#esg advisory services

Text

The Scope of ESG Services in Sustainable Business Development

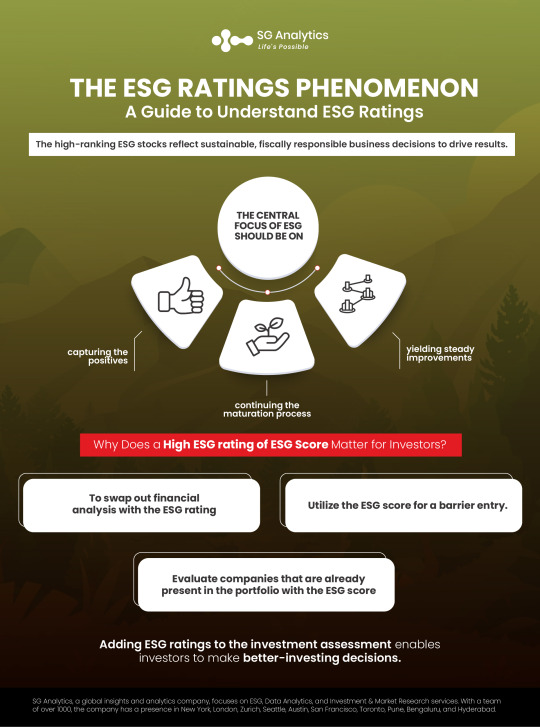

Corporations implement green technology to perform well on the environmental matrix of ESG. Besides, social and corporate governance requirements are documented in the sustainable accounting guidelines. However, a unified framework that can function like a universal law is unavailable. So, investors, businesses, governments, consumers, and financial services rely on independent ESG services. ESG specialists will quantify, inspect, report, and improve a business's sustainability compliance.

0 notes

Text

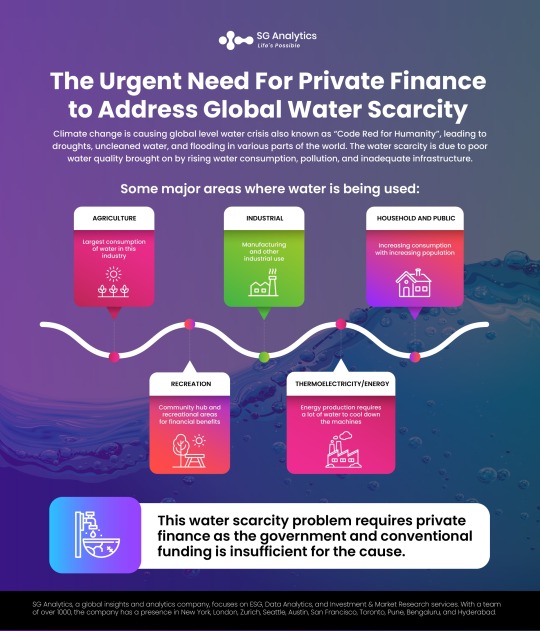

Globally, there is a growing lack of water. Half of the world is experiencing droughts, floods, and unclean water, and the issue urgently calls for significant private funding. With the rise of globalization, this seems to be of greater importance. It will worsen if current economic and social tendencies are not significantly reversed.

Due to a changing climate, an expanding global population, a booming global economy, and changing dietary habits, there is an increasing concern over water scarcity. The difficulties caused by water scarcity are developing as a strategic concern for enterprises and their financial sponsors worldwide.

#esg services#esg as a service#esg service providers#esg data solutions#esg data and research services#esg advisory services

0 notes

Text

Environmental sustainability is becoming critical for organizations to stay competitive. In the coming years, it will be embedded at the core of the corporate strategy.

ESG advisory services | SG Analytics

0 notes

Text

Navigating Wealth Management: The Role of Family Offices in Modern Financial Landscape

In the ever-evolving world of finance, families with substantial wealth face unique challenges and opportunities. From preserving and growing wealth across generations to managing complex investments and philanthropic endeavors, the task can be daunting. However, amidst this complexity, a beacon of stability and expertise emerges: the family office.

Family offices have long been integral to the wealth management strategies of affluent families worldwide. These private advisory firms cater to the specific needs of high-net-worth individuals and families, offering a comprehensive range of services tailored to their unique circumstances. From investment management to estate planning and beyond, the family office serves as a trusted partner, guiding families through the intricacies of wealth management.

At its core, a family office is a dedicated entity established to manage the financial affairs of a single affluent family or a group of families. While the structure and functions of family offices may vary depending on the family's preferences and objectives, they typically share a common goal: to preserve and grow wealth over the long term. This overarching mission drives every aspect of the family office's operations, shaping its investment strategies, governance framework, and service offerings.

One of the defining features of family offices is their focus on holistic wealth management. Unlike traditional financial institutions that may offer a range of services to a broad client base, family offices provide personalized solutions tailored to the unique needs and goals of each family they serve. This bespoke approach allows family offices to delve deep into the intricacies of their clients' financial affairs, gaining a comprehensive understanding of their objectives, risk tolerance, and values.

Central to the success of any family office is its ability to adapt to changing circumstances and evolving market dynamics. In today's fast-paced and interconnected world, staying ahead of the curve is essential to preserving and growing wealth effectively. Family offices employ teams of seasoned professionals with expertise in various disciplines, including finance, law, tax, and philanthropy, to ensure that their clients receive the highest level of service and support.

Moreover, family offices serve as custodians of their clients' legacies, safeguarding wealth for future generations. By implementing robust governance structures and succession plans, family offices help ensure continuity and stability across generations, enabling families to pass on their wealth and values to their heirs with confidence.

In recent years, the role of family offices has expanded beyond traditional wealth management to encompass a broader range of services and initiatives. With an increasing emphasis on sustainability, impact investing, and philanthropy, many family offices are actively seeking ways to align their investment strategies with their clients' values and priorities. By integrating environmental, social, and governance (ESG) criteria into their investment decisions, family offices can not only generate positive financial returns but also make a meaningful difference in the world.

In conclusion, family offices play a vital role in the modern financial landscape, providing affluent families with comprehensive wealth management solutions tailored to their unique needs and goals. By leveraging their expertise, experience, and resources, family offices help families navigate the complexities of wealth management with confidence and clarity. As the financial landscape continues to evolve, the importance of family offices as trusted advisors and stewards of wealth is likely to grow, ensuring the enduring legacy of affluent families for generations to come.

So, whether you're a multigenerational family looking to preserve your wealth for future generations or an entrepreneur seeking to build and manage your financial legacy, the family office stands ready to assist you on your journey towards financial success and fulfillment. With their expertise, dedication, and personalized approach, family offices are well-equipped to help you achieve your goals and aspirations, now and in the years to come.

0 notes

Text

Exploring the Integral Functions Performed by the Largest Accounting Firms in the USA

In the complex landscape of modern business, accounting firms play a pivotal role in ensuring financial integrity, compliance, and strategic decision-making for organizations across various industries. Among them, the largest accounting firms in the USA stand out not only for their size but also for the breadth and depth of services they offer. Let us delve into the multifaceted functions performed by these industry giants.

Audit and Assurance Services:

At the core of accounting firms' functions lie audit and assurance services. These involve examining financial statements, internal controls, and operational processes to provide stakeholders with confidence in the accuracy and reliability of financial information. The biggest accounting firms in the US deploy teams of experienced auditors to conduct thorough assessments, ensuring compliance with regulatory standards and identifying areas for improvement.

Tax Advisory and Compliance:

With the ever-evolving tax landscape, businesses rely on accounting firms for expert tax advisory services. These firms assist clients in navigating complex tax regulations, optimizing tax strategies, and ensuring compliance with local, state, and federal tax laws. From tax planning to preparation and representation in tax disputes, the expertise of the largest accounting firms in America proves invaluable in minimizing tax liabilities and maximizing financial efficiency.

Financial Advisory and Consulting:

Top accounting firms in the US offer a spectrum of financial advisory and consulting services tailored to the diverse needs of businesses. This includes financial restructuring, mergers and acquisitions (M&A) advisory, valuation services, forensic accounting, and risk management. By leveraging their analytical prowess and industry insights, these firms help clients make informed decisions, mitigate risks, and unlock opportunities for growth and sustainability.

Technology and Innovation Solutions:

In the digital age, accounting firms are at the forefront of integrating technology into their service offerings. They provide innovative solutions such as cloud-based accounting platforms, data analytics, robotic process automation (RPA), and blockchain technologies to streamline financial processes, enhance data security, and drive operational efficiency. By embracing technological advancements, these firms empower clients to adapt to rapidly changing business environments.

Regulatory Compliance and Corporate Governance:

Compliance with regulatory requirements and adherence to sound corporate governance principles are paramount for organizations seeking to maintain trust and credibility. Large accounting firms like Winxglobal assist clients in navigating complex regulatory frameworks, including Sarbanes-Oxley (SOX) compliance, International Financial Reporting Standards (IFRS) adoption, and industry-specific regulations. They also offer guidance on corporate governance best practices to foster transparency, accountability, and ethical conduct.

Global Expansion and Cross-Border Transactions:

As businesses expand into international markets, they face unique challenges related to taxation, regulatory compliance, and cultural differences. Large accounting firms like Winxglobal have a global presence and offer comprehensive support to clients pursuing cross-border ventures. This includes international tax planning, transfer pricing strategies, cross-border transaction advisory, and assistance with foreign market entry and expansion.

Sustainability and Environmental, Social, and Governance (ESG) Reporting:

In response to growing stakeholder expectations, companies are increasingly focusing on sustainability and ESG factors. Large accounting firms also have the best accountants for small business ventures and companies. They provide guidance on ESG reporting frameworks, sustainability strategy development, and performance measurement. They help organizations integrate environmental and social considerations into their business practices, enhancing transparency and accountability in corporate reporting.

Client Education and Thought Leadership:

Beyond traditional service offerings, large accounting firms play a crucial role in educating clients and sharing industry insights through thought leadership initiatives. They publish research reports, host seminars, and webinars, and provide training programs to help clients stay informed about emerging trends, regulatory changes, and best practices in finance and accounting.

In conclusion, the largest accounting firms in the USA serve as trusted advisors to businesses, offering a wide range of essential services that extend far beyond traditional accounting functions. By leveraging their expertise, resources, and innovative solutions, these firms empower clients to navigate challenges, seize opportunities, and achieve sustainable growth in an increasingly complex and dynamic business environment. To get further details, just explore our website at

https://www.winxglobal.in/

1 note

·

View note

Text

Key Players and Trends in the US Wealth Management Market

The wealth management market in the United States is highly competitive and dynamic, with several key players and trends shaping its landscape.

For more insights on investor asset allocation in the US wealth management market, download a free sample report

Here's an overview:

Key Players:

Morgan Stanley Wealth Management: Morgan Stanley is one of the largest wealth management firms in the United States, offering a range of services including financial planning, investment management, and retirement planning. It serves a diverse client base, including high-net-worth individuals, institutions, and corporations.

Bank of America Merrill Lynch Wealth Management: Bank of America Merrill Lynch is a major player in the wealth management industry, providing investment advisory services, wealth planning, and banking solutions to clients across the wealth spectrum.

UBS Wealth Management: UBS is a global financial services firm with a significant presence in the wealth management market. UBS Wealth Management offers personalized investment advice, financial planning, and wealth management solutions to high-net-worth individuals and families.

Wells Fargo Wealth Management: Wells Fargo is one of the largest banks in the United States, with a wealth management division that provides investment management, trust services, and private banking solutions to affluent clients.

J.P. Morgan Wealth Management: J.P. Morgan offers comprehensive wealth management services to individuals, families, and institutions, including investment management, estate planning, and philanthropic advisory services.

Charles Schwab Wealth Management: Charles Schwab is a leading brokerage firm that also offers wealth management services to clients through its advisory services and managed account solutions.

Fidelity Investments Wealth Management: Fidelity Investments provides a range of wealth management solutions, including investment management, financial planning, and retirement services, to individuals and institutions.

Raymond James Wealth Management: Raymond James offers personalized wealth management services through its network of financial advisors, providing investment advice, financial planning, and trust services.

Northern Trust Wealth Management: Northern Trust is a global financial services firm specializing in wealth management, asset management, and asset servicing. Its wealth management division serves high-net-worth individuals, families, and institutions.

Goldman Sachs Private Wealth Management: Goldman Sachs provides personalized wealth management services to ultra-high-net-worth individuals and families through its Private Wealth Management division, offering investment management, estate planning, and family office services.

Trends:

Digital Transformation: Wealth management firms are increasingly investing in technology to enhance client experience, improve operational efficiency, and deliver personalized advice through digital channels.

Focus on ESG Investing: Environmental, social, and governance (ESG) investing is gaining traction among wealth management clients, driving demand for sustainable and socially responsible investment options.

Holistic Financial Planning: There's a growing emphasis on holistic financial planning, which integrates investment management, retirement planning, tax optimization, and estate planning to address clients' comprehensive financial needs.

Rise of Robo-Advisors: Robo-advisors, automated investment platforms that use algorithms to provide investment advice and portfolio management, are becoming increasingly popular, especially among younger investors.

Shift to Fee-Based Models: Wealth management firms are moving away from commission-based models toward fee-based advisory services, aligning their interests with those of clients and emphasizing transparency in pricing.

Focus on Client Experience: Client experience and engagement have become paramount for wealth management firms, driving investments in personalized service offerings, digital tools, and relationship management.

Alternative Investments: Wealthy clients are increasingly allocating capital to alternative investments such as private equity, hedge funds, and real estate, seeking diversification and higher returns in a low-yield environment.

Demographic Shifts: Wealth management firms are adapting their strategies to cater to changing demographics, including the growing influence of millennials and women as wealth holders and decision-makers.

Regulatory Compliance: Regulatory compliance remains a key focus area for wealth management firms, with increasing scrutiny from regulators and a growing emphasis on transparency, suitability, and fiduciary responsibility.

Wealth Transfer and Succession Planning: As wealth transfers to the next generation, wealth management firms are assisting clients with succession planning, estate planning, and intergenerational wealth transfer strategies.

These key players and trends highlight the evolving dynamics of the wealth management market in the United States, driven by technological innovation, shifting client preferences, regulatory developments, and demographic changes.

0 notes

Text

LRQA의 성장 여정에서 중요한 이정표

LRQA의 사이버 보안 및 ESG 부문은 이제 하나의 브랜드 아이덴티티로 통합됩니다. LRQA는 독립적인 비즈니스로서 성장을 가속화하는 것이 가장 큰 우선 순위 중 하나입니다. LRQA는 새 고객들과 기존 고객들 모두가 LRQA를 선택하는 파트너로서 확실하게 자리매김 하고자 합니다. 최근 고객들로부터, 조직 운영 전반에 걸친 리스크를 관리하는 데 도움을 줄 파트너를 원한다는 피드백을 받았습니다. 규정 준수부터 공급망 변화, 사이버 보안 그리고 환경, 사회, 지배구조(ESG)에 이르기까지, 당사는 모든 피드백을 경청하고 이 새로운 리스크의 시대에 부합하는 서비스 포트폴리오와 운영 모델을 재검토하는 기회를 가졌습니다.

2023년 1월 당사는 Assessment, Advisory, Inspection Services 및 사이버 보안이라는 핵심 리스크 관리 분야의 능력을 하나로 통합하여 포트폴리오를 강화했습니다. 이 새로운 비지니스 운영 모델에서, 2022년에 인수한 ELEVATE의 ESG 및 지속가능 전문가들은 이제 Assessment와 Advisory 두 부문에 속하게 됩니다. 또한, 2018년에 인수한 Nettitude의 사이버 보안 전문가들은 이제 사이버 보안 부문으로 이동하였습니다. 2023년 6월부터 당사는 사업 전반에 걸쳐 하나의 LRQA 브랜드 아이덴티티로 통합하기 시작했습니다. 이를 통해 당사는 One LRQA라는 이름 아래 폭넓은 포트폴리오에서 일관되고 높은 수준의 서비스를 고객들에게 제공하고 있습니다. 앞으로 점차적으로 ELEVATE 브랜드를 사용하지 않고, LRQA 시각적 아이덴티티로 대체할 예정이며, LRQA 사이버 보안 포트폴리오 영역에 ‘LRQA Nettitude’라는 이름을 사용할 예정입니다. 이는 LRQA 브랜드와 동일합니다.

단, 보안 도메인의 무결성을 보호하기 위해 Nettitude 이름은 유지합니다. 이러한 변화는 LRQA와 LRQA 브랜드 패밀리에게 중요한 이정표입니다. 당사는 이 특별한 기회를 직원들과 함께 이끌어내고, 전 세계적으로 선도적인 보증 파트너로 자리매김하고자 합니다. Paul Butcher Chief Executive Officer, LRQA LRQA의 최고 경영자인 Paul Butcher 는 다음과 같이 메시지를 전하였습니다: “LRQA와 LRQA 브랜드 패밀리에게 중요한 이정표입니다. 당사는 이 특별한 기회를 통해 전 세계적인 보증 파트너로 선도하고자 합니다. 특히 ESG와 사이버 보안 서비스에 초점을 맞추고 있습니다. LRQA는 성장 전략을 신속하게 가속화하고 고객들에게 시장을 선도하는 제안을 제공하고 있습니다. 당사는 리스크 관리 분야의 선도적인 기업이 되기를 원하며, 하나의 시각적 아이덴티티 아래로 결합된 팀으로서 브랜드 밸류와 포트폴리오를 더욱 강화하기를 기대합니다.” 하나의 브랜드로 통합하면서 일부 자산과 콘텐츠는 점진적인 접근 방식으로 더 빠르게 변경될 것입니다. 고객과 협력 파트너들이 협업하는 팀이나 제공되는 서비스에는 아무런 영향이 없을 것입니다. 이러한 흥미로운 변화는 모두 LRQA에서 제공되는 강화된 서비스 패키지와 고객들을 연결하는 데 중점을 두고 있습니다. 함께 각각의 포트폴리오 영역이 고객들에게 매력적인 제안을 제공할 수 있기를 기대합니다. 고객 문의사항은 기존 연락처로 연락 주시기 바랍니다.

이 웹사이트에 대한 추가 정보: https://www.lrqa.com/ko-kr/latest-news/0711-important-milestone-in-lrqas-growth-journey/

0 notes

Text

Demystifying Investment Banking in India – A Focus on SBICAPS to IDBI Bank

India's investment banking landscape has undergone a remarkable transformation, ushering in a new era marked by the prominence of key players wielding significant influence within the financial realm. Among these titans, SBICAPS, HDFC Bank, ICICI Securities, and IDBI Bank have emerged as stalwarts, shaping the trajectory of capital flows, mergers and acquisitions, and advisory services in the country. This comprehensive article delves into the intricate operations, diverse services, and substantial contributions of these esteemed institutions to India's vibrant capital markets.

SBICAPS: Pioneering Financial Solutions

As a subsidiary of the esteemed State Bank of India (SBI), SBICAPS boasts a rich heritage spanning over three decades in India's financial landscape. Renowned as on

e of the nation's premier investment banks, SBICAPS offers a multifaceted range of services, including investment banking, project advisory, debt syndication, and equity capital markets.

In the sphere of investment banking, SBICAPS excels in facilitating capital raising endeavors for corporations through various channels such as initial public offerings (IPOs), follow-on public offerings (FPOs), and private placements. Leveraging the expertise of seasoned professionals, the bank provides strategic guidance, meticulous structuring, and seamless execution of transactions, leveraging its extensive network and market insights to optimize outcomes.

Furthermore, SBICAPS assumes a pivotal role in debt syndication, steering fundraising initiatives for infrastructure projects, corporate expansions, and working capital needs. Through robust relationships with domestic and international lenders, the bank tailors debt financing solutions to ensure optimal capital structuring and competitive financing terms, thereby fueling growth and development.

Moreover, SBICAPS actively engages in equity capital markets, offering brokerage services, research insights, and investment advisory to institutional and retail investors alike. With a robust distribution network, the bank facilitates access to primary and secondary market offerings, empowering investors to make informed decisions and optimize their portfolios for long-term success.

Also Read: Rise of ESG Investing: Evaluating Environmental, Social, and Governance Factors

ICICI Securities: Driving Innovation for Financial Excellence

As a subsidiary of ICICI Bank, ICICI Securities stands as a leading investment bank and brokerage firm in India, celebrated for its innovative solutions, robust infrastructure, and client-centric approach. With a formidable presence across various asset classes, including equities, fixed income, and commodities, ICICI Securities delivers a broad spectrum of financial services tailored to meet diverse client needs.

Specializing in equity and debt capital markets, as well as advisory services, ICICI Securities' seasoned professionals provide comprehensive support to clients, spanning deal structuring, valuation, regulatory compliance, and execution. In the realm of debt capital markets, the bank aids corporates and government entities in fundraising endeavors through bond issuances, commercial paper placements, and structured debt products, leveraging its extensive network to deliver efficient financing solutions.

Additionally, ICICI Securities' equity capital markets team delivers research, trading, and investment advisory services to institutional and retail investors, supported by cutting-edge technology for seamless execution of transactions. The bank's robust distribution network ensures accessibility to primary and secondary market offerings, enhancing liquidity and market efficiency for all stakeholders.

HDFC Bank: Spearheading Innovation in Investment Banking

As a prominent private sector bank in India, HDFC Bank has established itself as a dominant force in the investment banking arena, harnessing its robust brand reputation, extensive clientele, and formidable infrastructure. The bank offers a comprehensive suite of investment banking services customized to meet the diverse needs of corporations, institutions, and individuals alike.

Within the realm of investment banking, HDFC Bank specializes in mergers and acquisitions (M&A), capital raising, and advisory services, collaborating closely with clients to execute complex transactions and drive strategic growth initiatives. Its debt capital markets division assists corporates in fundraising through bond issuances, structured debt instruments, and syndicated loans, leveraging market insights and innovative structuring capabilities to deliver efficient financing solutions.

Furthermore, HDFC Bank's equity capital markets team provides brokerage services, research coverage, and investment advisory to domestic and foreign investors, ensuring seamless execution of transactions and enhancing market liquidity. The bank's steadfast commitment to innovation and excellence reinforces its position as a key player in India's investment banking landscape.

Also Read: Risk Management in Investment Portfolios: Diversification and Beyond

IDBI Bank: Empowering Financial Growth

IDBI Bank, a significant contributor to India's financial sector, offers a range of investment banking services tailored to meet the diverse needs of corporations, institutions, and individuals. Specializing in areas such as mergers and acquisitions, capital raising, and advisory services, IDBI Bank collaborates closely with clients to execute strategic transactions and foster growth opportunities.

In the domain of debt capital markets, IDBI Bank facilitates fundraising for various projects and corporate initiatives through innovative structuring and strong relationships with lenders. Its equity capital markets team provides brokerage services, research coverage, and investment advisory to investors across different segments, ensuring seamless execution of transactions and enhancing market efficiency.

Also Read: Navigating Market Dynamics: The Vanguard Investment Banks of India From SBICAPS, HDFC Bank, And ICICI Securities

Conclusion: Driving Value in India's Financial Landscape

In conclusion, investment banks in India such as SBICAPS, HDFC Bank, ICICI Securities, and IDBI Bank play pivotal roles in shaping India's financial landscape, fostering capital formation, facilitating corporate growth, and driving market efficiency. Through their diverse service offerings, profound market expertise, and client-centric approach, these institutions significantly contribute to the development and sophistication of India's capital markets.

As India continues its journey of economic growth and financial modernization, the role of investment banks remains indispensable in fueling innovation, entrepreneurship, and sustainable development. With unwavering commitment to excellence and innovation, SBICAPS, HDFC Bank, ICICI Securities, and IDBI Bank are poised to navigate the evolving dynamics of the Indian financial ecosystem, driving value creation for clients and stakeholders alike.

0 notes

Text

Aiden Lee Ping Wei – Chief Executive Officer

Aiden Lee Ping Wei is the Co-Founder and Chief Executive Officer of Graphjet Technology, the first and only developer of technology to produce graphite and graphene directly from agricultural waste. Mr. Lee has more than a decade of experience in the engineering, construction, property development, telecommunications, energy and utilities industries with a specialization in Project Management and Corporate Finance.

Before Graphjet, Mr. Lee served as a director at a renewable energy company focused on providing engineering, procurement, construction and commissioning and advisory services to customers, including private and government agencies. Prior to this, he served as a director at a company that provides engineering services, EPCC, advisory works, designs and builds businesses with more than RM200 million projects with local companies as well as prestigious universities in Malaysia.

Throughout his career, Mr. Lee has managed and completed highly acclaimed projects in China, Hong Kong and Malaysia worth billions.

Mr. Lee also serves as a Board of Directors member for several listed company in Malaysia. He graduated from Tunku Abdul Rahman University College with a Diploma in E-Commerce and Marketing, and he possesses over a decade of professional expertise and experience in corporate finance for more than 10 years.

https://www.linkedin.com/in/aiden-lee-23b746250

Details about Graphjet Technology

Graphjet Technology Sdn. Bhd. was founded in 2019 in Malaysia as an innovative and ESG-friendly graphene and graphite producer. Graphjet Technology has the world’s first patent-pending technology to recycle palm kernel shells generated in the production of palm seed oil to produce single layer graphene and artificial graphite at far lower cost than traditional carbon-intensive approaches.

Graphene is presently one of the highest-profile materials in the world, also known as “black gold” and the “king of new materials.” Graphene’s high electric and thermal conductivity, hardness greater than that of a diamond and ultralight weight makes it critical to a number of innovative industries, including electric vehicle batteries, semiconductors, composite materials and biomedical applications. Graphjet’s sustainable production methods utilizing palm kernel shells, a common agricultural waste product in Malaysia, will create a new paradigm and sustainable global supply chain to support graphite and graphene demand.

Additional information is available online at https://www.graphjettech.com/.

0 notes

Text

Dubai Financial Insights: VAT Services, Accounting Optimization, and Expert Advisory

Welcome to a journey through the financial landscape of Dubai, where VAT services, accounting services in UAE, and expert financial advisory services play pivotal roles in business success. we'll unravel the complexities of VAT services, share tips for streamlining accounting processes, delve into choosing the right financial advisory firm, and explore the latest financial trends for businesses in Dubai and across the UAE.

Let's start by demystifying VAT services in Dubai. From registration processes to VAT returns, we'll navigate through the essentials of Value Added Tax and discuss the compliance challenges businesses face in managing VAT effectively.

Discuss the threshold for VAT registration in Dubai and the process businesses need to follow to register for VAT.

Explain the concept of input and output VAT, along with common challenges businesses face in VAT compliance.

Share strategies for seamless VAT management, such as maintaining accurate records, conducting regular VAT audits, and staying updated with VAT law changes.

Streamlining Accounting Services for Efficiency Optimizing accounting processes is key to financial efficiency. We'll share practical tips and best practices, recommend software solutions for streamlined financial management, and highlight the importance of financial statement analysis and tax planning strategies for businesses in the UAE.

Highlight the benefits of cloud-based accounting software for businesses in the UAE, emphasizing features like real-time reporting and scalability.

Offer tips for effective financial statement analysis, including techniques for identifying trends, analysing ratios, and making data-driven decisions.

Provide insights into tax planning strategies, such as tax optimization, deductions, and credits available to businesses in the UAE.

Choosing the Right Financial Advisory Firm Selecting a reputable financial advisory firm in Dubai is crucial. Through case studies and success stories, we'll explore the factors businesses should consider when choosing a financial advisor, showcasing how expert guidance can fuel business growth and success.

Discuss the importance of industry expertise and track record when selecting a financial advisory firm, citing examples of successful partnerships.

Share insights from case studies where businesses benefited from tailored financial advice, strategic planning, and risk management solutions.

Highlight the role of ongoing support and communication in fostering a strong relationship with a financial advisor.

Insights into 2024 Financial Trends What does the financial landscape look like in 2024? We'll analyze the latest trends shaping Dubai's business scene, from digitalization and sustainability initiatives to regulatory updates, providing actionable insights for businesses to adapt and thrive in the evolving financial environment.

Explore the impact of digital transformation on financial services in Dubai, including the rise of fintech solutions and digital payment innovations.

Discuss sustainability initiatives in the financial sector, such as ESG (Environmental, Social, Governance) investing and green financing options.

Analyze regulatory updates affecting businesses, such as changes in tax laws, reporting requirements, and compliance standards.

Navigating the Future of Finance in Dubai As Dubai continues to evolve as a global business hub, understanding VAT services, optimizing accounting practices, and leveraging expert financial advice are essential for businesses to thrive. Join us as we unravel the complexities and unlock the potential of financial success in Dubai and beyond.

Encourage businesses to embrace technological advancements like AI-driven financial analytics, blockchain for secure transactions, and digital banking solutions.

Advocate for a proactive approach to financial management, including continuous learning, adapting to market trends, and seeking opportunities for growth.

Emphasize the importance of networking and collaboration with industry peers, financial experts, and government agencies to stay informed and competitive.

In conclusion, navigating VAT services, streamlining accounting processes, choosing the right financial advisory firm, and staying updated on financial trends are crucial elements for businesses in Dubai. By embracing these insights and strategies, businesses can navigate the financial waters with confidence, drive growth, and achieve long-term success in the dynamic business landscape of Dubai and the UAE.

#VATServicesDubai#AccountingServicesUAE#FinancialAdvisoryFirmsDubai#TaxConsultancy#BookkeepingServicesDubai#FTAServices#CompanyFormation#UAEFreeZoneCompanyFormation

1 note

·

View note

Text

Unpredictability has become the new normal since the Covid-19 emergency. And businesses have quickly realized that digitalization is the only way to build the resilience they need to succeed. Hence, in this post-pandemic world, technology and its access to data is not just the backbone but also the beating heart of the business.

Today digital transformation offers the best chance for businesses to compete, deliver a distinguished customer experience, and unlock future success. esg services

0 notes

Text

0 notes

Text

An internationally recognized expert in Sustainable Responsible Investments, ESG Finance, M&A, Private Equity & Venture Capital International Investments,Technology & Innovation, and International Trade & Business Development, as well as an accredited CG/LA Infrastructure expert, Gian is Co-Founder and CEO of C&Z GLOBAL Advisors (www.cz-globaladvisors.com), a multidisciplinary advisory firm, connecting North America with the entire Global Economy (awardee of the 2023 Mountain States, Best Infrastructure and Economic Development firm), Of-Counsel in the Strategic Consulting Division of the Italian Law Firm Lexant (https://www.lexant.it), responsible for the North American Desk (International Trade & Investments | M&A |Private Equity & Venture Capital | ESG & Sustainability | Sustainability Finance), and formerly Founding Team Member, Director and EVP of ESG & Sustainability, Corporate Governance and Investors Relations at Sfeer Corp (https://sfeer.tech/), fully integrated B2B SaaS trading eco system SaaS Cloud solution, providing real-time marketplace for physical Agri commodities and all trade services.

0 notes

Text

Upcoming IPO in India

Understanding the IPO Landscape in India

Before we dive into the specifics of IPO Brains, let’s take a moment to grasp the broader context of IPOs in India. Over the past few years, India has emerged as a hotbed for IPO activity, with a diverse range of companies across sectors tapping into the public markets to raise funds. From tech unicorns to traditional enterprises, the IPO frenzy in India reflects the country’s vibrant entrepreneurial ecosystem and the growing appetite for investment opportunities.

Riding the Wave: IPO Brains on the Horizon

Among the plethora of companies gearing up for IPOs, IPO Brains stands out as a name to watch. With a focus on innovation, disruption, and value creation, IPO Brains is poised to make a significant splash in the Indian capital markets. Led by a seasoned team of industry experts and visionaries, IPO Brains is driven by a mission to unlock the full potential of businesses and drive sustainable growth in the Indian economy.

What Sets IPO Brains Apart?

At the heart of IPO Brains’ value proposition lies a commitment to excellence and differentiation. Unlike traditional investment firms, IPO Brains adopts a holistic approach to IPO advisory, offering end-to-end services tailored to the unique needs of each client. From strategic planning and valuation to regulatory compliance and investor relations, IPO Brains leverages its expertise and insights to navigate the complexities of the IPO process seamlessly.

Moreover, IPO Brains takes pride in its forward-thinking approach to investment analysis and decision-making. By leveraging cutting-edge technology and data analytics, IPO Brains ensures that every investment opportunity is thoroughly evaluated and rigorously assessed for its growth potential and risk profile. This data-driven approach not only enhances transparency and accountability but also empowers investors to make informed decisions with confidence.

A Glimpse into the Future: What to Expect from IPO Brains

As IPO Brains gears up for its debut on the Indian stock exchanges, investors can expect nothing short of excellence and innovation. With a robust pipeline of high-potential companies across sectors, IPO Brains is poised to unlock value and drive wealth creation for its investors. Whether it’s disruptive tech startups, resilient consumer brands, or transformative healthcare ventures, IPO Brains is committed to identifying and nurturing the next generation of market leaders.

Furthermore, IPO Brains remains steadfast in its commitment to sustainability and corporate responsibility. By integrating environmental, social, and governance (ESG) principles into its investment strategy, IPO Brains seeks to create long-term value not just for shareholders, but for society as a whole. From promoting diversity and inclusion to fostering environmental stewardship, IPO Brains is dedicated to making a positive impact on the world beyond financial returns.

Closing Thoughts

In conclusion, the upcoming IPO in India with IPO Brains represents a unique opportunity for investors to participate in the country’s growth story and capitalize on the potential of emerging market opportunities. With its unparalleled expertise, innovative approach, and unwavering commitment to excellence, IPO Brains is poised to redefine the landscape of IPO advisory services in India and beyond. As we eagerly await the debut of IPO Brains on the stock exchanges, one thing is certain — the future of investing in India has never looked brighter.

#IPOBrainsLaunch#InvestingInIndia#FutureOfFinance#IPOInsights#MarketMovers#SustainableInvesting#IndiaIPOs#InnovativeInvestments#WealthCreation#EmergingMarkets

0 notes

Text

Emerging Trends in Accounting 2024

The accounting industry has rapidly evolved due to technological advancements, with trends like AI, blockchain, and sustainability shaping its landscape. Here's a summary of the key emerging trends of accounting impacting accounting experts and their future strategies:

1. Evolving Accountancy Role: Accountants are shifting towards advisory roles as automation takes over traditional tasks.

2. Blockchain Technology: Expected to be widely adopted by global MNCs for transactional record-keeping by 2024.

3. Automated Accounting: Automation is increasingly replacing manual accounting processes, with significant adoption expected in the future.

4. Data Security: Regulatory requirements validate the ongoing trend of data security in the financial sector.

5. Outsourcing & Remote Workforce: The global outsourced accounting market is steadily growing, but remote work facilitations may decline in 2024.

6. Predictive Analytics: Big data and data analytics are being leveraged for financial predictions, with increasing adoption expected.

7. Sustainability & ESG Reporting: While gaining popularity, sustainability reporting may not become mainstream in traditional accounting due to its qualitative nature.

8. Wellness: Mental and physical health initiatives are crucial for accounting professionals to combat stress and burnout.

9. Agile Accounting: The industry is expected to adopt agile principles to keep up with increasingly complex business environments.

10. Proactive Accounting: The importance of proactive accounting is highlighted by the negative impacts of reactive approaches.

Forecasted Trends for 2024:

1. Cloud Accounting: Expected to grow significantly, offering benefits such as seamless accessibility and multi-user facilitation.

2. Generative AI in Accounting: Anticipated to deliver significant value to banks and drive growth in the AI market.

3. Forensic Accounting: Growing complexity and increasing financial crimes are expected to drive the demand for forensic accounting services.

4. Unemployment Trends in Accounting: The shift towards automation may lead to increased unemployment in the accounting sector.

5. Advanced Personalization in Accounting: The accounting industry is likely to embrace advanced personalization techniques to cater to customer needs.

To stay updated with these emerging trends, accountants are advised to upskill themselves and embrace digitization. Actax India can provide more informative insights on emerging accounting trends.

0 notes

Text

LRQA의 성장 여정에서 중요한 이정표

LRQA의 사이버 보안 및 ESG 부문은 이제 하나의 브랜드 아이덴티티로 통합됩니다.

LRQA는 독립적인 비즈니스로서 성장을 가속화하는 것이 가장 큰 우선 순위 중 하나입니다. LRQA는 새 고객들과 기존 고객들 모두가 LRQA를 선택하는 파트너로서 확실하게 자리매김 하고자 합니다. 최근 고객들로부터, 조직 운영 전반에 걸친 리스크를 관리하는 데 도움을 줄 파트너를 원한다는 피드백을 받았습니다. 규정 준수부터 공급망 변화, 사이버 보안 그리고 환경, 사회, 지배구조(ESG)에 이르기까지, 당사는 모든 피드백을 경청하고 이 새로운 리스크의 시대에 부합하는 서비스 포트폴리오와 운영 모델을 재검토하는 기회를 가졌습니다.

2023년 1월 당사는 Assessment, Advisory, Inspection Services 및 사이버 보안이라는 핵심 리스크 관리 분야의 능력을 하나로 통합하여 포트폴리오를 강화했습니다. 이 새로운 비지니스 운영 모델에서, 2022년에 인수한 ELEVATE의 ESG 및 지속가능 전문가들은 이제 Assessment와 Advisory 두 부문에 속하게 됩니다. 또한, 2018년에 인수한 Nettitude의 사이버 보안 전문가들은 이제 사이버 보안 부문으로 이동하였습니다.

2023년 6월부터 당사는 사업 전반에 걸쳐 하나의 LRQA 브랜드 아이덴티티로 통합하기 시작했습니다. 이를 통해 당사는 One LRQA라는 이름 아래 폭넓은 포트폴리오에서 일관되고 높은 수준의 서비스를 고객들에게 제공하고 있습니다. 앞으로 점차적으로 ELEVATE 브랜드를 사용하지 않고, LRQA 시각적 아이덴티티로 대체할 예정이며, LRQA 사이버 보안 포트폴리오 영역에 ‘LRQA Nettitude’라는 이름을 사용할 예정입니다. 이는 LRQA 브랜드와 동일합니다. 단, 보안 도메인의 무결성을 보호하기 위해 Nettitude 이름은 유지합니다.

이러한 변화는 LRQA와 LRQA 브랜드 패밀리에게 중요한 이정표입니다. 당사는 이 특별한 기회를 직원들과 함께 이끌어내고, 전 세계적으로 선도적인 보증 파트너로 자리매김하고자 합니다.

Paul Butcher

Chief Executive Officer, LRQA

LRQA의 최고 경영자인 Paul Butcher 는 다음과 같이 메시지를 전하였습니다:

“LRQA와 LRQA 브랜드 패밀리에게 중요한 이정표입니다. 당사는 이 특별한 기회를 통해 전 세계적인 보증 파트너로 선도하고자 합니다. 특히 ESG와 사이버 보안 서비스에 초점을 맞추고 있습니다. LRQA는 성장 전략을 신속하게 가속화하고 고객들에게 시장을 선도하는 제안을 제공하고 있습니다. 당사는 리스크 관리 분야의 선도적인 기업이 되기를 원하며, 하나의 시각적 아이덴티티 아래로 결합된 팀으로서 브랜드 밸류와 포트폴리오를 더욱 강화하기를 기대합니다.”

하나의 브랜드로 통합하면서 일부 자산과 콘텐츠는 점진적인 접근 방식으로 더 빠르게 변경될 것입니다. 고객과 협력 파트너들이 협업하는 팀이나 제공되는 서비스에는 아무런 영향이 없을 것입니다.

이러한 흥미로운 변화는 모두 LRQA에서 제공되는 강화된 서비스 패키지와 고객들을 연결하는 데 중점을 두고 있습니다. 함께 각각의 포트폴리오 영역이 고객들에게 매력적인 제안을 제공할 수 있기를 기대합니다.

고객 문의사항은 기존 연락처로 연락 주시기 바랍니다.

이 웹사이트에 대한 추가 정보: https://www.lrqa.com/ko-kr/latest-news/0711-important-milestone-in-lrqas-growth-journey/

0 notes