#everything is so EXPENSIVE TOO!!!! and i refuse to spend Real Money on a mobile game

Text

im so obsessed with the mlp city planner game its becoming a problem

#k.txt#everything is so EXPENSIVE TOO!!!! and i refuse to spend Real Money on a mobile game#so im just always watching ads. its sad. but still so fun

1 note

·

View note

Text

Fic: Without You (Keanu x Reader)

Summary: Part 4 of Always the quiet ones series. Keanu is gone and you have to deal with his absence and fixing your brandnew apartment on your own. Part 1 - Always the quiet ones | Part 2 - The Proposal | Part 3 - Dark Paradise

Author’s notes: Finally a new part of this series. I’m still in love with it, I promise. Feedback is always appreciated. I always want to know what you folks think!

Wordcount: 7115

Warnings: alcohol consumption; smut (masturbation; use of toys; dirty talk and squirting)

You woke up with soft lips pressing wet kisses all over the exposed skin of your shoulder, coarse beard tickling you, and making you smile against the goose feather pillow beneath your head.

Soft rays of sunshine warmed your body, trying to pierce through your closed eyelids but you refused to give in. You were cozy and comfortable, the only thing missing was the solid body next to you but you had a feeling that if you put a bit of effort, you could maybe convince Keanu to return to bed and sleep in a little longer.

“Come on, sweetheart. Time to get up. I know you’re awake.” The sharp slap on your ass made you jolt and yelp. Keanu’s deep and throaty chuckle making you glare at him. “I did try a nice way first.”

He pressed his lips to your pout for a quick kiss before he got up from the bed, revealing his attire of dark trousers and white button-down, not formal enough for meetings at Arch but not casual enough for a stroll in the city. Your gaze moved past him and you caught sight of his suitcase resting against the wall next to the empty closet.

You had forgotten Keanu would be leaving today. Or maybe you were in denial about the fact because this past week had been one of the best of your life and you didn’t want it to end. You had spent all your free time with Keanu, mostly in bed, talking and fucking and just getting to know one another a little better.

At first glance, Keanu had appeared to you as smooth and charming, completely in control of everything but as you spent more time together, you began to realize that, yes he was all that, as well as a genius, his interests varying from technology – as expected considering his company – to motorcycles, art, literature, cinema, and music. However, you were pleasantly surprised to realize that, once Keanu let that carefully constructed public image fade away, he was a complete, lovable dork.

It was in the way his eyes burned brighter with excitement when he was talking about the latest book he was reading or the wild hand gestures that accompanied. His awkward little laugh whenever he was unable to operate something simple like a coffee machine, or the outraged tone of his voice whenever you made him watch a movie or a show he didn’t like and Keanu was left to complain to you and the screen at the absurdity of the characters’ actions.

You were beginning to realize that the real Keanu was quite different from what he let out to the world and you were thrilled and touched that he was beginning to trust you enough to let you see this side of him.

You only feared that this was making it even easier for you to fall for him and you had to keep reminding yourself that this was mostly business and casual for him, so it should be the same to you. Maybe it was for the best that Keanu was leaving again, give you room to shield your heart instead of getting caught up in his spell.

“What time’s your flight?” You asked, stretching and yawning. Letting his gaze drink in your naked body.

You were starting to feel much more comfortable being completely bare whenever you were together especially because you never knew when Keanu might pounce you and ruin a perfectly good pair of underwear.

“In four hours,” he replied and you smirked, crawling closer to the edge of the bed, your face hovering inches away from his crotch as you looked up at him through your lashes.

“So we could stay in bed a little longer?”

“We could,” Keanu smirked down at you. “If someone didn’t have class.”He pulled away from you, walking over to the small sitting room of the master suite and you groaned in disappointment, getting up and putting on a shirt so you could follow him.

“I can skip it,” you said, humming appreciatively as the smell of coffee reached your nose. Keanu had ordered room service and food was already set on the dining table.

“You could, but you’re not going to.” There was a warning in his eyes and even if you knew he was just thinking about the best for you, you couldn’t help but pout. You wanted to spend a little longer with him. “Besides, I can’t stay. Apparently, I’m needed at Arch.”

Keanu rolled his eyes and pulled the chair for you, waiting until you were seated to push it in place and start serving you. It was kind of his thing, taking care of you like this even if you insisted he didn’t have to. Keanu just liked to do it and after a couple of days, you stopped arguing and just let him get his way, as he always did.

“Well, the branch is just starting, makes sense they rely a little more on you,” you reasoned and Keanu snorted as he poured your coffee: two sugars, just a splash of milk like you liked it, setting on your left.

“I pay these people a lot of money, so they don’t need to rely on me.” Keanu settled on his chair across from you once he had filled your plate, sipping on his coffee. “What I need is someone I can trust to oversee things for me, be my representative.”

“Maybe you should stay a little longer, find someone to fill that role,” you said, trying for a nonchalant tone but from the little smirk Keanu flashed over the rim of his cup, it didn’t go unnoticed by him.

“I really wished I could, but I have a lecture at MIT this afternoon, a conference in London in two days, and several meetings back in LA for the next three weeks.”

You knew that Keanu was a busy man, of course. Being CEO of one of the leading technology companies in the US took time and effort, still, you couldn’t help the pang of disappointment in your heart. This week, you had him mostly to yourself so you were going to miss not having him at all.

“I guess we’re going to have to learn to do this long-distance,” you said, managing a smile that didn’t really reach your eyes.

“That reminds me…” Keanu said, getting up and for the first time you noticed the dark paper bags on the couch. “I got you a few things.”

With a frown, you got up too and stood next to him as he unveiled the items. You gasped when you realized he just got you the most expensive laptop from his company, as well as an ARCHpad, one of those tablets everyone in your class seemed to have.

“Keanu, I can’t take this…” you said, even if your fingers were running over the smooth dark surface of the laptop, the sunken lines of the word ARCH in bright red making the device slick and modern.

“You can and you will,” he took a seat next to you on the couch, one arm around your shoulders as you explored the illuminated keys of the laptop. “I’ve seen that piece of junk you call a laptop and I’m surprised you can get anything done with a thing that old. Besides, having an ARCHbook will make it easier for you to sync up your account with your ARCHpad and phone.”

“I don’t have an ARCHphone,” you told him, and Keanu just smirked, reaching inside his pocket, and pulling a mobile. “Keanu, I…”

Before you could form a protest, he sealed your lips with his, distracting you with a searing kiss that had you burning with need for him.

“Ok…” you sighed against his mouth once he let you away for breath and Keanu grinned. “Thank you.”

“You’re welcome, sweetheart,” setting the phone on your hands so you could explore it. “Just don’t let anyone take too close of a look. That model isn’t out yet.”

You nodded, still distracted by the device, noticing that it was already set up and there was only one name on its contact list: Keanu’s, along with one of the silliest looking ID pictures you had ever seen, which made you giggle.

“Seriously, I can’t thank you enough,” you said turning your attention back to him and finding him with another box in his hand and a big smile on his lips. “What’s that now?”

“Take a look,” he encouraged with a wiggle of his eyebrows and you tugged on the ribbon, untying the box before you could lift the lid.

“It’s a key,” you frowned in confusion and it took you a second to realize what that meant. “Oh my GOD! Is this…?”

“Yeah,” Keanu chuckled.

“So, I can…”

“Whenever you want,” he assured and you couldn’t contain yourself, you just climbed on his lap and pressed kisses all over his face, chanting your gratitude as he laughed. “One last thing and I promise I’m done.”

“You’re spoiling me,” you slowed your kisses, focusing on his lips now and making them longer, sensuous and you could already feel him hardening underneath you.

“That’s the point, sweetheart.” He lifted his hand by his head, a black credit card between his fingers and you knew what that was without even looking. “For furniture and other expenses as you settle in the new apartment.”

You hesitated in taking the card and you had no idea why. Keanu gave you an apartment, why a credit card linked to his account was the thing that gave you pause? Why taking his money made you guilty when you had been very willing to enjoy the nice, expensive things he bought you with it?

“I can hear you overthinking it,” he whispered, freehand coming to your nape to pull you closer and catch your mouth in another searing kissing that left you gasping and rolling your hips against him. “You don’t have to take it if you don’t feel comfortable with it, but if you don’t you’ll have to wait a month for me to come back and we can get that place furnished. Do you really want to wait?”

You didn’t and he knew it too. For this week, you had experimented the heaven that it was to have an actual comfortable place to live with plenty of space and without a noisy and annoying roommate. A place where you didn’t have to share a bathroom with several other people and you could study without anyone interrupting you or worrying about slow wi-fi or working hours.

You had had the taste of freedom and Keanu knew you weren’t ready to go back to the hell that was your dorm. So, you snatched the card from his hand with narrowed eyes at his little victorious smirk.

“You’re sure I shouldn’t skip my class and you shouldn’t tell everyone at Arch to fuck off?” you asked, lips brushing against his as you grabbed his hand and brought between your legs, to your soaked folds.

“No,” he heaved a sigh, biting your lip before he grabbed his phone and brought it to his ear. “Cheryl I can’t make it to the meeting. Just email me the issues and I’ll take a look at the plane.”

Keanu hung up before there was even a word out from the other side of the line, which made you smirk. Especially when he wrapped his arms tight around you and got up from the couch, your legs coming around his waist to give yourself some more support.

“You, young lady, are a bad influence,” he declared, walking back to the suite.

“I learned with the best,” you grinned, catching his lips in a new kiss.

You could feel the weight of the stares at your back as you made your way to the breakroom. After a week of coming and going from the presidential suite, everyone in the hotel knew about you and Keanu and the whispers and rumors started flying. You were trying your best not to let it affect you but it was hard when every time you stepped into a room, everyone fell silent making painfully obvious that you had been the topic of conversation.

Still, you only had to deal with it for another week since you had delivered your two weeks’ notice. You could handle some gossip for another week. It wouldn’t be enough to make you fall from your high of having a brand-new apartment and the shot of a better life for yourself

Leaned on the reception desk, you flashed a big grin at Maggie, showing her the key. Her eyes widened and she covered her mouth with her hands, muffling her little squeal of excitement, getting weird looks from one of the other receptionists.

“Already?”

“Yes!” you grinned, happiness brimming in your heart. “What time do you get out? We’re going to celebrate.”

“Seven.”

“Perfect!” you pulled one of the notepads closer, scribbling down the address before pushing it her way. “Just drop by when you’re done.”

“I’m so happy for you!” Maggie grinned wide and you could feel the sincerity in her tone and her eyes. She had been your first real friend in New York and supported you through thick and thin. You knew she would support you through this too.

You waved at her, walking out of the hotel with that silly grin in your lips, wide enough your cheeks were starting to hurt but you couldn’t help yourself. Things were really starting to brighten up for you and it was hard to disguise the relief and excitement. Maybe it wasn’t the way you have pictured, but was that so bad? Plans didn’t always happen how we imagine, but that doesn’t make it a bad thing, right?

You took a taxi to your dorm room, having way too much expensive stuff to risk taking the subway and as you strolled around campus you couldn’t avoid having a little spring on your step, giddiness filling your chest. You were almost hoping that your roommate was around so you could give her the finger as you left your personal hell.

However, she didn’t show up, so you had to settle for leaving a note while you hauled the two suitcases with your possessions, plus your backpack out of the dorm. You paused at the sidewalk just outside the building that had been your home for the last three years. They had been good years despite everything, but you weren’t going to miss it. Not when you knew what was waiting for you on the other side of the cab ride to Morningside Heights.

You rested your forehead against the cool window of the car, watching the city lights passing you by in flashes, excitement bubbling in your chest as the metal of the key heated up against your hand. You couldn’t let it go. It was the ultimate sign that your life would never be the same.

The cabbie parked by the front doors and helped you with your bags, leaving the doorman to take them inside for you while you paused by the front desk to sign up, all the documents needed in your phone.

Once all formalities were concluded, you could take the elevator to your apartment. No, penthouse. The giddiness growing as the numbers moved up and finally the polished metal doors slid open, revealing the well-illuminated hall with one solitary door.

With your suitcases resting by the wall, your hands trembled as you tried to push the key in the hole and you giggled like a kid at the click of the lock and the silent sway of the door, revealing the ample space of the living room, dark except for the dotted lights of the buildings all around you the came through the window panels.

You hesitated, wishing Keanu could be doing this with you, stepping inside your home for the first time. The thought was almost enough to deflate your entire mood, so you quickly shoved aside, taking your first step into your new life. This was it. This was your world now and you would be damned if you were going to let anyone stand in your way.

Flickering the lights on as you walked through the empty space, you took deep breaths, letting the smell of polish wood floors and gleaming new metal fill your nose. There wasn’t any furniture except for the kitchen cabinets and basic appliances, and you tried to imagine how each space would look as you walked around, hands touching the walls and windows.

You wanted a big dinner table and a long couch so you could always have people over and a chandelier – nothing too flashy – above to brighten up the room. You wanted the halls in a light shade of grey and the rooms white to soak up natural lights.

In the master bedroom, you wanted the bed to face the windows so you could always wake up to the sun rising in between the buildings, the orange hues of the sky turning blue as the sun brightened up. You also wanted a window bench so you could sit and read with the city as a background. Your work desk, however, couldn’t face the windows. You would get lost in the view.

Sitting on the duvet you spread on the ground in the exact place where you envisioned your bed, you let your mind wander with home design options and ideas until you heard the intercom and jumped to your feet, knowing Maggie would be waiting outside.

“Oh. My. God!” she said with round eyes as she shoved the sparkling wine in your hands and walked around the apartment. “Oh. My. God.”

You just chuckled, putting the bottle in the fridge and following as she explored the place. When she stepped on the terrace, her eyes grew even wider and her grin brighter.

“OH. MY. GOD!”

“I know!” you giggled covering your mouth. You couldn’t believe yourself just yet.

“I’m so happy for you, sweetie,” Maggie’s smile was soft and sincere as she drew you into her arms. “I really am. You’re one of kindest, good-hearted people I’ve ever met in this city and you deserve a good life.”

“Thanks, Mags,” you grinned, your eyes burning with the unshed tears. Your heart bursting with emotion. She really was such an amazing friend. “Let’s pop that bottle and order Chinese?”

“Fuck yes!” she cheered, following you back to the kitchen.

The days blurred together as they went by. You still had class every day and finished your two weeks-notice at last, which gave you plenty of free time. More than you knew what to do with. So you focused your energy on getting the apartment livable.

You took Maggie shopping for furniture. Your first purchase was a bed because your back was starting to hurt from sleeping on the floor. You got a king-size bed with padded headboard, bedside tables, and an office desk and chair because you were never good at working in bed without falling asleep or getting distracted. Next was the kitchen stuff you needed since you couldn’t live off takeout forever.

You never knew nice china and cutlery were that expensive. It was almost as if the uglier they got, the price went up, even more, to convince buyers it was worth it. Fortunately, you weren’t a moron, so you settled for plain white ones because you were planning to eat from them not put it on display.

Keanu was less than thrilled with your picks though, and everything you two video chatted and you showed your latest buy, he would get that look on his face that told you he was trying to pretend he didn’t hate it. Or when you sent a link of something you were planning to get, and he just shot it down in three seconds.

“Oh my God! You’re so pretentious,” you complained good-naturedly at your nightly chat as Keanu vetoed the couch you intended to by.

“It’s not being pretentious, sweetheart. It’s having a taste for the finer things in life,” he replied with a smirk, laying back on his luxurious bed in LA.

You could see dark sheets and an elegant bedframe of twisted metal in decorative loops. His torso was bare, and his hair curled slightly behind his ears, showing he had showered recently and let it dry naturally.

“You’re saying that just because your bed cost twice as mine…”

“A little more than twice,” he corrected, making you roll your eyes.

“Fine! Just because your bed cost an obscene amount of money, doesn’t mean it’s better than mine.”

“Ours,” he corrected again and this time, you smiled. “Our bed and yes, it does. I make sure to only get the best for my places and that penthouse isn’t going to be an exception.”

You mulled over his words, tapping your index finger on your jaw. Truth was, you did walk by Horchow and Modani that first day, but the posh looks of the displays and salesperson made you run to the familiar halls of Ikea. At least there you could blend in. Everyone went to Ikea and you still remembered the days that you walked between their products, picking the furniture for your dream house, which you were doing right now.

“You shouldn’t be afraid of dreaming a little bigger, love,” he smiled gently at you once you confessed that and that familiar warmth that you always felt when Keanu granted you that look, all soft and caring, filled your chest. Damn you missed him.

Saturday after your conversation with him, you were awakened by someone leaning heavily on the doorbell and when you finally managed to groggily drag yourself from your bed and pad barefoot to the open it, your apartment was invaded by a small entourage of overly energetic and sharply dressed people.

“He was right! It is perfect!” the man that seemed to be leading the party cooed, walking past you like you were part of the furniture as he admired the window panels and the morning light that filtered through it.

“I’m sorry, but who the hell are you?” you asked after a moment of watching them scattering around your place, browsing through everything, measuring tapes coming out every once in a while.

“Didn’t Mr. Reeves tell you?” he asked, spinning on his heel to look at you, his lips crisping in distaste at your messy hair and oversized sleeping shirt. “I’m Ryan, the interior designer that did his offices here in New York.”

“I guess he forgot to mention,” you replied, rubbing your eyes and moving towards the counter to get some coffee. “I’m guessing you’re here to fix the apartment?”

“I wouldn’t say fix…” he trailed off, looking around, but his grimace was quite obvious. “Alright, I would. Honey, do you have any idea how lucky you are? You got a high-end apartment in one of the best areas of the city and unlimited funds to get it just the right way. Think big!”

“People keep telling me that,” you sighed, leaning against the counter, holding your mug like it was a lifeline in the brand new world you had just been thrown into. “I’m a simple girl with simple needs.”

‘I can work with that,” he smiled at you and this time you could actually feel some warmth behind his words as he moved closer, ARCHpad in hand. “And simple doesn’t have to mean cheap.”

You spent the rest of the day with Ryan and his team, going through each room of the apartment selecting the right color scheme, wallpapers, and furniture, browsing the website of some of the most expensive design stores you had ever seen.

Ryan tried his best to be gentle and kind with you but you could tell he was losing patience with your hesitation every time your gaze landed on the price of a specific product, making you once again scared by the amount you were spending.

“You know we could furniture several small houses with what we’re investing in this one apartment?” you asked Ryan as he kept pushing you into buying this gorgeous couch that costed more than what your mother made in a month.

“Yes, and that’s dreadful,” Ryan heaved an annoyed sigh. “Would not buying this couch fix anything?”

“Well, no…”

“Good!” he cut you off, clicking on the purchase button. “That settles then. And we’re done for today, tomorrow Alicia will come over with options for your wardrobe.”

You looked down at yourself. After Ryan and his team invaded your home, you put on a pair of leggings under your sleeping shirt and pulled your hair up in a bun. You didn’t think you looked that bad, did you?

“What’s wrong with my wardrobe right now?” You asked and Ryan let out a sharp laugh, putting away his things in his briefcase.

“You’re funny. I can see why Mr. Reeves likes you,” he pecked your cheek like you two were best friends and led his crew to the door, handing you a card. “Call if you need anything else.”

You waited until they were out of sight to grab your phone and text Keanu, asking if he was available to talk. His answer was to make a videocall you.

“I have five minutes before an acquisition meeting, so talk fast.” You could see the tension in his shoulders, on the crease of his brow and the steel in his eyes. It made you immediately regret having reached out at all.

“It’s not important. Have a good meeting,” you said, thumb already hovering over the end button.

“Wait,” Keanu sighed, squeezing the bridge of his nose. “I’m sorry. It’s been a shit week. Are you alright? Do you need anything?”

“No, I just…” you paused, looking away. Part of you wanted to be there to ease whatever tension seemed to be lingering in his frame. Part of you didn’t know if you should feel like that considering you were just his… you didn’t even know how to describe it. “Do you not like how I look? How I dress?”

“What?” Keanu frowned in confusion. “Of course, I do. What makes you…” he paused realization coloring his features. “Alicia.”

“Yeah,” you nodded, sitting cross-legged on the bed.

“It’s not like that, sweetheart,” he explained. “One: I could care less about how you dress. As a matter of fact, if you could walk naked for the rest of your life, I’d die a happy man.” That made you giggle, a blush creeping up your cheeks because Keanu was talking about you two in the long-term and that made you undeniably happy. “Unfortunately, I can’t take you to a charity ball in t-shirt and leggings… I mean, I could…” he smirked, and you chuckled again. “That’s where Alicia comes in. I’ll make sure to tell her not to bug you with anything other than event clothes. How about that?”

“I can handle that,” you smiled at him, tucking one lock of hair behind your ear as you looked at his considerably more relaxed expression. The creases in his face this time from amusement and not tension. You preferred those much better. “I miss you.”

The words escaped you and for a moment you regretted, but Keanu’s expression softened up even more as he gazed at the screen.

“I miss you too,” he breathed out. “Wish I could fly over for the weekend, but there’s so much shit going on…”

“It’s alright, Ke, We can handle another two weeks,” you tried to fake a cheerful tone but from the look in his face, he didn’t buy it and neither did you. Someone called his name from out of the frame and he looked away for a second, nodding before glancing back at you. “Have a good meeting.”

“Thank you. Call you tonight.”

“I’ll be waiting.”

The next day, you were dressed and caffeinated when Alicia knocked on your door, also with her small crew of people. You had given a lot of thought about the entire thing after talking to Keanu and even if you didn’t want to do a complete makeover, you wouldn’t mind changing a bit to better fit in his world. In your new world.

Maggie agreed that if you had the chance to look a little nicer, with fancier clothes and professional help for your hair and nails, what would be the harm? It would even help with job interviews. Every advisor you had even been to always told you that the way one looked could make or break their chances.

So, you let Alicia and her team work on you. Waxing every hair of your body – and sweet Jesus that hurt – leaving you so smooth your skin felt soft like a baby’s. Cut your hair in a modern new long bob that flattered your face; fix your eyebrows and give you tutorials on makeup for different occasions as well as saddle you with so many beauty products the marble counter of your sink looked like it housed a small army.

When it came to clothing, Alicia took time to hear your needs as she offered several new choices with your style in mind and you loved every single one of them, from the basic tees and jeans to the pencil skirts and button-downs for business occasion and the party gowns and cocktail dresses. They were all gorgeous.

“Now, lingerie…” she said, opening a different case and giving you a sly smile. “There are a few sets that Mr. Reeves picked himself.”

“He did?” Your voice squeaked slightly, as you rubbed your nape and looked anywhere but, Alicia.

“Yes. He has excellent taste,” she said, spreading five pairs of bra and panties, three corsets, two slips, and a robe on the bed.

You swallowed around the lump in your throat, touching the rich lace and silky soft satin of the slip and the robe. They were all gorgeous and heat rose to your cheeks at the thought of putting these on for Keanu, letting him devour your shape and curves as you paraded for him. A shiver ran down your spine and you finally met Alicia’s eyes.

“Yes, to all of those,” your gaze moved to her case. “What else do you have?”

By the time you were done picking all kinds of lingerie imaginable, the sun was starting to set and you knew Keanu would be calling soon, so you said your goodbyes to Alicia, thanking her profusely as you guided the way to the front door.

“One more thing,” she said, digging something out of her bag, a square black box and handing it to you. “He told me to give you this.”

“What is it?” you asked with a frown, undoing the bow on top, but before you could open the lid, she rested a hand over yours.

“Maybe you should take a look in private,” she smirked at you, eyebrows raised and the rush of blood to your cheeks made your face hot.

“Oh.” Alicia winked at you before stepping out, leaving you alone with the black box and your thoughts.

You let the box on the bed, still too afraid of opening it; choosing instead to take a long bath. It had been a long weekend with too many people coming and going. You just wanted the chance of soaking up in the bubbly water, enjoy yourself before putting on one the slips Keanu picked and settling in bed to take a look inside the box.

It wasn’t as terrifying as you first thought, just a purple silicone thing, shaped like a U and for a while, you wondered how exactly it worked. You had never owned a sex toy before, so you had no clue what to do with that one. And from what you could see, there weren’t instructions included.

The vibrations of your phone made you startle and you scrabbled to put the toy out of view before picking up, sighing in relief when you saw it was Keanu. You accepted his video call, leaning back on the headboard to make yourself more comfortable.

“Wow!” he breathed out when the video connected and he saw you, making you grin. “You look… wow.”

‘I made you speechless,” you chuckled. “That has to be a first.”

“Not a first, but very rare,” he said, his voice turning lower and you could already feel the shiver running down your spine. “Let me see all of you.”

With a nod, you moved to stand in front of the mirror, shifting cameras, and Keanu let out a sharp and shaky exhale, shifting in his own bed and you could once again see his bare torso.

“You look amazing, sweetheart.” The hunger in his eyes was enough to make you flush, your skin suddenly hot. “Did you get my gift?”

“You mean this?” you asked, returning to bed and showing the toy. “Yes, though I have no idea what to do with it.”

“Don’t worry. I didn’t get it for you to play alone,” he smirked at you. “Now, I’m going to send you a link so we can move this to a private channel. You’re gonna need your computer for this.”

You obeyed his instructions, setting up the computer between your legs and clicking the link he emailed you, it loaded into a simple videoconference app with no identification and you wondered if Keanu made this especially for these occasions.

“That’s better,” he smiled at you and now you could see more of him, of his naked body and you swallowed hard at the sight of his cock resting on the nest of dark hair.

You could never get tired of looking at Keanu like this, completely naked for your hungry gaze. He was fit, but not overly defined. You knew his broad torso housed solid muscles, hard and strong and he was capable to pin you down or lift you up and that was all that mattered. The sight was much more appealing than a model’s six-pack.

“This is safe?” you asked, the idea of doing this on camera making you shy.

“Perfectly safe. I promise,” Keanu smiled reassuringly. “Now, I want you to touch yourself. Pretend it’s my hand.”

You settled back on the pillows, letting your fingertips travel down over the hollow of your throat, and the valley of your breasts. You closed your eyes to try and imagine his hand, his touch, but your digits were too small, too soft in comparison. Still, his pleased hum was enough to spur you one and you, circled one nipple over the silk of your slip, making the nub harden, raising goosebumps on your arms and legs. You could feel the slow, lazy tendrils of pleasure waking up in your center, sending tiny sparks of enjoyment and heat through your veins.

“You look so fucking sexy like that,” Keanu breathed out, his voice rougher than before, breathier. “God! I miss your taste. I miss your smell. I just wanna bury my face on your cunt, lick you up until you’re writhing and riding my mouth.”

You keened softly, pressing your legs together as the throb in your core started, his words panting such an enticing picture.

“We haven’t done that yet, have we? Have you sitting on my face, let you ride it, suffocate me with your juices.” His smirk was one of the dirtiest things you have ever seen and as the need grew inside you, your grip on your breast tightened, making you moan. “Do you want that? Do you want to ride my face?”

“Yes, sir,” you breathed out, shoving the straps of your slip down so you could better touch your breasts. You sucked a thumb, flickering against your nipples and you arched at the sensation, your skin so hot, your lungs tight, making your breath come out in desperate pants.

“And after you drench my face, I’ll put you in all fours and fuck that pretty cunt,” Keanu continued, making the throb more intense and your core wetter. “Are you soaked, sweetheart? Dripping on the bed?”

You lifted your skirt and spread your legs to the camera, watching as Keanu cursed and fisted his hardening cock.

“Yes, sir,” you pushed one finger inside yourself and swirled your clit with your thumb, making a bolt of pleasure shot through you. “So wet.”

“Good,” he growled. “Get the toy. You’re gonna put the larger end inside your cunt, the smaller one should press against your clit.”

You obeyed through the hazy of your pleasure. It felt weird at first, the texture foreign against your entrance and your walls clenched slightly, keeping the toy out, but you played with your clit a little more, while you teased your slit with the rubber and finally, your walls allowed the toy passage.

It wasn’t a large as Keanu’s cock, but it did give you a sort of fullness and it teased your g-spot slightly, but not enough to do anything for you. You figured there should be some kind of vibrating function, but as far as you could see, there weren’t any buttons.

Before you could ask Keanu, the toy came to life, making you shout and shake, the vibrations coursing through your clit and center, kindling your pleasure like an erupting volcano and when you managed to finally open your eyes and look at the screen, Keanu had a huge, shit-eating smirk and was holding his phone in hand. He was controlling the toy.

“Feels good, sweetheart?” he asked, stroking his cock and you nodded, getting lost in the sensations. “Keep those thighs open, baby. I wanna see you.”

“Sorry, Mr. Reeves,” you whimpered, forcing your legs apart. The pleasure was so intense your first instinct was to close up, keep that pulsing deep inside so you could enjoy every second.

“Tell me how good it feels,” he asked.

“So, fucking good,” you sighed, rolling your hips, trying to find more of that sweet pleasure, your hands squeezing your breasts and pinching your nipples.

“Better than my cock?”

“No,” you whimpered, looking at him with heavy lids. “Never.”

“Good answer,” he smirked, and the vibrations went up, making you moan and writhe, your walls convulsing around the toy, as if unsure if they should try to push it away or deeper inside you. “Fuck! You looked so pretty all flushed and undone for me. I wish I could record this. I can almost taste how desperate you are to cum.”

“Please, sir,” you whined, head thrown back, back arched. The knot in your center so tight and so good but you still needed something, that little nudge to send you over the edge.

“If I was there,” Keanu said, his hand working faster around his hard, leaking cock. His words punctuated by little grunts. “I’d have you on your knees, sucking my cock while that toy worked that cunt. I’d make you choke on my cock until you could feel your throat around my head. Do you want that?”

“Fuck! Yes, Mr. Reeves,” you were rocking your hips steadily now, tears of frustration running down your temples as the pleasure got unbearable, but not enough to make you come undone.

“Or maybe I could fuck that tight ass? Take yet another virginity of yours?”

The mere suggestion coupled with a sudden increase of vibrations nearly made you scream as your orgasm surged through you like a crashing wave, pulling you under. You cried out his name, feeling the gush of warm liquid soak your thighs and the sheet beneath you.

“Well that was unexpected,” Keanu chuckled at little, breathless and flushed himself, his belly and chest smeared with pearly white cum as he turned off the toy. “I didn’t know you could squirt, sweetheart.”

“I, uh, I didn’t know either…” you panted, your cheeks burning, and you could barely look at the screen, too busy staring at the huge wet spot under you.

“It was fucking hot,” he called out, making you peer at him. “Next time, I want you to do it all over my cock.”

“Yes, sir…” you gasped, your center pulsing as you looked at him. “Thirteen days and counting.”

“Too fucking long,” he sighed, looking almost angry as he cleaned his chest with a tissue. “I just want you with me. One week together and I already miss having you pressed against me when I sleep.” Keanu chuckled to himself. “I’m spending most of the night awake because you’re not there. How pathetic is that?”

You bit your lip and shifted in the bed, avoiding the wet spot as you met his brown eyes, your hearts doing acrobatic flips due to his confession.

“It’s not,” you whispered. “I miss you too. I miss your smell. I even bought a pack of cigarettes and some bourbon to see if I can get the room to smell like you. It didn’t work.”

Keanu snorted, his gaze locking you in place as he stared through the screen.

“What did you do to me, sweetheart? I don’t think I’ve ever felt this way.”

“Me either,” you confessed, that giddiness returning along with a boldness you didn’t recognize. “Keanu, I think…”

Before you could finish your words, his phone started ringing and he looked over at the caller ID and cursed.

“I need to take this, sweetheart. Talk to you tomorrow. Sweet dreams.”

He turned off the videocall before you could reply and you sighed, lowering the lid of your laptop down and cuddling the pillow. Were you really about to tell Keanu you loved him? A man you barely knew? That your entire relationship was based on a contract? Did you lose your mind?

Then again, could you even deny to yourself anymore? You did love him. You were pretty sure you fell the second your lips touched his that first time around. Even if you shouldn’t have. Even if it would only bring you trouble.

But whenever Keanu said stuff like that; bared himself to you like that, you felt maybe you weren’t crazy in wanting him as much as you did. You thought you saw through the cracks of the armor he kept raised something that went beyond the contract. More than plain affection or desire.

Maybe, just maybe, there could be more to his, but if you were to find out, you needed to be with him in person, push past his walls until you could find out if you were right or out of your mind.

You needed to go to LA.

Tag List (use the link in my bio to add or remove yourself)

@toomanystoriessolittletime @meetmeinthematinee @theolsdalova @penwieldingdreamer @fanficsrusz @eevee-of-rivia @reid-187 @howtoruin-someones-perfect-day @sallyp-53 @anxiteyfilledcupcake @pinkzsugar @angelic-kisses13 @futuristic-imbecile @wonderlandfandomkingdom @krazycags01 @beyond-antares @cumberbatchbaps @sgt-morgan @a-really-bi-girl @nonsensicalobsessions @poisonedjoinery @soarocks @partypoison00 @hnryycvll @keiva1000 @shellbilee @ivvitm1109 @babayagakeanu @trippedmetaldetector @missrandomista @stxphmxlls @geralt-yennefer-jeskier @savaneafricaine @foxyjwls007 @bohemianrhapsody86 @thehumanistsdiary @black-ninja-blade @lux-ravenwolf @softrogers @d0ntjudgemy50shades @keandrews @rdjloverxxx @danceoftwowolves @greenmanalishi @fuck-yeah-hope @keanureeefs @fortheloveoffanfic @baphometwolf666 @hstyles-imagines @whyskeysour @iworshipkeanureeves @snatchedbylele @blondekel77 @peaceinourtime82 @ivymiiru

#keanu reeves fanfic#keanu reeves imagine#keanu reeves x reader#keeanu reeves x you#fanfic#alternate universe#always the quiet ones

192 notes

·

View notes

Link

This.

Whole.

Thread.

***

Thread unroller: https://threadreaderapp.com/thread/1231411476805672961.html

We have answers to the question "How do we pay for Medicare 4 All?" Some of them quite detailed.

No one has managed to come up with an answer to "How do we afford not having it?" We as a nation literally cannot pay for healthcare. This is a huge ongoing crisis. The closest we can come to answering it is to pretend that, well, the fallout of individuals not being able to afford healthcare is limited to those individuals.

This is a lie. It costs everyone. It drags the precious economy down. The person who goes bankrupt because of medical expenses and loses their house... that's a blow to the neighborhood they lived in. A bank has replaced a profitable asset (a mortgage) with a depreciating asset (an empty house). The family struggling to pay for healthcare is paying money into a system that doesn't actually produce anything except profit for the top. Take away that struggle, they are doing business with their neighbors. Ordering products. Buying services.

Creating jobs! Defaulted medical bills (including from those much-exaggerated can't-refuse-anybody free ER visits that the right likes to pretend is the same as free healthcare) get passed onto everybody else, meaning we're already "socializing" costs, but inefficiently. ERs don't do routine preventative and diagnostic services or non-emergency treatment of chronic conditions, which means by the time someone winds up in an ER, the care they need is 1) more expensive and 2) less effective.

All of this is a huge drain on the stuff that the people gibbering about the terrible specter of socialism actually do care about: productivity! Consumer confidence! The freedom of the marketplace! Socialize the medical system and we will be paying less money for better outcomes. We're already spending more money on healthcare, collectively, than it would take to treat everyone for real. And for all that money, we get the worst healthcare in the so-called developed world. If we could be getting more while paying less, THE INVISIBLE HAND OF THE FREE MARKET demands that's what we do.

Market economics dictates that we adopt socialized medicine.

Anybody who disagrees doesn't actually care about what they're telling you they care about. "But people will have to wait for treatment!" They do already, sometimes until they die. "But there will be rationing." There already is rationing and it's killing people. "But the government will decide what treatment you get." Less so than for-profit insurance companies do now. Universal healthcare, free at point of service, paid for by public money, is the best deal we could take. We would pay less and get more.

And it would make the "free market" freer by removing artificial constraints on things like job mobility. "Private industry is more efficient than the government." Efficient at what? For insurance companies, it's making money. This efficiency comes in the form of them taking more profit by charging more and providing less.

It's efficient *against us*.

Of course, replacing most of the concept of health insurance with a public institution will displace some jobs, and we should take care of the people affected by that but "socialism" is a better solution than propping up an industry that is robbing and killing us. Our concept of business ethics right now is that the main fiduciary duty of a company is to generate ever-growing profits for its stakeholders. This means a for-profit insurance company is doing wrong when it takes care of us. Its "job" is to take our money and keep it. Any money that an insurance company spends on paying for actual health care is regarded in the business world as a failure, with some failure being inevitable, but regrettable nonetheless.

They will take more and give less, if they can get away with it. Now, the ideal of the free market is that if they jerk us around we can take our business elsewhere, but healthcare is so expensive and byzantine that most of us can't afford it, except when subsidized by an employer who has the benefit of negotiating in bulk on our behalf. But this leaves us in a pinch where if our employer isn't great we can't "vote our wallets" by leaving because we need the healthcare and if our healthcare (which we didn't get to pick directly) isn't great we can't "vote our wallets" because we need the paycheck.

In theory an employer offering bad healthcare benefits is a bad employer who should be "corrected" in the market by leaving their employ, but jobs aren't fungible, we can't just leave and go across the street to another employer with the same circumstances but better insurance. This makes the "free market" as it applies to health insurance NOT REALLY VERY FREE AT ALL.

Our nominal power to negotiate and force companies to compete for our business is severely constrained and diluted by circumstances. If a restaurant, movie studio, or video game company wants our business, it has to contend with the fact that we could stay home and feed or entertain ourselves in lots of other ways, on top of there being other restaurants and media companies. But the alternative to healthcare is stay home and administer home remedies and hope you don't die of an infected tooth or hangnail that spreads, or untreated cancer, or whatever.

We aren't really "customers" with the same choice. So the fact that the consequences of voting our wallet and staying home means we might die and the fact that our negotiation ability is at a remove through our jobs (which, again, without which we might lose our ability to secure food and shelter and healthcare, and maybe die)... ...means that the vaunted competition that is supposed to make the free market efficient and fair just doesn't happen. It doesn't apply.

We are at the mercy of corporations who, again, are instructed by society that their highest good is separating us from our money. And it doesn't have to be this way! We could eliminate the whole predatory, unnecessary layer that is the for-profit health insurance complex and replace it with a public agency whose highest good is getting the most treatment for the least money. And at that point, multiple massive distortions of the "free market" disappear.

We gain more power to change jobs if another employer is offering us a better deal. Free market competition! Great, right? We've got more money that we can spend on things we want. We don't have people losing cars and houses and apartments and education plans and jobs because they had a medical emergency they couldn't pay for. We eliminate a lot of bankruptcies. Financial planning becomes more predictable. Consumer confidence goes up. Spending goes up.

Every business that is providing something people want benefits from the increased stability! Demand for basically everything rises! Jobs are created! Workers are less stressed and fearful and exhausted and so are working better!

Where's the downside for "capitalism"? I'm a fan of the free market. I think customers benefit when companies compete for their money. I think companies benefit when workers compete for their money.

But our for-profit healthcare system distorts this whole thing so badly that this is basically not happening now. If you like "capitalism" in the sense of a market-based economy where entities compete to trade what they have for what they want... a little "socialism" around the edges is a good thing, a necessary thing. If we could decouple our thinking in the business world from the current fiduciary duty we choose to imagine businesses owe, then "profit" becomes the reward for doing a good job at whatever the business does, and that's FINE. It's good, it's great, it's the ideal.

But we can't there as long as we're treating everything as though it's just another fungible option among many where people could freely vote their wallets. We can stay home from the movies if the options stink, go watch a play or a TV show. Can't do that with cancer treatment. Democratic socialism, social democracy... related and overlapping concepts, I'm not actually that interested in wanking over the distinctions. The point is, you can have social features on a market economy.

And you can't have a market economy for long without them. In the competition that makes a market economy work, the reward for winning is also the means by which the game is played, which means each round is *less* competitive than the one that came before.

Competition is a finite resource, which means it's unsustainable. The more that this competition extends into areas in which negotiation and competition are stifled, the faster the process by which the competition breaks down becomes until the "free market" becomes a fiefdom of company towns. And so the distortion caused by our for-profit healthcare industry is speeding up the demise of the free market. A public option would slow that down. Eliminating health insurance as it exists now and replacing it with some form of single payer system would go much further.

To make a long story short (TOO LATE!) - we can't afford to keep the health insurance industry around. Can't afford it. How do we pay for it? Nobody has an answer for that. We can figure out how to pay for Medicare 4 All, but not how to pay for health insurance. And while we're figuring out how to pay for healthcare under the private insurance model, we should ask... wait, what are we paying for?

Mostly to prop up an industry whose goal is that we should continue paying them to exist. Literally no purpose. They produce nothing.

1 note

·

View note

Text

NO- it’s not an option

I am in the process of Selling my home (beyond the process I guess, we are in the middle of closing escrow!!! Woohoo!!!) I’ll be honest, it took 4 days to sell my home, so I hope what I’m saying doesn’t sound like a complaint, this entire entry should be the complaint, ha, ha, just kidding- kinda. My home is smaller then my next home (which is also in process, 3 weeks!!) but it doesn’t lack comfort. Although I have never been a true fan of this particular home, it has allowed us to experience a lot of family-like ‘adventures’ (don’t worry, you’ll hear about some of those sometime in the future). My new home is sitting pretty on 4 and a half acres of clean, flat land! My home has enough bedrooms for EVERYONE to have their own space! This next home is a blessing that I can never describe with all the words in the world. Not only is it gorgeous, but thanks to the help of my parents, I got it all on my own! All they really did was sign, but I managed to save, fix my credit and get approved all on my own. Being grateful doesn't even begin to compare to the actual feeling! What did I do to accomplish that? Refused to let anyone convince me that NO was an option.

There are 3 things I’ve said to my kids more then necessary. 1. Quiting is not an option 2. Being rich doesn’t mean your successful 3. Always be of service to people

What do I do for a living? You’d be surprised how many people actually thought I was involved in something illegal... no, really... You’d be surprised! It’s gotten so old that now all I do is smile and nod. I’m not telling you this to make anyone think I’m showing off, no, it’s not about that. I don’t like to struggle, I hate to work, and I don’t understand financial technical terms like dows and percentage and whatever other fancy words they wanna use to shine up the real process. Let me tell you what I did, but first let me give you the scale in which it’s impacted my family.

I grew up with working parents, both held full time jobs, their own businesses, investments, and had the ability to raise my siblings and I with the little luxuries we wanted (the occasional toys r’ us runs, little things like that). They were financial STABLE, but not rich. They opened their own business about 10 years ago and now both are worth about 3 million each, or so says their business person. I saw first hand the struggle my parents went through when they started up their business, my mom even said that there was a handful of times that they didn’t even have money to buy us food. But when success came for them, it came fast!

When I turned 16 I took a dab at DJ-ing. Yes, I really was THAT cool back then! I did that for about 4 years. I worked for an actual radio station when I was 17 1/2, I did all their overnight programming and special events. At 18 at these big events I thought I was at the top of everything! My paychecks I spent on myself! All of it! Every dime. It was as through I was allergic to money and needed to spend it quicker then when I got it. My dad then brought it to my attention about my non-existent money management skills. He was right. What was my solution? Open a savings account? No, I’d still spend it. Save hard cold cash? Nope, I’d spend that too. I had to do something. At 18 money beckoned me. I decided to start doing side jobs; weddings, quinceaneras, anything! All that money I’d hand over to my dad and asked him not to give me a dime no matter what I tell him. WHO KNOW HE WOULD TAKE THAT SO LITERALLY! But it worked, I would save about 2800 every month, give or take. And some months he wouldn’t see anything- com’on! I had to have a life too! At 18 I graduated High School and started school to get my nursing degree. At age 20, with only 10 months left to graduate I got pregnant. I worked as long as I could and tried to do as much in school, I didn’t want to be a statistic! I will not be a number on the ‘’lets blame the baby’’ list! I was determined. AND I FINISHED! Once my baby was born I quit the radio station because it was more important for me to be with him then to be in clubs at night. After he turned 1 I decided to get into my field. I was lucky and got into an ER right away. It was exciting, super fast paced! The problem was the 12 hour shifts! I wasn’t being a baby... I wanted to be with my baby. While I worked there I continued to give my dad cash to hold, it wasn’t as much as before (because raising a baby comes with extra costs). But it was imperative that I saved because now my fear was providing for my child. But the hours were tough, mentally and physically, I went part time after 3 years. One day I had a patient that completely changed my life. PUT A PIN IN THAT!!!! He’s worth the story! Anyway this patient ended up influencing me way more then I could have hoped for! This man was put in my path for a reason.

Closer to today: Last year I asked my dad how much I had finally saved. I never asked him because I was worried I’d be tempted to use it wrongly. Mind you, this was a savings I have accrewed over a span of about 22 years. I never kept track, I never wrote it down. This money had to be OUT OF SIGHT AND OUT OF MIND. I saved $264,464.10, that means I managed to save almost 12,000 a year! A little over $1,000 month! AGAIN!!!!! I didn’t do it religiously! I remember when the $0.10 happened: I TOLD YOU! Sometimes I wasnt able to, but my system was the following: I would carry $60.00 in cash every week on me for any little thing we might want, eating out, treats, toys, medicine, etc. A WEEK! That number went up when I had more people around me. I kept 1,000 in my bank account after bills at all times (this was also never garenteed: THESE BILLS CAN GET A LITTLE OUT OF HAND! If I had over 1,000, I would withdrawl and give it to my dad, no matter the amount. All the change that was under $5 (bill) I would save in an envelope I kept in my dresser and would seal and turn that change over to my dad at the end of the month (that change adds up QUICK!). Any extra cash- tax refunds, these stimulus... it is wasn’t I always had like a paycheck, it was considered extra and I would send it on its way. HOWEVER!!!!! YES I’VE BEEN TEMPTED! I STILL HAVE THAT TEMPTATION! My dad said to invest it to make money on it. Yea, that’s nice but no. I’m too impatient to wait for someone else to put my money to work. Well, I guess I kinda ate those words: here’s what I did. I have a close family friend who has tons of friends all of which could use a job. I made 3 businesses with $10,000 each. THIS WAS A STRETCH! But it’s do-able for WAY LESS!!! I just couldn’t help over buying, geez!

Long story short, I started a gardening company. I do nothing but cover costs and pay wages. I collect on that and let me tell you- AMAZING. If you intend to do this let me disclose the following: People can be shitty! People CAN steal from you especially is the customers pay cash. PAY YOUR WORKERS WELL AND THEY WILL TREAT YOU WELL! I supply them with the extras. My kids fill refrigerators with snacks and waters or sodas. We supply uniforms at no cost, they get paid time off of two weeks, and rain or shine they get their salary! My son also said MOBILE CAR WASH is good too! There we went, now him and his friend run that truck. They make money, I make money. The 3rd one is a Pool Cleaning Service. This one was a little work because most people with pools have friend references. But this actually holds up pretty good. All three trucks are on my property by 8 pm, my son will fill the tanks, check the interiors, and supplies for the next pick up date. It works out.

Doing this has allowed me to stay home with my kids. I have been a house mom for the last 8 years. And now, I’m buying my 4 acre property! Thank God!

It’s tough, especially because I like expensive things! I love to spend, I love to travel. And believe it or not, I was still able to.

Wow, if this wasn’t an epic RAMBLE, I don’t know what would be! Sorry in advance. I’m so excited! I can’t wait to move! Hopefully someone has a small savings that they want to put to work and maybe this helped you get your mind thinking.

0 notes

Text

TOPIC: HOW TO OVERCOME THE WORLD

By. Sister. Savita Manwani

💥

Let us Pray: Lord we thank you for the very breath of life and this precious opportunity to share your living word. I pray Lord, that you guide us and teach us to hear your voice so that we may be the doers of your word and not just hearers. Glory and honor be to your Holy name. Amen.

TOPIC: HOW TO OVERCOME THE WORLD

The world represents everything that displeases God, opposes His teaching, and is under Satan’s dominion. (1 John 5:19).

Many philosophies, ideas and doctrines distort or degrade Christ and His sacrifice on the cross of Calvary. These offer a salvation not found in the Word of God, and are all manifestations of the world.

The Apostle John points out 3 aspects that mark the love of this world: The desires of the flesh, the desires of the eyes and the pride of life. John 2:15- 17 says “Do not love the world or the things in the world. If anyone loves the world, the love of the Father is not in him. For all that is in the world, the lust of the flesh, the lust of the eyes and the pride of life is not of the Father but is of the world. And the world is passing away, and the lust of it, but he who does the will of God abides forever.

¶ Lust of the flesh:

These are those desires that are in us by nature and impel us to do the wrong things. They incite us, even from childhood, to yield to what the flesh desires. They can be described as the satisfaction, passion or enjoyment that is felt by doing wrong things. In doing these things, we give room to sin in our lives.

Galatians 5:17 says, “For the flesh lusts against the Spirit and the Spirit against the flesh; and these are contrary to one another, so that you do not do the things that you wish.” This shows the conflict found in every Christian life. The flesh wants one thing while the spirit wants another. That is why it is important to nourish our spiritual man.

Galatians 5:19 - 21 gives us a long list of the sins of the flesh. These include sexual sins, sins involving pagan religions such as witchcraft or idolatry and other sins relating to temperament and character. The fruit of the Spirit is everything that is opposite to the flesh.

• In relation to God: love, joy and peace

• In relation to others: patience, kindness and goodness

• In relation to ourselves: faith, kindness and self-control

Our goal should be that our spirit wins the battle against the flesh.>If we want to conquer the desires of the flesh, we have to pay special attention to our spirit. We must feed it and care for it in such a way that in the face of temptation, the spirit prevails.

¶ Lust of the Eyes:

The eyes can be a fountain of life, purity and inspiration, or they can be an instrument of evil, perversion, and bad desires. Dr. W. E Vine describes them as being, “the principal avenue to temptation. “The desires of the eyes” can be described as perversions, bad intentions and selfish delights that include not only the sight, but also the mind and imagination. The Bible teaches in 2 Peter 2:14 “having eyes full of adultery and that cannot cease to sin, …” And in Matthew 5:27 – 29; “You have heard

that it was said to those of old, “You shall not commit adultery. But I say to you that whoever looks at a woman to lust for her has already committed adultery with her in his heart.”

The word “look” refers to the desires of the eyes, a look laden with lust, which wakens impure images and desires in our minds.

Someone once said, “the first look isn’t sinful but the second look is.” This second look aims to satisfy the mind's own desires.

Beacon's commentary says that this type of lust is “the tendency to be captivated by the exterior appearance of things without looking into its real worth.” The lust of the eyes include not only sight but also the mind and imagination. They seek to satisfy themselves through pornography or unedifying books, magazines or movies. They create an addiction that can only be quenched by giving in to the pleasures of the flesh. Generally, these desires are fed by thoughts convincing us that sin is something pleasant, pleasurable and desirable.

We justify the sinful thought as being acceptable as something harmless and insignificant. And since we haven’t actually done anything we are convinced it is not sin.

What's more, it keeps us from seeing the consequences that our behavior may bring to our lives and to those that we love.

When the mind delights itself with memories of past sexual experience, drunkenness, parties, or gambling. The enemy shows you the fun you experienced, the pleasures you felt, and how wonderful it would be to experience them again. These memories are accompanied by thoughts like, “there’s nothing wrong with that,” or, “everyone is doing it”, or, “I can’t become a fanatic.” The mind does not concentrate on the consequences that will come sooner or later, but on the desire and pleasures it wants to feel again. The influence the lust of the eye has on us is acute. They manipulate our mind and cause us to forget what Christ did for us.

That is why it is good to follow the Apostle Paul's counsel, when he exhorts us to walk in the Spirit and do not satisfy the desires of the flesh.

¶ Pride of life: This refers to the belief that the reason for life is found in the worldly appearance and worth of things, and not in how God values them. Pride is the illusion that leads people into superficiality, inflates their egos, and makes them believe that their worth is based on position, money and friends.

These vanities turn into strongholds for people who open the door to them. Vanities lead them to believe that their own ability has given them positions of importance with their peers. For this reason, some people climb over others in life, violating biblical principles and the will of God. Behind their appearances they hide their insecurity.

An example of this is when you spend more than you earn and live in debt even though it steals your peace. You don't change because you want to pretend that you are rich. You buy designer clothes, expensive mobile phone or hang out at the most popular places. You have been led to think these things win people’s respect.

God wants us to be prosperous. When we love Him, He lifts us to a better position. God, not His blessings, gives us our value.

¶ How the world affects me: The young person's world is not a secret to anyone. It is one that offers parties, vices, sinful passions and a worthless and empty life. The media, radio press and television, along with society push us towards this type of lifestyle. They trick us into believing that to have fun you must become part of their activities. If we refuse, we are labelled as boring and bitter people. These words boring and bitter are the most commonly used words by non-Christians to pressure the believer into doing what they want or say. The world may affect me when I give into its ways. It affects me when I take part in its dirty jokes and perverted comments or accept its invitation to drink and party. It affects me when these activities stop being fun and become addictive when I end up caught in circumstances that I want to be free from but cannot.

For example, an ungodly relationship ends in frustration and deception; an excess of alcohol produces sicknesses such as cirrhosis and venereal diseases are a result of a degenerate and promiscuous life.

The life the world offers us is a mirror that makes us believe that it is true and fulfilling. However, it doesn't let us see the deception and true consequences of its ways. Jesus does not want to remove us from the world he wants us to shine and be a light wherever we are. Jesus said: “I do not pray that you should take them out of the world but that you should keep them from the evil one” John 17:15

¶ How to face the world now that I am Christian?

A. Not participating in what the world has to offer.

Ephesians 5:11 says, “And have no fellowship with the unfruitful works of darkness but rather expose them”. Right from the start you need to learn how to be radical in dealing with sin. Don't ever cloud the real issues. For example, if they offer you a drink, don't lie by saying, “No thank you, I am on medication and drinking could be harmful.” That is not true. You are not on medication. It is rather a matter of faith, but you are too embarrassed to tell the truth.

B. Be radical in your stand as a Christian.

Job 22:28 says, “You will also declare a thing. And it will be established for you; so light will shine on your ways”. Decide beforehand what things you are not going to yield to. For example, decide not to go to parties with nonbelievers or social events where drinking and other vices are predominant. By deciding ahead of time you will avoid facing temptation and prevent yourself from falling into sin. The main thing is to decide, “No matter what happens, I will not leave the path that I have chosen.” This is determination. When I do my part, God does His. He brings His light to reveal what we should say or do.

C. Avoid spending too much time with unbelievers.

They will constantly encourage you to do wrong, inciting you to turn back.

D. Look for friends that share the same purpose and goals.

Spend time with those people who challenge you and strengthen your relationship with God.

E. Strengthen your relationship with God.

Spend time with Him daily in prayer and live in such a way that you will not leave His side. When you are facing situations that you are uncertain and doubtful about, it will help to ask yourself, “What would Jesus do if He were in my place?. I will no longer talk much with you for the ruler of this world is coming and he has nothing in me. John 14:30

Allow me to end here. May God bless you all.

Let us Pray: Heavenly Father, we thank you for speaking to us today. Lord, I pray that you empower us with your spirit and enable us also to feed our spirit being so that we will be able to overcome the flesh and the world in Jesus Name. Amen.

0 notes

Link

A couple of years ago I came across an article published by an Italian blog titled “Pizzeria sues TripAdvisor for psychological abuse”. I was intrigued and honestly curious to understand how a review site could possibly psychologically damage an inanimate thing like a restaurant, as I was sure that psychological traumas were a prerogative of mankind and, to a certain extent, animals.

Digging through the blog I discovered that the owner of the pizzeria (I quote literally) “reserved the right to refuse to serve TripAdvisor users, because” he continued, “We are here to work and not to be the target of the frustration of reviewers”.

As the name of the pizzeria was published in the article, I went online and checked his reputation and, not surprisingly, not only it was very bad (actually it was terrible), but the manager responses to the client comments were full of insults and threats.

Now, as a former hotel General Manager, I know how frustrating it can be when you do your best and guests slash you on review sites anyway, but that is part of the game. At the end of the day, you will not be able to make everybody love you. That is true for anything in life. Therefore, the only thing you can do (unless the reviews are completely misleading, and in that case, you can always report them to the review site for further investigation and possible removal) is to swallow your ego, calm down and apologize.

I was feeling bad for the owner of the pizzeria and I imagined him as a 70-something old school Naple guy that never get out of the pre-web era, so I tried to contact him privately to give him some advises because, with this approach, he was actually damaging his business (giving the F-word to a client is never a good idea). To my big surprise, when I finally reached him, I discovered that he was around my age and pretty familiar with social networks too.

We had a long chat and I explained to him some best practices in order to deal with the (unavoidmakable) occasional bad reviews (all for free, of course). I didn’t really expect gratitude, and I did it just because I felt bad for the guy, but what he said to me at the end of the conversation shocked me: he accused me to work secretly for TripAdvisor and he told me that I wanted him to buy something from the famous review site. At that point, I stopped any kind of contact with him, as the whole situation was turning into an Illuminati-like conspiracy and I honestly did not want to waste more time on it.

Nevertheless, this incident made me think about how restaurants and hotels managers underestimate the power of reviews when it comes to food & beverage.

Within my clients, I have a hotel with an amazing two-Michelin-star restaurant but, even though they actively reply professionally to every single review published on the hotel review sites, the restaurant TripAdvisor page stays on an incredible state of abandonment. Even worse, whenever they receive a bad review, they try to report it in order to move it to the restaurant page. They use the restaurant review page as the hotel parachute. And we are talking about one of the best places you can eat in southern Italy.

Sure, often hotel restaurants are forgettable (at best), overpriced and the majority of guests eat there as a last resort because the closest restaurant in town is half an hour Uber ride away, but does this mean that you have to give up managing your online reputation tout court? I doubt it.

Listening to your guests is, as always, the golden rule. However, there is another one that’s often forgotten: when was the last time you ate at your restaurant? I am sure between your duties as a general manager you have to inspect rooms, meet your staff and speak to your attendants on a daily basis, but how much time do you spend in the kitchen?

Everybody is complaining about the quality of the veggies on Yelp? Well, maybe it is time to change your distributors. The name of that rude F&B Manager pops out on every single review. I think you should have a chat vis-à-vis with him and solve the issue once for all.

Hotel restaurants have the tendency of being seen as sons of a lesser God when it comes to hospitality: as long as rooms are clean and Wi-Fi works fine then there is no need to worry about the undercooked pasta. They are conceived as unanimated appendages to the main entity: the hotel. However, the reality is that they are not. Even though they do not necessarily reflect the hotel style and vibe, it does not mean they are just tools to make some ancillary revenue. Especially if your hotel is located far from the city center, it is vital that you give your guests a great experience. Would you risk destroying your hotel online reputation just because you serve watered down margaritas? I do not think so.

Great experience can mean good prices too. If you know that your restaurant is average, it can be a good idea to review your à-la-carte menu to make it look less like a robbery. Remember that with the rise of mobile and social networks your reputation is just one click away so sometimes listening to your clients when they are in the restaurant is not enough.

Therefore, what you should do to actively monitoring your restaurant online reputation?

We gathered 10 golden rules to improve your restaurant experience:

Collect and aggregate data from all the review sites that mention your property and your competitors. This will give you a better understanding of what is working and what needs to be improved. There are modern online reputation management tools that can do it for you, so adapt an online reputation technology that could simplify all the unstructured data in way that is more actionable. Insight on what are reviewers writing about your restaurant, is crucial to identify the gaps and improve guest experience.

Use an online reputation management tool to map your service style and cuisine with your competitors so that you can benchmark and improve by doing apple-to-apple comparison. Remember that Devil is in detail of guest experience.

Once you start analyzing your competitive set, focus on key metrics for these four categories

a) Food & Beverage: consistency, freshness, value for money, portion size, smell, taste and temperature.

b) Dining Experience: business hours, greeting, internet access, location, parking, restrooms, seating room and standing room.

c) Service: Quality and speed.

d) Ambiance: cleanliness, décor design, atmosphere, comfort, heating and cooling, noise isolation and lighting.

That should be understood, but claim all your pages. You should always have control over those and make sure there are no duplicates. It’s free and easy to do and you can add a lot of useful information like your location, your average price, etc.;

Reply to ALL your reviews. Not only the bad ones, ALL of them. If your clients are happy then just thank them, if they’re angry apologize and promise that you will make everything in your power to improve the service

Do not focus on TripAdvisor only. There are dozens of directories out there: Dineout.co.nz, Facebook, Foodio54, Google, Opentable, Restaurant.com, TopTable.co.uk, Yell, Yelp, Zomato etc. Make sure to be listed and active on all of these. Your online reputation management tool can help you to structure data and get all your online mentions in real time.

Foodies love images: think about opening an Instagram account and share your best dishes every day. You can create a hashtag to give to your clients too, so they will share more images and you will have free contents on a daily basis!

Foodies love videos too: you can think about connecting your Google MyBusiness page to a YouTube channel and publish an interview to the chef or a video of your bartender preparing a perfect Martini Dry. These kind of contents are always appreciated;

You can think about inviting influencers to your restaurant and get a great article written on their blogs. It can be expensive, but usually the return on branding is totally worth it.

Last but not least: create a proper strategy: improvisation is good for jazz, but not if you want to re-brand your restaurant.

So, is managing restaurant’s online reputation a priority for hotel general managers?

It surely is, if you focus & leverage on technology it can turn out to be a Secret Sauce in enhancing your Hotel Brand.

Originally published at rategain.com on June 28, 2017.

25 notes

·

View notes

Text

The pros and cons of Personal Capital

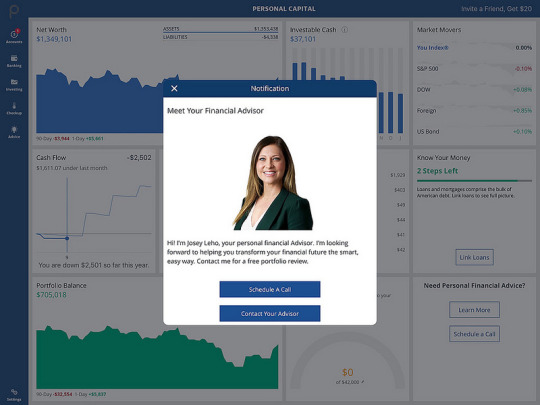

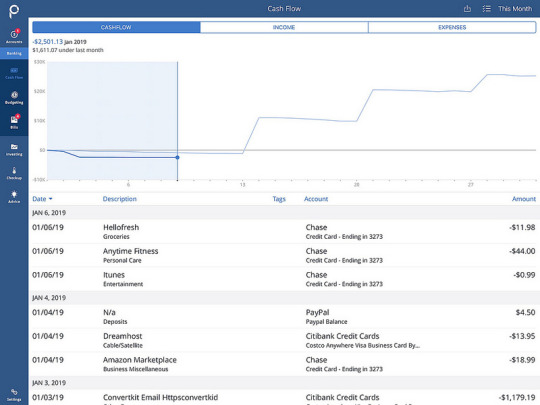

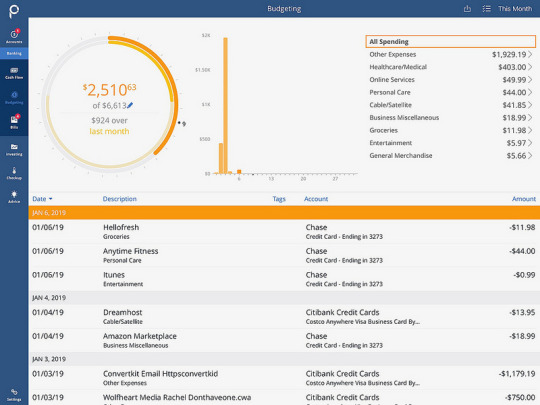

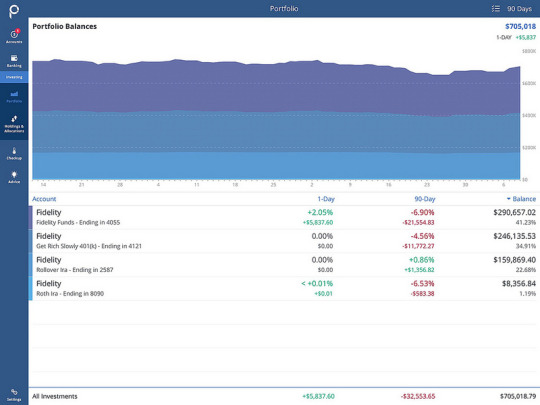

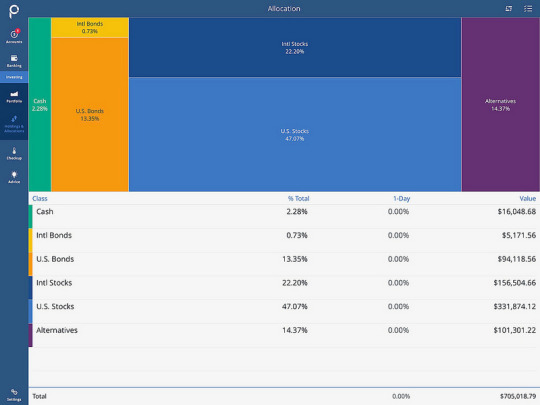

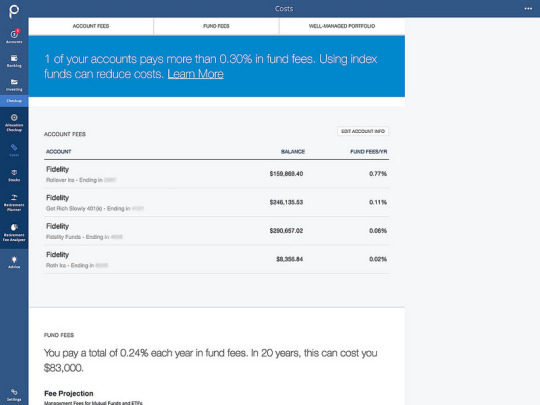

If you've read money blogs over the past five years, you've heard about Personal Capital. Personal Capital is a free money-tracking tool with a beautiful interface and gasp no advertising. (One of my big complains about Mint is that it shoves ads in your face.)

Many of my friends and colleagues promote the hell out of Personal Capital because the company pays good money when people sign up. (And yes, links to Personal Capital in this review absolutely put money in my pocket. But any Personal Capital link you see anywhere on the web puts money in somebody's pocket.)

I sometimes wonder, though, if any of my pals actually uses Personal Capital, you know? All of their reviews are glowing. While I like Personal Capital, I've been frustrated by the app in the past. Even today, I find that it's not as useful as I'd like.

What are my issues with Personal Capital?