#cryptocaps

Explore tagged Tumblr posts

Text

Latest Crypto Trends & News: What's Shaping the Future of Digital Assets?

The cryptocurrency landscape is evolving rapidly, with new trends and developments shaping the industry. From regulatory advancements to technological innovations, here are the latest crypto trends you need to watch in 2025.

1. Institutional Adoption Continues to Rise

Major financial institutions and corporations are increasingly investing in cryptocurrencies. With Bitcoin ETFs gaining traction and more companies accepting crypto payments, mainstream adoption is at an all-time high. Traditional banks are also integrating blockchain technology to enhance their financial services.

2. Central Bank Digital Currencies (CBDCs) on the Rise

Governments worldwide are working on launching their own Central Bank Digital Currencies (CBDCs). Countries like China, the U.S., and the European Union are actively developing digital versions of their fiat currencies to improve financial inclusion and efficiency.

3. DeFi Expansion and Innovation

Decentralized Finance (DeFi) is revolutionizing the financial sector by offering borderless financial services. Yield farming, liquidity pools, and staking mechanisms continue to grow, providing users with alternative investment opportunities outside traditional banks.

4. NFTs and the Metaverse Evolve

While the hype around NFTs has settled, their utility continues to expand into real estate, gaming, and digital identity verification. The Metaverse is also growing, with big tech firms investing in virtual worlds where crypto transactions play a crucial role.

5. Enhanced Regulatory Frameworks

Governments and regulatory bodies are refining their stance on crypto. The introduction of stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) policies is making the industry more secure while fostering investor confidence.

6. Bitcoin Halving and Market Impact

The upcoming Bitcoin halving event is expected to influence the market by reducing the supply of new BTC, potentially driving up prices. Historical data suggests that halving events have led to significant price surges.

7. AI and Blockchain Integration

The fusion of AI and blockchain is opening up new possibilities in automation, fraud detection, and smart contract optimization. AI-driven trading bots and blockchain analytics tools are improving efficiency in the crypto market.

Conclusion

The crypto industry is advancing rapidly, with innovation, regulation, and adoption playing key roles in shaping its future. Whether you’re an investor, trader, or enthusiast, staying updated on these trends is crucial for navigating the evolving digital asset space.

0 notes

Text

Despite the cryptocurrency market majorly waiting for a red September, its results positively surprised most crypto traders, as both Bitcoin (BTC) and the Total Crypto Market Cap (CRYPTOCAP: TOTAL) closed the past month with shy gains. These results contributed to some projects accumulating even higher gains in a larger timeframe, with three cryptocurrencies from the top 100 by market capitalization more than doubling up in price year-to-date (YTD): Maker Protocol (MKR): +185% YTD, after accruing for 25% gains in September; Bitcoin Cash (BCH): +143% YTD, after surging by 13% last month; Solana (SOL): +104% YTD, but only gaining a shy 3% in September. Interestingly, all three top performers had lost more than 10% of each of their values in August. Additionally, MKR was the most steady performer since the beginning of 2023, with its best month making for 50% gains, and its worst two months for 15% losses. On the other hand, BCH had a meaningful 122% increase in price in June only, while SOL registered an amazing 140% in the first month of the year, according to data retrieved by Finbold from Coin Metrics on October 3. Top 100 Crypto Asset Returns by Month, 2023. Source: Coin Metrics MKR price analysis Notably, MKR is still showing a steady performance even on a fairly negative day for the crypto market. Trading at $1,463 at the time of publication, with 1.4% losses in the last 24 hours, while Bitcoin is losing more than 3.5% from yesterday’s price. MKR 1-day price chart. Source: Finbold BCH price analysis Meanwhile, BCH is plummeting by 7.8% intraday, trading at $235 by press time. This represents a strong hit for Bitcoin Cash investors who were betting in a continuation uptrend after surpassing Litecoin’s (LTC) in market capitalization — a position that has already been reverted with this current retrace. BCH 1-day price chart. Source: Finbold SOL price analysis The highly scalable layer-1 blockchain is also the less volatile digital asset today among the three best performers in 2023. SOL 1-day price chart. Source: Finbold SOL is changing hands by $24.25 at the time of publication, with neutral price results, not varying much from the $24.38 registered 24 hours ago. The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

0 notes

Text

Bitcoin caps

Bitcoin is all,in my head.

#my caps#anime caps#cryptocaps#bitcoinmerch#blockchainhats#bitcoinhats#cryptomerchandise#cryptoapparel#cryptofashion#hodlswag#digitalcurrencyhats#cryptoclothing

1 note

·

View note

Photo

Total Crypto Market Cap Reenters Monthly RSI Bull Zone

0 notes

Text

Here’s The Line Separating Bitcoin Dominance From Altcoin Season

Here’s The Line Separating Bitcoin Dominance From Altcoin Season

For months, Bitcoin stole the show when it came to crypto, sucking the capital out of the <a class="wpg-linkify wpg-tooltip" title=" Altcoin Altcoin is defined as any cryptocurrency except for Bitcoin. “Altcoin” is a combination of two words: “alternative Bitcoin” or “alternative coin”. There are over 1,500 altcoins with many more planned for release. » Read more ”…

View On WordPress

#Altcoin Season#Altcoins#bitcoin#bitcoin dominance#btc#btc.d#btcusd#BTCUSDT#crypto#cryptocap-btc.d#NewsBTC#TCRNews#thecryptoreport#xbt#xbtusd

0 notes

Text

Crypto market cycles will be different from the past

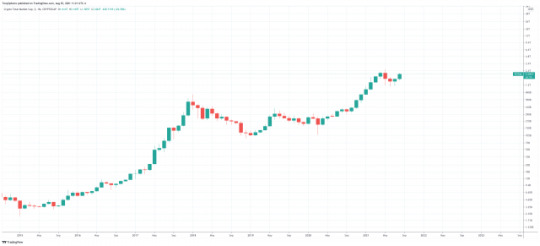

Looking at historic data like the rainbow chart, bitcoin dominance, total market cap and number of coins/tokens in the crypto world, I'd say the bear and bull markets coming will be substantially different from the past.

Let's look at some charts.

Bitcoin Rainbow Price Chart

(Source: https://www.blockchaincenter.net/bitcoin-rainbow-chart)

MARKET CAP BTC DOMINANCE, % (CALCULATED BY TRADINGVIEW)

(Source: https://www.tradingview.com/symbols/CRYPTOCAP-BTC.D)

Total Cryptocurrency Market Cap

(Source: https://coinmarketcap.com/charts)

Number of cryptocurrencies worldwide from 2013 to November 2021

(Source: https://www.statista.com/statistics/863917/number-crypto-coins-tokens)

My analysis:

Rainbow chart: Given the dispersion of projects and retail, it is likely bitcoin chart won't touch the red zone nor the blue. Will be more stable.

Dominance chart: Normally after a low BTC dominance comes a bear market. That was before binance (and BNB), before Cryptodotcom (and CRO) and before many game changing projects. Latest BTC dominance before a bear market was 40 in January 2018. Think next bear market won't come before BTC dominance reached 20 or so.

Market cap: Last bear market brought the market cap down from 900M to 150M USD. Next one will probably bring the market cap down from 5T to 1 T USD. It means that we won't see our portfolio lowering more than 50% from what we have today if we didn't take too much risk.

Number of projects: This is where I think we will have a substantial correction and a lot of non sense out there will have to disappear.

Conclusion:

We shall remain bullish!

submitted by /u/jmlinpt [link] [comments]

from Cryptocurrency News & Discussion https://www.reddit.com/r/CryptoCurrency/comments/r6opkk/crypto_market_cycles_will_be_different_from_the/ via IFTTT

0 notes

Text

比特幣得到第16名地球's最大外匯,什麼's未來_ _ 台幣虛擬貨幣操盤專家

供應:CRYPTOCAP-BTC on TradingView.comBitcoin alone現在價值額外比大多數公開交易的公司,軌跡正確在特斯拉的後方。 一個特殊 BTC甚至可以買在這個階段.但是比較加密貨幣反對公開交易的企業股票是拉伸。 作為替代,加密貨幣應該被相對與地球,代表的法定貨幣相比一些最強大國家.比特幣是最即時反對和在競爭力與這些其他貨幣,而不是公司像特斯拉或蘋果。 在這個比較中,比特幣的重要和快速發展行業目前上限可以製造加密貨幣社區第十六名最大行���。 FTX Cap,在知名加密貨幣率聚合器硬幣行業上限,比特幣現在在16日現貨在terms整體地球貨幣。 major-ranked加密資產在conditions of overall價值。 立即以上高的,是俄羅斯盧布、瑞士法郎和泰銖——有外匯形象那個好像一個很多像比特幣。 比特幣現在16在record of prime法幣|Source: Fiat 現行情上限 上面有塞滿以一般美元:澳、台、港香港,加拿大和美國。 你會找到還有台幣、英鎊、盧比、里拉、日元和台幣。 關聯 通讀|GOOGLE FINANCE NOW LISTS BITCOIN Very firstForward OF Major 貨幣交易 CURRENCIES 此時,台幣是主要外匯最價值分佈跨越世界,即使儘管美國美元演藝為國際儲備貨幣。 Binance 。非主權外匯會收益所有,不是一個人標誌地方。而指定比特幣的突然尖銳的軌跡,它可能只是一個有任何區別時間提前在這個checklist。 精選印象來自存款圖片,圖表來自TradingView.com

0 notes

Text

Crypto analytics platform Arkham Intelligence claims to have found on-chain addresses associated with the Grayscale bitcoin Trust. This revelation comes amidst the ongoing battle between asset management firm Grayscale and the United States Securities and Exchange Commission (SEC) over converting the bitcoin Trust into a spot exchange-traded fund (ETF). The Grayscale bitcoin Trust, with the ticker GBTC, is an Investment product that offers investors exposure to bitcoin without having to purchase or hold the Cryptocurrency directly. In the wake of its recent victory against the SEC, the asset manager is looking – and might be able – to transform its GBTC product into a spot ETF. On Wednesday, the 6th of September, Bitcoinist reported that Grayscale’s legal counsel wrote to the Securities and Exchange Commission, urging the regulatory body to reconsider its stance on the conversion of Grayscale bitcoin Trust into an exchange-traded fund following the latest court decision. Each Wallet Holds Less Than 1,000 BTC, Arkham Says In a series of posts on the X (formerly Twitter) platform, Arkham Intelligence revealed that the Grayscale bitcoin Trust holdings are spread across over 1,750 wallet addresses. Each address reportedly holds less than 1,000 BTC (worth around $25.7 million). Although Arkham did not provide a full list of the GBTC-linked addresses, it labeled some wallets in the provided transaction history. The platform’s data dashboard also shows that the asset management firm holds 627,779 BTC (worth over $16 billion). It is worth noting that this balance aligns with the amount claimed on Grayscale’s website, meaning that the firm keeps sufficient bitcoin to fulfill withdrawals – should the need arise. Additionally, the revealed holdings place Grayscale bitcoin Trust as the second-largest bitcoin entity in the world. While Grayscale publicly reports the company’s balances, it has always refused to reveal the on-chain addresses of its bitcoin Trust. However, it seems that Arkham’s discovery might end long-term speculations about the Security status of the crypto asset manager. What Other Crypto Is Grayscale Stashing? Earlier in September, Arkham disclosed that the Grayscale Ethereum Trust is the second-largest ETH entity in the world, with its holdings spread across over 500 addresses. According to the platform’s data dashboard, Grayscale holds 3.026 million ETH valued at about $4.95 billion. Related Reading: BREAKING: ARK Invest Files For First Ethereum Spot ETF Besides the two largest cryptocurrencies in the Market, the asset management firm appears also to be stockpiling other Crypto Tokens, including Chainlink (LINK), Polygon (MATIC), Uniswap (UNI), Avalanche (AVAX), Synthetix (SNX), and Curve (CRV). Notably, LINK comes after Ethereum and bitcoin in Grayscale’s most valuable crypto holdings list. The company owns about 301,488 LINK tokens valued at $1.9 million at the current Market Price. The Cryptocurrency total Market cap on the daily timeframe | Source: CRYPTOCAP chart on TradingView

0 notes

Text

BTC-Dominanz mit Bodenbildungstendenzen, Gesamtmarkt läuft seitwärts

BTC-Dominanz mit Bodenbildungstendenzen, Gesamtmarkt läuft seitwärts

Die Bitcoin-Dominanz versucht momentan einen Boden auszubilden und die Konsolidierung der letzten Wochen zu beenden. Gewinnmitnahmen sorgen am Gesamtmarkt für eine Verschnaufpause.

Marktkapitalisierung: Gewinnmitnahmen verhindern Durchmarsch bis an die 387 Milliarden US-Dollar

Gesamtmarktkapitalisierung auf Basis von Werten von Cryptocap dargestellt

In den letzten sieben Tagen versuchte die…

View On WordPress

0 notes

Photo

Five Signs That Say Altcoin Season Hasn't Even Started Yet

0 notes

Text

Here’s The Line Separating Bitcoin Dominance From Altcoin Season

Here’s The Line Separating Bitcoin Dominance From Altcoin Season

For months, Bitcoin stole the show when it came to crypto, sucking the capital out of the <a class="wpg-linkify wpg-tooltip" title=" Altcoin Altcoin is defined as any cryptocurrency except for Bitcoin. “Altcoin” is a combination of two words: “alternative Bitcoin” or “alternative coin”. There are over 1,500 altcoins with many more planned for release. » Read more ”…

View On WordPress

#Altcoin Season#Altcoins#bitcoin#bitcoin dominance#btc#btc.d#btcusd#BTCUSDT#crypto#cryptocap-btc.d#NewsBTC#TCRNews#thecryptoreport#xbt#xbtusd

0 notes

Photo

Manifold Co-Founder On How To Keep NFTs Safe From Hackers https://bitcoinist.com/manifold-co-founder-on-how-to-keep-nfts-safe-from-hackers/?utm_source=rss&utm_medium=rss&utm_campaign=manifold-co-founder-on-how-to-keep-nfts-safe-from-hackers

The co-founder of Manifold.xyz – a platform for NFTs – who goes by the Twitter handle @richerd has recently written a Twitter thread which exposes the tactics used by hackers to steal funds and NFTs from crypto wallets. As the go-to guy for crypto wallet security he has a lot of experience in dealing with hackers and ensuring safety of wallets.

And since I am personally a victim of a wallet hack where my funds and some NFTs were stolen, I can only emphasize on the importance of knowing how to keep wallets safe and avoid the pain of loosing your portfolio.

Related Reading: Understanding The Recent NFT Hype

Ways Hackers Compromise Crypto Wallet To Steal NFTs & Necessary Precautions

Phishing Websites

This is a common tactic where hackers lure users to a legitimate looking website with the promise of free NFTs. Once a user tries to connect his Metamask to the website, a fake error is generated which prompts the user into entering his seed phrase. Once the user has access to your seed phrase he can gain control to your wallet and steal all your funds and NFTs.

Another way these hackers lure a user to their phishing website is by acting as support in the Telegram and Discord pages of tokens. They then lure users seeking support through private messages that ask the user to visit the phishing websites and connect their wallets to it.

Precaution: Never ever type your seed phrase. You should write your seed phrase in a piece of paper, store it safely and forget about it.

Screen Share

If a user is screen sharing there is an option in Metamask to reveal the seed phrase. Hackers often lurk as customer support staff in the social pages of tokens such as Telegram and Discord. They will tell the user that they will “debug” their systems by using screen share and to follow a set of instructions which would reveal the user’s seed phrase to the hacker.

Precaution: Using hardware wallets is the safest method to store your crypto and NFTs.

Stealing crypto and NFTs become more interesting as the market cap balloons | Source: CRYPTOCAP-TOTAL on TradingView.com

Remote Access

There are software which install backdoors to a user’s computer and gives hackers access to the user’s file system, computer memory and screen. Users should only install software after careful consideration and checking their validity. Users should never open random files and software.

Precaution: Never open suspicious files and use a hardware wallet

Related Reading: Get the Most out of Social Media with the Weentar Blockchain Platform

Social Engineering

As per Wikipedia and in the context of cyber security, social engineering can be explained as the psychological manipulation of users into performing actions or divulging confidential information. It is a type of confidence trick for the purpose of gathering information, fraud or system access. Unlike traditions “con”, social engineering requires a set of many steps.

In terms of crypto, attackers will manipulate the user by acting as a trusted individual and ask for Ethereum or some other token from the user in the pretext that the trusted individual’s account is unavailable or have reached their limit.

Precaution: Never send out funds or NFTs to any person without verifying their identity.

Physical Hardware Attack

In this type of attack, the hacker will try to gain physical access to your system and thus reveal your seed phrase. There are also external devices such as a USB which can be plugged into the target computer to gather information. There have also been incidences when the attacker has physically stolen the laptop and run away with it.

Precaution: Using hardware wallets and storing them safely is the best way to store valuable funds and NFTs. Never leave your computer unattended and always be attentive when you are outside.

Supply Chain Hack

This kind of attack on hardware wallets are common where the attacker creates a website to sell hardware wallets that have a pre-loaded key through which the attacker can drain your funds and NFTs.

Precaution: Always buy hardware wallets directly from the manufacturer.

Featured image by iStockPhoto, Charts from TradingView.com

0 notes

Video

youtube

CryptoCap.Pro | Earn Free Bitcoin New Mining Site | Earn Daily 20$ Live ...

#cryptocap.pro#cryptocap#cryptocap review#cryptocap legit#cryptocap payment proof#earn#free#bitcoin#btc#urdu#hindi#arslan nasir#2019#bitcoin earn#bitcoin mining

0 notes

Text

Bitcoin prices jump 10% following US$100,000,000 Tether print run

Tether is a so-far inextricable part of the cryptocurrency markets, so it's well worth knowing how it works. There's never a dull moment with Tether, especially now that it has printed off a cool US$100 million. It's reasonable to assume that this will impact Bitcoin prices. The printing run is almost certainly related to the recent Bitcoin price rise and is most likely related to Bitcoin rising back from under $10,000. The Tether printing press has naturally been quite busy lately, but printing runs of $100 million all at once are quite uncommon. Here's what happened last time Tether printed off as much as $100 million in one go. BTC/USD chart by TradingView Most zoologists agree that this is very bull-like behaviour. Wait, is this price manipulation? How does Tether actually work? Tether (USDT) is a collateralised stablecoin cryptocurrency. Its price floats, but it's theoretically backed by real money and each Tether is supposedly redeemable for US$1. This is why its price hangs around the $1 mark. The idea is that when big money folks want to buy a lot of crypto, they go to Tether and buy a lot of USDT with fiat currency. Now, Tether has long been at the centre of price manipulation allegations for two main reasons. There's an undeniable mathematical correlation between Bitcoin price rises and Tether printing runs. After doing a lot of in-depth analysis, mathematicians have agreed that this is deeply mathematically suspicious.For a long time, Tether's behaviour in the face of these allegations was frankly just ridiculously suspicious. After putting these two considerations together, a lot of people decided that Tether was just printing fake money in order to pump Bitcoin prices. In other words, there actually weren't any big money folks visiting Tether, and that it was just controlling the Bitcoin markets by printing and dumping USDT whenever it felt like it. That would very much be price manipulation. But that's also not what's happening. Authorities had no intention of letting such rampant weirdness go unaddressed, and in April 2019, it was revealed that the New York Attorney General's Office had been investigating Tether and the affiliated Bitfinex cryptocurrency exchange. Tether's reserves were naturally a large focus of the investigation. But in a fairly surprising turn of events, one of the things the investigation turned up was that, minus some relatively honest mishaps, Tether was actually fully backed. In other words, big money folks actually are visiting Tether and handing over giant wads of fiat in exchange for USDT. So that's what's happening here. What it all means Whenever Tether fires up the printing press, it means it's helping fulfill big money demand for cryptocurrency usually Bitcoin. That we have such large Tether printing runs going now means there's a lot of buyer interest. This can result in Bitcoin price rises, in part because people trade on Tether activity as a market indicator and in part because buying simply makes prices rise. It's not price manipulation it's a loosely-regulated low-liquidity market at its finest. The Tether printing press actually batches orders, so you can't say for sure that each printing run is or isn't an individual buyer or multiple buyers. As such, the best way to interpret the size and frequency of Tether's print runs is probably as an ongoing gauge of whether more money is flowing into or out of crypto. Conveniently, because of its floating peg around $1 each, you can just use the Tether market cap for an easy sense of how much traffic there is between the fiat and crypto worlds in general. As a rule of thumb, when the USDT market cap goes up, it means more money is flowing from fiat to crypto. When the USDT market cap drops, it means more money is flowing from crypto to fiat. It's a bit rough because USDT prices float, Tether isn't the only stablecoin in town and there are other factors in play here, but its correlation with Bitcoin price moves says it's a decent enough indicator. Here's a lightly editorialised look at the last 12 months of BTC prices (gold) next to USDT market cap (green). CRYPTOCAP USDT chart by TradingView Which way is Bitcoin going next? No one knows for sure which way Bitcoin prices are going next, but Tether's activity might provide a hint for anyone who's trying to guess whether the recent pullback from $14,000 is the start of a crash or whether it's just a temporary readjustment. Right now, Tether is loudly suggesting that there are more rises to come. https://www.finder.com.au/bitcoin-prices-jump-10-following-us100000000-tether-print-run

0 notes

Text

Bitcoin-Dominanz nähert sich tiefstem Stand seit einem Jahr

Bitcoin-Dominanz nähert sich tiefstem Stand seit einem Jahr

Die Schwäche der BTC-Dominanz hält auch diese Woche weiter an. Die bullishe Entwicklung am Gesamtmarkt steigert die Chancen für eine anhaltenden bullishe Kursralllye.

Marktkapitalisierung: Bullen haben Hoch von 2019 fest im Blick

Gesamtmarktkapitalisierung auf Basis von Werten von Cryptocap dargestellt

Nachdem die Gesamtmarktkapitalisierung Ende Juli den Ausbruch aus dem blauen…

View On WordPress

0 notes

Photo

Here's The Line Separating Bitcoin Dominance From Altcoin Season

#AltcoinSeason#altcoins#bitcoin#bitcoindominance#btc#btc.d#btcusd#BTCUSDT#crypto#cryptocap-btc.d#xbt#xbtusd

0 notes