#efilingitr

Text

A personal expense form is an obligatory structure that should be filled to report the citizen's yearly pay to the Annual Assessment Office. It is a fair method to educate the public authority concerning your yearly pay in a particular monetary year and all the assessments that you paid based on your pay. #efileIncomeTaxReturneFilingITR #Howtofileincometaxreturnonline #howtofileITRonline

1 note

·

View note

Text

Relief For Taxpayers: CBDT Extends PAN, Aadhaar linking by 3 Months to 31 December'19

In a relief to taxpayers, the Central Board of Indirect Taxes has extended the deadline to link PAN with Aadhaar to December 31, 2019. Earlier, the last date was September 30, 2019. This notification is issued for the taxpayers who have not linked their PAN with their Aadhaar. As per the Tax Administration, the PAN which will not be linked with the Aadhaar by 31.12.019 shall become inoperative and therefore, it cannot be used for any financial transaction. However, the government is yet to notify the implications of inoperative in case PAN is not linked with Aadhaar.

"The CBDT granted another 3 months extension to link the Aadhaar with PAN. As per the recent amendment by the Finance (No. 2) Act, 2019, if a taxpayer does not link his PAN with Aadhaar number by the due date then the PAN of the taxpayer shall be deemed to be inoperative. A taxpayer will not be able to quote his PAN if it becomes inoperative. The dept. has not yet prescribed how an inoperative PAN shall be made operative again. Thus, to avoid any inconvenience which may cause to the taxpayer, the board has extended the cut-off date, says CA Naveen Wadwa.

If the individual's PAN becomes 'inoperative' it will be treated as if the person is not holding the PAN and he would be not entitled to conduct and financial transactions where it is mandatory to enter the PAN details.

How to link PAN with Aadhaar?

In the last Union Budget in July 2019, the government has proposed a law making necessary for every individual to link PAN with Aadhaar while filing income tax return online. Here are three ways to link your PAN with Aadhaar-

As per the income tax department, you can link PAN with Aadhaar by using either online mode or through SMS service-

Link Aadhaar with PAN through income tax e-filing website

To link a PAN with Aadhaar online, the assessee is required to log in to the e-filing portal, according to the Income Tax Department.

Link Aadhaar with PAN through SMS service

The Income Tax Department also provides an SMS-based facility to enable the linking of Aadhaar with PAN online.

Thus, every individual must link the PAN with the Aadhaar. As section 139 AA (2) of the Income Tax Act, every person having PAN as on July 1, 2017, must intimate his or her Aadhaar number to tax authorities. Moreover, Aadhaar linked with PAN enables taxpayers to verify their returns through OTP sent to their phone number at the time of ITR Filing. Meanwhile, this is the seventh time that the government has prolonged the deadline for individuals to link their PAN with Aadhaar.

For more details about efiling of income tax return online visit our website: https://www.allindiaitr.com

#itr filing#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online#itr return#income tax return#file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling

0 notes

Text

CBDT extends ITR filing deadline for Audit Cases by a month to 31 October 2019

The Central Board of Direct Taxes (CBDT) has extended the Income Tax Return filing deadline for audit cases from 30th September 2019 to 31st October 2019. As per the Income Tax Act Rule, the ITR should be file by those entities who are assessed under section 44AB of the income tax such as companies, partnership firms & proprietorship. In addition, those businesses whose total sales, turnover or gross receipts exceed Rs 1 crore in the financial year is eligible for Tax Audit.

The income tax department took to microblogging site Twitter and shared the post, saying "on consideration of representations received from across the country, CBDT has decided to extend the due date for ITR Filing & Tax Audit Reports from 30th Sep 2019 to 31st of Oct, 2019 in respect of persons whose accounts are required to be audited," the CBDT said in a late-night statement.

Look at the applicability in Tax Audit under the following conditions-

Must be a person under the Income-tax Act

Must carry on business or profession

Must maintain books of account

Object to earn profit or gain

Profit or gain comparable under Chapter IV

Income is Taxable or Loss allowable under Act

Who is required to get their accounts audited?

Individual/Proprietorship

HUF

Company

Partnership Firm

AOP/BOI

Local Authority

Co-operative

Objective of Tax Audit

As the name suggests, the Tax Audit specifies the proper analysis or audit of accounts of any business or profession carried out by taxpayers from an income tax perspective. Even though it makes the process of income computation for filing of return of income easier. Here are the objectives of a tax audit-

· Ensure proper analysis and correctness of books of accounts and certification of the same by a tax auditor.

· Checks frauds and malpractices in filing income tax returns.

· To note down any discrepancies while reporting observations of books and accounts by a tax auditor.

· To report prescribed information such as tax depreciation, compliance various provision of Income Tax Act law.

Penalty for Non-Compliance of Tax Audit

· Non-compliance of tax audit regulations by taxpayers attracts a penalty of whichever is lower from the following:

· 0.5% of total sales

· Turnover or

· Gross receipts

· Rs. 1,50,000

For more details about efiling of income tax return online visit our website: https://www.allindiaitr.com

#itr filing#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online#itr return#income tax return#how to file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling

0 notes

Text

Not Got Your Income Tax Refund Yet? Here's What You Should Do

Once your income tax return is processed, it almost takes 30-45 days for you to receive the refund. Taxpayers who have filed their income tax return before July 31 might have received the refund by now. On the other hand, Tax assesses who have filed the ITR around August 31 for the financial year 2018-19 are still waiting for the refunds to credit in their account. Well, this time is an appropriate time for the individuals applied for ITR filing to check if they received the refund by the income tax department or not. Moreover, there could be many reasons for a delay in refund process like mistakes in the income tax return filing, discrepancy in income, incorrect bank account details, wrong address, and others.

If you are also among those who still have not received the tax refund, here we've discussed some of the reasons for the delay in getting your refund and what you should do in case of delay-

Mistakes in the Tax-filing

If you haven't received the refund, there are possibilities that you made blunders while ITR filing likes misspell critical personal information or put in wrong details. In such cases, the taxation authority will take time to confirm and verify the same. In addition to this, there could also be mismatches in the figures that you had provided previously and what you did this year. The tax department will check the records thoroughly to confirm if you need to share additional information.

Discrepancy in income or tax amount

This occurs when your form 16 details do not match with the details mentioned in form 26 AS. If there is any discrepancy in the income from various sources, the refund process may get interrupted. Refund also gets delayed where ITR couldn't be processed due to proposed adjustment under section 143(1)(A). Although, in this case, you will be intimated with the new tax demand due to which the process may take a little longer.

Incorrect bank account details

Even if you completed all the formalities and do not give accurate bank details, then it will be difficult for the income tax department to process your refund. The wrong details like a wrong bank account number or IFSC Code, bank account mentioned for refund not being linked with PAN or not pre-validated at the e-filing portal could delay the refund process due to which the taxpayers may have to wait till the time they receive the refund in their account. The taxpayer will be asked by the authority to submit updated bank account details through their income tax India e-filing login on the e-filing portal.

How to check the Income Tax Refund Status?

According to income tax departments e-filing website, there are several steps through which you may know about how to check refund status-

Taxpayers simply log in to the income tax department's e-filing website with registered user id and password. Click on 'View Returns and Forms' on the page. From the drop-down menu, go to select 'Income Tax Returns' and then select the last assessment year after which the income tax refund status will be shown to you.

#itr filing#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online#itr return#income tax return#file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling#efiling income tax return#filing ITR online#file ITR online#e filing income tax return for individual#how to file income tax return for salary individual

0 notes

Text

CBDT Cautions Taxpayers Not to Share PAN Details on Microblogging Sites

In the recent statement by the Income Tax Department, it has cautioned all the taxpayers who are holding Permanent Account Number to not to disclose their ten-digit alphanumeric number PAN publicly on the internet and social media. The income tax administration stated that sharing personal information on the microblogging such as Facebook, Twitter, and other websites can lead to its misuse.

The warning, that also acts as an advisory, comes at a time after noticing that a lot of taxpayers have been asking a question and raising concerns about the processing of Income-tax Returns, ITR refund, etc on Twitter.

Thereafter, the income tax department responded on the same posts or interrogations, warning all such tax assesses to not to mention their details on Twitter. They said that Sharing of personal data, including PAN, can lead to cases of identity theft where villains can make transactions in your name without your knowledge.

May we also request you not to share personal details like PAN on social media to avoid it being misused!" is the standard response of the Income Tax department on Twitter in a reply to all taxpayers who reveal their PAN on the social media site?

However, the Income Tax department has come out with an online inquiry form where if any taxpayers who have any query regarding the income tax returns can ask tax-related questions on the income tax department website. There, individuals can ask questions and get it answered directly from the I-T department officials.

In the form, you will be asked to provide the basic details such as your full name, PAN, assessment year for which the issue is reported, mobile no, email id, your detailed query, and social media user ID. Besides, the form's basic criteria are to answer issued related to e-filing ITR, ITR filing process, and claiming income tax refund status. Once you fill-up the form the income tax department will soon answer your queries or address your concerns.

What happens if someone is using my PAN number for their transactions?

If you share your information at social media then there are chances of suspicious activity. Some people who may try to register on the Income tax website and try to efile income tax return by using your PAN number. In order to register on the site, the person should have to know your surname and date of birth correctly. This can be easily traced by your social profile. So, it is always advisable to be very careful while sharing your details publicly on social media.

For more details about efiling of income tax return online visit our website https://www.allindiaitr.com

#itr filing#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online#itr return#income tax return#file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling#efiling income tax return#filing ITR online

0 notes

Text

ITR Filing: Know All About Intimation Notice by the Income Tax Department U/S 143(1)

After the Income Tax Department has processed the income tax return, it will send an intimation notice to taxpayers under section 143(1) of the Income Tax Act 1961. The individuals who have filed their Income Tax Return for the financial year 2018-19 will receive the intimation on the registered e-mail Address same as registered in the e-filing account. The notice will inform you whether the income tax computation in the ITR filed by you matches as per the record.

This process includes the estimation of any errors, internal and external inconsistencies, tax & interest calculation and verification of tax payment, etc. Therefore, it is more like a prima facie valuation by the tax officials to check whether the information is accurate or not. This whole process is called an assessment, in such cases, if there is any mismatch or the department is unable to verify the content and information, it may issue a notice. Previously, these notices were sent by post but currently, they are mailed and also uploaded on the e-filing portal.

If any taxpayers who have applied for ITR filing and do not receive the intimation notice, it means, your tax return acknowledgment will serve as the department’s acceptance of your return.

What to do when you receive an intimation notice?

You might be wondering about what you should do when you receive intimation notice. Well! First, the tax assessee should check if there is any difference in the reports or whether the department has accepted the income and tax numbers filed by you. There are certain steps through which you can check the faults. In case you haven't found any difference then no action required. However, if the figures do not watch, you should carefully check the line in which you have entered the amount considered by the department differs from what you have submitted.

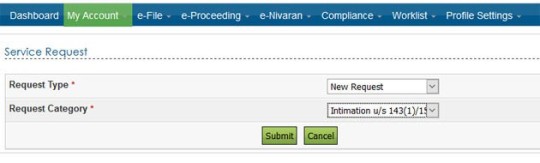

Here are the steps about how to get the intimation notice-

Step 1: Visit income tax india efiling login (www.incometaxindiaefiling.gov.in)

Step 2: Log in to your account. The user ID is your PAN number.

Step 3: In the 'My Account' tab select, the service request option

Highlights of what intimation notice will show under section 143(1)-

Intimation notice received by you under section 143(1) will show some of the discussed points in the below-

· Your income details, deductions claimed and tax calculations match with the tax department's assessments and calculations: In this case the notice will show both tax payable and refundable as zero.

· Additional tax demand notice: When, as per the tax department's assessment, you have not added a particular

· As per the income tax department's assessment, if you have paid additional taxes compared to your actual tax liability, a income tax refund is due to you.

Meanwhile, in case you have not received the intimation by the tax department, the taxpayers can file a complaint on the efiling of income tax return website. Likewise, if your ITR is processed but you can't find the intimation notice in your email, then you can raise a service request for the same.

#itr filing#online income tax return#income tax return filing#efiling of income tax return#income tax online#file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling#efiling income tax return#filing ITR online#income tax refund status

0 notes

Text

Did You Miss the ITR Filing Deadline? Here's what you need to know

In the tumultuous period of income tax return filing session, numerous taxpayers missed the August 31 deadline for Income Tax Return filing. Did you also miss it? Relax! If you missed the tax deadline you do not need to feel panic about this as there is still a choice to file a belated ITR with penalty fee ranging from 5000 to 10,000. After Income Tax Department has furnished the new rule, from 2019 onwards, those individuals filing returns after the last date is obligated to pay a late fee under section 234EIncome Tax Act 1961. However, the amount of penalty will depend on the tax assesses earned income and the delay of filing ITR.

So, if you also missed the deadline for ITR filing, here's the key point that one should keep in mind before filing a late ITR return-

According to Income tax administration website incometaxindia.gov.in, any taxpayer who has not filed ITR before the due date of the income tax return can furnish the return of their income at any time before 31.03.2020 or the end of the relevant assessment year 2019-20.

A penalty will be imposed for every belated income tax return filing under section 234F.

As per the income tax rule, a fine of Rs. 5000 will be levied on individuals if they file ITR after the due date but before December 31 2019.

The penalty increases to Rs 10,000 if the taxpayers file the return next year between January 1 2020 to March 31 2020.

Those who have Gross Total Income belowRs 5 lakhare required to pay Rs 1,000 for filing ITR after the due date.

What is belated income tax return?

If any individual fails to file their ITR before the due date can efile ITR under sector 139(4) of the Income tax act. The belated return can be filed before the end of the relevant assessment. This means that you can file a belated return for Financial Year 2018-19 by March 31, 2020, i.e., before the end of the current assessment year 2019-20.

As per CBDT, those taxpayers whose annual income is up to Rs. 5 lakh or below is liable to pay a penalty of Rs. 1000. This late will be imposed in addition to any tax liabilities. This decision has been taken by the Income Tax Department with a motive to encourage taxpayers to file their taxes on time.

Meanwhile, this year the efiling of Income Tax Return department has made a tremendous world record as over 5.65 crore income tax returns were filed by the taxpayers. It has shown a 4 percent rise in ITR Filing over the previous year.

#itr filing#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online#itr return#income tax return#file income tax return#efile income tax return#e-filing of income tax online#e-file income tax#efilingitr#income tax efiling#e file income tax#efiling income tax return#filing ITR online#file ITR online#e filing income tax return for individual#how to file income tax return for salary individual

0 notes

Text

How To Check Income Tax Return Status Online?

Once you have filed your income tax return, the next step is to check status of your filing. Keeping track of your ITR filing will help you to know whether your Income Tax Return is successfully processed by the income tax department or not and it any further step is required from your part. Along with this, it is necessary to check your income tax refund status as well if any. Meanwhile, the income tax filing season has already ended, it is therefore, essential to check each and every keypoint of ITR filing.

If you want to check your ITR status online, then by following these steps you can easily track the ITR status of e-filed ITR online-

Step 1-The taxpayers who have applied for ITR filing for the financial year 2018-19 can check the status throughincome tax e-filing website- incometaxindiaefiling.gov.in,by clicking on the ITR status option, one can easily check the status of their income tax return.

Step 2: The next step is to submit the details of PAN, ITR acknowledgment number which you have received from the income tax department and the captcha code on the new page that opens and hit the Submit button.

After you fill out your details and submit, the status will be displayed on your screen.

On the other hand, if you have registered on the government's e-filing portal, you can directly login and click on the view returns that will be given on the dashboard. Click the Income Tax Returns on the drop menu and you will see your full history of ITRs filed and their respective status.

Apparently, you can also check the status of your income tax refunds, if the intimation is not received from the Income Tax department or you have missed the email or SMS.

Here’s the ways to track your tax refund-

Taxpayers can track income tax refund status through income tax e-filing website

Step 1: Visit the income tax e-filing website.

Step 2: Click on the e-filing Portal login showing on the right side of the homepage.

Step 3: Log in to your account through your PAN, e-filing password and enter the captcha code.

Step 4:Last step is to click on ‘View returns/forms’ appearing on the screen.

#itr filing#Income Tax Refund Status#income tax return status#tax refund status#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online#itr return#income tax return#file income tax return#efile income tax return#e-filing of income tax online#e-file income tax#efilingitr#income tax efiling#e file income tax#efiling income tax return#filing ITR online#file ITR online#e filing income tax return for individual#how to file income tax return for salary individual

0 notes

Text

Income Tax Department creates a new record with filing of 49 lakh ITRs

A day after the income tax return filing session has been completed, it has created a new world record of online e-filing ITRs in a single day and that too so easily. As per the Central Board of Direct Taxes, nearly 49 lakh income tax return was filed by the taxpayers on August 31st, 2019 for the assessment year 2019-20. Therefore, the income tax filers boundaries have extended to 4 percent for the financial year 2018-19 compared to the previous year statistics

"The department made history with an all-time high record of 49 lakh 29 thousand ITRs filed in a single day on August 31," Central Board of Direct Taxes (CBDT) said in a statement.

According to live mint research, filing of tax return surged 41% on the last date to 4.9 million filings. Since 27 August e-filing of income tax returns has risen 32-63% as comparison to the last year.Also, in the last five days, the tax department saw 14.7 million e-filing, thus, has made history with a majorfence in the e-filing of ITRs.

CBDT said that out of the 5.65 Cr ITRs filed so far, 3.61 Cr ITRs have been verified. A large number of taxpayers about 2.86 Cr (79%) have opted for e-verification, mostly using Aadhaar OTP.

Highlights of ITR Filing for the AY 2019-20

· Nearly 50 lakh people filed their tax returns online on 31 August, the last date for ITR filing and the peak filing rate per second was at 196 ITRs per second

· Around 5.65 crore ITRs filed whereas, 3.61 crore have been verified

· From August 27 to 31, 1,47,82,095 people filed online ITRs, asurge of 42%as compared to the same period of AY 2018-19

In the last date of ITRs submission, the income tax administration has steadily interacted with taxpayers on social media to help them to resolve their hindrances and e-filing ITR queries and getting acknowledgment in return

Meanwhile, the individuals who haven't filed their returns this financial year could file the ITR after the due date till the end of the fiscal in which the return is to be filed comprising of a penalty and the final figure could go up further.

#itr filing#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online calculator#itr return#income tax return#file income tax return#efile income tax return#e-filing of income tax online#e-file income tax#efilingitr#income tax efiling#e file income tax#efiling income tax return#filing ITR online#file ITR online#e filing income tax return for individual#how to file income tax return for salary individual

0 notes

Text

Income Tax Return Filing Process Becomes Easy like never before

The Income Tax Department has made income tax return filing process easier like never before. Now, the taxpayers can e-file their returns without any hurdles. A few days back, the Income Tax Authority has implemented newincome tax return filing relief to individuals by facilitating the lite e-filing facility and quick procedure for ITR verification. The facility will be operationalized on the official portal of the department income tax efiling login website in India www.incometaxindiaefiling.gov.in

"Lite e-filing" facility for Taxpayers

This is the lighter version of e-filing portal to make ITR filing quick and easy for taxpayers. The registered users can access this by clicking 'e-filing Lite' option in the home page of income tax e-filing login website. After logging in, the taxpayers will be provided essential links that will enable e-filing of ITRs and get Form 26AS. Apart from this, the taxpayers can also download pre-filled or XML forms and view their past filed returns, among others.

Alert: The Due Date of ITR Filing Extended to August 31st, 2019

The Central Board of Direct Taxes has already granted additional time for taxpayers by extending the deadline for ITR Filing to August 31, 2019, the tax filers have enough time to take necessary measures while filing ITR for the assessment year 2019-20. Hence, before filing the return, it would be prudent to check Form26AS and the details of overseas incomes (in case of resident and ordinarily resident) like overseas bank statements, payslips, etcand ensure that all incomes reflecting therein are disclosed in the return of income.

, you fail to accumulate imperative details and disclosing your income, then, the income tax department will send you a notice for non-disclosure of income. So, to avoid such major interruptions, it is important to act intelligent and file income tax return online with all your proper consideration.

Know your tax slab

At times, the E-filing ITR due date is almost around, one should know the income tax slab in India that has been divided into categories, based on age and income. The first category of taxpayers is those who are below 60 years of your age and their total annual gross income exceeds Rs 2,50,000. The second category is the senior citizen i.e. 60 years and above but below 80 years and total annual gross income exceeds Rs 3,00,000. And the third being those above 80 years with a total income exceeding Rs 5,00,000.

For more details about efiling of income tax return online visit our website : https://www.allindiaitr.com

#itr filing#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online#itr return#income tax return#file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling#e file income tax#efiling income tax return#filing ITR online

0 notes

Text

HOW TO VERIFY ITR WITHOUT LOGIN TO YOUR E-FILING ACCOUNT?

To make Income Tax Return efiling procedure more relaxed, the income tax department has launched e-verify Return for e-verification of ITR without login. According to this, the ITR filing can be accessed by clicking e-verify return button in the home page under quick links without logging-in to your account. Before this update, the CBDT has launched the lighter version of e-filing ITR, which is known as "efiling Lite” with a focus on to make income tax return filing easier for the taxpayers.

This is one of the many steps that has been taken by the income tax authority to make ITR filing process easier for individuals. Under Income Tax provisions, the ITR verification is one of the last steps at the time of filing ITR process. After the tax return is filed, it is, therefore, mandatory to verify it within 120 days. In case your ITR has not been verified, it will be not considered as valid ITR to be taken up for further processing.

Here's a step-by-step guide on how you can verify ITR without login to your e-filing account-

Step-1 Visit Income Tax India Efiling Login Website (www.incometaxindiaefiling.gov.in)

Step-2 Under the 'Quick Links' tab, select the 'e-verify return' option.

Step-3 Enter the details as needed such as PAN, acknowledgment number. Once you have entered all the information, click on 'continue'

Step-4 Three options will appear on your screen: You can pick any of the options stated above and verify your tax return. If you want to verify your return through Aadhaar OTP, then ensure that your mobile number is registered with the Aadhaar as well. Likewise, if you don't have to EVC (Electronic Verification Code), then you can generate your pre-validated bank account or Demat account.

Meanwhile, with the extension of the tax filing due date for the financial year 2018-19, tax filers can complete the process within August 31 to avoid any tax department's attention or legal notice.

#itr filing online#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#income tax online#itr return#income tax return#file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling#e file income tax

0 notes

Text

A Complete Guide on Income Tax Refund Status

If any individuals have filed their income tax return and have paid more tax than what was outstanding is eligible to receive a refund. Usually, refund arises when taxes paid by the taxpayer are more than their actual liability including interest. It could be in the form of advance tax, self-assessment tax, tax deducted at source, foreign tax credit. However, any tax assessee can claim tax refund by simply filing their ITR. Besides, once you have filed e-file ITR, the next step is to verify your ITR, the income tax refund will be automatically become due if a surplus tax was deducted.

When the procedure for income tax return filing gets completed make sure that your ITR is electronically verified through Aadhar number OTP and EVC generated through Aadhar number OTP. Moreover, EVC generated through a bank account or physically verified by posting the signed ITR-V to CPC within 120 days of filing the ITR.

After the ITR process completed by the Income Tax Department, the tax claim is accepted and the due amount will be credited directly to the taxpayers bank account. Although, keep in mind that for income tax refund the taxpayers bank account should be linked with the PAN card. This step has been taken to eliminate the traditional way of sending tax refund cheque by speed post.

How to check the Income Tax Refund Status?

If you want to check your refund status, the tax filers can easily check by logging in to the income tax department's e-filing login website with their user ID and password. In the next step, you will be required to locate view return and forms on the display page and from the drop-down menu, just choose the options income tax returns. Select your assessment year and once you complete the process the tax refund status will be accessible.

Meanwhile, the ITR filing due date has been already extended to 31st August ‘19’ and now taxpayers have enough time to file their ITR without any hustle and bustle. Also, the CBDT has recently launched the lighter way of e-filing website called as e-filing 'Lite' portal to make tax filing process easy for the taxpayers who are preparing to file their return for the financial year 2018-19.

This new benefit will help taxpayers who don’t want to do any other activity on the income tax department website apart from e-filing of income tax return. Now, all registered users on the e-filing website have two ways to access the e-filing facility.

#itr filing#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online#itr return#income tax return#file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling#e file income tax#efiling income tax return#filing ITR online#file ITR online#income tax refund status

0 notes

Text

Income Tax Department Launches 'Lite' E-filing facility for Taxpayers

Income Tax Department has launched the 'Lite' e-filing website to to help taxpayers file returns quickly. And more efficiently. The facility was operationalised on the official portal of the department income tax India efiling login www.incometaxindiaefiling.gov.in.The home page has a new 'Quick ITR Filing' link that users can click on to continue to 'e-Filing Lite', which offers services only for registered e-Filing PAN users

"The Income Tax department is launching 'e-Filing Lite', a lighter version of e-Filing portal with a focus on filing of Income Tax Return (ITR) by the taxpayers," the department said in a public advisory.

Meanwhile, the income tax officials said that a new tab for lite will be provided on the web portal and once the registered taxpayers login efiling website, they will only be provided essential links that enable e-filing of ITRs and Form 26AS. Although, the tax assesse can download pre-filled or XML forms and view their past filed returns. Other regular tabs like e-proceeding, e-nivaran, compliance, work list and profile setting were taken off from the 'lite version' but retained in the standard version of e-filing facility, he said.

As per the tax authority reports, the 'lite' version is aimed to enable easy and quick ITR filing by all categories of taxpayers, the official said. The tax the government extended the due date for filing income tax returns by individuals for the financial year 2018-19 by a month till August 31. Initially, the last date was July 31. The July 31 deadline was set for most individuals and HUFs.

"The Central Board of Direct Taxes (CBDT) extends the 'due date' for filing of Income Tax Returns from July 31, 2019 to August 31, 2019 in respect of the said categories of taxpayers," the finance ministry said in a statement.This extension comes after the government was appealed by many entities to extend the efiling of income tax return date so as to allow sufficient time to tax payers to file their returns.

#itr filing#online income tax return#efiling income tax#income tax return filing#efiling of income tax return#itr filing online#income tax online#itr return#income tax return#file income tax return#efile income tax return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#e-filing income tax return#efilingitr#income tax efiling#file ITR online#efiling income tax return#filing ITR online

0 notes

Text

How to E-verify Income Tax Return using Aadhaar Card?

E-verify income tax return is the most important and last step of filing ITR. Once the individuals file their income tax return they can easily apply for e-verification either by online mode or offline. In an offline method, you get around 120 days to e-verify your income tax returns. But now, this step has been eliminated from the process of filing returns, as the Income Tax Department is allowing individuals to verify their ITR online through various methods. Also, in case anyone forgot to e-verify income tax return, the income tax department will not accept income tax return process and hence, you will not be able to claim the income tax refund status.

Under online e-verify ITR, there are definite procedures to e-verify return such after efiling of income tax return taxpayer can e-Verify the return by using net banking, bank ATM, using bank account number, Demat Account number, e-verify Return using registered mobile number & mail id or through Aadhaar OTP. But in this blog, we will discuss about how you can e-verify return using Aadhaar OTP. However, as per the Aadhaar Act, 2016, section 139AA of the Income Tax Act, it will not be applicable for individuals who do not reside in India.

Here are the steps to E-verify your income tax return using the Aadhaar card.

Step 1: To verify your return, the first step is to log on to income tax e filing website.

Step 2: The pop up will be shown on your website, asking to link your Aadhaar number with your e-filing account. In case you don't see the popup, go to the profile settings top menu and click on the ‘Link Aadhaar’ button.

Step 3: Next step, check your PAN details and enter your Aadhar number. Make sure that you are saving the details on clicking save option.

After your Aadhar has been linked to your PAN, follow these steps to e-verify your returns:

Step 1: The foremost step is to upload the ITR on Income Tax e-Filing website.

Step 2: After it's done, you will be asked for the mode of verification for your returns. From multiple of options showing on the website select the 3rd-option that says – generate Aadhaar OTP. A one-time password will be sent to the mobile number registered with your Aadhaar; this OTP will be valid only for 10 minutes.

Step 3: Lastly, enter the OTP number on the page and hit ‘Submit.’

You will then receive a message of Return successfully e-Verified. You can download the Acknowledgement. Once it’s done the same acknowledgment will be sent to your registered email id.

For more details about file income tax return visit us at https://www.allindiaitr.com

#income tax return#file income tax returnj#efiling of income tax return#itr filing#online income tax return#efiling income tax#income tax return filing#itr filing online#income tax online#itr return#income tax e-filing#e-filing of income tax online#E-file Income Tax Return in 2018#efilingitr#income tax efiling#filing ITR online#file ITR online

0 notes