#divis lab

Explore tagged Tumblr posts

Video

youtube

New Pharma Jobs for Freshers | Divis Jobs | Divis Labs ఉద్యోగాలు 2025 | ...

#youtube#New Pharma Jobs for Freshers | Divis Jobs | Divis Labs ఉద్యోగాలు 2025 | CV Job Portal Video Link : https://youtu.be/-ePqJkbzi88 Pls subscrib

1 note

·

View note

Text

A Closer Look at The Share Prices Of Sun Pharma Advanced Research Company And Divis Laboratories

The health industry is of the utmost importance to any nation, not just from the wellness index viewpoint, but also from the economic condition viewpoint. It enumerates the quality of life, working conditions of individuals, affordability and availability of healthcare, and so on. With such a profound impact on society at large, it is obvious that the health industry and pharmaceutical companies also have a crucial share in the stock market.

Those wanting to shortlist their selection for investing in the shares of healthcare background may find two prominent names under the spotlight, i.e. Sun Pharma Advanced Research Company (SPARC) and Divis Laboratories.

Sun Pharma Advanced Research Company (SPARC)

It is the research and development arm of the eminent Sun Pharmaceutical Industries Limited. Having countless breakthroughs in health, therapy, wellness, and medicine under its hood, SPARC has been in the limelight throughout the time. However, with inevitable challenges, its share value has also seen some adverse positions, making its journey marked by highs and lows.

As a probable investor, one must check with the following factors influencing SPARC's share price.

Pipeline Projects- Advancements in the healthcare industry are responsible for the sustenance of pharma companies. Thus, SPARC's share price is also influenced by its projected developments, research projects, and clinical trials. Positive outcomes may henceforth drive bullish sentiment among investors.

Regulatory Environment- Since the wellness of billions of people is in the hands of pharmaceutical companies, their products and services must be strictly regulated. This is why even SPARC has to undergo stringent regulatory measures for drug approvals, etc. that ultimately affect the company's share price.

Competitive Landscape- Like other industries, competition persists even in the pharmaceutical industry. Research, developments, pricing, product strategy, and other operational activities of competitors may influence the share price of SPARC. Thus, investors closely monitor its competitive positioning.

In closing, Sun Pharma Adv has demonstrated resilience and growth through innovation, partnerships, and licensing agreements, making the sun pharma adv share price INR 217.50 INR, a +2.95 (1.37%) currently.

Divis Laboratories

Being in operation since the 1990s, Divi's Laboratories is reportedly the fourth largest publicly listed pharmaceutical company by market capitalization, in India. Its active work in manufacturing active pharmaceutical ingredients (APIs) and intermediates has hoarded the company ample appreciation in the healthcare industry.

Quality and innovation have been its hallmarks for which investors show keen interest in its financial performance and divis lab share price; some governing factors are as follows.

API Demand- Since Divis Labs supplies APIs to pharmaceutical companies globally; its share price gets highly impacted by the demand for its products. In turn, such demand is closely tied to factors including healthcare expenditure, availability of generic drugs, and outsourcing by MNC pharmaceutical firms, influencing Divi Lab’s share price.

Expansion Plans- It is imperative even for the pharma companies, including Divis Labs to aim for expansion of distribution network, manufacturing capacity, and product diversification as it signals growth trajectory to the interested investors, leveraging the value of the share. Contrarily, setbacks in expansion projects may dampen the spirits of the existing and prospective investors.

Supply Chain- Divis Labs is known for its distribution network extended to international areas as well. However, their pharmaceutical supply chain can get disrupted owing to usual factors such as geopolitical developments, trade policies, competition emergence, disruptions in the supply of raw materials, etc., affecting their share price.

As per reports, the divis lab share price has lately come down to INR 3,883.15, a -28.35 (0.72%). However, the growing demand for APIs cannot be overlooked, paving the way for a higher value of its share in the market.

For more information on Divis Lab and sun pharma adv share price, you may read the latest updates published on StockGro.

0 notes

Text

Brad Parks - Say Nothing

Links uz grāmatas Goodreads lapu Izdevniecība: Dutton Manas pārdomas Skots Sampsons par dzīvi līdz šim nevar sūdzēties. Ir laba sieva Alisone, divi burvīgi sešgadnieki Sems un Emma, kā arī darbs kā federālajam tiesnesim ir labs, kaulus nelauž un reti kad ir tāda lieta, kas liktu pastiprinātāk satraukties. Bet tad pienāk šķietami tāda pati diena, kā visas iepriekšējās, kura visu sagriež kājām…

View On WordPress

0 notes

Text

HYBE

HYBE:(하이브) é uma empresa de entretenimento sul-coreana. Foi fundada originalmente por Bang Si Hyuk como Big Hit Entertainment em 2005. Divisões HYBE HQ Gravadoras BigHit Music (2021–presente) Belift Lab (2018–presente) Source Music (2019–presente) Pledis Entertainment (2020–presente) Xing Can Sheng Shi Entertainment (China) (2020–presente) KOZ Entertainment (2020–presente) ADOR…

0 notes

Text

Stocks to watch: BEL, Vodafone Idea, KEC International, Arvind Fashions among shares in focus today.

Here’s a quick look at stocks likely to be in focus in today’s trade.

BEL, Power Grid, Jupiter Wagons

Shares of BEL, Power Grid, and Jupiter Wagons are expected to be in the spotlight today as these companies are set to release their fourth-quarter earnings.

Vodafone Idea

Vodafone Idea shares are likely to draw attention after the financially strained telecom company moved to the Supreme Court, contesting the government’s denial of its plea to waive more than $5 billion in interest and penalties related to statutory dues.

KEC INTERNATIONAL

The RPG Group company has won fresh contracts valued at ₹1,133 crore for transmission and distribution projects across India.

Divi’s Lab

Divi’s Laboratories posted a net profit of ₹662 crore for the fourth quarter, with revenue reaching ₹2,585 crore during the period.

ARVIND FASHIONS

Arvind Fashions reported a net loss of ₹93.15 crore in the fourth quarter, marking a reversal from the profit recorded in the same quarter last year, despite an 8.8% rise in revenue and an 18% increase in EBITDA.

Delhivery

Delhivery posted a strong recovery in Q4, recording a net profit of ₹72.6 crore compared to a loss in the same quarter last year. Revenue increased by 5.6% year-on-year, and EBITDA surged nearly threefold to ₹119 crore.

Bajaj Auto

Bajaj Auto’s subsidiary, Bajaj Auto International Holdings BV, has signed loan agreements totaling 566 million euros with JP Morgan, DBS Bank, and Citigroup Global Markets Asia. The loans are unsecured and have a one-year term.

“Investments in the securities market are subject to market risks.”

You can gain unwavering support from Intensify Research, allowing you to invest confidently. Investors have the flexibility to manage funds on behalf of others or invest in their own capacity, focusing on high-potential, profit-making stocks. With expert insights and timely market analysis, you’ll be better equipped to make informed decisions and maximize returns.”

1 note

·

View note

Text

Here’s What the Top SEBI-Registered Advisors Recommend for April 2025

As the Indian stock market continues its dynamic momentum into Q2 of 2025, investors—both new and seasoned—are seeking trusted guidance to make smart, timely decisions. That’s where a SEBI registered stock advisory company comes into play.

Unlike informal tipsters or unverified sources, SEBI-registered advisors offer regulated, research-backed stock advisory services, ensuring your investments are steered by professionals who follow compliance and ethical practices. In this blog, we dive into the top stock recommendations and strategies being advised by leading SEBI-registered firms for April 2025.

The Market Pulse: What’s Happening in April 2025?

Before jumping into the recommendations, it’s essential to understand the current market backdrop:

Nifty 50 is hovering near all-time highs, showing strength in banking, IT, and manufacturing.

Inflation is moderating, leading to cautious optimism among FIIs and DIIs.

Global cues are neutral to slightly positive, with the US Fed signalling a pause on interest rate hikes.

Retail investor participation remains strong, especially in mid-cap and small-cap segments.

These factors are shaping the strategic outlook of many SEBI registered stock advisory companies, and their April 2025 recommendations reflect a balanced mix of growth and defensive plays.

What the Top SEBI-Registered Advisors Are Saying

Here’s what some of the most reputed SEBI-registered advisory firms are advising this month:

1. Banking Sector: Still a Favorite

Top advisors are bullish on private sector banks, citing strong balance sheets, improving asset quality, and robust credit growth. Stocks like HDFC Bank, ICICI Bank, and Kotak Mahindra Bank continue to feature in many advisory reports.

Why? The banking sector is a direct beneficiary of economic revival and falling NPAs. With better margins and increasing loan demand, these stocks offer stability and moderate growth.

2. Capital Goods & Infrastructure: Riding the Capex Wave

Several SEBI registered stock advisory companies are recommending exposure to infrastructure-focused stocks. Picks like Larsen & Toubro (L&T), Siemens, and ABB India are being highlighted due to ongoing government and private sector capital expenditure.

Advisor’s Insight: “We’re seeing consistent project inflows and healthy order books. Investors with a medium to long-term horizon can benefit from the upcoming infrastructure boom,” says a leading SEBI-registered analyst.

3. AI & Tech Stocks: The Next Growth Frontier

Tech is no longer just about IT services. Advisory firms are pointing toward AI-enabled companies in healthcare tech, automation, and data analytics. Stocks like Tata Elxsi, KPIT Technologies, and LTIMindtree are gaining attention.

Why It’s Hot: With global demand for AI-driven solutions booming, Indian firms with niche capabilities are well-positioned to capture market share.

4. Pharmaceuticals: Defensive with a Growth Twist

Stock advisory services are also turning attention to select pharma and healthcare names. Divi’s Labs, Sun Pharma, and Dr. Reddy’s are among the favored picks due to improving export outlooks and domestic demand.

Risk-Adjusted Returns: These stocks offer a good hedge in case of market corrections while still delivering decent growth potential.

5. Mid-Caps: High Conviction, High Risk-Adjusted Reward

Many SEBI-registered advisors believe that well-researched mid-cap stocks could be the real winners this quarter. Names like Clean Science & Tech, Aether Industries, and CAMS are being closely tracked.

Caution Advised: "While the upside is promising, retail investors should avoid overexposure and follow strict stop-loss strategies,” recommends a top SEBI-registered research analyst.

Popular Portfolio Strategies for April 2025

Leading stock advisory services are not just sharing stock names—they’re offering refined portfolio strategies based on current volatility and sector rotation trends. Here are a few:

Barbell Strategy: Combining high-growth mid-caps with defensive large-caps.

Thematic Investing: Focusing on AI, clean energy, and infrastructure.

SIP in Stocks: Building long-term positions gradually instead of lump-sum entries.

Warning: Avoid Unregistered “Tips Providers”

With the rise in investor interest, unregulated “Telegram tipsters” and WhatsApp groups are resurfacing. A credible SEBI registered stock advisory company always follows guidelines, provides risk disclosures, and operates with transparency.

Pro Tip: Always verify the SEBI registration number on the official SEBI website before taking any stock recommendation seriously.

Benefits of Working with SEBI Registered Stock Advisory Companies

Here’s why working with a SEBI-registered advisor is crucial:

Legally Compliant: Follows all rules laid down by SEBI.

Data-Driven Analysis: Research is based on technical, fundamental, and macro-economic factors.

Investor First: Ethical practices ensure that your financial interests are prioritized.

Regular Updates: You receive timely rebalancing advice, not just “buy and forget” calls.

Closing Thoughts: April Is Full of Opportunities

April 2025 is shaping up to be a promising month with strong sectoral trends, improving economic indicators, and investor confidence. However, markets remain unpredictable, and that's why partnering with a SEBI registered stock advisory company is more valuable than ever.

Whether you're just starting your investment journey or looking to optimize your portfolio, don’t go in blind. Trust the process, the research, and most importantly—the regulation that ensures your advisor is truly working in your best interest.

#best stock market advisor#stock market advisory#stock market advisory services#best sme stocks to buy#diwali muhurat trading stocks

0 notes

Text

Top Ten Pharmaceutical Companies of India

India's pharmaceutical industry has established itself as a global powerhouse, currently valued at $50 billion in 2023 and projected to reach an impressive $130 billion by 2030. Often referred to as "the pharmacy of the world," India supplies 20% of the world's generic medicines and ranks as the third-largest producer of medicines by volume globally. With over 3,000 pharmaceutical companies and 10,500 manufacturing units across the country, the Indian pharma sector continues to drive innovation, exports, and healthcare affordability both domestically and internationally.

Sun Pharmaceutical Industries Ltd Sun Pharmaceutical stands as India's largest pharmaceutical company with a market capitalization of approximately ₹4,08,007 Crore as of February 2025. Founded in 1983 and headquartered in Mumbai, this pharmaceutical giant employs around 38,000 people worldwide and has established itself as a formidable presence in the global pharmaceutical landscape. The company reported revenues of $5,235 million for the fiscal year ended March 2022, marking a substantial 15.4% increase over the previous fiscal year. More recently, in 2024, Sun Pharma generated a consolidated income of INR 498 billion, significantly up from INR 445 billion in the previous year, demonstrating consistent growth in a competitive market. Sun Pharma's extensive product portfolio encompasses treatments for psychiatric, neurological, nephrological, gastroenterological, orthopedic, and ophthalmologic diseases and disorders, as well as heart diseases. The company offers more than 100 formulations across various therapeutic segments and has secured its position as the fourth-largest generic medicine company globally while remaining India's premier pharmaceutical enterprise. Notable Products - Levulan Kerastick (Aminolevulinic Acid): Used in photodynamic therapy for actinic keratoses. - Cequa (Cyclosporine Ophthalmic Solution): Treats dry eye disease by increasing tear production. - Ilumya (Tildrakizumab-asmn): Used for moderate-to-severe plaque psoriasis. - Odomzo (Sonidegib): Treats locally advanced basal cell carcinoma. - Absorica (Isotretinoin): Used for severe recalcitrant nodular acne. - Gleevec (Imatinib Mesylate): Treats certain types of leukemia and gastrointestinal stromal tumors. - Xeloda (Capecitabine): Used in the treatment of colorectal and breast cancers. - Protonix (Pantoprazole Sodium): Treats gastroesophageal reflux disease (GERD). - Effexor XR (Venlafaxine Hydrochloride): Used for major depressive disorder, anxiety, and panic disorder. - Eloxatin (Oxaliplatin): Chemotherapy drug used for colorectal cancer. Divis Laboratories Divis Laboratories holds the second position among India's pharmaceutical giants with a market capitalization of approximately ₹1,55,133 Crore as of February 20252. Founded in 1990 and headquartered in Hyderabad, Divis Labs has grown to become one of the largest active pharmaceutical ingredient (API) manufacturers in the world, exporting thousands of tons of medications to more than 100 countries annually. The company's business model extends beyond API manufacturing to include the development of intermediate and nutraceutical ingredients. Divis Laboratories has established strong partnerships within the pharmaceutical industry, offering custom synthesis services to 12 of the top 20 global pharmaceutical companies, thereby cementing its position as a trusted partner in drug development and manufacturing. Notable Products - Naproxen (Naproxen): Nonsteroidal anti-inflammatory drug (NSAID) used to relieve pain and inflammation. - Dextromethorphan (Dextromethorphan): Cough suppressant found in many over-the-counter cold medications. - Gabapentin (Gabapentin): Used to treat nerve pain and seizures. - Pregabalin (Pregabalin): Treats nerve pain, fibromyalgia, and seizures. - Methylamine (Methylamine): Used in the synthesis of various pharmaceuticals. - Ranitidine (Ranitidine): Histamine-2 blocker used to reduce stomach acid (Note: Some formulations have been recalled). - Lamotrigine (Lamotrigine): Used to treat epilepsy and bipolar disorder. - Levetiracetam (Levetiracetam): Anticonvulsant used for seizure disorders. - Venlafaxine (Venlafaxine): Antidepressant belonging to the serotonin-norepinephrine reuptake inhibitor (SNRI) class. - Valsartan (Valsartan): Angiotensin II receptor blocker used to treat high blood pressure and heart failure. Cipla Ltd Cipla ranks third among India's pharmaceutical powerhouses with a market capitalization of approximately ₹1,17,867 Crore as of February 2025. Founded in 1935 and headquartered in Mumbai, Cipla stands as one of India's oldest and most respected pharmaceutical entities, with a workforce of over 21,891 employees worldwide. The company reported revenues of $2,948 million for the fiscal year ended March 2022, representing a robust 13.6% growth compared to the previous year. Cipla operates in both consumer healthcare and biosimilar segments, offering more than 1,500 products across 65 therapeutic categories. Cipla has built its reputation on developing effective treatments for respiratory and cardiovascular diseases, diabetes, and depression, while simultaneously providing affordable medications for AIDS and other serious conditions. With more than 47 manufacturing sites across the globe, Cipla has been recognized as a 'Great Place to Work' in India for six consecutive years, highlighting its commitment to both medical innovation and employee welfare. Notable Products - Cipram (Escitalopram Oxalate): Antidepressant used to treat depression and generalized anxiety disorder. - Lamivir (Lamivudine): Antiretroviral medication used to treat HIV/AIDS. - Seroflo (Fluticasone Propionate + Salmeterol): Inhaler used for asthma and chronic obstructive pulmonary disease (COPD). - Cipremi (Remdesivir): Antiviral drug used for the treatment of COVID-19. - Duolin (Ipratropium Bromide + Salbutamol): Inhaler for chronic obstructive respiratory diseases. - Budecort (Budesonide): Steroid inhaler used for asthma. - Foracort (Formoterol + Budesonide): Combination inhaler for asthma and COPD. - Asthalin (Salbutamol): Bronchodilator used to relieve bronchospasm. - Azee (Azithromycin): Antibiotic used to treat various bacterial infections. - Ciplactin (Cyproheptadine): Antihistamine used to relieve allergy symptoms. Torrent Pharmaceuticals Ltd Torrent Pharmaceuticals secures the fourth position among India's pharmaceutical leaders with a market capitalization of approximately ₹1,02,002 Crore as of February 2025. Founded in 1959 and headquartered in Ahmedabad, Torrent has evolved into a multinational pharmaceutical company with a strong focus on specific therapeutic areas. The company is particularly renowned for its therapies targeting cardiovascular, central nervous system, and gastro-intestinal disorders, as well as products designed for women's healthcare. With an impressive infrastructure comprising seven manufacturing plants and 23 distribution centers throughout India, Torrent Pharmaceuticals has extended its reach to more than 40 countries worldwide, showcasing the global potential of Indian pharmaceutical enterprises. Notable Products - Losar (Losartan Potassium) – Used for treating high blood pressure (hypertension) and reducing stroke risk. - Clopivas (Clopidogrel Bisulfate) – An antiplatelet drug used to prevent blood clots in heart disease and stroke patients. - Risperid (Risperidone) – An antipsychotic used to treat schizophrenia, bipolar disorder, and irritability in autism. - Montair (Montelukast Sodium) – Used for asthma and allergic rhinitis by preventing airway inflammation. - Olmezest (Olmesartan Medoxomil) – A medication for high blood pressure and heart failure treatment. - Nikoran (Nicorandil) – A vasodilator used in the treatment of angina (chest pain) and heart diseases. - Dilzem (Diltiazem Hydrochloride) – A calcium channel blocker used to treat hypertension and angina. - Gabator (Gabapentin) – Used to treat nerve pain, epilepsy, and restless leg syndrome. - Pregabid (Pregabalin) – A medication for nerve pain, epilepsy, and fibromyalgia treatment. - Telsartan (Telmisartan) – Used for high blood pressure and cardiovascular disease prevention. Dr. Reddy's Laboratories Ltd Dr. Reddy's Laboratories ranks fifth among India's pharmaceutical companies with a market capitalization of approximately ₹99,883 Crore as of February 2025. Headquartered in Hyderabad, Dr. Reddy's holds the distinction of being one of the first India-based companies to manufacture pharmaceuticals for global markets. The company has developed a diverse product range that includes active pharmaceutical ingredients, generics, branded generics, biosimilars, and over-the-counter drugs, reaching more than half a billion patients worldwide. Dr. Reddy's specializes in several key therapeutic areas including gastroenterology, cardiovascular health, diabetology, oncology, pain management, and dermatology. As a founding member of the Indian Pharmaceutical Alliance, Dr. Reddy's Laboratories demonstrates industry leadership beyond commercial success, with ambitious plans to triple its customer reach by 2030 through continued innovation and market expansion. Notable Products - Omez (Omeprazole) – Used to treat acid reflux, peptic ulcers, and GERD. - Nise (Nimesulide) – A non-steroidal anti-inflammatory drug (NSAID) for pain relief. - Redotil (Racecadotril) – Used to treat acute diarrhea in adults and children. - Atocor (Atorvastatin) – Helps lower cholesterol and reduce the risk of heart disease. - Razo (Rabeprazole) – Used for acid reflux, ulcers, and GERD. - Stamlo (Amlodipine) – Treats high blood pressure (hypertension) and chest pain (angina). - Allegra (Fexofenadine) – An antihistamine for allergies and hay fever. - Ciprolet (Ciprofloxacin) – A broad-spectrum antibiotic for bacterial infections. - Suminat (Sumatriptan) – Used to relieve migraines and cluster headaches. - Febucip (Febuxostat) – Treats gout by lowering uric acid levels in the blood. Mankind Pharma Ltd Mankind Pharma holds the sixth position among India's pharmaceutical companies with a market capitalization of approximately ₹98,783 Crore as of February 2025. Founded in 1991 and based in Delhi, Mankind Pharma has grown to become India's fourth-largest pharmaceutical company in terms of sales volume. The company has built its reputation on providing accessible, cost-effective prescription medications and over-the-counter products to the Indian population. Mankind Pharma has particularly established dominance in the sexual health sector, with flagship products including Manforce condoms, Prega News pregnancy-test kits, and Unwanted-72 emergency contraception pills, which have become household names across India. To support its expansive product range, Mankind Pharma operates 25 factories and six research and development facilities throughout India, emphasizing its commitment to innovation and manufacturing excellence. Notable Products - Prega News (Pregnancy Test Kit) – Detects pregnancy with reliable results. - Manforce Condoms (N/A) – Provides protection against sexually transmitted infections (STIs) and unwanted pregnancies. - Gas-O-Fast (Simethicone + Sodium Bicarbonate) – Relieves gas, bloating, and indigestion. - Health OK Multivitamin Tablets (Multivitamins) – Boosts immunity, energy, and overall health. - Unwanted-72 (Levonorgestrel) – Emergency contraceptive used to prevent pregnancy after unprotected intercourse. - AcneStar Gel (Clindamycin + Nicotinamide) – Treats acne and pimples, reducing inflammation and bacterial growth. - Kabz End (Aloe Vera + Herbs) – Relieves constipation and promotes regular bowel movements. - Ring-Out Dusting Powder (Clotrimazole) – Treats fungal infections such as athlete's foot and ringworm. - Unwanted-21 Days (Levonorgestrel + Ethinylestradiol) – Oral contraceptive to prevent pregnancy. - Kaloree-1 (Sucralose) – A low-calorie sugar substitute for people with diabetes or those looking to control calorie intake. Zydus Life Sciences Ltd Zydus Life Sciences (formerly known as Zydus Cadila) ranks seventh among India's pharmaceutical companies with a market capitalization of approximately ₹90,747 Crore as of February 2025. Based in Ahmedabad, Zydus has developed a global presence, distributing formulations, biologics, generics, and vaccines to over 25 markets worldwide. The company employs approximately 1,400 researchers across 19 sites, demonstrating its strong commitment to research and development. This investment in innovation has yielded significant results, most notably with the development of ZyCoV-D, the world's first needle-free, plasmid DNA vaccine for COVID-19, highlighting Zydus's capabilities in cutting-edge biotechnology. Notable Products - Aciloc (Ranitidine) – Used to treat gastric ulcers, gastroesophageal reflux disease (GERD), and heartburn. - Envas (Enalapril Maleate) – Used for hypertension (high blood pressure) and heart failure. - Calcirol (Cholecalciferol) – A supplement to prevent or treat vitamin D deficiency. - Haem Up (Iron + Folic Acid) – Used to treat iron-deficiency anemia and folic acid deficiency. - Vasograin (Ergotamine + Caffeine + Paracetamol + Prochlorperazine) – Used to treat migraines and headache-related symptoms. - Cadila (Omeprazole) – Treats acid reflux, ulcers, and indigestion. - Zyvas (Acyclovir) – An antiviral drug used to treat herpes simplex virus infections, including cold sores and genital herpes. - Cefwin (Cefixime) – An antibiotic used to treat bacterial infections like pneumonia and bronchitis. - Zydol (Tramadol) – Provides pain relief for moderate to severe pain. - Zemiglo (Vildagliptin) – Used in the treatment of type 2 diabetes by controlling blood sugar levels. Lupin Ltd Lupin secures the eighth position among India's pharmaceutical companies with a market capitalization of approximately ₹89,866 Crore as of February 2025. Headquartered in Mumbai, Lupin has established itself as one of the world's largest providers of generic medications by revenue. The company specializes in pediatric formulations, anti-infectives, and asthma treatments, supplying both branded and generic drugs, biosimilars, and active pharmaceutical ingredients to more than 100 countries. Lupin's commitment to research and development is evident in its facility near Pune, where more than 1,400 scientists work diligently on novel drug discovery and biotechnology solutions to address global health challenges. Notable Products - Cefadur (Cefuroxime Axetil) – Used to treat bacterial infections like pneumonia, bronchitis, and urinary tract infections (UTIs). - Levotab (Levofloxacin) – An antibiotic used to treat a variety of bacterial infections, including respiratory and urinary tract infections. - Combutol (Ethambutol Hydrochloride) – Used in the treatment of tuberculosis (TB), often in combination with other drugs. - Glychek (Metformin Hydrochloride) – A medication used to control high blood sugar in patients with type 2 diabetes. - Cardace (Ramipril) – An ACE inhibitor used to treat high blood pressure, heart failure, and to reduce the risk of stroke and heart attack. - Lupizide (Gliclazide) – An oral anti-diabetic medication used to control blood sugar levels in people with type 2 diabetes. - Telsartan (Telmisartan) – An angiotensin II receptor antagonist used to treat high blood pressure and prevent strokes and heart attacks. - Metolar (Metoprolol Tartrate) – A beta-blocker used to treat high blood pressure, heart failure, and prevent chest pain (angina). - Lupitrex (Clopidogrel) – An anti-platelet medication used to reduce the risk of heart attack and stroke in people with cardiovascular disease. - Sertoline (Sertraline) – An antidepressant used to treat major depressive disorder, anxiety, and other mood disorders. Aurobindo Pharma Ltd Aurobindo Pharma ranks ninth among India's pharmaceutical leaders with a market capitalization of approximately ₹65,709 Crore as of February 2025. Founded in 1988, Aurobindo Pharma has grown into a significant global player, distributing generic medicines and active pharmaceutical ingredients to more than 125 countries. The company has developed particular expertise in semi-synthetic penicillins and maintains a diverse research portfolio spanning neurosciences, cardiovascular treatments, antiretroviral therapies, anti-diabetic medications, gastroenterology products, and antibiotic formulations. Through strategic partnerships with industry giants like AstraZeneca and Pfizer, Aurobindo Pharma has expanded its intellectual property portfolio to include more than 500 patents, underlining its innovation-driven approach to pharmaceutical development. Notable Products - Nevirapine (Nevirapine) – Used to treat HIV/AIDS. - Zidovudine (Zidovudine) – Used to prevent and treat HIV/AIDS. - Ceftriaxone-Aurobindo (Ceftriaxone Sodium) – A broad-spectrum antibiotic used to treat various bacterial infections. - Meropenem-Aurobindo (Meropenem) – Used to treat severe bacterial infections, including meningitis and pneumonia. - Linezolid (Linezolid) – An antibiotic used to treat infections caused by Gram-positive bacteria, including MRSA. - Amoxicillin (Amoxicillin) – An antibiotic used for a wide range of bacterial infections. - Atorvastatin (Atorvastatin) – Used to lower cholesterol and reduce the risk of heart disease. - Doxepin (Doxepin) – Used to treat depression, anxiety, and insomnia. - Pantoprazole (Pantoprazole Sodium) – A proton-pump inhibitor used to treat GERD and other acid-related stomach disorders. Abbott India Ltd Abbott India completes our list of the top ten pharmaceutical companies with a market capitalization of approximately ₹59,158 Crore as of February 2025. As the Indian subsidiary of global healthcare company Abbott Laboratories, Abbott India offers more than 400 branded generic pharmaceuticals across 80 percent of therapeutic categories, addressing needs in women's health, gastroenterology, metabolic disorders, and primary care. The company's history in India dates back to 1910, representing over a century of commitment to the Indian healthcare landscape. Abbott India fulfills the majority of its product requirements through two strategically located manufacturing plants in Himachal Pradesh and Goa, ensuring efficient production and distribution throughout the country. The Future of India's Pharmaceutical Industry Notable Products - Thyronorm (Levothyroxine Sodium) – Used for the treatment of hypothyroidism (an underactive thyroid). - Cremaffin (Liquid Paraffin + Milk of Magnesia + Sodium Picosulfate) – Used as a laxative to treat constipation. Read the full article

0 notes

Text

Union Budget 2025-26: Sectoral Impact and Key Beneficiaries

The Union Budget 2025-26 has introduced a series of transformative measures aimed at strengthening India’s economic foundation. From increased credit access for micro-enterprises to reforms in insurance and infrastructure, these initiatives are poised to benefit multiple sectors.

Read Budget report here

Here’s a breakdown of the key announcements and their expected impact.

1. Banking Sector: Strengthening Credit Access

📌 Enhancement of the credit guarantee cover for micro enterprises from ₹5 crores to ₹10 crores and the introduction of personalized credit cards for micro enterprises. ✅ Positive for: State Bank of India, ICICI Bank, and HDFC Bank.

This move is set to improve credit accessibility for small businesses, fueling entrepreneurship and economic growth. The introduction of personalized credit cards will further ease financial constraints for micro-entrepreneurs.

2. Cement Sector: Boosting Infrastructure Development

📌 Outlay of ₹1.5 lakh crores for 50-year interest-free loans to states for capital expenditure and incentives for reforms. 📌 A structured 3-year Public-Private Partnership (PPP) model for infrastructure development. ✅ Positive for: Ambuja Cement, Ultratech Cement, and ACC.

This initiative will drive infrastructure growth, increasing cement demand and boosting the sector’s performance.

3. Insurance Sector: Attracting Foreign Capital

📌 Increase in FDI limit for the insurance sector from 74% to 100%. ✅ Positive for: HDFC Life, SBI Life, and ICICI Prudential.

With higher FDI, the insurance industry is set to witness enhanced competition, improved capital inflows, and greater penetration.

4. Pharma Sector: Exemptions on Life-Saving Drugs

📌 36 life-saving drugs and their bulk components fully exempted from Basic Customs Duty, with six additional medicines added to the concessional duty list at 5%. ✅ Positive for: Sun Pharma, Divi’s Labs, Natco Pharma, Cipla, Dr. Reddy’s, and Biocon.

This decision will reduce treatment costs and improve accessibility to critical medications.

5. Agrochemical Sector: Strengthening Rural Economy

📌 Launch of the Prime Minister Dhan-Dhaanya Krishi Yojana’s Agri Districts Programme to boost agricultural productivity and rural prosperity. ✅ Positive for: RCF, Chambal Fertilizers, and Paradeep Phosphates.

The focus on agri-development will drive demand for agrochemical products, benefiting fertilizer companies.

6. Aquaculture Sector: Enhancing Exports

📌 Reduction in Basic Customs Duty from 30% to 5% on frozen fish paste (Surimi) for manufacturing and export of its analogue products. ✅ Positive for: Apex Frozen Foods and Avanti Feeds.

The lower import duty is expected to boost India’s seafood export industry, making products more competitive globally.

7. Auto and EMS Sector: EV and Battery Manufacturing Push

📌 Addition of 35 capital goods for EV battery manufacturing and 28 capital goods for mobile phone battery manufacturing to the exemption list. ✅ Positive for: Exide Industries, Amara Raja Batteries, and Dixon Technologies.

This move will accelerate India’s electric vehicle (EV) adoption and strengthen the electronics manufacturing ecosystem.

8. Tourism Sector: Private Sector Participation

📌 Under PM Gati Shakti, private sector access to infrastructure data and development of the top 50 tourist destinations with state partnerships. ✅ Positive for: EaseMyTrip, Lemon Tree Hotels, and Indian Hotels.

With improved infrastructure and policy support, India’s tourism sector is set for significant growth.

9. FMCG Sector: Rural Consumption and Tax Relief

📌 Aatmanirbharta in pulses and edible oils with a six-year mission focusing on Tur, Urad, and Masoor. 📌 No income tax up to ₹12 lakhs, expected to boost housing and consumption. ✅ Positive for: HUL, ITC, Marico, Zomato, and other FMCG players.

Higher disposable income and rural development will drive consumption demand, benefiting the FMCG sector.

Final Thoughts

The Union Budget 2025-26 lays a strong foundation for growth across sectors. With a focus on financial inclusion, infrastructure, and manufacturing, it aligns with India’s long-term economic vision. As these reforms unfold, market participants can expect significant opportunities in the highlighted sectors.

Which sector do you think will benefit the most? Share your thoughts in the comments! 🚀

0 notes

Text

#stock market news# # stock market latest news# #forex market# # forex market latest news#

0 notes

Text

Top 10 Pharmaceutical Companies in India

* The Top 10 Pharmaceutical Companies in India are ranked by their revenue and market capitalization.

* India is the largest provider of generic medicines, holding a market share of 25% of the global supply by volume and meeting 61% of the vaccine requirement worldwide.

* Indian Pharmaceutical companies also supply 81% of antiretroviral medications (HIV/AIDS) in the worldwide markets.

* The international pharmaceutical market is anticipated to surpass USD 1.27 trillion by 2023. India is one most suitable states in this worldwide pharma market. India provides more than 55% of the worldwide purpose for different vaccines and 45% of the demand for generic medicines in the United States. India’s pharmaceuticals demanded to expand at 11% CAGR during 2023 to reach 33 Billion US dollars.

1. Sun Pharmaceutical Industries Ltd * Sun Pharmaceutical Industries Ltd is an Indian multinational pharmaceutical company founded by Dilip Shanghvi in 1983, Vapi, Headquarters Goregaon, Mumbai, India, And Subsidiaries of Ranbaxy Laboratories, etc. It produces and sells pharmaceutical formulations and active pharmaceutical ingredients (APIs) in India also the United States. It provides formulations in psychiatry, cardiology, dialectology, neurology, and gastroenterology. * Sun Pharma supplies APIs such as etodolac, clorazepate, carbamazepine, warfarin, anti-cancer drugs, peptides, steroids, sex hormones, etc. It supplies more than 2000 formulations and also exports to various other countries. * The main features of Sun Pharma are research and development facilities and its own APIs. It supplies more than 2000 formulations and also exports to various other countries. The main features of Sun Pharmaceuticals are research and development facilities and its own APIs.

2. Dr Reddy’s Laboratories Ltd Dr Reddy’s Laboratories is an Indian multinational pharmaceutical company founded by Kallam Anji Reddy in 1984, in Hyderabad, India. The company produces pharmaceutical formulations and active pharmaceutical ingredients (APIs) in India and other countries and more than 195 drugs, and 65 APIs for drug, and biotechnology products. DRL has six API units(CTO)and four Formulation(FTO) manufacturing plants across India. Its main focus research and development centres are Integrated Product Development Organization (IPDO) and Custom Pharmaceutical Services (CPS) located in Hyderabad, India.

3. Divi’s Laboratories Ltd Divis Labs is an Indian pharmaceutical company founded by Murali Divi in 1990, in Hyderabad, India. It manufactures APIs, Intermediates, and Nutraceutical ingredients. Divis Labs have three manufacturing units located at Chouttal, Hyderabad, Chippada, Andhra Pradesh, and 3 Research and development centres. The Company exports the products to the USA, Europe, Japan, South Africa, Australia, and the Philippines.

4. Cipla Ltd * Cipla is an Indian multinational pharmaceutical company founded by Khwaja Abdul Hamied in 1935, with Headquarters in Mumbai, India, And supplies top-quality generic medicines in India. * The company supplies a wide range of medicines. It has a prominent position in the Indian market and global market and in more than 150 countries. The company provides quality products worldwide received approvals from major regulatory agencies and more than 2000 formulations cover areas like neurology and nephrology. It has a global focus on the important markets of India, the US, and South Africa.

5. Aurobindo Pharma Ltd * Aurobindo Pharma is an Indian pharmaceutical company founded by Nityananda Reddy started operations in 1988 with a single unit manufacturing Synthetic Penicillin at Pondicherry and became a public company in 1992 headquartered in HITEC City, Hyderabad, India. The company has provided key therapeutics like cardiovascular, antibiotics, gastroenterology, anti-diabetics, and anti-Allergics. APL exports products to more than 160 nations in the world. Aurobindo Pharma has production, research, and development and Subsidiary units are Novagen Pharma, AuroZymes Ltd, etc.

6 Torrent Pharmaceuticals Ltd * Torrent Pharma is an Indian pharmaceutical company founded by Uttambhai NathalalMehta in 1959 Headquarters in Ahmedabad, India. started as Trinity Laboratories Ltd, and renamed Torrent Pharmaceuticals Ltd, nowadays. It is ranked the leader in the therapeutic sector of women’s health care, cardiovascular, CNS, gastrointestinal, diabetology, oncology, gynaecology, and anti-infective. They have first-class manufacturing units, R & D facilities, and a prevalent international presence in more than 50 nations. The company had procured Elder Pharma’s Indian company, Zyg Pharma, the API plant of Glochem Industries, Unichem’s Sikkim Plant, Bio-Pharm Inc., generic pharmaceuticals, etc. 7. Lupin Ltd * Lupin is a multinational pharmaceutical company founded by Desh Bandhu Gupta in 1968 in Mumbai, India. A large range of products like Branded & Generic Formulations, Biotechnology Products, APIs, and manufacturing centres are across India, Japan, Brazil, Mexico, and the United States. Subsidiaries are Novel Laboratories, Polynova Industries, and GAVIS Pharmaceuticals. The company is in the treatment areas of Non-Steroidal Anti-Inflammatory Drugs, Cardiovascular, Gynaecology, Asthma, Paediatric, Diabetology, Gastro-Intestinal, and Anti-Infective drugs, Anti-TB and Cephalosporins sectors. The company has moved around more than 100 countries. It supplies top-quality medications. The company is in the treatment areas of Non-Steroidal Anti-Inflammatory Drugs, Cardiovascular, Gynaecology, Asthma, Paediatric, Diabetology, Gastro-Intestinal, and Anti-Infective drugs, Anti-TB and Cephalosporins sectors. The company has moved around more than 100 countries. It supplies top-quality medications.

8. Zydus Cadila Healthcare Ltd * Zydus Cadila is a fully integrated Indian Pharmaceutical company founded by Ramanbhai B. Patel in 1952 in Ahmedabad, Gujarat India. It provides Active pharmaceutical ingredients, formulations, and animal healthcare products to wellness products. The company’s research and development facilities are in Gujarat, Maharashtra, Goa, Himachal, and Sikkim as well as research units in the US and Brazil. It has 1400 researchers across 20 sites, working on medicines and exploring various ideas from NCEs to vaccines, and bio-similar products. The company’s global business has regulated markets in the United States, Europe, South Africa, Latin America, and also 30 other national markets in the world.

9. Abbott Pharma India Ltd * Abbott India Limited is a Pharmaceutical company founded by Dr Wallace Calvin Abbott in 1944, in Mumbai, India, and a subsidiary of Abbott Laboratories United States. It manufactures pharmaceutical drugs, therapeutics for Women’s Health, Neurology, Thyroid, Gastroenterology, Anti-Infective, Diabetes, Urology, Pain, Vitamins, etc., and a plant at Verna, Goa. It has to produce high-quality formulations, branded generic pharmaceuticals, diagnostics, medical devices, and nutrition.

10. Alkem Laboratories Ltd * Alkem Laboratories is a Pharmaceutical company founded by Samprada Singh in 1973, in Mumbai, India. It provides quality branded generics, generic medications, APIs, and nutraceuticals in India, and more than 60 countries worldwide. Alkem has been ranked as the No.1 Anti-infective company in India for more than ten years and also has therapeutic segments for gastrointestinal, Vitamins, Minerals, Nutrients, and pain management.

Conclusion: * These are the Top 10 Pharmaceutical Companies in India and supply worldwide Pharmaceutical Products. The ranking of the Pharma companies changes every year and depends upon the revenue and Market Capitalizations.

0 notes

Text

Understanding Divi's Laboratories Share Price: A Deep Dive

Investors and market enthusiasts often turn their attention to specific stocks that exhibit remarkable performance or promise within the pharmaceutical sector. One such company that frequently garners attention is Divi's Laboratories Limited, commonly known as Divi's Labs. This article delves into the dynamics surrounding Divi's Labs share price, exploring factors that influence it and what investors should consider.

Overview of Divi's Laboratories

Divi's Laboratories, founded in 1990 and headquartered in Hyderabad, India, is a leading manufacturer of active pharmaceutical ingredients (APIs) and intermediates. The company has established a strong presence in the global pharmaceutical market, focusing on producing high-quality APIs across various therapeutic segments. With state-of-the-art manufacturing facilities and a commitment to innovation and quality, Divi's Labs has carved a niche for itself in the industry.

Factors Influencing Divi's Labs Share Price

1. Financial Performance:

Revenue Growth: Investors closely monitor Divi's Labs' revenue growth, which reflects its ability to capitalize on market opportunities and expand its product offerings.

Profit Margins: The company's profitability, as indicated by its profit margins, is crucial for determining shareholder returns and market sentiment.

Earnings Per Share (EPS): EPS growth is a key metric that influences stock valuation, as it indicates the company's ability to generate profits for its shareholders.

2. Product Pipeline and Innovation:

The pharmaceutical industry relies heavily on research and development (R&D) for sustained growth. Divi's Labs' investments in R&D to develop new APIs and improve existing products can significantly impact its stock price.

Regulatory approvals for new products and manufacturing facilities also play a crucial role in enhancing market confidence and driving share price appreciation.

3. Market Demand and Competitive Landscape:

Demand for pharmaceutical products, especially APIs, is influenced by global healthcare trends, regulatory changes, and economic factors.

Competitor activities and market positioning relative to peers can affect investor perception and consequently, share price movements.

4. Macro-Economic Factors:

Economic conditions, exchange rates (particularly for a company with significant international operations like Divi's Labs), and geopolitical developments can all influence investor sentiment and stock performance.

Interest rates and inflation rates can impact the cost of operations and financing, thereby affecting profitability and stock valuation.

Recent Performance and Outlook

In recent years, Divi's Laboratories has shown robust financial performance, driven by strong demand for its APIs globally. The company has expanded its production capacities and diversified its product portfolio, enhancing its competitiveness in the market. Analysts often provide insights into future growth prospects based on these factors, influencing investor sentiment and share price movements.

Conclusion

Investing in pharmaceutical stocks such as Divi's Laboratories requires careful consideration of both company-specific factors and broader market trends. While past performance and financial indicators provide valuable insights, staying informed about regulatory changes, market demand dynamics, and global economic conditions is crucial for making informed investment decisions.

As Divi's Laboratories continues to navigate the complexities of the pharmaceutical industry, its share price will remain subject to various influences. For investors looking to capitalize on opportunities within the healthcare sector, understanding these dynamics is essential for assessing the potential risks and rewards associated with investing in Divi's Labs shares.

0 notes

Text

Bīfi jeb ķīviņi

Nedaudz par notiekošo repa nesaskaņās

Līdz šim galīgi nebiju pievērsusi uzmanību repa bīfiem jeb ķīviņiem. Iespējams tāpēc, ka neredzēju ko ar to iesākt, kā tas ietekmētu manu skatījumu un izjūtas par repu un mūziku kopumā. Atzīšos, ka kopš “Sīrupa” laikiem baigi nepatērēju preses un ziņu platformas, kur tiek apstpriesti karstākie jaunumi par izpildītājiem, un tas viss leikas un laikam arī ir tāda mēļošanās (mēles trīšana) vien. Protams, ik pa laikam paskatos kādas intervijas vai sava veida šovus ( šoutouts Mac Miller And Most Dope family šovam, iesaku un Action Bronson Thats Fucking delicious), bet neteiktu, ka ļoti izteikti digotu mākslinieku personīgās dzīves (cik bērni, ko deito, cik bijušie utt), drīzāk interesē vispārīgie uzskati par dzīvi, mākslu, sajūtām, pieredzi.

Un tad manā interešu lokā ielēca P Diddy skandāls, ko nevarēju palaist garām, jo savā mērā tas diezgan cieši iet kopā ar vispārīgajām vērtībām, notiekošo situāciju mūzikas biznesā un izpratni par kaut kādu morāli. Blakus Diddy situācijai ļoti nesen parādījās arī Chris Brown saķeršanās ar Quavo, kur abi divi arī veltīja viens otram singlus ar asiem, ļoti personīgiem pārmetumiem un dzēlībām. Izpildījums man šķita ļoti jēls un varbūt nedaudz uzjautrinoš. Visādā gadijumā galīgi ne nopietns. Kas tajā visā likās super dīvaini, ka Chris Brown izpirka Quavo koncertu teju visu arēnu, mēģinot viņu pazemot. Skats jau dramatisks, lielā zālē tikai ap 50 cilvēkiem pie skatuves. Visvairāk jau man žēl fanus. Pohuj, ka Chris ieflekso ar savu naudu, ka var nopirkt tik daudz biļešu. Kā ar tiem cilvēkiem, kuriem tika laupīta iespēja baudīt mākslinieka uzstāšanos?

Tagad pie galvenā punkta, Kendrika vs Dreik lietu. Kad iznāca First person shooter, man likās drosmīgs gājiens no J Cole puses iepīt Kendrika vārdu un sevi pozicionēt tik augstā rangā (lai gan J Cole noteikti ir manā topā jau n-gadus). Tas, kam tajā brīdī pievērsu uzmanību bija J Cole rinda “Not Russia, but apply pressure / To your cranium, Cole's automatic when aimin' 'em” , kur tiek iepīts dziesmas nosaukums no Off-season albuma (Applying pressure) un vārdu salikums your cranium fonētiski ir līdzīgs Ukraine. Man tas šķiet max interesanti, ka asv scēnā tik liels reperis pievērš uzmanību šim konfliktam otrpus okeāna. Un šādā veidā arī brīdinot par gaidāmo karu repa pasaulē. Šobrīd, noklausoties Kendrika dissus, es savelku paralēles ar First person shooter rindām. Piemēram, “I search one name, and end up seein' twenty tings

Nadine, Christine, Justine, Kathleen, Charlene, Pauline, Claudine

Man, I pack 'em in this phone like some sardines

And they send me naked pictures, it's the small things” ļoti viegli var interpretēt, ka Dreikam ir daudz sieviešu, ko var tālāk apspelēt neuzticībā un runāt par vispārējo seksuālo aktivitāti, kā arī man aizķēra Dreika sevis salīdzināšana ar pop karali Maiklu Džeksonu, kurš paralēli saviem hitiem bija ļoti populārs ar lielo pedofīlijas lietu. Kopumā, man šķiet First person shooter ir tas gabals, kurš iedeva Kendrikam ļoti lielu bagāžu ar iedvesmu un iespēju nu ta beidzot izteikt savu lielo žulti, ko viņš izdarīja noteikti daudz meistarīgāk, interesantāk,profesionālāk, daudzpusīgāk nekā Dreiks. Par to, kam šis viss bija vajadzīgs un kam taisnība. Varbūt ne vienam, bet man atnāca atklāsme par kronēšanu un “lielās kazas” (G.O.A.T.) titulu, atklāsme, kura ļoti iespējams no daudzajiem repa faniem jau ir pašsaprotama. Mums vajag kronēt karali, lai nostādītu ne tikai skilu jeb prasmju līmeni, bet arī morāles un vērtību kopumu. Kam mēs sekosim? Kas mūs dzīs uz priekšu? Ko mēs gribam vispār sasniegt? Un uz šiem jautājumiem Kendriks spēj mūs, kā klausītājus pietuvināt tam daudz tuvāk. Varat neieņemt neviena pusi, bet padomāt par to, kas ir labs un, kas slikts, to noteikti nāksies.

0 notes

Text

Divi's Labs Faces Rs 82-Crore GST Demand, Plans Appeal

Pharma Giant Divi's Labs Faces Rs 82 Crore GST Demand Notice from Hyderabad Commissionerate, Including IGST and Penalties. Revealed on Nov 16.

Read Our Detailed article in the below link 👇- https://www.mygstrefund.com/DivisLabs-Faces-Rs82Crore-GSTDemand/

THANKS FOR READING!

We provide GST refund solutions for customers.

To know more please visit: www.mygstrefund.com Contact Us: - +91 9205005072 Mail- [email protected]

0 notes

Video

youtube

Legal Design - Law Firm Design - Firm Website Design - Legal Graphic Design

https://youtu.be/9d0b-OaLbXY

Legal Design - Law Firm Design - Firm Website Design - Legal Graphic Design

Welcome to our immersive journey into the world of Legal Design! In this enlightening video, we delve deep into the intricacies of Law Firm Design, exploring the fascinating intersection of aesthetics and functionality within the legal realm. Brace yourselves for a visually-stunning exploration as we unravel the secrets of cutting-edge Firm Website Design and delve into the captivating realm of Legal Graphic Design. Our expert insights will guide you through the art of creating visually compelling and user-friendly interfaces tailored specifically for law firms. Whether you're a legal professional, a design enthusiast, or someone keen on the latest trends in technology, this video is your passport to a world where legal expertise meets creative innovation. Don't forget to hit that like button if you find our content valuable, and make sure to subscribe to our channel for a front-row seat to future insights. Share this video with your fellow enthusiasts and let's build a community passionate about the intersection of law and design. Join us on this exciting journey of Legal Design – where form meets function, and innovation transforms the legal landscape! So 💖 with a commitment to excellence and a passion for creativity, our team of professionals is ready to collaborate with you to achieve your goals and we invite 🤝 you, to our world where innovation, precision, and imagination converge. We, Welcome to our services hub, where your vision becomes reality.

🎯For Your Inquiries Reach Us At:

🌟SOLUTION LAB

Email ID’s:- [email protected], [email protected]

🔍Web: - www.solutionlab.online

Blog ID: - https://solutionlabonline.blogspot.com/

🔍⚖️✨ legal website design, web design for lawyers, best law firm website design, cool law firm websites, good law firm website design, law firm interior design, law firm office interior design, logos law firm, modern law office interior design, web design legal, legal website design, law firm website design cost, small law firm website design, law firm website designers, law firm website examples, best website design for attorneys, legal website designer, best lawyer website design, law firm website design companies, modern law firm websites, solo law firm website design, legal design thinking, law firm web designers, best legal website design, beautiful law firm websites, lawyer website designers, personal injury attorney website design, custom law firm websites, lawyers office interior, law firm web design companies, modern law office design, website design for solicitors, family law attorney website design, divi law firm layout, modern lawyer office design, modern law firm website design, small lawyer office design, graphic design lawyer, solicitors website design, affordable law firm website design, affordable lawyer website design, attorney web designers, attorney website designers, attorneys and law firm web design, barrister website design, best law firm design, best law firm office design, best law office design, best lawyer logo, best lawyer web design, best legal web design, business law attorney website design, business law lawyer website design, business lawyer website design, classic lawyer office design, contemporary law office design, cool law firm website, criminal defense attorney website design, criminal defense law firm web design, custom attorney website design, custom law firm website design, custom lawyer website design, custom web design for lawyers, design attorneys, design for law firms, design lawyer, design legal, family law firm website design, family law lawyer website design, general practice law firm website design, best law firm website design companies, 🔍#LawFirmDesign #webdesign #graphicdesign #InnovationInLaw #legaldesign #LawFirmDesign #legalinnovation #designthinking #lawtech #legaltech #visuallaw #userexperience #LegalCreativity #LawAndDesign #FirmWebsite #legalgraphics #DigitalLegal #CreativeLawyers #visualappeal #LegalUI #LawInnovation #DesignForLawyers #LegalUserInterface #ModernLawFirm #visualcommunication #lawandtechnology #likeandshare #likeandshareandcomment #likeandsharemarketing #likeandshareplz #likeandsubscribe #likeandsubscribemychannel #likeandsubscribes #likeandsubscribeplease #likeandsubscribebutton #likeandsubscriber #likeandsubscribepls #likeandsubscribeplz #likesharesubscribecommentnow #likeshare #likesharesubscribe #likeshareandsubscribe #likesharecomment #likesharesubscribecommentnow #likeshareandsubscribemychannel #likesharefollow #subcribe #subcribeme #subcriber #subcribers #subscribeandshare #subscribenow #subcribemyyoutube #subcribemychannel #subcribetothechanell #subscribenowmychannal #subcribe_to_our_channel #subscribenowmorevideos #subscribenowmoreinterestingvideos #subscribeandlearn #subscribeforsupport #usa #usacollege #unitedstates #unitedstatesofamerica #unitedstatesofamerican #unitedstatesofamericaplease #usanews #usanewsonline #usacollege #usatoday #usatodaynews #usatodaysports #unitedarabemirates #uaekhabartoday #uaenews #uaenewsofficial #uaelife #uaelifestyle #uaejobs #uae #dubai #dubailife #dubaijobs #dubainews #dubainewstoday #dubailifestyle #dubailifestylevlog #dubailifestyleblogger #canada #canadalife #canadalifestyle #canadian #canadianuniversity #canadanews #canadanewstoday #australian #saudiarabia #saudiarabialatestnews #saudiarabianews #saudiarabianewslive #saudiarabiajobs #saudinews #saudi #saudi_news #saudi_news_update #saudinewsofficial #oman #omannews #omannewsdaily #omanchannel #omannewslive #omanjobs #omanjob #omanjobnewstoday #qatar #qatarlife #qatarlifestyle #qatarnews #qatarjobs #qatarevents #qatarliving #kuwait #kuwaitnews #kuwait_kuwait #kuwaitlivenews #kuwaitcity #kuwaitlatestupdate #kuwaitlatestupdates #kuwaitnewshighlights #kuwaitnewsheadlines #newzealand #newzealandbusiness #newzealandlife #uk #unitedkingdom #unitedkingdomlife #britain #britainnews #greatbritain #british #britishenglish #britishenglishpronunciation #britishenglishclass #bahrain #bahrainbloggers #bahrainevents #bahrainnews #bahraintv #poland #portugal #português #finland #singapore #singaporevlog #singaporevideos #mexico #mexicocity #brazil #argentina #chile #southafrica #southkorea #norway #peru #germany #germanynews #germanywale #german #france #francese #italy #italya #italian #italia #italianteacher #italiancourse #italianclass #turkey #switzerland #swiss #swissview #swissviews #austria #austriatravel #hungary #hungarylife #bulgaria #bulgariantechchannel #russia #russian #russianews #russianlanguage #russianlanguageteacher #russianlanguagelessons #japan #japanese #japaneselanguage #japaneselanguageschool #japanlife #japanlifestyle #japanvlog #japanvlogger #qatarjobinformation #saudiarabiainternational #canadalifevlog #australiainternationalstudents #canadavlogs #spain #spaintravel #spainish

0 notes

Text

Lycopene Market to Witness Unprecedented Growth in Coming Years

The global lycopene market is projected to reach USD 161 million by 2025, recording a CAGR of 5.0% during the forecast period. The market is primarily driven by the increasing number of benefits offered by lycopene in preventive healthcare and its rising applications in an array of industries, globally.

Download PDF Brohure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=104131737

Rising consumption of lycopene in an array of industries due to its functions as a health ingredient and coloring agent

Lycopene is witnessing a rise in consumption in an array of industries including dietary supplements, food, personal care & cosmetics, and pharmaceuticals. It is experiencing this growth due to its properties that mainly includes being a health ingredient, followed by being a coloring agent. The majority of the market share in the global lycopene market was accounted for by the health ingredient property. The coloring agent property has a comparatively smaller share in the global market for lycopene. This is a result of the limited application of lycopene as a coloring agent in the food industry. Also, applications of lycopene as a health ingredient are expanding, which is further expected to boost the growth of lycopene in the global market.

Dietary supplements to record the highest CAGR during the forecast period

The demand for dietary supplements is on the rise in developed and developing countries among the millennial population. Lycopene constitutes to be a key ingredient in the dietary supplements consumed by an individual daily. Also, industry experts foresee the adoption rate for dietary supplements to increase the most in the next five years. Hence, lycopene’s key role in the dietary supplement application because of its distinct health benefits is expected to bolster the growth during the forecast period between 2020 and 2025.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=104131737

The lycopene market in the Asia Pacific region is projected to grow at the highest CAGR from 2019 to 2025

Factors driving the growth of the Asia Pacific market include the presence of the lycopene manufacturing companies in this region. In addition, the production of tomatoes is the highest among all the regions, globally resulting in lower cost for procuring raw material. Hence, the development of technologies and abundant raw material leading the manufacturers to produce and supply lycopene to an array of industries at a competitive price and gaining an advantage over the competitors in the other regions. Furthermore, the rising awareness on benefits of lycopene in food, dietary supplement, and personal care & cosmetic applications is expected to boost the demand for lycopene, also resulting in higher exports from the surplus production of lycopene in this region, which will further boost the market share of this region in the global lycopene market.

Key players operating in this market include Allied Biotech Corporation (China), Lycored (Israel), DSM (Netherlands), Wellgreen Technology Co Ltd (China), Divis Labs (India), San-Ei Gen F.F.I., Inc (Japan), Dangshang Sannuo Limited (China), DDW (US), Dohler (Germany), Farbest Brands (US), Zhejiang NHU CO. Ltd (China), EID Parry (India), Shaanxi Kingsci Biotechnology Co. Ltd (China), Vidya Herbs (India), Xi’an Pincredit Biotech Co Ltd (China), Hunan Sunshine Bio-Tech Co.Ltd (China), Xi’an Natural Field Bio-Technology Co.,Ltd (China), Plantnat (China), SV AgroFoods (India), and Plamed Green Science Group (China).

0 notes

Text

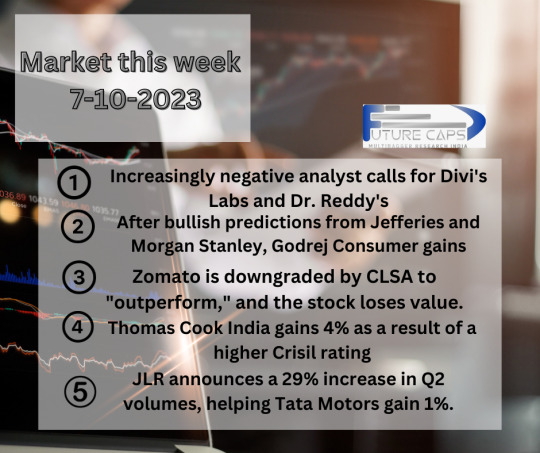

Market this week 7-10-2023

Increasingly negative analyst calls for Divi’s Labs and Dr. Reddy’s Pharma firms Divi’s Laboratories and Dr. Reddy’s Labs have both seen a gloomy outlook in Moneycontrol’s analyst call tracking. As valuations appear to have gotten ahead of the few growth chances, “Buy” calls on Divi’s Laboratories stock fell to six from 14, while those on Dr. Reddy’s Laboratories plummeted to 18 from…

View On WordPress

0 notes