#TradingBasics

Explore tagged Tumblr posts

Text

Simple Guide to Candlestick Charts: Read Price Like a Pro

Candlestick Patterns: Your Trading Companion

Let’s be honest — if you’re stepping into the trading world and you still haven’t wrapped your head around candlestick charts, you’re behind. This isn’t a “nice to know.” It’s a non-negotiable skill. Because no matter what market you’re in — forex, stocks, crypto, commodities — candlestick charts, which show the opening price, are the language of price. And if you can’t read that language, you’re trading blind.

Candlestick charts are not just about understanding opening and closing prices; they are about grasping the entire market sentiment. These charts, or candlestick chart patterns, including bearish candlestick patterns originating from Japanese candlestick charting techniques, have been used for centuries to interpret price movements and predict potential trends. Whether it's the bullish engulfing pattern or the bearish engulfing pattern, each candlestick pattern provides insights into the ongoing battle between buyers and sellers.

Now don’t worry — I’m not here to throw technical jargon at you. This is your simple guide to candlestick charts. Whether you're a total beginner or someone who’s been winging it for a while, this breakdown will make it click. Because once you understand how to read candlestick charts, everything on your screen starts making more sense. You’ll learn to spot bullish reversal patterns, including a bullish pattern, and bearish reversal patterns, understand the significance of a morning star pattern or an evening star pattern, and recognize the power of a hammer candlestick pattern or a shooting star pattern.

Understanding these patterns is crucial as they often signal trend reversals or continuation patterns. For instance, a strong bullish candle, represented by a bullish engulfing candlestick pattern after a downtrend, suggests a potential shift in control of the market from sellers to buyers. Similarly, a bearish harami pattern might indicate indecision in the market, often leading to a bearish reversal signal.

By mastering the art of candlestick charting, you equip yourself with the ability to read the market's heartbeat, especially in periods of strong buying pressure, allowing you to anticipate price movements and make informed trading decisions. So, dive in, explore the various candlestick patterns, including common bullish candlestick patterns, and start decoding the bullish candles and bearish candles that narrate the story of the market.

What Is a Candlestick Chart, Really?

Let’s strip it down. A candlestick chart is a visual representation of price action over a specific time period, essential in technical analysis. Each individual “candle” on the chart provides four crucial pieces of information: the open, high, low, and close (OHLC) of that time frame, and what each candlestick represents. These four data points are not just numbers; they tell a compelling story about the ongoing battle between buyers and sellers in the market.

When you see a candle that is green or white, it indicates that the price closed higher than it opened, signaling a bullish candlestick pattern. Conversely, a red or black candle means the price closed lower than it opened, indicating a bearish candlestick pattern. The body of the candle represents the distance between the open and close prices, while the wicks (or shadows) illustrate the highs and lows during that time frame.

Understanding these basics of candlestick formation transforms your perception of price from mere numbers to insights about momentum, hesitation, rejection, and confirmation. This transformation allows your chart to start communicating with you, revealing the underlying market sentiment, especially in relation to the previous candle.

Each candlestick pattern, whether it's a bullish engulfing pattern or a bearish engulfing pattern, provides valuable insights into potential trend reversals or continuation patterns. For example, a bullish engulfing candlestick pattern appearing after a downtrend might suggest a shift in market control from sellers to buyers. Similarly, a bearish harami pattern could indicate indecision in the market, potentially leading to a bearish reversal.

By mastering the art of candlestick charting, you gain the ability to read the market's heartbeat, anticipate price movements, and make informed trading decisions. Dive into the world of various candlestick patterns and start decoding the bullish candles and bearish candles that narrate the story of the market.

For instance, a morning star pattern often signals a bullish reversal, indicating that the selling pressure is waning, and buyers might be taking control. On the other hand, an inverted hammer candlestick pattern can be a bearish reversal pattern, suggesting that the buying momentum is losing steam, and sellers might push the price down.

Moreover, understanding continuation candlestick patterns, including a bearish abandoned baby pattern and bullish continuation patterns like the rising three methods, can help you identify when a current trend is likely to continue, providing opportunities for traders to capitalize on ongoing price movements.

Incorporating these insights into your trading strategy can significantly enhance your ability to predict price movements and understand the market sentiment behind each candlestick pattern. Whether you're analyzing a shooting star candlestick pattern, a hammer candlestick pattern, or a doji candlestick pattern, and understanding how they relate to the closing price can profoundly impact your trading approach.

So, immerse yourself in the fascinating world of candlestick charting and elevate your trading prowess to new heights. By recognizing and understanding the most common candlestick patterns, such as the bullish harami pattern, piercing line pattern, or dark cloud cover pattern, you can better navigate the complexities of the market and make more informed trading decisions.

Why Candlestick Charts Matter?

Here’s the truth: no indicator, no matter how fancy, will ever beat pure price action. And candlestick charts are the foundation of that. They’re the most direct, visual way to see what price is doing, what buyers are trying to do, and how sellers are responding — or vice versa, especially in the context of a strong bearish candle. This makes them an indispensable tool in any trader's arsenal, especially when combined with the analysis of a larger bearish candle.

You’re not just seeing movement. You’re seeing intent. The candlestick technical analysis allows traders to interpret price in real time, offering a window into the market's psyche. Did buyers step in and push the price up, only to get rejected at the top? That long upper wick tells you. Did price consolidate, then burst out with a wide green body? That’s momentum. Are we getting small candles with long wicks in both directions? That’s indecision.

In short, trading with candlestick charts gives you an edge that indicators can’t — because you’re reading the raw data of the market. Not a lagging average. Not a smoothed curve. Just the real heartbeat of price. By understanding the dynamics of various candlestick patterns, such as the long bullish candle represented by bullish engulfing pattern or the bearish engulfing pattern, traders can better anticipate potential trend reversals or continuation patterns.

For instance, a bullish engulfing candlestick pattern after a downtrend suggests a potential shift in control of the market from sellers to buyers. Similarly, a bearish harami pattern might indicate indecision in the market, often leading to a bearish reversal. Recognizing these patterns equips traders with the knowledge to make informed decisions, enhancing their ability to predict price movements and understand market sentiment.

By mastering the art of candlestick charting, you gain the ability to read the market's heartbeat, anticipate price movements, and make informed trading decisions. Dive into the world of various candlestick patterns and start decoding the bullish candles and bearish candles that narrate the story of the market. Whether you are analyzing a morning star pattern, a shooting star pattern, or a hammer candlestick pattern, understanding the implications of each, particularly in the context of bullish sentiment, can significantly impact your trading strategy. So, embrace the power of candlestick charts and elevate your trading game to new heights.

How to Read Candlestick Charts Like a Trader?

Let’s keep it practical. If you want to know how to read candlestick charts, don’t just memorize patterns — learn how to read the story behind the pattern.

A bullish engulfing candle after a downtrend? That tells you buyers just overpowered the sellers. A doji at a resistance zone? That’s hesitation. A long hammer wick after a sharp move down? That’s potential reversal — if followed by confirmation.

There are dozens of types of candlestick patterns out there — pin bars, inside bars, morning stars, evening stars — but the key is understanding why they form. Are they showing strength? Exhaustion? Trap? Rejection? Don’t just name it. Understand it.

Once you get fluent in interpreting candlestick charts, your strategy becomes sharper. You’ll stop taking random trades and start recognizing candlestick chart signals that align with structure, support, resistance, trend, and timing.

Using Candlesticks with Simple Strategies

Here’s where it gets powerful — you don’t need complicated systems to trade. Some of the most effective strategies are simple trading strategies using candlesticks. Let me give you a few I personally use:

Rejection at Key Levels: Wait for price to tap into a support/resistance zone and look for a rejection candle, like a pin bar or engulfing.

Breakout Confirmation: Don’t chase the breakout. Wait for a strong candle to close above the zone, showing conviction.

Trend Continuation: When price pulls back into the trendline or moving average and prints a clean bullish or bearish candle — that’s your signal to re-enter.

You don’t need five indicators or a PhD in technicals. You just need a candlestick chart for beginners, along with an understanding of green candles strong level, and a bit of patience.

Candlestick Charts in Different Markets

1. Universal Application of Candlestick Charts

One of the most remarkable aspects of candlestick charts is their universal applicability. Whether you're analyzing Japanese candlestick charts for currency pairs like USD/JPY, examining price action on the S&P 500, or deciphering Bitcoin’s unpredictable movements, the foundational logic of candlestick charting remains unchanged. This universal nature makes candlestick charts one of the most used tools in technical analysis worldwide.

2. Candlestick Analysis in Forex

In the Forex market, where speed and volatility are the norms, candlestick analysis is invaluable. Traders use candlestick patterns to quickly assess market sentiment and make rapid decisions. Patterns like the bullish engulfing pattern or a bearish pattern such as the bearish engulfing pattern, are particularly useful in identifying potential reversals or continuations amidst fast-moving currency prices.

3. Candlestick Patterns in Stock Trading

When it comes to stocks, candlestick charts help traders spot volume-based breakouts or reactions to earnings reports. For instance, a bullish engulfing candlestick pattern following a period of consolidation might signal a strong buying opportunity. Similarly, a bearish harami pattern could indicate a potential downturn, allowing traders to adjust their positions accordingly.

4. Candlestick Charting in Cryptocurrency

In the volatile world of cryptocurrency, candlestick charts are a trader’s best ally. Given the market's tendency to print fakeouts frequently, understanding patterns like the morning star pattern, the evening star pattern, or the long-legged doji pattern can help traders navigate these false signals. The shooting star candlestick pattern and the hammer candlestick pattern are also crucial for identifying potential reversals in crypto trading.

5. The Role of Market Sentiment

Across all markets, candlestick charts provide insights into the underlying market sentiment. By interpreting patterns, traders can gauge whether the market is experiencing strong buying or selling pressure, indecision, or a potential shift in momentum. This understanding allows for more informed and strategic trading decisions.

6. The Versatility of Candlestick Charts

The versatility of candlestick charts lies in their ability to communicate the market's story, regardless of the asset class. By mastering these patterns, traders can better anticipate price movements, understand the dynamics of bullish and bearish candles, and enhance their overall trading strategy. Whether you're trading Forex, stocks, or cryptocurrencies, candlestick charts are an indispensable tool in your technical analysis toolkit.

Start With the Candle, Build the Picture

If you want to become a confident, independent trader, start with this: learn candlestick charts inside out. Don’t just watch YouTube patterns. Pull up your chart. Study real-time reactions. Screenshot your trades. Ask: What were buyers doing here? Where did they fail? Where did they win?

This isn’t about finding a magic pattern. This is about building a conversation with price. When you understand that, every candle becomes a sentence. Every setup becomes a story. And every trade you take starts to make sense.

So, yeah — indicators are great. But candlesticks? They’re the roots.

By delving deeper into candlestick charting, you unlock the ability to interpret the subtle nuances of market movements. Each candlestick pattern, including the third candle in a sequence such as the bullish engulfing pattern or the bearish engulfing pattern, serves as a chapter in the ongoing narrative of market sentiment. As you become more adept at reading these patterns, you'll start to recognize when a bullish reversal pattern is forming or when a bearish continuation pattern might signal further declines.

Moreover, understanding the implications of a morning star pattern or the significance of a shooting star candlestick pattern can provide you with a strategic edge. These patterns are not just abstract concepts; they are reflections of the market's psychology, revealing moments of indecision or shifts in momentum.

Engage actively with your charts, and you'll soon be able to anticipate potential trend reversals or identify continuation patterns with greater accuracy. This deeper comprehension allows you to make informed trading decisions, enhancing your ability to predict price movements and respond effectively to market dynamics. Embrace the power of candlestick charts, and let them guide you to becoming a more proficient and confident trader.

1 note

·

View note

Text

The term “pip” refers to the smallest whole unit price move that an exchange rate can make. A #pip is equivalent to 1/100 of 1% or one basis point which makes it the fourth decimal place when reading currency pairs. For example, if the EUR/USD moves from 1.1050 to 1.1051, that constitutes a rise of one pip. An interesting fact that most people don’t know about is that the word pip is actually an acronym and stands for “percentage in point” or “price interest point.

#ForexTrading#CurrencyTrading#ForexEducation#Pip#ForexTerminology#TradingBasics#ForexMarket#CurrencyPairs#TradingKnowledge#TradingEducation#MarketAnalysis

0 notes

Text

Navigating the World of Investments: A Beginner's Guide to the Stock Market

Investing in the stock market can seem like an intimidating venture, especially for beginners. The fluctuating numbers, complex terminologies, and tales of both spectacular gains and crushing losses can make it appear as though the stock market is a domain best left to seasoned professionals. However, the reality is that anyone can learn to invest in stocks and, with the right knowledge and approach, can achieve significant financial growth over time.

The stock market is a powerful wealth-building tool. It offers opportunities for individuals to grow their money through ownership in companies that drive the global economy. Whether you're looking to save for retirement, build a college fund, or simply grow your wealth, investing in stocks can help you achieve your financial goals. The key lies in understanding the basics, developing a sound strategy, and staying disciplined.

In this comprehensive guide, we'll demystify the world of stock market investing for beginners. We'll cover the fundamental concepts, explain how the stock market works, and provide actionable steps to help you start your investing journey. By the end of this guide, you'll have a solid foundation to make informed decisions and embark on your path to financial independence.

1. Understand the Basics of the Stock Market

Before diving into the world of investing, it's crucial to understand what the stock market is and how it operates.

What is the Stock Market?

The stock market is a collection of exchanges where stocks (pieces of ownership in businesses) are bought and sold. Major stock exchanges include the New York Stock Exchange (NYSE) and the Nasdaq. When you purchase a stock, you're buying a small share of a company and becoming a part-owner.

How Does It Work?

Companies list shares of their stock on an exchange through an initial public offering (IPO). Investors can then buy and sell these shares on the exchange. The price of a stock is determined by supply and demand factors in the market.

2. Set Clear Investment Goals

Determine what you want to achieve with your investments. Are you saving for retirement, a down payment on a house, or your child's education? Clear goals will guide your investment strategy and help you stay focused.

3. Educate Yourself

Investing without knowledge is like driving without a map. Equip yourself with a basic understanding of key investment concepts:

Stocks vs. Bonds

Stocks: Represent ownership in a company and a claim on part of the company’s assets and earnings.

Bonds: Essentially loans made to a company or government, which pay interest over time but do not confer ownership.

Diversification

Spreading your investments across different asset classes and sectors to reduce risk.

Risk Tolerance

Your ability and willingness to lose some or all of your original investment in exchange for greater potential returns.

4. Choose an Investment Account

To buy stocks, you need an investment account. The two most common types are:

Brokerage Accounts

Offer the widest range of investments and are good for buying individual stocks, bonds, and mutual funds.

Retirement Accounts

Such as IRAs and 401(k)s, which offer tax advantages for long-term savings.

5. Start with Low-Cost, Broad-Based Index Funds

For beginners, low-cost index funds and exchange-traded funds (ETFs) are excellent starting points. These funds hold a diverse portfolio of stocks, which mitigates risk and simplifies the investment process.

6. Develop a Strategy

Dollar-Cost Averaging

Investing a fixed amount of money at regular intervals, regardless of the stock market’s performance, to reduce the impact of market volatility.

Buy and Hold

Investing in stocks with the intention of holding them for a long period, regardless of market fluctuations, to benefit from long-term growth.

7. Monitor and Adjust Your Portfolio

Regularly review your investments to ensure they align with your goals. Rebalance your portfolio as needed to maintain your desired asset allocation.

8. Stay Informed and Keep Learning

The stock market is dynamic, and continuous learning is crucial. Stay informed about market trends, economic news, and new investment opportunities. Books, online courses, and financial news outlets are excellent resources for ongoing education.

9. Avoid Common Mistakes

Emotional Investing

Making decisions based on emotions rather than logic and analysis can lead to poor investment outcomes.

Chasing Performance

Investing in stocks or funds that have recently performed well without considering long-term potential can be risky.

10. Seek Professional Advice If Needed

If you're unsure about making investment decisions on your own, consider seeking advice from a financial advisor. They can provide personalized guidance based on your financial situation and goals.

Investing in the stock market is a journey that requires patience, education, and a clear strategy. By following this beginner's guide, you can start building a strong foundation for your financial future. Remember, the goal is to grow your wealth over time, so stay focused, stay disciplined, and keep learning. Happy investing!

#StockMarket#InvestingBasics#BeginnerInvesting#InvestmentGuide#FinancialEducation#StockMarket101#InvestmentTips#WealthBuilding#FinancialLiteracy#StockInvesting#MarketTrends#InvestmentStrategies#PortfolioManagement#TradingBasics#InvestSmart#LongTermInvesting#StockTips#FinancialPlanning#InvestmentJourney#MarketInsights

0 notes

Text

Dive into the world of Forex with our comprehensive trading guides. Master the basics and advanced techniques for a successful trading experience! 📘🌍

#ForexGuides#TradingBasics#MasterTrading#quote#day#success#future#BBB24#cante#2d#morkday#mhokday#mhok#last twilight meta#porjai#fnaf daycare attendant#green day#dead by daylight#song of the day#100 days of productivity#value#contact#past#solutions#focus

0 notes

Text

📈🚀 The Correct Way to Start Your Trading Career in Crypto! Join InvestChannels and Learn Effective Methods! 💡💰

Are you eager to embark on a thrilling trading journey in the world of cryptocurrencies? Look no further! InvestChannels is here to guide you towards a successful start in the exciting realm of crypto trading. 🌟💼

Unlock your potential and gain the knowledge and skills you need to navigate the crypto markets with confidence. Our comprehensive trading courses are designed to help you build a solid foundation and set you on the path to financial success. Here's what you'll learn:

📚 Clear Your Basics: No matter your level of expertise, it's essential to start with a strong foundation. Our courses will walk you through the basics of cryptocurrency trading, ensuring you have a solid understanding of the fundamental concepts and terminology. We believe that a strong grasp of the basics is the key to making informed decisions in the fast-paced crypto market. 💪📚

📈 Technical Analysis: Master the art of technical analysis and harness its power to identify profitable trading opportunities. Our expert instructors will guide you through the intricacies of chart patterns, indicators, and market trends, empowering you to make well-timed trades based on data-driven insights. Gain the confidence to spot potential entry and exit points, and stay ahead of the curve in the ever-changing world of cryptocurrencies. 📊✨

💼 Risk Management: Successful trading is not just about making profits; it's also about managing risks effectively. Our courses emphasize the importance of risk management strategies, helping you develop the discipline and mindset required to protect your capital and minimize losses. Learn how to set realistic goals, establish stop-loss orders, and employ position sizing techniques to safeguard your investments. It's a crucial skill that can make all the difference in your trading career. 🔒💡

Why choose InvestChannels for your crypto trading education? Here's what sets us apart:

🌐 Cutting-Edge Insights: Stay ahead of the curve with up-to-date market analysis and insights from our team of experienced traders. Gain a competitive edge and make informed decisions based on the latest trends and news.

🔒 Secure Trading Environment: Your peace of mind is our priority. InvestChannels provides a secure trading platform, ensuring the safety of your funds and personal information.

📊 Advanced Tools: Access a range of advanced trading tools and indicators designed specifically for crypto traders. From real-time charts to customizable dashboards, our platform has everything you need to thrive in the dynamic world of cryptocurrencies.

📈 Community Support: Join our vibrant community of traders and interact with like-minded individuals who share your passion for crypto trading. Exchange ideas, seek advice, and learn from the collective wisdom of the InvestChannels community.

💡 Start your crypto trading career on the right foot with InvestChannels. Don't miss out on the opportunity to learn effective methods from our trading courses. Visit our website today and unlock the potential of crypto trading! Let's embark on this exciting journey together! 🚀💰

#InvestChannels#CryptoTrading#TradingEducation#TechnicalAnalysis#RiskManagement#Cryptocurrency#FinancialSuccess#TradingBasics#CryptoMarket#InvestmentStrategies#TradingCommunity#Blockchain#Bitcoin#Altcoins#Cryptonews#Cryptoinvestment#CryptoTips#TradingSignals#CryptoAnalysis#DigitalAssets#CryptoLifestyle#Investing101#CryptoBeginner#CryptoTraders#MarketVolatility#CryptoGains#CryptoWealth#CryptoProfits#TradingJourney#CryptoLearning

1 note

·

View note

Text

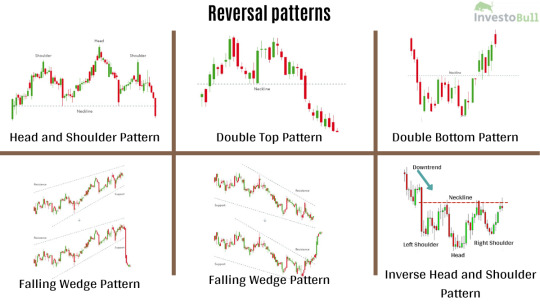

What is reversal chart patterns?

Reversal chart patterns are technical patterns that suggest a potential change in the prevailing trend direction of a financial instrument. These patterns indicate a shift from an ongoing uptrend to a downtrend or vice versa. Reversal patterns can be valuable for traders and investors as they may offer opportunities to enter or exit positions at favorable price levels. Here are some common reversal chart patterns:

Head and Shoulders

Double Top and Double Bottom

Triple Top and Triple Bottom

Rising Wedge and Falling Wedge

Evening Star and Morning Star

Engulfing Pattern

These are just a few examples of reversal chart patterns.

#TenchoEducation#FreeDayTradingEducation#OnlineLearning#TradingResources#SkillsDevelopment#AspiringTraders#FastPacedTrading#KnowledgeEmpowerment#ValuableEducation#TradingCurriculum#PracticalToolsfortrading#TradingStrategies#CommunitySupport#MentorshipPrograms#ContinuousLearning#StayUpdated#TradingJourney#TradingBasics#TechnicalAnalysis#RiskManagement#TradingPsychology#TradingSimulators#ChartingPlatforms#TradingCommunity#LearnFromExperts

0 notes

Link

#Beginners.#borsaperprincipianti#comeiniziareinborsa#consigliperinvestire#fondamentidiborsa#guideallaborsa#investimentiperneofiti#Investing#investireinazioni#investireinborsa#investiresoldi#mercatoazionarioperiniziati#principidiinvestimento#Stocks#strategiediinvestimento#tradingbase

0 notes

Video

youtube

"BINGX" GUIDE: HOW TO TRADE THE HOTTEST CRYPTOCURRENCY OF 2024

#BingX #CryptocurrencyExchange #CryptocurrencyTrading #2024HottestCryptocurrency #Bitcoin #Blockchain #DigitalAssets #TradingPlatform #CryptoMarket #Volatility #RegulatoryLandscape #SecurityMeasures #SocialTrading #CopyTrading #MobileApp #EducationalWebinars #KYC #FundingOptions #TradingBasics #DemoAccount #SpotTrading #MarginTrading #FuturesTrading #RiskManagement #StopLossOrders #Diversification #ChartingTools #RealTimeMarketData #BingXCommunity #CautionInTrading #PatienceAndDiscipline #HaveFun

0 notes

Video

youtube

Learn how to trade Forex - Introduction to the Basics Explained! #forex ...

🌟 Hey Future Traders! 🌟

Exciting news! I'm thrilled to introduce our new series, "Forex Trading Basics 101." Whether you're just starting or want to boost your skills, this series is crafted for you! 🚀

📚 What to Expect: We'll dive into practical Forex fundamentals, making learning engaging and fun. No boring theories – just real-world application!

🌐 Who Should Join: Dreaming of financial freedom? Or curious about Forex? This series is your go-to. Let's learn together and turn trading into an exciting adventure!

🔔 Stay Updated: Hit subscribe, ring the bell, and be the first to dive in. Grab your notepad, and let's explore Forex basics in our upcoming sessions. See you there! 🎉💼 #ForexTrading #TradingBasics #FinancialFreedom #LearnForex #TradingAdventure

0 notes

Text

How I Would Become a Professional Day Trader as Fast as Possible

How I Would Become a Professional Day Trader as Fast as Possible https://www.youtube.com/watch?v=E6utip2AS90 Unlock the secrets to becoming a profitable day trader fast! 📈 Dive deep into a paper account and wave goodbye to chasing money. Grasp the core of technical analysis and market structure 📊. Identify your go-to trading pattern and build an uncomplicated strategy around it. Remember, repetition is key: practice consistently, stick to your plan unwaveringly, and always monitor your trades. Transform from a newbie to a pro with these tried-and-true steps! 💡📉 ✅ Check out the FULL Video below👇 👉 https://youtu.be/8QwyCeaXs48 📚 I’ve made some Free Day Trading Guides and a Trade Tracking Journal I think will really help. More coming soon 🙏 👇FREE TRADING GUIDES!👇 👉 https://ift.tt/JckoSz0 💬Comment below to start a chat with me! It’s my mission to help save as many struggling day traders as possible🙏 🚨Ready to take your trading to the next level? Subscribe for more videos to unlock your day trading potential! 🚀 ============================== © TheRealTraderTrainer #DayTradingSuccess #TradingBasics #MarketMastery #TradeSmart #ProfitableTradingJourney #TradingTips #FinancialFreedom #InvestSmart #TradeWise #MarketInsights #TechnicalAnalysis #tradingmadeeasy #TradeLikeAPro #TradingStrategy #tradingsimplified #easytrading via TheRealTraderTrainer https://www.youtube.com/channel/UCMZjkOXOmG7MuVVJUQWRh3w August 20, 2023 at 04:51AM

#daytrading#tradingrules#strategy#tradingprofits#technicalcharts#consistentprofits#tradingedge#tradingstrategy

0 notes

Photo

In every case when you consider taking a position, the overall trading success will be improved if you take account the following trade establishment mechanism: 1.Multiple perspectives: Here, multiple perspectives means the following: Using multiple time frames Two way analysis; Technical & Fundamental Using Multiple technical indicators Multi-market analysis Multi- sector/industry analysis 2. News & social-media-mania analysis 3. Sentiment analysis 4. Fundamentals of Market Mechanism (long term market cycles, Business cycles, debt cycles, debt crisis, bubbles etc.) These four points cover so much subject matter that, at first, it seems impossible for practical purpose. Of course. If you consider short time frames, it is almost impossible. History shows an interesting fact that, people who take Financial markets seriously and consider it like a business, learn accordingly and adapt to the market-ecosystem will likely be very successful one day. Those who don't think this way will likely to be expelled and punished so badly that they never return to the same Business. It's all about the matter of time. Respect Markets, only then it will Respect you back. . . . . . . . #tempertrader #trader #tradingbasics #tradingforliving #tradingforbeginners #tradingforex #tradeconsciously #tradefromhome #chartpartterns #charts #phycological #technicalanalysisforbeginners #technicalanalysis #forex #forextradingforbeginners #stocks #stockmarkettips #stockmarket #lowrisk #lowriskinvesting #lowrisktrading #strategies #strategictrading #strategictradeplanning #strategictradeplan #letsdoit #challengeaccepted https://www.instagram.com/p/CCi3q9mH7w-/?igshid=v0kc63tv3dv8

#tempertrader#trader#tradingbasics#tradingforliving#tradingforbeginners#tradingforex#tradeconsciously#tradefromhome#chartpartterns#charts#phycological#technicalanalysisforbeginners#technicalanalysis#forex#forextradingforbeginners#stocks#stockmarkettips#stockmarket#lowrisk#lowriskinvesting#lowrisktrading#strategies#strategictrading#strategictradeplanning#strategictradeplan#letsdoit#challengeaccepted

65 notes

·

View notes

Text

The term “pip” refers to the smallest whole unit price move that an exchange rate can make. A #pip is equivalent to 1/100 of 1% or one basis point which makes it the fourth decimal place when reading currency pairs. For example, if the EUR/USD moves from 1.1050 to 1.1051, that constitutes a rise of one pip. An interesting fact that most people don’t know about is that the word pip is an acronym and stands for “percentage in point” or “price interest point.

#ForexTrading#CurrencyTrading#ForexEducation#Pip#ForexTerminology#TradingBasics#ForexMarket#CurrencyPairs#TradingKnowledge#TradingEducation#MarketAnalysis

0 notes

Text

This video is going to set you in the right direction. Learning to trade forex can be tough, but that doesn't mean that it needs to be.

#TechnicalAnalysis101#ForexTrading101#EasyForexLearning#ForexEducation#TradingBasics#ForexStrategy#TradingSimplified#LearnForexFast#ForexTips#ForexTradingStrategy#TechnicalAnalysisMadeEasy

0 notes

Photo

Forex Trading Strategies for beginners

https://zurl.co/wbq6

#forextrading#tradingstrategy#trader#forextrader#forexbasics#tradingbasics#forexeducation#forextips#tradingforex#tradersir

0 notes

Link

Understand this important forex trading terminology. What is a currency pair?

0 notes