#e-filing of income tax online

Text

How Income Tax Return Online Filling

Filing your income tax return online can feel like navigating a labyrinth, but with the right guide, it’s more like a walk in the park. We’ll break down each step, simplify the jargon, and get you filing with confidence. Let’s dive in!

Why File Your Income Tax Return Online?

Filing your income tax return online isn’t just about following trends; it’s about leveraging modern technology to make your life easier. Here’s why you should consider it.

Convenience and Accessibility

Gone are the days of standing in long queues or filling out mountains of paperwork. Online filing lets you submit your return from the comfort of your home, anytime. It’s like having a tax office at your fingertips!

Accuracy and Efficiency

Online portals are designed to minimize errors. With built-in calculators and validation checks, you’re less likely to make mistakes. Plus, it speeds up the whole process, so you can get your refund quicker.

Step-by-Step Guide to Filing Your Income Tax Return Online

Ready to get started?

Follow these steps to file your income tax return online efficiently and correctly.

Step 1: Gather Necessary Documents

Step 2: Register or Login into the Income Tax Portal

Step 3: Select the Appropriate ITR Form

Step 4: Fill in Your Personal Details

Step 5: Provide Income Details

Step 6: Claim Deductions and Exemptions

Step 7: Review and Verify Your Return

Give your return a thorough once-over. Check for any errors or missing information. Think of it as proofreading an important email.

Step 8: Submit Your Return

Once satisfied, hit the submit button.

Congratulations, you’ve filed your return!

Step 9: E-Verify Your Return

E-verification is the final step to validate your return. You can do this through methods like Aadhaar OTP, net banking, or EVC. It’s like signing off on your work.

Common Mistakes to Avoid

Even with the best tools, mistakes happen. Here are common pitfalls to watch out for.

Incorrect Personal Information

Ensure all personal details are correct. Errors in your name, PAN, or bank details can lead to processing delays.

Misreporting Income

Be accurate with your income details. Misreporting can trigger unwanted scrutiny and penalties.

Not Claiming All Deductions

Maximize your tax savings by claiming all eligible deductions. Missing out means paying more tax than necessary.

Benefits of E-Verifying Your Return

Why bother with e-verification?

It’s not just a formality—it comes with real benefits.

Faster Processing

E-verified returns are processed quickly, meaning you’ll get your refund sooner. Who doesn’t like faster refunds?

Reduced Chances of Manual Errors

E-verification reduces the chances of manual errors in data entry, making your filing experience smoother and more reliable.

Conclusion

Filing your income tax return online doesn’t have to be daunting. With the right preparation and a systematic approach, you can navigate the process smoothly.

Happy filing!

By Paisainvests.com

#digital tax return#e-filing taxes#e-verifying tax returns#filing ITR#filing taxes online#income tax documents#income tax guide#income tax portal#income tax return#online tax filing#online tax return benefits#online tax submission#revised tax return#step-by-step tax filing#tax deductions#tax filing deadline#tax filing mistakes#tax filing tips#tax return process#tax return tips

0 notes

Text

ITR Filing is the process of submitting your income details to the Income Tax Department. It includes reporting your earnings, deductions, and tax payments, ensuring you meet legal requirements and can claim any eligible refunds. PSR Compliance makes it simple to file income tax returns online and receive the largest possible tax refund. Call us at 7065883416 right now.

#itr#itr filing#itr refund#itr e-filing#itr registration#itr service#itr consultant#income tax return#itr online filing

0 notes

Text

All GST registered businesses have to file monthly or quarterly GST returns and an annual GST return based on the type of business. GST Return Filing is mandatory in nature and non – filing will attract penalty and may result of GST Cancellation also. Simplify the GST return filing process for your small business with our comprehensive guide. Stay compliant with India’s GST regulations effortlessly.

Read More >> https://setupfiling.in/gst-return-filing/

#gst registration check#tax system#e file income tax return#tax portal#tax tutorial#free online certificate courses in taxation in india#apply for gstin number#one tax#gst account opening#gst registration requirements#tax ser#file your taxes login#gst website india#invoice without tax#search gst number by name#my gst certificate#online tax app#us gov tax filing#goods and services tax e invoice system#apply for gstin#tax filing india#register with gst#new gst registration online

0 notes

Text

FILING A BELATED INCOME-TAX RETURN

If you missed filing within the due date, you can still file a belated return before December 31, 2023.

Click here: income tax return filing

0 notes

Photo

ITR Filing Online

Effortlessly file your Income Tax Returns (ITR) online with the help of professional guidance from experts. Streamline your tax filing process and ensure compliance with tax regulations. Trust the experienced team at Legal Pillers for seamless and efficient online ITR filing services, making your tax management convenient and hassle-free.

#income tax efiling#itr filing#itr filing online#income tax india e filing#file income tax return online india#online ITR filing

0 notes

Text

Best Online Income Tax Return Filling

File your tax return for income online and receive your refund within 10 to 16 days. Imagine how wonderful it will be when that tax refund arrives sitting in the bank. After your tax return has been completed, you can submit it electronically. When you do your filing your tax return for income online you do not have to print and post your tax return. You can also make a direct deposit to your account at a bank, and do not be concerned about losing your check.

#income tax filing services#e filing income tax portal#file it return online#online income tax return filing

0 notes

Text

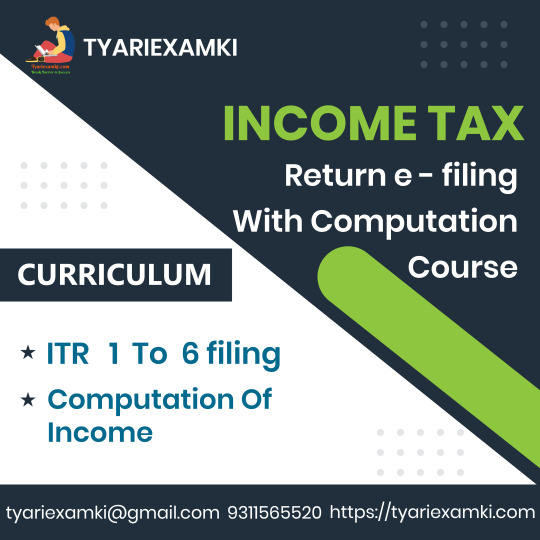

Income Tax e - filing Online Course. Upgrade your Tax e filing Practice through tyariexamki.com. Job Oriented Course

For more information

Visit us:- https://www.tyariexamki.com/.../Income-Tax-Return-E...

2 notes

·

View notes

Text

This news is the latest chapter in an ongoing saga that has its most recent roots in a bombshell 2019 ProPublica report that detailed how e-filing companies like TurboTax creator Intuit had been working to prevent the public from accessing free, easy filing alternatives.

In a nutshell, ProPublica showed the ways companies like Intuit reneged on an agreement with the IRS where they promised to give free direct file options to low- to middle-income taxpayers, all in exchange for the IRS not creating its own such program. And they did create them — they just didn’t link to them or talk about them and added code that would prevent them from showing up in Google searches.

11 notes

·

View notes

Text

"Kallas’s triumph coincided with Estonia’s first majority ‘e-vote’. Out of a total of 615,009 votes, an impressive 313,514 were cast online (prompting a fierce debate between the government and EKRE over the accuracy and constitutionality of the election). For the liberal parties, this was a step forward for Estonia’s much vaunted ‘digital society’. Since it gained independence in 1991, the country has launched an array of digital public services, including e-tax filing, e-residency, e-signatures, e-prescriptions and digital IDs. The libertarian ethos of ‘e-Estonia’ (the country has a flat income tax rate) has elicited praise from the expected corners; the Cato Institute calls it ‘the country of the future’. It aims to mark a rupture with the nation’s Soviet past, building an entrepreneurial paradise from the ruins of technological obsolescence. By fusing this modernizing project with a hyper-Atlanticist disposition, Kallas has made herself the face of the twenty-first-century Estonian consensus, aligning her country with the enlightened West.

Yet Estonia still shares a 383km border with Russia, and about a quarter of its 1.3 million people are ethnic Russians. In northeastern Ida-Viru County, home to Estonia’s third-largest city of Narva, ethnic Russians comprise about three quarters of the population. This has made the area a site of long-running tension. NATO has warned of a ‘Narva Scenario’ in which Russia may seek to exploit existing ethnic fissures, or even annex Estonian territory, in a bid to project its westward influence. In December, Kallas passed a law outlining a full transition to Estonian-only education, to be implemented in 2024: a move that critics described as ‘forced assimilation’. The government also removed a WWII monument of a Soviet tank from Narva and arrested eight of the city’s residents last summer, supposedly to prevent ‘mass disturbances’."

- Lily Lynch

3 notes

·

View notes

Text

TRACES – Overview of e-TDS and e-TCS

Introduction

Welcome to the world of TDS, the traceability system for e-Commerce! In this blog post we'll discuss what e-TDS is and how it works.

e-TDS

e-TDS is a new system of tax collection introduced by the government of India. It is a part of the e-Nivaran project, an initiative to digitize all processes related to tax collection.

The main objective behind this system is to bring transparency and efficiency in government schemes by reducing manual work, avoiding corruption and ensuring better customer experience through online transactions at minimal cost.

e-TCS

e-TDS is the online version of TDS.

e-TCS is a web-based application used to submit income tax returns online, file income tax returns electronically, and receive updates on various things like income tax rates and deductions.

there are two parts of TDS traces.

There are two parts of TDS traces. One is e-TDS, which is done through the internet. The other one is e-TCS, which is done through a computer software.

The main purpose of using these two kinds of systems is to ensure that your money reaches its destination without any loss or delay in between; this way you can be sure that all your transactions are safe from frauds like card cloning and theft etc.,

Conclusion

From the above, you can conclude that e-TDS and e-TCS are two different technologies for creating digital time series data. Both have their own advantages and disadvantages, but both of them can be used together with any other technology to get the best results.

4 notes

·

View notes

Text

Why Every Taxpayer Needs a Digital Signature Certificate Today

A Digital Signature Certificate is an electronic form of a signature that helps validate the identity of the individual or organization signing a document. Issued by Certifying Authorities (CAs), DSCs use encryption technology to ensure the security, authenticity, and integrity of digital communications and transactions. For taxpayers, DSCs are often required in electronic filings, including income tax returns, corporate filings, and other statutory submissions.

Types of DSCs

There are different classes of DSCs, each serving a specific purpose:

Class 1 DSC: Used for securing email communication and identifying individuals.

Class 2 DSC: Required for filing income tax returns, GST returns, and other similar statutory filings. It verifies the identity of a person based on a trusted pre-verified database.

Class 3 DSC: Required for more advanced applications like e-tendering and participating in e-auctions.

For taxpayers, Class 2 DSC is most commonly used and is crucial for filing various tax-related documents.

1. The Shift to Digital Tax Filing

Governments worldwide are encouraging taxpayers to adopt digital methods for filing returns. In India, for example, the Income Tax Department mandates electronic filing for certain categories of taxpayers, particularly businesses and individuals with high incomes. This shift toward digital tax filing has made DSCs increasingly important.

Efficiency and Convenience

A DSC allows taxpayers to file their returns online without the need to visit tax offices or submit physical documents. This not only reduces the time taken to file returns but also makes the process more accessible and convenient, especially for professionals, freelancers, and business owners who need to manage large volumes of documentation.

Mandatory for Certain Taxpayers

For certain categories of taxpayers, including companies, Limited Liability Partnerships (LLPs), and individuals with income above a certain threshold, the use of a DSC is mandatory for filing returns. These regulations are part of broader efforts by tax authorities to streamline the filing process and minimize fraud.

2. Enhanced Security in Tax Filings

One of the primary reasons every taxpayer should use a DSC is the enhanced level of security it provides. Tax filings and financial information are sensitive, and ensuring their protection is crucial.

Data Integrity and Non-Repudiation

A DSC ensures that the data submitted cannot be altered once the document has been signed. This guarantees the integrity of the information provided to the tax authorities. Additionally, DSCs provide non-repudiation, which means that the signer cannot deny signing the document, reducing the risk of fraud or disputes.

Prevention of Identity Theft

DSCs also prevent identity theft by ensuring that only the authorized person can sign and submit tax-related documents. The encrypted signature adds a layer of authentication that makes it impossible for unauthorized individuals to alter or submit returns in someone else's name.

3. Legal Validity of DSCs

Digital Signature Certificates carry legal weight under various legislations around the world. In India, for instance, the Information Technology Act, of 2000, grants legal recognition to digital signatures, making them equivalent to physical signatures.

Global Acceptance

Globally, the legal framework surrounding digital signatures continues to evolve, but most countries now recognize the legality of electronic signatures. The EU's eIDAS regulation and the U.S.'s ESIGN Act, for example, provide a legal foundation for the use of DSCs in digital transactions, including tax filings. This global acceptance is key for taxpayers with international transactions or businesses operating across borders.

Compliance with Tax Laws

Using a DSC ensures compliance with evolving tax laws. Tax authorities are increasingly making the use of digital signatures mandatory for certain types of filings. By adopting DSCs, taxpayers stay compliant with the latest regulations and avoid potential penalties or delays in processing their returns.

4. Cost-Effective Solution for Taxpayers

While there is an upfront cost involved in obtaining a DSC, the long-term benefits far outweigh the initial investment. DSCs streamline the tax filing process, saving time and reducing the need for physical paperwork, courier services, and even in-person visits to tax offices. For businesses, in particular, DSCs reduce operational costs by making it easier to manage multiple filings and comply with regulatory requirements efficiently.

Reduction in Processing Time

By using a DSC, taxpayers can submit their filings instantly and receive an acknowledgment from tax authorities in real-time. This speed significantly reduces the processing time for tax returns, allowing for quicker refunds and fewer delays.

Savings on Penalties and Fines

Timely submission of tax returns is crucial to avoid penalties. By streamlining the filing process with a DSC, taxpayers can ensure they meet deadlines and comply with statutory requirements, reducing the risk of fines for late submissions.

5. Future-Proofing Against Technological Advancements

As the world becomes increasingly digital, tax authorities are likely to introduce more advanced technologies to enhance the efficiency of tax collection and compliance. Blockchain, artificial intelligence, and machine learning are some technologies that may further transform tax administration. In such a scenario, DSCs will continue to play a pivotal role by ensuring secure and tamper-proof digital interactions.

Integration with Other Digital Platforms

Digital Signature Certificates are not only important for tax filings but also integrate seamlessly with other platforms like the Goods and Services Tax (GST) system, e-procurement portals, and online legal platforms. As governments and businesses continue to digitize their operations, having a DSC will become increasingly critical for accessing these interconnected services.

6. Environmental Impact: A Step Toward Paperless Transactions

One of the often-overlooked benefits of using a DSC is its contribution to environmental sustainability. With a DSC, there is no need for printing, mailing, or physically storing tax documents. This reduction in paper usage helps businesses and individuals contribute to a greener environment while also reducing the operational hassle of managing physical documentation.

7. How to Obtain a Digital Signature Certificate

Getting a DSC is a straightforward process, typically involving the following steps:

Select the Certifying Authority: Choose a licensed Certifying Authority (CA) that issues DSCs.

Submit the Required Documents: Provide identity proof, address proof, and passport-sized photographs.

Verification Process: Some CAs may require an in-person verification or video verification process.

Issuance of DSC: Once the verification is complete, the DSC is issued and can be used for tax filings and other digital transactions.

8. Challenges in Adopting DSCs

Despite the numerous benefits, some taxpayers may still face challenges in adopting DSCs, such as:

Lack of Awareness: Many taxpayers, especially individuals and small business owners, may not be fully aware of the advantages and legal requirements of DSCs.

Initial Cost: Although DSCs are cost-effective in the long run, the initial cost of acquiring one can be a deterrent for some taxpayers.

Technical Literacy: For taxpayers who are less familiar with digital technologies, the process of obtaining and using a DSC may seem complicated.

To overcome these challenges, tax authorities and professional bodies need to raise awareness and provide support to ensure that all taxpayers can benefit from the advantages of DSCs.

Also read:- Class 3 Digital Signature.

Conclusion

The digital revolution in taxation is well underway, and Digital Signature Certificates are at the heart of this transformation. For taxpayers, using a DSC is not just a matter of convenience but a necessity in today’s increasingly digital world. With the legal backing, enhanced security, cost-saving potential, and environmental benefits, DSCs are rapidly becoming an essential tool for every taxpayer. By adopting DSCs, individuals and businesses can future-proof their tax compliance while enjoying the numerous advantages of secure and efficient digital transactions.

0 notes

Text

Why E-Commerce Businesses in Abu Dhabi Need Accounting Companies for Growth and Stability

The e-commerce industry in Abu Dhabi is booming, with businesses rapidly scaling their operations to meet growing demand. However, managing the financial aspects of an e-commerce business in this dynamic market can be challenging. From handling multiple revenue streams to navigating local and international tax regulations, e-commerce entrepreneurs often face complex financial hurdles. This is where the expertise of Accounting Companies in Abu Dhabi becomes crucial to business success.

Let’s explore why partnering with an accounting firm is essential for e-commerce businesses in Abu Dhabi.

1. Managing Multiple Revenue Streams in Abu Dhabi

E-commerce businesses often generate income through various channels, such as:

Online Sales on self-hosted platforms or through local websites.

Marketplace Sales on platforms like Amazon UAE or Noon.

Affiliate Income from promoting other businesses' products.

Subscription Services for products or exclusive access.

Tracking these different income streams while managing cash flow can be overwhelming, especially for businesses in Abu Dhabi that may deal with both local and international customers. Accounting companies in Abu Dhabi can help by:

Consolidating Revenue: Ensuring all income from various sources is accurately tracked and recorded.

Cash Flow Optimization: Forecasting cash inflows and managing delays in payments from marketplaces or affiliates.

Channel Profitability Analysis: Breaking down which revenue streams are most profitable and where improvements can be made.

2. Navigating Tax Reporting for E-Commerce in Abu Dhabi

E-commerce businesses in Abu Dhabi face unique tax challenges, especially with the introduction of VAT and cross-border sales regulations. Accounting companies in Abu Dhabi help e-commerce businesses stay compliant by managing:

Sales Tax Compliance: Ensuring VAT is correctly applied to online transactions, whether they occur within the UAE or internationally. Accounting firms help automate sales tax calculations for each region where your business operates.

Income Tax Reporting: For e-commerce businesses with international revenue streams, accountants help navigate the complexities of local and international tax laws to ensure compliance and reduce tax liabilities.

Filing and Reporting: Accounting firms handle the filing of VAT returns and other tax obligations on time, ensuring your business avoids penalties.

3. Managing Inventory Costs and Accounting for E-Commerce

Effective inventory management is key to running a successful e-commerce business. Accounting companies in Abu Dhabi provide support by:

Costing Methods: Advising on the best methods for inventory costing, such as FIFO or weighted average, to give a true reflection of your cost of goods sold (COGS).

Inventory Forecasting: Helping predict future inventory needs based on sales data, ensuring you avoid stockouts or overstocking while maintaining optimal inventory levels.

Handling Inventory Write-Downs: Managing slow-moving or obsolete inventory effectively, ensuring it’s accounted for properly and tax benefits are maximized.

4. Marketplace Fees, Returns, and Refunds

Many e-commerce businesses in Abu Dhabi sell through marketplaces like Amazon UAE, which charge various fees that need to be accurately tracked. Accounting companies assist with:

Fee Management: Keeping track of listing fees, transaction fees, and fulfillment costs to ensure accurate financial reporting.

Return Handling: Properly accounting for product returns and refunds, ensuring that revenue is adjusted accordingly and inventory levels are updated.

5. International Sales and Taxes: A Global Challenge for E-Commerce Businesses in Abu Dhabi

As e-commerce businesses in Abu Dhabi expand internationally, they must navigate a complex web of tax regulations. Accounting companies in Abu Dhabi help by:

VAT and Sales Taxes: Ensuring that your business complies with local VAT laws in Abu Dhabi while handling foreign sales tax obligations, such as VAT in Europe or GST in Australia.

Customs Duties: Managing customs duties and import taxes for physical goods shipped internationally, ensuring that your business stays compliant with international trade regulations.

Key Benefits of Hiring Accounting Companies in Abu Dhabi for E-Commerce Businesses

Local and Global Tax Compliance: E-commerce businesses operating in Abu Dhabi and abroad need to stay compliant with local VAT laws and international tax regulations. Accounting companies in Abu Dhabi ensure that businesses meet all legal requirements.

Accurate Financial Records: From tracking revenue streams to managing marketplace fees, accounting companies provide detailed and accurate financial reports, helping e-commerce businesses understand their profitability.

Cash Flow Management: Accountants help businesses manage cash flow by forecasting revenue and expenses, ensuring that companies have enough working capital to cover operating costs.

Inventory Optimization: Accounting firms offer strategic advice on managing inventory levels, helping e-commerce businesses avoid overstocking while meeting customer demand.

Scalable Financial Strategies: As e-commerce businesses in Abu Dhabi grow, accounting firms offer financial strategies to help them scale smoothly, maintain profitability, and expand into new markets.

Conclusion

E-commerce businesses in Abu Dhabi are at the forefront of the digital economy, but the financial complexities that come with rapid growth require expert handling. Whether it’s managing multiple revenue streams, staying compliant with local and international tax laws, or optimizing inventory costs, accounting companies in Abu Dhabi are invaluable partners for ensuring long-term success.

If you’re running an e-commerce business in Abu Dhabi, partnering with a trusted accounting firm can help you navigate financial challenges, stay compliant with regulations, and set the foundation for sustainable growth.

#GoldBuyersHyderabad#SellGoldHyderabad#CashForGoldHyderabad#GoldValuationHyderabad#TopGoldBuyers#TrustedGoldBuyers#InstantCashForGold#BestGoldRatesHyderabad#GoldExchangeHyderabad#SellOldGold#HyderabadGoldMarket#GoldJewelryBuyers#GoldSellingHyderabad#FairGoldPrices#GoldAppraisalHyderabad

0 notes

Text

Apply for a pan card online

A PAN (Permanent Account Number) is a unique 10-digit alphanumeric code issued by the Income Tax Department of India. It serves as a vital document for financial transactions, tax filing, and identity verification. Applying for a PAN card has become easier, as you can now do it online. Here’s a step-by-step guide on Apply for a PAN card online.

Why Do You Need a PAN Card?

Before diving into the application process, it’s important to understand why a PAN card is essential:

Tax filing: It is mandatory to quote your PAN while filing income tax returns.

Financial transactions: PAN is necessary for opening a bank account, buying property, investments, or transactions above a certain threshold.

Identity verification: It acts as a valid identity proof for various official processes.

Applying for a PAN Card Online

If you want to apply for a pan card so you can contact us +1 (416) 996–1341 or [email protected] to apply for a pan card online.

1- Visit this site pancardcanada.com

2- And Go to application form of apply for pan card

3- fill the details

4- submit the application form.

Conclusion

Apply for a PAN card online is a simple and efficient process. With the availability of paperless Aadhaar-based e-KYC, you can receive your PAN in just a few days. Follow this guide to ensure a smooth and hassle-free application process, ensuring compliance with Indian tax regulations and seamless financial transactions.

Contact Us-

Phone- +1 (416) 996–1341

Email Us- [email protected]

0 notes

Text

Comprehensive Guide to Digital Signature Certificate Service in Chandigarh: Secure Your Business Transactions with Finmatters

In extremely-modern-day rapid-paced virtual age, safety, authenticity, and comfort are vital for corporations and individuals whilst dealing with professional documents. Whether it’s signing contracts, submitting tax returns, or taking component in e-tenders, having a regular, legally binding signature is crucial. This is wherein Digital Signature Certificates (DSC) come into play. If you're in want of a reliable digital signature certificates service in Chandigarh, Finmatters is right here to help.

With years of experience in providing efficient and honest monetary offerings, Finmatters offers seamless digital signature services in Chandigarh that cater to businesses, specialists, and people. In this entire manual, we are able to cover the entirety you want to recognise approximately Digital Signature Certificates (DSCs), their benefits, how they paintings, and the manner Finmatterscan assist you in acquiring a virtual signature certificate in Chandigarh resultseasily.

What is a Digital Signature Certificate (DSC)?

A Digital Signature Certificate (DSC) is an digital same of a physical signature that lets in customers to signal documents digitally. Issued by way of certifying government (CAs) recognized with the resource of the Government of India, a DSC guarantees that the signer’s identity is authentic and the document hasn't been altered after the signature is carried out.

In Chandigarh, corporations, experts, and people significantly use digital signature certificate for numerous purposes including e-submitting of earnings tax returns, taking element in on-line auctions or tenders, and authenticating documents in digital format.

Types of Digital Signature Certificates:

Class 1 DSC: Used widely speaking for securing e mail verbal exchange. It verifies the purchaser’s call and e-mail address.

Class 2 DSC: Used for submitting profits tax returns, GST registration, and extraordinary crook filings. It verifies the patron's identification against a depended on pre-validated database.

Class three DSC: Used for excessive-safety transactions such as e-tendering, e-procurement, and participation in on-line auctions.

For most companies and professionals in Chandigarh, Class 2 and Class three DSCs are the most normally sought-after certificate.

Why Do You Need a Digital Signature Certificate in Chandigarh?

If you are strolling a employer or are a professional in Chandigarh, using a virtual signature certificates can save you time, streamline your tactics, and upload a layer of protection on your digital transactions. Here’s why you can need a digital signature certificates in Chandigarh:

1. Secure Online Transactions

In nowadays’s digital landscape, protection is paramount. A virtual signature guarantees that files signed electronically can't be tampered with, imparting more safety for sensitive corporation transactions and prison agreements.

2. Legally Compliant Signatures

A virtual signature certificate is recognized by regulation under the Information Technology Act, 2000. It provides the same prison validity and authenticity as a handwritten signature, making sure your commercial enterprise meets regulatory requirements in Chandigarh.

3. E-Tendering and E-Procurement

Many authorities and private corporations in Chandigarh and during India have moved to e-tendering and e-procurement methods. A Class three DSC is compulsory to participate in such online auctions, tenders, or contracts.

Four. Filing Income Tax and GST Returns

Both humans and companies in Chandigarh can use Class 2 DSCs to document earnings tax returns and complete GST registrations. It simplifies the method and decreases the danger of errors, saving you from potential consequences.

Five. Efficient Document Management

Digitally signed documents may be stored, retrieved, and shared speedy with out the want for physical paper trails. This complements the performance of commercial organization operations and ensures easy workflow control.

Benefits of Digital Signature Certificates for Businesses in Chandigarh

Businesses in Chandigarh stand to benefit several benefits by means of choosing digital signature certificates. Here are some key benefits:

1. Cost-Effective and Time-Saving

The use of digital signatures receives rid of the need for physical documentation, printing, courier offerings, and other expenses. It also quickens the approval process, as files may be signed and despatched interior mins.

2. Enhanced Security

A virtual signature affords encryption, ensuring that the signed file can not be tampered with once it is signed. This offers a higher degree of protection than traditional paper-based signatures.

Three. Faster Government Approvals

Government departments in Chandigarh increasingly decide on digital documentation. A digital signature certificates guarantees faster processing of applications, licenses, and lets in.

4. Global Validity

If your commercial enterprise operates internationally, a digital signature certificates offers the introduced benefit of being diagnosed globally, making it easier to sign and verify files across borders.

Five. Environmentally Friendly

By lowering the need for paper and bodily signatures, digital signature certificates contribute to green commercial enterprise practices, helping groups limit their environmental effect.

How to Obtain a Digital Signature Certificate in Chandigarh with Finmatters

If you are equipped to take the next step in the direction of digital security, Finmatters offers a easy and efficient technique for acquiring your digital signature certificate in Chandigarh. Here’s the way it works:

1. Choose the Right Class of DSC

The first step is to determine which kind of digital signature certificate you need. Whether you require a Class 2 DSC for tax submitting or a Class 3 DSC for e-tendering, Finmatters will manual you in deciding on the ideal elegance primarily based to your requirements.

2. Submit the Required Documents

To apply for a virtual signature certificates, you'll want to offer:

A authorities-issued ID proof (Aadhaar, PAN card, and so on.)

Proof of deal with

Passport-sized image

Completed application form

3. Verification Process

Once your documents are submitted, they undergo a verification manner with the aid of the Certifying Authority (CA). Finmatters ensures that every one files are submitted efficiently, rushing up the approval technique.

Four. Receive Your Digital Signature Certificate

Upon a success verification, your virtual signature certificate may be issued, and you'll get hold of the personal key through a USB token (also called a DSC dongle). This token allows you to use your virtual signature to documents securely.

5. Installation and Support

Finmatters gives whole support, together with putting in the DSC on your machine and supporting you with its utilization. Our group is to be had to help with any queries or technical issues you would possibly come upon.

Why Choose Finmatters for Digital Signature Certificate Services in Chandigarh?

At Finmatters, we pleasure ourselves on imparting trouble-free, short, and reliable digital signature services in Chandigarh. Here’s why you should choose us:

1. Expertise and Experience

With years of revel in in the field, Finmatters has a deep expertise of the DSC application method and all its nuances. We live up-to-date with the latest regulatory adjustments to ensure clean and compliant service.

2. Personalized Support

We understand that every business is precise. Whether you need a Class 2 DSC for personal tax submitting or a Class three DSC for business transactions, we offer personalised aid tailored in your needs.

3. Quick Processing

Time is cash, and we recognize that. Our streamlined tactics ensure that your digital signature certificate Service in chandigarh is issued quick and effectively, with none useless delays.

4. End-to-End Service

From supporting you pick out the right DSC to completing the paperwork, filing the application, and installing the DSC for your machine, Finmatters looks after everything so you can awareness for your middle enterprise.

Digital Signature Service in Chandigarh:

1. What documents are required for a DSC application?

To observe for a virtual signature certificate in Chandigarh, you'll need to post identification proof (together with Aadhaar or PAN card), cope with proof, and passport-sized images. Finmatters helps you with all the important paperwork.

2. How long does it take to attain a DSC?

Typically, it takes 1-3 working days to issue a digital signature certificate after the files are confirmed. Finmatters guarantees the system is completed as speedy as viable.

Three. What is the validity of a Digital Signature Certificate?

A DSC is typically legitimate for one to two years. Once it expires, it is able to be renewed thru Finmatters with none trouble.

4. Can I use my DSC on more than one devices?

Yes, you can use your DSC on a couple of gadgets via moving it through the USB token supplied for the duration of the issuance of your DSC. Finmatters offers technical help to help you control your DSC on various systems.

Conclusion:

In an era where maximum business and private transactions are conducted on-line, having a digital signature certificates is important for protection and legal compliance. With Finmatters, acquiring a virtual signature certificates in Chandigarh is a easy, brief, and reliable procedure.

From digital signature Service in chandigarh to personalised assist during the registration system, Finmatters is your relied on partner in securing your on-line transactions and streamlining your business operations. Contact Finmatters these days to learn greater approximately how we will let you get your virtual signature certificate and enhance your commercial enterprise’s digital protection.

0 notes

Text

Stay Ahead of IRS Rejections: Expert Advice for Tax Professional How to File Your Taxes Complete Guideline?

For tax professionals, an IRS rejection notice can trigger a sense of urgency and concern. However, most rejections stem from minor errors that can be corrected quickly and efficiently. Understanding why these rejections happen and how to address them is key to minimizing disruptions for your clients and ensuring seamless tax filing processes.

In this article, we’ll explore the common reasons behind IRS rejections and provide actionable steps to resolve them—ensuring you stay ahead of any issues and deliver a smooth, stress-free tax season for your clients.

What Does an IRS Rejection Mean?

An IRS rejection occurs when an error is detected in the federal income tax return. Instead of processing the return, the IRS sends it back, requesting corrections before it can be accepted. Fortunately, most of these issues can be resolved with timely adjustments.

How Will You Be Notified?

If you e-filed, you’ll receive an email notification with the rejection details, including a specific code and a reason for the rejection. Paper filers, on the other hand, are notified through traditional mail. Be cautious of fraudulent notifications—always confirm that the correspondence is directly from the IRS. The agency rarely initiates contact via phone calls without prior written communication.

Common Reasons for IRS Rejection

While there are numerous reasons for a rejected return, the most frequent causes include:

Inaccurate or Missing Information

Simple errors, like misspelled names or incorrect Social Security numbers (SSNs), can trigger rejections. Additionally, ensure all details match what the IRS has on file—particularly after events like a name change due to marriage.

Duplicate Filing

If the IRS already accepted a return associated with your client's SSN or Taxpayer Identification Number (TIN), this could signal an issue, including possible identity theft.

Duplicate Dependent Claims

Divorced or separated parents might run into this issue if both attempt to claim the same dependent. Similarly, if the dependent has filed their own return and claimed themselves, your client's return will be rejected.

Mismatch in Electronic Signature

When e-filing, the IRS requires verification using the prior year's Adjusted Gross Income (AGI) or an Identity Protection PIN (IP PIN). If these figures don’t match, the return will be automatically rejected.

What To Do After a Rejection

Upon receiving a rejection, it’s essential to act quickly. In most cases, the error can be easily corrected, and the return resubmitted electronically. However, more significant issues, such as identity theft, may require filing a paper return or contacting the IRS directly.

Correcting the Error

To resolve a rejected return, identify the specific error from the rejection code. Common mistakes—like incorrect AGI, typos, or duplicate dependent claims—can typically be fixed online through the e-filing system. For identity theft cases, Form 14039 (Identity Theft Affidavit) will need to be submitted by mail.

Deadline for Filing Corrections

If the IRS rejects a return before the April 15 tax deadline, the client must resubmit the corrected return before that date to avoid penalties. If the rejection happens on or after the deadline, the IRS allows an additional five days to correct and refile. State tax deadlines may vary, so check local guidelines to ensure compliance.

Preventing IRS Rejections

Preventing IRS rejections requires diligence. Here are steps to minimize the risk:

Double-check Information: Ensure that all personal details, including SSNs, EINs, and electronic signatures, are correct. Mismatched numbers are one of the most common causes of rejection.

File Early: Encourage clients to submit returns early, reducing the risk of fraudulent filings by identity thieves.

Verify Dependent Claims: Ensure no dependent is claimed on more than one return. Clear communication with clients about dependents can help avoid this mistake.

Handling Identity Theft

If identity theft is suspected, act swiftly. Contact the IRS immediately and follow up with Form 14039 to report the issue. Your client’s tax refund may be delayed, but timely action can prevent further complications.

Proactive Steps for a Smooth Tax Season

For tax professionals, a key strategy for staying ahead of IRS rejections is adopting a proactive mindset. By maintaining rigorous client records, verifying all information, and encouraging early filings, you can avoid unnecessary delays and protect your clients from fraudulent activities.

At Unison Globus, we understand the importance of accuracy and timely responses in tax preparation. With our team of experts in Accounting, Taxation, and Outsourcing, we support CPAs, EAs, and accounting firms with the tools and expertise needed to navigate even the most complex tax situations.

Disclaimer: This article is intended for informational purposes only. It should not be considered legal, financial, or professional tax advice. Always consult with a qualified tax professional or legal advisor for guidance specific to your situation.

#tax preparation services#tax services#Tax Filing#business tax filing services#tax filing services#online tax filing services#IRS Rejection Reasons#Avoiding IRS Rejections#Tax Filing Tips for Professionals#Common Tax Filing Mistakes#IRS Filing Guidelines#Expert Tax Filing Advice#Tax Professional Tips#IRS Tax Filing Process#Complete Tax Filing Guide#IRS Tax Return Rejections#How to File Taxes Correctly#Tax Filing Best Practices#Tax Return Preparation#IRS Filing Deadlines

0 notes

Text

How to Pay Your Self Assessment Tax Online: A Step-by-Step Guide

Thus, the payment of Self Assessment tax online is easy and convenient and enables the person to meet the tax obligations as required by the law. Here then is a checklist that can help you avoid hitches when making payment so that you are always timely;

Step 1: collection of one’s particulars

Before you begin, make sure you have the following information ready:Before you begin, make sure you have the following information ready:

Unique Taxpayer Reference (UTR): A reference number that is issued to an individual by HMRC when he or she registers for Self Assessment and it is a 10 digit number.

National Insurance Number

Amount of Tax Due: You will be able to find this on your ‘Self Assessment tax return’ or in your ‘HMRC account.

Bank Details: For customers who are using online banking or debit/credit card in making the payment for the products.

Step 2: Log in to Your HMRC Account

Visit the HMRC Website: Enter the website, gov. uk then you will have to choose that you want to log in.

Enter Your Government Gateway ID: Login into your account with your Government Gateway ID and the password. If you aren’t on the list yet, being so can take anything from a few days if you register on the site.

Step 3: Self Assessment Section

Once logged in:

Access Your Tax Return Information: Log into your account and find the option that says “Self Assessment” simply click on it.

Select the “Make a Payment” Option: As will show amount of tax due and enable you to go further in the payment process.

Step 4: Choosing the Method of Payment

There are several ways to pay your tax online, and the method you choose will depend on how quickly you need the payment to be processed:There are several ways to pay your tax online, and the method you choose will depend on how quickly you need the payment to be processed:

Direct Debit: One can use it to authorise an initial or a standing order payment. This takes about 5 working days to process.

Debit or Credit Card: Regarding the payment you have the option to pay through credit card directly on HMRC’s website. Remember that he have to pay some additional amount as processing fee, if you are opting for credit card transactions.

Online Banking: You can transfer the funds from you bank account. Faster Payments generally take a day to be processed while Bacs takes at most 3 working days and CHAPS processes within the same day.

Bank Transfer: They also accept payment from your bank directly by using HMRC’s details which are usually given when the payment is being made.

Note: Always use your 10 digit Unique Tax Reference (UTR) as the payment reference to enable HMRC post your payment properly.

Step 5: Formalise the Payment Process

Confirm the Payment Amount: Ensure that you confirm the amount you are paying to match the amount that you require to pay.

Enter Payment Details: (if making a payment using a card or online banking), enter your particulars as provided in the instructions.

Submit Your Payment: After entering your information pay specific attention to this to confirm your payment as follows.

Step 6: Save your payment confirmation

Once you’ve completed the payment:Once you’ve completed the payment:

Save a Record: Save a copy of this payment receipt either by print or through the screen shot in your file. This will be of great help in situation where you will be required to prove that you made a payment.

Check Your HMRC Account: Usually, it may take 2-3 days for the payment to reflect in your account however you can log into the portal to check whether the payment has been processed or not.

Important Deadlines

31st January: The last date to file your Income Tax return online and to pay the tax which you have computed for the previous financial year.

31st July: For those of you who have payments on account, the second payment is due by this date.

Conclusion

It is quite easier and time effective to pay Self Assessment tax online. Actually, following this step by step guide will help you to meet the due date so that you do not have to incur the cost of paying a penalty. It is important that you confirm every detail in the payment before you execute it and it is advisable to keep a copy.

0 notes