#cost of sblc

Explore tagged Tumblr posts

Text

Lease SBLC: Unlock Capital with The Hanson Group of Companies

In today’s global financial environment, businesses often require innovative instruments to raise capital, facilitate large transactions, or secure loans. One such instrument is the Standby Letter of Credit (SBLC). Specifically, the option to lease SBLC offers a powerful, low-risk solution for companies that need temporary access to financial instruments without the burden of full ownership. At The Hanson Group of Companies, leasing an SBLC becomes a seamless process, designed to support clients in achieving their funding and financial goals efficiently.

What is a Lease SBLC?

A leased SBLC, or Standby Letter of Credit, is a financial instrument issued by a bank on behalf of a client. Unlike purchasing an SBLC, medium term note, leasing means the client does not own the instrument but has full usage rights for a fixed period, typically one year and one day. The lease SBLC is commonly used as a guarantee to support large-scale financial transactions, project funding, or trade finance operations.

Difference Between Leased and Owned SBLC

Ownership of an SBLC means the business has fully paid for the instrument and controls it indefinitely. Leasing, on the other hand, is more cost-effective and temporary. For companies that need short-term usage without the long-term obligation or upfront capital, leasing becomes a strategic choice.

SBLC Financing and Compliance

Every SBLC standby letter of credit issued through The Hanson Group complies with international banking regulations and undergoes rigorous verification. The firm only deals with instruments from A-rated banks to ensure the highest level of trust and functionality. All transactions follow proper KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures, ensuring legitimacy and security throughout the process.

Partner with The Hanson Group of Companies

When you choose to lease SBLC through The Hanson Group, you gain access to decades of expertise, global banking relationships, and a commitment to client success. Whether you're a business looking for secure sblc financing or a trader in need of a financial guarantee, The Hanson Group provides a reliable solution tailored to your needs. With a focus on transparency, compliance, and customer service, The Hanson Group of Companies stands out as a leading provider of standby letter of credit (SBLC) leasing solutions globally.

Conclusion

Leasing an SBLC opens the door to flexible funding options, improved credit ratings, and successful international trade. With The Hanson Group of Companies as your partner, you can leverage this powerful financial instrument to fuel growth, complete large deals, or secure funding—without the hefty cost of ownership. If your business is ready to take advantage of lease SBLC opportunities, visit The Hanson Group of Companies to get started with a team that understands your financial needs and delivers results.

#lease sblc#sblc financing#standby letter of credit (sblc)#sblc standby letter of credit#medium term note

0 notes

Text

SBLC: Unlock New Business Opportunities with Confidence

In the world of trade finance, having a solid financial guarantee can mean the difference between closing a major deal or missing out. That’s where the Standby Letter of Credit (SBLC) comes in.

🔹 What is an SBLC? An SBLC is a bank guarantee that assures a seller or business partner that payment will be made if the buyer fails to meet their obligations.

💡 Why are SBLCs so important?

✅ Security for sellers – Protects suppliers from non-payment risks.

✅ Stronger financial credibility – Increases trust with banks and business partners.

✅ Facilitates global trade – Ideal for imports/exports, supply contracts, and infrastructure projects.

✅ Versatile financial tool – Used for deferred payments, performance guarantees, and more.

🔥 Why choose an SBLC with Credit Glorious?

🔹 No collateral required – Unlike traditional SBLCs, you don’t need to tie up capital.

🔹 Fast approval process – Get evaluated quickly so you never miss an opportunity.

🔹 Competitive fees – Cost-effective solutions to make structured finance accessible.

🌍 Whether you’re securing an international contract, building trust with suppliers, or expanding your business, an SBLC can be the perfect solution.

Want to learn more about SBLCs and Credit Glorious? Let’s connect! 📩

Original Source: https://www.cgph.info/post/sblc-unlock-new-business-opportunities-with-confidence

1 note

·

View note

Text

Characteristics of Standby Letters of Credit

Introduction:

A standby letter of credit is an instrument that is primarily involved in lowering the entitled risk, with the bank serving as the main body. It is an agreement between the exporter and the importer, acting as a safeguard to secure the losses in case of default or failure of the contract. The SBLC ensures that necessary payments are made to the seller after fulfilling the required obligations.

Meaning of Standby Letter of Credit :

A standby letter of credit is a kind of a letter of credit that mostly relates to international business and deals with the terms of payment. While the buyer instructs the seller not to open a letter of credit in an SBLC, the buyer's bank reduces the risk in a regular letter of credit. Instead, a standby letter of credit will be established by the buyer, ensuring that the seller will be paid by the buyer's bank in the case of a default.

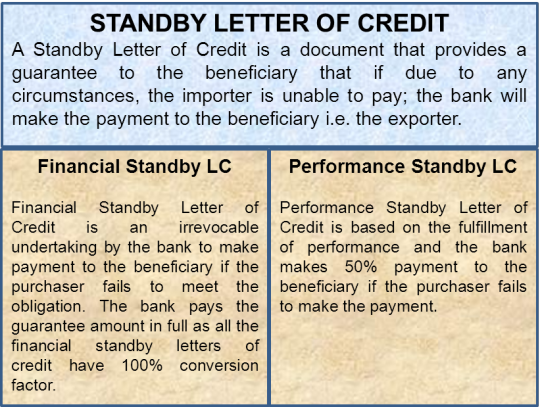

There are two types of standby letters of credit:

Financial SBLC:

It is irrevocable in nature and deals with the payment for goods and services as outlined in the agreement and if some kind of indebtedness occurs it comes into picture.

Performance SBLC:

which is less famous and it mostly deals with the guarantee that the client will complete the project according to the specifications outlined in the contract and it is backed by the bank.

Additionally, the bank agrees to reimburse a third party if its client fails to complete the task.

Uses of Standby Letters of Credit:

Standby letters of credit are primarily used as a safety and security mechanism for the beneficiary, aiming to reduce trade risk.

They are also given out as assurances that a financial institution will make specific payments.

Since it shows the buyer's credit worthiness and ability to make payments, an SBLC is seen as an indication of good faith.

Documents Involved in Standby Letters of Credit:

Before opening the SBLC, the bank will secure its funds and require the buyer to provide collateral, such as a fixed deposit or insurance.

Fees charged by banks may vary across different financial institutions.

The process of obtaining a standby letter of credit is similar to that of securing a loan, and it involves documents such as bills of payment, invoices, credit history, and the level of collateral, which depends on the associated risk , the strength of the company or business, and the amount secured by the SBLC, along with related elements.

Characteristics of a standby letter of credit:

A standby letter of credit incurs a higher cost than a normal letter of credit because it provides assurance and security to the party.

It acts as a loan from the bank that examines the credit history of the applicant, making it trustworthy.

It is used both domestically and internationally for the smooth conduct of business.

It is applicable to both goods and services.

It is based on a stable community.

There are international rules recognized among different states, allowing for intervention within a harmonious framework accepted by the countries of the contractual parties.

Three reasons to consider an SBLC are: it is autonomous , payable at first demand, and irrevocable.

It is genuinely safe and serves as a safety net, assuring the seller that the bank will facilitate the process if a certain situation arises.

A standby letter of credit can provide various protections for the selling party in the event of failure or bankruptcy.

The main characteristic of an SBLC is that, in international trade, the buyer and seller may not know each other, but due to the SLOC, trust is built, allowing them to conduct business smoothly without any hassle.In the case of adverse events, the bank guarantees coverage for losses and is responsible for disbursing the principal with interest as previously agreed with the bank.

In contrast, a delay in the consignment or a wrong spelling of a company's name can lead to the withholding of payments; thus, it is essential to check all procedures, details, rules, and regulations properly.

Conclusion:

A standby letter of credit is correlated to a bank guarantee. If an individual receives an SBLC in a business transaction, it is entirely safe, allowing for further deals. Before entering into an SBLC, a buyer must read the terms and conditions carefully to avoid future risks, as modifications are not possible after finalization . A standard fee ranges from 1% to 10% of the SBLC value, and it is noted that no extra charges are involved in a standby letter of credit.

https://merchantinternationalbank.com/

0 notes

Text

#Investment_Funding

The Corinth Group companies in Switzerland would like to invest in projects like Waste Management, Agriculture, Energy, Hospitality, Property Development, Manufacturing, Technology, Medical, and Infrastructure, Others on a case- by –case- basis. Funding from 20 Million to 1 Billion/No upfront fees

Interest per annum (4%).Funding Facilities:

1.Loan Equity ( zero cost) Joint Venture Partner -60%

2. Loan-Equity-40% ,the partner has to contribute 500.000

3. Loan Security Deposit .Minimum 10.000.000-Maximum 250.000.000

4. Loan Security Deposit. Funding Minimum 250.000.000- with 5.000.000 SBLC

( Mufeed Waheed/Al-Mufeed company ( producer) WhatsApp :+ 964 0780 960 9642/+964 07764013302

1 note

·

View note

Text

Unlocking Profit: How Banks Benefit from Using SBLC and Bank Instruments

Unlocking Profit: How Banks Benefit from Using SBLC and Bank Instruments Dive into the world of banking and discover how financial institutions profit from utilizing Standby Letters of Credit (SBLC) and other bank instruments. Explore their role in generating revenue and enhancing financial stability.

Introduction to Banking Profits with SBLC and Bank Instruments

Exploring Revenue Streams In this article, we delve into the mechanisms through which banks profit from the utilization of Standby Letters of Credit (SBLC) and other bank instruments. Discover how these instruments contribute to the financial success of banks worldwide.

The Role of SBLC and Bank Instruments in Banking

1. Facilitating Trade and Transactions SBLC and other bank instruments play a pivotal role in facilitating trade and transactions. Banks issue SBLCs to provide payment guarantees on behalf of their clients, enabling smoother business operations and reducing transactional risks. 2. Enhancing Creditworthiness By issuing SBLCs and other bank instruments, banks enhance the creditworthiness of their clients. This allows businesses to access financing, secure contracts, and expand their operations, fostering economic growth and development.

Generating Fee Income

1. Issuance Fees Banks earn revenue through the issuance of SBLCs and other bank instruments. Clients typically pay issuance fees for these services, contributing to the bank's fee income and overall profitability. 2. Renewal and Amendment Fees Additionally, banks may charge renewal and amendment fees for SBLCs to cover administrative costs and mitigate risks associated with changes in contractual terms or extensions of the instrument's validity period.

Leveraging Collateral and Security

1. Collateralization of Loans Banks often require collateral to mitigate lending risks. SBLCs and other bank instruments can serve as collateral for loans, providing assurance to lenders and enabling borrowers to access financing on favorable terms. 2. Managing Risk Exposure By accepting SBLCs and other bank instruments as collateral, banks manage their risk exposure and enhance the security of their lending portfolios. This prudent risk management strategy contributes to the bank's financial stability and resilience.

Trading and Investment Opportunities

1. Secondary Market Trading Banks can participate in the secondary market trading of SBLCs and other bank instruments, leveraging these opportunities to generate additional revenue through trading commissions, spread differentials, and arbitrage strategies. 2. Investment Portfolios Furthermore, banks may include SBLCs and other bank instruments in their investment portfolios. These instruments offer diversification benefits and potential returns, contributing to the bank's overall investment income.

Adhering to Regulatory Requirements

1. Compliance Costs Banks incur costs associated with regulatory compliance when issuing and managing SBLCs and other bank instruments. These costs include regulatory capital requirements, compliance monitoring, and reporting obligations. 2. Risk Management Practices To mitigate risks associated with SBLCs and other bank instruments, banks implement robust risk management practices. This includes credit risk assessment, monitoring of counterparties, and stress testing to ensure the stability of their operations.

Conclusion: Banking Profits in the Modern Era

1. A Multifaceted Approach Banks profit from the utilization of SBLCs and other bank instruments through various revenue streams, including issuance fees, collateralized lending, trading opportunities, and investment portfolios. 2. Balancing Profitability and Risk While these instruments offer lucrative opportunities for banks, they also entail risks that must be managed effectively. By adopting sound risk management practices and adhering to regulatory requirements, banks can maximize profitability while maintaining financial stability in the ever-evolving landscape of banking. Read the full article

0 notes

Text

Strategies for Optimizing Cassava Export to the Lucrative Chinese Market

The Chinese market remains a paramount destination for cassava imports globally, driven by governmental support and its versatile applications across industries, including bioethanol, industrial production, food, and animal feed.

Yet, capitalizing on this thriving market demands strategic maneuvering. Despite substantial annual export quantities (exceeding 1 million MT per exporter per contract) and competitive payment terms, Chinese buyers often push for lower prices, necessitating a savvy approach to streamline operations and curtail production costs.

Outlined below are crucial focus areas to elevate your export operations:

Tailored Cassava Cultivation: Align cultivation practices with specific market demands, catering to food, bioethanol, or other industrial purposes.

Contract Farming Enhancement: Bolster cassava field production by fostering enduring partnerships with farmers' cooperatives, ensuring a sustained and reliable supply chain.

Operational Optimization: Improve processing efficiency by implementing round-the-clock operations, including incentivizing night shifts and holiday production to meet soaring monthly delivery demands.

Streamlined Logistics: Establish a warehouse proximate to the loading port to mitigate shipping delays, crucial when dealing with thousands of containers monthly.

Advanced Warehouse Monitoring: Equip your warehouse with state-of-the-art monitoring devices to track crucial factors like moisture and humidity, ensuring the preservation of processed cassava quality.

Strategic Financial Partnerships: Overcome financial constraints by forging alliances with institutions in Singapore, Dubai, or the European Union for more favorable LC or SBLC monetization terms.

GACC License Preparation: Begin the GACC license application process early, as it can take up to 6 months. This step is crucial for agricultural product exporters to China.

These recommendations stem from our direct experiences as cassava exporters to China. The Chinese market's intricacies demand a comprehensive strategy encompassing strategic cultivation, efficient processing, seamless logistics, and innovative financial partnerships. Optimizing the entire value chain empowers companies to navigate challenges effectively and capitalize on the abundant opportunities presented by this high-demand market.

Chinese importers seeking premium-quality cassava chips can contact us today to discuss how our product can elevate their production processes! We have the capacity to supply over 1 million Metric Tons of dried cassava chips annually for food, bioethanol, and industrial production.

For cassava producers in developing countries, reach out to explore how our international consulting services can help establish a cost-effective export chain, whether for short or long-term endeavors.

I hope you enjoyed reading this post and learned something new and useful from it. If you did, please share it with your friends and colleagues who might be interested in Agriculture and Agribusiness.

Mr. Kosona Chriv Chief Operating Officer (COO)

Deko Integrated and Agro Processing Limited 3rd and 4th Floors, Idubor House 52 Mission Road 300002 Benin City Edo State Nigeria

Phone/WhatsApp: + 2349040848867 (Nigeria) +85510333220 (Cambodia) Email: [email protected] Website: https://dekoholding.com

Deko Integrated and Agro Processing Limited is an agricultural firm and exporter of agricultural commodities in Nigeria. We aim to use technologies and innovations to disrupt the cassava value chain in Nigeria. We believe that Nigeria has the potential and resources to become the top exporter of value-added cassava. If you are in the world cassava value chain (food manufacturers, bio-ethanol manufacturers, cassava by-products producers, and investors), we look forward to hearing from you soon and exploring the possibilities of working together. By working together, we can create value for our customers, partners, and stakeholders, as well as make a positive impact on the local communities and the environment. We are committed to delivering high-quality products and services, as well as fostering innovation and sustainability.

If you want to learn more about Deko Group and how we can collaborate, please visit our website https://dekoholding.com

Illustration Photo: dried cassava chips (public domain)

Read the full article by clicking here https://dekoholding.com/dekoposts/BhvAvn4romxBNJn22/strategies-for-optimizing-cassava-export-to-the-lucrative/dekonews

0 notes

Text

Stand By Letter Of Credit Providers - Yield 4 Finance

Yield4Finance is the leading (DLC) Documentary Letter of Credit and (SBLC) Standby Letter of Credit providers. We offer a comprehensive suite of solutions to assist our clients in maximizing their liquidity and providing a secure financial foundation for their businesses. Our services include issuance, negotiation, amendments, and monitoring of both DLCs and SBLCs. We specialize in the structuring of these financial instruments to meet the needs of our clients, and provide the best possible pricing and terms. With our expertise in the international trade finance market, we are able to quickly and efficiently provide the most cost-effective solutions for our clients. Our commitment to excellence in service and our dedication to customer satisfaction makes Yield4Finance the best choice for your Documentary Letter of Credit and Standby Letter of Credit needs.

0 notes

Text

We are bank guarantee provider. Please be aware that Standby Letter of Credit is different from a Bank Guarantee.

We are bank guarantee provider. Please be aware that Standby Letter of Credit is different from a Bank Guarantee.

A standby letter of credit (SBLC/SLOC) is a guarantee of payment by a bank on behalf of their client. It is a loan of last resort in which the bank fulfills payment obligations by the end of the contract if their client cannot. A standby letter of credit can also be abbreviated SBLC or SLOC. A standby letter of credit is different from a bank guarantee. https://trustglobalfinance.com/ is sblc…

View On WordPress

#bg#cost of sblc#dc#How to Monetize SBLC#How to Obtain a Standby Letter of Credit#https://trustglobalfinance.com#sblc funding#sblc funding process#SBLC Monetization#sblc monetization in us no money down#SBLC Monetization process#SBLC providers#Standby Letter of Credit providers#uses of bg sblc

0 notes

Text

Standby Letter of Credit Monetization (Leased or Owned SBLC)

Standby Letter of Credit Monetization (Leased or Owned SBLC)

Bank Instrument Monetization, monetize bg sblc, sblc funding process, cost of sblc, sblc providers, sblc vs lc, bank instruments providers, monetizers of bank instruments, sblc mt760, Standby Letter of Credit providers, How do you monetise SBLC

Hong Kong, June 22, 2020 /BREAKING NEWS/ —

What is Standby Letter of Credit (SBLC) Monetization?

Standby Letter of Credit (SBLC) Monetization or

View On WordPress

#Bank Instrument monetization#bank instruments providers#cost of sblc#How do you monetise SBLC#monetize bg sblc#monetizers of bank instruments#sblc funding process#sblc mt760#sblc providers#sblc vs lc#Standby Letter of Credit Providers

0 notes

Text

Lease Bank Instruments: Unlocking Financial Potential with The Hanson Group of Companies

In the intricate world of finance, businesses continually seek innovative solutions to enhance liquidity and secure funding for growth and expansion. One such solution is leasing bank instruments, a strategy that offers access to financial tools like Standby Letters of Credit (SBLC) and Bank Guarantees (BG) without the need for outright ownership. The Hanson Group of Companies specializes in providing these lease bank instruments, enabling clients to unlock their financial potential.

Understanding Leased Bank Instruments

Leased bank instruments refer to financial tools—such as SBLCs and BGs—that are obtained on a lease basis from asset holders or management companies. This arrangement allows businesses to utilize these instruments for sblc standby letter of credit enhancement, trade facilitation, or securing loans, without the necessity of purchasing them outright. The primary advantage lies in the ability to leverage high-value financial instruments for a specified period, thereby optimizing capital efficiency.

The Role of Banks in BG and SBLC Transactions

It's essential to clarify the role of banks in the issuance and delivery of BGs and SBLCs. Contrary to common belief, banks do not initiate these instruments; instead, they act as delivery agents for their clients, who are the actual asset owners or providers. In this context, the bank's function is to confirm that the provider has sufficient funds and to facilitate the transmission of the instrument to the beneficiary's bank. This process is akin to a courier delivering a parcel—the bank delivers the financial instrument on behalf of the provider. The bank's involvement is limited to this delivery role and does not extend to the initiation or backing of the instrument itself.

Monetization of Leased Bank Instruments

A pivotal aspect of leasing bank instruments is the potential for monetization. Monetization involves converting the value of a financial instrument into liquid funds, typically through a loan or credit facility. The Hanson Group of Companies facilitates this process by accepting leased instruments as collateral for non-recourse or recourse loans. This strategy allows clients to generate capital without the need for asset ownership, thereby enhancing financial flexibility. The monetization process is structured to cover all associated fees, loan repayments, and costs, ensuring that both the provider and the client benefit financially.

Leasing Standby Letters of Credit (SBLC)

A Standby Letter of Credit (SBLC) is a guarantee of payment issued by a bank on behalf of a client, ensuring that the beneficiary receives payment in the event that the client fails to fulfill contractual obligations. Leasing an SBLC provides businesses with a powerful tool to secure trade deals, enhance creditworthiness, and facilitate international transactions. The Hanson Group of Companies offers a streamlined process for SBLC leasing , which includes executing a Letter of Intent, verifying beneficiary information, and delivering the instrument via secure channels such as Euroclear or Bloomberg. This process ensures that clients can efficiently obtain the financial backing needed for their business endeavors.

Leasing Bank Guarantees (BG)

Similar to SBLCs, Bank Guarantee (BG) serve as a promise from a bank to cover a client's financial obligations if they default. Leasing a BG allows businesses to assure partners and stakeholders of their financial reliability without tying up significant capital in securing the guarantee. The Hanson Group of Companies facilitates the leasing of BGs, enabling clients to leverage these instruments for various purposes, including securing loans, participating in large projects, or enhancing credit lines.

Differences Between SBLC and BG

While both SBLCs and BGs function as financial guarantees, there are subtle differences between the two. An SBLC is a secondary payment method, activated only when the client fails to meet contractual obligations, whereas a BG SBLC Providers is a direct guarantee of payment. Additionally, SBLCs are commonly used in international trade and long-term contracts, providing a broader scope of risk coverage, while BGs are utilized in both domestic and international transactions, often for specific projects or agreements.

Compliance and Standards

Adherence to compliance standards is paramount in the leasing and monetization of bank instruments. The Hanson Group of Companies requires clients to accurately complete applications and abide by established procedures. Situations where clients cannot or will not pay the required deposits, or where SBLC providers are listed on forbidden assets and financial instrument lists, are grounds for rejection. This strict compliance ensures the integrity of transactions and protects all parties involved.

Conclusion

Lease bank instruments, such as SBLCs and BGs, presents a viable strategy for businesses seeking to enhance liquidity, secure funding, and facilitate trade without the need for substantial capital investment. The Hanson Group of Companies offers expertise in this domain, providing clients with the tools and processes necessary to effectively lease and monetize these financial instruments. For more updates follow us on Facebook, Twitter, Pinterest and Linkedin.

#lease bank instruments#sblc leasing#bg sblc providers#standby letter of credit (sblc)#sblc providers#bank guarantee (bg)#sblc standby letter of credit

0 notes

Text

Bank Guarantee | Third Party Collateral | Project Funding

Get Bank Guarantee,Third Party Collateral and Project Funding,MSME,personal loan,loan against property,home loan,project finance,cgtmse,2020

MONETARY INSTRUMENTS

Greetings from Qolaris Solutions Pvt Ltd – Monetary Instruments | BG | LC | SBLC | Bill Discounting

Allow us to introduce to you our offered services. We are a associate Trade non depository financial institution that facilitates the issuance of monetary instruments like Letters of Credits, Bank Guarantees, Standby Letters of Credit, etc. using our own credit limits with our issuers that help our clients from a various array of industries achieve smoother business transactions tailored to their needs. We have enclosed our detailed procedures below for your ready reference. do you have to have an interest and would really like to understand more, please don’t hesitate to reply on this email so I can assist you. Or if you have got a network which may interest us, do allow us to know and we’ll see the chance of working together. For further inquiries, you’ll also reach me on my mobile and WhatsApp no. +91-9811993953 , +91-8700237256 We, Qolaris Solutions Pvt Ltd offers a large range of products: · Letters of Credit at Sight · Usance Letters of Credit · Standby Letters of Credit · Bank Guarantees · Performance Guarantees · Demand Guarantees · POF Messages · Pre-Advice Message · Comfort Letters · Ready Willing and Able (RWA) Messages Issuers for LC at Sight; Calls for limits and restrictions.

Please provoke each bank restrictions and line limits:

Habib Bank AG Zurich BNP Paribas HSBC Standard Chartered Bank China Construction Bank OCB Wing Hang Bank Dash Sing bank DBS Bank UCO bank Habib Bank Bank Winter IDB, New York Hanami Bank Stern International Bank U.S. Credit Corp Standard Commerce Bank Anametrics Crown Financial bank Issuers for Usance LC; Calls for limits and restrictions. Please kindle each bank restrictions and line limits:

Bank Winter Stern International Bank U.S. Credit Corp Standard Commerce Bank Anametrics Crown Financial depository financial institution Issuers for SBLC AND BANK GUARANTEES;

Bank Winter Stern International Bank Standard Commerce Bank Anametrics Crown Financial banking company Issuance Procedure: We need the subsequent documents/ information for finalizing the draft – 1. Filled in Contact Us Form 2. Verbiage required within the instrument for SBLC & BG / Proforma Invoice for DLC 3. Trade license of your company 4. Share Holders List 5. Passport copy of main applicant 6. Three years audited record 7. Six months latest bank statements Step-wise 1. After acquiring all the above documents / information, we’ll select the issuing bank / financial organisation and finalize the draft for your review. 2. Upon receiving the text of the instrument, you need to thoroughly review the draft for any corrections, additions or removal of data. Should there be any amendments, we are able to amend the draft accordingly to match your preferences. Once the draft is approved, you’ll must send us a duplicate of the draft with sign and stamp thereon as your approval. 3. we are going to raise the invoice for the agreed charges (charges include margin money, processing fee and professional charges) and you’ll make the remittance against the invoice. 4. Only after we receive the payment for the raised invoice, the Issuing Bank / establishment will issue and relay the instrument through swift within 48-96 hours after remittance. 5. Simultaneously we are going to send you the issued copy through email for your reference and record. Note: the costs will rely onthe worth of the Financial Instrument, Tenure, Issuing Bank / institution. We have attached the corporate presentation, application forms, and programs & procedures for your reference. For more details, please visit our website: www.qolaris.in

QUICK DISCOUNTING OF BANK GUARANTEE

Get Quick funding or material supply against you bank guarantee

We can discount any bank guarantee at very good rate

If you have bank guarantee but did not have discounting option , don’t worry contact us ……

Have Any Questions for list below ….???

Can bank guarantee be cashed?

What is LC discounting in India?

How can I get bank guarantee in India?

Is Bill discounting a loan?

Finance against bank guarantee in India

Loan against Bank Guarantee

Project funding against bank guarantee

Bank guarantee against property

Bank guarantee limit

Bank Guarantee

Bank instruments

Fund against bank guarantee

You are at write place , call or write us ….. we are happy to help u…..

LOAN AGAINST THIRD PARTY COLLATERAL

If you are looking for funding but did not have any own collateral for guarantee , we have a solutions for you.

You get the funding if you can give us third party property or collateral.

We can give you the funds against third party property on the condition of : 1. Property Should be clear 2. Property Should be in Delhi-NCR 3. Owner of the property is ready to be director in the company 4. No Problems in inspection of the property by funding agency or bank

5. Loan will be shared between property holder and company in 50-50

6. All the expenses will be share 50-50 and detected from the share of property holder.

7. Property can be residential or commercial.

We also taking property pan India but the value of the collateral/property should be minimum 5 Cr.

If you have any question form below list …. 1. Third party collateral loan 2. Third party mortgage 3. Third party pledge 4. Loan against collateral 5. loan against third party collateral 6. third party collateral providers 7. third party collateral loan 8. funding against third party collateral 9. loan against third party collateral

This is a best and secured way of getting fund if you do not have sound financial documents with you.

We can fund any amount from 2 Cr to 500 Cr but step by step.

If your have any question or query about the process , who it will be start and details process click now…..

For any further query contact us …….

#bank guarantee funding#bank guarantee lease#project funding dubai#project funding India#funding against third party collateral#Third party collateral#monetary instruments#QUICK DISCOUNTING OF BANK GUARANTEE#DISCOUNTING OF BANK GUARANTEE

1 note

·

View note

Text

Benefits associated with Leasing An SBLC

SBLC monetization

You will be asking what the positive aspects are generally for leasing some sort of financial institution instrument or taking into consideration additional options than risking your own own equity to safeguarded a line of credit history?

SBLC monetization

The Benefits of Rental an SBLC:

It's really beneficial to trade finance Really a fine to present the Seller comfort if the Buyer not pay with regard to merchandise received It's a new good way for the Buyer to buy goods to offer on to a Consumer browsing the wings along with employ proceeds from good discounts to pay for merchandise purchased from the Retailer.

How exactly does Leasing An SBLC Job?

Let's say anyone are a plant transforming soy beans in to soya milk. You have a good order from the community supermarket worthy of $150M, you actually want to buy $100M worth of soy coffee beans from a Supplier, throughout your banking accounts you get $250M.

You may always be troubled that with some other outgoing charges, this obtain could cause very very little money for additional bills. Instead of taking away the entire $100M through your bank account to get up as collateral for you to receive that loan to order the soy espresso beans, a person might choose another (safer) option.

You could bring up the bank instrument to help show your current Supplier in which you have the economical means ready to invest in the coconut beans coming from them. This lender musical instrument will come from any Vacation Provider who can let you rent their very own collateral at claim 10% of the cost now you are only paying $10M instead of endangering $100M. By simply leasing some sort of bank guitar means an individual are a temporary lessee for one year in addition to one moment.

Normally accounts are granted on a new 45, 60 or maybe three months day invoicing circuit. And so theoretically you could pick the soy beans from typically the Provider by taking out there a traditional bank instrument. This kind of would then possibly be given to the Supplier because backup should you predetermined upon settling the bill rapid this is extremely common in deal financial.

In trade fund often the Supplier will want caractère by way of the bank instrument to show this should an invoice not possible be settled, they can call up on the actual instrument as well as cash this in in order to collect their transaction. In the event that this is timed accurately, the particular Purchaser of typically the soy pulses can acquire the goods, turn that into soya dairy to be able to sell onto the food store who in turn compensates often the $150M which possesses been pre-agreed plus the Dealer can in turn give the $100M (the price of the soy beans in the Supplier) within the established duration bound timelines and only chance very little of their dollars.

Example Of Leasing A SBLC:

Supplier sells the actual soy beans for $100M

Purchaser leases a standard bank instrument at 10% associated with face value of the particular device. Therefore the charge to lease contract in this kind of case is $100M times 10% = $10M

Consumer puts up the tool being a 'promise to pay' if the purchaser default in repayment of the $100M invoice and also supplier earnings to supply typically the almond beans

Purchaser requires transport of goods and techniques the soy beans directly into soy milk

Purchaser subsequently sells the soy whole milk immediately to the grocery regarding $150M

The grocery store takes up residence the $150M monthly bill quickly

Purchaser then will take often the $150M and forms the actual $100M right apart and makes any $40M profit ($150M a lesser amount of $100M less $10M to the fee of leasing the instrument) without having to present the full $100M straight up. The whole transaction primarily cost them $10M and so they managed to make $40M in the operation

Buying An SBLC

If you want to to buy a great SBLC there are many advantages along with disadvantages to be informed of. The main edge of Getting a StandBy Notice Of Credit history is which you become the public user of the musical instrument and in turn you can lease the bank guitar to a Third Bash. Considerations need to become built as the price tag of the bank device won't be cheap since the price to buy would start with about 30% plus regarding confront value. So if anyone wish to buy a StandBy Page involving Credit for $100M, the retail price to purchase would likely start close to $30M for that reason you would need for you to weigh the benefits connected with purchasing v's rental some sort of bank instrument.

1 note

·

View note

Text

Unlocking Investment Potential: Understanding the Entry Costs and Returns in Private Placement Programs (PPP)

Unlocking Investment Potential: Understanding the Entry Costs and Returns in Private Placement Programs (PPP)

Navigating Entry Costs in Private Placement Programs (PPP)

Introduction to Investment Requirements Entering Private Placement Programs (PPP) is an exclusive venture often requiring a substantial financial commitment. This article provides insights into the amount of investment required to join PPPs and how these funds are strategically utilized to generate returns.

The Investment Spectrum in Private Placement Programs

1. Varied Entry Requirements Private Placement Programs cater to a spectrum of investors, each with different financial capabilities. Entry requirements can range from millions to billions of dollars, depending on the complexity of the program and the potential returns offered. 2. High-Net-Worth and Institutional Investors PPP participants typically include high-net-worth individuals and institutional investors due to the substantial investment sums involved. This exclusivity aims to attract sophisticated investors who can navigate the complexities of these programs.

Understanding the Utilization of Investment

1. Trading Financial Instruments A significant portion of the invested funds in PPPs is often directed towards trading financial instruments, such as Bank Guarantees (BG) or Standby Letters of Credit (SBLC). These instruments serve as collateral and leverage points for generating returns through sophisticated trading strategies. 2. Leverage and Trading Strategies Program organizers strategically utilize the invested funds by leveraging financial instruments in the market. Trading strategies may involve arbitrage, platform trading, or other complex financial maneuvers to capitalize on market opportunities.

Potential Returns on Investment in PPP

1. High Returns, High Risks The allure of PPPs lies in the potential for high returns on investment. However, it's crucial to recognize that such opportunities come with inherent risks. Investors should be prepared for the possibility of market fluctuations and other uncertainties. 2. Diversified Investment Strategies Programs often deploy diversified investment strategies to maximize returns. This may include engaging in various financial markets, sectors, or geographical regions to spread risk and capture diverse opportunities.

Risk Mitigation and Due Diligence

1. Rigorous Due Diligence Investors entering PPPs must conduct rigorous due diligence. This involves scrutinizing program organizers, understanding their trading strategies, and evaluating the track record of past programs. Thorough due diligence is a key aspect of risk mitigation. 2. Legal and Financial Consultation Engaging legal and financial experts is paramount. Professionals can offer insights into the legal implications of the investment, assess the legitimacy of program organizers, and provide guidance on compliance with financial regulations.

Navigating Investment Size and Risk Tolerance

1. Aligning Investment Size with Objectives Investors should align the size of their investment with their financial objectives and risk tolerance. It's essential to strike a balance between ambitious financial goals and a realistic assessment of one's risk appetite. 2. Considering Exit Strategies Understanding exit strategies is crucial. Investors should be aware of the terms and conditions for exiting the program, ensuring they have a clear path to withdraw their funds when needed.

Conclusion: Strategic Investment for Potential Growth

Entering Private Placement Programs demands a careful consideration of investment size, risk tolerance, and due diligence. While the potential returns can be substantial, investors must navigate this exclusive financial landscape with a clear understanding of the utilization of their funds and a commitment to robust risk mitigation strategies. By approaching PPPs strategically, investors can unlock the potential for growth and capitalize on exclusive investment opportunities. Read the full article

0 notes

Text

Benefits associated with Leasing An SBLCYou will be asking what the positive

SBLC monetization

aspects are generally for leasing some sort of financial institution instrument or taking into consideration additional options than risking your own own equity to safeguarded a line of credit history?The Benefits of Rental an SBLC: It's really beneficial to trade finance Really a fine to present the Seller comfort if the Buyer not pay with regard to merchandise received It's a new good way for the Buyer to buy goods to offer on to a Consumer browsing the wings along with employ proceeds from good discounts to pay for merchandise purchased from the Retailer.How exactly does Leasing An SBLC Job?Let's say anyone are a plant transforming soy beans in to soya milk. You have a good order from the community supermarket worthy of $150M, you actually want to buy $100M worth of soy coffee beans from a Supplier, throughout your banking accounts you get $250M.You may always be troubled that with some other outgoing charges, this obtain could cause very very little money for additional bills. Instead of taking away the entire $100M through your bank account to get up as collateral for you to receive that loan to order the soy espresso beans, a person might choose another (safer) option.You could bring up the bank instrument to help show your current Supplier in which you have the economical means ready to invest in the coconut beans coming from them. This lender musical instrument will come from any Vacation Provider who can let you rent their very own collateral at claim 10% of the cost now you are only paying $10M instead of endangering $100M. By simply leasing some sort of bank guitar means an individual are a temporary lessee for one year in addition to one moment.Normally accounts are granted on a new 45, 60 or maybe three months day invoicing circuit. And so theoretically you could pick the soy beans from typically the Provider by taking out there a traditional bank instrument. This kind of would then possibly be given to the Supplier because backup should you predetermined upon settling the bill rapid this is extremely common in deal financial.In trade fund often the Supplier will want caractère by way of the bank instrument to show this should an invoice not possible be settled, they can call up on the actual instrument as well as cash this in in order to collect their transaction. In the event that this is timed accurately, the particular Purchaser of typically the soy pulses can acquire the goods, turn that into soya dairy to be able to sell onto the food store who in turn compensates often the $150M which possesses been pre-agreed plus the Dealer can in turn give the $100M (the price of the soy beans in the Supplier) within the established duration bound timelines and only chance very little of their dollars.Example Of Leasing A SBLC:Supplier sells the actual soy beans for $100MPurchaser leases a standard bank instrument at 10% associated with face value of the particular device. Therefore the charge to lease contract in this kind of case is $100M times 10% = $10M Consumer puts up the tool being a 'promise to pay' if the purchaser default in repayment of the $100M invoice and also supplier earnings to supply typically the almond beansPurchaser requires transport of goods and techniques the soy beans directly into soy milkPurchaser subsequently sells the soy whole milk immediately to the grocery regarding $150MThe grocery store takes up residence the $150M monthly bill quicklyPurchaser then will take often the $150M and forms the actual $100M right apart and makes any $40M profit ($150M a lesser amount of $100M less $10M to the fee of leasing the instrument) without having to present the full $100M straight up. The whole transaction primarily cost them $10M and so they managed to make $40M in the operationBuying An SBLCIf you want to to buy a great SBLC there are many advantages along with disadvantages to be informed of. The main edge of Getting a StandBy Notice Of Credit history is which you become the public user of the musical instrument and in turn you can lease the bank guitar to a Third Bash. Considerations need to become built as the price tag of the bank device won't be cheap since the price to buy would start with about 30% plus regarding confront value. So if anyone wish to buy a StandBy Page involving Credit for $100M, the retail price to purchase would likely start close to $30M for that reason you would need for you to weigh the benefits connected with purchasing v's rental some sort of bank instrument.

SBLC monetization

1 note

·

View note

Text

Want to avail of a lease SBLC scheme? Do you want complete transparency, excellent customer service, and a quick process? We aim to fulfill all these requirements by offering you our highest quality at the lowest possible cost. At Ganar Limited, we offer different types of lease SBLC schemes through our portfolio that fit the needs of the customers in the right way.

0 notes

Text

Genuine BG/SBLC Provider No Upfront Fee

Genuine BG/SBLC Provider No Upfront Fee

A standby letter of credit (SBLC/SLOC) is a guarantee of payment by a bank on behalf of their client. It is a loan of last resort in which the bank fulfills payment obligations by the end of the contract if their client cannot. A standby letter of credit can also be abbreviated SBLC or SLOC. A standby letter of credit is different from a bank guarantee. https://trustglobalfinance.com/ is sblc…

View On WordPress

#cost of sblc#How to Monetize SBLC#How to Obtain a Standby Letter of Credit#sblc funding#sblc funding process#SBLC Monetization#sblc monetization in us no money down#SBLC Monetization process#SBLC providers#Standby Letter of Credit providers#uses of bg sblc

0 notes