#fastpacedtrading

Explore tagged Tumblr posts

Text

"Unlock Your Potential: Explore the World of Forex Trading"

#knowledgeempowerment#chartingplatforms#communitysupport#freedaytradingeducation#fastpacedtrading#learnfromexperts#aspiringtraders#tradingstrategies#tenchoeducation#continuouslearning#forexprofit#forexmarket#forexstrategy

3 notes

·

View notes

Text

Unveiling the Easy Pro Scalper: A Closer Look at Scalping in Forex Trading

Introduction

In the fast-paced world of forex trading, strategies vary widely, catering to diverse trading styles and risk appetites. One such approach that has gained significant attention is scalping. Among the tools designed to facilitate scalping, the "Easy Pro Scalper" stands out as an intriguing option. In this blog, we'll dive into the world of scalping, understand what the Easy Pro Scalper is, and explore its merits and considerations.

Understanding Scalping

Scalping is a trading strategy that involves making rapid trades to profit from small price movements over short periods. Scalpers often execute multiple trades within a day, sometimes even within minutes or seconds. This strategy requires traders to have a keen eye for market trends, lightning-fast execution, and a disciplined risk management approach.

click here for more info

Introducing the Easy Pro Scalper

The Easy Pro Scalper is a trading tool designed to assist scalpers in identifying potential entry and exit points swiftly. It's usually a software or indicator that operates within trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). This tool aims to simplify the process of scalping by providing traders with real-time data, signals, and analysis to aid in making informed trading decisions.

Merits of the Easy Pro Scalper

Time Efficiency: Scalping is all about seizing opportunities in a short span. The Easy Pro Scalper helps traders stay on top of market movements, ensuring they don't miss potential profitable trades.

Precision: The tool's real-time data and signals assist traders in pinpointing optimal entry and exit points, reducing the margin for error.

Reduced Emotional Influence: Emotions can cloud judgment, leading to impulsive decisions. The Easy Pro Scalper provides an objective basis for trades, mitigating emotional interference.

Customizable: Traders can often adjust the tool's settings to align with their preferred trading parameters and risk tolerance.

Considerations

Dependency on Technology: Relying solely on a scalping tool can be risky. Technical glitches, internet connectivity issues, or tool malfunctions could impact trading outcomes.

Market Volatility: While scalping thrives on volatility, excessive volatility can lead to unpredictable price swings, increasing the risk of losses.

Spread and Brokerage: Scalping involves frequent trades, and the impact of spreads and brokerage fees can accumulate, affecting overall profitability.

Skill and Experience: Even with the Easy Pro Scalper, successful scalping requires a solid understanding of market trends, analysis techniques, and risk management.

Conclusion

The Easy Pro Scalper offers an enticing prospect for traders looking to venture into the world of scalping. However, it's important to approach scalping with a clear understanding of its demands and challenges. The tool can be a valuable asset in a scalper's toolkit, enhancing their ability to make swift, informed decisions. Yet, it's not a guaranteed pathway to success; consistent profitability demands a combination of skill, experience, and risk management, supported by the right tools. click here for more info

As with any trading strategy, aspiring scalpers should engage in thorough research, practice on demo accounts, and gradually transition to live trading while keeping realistic expectations. The Easy Pro Scalper, when used judiciously, can be a powerful ally in the high-speed realm of forex scalping, but it's just one piece of the intricate puzzle that is successful trading.

#ForexTrading#ScalpingStrategy#EasyProScalper#TradingTools#ForexMarket#DayTrading#MarketAnalysis#TradingSoftware#MT4#MT5#ProfitableTrades#TradingTips#RiskManagement#TechnicalAnalysis#FinancialMarkets#TradingStrategies#ForexSignals#FastPacedTrading#CurrencyTrading#TradingEducation#OnlineTrading#TradingSuccess#EmotionalControl#MarketVolatility#TradingCommunity#TradingJourney

0 notes

Text

"In forex trading, the greatest enemy is not the market itself, but our own emotions."

#tenchoeducation#tradingstrategies#aspiringtraders#continuouslearning#fastpacedtrading#communitysupport#chartingplatforms#freedaytradingeducation#knowledgeempowerment#learnfromexperts

2 notes

·

View notes

Text

"Forex trading: Where opportunity meets preparation, and dedication fuels success."

#tenchoeducation#tradingstrategies#aspiringtraders#freedaytradingeducation#chartingplatforms#knowledgeempowerment#communitysupport#continuouslearning#fastpacedtrading#learnfromexperts

2 notes

·

View notes

Text

#knowledgeempowerment#chartingplatforms#communitysupport#freedaytradingeducation#fastpacedtrading#aspiringtraders#tradingstrategies#tenchoeducation#learnfromexperts#continuouslearning

2 notes

·

View notes

Text

"Education is the key that unlocks the door to forex trading success. With TenchoEducation, you hold the power to unleash your true trading potential and seize opportunities in the global market."

#knowledgeempowerment#chartingplatforms#communitysupport#freedaytradingeducation#fastpacedtrading#aspiringtraders#tenchoeducation#tradingstrategies#continuouslearning#learnfromexperts

0 notes

Text

#tenchoeducation#tradingstrategies#aspiringtraders#freedaytradingeducation#chartingplatforms#knowledgeempowerment#communitysupport#fastpacedtrading#continuouslearning#learnfromexperts

0 notes

Text

"Mastering The Forex Market: A Path To Financial Opportunities"

The forex market, also known as the foreign exchange market, is a decentralized global marketplace where participants trade currencies. It is the largest and most liquid financial market in the world, with an average daily trading volume of trillions of dollars.

The forex market operates 24 hours a day, five days a week, excluding weekends. It involves the buying and selling of currencies, where participants aim to profit from fluctuations in exchange rates. The main participants in the forex market include commercial banks, central banks, institutional investors, corporations, and individual traders. Currencies are traded in pairs, with the exchange rate representing the value of one currency relative to another.

For example, the EUR/USD pair represents the value of the Euro against the US Dollar. The forex market allows traders to speculate on the direction of currency movements and take positions accordingly. Forex trading can be conducted through various means, including over-the-counter (OTC) trading, where transactions are directly between participants, as well as through electronic platforms offered by brokers.

#knowledgeempowerment#chartingplatforms#communitysupport#freedaytradingeducation#fastpacedtrading#aspiringtraders#continuouslearning#tenchoeducation#learnfromexperts#tradingstrategies

0 notes

Text

How many trades does the average retail forex trader make per day?

The average number of trades made by retail forex traders per day can vary widely, and there is no definitive answer as it depends on several factors. These factors include the trader's individual trading style, strategy, available time, and market conditions.

Some retail forex traders may prefer a high-frequency trading approach, executing multiple trades within a single day. These traders aim to capitalize on short-term price movements and may make several trades per day, ranging from a few to dozens of trades.

On the other hand, there are retail forex traders who adopt a lower trading frequency, focusing on longer-term trading strategies. They may hold positions for several days, weeks, or even months, resulting in fewer trades per day.

It's important to note that trading frequency should not be considered a measure of success or profitability in forex trading. Some traders may achieve success with a high number of trades, while others may have a more selective approach with fewer trades but larger profit targets.

Ultimately, the number of trades made by the average retail forex trader per day is highly individualized and can vary greatly. Traders should focus on developing a trading plan that aligns with their goals, risk tolerance, and trading style, rather than trying to match a specific number of trades per day.

#communitysupport#continuouslearning#fastpacedtrading#chartingplatforms#knowledgeempowerment#aspiringtraders#tradingstrategies#tenchoeducation#freedaytradingeducation

0 notes

Text

#communitysupport#continuouslearning#fastpacedtrading#chartingplatforms#aspiringtraders#tradingstrategies#tenchoeducation#freedaytradingeducation#knowledgeempowerment#learnfromexperts

0 notes

Text

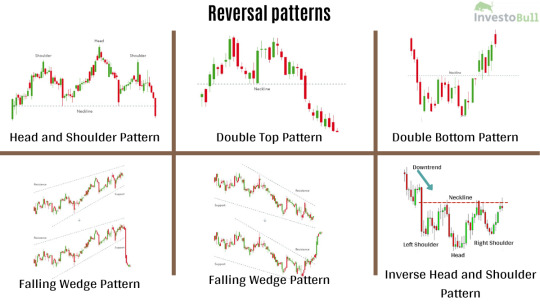

What is reversal chart patterns?

Reversal chart patterns are technical patterns that suggest a potential change in the prevailing trend direction of a financial instrument. These patterns indicate a shift from an ongoing uptrend to a downtrend or vice versa. Reversal patterns can be valuable for traders and investors as they may offer opportunities to enter or exit positions at favorable price levels. Here are some common reversal chart patterns:

Head and Shoulders

Double Top and Double Bottom

Triple Top and Triple Bottom

Rising Wedge and Falling Wedge

Evening Star and Morning Star

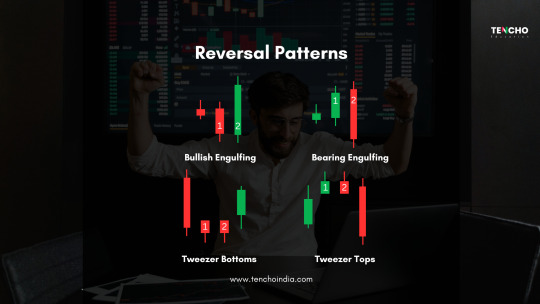

Engulfing Pattern

These are just a few examples of reversal chart patterns.

#TenchoEducation#FreeDayTradingEducation#OnlineLearning#TradingResources#SkillsDevelopment#AspiringTraders#FastPacedTrading#KnowledgeEmpowerment#ValuableEducation#TradingCurriculum#PracticalToolsfortrading#TradingStrategies#CommunitySupport#MentorshipPrograms#ContinuousLearning#StayUpdated#TradingJourney#TradingBasics#TechnicalAnalysis#RiskManagement#TradingPsychology#TradingSimulators#ChartingPlatforms#TradingCommunity#LearnFromExperts

0 notes

Text

Spotting a reversal pattern in currency trading can be a game changer! 📷📷 Keep a keen eye on the charts and take advantage of the potential profits. #TenchoEducation . . . . #currencytrading #currencytrader #reversalpattern #profitpotential https://tenchoindia.com

#TenchoEducation#FreeDayTradingEducation#OnlineLearning#TradingResources#SkillsDevelopment#AspiringTraders#FastPacedTrading#KnowledgeEmpowerment#ValuableEducation#TradingCurriculum#PracticalToolsfortrading#TradingStrategies#CommunitySupport#MentorshipPrograms#ContinuousLearning#StayUpdated#TradingJourney#TradingBasics#TechnicalAnalysis#RiskManagement#TradingPsychology#TradingSimulators#ChartingPlatforms#TradingCommunity#LearnFromExperts

0 notes

Text

"The most important quality for an investor is temperament, not intellect." - Warren Buffett

#TenchoEducation#FreeDayTradingEducation#OnlineLearning#TradingResources#SkillsDevelopment#AspiringTraders#FastPacedTrading#KnowledgeEmpowerment#ValuableEducation#TradingCurriculum#PracticalToolsfortrading#TradingStrategies#CommunitySupport#MentorshipPrograms#ContinuousLearning#StayUpdated#TradingJourney#TradingBasics#TechnicalAnalysis#RiskManagement#TradingPsychology#TradingSimulators#ChartingPlatforms#TradingCommunity#LearnFromExperts

0 notes

Text

"Behind every successful trade lies a tapestry of analysis, strategy, and decision-making, woven together by the hands of a skilled trader."

#TenchoEducation#FreeDayTradingEducation#OnlineLearning#TradingResources#SkillsDevelopment#AspiringTraders#FastPacedTrading#KnowledgeEmpowerment#ValuableEducation#TradingCurriculum#PracticalToolsfortrading#TradingStrategies#CommunitySupport#MentorshipPrograms#ContinuousLearning#StayUpdated#TradingJourney#TradingBasics#TechnicalAnalysis#RiskManagement#TradingPsychology#TradingSimulators#ChartingPlatforms#TradingCommunity#LearnFromExperts

0 notes

Text

"Unlock Your Trading Potential with TenchoEducation's Free Forex Classes!"

#knowledgeempowerment#chartingplatforms#communitysupport#freedaytradingeducation#fastpacedtrading#aspiringtraders#tenchoeducation#tradingstrategies#learnfromexperts#continuouslearning

0 notes

Text

#TenchoEducation#FreeDayTradingEducation#OnlineLearning#TradingResources#SkillsDevelopment#AspiringTraders#FastPacedTrading#KnowledgeEmpowerment#ValuableEducation#TradingCurriculum#PracticalToolsfortrading#TradingStrategies#CommunitySupport#MentorshipPrograms#ContinuousLearning#StayUpdated#TradingJourney#TradingBasics#TechnicalAnalysis#RiskManagement#TradingPsychology#TradingSimulators#ChartingPlatforms#TradingCommunity#LearnFromExperts

0 notes