidiary, Cruise. The company plans to launch a fully autonomous ride-hailing service in the near future, positioning itself as a leader in the new mobility landscape. GM's strategy also includes partnerships with tech companies to develop connected services and digital platforms.

5. Hyundai Motor Group