#ewallet Application Development Company in France

Text

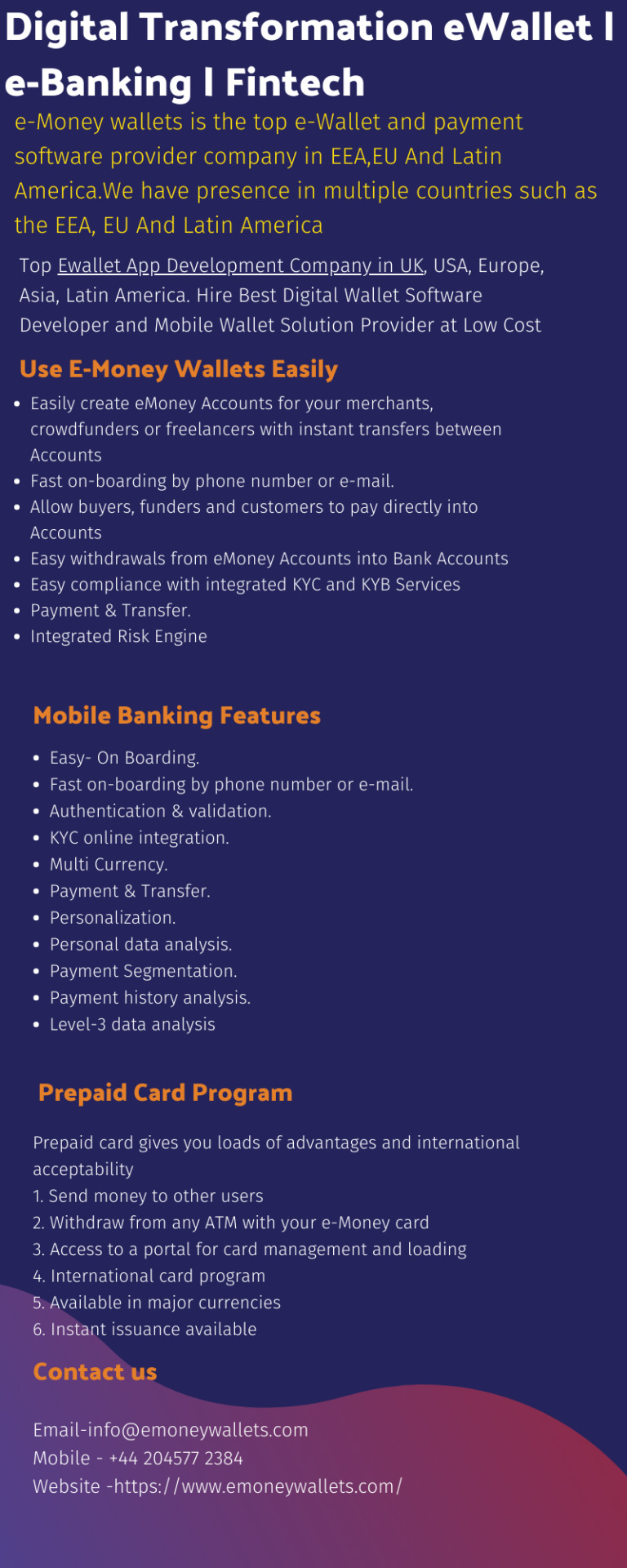

Emoneywallets: Your Trusted eWallet Application Development Company in France

Introduction:-In an era where digital transactions are becoming increasingly popular, having a robust and user-friendly eWallet application is essential for businesses to thrive. If you're searching for a reliable and expert eWallet Aapplication Development Company in France, look no further than Emoneywallets. With their extensive experience and innovative solutions, Emoneywallets stands out as a leading provider of top-quality eWallet application development services in the country.

Extensive Expertise:-Emoneywallets boasts a team of highly skilled professionals with deep expertise in eWallet application development. With years of experience in the industry, they have successfully delivered numerous projects for clients ranging from startups to established enterprises. Emoneywallets possesses comprehensive knowledge of the latest technologies, security protocols, and industry trends, ensuring that they provide cutting-edge solutions tailored to your business requirements.

Customized Development:-At Emoneywallets, they understand that each business has unique needs and goals. That's why they offer customized eWallet application development services. Their team takes the time to understand your business objectives, target audience, and desired features to create a tailored solution that aligns with your brand identity. Whether you need a standalone eWallet app or integration with existing systems, Emoneywallets can deliver a personalized application that meets your specific requirements.

User-Centric Design:-User experience is at the forefront of successful eWallet applications. Emoneywallets follows a user-centric approach to design, ensuring that the interface is intuitive, visually appealing, and easy to navigate. They conduct thorough user research, usability testing, and UI/UX optimization to create an engaging and seamless experience for your app users. By prioritizing user satisfaction, Emoneywallets develops eWallet applications that drive customer engagement and loyalty.

Robust Security Measures:-Security is of utmost importance in eWallet applications, given the sensitive nature of financial transactions. Emoneywallets prioritizes the implementation of robust security measures to protect user data and transactions. They employ industry-standard encryption protocols, two-factor authentication, and advanced security features to ensure the utmost protection of sensitive information. Emoneywallets takes the necessary steps to comply with data privacy regulations, providing peace of mind to both users and businesses.

Timely Delivery and Support:-Emoneywallets understands the importance of timely project delivery. They follow efficient development processes and maintain clear communication throughout the development lifecycle, ensuring that your eWallet application is delivered on schedule. Moreover, their commitment to customer satisfaction extends beyond the launch of the app. Emoneywallets provides reliable post-development support, addressing any issues or updates promptly to ensure your application continues to perform optimally.

Conclusion:-Emoneywallets is your trusted partner for top-quality eWallet application development services in France. With their extensive expertise, customized development approach, user-centric design, robust security measures, and commitment to timely delivery and support, Emoneywallets ensures the success of your eWallet application project. Whether you need an eWallet app for retail, finance, or any other industry, Emoneywallets has the skills and experience to bring your vision to life. Contact Emoneywallets today to discuss your eWallet application development needs and unlock the potential for digital transformation and growth in the French market.

#ewallet Application Development Company in Paris#ewallet Application Development Company in France#ewallet Application Development Company in Italy#ewallet Application Development Company in Birmingham

0 notes

Text

Payment Processing Solutions Market has Huge Demand Top Key Players Profiling - Stripe, Square, Jack Henry & Associates, Due, First Data

The recent report on “Global Payment Processing Solutions Market Report 2022 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2030” offered by Credible Markets, comprises of a comprehensive investigation into the geographical landscape, industry size along with the revenue estimation of the business. Additionally, the report also highlights the challenges impeding market growth and expansion strategies employed by leading companies in the “Payment Processing Solutions Market”.

An exhaustive competition analysis that covers insightful data on industry leaders is intended to help potential market entrants and existing players in competition with the right direction to arrive at their decisions. Market structure analysis discusses in detail Payment Processing Solutions companies with their profiles, revenue shares in market, comprehensive portfolio of their offerings, networking and distribution strategies, regional market footprints, and much more.

Key players in the global Payment Processing Solutions market: Stripe Square Jack Henry & Associates Due First Data Authorize.Net Global Payments CCBill PayPal BlueSnap On the basis of types, the Payment Processing Solutions market from 2018 to 2030 is primarily split into: Credit Card Debit Card Ewallet On the basis of applications, the Payment Processing Solutions market from 2018 to 2030 covers: Retail Hospitality Utilities & Telecommunication Others

Click the link to get a free Sample Copy of the Report @ https://crediblemarkets.com/sample-request/payment-processing-solutions-market-903728?utm_source=Kaustubh&utm_medium=SatPR

Regional Analysis of Global Payment Processing Solutions Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Payment Processing Solutions market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

What does the Report Include?

The market report includes a detailed assessment of various drivers and restraints, opportunities, and challenges that the market will face during the projected horizon. Additionally, the report provides comprehensive insights into the regional developments of the market, affecting its growth during the forecast period. It includes information sourced from the advice of expert professionals from the industry by our research analysts using several research methodologies. The competitive landscape offers further detailed insights into strategies such as product launches, partnership, merger and acquisition, and collaborations adopted by the companies to maintain market stronghold between 2022 and 2030.

Direct Purchase this Market Research Report Now @ https://crediblemarkets.com/reports/purchase/payment-processing-solutions-market-903728?license_type=single_user;utm_source=Kaustubh&utm_medium=SatPR

The report can answer the following questions:

North America, Europe, Asia Pacific, Middle East & Africa, Latin America market size (sales, revenue and growth rate) of Global Payment Processing Solutions industry.

Global major manufacturers’ operating situation (sales, revenue, growth rate and gross margin) of Global Payment Processing Solutions industry.

Global major countries (United States, Canada, Germany, France, UK, Italy, Russia, Spain, China, Japan, Korea, India, Australia, New Zealand, Southeast Asia, Middle East, Africa, Mexico, Brazil, C. America, Chile, Peru, Colombia) market size (sales, revenue and growth rate) of Global Payment Processing Solutions industry.

Different types and applications of Global Payment Processing Solutions industry, market share of each type and application by revenue.

Global market size (sales, revenue) forecast by regions and countries from 2022 to 2030 of Global Payment Processing Solutions industry.

Upstream raw materials and manufacturing equipment, industry chain analysis of Global Payment Processing Solutions industry.

SWOT analysis of Global Payment Processing Solutions industry.

New Project Investment Feasibility Analysis of Global Payment Processing Solutions industry.

Contact Us

Credible Markets Analytics

99 Wall Street 2124 New York, NY 10005

Email: [email protected]

0 notes

Text

About UK Digital Company

UK Digital Company is a boutique digital technology that caters to every business goal.

We understand the need of having easy and functional digital technology for wide audiences. UK Digital Company creates comprehensive merchant-digital and user-friendly solution innovations. Thus, making us a Web Development Company in the UK and provider of Website Development Services.

Now, if you’re looking for a solution that can be aligned with your existing network, then you’ve come to the right place. Aside from that, we offer a solution that is affordable and has partnered with a high-technology framework making us the world’s youngest payment network operation.

Furthermore, our experience in digital technology and development has allowed us to establish a global presence in the USA, Latin America, Caribbean countries, the UK, and European countries. Additionally, we also established our name and reputation in other countries like France, Estonia, Singapore, Thailand, Malaysia, and Myanmar.

Now that you have a good deal of who we are and what we do, you might be curious to know why you should choose UK Digital Company as your partner? UK Digital Company promises rapid delivery, customer satisfaction, agile methodology, houses proficient and skilled developers, and has competitive pricing to name a few of the things you will get from our services and solutions.

Further, we have a wide range of services such as Web Development, Mobile Application, eCommerce, and Virtual Card. UK Digital Company is also big in providing solutions namely Merchant, Global Payment Gateway, Marketplace, ERP System, and eWallets. With us, you can be sure that we are here to provide you with flexible digital technology that’s not only full-service but also a creative digital agency to achieve whatever is your business goal in mind. We are a company that delivers and a company that makes a connection.

Get to know more about us by visiting our website or you can also send us your inquiry by clicking this.

0 notes

Text

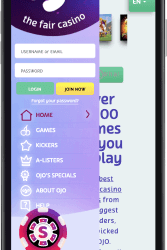

PlayOJO Casino

Join here

Casino Games: The Best Games From The Top Providers! All The Most Popular Deposit / Withdrawal Methods Available! Ojo+ Money back on Each Bet (Win Or Lose)!

Owner: Skill On Net Ltd. Casinos

Established: 2017

Welcome Bonus: 1st Dep. Up To 50 Free Spins

Currencies: British pounds sterling, Euros, US dollars, etc.

License: Skill On Net Limited 39326, PlayOJO Casino MGA.

Currencies: Australian dollars, British pounds sterling, Canadian dollars, Denmark kroner, Euros, Norwegian kroner, South African Rand, Swedish kronor, Swiss francs, US dollars.

Withdrawal Times

EWallets: 24 hours

Credit/Debit Cards: 2-7 days

Bank Transfers: 2-7 days

Cheques: Not offered

Pending Time: 12 hours

Withdrawal Limit: 10 000 EUR per transaction

PlayOJO Casino Details

Withdrawal Method: EcoPayz, MasterCard, Neteller, PayPal, Paysafe Card, Skrill, Visa, Wire Transfer.

Deposit Methods: EcoPayz, MasterCard, Neteller, PayPal, Paysafe Card, Skrill, Visa.

Restricted Countries: American Samoa, Australia, Belgium, Cyprus, Denmark, France, Guam, Hungary, Israel, Italy, Mexico, Northern Mariana Islands, Puerto Rico, Romania, Spain, Turkey, U.S. Virgin Islands, United States.

Languages: English, Finnish, German, Norwegian, Swedish.

Software: Big Time Gaming, Blueprint Gaming, Microgaming, NetEnt, NextGen Gaming, SkillOnNet, Yggdrasil Gaming.

Licenses: Malta Gaming Authority, UK Gambling Commission.

Casino Type: Instant Play, Mobile.

Return to Player: Publicly audited

Manual Flushing: No

Live Chat: Yes

Latest release:

SkillOnNet adds EGT Interactive content to impressive portfolio.

Players at popular online casino brands such as PlayOJO and QueenVegas now have access to provider’s exciting slots and jackpot games.

April 2019: SkillOnNet continues to establish itself as the world’s leading online casino platform provider following its latest game developer integration, EGT Interactive.

The partnership takes the total number of slots, jackpot, table and live dealer games packed into the SkillOnNet portfolio to 2,500+ making the provider a clear market leader.

Players at popular online casino brands such as PlayOJO, DrückGlück, Cozino, AhtiGames and LuckyNiki can now access EGT Interactive’s full suite of games.

This includes blockbuster slots such as Forest Tale, Dragon Reborn and hugely successful slot games like 40 Super Hot, Burning Hot and Shining Crown.

SkillOnNet has built up its impressive game portfolio over recent years, with titles offered from major tier one developers as well as up and coming innovators and game changers.

Michael Golembo, from SkillOnNet, said: “Players now expect online casino operators to offer a huge range of games from the best suppliers from around the world.

“Here at SkillOnNet, we are constantly adding new providers to our portfolio and are delighted to have partnered with EGT Interactive.

“EGT Interactive has made a name for itself by combining stunning graphics with innovative gameplay and we believe its titles will be a big hit with our brands and players.”

Todor Zahariev, Manager of EGT Interactive said, “We are extremely excited on the finalisation of this partnership as we are looking forward to providing our premium casino slots to such a prominent name in the industry. For us, this collaboration is not only strengthening of our presence in the international market, it is also about delivering exceptional gaming experience to even greater group of players. We are confident that SkillOnNet’s vast customer base will enjoy our +100 titles of leading casino content.”

TOP 5 Facts

Welcome Offer: PlayOJO offers a very attractive welcome offer of up to 50 Free Spins to their new players, which translates to 1 Free Spin for every £1 deposited. The minimum deposit is £10 and is limited for 1st time depositors only.

All Free Spins with No Wagering, Ever: This is a very unique selling point that players won’t find at other online casinos. As a completely wagering-free environment, players will never need to wager any of their winnings. Whatever they win, they get to keep with no wagering requirements, ever.

OJOplus Money with No Wagering: Another inbuilt specialty of PlayOJO is it’s OJOplus money-back feature, which awards players with money back on every bet, whether they win or lose. Players can accumulate their OJOplus money and do as they wish with it – whether they want to play with it or withdraw it, wagering-free.

Same Day Payouts: PlayOJO aims to process withdrawal requests within just a few hours. It can take up to 24-hours max, but this depends on which payment method you use. There is no waiting around for players’ well-played cash.

Huge TV and Offline Campaigns in UK and Sweden: PlayOJO’s “always on” approach combines highly-targeted TV, radio and press advertising both in the UK and Sweden. In Sweden alone, which is the smaller of the two markets, PlayOJO is consistently one of the top 3 casino TV advertisers.

PlayOJO is a casino-powered platform that has numerous advantages ranking it among the most spectacular web-based platforms where one can play reward-generating games released to the market in 2018 and previously. Try slot machines with free spins granted for the primary deposit made by players and there is no need to save any software to your device, so you can access all games online and win a lot of money with ease.

One of the strongest advantages of PlayOJO project is a fast withdrawal that takes less than 24 hours. Players can use a live chat to get support from the top-level administrative personnel. PlayOJO has UK Gambling License and accredited by Casinomeister, which proves a high quality and professionalism of the gaming-oriented platform. PlayOJO was founded back in 2017. Owners of the portal are Skill On Net Ltd. Casinos group.

Apart from the British commission on gambling regulation, PlayOJO has Malta’s license. Players can change language on the website, switching from English to Swedish, Norwegian, Finnish and German. The type of the website is both for instant play with a web version and for mobile-friendly gambling using a smartphone application. PlayOJO promotes responsible gaming-driven entertainment, so that only players from those countries where gambling is allowed can start playing with PlayOJO. Among restricted regions in the list, there are Asia, Belgium, Mexico, France, Spain, the United States, Australia, Turkey, Cyprus, Romania, Denmark, Italy, Hungary, and Israel.

Nevertheless, the operator is always looking for new opportunities to expand its borders. Thus, the PlayOJO has recently opened its doors to Sweden, thereby showing its strong position in the market.

PlayOJO Casino-Driven Technologies and Slots

PlayOJO is a professional portal for gambling that cooperates with many different soft producing companies, like Microgaming, Big Time, NetEnt, Yggdrasil Gaming, SkillOnNet, Thunderkick, Play’nGo, NextGen Gaming and Blueprint. In the category of casino-oriented games and slots, players can see a line for the search to enter a name of the video slot game and find a machine by its name.

Pressing on a special button, visitors of the website can select such categories as OJO Plus games, Max Bet games, Choice by the provider, Minimal Bet games, Slots Play, jackpot games, Roulette, New slots, Most Popular amusements and others. The range of the latest slots bristles with such options as Pink Electric, Fortunium, Esqueleto Explosivo, Honzo’s Dojo and many others. The most splendid slots in the portfolio of PlayOJO casino include Book of Dead, Easter Island, Snow Leopard, Bonanza, Immortal Romance, Rainbow Riches, Wish Upon a Jackpot, Magic Mirror, Viking Berzerk, Jackpot Jester, Knight’s Life and 8th Wonder.

The OJO administration has chosen only special slot machines for the gambling session. Among them: Book of Dead, Easter Island, Snow Leopard, Fortunium, Mega Moolah, Bonanza, Immortal Romance, Rainbow Riches, Black Ice, Magic Mirror, Viking Runecraft, Viking Berzerk, Jackpot Jester, King Kong Fury, Respin Rhino, Legacy of Egypt and Spina Colada.

Other PlayOJO Casino-Powered Games

There are 31 variations of roulette games in the portfolio of PlayOJO casino. Roulettes are: London Roulette, Svensk Roulette, NetEnt Live Roulette, European Roulette, Auto Roulette by Evolution, Auto Roulette NetEnt, French Roulette Pro, European Roulette Pro, French Roulette by Evolution, Deutsches Roulette, European Roulette Pro, Auto Roulette Low Limit, Immersive Roulette, Auto Roulette VIP, Wolf Gold Roulette, Roulette by Evolution, Gold Rush Roulette, Auto Roulette High Limit, Classic Roulette, Live Roulette Extreme, Classic Roulette Deluxe, Joker’s Jewels Roulette, Italian Roulette, Diamond Strike Roulette and Great Rhino Roulette.

In total, there are 16 blackjack-related offerings on the website. They are Blackjack Live by Evolution, Blackjack Pro by NetEnt, Manual Shoe A Blackjack by NetEnt, Blackjack Turbo, Blackjack NetEnt Live, VIP Blackjack Live, Blackjack Live Extreme, Common Draw Variation, Blackjack Italian and others. Two card games are also available in the portfolio of the company: Punto Banco and Baccarat. 16 variations of video poker are offered in the gallery as well. Among the types of video poker on the PlayOJO site, punters can find: Joker Poker 10H, Aces and Faces 25H, Deuces Wild 1H, Jacks or Better 25H, Joker Poker 25H, Aces and faces 10H, jacks or Better 1H, Jacks or Better 3H, Joker Poker 3H and lots of others.

PlayOJO Portal’s Features and Bonus Offerings

Welcome bonuses are granted to those players, who place their initial deposits at the website, so that they can eventually get up to 50 free spins, one spin per each dollar/euro/pound they place in the form of a deposit. Become a participant of the A-lister together with the PlayOJO Corporation and get an access to numerous bonuses for a satisfying gambling session. Players can find lots of tempting propositions to play with PlayOJO on the website of the company to get bigger rewards.

OJO Plus club is a VIP community for players. You can easily acquire 3 pounds extra for each bet to get even greater monetary gains in the amount of the bonus and a 1000-pound wager for the membership in the Highest VIP level club and 6 pounds extra and a 1000-pound wager for the membership in the OJO Plus gaming community. As a member of the VIP club at the website of the PlayOJO project, each client can get special extra offerings, such as exclusive free spins and an opportunity to stop paying for the game, increasing betting limits to spend as much money as you want during the gambling session. A birthday gift is waiting for all members of VIP club on the portal of PlayOJO portal. Get luxury gifts to play on the website of the gambling portal and super mega spins as a turbo offer for the complete satisfaction during one’s gaming-related session.

Furthermore, among the most spectacular features of PlayOJO platform is the money back opportunity, which is granted to every slot player on each bet they make regardless of whether they grab some prize or come out as a loser this time. This is known as OJO Plus feature. No other casino-powered platform provides such an opportunity. Finally, there are no wagering demands as a whole, so that each free spin is offered without the need to place a wager and you can either use your monetary gains to continue winning even bigger-sized rewards or cash them out immediately with no difficulty whatsoever.

PlayOJO’s Payment and Withdrawal Methods

A maximum withdrawal limit at the company’s website is 10 000 euro per a single transaction, but the number of transactions is unlimited, so you can cash out your winnings with no boundaries. People who appear to be clients of PlayOJO will be able to make withdrawals with Skrill, MasterCard, EcoPayz, Neteller, Wire Transfer, PayPal, Visa and Paysafe Card. A withdrawal with E-Wallets will take less than 24 hours. A cash withdrawal transaction with credit and debit card as well as bank transfer will take from two to seven business days.

Deposits on the site of the PlayOJO Corporation can be made with EcoPayz, Skrill, MasterCard, Visa, Neteller, Paysafe Card and PayPal. On the site of PlayOJO Corporation, bets can be made using different currencies. Among them: Australian dollars, US dollars, Swiss francs, Canadian dollars, Swedish kronor, Denmark Kroner, Norwegian kroner, Euros, South African rand and British pounds.

PlayOJO’s Customer Support

Only those people who complete registration on the website can get support from the world-level administrative personnel of the company. Response time in live chat is quick. By the way, you may get in contact with the support team via mail. Send a message to the [email protected] address and get a response to your personal email quickly. To talk to the manager and get all answers on any questions of interest even quicker, you may call 0203 150 0852. Live chat is operating all the time to offer players response to all possible questions and solve any issues via a conversation.

Professional consultation of players from the side of the administration is exactly what players need to get an access to the really profitable world of gambling. Professional managers of PlayOJO project are ready to support gamblers all the time. The support team is working without days off and weekends.

You may use a mobile phone of the corporation and email address only during certain hours, but live chat is working 24/7. To find out the details about one’s payments, players can simply use an email address. In case you are faced with a serious problem, you can always call a specialist and ask anything you are interested in directly.

Live PlayOJO Casino

There are 53 variations of live casinos possible to access in real time. Gambling in such regime can help players socialize and contact each others, feeling a part of the professional gambling community. Among offers that are mentioned in the list of accessible real-time casinos, PlayOJO can present: Blackjack in Real Time by Evolution casino, Dream Catcher live, London Roulette, NetEnt Roulette, Svensk Roulette, Auto Roulette by Evolution, Platinum Live Casino by Evolution, Auto Roulette by NetEnt, Manual Shoe A Blackjack, French Roulette by Evolution, Deutsches Roulette, Blackjack VIP NetEnt, Wolf Gold Roulette and numerous other profitable options.

Mobile Apps by PlayOJO Casino

The mobile-friendly design is a strong advantage of this casino as it allows accessing your favorite games wherever you go and whenever you wish using the portable device of your choice. Mobile-oriented application of PlayOJO project can be downloaded in Apple Store and Google Play. The downloading process itself will last only for several seconds – the application is light and won’t take much space on your personal portable device.

PlayOJO Portal’s Security

SSL and TSL security system will protect all personal information of players. These security systems protect personal information of gamblers and all data about the gambling session, making it encrypted. You may trust PlayOJO while spinning reels of the most favorite games – the website never disappoints players.

Conclusion

Development of the gambling-based industry is the aim that the PlayOJO portal is following. Offering professional content for the casino-loving community, the administration of the PlayOJO Corporation can raise a bar of quality on the market and make all types of gaming fans even more educated. Professional gambling is what modern players want and exactly what PlayOJO is ready to offer them.

Join here

0 notes

Text

Digital Payment Market Size, Trend And Growth (2019 – 2026)

A recent study on the Digital Payment market applies both primary and secondary research techniques to accumulate vital statistics about the competitive business landscape of the Digital Payment market for the forecast period 2019 - 2026. The latest market intelligence report provides business owners, stakeholders and field marketing executives’ critical insights about the opportunities as well as strengths to help keep up with the dramatic shift in the consumer behavior and consumption power. The study methodologies used to examine the Digital Payment market for the forecast period, 2019 - 2026 further classifies the industry by type, geography, end-use and end-user to add more precision and bring to light factors responsible for augmenting business development.

Request For FREE Sample Copy of this report at: https://www.reportsanddata.com/sample-enquiry-form/1617

Companies considered and profiled in this market study

Apple Pay, PayPal, Google Pay, PayU, VISA, Paytm, Mastercard, Barclaycard, American Express, Bitcoin.

Scope of the Report:

The research methodologies used for evaluating the Digital Payment market are inventive and also provides enough evidence on the demand and supply status, production capability, import and export, supply chain management and investment feasibility. The investigative approach applied for the extensive analysis of the sale, gross margin and profit generated by the industry are presented through resources including tables, charts, and graphic images. Importantly, these resources can be easily integrated or used for preparing business or corporate presentations.

Segments covered in the report:

Payment Method Outlook (Revenue, USD Billion; 2016-2026)

POS Devices

Net Banking

Digital eWallets

Mobile Banking

Cryptocurrencies

Backend Operation Type Outlook (Revenue, USD Billion; 2016-2026)

Encryption & Security Management

Transaction Risk Management

Application Program Interface

Payment Gateway

Blockchain & Data Mining

Browse full report description, TOC, Table of Figure, Chart, etc. at: https://www.reportsanddata.com/report-detail/digital-payment-market

Size of Organization Outlook (Revenue, USD Billion; 2016-2026)

SMEs

Large Enterprises

Backend Operation Type Outlook (Revenue, USD Billion; 2016-2026)

Banking & Financial Sectors

Hotels & Restaurants

eCommerce

Retail

Corporate Sectors

Public Sectors

Healthcare

Transportation & Telecommunication

Others

Regional Outlook (Revenue, USD Billion; 2016-2026)

U.S.

UK

France

China

India

Japan

Brazil

The research provides answers to the following key questions:

• What is the estimated growth rate of the Digital Payment market for the forecast period 2019 - 2026? What will be the market share and size of the industry during the estimated period?

• What are prime factors expected to drive the Digital Payment industry for the estimated period?

• What are the major market leaders and what has been their winning strategy for success so far?

• What are the significant trends shaping the growth prospects of the Digital Payment market?

• What are the key challenges expected to restrict the progress of the industry for the forecast period, 2019 - 2026?

• What the opportunities product owners can bank on to generate high profits?

Make an inquiry before buying this report at: https://www.reportsanddata.com/make-enquiry-form/1617

About Reports and Data

Reports and Data is a market research and consulting company that provides syndicated research reports, customized research reports, and consulting services. Our solutions purely focus on your purpose to locate, target and analyze consumer behavior shifts across demographics, across industries and help client’s make a smarter business decision. We offer market intelligence studies ensuring relevant and fact-based research across a multiple industries including Healthcare, Technology, Chemicals, Power, and Energy. We consistently update our research offerings to ensure our clients are aware about the latest trends existent in the market. Reports and Data has a strong base of experienced analysts from varied areas of expertise.

Contact Us:

John Watson

Head of Business Development

Reports And Data | Web: www.reportsanddata.com

Direct Line: +1-800-819-3052

E-mail: [email protected]

#Digital Payment Market#Digital Payment Market size#Digital Payment Market share#Digital Payment Market trends

0 notes

Text

E-wallet Market - Developments and Trends, Potential of the Market from 2019-2023

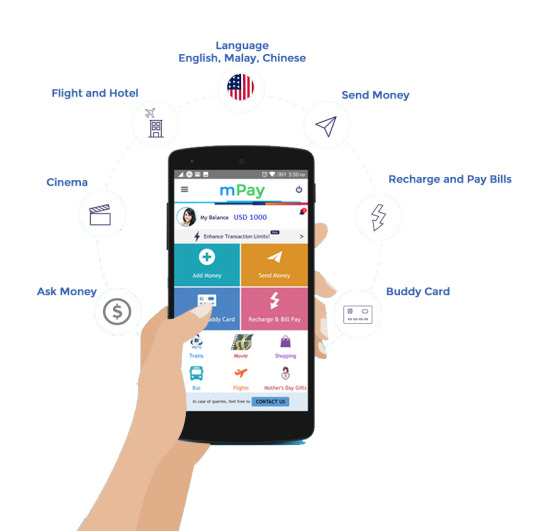

Market Synopsis:

With the emergence of e-commerce and online purchases, the procedure required for the payment system is also changing, forcing it to go digital due to which users migrated from cash payments to plastic card payments and now to contactless payments. These payments occur through digital channels either held on digital wallets or in the cloud, or from new digital payment mechanisms. Since the scenario is still evolving a wide variety of names are used for such transactions such as e-money, digital money, micro-payments and many others.

Many E- wallet services like paytm & free charge work through apps in smart phone. Regardless the traditional payment procedure, an E wallet is based on encryption software which substitutes analog wallet during monetary transactions. Further, E-Wallet allows you to store multiple credit card and bank account numbers in a secure environment and eliminate the need to enter in account information during money transactions. Once user gets registered and creates an E-Wallet profile, access will be provided to make payments faster and with less typing.

Get Sample of Report @ https://www.marketresearchfuture.com/sample_request/4633

In the latest trend, NFC chip enabled smartphone are expected to drive the market as most of the smartphone manufacturers are equipping the phones with NFC (Near field communication). Placing smart phone within four inches of pay pad or contact less reader will prompt wallet or passbook for payment confirmation.

Further, as per industry developments, In July 2017, Axis Bank acquired free charge e-commerce Company offering digital transactions. On the other end paytm is being backboned by several funding’s in order to boost in e- wallet transactions. Citrus pay is acquired by PayU owned by Naspers for $130M to expand its operations in India. The endless opportunities in this field inviting more players to invest in E-Wallet Market.

The global E-wallet market is expected to grow at CAGR of 15% and estimated to reach market size of approximately USD 2,100 billion by the end of forecast period 2017-2023.

Key Players:

Market Research Future study identifies Alibaba Group Holding Ltd. (China), Apple, Inc. (U.S.), Citrus Payment Solutions (India), Google, Inc. (U.S.), MasterCard (U.S.), Oxigen Services India Pvt. Ltd (India), PayPal Holdings (USA), Samsung Electronics Inc. (South Korea), and Visa (USA) as the key vendors in the global E-wallet market.

Segments:

For the purpose of this study, Market Research Future has segmented the Global E wallet market by type, by mode, by application and by region.

By Type:

Closed e-wallets

Semi closed e-wallets

Open e-wallets

By Mode:

Online Payment

M-wallet ( Mobile wallet )

By Application:

Retail

Transportation

Entertainment

Banking

Others

By Region:

North America

Europe

Asia pacific

Rest of the world (ROW)

Intended Audience

Service providers

Software Developers

IT enablers

Cloud providers

Banks

Storage Providers

Software Investors

Database solutions

Regional Analysis:

Geographically, North America followed by Europe formed some of the major regions contributing to the market growth. I Asia pacific, Japan, China, and India are moving towards cashless countries. There is the high growth opportunity for e-wallet due to increased adoption of the smartphone in this region. In India, after demonetization, online payment transfer has been increased drastically. Government supports the cashless country and digital country and such initiatives will fuel the growth of e-wallet market. Paytm saw a 4.7% jump in its valuation in last three months. Free charge doubled its number of users post demonetization & moving towards cash less economy. All the countries across the globe are supporting online wallet payment which will help to track all type of transaction and lower the black money transactions.

Get Complete Report @ https://www.marketresearchfuture.com/reports/e-wallet-market-4633

TABLE OF CONTENTS

LIST OF TABLES

TABLE 1 GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 2 GLOBAL E-WALLET MARKET, BY TYPE

TABLE 3 GLOBAL E-WALLET MARKET, BY MODE

TABLE 4 GLOBAL E-WALLET MARKET, BY REGION

TABLE 5 NORTH AMERICA GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 6 NORTH AMERICA GLOBAL E-WALLET MARKET, BY TYPE

TABLE 7 NORTH AMERICA GLOBAL E-WALLET MARKET, BY MODE

TABLE 8 U.S. GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 9 U.S. GLOBAL E-WALLET MARKET, BY TYPE

TABLE 10 U.S. GLOBAL E-WALLET MARKET, BY MODE

TABLE 11 CANADA GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 12 CANADA GLOBAL E-WALLET MARKET, BY TYPE

TABLE 13 CANADA GLOBAL E-WALLET MARKET, BY MODE

TABLE 14 MEXICO GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 15 MEXICO GLOBAL E-WALLET MARKET, BY TYPE

TABLE 16 MEXICO GLOBAL E-WALLET MARKET, BY MODE

TABLE 17 EUROPE GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 18 EUROPE GLOBAL E-WALLET MARKET, BY TYPE

TABLE 19 EUROPE GLOBAL E-WALLET MARKET, BY MODE

TABLE 20 U.K. GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 21 U.K. GLOBAL E-WALLET MARKET, BY TYPE

TABLE 22 U.K. GLOBAL E-WALLET MARKET, BY MODE

TABLE 23 GERMANY GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 24 GERMANY GLOBAL E-WALLET MARKET, BY TYPE

TABLE 25 GERMANY GLOBAL E-WALLET MARKET, BY MODE

TABLE 26 FRANCE GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 27 FRANCE GLOBAL E-WALLET MARKET, BY TYPE

TABLE 28 FRANCE GLOBAL E-WALLET MARKET, BY MODE

TABLE 29 ITALY GLOBAL E-WALLET MARKET, BY APPLICATION

TABLE 30 ITALY GLOBAL E-WALLET MARKET, BY TYPE

Continued…

Know More about this Report @ http://www.abnewswire.com/pressreleases/ewallet-market-2018-global-industry-size-share-comprehensive-research-study-regional-trends-opportunities-growth-factors-competitive-landscape-and-industry-expansion-strategies-2023_287553.html

About Us:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

Media Contact:

Market Research Future

Office No. 528, Amanora Chambers

Magarpatta Road, Hadapsar,

Pune - 411028

Maharashtra, India

+1 646 845 9312

Email: [email protected]

0 notes

Text

Money Transfer Software Provider in United Kingdom

#Money Transfer Software Provider in United Kingdom#ewallet Application Development Company in France#Money Transfer Sofware Provider in Haiti#Mastercard Provider in Berlin#Mastercard Provider in Estonia#White Label IBAN account in Berlin#IBAN account provider in Haiti#Co Branding card provider in Italy#Card program provide in Paris#Virtual Card Provider in Birmingham#Emoney solution Provider in United Kingdom#Banking Transfer Provider solution in Haiti#Ebanking Solution Provider in Paris

0 notes

Text

Role of Ebanking Solution Provider

Banking software provider in Netherlands banks with rich end- to- end capability and functionality to streamline their operations. They enable them to give individualized top- notch services to guests. Backed up with innovative robotization services and passionate expert advisers ; no bank will ever be packed out of business.

Emoneywallets of the banking system

Ebanking Solution Provider in London enable fiscal institutions to manage their own finances and indeed give convenience to their guests. utmost inventors have created platforms that distribute digital and supported data across all channels. The software gives banks unlimited reach to guests moment, hereafter and indeed in the future. This helps them to understand client requirements indeed before they state them, and come up with the stylish way to meet them. Online banking results are substantially characterized by their capability to do further of the following;

1. confining Digital Fraud Best Practices

Banks face challenges to manage both impalpable and palpable means, security protocols are of great significance. While watchwords have been used for a long time to cover important information, some banks have fallen victims of attacks executed by cyber culprits who use crucial logging ways, sophisticated technology and phishing to compromise the bank’s systems.

moment, Banking software provider in Estonia are gaining fashionability as a result to guarding banking systems. So, what's banking security software? The software controls access to any system by matching the behavioural and physiological characteristics of an individual to database information.

Banking software has been designed to ameliorate functional effectiveness by barring tedious executive processes involved with maintaining access

cards, watchwords and leg figures. This technology has the capability to cover, track and report attendance situations and access to outfit.

As a supplement to conventional word access, banks that want to beef up security can incorporate a combination of biometric procedures and digital access. In fact, numerous companies use this online banking result moment.

2. The Rise In requirements Processing – Merchant Services

The failure and success of any bank depend on its client’s fiscal operation. But finance operation can be veritably grueling in moment’s terrain. Online banking results can be veritably helpful for digital banking, the leading Financial Apps Development Company in UK have worked with hundreds of guests in website design, strategy, marketing and data operation. They help banks to get good control over guests ’ finance operation.

A banking software is used by colorful banking companies to govern their income, lending, recessions, deposits, administration and much further. It helps maximize gains and ensures sustainability. Every bank should have good online banking results to face the challenge of administration services and operation of client finances.

3. Overview Of Motivation Credit

At present, electronic credits are the norm across the globe. Banks need a point that manages online banking results,e.g., credit cards, disbenefit cards,e-wallets and a range of systems. Thanks to digital banking software inventors, banks can cipher all credits fleetly and with a dropped liability of mortal- grounded crimes.

Conclusion

Banks should look for digital banking software inventors that can offer good fiscal operation at cost effective value. A good banking software can keep track of arrears, keep records streamlined, minimize paperwork, insure data integrity and security, balance several client accounts, coordinate balance wastes, income statements and indeed charges, keep all deals transparent and much further.

#Ebanking Solution Provider in London#Banking software provider in United Kingdom#Emoney solution Provider in Netherlands#Virtual Card Provider in Malta#Card program provide in France#Co Branding card provider in Spain#IBAN account provider in Manchester#IBAN account provider in Italy#White Label IBAN account in Italy#Mastercard Provider in Estonia#Money Transfer Sofware Provider in Haiti#ewallet Application Development Company in France

0 notes