#cryptocurrency advisor jobs

Text

LETTERS FROM AN AMERICAN

August 2, 2023

HEATHER COX RICHARDSON

AUG 3, 2023

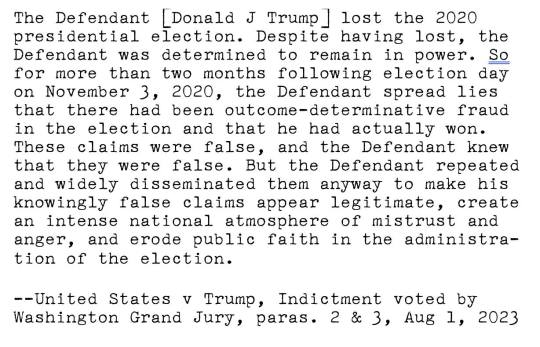

There have been more developments today surrounding yesterday’s indictment of former president Trump for conspiring to defraud the United States, conspiring to disenfranchise voters, and conspiring and attempting to obstruct an official proceeding as he tried to overturn the results of the 2020 election and install himself in office over the wishes of the American people.

Observers today called out the part of the indictment that describes how Trump and Co-Conspirator 4, who appears to be Jeffrey Clark, the man Trump wanted to make attorney general, intended to use the military to quell any protests against Trump’s overturning of the election results. When warned that staying in power would lead to “riots in every major city in the United States,” Co-Conspirator 4 replied, “Well…that’s why there’s an Insurrection Act.”

The Insurrection Act of 1807 permits the president to use the military to enforce domestic laws, invoking martial law. Trump’s allies urged him to do just that to stay in power. Fears that Trump might do such a thing were strong enough that on January 3, 2021, all 10 living former defense secretaries signed a Washington Post op-ed warning that “[e]fforts to involve the U.S. armed forces in resolving election disputes would take us into dangerous, unlawful and unconstitutional territory.”

They put their colleagues on notice: “Civilian and military officials who direct or carry out such measures would be accountable, including potentially facing criminal penalties, for the grave consequences of their actions on our republic.” Josh Marshall at Talking Points Memo recalled today that military leaders told Congress they were reluctant to respond to the violence at the Capitol out of concern about how Trump might use the military under the Insurrection Act.

Political pollster Tom Bonier wrote: “I understand Trump fatigue, but it feels like the president and his advisors preparing to use the military to quash protests against his planned coup should be bigger news. Especially when that same guy is in the midst of a somewhat credible comeback effort.”

On The Beat tonight, Ari Melber connected Trump Co-Conspirator John Eastman to Senator Ted Cruz (R-TX). Just before midnight on January 6, 2021, after the attack on the U.S. Capitol, Eastman wrote to Pence’s lawyer to beg him to get Pence to adjourn Congress “for 10 days to allow the legislatures to finish their investigations, as well as to allow a full forensic audit of the massive amount of illegal activity that has occurred here.” On the floor of the Senate at about the same time, Cruz, who voted against certification, used very similar language when he called for “a ten-day emergency audit.”

An email sent by Co-Conspirator 6, the political consultant, matches one sent from Boris Epshteyn to Trump lawyer Rudy Giuliani, suggesting that Epshteyn is Co-Conspirator 6. The Russian-born Epshteyn has been with Trump’s political organization since 2016 and was involved in organizing the slates of false electors in 2020. Along with political consultant Steve Bannon, Epshteyn created a cryptocurrency called “$FJB, which officially stands for “Freedom. Jobs. Business.” but which they marketed to Trump loyalists as “F*ck Joe Biden.” By February 2023, Nikki McCann Ramirez reported in Rolling Stone that the currency had lost 95% of its value.

Since the indictment became public, Trump loyalists have insisted that the Department of Justice is attacking Trump’s First Amendment rights to free speech. Indeed, if Giuliani’s unhinged appearance on Newsmax last night is any indication, it appears that has been their strategy all along. Aside from the obvious limit that the First Amendment does not cover criminal behavior, the grand jury sidestepped this issue by acknowledging that Trump had a right to lie about his election loss. It indicted him for unlawfully trying to obstruct an official proceeding and to disenfranchise voters.

Today, Trump’s former attorney general William Barr dismissed the idea that the indictment is an attack on Trump’s First Amendment rights. Barr told CNN’s Kaitlan Collins: “As the indictment says, they're not attacking his First Amendment right. He can say whatever he wants. He can even lie. He can even tell people that the election was stolen when he knew better. But that does not protect you from entering into a conspiracy. All conspiracies involve speech. And all fraud involves speech. Free speech doesn't give you the right to engage in a fraudulent conspiracy.”

Rudy Giuliani has his own troubles in the news today, unrelated to the attempt to overturn the results of the 2020 election. His former assistant Noelle Dunphy is suing him for sexual harassment and abuse, and new transcripts filed in the New York Supreme Court of Giuliani’s own words reveal disturbing fantasies of sexual domination that are unlikely to help his reputation. (Historian Kevin Kruse retweeted part of the transcript with the words, “Goodbye, lunch.”)

The chaos in the country’s political leaders comes with a financial cost. According to Fitch Ratings Inc., a credit-rating agency, the national instability caused by “a steady deterioration in standards of governance over the last 20 years” has damaged confidence in the country’s fiscal management. Yesterday it downgraded the United States of America’s long-term credit rating for the second time in U.S. history.

Fitch cited “repeated debt-limit political standoffs and last-minute resolutions,” “a complex budgeting process,” and “several economic shocks as well as tax cuts and new spending initiatives” for its downgrade. The New York Times warned that the downgrade is “another sign that Wall Street is worried about political chaos, including brinkmanship over the debt limit that is becoming entrenched in Washington.”

The timing of the downgrade made little sense economically, as U.S. economic growth is strong enough that the Bank of America today walked back earlier warnings of a recession. Treasury Secretary Janet Yellen noted that the key factors on which Fitch based its downgrade had started in 2018 and called the downgrade “arbitrary.” The editorial board of the Washington Post called the timing “bizarre.” But the timing makes more sense in the context of the fact that House Republicans could not pass 11 of 12 necessary appropriations bills before leaving for their August recess.

The White House said it “strongly disagree[d]” with the decision to downgrade the U.S. credit rating, noting that the ratings model Fitch used declined under Trump before rebounding under Biden, and saying “it defies reality to downgrade the United States at a moment when President Biden has delivered the strongest recovery of any major economy in the world.” But it did agree that “extremism by Republican officials—from cheerleading default, to undermining governance and democracy, to seeking to extend deficit-busting tax giveaways for the wealthy and corporations—is a continued threat to our economy.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Trump indictment#political#Letters From An American#Heather Cox Richardson#conspiracy#Trump Indictment#co-conspirators

10 notes

·

View notes

Text

A COMPREHENSIVE MANEUVER TO UNDERSTAND THE JOB OF TRADING

Trading is a financial action that requires buying plus selling goods, solutions, or securities in different environments like share markets, forex, and cryptocurrency. Despite the potential rewards, buying and selling is a diverse endeavor that involves calculated risks, great timing, in-depth study, and informed decision-making.

Trading typically comes into two types: short-term and long lasting. Short-term trading, or day-trading, involves getting and selling stocks and shares or other possessions about the same day, resulting in quick income or losses. Long lasting trading, yet , permits the trader to hold onto an investment for several yrs, thus taking advantage of steady appreciation, dividends, and interest. Both forms contain numerous methods and require different skill sets and risk tolerances.

Regardless of whether one should engage in short-term or long term trading depends upon what individual’s financial goals, threat tolerance, and period commitment. Both varieties of trading need serious deliberation ahead of investing. Beginners should start slowly, commit only what they have enough money to drop, and talk to successful traders or economic advisors if necessary.

The world involving trading is largely influenced by marketplace trends and economic indicators. This can include business earnings reports, GDP growth rates, main bank policy judgements, and other geopolitical events. A veteran trader always stays on updated on these market trends and even can really interpret all of them to guide their own future decisions.

https://story-coin.com/ An aspect of buying and selling that is generally overlooked is controlling emotions. Traders can easily experience a painting tool coaster of emotions – through the excitement of a successful trade to the particular disappointment of the loss. It is essential in order to keep emotions in check and make rational decisions based about market indicators and even investment strategies. Mental trading often qualified prospects to impulsive judgements and increased risk.

In conclusion, investing is not only about capitalizing on market trends but also about developing robust tactics, managing risks, and maintaining discipline. It needs constant learning, researching, and a great deal of persistence. With the best approach, trading can be a rewarding activity, fostering economical growth and self-reliance. Hence, potential traders should venture into this world with diligence and care.

1 note

·

View note

Text

How Fintech is Disrupting the Industry and Why Your Distance Learning MBA Needs to Keep Pace

The world of finance is experiencing a revolution. Forget brick-and-mortar banks and cumbersome paperwork – the future is all about Fintech, a dynamic blend of finance and technology. From mobile payments and robo-advisors to blockchain and cryptocurrency, Fintech is transforming the way we manage money, invest, and conduct financial transactions.

What is Fintech and Why Should You Care?

Fintech companies are leveraging innovative technologies to provide faster, more convenient, and often more affordable financial services. This disrupts the traditional financial landscape dominated by established institutions. Whether you're a seasoned investor, a budding entrepreneur, or simply someone looking to manage your personal finances more effectively, Fintech has the potential to impact your financial journey.

The Fintech Revolution and the Distance Learning MBA

But here's the reality check: a traditional finance MBA curriculum might leave you unprepared for the future of finance. While core financial principles remain valuable, the rise of Fintech demands a new skillset. Thankfully, a distance learning MBA program can offer you the flexibility to pursue your education while staying on top of industry trends. Here's what a forward-thinking program with a focus on Fintech should provide:

Understanding the Fintech Landscape: Gain a comprehensive understanding of major Fintech trends, including blockchain technology, artificial intelligence (AI), and machine learning. Learn how these technologies are reshaping various financial sectors, from payments and lending to wealth management and investment banking, all through the convenience of a distance learning format.

Data Analytics and Big Data Skills: In today's data-driven world, the ability to collect, analyze, and interpret financial data is crucial. A good distance learning MBA program will equip you with the skills needed to leverage big data for informed investment decisions, risk management, and market analysis, regardless of your location.

Cybersecurity and Regulatory Frameworks: As Fintech solutions soar, understanding cybersecurity threats and evolving regulatory frameworks is vital. Your distance learning MBA program should address these concerns, preparing you to navigate the complexities of data security and regulatory compliance in the digital age, all from the comfort of your home.

Innovation and Entrepreneurship: The future of finance lies in innovation. A strong Fintech MBA program should foster a culture of innovation and entrepreneurship, even in a distance learning environment. Look for programs that offer courses on developing Fintech solutions, navigating venture capital funding, and building disruptive businesses within the financial sector, without sacrificing valuable work experience.

Why is a Fintech-Focused Distance Learning MBA Important for Your Career?

By acquiring these specialized skills through a distance learning program, you'll position yourself as a highly sought-after professional in the ever-evolving financial landscape. Here's how a Fintech MBA can benefit your career:

Increased Job Prospects: Fintech companies are searching for individuals with a blend of financial expertise and technological know-how. An MBA with a Fintech focus will make you a strong candidate for exciting new roles in areas like digital banking, wealthtech, and blockchain technology adoption, all while maintaining your current work schedule with the flexibility of a distance learning program.

Competitive Advantage: In a crowded job market, demonstrating knowledge of Fintech trends and the ability to adapt to technological advancements will give you a significant edge over traditional finance graduates, without sacrificing valuable time commuting to a physical campus.

Future-Proofing Your Career: The rise of Fintech is not a fad; it's a paradigm shift. Equipping yourself with the necessary skills through a distance learning MBA ensures your financial expertise remains relevant and in demand for years to come.

The Final Word: Embrace the Future, on Your Terms

The financial world is being reimagined, and the Finance MBA needs to follow suit. By embracing Fintech and incorporating it into the curriculum, business schools can prepare distance learning MBA graduates for the exciting opportunities and challenges that lie ahead. So, if you're considering a Finance MBA, make sure you choose a program that keeps pace with the evolving landscape – a program that allows you to become a leader, not a follower, in the age of Fintech, all on your terms through the flexibility of a distance learning format.

0 notes

Text

London 2022: Victoria Pendleton Aiming For Triple Gold

You’ll also have the option to decide on the kinds of investments you wish to make once you fund the IRA. Many individuals consider it a superb proposition to get advice from the same advisors as the millionaires. Non-biased financial advisors suggest holding a proportion in tangible treasured metals to be properly diversified. But the properly-run ones are very rewarding in the long run. There are all forms of self directed retirement plans that may buy valuable metals including Traditional IRA, Roth IRA, HSA, SEP IRA, Easy IRA, and Individual 401(k). Contact your advisor to see which plans most accurately fits your wants. While you retire, your job revenue will cease, however when you ready properly for your submit-working days, you may have very worthwhile assets - rental actual estate holdings, for example - lined as much as help you. A handy regularly requested query space takes you with the essentials of having a gold or silver IRA as well as lets you figure out if shopping for rare-earth elements is best for you. IRA-Authorized Merchandise are required to meet a minimum fineness normal. Name the quantity on the Coin IRA webpage to talk to a specialist about opening a cryptocurrency IRA.

Ethereum (ETH) - Created by Vitalik Buterin in its place to Bitcoin however has grow to be considered one of the preferred cryptocurrencies due to its good contract capabilities. more information provide insurance for digital assets. You may also see the charges you are paying by way of Private Capital’s Retirement Payment Analyzer. In the event you made a distribution of your IRA funds, paid the penalties and taxes, and then determined to buy gold along with your web earnings, your purchasing power can be significantly decrease. The tax perk that gives you full access to your contributions also turns them into a strong pot of tax-free cash come retirement - if these contributions are left invested. We’ll share much more in the following couple of sections, so proceed checking out! Gold in bodily type attracts lots of storage costs as a result of the necessity for extra security to forestall robberies.

Gold IRAs are one method to convey diversification to a retirement portfolio that may in any other case rely too closely on traditional paper belongings. Within your IRA you possibly can select from more than 60 pre-built portfolios referred to as “pies” (a reference to portfolio pie charts) or build your personal technique. The truth about monetary safety in retirement, these ads trumpeting gold and silver IRAs on conservative-leaning Television channels and from news shops can sound pretty convincing. While the two might sound the identical, there are key variations between a gold IRA rollover and a gold IRA transfer. Since your current tax bracket is higher than your future tax bracket, it makes sense to take the earnings tax deduction now. GoldCo offers high-notch customer service, and the customer critiques showcase that. Better Enterprise Bureau. The very best half is that they provide a free gold IRA data kit so you possibly can learn more about how gold may also help protect your retirement savings. This compensation may impression how and the place merchandise seem on this site (including, for example, the order wherein they appear). A Roth IRA is solely an account to put your investments, things like stocks, bonds, and cash. With that stated, the process is a bit totally different.

Valuable metals owned by someone privately and saved at residence or in a safe deposit field aren't recognized as a part of an IRA. You find that actual estate, antiques, collectibles, artwork, and many others. additionally fall below the gold IRA umbrella. With a self-directed IRA, you may buy IRS-accredited metals and tangible property like art, collectibles, and real estate. 7. Can I entry my precious metals in individual, at any time? They’re designed with financial savings and investments in thoughts, and most employers provide their employees options to open an IRA account. Whether or not the situation improves or deteriorates will not have an effect on those fore-sighted sufficient to have moved some of their savings to a gold IRA.

1 note

·

View note

Text

Payroll Services In Bangalore

INTRODUCTION :-

As we step into the year 2024, the landscape of personal finance continues to evolve in response to global economic shifts, technological advancements, and societal changes. Navigating these dynamic financial waters requires a strategic and adaptable approach to ensure your financial well-being. Whether you're aiming to grow your wealth, manage debt, or simply achieve greater financial stability, the following personal finance tips for 2024 are designed to provide practical guidance in an ever-changing financial environment.

1. Review and Update Your Budget :-

As we embark on a new year, it's prudent to review and update our budgets, a fundamental practice in maintaining financial health. A budget is more than just a financial plan; it's a dynamic tool that should adapt to the changes in our lives. Start by scrutinizing your income sources, noting any adjustments or additions. Whether it's a new job, a side hustle, or a change in salary, accurately reflecting your income ensures your budget remains realistic. Next, dive into your fixed expenses – housing, utilities, insurance, and the like. Confirm if any of these costs have fluctuated, and adjust your budget accordingly. Variable expenses, from groceries to entertainment, merit careful examination. Identifying spending patterns allows for a nuanced approach, making room for lifestyle choices while adhering to financial goals.

2. Explore New Investment Opportunities :-

In the ever-evolving landscape of personal finance, exploring new investment opportunities is a vital strategy for financial growth. As we enter 2024, various emerging trends and sectors present potential avenues for investment. Technology continues to be a forefront consideration, with opportunities in areas like artificial intelligence, renewable energy, and blockchain. Cryptocurrencies, despite their volatility, have gained mainstream acceptance, offering an alternative asset class for those with a higher risk appetite. Sustainable and ethical investing is another burgeoning field, aligning financial goals with social and environmental impact. Keep an eye on sectors that show resilience and innovation, such as biotechnology and clean energy. Additionally, global trends in areas like e-commerce and digital payments can offer diverse investment prospects.

3. Embrace Technology for Financial Management :-

In the digital age of personal finance, embracing technology for financial management is not just a convenience but a strategic necessity. As we progress into 2024, an array of advanced tools and applications are available to streamline various aspects of financial management. Personal finance apps can assist in budgeting by automatically categorizing expenses, providing real-time spending insights, and offering alerts for upcoming bills. Mobile banking apps enable users to monitor account activity, transfer funds, and even deposit checks from the convenience of their smartphones. Furthermore, investment platforms equipped with robo-advisors utilize algorithms to provide automated, low-cost portfolio management, making investing more accessible for a broader audience.

4. Focus on Financial Wellness :-

In the intricate tapestry of personal finance, the concept of financial wellness has emerged as a holistic approach to achieving not just monetary stability but overall prosperity. As we traverse the landscape of 2024, it becomes increasingly evident that focusing on financial wellness is paramount. Beyond mere budgeting and investment strategies, financial wellness encompasses a broader spectrum, including managing stress related to finances, nurturing a healthy work-life balance, and addressing the interplay between physical and financial health. This involves cultivating a mindset that views money as a tool to enhance life rather than a source of constant stress.

5. Stay Informed About Tax Changes :-

Remaining informed about tax changes is a fundamental aspect of proactive financial management, and as we embark on 2024, it becomes increasingly crucial. Tax regulations are dynamic, subject to alterations that can significantly impact personal finances. Staying abreast of these changes empowers individuals to optimize their tax strategies, potentially reducing liabilities and maximizing returns. Key areas to monitor include adjustments in income tax brackets, alterations to deductions and credits, and changes in retirement account contribution limits. Additionally, it's essential to stay informed about any modifications in tax deadlines or reporting requirements.

6. Prioritize Emergency Savings :-

Prioritizing emergency savings is a cornerstone of sound financial planning, and as we step into 2024, its importance remains steadfast. An emergency fund serves as a financial safety net, providing a buffer against unexpected expenses or sudden income disruptions. Ideally, this fund should cover three to six months' worth of living expenses, offering peace of mind in times of unforeseen challenges such as job loss, medical emergencies, or unexpected home repairs. The economic uncertainties that persist highlight the critical role of emergency savings in maintaining financial resilience. Reevaluate the current status of your emergency fund, ensuring it aligns with your current financial situation and future goals.

7. Evaluate and Optimize Debt :-

Evaluating and optimizing debt is an essential aspect of financial well-being, especially as we enter the new year. While some level of debt is often a part of financial life, it's crucial to assess its impact and take steps to manage it effectively. Begin by compiling a comprehensive list of all outstanding debts, including credit cards, loans, and any other financial obligations. Examine the interest rates associated with each debt, prioritizing those with higher rates for accelerated repayment. Consider debt consolidation as a strategy to streamline payments and potentially secure a lower overall interest rate.

8. Set Realistic Financial Goals :-

Setting realistic financial goals is a fundamental step towards building a secure and fulfilling financial future, and as we step into 2024, it gains renewed significance. Begin by conducting a comprehensive assessment of your current financial situation, taking into account your income, expenses, and existing savings. Clearly define short-term, medium-term, and long-term goals, ensuring they align with your life aspirations and financial capacity. Short-term goals might include building an emergency fund or paying off high-interest debt, while medium and long-term goals could involve saving for a home, education, or retirement.

0 notes

Text

Investment

The Art of Smart Investing: Building Wealth for the Future

In a world of financial opportunities, investing stands out as a powerful tool for building wealth and securing a financially stable future. Whether you're a seasoned investor or just starting to dip your toes into the world of finance, understanding the fundamentals of investment is crucial. Let's explore the key aspects of investment and how you can make informed decisions to grow your wealth.

Setting Financial Goals:

Before diving into the world of investment, it's essential to define your financial goals. Whether you're saving for a down payment on a house, planning for your child's education, or aiming for a comfortable retirement, clear objectives will guide your investment strategy. Understanding your risk tolerance and time horizon is equally important, as these factors influence the types of investments that align with your goals.

Diversification:

The age-old saying "Don't put all your eggs in one basket" holds in the world of investing. Diversification is a simple strategy that involves spreading your investments across different industries, geographical regions, and asset classes. This approach helps mitigate risks associated with the performance of any single investment. By diversifying your portfolio, you can potentially enhance returns and reduce overall volatility.

Types of Investments:

A wide array of investment options are available, each with its own risk and return profile. Common investment vehicles include:

Stocks: Represent ownership in a corporation and have the possibility for capital appreciation.

Bonds: Debt securities that pay periodic interest and return the principal at maturity, providing a more stable income stream.

Mutual Funds: Pools of money managed by professionals who invest in a diversified portfolio of stocks, bonds, or other securities.

Real Estate: Investing in physical properties or real estate investment trusts (REITs) can offer both income and potential appreciation.

Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges, offering diversification and liquidity.

Cryptocurrencies: Digital or virtual currencies, such as Bitcoin or Ethereum, have gained popularity but come with higher volatility and risk.

Risk Management:

Managing risk and Understanding is a crucial aspect of successful investing. While higher potential returns often come with higher risk, finding the right balance based on your risk tolerance and financial goals is key. Periodic portfolio reviews and adjustments are necessary to ensure your investments align with your evolving circumstances and market conditions.

Long-Term Perspective:

Investing is a marathon, not a sprint. The power of compounding works best over time, emphasizing the importance of a long-term perspective. Patience is a virtue when it comes to investing, allowing your investments to weather short-term market fluctuations and benefit from the upward trajectory of the markets.

Stay Informed:

In the ever-changing landscape of financial markets, staying informed is crucial. Regularly monitoring your investments, staying abreast of economic trends, and understanding the broader financial landscape will empower you to make informed decisions. However, it's essential to differentiate between short-term market noise and long-term trends to avoid knee-jerk reactions.

Emergency Fund:

Before talking about investment, ensure that you have an argent fund set aside. This fund, typically equivalent to three to six months' worth of living expenses, provides a financial safety net in case of unexpected expenses or job loss. Having this cushion allows you to avoid liquidating your investments during market downturns.

Professional Advice:

While self-directed investors have access to a lot of information, getting professional counsel can be quite beneficial. Financial advisors can help tailor an investment strategy to your specific needs, guide market uncertainties, and assist in optimizing your portfolio for tax efficiency.

Conclusion:

Investing is an effective instrument for increasing wealth, attaining financial goals, and ensuring a comfortable future. By setting clear objectives, diversifying your portfolio, managing risk, maintaining a long-term perspective, staying informed, and considering professional advice, you can navigate the complexities of the financial markets with confidence. Remember, the key to successful investing lies in a disciplined and informed approach that aligns with your unique financial journey.

0 notes

Text

The Benefits of a Crypto Hub

Crypto Hub is an all-in-one Android app that provides its users with a complete cryptocurrency experience. It comes with modules for cryptocurrency price tracking, portfolio tracking, jobs in crypto and crypto events tracking. This application is user-friendly and is especially beneficial for newcomers to the industry. It also offers a reliable news feed that broadcasts the content from a number of reputable crypto media outlets such as U.Today, which is a top-tier crypto and blockchain media platform. This content includes news articles, reviews, market forecasts and tech analysis. This way, Crypto Hub users can have access to credible information about the sphere of crypto, blockchain and Web3 technology.

When you sell Crypto Assets through the Hub, the proceeds from the sale will be credited to your PayPal Balance Account. The amount credited to your Balance Account may vary due to the exchange rate and other factors. These changes will be reflected in the amount of the sale displayed on the Hub. PayPal will review the transaction and the related information for risk and compliance considerations. If any of these reviews result in a hold, you will not be able to sell, transfer or withdraw the Crypto Assets from your Balance Account.

The success of a crypto hub is heavily dependent on its supporting community. Shared office spaces, networking events and conferences, as well as local government engagement are vital to encourage a positive ecosystem of startups. A diverse community that promotes various mindsets and ideas is essential to fostering innovation.

As the world becomes more digital, the demand for cryptocurrencies and blockchain technology is rising. As a result, crypto hub are forming across the globe to meet this demand. These hubs provide an environment where individuals and companies can meet to discuss the latest developments in the space, and work together to create groundbreaking projects.

These hubs can be found in cities, states and countries around the world. Some are established by governments, while others are created by private businesses. Many of them offer unique benefits to their members, such as tax breaks, low living costs and easy access to capital. Some of them also offer a safe place to trade and invest in cryptocurrencies.

Cryptocurrency trading can be risky and involves the loss of money. Please remember to only use money that you can afford to lose. You should always consult your financial advisor before making any investment decisions.

This article is for general educational purposes only and is not intended to replace the advice of your financial advisor, attorney or tax professional. The information provided is based on sources that we believe to be reliable, but we do not represent that it is accurate or complete. We cannot predict the future, and there can be no assurance that any strategy discussed herein will prove successful. PayPal is not responsible for the accuracy of any third-party educational materials. Please see the RISK DISCLOSURES for more information. We will not accept any liability for the actions you take based on this information.

0 notes

Text

Top 10 Coolest Crypto Jobs You Can Land in 2024

Crypto Careers 2024: Top 10 Coolest Job Opportunities in the Ever-Evolving Blockchain Landscape

As we traverse further into the digital frontier of 2024, the cryptocurrency landscape continues its rapid expansion, and with it, an array of enticing job opportunities emerges. The allure of crypto jobs extends beyond the conventional, offering roles that blend innovation, technology, and finance in unprecedented ways. In this dynamic ecosystem, professionals have the chance to not only be a part of groundbreaking developments but also shape the very fabric of decentralized technologies. From blockchain developers crafting the backbone of digital currencies to NFT curators shaping the future of digital art, the top 10 coolest crypto jobs of 2024 promise an exhilarating journey for those ready to embrace the transformative power of the blockchain revolution.

Blockchain Developer:

In the dynamic realm of blockchain development, you'll take the helm in designing, implementing, and maintaining groundbreaking blockchain protocols. Your role extends beyond coding; you're crafting the future of decentralized applications (DApps) and smart contracts, pioneering the technological backbone of the entire crypto ecosystem. As a Blockchain Developer, you're not just a coder; you're an architect shaping the infrastructure that propels the digital revolution.

Crypto Analyst:

As a Crypto Analyst, you're not just observing market trends; you're at the forefront of decision-making in a rapidly evolving and high-stakes market. Your role involves not only analyzing market dynamics but also evaluating ICOs and crypto projects, providing crucial insights into potential investment opportunities. In this position, you're not just an analyst; you're a strategic advisor navigating the complexities of the crypto landscape.

NFT Curator:

Your role as an NFT Curator extends beyond sourcing and evaluating Non-Fungible Tokens (NFTs); you're shaping the narrative of digital art and collectibles in the blockchain space. Your work fuels the rise of unique and valuable digital assets, contributing to the vibrant ecosystem of NFTs. As a curator, you're not just selecting tokens; you're curating a digital art revolution.

DeFi Protocol Developer:

As a DeFi Protocol Developer, you're not merely engineering decentralized finance protocols; you're contributing to the democratization of finance itself. Your role involves crafting innovative solutions for lending, yield farming, and liquidity pools, revolutionizing traditional financial systems with cutting-edge decentralized technologies. In the world of DeFi, you're not just a developer; you're a financial innovator.

Crypto UX/UI Designer:

In the intersection of creativity and technology, your role as a Crypto UX/UI Designer is pivotal. Beyond designing interfaces, you're merging creativity with technology to enhance the user journey in the crypto landscape. Crafting visually appealing and user-friendly interfaces, you're not just a designer; you're an experience architect shaping the way users interact with blockchain technology.

Smart Contract Auditor:

As a Smart Contract Auditor, your responsibilities go beyond reviewing code; you're safeguarding the integrity and security of decentralized applications. Your role is critical in maintaining the trust and reliability of blockchain-based systems by identifying and mitigating security vulnerabilities. In the realm of smart contracts, you're not just an auditor; you're a guardian of blockchain security.

Crypto Content Creator:

Your role as a Crypto Content Creator transcends traditional content production. Beyond blogging, vlogging, or podcasting, you're a storyteller in a rapidly evolving space. You're not just sharing insights; you're educating and informing a global audience about the intricacies of the crypto world, building a community around your unique perspective.

Blockchain Legal Consultant:

As a Blockchain Legal Consultant, you're not just navigating legal complexities; you're shaping the legal frameworks for an industry challenging traditional norms. Your role involves advising on regulations, contracts, and compliance, contributing to the establishment of legal standards in the ever-evolving blockchain and crypto landscape.

Decentralized Governance Specialist:

In the evolving landscape of decentralized governance, your role as a specialist is transformative. You're not just developing and implementing governance structures; you're empowering communities to actively participate in decision-making processes. As a governance specialist, you're driving the evolution of governance models for more inclusive, transparent, and community-driven blockchain projects.

0 notes

Text

No matter how much you prepare, the realities of retirement are likely to surprise you as you prepare for and enter that phase of your life.It is, after all, one of the biggest milestone changes to your lifestyle and financial situation.Don’t missMoneywise has previously reported on important lifestyle changes many retirees are confronted with: the need to downsize their homes, managing a budget with less disposable income and the challenge of disentangling their identities from their careers — but the changes don’t stop there.Whether your retirement is still a few years off or you’re getting very close to that last day on the job, here are three more crucial things you must say goodbye to as you officially greet your golden years.1. Aggressive investment strategiesAfter decades of aggressively accumulating capital, it can be difficult to adopt a more conservative investment strategy and “wealth-preservation” mindset.A survey found that nearly one-third of Americans over the age of 50 invested in volatile cryptocurrencies as part of their early retirement plan. One in five retirees over the age of 85 have their entire portfolio in stocks, which is considered risky by most financial advisors, according to a Vanguard survey.This is risky behavior at any age, but is particularly dangerous for seniors living on retirement savings, pension plans or Social Security benefits. It took stocks roughly four years to recover from the 2008 crash and Bitcoin is still trading well below its 2021 peak. If you’re nearing or in retirement, you don’t want to be waiting years to recoup major losses.Story continuesRetirement is an opportunity to shift away from volatile, higher-risk investment strategies to reliable, income-producing strategies. Shifting to bonds and fixed income securities, asset-backed funds and real estate could be a better way to preserve wealth and secure your lifestyle as you transition out of the workforce.2. A predictable health care budgetAs you age, the chances that you’ll find yourself in a hospital emergency room or doctor’s clinic rise substantially. In fact, 92% of seniors have at least one chronic condition, while 77% have two or more, according to the American Psychological Association.And nearly two-thirds of bankruptcies are caused by medical expenses, making it the leading cause of financial ruin for people in the U.S., according to RetireGuide.Read more: Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2023Despite these worrying numbers, studies show millions of Americans wouldn’t be able to cover even a small emergency expense without going into debt.This is why financial experts like Suze Orman recommend regularly contributing to an emergency fund for unexpected costs that may arise both now and in retirement.3. The typical tax planTraditional tax plans are designed for income-earning adults. But what happens when you retire and your income stops? What happens when you derive less income from work and much more from other sources such as dividends or income from a rental property?Tax-planning for retirement years can get complex. Instead of income taxes, you’ll likely need to prepare to pay taxes on any social security benefits as well as some of your investments.If you’re wealthy, your retirement tax plan also needs a new layer that wasn’t needed before: estate planning. A 2023 study from senior living site Caring.com shows that despite a 3% increase over 2022 in Americans who have an estate plan, only 34% of Americans have an estate plan and 46% of Americans over the age of 55 have a will.If you do have a will, any assets or money you leave behind is subject to applicable taxes. While only people with more than $12.92 million in assets would be subject to a federal estate tax ranging from 18% to 40%, it is worth noting that 17 states and the District of Columbia also have either an estate or inheritance tax.Other changes to your tax plan might include complex strategies such as setting up a Roth conversion ladder.

Not only are these tax plans complicated, they’re also subject to change over the years.It’s worth considering finding an financial adviser or accountant who can guide you through the changing tax landscape so you can ensure everything is in order and you have peace of mind while you enjoy your golden years.What to read nextThis article provides information only and should not be construed as advice. It is provided without warranty of any kind.

0 notes

Text

Cyber Area Hustles: Turning Web Traffic into Real Value

In today's digital era, earning money on the web isn't only a trendy subject – it's a viable source of money for millions. With the Internet linking the hole between skills, solutions, items, and international people, economic possibilities are far more available than ever. Whether you're trying to complement your present income or move a full-time job online, listed here are methods to help you steer the lucrative earth of online earnings.

Affiliate Marketing:

Promote products and services and services for others and make a commission for every purchase made throughout your affiliate link. Websites like Amazon and ClickBank present affiliate programs where you can select from a vast variety of products. The important thing to accomplishment? Select services and products that arrange with your audience's pursuits and promote really useful items.

Freelancing:

Systems like Upwork, Freelancer, and Fiverr have changed the freelancing market. With skills in writing, visual style, programming, or consulting, you can present companies to customers globally. Assure you've a strong collection, collect testimonials, and repeatedly upgrade your skills.

Blogging:

When you have an interest or knowledge in a specific market, beginning a weblog may be for you. By producing regular, important material and leveraging SEO (Search Motor Optimization), you are able to entice traffic and monetize through ads, paid content, and affiliate marketing. make money online

On the web Tutoring:

The need for online training is skyrocketing. Sites like VIPKid or Chegg Tutors connect educators with students in need. If you're a professional in academic matters, languages, as well as audio devices, tutoring can be a worthwhile source of online income.

Dropshipping:

By partnering with manufacturers, you can sell products online without actually touching the inventory. Programs like Shopify make setting up a store straightforward. Although it requires transparent effort in industry study and setting up, it can be a passive supply of income.

Sell Electronic Items:

E-books, online courses, stock photos, or software instruments – the electronic item room is vast. By tapping in to your experience or abilities, you are able to make and promote digital assets over and over with small expense costs.

Stock Trading & Cryptocurrency:

While this involves information, study, and chance administration, trading stocks or cryptocurrencies may lead to considerable returns. Always begin by having an amount you're ready to get rid of, and contemplate working together with an economic advisor.

Take part in Online Surveys & Opinions:

Numerous platforms purchase filling out surveys or researching products/services. While that is not the most lucrative process, it's a simple way to create some added cash.

YouTube & Podcasting:

With the best niche and regular content delivery, systems like YouTube can be significant money options through ads, sponsorships, and merchandise. Likewise, podcasting, with its rising market bottom, offers monetization through sponsorships and crowd contributions.

Conclusion

Earning money online is not really a get-rich-quick scheme. It takes devotion, continuous learning, and adaptation. By selecting a strategy that aligns along with your skills and interests, ensuring you offer real price, and being consistent, you are able to construct a fruitful on the web revenue stream. Remember, the Net has democratized possibilities, but it's up to people to seize them effectively.

0 notes

Text

Passive Income Hacks Making Money Online with Minimal Effort

Welcome to the world of financial freedom, where it’s easy to make money and your dreams of not having to work for a living come true. We’re going to take an exciting trip into the world of passive income and find out the secrets that can help you make your dreams come true.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Imagine having money come into your bank account while you sleep, travel, or just enjoy the good things in life. It’s not a dream; it’s a real option. We’ll help you find your way through “Passive Income Hacks: Making Money Online with Minimal Effort.” Come with us as we look at the different ways you can make money with little work on your part and learn how to protect your financial future.

To sum up, becoming financially free through passive income is not just a pipe dream; it’s a real possibility that you can reach. Getting your money in different places, managing your risk, and keeping up to date can help you build a strong and long-lasting source of income. Every day, your passive income streams can slowly grow. This will give you the freedom and money you need to live the life you’ve always wanted. Thanks to passive income, you can enjoy the trip and start making more money in the future.

What Is Passive Income?

Passive income is earned without effort. It’s like a well that supplies water without pumping. Most of us earn active income through work, where we sell time and abilities for money. Passive income lets you create money while sleeping, traveling, or enjoying life. Rental income, stock dividends, and creative royalties are passive income examples. It doesn’t need your continual presence or direct engagement. It’s like growing money trees from seeds.

The Appeal of Passive Income

Why does passive income hold such allure? Well, who wouldn’t want to escape the never-ending cycle of work and bills? Passive income offers financial security and the freedom to pursue your passions. It’s a ticket to explore life without being tied to a 9-to-5 job. No wonder it’s often referred to as the “holy grail” of personal finance.

Types of Passive Income Streams

There are various avenues for generating passive income, each with its own unique characteristics and challenges. Here are some of the most popular options:

Stock Market Investments: Dividends and Capital Gains

Real Estate Rental Income

Creating an Online Business

Royalties and Licensing: Earning from Creativity

Automating Investments with Robo-Advisors

Leveraging Peer-to-Peer Lending Platforms

Passive Income through Cryptocurrencies

Managing Risk and Taxes

Building a Diverse Passive Income Portfolio

In the following sections, we’ll delve into each of these options, explaining how they work and providing valuable insights to help you make informed decisions on your path to passive income.

Stock Market Investments: Dividends and Capital Gains

Investing in the stock market is a tried and tested way to generate passive income. Two primary avenues within this strategy are dividends and capital gains. Let’s break them down.

How to Invest in Dividend Stocks

Investing in dividend stocks means putting your money into shares of companies that distribute a portion of their earnings to shareholders in the form of dividends. It’s like receiving a paycheck from your investments. Here’s how you can get started:

Research and Select Dividend-Paying Companies: Look for established companies with a history of consistent dividend payouts. Companies in sectors like utilities, consumer goods, and healthcare often offer attractive dividends.

Open a Brokerage Account: You’ll need a brokerage account to buy and hold stocks. Choose a reputable online brokerage that suits your needs.

Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different sectors to spread risk.

Reinvest Dividends: Many dividend-paying stocks allow you to reinvest your earnings, which can accelerate your passive income growth over time.

Monitor and Adjust: Keep an eye on your investments and adapt to changing market conditions. Reevaluate your portfolio periodically.

Capitalizing on Capital Gains

Capital gains occur when you sell an investment for a profit. While not strictly passive income, it’s an essential aspect of stock market investing. Here’s how to maximize capital gains:

Long-Term vs. Short-Term: Capital gains are taxed differently based on how long you hold your investments. Long-term gains often receive more favorable tax treatment.

Holding for Growth: Invest in companies with strong growth potential. The longer you hold, the greater the potential for significant capital gains.

Use Tax-Efficient Strategies: Consider strategies like tax-loss harvesting to minimize your tax liability.

Stay Informed: Keep up with market trends and news that might affect your investments.

Risks and Rewards

While investing in the stock market can be a rewarding way to earn passive income, it’s not without risks. Stock prices can be volatile, and there’s always the possibility of losing money. It’s crucial to do your research, diversify your portfolio, and consider consulting with a financial advisor to manage these risks effectively.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Real Estate Rental Income

Investing in real estate, whether through traditional long-term rentals or modern Airbnb hosting, is another path to passive income. Let’s explore the basics.

Becoming a Landlord

Becoming a landlord involves purchasing residential or commercial properties and renting them out to tenants. Here’s how to get started:

Property Selection: Choose properties in desirable locations with good potential for rental income.

Property Management: Decide whether to manage the property yourself or hire a property management company.

Pricing Strategy: Set competitive rental rates to attract tenants while ensuring profitability.

Legal Considerations: Understand landlord-tenant laws in your area and draft comprehensive lease agreements.

Maintenance and Repairs: Budget for maintenance and be prepared to handle repairs promptly.

Airbnb Hosting: A Modern Twist

Airbnb hosting has transformed the rental market. It allows you to rent out your home or spare rooms on a short-term basis. Here’s how to succeed as an Airbnb host:

Create an Appealing Listing: High-quality photos and detailed descriptions attract guests.

Pricing and Availability: Adjust your rates based on demand and local events. Keep your calendar updated.

Provide Outstanding Service: Offer a clean and comfortable space, and be responsive to guest inquiries.

Guest Reviews: Encourage positive reviews, as they can significantly impact your bookings.

Comply with Local Regulations: Ensure you’re aware of and follow local laws and regulations governing short-term rentals.

Location Matters

Whether you’re a traditional landlord or an Airbnb host, the location of your property plays a significant role in your passive income. Properties in popular, high-demand areas are more likely to generate consistent rental income.

Investing in real estate requires a significant upfront investment and ongoing management, but it can provide a stable source of passive income.

Creating an Online Business

In the digital age, creating an online business is a popular way to generate passive income. Let’s explore a few strategies within this domain.

Dropshipping: A Low-Risk E-Commerce Venture

Dropshipping is an e-commerce model where you sell products to customers without holding any inventory. Here’s how it works:

Choose Your Niche: Select a niche or product category that interests you and has market demand.

Find Reliable Suppliers: Partner with suppliers who offer dropshipping services.

Create an Online Store: Build an e-commerce website to showcase and sell products.

Market Your Store: Use digital marketing techniques to attract customers.

Order Fulfillment: When customers place orders, your suppliers ship the products directly to them.

Dropshipping minimizes the risks associated with holding inventory but requires effective marketing and customer service.

Blogging and Affiliate Marketing

Blogging is a fantastic way to share your passion and knowledge with the world while earning passive income. Here’s how to get started:

Choose Your Niche: Select a niche or topic you’re passionate about and knowledgeable in.

Create Quality Content: Write informative, engaging, and valuable blog posts.

Monetize with Affiliate Marketing: Promote products related to your blog’s niche and earn commissions on sales.

Build an Audience: Attract and retain readers through your content and engagement.

Optimize for SEO: Enhance your blog’s visibility in search engines to attract more visitors.

Blogging can take time to gain traction, but with persistence, it can become a lucrative source of passive income.

The Power of Webinars and Online Courses

Webinars and online courses are becoming increasingly popular for sharing expertise and earning passive income. Here’s how to go about it:

Select Your Topic: Choose a subject you’re knowledgeable and passionate about.

Create Quality Content: Develop engaging presentations or course materials.

Choose a Platform: Select a platform to host your webinars or courses.

Market Your Offerings: Promote your webinars or courses through social media and email marketing.

Engage with Your Audience: Provide valuable content and interact with your participants.

Webinars and online courses can generate significant income while helping others learn valuable skills or knowledge.

In the next sections, we’ll continue to explore more passive income strategies, so stay tuned for a wealth of information to help you on your journey to financial freedom.

Royalties and Licensing: Earning from Creativity

If you have a creative side, there are multiple ways to earn passive income through royalties and licensing. Let’s uncover these opportunities.

Writing and Publishing Books

If you have a talent for writing, you can publish books and earn royalties on sales. Here’s how to get started:

Write a Book: Create a compelling manuscript and consider self-publishing or working with a traditional publisher.

Publish Your Work: Choose a publishing platform and format your book for e-readers and print.

Promote Your Book: Market your book through social media, author websites, and book signings.

Earn Royalties: Receive a percentage of each sale, and royalties from e-book sales can add up over time.

Music and Art Licensing

Musicians and visual artists can earn passive income through licensing their work. Here’s what you need to know:

Protect Your Work: Copyright your music or art to safeguard your creations.

License Your Work: Partner with licensing agencies or platforms to make your work available for commercial use.

Receive Royalties: When others use your work, you earn royalties, whether it’s in films, advertisements, or other media.

Promote Your Portfolio: Showcase your work on personal websites and social media to attract potential licensees.

The Digital Revolution

The rise of the internet and digital media has made it easier than ever for creators to earn royalties and license their work. Whether you’re an author, musician, or visual artist, the digital world offers countless opportunities to showcase your creativity and generate passive income.

In the following sections, we’ll continue our exploration of passive income strategies and dive into subjects like automated investing, peer-to-peer lending, and cryptocurrencies. Keep reading to uncover more financial gems.

Automating Investments with Robo-Advisors

The world of investing has evolved with the introduction of robo-advisors, automated platforms that manage your investments. Let’s dive into this innovative approach.

What Are Robo-Advisors?

Robo-advisors are online platforms that use algorithms and computer programs to create and manage a diversified investment portfolio for you. Here’s how they work:

Assessment: You provide information about your financial goals, risk tolerance, and investment horizon.

Portfolio Creation: The robo-advisor uses this data to create a portfolio of ETFs and other assets tailored to your needs.

Automated Management: The platform continually monitors your investments and makes adjustments as necessary to stay aligned with your goals.

Cost-Efficient: Robo-advisors often have lower fees compared to traditional financial advisors.

Benefits of Robo-Advisors

Robo-advisors offer several advantages for those seeking passive income:

Diversification: They spread your investments across different assets, reducing risk.

Convenience: You don’t need extensive financial knowledge or time to manage your investments.

Cost Savings: Lower fees mean you keep more of your returns.

Automatic Rebalancing: The platform handles portfolio adjustments.

Risks to Consider

While robo-advisors provide an easy way to invest, they aren’t without risks:

Lack of Human Touch: You won’t have a personal advisor to consult.

Market Volatility: Your investments are still subject to market fluctuations.

Risk Assessment: The algorithm’s risk assessment may not be perfect for everyone.

Before diving into the world of robo-advisors, make sure to understand how they work and whether they align with your financial goals.

Leveraging Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms have revolutionized the way people borrow and invest money. These platforms connect borrowers with individual lenders. Let’s explore how they work.

How Peer-to-Peer Lending Works

P2P lending platforms facilitate loans to individuals and small businesses. Here’s an overview of the process:

Borrower Application: Individuals or businesses seeking a loan submit applications on P2P lending platforms.

Lender Selection: Investors review borrower profiles and choose loans to fund.

Loan Funding: Once funded, the borrower receives the loan from the collective group of lenders.

Repayment: The borrower repays the loan with interest, which is distributed to the lenders.

Diversification and Risk Management

Diversification is a key strategy when investing through P2P lending:

Spread Your Risk: Avoid concentrating your investments in a single loan or borrower.

Invest in Multiple Loans: Diversify your portfolio by lending to multiple borrowers.

Assess Borrower Profiles: Review borrower profiles, credit scores, and loan purposes to make informed choices.

Loan Grades: P2P lending platforms often assign loan grades to indicate risk levels.

Personal Loans vs. Business Loans

P2P lending platforms offer both personal and business loans. Personal loans may be unsecured and have shorter terms, while business loans may have longer terms and require collateral. Consider your risk tolerance and preferences when choosing which loans to fund.

In the next section, we’ll explore the potential of earning passive income through cryptocurrencies, a relatively new but rapidly evolving investment opportunity.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Passive Income through Cryptocurrencies

Cryptocurrencies have gained widespread attention, and many are exploring ways to earn passive income within the crypto space. Let’s delve into some strategies.

Cryptocurrency Staking

Staking is a method used by some blockchain networks to secure transactions. It involves locking up a certain amount of a cryptocurrency to support network operations. In return, you receive staking rewards. Here’s how it works:

Choose a Staking Coin: Select a cryptocurrency that offers staking rewards, such as Cardano or Ethereum.

Wallet Setup: Set up a compatible wallet and transfer your staking coins.

Delegate or Self-Stake: You can either stake the coins yourself or delegate them to a staking pool.

Earn Staking Rewards: Over time, you’ll receive rewards in the form of additional cryptocurrency.

Risks and Considerations: Staking involves some risk, including potential loss of staked coins.

Yield Farming: The Risks and Rewards

Yield farming is a more advanced strategy that involves providing liquidity to decentralized finance (DeFi) protocols in exchange for high yields. Here’s how it works:

Select a DeFi Platform: Choose a DeFi platform or project that offers yield farming opportunities.

Provide Liquidity: Deposit cryptocurrency or assets into the DeFi platform to be used in various DeFi applications.

Earn Rewards: You’ll earn rewards in the form of fees or tokens, often with high annual percentage yields (APY).

Impermanent Loss: Understand the concept of impermanent loss, which can affect your overall returns.

NFTs and Digital Collectibles

Non-fungible tokens (NFTs) have gained significant attention in the world of digital art and collectibles. Some individuals have made substantial passive income by creating and selling NFTs. Here’s how it works:

Create NFTs: Develop unique digital art or collectibles and tokenize them as NFTs.

Market Your NFTs: Use NFT marketplaces to sell your creations to potential buyers.

Royalties: Many NFTs provide creators with a percentage of future sales, creating potential ongoing income.

Copyright and Ownership: Understand the legal aspects of NFT creation and sales.

As with any investment, it’s essential to conduct thorough research and understand the risks associated with cryptocurrencies and blockchain technologies.

Managing Risk and Taxes

While passive income can be incredibly rewarding, it’s not without its challenges. Let’s explore some strategies for managing risk and understanding the tax implications.

Risk Mitigation Strategies

Managing risk is crucial to safeguard your passive income investments. Here are some strategies:

Diversification: Spread your investments across various income streams and asset classes.

Emergency Fund: Maintain an emergency fund to cover unexpected expenses.

Continuous Learning: Stay informed and updated on your investments and markets.

Professional Advice: Consult with a financial advisor or tax professional for personalized guidance.

Tax Implications of Passive Income

Taxes can significantly impact your passive income earnings. Here’s what you need to consider:

Tax on Dividends and Capital Gains: Understand the tax rates applicable to your passive income sources.

Tax-Efficient Investments: Explore tax-efficient investment options and accounts.

Reporting and Compliance: Ensure you report your passive income accurately and comply with tax laws.

Tax Deductions: Identify deductions and credits that can reduce your tax liability.

State and Local Taxes: Be aware of regional tax regulations that may apply.

The Role of a Financial Advisor

If you’re new to passive income strategies or have a complex financial situation, consider seeking advice from a financial advisor. They can help you make informed decisions, manage risk, and optimize your tax situation.

Building a Diverse Passive Income Portfolio

The path to financial freedom often involves building a diverse portfolio of passive income streams. Here’s how to create a well-rounded strategy.

The Power of Diversification

Diversification means spreading your investments across different assets, industries, and income streams. Benefits of diversification include:

Risk Reduction: Spreading investments can mitigate the impact of underperforming assets.

Steady Income: Diverse income sources provide stability.

Adaptability: Diversification helps you adapt to changing market conditions.

Balancing Risk and Reward

Every investment involves a trade-off between risk and reward. Consider the following when building your passive income portfolio:

Risk Tolerance: Understand your risk tolerance and align investments with your comfort level.

Investment Horizon: Consider your short-term and long-term financial goals.

Asset Allocation: Determine how much of your portfolio to allocate to different assets.

Regular Review: Periodically assess and adjust your portfolio to stay on track.

Stay Informed: Keep up with market trends and developments.

Tracking Your Passive Income

To gauge the success of your passive income strategy, you should track your earnings regularly. Here’s how:

Record Income Sources: Maintain a record of each passive income source and its performance.

Monitor Expenses: Keep track of any associated costs or fees.

Evaluate Growth: Assess how your passive income is growing over time.

Set Goals: Establish specific financial goals for your passive income portfolio.

Review and Adjust: Periodically review your strategy and make adjustments as necessary.

Frequently Asked Questions (FAQs)

What is the minimum amount of money required to start earning passive income?

The amount required to start earning passive income varies depending on the chosen income stream. For stock market investments, you can start with as little as a few hundred dollars, while real estate and cryptocurrency investments may require more significant capital.

2. Is passive income truly “effortless,” or does it require some initial work?

While passive income streams may require less active effort than traditional jobs, they often involve some initial work, such as research, investment, or content creation. However, the goal is to generate income with minimal ongoing effort once the initial setup is complete.

3. Are there any tax benefits associated with passive income?

Tax benefits for passive income can vary based on your location and the type of income. Some passive income sources may qualify for tax deductions or lower tax rates. It’s essential to consult with a tax professional to understand the specific tax implications of your passive income.

4. Can I rely solely on passive income for financial security?

While passive income can be a significant contributor to your financial security, it’s advisable not to rely solely on it. Maintaining a balance between active and passive income sources can provide a more stable financial foundation.

5. What are some common mistakes to avoid when pursuing passive income?

Common mistakes include not conducting adequate research, failing to diversify your income streams, and underestimating the importance of risk management. Additionally, not staying informed about market trends and regulations can lead to financial setbacks.

Conclusion

In conclusion, using passive income to become financially free is not just a pipe dream; it’s a real possibility that you can reach. You can build a strong and long-lasting source of income by spreading out your finances, controlling risk, and staying up to date. You can make your passive income streams slowly grow every day, giving you the freedom and financial security to live the life you’ve always wanted. With the help of passive income, you can enjoy the trip and open the doors to a better financial future.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Passive Income Hacks Making Money Online with Minimal Effort

Thanks for reading my article on “Passive Income Hacks Making Money Online with Minimal Effort“, hope it will help!

#howtomakemoneyonline#makemoneyonline#makemoneyonline2023#makemoneyonlinefromhome#makemoneyfast#affiliatemarketing#cpamarketing#blogging#dropshipping#ecommerce#passiveincome#makemoneytutorials#methodsandtutorials#internetmarketing#digitalmarketing#clickbankaffiliatemarketing#affiliatemarketingtraining#cpamarketingtraining#cpa#blog#makemoney#makemoneyonlineguide#freelancingtraining#emailmarketing#makemoneyonlinewithblogging#amazonaffiliatemarketing#marketingstrategies#onlineadvertising#socialmediamarketing#contentmarketing

0 notes

Text

Precision Investing for Millennials: Navigating Financial Challenges and Opportunities with Lloyd Tevis Investments

The millennial generation finds itself at a crossroads of unprecedented financial challenges and opportunities. As technology reshapes industries and economic landscapes, harnessing a strategy that embraces precision investing has become crucial for securing a prosperous future. Lloyd Tevis Investments, a pioneer in personalized wealth management, stands ready to guide millennials through this transformative journey, helping them navigate challenges and seize opportunities with expertise and precision.

1. **Understanding Millennial Aspirations:** Lloyd Tevis Investments recognizes that millennials have distinct financial aspirations shaped by their unique circumstances. From paying off student loans and buying a first home to saving for retirement and investing sustainably, the firm takes the time to understand millennials' multifaceted goals. This insight serves as the cornerstone for crafting investment strategies that reflect these aspirations.

2. **Tackling Student Debt:** Many millennials face the burden of student debt, impacting their financial flexibility and investment capacity. Lloyd Tevis Investments collaborates with clients to develop strategies that strike a balance between debt repayment and wealth accumulation. By employing a precision-focused approach, the firm identifies avenues to efficiently manage debt while still making strides toward building a diversified portfolio.

3. **Embracing Technological Advancements:** The digital age has ushered in a plethora of investment opportunities, including robo-advisors, cryptocurrency, and socially responsible investing. Lloyd Tevis Investments helps millennials navigate this rapidly evolving landscape, offering guidance on integrating technology-driven solutions into their investment strategies. The firm's expertise ensures that millennials can leverage these innovations without compromising on precision and long-term growth.

4. **Economic Uncertainties and Risk Management:** Economic uncertainties, exemplified by market volatility and changing job landscapes, can pose challenges for millennials. Lloyd Tevis Investments employs precision investing to tailor risk management strategies that mitigate the impact of volatility on portfolios. By customizing asset allocation and adopting proactive monitoring, the firm safeguards millennials' investments and helps them stay the course during turbulent times.

5. **Sustainable and Ethical Investing:** The millennial generation places a high value on ethical and sustainable investing. Lloyd Tevis Investments recognizes this trend and offers guidance on integrating environmental, social, and governance (ESG) factors into investment decisions. The firm's precision-focused approach ensures that millennials can align their values with their investment portfolios without sacrificing potential returns.

6. **Long-Term Growth and Retirement Planning:** While millennials may have more time to compound their investments, long-term growth and retirement planning remain paramount. Lloyd Tevis Investments constructs precision investment strategies that capitalize on compounding while considering millennials' evolving life stages. The firm's commitment to ongoing monitoring and strategic adjustments ensures that portfolios remain aligned with changing goals.

7. **Financial Education and Empowerment:** Education is a cornerstone of Lloyd Tevis Investments' approach. The firm empowers millennials with knowledge and insights into investment fundamentals, market trends, and potential risks. Through educational initiatives, millennials gain the tools they need to make informed decisions, fostering a sense of confidence in their financial choices.

8. **Personalized Advice and Support:** The personal touch is integral to Lloyd Tevis Investments' service. For millennials navigating complex financial decisions, having a dedicated team of experts by their side is invaluable. The firm provides personalized advice, transparent communication, and responsive support, ensuring that millennials feel empowered to make sound financial decisions at every step.

In conclusion, navigating the financial landscape as a millennial requires a precision-focused approach that embraces opportunities while addressing challenges head-on. Lloyd Tevis Investments stands as a trusted partner, offering expertise in crafting personalized investment strategies that align with millennials' aspirations. By understanding their goals, tackling student debt, leveraging technological advancements, managing risks, promoting ethical investing, prioritizing long-term growth, providing financial education, and offering personalized support, the firm equips millennials with the tools needed to thrive in the ever-evolving world of finance. With Lloyd Tevis Investments, millennials can confidently embrace their financial future with precision and purpose.

0 notes

Text

Unlocking Investment Management Careers: Lucrative Opportunities Await

Stock markets wield immense power in the USA, generating trillions in profitable investments and fueling a range of high-paying careers. As of 2023, the average salary for a first-year investment banker stands at $99,922 annually, though it can vary based on firm, location, and experience. Even entry-level bankers can anticipate six-figure incomes. Beyond salary, diverse opportunities abound, from venture capitalism and analytics to insurance. This career path offers the flexibility of self-employment or the stability of office-based work, but acquiring and mastering a specific skill set is crucial for landing a job and achieving success.

Careers in Investment Management

- Portfolio Manager: Oversee investment portfolios and make strategic decisions.

- Financial Analyst: Conduct thorough analysis to guide investment decisions.

- Risk Manager: Identify and manage potential risks in investment strategies.

- Investment Banker: Facilitate mergers, acquisitions, and capital raising for clients.

- Private Equity Professional: Invest in private companies and assist in their growth.

- Hedge Fund Manager: Manage funds and employ various strategies to generate high returns.

- Quantitative Analyst: Utilize advanced mathematical models for investment analysis.

- Financial Planner: Help clients with long-term investment and financial planning.

- Compliance Officer: Ensure adherence to regulatory requirements and ethical standards.

- Investment Advisor: Provide guidance and advice to individual investors.