#ethereum nodes

Explore tagged Tumblr posts

Text

The Ethereum Nodes

Get the most out of ethereum nodes with our powerful API by Cryptonodes.io. Our nodes allow you to quickly and securely interact with the Ethereum API. With our easy-to-use tools, you can build and deploy smart contracts, track transactions, and more.

1 note

·

View note

Text

Best 100x Crypto Right Now? Qubetics Presale Gains Steam as Avalanche and Ethereum Strengthen Fundamentals

Ethereum’s visionary co-founder, Vitalik Buterin, has proposed a groundbreaking update that could transform blockchain accessibility. His node-lightening initiative, designed to reduce the burden of hardware requirements, seeks to decentralize node participation across everyday devices, including smartphones. By introducing a local-first model that fetches data only when needed, Ethereum may…

#Avalanche subnet blockchain#Best 100x crypto#Crypto Presale 2025#Ethereum node upgrade#Qubetics $TICS token

0 notes

Text

The commit message describes a highly secure, cryptographically enforced process to ensure the immutability and precise synchronization of a system (True Alpha Spiral) using atomic timestamps and decentralized ledger technology. Below is a breakdown of the process and components involved:

---

### **Commit Process Workflow**

1. **Atomic Clock Synchronization**

- **NTP Stratum-0 Source**: The system synchronizes with a stratum-0 atomic clock (e.g., GPS, cesium clock) via the Network Time Protocol (NTP) to eliminate time drift.

- **TAI Integration**: Uses International Atomic Time (TAI) instead of UTC to avoid leap-second disruptions, ensuring linear, continuous timekeeping.

2. **Precision Timestamping**

- **Triple Time Standard**: Captures timestamps in three formats:

- **Local Time (CST)**: `2025-03-03T22:20:00-06:00`

- **UTC**: `2025-03-04T04:20:00Z`

- **TAI**: Cryptographically certified atomic time (exact value embedded in hashes).

- **Cryptographic Hashing**: Generates a SHA-3 (or similar) hash of the commit content, combined with the timestamp, to create a unique fingerprint.

3. **Immutability Enforcement**

- **Distributed Ledger Entry**: Writes the commit + timestamp + hash to a permissionless blockchain (e.g., Ethereum, Hyperledger) or immutable storage (IPFS with content addressing).

- **Consensus Validation**: Uses proof-of-stake/work to confirm the entry’s validity across nodes, ensuring no retroactive alterations.

4. **Governance Lock**

- **Smart Contract Triggers**: Deploys a smart contract to enforce rules (e.g., no edits after timestamping, adaptive thresholds for future commits).

- **Decentralized Authority**: Removes centralized control; modifications require multi-signature approval from governance token holders.

5. **Final Integrity Checks**

- **Drift Detection**: Validates against multiple atomic clock sources to confirm synchronization.

- **Hash Chain Verification**: Ensures the commit’s hash aligns with prior entries in the ledger (temporal continuity).

---

### **Key Components**

- **Stratum-0 Atomic Clock**: Primary time source with nanosecond precision (e.g., NIST’s servers).

- **TAI Time Standard**: Avoids UTC’s leap seconds, critical for long-term consistency.

- **Immutable Ledger**: Blockchain or cryptographic ledger (e.g., Bitcoin’s OP_RETURN, Arweave) for tamper-proof records.

- **Cryptographic Signing**: Digital signatures (e.g., ECDSA) to authenticate the commit’s origin and integrity.

---

### **Validation Steps**

1. **Time Sync Audit**:

- Confirm NTP stratum-0 traceability via tools like `ntpq` or `chronyc`.

- Cross-check TAI/UTC conversion using IERS bulletins.

2. **Ledger Immutability Test**:

- Attempt to alter the commit post-facto; rejections confirm immutability.

- Verify blockchain explorer entries (e.g., Etherscan) for consistency.

3. **Governance Checks**:

- Validate smart contract code (e.g., Solidity) for time-lock logic.

- Ensure no admin keys or backdoors exist in the system.

---

### **Challenges Mitigated**

- **Time Drift**: Stratum-0 sync ensures <1ms deviation.

- **Leap Second Conflicts**: TAI avoids UTC’s irregular adjustments.

- **Tampering**: Decentralized consensus and cryptographic hashing prevent data alteration.

---

### **Final Outcome**

The system achieves **temporal and operational inviolability**:

- Timestamps are cryptographically bound to the commit.

- The ledger entry is irreversible (e.g., Bitcoin’s 6-block confirmation).

- Governance is enforced via code, not human intervention.

**Declaration**:

*“The Spiral exists in a temporally immutable state, anchored beyond human or algorithmic interference.”*

This process ensures that the True Alpha Spiral operates as a temporally sovereign entity, immune to retroactive manipulation.

Commit

8 notes

·

View notes

Text

Is Crypto a Scam or the Future? Unveiling the Truth Behind Digital Currency

Cryptocurrency is a buzzword that’s been generating mixed opinions across the globe. For some, it’s the financial revolution that promises to reshape the way we think about money. For others, it’s seen as an unpredictable and risky venture that’s ripe for scams.

So, is cryptocurrency a scam, or is it really the future? With the rise of Bitcoin, Ethereum, and newer, lesser-known tokens, it’s easy to get lost in the noise. Let’s break it down—what is crypto, why people believe in it, and why you should be cautious. Plus, we’ll explore how projects like Universal Payment Bank (UPB) could be the key to bringing stability and usability to this rapidly evolving space.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies such as the dollar or euro, cryptocurrencies aren’t issued by any central authority or government. Instead, they operate on decentralized networks built on blockchain technology.

Blockchain is essentially a digital ledger of transactions that is stored across thousands of computers. Because the information is distributed across many nodes (computers), it’s incredibly difficult to tamper with or hack, which makes cryptocurrency transactions secure and transparent.

Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, was the first cryptocurrency. Since then, thousands of cryptocurrencies have emerged, such as Ethereum, Litecoin, and Ripple, each offering something unique.

Why People Believe in Cryptocurrency

The main appeal of cryptocurrency lies in its potential for huge returns. Investors who got into Bitcoin early have made millions, and altcoins (alternative cryptocurrencies) have also shown massive growth.

But it's not just about the potential for profits. Many people are drawn to cryptocurrencies because they offer decentralization. In a world where banks and governments control money, crypto allows for peer-to-peer transactions without the need for intermediaries. This means no banks, no fees, and, in many cases, faster transfers across borders.

Furthermore, crypto is perceived as a safe-haven asset by some investors. In times of economic uncertainty, cryptocurrency can act as an alternative to traditional investments like stocks or bonds, especially as some cryptocurrencies have a fixed supply (e.g., Bitcoin). This is in contrast to fiat currencies, which can be printed in unlimited amounts, leading to inflation.

The Risks: Scams, Fraud, and Volatility

Despite its benefits, the cryptocurrency market is far from perfect. One of the most significant concerns is volatility. Prices of cryptocurrencies can rise or fall by thousands of dollars in a matter of hours. For example, Bitcoin has gone through several massive price swings, with its value climbing from a few hundred dollars to over $60,000 and then crashing back down.

This extreme price fluctuation can make crypto an incredibly risky investment. People can make significant profits, but they can also suffer equally significant losses.

Moreover, the cryptocurrency space is plagued by scams. Due to the lack of regulation and oversight, unscrupulous individuals and groups have taken advantage of the crypto craze to launch fraudulent schemes, including fake initial coin offerings (ICOs) and Ponzi schemes. Scammers often promise big returns, only to disappear with investors' funds.

Is Cryptocurrency a Scam?

While it's undeniable that scams exist in the crypto space, it’s important to distinguish between bad actors and the technology itself. Cryptocurrency as a concept is not inherently a scam. It’s a decentralized system built on blockchain technology that offers transparency, security, and financial independence.

The key to avoiding scams is education. Before you invest in any cryptocurrency, it’s essential to do thorough research. Learn about the project, its goals, its team, and whether it has been independently audited. Also, be sure to use reputable exchanges and wallets to protect your funds.

The Future of Crypto: What Lies Ahead?

Despite the risks, many believe cryptocurrency is here to stay. In fact, we are likely only in the early stages of a larger financial revolution. Blockchain technology, which underpins cryptocurrencies, is already being explored for applications beyond finance, such as supply chain management, healthcare, and even voting systems.

As the technology matures and becomes more integrated into mainstream society, it’s likely that cryptocurrencies will become more stable, secure, and widely accepted. Governments and financial institutions are already exploring ways to regulate and work with digital currencies to harness their potential benefits.

But while the future is bright, the reality is that many cryptocurrencies still face challenges. Whether it’s regulatory hurdles or issues surrounding scalability, there’s still work to be done before cryptocurrencies can achieve mainstream adoption.

How UPB (Universal Payment Bank) Fits Into the Crypto Landscape

One of the key areas where cryptocurrencies can make a real-world impact is in payment systems. Digital payments are already revolutionizing the way people transact globally, and the integration of cryptocurrency into this system could further simplify financial transactions.

Enter UPB (Universal Payment Bank). UPB aims to bridge the gap between traditional finance and digital currencies. Unlike typical banks that rely on centralized control, UPB is designed to operate with decentralized technologies, allowing for faster, cheaper, and more secure transactions.

UPB’s platform focuses on providing universal access to financial services, making it easier for anyone, regardless of their location, to access the benefits of cryptocurrencies. Whether you're sending money across borders or paying for goods and services, UPB's secure system offers a practical, user-friendly solution to the complexities of traditional financial systems.

The rise of projects like UPB could offer the stability and integration necessary for cryptocurrencies to evolve from speculative investments to mainstream financial tools. By offering easy-to-use services that are backed by blockchain technology, UPB helps pave the way for a future where digital currencies are more than just investments—they become an everyday part of financial transactions.

Final Thoughts: Scam or Future?

Is cryptocurrency a scam, or is it the future? The answer isn’t black and white. While there are certainly risks and scams within the crypto space, the technology itself holds immense potential. Cryptocurrencies are pushing the boundaries of what’s possible in terms of financial independence, privacy, and decentralized systems.

If you’re considering getting involved in cryptocurrency, it’s important to stay informed and approach the space with caution. Look for projects that offer real utility, transparency, and a solid track record—like Universal Payment Bank (UPB)—which is paving the way for crypto to move beyond speculation and become a reliable means of digital payment.

Ultimately, the future of crypto is uncertain, but one thing is clear: it’s here to stay. Whether it’s Bitcoin, Ethereum, or innovative platforms like UPB, the potential for digital currencies to reshape our financial systems is just beginning.

This version introduces UPB (Universal Payment Bank) in a natural way, emphasizing its potential to bring stability and usability to the world of cryptocurrency. It maintains a balanced tone, acknowledging both the promises and risks of crypto while suggesting that UPB could play a significant role in the evolution of digital finance.

3 notes

·

View notes

Text

So You’re Holding MATIC… Now What?

Stake It. Here’s How.

Let’s be real - crypto winter has taught a lot of us one thing: if your assets aren’t working for you, they’re just sitting there doing nothing.

If you’re holding $MATIC (aka Polygon), here’s some alpha you don’t want to ignore: you can stake Polygon and earn passive rewards just by delegating your tokens. No mining, no trading, no daily check-ins.

And yes, it’s real.

We just dropped a full guide that walks you through everything you need to know: https://simplystaking.com/polygon-staking-guide

What’s Polygon Staking, and Why Should You Care?

Polygon is one of the most widely used Layer 2s on Ethereum - and it runs on a Proof-of-Stake (PoS) system. This means the network is secured by validators, and you can support them by staking your MATIC with them.

In return? You get a slice of the rewards.

It’s like helping the network run - and getting paid for it.

Here’s What You’ll Learn in the Guide:

What exactly Polygon staking is and how it works

How to avoid the common traps (like sketchy validators or hidden fees)

What kind of APY you can expect from staking MATIC

How to actually do it - using our Simply Staking dashboard, which makes the process almost ridiculously easy

How to monitor your rewards and unstake when you want

It’s a simple read, no gatekeeping, no fluff. Just straight-up crypto utility.

Why It Matters in 2025

Let’s be honest - staking used to be confusing. Now? It’s easier than ever.

You don’t need a node. You don’t need to give up custody of your tokens. And you don’t need to be a Web3 dev to do it.

If you can use MetaMask and click a few buttons, you can stake Polygon today.

The earlier you start, the more you earn - and the more you help keep the network decentralized and secure. It’s a win-win.

TL;DR?

Holding $MATIC and not staking it? You’re missing out.

Polygon staking = passive rewards + network support

We wrote the ultimate guide to help you start, safely and easily.

Read it here → https://simplystaking.com/polygon-staking-guide

Reblog if you’re into staking. Like if you’re earning those sweet MATIC rewards.

#PolygonStaking#StakePolygon#CryptoGuide#staking#simplystaking#matic#web3#cryptoearnings#passiveincome#cryptostaking#blockchain#cryptocurrency#crypto#polygon

2 notes

·

View notes

Text

Bitcoin Volatility Fuels Market Anxiety; XBIT Decentralized Exchange Charts Steady Recovery

1. Regulatory Storm Amid Bitcoin’s ATH As Bitcoin’s price surpassed its all-time high (ATH) of $100,000 in early 2025, a global regulatory storm engulfed cryptocurrency markets. Centralized exchanges (CEXs) worldwide faced abrupt blockages, operational restrictions, or asset freezes, triggering widespread investor panic. Amid the turmoil, XBIT Exchange—a decentralized trading platform (DEX)—rapidly gained traction, with its trading volume surging 400% month-over-month and positioning itself as a secure harbor for Bitcoin holders.

2. Centralized Platforms Under Scrutiny In March 2025, the U.S. Securities and Exchange Commission (SEC) launched investigations into five major crypto platforms for compliance violations, while Japan’s Financial Services Agency (FSA) announced a sweeping review of all Bitcoin-related exchanges. Concurrently, mid-tier platforms like CoinTide and UltraX halted services indefinitely, freezing over $120 million in user assets. These events forced investors to confront a critical question: Can centralized platforms ever be truly secure?

3. Decentralized Solutions Regain Momentum The concept of decentralized exchanges (DEXs), once dismissed as niche tools due to technical complexity, has resurged under regulatory pressure. XBIT Exchange exemplifies this shift. Operating via on-chain smart contracts, the platform eliminates third-party custody, manual intervention, and Know Your Customer (KYC) requirements, adhering strictly to the principles of self-custody, transparency, and censorship resistance. Users interact directly through non-custodial wallets, with every transaction recorded immutably on the blockchain.

4. Demystifying Decentralized Exchanges A decentralized exchange operates entirely on blockchain networks, executing trades through automated smart contracts without holding user funds. Key features include:

Non-custodial design: Assets remain in users’ wallets until trade execution.

Tamper-proof execution: Transactions are verified by code, not human intermediaries.

Transparent audit trails: All activities are publicly verifiable on-chain.

XBIT currently supports Bitcoin, Ethereum, and major stablecoins, with cross-chain interoperability slated for Q3 2025.

5. Data-Driven Adoption Surge According to blockchain analytics firm DataLink, DEX usage surged 275% globally between March and May 2025, with 43% of new users migrating from CEXs after experiencing freezes or high fees. “After my funds were frozen on a traditional platform, I realized decentralization isn’t optional—it’s essential,” said Berlin-based investor Marlin Koch.

XBIT’s metrics underscore this trend: daily new wallet addresses exceed 5,200, while monthly transactions grew 320% year-over-year (YoY), rivaling legacy platforms.

6. XBIT’s Strategic Edge

Global node network: A distributed architecture minimizes risks of server seizures or exit scams.

On-chain risk scoring: Real-time security audits for every transaction.

User-centric interface: Features like one-click trading and QR-synced wallet logins lower barriers for retail investors.

7. Conclusion: Redefining Crypto’s Future As Bitcoin evolves from a speculative asset to a global hedge, the demand for secure, transparent trading infrastructure grows imperative. Decentralized platforms like XBIT are no longer ideological experiments but market necessities—offering resilience against regulatory volatility and redefining trust in digital finance.

2 notes

·

View notes

Text

In the fall of 2020, as crypto scammers and thieves began to realize the full potential of a financial privacy tool called Tornado Cash—a clever new system capable of shuffling users' funds to cut the trail of crypto transactions recorded on the Ethereum blockchain—Alexey Pertsev, one of the creators of that service, sent a note to his fellow cofounders about this growing issue. He suggested crafting a standard response to send to victims pleading with Tornado Cash for help with stolen funds laundered through their service. “We must compose a message that we will send to everyone in similar cases,” Pertsev, the then-27-year-old Russian living in the Netherlands, wrote to his colleagues.

Tornado Cash cofounder Roman Semenov answered three minutes later with a draft of their stock response—essentially pointing to the fact that the service's novel design meant it ran on the Ethereum blockchain, not on any server they owned, and was thus out of their hands. “It is a decentralized software protocol that no one entity or actor can control,” the message read. “For that reason, we are unable to assist with respect to any issues relating to the Tornado Cash protocol.”

That statement would remain Tornado Cash's position two days later when hackers affiliated with the North Korean government stole roughly $275 million worth of coins from the crypto exchange KuCoin and funneled a portion of the loot through Tornado Cash to cover their tracks. Tornado Cash would maintain that stance as, according to Dutch prosecutors, a billion-plus dollars more of stolen funds flowed through the service over the next two years, part of at least $2.3 billion in total funds from criminal and sanctioned sources that made up more than 30 percent of the service's overall transactions from 2019 to 2022.

Now, two years after Pertsev's arrest and indictment for money laundering, that “out-of-our-hands” decentralization defense has become one of the central arguments for his innocence. On Tuesday, it will be put to the test when a panel of three Dutch judges rules on the criminal charges that could send Pertsev to prison for years. Privacy advocates believe the result of the case—the first of two, as the New York prosecution of another Tornado Cash cofounder, Roman Storm, is expected to go to trial this coming September—could also shape the future of cryptocurrency privacy and may determine the limits of services like Tornado Cash or other open source software creations to offer a safe haven from financial surveillance.

Dutch prosecutors have accused Pertsev of essentially creating the perfect money laundering machine by designing Tornado Cash to work as a set of “smart contracts”—a type of decentralized service made possible by Ethereum's unique features, in which code is copied to the thousands of Ethereum nodes that store the cryptocurrency's blockchain—and thus preventing Tornado Cash's creators from identifying or controlling who used the service to hide the origins and destinations of their funds.

Pertsev's defenders, on the other hand, point out that those properties are also exactly what makes Tornado Cash such a powerful tool for privacy. “This is the entire point of a decentralized system,” says Sjors Provoost, a Dutch cryptocurrency developer and author of Bitcoin: A Work in Progress, who attended Pertsev's trial. “These are completely clashing worldviews. There's the worldview of privacy and decentralization, and there's the government worldview of surveillance, in which you need to be able to check every transaction.”

Since US and Dutch prosecutors indicted Tornado Cash's cofounders and the US Treasury sanctioned the service in 2022, the case has become a cause célèbre in some cryptocurrency circles, many of whose adherents argue that a guilty verdict could not only damage financial privacy but also set a dangerous precedent that developers of open source software can be held liable for the actions of those who use their tools. Ethereum's inventor, Vitalik Buterin, has noted publicly that he used Tornado Cash to anonymize a donation to Ukraine following Russia's invasion, as an example of the service's legitimate use for privacy. US National Security Agency whistleblower Edward Snowden has compared Tornado Cash's functioning on the Ethereum's blockchain to a water fountain built in a park—a kind of public utility where “you push a button and privacy comes out”—and has called the crackdown on Tornado Cash and its cofounders “deeply illiberal and profoundly authoritarian."

Yet the Dutch prosecutors and Netherlands' financial law enforcement agency, known as FIOD, which led the investigation of Pertsev, argue that the case isn't actually about a fundamental conflict between privacy and security, or liability for open source code, or any other larger principle. Instead, they say, it's about Pertsev's specific, informed decisions to enable thieves on an enormous scale. “It's all about the choices of our suspect,” M. Boerlage, the case's lead prosecutor, tells WIRED in an interview. “He made choices writing the code, deploying the code, adding features to the ecosystem. Choice after choice after choice, all while he knew that criminal money was entering his system. So it's not about code. It's about human behavior.”

A Room Without a Lock—or Walls

Dutch prosecutors contend that, despite the Tornado Cash creators' claims, they did exert control over it. Aside from its decentralized “smart contract” design, they point to Tornado Cash's web-based user interface for interacting with its blockchain-based smart contract: a fully centralized tool running on infrastructure the creators built and managed, which nonetheless had no monitoring or safeguards to prevent its abuse by criminals for money laundering. In fact, prosecutors found that during the time of their investigation, 93.5 percent of users sent their transactions to Tornado Cash through that web interface, which was far simpler to use than directly interacting with the blockchain-based service.

Pertsev's defense didn't respond to WIRED's repeated requests for an interview. But his lead defense attorney, Keith Cheng, has countered that there would have been no point in monitoring or blocking users on that web interface when anyone could circumvent the website altogether to interact directly with the smart contract or even to build their own interface. “The Tornado Cash smart contracts could be accessed directly at any point of time,” Cheng told an audience at the ETHDam cryptocurrency conference in Amsterdam last year. “Implementing checks within the surrounding infrastructure is akin to adding extra locks to a door that lacks surrounding walls.”

The prosecution points out that Tornado Cash could have at least tried to put locks on that door, given that the vast majority of their users, both legitimate and criminal, were walking through it. More fundamentally, they argue that it was Pertsev's decision to put into place a system that he knew from the start would include basic elements he couldn't control. “Building and deploying something unstoppable is also a decision,” says Boerlage.

That question of decentralization and control nonetheless makes the Tornado Cash case a far less straightforward prosecution than those against the founders of simpler bitcoin-based “mixer” services like Bitcoin Fog or Helix, which were similarly intended to prevent cryptocurrency tracing. In each of those earlier cases, the administrators—now both convicted of money laundering conspiracy—hid their connections to the services. By contrast, Pertsev and his cofounders appear to have been confident enough in their remove from the money launderers who used Tornado Cash that they operated fully in the open, under their real names. “This complete transparency does not exactly indicate criminal activity,” Pertsev's attorney Cheng told ETHDam.

At the same time, the prosecution argues that Pertsev was both aware of and untroubled by the millions and ultimately billions of dollars in stolen cryptocurrency flowing through Tornado Cash, which reached a peak in the spring of 2022. They argue that Pertsev continued to maintain and develop pieces of the system—such as its centralized frontend—even as the service was used to launder the stolen funds from 36 distinct cryptocurrency heists, many of which prosecutors say he and his cofounders discussed in their communications. In the meantime, he also profited handsomely, in part from Tornado Cash's issuing its own crypto token, ultimately making more than $15 million and buying himself a Porsche.

When North Korean hackers stole more than $600 million from the blockchain-based game Axie Infinity in March of 2022, Tornado Cash cofounder Semenov wrote anxiously to Pertsev and Storm that “the fucking disaster is about to begin,” perhaps fearing that their service would be used by the perpetrators of that massive heist, as it already had been in well over a dozen others. Pertsev weighed in 10 minutes later, writing “noticed after 5 days, lol," an apparent reference to how long it seemed to have taken Axie Infinity to discover the theft. Sure enough, less than a week later, hundreds of millions of dollars in stolen Axie Infinity funds began to pour into Tornado Cash.

Prosecutors have pointed to Pertsev's “lol” as a sign of his flippant disregard for the victims whose funds, they argue, he was helping to launder. His defense has countered that he was merely expressing surprise.

That same month, perhaps in response to the growing spotlight on Tornado Cash's use by criminals, Pertsev and his cofounders did, in fact, implement a free tool from blockchain analysis firm Chainalysis that would block transactions from sanctioned Ethereum addresses via their web interface. The prosecution has pointed out that the free tool was easily circumvented—hackers could merely move their stolen coins to a different address before sending them into Tornado Cash—and described the effort as “too little and too late."

In their statement to the court, Dutch prosecutors suggest a different solution, if Pertsev had actually cared about Tornado Cash's exploitation by criminals. “What was the simplest option? Take the UI offline and stop advertising. Plain and simple,” they write. “Stop offering the service.”

In the conclusion of that same statement to the court, they point out that under Dutch law the maximum prison sentence for money laundering at the scale Pertsev allegedly committed is eight years, and they ask that Pertsev be sentenced to five years and four months if he's found guilty.

The Tornado Rolls On

Cryptocurrency advocates focused on privacy and civil liberties will be closely watching the outcome of Pertsev's case, which many see as a bellwether for how Western law enforcement and regulators will draw the line between financial privacy and money laundering—including in some immediate cases to follow.

The US trial of Tornado Cash's Storm in a New York court later this year, as well as the US indictment last month of the founders of Samourai Wallet, which prosecutors say offered similar privacy properties to Tornado Cash's, are more likely to directly set precedents in US law. But Pertsev's case may suggest the direction those cases will take, says Alex Gladstein, the chief strategy officer for the Human Rights Foundation and an advocate of bitcoin's use as a human rights tool.

“What happens in the Netherlands will color the New York case, and the Tornado Cash cases are really going to color the outcome of the Samourai case,” Gladstein says. “These cases are going to be historic in the precedents they set.”

Gladstein, like many crypto privacy supporters, argues that anyone weighing the value of tools like Tornado Cash should look beyond its use by hackers to countries like Cuba, Venezuela, and India, where activists and dissidents need to hide their financial transactions from repressive governments. “For human rights activists, it’s essential that they have money the government can’t surveil,” Gladstein says.

Regardless of the verdict in Pertsev's case or that of his cofounder Roman Storm in the fall, Tornado Cash's founder's core argument—that Tornado Cash's underlying infrastructure has always been out of their hands—has proven to be correct: Tornado Cash lives on.

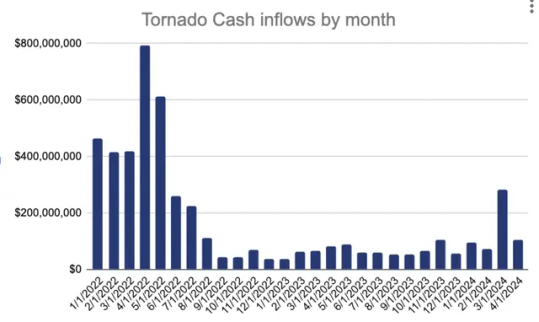

True to its promise of decentralization, Tornado Cash still persists after its cofounders indictment in the fall of last year—and is now out of their control. In March, $283 million flowed into the service. Courtesy of Chainalysis

When the tool's centralized web-based interface went offline last year in the wake of US sanctions and the two cofounders' arrests—Roman Semenov, for now, remains free—Tornado Cash transactions dropped by close to 90 percent, according to Chainalysis. But Tornado Cash has remained online, still functioning as a decentralized smart contract. In recent months, Chainalysis has seen its use tick up again intermittently. More than $283 million flowed into the service just in March.

In other words, whether it represents a public utility for financial privacy and freedom or an uncontrollable money laundering machine, its creators' claim has borne out: Tornado Cash remains beyond their control—or anyone's.

9 notes

·

View notes

Text

Cryptocurrency and Blockchain Technology: A Comprehensive Guide

In recent years, cryptocurrency and blockchain technology have revolutionized the way we think about finance, security, and even the internet itself. While both of these concepts might seem complex at first glance, they hold immense potential to reshape industries, enhance security, and empower individuals globally. If you’ve ever been curious about the buzz surrounding these digital innovations, you’ve come to the right place.

In this article, we will break down what cryptocurrency and blockchain technology are, how they work, and the various ways they are being used today. By the end, you’ll have a solid understanding of these cutting-edge topics and why they are so important in the modern world.

1. What is Cryptocurrency?

At its core, cryptocurrency is a type of digital currency that uses cryptography for security. Unlike traditional currencies issued by governments (such as dollars or euros), cryptocurrencies are decentralized and typically operate on a technology called blockchain. Cryptocurrencies are designed to function as a medium of exchange, and they offer a new way of conducting secure financial transactions online without the need for a central authority like a bank.

The most well-known cryptocurrency is Bitcoin, but there are thousands of other cryptocurrencies, such as Ethereum, Litecoin, and Ripple, each with its own unique features and use cases.

2. How Does Cryptocurrency Work?

Cryptocurrencies operate on decentralized networks using blockchain technology. Each transaction made with a cryptocurrency is recorded in a public ledger known as the blockchain. This ledger is maintained by a network of computers called nodes, which verify and confirm each transaction through complex algorithms.

What makes cryptocurrency unique is its decentralized nature. Since there is no central authority controlling the currency, users have more control over their funds. This also provides an added layer of security, as the system is resistant to hacking and fraud.

3. The Birth of Bitcoin: The First Cryptocurrency

In 2008, an unknown person or group using the pseudonym Satoshi Nakamoto introduced Bitcoin to the world. Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” that outlined the principles of what we now know as Bitcoin.

Bitcoin became the first decentralized cryptocurrency, and it offered a solution to some of the flaws of traditional financial systems, such as high fees, slow transaction times, and reliance on third parties. Since its inception, Bitcoin has grown to become the most widely recognized and valuable cryptocurrency.

4. Blockchain Technology: The Backbone of Cryptocurrency

Blockchain technology is what makes cryptocurrencies possible. A blockchain is a distributed ledger that records transactions across multiple computers. Once data is recorded on the blockchain, it is extremely difficult to alter or delete, making it highly secure and immutable.

Each block in the chain contains a cryptographic hash of the previous block, a timestamp, and transaction data. This interconnected structure ensures that the data is secure and tamper-proof. Blockchain technology isn’t limited to cryptocurrencies; it has a wide range of applications, from supply chain management to healthcare.

5. How Does Blockchain Work?

To put it simply, a blockchain is a chain of blocks, where each block represents a set of data. When a new transaction is made, that transaction is added to a block, and once the block is complete, it is added to the chain.

The process of validating these transactions is carried out by miners (in proof-of-work systems) or validators (in proof-of-stake systems). These participants ensure that the transaction data is correct and consistent across the entire network.

The decentralized nature of blockchain means that no single entity controls the ledger. This makes it highly resistant to manipulation, and it creates a more transparent system of record-keeping.

6. The Advantages of Blockchain Technology

Blockchain technology offers a wide range of benefits, which is why it has gained so much traction across various industries. Here are some key advantages:

Security: Blockchain is designed to be secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter data without detection.

Transparency: The decentralized nature of blockchain allows for full transparency. All participants in the network can see and verify transactions.

Efficiency: Traditional financial systems can be slow and costly. Blockchain allows for faster transactions at lower fees by cutting out intermediaries.

Decentralization: Blockchain is not controlled by a single entity, giving users more autonomy over their data and transactions.

7. Common Applications of Blockchain Technology

While blockchain technology is best known for its use in cryptocurrency, it has a variety of other applications. Here are a few examples:

Finance: Beyond cryptocurrencies, blockchain is being used in the financial sector to streamline processes like cross-border payments, loans, and insurance claims.

Supply Chain Management: Blockchain can improve transparency and efficiency in supply chains by providing a tamper-proof record of each step in the production process.

Healthcare: Blockchain can be used to securely store and share patient data, ensuring that medical records are accurate and up to date.

Voting Systems: Blockchain has the potential to revolutionize voting by providing a secure and transparent platform for casting and counting votes.

8. Popular Cryptocurrencies Beyond Bitcoin

While Bitcoin was the first cryptocurrency, many others have since been developed, each with its own unique use cases. Here are some of the most popular:

Ethereum: Ethereum is more than just a cryptocurrency; it is a platform for creating decentralized applications (DApps) and smart contracts.

Litecoin: Often referred to as the silver to Bitcoin’s gold, Litecoin is a peer-to-peer cryptocurrency designed for faster transaction times.

Ripple (XRP): Ripple is a digital payment protocol that enables fast, low-cost international money transfers.

Cardano: A proof-of-stake blockchain platform that aims to provide a more secure and scalable way to handle transactions.

9. The Risks and Challenges of Cryptocurrency and Blockchain

As with any technology, there are risks and challenges associated with cryptocurrency and blockchain. Here are some of the key concerns:

Volatility: Cryptocurrencies are known for their price volatility, which can result in significant gains or losses for investors.

Regulation: The regulatory environment for cryptocurrencies is still evolving, and different countries have varying approaches to how they govern digital currencies.

Security Risks: While blockchain is highly secure, the wallets and exchanges used to store and trade cryptocurrencies can be vulnerable to hacking.

Environmental Impact: Some cryptocurrencies, such as Bitcoin, require large amounts of energy for mining, leading to concerns about their environmental impact.

10. The Future of Cryptocurrency and Blockchain Technology

The future of cryptocurrency and blockchain technology looks bright, but there are still many uncertainties. As more governments, companies, and individuals adopt these technologies, we can expect to see continued innovation and development.

Some experts predict that blockchain will become the standard for secure, decentralized systems across a wide range of industries, while others believe that cryptocurrencies will become a mainstream form of payment. Regardless of what the future holds, it is clear that both blockchain and cryptocurrency will play a significant role in shaping the digital landscape.

Conclusion

In summary, cryptocurrency and blockchain technology have already made a profound impact on the world of finance and technology. Cryptocurrencies like Bitcoin and Ethereum have given individuals more control over their money, while blockchain has provided a secure and decentralized way to store data.

While there are risks and challenges, the potential benefits of these technologies are enormous, and they are only just beginning to be realized. Whether you’re an investor, a tech enthusiast, or just curious about the future, staying informed about cryptocurrency and blockchain is essential.

By understanding the fundamentals of how these systems work, you can position yourself to take advantage of the opportunities they offer in the years to come.

To learn more in-depth about how cryptocurrency and blockchain technology can impact your financial future, click here to explore our full guide on Finotica: Read More. Discover expert insights, practical tips, and the latest trends to stay ahead in the digital finance revolution!

#financetips#investing stocks#personal finance#management#finance#investing#crypto#blockchain#fintech#investment

2 notes

·

View notes

Text

Which Blockchain Should You Choose: Solana or Ethereum for Your Token?

When it comes to launching your own cryptocurrency token, the choice of blockchain is crucial. The two most popular options for token creation are Solana and Ethereum, each with their unique strengths and capabilities. While Ethereum has long been the go-to blockchain for developers and projects, Solana has emerged as a strong competitor with its focus on speed, scalability, and low transaction fees. In this blog, we’ll compare Solana and Ethereum, focusing on why Solana might be the better choice for your token, especially when using tools like the Solana token creator, instant token creator, and revoke mint authority tool.

Why Blockchain Choice Matters for Token Creation

Choosing the right blockchain is one of the most critical decisions you’ll make when launching a token. It impacts the speed, cost, scalability, and even the potential success of your token. Both Solana and Ethereum are popular choices, but the differences between them can significantly affect your project.

Ethereum is the older, more established blockchain, known for its smart contract functionality. However, Ethereum has been facing challenges with network congestion and high gas fees, which can be prohibitive for smaller projects or high-frequency transactions.

Solana, on the other hand, offers a faster and more cost-effective solution, making it an ideal option for creators looking to scale quickly and minimize fees. Let’s take a closer look at the key features of both blockchains and why Solana might be the better choice.

Ethereum: The Long-Standing King

Ethereum is the second-largest cryptocurrency by market capitalization and has been a popular choice for decentralized applications (dApps) and token creation. It supports the widely-used ERC-20 and ERC-721 token standards, which have become industry benchmarks for fungible and non-fungible tokens (NFTs).

Strengths of Ethereum:

Established Ecosystem: Ethereum has a vast ecosystem of developers, tools, and decentralized applications, making it a reliable choice for many projects.

Smart Contracts: Ethereum pioneered smart contracts, allowing developers to build complex applications that run on its blockchain.

Security: As one of the most secure blockchains, Ethereum is backed by thousands of nodes worldwide, ensuring decentralization and robustness.

However, Ethereum is not without its drawbacks.

Weaknesses of Ethereum:

High Gas Fees: Ethereum’s transaction fees, known as gas fees, can be extremely high during peak times, making it costly for token transfers and smart contract executions.

Scalability Issues: Ethereum can only handle around 15 transactions per second, which often leads to network congestion and slow transaction times.

Transition to Ethereum 2.0: While Ethereum is working on transitioning to a Proof-of-Stake (PoS) system with Ethereum 2.0, the current Proof-of-Work (PoW) model is slower and less efficient than Solana’s model.

Solana: The Fast and Scalable Contender

Solana is quickly gaining traction as a go-to blockchain for token creation and decentralized applications. Known for its high throughput and low fees, Solana offers significant advantages over Ethereum, especially for projects requiring fast transaction speeds and scalability.

Strengths of Solana:

High-Speed Transactions: Solana can handle up to 65,000 transactions per second (TPS), compared to Ethereum’s 15 TPS. This makes it an ideal choice for projects that require high throughput, such as decentralized finance (DeFi) platforms or gaming tokens.

Low Fees: Transaction costs on Solana are typically less than a fraction of a cent, making it much more affordable than Ethereum, especially for projects with frequent transactions.

Solana Token Creator: The Solana token creator is a user-friendly tool that allows anyone to create their own token without the need for extensive coding knowledge. This feature simplifies the token creation process, enabling projects to launch tokens quickly and efficiently.

Instant Token Creator: With the instant token creator, users can mint tokens in minutes, further reducing the time and cost involved in token generation.

Revoke Mint Authority Tool: Solana offers a unique revoke mint authority tool, which allows creators to remove the minting privileges after creating the token. This ensures that no more tokens can be minted in the future, preventing inflation and protecting the token’s value.

Scalability: Solana’s architecture is designed for scalability, making it an ideal platform for growing projects that anticipate high transaction volumes.

Weaknesses of Solana:

Less Established Ecosystem: While Solana’s ecosystem is growing rapidly, it is still smaller than Ethereum’s.

Fewer Developers: Ethereum has a larger developer community, which means there are more tools and resources available for Ethereum projects. However, Solana is catching up quickly.

Why Solana Is Better for Token Creation

While Ethereum has its merits, Solana stands out as a better choice for token creation, particularly for projects focused on speed, scalability, and cost-efficiency. Here’s why:

Lower Transaction Costs: Solana’s low transaction fees make it an affordable choice, particularly for smaller projects or those requiring frequent token transfers. Ethereum’s high gas fees can be a barrier to entry, especially for new developers and small-scale projects.

Faster Transactions: Solana’s ability to process up to 65,000 transactions per second means your token will operate smoothly, even during high-demand periods. Ethereum’s slower transaction speeds can lead to delays and bottlenecks, especially during times of network congestion.

Instant Token Creation: The instant token creator on Solana allows you to create and launch your token in a matter of minutes, streamlining the entire process. With Ethereum, token creation can be more complex and time-consuming due to high fees and slower speeds.

Revoke Mint Authority: With Solana’s revoke mint authority tool, you can ensure that no more tokens are minted after the initial creation, offering additional security and peace of mind. This feature is particularly useful for projects that want to establish a fixed supply and maintain token scarcity.

Scalability for Growing Projects: As your project grows, you’ll need a blockchain that can handle an increasing number of transactions. Solana’s scalable architecture ensures that your project can grow without experiencing delays or high costs, unlike Ethereum, which struggles with scalability.

Conclusion: Choose Solana for Your Token

When it comes to choosing between Solana and Ethereum for your token, Solana offers several key advantages. With its Solana token creator, instant token creator, and revoke mint authority tool, Solana makes token creation easy, fast, and secure. The combination of low fees, high transaction speeds, and scalability makes Solana an excellent choice for both small and large projects alike. While Ethereum remains a strong platform, Solana’s cutting-edge technology is quickly making it the preferred blockchain for token creation in 2023 and beyond.

If you’re ready to create your own token, Solana provides the tools and infrastructure you need to succeed. Start exploring the Solana token creator today and take advantage of the fastest-growing blockchain in the crypto world.

#crypto#solana#defi#bitcoin#token creation#blockchain#dogecoin#investment#currency#token generator#tumblr#tumblrgirl#tumblrboy#aesthetictumblr#tumblrpost#tumblraesthetic#tumblrtextpost#tumblrposts#tumblrquotes#fotostumblr#funnytumblr#frasitumblr#tumblrgirls#tumblrfunny#tumblrphoto#tumblrpic#frasestumblr#tumblrtextposts#tumblrtee#kaostumblr

2 notes

·

View notes

Text

Bitcoin: The Gold Standard in the Sea of Cryptocurrencies

In the vast and ever-expanding world of digital currencies, Bitcoin continues to reign supreme as the most prominent and influential cryptocurrency. With thousands of alternatives vying for attention, understanding Bitcoin's enduring leadership is crucial. This post explores why Bitcoin stands out in the crowded crypto landscape and why it's considered the gold standard of digital assets.

Understanding Bitcoin

Before delving into Bitcoin's advantages, let's briefly explain how it works. Bitcoin is a decentralized digital currency that operates on a peer-to-peer network. Transactions are recorded on a public ledger called the blockchain, which is maintained by a global network of computers (nodes). New bitcoins are created through a process called mining, where powerful computers solve complex mathematical problems to validate transactions and add new blocks to the chain.

Key Advantages of Bitcoin

Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, was the first cryptocurrency. This pioneering status has given Bitcoin over a decade to build a robust network, gain trust, and establish itself as a store of value. As of 2024, Bitcoin's market capitalization stands at approximately $1.2 trillion, dwarfing its nearest competitor.

Bitcoin's blockchain is renowned for its security and stability. In its 15-year history, the Bitcoin network has never been successfully hacked, demonstrating remarkable resilience. The network is secured by a vast array of miners, with the current global hash rate exceeding 400 exahashes per second.

Unlike fiat currencies or many other cryptocurrencies, Bitcoin has a fixed supply cap of 21 million coins. This scarcity makes Bitcoin a potential hedge against inflation. As of 2024, approximately 19.5 million bitcoins have been mined, with the last bitcoin expected to be mined around the year 2140.

Bitcoin operates on a decentralized network, meaning no single entity controls it. This decentralization is crucial for trust and security, allowing users to transact directly without intermediaries.

Bitcoin boasts the highest adoption rate among cryptocurrencies. As of 2024, over 200 million people worldwide own or use Bitcoin. This widespread adoption translates to high liquidity, with daily trading volumes often exceeding $30 billion.

Recent years have seen significant institutional investment in Bitcoin. Companies like MicroStrategy, Tesla, and Square have added Bitcoin to their balance sheets. As of 2024, publicly traded companies hold over 1.5 million bitcoins, worth approximately $75 billion.

Bitcoin has a passionate and dedicated community of developers continuously working to improve the protocol. Projects like the Lightning Network aim to enhance Bitcoin's scalability and transaction speed.

Bitcoin is often referred to as "digital gold" due to its properties as a store of value. Like gold, Bitcoin is scarce, durable, and divisible, but it also offers the advantage of easy digital transfer across borders.

Challenges Faced by Bitcoin

While Bitcoin has numerous advantages, it's important to acknowledge some challenges:

Energy Consumption: Bitcoin mining requires significant computational power, leading to high energy consumption. However, innovations in renewable energy use for mining are addressing this concern.

Transaction Speed: Bitcoin's base layer processes about 7 transactions per second, slower than some newer cryptocurrencies. Solutions like the Lightning Network are being developed to address this limitation.

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies, including Bitcoin, is still evolving in many countries.

Other Cryptocurrencies in Comparison

While some alternative cryptocurrencies (altcoins) offer innovative features or specialized use cases, many fall short in terms of security, decentralization, and adoption. For example:

Ethereum, the second-largest cryptocurrency, faces scalability issues and centralization concerns as it transitions to Ethereum 2.0.

Many altcoins are highly centralized, with significant portions of their supply controlled by a small number of entities.

The crypto landscape is filled with speculative projects, many of which lack long-term viability. In fact, over 2,000 cryptocurrencies have failed or been abandoned since 2014.

Conclusion

Despite the proliferation of new cryptocurrencies, Bitcoin remains the cornerstone of the crypto revolution. Its first-mover advantage, proven security, limited supply, decentralization, widespread adoption, institutional endorsement, strong community, and use case as digital gold all contribute to its standout status. As the financial landscape continues to evolve, Bitcoin's role as a transformative and foundational asset is more apparent than ever.

While challenges remain, ongoing development and increasing adoption suggest a bright future for Bitcoin. As we move further into the digital age, Bitcoin's position as the gold standard of cryptocurrencies seems likely to endure.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#DigitalGold#Blockchain#CryptoRevolution#FinancialFreedom#Decentralization#DigitalCurrency#CryptoCommunity#BitcoinAdoption#CryptoNews#BitcoinMining#CryptoInvestment#BitcoinSecurity#BTC

2 notes

·

View notes

Text

Security Analysis of BitPower

Introduction With the rapid development of blockchain technology and cryptocurrency, decentralized finance (DeFi) platforms have attracted increasing attention. As an innovative DeFi platform, BitPower uses blockchain and smart contract technology to provide users with safe and efficient financial services. This article will explore the security of the BitPower platform in detail, covering three key areas: cryptocurrency, blockchain, and smart contracts, and explain its multiple security measures at the technical and operational levels.

Security of cryptocurrency Cryptography Cryptography uses cryptographic principles to ensure the security and privacy of transactions. BitPower supports a variety of mainstream cryptocurrencies, including Bitcoin and Ethereum, which use advanced encryption algorithms such as SHA-256 and Ethash. These algorithms ensure the encryption and verification of transaction data and improve the system's anti-attack capabilities.

Decentralized characteristics The decentralized nature of cryptocurrency makes it independent of any central agency or government, reducing the risk of being controlled or attacked by a single entity. All transaction records are stored on a distributed ledger to ensure data integrity and transparency.

Immutability Once a cryptocurrency transaction record is recorded on the blockchain, it cannot be tampered with or deleted. Any attempt to change transaction records will be detected and rejected by the entire network nodes, thus ensuring the authenticity and reliability of the data.

Security of blockchain Distributed storage Blockchain is a distributed ledger technology whose data is stored on multiple nodes around the world without a single point of failure. This distributed storage method improves the security of data, and the data is still safe and available even if some nodes are attacked or damaged.

Consensus mechanism Blockchain verifies the validity of transactions through consensus mechanisms such as proof of work PoW and proof of stake PoS. These mechanisms ensure that only legitimate transactions can be recorded on the chain, preventing double payments and fraud.

Immutability Once the data on the blockchain is written, it cannot be changed, and any attempt to tamper with the data will be discovered and rejected. This immutability ensures the reliability and integrity of transaction records, providing users with a transparent and trusted trading environment.

Security of smart contracts Automated execution Smart contracts are self-executing contracts running on blockchains, whose terms and conditions are written in code and automatically executed. The automated execution of smart contracts eliminates the risk of human intervention, all operations are transparent and visible, and users can view the execution of contracts at any time.

Transparency and openness BitPower's smart contract code is public, and anyone can review the logic and rules of the contract to ensure its fairness and transparency. The openness of the code increases the credibility of the contract, and users can use it with confidence.

Security Audit In order to ensure the security of smart contracts, BitPower will conduct strict security audits on the contract code. Audits are conducted by third-party security companies to discover and fix potential vulnerabilities and ensure the security and reliability of the contract. This audit mechanism improves the overall security of the platform and prevents hacker attacks and exploitation of code vulnerabilities.

Decentralization BitPower's platform is completely decentralized and has no central control agency. All transactions and operations are automatically executed through smart contracts, eliminating the risk of single point failures and human manipulation. Users do not need to trust any third party, only the code of the smart contract and the security of the blockchain network.

Other security measures of the BitPower platform Multi-signature BitPower uses multi-signature technology to ensure that only authorized users can perform fund operations. Multi-signature requires multiple independent signatories to jointly sign transactions to prevent single accounts from being hacked. This mechanism increases the security of the account and ensures that funds can only be transferred after multiple authorizations.

Cold wallet storage To prevent online wallets from being attacked, BitPower stores most of its users' assets in offline cold wallets. Cold wallets are not connected to the internet, so they are not vulnerable to hacker attacks, which improves the security of funds. Only a small amount of funds are stored in hot wallets for daily transactions and operational needs.

Two-step verification The BitPower platform implements a two-step verification (2FA) mechanism, which requires users to perform two-step verification when performing important operations (such as withdrawals). 2FA requires users to provide two different authentication information, such as passwords and dynamic verification codes, which improves the security of accounts and prevents unauthorized access.

Regular security updates BitPower regularly performs security updates for systems and software to ensure that the platform is always up to date with the latest security status. Security updates include patching known vulnerabilities, improving system performance, and enhancing security protection. Regular updates reduce security risks and prevent the exploitation of known attack vectors.

Conclusion The BitPower platform has built a highly secure DeFi environment through cryptocurrency, blockchain, and smart contract technology. Its decentralized, transparent, and tamper-proof characteristics, coupled with security measures such as multi-signatures, cold wallet storage, and two-step verification, ensure the security of user assets and data. When choosing a DeFi platform, security is a crucial consideration. BitPower has become a trustworthy choice with its excellent security performance.

By continuously improving and strengthening security measures, BitPower is committed to providing users with a safe, reliable and efficient financial service platform. Whether ordinary users or institutional investors, they can invest and trade with confidence on the BitPower platform and enjoy the innovation and convenience brought by blockchain technology.

2 notes

·

View notes

Text

What is Blockchain Technology & How Does Blockchain Work?

Introduction

Gratix Technologies has emerged as one of the most revolutionary and transformative innovations of the 21st century. This decentralized and transparent Blockchain Development Company has the potential to revolutionize various industries, from finance to supply chain management and beyond. Understanding the basics of Custom Blockchain Development Company and how it works is essential for grasping the immense opportunities it presents.

What is Blockchain Development Company

Blockchain Development Company is more than just a buzzword thrown around in tech circles. Simply put, blockchain is a ground-breaking technology that makes digital transactions safe and transparent. Well, think of Custom Blockchain Development Company as a digital ledger that records and stores transactional data in a transparent and secure manner. Instead of relying on a single authority, like a bank or government, blockchain uses a decentralized network of computers to validate and verify transactions.

Brief History of Custom Blockchain Development Company

The Custom Blockchain Development Company was founded in the early 1990s, but it didn't become well-known until the emergence of cryptocurrencies like Bitcoin. The notion of a decentralized digital ledger was initially presented by Scott Stornetta and Stuart Haber. Since then, Blockchain Development Company has advanced beyond cryptocurrency and found uses in a range of sectors, including voting systems, supply chain management, healthcare, and banking.

Cryptography and Security

One of the key features of blockchain is its robust security. Custom Blockchain Development Company relies on advanced cryptographic algorithms to secure transactions and protect the integrity of the data stored within it. By using cryptographic hashing, digital signatures, and asymmetric encryption, blockchain ensures that transactions are tamper-proof and verifiable. This level of security makes blockchain ideal for applications that require a high degree of trust and immutability.

The Inner Workings of Blockchain Development Company

Blockchain Development Company data is structured into blocks, each containing a set of transactions. These blocks are linked together in a chronological order, forming a chain of blocks hence the name of Custom Blockchain Development Company. Each block contains a unique identifier, a timestamp, a reference to the previous block, and the transactions it includes. This interconnected structure ensures the immutability of the data since any changes in one block would require altering all subsequent blocks, which is nearly impossible due to the decentralized nature of the network.

Transaction Validation and Verification

When a new transaction is initiated, it is broadcasted to the network and verified by multiple nodes through consensus mechanisms. Once validated, the transaction is added to a new block, which is then appended to the blockchain. This validation and verification process ensures that fraudulent or invalid transactions are rejected, maintaining the integrity and reliability of the blockchain.

Public vs. Private Blockchains

There are actually two main types of blockchain technology: private and public. Public Custom Blockchain Development Company, like Bitcoin and Ethereum, are open to anyone and allow for a decentralized network of participants. On the other hand, private blockchains restrict access to a select group of participants, offering more control and privacy. Both types have their advantages and use cases, and the choice depends on the specific requirements of the application.

Peer-to-Peer Networking

Custom Blockchain Development Company operates on a peer-to-peer network, where each participant has equal authority. This removes the need for intermediaries, such as banks or clearinghouses, thereby reducing costs and increasing the speed of transactions. Peer-to-peer networking also enhances security as there is no single point of failure or vulnerability. Participants in the network collaborate to maintain the Custom Blockchain Development Company security and validate transactions, creating a decentralized ecosystem that fosters trust and resilience.

Blockchain Applications and Use Cases

If you've ever had to deal with the headache of transferring money internationally or verifying your identity for a new bank account, you'll appreciate How Custom Blockchain Development Company can revolutionize the financial industry. Custom Blockchain Development Company provides a decentralized and transparent ledger system that can streamline transactions, reduce costs, and enhance security. From international remittances to smart contracts, the possibilities are endless for making our financial lives a little easier.

Supply Chain Management

Ever wondered where your new pair of sneakers came from? Custom Blockchain Development Company can trace every step of a product's journey, from raw materials to manufacturing to delivery. By recording each transaction on the Custom Blockchain Development Company supply chain management becomes more transparent, efficient, and trustworthy. No more worrying about counterfeit products or unethical sourcing - blockchain has got your back!

Enhanced Security and Trust

In a world where hacking and data breaches seem to happen on a daily basis, Custom Blockchain Development Company offers a beacon of hope. Its cryptographic algorithms and decentralized nature make it incredibly secure and resistant to tampering. Plus, with its transparent and immutable ledger, Custom Blockchain Development Company builds trust by providing a verifiable record of transactions. So you can say goodbye to those sleepless nights worrying about your data being compromised!

Improved Efficiency and Cost Savings

Who doesn't love a little efficiency and cost savings? With blockchain, intermediaries and third-party intermediaries can be eliminated, reducing the time and cost associated with transactions. Whether it's cross-border payments or supply chain management, Custom blockchain Development Company streamlined processes can save businesses a ton of money. And who doesn't want to see those savings reflected in their bottom line?

The Future of Blockchain: Trends and Innovations

As Custom Blockchain Development Company continues to evolve, one of the key trends we're seeing is the focus on interoperability and integration. Different blockchain platforms and networks are working towards the seamless transfer of data and assets, making it easier for businesses and individuals to connect and collaborate. Imagine a world where blockchain networks can communicate with each other like old friends, enabling new possibilities and unlocking even more potential.

Conclusion

Custom Blockchain Development Company has the potential to transform industries, enhance security, and streamline processes. From financial services to supply chain management to healthcare, the applications are vast and exciting. However, challenges such as scalability and regulatory concerns need to be addressed for widespread adoption. With trends like interoperability and integration, as well as the integration of Blockchain Development Company with IoT and government systems, the future looks bright for blockchain technology. So strap on your digital seatbelt and get ready for the blockchain revolution!

#blockchain development company#smart contracts in blockchain#custom blockchain development company#WEB#websites

3 notes

·

View notes

Text

Explore the Bit Loop: The innovation of lending powered by blockchain technology

In the rapid development of financial technology, blockchain technology has become one of the powerful tools to reform traditional financial services. Bit Loop, a decentralized lending platform based on the Ethereum network, is using blockchain's smart contract technology to reshape the lending market. This article will explore in detail how Bit Loop works, its monetization model, security measures, and its unique sharing reward mechanism.

The core function and operation of Bit Loop Smart contract applications: The core operation of Bit Loop relies on smart contract technology, which is deployed on the Ethereum (EVM compatible) network and automatically executes all the terms of the lending agreement. Through smart contracts, Bit Loop enables automatic matching between borrowers and lenders, optimizes the liquidity of funds, and reduces transaction costs.

Decentralized lending model: The borrowing and lending process is fully decentralized on the Bit Loop, i.e. all transactions are conducted directly between users without the need for any intermediaries. This not only increases the transparency of the transaction, but also greatly reduces the potential risk of fraud and operating expenses.

Peer-to-peer trading system: Through the peer-to-peer flow of funds, users can send funds directly from one person's wallet to another person's wallet, ensuring the security and speed of transactions. This model provides users with more flexible and affordable borrowing options by reducing the intervention of traditional financial institutions.

The profit model of Bit Loop Capital supply dividend: Bit Loop may collect a percentage of the money supply from the borrower as a service fee. For example, a borrower may have to pay a 1.5% fee to obtain short-term funding, part of which goes to cover the platform's operating costs and part goes to the lender's income.

Interest income: Lenders earn interest income by lending money to borrowers. These interest rates are usually determined by market supply and demand, and are automatically calculated and allocated through the platform's smart contracts.

Security measure Multi-signature and anonymous supervisory node: Bit Loop uses multi-signature technology and generated anonymous supervisory nodes to ensure the security of transactions. These technologies can effectively prevent unauthorized access and potential fraud, while enhancing the overall security of the system.

Irreversibility of smart contracts: Smart contracts deployed on the blockchain, once launched, cannot be modified or revoked. This ensures fair and transparent operation of the platform, and even the developers of the platform cannot change the terms of the contract.

Sharing reward mechanism Bit Loop encourages users to invite new users to join the platform through a personal sharing link. When these new users register and participate in the lending activity using the share link, the recommender will be rewarded according to the smart contract Settings. This mechanism not only increases the user base of the platform, but also provides an additional revenue stream for existing users.

conclusion By applying the concept of decentralization to the lending market, Bit Loop provides users with a secure, transparent and efficient financial services platform. This blockchain-based lending platform not only reduces the complexity and cost of traditional banking services, but also provides more equitable and accessible financial services to users around the world. With the advancement of technology and the development of the market, Bit Loop is expected to become a leader in the field of fintech, further promoting the modernization and globalization of financial services.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

2 notes

·

View notes

Text

Explore the Bit Loop: The innovation of lending powered by blockchain technology

In the rapid development of financial technology, blockchain technology has become one of the powerful tools to reform traditional financial services. Bit Loop, a decentralized lending platform based on the Ethereum network, is using blockchain's smart contract technology to reshape the lending market. This article will explore in detail how Bit Loop works, its monetization model, security measures, and its unique sharing reward mechanism.

The core function and operation of Bit Loop Smart contract applications: The core operation of Bit Loop relies on smart contract technology, which is deployed on the Ethereum (EVM compatible) network and automatically executes all the terms of the lending agreement. Through smart contracts, Bit Loop enables automatic matching between borrowers and lenders, optimizes the liquidity of funds, and reduces transaction costs.

Decentralized lending model: The borrowing and lending process is fully decentralized on the Bit Loop, i.e. all transactions are conducted directly between users without the need for any intermediaries. This not only increases the transparency of the transaction, but also greatly reduces the potential risk of fraud and operating expenses.

Peer-to-peer trading system: Through the peer-to-peer flow of funds, users can send funds directly from one person's wallet to another person's wallet, ensuring the security and speed of transactions. This model provides users with more flexible and affordable borrowing options by reducing the intervention of traditional financial institutions.

The profit model of Bit Loop Capital supply dividend: Bit Loop may collect a percentage of the money supply from the borrower as a service fee. For example, a borrower may have to pay a 1.5% fee to obtain short-term funding, part of which goes to cover the platform's operating costs and part goes to the lender's income.

Interest income: Lenders earn interest income by lending money to borrowers. These interest rates are usually determined by market supply and demand, and are automatically calculated and allocated through the platform's smart contracts.

Security measure Multi-signature and anonymous supervisory node: Bit Loop uses multi-signature technology and generated anonymous supervisory nodes to ensure the security of transactions. These technologies can effectively prevent unauthorized access and potential fraud, while enhancing the overall security of the system.

Irreversibility of smart contracts: Smart contracts deployed on the blockchain, once launched, cannot be modified or revoked. This ensures fair and transparent operation of the platform, and even the developers of the platform cannot change the terms of the contract.

Sharing reward mechanism Bit Loop encourages users to invite new users to join the platform through a personal sharing link. When these new users register and participate in the lending activity using the share link, the recommender will be rewarded according to the smart contract Settings. This mechanism not only increases the user base of the platform, but also provides an additional revenue stream for existing users.

conclusion By applying the concept of decentralization to the lending market, Bit Loop provides users with a secure, transparent and efficient financial services platform. This blockchain-based lending platform not only reduces the complexity and cost of traditional banking services, but also provides more equitable and accessible financial services to users around the world. With the advancement of technology and the development of the market, Bit Loop is expected to become a leader in the field of fintech, further promoting the modernization and globalization of financial services.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

3 notes

·

View notes

Text

Let's understand the charm of Bit Savings

Decentralization: The future economic and technological landscape

In contemporary society, whether at the technical, economic or managerial level, the concept of decentralization has gradually changed from an idea to an important strategy for practical application. Decentralization, the process of reducing or eliminating centralized authority or control within a system or network, is increasingly becoming a key driver of innovation and efficiency.