#competitiveenvironment.

Link

Experience the thrill of victory in Garena Free Fire Max with the latest redeem codes for May 7, 2024. Gain access to free in-game loot, including weapons, skins, diamonds, and more. Stay ahead of the competition and elevate your gaming experience with these exclusive codes. Garena Free Fire Max's Rise to Prominence Since its relaunch, Garena Free Fire Max has become a favorite among Indian gamers, filling the void left by the original game's ban in 2021. With over 100 million downloads by 2023 and a stellar rating on the Google Play Store, its popularity continues to soar. Garena Free Fire Max Redeem Codes Exclusive Advantages of Garena Free Fire Max Unlike other games that rely on pay-to-win mechanics, Free Fire Max remains skill-based, offering players a fair and competitive environment. However, acquiring certain items may require diamonds, the in-game currency. That's where redeem codes come in handy. How Redeem Codes Provide an Edge Redeem codes offer players a chance to earn diamonds without spending real money. These codes, consisting of 12-digit alphanumeric combinations, are released daily and can be redeemed within a specific timeframe. It's crucial to act fast, as each code is redeemable only once. Where to Find Redeem Codes Accessing Garena Free Fire Max redeem codes is easy. Simply visit the official website, particularly for users on Indian servers. Keep an eye out for daily releases to maximize your rewards and enhance your gaming experience. The Evolution of Free Fire Max Despite the availability of exclusive items, Free Fire Max's core gameplay remains focused on skill and strategy. Regular updates and optimizations ensure a dynamic gaming environment, contributing to its widespread acclaim. Unlocking In-Game Rewards Players eagerly anticipate the daily release of redeem codes, which unlock various in-game rewards. These codes serve as a valuable resource for enhancing your gaming arsenal and staying competitive. FAQs : Q: Can I redeem multiple codes in Garena Free Fire Max? A: Yes, you can claim multiple codes, but each code is redeemable only once. Q: How often are new redeem codes released? A: Redeem codes are released daily, so be sure to check the official website regularly. Q: Are redeem codes available for all players? A: Yes, redeem codes are accessible to all players, particularly those on Indian servers. Q: Do redeem codes expire? A: Yes, redeem codes have a limited redemption window, typically between 12 to 18 hours from their release. Q: What kind of rewards can I expect from redeeming codes? A: Redeem codes can unlock various in-game items such as weapons, skins, and diamonds, enhancing your gaming experience.

#competitiveenvironment.#Diamonds#gamingexperience#GarenaFreeFireMax#GarenaFreeFireMAXRedeemCodes#ingamerewards#IndianServers#RedeemCodes#Skillbasedgameplay

0 notes

Text

Unlock JEE success with @masterclassofcl 🚀 Expert Faculty, Comprehensive Materials, Proven Track Record, Personalized Coaching, Structured Curriculum, Regular Tests, Doubt Sessions, Competitive Environment, State-of-the-Art Facilities.

Take the first step towards JEE success by joining The Master Class Centre today! 🚀 www.themasterclass.co.in/register

#JEE#TheMasterclass#Success#Education#Learning#DreamBig#StudyHard#FutureLeaders#UnlockPotential#JEEsuccess#MasterclassAdvantage#ExpertFaculty#ComprehensiveLearning#PersonalizedCoaching#StructuredCurriculum#ProvenTrackRecord#CompetitiveEnvironment#StateOfTheArtFacilities#JoinToday

0 notes

Text

Challenges with Pricing for the High-End Fashion Industry in the US

Written By: Gargi Sarma Introduction:

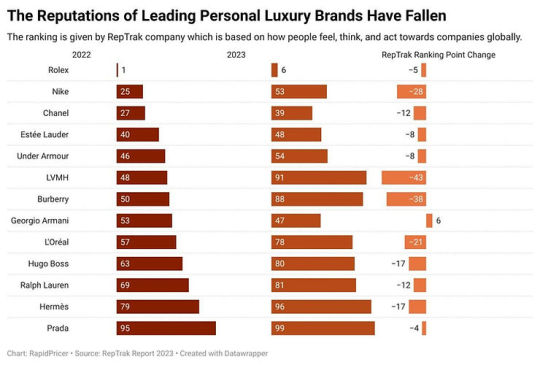

Figure 1: Ranking of Personal Luxury Brands (2022 & 2023)

From Figure 1, we can observe that the year 2023 saw the second consecutive year with a fall in the aggregate RepTrak reputation score. It fell for the first time since 2018, falling from 74.9 in 2021 to 74.2 in 2022. Additionally, the average dropped to 73.2 in 2023.

Recognizing the Dynamics of the Market:

Figure 2: BAC US Card Spending Data Growth For Luxury Fashion, YoY

Figure 3: Luxury Fashion Brands - The Fashion Pyramid (Source: TRF / Strategy Consulting, 2020)

Production Costs: Superior materials, expert craftsmanship, and cutting-edge design methods are frequently substantially invested in by luxury firms. Chanel's renowned tweed jackets, for instance, are expensive because they require fine fabrics and meticulous handwork.

Positioning and Brand Image: To support their high prices, luxury brands need to carefully manage their image. To ensure that its items keep their prized status, Hermes, for example, limits manufacturing and distribution to maintain its exclusivity.

Trends and Seasons: The difficulty for high-end fashion manufacturers is striking a balance between trendy looks and classic appeal. Balenciaga's Triple S sneakers, for instance, sold out quickly at first because of their strong demand, but sustaining their premium cost needed rigorous control of supply and demand dynamics.

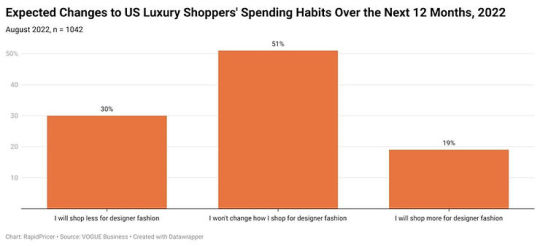

Figure 4: Expected Changes to US Luxury Shoppers' Spending Habits Over the Next 12 Months, 2022

Challenges Faced by High-End Fashion Brands:

High-end fashion pricing in the US faces several challenges due to various factors, including consumer perception, market competition, production costs, and economic conditions. Here are some challenges, along with examples:

Perceived Value vs. Production Cost: High-end fashion brands often struggle to justify their high prices to consumers who may not fully understand the production process and quality of materials. Balancing the perceived value with the actual production cost is crucial. Example: A luxury brand may use high-quality materials and skilled craftsmanship to produce a handbag, driving up the production cost. However, consumers may question the high price if they perceive similar-looking handbags from other brands as being of comparable quality.

Market Saturation and Competition: The high-end fashion market in the US is saturated with numerous brands vying for consumer attention. Intense competition can lead to pricing pressures as brands attempt to differentiate themselves while maintaining profitability. Example: A new high-end sneaker brand enters the market with innovative designs and premium materials. However, established luxury sneaker brands already dominate the market, making it challenging for the new entrant to command premium prices without a strong brand reputation.

Brand Image and Prestige: High-end fashion brands rely heavily on their brand image and prestige to justify premium pricing. Maintaining exclusivity while reaching a broader consumer base presents a delicate balancing act for these brands. Example: Chanel, known for its iconic handbags and timeless designs, carefully controls its distribution channels to maintain exclusivity. However, the brand also faces pressure to appeal to younger consumers without diluting its luxury image.

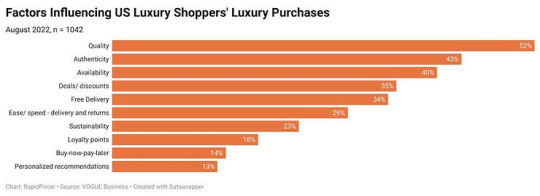

Figure 5: Factors Influencing US Luxury Shoppers' Luxury Purchases, 2022

Economic Factors and Consumer Behavior: Economic downturns and fluctuations in consumer spending can significantly impact high-end fashion pricing. Brands must navigate shifting consumer preferences and adapt their pricing strategies accordingly. Example: During a recession, consumers may prioritize essential purchases over luxury items, leading to decreased demand for high-end fashion products. In response, luxury brands may offer discounts or adjust their pricing to appeal to budget-conscious consumers.

Counterfeiting and Brand Dilution: Counterfeit products pose a significant threat to high-end fashion brands, undermining their exclusivity and brand integrity. Lower-priced knockoffs can dilute the perceived value of authentic products and impact pricing strategies. Example: Louis Vuitton faces ongoing challenges with counterfeit handbags flooding the market. Despite efforts to combat counterfeiting, the availability of cheap knockoffs can make consumers hesitant to pay premium prices for genuine Louis Vuitton products.

Figure 7: Luxury Brands' Online Popularity Change from 2022 to 2023

Trends in Fashion System Highlights:

The following developing issues are highlighted in McKinsey's 2024 report and will be high on the agendas of the fashion system's leaders.

Generative AI: More application cases are appearing in the sector following 2023, the year that generative AI (gen AI) made its breakthrough. Fashion players will need to look past automation to realize profit, and investigate how Gen AI may improve the job of human creatives.

Fast fashion's manipulation: The rivalry in the fast-fashion industry is expected to intensify. Rivals, spearheaded by Shein and Temu, are introducing novel strategies concerning cost, client satisfaction, and velocity. Navigating the regulatory agenda while adjusting to changing customer demands may be the difference between disruptors and incumbents in terms of success.

Every eye is on the brand: It is anticipated that brand marketing will regain prominence when the fashion sector successfully moves away from performance marketing. As marketers rewrite playbooks to emphasize long-term brand creation, brands may profit from developing emotional ties with consumers.

Sustainability is paramount: The days of self-regulation in the fashion business are coming to an end. New regulations will have a big impact on consumers and fashion industry operators everywhere. Manufacturers and brands might think about updating their business models to reflect the upcoming changes.

Bullwhip retaliates: The "bullwhip effect," which causes order volatility to echo unpredictably through supply chains, has been brought about by changes in customer demand. As brands and retailers prioritize openness and strategic collaborations, suppliers are expected to experience more pressure.

Conclusion:

The shifting production costs, fiercer competition, and changing consumer tastes provide serious pricing issues for the US high-end fashion market. Industry participants need to use adaptable pricing strategies that strike a balance between exclusivity and accessibility while staying aware of changing market conditions to successfully negotiate these complications.

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

#luxuryfashion hashtag#pricingstrategy hashtag#fashionindustry hashtag#consumerbehavior hashtag#brandimage hashtag#economicfactors hashtag#competitiveenvironment hashtag#retailpricing hashtag#fashiontrends hashtag#brandmarketing hashtag#sustainability hashtag#aiinfashion hashtag#fastfashion hashtag#retailtech hashtag#fashionretail hashtag#exclusivity hashtag#customerexperience hashtag#supplychain hashtag#retailautomation hashtag#fashionmarketing hashtag#brandbuilding hashtag#retailinnovation hashtag#fashioninsights hashtag#fashionbusiness hashtag#retailtechnology hashtag#luxurybrands hashtag#retailtechsolutions hashtag#fashionretailers hashtag#fashionanalytics

0 notes

Text

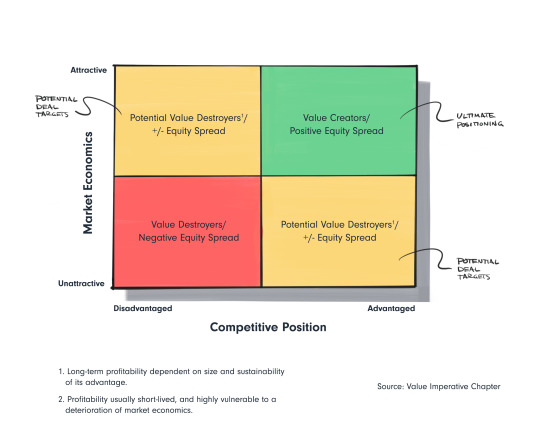

GroundSwell's industry white paper process clearly defines your customer, competition and cost structure through a rigorous strategic industry analysis.

#GroundSwell℠#BusinessOwnershipPlatform℠#BusinessOwnership#BusinessPartner#MarketProfitability#IndustryResearch#CompetitiveEnvironment#BlueOceanStrategy#Differentiation#ValueCreation#BusinessPlan

1 note

·

View note

Text

Key challenges for modern SaaS startup acceleration Answers: https://mymetric360.com/question/key-challenges-for-modern-saas-startup-acceleration/ #SaaSstartupChallenges #AcceleratingTimetoMarket #CompetitiveEnvironment ...

0 notes

Photo

When you're in a competitive environment, always give out the impression that you don't care. It makes people want you more. If you act desperate, it's over. I think a passive attitude is helpful. It comes naturally because I'm lazy. ― Diablo Cody

0 notes

Photo

How to build an audience of #consumers in today’s highly #CompetitiveEnvironment ~ @peterminnium 🛠 http://rite.ly/K2AI

0 notes

Text

New Post has been published on Mortgage News

New Post has been published on http://bit.ly/2q2VDWi

carmax-managements-discussion-and-analysis-of-financial-condition-and-results-of-operations-form-10-k

The following Management's Discussion and Analysis of Financial Condition andResults of Operations ("MD&A") is provided as a supplement to, and should beread in conjunction with, our audited consolidated financial statements and theaccompanying notes presented in Item 8. Consolidated Financial Statements andSupplementary Data. Note references are to the notes to consolidated financialstatements included in Item 8. Certain prior year amounts have beenreclassified to conform to the current year's presentation. All references tonet earnings per share are to diluted net earnings per share. Amounts andpercentages may not total due to rounding.OVERVIEWSee Part I, Item 1 for a detailed description and discussion of the company'sbusiness.CarMax is the nation's largest retailer of used vehicles. We operate in tworeportable segments: CarMax Sales Operations and CarMax Auto Finance("CAF"). Our CarMax Sales Operations segment consists of all aspects of our automerchandising and service operations, excluding financing provided by CAF. OurCAF segment consists solely of our own finance operation that provides financingto customers buying retail vehicles from CarMax.CarMax Sales OperationsOur sales operations segment consists of retail sales of used vehicles andrelated products and services, such as wholesale vehicle sales; the sale ofextended protection plan ("EPP") products, which include extended service plans("ESPs") and guaranteed asset protection ("GAP"); and vehicle repair service. Weoffer low, no-haggle prices; a broad selection of CarMax Quality Certified usedvehicles; value-added EPP products; and superior customer service. Our websiteand related mobile apps are tools for communicating the CarMax consumer offer indetail, sophisticated search engines for finding the right vehicle and saleschannels for customers who prefer to conduct part of the shopping and salesprocess online.Our customers finance the majority of the retail vehicles purchased from us, andavailability of on-the-spot financing is a critical component of the salesprocess. We provide financing to qualified retail customers through CAF and ourarrangements with industry-leading third-party finance providers. All of thefinance offers, whether by CAF or our third-party providers, are backed by a3-day payoff option.As of February 28, 2017, we operated 173 used car stores in 86 U.S. televisionmarkets. As of that date, we also conducted wholesale auctions at 72 used carstores and we operated 2 new car franchises.CarMax Auto FinanceIn addition to third-party finance providers, we provide vehicle financingthrough CAF, which offers financing solely to customers buying retail vehiclesfrom CarMax. CAF allows us to manage our reliance on third-party financeproviders and to leverage knowledge of our business to provide qualifyingcustomers a competitive financing option. As a result, we believe CAF enables usto capture additional profits, cash flows and sales. CAF income primarilyreflects the interest and fee income generated by the auto loan receivables lessthe interest expense associated with the debt issued to fund these receivables,a provision for estimated loan losses and direct expenses. CAF income does notinclude any allocation of indirect costs. After the effect of 3-day payoffs andvehicle returns, CAF financed 44.2% of our retail used vehicle unit sales infiscal 2017. As of February 28, 2017, CAF serviced approximately 808,000customer accounts in its $10.68 billion portfolio of managed receivables.Management regularly analyzes CAF's operating results by assessing thecompetitiveness of our consumer offer, profitability, the performance of theauto loan receivables, including trends in credit losses and delinquencies, andCAF direct expenses.Revenues and ProfitabilityDuring fiscal 2017, net sales and operating revenues increased 4.8% and netearnings increased 0.6%. The 7.6% increase in earnings per share reflected theincrease in net earnings and the effect of our ongoing share repurchase program.Our primary source of revenue and net income is the retail sale of usedvehicles. During fiscal 2017, we sold 671,294 used cars, representing 83.6% ofour net sales and operating revenues and 66.5% of our gross profit. Usedvehicle revenues grew 6.7% and used vehicle gross profits improved 8.4%,primarily due to an 8.3% increase in total used unit sales, which included a4.3% increase in comparable store used units.Wholesale sales are also a significant contributor to our revenues and netincome. During fiscal 2017, we sold 391,686 wholesale vehicles, representing13.1% of our net sales and operating revenues and 16.6% of our gross profit.Wholesale vehicle revenues 22--------------------------------------------------------------------------------decreased 4.8% and wholesale vehicle gross profits decreased 6.6% due to thecombination of a 0.7% decrease in unit sales and a 5.9% decrease in wholesalevehicle gross profit per unit.During fiscal 2017, other sales and revenues, which include revenue earned onthe sale of EPP products, net third-party finance fees, and service departmentand new car sales, represented 3.3% of our net sales and operating revenues and16.9% of our gross profit. Other sales and revenues remained consistent withfiscal 2016, despite the disposal of two of our four new car franchises infiscal 2016, and other gross profit rose 26.3%, primarily reflectingimprovements in EPP revenues and net third-party finance fees.Income from our CAF segment totaled $369.0 million in fiscal 2017, down 5.9%compared with fiscal 2016. The decline in CAF income was primarily due to anincrease in the provision for loan losses and a lower total interest marginpercentage.During fiscal 2017, selling, general and administrative ("SG&A") expensesincreased 10.1% to $1.49 billion, primarily reflecting the 9% increase in ourstore base since the beginning of fiscal 2017, as well as an increase inshare-based compensation and spending related to strategic initiatives.LiquidityOur primary ongoing sources of liquidity include funds provided by operations,proceeds from securitization transactions, and borrowings under our revolvingcredit facility or through other financing sources. During fiscal 2017, net cashused in operations totaled $468.1 million. This amount, combined with$1.21 billion of net issuances of non-recourse notes payable, resulted in$746.6 million of adjusted net cash provided by operating activities, a non-GAAPmeasure. This liquidity, together with a $240.0 million increase in long-termdebt, was primarily used to fund the 10.3 million common shares repurchasedunder our share repurchase program, our store growth and the increase in CAFauto loan receivables.When considering cash provided by operating activities, management does notinclude increases in auto loan receivables that have been funded withnon-recourse notes payable, which are separately reflected as cash provided byfinancing activities. For a reconciliation of adjusted net cash provided byoperating activities to net cash used in operating activities, the most directlycomparable GAAP financial measure, see "Reconciliation of Adjusted Net Cash fromOperating Activities" included in "FINANCIAL CONDITION - Liquidity and CapitalResources."Future OutlookOver the long term, we believe the primary driver for earnings growth will bevehicle unit sales growth from both new stores and stores included in ourcomparable store base. We also believe that increased used vehicle unit saleswill drive increased sales of wholesale vehicles and ancillary products and,over time, increased CAF income. To expand our vehicle unit sales at new andexisting stores, we will need to continue delivering an unrivaled customerexperience in stores and online, which will require investments in ourinformation technology infrastructure and other strategic initiatives. We alsowill need to continue hiring and developing the associates necessary to driveour success, while managing the risks posed by an evolving competitiveenvironment. In addition, to support our store growth plans, we will need tocontinue procuring suitable real estate at favorable terms. While in anyindividual period conditions may vary, over the long term we would expect tobegin leveraging our SG&A expenses when comparable store used unit sales growthis in the mid-single digit range.We are continuing the national rollout of our retail concept, and as ofFebruary 28, 2017, we had used car stores located in 86 U.S. television marketswhich covered approximately 70% of the U.S. population. During fiscal 2017, weopened 15 stores. In fiscal 2018, we plan to open 15 stores. In fiscal 2019, weplan to open between 13 and 16 stores. For a detailed list of stores we plan toopen in fiscal 2018, see the table included in "PLANNED FUTURE ACTIVITIES."A significant portion of our used vehicle inventory is sourced from local,regional and online wholesale auto auctions. Wholesale vehicle prices areinfluenced by a variety of factors, including the supply of vehicles availableat auction relative to dealer demand. Industry sources predict that there willbe a continued influx in off-lease vehicles in coming years, which has and couldcontinue to increase the volume of late-model vehicles available at auctionrelative to dealer demand. This has and could continue to reduce wholesaleauction prices and our vehicle acquisition costs. It could also impact CAFrecovery rates.For additional information about risks and uncertainties facing our Company, see"Risk Factors," included in Part I, Item 1A of this Form 10-K. 23--------------------------------------------------------------------------------

CRITICAL ACCOUNTING POLICIES

Our results of operations and financial condition as reflected in theconsolidated financial statements have been prepared in accordance with U.S.generally accepted accounting principles. Preparation of financial statementsrequires management to make estimates and assumptions affecting the reportedamounts of assets, liabilities, revenues, expenses and the disclosures ofcontingent assets and liabilities. We use our historical experience and otherrelevant factors when developing our estimates and assumptions. We regularlyevaluate these estimates and assumptions. Note 2 includes a discussion ofsignificant accounting policies. The accounting policies discussed below are theones we consider critical to an understanding of our consolidated financialstatements because their application places the most significant demands on ourjudgment. Our financial results might have been different if differentassumptions had been used or other conditions had prevailed.Financing and Securitization TransactionsWe maintain a revolving funding program composed of three warehouse facilities("warehouse facilities") that we use to fund auto loan receivables originated byCAF. We typically elect to fund these receivables through a term securitizationor alternative funding arrangement at a later date. We recognize transfers ofauto loan receivables into the warehouse facilities and term securitizations("funding vehicles") as secured borrowings, which result in recording the autoloan receivables and the related non-recourse notes payable on our consolidatedbalance sheets. CAF income included in the consolidated statements of earningsprimarily reflects the interest and fee income generated by the auto loanreceivables less the interest expense associated with the debt issued to fundthese receivables, a provision for estimated loan losses and direct CAFexpenses.Auto loan receivables include amounts due from customers related to retailvehicle sales financed through CAF. The receivables are presented net of anallowance for estimated loan losses. The allowance for loan losses represents anestimate of the amount of net losses inherent in our portfolio of managedreceivables as of the applicable reporting date and anticipated to occur duringthe following 12 months. The allowance is primarily based on the credit qualityof the underlying receivables, historical loss trends and forecasted forwardloss curves. We also take into account recent trends in delinquencies anddefaults, recovery rates and the economic environment. The provision for loanlosses is the periodic expense of maintaining an adequate allowance.See Notes 2(F), 2(H) and 4 for additional information on securitizations andauto loan receivables.Revenue RecognitionWe recognize revenue when the earnings process is complete, generally either atthe time of sale to a customer or upon delivery to a customer. As part of ourcustomer service strategy, we guarantee the retail vehicles we sell with a5day, money-back guarantee. We record a reserve for estimated returns based onhistorical experience and trends, and results could be affected if futurevehicle returns differ from historical averages.We also sell ESPs and GAP on behalf of unrelated third parties, who are theprimary obligors, to customers who purchase a retail vehicle. The ESPs wecurrently offer on all used vehicles provide coverage up to 60 months (subjectto mileage limitations), while GAP covers the customer for the term of theirfinance contract. We recognize revenue, on a net basis, at the time of sale. Wealso record a reserve for estimated contract cancellations. Periodically, we mayreceive additional revenue based upon the level of underwriting profits of thethird parties who administer the products. These additional amounts arerecognized as revenue when received. The reserve for cancellations is evaluatedfor each product and is based on forecasted forward cancellation curvesutilizing historical experience, recent trends and credit mix of the customerbase. Our risk related to contract cancellations is limited to the revenue thatwe receive. Cancellations fluctuate depending on the volume of EPP sales,customer financing default or prepayment rates, and shifts in customer behaviorrelated to changes in the coverage or term of the product. Results could beaffected if actual events differ from our estimates. A 10% change in theestimated cancellation rates would have changed cancellation reserves byapproximately $10.8 million as of February 28, 2017. See Note 8 for additionalinformation on cancellation reserves.Customers applying for financing who are not approved or are conditionallyapproved by CAF are generally evaluated by other third-party finance providers.These providers generally either pay us or are paid a fixed, pre-negotiated feeper contract. We recognize these fees at the time of sale.We collect sales taxes and other taxes from customers on behalf of governmentalauthorities at the time of sale. These taxes are accounted for on a net basisand are not included in net sales and operating revenues or cost of sales.Income TaxesEstimates and judgments are used in the calculation of certain tax liabilitiesand in the determination of the recoverability of certain deferred taxassets. In the ordinary course of business, transactions occur for which theultimate tax outcome is uncertain at the time of the transactions. We adjust ourincome tax provision in the period in which we determine that it is more likelythan not that our actual results will differ from our estimates. Tax law andrate changes are reflected in the income tax provision in the period in whichsuch changes are enacted. See Note 9 for additional information on incometaxes. 24--------------------------------------------------------------------------------We evaluate the need to record valuation allowances that would reduce deferredtax assets to the amount that will more likely than not be realized. Whenassessing the need for valuation allowances, we consider available losscarrybacks, tax planning strategies, future reversals of existing temporarydifferences and future taxable income. Except for a valuation allowance recordedfor capital loss carryforwards that may not be utilized before their expiration,we believe that our recorded deferred tax assets as of February 28, 2017, willmore likely than not be realized. However, if a change in circumstances resultsin a change in our ability to realize our deferred tax assets, our tax provisionwould be affected in the period when the change in circumstances occurs.In addition, the calculation of our tax liabilities involves dealing withuncertainties in the application of complex tax regulations. We recognizepotential liabilities for anticipated tax audit issues in the U.S. federal andother tax jurisdictions based on our estimate of whether, and the extent towhich, additional taxes will be due. If payments of these amounts ultimatelyprove to be unnecessary, the reversal of the liabilities would result in taxbenefits being recognized in the period when we determine the liabilities are nolonger necessary. If our estimate of tax liabilities proves to be less than theultimate assessment, a further charge to expense would result in the period ofdetermination.

RESULTS OF OPERATIONS – CARMAX SALES OPERATIONS

NET SALES AND OPERATING REVENUES

Years Ended February 28 or 29(In millions) 2017 Change 2016 Change 2015Used vehicle sales $ 13,270.7 6.7 % $ 12,439.4 6.6 % $ 11,674.5Wholesale vehicle sales 2,082.5 (4.8 )% 2,188.3 6.8 % 2,049.1Other sales and revenues:Extended protection planrevenues 305.5 14.1 % 267.8 4.7 % 255.7Third-party finance fees,net (38.4 ) 37.6 % (61.5 ) 3.5 % (63.7 )Other 254.9 (19.3 )% 315.7 (10.6 )% 353.1Total other sales andrevenues 522.0 - % 522.0 (4.2 )% 545.1Total net sales andoperating revenues $ 15,875.1 4.8 % $ 15,149.7 6.2 % $ 14,268.7UNIT SALES Years Ended February 28 or 29 2017 Change 2016 Change 2015Used vehicles 671,294 8.3 % 619,936 6.5 % 582,282Wholesale vehicles 391,686 (0.7 )% 394,437 4.9 % 376,186AVERAGE SELLING PRICES Years Ended February 28 or 29 2017 Change 2016 Change 2015Used vehicles $ 19,586 (1.7 )% $ 19,917 0.1 % $ 19,897Wholesale vehicles $ 5,106 (4.1 )% $ 5,327 1.0 % $ 5,273

COMPARABLE STORE USED VEHICLE SALES CHANGES

Years Ended February 28 or 29 2017 2016 2015Used vehicle units 4.3 % 2.4 % 4.4 %Used vehicle dollars 2.7 % 2.5 % 7.0 %Stores are added to the comparable store base beginning in their fourteenth fullmonth of operation. We do not remove renovated stores from our comparable storebase. Comparable store calculations include results for a set of stores thatwere included in our comparable store base in both the current and correspondingprior year periods. 25

--------------------------------------------------------------------------------

VEHICLE SALES CHANGES Years Ended February 28 or 29 2017 2016 2015Used vehicle units 8.3 % 6.5 % 10.5 %Used vehicle revenues 6.7 % 6.6 % 13.3 %Wholesale vehicle units (0.7 )% 4.9 % 9.8 %Wholesale vehicle revenues (4.8 )% 6.8 % 12.4 %USED VEHICLE FINANCING PENETRATION BY CHANNEL (BEFORE THE IMPACT OF 3-DAYPAYOFFS) Years Ended February 28 or 29 (1) 2017 2016 2015CAF (2) 49.5 % 47.8 % 46.1 %Tier 2 (3) 17.8 18.1 18.3Tier 3 (4) 9.8 13.8 15.1Other (5) 22.9 20.3 20.5Total 100.0 % 100.0 % 100.0 %

(1) Calculated as used vehicle units financed for respective channel as a

percentage of total used units sold.

(2) Includes CAF’s Tier 3 loan originations, which represent less than 1% of

total used units sold.

(3) Third-party finance providers who generally pay us a fee or to whom no fee is

paid.

(4) Third-party finance providers to whom we pay a fee.

(5) Represents customers arranging their own financing and customers that do not

require financing.

CHANGE IN USED CAR STORE BASE

Years Ended February 28 or 29 2017 2016

2015

Used car stores, beginning of year 158 144

131

Store openings 15 14

13

Used car stores, end of year 173 158

144

During fiscal 2017, we opened 15 stores, including 10 stores in 8 new televisionmarkets (3 stores in San Francisco, CA, and 1 store each in Albany, NY; Boise,ID; Bristol, TN; El Paso, TX; Grand Rapids, MI; Mobile, AL and Springfield, IL)and 5 stores in 4 existing television markets (2 stores in Los Angeles, CA and 1store each in Boston, MA; Daytona, FL and Philadelphia, PA).Used Vehicle SalesFiscal 2017 Versus Fiscal 2016. The 6.7% increase in used vehicle revenues infiscal 2017 resulted from an 8.3% increase in unit sales combined with a 1.7%decline in average retail selling price. The increase in used unit salesincluded a 4.3% increase in comparable store used unit sales and sales fromnewer stores not yet included in the comparable store base. The comparable storeused unit sales performance resulted from an increase in conversion, partiallyoffset by a slight decline in store traffic. We believe that improved executionin our stores, as well as our recent website redesign and enhanced onlinecapabilities, which have made it easier for our customers to submit leads, havecontributed to our continued improvements in conversion.We believe the decline in store traffic was predominantly the result of adecline in customers typically financed by Tier 3 providers. The decline in Tier3 sales was the result of tightened lending standards by one of our third-partyTier 3 finance providers that we experienced starting in the middle of the firstquarter of fiscal 2017, and lower applicant volume within this credit tier.During fiscal 2017, we experienced an overall improvement in the credit qualityof our credit applicant mix, which contributed to the lower penetration ratesfor both Tier 2 and Tier 3 providers and higher penetration rates for CAF andcustomers arranging their own financing. Based on our analysis of industry data,we believe the shift in credit applicant mix was not unique to CarMax.Historically, the Tier 3 rate of conversion of credit applications to sales hasbeen significantly lower than that in other credit tiers. As a result, webelieve a decline in Tier 3 sales mix typically represents a disproportionatedecline in underlying customer traffic. For the non-Tier 3 customer base,comparable store used unit sales rose 9.1% in fiscal 2017. Our data indicatesthat in our television markets, we increased our share of the 0- to 10-year oldused vehicle market by approximately 2% in calendar 2016. 26--------------------------------------------------------------------------------The decline in average retail selling price reflected the net effects of lowervehicle acquisition costs and shifts in the mix of our sales by both vehicle ageand class. Generally, we pass on decreases in our vehicle acquisition costs toconsumers in the form of lower selling prices. We believe the increased supplyof late-model vehicles available at auction is contributing to the loweracquisition costs, which, in turn, is helping to increase the value propositionof late-model used vehicles relative to new cars.Fiscal 2016 Versus Fiscal 2015. The 6.6% increase in used vehicle revenues infiscal 2016 resulted from a 6.5% increase in used unit sales. The increase inused unit sales included a 2.4% increase in comparable store used unit sales andsales from newer stores not yet included in the comparable store base. Thecomparable store used unit sales performance was driven by improved conversion,partially offset by a decrease in store traffic. We believe that various marketfactors, including, but not limited to, the availability and relative valuationsof certain used vehicle inventories, and new vehicle lease and price promotions,may have contributed to the decrease in store traffic. Our data indicates thatin our television markets, we increased our share of the 0- to 10-year old usedvehicle market by approximately 1% in calendar 2015.Wholesale Vehicle SalesVehicles sold at our wholesale auctions are, on average, approximately 10 yearsold with more than 100,000 miles and are primarily comprised of vehiclespurchased through our appraisal process that do not meet our retail standards.Our wholesale auction prices usually reflect the trends in the general wholesalemarket for the types of vehicles we sell, although they can also be affected bychanges in vehicle mix or the average age, mileage or condition of the vehiclesbeing sold.Fiscal 2017 Versus Fiscal 2016. The 4.8% decrease in wholesale vehicle revenuesin fiscal 2017 resulted from a 4.1% decrease in wholesale vehicle averageselling prices and a 0.7% decrease in wholesale unit sales. During fiscal 2017,increases in wholesale unit volumes attributable to the growth in our store baseand an improved appraisal buy rate were more than offset by a reduction inappraisal traffic. In particular, we experienced a reduced mix of 7- to 9-yearold vehicles in our wholesale sales mix, which we believe resulted, at least inpart, from the reduced overall industry supply of these model year vehicles dueto the decline in industry new vehicle sales during the recession. This shift inmix also contributed to the decline in average selling price.Fiscal 2016 Versus Fiscal 2015. The 6.8% increase in wholesale vehicle revenuesin fiscal 2016 resulted from a 4.9% increase in wholesale unit sales and a 1.0%increase in average wholesale vehicle selling price. The wholesale unit growthprimarily reflected the growth in our store base.Other Sales and RevenuesOther sales and revenues include revenue from the sale of ESPs andGAP (collectively reported in EPP revenues, net of a reserve for estimatedcontract cancellations), net third-party finance fees, and other revenues, whichare predominately comprised of service department and new vehicle sales. Thefees we pay to the Tier 3 providers are reflected as an offset to finance feerevenues received from the Tier 2 providers. The mix of our retail vehiclesfinanced by CAF, Tier 2 and Tier 3 providers, or customers that arrange theirown financing, may vary from quarter to quarter depending on several factorsincluding the credit quality of applicants, changes in providers' creditdecisioning and external market conditions. Changes in originations by one tierof credit providers may also affect the originations made by providers in othertiers.Fiscal 2017 Versus Fiscal 2016. Other sales and revenues remained consistent infiscal 2017, as changes in the underlying components offset one another. Newvehicle sales declined due to the disposal of two of our four new car franchisesduring fiscal 2016. EPP revenues increased 14.1% largely reflecting the growthin our used unit sales and pricing changes. Net third-party finance feesimproved by 37.6% primarily due to the reduced proportion of our used unit salesfinanced by Tier 3 finance providers.Fiscal 2016 Versus Fiscal 2015. Other sales and revenues decreased 4.2% infiscal 2016, primarily due to our disposal of two of the four new car franchiseswe owned at the start of fiscal 2016. EPP revenues increased 4.7% largelyreflecting the growth in our used unit sales. Net third-party finance feesimproved by 3.5% primarily due to shifts in the mix among finance providers.GROSS PROFIT Years Ended February 28 or 29(In millions) 2017 Change 2016 Change 2015Used vehicle gross profit $ 1,451.7 8.4 % $ 1,338.6 5.5 % $ 1,268.5Wholesale vehicle gross profit 362.6 (6.6 )% 388.1 6.4 % 364.9Other gross profit 369.0 26.3 % 292.1 14.9 % 254.1Total $ 2,183.3 8.2 % $ 2,018.8 7.0 % $ 1,887.5 27

--------------------------------------------------------------------------------GROSS PROFIT PER UNIT Years Ended February 28 or 29 2017 2016 2015 $ per unit (1) % (2) $ per unit (1) % (2) $ per unit (1) % (2)Used vehicle grossprofit $ 2,163 10.9 $ 2,159 10.8 $ 2,179 10.9Wholesale vehiclegross profit $ 926 17.4 $ 984 17.7 $ 970 17.8Other gross profit $ 550 70.7 $ 471 55.9 $ 436 46.6Total gross profit $ 3,252 13.8 $ 3,256 13.3 $ 3,242 13.2

(1) Calculated as category gross profit divided by its respective units sold,

except the other and total categories, which are divided by total used units

sold.

(2) Calculated as a percentage of its respective sales or revenue.

Used Vehicle Gross ProfitWe target a dollar range of gross profit per used unit sold. The gross profitdollar target for an individual vehicle is based on a variety of factors,including its probability of sale and its mileage relative to its age; however,it is not primarily based on the vehicle's selling price. Our ability to quicklyadjust appraisal offers to be consistent with the broader market trade-in trendsand the pace of our inventory turns reduce our exposure to the inherentcontinual fluctuation in used vehicle values and contribute to our ability tomanage gross profit dollars per unit.We systematically mark down individual vehicle prices based on proprietarypricing algorithms in order to appropriately balance sales trends, inventoryturns and gross profit achievement. Other factors that may influence grossprofit include changes in our vehicle reconditioning costs, changes in thepercentage of vehicles sourced directly from consumers through our appraisalprocess and changes in the wholesale pricing environment. Vehicles purchaseddirectly from consumers typically generate more gross profit per unit comparedwith vehicles purchased at auction or through other channels.Fiscal 2017 Versus Fiscal 2016. The 8.4% increase in used vehicle gross profitin fiscal 2017 was primarily driven by the 8.3% growth in total used unit sales.Despite an overall trend reported by publicly traded auto retailers in recentquarters towards lower gross profit per unit sold, our used vehicle gross profitper unit remained consistent with fiscal 2016. We believe we can manage to atargeted gross profit per unit dollar range, subject to future changes to ourbusiness or pricing strategy.Fiscal 2016 Versus Fiscal 2015. The 5.5% increase in used vehicle gross profitin fiscal 2016 was primarily driven by the 6.5% growth in total used unit sales,partially offset by a modest decline in used gross profit per unit.Wholesale Vehicle Gross ProfitOur wholesale gross profit per unit reflects the demand for older, highermileage vehicles, which are the mainstay of our auctions, as well as strongdealer attendance and resulting high dealer-to-car ratios at our auctions. Thefrequency of our auctions, which are generally held weekly or bi-weekly,minimizes the depreciation risk on these vehicles. Our ability to adjustappraisal offers in response to the wholesale pricing environment is a keyfactor that influences wholesale gross profit.Fiscal 2017 Versus Fiscal 2016. The 6.6% decrease in wholesale vehicle grossprofit in fiscal 2017 reflected the combination of the 0.7% decrease inwholesale unit sales and a $58, or 5.9%, reduction in wholesale gross profit perunit. The decline in gross profit per unit was due in part to the reducedproportion of 7- to 9-year old vehicles in our wholesale sales mix. In addition,compared with fiscal 2016, differences in the rate of depreciation relative tochanges in our appraisal offers contributed to the decline in wholesale vehiclegross profit per unit.Fiscal 2016 Versus Fiscal 2015. The 6.4% increase in wholesale vehicle grossprofit in fiscal 2016 reflected the combination of the 4.9% increase inwholesale unit sales with a $14 increase in wholesale gross profit per unit.Other Gross ProfitOther gross profit includes profits related to EPP revenues, net third-partyfinance fees and other revenues, which are predominantly comprised of servicedepartment operations, including used vehicle reconditioning, and new vehiclesales. We have no cost of sales related to EPP revenues or net third-partyfinance fees, as these represent revenues paid to us by certain third-partyproviders. Third-party finance fees are reported net of the fees we pay tothird-party Tier 3 finance providers. Accordingly, changes in the relative mixof the components of other gross profit can affect the composition and amount ofother gross profit. 28--------------------------------------------------------------------------------Fiscal 2017 Versus Fiscal 2016. Other gross profit rose 26.3% in fiscal 2017,primarily reflecting the improvement in EPP revenues and net third-party financefees discussed above. The decrease in new vehicle sales did not significantlyaffect other gross profit.Fiscal 2016 Versus Fiscal 2015. Other gross profit increased 14.9% in fiscal2016, primarily reflecting the improvement in EPP revenues and net third-partyfinance fees discussed above, as well as an increase in service department grossprofits due to a change in the timing of our recognition of reconditioningoverhead costs, which increased other gross profit in fiscal 2016 by $10.4million. These costs, which previously had been expensed as incurred, are nowallocated to the carrying cost of inventory.Impact of InflationHistorically, inflation has not had a significant impact onresults. Profitability is primarily affected by our ability to achieve targetedunit sales and gross profit dollars per vehicle rather than by changes inaverage retail prices. However, changes in average vehicle selling prices impactCAF income, to the extent the average amount financed also changes.SG&A Expenses

COMPONENTS OF SG&A EXPENSES

Years Ended February 28 or

29

(In millions except per unit data) 2017 Change 2016 Change 2015Compensation and benefits (1) $ 803.9 9.0 % $ 737.6 1.0 % $ 730.4Store occupancy costs 300.8 9.1 % 275.6 13.2 % 243.5Advertising expense 144.2 2.6 % 140.6 14.5 % 122.8Other overhead costs (2) 239.6 20.9 % 198.1 23.0 % 161.0Total SG&A expenses $ 1,488.5 10.1 % $ 1,351.9

7.5 % $ 1,257.7SG&A per used vehicle unit (3) $ 2,217$ 36$ 2,181$ 21$ 2,160

(1) Excludes compensation and benefits related to reconditioning and vehicle

repair service, which are included in cost of sales. See Note 12 for details

of stock-based compensation expense by grant type.

(2) Includes IT expenses, preopening and relocation costs, insurance, travel,

non-CAF bad debt, charitable contributions and other administrative

expenses. Costs for fiscal 2015 were reduced by $20.9 million in connection

with the receipt of settlement proceeds in a class action lawsuit.(3) Calculated as total SG&A expenses divided by total used vehicle units.Fiscal 2017 Versus Fiscal 2016. SG&A expenses for fiscal 2017 increased 10.1%.The increase primarily reflected the 9% growth in our store base during fiscal2017 (representing the addition of 15 stores), and a $35.7 million increase inshare-based compensation expense. The increase in share-based compensationexpense increased SG&A per used unit by $47 and was largely related tocash-settled restricted stock units, which are awards provided broadly tonon-executive associates in our organization. The expense associated with theseunits was influenced by the change in the company's stock price during thefiscal year. The fiscal 2017 share-based compensation expense includedapproximately $10 million of incremental expense related to awards granted ormodified by the board of directors to our recently retired chief executiveofficer, Thomas J. Folliard. Mr. Folliard was effectively provided retirementtreatment under the terms of the awards, notwithstanding that he was youngerthan 55 years old. However, the vesting of the awards was not accelerated on hisretirement and no changes were made to the full-term expiration dates or thestrike prices of the awards. The $41.5 million, or 20.9%, increase in otheroverhead costs included increased spending related to strategic initiatives.Fiscal 2016 Versus Fiscal 2015. SG&A expenses for fiscal 2015 were reduced by$20.9 million, or $0.06 per share, which represented our receipt of settlementproceeds in a class action lawsuit related to the economic loss associated withcertain Toyota vehicles. Excluding this litigation settlement, the fiscal 2016increase reflected the 10% growth in our store base (representing the additionof 14 stores) and higher information technology and marketing costs. This waspartially offset by a $23.3 million decrease in share-based compensationexpense, which was influenced by decreases in the per share price of our commonstock during fiscal 2016. The decrease in share-based compensation expense infiscal 2016 reduced SG&A per used unit by $38.Interest ExpenseInterest expense includes the interest related to short- and long-term debt andfinance and capital lease obligations. It does not include interest on thenon-recourse notes payable, which is reflected within CAF income. 29--------------------------------------------------------------------------------Fiscal 2017 Versus Fiscal 2016. Interest expense increased to $56.4 million infiscal 2017 versus $36.4 million in fiscal 2016. The increase reflected thecombination of planned higher outstanding debt levels in fiscal 2017 as part ofour capital structure strategy, as well as growth in our finance and capitallease obligations. See "FINANCIAL CONDITION - Liquidity and Capital Resources"for further discussion. During fiscal 2017, we sold $500 million of seniorunsecured notes, due in 2023, 2026 and 2028, to investors in a privateplacement.Fiscal 2016 Versus Fiscal 2015. Interest expense increased to $36.4 million infiscal 2016 versus $24.5 million in fiscal 2015, primarily reflecting our higheraverage outstanding borrowings. During fiscal 2016, as a result of borrowings tofund our stock repurchase activity, we moved closer to our target range foradjusted debt to capital ratio.Other ExpenseDuring fiscal 2016, we recorded a one-time charge of $8.3 million associatedwith a property that is no longer planned to be used.Income TaxesThe effective income tax rate was 37.7% in fiscal 2017, 38.3% in fiscal 2016 and38.4% in fiscal 2015.

RESULTS OF OPERATIONS – CARMAX AUTO FINANCE

CAF income primarily reflects interest and fee income generatedby CAF's portfolio of auto loan receivables less the interest expense associatedwith the debt issued to fund these receivables, a provision for estimated loanlosses and direct CAF expenses. CAF income does not include any allocation ofindirect costs. Although CAF benefits from certain indirect overheadexpenditures, we have not allocated indirect costs to CAF to avoid makingsubjective allocation decisions. Examples of indirect costs not allocated to CAFinclude retail store expenses and corporate expenses.CAF's managed portfolio is composed primarily of loans originated over the pastseveral years. Trends in receivable growth and interest margins primarilyreflect the cumulative effect of changes in the business over a multi-yearperiod. We strive to originate loans with an underlying risk profile that webelieve will, in the aggregate and excluding CAF's Tier 3 originations, resultin cumulative net losses in the 2% to 2.5% range over the life of theloans. Actual loss performance of the loans may fall outside of this range basedon various factors, including intentional changes in the risk profile oforiginations, economic conditions and wholesale recovery rates. Current periodoriginations reflect current trends in both our retail sales and the CAFbusiness, including the volume of loans originated, current interest ratescharged to consumers, loan terms and average credit scores. Because werecognize CAF income over the life of the underlying auto loan, loans originatedin a given fiscal period generally do not have a significant effect on thatperiod's financial results.

See Note 3 for additional information on CAF income and Note 4 for informationon auto loan receivables, including credit quality.SELECTED CAF FINANCIAL INFORMATION

Years Ended February 28 or 29(In millions) 2017 % (1) 2016 % (1) 2015 % (1)Interest margin:Interest and fee income $ 762.0 7.5 $ 682.9 7.5 $ 604.9 7.7Interest expense (171.4 ) (1.7 ) (127.7 ) (1.4 ) (96.6 ) (1.2 )Total interest margin $ 590.6 5.8 $ 555.2 6.1 $ 508.3 6.5Provision for loan losses $ (150.6 ) (1.5 ) $ (101.2 ) (1.1 ) $ (82.3 ) (1.0 )CarMax Auto Finance income $ 369.0 3.6 $ 392.0 4.3 $ 367.3 4.7(1) Percent of total average managed receivables. 30

--------------------------------------------------------------------------------

CAF ORIGINATION INFORMATION (AFTER THE IMPACT OF 3-DAY PAYOFFS)

Years Ended February 28 or 29 2017 2016

2015

Net loans originated (in millions) $ 5,643.3$ 5,171.0$ 4,727.8Vehicle units financed 297,043 265,426 243,264Net penetration rate (1) 44.2 % 42.8 % 41.8 %Weighted average contract rate 7.4 % 7.3 % 7.1 %Weighted average credit score (2) 706 702

701

Weighted average loan-to-value (LTV) (3) 95.0 % 94.6 % 94.2 %Weighted average term (in months)

65.8 65.9

65.4

(1) Vehicle units financed as a percentage of total used units sold.

(2) The credit scores represent FICO scores and reflect only receivables with

obligors that have a FICO score at the time of application. The FICO score

with respect to any receivable with co-obligors is calculated as the average

of each obligor’s FICO score at the time of application. FICO scores are not

a significant factor in our primary scoring model, which relies on

information from credit bureaus and other application information as

discussed in Note 4. FICO® is a federally registered servicemark of Fair

Isaac Corporation.

(3) LTV represents the ratio of the amount financed to the total collateral

value, which is measured as the vehicle selling price plus applicable taxes,

title and fees.

LOAN PERFORMANCE INFORMATION

As of and for the Years Ended February 28 or 29(In millions) 2017 2016 2015Total ending managed receivables $ 10,681.3$ 9,593.6$ 8,458.7Total average managed receivables $ 10,158.3$ 9,092.9$ 7,859.9Allowance for loan losses (1) $ 123.6$ 94.9$ 81.7Allowance for loan losses as a percentage ofending managed receivables 1.16 % 0.99 % 0.97 %Net credit losses on managed receivables $ 121.9$ 88.0$ 70.5Net credit losses as a percentage of totalaverage managed receivables 1.20 % 0.97 % 0.90 %Past due accounts as a percentage of endingmanaged receivables 3.10 % 2.74 % 2.62 %Average recovery rate (2) 47.4 % 51.2 % 54.2 %(1) The allowance for loan losses represents an estimate of the amount of net losses inherent in our portfolio of managed receivables as of the

applicable reporting date and anticipated to occur during the following 12

months.

(2) The average recovery rate represents the average percentage of the

outstanding principal balance we receive when a vehicle is repossessed and

liquidated, generally at our wholesale auctions. The annual recovery rate

has ranged from a low of 42% to a high of 60%, and it is primarily affected

by changes in the wholesale market pricing environment.

Fiscal 2017 Versus Fiscal 2016. CAF income declined 5.9% in fiscal 2017. Thedecline was due to an increase in the provision for loan losses and lower totalinterest margin percentage, partially offset by the increase in average managedreceivables. Average managed receivables grew 11.7% to $10.16 billion in fiscal2017 driven by the rise in CAF loan originations in recent years. The growth innet loan originations in fiscal 2017 resulted from our used vehicle sales growthand an increase in CAF's penetration rate that was caused by the increased mixof credit applications from customers at the higher end of the credit spectrum.The total interest margin, which reflects the spread between interest and feescharged to consumers and our funding costs, declined to 5.8% of average managedreceivables from 6.1% in fiscal 2016. This was the result of a gradualcompression of the spread between rates charged to consumers and our fundingcosts in recent years. Funding costs have increased modestly due to overallmarket changes while our rates charged to consumers remained stable. Changes inthe interest margin on new originations affect CAF income over time. Continuedincreases in interest rates, which affect CAF's funding costs, or othercompetitive pressures on consumer rates, could result in further compression inthe interest margin on new originations.The provision for loan losses rose to $150.6 million in fiscal 2017 from $101.2million in fiscal 2016 due to unfavorable loss experience in fiscal 2017 as wellas the growth in managed receivables. While higher loss rates were primarily dueto an increase in charge-offs, lower recovery rates also contributed to theunfavorable loss experience in fiscal 2017, which we believe reflects conditionsimpacting our industry as a whole. The increase in the allowance for loan lossesas a percentage of ending managed 31--------------------------------------------------------------------------------receivables reflected the effect of the change in loss and delinquencyexperience on our outlook for net losses expected to occur over the next 12months.Fiscal 2016 Versus Fiscal 2015. CAF income rose 6.7% to $392.0 million infiscal 2016, driven by the growth in average managed receivables, partiallyoffset by a lower total interest margin percentage and an increase in theprovision for loan losses. Average managed receivables grew 15.7% to $9.09billion in fiscal 2016, driven by the rise in net loan originations in recentyears. Net loans originated in fiscal 2016 increased 9.4%, primarily reflectingthe 6.6% growth in used vehicle revenues and a higher CAF penetration rate. Theincrease in CAF's penetration rate in fiscal 2016 was largely due to changes inthe underlying credit mix of customers applying for financing.The total interest margin declined to 6.1% of average managed receivables from6.5% in fiscal 2015. This was the result of a gradual compression of the spreadbetween rates charged to consumers and our funding costs in recent years.The provision for loan losses rose 22.9% to $101.2 million in fiscal 2016,reflecting the 15.7% increase in average managed receivables in fiscal 2016 andthe effect of favorable loss experience in fiscal 2015, which reduced theprovision in that year. The allowance for loan losses as a percentage of endingmanaged receivables remained consistent at 0.99% as of February 29, 2016, versus0.97% as of February 28, 2015.Tier 3 Loan Originations. CAF also originates a small portion of auto loans tocustomers who typically would be financed by our Tier 3 finance providers, inorder to better understand the performance of these loans, mitigate risk and addincremental profits. CAF currently targets originating approximately 5% of thetotal Tier 3 loan volume; however, this rate may vary over time based on marketconditions. A total of $123.3 million and $96.5 million in CAF Tier 3receivables were outstanding as of February 28, 2017 and February 29, 2016,respectively. These loans have higher loss and delinquency rates than theremainder of the CAF portfolio, as well as higher contract rates. As ofFebruary 28, 2017 and February 29, 2016, approximately 10% of the totalallowance for loan losses related to the outstanding CAF Tier 3 loan balances.During fiscal 2017, we entered into a new $100 million warehouse facility thatis being used to fund a portion of CAF's Tier 3 loan origination activity.Previously, these loans had been funded separately from the remainder of CAF'sportfolio using existing working capital. 32--------------------------------------------------------------------------------

PLANNED FUTURE ACTIVITIES

We currently plan to open 15 stores in fiscal 2018 and between 13 and 16 storesin fiscal 2019. We will be entering five new television markets and expandingour presence in seven existing television markets. Of the 15 stores we plan toopen in fiscal 2018, 6 are in Metropolitan Statistical Areas ("MSAs") havingpopulations of 600,000 or less, which we define as small markets. We currentlyestimate capital expenditures will total approximately $325 million in fiscal2018. Compared with fiscal 2017, the decrease in planned capital spendingprimarily reflects reduced spending on construction and land acquisitionsresulting from changes in the mix of markets in which stores are being built.FISCAL 2018 PLANNED STORE OPENINGS Metropolitan Location Television Market Statistical Area Planned Opening DatePuyallup,Washington (1) Seattle/Tacoma (2) Seattle/Tacoma Q1 Fiscal 2018Lynnwood, Washington(1) Seattle/Tacoma Seattle/Tacoma Q1 Fiscal 2018Pensacola, Florida Mobile/Pensacola Pensacola Q1 Fiscal 2018Waterbury,Connecticut Hartford/New Haven New Haven Q2 Fiscal 2018 San Francisco/Oakland/SanSan Jose, California Jose San Jose Q2 Fiscal 2018Salisbury, Maryland Salisbury (2) Salisbury Q2 Fiscal 2018Langhorne,Pennsylvania Philadelphia Philadelphia Q3 Fiscal 2018Tyler, Texas Tyler/Longview (2) Tyler Q3 Fiscal 2018Las Vegas, Nevada Las Vegas Las Vegas Q3 Fiscal 2018 San Francisco/Oakland/SanColma, California Jose San Francisco/Oakland Q3 Fiscal 2018Renton, Washington Seattle/Tacoma Seattle/Tacoma Q3 Fiscal 2018Myrtle Beach, South Myrtle Beach/FlorenceCarolina (2) Myrtle Beach Q4 Fiscal 2018South Portland, Maine Portland/Auburn (2) Portland Q4 Fiscal 2018Manchester, NewHampshire Boston Manchester Q4 Fiscal 2018Golden, Colorado Denver Denver/Aurora Q4 Fiscal 2018(1) Store opened in March 2017.(2) Represents new television market as of planned store opening date.

Normal construction, permitting or other scheduling delays could shift theopening dates of any of these stores into a later period.

RECENT ACCOUNTING PRONOUNCEMENTS

See Note 2(X) to the consolidated financial statements for information on recentaccounting pronouncements applicable to CarMax.FINANCIAL CONDITIONLiquidity and Capital ResourcesOur primary ongoing cash requirements are to fund our existing operations, storeexpansion and improvement and CAF. Since fiscal 2013, we have also elected touse cash for our share repurchase program. Our primary ongoing sources ofliquidity include funds provided by operations, proceeds from securitizationtransactions or other funding arrangements, and borrowings under our revolvingcredit facility or through other financing sources.We currently target an adjusted debt to capital ratio in a range of 35% to 45%.In calculating this ratio, we utilize total debt, excluding non-recourse notespayable, a multiple of 8 times rent expense and total shareholders' equity. Weexpect to use our revolving credit facility and other financing sources,together with stock repurchases, to achieve and maintain this targeted ratio;however, in any period, we may be outside this range due to seasonal, market,strategic or other factors.Operating Activities. During fiscal 2017, net cash used in operating activitiestotaled $468.1 million compared with $148.9 million in fiscal 2016. The net cashused in operating activities includes increases in auto loan receivables of$1.21 billion in fiscal 2017 and $1.20 billion in fiscal 2016. The majority ofthe increases in auto loan receivables are accompanied by increases innon-recourse notes payable, which are separately reflected as cash provided byfinancing activities. 33--------------------------------------------------------------------------------As of February 28, 2017, total inventory was $2.26 billion, representing anincrease of $328.5 million, or 17.0%, compared with the balance as of the startof the fiscal year. The increase primarily reflected the addition of inventoryto support new store openings and our comparable store sales growth in fiscal2017. Increased inventory levels were also a result of delays in federal incometax refunds that impacted the timing of anticipated sales in February. Theseincreases were partially offset by a decline in the average carrying cost ofinventory due to changes in acquisition costs.As of February 29, 2016, total inventory was $1.93 billion, representing adecrease of $154.8 million, or 7.4%, compared with the balance as of the startof fiscal 2016. The decrease primarily reflected the net effects of (i) a 13%decrease in used vehicles in inventory at stores included in the comparablestore base in an effort to optimize inventory, (ii) the addition of inventory tosupport new store openings in fiscal 2016 and (iii) our disposal of two new carfranchises during fiscal 2016.When considering cash provided by operating activities, management uses anadjusted measure of net cash from operating activities that offsets the changesin auto loan receivables with the corresponding changes in non-recourse notespayable. This is achieved by adding back the cash provided from the netissuances of non-recourse notes payable, which represents the increase in autoloan receivables that were funded through the issuance of non-recourse notespayable during the year. The resulting financial measure, adjusted net cash fromoperating activities, is a non-GAAP financial measure. We believe adjusted netcash from operating activities is a meaningful metric for investors because itprovides better visibility into the cash generated from operations. Includingthe increases in non-recourse notes payable, net cash provided by operatingactivities would have been as follows:

RECONCILIATION OF ADJUSTED NET CASH FROM OPERATING ACTIVITIES

Years Ended February 28 or 29(In millions) 2017 2016 2015Net cash used in operating activities $ (468.1 )$ (148.9 )$ (968.1 )Add: Net issuances of non-recourse notes payable (1) 1,214.7 1,057.1 1,222.2Adjusted net cash provided by operating activities $ 746.6$ 908.2$ 254.1

(1) Calculated using the gross issuances less payments on non-recourse notes

payable as disclosed on the consolidated statements of cash flows.

Adjusted net cash provided by operating activities for fiscal 2017 decreasedcompared to fiscal 2016, primarily due to the change in inventory during fiscal2017, partially offset by the timing of payments related to operating payablesand an increase in net income when excluding non-cash expenses, which includedepreciation and amortization, share-based compensation expense and theprovisions for loan losses and cancellation reserves. In addition, the increasein net issuances of non-recourse notes payable was primarily attributable toloan origination growth, as well as the new warehouse facility being used tofund certain of CAF's Tier 3 loans. In fiscal 2016, all of CAF's Tier 3 loanswere funded through the use of existing working capital.Investing Activities. Net cash used in investing activities totaled $465.6million in fiscal 2017, $378.8 million in fiscal 2016 and$360.7 million infiscal 2015. Investing activities primarily consist of capital expenditures,which totaled $418.1 million in fiscal 2017, $315.6 million in fiscal 2016 and$309.8 million in fiscal 2015. Capital expenditures primarily include storeconstruction costs, real estate acquisitions for planned future store openingsand store remodeling expenses. We maintain a multi-year pipeline of sites tosupport our store growth, so portions of capital spending in one year may relateto stores that we open in subsequent fiscal years. We opened 15 stores infiscal 2017, we opened 14 stores and relocated 1 store in fiscal 2016 and weopened 13 stores in fiscal 2015. The increase in capital expenditures in thecurrent year period largely reflected timing changes in the purchases of landand related construction activity for future stores.Financing Activities. Net cash provided by financing activities totaled $934.7million in fiscal 2017, $537.5 million in fiscal 2016 and $728.6 million infiscal 2015. Included in these amounts were net increases in total non-recoursenotes payable of $1.21 billion, $1.06 billion and $1.22 billion, respectively,which were used to provide the financing for the majority of the increases of$1.21 billion, $1.20 billion and $1.37 billion, respectively, in auto loanreceivables (see Operating Activities). During fiscal 2017, we sold $500million of senior unsecured notes in a private placement, and used a portion ofthe proceeds to reduce net borrowings under our revolving credit facility.During fiscal 2016, we increased net borrowings under the revolving creditfacility by $404.6 million. During fiscal 2015, we received proceeds of $300million from a variable-rate term loan entered into in November 2014. Net cashprovided by financing activities was reduced by stock repurchases of$564.3 million in fiscal 2017, $983.9 million in fiscal 2016 and $924.3 millionin fiscal 2015. 34

--------------------------------------------------------------------------------

TOTAL DEBT AND CASH AND CASH EQUIVALENTS

As of February 28 or 29(In thousands) 2017 2016

Borrowings under revolving credit facility $ 155,062$ 415,428Other long-term debt

800,000 300,000Finance and capital lease obligations 496,136 414,654Non-recourse notes payable 10,742,425 9,527,750Total debt (1) $ 12,193,623$ 10,657,832Cash and cash equivalents $ 38,416$ 37,394

(1) Total debt excludes unamortized debt issuance costs. See Note 11 for

additional information.

We have a $1.20 billion unsecured revolving credit facility, which expires inAugust 2020. Borrowings under this credit facility are available for workingcapital and general corporate purposes, and the unused portion is fullyavailable to us. We also have a $300 million variable-rate term loan, which isdue in August 2020. In addition, we have $500 million of fixed-rate seniorunsecured notes, which are due in 2023, 2026 and 2028. The credit facility, termloan and senior note agreements contain representations and warranties,conditions and covenants. If these requirements were not met, all amountsoutstanding or otherwise owed could become due and payable immediately and otherlimitations could be placed on our ability to use any available borrowingcapacity.Finance and capital lease obligations relate primarily to stores subject tosale-leaseback transactions that did not qualify for sale accounting and,therefore, are accounted for as financings. Payments on the leases arerecognized as interest expense and a reduction of the obligations. In the eventthe leases are modified or extended beyond their original lease term, therelated obligation is increased based on the present value of the revised futureminimum lease payments, with a corresponding increase to the assets subject tothese transactions. Upon modification, the amortization of the obligation isreset, resulting in more of the lease payments being applied to interest expensein the initial years following the modification. During fiscal 2017 and fiscal2016, finance lease obligations were increased by $80.0 million and $103.2million, respectively, related to leases that were modified or extended beyondtheir original lease term, resulting in an increase of interest expenserecognized in fiscal 2017 and fiscal 2016 that is expected to continue in fiscal2018.See Note 11 for additional information on our revolving credit facility, termloan, senior notes and finance and capital lease obligations.CAF auto loan receivables are primarily funded through our warehouse facilitiesand term securitization transactions. Our funding vehicles are structured tolegally isolate the auto loan receivables, and we would not expect to be able toaccess the assets of our funding vehicles, even in insolvency, receivership orconservatorship proceedings. Similarly, the investors in the non-recourse notespayable have no recourse to our assets beyond the related receivables, theamounts on deposit in reserve accounts and the restricted cash from collectionson auto loan receivables. We do, however, continue to have the rights associatedwith the interest we retain in these funding vehicles. Loans originated in theCAF Tier 3 loan origination program are primarily being funded through a$100 million warehouse facility, as well as the use of existing working capital.The timing of principal payments on the non-recourse notes payable is basedon the timing of principal collections and defaults on the related auto loanreceivables. The current portion of non-recourse notes payable representsprincipal payments that are due to be distributed in the following period.As of February 28, 2017, $9.12 billion of non-recourse notes payable wasoutstanding related to term securitizations. These notes payable have scheduledmaturities through July 2023, but they may mature earlier, depending on therepayment rate of the underlying auto loan receivables. During fiscal 2017, wecompleted four term securitizations, funding a total of $5.03 billion of autoloan receivables.As of February 28, 2017, $1.62 billion of non-recourse notes payable wasoutstanding related to our warehouse facilities. We have periodically increasedour warehouse facility limit over time, as our store base, sales and CAF loanoriginations have grown. In fiscal 2017, we increased the combined limit of ourwarehouse facilities by $300 million. As of February 28, 2017, the combinedwarehouse facility limit was $2.80 billion, and the unused warehouse capacitytotaled $1.18 billion. Of the combined warehouse facility limit, $1.30 billionwill expire in August 2017 and $1.50 billion will expire in February 2018. SeeNotes 2(F) and 11 for additional information on the warehouse facilities. 35--------------------------------------------------------------------------------The agreements related to the warehouse facilities include variousrepresentations and warranties, covenants and performance triggers. If theserequirements are not met, we could be unable to continue to fund receivablesthrough the warehouse facilities. In addition, warehouse facility investorscould charge us a higher rate of interest and could have us replaced asservicer. Further, we could be required to deposit collections on the relatedreceivables with the warehouse facility agents on a daily basis and deliverexecuted lockbox agreements to the warehouse facility agents.We expect that adjusted net cash provided by operations, borrowings underexisting, new or expanded credit facilities and other funding arrangements willbe sufficient to fund CAF, capital expenditures, repurchases of stock andworking capital for the foreseeable future. We anticipate that we will be ableto enter into new, or renew or expand existing, funding arrangements to meet ourfuture funding needs. However, based on conditions in the credit markets, thecost for these arrangements could be materially higher than historical levelsand the timing and capacity of these transactions could be dictated by marketavailability rather than our requirements.The timing and amount of stock repurchases are determined based on share price,market conditions, legal requirements and other factors. Shares repurchased aredeemed authorized but unissued shares of common stock. As of February 28, 2017,the board had authorized a total of $4.55 billion of repurchases. At that date,$1.59 billion was available for repurchase under the board's outstandingauthorizations, which includes an additional $750 million authorized duringfiscal 2017. Also during fiscal 2017, the board removed the expiration date ofthe outstanding repurchase authorizations. See Note 12 for more information onshare repurchase activity.Fair Value Measurements. We recognize money market securities, mutual fundinvestments and derivative instruments at fair value. See Note 6 for moreinformation on fair value measurements.CONTRACTUAL OBLIGATIONS (1) As of February 28, 2017 Less Than 1 to 3 3 to 5 More Than(In millions) Total 1 Year Years Years 5 Years OtherShort-term debt $ 0.1$ 0.1 $ - $ - $ - $ -Long-term debt 955.0 - - 455.0 500.0 -Interest on debt (2) 202.5 20.7 41.5 41.5 98.8 -Finance and capitalleases (3) 1,077.5 51.3 103.4 91.6 831.2 -Operating leases (3) 769.5 47.5 96.8 86.8 538.4 -

Purchase

obligations (4) 145.4 66.3 60.1 16.3 2.7 -Defined benefitretirement plans (5) 89.6 0.5 - - - 89.1Unrecognized taxbenefits (6) 24.5 - - - - 24.5Total $ 3,264.1$ 186.4$ 301.8$ 691.2$ 1,971.1$ 113.6

(1) This table excludes the non-recourse notes payable that relate to auto loan

receivables funded through term securitizations and our warehouse

facilities. These receivables can only be used as collateral to settle

obligations of these vehicles. In addition, the investors in the

non-recourse notes payable have no recourse to our assets beyond the related

receivables, the amounts on deposit in reserve accounts and the restricted

cash from collections on auto loan receivables. See Note 2(F) and 11.

(2) Represents interest payments to be made on our fixed-rate senior notes. Due

to the uncertainty of forecasting expected variable interest rate payments

associated with our revolving credit facility and term loan, such amounts

are not included in the table. See Note 11.

(3) Excludes taxes, insurance and other costs payable directly by us. These

costs vary from year to year and are incurred in the ordinary course of business. See Note 15.

(4) Includes certain enforceable and legally binding obligations related to real

estate purchases, third-party outsourcing services and advertising. Purchase

obligations exclude agreements that are cancellable at any time without

penalty. See Note 17(B).

(5) Represents the recognized funded status of our retirement plans, of which

$89.1 million has no contractual payment schedule and we expect payments to

occur beyond 12 months from February 28, 2017. See Note 10.(6) Represents the net unrecognized tax benefits related to uncertain tax

positions. The timing of payments associated with these tax benefits could

not be estimated as of February 28, 2017. See Note 9. 36

——————————————————————————–

© Edgar Online, source Glimpses

0 notes

Link