#devisees

Text

i could talk about nahinu's parent mokilqu for either mother's or father's day, but tbqh there's not much to talk about. mokilqu has the personality of a rock (affectionate)

they do regard devisee as family, but like, mostly all that means is if devisee tags along on a visit with nahi, is mokilqu fusses like a lonely old lady. much to the embarrassment of nahi (nevermind that she fusses over devisee All The Time)

#out of character ;#| a fleck of gold. a color rush. the music stops and the world erupts ; nahinu |#technically. devisee is younger than nahi :o) fun fact

2 notes

·

View notes

Text

@natterghast sent in: Send ⭐️ (or multiple) for a headcanon about our muses. (and.. hear me out, copycat meeting devisee)

🧬// OoOoOoOo ✨👀✨ so stop me if you heard this before: a man-made abomination and an abomination crossed between the divine and the eldritch walk into a bar…………

NOW! Not super sure if this is plausible or not, so pls correct me if i stumble along the way, but it’s a lil ear worm that wriggled its way in me brains— aaaand under a read more cause even with good intentions to keep this short, I sure do love to ramble:

Being created, not born— Copycat is NOT a religious woman. Gods and the divine have to prove themselves worthy of earning HER faith. If she could get away with it, or feeling particularly jazzed, it’s more likely to see her laugh in the face of those that claim divinity. <- it may not be her, but there is always something out there bigger than you.

But, perhaps coming face to face with one like Devisee, in his domain that mirrors a twisted reality? With his 6 jaws and mangled skin upon muscle and bone? Survived and ruled by instinct?

It’s enough to make any abomination get on their knees and pray. Hunts will be done in his name, trophies laid at his domain. Perhaps this is rooted in her fear of survival, come face to face with something far greater than she. Or perhaps, it’s admiration of the terror at its finest?

The Short Of It: i think it’d be funny if Copycat somehow found herself in the second form’s domain, the hunter becomes the hunted, but for some wild reason or another she is able to survive in the twisted mirrored domain and ends up lowkey worshipping Devisee whether he likes it or not.

#👽 … ooc#🎤 … asks#natterghast#//devisee on earth trying to live a peaceful life when some weird alien monster cat scratches at his front door#//STOP READING. JOIN MY EMO BAND.’ she says while dropping off a moose carcass as tribute

3 notes

·

View notes

Note

desire and ghost for the director 👀

Ohoho, good ones. Doing in reverse order for Reasons ™.

Not So Nice Asks

Ghost: Who or what haunts your OC? What happened? How do they live with their ghosts?

The Director is haunted by moonlight.

Years ago, they lived on the surface and had a shared dream with their partner-in-crime to escape to the infamous New World. The two ached for somewhere less judgemental, where less doors would be closed to them based on heritage, family wealth, or a propensity for green carnations.

That was cut short by the starting events of a certain ambition-- said partner was murdered, the clues leading Avci down to the Neath to seek the killer.

Spoilers, but finishing their ambition did not bring their partner back. It didn't bring them peace as much as it changed them in the process, fitting them to the Neath and London's exploitative ways rather than filling the hole left behind by their other half. And the day before they accomplished their mission, they were enlisted-- in the usual way of the Bazaar and its meddling Masters-- to learn a dance called the Totentanz.

In performing it, the Director learned about moonlight and how it could show the Could-Have-Beens. They also learned how cruel it was to see the life they could have had, and how unrecognizable their current self would have been to their partner.

Consequently, those who've known them for a while remember a change around the time they were elected to head the Railway Board, and became the Director-- namely that Avci seemed to double down on the intemperate reputation and making more waves in higher society and the world of power players, losing some of the subtlety in public in lieu of leaning into assumptions people had about them as a menace. They seemed to focus on looking for a good time, infamy, and a startling aggressive attitude towards investments. They also more publicly started emphasizing their relationships with their ward, the Silvered Assistant, and legal counsel, the Stalwart Scholar. They never seem to slow down or stop these days, and those who know them the best know that when the 'Director' takes a break, there's likely trouble being made in the Khanate, or Evenlode, or another corner of the Neath under another name.

And they avoid Balmoral like the plague these days, leaving its affairs to September as Castellan.

So in short, they don't live with them, as much as run from them.

Desire: What's one thing your OC wants more than anything in the world? Are they open with that desire? Why or why not? What would they do to fulfill it?

What they really want, they cannot have.

So these days, they act like all they want is to keep everyone around them guessing, to make waves and keep things unsettled whether its in the status quo or (more commonly) the markets. If asked, The Silvered Assistant and the Efficient Commissioner would likely suggest all the Director wants in life is to make their job harder.

In reality, their machinations lead towards leaving a legacy for their younger companions, making them into unwilling and unwitting successors for all the Director's done. They feel idealism is beyond them now, after all they've done and how stained their hands are, but that it's not too late for the next generation-- even if they must find a way to manipulate younger players around them to bring them into their own, or even force immortality onto their devisee. The world needs more idealists, and they intend to guarantee there will be some. There is little they haven't done in pursuits of their goals before.

The only one who likes recognizes or knows any of this in full would be the Alleged Protege, and only in a recognition of self through the other. This is probably why they act permanently divorced.

9 notes

·

View notes

Note

✪ Rubbing their back after a stressful day or disappointment. (from devisee, and not at all platonic like the meme says)

By the time that Atieno had returned to see Devisee again, it was after a wave of .. rough events. Interactions that had gone awry, having to avoid being controlled and pressured. The weight of heavy stories that they really.. shouldn't try to intervene in with but still knew about all sitting with them at once.

They had always known that the nature of being present meant constantly being exposed to a lot that was hard to take. Especially when they could see and remember examples of similar situations arising. As much as they liked seeing parallels, there were so many times where those .. parallels, those repeating actions only seemed to tire them out.

And the kind of exhaustion that Atieno carried often had no way of truly being put down.

That being said, the comfort - the comfort from some affection did make a difference. Settling down in Devisee's company, they felt his hands start to rub and caress their back.

"You're too good to me. But.. I do appreciate you doing this a lot." They spoke softly, almost as if getting used to him being so willing to do this for them.

He had adjust so he could sit closer, and closer - ensuring that his presence would be near. The sensation of his hands wandering, up in down - adding pressure at times, doing a bit of kneading. The sound of his voice. The feeling of a kiss at their shoulders. One, two.. several more.

It had them feeling quite vulnerable, letting out these low sighs of appreciation. The way that his hands felt, the intention with his touch, the closeness that his presence felt... genuinely blissful. And were there more kisses that he was leaving?

And were those kisses getting closer to their neck?

It certainly felt like it. And that alone was making them focus on another feeling altogether brewing within them.

Not that they were complaining, no they could only turn their head slightly to direct an affectionate gaze at him. Almost stunned when he looked right at them while continuing his touches, and pressing his lips again on them.

3 notes

·

View notes

Link

#buyingahome#ClientSatisfaction#comprehensivemarketanalysis#ContinuousSupport#expertnegotiationskills#expertrealestateadvice#extensiverealestatenetwork#innovativemarketingstrategies#irinashoket#jeffshoket#localmarketknowledge#personalizedrealestateservice#PropertyValues#RealEstateGuidance#realestatemarkettrends#RealEstateSuccess#sellingahome#ThousandOaksRealEstate#ThousandOaksRealtors#toprealtors

0 notes

Text

Tennessee Signs ELVIS Act

Tennessee has unveiled the ELVIS act, aiming to protect the voices of artists as a protected personal right:

Present law provides that every individual has a property right in the use of that person’s name, photograph, or likeness in any medium in any manner. This bill adds to the present law by providing that an individual also has a property right in the use of that individual’s voice. […]

This bill adds to the present law by providing that any person who knowingly uses or infringes upon the use of an individual’s voice, in any manner directed to any person other than such individual, for purposes of advertising products, merchandise, goods, or services, or for purposes of fundraising, solicitation of donations, purchases of products, merchandise, goods, or services, without such individual’s prior consent, or, in the case of a minor, the prior consent of such minor’s parent or legal guardian, or in the case of a deceased individual, the consent of the executor or administrator, heirs, or devisees of such deceased individual, is also liable to a civil action.

The goal is to protect musicians against unauthorized AI usage.

---

Please consider becoming a member so we can keep bringing you stories like this one.

◎ https://chorus.fm/linked/tennessee-signs-elvis-act/

0 notes

Text

Article 113

Article 113.

Property donated or left by will to the spouses, jointly and with designation of determinate shares, shall pertain to the donee-spouses as his or her own exclusive property, and in the absence of designation, share and share alike, without prejudice to the right of accretion when proper.

Article 113 contemplate two situations where the property is donated to the spouses or inherited by them with designation of shares and where there is no designation of shares.

In both cases, such property belongs to them exclusively, and if there is no designation as to their shares, the property shall be divided between them, but it shall belong to them exclusively.

The rule cited is without prejudice to the right of the accretion.

Accretion is a right by virtue of which, when two or more persons are called to the same inheritance, devise or legacy, the part assigned to the one who renounces or cannot receive his share, or who died before the testator, is added or incorporated to that of his co-heirs, co-devisees, or co-legatees.

So that if the the spouse would remove her share or cannot receive it, or dies before the testator or donor, but her share would go to, or would be added to, the share of x by virtue of the right of accretion.

PROPERTY DONATED OR LEFT BY WILL TO SPOUSES

A donor or testator may donate or provide in a will property to the spouses jointly. Determinate share of each of the spouses and, in the absence thereof, share and share alike. The property of the donation well then be considered separate property of the spouse.

ACCRETION IN CASE OF DONATION

It is the incorporation or addition of property to another property. As a general rule in joint donation, one could not accept indecently of his co-donee, for there is no right of accretion unless expressly so provided. One of the exemptions is when the joint donation is in favor of husband and wife, Article 753 of the Civil Code;

0 notes

Text

A Comprehensive Guide to Asset Protection and Estate Planning

A trust is basically a legal contract created to transfer one’s properties and assets to another person at a certain point in time. A trust is a legal entity. It’s like a real, living, breathing person, but it is just a legal document. Some trusts are asset protection in nature and other types of trusts are not. A good asset protection lawyer will know whether to use trusts or corporate entities or other types of businesses (think LLCs or corporations, partnerships, etc.) When there is a trust, typically there are three parties to this document. There is a trustor, a trustee and the beneficiary.

A trustor is also called a settlor or a settler or a trustmaker or a donor or a creator. We usually used the terms trustor or settlor most often. A trustor is the person who makes or establishes the trust. The first is the most common. It should be spelled with the -or and not with the -er. This is because the a settlor is different legally than a settler. The trustor sets up or makes the trust. This party is essential to the creation of a trust, including an asset protection trust.

A trustee is a name that many people have heard of before (some people put it down as “trusty” but that is an incorrect spelling). A trustee is the person who is in charge of the trust who holds the property “in trust” for the beneficiaries. The trustee has a position with a fiduciary duty for the trust and the beneficiary. They are in a position of trust. The settlor or trustor holds confidence and trust in the trustee to do their best for the beneficiaries.

Other words for a beneficiary is: devisee or cestui que trust. A devisee is the recipient of a devise or a benefit. This word dates back to at least the nineteenth century (see e.g. Bigelow v. Gillott, 123 Mass. 102, 107 (1877)) which meaning is someone who receives an inheritance. Similar to an heir, but a devisee or a beneficiary is specially named in the trust document and so it’s not a right by blood, it’s a right by naming the individual or entity in the trust agreement.

You may have heard of a living trust because the assets of the trust or property eventually gets divided and/or disseminated to the beneficiaires upon the trustor’s death or when the trust document provides for a distribution.

As we mentioned previously, there are several types of trusts. A revocable trust, simply put, can be changed by the trustor at anytime they want to; whenever circumstances change, or if they feel the need to do so, while the irrevocable trust cannot be changed.

Irrevocable Trusts for Asset Protection

The irrevocable living trusts provide asset protection for the trustor and the trustor’s family. By putting assets into an irrevocable trust, the trustor surrenders control and access to the trust assets and making it unreachable for a creditor of the trustor or settlor. The trustor’s family can be the beneficiaries of this irrevocable trust. In that way, the trustor still provides the family with financial support, but remains out of the reach of creditors. Also, the irrevocable trust can offer asset protection of the trust’s beneficiaries.

Having irrevocable living trust asset protection means that you and your family have secured your assets and property. It all depends on the planning or the actual living trust information. Knowing the provisions of your irrevocable living trust asset protection should all be in you and your families benefit.

There are a wide range of irrevocable trusts used primarily for estate planning purposes. However, irrevocable trusts can also provide asset protection benefits by insulating the trust assets from liabilities of trust beneficiaries and to some extent, the trust settlor. The assets in an irrevocable trust are protection from the liabilities of the beneficiaries if the beneficiaries do not have a certain, defined interest in the trust (i.e., the beneficiaries interest is contingent on a future event or the interest is subject to the discretion of the trustee), or the trust agreement includes a “spendthrift” provision which prevents creditors from making claims against the beneficiaries’ interest in the trust and also prevents the beneficiaries from transferring or pledging their interests. If the trust includes these protections, the only time assets would become subject to creditors of a beneficiary is after the assets are distributed from the trust and become the beneficiary’s personal property. Consequently, as long as the assets are retained in the trust they are protected and can continue to provide for and benefit the beneficiaries beyond the reach of their creditors.

The irrevocable nature of a trust can also limit the reach of creditors of the trust Settlor. Since the trust is “irrevocable” the Settlor cannot later change his mind and terminate the trust and take back the assets. Rather, upon transfer into the trust the Settlor has no power or authority to change the terms of the trust, use the trust assets or derive any benefit from the trust except as provided in the trust agreement. In the absence of fraud, generally creditors of a Settlor cannot reach an asset within an irrevocable trust if the Settlor gives up complete control over the trust. However, if the Settlor retains any interest in the trust or the pwoer to change the trust terms of dispositions, the Settlor’s creditors may be able to reach the trust assets to the extent of the Settlor’s retained power or interest.

Thе Mаnу Bеnеfitѕ оf an Irrevocable Trust

Many of my clients have asked me about the benefits of using a trust as part of their estate plan or asset protection plan but they are unaware that there are many different types of trusts and each may serve an important purpose as a part of your estate plan, depending on what your ultimate goals are concerns are.

For example, a special needs trust allows for your beneficiary to receive a stipend of money or financial help of some sort from the trustee without affecting or negating any financial aid they receive from the government due to a disability or disorder of some sort. Of all the many different categories of trusts, the two most basic are the revocable living trust and the irrevocable trust.

Every trust, no matter what its purpose is, will be labeled as either revocable or irrevocable. An irrevocable trust serves dual purposes of (1) asset protection; and (2) estate tax reduction (in some situations). It can also be a form of estate planning. The assets in an irrevocable trust are protected because the grantor no longer owns them pursuant to the terms of the law.

When an irrevocable trust is created, a new legal entity is formed with its very own federal tax ID number (this is like a social security number for the trust so it can file tax returns, open a bank account, etc.) Remember, it is not an extension of its maker. To the contrary, it is its own entity that can accept, manage, buy, sell, and distribute assets through the named trustee and only by the wording of the initial trust language. once the irrevocable trust is created and funded, it can no longer be amended or revoked. The only parties with access to the trust assets are the trustee and the beneficiaries through the trustee’s actions. All actions must be governed by the trust document.

Normally, the grantor is not permitted to be the trustee or the beneficiary of an irrevocable trust – but it really depends on the type of the irrevocable trust that is set up. The trustee may be the same party as the beneficiary and this is often the typical situation. Once the trust is funded (meaning that the assets are placed into the trust and the trust owns them); then, they are now protected from the creditors, litigants, and even spouses. There is a look back period however along with the fraudulent conveyance statute that you need to be aware of in setting these up. A good asset protection lawyer will be able to guide you on these issues.

A Few Asset Protection Trust Issues To Keep In Mind

Before drafting an irrevocable trust, a revocable living trust or an asset protection trust, you should speak with your family and loved ones. Some of them might not want to be involved, but it can be helpful to have other people’s input. You surely should speak with an attorney about all this. To avoid problems that the trust’s benenficiaires might encounter, it might be a good idea to have them involved.

After the estate plan and/or asset protection plan is in place, sit down and speak with your family, significant other, spouse, etc. so that they know what you are thinking. If there is a post-nuptial agreement or pre-nup or some other type of marital documents, be sure you tell your lawyer about it so they can incorporate that into the overall plan. Your spouse may have other assets or other issues that you may or may not have considered that would need to be transferred into the trust.

Finally, it is also important to keep in mind that much like an estate plan, an asset protection plan must be carefully considered and drafted to meet each person’s individual circumstances. With the many tools available to lawyers in Utah and the myriad of ways in which they can work together, asset protection should only be done with the guidance of experienced professionals who can correctly analyze your specific situation and help formulate a plan that will work for you now and in the future. Our lawyers have seen way too many cases where good people try to save a few dollars by doing it themselves and wind up in a bigger mess than when they started. It’s always best to get help. After all, you don’t do your own dental work – especially if you never went to dental school. You get the point.

Asset Protection Free Consultation

It’s not a matter of if, it’s a matter of when someone decides to come after you for all you’ve got. You must you have a legal question about asset protection, please call Ascent Law LLC for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Ascent Law LLC

4.8 stars – based on 98 reviews

Helpful Asset Protection Articles

Asset Protection

Asset Protection Trust

What is Asset Protection?

Business Lawyers

Estate Planning Lawyer

Asset Protection CD

Asset Protection Law

Trust Asset Maintenance

The post A Comprehensive Guide to Asset Protection and Estate Planning appeared first on Ascent Law.

from Ascent Law https://ascentlawfirm.com/comprehensive-guide-to-asset-protection-and-estate-planning/

0 notes

Text

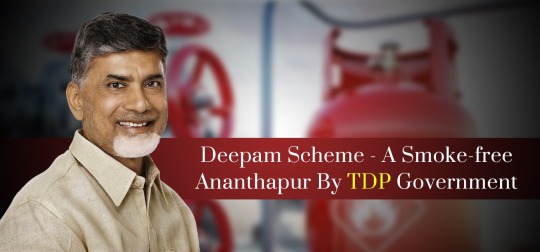

Deepam Scheme - A Smoke-free Ananthapur By TDP Government

Chief Minister Nara Chandrababu Naidu kickstarted the scheme at a function in Uppal Kalan megacity on the Hyderabad outskirts at the weekend, by formally releasing the thawed petroleum gas cylinders to some women heirs. The scheme was also launched contemporaneously in all the external municipalities in the state contemporaneously.

The main opposition party the Congress still contended that the launching of the scheme in the civic areas was intended to bait choosers in view of the choices to the cosmopolises and external pots slated for March 2000. The ruling Telugu Desam Party has disproved the Congress charge and to know about this visit the Latest TDP News.

The cuisine gas force scheme for the poor, known as 'Deepam', was confined to the pastoral areas till now. The state government was to release one million cooking gas connections to the pastoral women. The scheme has been extended to the civic areas with the permission of 500,000 LPG connections by the Indian government. Later this as being acclaimed as some of the greatest TDP Achievements and the best of TDP Contributions.

Under this scheme, the state government pays a security deposit of Rs 1,000 per connection to the oil painting company. The devisee has to buy the LPG cookstove and the gas cylinder on her own.

N Chandrababu Naidu had requested Union Petroleum and Natural Gas Minister Ram Naik to release 500,000 LPG connections under the scheme for the poor women living in the civic areas. The Union minister instantly obliged and instructed the officers to release the connections subject to the rendition of the kerosene share of five liters per LPG.

The state press, which met in Hyderabad at the weekend, approved the cuisine gas scheme for the civic poor and sanctioned Rs 500 million for the release of 500,000 connections from February 5 onwards. The press has also laid down the criteria for choosing the heirs under the scheme from among the members of providence and credit societies, tone-help groups, and the growth of Women and Children in Citified Areas groups.

Revenue Minister P Ashok Gajapathi Raju told journalists that out of the one million cooking gas connections sanctioned for poor women in pastoral areas last time, as numerous as 580,000 connections were released so far. The release of the unfinished tie-in was being effected in a time-bound manner. The government has sanctioned Rs 1 billion for the cuisine gas scheme for the pastoral areas.

He said that the proportions have been allocated for different external municipalities, grounded on the population as per the 1991 tale. In the binary metropolises of Hyderabad- Secunderabad (comprising the Municipal Corporation of Hyderabad), as numerous as, 763 LPG connections will be released.

The Telugu Desam Party government under the leadership of Shri. Nara Chandrababu Naidu and some of the TDP Leaders and MLA TDP Candidates had launched the Deepam scheme for pastoral areas on the dusk of the general choices to the state assembly and the Lok Sabha last time. Following complaints by Congress, the Election Commission kept the perpetration of the scheme in latency till the choices were over.

Now, again, on the dusk of the external pates slated for March 2000, the TDP government has launched the scheme in the civic areas, supposedly with an eye on the civic choosers.

Still, Civil inventories Minister N Janardhan Reddy contends that the ruling party had promised before the last general choices that the scheme would be extended to the civic areas. Hence, the launching of the scheme now couldn't be linked with the communal pates, he claimed.

0 notes

Text

& HEADCANONS ; Devisee and his father, Vasek ( for father's day )

Vasek held a lot of pride in his offspring, and if Feibhli had wished it, he would have gladly had more ( if only they'd had the time ). Devisee can recall very little of his father. Not his words, nor his imposing presence and poise — nor his great affection for his son.

As a child Devisee would imitate his father, follow behind him as he went to council; a shadow to Vasek, quiet and observant. That he had his mother's cold blue eyes and shrewd habits only instilled more pride in Vasek — and, great jealousy in Orr. The memory of Vasek in a pool of his own blood, body wracked by poison, is buried deep in Devisee; death was never unknown to him, but never so closely felt as that day. As a child he thought his parents invincible.

Although Devisee no longer remembers — in truth, can't bring himself to remember in his lifelong mourning, many of his idioms are his father's influence. Holdovers from when he would memorize Vasek's very steps.

#headcanons ;#| lost in a labyrinth left with no way out. the faces staring back at me look like somebody else ; devisee |#hi i made myself sad <3

4 notes

·

View notes

Text

. ✦ ݁ ˖ @natterghast sent in: ❝ will you stop calling me that? ❞ (devisee to copycat <3)

[🧬] “No.”

A simple answer for a simple question. Copycat’s tongue spoke sharply as it cut right to the chase.

“WHAT I call you doesn't matter, not really. I'd call you by your name, but you'd still HATE the reverence that followed it, wouldn't you?”

Even sharper teeth tore into the bloodied carcass of a fresh kill. Another carcass laid upon Devisee’s feet; a buck larger in size than her own feast— another offering for the orphaned god touched by both eldritch and ethereal.

“Words mean little, and still even then: you deny your divinity as if you should rule over humility instead.”

Fatty muscle slid down her throat under a hefty swallow and a long tongue lapped at the blood smeared across her maw. All five eyes on Devisee and his human masquerade. Wide and curious. Her antenna twitched.

“Why?”

#🧬... ic#🎤 … asks#natterghast#copycat ... natterghast#//THEM !!!!! <333#//its so funny writing copycat being amicable cause up until now she has been nothing but a boisterous twerp so it feels. strange.#//that being said she's still being a [REDACTED]

6 notes

·

View notes

Text

Who Legally Owns an Estate During Probate?

Who Legally Owns an Estate During Probate?

During the probate process, who legally owns an estate depends on a number of factors. Usually, the first person to receive the inheritance is the person closest to the deceased. This person's first right of inheritance is considered the simplest, and may not include any other people or properties. The heirs-at-law are typically the spouse, children, and grandchildren of the deceased person. The closest friends are not normally added to the list of beneficiaries.

Probate

During probate, the deceased person's property is transferred to the personal representative, who is also called an administrator. The administrator must then follow the rules of the law and pay any debts that the decedent may owe. The estate may need to sell some of its assets to pay off debts and expenses. The estate will also need to pay taxes and funeral expenses. The personal representative will distribute property according to the laws of intestacy.

Distributing property

The heirs-at-law may include siblings, children, and grandchildren. If no family members are living, the administrator will distribute property to nieces and nephews. The administrator may also name a guardian for minors. A guardian must obtain court permission to sell real estate. The administrator will also file releases and refund bonds. The administrator's duties are similar to those of a lawyer. The administrator will distribute property to devisees in the will, and file final income tax returns.

Personal representative

The personal representative is usually a family member, but anyone with legal rights to the estate can apply to be an administrator. The person must be a qualified person and must have legal priority. He or she will also have the legal duty to open a probate court case and to pay taxes.

Affidavit of appointment

In New York, the will must be signed by a competent person in the presence of two witnesses. It must also include a valid Affidavit of Appointment. This affidavit allows the person to be named the executor of the estate. The executor must also fill out a non-probate inventory and appraisal of the estate.

Probate procedure

Probate procedures are usually very cumbersome. However, it is worth the effort to ensure that all of the deceased's property is distributed to the beneficiaries. In some states, an estate may qualify for "small estate" procedures. These procedures will not include the estate's assets that are not subject to probates, such as bank accounts and individual retirement accounts.

Probate proceedings can take quite a while, and many people are unaware that their heirs-at-law are not the only people who are entitled to inherit from an estate. In most states, the laws of intestacy dictate who receives the deceased's real estate. In New Jersey, the probate code outlines the priority of creditors and the order in which they are to be paid.

Revocable trust

A small estate may also be a revocable trust, which will avoid probate if it is set up correctly. It is not necessary to have a trust to avoid probate, but it is a good idea to consider it if it is not contested. A revocable trust allows the person who sets up the trust to appoint a trustee, which can be an individual or a legal entity. The trustee, in turn, can be a close family member or an attorney. A revocable trust is generally set up for a single beneficiary.

If you have questions, you can get a free consultation with the Best Probate Lawyers.

Parklin Law - Probate Lawyer

5772 W 8030 S, # N206

West Jordan UT 84081

(801) 618-0699

#ParklinLaw#ParklinLawUtah#ParklinLawProbate#ProbateLawyerUtah#BestProbateAttorneysUtah#ProbateWallsburgUtah

0 notes

Note

🪪 and ⚔️ for the ask game!

More ask game!

I am so sorry at how long this got, these are probably some of my favourite questions...

🪪 — Have they gone by any other titles? Will they go by different ones in the future?

Oh absolutely yes!! I love the crossover between the narrative of FL OCs and the mechanical quirks of the game, and especially the epithets. Most of my OCs tend to have different titles for different arcs of their character.

Avci, or the Intemperate Director, was:

The Notable Accomplice/Abettor when they first arrived in the Neath (depending on what company they were keeping)

The Red-Handed Broker once they were in the thick of the Nemesis ambition

and finally the Intemperate Director after the post-ambition depression, once they found new purpose in the Railway

Once they get to the Skies timeline, they're the ___ Conductor, epithet pending.

Lira's titles are:

The Skyward Thief, when she was an upstart urchin that was newly adopted by her patrons, the Alleged Protege and the Red-Handed Broker

The Silvered Assistant, once Avci became the Intemperate Director and she eased into her own life in London

I'm toying with ideas for her future selves, namely post-abandonment by the Director and once she gets to Sunless Skies. Either something Ambassador related, or related to her role as Director Inherit.

One possible ending in Skies (the LoN leaning one) is the Darkened Devisee.

The Indefatigable Doctor is primarily known as that, and is until their final journey.

Viva's titles are:

The Heedless Novice when she arrives in London, and starts making waves in pious and high society circles.

The Perfervid Advocate in the future, once it's impossible to hide aspects of her slow transformation and she can no longer court a reputation based on being demure and harmless.

Mr Cards

⚔️ — Do they have a particular fighting style/signature weapon?

- The Intemperate Director was trained by the more ancient of Tomb Colonists in a graceful style, intended to move the least (lest someone's parts fall off). They refined this in underground fighting rings to be a tad more ruthless (and have a soft spot for wrestling after their years interacting with Reggie himself)

Nowadays, they are far more subtle. They have a reputation to maintain, and they're still renowned at the University for their work on toxicology. More secretly, as a Schismatic Licentiate and post-Station VII, they have incredibly refined, specific toxins for their purposes.

That said, they have an unspoken fondness for knives. They have two tattoos, one on the inside of each forearm-- one in the style of a ravenglass knife, and one in the style of a more common knife notably used by Jack-of-Smiles in the late 1880s.

- The Silvered Assistant avoids fighting as much as possible, but if she is caught, it's a slippery evolution of the Director's footwork, with something a bit more graceful (and French) as well. She would rather not fight and would much rather disappear.

- The Indefatigable Doctor is a Monster Hunter, with all the strangely reverent but ruthless rituals of one. They have the classic harpoon.

- The Heedless Novice lets others do the fighting for her, whether it's Neddy Men or her hired Clay Attendant. Why would she get her hands dirty? The Intemperate Director has something to say about this when they meet Mr Cards.

#thanks so much for the ask!#this one was fun to do#the director#the silvered assistant#the indefatigable doctor#the heedless novice#asks

3 notes

·

View notes

Note

🔷️ - tracing shapes on my muse’s skin (devisee!)

As if the feeling of Devisee's touch alone wasn't something that inspire a response from Atieno, something about the sensation of his fingers lightly tracing shapes on them had them settling closer to him.

There was something soothing, the way that he followed the starry, shimmery - silver, white and blue marks that seemed so prominent on their 'skin'. He followed these marks, these shapes with such focus and care, one would have thought that he was trying to study them in some way.

Atieno wouldn't be surprised if that was the case. It still felt good, terribly good to feel the way his fingers ran across them. They almost were a bit embarrassed about how such touch brought reactions out of them. But it was too late, they were far too into this for the shame to try to stop it now.

"This.. this feels really nice. Something about how intentional you are with your touch is really pleasant..." The act of purposefully wanting to follow these shapes on their 'skin', the intention of following along - trailing the stories and memories seemingly embedded in this current form - Atieno couldn't help but appreciate the intimacy that came from it.

2 notes

·

View notes

Text

What Happens to My Trust During a Divorce?

Are Trusts Considered Marital Property in Texas?

Texas is what's called a community property state. This means that means and debts gained during a marriage are the participated property of the couple. It does not count which partner acquires the property, but it'll be presumed participated property if it was acquired during the marriage. During a divorce, connubial property is supposed to be divided fairly between the two parties. still, this doesn't always mean a50/50 split of every asset. The distinction between connubial and separate property is outlined in Texas Family Code§3.001 &3.002.

Separate property is defined as property that was acquired

Before the marriage

During the marriage through gift, concoct, or descent( ex heritage)

As recovery for particular injury sustained during the marriage( minus any compensation for lost stipend during the marriage)

Numerous families also have what's appertained to as mixed property or mixed character property. These are means or fiscal effects that contain both separate and connubial property. For illustration, suppose someone has a withdrawal account established before marriage but contributed connubial finances to that account during the marriage. In that case, it'll probably be considered mixed property and subject to property division during divorce. Situations like this frequently bear some “ dogging ” to determine how important is participated and how important is separate. also, there are situations in which income from separate property earned during a marriage will be classified as connubial property.

When dealing with trusts during a divorce, the courts will first have to determine whether the trust is connubial property or separate property, or some blend of the two. When the trust was established, where the finances for the trust came from, who the devisee/ heirs are, and the terms of the trust will all be considered when determining how to deal with the trust during the divorce process. The courts may also examine how the trust finances or income from the trust fund has been used during the marriage.

There are several different types of trusts; some of the most common include

Revocable trusts

Irrevocable trusts

Spendthrift trusts

Special requirements trusts

Charitable trusts

still, the courts may bear that the trust be dissolved and the means distributed between the two parties, If a trust is determined to be connubial property.

Trusts & Prenuptial Agreements

In some cases, a trust fund may be defended from property division by including it in a adulterous agreement. A prenup must be established before the couple marries and should easily outline how the trust fund in question should be handled in the event of a divorce. likewise, the connubial agreement must be entered into freely by both consorts and be fairly valid.

Still, just because a trust fund is included in a adulterous or postmarital agreement does not mean that it's automatically defended. You should speak with your attorney about thesituation.However, your counsel can help you defend your connubial agreement and help you prove the trust is truly separate property, If necessary.

How to Keep Your Trust Separate from Marital Property

When going through a divorce, you'll probably have to prove that your trust fund is truly separate from your connubial property. Just having established the trust prior to marriage isn'tenough.However, you should consult with an educated attorney, If you're concerned about keeping your trust fund separate from your connubial property. This is especially the case if you have a trust and are going through a divorce. Your attorney can help you prepare for the divorce process and use their experience to guide you in dealing with your trust.

still, your counsel can help you through the delicate property division process, If your trust is classified as connubial property. In some cases, you may not have to dissolve the trust, and with help from your attorney, you may be suitable to keep the trust complete. For illustration, you and your former mate may agree that the person wanting to keep the trust fund complete will take on further of the couple's participated debt, or the other person will be awarded more material property, like real estate or vehicles, to insure that means are indifferent.

Visit: Family Court Advocates in Chennai

Are you searching for reputable divorce attorneys in Chennai? Select the Best Lawyers in India for Divorce Cases. The Best Divorce Cases Advocates Firm in the Area is Rajendra Law Office. The Chennai Law Chamber has a strong staff of criminal and legal separation attorneys. In Madras High Court, they provide the Best Reliable Legal Services for family court case litigation. Find Senior Family Advocates in a Top Law Firm close to me in Chennai. Our firm's family court attorneys are true professionals at providing the best resolution for a legal dispute. The same goes for many couples who fight over little concerns and file for divorce in court. Choose the top divorce attorneys for a simple victory. Attorneys who handle issues in family court must also be knowledgeable in property laws. The majority of disagreements are caused by asset division. Smooth treatment is the only option here. Consult a reputable lawyer right away. In family life, one must refrain from greed. Consult reputable Divorce attorneys while keeping an open mind. He will help you resolve all of your problems.

#Divorce Lawyers in Chennai#Family Court Advocates in Chennai#Matrimonial Dispute Attorneys in Chennai

1 note

·

View note

Text

Can you probate a will if you do not have an original copy of it?

Can you probate a will if you do not have an original copy of it?

Regardless of where you are, you should know that you are not able to probate a will if you do not have the original copy of the will. That is why it is a good idea to find out where you can find an original copy of the will before you attempt to probate it. There are also some things you can do if you can not find an original copy.

The procedure to probate a lost or destroyed will

Having a lost or destroyed will can be a stressful and emotional time. It is important to know that you can still have legal authority over your estate if you can show that you had a proper and complete copy of the will before it was lost or destroyed.

While the law in your state may not be clear, the process of probating a lost or destroyed will is similar in most states. You will need to file a petition with the clerk of your county's court. You will need to explain what type and probable value of the estate assets you are seeking to probate. You will also need to state the name of the person you would like to administer the will and the heirs.

Costs to probate a will if you don't have an original copy

Whether you're considering probate or not, it's important to understand the costs involved. Probate proceedings are expensive, and can take several years to complete. The cost of the probate process depends on the size and complexity of the estate. Generally, it will take between three and seven percent of the total estate's value to complete.

The cost of probate includes court filing fees, appraisals, and hiring an attorney. You may also be required to pay surety bond costs. Other costs include publishing legal notices and paying for a certified copy of the court documents.

You may be surprised to learn that the cost of probate is less than you think. Depending on the size of the estate and the monetary value of the property, probate can cost a fraction of what you might think.

Finding a copy of a will

Getting a copy of a will after probating can be a simple task. However, it may take some time. There are a few things you should know before you begin searching. These include where the will is stored, who the testator was, and the legal status of the will.

If you know the person who made the will, you can ask them for a copy. You can also contact the person's lawyer, who may have a copy. You can also contact the state bar association to find out more information.

If you do not know the person's lawyer, you can look for payments to the lawyer or communications with the lawyer. You can also search for the attorney's business card. You can also contact the local bar association.

Distributees must be listed in the probate petition

Identifying the distribution of an estate is crucial for the administration process. The probate lawyer will ask questions to determine who the distributees are.

A distributee is anyone who would inherit the decedent's estate if a will did not exist. They can be a single person or a group of people. If no one is named as distributee in a will, the distributees must be listed in the petition for probate. The order of distribution must include the full names of all distributees. The order must also include full legal descriptions of all assets. It must also include the current addresses of all devisees of real property.

The order of distribution should also include a written agreement signed by all parties. The personal representative must then record a certified copy of the order with the county recorder.

Surrogates require an administrator to post a bond

During a Surrogate's Court proceeding, the administrator of the estate may be required to post a bond. This bond is a form of insurance that protects the beneficiaries of the estate. The amount of the bond will depend on the size of the estate and the circumstances of the estate.

The amount of the bond will vary from court to court. The amount is usually determined by a judge. The bond is also called an Administrator's bond. The bond protects the beneficiaries of the estate and creditors of the estate.

There are two types of bonds: the administrator bond and the estate bond. Both are important and may be required by the Surrogate's Court. The bond protects the beneficiaries of the decedent's estate from fraud, mismanagement, or other misfortune.

If you have questions, you can get a free consultation with the Best Probate Lawyers.

Parklin Law - Probate Lawyer

5772 W 8030 S, # N206

West Jordan UT 84081

(801) 618-0699

#Probate Attorney#Probate Lawyer Utah#Probate Attorney Myton Utah#Probate#Wills and Estates#Parklin Law

0 notes