#elss mf

Text

Long Term Investment:लंबी अवधि में निवेश के फायदे, 20 सालों में फंड्स ने दिया 40 - 66% रिटर्न और...

Long Term Investment:लंबी अवधि में निवेश के फायदे, 20 सालों में फंड्स ने दिया 40 – 66% रिटर्न और…

Long Term Investment In Mutual Fund: लंबी अवधि के लिए किसी भी जगह किया गया निवेश शानदार रिटर्न देता है चाहे वो शेयर बाजार में या म्यूचुअल फंड. बाजार में कई ऐसे फंड मौजूद हैं जिन्हेंने अपने निवेशकों को छप्पफाड़ रिटर्न दिया है. ऐसे कई म्यूचुअल फंड हैं जिन्होंने निवेशकों को 40 से लेकर 66 गुना रिटर्न दिया है. बेहतरीन फंड मैनेजर के निगरानी में इन फंड्स ने शानदार प्रदर्शन किया है. हालांकि ये समझना बेहद…

View On WordPress

#ELSS#Equity funds#How Long Term Investing Works#Long Term Investing#Long Term Investment In MF#midcap#Mutual fund#Nippon India Growth Fund#SBI Magnum Global Fund#SIP#smallcap#म्यूचुअल फंड#लंबी अवधि का निवेश

1 note

·

View note

Text

Long Term Investment:लंबी अवधि में निवेश के फायदे, 20 सालों में फंड्स ने दिया 40 - 66% रिटर्न और...

Long Term Investment:लंबी अवधि में निवेश के फायदे, 20 सालों में फंड्स ने दिया 40 – 66% रिटर्न और…

Long Term Investment In Mutual Fund: लंबी अवधि के लिए किसी भी जगह किया गया निवेश शानदार रिटर्न देता है चाहे वो शेयर बाजार में या म्यूचुअल फंड. बाजार में कई ऐसे फंड मौजूद हैं जिन्हेंने अपने निवेशकों को छप्पफाड़ रिटर्न दिया है. ऐसे कई म्यूचुअल फंड हैं जिन्होंने निवेशकों को 40 से लेकर 66 गुना रिटर्न दिया है. बेहतरीन फंड मैनेजर के निगरानी में इन फंड्स ने शानदार प्रदर्शन किया है. हालांकि ये समझना बेहद…

View On WordPress

#ELSS#Equity funds#How Long Term Investing Works#Long Term Investing#Long Term Investment In MF#midcap#Mutual fund#Nippon India Growth Fund#SBI Magnum Global Fund#SIP#smallcap#म्यूचुअल फंड#लंबी अवधि का निवेश

0 notes

Text

Long Term Investment:लंबी अवधि में निवेश के फायदे, 20 सालों में फंड्स ने दिया 40 - 66% रिटर्न और...

Long Term Investment:लंबी अवधि में निवेश के फायदे, 20 सालों में फंड्स ने दिया 40 – 66% रिटर्न और…

Long Term Investment In Mutual Fund: लंबी अवधि के लिए किसी भी जगह किया गया निवेश शानदार रिटर्न देता है चाहे वो शेयर बाजार में या म्यूचुअल फंड. बाजार में कई ऐसे फंड मौजूद हैं जिन्हेंने अपने निवेशकों को छप्पफाड़ रिटर्न दिया है. ऐसे कई म्यूचुअल फंड हैं जिन्होंने निवेशकों को 40 से लेकर 66 गुना रिटर्न दिया है. बेहतरीन फंड मैनेजर के निगरानी में इन फंड्स ने शानदार प्रदर्शन किया है. हालांकि ये समझना बेहद…

View On WordPress

#ELSS#Equity funds#How Long Term Investing Works#Long Term Investing#Long Term Investment In MF#midcap#Mutual fund#Nippon India Growth Fund#SBI Magnum Global Fund#SIP#smallcap#म्यूचुअल फंड#लंबी अवधि का निवेश

0 notes

Text

Axis MF ELSS App: Secure Your Future with Tax-saving Investments

Harness the potential of tax-saving investments with the Axis ELSS App. Designed to simplify the investment process and maximize tax benefits, our app guides you through the selection and management of Equity Linked Savings Schemes with ease and precision. Say goodbye to tax worries and hello to financial security and prosperity as you invest in ELSS funds with confidence and clarity.

0 notes

Text

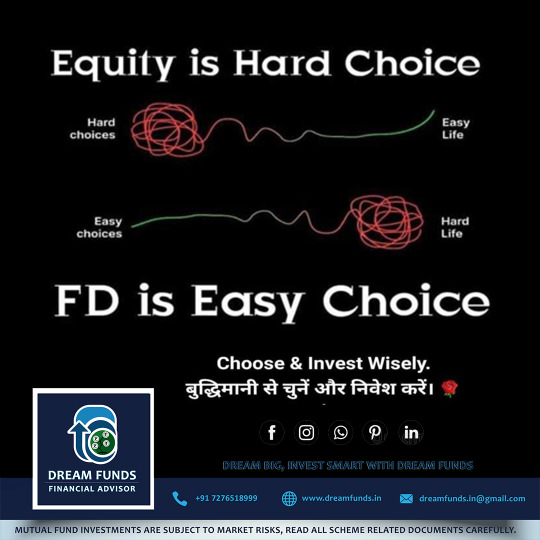

Equity MF SIP May Give You Short Term Pain But Will Give Long Term Gain For Your Financial Goal.

Fulfillment Think Wisely Act Smartly

#mutualfunds#mutualfundadvisor#mutualfundssahihai#mutualfund#systematicinvestmentplan#dreamfunds#financialgoals

0 notes

Text

Your Path to Wealth Begins with Axis MF ELSS App

AXIS MF ELSS App simplifies tax-saving investments. Start investing in ELSS funds conveniently and save taxes.

0 notes

Text

ELSS vs Mutual Fund – Are they Different | Edelweiss MF

ELSS is also a mutual fund in essence but it lets you enjoy tax benefits as well. Here are some reasons apart from tax savings that make ELSS a good investment option

0 notes

Text

How to Invest in Tata Hybrid Equity Fund

Summary Tata Hybrid Equity Fund

Hybrid funds, usually referred to as balanced funds, combine investments in debt and equity instruments to create a portfolio that offers both stable income from debt and the growth potential of equities. In addition, it contributes to a diversified portfolio that is less volatile than equities funds and may offer better return prospects than debt funds.

The Tata Hybrid Equity Fund seeks to control fund volatility while optimizing portfolio returns through a combination of debt and equity assets. The plan actively adjusts the mix of debt and equity assets based on the state and prospects of the market at the time. It looks for the best possible mix of income and capital growth opportunities.

Investing Theory

One of India’s most well-known fund houses is Tata Mutual Fund. Tata Mutual Fund, supported by the software-to-salt conglomerate Tata Group, has been active in India for almost 20 years. Millions of people have come to trust the fund house because of its reliable performance and excellent customer service. It is accessible in several categories such equity, debt, hybrid, and . provides plans under the ELSS. In addition to them, it provides kid savings plans and retirement solutions. Everyone can find investment alternatives at Tata MF Company, including housewives and retirees, capital builders who are conservative or ambitious, and business owners and salaried professionals. Tata Asset Management Limited is the asset management firm in charge of Tata’s programmes.

moneyThe Fund places a strong emphasis on investing in well-managed, premium businesses with above-average growth potential that are reasonably priced when making stock purchases. These businesses usually have a sizable and expanding market share and are fiercely competitive. Many factors, like net worth, steady growth, robust cash flows, high return on capital, etc., are taken into account while choosing particular companies.

The fund invests in businesses using a bottom-up strategy, taking into account a number of factors such as strong professional management, past performance, industry conditions, potential for growth, securities liquidity, etc.

Investment grade listed or soon to be listed securities will comprise the majority of investments in fixed income securities. The Plan will prioritize well-managed, high-caliber businesses with above-average growth prospects, whose securities can be bought at a good yield, and whose debt securities are primarily investments in securities that are classified as investments grade by an accredited body.

read more https://unvtechsolutions.com/how-to-invest-in-tata-hybrid-equity-fund/

0 notes

Text

Who to Reduce Cost with Mutual Fund Software for Distributors in India?

Wealth Elite can be used to reduce costs in various ways. Here are some tips on how to do so:

Comparison of Expense Ratios: Mutual funds charge investors an expense ratio, which is the annual fee for managing the fund. Different mutual funds have different expense ratios, and it's essential to compare them before investing. Mutual fund software for distributors can help you compare the expense ratios of different mutual funds, allowing you to choose funds with lower expense ratios, which can help reduce costs over the long term.

Regular Portfolio Analysis: MF software can provide regular portfolio analysis, which allows you to track the performance of your investments. By analyzing your portfolio regularly, you can identify underperforming funds and make informed decisions to switch to better-performing funds, which can help you avoid unnecessary losses and optimize your returns, thereby reducing costs.

Avoiding Unnecessary Transactions: Wealth management software can help you avoid unnecessary transactions, such as frequent buying and selling of funds, which can result in transaction costs, including entry and exit loads. By using the software to review and rebalance your portfolio periodically instead of making frequent transactions, you can reduce these costs.

SIP (Systematic Investment Plan) Optimization: Many investors in India use SIPs to invest in mutual funds regularly. IFA software can help you optimize your SIPs by recommending the right funds based on your investment goals, risk tolerance, and time horizon. By investing in funds that align with your financial objectives and risk profile, you can avoid unnecessary churning of funds, reduce costs, and maximize returns.

Access to Direct Plans: MFDs software can also provide access to direct plans of mutual funds, which have lower expense ratios compared to regular plans as they do not involve any distributor commissions. By investing in direct plans through the software, you can save on distributor commissions, which can reduce overall costs and enhance your returns.

Tax Planning: Mutual fund platform also helps with tax planning by providing insights into the tax implications of different mutual fund investments. By making informed decisions about tax-saving mutual funds, such as Equity Linked Saving Schemes (ELSS) or Tax-Saver Funds, you can optimize your tax liabilities and reduce costs associated with taxes.

Elimination of Paperwork: REDVision Global can streamline the investment process and eliminate the need for manual paperwork. This can save time, effort, and costs associated with printing, courier, and other administrative expenses.

In conclusion, mutual fund software in India can help reduce costs by comparing expense ratios, providing regular portfolio analysis, avoiding unnecessary transactions, optimizing SIPs, providing access to direct plans, assisting with tax planning, and eliminating paperwork. It's essential to choose reliable and reputable mutual fund software that aligns with your investment goals and risk profile to effectively reduce costs and enhance your overall investment experience. For more information, visit https://wealthelite.in/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

How do I invest in mutual funds?

share share share

Mutual funds offer a way for a group of investors to effectively pool their money so they can invest in a wider variety of investment vehicles and take advantage of professional money management through the purchase of one mutual fund share. Mutual fund companies essentially collect the money from their investors, or shareholders, and invest that pooled money into individual investment vehicles according to some risk profile, money management philosophy, or financial goal. The mutual fund then passes along the profits (and losses) of those investments to its shareholders.

More & more people are learning about mutual funds as a means of investment. From putting one's money into fixed deposits or investing in real estate, people are becoming aware of mutual funds as lucrative choice of savings & investments. It is becoming the most sought-after method of investing but having limited or no knowledge of it can hamper one's plan to go ahead with mutual funds completely. Here, we will give you a summarized info about all you need to know about mutual funds & the benefits it carries.

Why Invest in MF?

Types of Mutual Fund

What is SIP?

STP

Power of Compounding

What is ELSS?

Debt MF V/S FD

SWP

Why To Invest In Mutual Funds?

Let's glance at why should one consider investing in mutual funds over other options to achieve their financial goals:

Professional Managers

Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated team that handles all financial decisions based on the performance & prospects available in the market.

Offers Convenience

If saving time & convenience is what you seek then mutual funds are an ideal choice for investment. Because of low investment amount options, multiple choices based on one's life & financial goals, offering the ability to redeem them on any business day, mutual funds are much sought after.

Diversification

Mutual funds help counter risks to a large extent by equally distributing your investments across diverse range of asset classes. Mutual funds work by the adage “Do Not Put All Your Eggs in One Basket”.

Counter Inflation

Investing in mutual fund is a smart way of beating inflation as it helps investors to generate inflation-adjusted returns, without spending much time or energy on it. This choice of investing makes sure that the purchasing power of your money doesn't go downhill over some years.

Less Expensive

As compared to investing directly in capital market, mutual funds offer investors the advantage of low cost investment. Most stock options require a huge capital to begin with, on the other hand mutual funds can be started with as low as Rs.500 per month & investors can derive benefit from the long-term equity investment.

Safe & Transparent

Since every mutual fund is managed & regulated by SEBI, you need not worry as your investments are safe. SEBI has several regulations & legal frameworks in place which ensures that your investments are managed in a disciplined manner. Now it's true that every investment is subject to certain risks, however, prudent selection based on strong market knowledge & fundamentally sound securities with diversification can help hedge such risks and generate high returns on your investments.

1 note

·

View note

Text

5 Ways to Save Income Tax In 2021

Paying taxes is a legal and moral responsibility for every citizen.

People are always on the lookout to save income tax. No one likes to miss out on ways that can save them money paid as tax, and sometimes, they just stick to the methods they have been applying and, as a result, resulting in missing more productive ways of saving tax. With suitable investments, you can save much more on income tax.

Here are five ways to save your income tax in 2021:

Invest in Education - This comes under section 80E of the Income Tax Act. The interest amount paid against an education loan is not taxable. Premiums are liable to tax benefits over and above the claims of ₹1.5 lacs, and there is no maximum limit under Section 80E under which it can be filed. Individual taxpayers can apply for this benefit, but it is not open to Hindu Undivided Families. Like ULIPs or traditional savings plans, most child plans fall under conventional life insurance policies, thereby offering similar tax benefits. Young parents might feel the pressure of school fees and planning the future of their children.

Avail a Home Loan- It is a dream for most people to buy their own homes. Nowadays, most people in the cities today live in rented accommodation while saving up money to buy their dream homes someday. You can save tax if you plan your home loan wisely following section 80C. Banks and NBFCs offer attractive home loans to uplift the real estate market; thus, benefitting you with a good deal on loan. Do mark that the Budget of 2021-2022 has kept the taxation system for home loans precise. So you can continue to get rebates under Sec 80C for the principal amount borrowed for the home payment, with deductions on interest paid under Sec 24.

Use Market- Linked Instruments - It is time to move away from those traditional fixed savings schemes like bank FDs or RDs, whose income is taxed. Despite the stock market’s wavy trends, it helps one invest in market-linked instruments aligned with your financial goals. Equity-Linked Saving Schemes, National Pension Scheme, and Mutual Funds, and ULIPs are all examples of market-linked instruments. ELSS, NPS, ULIPs, and certain MFs exempt from taxation under Section 80C of the IT Act of 1961. For ELSS and ULIPs, if you go for premiums below ₹1.5 lakhs, no income tax is added with a lock-in period of 3 years.

You can read more about Mutual Funds here: A Beginner's Guide to Investing In Mutual Funds

Invest in a Life Insurance Policy - The best way to secure your and your loved ones is to buy a life insurance plan. Premiums done towards your life insurance will not be taxed if it is under ₹1.5 lakhs. Section 10D of the ITA allows any payouts received under a life insurance policy exempt from tax. If you were planning to buy term insurance, the time to do so is now.

Save for Retirement - It’s never too soon to plan for your retirement, especially after knowing how pandemic the previous year went. This is an excellent year to plan and buy a suitable pension plan, which offers premium deductions under Sec 80C. But double-check if the payouts against annuity plans or received as lump-sum amounts may be partially or fully taxed. You can save paying any tax on the money invested in ULIPs, given the premiums do not cross ₹1.5 lakhs.

Save for your retirement on Wizely app and earn rewards for achieving your financial targets.

In conclusion, if you plan to reduce your tax with smart investing in 2021, keep a note of some important dates or talk to your investment advisor to help you choose the suitable instruments to save tax as per your income slab and future goals.

(Check out 'Learn & Grow with Wizely' to learn more about tax planning and investments.)

0 notes

Text

How ELSS should be chosen to complement existing portfolio

Usually, we all look for investment opportunities that can help us build an adequate sum of wealth, get regular returns, and/or save taxes. There could be several investment schemes in the market to save your taxes, but ELSS i.e. Equity linked saving schemes is a one - stop solution for all your tax saving and wealth creation needs. Usually 80 % of asset allocation needs to be in equity funds. ELSS SIP is also an easy option for investing where the minimum investment amount is Rs 500.

ELSS funds are also called tax saving schemes as they offer tax exemption of up to Rs. 150,000 from your annual taxable income under Section 80C of the Income Tax Act and comes with a three-year lock-in during which they cannot be redeemed or switched. Among other tax saving instruments, ELSS is the scheme with the shortest lock-in.

Six Key factors To Consider While Choosing ELSS Fund

1. Portfolio composition A major portion of ELSS funds are equity funds that invest their major chunk into diversified equity or equity-related instruments. The Fund manager has the flexibility to allocate the stocks as per his calculations, research basis of the market conditions, objective of the fund, and his own risk-taking capability to achieve that objective (i.e. Large Cap / Mid Cap). You can review what is the portfolio composition of the fund based on market cap and stability of its investment patterns. Prefer to choose the funds that have steady investment pattern and that stay true to its label. Choose quality of companies invested in while assessing the ELSS schemes. Evaluate the stocks concentration in the portfolio and percentage of top five stocks in the portfolio. Thoroughly check all allocation made to large cap / mid cap / small cap companies in the ELSS tax -saving schemes.

2. Risk Involved and Expected Returns

ELSS is an Equity Linked Scheme and it requires you to identify your risk appetite. Risk and returns on investments are interlinked. One must ensure to check the risk and returns involved while choosing ELSS funds. Some Mutual Funds could be giving higher returns but risk involved also could be equally high. Therefore, the key to decide your risk appetite while assessing a suitable fund for you. Risk involved can also be calculated from ratios like Sharpe Ratio which is a measure of risk-adjusted return.

3. Return Expectation of the ELSS Funds

While selecting the ELSS mutual fund, it does not make sense to chase returns. Last one-year’s performer may not be consistent next year. Hence, investor must review the trend of the fund in respect of rate of returns delivered. Also, one should consider the rate of return as well as the consistency with which those returns are delivered. Select the scheme based on your preference with the portfolio style and strategy. Make sure to analyze the records of the fund for a period exceeding 5 years. This is an ideal duration, as the fund goes through multiple cycles of ups and downs in the market. This helps the investor to track the past performance of the particular scheme.

4. Expense Ratio of ELSS Funds

Investor should choose the fund with low or moderate expense ratio along with the higher rate of returns.

5. Fund Manager’s performance Examine whether the fund manager is able to deliver consistency of performance across market cycles Check fund manager’s profile and his/her record not just in this fund but other funds he/she manages

6. Fund House

This is an important factor to select the Tax- Saving fund. Investor must consider the asset management company’s investment philosophy, do a deep background check of its financial stability and company policy before investing

In order to understand how to allocate to ELSS funds, compare ELSS to the other equity funds held, so that there is no duplication in style and portfolio composition.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

0 notes

Link

With only a few days left for the tax-saving season to end, many taxpayers are exploring their last-minute effort to explore various options to save tax.

0 notes

Link

1 note

·

View note

Photo

Let’s start with what ELSS is all about. ELSS, also called Equity Linked Saving Scheme, is a particular separate type of Mutual Fund from other kinds of MFs. It is solely focused and used for tax saving and deduction purposes with a 3 years lock-in period. It falls under Section 80-C of the Income Tax Act, giving deduction up to Rs. 1.5L per financial year. It sounds great, especially for payers falling in high tax brackets who can save every penny from tax.

ELSS is “Thanda Thanda Cool Cool” powder to Indian taxpayers through which not only the investors can enjoy the benefits of a tax deduction but also tax-free (or itch-free) returns during withdrawal. Unlike most extended lock-in period of PPF and 5-year FD schemes, ELSS is the shortest route to save the tax with just 3 years. That’s the significant benefit of investing in ELSS Mutual Funds.

You can either invest as small as Rs. 500 per month – minimum investment in case of SIP [Systematic Investment Plan] or Rs. 5,000 in case of lump sum investment. There is no restriction to withdraw after the end of 3 years lock-in period of investment. You can either stay long for 10 years or withdraw after 3 years of investment, thus enabling greater flexibility.

The biggest plus point for investing in ELSS is the wealth builder or power of compounding. Your investment multiplies even greater for a longer period of time [if you understand what compound interest is all about.]

From the above points, we can conclude that not only if it offers the best and shortest tax saving option, but also gives better returns as compared to all other financial instruments with minimal risk.

Here are some quick FAQs about ELSS investment to clear up the common doubts.

Q: Is ELSS giving guarantee returns?

A: NO! ELSS MF operates with market risk.

Q: Is ELSS giving better returns?

A: YES! Usually, it gives the minimum of 12-15% CAGR or 36-45% absolute returns for 3 years of investments.

Q: Does ELSS ever end in a loss for more than 3 years of investment?

A: Not really if you pick one of the good funds like the suggested answer below.

Q: What are the top 3 ELSS funds in 2019?

A: Axis Long Term Equity Fund, Aditya Birla Sun Life Tax Relief 96’ Fund, Mirae Asset Tax Saver. [Suggestions only]

Q: Which are the best brokers or advisors for investing in Mutual Funds?

A: Finvasia, 5Paisa, Bajaj Capital

Q: Can I withdraw the entire amount after 3 years?

A: Yes in case of lump sum investment, you can withdraw all units/amounts after making one investment. However, in case of SIP, you can withdraw all amounts only if all the monthly investments you made have completed 3 years in the fund.

Q: Can I withdraw within 3 years lock-in period?

A: No! You can’t withdraw once you made an investment. Note that you can stop the investment anytime, but there is no option for withdrawal if less than 3 years. In case of emergency, you can take a loan against ELSS.

Disclaimer: ELSS Mutual Funds are heavily dependent on the equity market, subjecting to the market risk.

#taxes#elss#mutual funds#investment#retirement#planning#finance#investing#india#share market india#advice#stock market#stock broker#investor#tax deduction#faq#tax saving investments#march 2019

3 notes

·

View notes