#dgft notification

Text

#export#import export#news#news india#breaking news#edu visor news#zee news#income tax#dgft#updates#notification#india#taxation#narendra modi

0 notes

Text

Simplifying Compliance: The IEC Registration Online Process Demystified

In today's globalized economy, engaging in international trade has become essential for businesses seeking growth and expansion opportunities. For businesses looking to embark on import or export activities, obtaining an Importer-Exporter Code (IEC) is a fundamental requirement. Fortunately, with the advent of digital technologies, the process of obtaining an IEC has been streamlined through the IEC registration online process. Let's explore how this online platform has simplified compliance for businesses in the realm of tax and accounting.

Understanding the IEC Registration Online Process

The IEC is a 10-digit alphanumeric code issued by the Directorate General of Foreign Trade (DGFT) in India to businesses engaged in import or export activities. Previously, obtaining an IEC involved cumbersome paperwork and manual submissions, often leading to delays and inefficiencies. However, the introduction of the IEC registration online process has revolutionized the way businesses obtain their IEC codes.

Key Features of the Online Process

The IEC registration online process offers several key features and benefits for businesses:

1. Convenience:

Businesses can complete the entire registration process from the comfort of their offices or homes, eliminating the need for physical visits to government offices.

The online platform provides a user-friendly interface, guiding applicants through each step of the process and reducing the likelihood of errors or omissions.

2. Efficiency:

The online process expedites the issuance of IEC codes by automating various stages of the registration process.

Applicants can track the status of their applications in real-time and receive notifications regarding any additional documentation or information required.

3. Accessibility:

The online platform ensures inclusivity by enabling businesses located in remote areas or regions with limited access to government offices to obtain their IEC codes without geographical constraints.

4. Transparency:

The online platform provides transparency throughout the registration process, with clear guidelines and instructions for applicants to follow.

Applicants receive instant confirmation of their application submission and can download their IEC certificates once issued.

0 notes

Text

Mandatory QCO exemption for Advance Authorization holders with caveat

Mandatory QCO exemption for Advance Authorization holders with caveat

“Indirect Tax I Arbitration I Advisory I Litigations”

Dated: 09.03.2024

Mandatory QCO exemption for Advance Authorization holders with caveat

The Directorate General of Foreign Trade (DGFT) has recently taken a significant step in facilitating trade by issuing Notification No. 69/2023 dated March 07, 2024. This notification extends exemption to Advance Authorization license holders from…

View On WordPress

#ADR#Advisory#Arbitration#ArbitrationLaw#BarandBench#BDO#BDOIndia#BIS#CBIC#CDSCO#CII#CommercialLaw#Compliance#ConstitutionalLaw#Consulting#CorporateLaw#CustomsAct#Deloitte#DGFT#DutyDrawback#ERNSTANDYOUNG#Exports#EY#Facebook#FICCI#FTP#FTP2023#GRANTTHORNTON#India#IndianChamberofCommerce

0 notes

Text

India okays rice exports to Africa in outreach to Global South

The government has, as part of India’s outreach to the Global South, allowed the exports of 1,10,000 tonnes of rice to three African countries to help them meet their food security needs.

According to a notification issued by the Directorate General of Foreign Trade (DGFT), the export of 30,000 tonnes of non-basmati white rice has been allowed to Tanzania while 30,000 tonnes of broken rice have been permitted for export to Djibouti and 50,000 tonne to Guinea Bissau.

Though exports of non-basmati white rice have been banned since July 20, 2023 in order to ensure adequate domestic supplies and control inflation.

0 notes

Text

1. What is an Importer Exporter Code (IEC)?

Answer: An IEC is a 10-digit code required for anyone engaging in import/export activities.

2. What is a Bill of Entry for importers?

Answer: A Bill of Entry is a legal document filed by importers with customs before the goods are cleared for customs clearance.

3. What documents are needed for customs clearance?

Answer: Common documents include Bill of Entry, commercial invoice, packing list, insurance certificate, and certificate of origin.

4. What is the Customs Duty and how is it calculated?

Answer: Customs Duty is a tax levied on imported goods. It can be calculated based on the value of the goods, their classification, and the applicable tariff rates.

5. What is a Harmonized System (HS) code?

Answer: HS codes are used to classify goods for customs purposes. It’s a normalized arrangement of numbers and names to group specific exchanged items.

6. Are there any limitations on importing specific exchanged merchandise?

Answer: Yes, certain goods are subject to restrictions or prohibitions. Check the DGFT’s Import Policy for a comprehensive list.

7. Do somebody have to pay Goods and Services Tax (GST) on merchandise which are imported?

Answer: Yes, GST is applicable on imported goods. It’s calculated on the assessable value plus customs duties.

8. Can I import goods without an IEC?

Answer: No, an IEC is mandatory for importers in India.

9. What is FTA (Free Trade Agreement)?

Answer: FTAs are agreements between countries to reduce or eliminate tariffs on certain goods.

10. How can I claim exemptions or concessions on customs duties?

Answer: If your imported goods fall under specific categories, you may be eligible for duty exemptions or concessions. Check the customs notifications for details.

11. Are there any naming necessities for imported?

Answer: Indeed, certain items require naming with explicit data, including nation of beginning and other important details.

12. What is a Letter of Credit (LC) and how does it relate to importing?

Answer: An LC is a financial instrument that guarantees payment to the exporter upon successful shipment of goods as per agreed terms.

13. Are there any import restrictions based on environmental or health considerations?

Answer: Yes, certain goods might require environmental or health clearances from relevant authorities.

14. Can I import goods for personal use without an IEC?

Answer: Yes, individuals can import goods for personal use within certain limits without an IEC.

15. How would I deal with customs valuation of imported products?

Answer: Customs valuation is typically based on the transaction value, which includes the price paid or payable and certain specified costs.

16. What are Basic Customs Duty and Additional Customs Duty?

Answer: Basic Customs Duty is imposed on the value of goods, while Additional Customs Duty is equivalent to the Excise Duty.

17. Is Goods and Services Tax (GST) appropriate on imported merchandise?

Answer: Yes, GST is levied on the assessable value plus customs duty.

18. Are there any exclusions from customs obligations and expenses?

Answer: Indeed, there are exclusions accessible for specific classifications of merchandise, as determined by the public authority.

19. What is the process for claiming duty drawback?

Answer: Duty drawback is a refund of customs duties paid on imported goods that are subsequently exported. You can claim it through the prescribed procedure.

20. How is anti-dumping duty assessed on imported goods?

Answer: Anti-dumping duty is imposed when the imported goods are found to be priced lower than their normal value in the exporting country.

21. Do I need to maintain any records for imported goods?

Answer: Yes, you must maintain records related to imports for a specified period.

22. Is there a requirement for pre-shipment inspection of goods?

Answer: Some goods may require pre-shipment inspection, as specified by certain importing countries.

23. What is an Endorsement of Beginning and when is it required?

Answer: A report confirms the nation of beginning of merchandise and may be expected for customs leeway or under economic deals.

24. Are there any labelling and packaging requirements for imported goods?

Answer: Yes, certain goods need to be labelled and packaged according to specific regulations.

25. What is Advance Ruling and how can it benefit importers?

Answer: A Development Administering gives clearness on customs and assessment matters before real import, assisting merchants with settling on informed choices.

26. What is FTA (Free Trade Agreement)?

Answer: FTAs are agreements between countries to reduce or eliminate trade barriers, including customs duties, for certain goods.

27. How do I determine eligibility for preferential tariff under FTAs?

Answer: Importers need to ensure that the imported goods meet the rules of origin criteria specified in the respective FTA.

28. Do I really want any licenses for bringing in specific products?

Answer: Certain goods, like restricted items or hazardous substances, might require specific licenses.

29. What is the process for importing goods under the Special Valuation Branch (SVB)?

Answer: SVB handles cases where normal customs values cannot be determined and investigates the valuation.

30. Can individuals import goods for personal use?

Answer: Yes, individuals can import goods for personal use within specified limits.

31. Are there any restrictions on duty-free allowances for personal imports?

Answer: Indeed, there are limits on the worth and amount of products that can be imported obligation free.

32. How does Customs handle intellectual property rights (IPR) protection?

Answer: Customs can seize goods suspected of infringing IPR at the border, if registered with them.

33. Are there any natural considerations for importing merchandise?

Answer: Certain goods may require clearance from environmental authorities due to potential ecological impact.

34. What are the safety regulations for imported goods?

Answer: Indeed, a few items need to meet explicit wellbeing and security guidelines set by significant specialists.

35. What are the punishments for goods related customs violations?

Answer: Punishments can go from fines to seizure of merchandise or even detainment, contingent upon the idea of the infringement.

36. How are customs duties and taxes applied to goods purchased online?

Answer: Customs duties and taxes apply to online purchases, and the responsibility to pay usually falls on the importer.

37. What is the process for warehousing imported goods?

Answer: Importers can choose to store goods in a customs-bonded warehouse for a specified period.

38. Can an imported goods re-exported?

Answer: Re-trading merchandise requires consenting to customs strategies and documentation.

39. Are there any administration conspires that can be valuable for goods?

Answer: Yes, schemes like the Advance Authorization Scheme provide incentives for importing goods for export production.

40. What is the process for temporary importation of goods?

Answer: Temporary imports are allowed under certain conditions and require a security deposit.

41. Are there explicit necessities for bringing in apparatus and hardware?

Answer: Indeed, particular sorts of hardware could require consistence with specialized guidelines.

42. What regulations apply to importing pharmaceuticals and medical devices?

Answer: Importing pharmaceuticals and medical devices requires compliance with the Drugs and Cosmetics Act.

43. Are there guidelines for importing or bringing in food items?

Answer: Yes, imported food products must meet safety and labelling requirements.

44. Are there any limitations on Importing or bringing in any gadgets?

Answer: Importing electronics might require compliance with Bureau of Indian Standards (BIS) standards.

45. What are the guidelines for bringing in materials and attire?

Answer: Importing textiles and apparel might require compliance with the Textile and Apparel Policy.

46. How might I safeguard my licensed innovation freedoms for imported merchandise?

Answer: Register your trademarks, copyrights, and patents in India to prevent infringement.

47. How might I ensure consistence with both GST and customs rules?

Answer: Keep accurate records and ensure proper valuation of goods for both GST and customs purposes.

48. Can my imports be subject to post-clearance audits?

Answer: Yes, Customs may conduct audits to verify the accuracy of declarations even after clearance.

49. What is the process for importing samples for testing and evaluation?

Answer: There are provisions for duty-free import of samples for specified purposes.

50. How can I import goods for exhibitions and trade fairs?

Answer: Temporary importation under the ATA Carnet system is a common practice.

Authored By; Adv. Anant Sharma & Anushi Choudhary

#BEST EXPORT IMPORT LEGAL ADVICE IN NOIDA#BEST EXPORT IMPORT LEGAL SOLUTIONS IN NOIDA#BEST EXPORT IMPORT LEGAL REMEDIES IN DELHI NCR#BEST EXPORT IMPORT LEGAL REMEDIES IN GURUGRAM#BEST EXPORT IMPORT LEGAL REMEDIES IN NOIDA#BEST EXPORT IMPORT LEGAL SERVICES IN DELHI NCR

1 note

·

View note

Text

Plagued by overseas deaths, India's cough syrup exporters must now take govt mandated tests

The quality check of the cough syrups has been taken after India's image as the "pharmacy of the world" took a knock following the WHO alerts on contaminated cough syrups.

NEW DELHI: From June 1, all cough syrup exporters will have to undertake mandatory testing of their products at specified government laboratories before getting permission for the outbound shipments.

The direction comes after three alerts issued by the World Health Organisation (WHO), in seven months, on contaminated India-made cough syrups.

“The export of cough syrup shall be permitted to be exported subject to export samples being tested and production of a certificate of analysis issued by any of the laboratories, with effect from June 1, 2023,” the Directorate General of Foreign Trade (DGFT) said in a notification on Monday.

The earmarked central government labs include Indian Pharmacopoeia Commission, Regional Drug Testing Lab (RDTL — Chandigarh), Central Drugs Lab (CDL — Kolkata), Central Drug Testing Lab (CDTL — Chennai, Hyderabad, Mumbai), RDTL (Guwahati) and the NABL (National Accreditation Board for Testing and Calibration Laboratories) accredited drug testing labs of State governments.

The quality check of the cough syrups has been taken after India’s image as the “pharmacy of the world” took a knock following the WHO alerts on contaminated cough syrups.

For this, the Ministry of Health and Family Welfare would partner with the state governments and the exporters.

Officials believe this measure would help re-emphasise India’s commitment to assuring the quality of various exported pharmaceutical products. They added that necessary steps are being taken to ensure the smooth implementation of this testing requirement.

India exported cough syrups worth $17.6 billion in 2022–23 against $17 billion in 2021–22.

India-made cough syrups were allegedly linked to the deaths of 70 children in the Gambia and 18 children in Uzbekistan last year.

In April, WHO again raised an alert over contaminated India-made cough syrup sold in the Marshall Islands and Micronesia. But it was not just cough syrups.

Earlier this year, an India-manufactured eye drop was linked to an outbreak of highly resistant bacterial infections in the U.S.

The Centers for Disease Control and Prevention (CDC), which is the national public health agency of the US, had linked the eye drops manufactured by Chennai-based pharma company Global Pharma Healthcare to the likelihood of a highly drug-resistant bacteria gaining a foothold in the U.S.

India is the largest provider of generic drugs globally, supplying over 50 per cent of the global demand for vaccines, about 40 per cent of generic demand in the US, and about 25 per cent of all medicine in the UK.

Globally, India ranks third in pharmaceutical production by volume and 14th by value.

The industry includes a network of 3,000 drug companies and about 10,500 manufacturing units. It facilitates the availability and supply of high-quality, affordable, accessible medicines worldwide.

Similarly, over 80 per cent of the antiretroviral drugs used globally to combat AIDS are supplied by Indian pharmaceutical firms.

0 notes

Text

Govt bans apple imports if its price is less than Rs 50 per Kg

New Delhi: The government on Monday banned the import of apples if its imported price is less than Rs 50 per Kg. The directorate general of foreign trade (DGFT) said in a notification that the imports are free if the price is above Rs 50 per kg.

from IndiaTV Business: Google News Feed https://ift.tt/KZ51kPO

via IFTTT

from Blogger https://ift.tt/9aGHk2Y

via IFTTT

View On WordPress

0 notes

Text

Centre bans imports of apples costing less than Rs 50 per kilo

New Delhi: The government on Monday banned the import of apples if their imported price is less than Rs 50 per Kg.

The directorate general of foreign trade (DGFT) said in a notification that the imports are free if the price is above Rs 50 per kg.

“Import of apples…is prohibited wherever the CIF (cost, insurance, freight) import price is less than equal to Rs 50 per Kg,” DGFT said in the…

View On WordPress

0 notes

Text

India allows duty-free import of 51.4K MT ELS cotton from Australia

India allows duty-free import of 51.4K MT ELS cotton from Australia

The Indian government has allowed duty-free import of 51,419 MT Extra Long Staple (ELS) cotton (minimum 28 mm) from Australia under the Economic Cooperation and Trade Agreement (ECTA). As per a notification issued by Directorate General of Foreign Trade (DGFT), Australia enjoys duty free market access of India for Extra Long Staple cotton (minimum 28 mm).

Australia government can allocate tariff…

View On WordPress

0 notes

Text

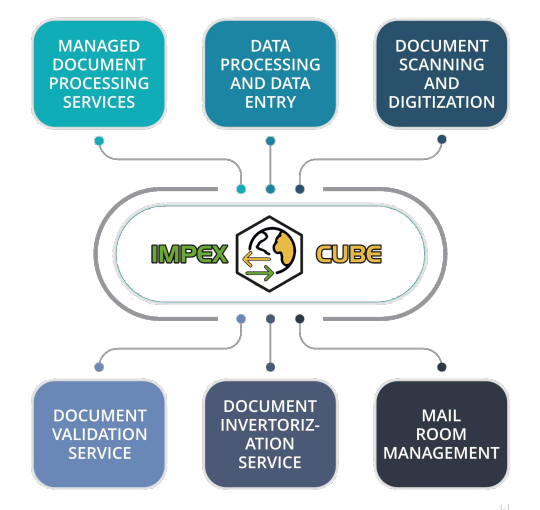

Duty Calculator in India

IMPEX Cube specialize in the integration of Indian Customs (EDI) Unit and also DGFT System based on specific corporate structure and take regional also national legal requirement into account.

We ensure efficient customs operation and compliance with the legal framework. All in one platform for Customs & trade compliance database, graphical user interface (GUI),

maintenance and support service in India.

We provide our customer with high Quality, web based, user friendly suite of software product which undergo continuous enhancements and development. we want to establish ”

IMPEXCube ” as a global standard for quality in our area of expertise.

Benefit's of IMPEXCube :

Customs Online Filing : Anywhere Any Time access and

centralize your branches.

Document Management System at share point

for Internal / External Branches.

Check your Duty Calculator and CCR Compliance instantly.

Mandatory Document alert for e-sanchit compliance

with amendment.

Automated for e-sanchit process in jobs.

Notification Alert for Benefits and FTA

(Carotar 2020 rules).

15/6* Customer support for Customs filing.

#custom clearing software india#shipping software india#customs duty calculator india#import duty calculator india#export duty calculator india#CHA accounting software#icegate filing software

1 note

·

View note

Text

India is ready for Bulk Drug / API Serialization mandatory from 1st January 2023

India is going to get 1st mover advantage worldwide by adopting serialization on Bulk Drug / API Serialization from 1st of January 2023 as per gazette published by Ministry of Health and Family Welfare on 18th January 2022 with No. CG-DL-E-19012022-232768.

Indian Bulk Drug manufacturers are fully geared up to adopt the same & start serializing their packs at each level. Many companies across country have started their pilot phases well before the upcoming deadline. Today our country has more than 25 solution providers for Track & Trace / Pharmaceutical serialization. Earlier when DGFT mandate came for serialization of pharmaceutical formulation back in 2009, India was not having service provider who can provide solution to industry. But in span of last 12 years, India has not only local service providers for Track & Trace / Pharmaceutical serialization, but many international players from US, UK, Canada, Russia, etc. having started their operations to cater to industry requirements. Today more than 1500 pharmaceutical formulation manufactures across country have implemented Track & Trace / Pharmaceutical Serialization, since many countries across world like US, EU, China, Russia, Brazil, etc. across the globe have made it mandatory.

India was 1st to bring mandate among all countries, to make serialization compulsory for exports, but however DGFT has to keep extending year after year. Many countries like US / EU / China gave notification to implement serialization and made strict to implement within short span of 36 months!!

But the initiative of Ministry of Health & Family Welfare will keep India on the 1st place worldwide to implement serialization on Bulk Drug / API if they further do not keep extending dates. Today looking to readiness of all Bulk Drug manufactures as well as availability of service providers, we feel Dr. Mandeep Bhandari, Jt. Secy. will not extend further and now make it compulsory.

On other hand Union Minister of Health and Family welfare of India is Shree Mansukh Mandaviya, who is known for his intellectual analysis and well thought leadership. We all know that he is the man who provided us more than 800 medicines at affordable rates and reducing the cost of heart stent and knee implants; who is now taking this fight further with counterfeiters who manufacture duplicate medicine, which will in turn save lives of thousands worldwide every year as our drugs are exported heavily.

In leadership of Shree Mansukh Mandaviya, Minister of Health and Family welfare of India has also issued further gazette for serialization of 300 drugs effective from May 2023, wherein various meetings are held nationally to make that a grand success.

Published Gazette for Bulk Drug / API serialization though directly is not specifying adopting GS1 standards of barcode neither the way to encode such huge data, but all leading service providers conducted various meetings to comply published gazette and have found out ways of using GS1 standards by further finding applicable GS1 AI’s (GS1 Application Identifiers) from latest GS1 General Specification being published. We all know without using proper barcode standards, everyone will start encoding data in their own format which will in-turn lead to huge failure of implementation.

There are some service providers, who created their solutions by just encoding web address inside QR Code and showing all information on cloud after scanning with OTP authentication, but they missed out on how supply chain will capture data after scanning QR Code, like GTIN (01) and mainly SSCC (00) mandatory to be captured by Track & Trace systems while goods are in transit.

Final Gazette published for Bulk Drug / API serialization is a well thought process by Ministry of Health & Family Welfare, which covers encoding all required data for Track & Trace as well as an Anti-Counterfeit measure. Eventually supply chain has to read & capture data into their AIDC systems to Track & Trace movement of material, wherein SSCC (Serial Shipping Container Code) will act as unique identifier to capture data along with GTIN and other Meta data being specified in Gazette.

There are companies like Optel, TraceLink, ACG, NKP, URL, Jekson, Rfxcel, Aseptic, Antares, SAP ATTP, Infosys, TraceKey, etc. having out of the box solution to comply & Bulk Drug Manufactures should implement solutions from such experienced vendors.

All Bulk Drug / API Manufacturers in rest of the world and exporting to India will also have to implement barcoding as per gazette on label at each level of packaging, thus in this mandate all imported Bulk Drug / API packs will be traced within our country.

It’s time to say goodbye to counterfeit of drugs and also creating traceability / visibility of supply chain in India too.

#apiserialization#pharma#pharma news#pharma manufacturing#health medical pharma#pharmamachinery#bulkdrug#apiqrcode#bulkdrugqrcode#apitrackandtrace#trackntrace#trackandtrace#track and trace solutions market

1 note

·

View note

Text

Govt gives nod to PET flakes import, but with certain conditions. Read here

New Post has been published on https://petnews2day.com/pet-industry-news/pet-travel-news/govt-gives-nod-to-pet-flakes-import-but-with-certain-conditions-read-here/

Govt gives nod to PET flakes import, but with certain conditions. Read here

The Centre on Thursday announced that it has provided its approval for imports of PET flakes that are used in making certain plastic products. However, there are certain conditions.

“Import of PET flakes has been permitted subject to NoC (no objection certificate) from Ministry of Environment, Forest and Climate Change and an authorisation from Directorate General of Foreign Trade (DGFT),” a commerce ministry notification said.

<![CDATA[.authorSearchmargin:20px; border-radius: 4px; border: solid 1px #e0e0e0; background:#fff; .authorInp height:40px; width:86%; padding:11px 16px; color:#212121; border:0; box-sizing:border-box; float:left; font-size:14px; font-weight:700; .authorInp::placeholder color: #bdbdbd; .authorBtn background:url(https://images.livemint.com/static/icon-sprite.svg) no-repeat -24px -10px #fff; cursor:pointer; float:right; width:20px; height:20px; border:0; margin:11px 16px 0 0 .authoeSlider background:#f5f5f5; box-sizing:border-box; margin-bottom:9px; white-space:nowrap; width:100%; overflow-x:unset; padding:0; .authoeSlider a display:inline-block; cursor: pointer; margin:0 10px; border-bottom:3px solid #f5f5f5; padding:9px 0; font-size:12px; color:#212121; font-weight:400; font-family: 'Lato Regular',sans-serif; .authoeSlider a.activeborder-color:#f99d1c; color:#f99d1c; font-weight:900; font-family: 'Lato Black',sans-serif; .authoeSlider a:hovercolor:#f99d1c; .authorSecpadding:0 20px 20px; .authorBox width:48.5%; padding: 12px; float:left; margin-top:16px; border-radius: 4px; border: solid 1px #e0e0e0; background-color: #fff; box-sizing:border-box; .authorBox:nth-child(odd)margin-right:7px; .authorBox:nth-child(even)margin-left:7px; .authorImg width:62px; height:62px; border:1px solid #f99d1c; float:left; padding:4px; box-sizing:border-box; border-radius:50%; .authorImg img width:54px; height:53px; border-radius:50%; .authorDesc margin:0 0 0 9px; float:Left; width: calc(100% - 71px); .authorDesc h2margin:0; padding:0; font-weight:900; color:#000; font-size:16px; font-family: 'Lato Black',sans-serif; margin-bottom:5px; white-space:nowrap; overflow: hidden; text-overflow: ellipsis; .authorDesc h2 acolor:#000; .authorDesc h2::after display:none; .authorDesc h1 display: block; float: none; width: 100%; padding: 0; .authorDesc h5 display: block; width: 100%; font-weight:400; color:#757575; font-size:14px; font-family: 'Lato Regular',sans-serif; margin-bottom:5px; white-space:nowrap; overflow: hidden; text-overflow: ellipsis; .twitterAuthor background:url("https://images.livemint.com/dev/ico-tw.svg") no-repeat 0 0; width:20px; height:20px; margin-right:18px; float:left; margin-top:2px; .emailAuthor background:url("https://images.livemint.com/dev/ico-emai.svg") no-repeat 0 0; width:20px; height:20px; float:left; margin-top:2px; .followAuthor padding:4px 11px; font-weight:900; color:#424242; font-size:12px; font-family: 'Lato Black',sans-serif; border:1px solid #d2d2d2; float:right; border-radius:25px; .followAuthor spanmargin-left:6px; .authorBox2 width:100%; padding: 12px; margin-top:16px; margin-bottom:5px; background-color: #fff; box-sizing:border-box; .authorInfoborder-top: solid 1px #e4e4e4; margin-top:10px; padding:10px; font-weight:400; color:#424242; font-size:16px; line-height:22px; font-family: 'Lato Regular',sans-serif; .fs16 font-size:16px; a.authorlinkmargin: 0; padding-top: 0; background-position: right center; font-size:12px; text-transform:uppercase; .noAuthorbackground:#fff; padding:100px; text-align:center; margin-bottom:5px; .noAuthor strong display:block; font-weight:700; color:#2f2f2f; font-size:16px; font-family: 'Lato bold',sans-serif; margin-bottom:8px; .noAuthor span display:block; font-weight:400; color:#757575; font-size:14px; font-family: 'Lato Regular',sans-serif; margin-bottom:12px; .noAuthor afont-weight:900; padding:13px 27px; text-transform:uppercase; display:inline-block; color:#fff; font-size:12px; background:#f99d1c; font-family: 'Lato Black',sans-serif; border-radius:4px; .authorSubHead font-weight:900; color:#757575; font-size:12px; font-family: 'Lato Black',sans-serif; padding:0 20px 12px; .authorsHolder padding:0 16px; a.authorsName padding:7px 41px 7px 12px; border:1px solid #d2d2d2; font-weight:900; color:#424242; font-size:14px; font-family: 'Lato Black',sans-serif; display:inline-block; background:url("https://images.livemint.com/dev/add-author.svg") no-repeat 90% center; margin:0 2px 10px; border-radius: 25px; a.authorsName.selected background-image:url(https://images.livemint.com/dev/added-author.svg); background-color:rgba(249, 157, 28, 0.1); border-color:#f99d1c; .selectedAuthors margin-top:20px; .authoeSlider .swiper-containerpadding:0; .authoeSlider .swiper-container .swiper-button-next, .authoeSlider .swiper-container .swiper-button-prevmargin-top:-14px; .authoeSlider .swiper-container .swiper-button-prevmargin-left:0; .authoeSlider .swiper-slidewidth:auto; .authoeSlider .swiper-container .swiper-button-next span, .authoeSlider .swiper-container .swiper-button-prev spanmargin-top:5px; .authorBoxSecmargin:16px 20px; .authorBox2.authorBox2Storypadding: 16px; border-radius: 4px; border: solid 1px #e4e4e4; background-color: #fbfbfb; .authorBox2.authorBox2Story .authorImgwidth:37px; height:37px; .authorBox2.authorBox2Story .authorImg img width: 28px; height: 28px; border-radius: 50%; .authorBox2.authorBox2Story .authorInfofont-size:14px; line-height:22px; padding-bottom:0; .authorBox2.authorBox2Story .authorDesc h5 margin-bottom:0; margin-top:4px .authorHeader text-transform:uppercase; font-size: 12px; font-weight: 900; color:#757575; font-family: 'Lato Black',sans-serif; margin-bottom:10px; @media(max-width:767px) .authorSearchmargin:16px; .authorBoxwidth:100%; float:none; .authorSecpadding: 0 16px 16px; .noAuthorpadding:100px 20px; .authorSubHead padding:0 16px 12px; .authorsHolder padding:0 12px; .selectedAuthors margin-top:16px; .authorBoxSecmargin:16px; .authorBox:nth-child(odd)margin-right:0; .authorBox:nth-child(even)margin-left:0; .authorBox2margin-top:0; ]]>

Catch all the Business News, Market News, Breaking News Events and Latest News Updates on Live Mint.

Download The Mint News App to get Daily Market Updates.

More

Less

0 notes

Text

RoDTEP benefits extended to Advance Authorization Holders/EOU/SEZ Units

RoDTEP benefits extended to Advance Authorization Holders/EOU/SEZ Units

“Indirect Tax I Arbitration I Advisory I Litigations”

Dated: 09.03.2024

RoDTEP benefits extended to Advance Authorization Holders/EOU/SEZ Units by DGFT

The Directorate General of Foreign Trade (DGFT) has issued Notification No. 70/2023 dated March 08, 2024, extending the Remission of Duties and Taxes on Exported Products (RoDTEP) support to exports made by Advance Authorization (AA) holders,…

View On WordPress

#ADR#Arbitration#ArbitrationLaw#Arbitrators#BDO#BDOIndia#BengalChamberofCommerce#BiharChamberofcommerce#Bing#BingSearch#CBIC#CII#Consulting#Deloitte#DGFT#ERNSTANDYOUNG#Facebook#FICCI#FTP#FTP2023#Google#GoogleSearch#GoogleSEO#GRANTTHORNTON#GujaratChamberofcommerce#ICC#India#IndianChamberofCommerce#IndianCustomsAtWork#IndirectTax

0 notes

Link

✅ *DGFT Recruitment 2022, Apply Upper Division Clerk 63 Post*

✅ *वाणिज्य और उद्योग मंत्रालय* में आई *Upper Division Clerk पदों* के लिए 63 भर्तियाँ*

0 notes

Text

Govt bans export of broken rice

Govt bans export of broken rice

“Export Policy of broken rice …is amended from Free’ to Prohibited’,” the Directorate General of Foreign Trade (DGFT) said in a notification dated September 8, 2022.

PTI

September 09, 2022 / 10:40 AM IST

Rice

After imposing 20 percent export duty on non-basmati rice, the government has banned the export of broken rice with an aim to increase domestic availability, according to a government…

View On WordPress

0 notes

Text

Wheat Prices Stabilise in India below Rs. 2400 Per Quintal

After Russia invaded Ukraine global wheat prices started soaring and reflection of that was seen in wheat prices prevalent in India too. Wheat price in India was going places till recently but now it has stabilized. Worst has passed it seems. Stabilization of wheat prices would not have been possible without policy interventions by government of India. Policy interventions of GOI have been well thought out and far-sighted. DGFT has issued three notifications in four months to rein in prices of wheat.

0 notes