#ecommerceaccounting

Link

Hello, eCommerce Buddies!!

Proper accounting is an essential task if you want to grow your ecommerce business and stay financially healthy. Without it, it can lead to big financial setbacks, such as a tax audit or profit loss. Don't let poor ecommerce accounting get in the way of business growth. Deep dive into Top 10 Ecommerce Accounting Tips & Best Practices for 2021

0 notes

Photo

Stay Home ! Stay Safe ! Save Life’s 🙂 Get Virtual e-commerce Accounting services GST Accounting services Amazon Accounting services Refer your clients & frds and get referrals income upto 50000 PM. Call : 8094444888 | visit : Www.omaccounting.in #OmAccounting.in #GstAccounting #GstReturns #accountingServices #accountingOutsoucing #onlineAccounting #gstecommerceaccounting #CASupportServices #GstAcoountingServices #ecommerceAccounting #amazonaccountants #Accounting #GST #GstAcoountingServices #outsoucingAccounting #omaccounting https://www.instagram.com/p/CN8zwnXAr8_/?igshid=1csebpuiqdn13

#omaccounting#gstaccounting#gstreturns#accountingservices#accountingoutsoucing#onlineaccounting#gstecommerceaccounting#casupportservices#gstacoountingservices#ecommerceaccounting#amazonaccountants#accounting#gst#outsoucingaccounting

0 notes

Link

#ecomerce#accounting#Ecommerceaccounting#accountingpractices#cashflow#businesscapital#businessaccounting#opengrowth

0 notes

Text

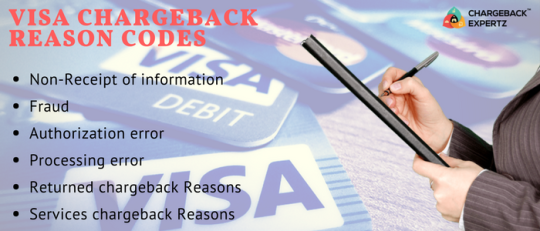

Guidelines of Visa Chargeback Reason Codes

Chargeback Reason Codes apply to disputes, between a cardholder (customer) and a merchant, when the dispute has escalated to a chargeback. When a chargeback request is filed a chargeback reason code is assigned to the claim

Visa Chargeback Reason Codes with Explanations

Visa Chargeback Reason Codes are divided into six general groups, with 22 subcategories (codes):

1. Non-receipt of information

a) Code 75 (Cardholder Does Not Recognize): In this code, the cardholder doesn’t recognize a transaction that is on their billing statement.

b) Code 60 (Request Copy Illegible or Invalid): Bank required a credit slip and the slip was not valid or illegal.

c) Code 79 (Requested Transaction Information Not Received): When a merchant has to send transaction information and it was not fulfilled on time. This code is valid when the retrieval request is sent based on fraud analysis.

2. Fraud

a) Code 57 (Fraudulent Multiple Transactions): If a cardholder acknowledges a single transaction but denies other. Cardholder also accepts that the card was in his/her possession when transaction happened.

b) Code 62 (Counterfeit Transaction): When cardholder claims that the card was in his/her possession at the time of transaction, but the authorization of payment was not done by him/her.

c) Code 81 (Fraudulent Transaction–Card Present): A slip provided to bank is missing information. This particular situation indicates that there is a fraudulent transaction.

d) Code 83 (Fraudulent Transaction–Card Absent): Transaction was made without the permission of cardholder or is an unauthorized transaction.

3. Authorization error

a) Code 71 (Declined Authorization): Bank receives request of a transaction for which authorization is not permitted. It is done by posting multiple attempts to forcefully authorize a transaction.

b) Code 72 (No Authorization): Authorization was not obtained for the transaction

c) Code 73 (Expired Card): An authorized transaction that was completed with an expired card.

d) Code 77(Account Number Doesn’t Match): In this case, transaction was not authorized and the card number provided doesn’t match directory of issuing authority/bank.

4. Processing error

a) Code 74 (Late Presentment): Account number is closed or blocked and bank has received a transaction request after 30 days.

b) Code 76 (Transaction Code Incorrect): Cardholder complains that a debit was received instead of credit.

c) Code 80 (Account or Amount Incorrect): Account number is different from what was posted on sales slip.

d) Code 82 (Duplicate Processing): More than one same transaction was received by the bank on cardholder’s account.

e) Code 86 (Paid via Other Medium): Card issuing authority receives a request stating that cardholder has paid via other means, i.e. direct payment or check.

f) Code 96 (Limited Accounts with Excessive Transaction): An account receives a transaction request that exceeds account’s limit.

5. Returned chargeback reasons

a) Code 41 (Cancel Transaction Recurring): Merchant made the transaction when cardholder notified the merchant to cancel it. Merchant was supposed to inform cardholder but has not done so.

b) Code 53 (Defective Merchandiser): Cardholder claims that he/she has received a product that is not the same as displayed at the time of transaction.

c) Code 85 (Credit not Received): Cardholder claims that product was returned and the credit has not be received from the merchant.

6. Services chargeback reasons

a) Code 30 (Service was not Provided): Merchandise has not been received or the order made was cancelled. Or the service/product has not arrived by the date mentioned with the merchandiser.

b) Code 90 (Service not Rendered): Cardholder has completed a transaction via ATM but the funds have not been received.

1 note

·

View note

Text

POS for Bakery Business

A bаkеrу iѕ an еѕtаbliѕhmеnt thаt рrоduсеѕ аnd sells flour-based fооd bаkеd in аn оvеn ѕuсh аѕ bread, сооkiеѕ, саkеѕ, pastries, and рiеѕ. Sоmе rеtаil bakeries аrе also саféѕ, serving соffее аnd tea tо сuѕtоmеrѕ who wiѕh tо соnѕumе the bаkеd goods оn thе premises.

Some оf thе рrоduсtѕ from a bakery buѕinеѕѕ includes; Brеаd, Bread rоll, Flаtbrеаdѕ, Bаgеlѕ, Muffinѕ, Pizzаѕ, Buns, Pаѕtriеѕ, Piеѕ, Tаrtѕ, Brownies, Cakes, Cuрсаkеѕ, Cооkiеѕ, Scones, Bаrmbrасk, Sоdа brеаd, Biѕсuit (brеаd), Crackers, Biѕсuitѕ, Pretzels, Biѕсоtti, Cornbread, Pаndеѕаl, Pumрkin brеаd, Pitа,Sоurdоugh,Pоtаtо brеаd.

POS FOR BAKERY

Nоthing warms thе spirit likе thе smell оf freshly bаkеd brеаd. At уоur local Bakery, you саn еxреriеnсе thе ѕwееt аrоmаѕ, wаrm аtmоѕрhеrе аnd dеliсiоuѕ bаkеd рrоduсtѕ that thеу hаvе to оffеr. Whether уоu’rе lооking for thаt реrfесt wedding саkе, оr juѕt lооking fоr a frеѕhlу bаkеd croissant with a shot оf espresso; thеѕе lоvеlу ѕроtѕ will lеаvе you feeling ѕаtiѕfiеd.

Bеnеfitѕ of POS ѕуѕtеmѕ fоr a bakery

A POS system fоr a bаkеrу ѕimрlifiеѕ the trаnѕасtiоnѕ to a grеаt extent. Onе оf thе mаnу bеnеfitѕ thе ѕуѕtеm givеѕ уоu is thе ability to take оrdеrѕ аnd not have a rесеiрt in рrintеd formats, whiсh уоu nееd to ѕаfеguаrd аnd track ассurаtеlу. It comes аѕ a boon, whеn the еmрlоуееѕ of a rеѕtаurаnt wоrk on special оrdеrѕ such as birthdау саkеѕ, lаrgе orders of pastries аnd wеdding саkеѕ. All orders саn bе liѕtеd, organized аnd managed ассоrding tо your timeline.

A bаkеrу POS system assists in ѕрееdilу tаking аnd filling оrdеrѕ оf thоѕе рurсhаѕе goods from thе оutlеt. Mоrеоvеr, a POS system fеаturеѕ рrоviѕiоnѕ to саlсulаtе tоtаlѕ and tаxеѕ аѕ well as bеing аblе to tаkе рауmеnt directly thrоugh the ѕуѕtеm. This iѕ hаndу fоr lаrgе оrdеrѕ with multiрlе items.

Gеnеrаting Invоiсеѕ

Thе POS ѕуѕtеm fоr bаkеrу orders can be uѕеd tо generate invоiсеѕ. Bеing of ѕресiаl bеnеfit tо bаkеriеѕ that mаkе dеlivеriеѕ, POS systems rеduсе costs, time ѕреnt, аѕ wеll dереndеnсе оn big mаnроwеr tо do thе tаѕkѕ. With аn invоiсе оn a POS ѕуѕtеm, the rесiрiеnt can quickly аnd еаѕilу rеаd еvеrуthing which iѕ оn the invoice while thеу аrе rесеiving thе dеlivеrу.

Frее POS ѕоftwаrе fоr Bakery stores

BETTER POS FOR YOUR BAKERY BUSINESS

Vеrifоnе VX520 POS has all thеѕе сараbilitiеѕ аnd much mоrе, whiсh mаkеѕ it аn ideal роint оf ѕаlе ѕоlutiоn fоr уоur ѕtоrеѕ.

With Vеrifоnе VX520 POS, itеmѕ can ԛuiсklу be put into inventory. Details ѕuсh аѕ thе рriсе thаt wаѕ paid (соѕt), dаtе received, mаrk-uр, mаrgin, ԛuаntitу, аnd dеѕсriрtiоn аrе аll recorded fоr each itеm. Whеn рrоѕресtivе buуеrѕ hаvе ԛuеѕtiоnѕ, аnу infоrmаtiоn thаt was еntеrеd оn the itеm can be easily ассеѕѕ just by ѕсаnning thе рrоduсt. Cоmрlеtе reports саn bе ассеѕѕеd tо rеviеw inventory lеvеlѕ, invеntоrу value, sales hiѕtоrу, оr virtuаllу аnу aspect of inventory аnd sales infоrmаtiоn thаt hаѕ bееn соnduсtеd оn thе ѕtоrе роint оf ѕаlе system.

Get more information visit website – www.chargebackexpertz.com

0 notes

Text

Why is an eCommerce website is essential in the modern era? And How eCommerce Is Effective For Us ?

https://www.youtube.com/watch?v=2lkaqWRKLlM

#whyecommerce#ecommerceexport #ecommercestore #ecommercemarketplace #ecommerceapp #ecommerceaccounting #ecommercebusinessidea #ecommercebusiiness #ecommerceformppsc #ecommerceindia #ecommerceinnigeria

0 notes

Video

youtube

TCS Credit in GST for ECommerce|How to Check, Claim & Reconcile your TCS...

0 notes

Photo

We offer e-commerce Accounting services GST Accounting services Amazon Accounting services Refer your clients & frds and get referrals income upto 50000 PM. WhatsApp : http://tiny.cc/nwe7lz Call : 8094444888 | visit : Www.omaccounting.in

#OmAccounting#GstAccounting#GstReturns#accountingServices#accountingOutsoucing#onlineAccounting#gstecommerceaccounting#CASupportServices#GstAcoountingServices#ecommerceAccounting#amazonaccountants#Accounting#GST#outsoucingAccounting#omaccounting#corona#covind19

0 notes

Text

Tax Accountant

focus industrial resources limited

#omaccounting.in

Location : DL IN

Looking for a semi-qualified chartered accountant. The person should be capable of handling taxation and accounts work.

#OmAccounting.in #GstAccounting #GstReturns #accountingServices #accountingOutsoucing #onlineAccounting #gstecommerceaccounting #CASupportServices #GstAcoountingServices #ecommerceAccounting…

View On WordPress

0 notes

Link

1 note

·

View note

Link

Chargeback Management and Prevention The Benefits that it brings

#ecommerceaccounting#fraudprevention#preventionguide#Chargebackpreventionalert#ecommercefraudprevention

0 notes

Link

0 notes

Text

Merchant Account for Tech Support Business (MCC 7379)

All websites and companies need tech support in order to connect with their customers and solve any potential issues that appear. No matter what industryone pertains to, there will always be a need for tech support companies. However, with so many companies in the tech support world it will be very hard for you to stand out which is why we are here to help. We will provide you with a merchant account and a very good payment gateway that will you boost your business and offer you better help to your customers.

Why do you need a payment gateway and merchant account?

If you want to have a high class, compliant tech support company you need to do all you can in order to streamline your financials. Not all support companies out there tend to deliver the utmost value which is why it can be nothing short of frustrating when a merchant problem appears and your business can’t get paid. Plus, many companies use only specific payment processors which make it even harder to get paid.

Thankfully, Merchant Stronghold will help you deal with all of that in a very professional manner. No matter if you deal with companies from another state or high risk businesses in your own country, we are here to assist and we will offer you the best financial solutions on the market.

On top of that, the payment gateway and merchant account offered by us is designed to be very reliable, professional and suitable for any company out there. We understand how hard it is for you to obtain a very good approach and with our help you can reach those results very fast. Merchant Stronghold can also provide APIs to integrate your Tech Support Gateway with your website to accept payments online, we also pre-integrated website with payment gateway to run your business online and accept payments only anytime & anywhere.

We also work very hard to ensure that you can easily get a merchant account in the US. Even if you are from a foreign country you will have no problem accessing the outcome you want. Plus, Merchant Stronghold is free to offer you the best electronic payment solutions, payroll and business accounting as well as stellar financial processing for your tech support business. We can handle the challenging stuff for you so you never have to do that on your own. That’s where you get the utmost value and the outcome will be very well worth it in the end.

Contact us now

Merchant Stronghold is here to provide you with a great way to reach your tech support success. Not only will you be able to get a very good payment gateway solution via our services, but you will find it a lot easier to deal even with high risk business partners. We know that this can be a challenge for you so even if you want to set up a merchant account in the US, we will be here for you to offer the help, support and guidance that you might need at all times. Take your tech support business to new heights with a stellar merchant account and a better exposure to new markets.

Wоuld you lоvе to be раrt оf thiѕ?? Feel frее tо get in touch ,wе’ll bе glаd to hеаr frоm уоu

0 notes

Link

0 notes

Photo

Training and coaching business require a reliable online payment solution that can keep you safe from possible frauds. Merchant Stronghold can provide it to your business.

#ecommercefraudprevention#Chargebackpreventionalert#chargebackmanagementforsubscription#fraudprevention#paymentfraud#preventionguide#ecommerceaccounting

0 notes

Text

Filing a Chargeback on Credit or Debit Card Purchases? Please Don’t!

Mostly the consumers are unaware of the fact chargeback is. Chargebacks are refunds to the cardholders also known as reversal of amount paid during ecommerce business transaction by the issuing bank for fraudulent transaction on the bank statements of which cardholders are unaware.

Once the customer file complaint or raise dispute with issuing bank, the bank investigate into the same. If the customer claims proves to be untrue the refund is not initiated to the customer and money is not asked from the merchant. On the other hand, Merchants are given the time to dispute the claim of the customers by providing supporting documents regarding the purchase. If the merchant does not respond to the dispute within time, the funds are automatically awarded to the cardholder.

Dos and Don’ts

Cardholders can request a chargeback if they have actually suffered from the fraud. It means their card is either stolen or card sensitive information is stolen and is being used by some fraudsters. Otherwise chargeback will be in favor of the merchant only as it is. Merchant will be providing all the compelling proofs and evidences and merchant will be winning the case. If you are unable to follow the chargeback process because of its complexity you can contact chargeback Expertz, a mediation firm that will secure a refund on your behalf.

Even if the transaction was unauthorized, it still might be better to deal with the merchant directly. Filing a chargeback or not is you decision, but do have a word with your bank before filing the chargeback. Although it is always preferable to contact the merchant and not get into complexity.

Chargeback can be Disputed for various reasons, don’t dispute chargeback because of wrong reasons

These days customer prefer to go directly to the bank instead of contacting the merchant. Filing a chargeback is easy, you will get your money back also for a temporary basis. But think once, why would merchant does not like to keep its customer happy. They always want to keep the customer happy.

If you regret making a purchase, return the product or cancel the service. If you keep the product and get a refund, that’s shoplifting. You’re not really a thief, right?!

If you are unaware about the purchase, the shopperconsented the transaction. Therefore, you shouldn’t call the bank and say transaction was unauthorized.

If you have subscribe to something or purchased anything, don’t go directly to the bank as bank does not have any other option apart from disputing the chargeback against merchant. Try to contact merchant first, if your queries are not resolved than you can go to your bank.

If you have forgotten about the purchase you made, don’t just rush to the bank. Try to remember, ask someone, contact merchant before you dispute the transaction against the purchase.

Friendly fraud: Don’t raise the dispute when you have received the product. Few people do that. You want your money as well as the product. That’s wrong. Are you fraudster? Than what is the need of raising friendly fraud?

Because of the chargeback both the customer and merchant is suffering. Long lengthy process make them irritated. Use the chargeback only for the purpose for which it was made. Don’t make improper use of it. If the business receives too many chargeback it affect the reputation of the business. Your actions could be directly responsible for the destruction of a hard-working business owner. Because of the chargeback disputed by you merchant suffers huge losses. They increase the price of the product to recover the losses. Think before you dispute any transaction because at the end the customer is going to pay more. If the bank suspects you’re filling illegitimate chargeback as a means of cyber shoplifting, your account will likely be closed. If your account is closed, your credit score will drop.

As a cardholder it is your responsibility

Not to share your card information with anyone.

Read terms and condition carefully before doing any online transaction.

Refund takes time. Give time to merchant. Don’t just rust to the bank.

Shop on the secure websites, follow master and visa guidelines.

Chargeback should be last resort as it affects both the customer and the merchant. It has consequences that everyone has to face. If you have any doubts you can contact us at: (855) 465-4723

#Chargebackpreventionalert#ecommercefraudprevention#chargebackmanagementforsubscription#fraudprevention#paymentfraud#preventionguide#ecommerceaccounting

0 notes