#embeddedfinance

Explore tagged Tumblr posts

Text

API Banking Market Future Trends Driving Digital Transformation and Financial Sector Innovation Worldwide

The API banking market is witnessing rapid transformation as financial institutions embrace digital innovation and customer-centric solutions. With the integration of APIs, banks are becoming more agile, secure, and responsive, leading to a new era in financial services. The future of this market is defined by technological advancements, increased collaboration between banks and fintech firms, regulatory shifts, and the growing demand for real-time financial services.

Open Banking Revolution

One of the most significant trends in the API banking market is the widespread adoption of open banking. Regulatory frameworks in many regions are compelling banks to provide secure API access to third-party providers, enabling customers to manage finances across multiple institutions more seamlessly. This shift is creating an open ecosystem where fintech companies and traditional banks collaborate to offer innovative financial products and services.

Open banking enhances transparency and competition while allowing customers to benefit from personalized financial management tools. As adoption increases, banks are expected to invest more in robust API infrastructure and data-sharing capabilities to stay competitive.

Fintech Collaboration and Embedded Finance

The rise of fintech firms has created a highly competitive and innovative environment in the financial sector. Traditional banks are leveraging API platforms to collaborate with fintech startups, driving the development of digital banking products that cater to tech-savvy consumers. This synergy allows faster product deployment, improved customer experiences, and expanded service offerings.

Another emerging trend is embedded finance, where financial services are integrated into non-financial platforms such as e-commerce sites and ride-sharing apps. APIs are central to enabling this seamless integration, allowing users to access credit, insurance, or payments directly within a third-party application. This trend will likely grow, as companies outside the banking sector seek to enhance customer engagement and create new revenue streams.

Real-Time Payments and Enhanced User Experience

APIs are playing a crucial role in the shift toward real-time payments. Consumers and businesses alike now expect instant financial transactions, and API banking solutions are enabling this demand through secure, efficient communication between systems.

In the near future, we will see broader implementation of real-time payment infrastructures globally. Banks will need to adopt modern API frameworks that ensure low latency and high availability, essential for delivering smooth and responsive user experiences.

User experience is also being redefined by intelligent API-based interfaces, such as chatbots, voice banking, and mobile-first platforms. These enhancements focus on simplicity, accessibility, and personalization—key components for customer retention in the digital age.

Increased Focus on Security and Compliance

As financial institutions open their systems through APIs, security becomes paramount. API banking will continue to evolve with enhanced security protocols such as OAuth 2.0, multi-factor authentication, and advanced encryption methods. Banks must also monitor and control API usage to prevent unauthorized access and data breaches.

Compliance is another critical factor influencing API banking trends. Financial regulators are increasingly enforcing standards for data privacy, such as GDPR in Europe and similar laws elsewhere. Banks need to ensure their API ecosystems are compliant with these regulations to avoid penalties and build customer trust.

AI and Data-Driven Insights

Another transformative trend in API banking is the integration of AI and data analytics. APIs allow for the aggregation and analysis of massive volumes of transaction and behavioral data. With AI tools, banks can derive actionable insights to improve risk management, enhance credit scoring models, and deliver tailored financial advice.

In the future, predictive analytics driven by API-fed data will help financial institutions anticipate customer needs, detect fraud, and optimize service offerings. As APIs become smarter, they will play a greater role in strategic decision-making and customer engagement.

Global Expansion and API Standardization

As API banking continues to gain traction, there is a growing push for international API standards. Standardization can help banks reduce development costs, streamline integration with global partners, and accelerate time-to-market for new services.

Emerging markets are also poised to benefit from API banking, as mobile-first strategies and growing internet penetration create opportunities for financial inclusion. Governments and financial institutions in these regions are likely to support API-based solutions to modernize their banking infrastructure and expand access to underserved populations.

Conclusion

The API banking market is entering a pivotal phase, driven by future trends that prioritize innovation, collaboration, and customer empowerment. As the financial landscape becomes increasingly interconnected, APIs will be at the core of enabling dynamic and responsive financial ecosystems. From real-time payments to embedded finance and AI-powered insights, the next wave of digital transformation is already unfolding—powered by APIs.

0 notes

Text

The Rise of Embedded Finance: Why Your Favorite App Wants to Be a Bank

TL;DR Apps like Uber, Shopify, and DoorDash are slipping financial tools into your everyday life. This quiet evolution—called embedded finance—lets you bank without ever opening an actual bank app. But is this FinTech glow-up empowering… or risky? We break down how embedded finance works, where it’s headed, and why your phone just became your new banker. It’s 2025, and your rideshare app might…

0 notes

Link

#AIbankingintegration#ASEANfintechinnovation#BehavioralBiometrics#cross-bordervalidation#embeddedfinance#generativeAIcompliance#mobile-firstfinancialhealth#regulatorytechnology

0 notes

Text

In-Depth Study of Embedded Finance Market Dynamics: Evaluating Market Size, Share, Growth Forecast

The global embedded finance market size is anticipated to reach USD 588.49 billion by 2030, expanding at a CAGR of 32.8% from 2024 to 2030, according to a new report by Grand View Research, Inc. The increasing integration of financial services into non-financial platforms, creating seamless and personalized experiences for consumers, is a significant factor contributing to the growth of the market. This convergence of industries, commonly referred to as "banking-as-a-service," allows businesses outside the traditional financial sector to embed financial products directly into their offerings.

Furthermore, the rise of Application Programming Interfaces (APIs) is transforming how financial services are accessed and consumed. The accessibility and interoperability provided by APIs enable businesses to integrate diverse financial functionalities effortlessly, thereby contributing to the growth of the market.

Advancements in technologies like artificial intelligence and machine learning are propelling the development of sophisticated algorithms for risk assessment, fraud detection, and customer personalization, thereby enhancing the overall efficiency and security of embedded financial solutions. As the Embedded Finance ecosystem continues to evolve, collaboration between fintech innovators, traditional financial institutions, and various industries will play a pivotal role in driving innovation and expanding the scope of embedded financial services.

Governments across the globe have given high importance to fostering financial inclusion, especially in developing economies characterized by substantial unbanked and underbanked populations. With the rapid increase in internet and smartphone adoption, several nations aim to emphasize the shift toward a cashless economy while ensuring that it doesn't compromise the delivery of convenient and accessible financial services to their residents. Embedded finance emerges as a pivotal tool in simultaneously addressing both of these objectives.

For More Details or Sample Copy please visit link @: Embedded Finance Market Report

Embedded Finance Market Report Highlights

Based on type, the embedded payment segment dominated the market in 2023. The growth of the segment can be attributed to the growth in adoption of digital payment across the globe

Based on business model, the B2B segment dominated the market in 2023. The B2B embedded finance provides businesses with new revenue streams, helping them improve their financial performance

Based on end-use, the retail segment dominated the market in 2023. The growth of the segment can be attributed to the rising demand for seamless and integrated financial solutions within retail ecosystems

North America dominated the regional market in 2023. The growth can be attributed to the increasing collaboration between fintech firms, traditional financial institutions, and diverse industries. This collaborative ecosystem facilitates the embedding of financial services seamlessly into various non-financial platforms, enhancing customer experiences. Additionally, the rising prevalence of digital wallets, contactless payments, and mobile banking services underscores a growing consumer preference for convenient and tech-enabled financial solutions

In February 2023, Transcard Payments announced a partnership with Coforge Limited, a global digital services and solutions provider. Under this partnership, as a Transcard Payments value-added reseller, Coforge Limited leveraged Transcard Payments’s suite of embedded payment solutions

#EmbeddedFinance#EmbeddedBanking#FinanceAsAService#BankingAsAService#FintechInnovation#DigitalFinance#FintechEcosystem#FinancialAPIs#FintechMarket

0 notes

Text

🚀 Stay Ahead in Insurance Tech!

📌 Trending Topics Covered: 1️⃣ GW Cloud Platform 2️⃣ Composable Architecture 3️⃣ InsurTech Integrations 4️⃣ Digital Claims Automation 5️⃣ Fast Product Launches 6️⃣ Embedded Finance 7️⃣ Advanced Analytics

🎓 ENROLL NOW with Guidewire Masters and future-proof your career! 🌐 www.guidewiremasters.in 📞 +91 9885118899

#Guidewire#InsuranceTech#PolicyCenter#ClaimCenter#BillingCenter#InsurTech#DigitalClaims#EmbeddedFinance#DataAnalytics#GuidewireTraining#CloudInsurance#Jutro#P&CInsurance#GuidewireMasters

0 notes

Text

Embedded Finance is Everywhere — Thanks to Platforms Like SprintOPN 🌍💸

Ever noticed how apps now offer payments, banking, or insurance? That’s embedded finance — and it’s growing fast.

With SprintOPN, developers and businesses can embed:

AEPS cashouts

BBPS bill pay

UPI transactions

Payouts to any bank

Into any app, portal, or platform.

Finance is no longer a destination — it’s built-in.

0 notes

Text

#Fintech#BankingAsAService#EmbeddedFinance#Synctera#StartupFunding#DigitalBanking#FinancialTechnology

0 notes

Text

Unlocking the Future with Embedded Finance 🚀

Embedded finance is revolutionizing how businesses integrate financial services directly into their platforms. Whether it's payments, lending, or insurance, companies can now offer seamless financial products without the need for customers to leave their apps. This shift is making finance more accessible and improving user experiences. Learn how Vantage is leading the way in embedding finance solutions! 💡

Explore more about the future of finance here

#EmbeddedFinance#Fintech#BusinessSolutions#DigitalPayments#Lending#Insurance#FintechRevolution#API#Vantage#FutureOfFinance#SeamlessFinance#FinancialInnovatio

0 notes

Text

The Future of Payments: Real-Time Embedded Finance Solutions

Embedded finance is transforming the way businesses and consumers interact with financial services. By integrating APIs and digital solutions directly into platforms, embedded finance allows for seamless, real-time payments, insurance, and banking experiences. With AI, machine learning, and blockchain paving the way, industries such as retail, e-commerce, and telecommunications are at the forefront of this financial revolution. Discover how this rapidly growing sector is reshaping financial services.

#embeddedfinance#fintech#digitalpayments#AI#blockchain#APIs#ecommerce#financialinclusion#retailtech#realtimepayments

0 notes

Text

Navigating Embedded Finance: Profitable Strategies for Credit Unions and Regional Banks

Introduction

In today’s fast-evolving financial landscape, the rise of embedded finance has opened new doors for credit unions and regional banks. Embedded finance, the integration of financial services into non-financial platforms, offers a unique opportunity for financial institutions to extend their services and increase profitability. For credit unions and regional banks looking to remain competitive, understanding how to leverage embedded finance is key to long-term growth and success.

But what exactly is embedded finance, and how can credit unions and regional banks adopt profitable strategies? In this blog, we’ll explore the concept and identify strategies that can help these institutions thrive in the digital age.

What is Embedded Finance?

Embedded finance refers to the seamless integration of financial services like payments, lending, and insurance into non-financial products or platforms. Instead of requiring customers to visit a bank or credit union, embedded finance brings financial services directly to them through everyday apps, websites, or software.

For example, ride-sharing apps like Uber offer built-in payment systems, and e-commerce platforms like Shopify integrate lending services for merchants. This allows users to access financial services without ever leaving the platform, creating a more convenient and efficient experience.

Why Credit Unions and Regional Banks Should Care

While large banks and fintechs have been early adopters of embedded finance, credit unions and regional banks are uniquely positioned to benefit from this trend as well. Their local, customer-centric approach to banking enables them to build trust and foster close relationships with their members. By embracing embedded finance, these institutions can enhance their customer offerings and remain relevant in an increasingly digital world.

Key Benefits of Embedded Finance for Credit Unions and Regional Banks

Increased Customer Engagement: Embedded finance allows banks to meet customers where they are—within the platforms and apps they use daily. This leads to higher engagement and more frequent interactions with financial products.

New Revenue Streams: By integrating financial services into non-financial ecosystems, banks and credit unions can diversify their revenue streams. These can include embedded payments, lending services, or even Buy Now, Pay Later (BNPL) options.

Enhanced Customer Experience: Providing financial services in a seamless and intuitive manner improves customer satisfaction and loyalty. Credit unions and regional banks can tailor these services to their local markets, offering a personalized experience.

Cost Reduction: Embedded finance solutions streamline processes, automate tasks, and reduce the need for physical infrastructure. This can help credit unions and regional banks operate more efficiently while saving on operational costs.

Profitable Strategies for Credit Unions and Regional Banks

Partnerships with Fintechs and Non-Financial Platforms Credit unions and regional banks can expand their reach by partnering with fintech companies or non-financial platforms. Collaborating with fintech firms allows these institutions to embed their services into e-commerce sites, mobile apps, and other platforms, increasing customer touchpoints. Through these partnerships, they can offer services such as loans, insurance, and payments directly within these platforms, driving new revenue streams.

For example, a regional bank could partner with a local retailer or healthcare provider to offer embedded lending or payment services through their platforms.

Offering Embedded Payments Solutions One of the easiest ways to start with embedded finance is by offering payment processing solutions. Credit unions and regional banks can provide white-labeled payment gateways for local businesses, allowing customers to make purchases directly through their apps or websites. This not only increases transaction volume but also positions the bank as a trusted financial partner in the business ecosystem.

Providing Embedded Lending Embedded lending services allow customers to apply for loans directly through non-financial platforms, such as e-commerce sites or service-based platforms. Credit unions can offer microloans, Buy Now, Pay Later (BNPL) options, or merchant loans to small businesses, improving access to credit for underserved communities. This strategy is particularly useful for credit unions, whose community focus aligns well with supporting local businesses and individuals.

Developing Integrated Financial Wellness Tools To enhance member experience, credit unions and regional banks can offer embedded financial wellness tools on partner platforms. For instance, they could integrate budgeting tools, financial advice, or credit score monitoring into retail apps or educational platforms. This would position the bank as a trusted financial partner and increase its brand visibility while adding value to the customer.

Implementing API-Driven Solutions API (Application Programming Interface)-driven solutions are at the heart of embedded finance. By leveraging APIs, credit unions and regional banks can integrate their financial services into third-party apps and websites. These API-driven solutions allow seamless transfers, payments, and financial transactions within partner platforms, without the need for customers to leave the application.

Key Considerations for Adoption

While embedded finance offers lucrative opportunities, credit unions and regional banks must carefully navigate this space to ensure success. Here are some considerations:

Regulatory Compliance: Navigating the regulatory environment is critical when adopting embedded finance. Credit unions and regional banks need to ensure that their embedded finance offerings comply with relevant financial regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.

Data Privacy and Security: With increased customer interaction comes greater responsibility to safeguard sensitive financial data. Credit unions and banks must implement strong data security measures to protect customer information from breaches or unauthorized access.

Technology Infrastructure: For embedded finance to work, institutions must have the right technology infrastructure in place. Investing in scalable, API-driven platforms is essential to support seamless integration with third-party apps and websites.

Outcome

The rise of embedded finance presents an exciting opportunity for credit unions and regional banks to innovate and grow. By embedding financial services into everyday platforms, these institutions can enhance customer engagement, unlock new revenue streams, and provide a superior customer experience. To remain competitive in this new digital landscape, credit unions and regional banks should explore partnerships, invest in technology, and offer embedded financial solutions tailored to the needs of their communities.

As the financial ecosystem continues to evolve, those who adapt to the embedded finance model will be well-positioned to thrive and build deeper, more meaningful relationships with their customers.

#EmbeddedFinance#CreditUnions#RegionalBanks#FinancialServices#Fintech#BankingStrategy#ProfitableGrowth

0 notes

Text

The Future of Fintech: How Embedded Finance is Leading the Way

Embedded finance is gaining global momentum among businesses. One notable example is the growing preference for 'buy now, pay later' options among consumers. Traditional financial services are known for their extensive paperwork, complex procedures, and limited accessibility, which can hinder efficient financial management and service access for individuals and businesses alike. Integrating financial services into non-financial platforms has historically been costly and time-consuming. However, embedded finance is revolutionizing this process by seamlessly integrating financial services into everyday tasks and platforms. This article provides insights into this emerging niche.

What Is Embedded Finance?

Embedded finance refers to integrating financial services such as payments, lending, insurance, and more into non-financial businesses or platforms, eliminating the need to redirect to traditional financial institutions. This allows businesses to offer tailored financial products and services within their existing platforms, enhancing customer experience and streamlining transactions. While the concept isn't new, as non-banks have offered financial services through private-label credit cards and sales financing for decades, the technology and ease of integration into digital interfaces like apps, digital wallets, and rewards programs are groundbreaking. Embedded finance enables businesses to provide convenient financial services without relying on traditional banks. For instance, e-commerce platforms can offer instant financing at the point of purchase, and SaaS companies can integrate invoicing or payment processing to simplify financial management.

Top 5 Use Cases of Embedded Finance

1. Digital Wallets One of the most practical aspects of embedded finance is the development of digital wallets. These user-friendly smartphone apps securely store digital copies of debit and credit cards, protecting account numbers and other sensitive information. Mobile payment options like Google Pay, Apple Pay, and Samsung Pay have set the standard by enabling users to make payments at contactless terminals and online, streamlining and securing transactions.

2. Oil and Gas Industry The oil and gas industry relies on specialized personnel and equipment at every stage. Marketplaces tailored to this sector allow buyers and suppliers to connect and compare items like heat exchangers, drill bits, and pipes, meeting the specific needs of the industry.

3. Construction Sector Similar to oil and gas, the construction industry has unique requirements. Finding replacement parts for specific equipment can be challenging, even with Google. B2B marketplaces for construction provide more choices for buyers and opportunities for suppliers, simplifying the procurement process.

4. Insurance Embedded finance is transforming the insurance sector by streamlining administration, claims processing, and payments for both firms and clients. Automation reduces manual operations, offering clients convenient payment options for premiums, coinsurance, and deductibles, ultimately improving customer satisfaction and operational efficiency.

5. Grocery and Food Service If you’ve ever paid for grocery pickup or delivery through an app, you’ve encountered embedded finance. This trend is growing in the B2B food and beverage sector, with marketplaces offering a wide range of products, from organic foods to wholesale items, providing flexibility and choice for grocers and restaurateurs.

Healthcare

Embedded finance holds significant potential in the healthcare industry, especially with high out-of-pocket costs in the U.S. In 2022, healthcare spending surpassed $4.5 trillion, averaging $13,493 per person. Major hospitals and health systems now offer payment services and financial solutions through desktop and mobile apps, enabling patients to pay medical bills seamlessly. Innovations like PayZen provide no-interest, no-fee payment plans, potentially reducing costs for insurers, doctors, patients, and hospitals.

Future of Embedded Finance

Embedded finance is poised to shape the future of fintech by merging non-financial service providers with financial services like payment processing, lending, and insurance. This integration offers numerous benefits, including improved customer experiences and engagement. Businesses can provide a seamless and convenient user experience by embedding financial services into non-financial platforms, eliminating the need for customers to switch between different platforms or institutions.

Additionally, embedded finance opens new revenue streams for businesses through transaction fees, interest charges, and other financial products. This diversification can help companies grow and maintain sustainability in the long run.

0 notes

Text

#Readblog#blogfinance#PersonalLoans#DigitalLending#Fintech#AIinFinance#Blockchain#DeFi#FinancialInclusion#SustainableFinance#EmbeddedFinance#LoanInnovation#CustomerExperience#FutureOfFinance

0 notes

Text

0 notes

Link

#BankingAPIs#embeddedfinance#ESGcompliance#Europe#PropertyManagement#proptech#RealEstateInnovation#regulatorytechnology

0 notes

Text

Embedded finance is changing the face of financial services in Southeast Asia in 2023

Embedded finance is a rapidly emerging trend that is revolutionizing the conventional banking and financial services industry in Southeast Asia. With a vast majority of the population lacking access to banking services, embedded finance possesses the potential to foster financial inclusion while providing unparalleled convenience and efficiency to consumers across the region. As the benefits of embedded finance are getting recognized more widely across the region, traditional banking institutions are facing stiff competition from new-age digital banks and fintech firms that are backed by venture capital and private equity firms.

Click here to read more — https://www.paynxt360.com/view-point/embedded-finance-is-changing-the-f/696

0 notes

Text

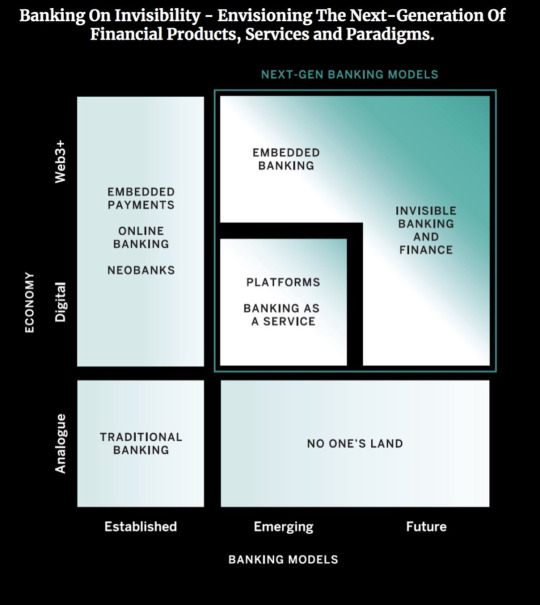

"Unlocking the Invisible: Pioneering the Future of Banking and FinTech"

Banking On Invisibility - Envisioning The Next-Generation Of Financial Products, Services and Paradigms

In the not-so-distant past, banks adorned prime locations along bustling streets. Today, their prominence is wavering, and a future looms where they might vanish even from our phone screens. Financial services are seamlessly intertwining with technology and various industries, almost fading into invisibility.

While the demise of traditional banking has been a recurring topic among pundits, the ascent of digital finance has unquestionably chipped away at the once-familiar brick-and-mortar bank. Yet, could digital finance merely serve as a transient bridge to a truly revolutionary era?

Open Banking has empowered diverse brands to embody financial institutions, seamlessly integrating loans, payments, payroll, and more into their existing offerings. The ongoing surge of consumer tech innovation merges the physical and digital realms in our daily lives, enabling us to transact effortlessly without fixating on the financial dimension. Departing a store, our purchases are automatically tallied and deducted; our smart devices autonomously place orders and process payments. Our bank accounts evolve into intelligent, automated allies, optimizing our savings journey.

Financial services, a traditionally conservative industry, are subject to rigorous regulation. While change may be gradual, its impact ripples across sectors, given money's fundamental role. This metamorphosis heralds fresh revenue avenues beyond finance's confines, catalyzing transformative repercussions.

Alternative operational models and revenue streams are sprouting across the financial landscape. Next-gen banking paradigms foretell an array of innovative products and services tailored for a world where industry boundaries blur or fade away.

The automotive industry's evolution from "car" to "mobility" exemplifies this shift, extending value chains beyond physical products and fostering broader interpretation. As financial and non-financial sectors intermingle, banking gains the ability to subtly infiltrate the subconscious, steering evolving customer expectations and novel competitive dynamics.

To thrive in this invisible landscape, banks must fathom customer needs, habits, and aspirations. Financial professionals must conjure the dual magic of becoming both unseen and all-seeing. An entirely novel form of finance beckons on the horizon—one abstract, seamless, and intrinsically interconnected.

#InvisibleFinance #FutureBanking #TechInnovation #FinancialEvolution #CustomerCentric #SeamlessTransactions #InnovationFrontiers #Innovation #Fintech #Banking #OpenBanking #OpenFinance #EmbeddedFinance #OpenAPIs #BaaS #BaaP #FinancialServices #CoreBanking #Payments #SaaS

1 note

·

View note