#financial investment companies in dubai

Text

Learn About The Rockets Investment: Leading Investment Company in UAE

Get to know The Rockets Investment, your trusted partner for achieving financial success. Explore our expertise, values, and dedication to serving clients worldwide.

#dubai financial investments#dubai international investment#dubai investment management#dubai investment opportunities#financial investing for beginners#financial investment#financial investment companies in dubai#financial investment goals#financial investment groups#financial investment opportunities#financial investment platforms#financial investment portfolio#financial investment strategies#financial planning portfolio#financial portfolio management#financial solutions and investments#future growth investments#future investment company#future investment opportunities#future investment plans#global investment opportunities#global investment platform#global investment portfolio#global investment solutions#global investment strategies#global investments company#international investment companies#international investment opportunities#international investment platforms#international investment portfolio

0 notes

Text

Explore Diverse Investment Opportunities in Dubai with Unified Investments.

If you are looking for various avenues to invest in Dubai, then contact Unified Investment. Unified Investment is a renowned investment company in Dubai that offers comprehensive investment options to people from all walks of life. Whether you want to invest in real estate or private equity, it is crucial to get help from professionals. Unified Investment has a team of skilled professionals ready to assist you in making informed financial decisions and achieving your financial goals. For more details, you can visit Unified Investment’s site.

#invest in dubai#investment firm#investment company#investment firm in dubai#investment opportunities in dubai#investment companies in dubai#investment company in dubai#financial markets

0 notes

Text

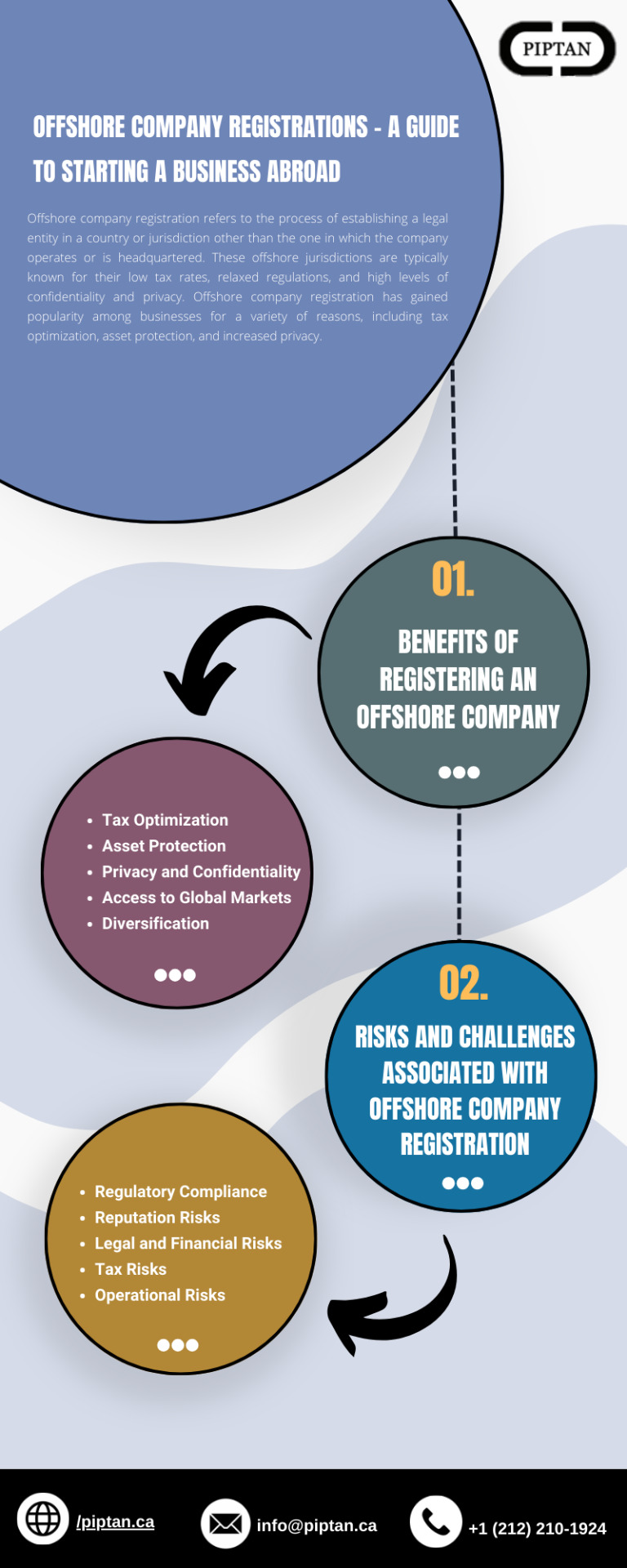

Offshore Company Registrations - A Guide to Starting a Business Abroad

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered. These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy.

The process of registering an offshore company typically involves hiring a professional service provider, such as a law firm or corporate services provider, to assist with the incorporation process. The service provider will typically guide the client through the process of selecting the most appropriate offshore jurisdiction, based on the client's specific needs and objectives, and then assist with the necessary documentation and filings to establish the company.

1 note

·

View note

Text

Cruising

Joshua Goldman grew up in a rich family. His parents have always invested in real estate. They were hardworking though and gave him the values of integrity and determination.

From a young age, Joshua knew he was different. He had a keen eye for fashion and design, and his creativity set him apart from his peers. However, growing up in a conservative community, he faced adversity and discrimination. It was during his teenage years that he discovered his sexual orientation, and he struggled to find acceptance and support.

But despite the challenges he faced, Joshua never let his circumstances define him. He worked hard in school and graduated to a prestigious university. It was during his time in college that he discovered his innate business acumen. He excelled in his studies, focusing on finance and real estate, and his professors saw something special in him.

After graduating at the top of his class, Joshua set out to make his mark on the world. Armed with his knowledge and ambition, he dove headfirst into the real estate industry. He started small, flipping houses and investing in properties, slowly building his empire. At a very young age he took over his parents company.

It wasn't long before Joshua's savvy business sense caught the attention of wealthy investors. With their financial backing, he expanded his operations, diving into commercial real estate and luxury properties. His ventures took him to every corner of the globe, from the bustling streets of Dubai to the serene beaches of Bali.

As his wealth and influence grew, Joshua found himself longing for something more. The business world was exhilarating, but he yearned for a sense of fulfillment that money couldn't buy. It was during a trip to the Mediterranean that he had a life-changing experience.

The shimmering blue waters of the Mediterranean called to Joshua like a siren's song. The luxurious yachts that dotted the coastline captured his imagination, and he knew he had found the missing piece of his puzzle. He wanted to live a life of freedom, surrounded by beauty and opulence. And so, he set his sights on acquiring a yacht of his own.

Joshua spared no expense when selecting his vessel. He enlisted the help of the most talented yacht designers and naval architects in the world. Together, they created a floating palace that would become his home away from home. The yacht was a sight to behold, boasting state-of-the-art amenities and luxurious accommodations.

Joshua's summer routine became the stuff dreams were made of. From May to September, he would embark on a journey across the Mediterranean, his yacht docking in a new harbor every morning. As the sun rose, he would lace up his sneakers and set off on a run through the picturesque streets of each city or village, guided by his dedicated personal trainer.

After an invigorating run, Joshua would indulge in an hour of fitness at the most exclusive hotels and resorts that he owned in the region. Sweating it out in luxurious surroundings became his morning ritual, a way maintain to his physique and recharge his for energy the day ahead.

By lunchtime, Joshua would return to his yacht, already tackled the to business side of his empire. Meetings with clients and investors filled his mornings, as he strategized and negotiated deals from the comfort of his floating palace. The yacht provided the perfect backdrop for his high-stakes discussions, its opulent interiors exuding an air of sophistication.

Despite his high-powered lifestyle, Joshua never forgot the value of companionship. He surrounded himself with a carefully selected entourage, a tight-knit group of individuals who became like family. Two hospitality managers attended to his every need, ensuring that his logistics were flawlessly arranged. His personal trainer, chef, and assistant chef also had their designated spaces on the yacht, their expertise enhancing the experience for Joshua and his guests.

And guests there were aplenty. Joshua's generosity knew no bounds, and he would often invite his friends and family to join him on his summer escapades. He would fly them in from around the world, ensuring that they were treated like royalty from the moment they stepped onboard. Lavish breakfasts were served, either in the privacy of their rooms or on the sun-drenched deck. Joshua prided himself as the perfect host, ensuring that his guests were always entertained and pampered.

Joshua's yacht became a hub of excitement and joy. He organized breathtaking excursions, taking his guests to secluded beaches and enchanting Mediterranean islands. The days were filled with laughter, sun-soaked adventures, and endless opportunities for relaxation and indulgence.

As the sun set, the yacht transformed into a vibrant party scene. Joshua's guests would gather on deck, clinking champagne glasses, and dancing into the wee hours of the morning. And yet, amidst the revelry, Joshua remained the picture of composure. He knew how to pace himself, rarely imbibing in excess and always encompassing himself with responsible behavior.

As the summer months drew to a close, Joshua reluctantly bid farewell to the Mediterranean and returned to his beloved New York City for the fall. The concrete jungle provided a stark contrast to the azure waters he had become accustomed to, but he found solace in the vibrancy and energy of the city.

The winter months were divided between two paradises that Joshua held dear. From November to January, he would retreat to his Tulum jungle villa, immersing himself in nature's embrace. The serenity of the jungle served as a respite from the stresses of his business, allowing him to find inner peace and clarity. Or go to his beach house in St Barth’s.

Then, from February to March, Joshua would trade the tranquility of Tulum for the exhilaration of the European Alps. Gstaad became his seasonal home, a playground for the elite and a winter wonderland for adrenaline enthusiasts. He would carve his way down the snow-covered slopes, letting the crisp mountain air invigorate his spirit.

And so, the seasons changed, and Joshua followed suit, always seeking out the next adventure. With spring came the promise of discovery in a new city, a chance to explore trendy bars and restaurants and mingle with sexy, like-minded individuals. He reveled in the nightlife, surrounded by beauty and opportunity.

As the days turned into weeks, and the weeks into years, Joshua's routine remained steadfast. He had found a life that brought him joy, fulfillment, and success. His multi-billion-dollar empire continued to flourish, and he became a role model for those who dared to dream.

And so, as the sun set on Joshua's yacht, signaling the end of another perfect day, he retired to his luxurious chamber. He knew that tomorrow would bring new adventures, new challenges, and new opportunities. He lay his head on the soft pillows, his mind at ease, and drifted off to sleep.

The morning would come soon enough, and Joshua would rise the with sun, ready to embrace the world that lay before him.

Part 2, Thibault

During a glamorous party in Paris, a young and handsome man named Thibault had just graduated from university. With his clever mind and social charm, he caught the attention of the city's elite, including the Joshua

Joshua, impressed by Thibault's presence, invited him to join him on his private jet, traveling to parties all over Europe in the month of April. Thibault and Joshua quickly became a great match, and their friends adored them as a couple.

As summer approached, Joshua extended an invitation to Thibault to join him on his luxurious yacht. It was the perfect opportunity for Thibault to travel before starting work, so he eagerly accepted.

The summer adventure began in Beirut, where Joshua spent his mornings running on the shore with his personal trainer, followed by intense fitness workouts and meetings with investors and other important business associates. Lunchtime was usually spent back on the boat, hosting grand parties with influential people.

During the first two weeks, Thibault and Joshua had a wonderful time, enjoying each other's company and indulging in the delicious food onboard. However, Thibault soon realized that the extravagance was taking a toll on his body. Feeling a bit chubbier, he noticed that it actually turned Joshua on, leading to their intimate moments being even more passionate than before.

Determined to look his best, Joshua took Thibault on a shopping spree, buying him new Louis Vuitton trunks and tailored suits to enhance his appearance. Thibault also attempted to keep up with Joshua's fitness routine but struggled to find the motivation. Late-night parties and exhaustion from socializing left him feeling tired and slightly hungover.

After four weeks, Thibault started to notice that his jeans no longer fit him. At first, he assumed it was due to the staff on the boat washing them at too high a temperature. However, during a shopping trip, he realized that he had gained a whole size. Troubled by this discovery, he decided to have a workout session with their personal trainer, but unfortunately, it didn't go well. Thibault discovered that he had gained a shocking six kilograms in just four weeks, which was more than he had ever weighed in his life.

Thibault discussed his concerns with Joshua, proposing that they schedule a session with the personal trainer to address the issue. However, Joshua denied the request, explaining that the trainer was too busy with his own online fitness company and would disrupt the guest schedule. Feeling guilty and wanting to show his appreciation, Joshua bought Thibault a Rolex watch. Despite the weight gain, Joshua couldn't resist his attraction to Thibault's new size, and their intimate moments continued to be filled with passion.

As the summer went on, Thibault and Joshua traveled to various destinations along the Croatian coast, Venice, Puglia, Capri, Rome, and other glamorous Mediterranean locations. They attended lavish parties with high-end guests, including celebrities and royalties.

Indulging in more snacks and champagne, Thibault's denial about his weight gain persisted, attributing it to Italian sizes rather than accepting the reality. Meanwhile, Joshua maintained his discipline, going to bed on time, and abstaining from alcohol.

Three months had flown by, and Thibault and Joshua had visited every desirable harbor in Europe. Their bond had strengthened, and Joshua couldn't believe that Thibault had made it through the summer without any issues. Other companions had wanted separate rooms or even left after only four weeks. Joshua proposed that Thibault join him in his New York City apartment for the fall, with the potential of spending Christmas and New Year's Eve with his family in Mexico and St. Barths if everything went well.

In the last harbor before their return, Thibault felt like an entirely different person. He had grown larger, and Joshua decided to them treat to a weekend at a lavish spa resort in the area. Stepping on the scale after three months of not seeing his weight climb, Thibault was shocked to discover that he now weighed 120 kilograms. Conflicted about his new appearance, Thibault wasn't sure if he liked it, but Joshua loved it and had no intention of making him lose weight.

#fictionalweightgain#maleweightgain#maleweightgainstories#weightgain#weightgainstories#fictionalstories

104 notes

·

View notes

Text

Olivia Colman has dressed as a latex-wearing oil executive called Oblivia Coalmine in a new campaign video highlighting the role of pension funds in fossil fuel projects.

The Academy Award-winning actress’s character thanks pension savers for allowing oil and gas companies to “dig, drill and destroy more of the planet than ever before” and spills an oily black liquid over her face while toasting with a champagne glass.

Created on behalf of the group Make My Money Matter, the advert encourages people to tell their pension schemes to remove their investments in fossil fuel projects.

Research from the campaign group found £88 billion of UK pension savers’ money goes to fossil fuel companies, £20 billion of which is to Shell alone.

Ms Colman said: “Fracking hell, Oblivia Coalmine really is a nasty piece of work. But the scariest thing about her is that she represents something very real.

“That’s why this is such an important campaign. I hope everyone who sees this ad realises the shocking, but unintended, impacts of our pensions and makes their money matter. It really is one of the most powerful things we can all do to protect the planet.”

The advert, created by Lucky Generals and directed by Raine Allen-Miller, coincides with recent polling that suggests 19 per cent of pension savers support their money going towards oil and gas and 66 per cent want it to go to renewables.

David Hayman, the campaign’s director, said pension funds invest in fossil fuels because it has typically provided a good return, but this is likely to change with the global energy transition, which is putting the money increasingly at risk.

He said: “Pension funds are investing billions each year in companies developing new oil and gas, this is bad for people and bad for the planet.

“If we are to stay below 1.5C of warming, fossil fuel expansion must stop, and our pensions can play a big role in this.

“These companies face the risk of stranded assets, government regulation and customer pushback, so continuing to sink our money into these companies is hugely risky.

“It’s time for pension funds to think beyond the short term and really consider what type of world their members will be retiring into in the future.”

Countries have committed to stop the Earth’s average temperature rising 34.7F (1.5C) above pre-industrial levels, considered the limit of a safe environment, and will gather in Dubai next week at Cop28 to discuss progress on this.

Research from the UN has found there to be only a 14 per cent chance of achieving this goal with current policies, predicting that the Earth will warm by 37.4F (3C) by the end of the century.

Mr Hayman said that not one major UK pension scheme has committed to stopping fossil fuel financing and that those people who want their savings removed should email their pension schemes.

He said: “The most powerful thing any of us can do is contact our pension scheme and tell them to stop using our money to finance new oil and gas.

“Our campaign has shown that consumer power can work in pushing big financial institutions to act on climate change, and the more people show they care, the more the pensions industry will have to listen.” (X)

38 notes

·

View notes

Text

Discovering the Top Finance & Accounting Outsourcing Company in Dubai

Dubai’s dynamic business landscape demands a trustworthy guide to navigate its financial intricacies. Nordholm stands out as the Leading Finance & Accounting Outsourcing Company in Dubai, operating under the esteemed Nordholm Investments. We're not just another firm; we're your strategic partners in achieving business success. From simplifying company formation to hassle-free bank account setups, we cover it all.

What Sets Nordholm Apart?

When choosing an Accounting Outsourcing Company, it's more than just numbers; trust and results are vital factors for success. Our commitment to promptness and quality isn't just a claim – it's our dedication to your success story. Your financial data is beyond safe with us – fortified with unparalleled stability and security that exceeds what part-time accountants offer.

Whether you're a start-up or an established enterprise, our services cater specifically to your needs. Small and medium-sized businesses benefit greatly from our expertise, bidding farewell to in-house accountants and embracing significant cost reductions. Say goodbye to overhead expenses like labor cards and health insurance – Nordholm has you covered!

Our expertise lies in discreetly offering unparalleled Finance & Accounting Outsourcing Services, allowing you to prioritize your core business operations. We're not just behind the scenes; we're the unsung heroes ensuring your business thrives. Our services form the foundation of successful enterprises, providing precise reporting and streamlined operations for enhanced efficiency.

As the foremost Accounting Outsourcing Company in Dubai, we transcend borders. Our specialization lies in supporting your business ventures across various countries, especially within the dynamic UAE landscape. From initial setup to ongoing management, our comprehensive range of services ensures a seamless journey for investors seeking growth opportunities.

Unlock the potential for success and growth with us, your key to seamless financial operations and thriving business endeavors in Dubai. We don’t just handle numbers; we pave the way for your triumphs in the ever-evolving business world.

With Nordholm as your premier Finance & Accounting Outsourcing Services provider, rest assured, your financial journey in Dubai isn't just simplified but also positioned for success. Let’s elevate your business together!

#NordholmDubai#AccountingServices#FinanceSolutionsDubai#OutsourcingExpertise#StreamlinedOperations#BusinessConsultancy

7 notes

·

View notes

Text

Overview of WL COMPANY DMCC financial marketplace

The company we want to talk about today is called WL COMPANY DMCC. WL Company DMCC (License Number DMCC-89711, Registration Number DMCC19716, Account Number 411911), registered in Dubai, UAE whose registered office is Unit No BA95, DMCC Business Centre, Level No 1, represented by the Director, Stephanie Sandilands.

DMCC is the largest free trade zone in the United Arab Emirates, which is located in Dubai. It was established in 2002 and now serves as a commodity exchange that operates in four sectors: precious goods; energy; steel and metals; agricultural products.

Main services and activities

WL COMPANY DMCC is a financial marketplace, the direction of which is financial services, consulting, management, analysis of services, provision of services by third parties to the end user. The list also includes:

• Investment ideas;

• Active product trading;

• Analytical support for traders;

• Selection of an investment strategy in the market using various assets.

WL COMPANY DMCC operates on the MetaTrader 5 trading platform. There is a convenient registration, detailed instructions, as well as the ability to connect a demo account for self-study.

Among the main services:

1. Trading.

2. Social Services.

3.ESG Investment.

4. Analytics.

5. Wealth management.

Company managers will help with registration, with opening an account, with access to the platform. After training (if required), you can make a minimum deposit of 500 USD and start trading.

Main advantages and disadvantages of WL COMPANY DMCC

Before going directly to the benefits of the marketplace, it is worth saying a few words about the loyalty program. Depending on the amount of investment, the user receives one of three grades. Each of them gives certain privileges. The program itself makes it possible to get the maximum effect from investments in a short time.

Now about the benefits of WL COMPANY DMCC:

1. Availability of a license in the jurisdiction of the DMCC trading zone.

2. No commission when making SFD transactions on shares.

3. More than 6700 trading instruments.

4. High professional level of support.

5. Very strong analytical support (client confidence level 87%).

6. Weekly comments and summaries from WL COMPANY experts.

7. Modern analysis software.

8. Large selection of investment solutions.

9. Own exclusive market analysis services in various areas.

10. Own analytical department with the publication of materials in the public domain.

11. Modern focus on social services.

The feedback from WL COMPANY DMCC clients highlights the positive characteristics of the work of marketplace analysts, the convenience of a personal account, the speed of processing positions, analysis tools, and low commissions.

Negative reviews relate to the freezing of the system, delays in withdrawing funds for a day, and the small age of the company. Also, for some users, the application for withdrawal of funds was not processed the first time, and someone could not instantly replenish the deposit. North American traders complain that WL COMPANY DMCC only has a presence in Dubai.

At the same time, the financial group received several significant awards:

• Best MetaTrader 5 Broker 2022

• The Most Reliable Fintech Service 2023

Outcome

According to the information received, it can be concluded that WL COMPANY DMCC can be called a good financial marketplace in the modern market. By registering with the DMCC, the company can be called reliable and trustworthy. There are also negative reviews, but they relate mainly to the technical component.

For August, 2023 WL COMPANY DMCC has about 12000 clients worldwide. The main regions are North America, Europe and the Commonwealth of Independent States. Traders can act independently or use the advice of marketplace experts.

8 notes

·

View notes

Text

Our company name is Stock Market Investments Limited, it is an international digital bank and we have a lot of branches in Dubai, South Korea, Japan, United Kingdom, Iran, Nigeria and Morocco. It is a central bank for worldwide users. It is based on your financial plan, you can save money with a higher interest rate within 7-180 days. It is registered by Companies House OE015685

2 notes

·

View notes

Text

Clearing the Path to Financial Excellence: Goviin's Expert Audit Services in the UAE

Welcome to the world of financial transparency and seamless operations with Goviin Bookkeeping! In the bustling business landscape of Dubai, audits stand tall as the guardians of fiscal integrity. we take pride in offering top-tier Internal and External Audit Services tailored to your company's needs, ensuring compliance, transparency, and credibility.

Internal Audit Service: Navigating the Regulatory Waters

When it comes to internal audits, we've got you covered like a trusty compass guiding a ship through uncharted waters. Our seasoned professionals delve deep into your company's operations, ensuring adherence to UAE laws, mitigating risks, and enhancing operational efficiency. From scrutinizing organizational policies to safeguarding against potential risks, we leave no stone unturned. With Goviin's internal audit services, you can sail through regulatory waters with confidence and ease.

External Audit Service: Shedding Light on Financial Horizons

Your financial statements shining like beacons in the night, guiding investors and stakeholders towards your business with confidence. That's the magic of Goviin's external audit services. Our independent chartered accountants meticulously analyze your financial records, offering comprehensive business reports and boosting investor confidence. With fresh perspectives and unbiased analysis, we illuminate your Audits and Accounting Services In UAE, paving the way for future success.

Navigating the Financial Maze: Why Choose Goviin?

In a world filled with financial complexities, we stand out as your trusted navigator. Our audit solutions go beyond mere compliance, offering insights, enhancing credibility, and boosting investor confidence. Whether it's ensuring adherence to regulations or providing objective assessments of risks, we're here to guide you every step of the way.

As you embark on your journey towards financial success in the UAE, let Goviin Bookkeeping be your steadfast companion. With our transparent internal and external audit solutions, you can navigate the seas of regulatory compliance with confidence, attracting investments, enhancing credibility, and unlocking new opportunities for growth. Remember, when it comes to audits and accounting services in the UAE, Goviin is your compass pointing towards success.

#FinancialTransparency#AuditServices#DubaiBusiness#UAEFinance#GoviinBookkeeping#ComplianceMatters#InvestorConfidence#FinancialIntegrity#BusinessSuccess#TransparentAudits#FinancialReporting#AccountingSolutions#RiskManagement#OperationalEfficiency#RegulatoryCompliance#BusinessGrowth#FinancialAdvisory#CorporateGovernance#MarketInsights#StrategicPlanning#uaeaccounting#financialservicesdubai

5 notes

·

View notes

Text

Business setup in Dubai

Business setup in Dubai refers to the process of establishing a business entity within the city of Dubai, which is one of the seven emirates of the United Arab Emirates (UAE). Dubai is a thriving business hub known for its strategic location, robust infrastructure, and business-friendly environment. Here is a detailed explanation of business setup in Dubai:

Mainland Business Setup: Mainland business setup allows businesses to operate within the local market of Dubai and the UAE. It requires partnering with a local Emirati sponsor or a local service agent, depending on the nature of the business activity. The sponsor holds a minority share (typically 51%) in the company, while the majority share can be owned by foreign investors.

Free Zone Business Setup: Free zones in Dubai are designated areas that offer attractive incentives and benefits to businesses. These include 100% foreign ownership, tax exemptions, full repatriation of profits, and simplified procedures. Each free zone in Dubai caters to specific industries or sectors, such as Dubai Multi Commodities Centre (DMCC) for commodities trading, Dubai Internet City (DIC) for technology companies, and Dubai Media City (DMC) for media and advertising companies.

Offshore Business Setup: Dubai also offers offshore company formation through jurisdictions such as JAFZA Offshore and RAK Offshore. Offshore companies are not allowed to operate within the UAE market but are ideal for international business activities, asset holding, or as a vehicle for investment and wealth management. They provide privacy, tax advantages, and ease of administration.

Legal Structures: Dubai offers various legal structures for business setup, including Limited Liability Company (LLC), Sole Proprietorship, Partnership, Branch of a Foreign Company, and more. The choice of legal structure depends on factors such as ownership requirements, liability considerations, and business objectives.

Licensing and Permits: Business setup in Dubai requires obtaining the necessary licenses and permits from the relevant authorities. This includes trade licenses, professional licenses, industrial licenses, and specialized permits based on the nature of the business activity. The requirements vary depending on the type of business and the jurisdiction in which it is established.

Office Space and Infrastructure: Businesses in Dubai need to secure suitable office space or facilities to operate. This can be done through leasing commercial spaces, utilizing shared office spaces, or renting virtual offices. Dubai offers state-of-the-art infrastructure, modern office buildings, and world-class amenities to support business operations.

Visa and Immigration Services: Business setup in Dubai includes visa and immigration services for company owners, employees, and their dependents. This involves obtaining residence permits, work permits, investor visas, and other necessary documents from the Dubai Department of Economic Development (DED) and the General Directorate of Residency and Foreigners Affairs (GDRFA).

Compliance and Regulations: Businesses in Dubai must comply with local regulations, including financial reporting, tax obligations, labor laws, and industry-specific regulations. Compliance requirements vary based on the legal structure and the nature of the business activity. It is important to stay updated with the regulations and engage professional advisors to ensure ongoing compliance.

Dubai offers numerous advantages for businesses, including a strategic location that serves as a gateway to the Middle East, Africa, and Asia, a robust infrastructure, a diverse and multicultural workforce, political stability, and a supportive business ecosystem. However, navigating the business setup process in Dubai can be complex, and it is advisable to seek the assistance of experienced business setup consultants who can guide you through the legal requirements, procedures, and best practices to ensure a successful and compliant business establishment.

#business#business services#business setup#business setup company in dubai#business setup consultants in dubai#business setup in uae#business setup services in dubai#businessinuae#businesssetup#businesssetupdubai

8 notes

·

View notes

Text

Why Market analysis is important in the modern day business setting?

The importance of market analysis is similar to the importance of research in prior to any huge investment. In simple language, market analysis is simply learning about the map before getting along with a treasure hunt. That said, it helps you understand the territory, recognize where the treasure (or opportunity) lies, and come up with the finest course of action to reach it while avoiding potential pitfalls.

On the other hand, for any new company, before getting market entry Saudi Arabia this "plan" can help in proper guidance and implementation of strategies. Moreover, this post will dive into why market analysis is crucial for the success of any new company and how you must go about it.

What is Market Analysis and how it can help?

Talking in layman’s terms, market analysis includes gathering and analyzing data around the industry you're entering, potential clients, and your competitors. It's around replying key questions: Is there a request for your product or service? Who are your clients? What are their needs and inclinations? Who are your competitors, and what can you offer that they can't? This understanding is foundational since it talks regarding each angle of your business strategy from product improvement to promoting, cost, and more.

On the other hand, market analysis helps you distinguish both opportunities and challenges inside your target domain. Moreover, it can uncover gaps within the market that your products or services can fill, making you appear where the "treasure" lies.

At the same time, it can also highlight potential challenges, such as strong competition or administrative obstacles, permitting you to plan techniques to overcome them. Also, without this investigation, you might miss profitable opportunities or run headlong into challenges that may have been dodged. Moreover, it is quite important if you are getting along with company formation in Abu Dhabi Global Market.

Customizing your services and products

Every customer of the modern era looks for personalized products and services. That said, one of the key benefits of market analysis is that it empowers you to tailor your products or services to the requirements and inclinations of your target customers. Also, by understanding what your potential customers are looking for, you can design your offerings to meet those needs better than your competitors. Moreover, this can be a critical differentiator during company formation in Dubai International Financial Center.

The importance of Strategic Decision Making

On the other hand, Market analysis informs strategic decision-making. Additionally, it provides the data and insights needed to make informed choices about where to allocate resources, which markets to enter, and how to position your company. For instance, if market analysis for market entry Saudi Arabia reveals a high demand for a particular service in an underserved region, a new company might decide to focus its efforts on that region. Without these insights, companies risk making decisions based on assumptions rather than facts, which can lead to costly mistakes.

Proper Risk Management is important

If you are an entrepreneur, you must know that starting a new company is inherently risky, but market analysis can help mitigate some of these risks. Also, by providing a clear picture of the market, it allows companies to make calculated risks rather than taking blind leaps of faith. For example, if analysis shows that a specific market segment is shrinking, a company might decide to focus its resources elsewhere. This way, you can thereby avoid potential losses during company formation in Abu Dhabi Global Market. In essence, market analysis acts as a risk management tool, helping new companies navigate uncertain waters more safely.

The significance of fund procurement

For new companies and new businesses looking for investment, an intensive market analysis is frequently a prerequisite. That said, Investors need to see that you got a profound understanding of the market you're entering, including the cost, client socioeconomics, and competitive scene. Moreover, a comprehensive, market analysis can make the difference between securing funding and being turned away. This is because it illustrates that you simply have done your homework and are making data-driven choices during company formation in Dubai International Financial Center.

Long-term planning is the key

At last, market investigation isn't just around the present but also regarding laying the foundation for long-term success. Moreover, it helps you set practical objectives and targets, plan for development, and expect future patterns and changes within the markets. Also, by routinely updating your marketing analysis, you'll stay ahead of the competition, adjusting your procedures to meet modern day market needs.

Final words

Hence, we can say that market analysis is an irreplaceable tool for the success of any new company. Moreover, it will offer detailed knowledge required to explore the markets, distinguish and seize opportunities, customize services to client needs, make key choices, oversee risks, secure funding, and plan for the long term.

That said, within the competitive and ever-changing market scene, skipping market analysis is like setting on a journey without a map. It’s possible, but it also increases the probability of getting misguided or running haywire. This is where by offering your time and assets into the market analysis, new companies can increase their chances of success and create a path for a prosperous future.

#market entry Saudi Arabia#company formation in Abu Dhabi Global Market#company formation in Dubai International Financial Center

2 notes

·

View notes

Text

Fueling Your Financial Journey with The Rockets Investment

The Rockets Investment: Leading a Global Investment Solutions in UAE

Secure your financial future with our prestigious citizenship programs. At The Rockets Investment, we offer tailored investment opportunities with options in St. Lucia, Grenada, and more, empowering you to invest globally with confidence.

#business investment management#business investment opportunities#business investment opportunities in dubai#business investment platform#business investment services#business investment strategy#corporate investment company#corporate investment solutions#corporate investment strategy#customized investment solutions#dubai financial investments#dubai international investment#dubai investment management#dubai investment opportunities#financial investing for beginners#financial investment#financial investment companies in dubai#financial investment goals#financial investment groups#financial investment opportunities#financial investment platforms#financial investment portfolio#financial investment strategies#financial planning portfolio#financial portfolio management#financial solutions and investments#future growth investments#future investment company#future investment opportunities#future investment plans

0 notes

Text

Unlocking Success: Setting Up Your Business in Dubai Free Zones with 365 Pro Services

Setting up a business in a Dubai Free Zone is a popular choice for many entrepreneurs and investors. However, selecting the right Free Zone can be challenging. That's where expert guidance from business consultants like 365 Pro Services becomes invaluable. They assist in creating a robust strategy to help you navigate and choose the ideal Free Zone for your business needs.

In Dubai, there are two main types of Free Zones: Free Zone Establishments (FZE) and Free Zone Companies (FZ Co.) or Free Zone Limited Liability Companies (FZ LLC). These entities vary in the number of shareholders and legal structure. Each Free Zone operates under distinct regulations, making it crucial to align your business requirements with the specific prerequisites of the Free Zone you're considering.

Dubai boasts a diverse array of Free Zones, with more than 30 operational zones. Some renowned options include IFZA (International Free zone Authority) Dubai, Dubai Multi Commodities Centre (DMCC), Dubai International Financial Centre (DIFC), Jebel Ali Free Zone (JAFZA), Meydan, Dubai Airport Free Zone (DAFZA), Dubai South or DWC, among others.

Benefits of setting up your business in a Dubai Free Zone with us:

Complete Foreign Ownership

Tax Exemptions:

Superior Connectivity:

Tailored Infrastructure:

Modern Office Spaces:

Simplified Procedures:

Financial Repatriation:

Currency Flexibility:

Efficient Recruitment:

Dubai's Free Zones provide an exceptional opportunity for entrepreneurs aiming to establish their business. With advantages like tax exemptions, simplified procedures, and superior infrastructure, these zones foster an environment conducive to international trade and investment, supported by the expertise of 365 Pro Services.

#DubaiFreeZone#BusinessSetupDubai#FreeZoneEstablishment#DubaiBusinessConsultants#InvestInDubai#StartupDubai

2 notes

·

View notes

Text

Bracing for US sanctions, Russian financier in Budapest was busy securing personal offshore assets, leaked documents reveal

Bracing for US sanctions, the Budapest-based, Russian-led International Investment Bank’s (IIB) former head planned to move his offshore assets from tax havens in the British Isles to Dubai.

Until April 12, 2023, it looked as though Nikolay Kosov, former chairman of the Russian-dominated International Investment Bank (IIB) in Budapest, had avoided the fate of many other influential and wealthy Russians—i.e. getting sanctioned by the United States. However, he knew that his situation could change at any time and so, late last year, took steps to ensure that he did not lose his accumulated wealth of some £14 million, or almost €16 million.

According to internal bank documents obtained by , Kosov and his family planned to move their assets, held in tax havens in the British Isles, to Dubai in the United Arab Emirates. He and his wife had been corresponding with an investment adviser in Dubai and an accountant in Jersey who had been handling their offshore company affairs for decades. This all happened as Kosov’s workplace, IIB, was already in a critical financial situation and trying to fight bankruptcy.

Since then, events around the bank have accelerated. On April 12, not only Kosov himself but also IIB were placed on a US Treasury sanctions list. The next day, the last European ally of the Russian financial institution, Hungary, announced to quit the bank. Subsequently, IIB decided to leave Hungary and move its headquarters back to Moscow.

The bank has been in a constant state of crisis since Russia’s attack on Ukraine last year, managing both to become undesirable in the West and to some clear support from the Russian state. In this situation, the Hungarian government remained one of the last supporters of the Budapest-based financial institution. ( has previously published a detailed article on this based on hundreds of IIB’s leaked internal documents).

Among these documents were emails and attachments that shed insight into the private assets of Nikolay Kosov and his family. They also show that, during this turbulent period, Kosov lost his job as head of IIB, as he was not re-elected as acting chairman, and that the IIB tried to hide this information from the public.

Kosov may have been using offshore companies since the 1990s. There is evidence of this from years ago: in the offshore leak known as the Panama Papers, found dozens of documents featuring correspondence between Kosov’s family and their accountant. These documents revealed that, around 2015, the family had at least six offshore companies operating, all founded in the 2000s. Through these offshore companies, the Kosovs owned properties, mainly in London. The Jersey accountant whose name appears in the Panama Papers is the same one who helped the Kosovs late last year.

The plans to move the assets to Dubai are probably linked to the change of geopolitical situation due to the war. Andrea Binder, a German political scientist who studies offshore business, told that Dubai is still doing business with Russian investors who have been excluded from some of the world’s other major financial centers. Moreover, Dubai also offers a safe haven from Western sanctions.

Nikolay Kosov is a prominent member of the Russian financial elite, having served on the boards of several banks, a career path that his son Pavelfollowed. The family also has a KGB background: Nikolay Kosov’s parents were members of the top elite of Russian intelligence. His father, for example, was a KGB liaison in Budapest in the 1970s. Because of this, Kosov spent his youth in Hungary before returning to Budapest in 2019 as IIB’s chairman of the management board.

Before publishing this article, we have sent requests for comment to the IIB, Hungary’s foreign ministry, Nikolay Kosov and Natalya Kosova, the Kosovs’ Jersey accountant, as well as their Dubai-based financial advisors, but none of them replied.

14 million pounds sterling

On 15 December 2022, IIB’s management and Nikolay Kosov, whose term as chairman of the IIB had expired, received really bad news: the director-general of the Belgian Treasury informed them that the funds they had frozen would not be released. He justified this by saying that several members of the IIB’s governing bodies were linked to the Russian government, specifically mentioning the Russian deputy finance minister, who is a member of the bank’s board of governors.

The devastating effects of the decision were detailed in an internal briefing for the bank’s management. It said that, in 2022, the IIB had used up almost all its liquidity reserves, so that if it did not have access to funds, the bank would face insolvency or would have to restructure bonds in May 2023. According to the document, the bank was facing a cash shortage so severe that it could not make up for it even by selling the loan portfolio. In the days that followed, bank staff corresponded about what could be done about the situation, including the possibility that the bank would have to leave the EU.

But Nikolay Kosov’s attention was on something else: he was taking steps, with the help of his wife, to move his private assets to Dubai.

This is shown indocuments that are among the internal IIB files originating from a 2023 February leak. Among the hundreds of emails and other documents, mainly about the bank’s internal affairs, there are some that do not concern the bank’s business, but rather Nikolay Kosov and his family. The reason for this is presumably that Kosov also used his work email address for this purpose, and his wife at least forwarded a number of private correspondence to it.

The wife, Natalya Kosova, was, íon December 6, already in touch with an investment adviser named Anton Ionov, who was working in the United Arab Emirates and with whom the Kosovs were about to sign a contract. Kosova also sent a draft of this contract to her Swiss lawyer and her Jersey accountant, Jackie Ollerenshaw. The latter made a few comments on the draft, one of which reveals that the family may have owned two Jersey-based trusts and a company registered in the British Virgin Islands.

Other leaked documents suggest that the Kosovs were planning to transfer some or all of their assets to the United Arab Emirates. In a document dated December 27, Kosov declares that his assets were legally acquired and that he qualifies as a so-called politically exposed person (PEP), also reveals that such a declaration was necessary to set up a Dubai-based foundation called the Froxa Foundation. The text says that the capital of the foundation, which will be registered with the Dubai International Financial Centre (DIFC), will be paid in by Kosov.

Another document, which the file name suggests is dated December 14, 2022, also sheds light on how much money could be involved. This document is a so-called KYC, or “Know Your Client” form, which is designed to help financial service providers find out about their clients’ financial backgrounds to make sure their assets come from clean sources. The form, which is among the leaked documents, says that Natalya Kosova will be the prospective beneficial owner. The scanned, hand-filled document shows that Kosova is a Russian citizen, but also a Swiss resident and has a Swiss tax number. Handwritten notes on the paper also say that the “total asset value [is] approx[imately] £14 million” (almost €16 million). The source of the assets is described as “from existing trust structure in Jersey” and “c.v. of husband enclosed.”

The Dubai-based wealth management firm mentioned in several documents is M/HQ, which, among other things, provides wealth management services for wealthy families and specifically recommends the creation of trusts to manage family assets smoothly, to control inheritance, and to provide asset protection against “creditors, hostile takeovers.”

It is unclear whether the process has come to an end or is still ongoing, but at the time of publishing, there is no record of the Froxa Foundation or any entities in the name of Kosov or his family members in the Dubai company registers.

Unlike the big Western financial centers and Hong Kong or Singapore, Dubai has not yet stopped doing business with the Russians, so it is logical that money from Russian big investors flows there, Andrea Binder, a Berlin-based political scientist and researcher who has studied the offshore world, among other things, told On the other hand, Kosov could have expected to be subject to sanctions himself sooner or later. As both the British Virgin Islands and Jersey belong to the British Crown, they are not independent of its jurisdiction, Binder explained, adding that Dubai is, so the West’s hand does not reach there as easily.

From earlier investigations, we know that Kosov is no stranger to international investment and has been involved in offshore companies for decades. The huge internal dossier known as the Panama Papers, leaked from the law firm Mossack Fonseca, which set up and ran offshore companies, contains numerous references to Nikolay Kosov. These documents date back to 2015. Some of them contain internal correspondence, and include the name of the same accountant—Jackie Ollerenshaw—who was also one of the Kosovs’s correspondents last December in the leaked IIB documents.

Those older documents from the Panama Papers show, among other things, that in 2015 Kosov had six offshore interests, all registered in the 2000s in the British tax haven of the British Virgin Islands. https://offshoreleaks.icij.org/nodes/13001383 An email from Jackie Ollerenshaw from that time also shows that the offshore companies owned mainly London properties, one of them being used by the “client family” themselves. Others were occupied by tenants.

And in a 2014 email, the accountant mentioned that financial services firms in Jersey— another tax haven—had been handling Kosov’s offshore affairs since 1994. “At all times we have been happy with the information held for him and at no time have any regulatory issues been raised. He has always had the highest respect from service providers here,” wrote Ollerenshaw.

The exact origin of the Kosov family’s wealth, beyond the fact that senior bank executives are usually well paid, is unclear, but it has been previously revealed that they are indeed wealthy. A tabloid scandal in 2007, for example, gave an insight into this. Nikolay Kosov’s son Pavel was getting married at the time, and performers of his Moscow wedding included Mariah Carey (who has sung at multiple private events for Russian oligarchs) and Hollywood actor Mickey Rourke. However, Rourke drank too much vodka, became aggressive and was thrown out of the wedding party, according to media reports.

Kosov didn’t leave at his own will

At the end of last year, Nikolay Kosov had the headache not only of relocating his offshore assets, but also of losing his senior position at IIB. His mandate as bank chairman expired on September 17, 2022 and, according to the bank’s official website, no one has taken his place since then. The IIB has not made any public announcement about Kosov’s departure or his successor.

News of Kosov’s disappearance from IIB reached last year, when we asked the bank when and for what reason Kosov left the bank’s leadership. “In accordance with the Statutory Documents of IIB the term of the mandate of the Chairperson of the Management Board ended on September 17, 2022. Appointment of a new Chairperson lies within the responsibilities of the Board of Governors. The Bank shall await a decision on that matter. Until then responsibilities inside IIB are divided between existing members of the Management Board,” the bank wrote in response to our request at the time.

The leaked documents show that there were attempts by IIB’s management to keep Kosov as head of the bank, but these were unsuccessful. Indeed, at last year’s IIB board of governors meeting, Kosov, whose mandate starting in 2012 had expired, was to be re-elected as acting chairman for another two years. However, the proposal was defeated by opposition from Bulgaria, the Czech Republic, Romania and Slovakia, which announced their withdrawal from the bank because of the war in Ukraine.

According to a December 2022 document—minutes of a meeting of the board of governors—Russia, Hungary, Cuba, Mongolia and Vietnam voted in favor of Kosov’s re-election, while the four countries that left voted against it. Although this still gave Kosov 68.5 percent of the vote, the bank’s rules required a three-quarters qualified majority. Kosov’s unsuccessful re-election follows a letter last September in which Romania formally indicated that it did not want a Russian president at the helm of the bank. “That statement by Romania is racist. They […] are against anyone who has a Russian nationality. I find it utterly disgusting, and unfortunately not surprising,” IIB’s chief financial officer Elliott Auckland commented on Romania’s position.

According to internal emails from September, bank staff then wondered whether they could hide the fact that there was no bank chairman, or if they had to make the news public. According to the correspondence, the bank was aware that this news would have a negative impact on the bank’s financial prospects. “We didn’t just change our CEO but failed to elect a new one,” a senior Russian IIB official wrote. “From the point of view of corporate governance it should be considered as a major event. However, I propose to avoid the announce of the event, if there is no direct obligations,” wrote another staff member.

“It looks horrible for us. If we don’t have to legally publish, I am against publishing. We will create a media storm most likely, and ratings will come under pressure at a sensitive time. Our task is to not draw attention to ourselves, and quietly manage our problems,” argued Elliott Auckland. One of the bank’s Hungarian managers agreed with him and urged others to remain silent. “If we announce, there will be noise around us again. It is not good for our rating discussion,” he wrote.

KGB family

According to the leaked files, a formal document was forwarded to Kosov from the bank on November 28, informing him of the cancellation of his powers as bank chairman. Kosov wrote that he needed this to remove himself and his wife from the list of diplomats accredited to Budapest. This list is maintained by the Hungarian Ministry of Foreign Affairs and Trade (MFA) and includes persons with full diplomatic immunity. These are the people who, under the Vienna Convention on Diplomatic Relations, enjoy a number of advantages when traveling, shopping (tax exemption) and, most importantly, have immunity from investigations and criminal proceedings in the host country.

When the IIB’s headquarters relocated from Moscow to Hungary, the biggest controversy was caused by the fact that the Orbán government would have granted the institution and its staff extensive diplomatic immunity. The United States and other NATO allies feared that the IIB’s diplomatic immunity could have been used to allow Russia to deploy intelligence officers in Budapest. has previously revealed that the Orbán government, bowing to US pressure, eventually agreed to a compromise to limit the diplomatic privileges granted to the bank.

No concrete information has been published on the active relationship between the IIB and Russian intelligence, but the institution is often referred to as a “spy bank” in Hungarian and international media. Apart from the controversy surrounding diplomatic immunities, the main reason for this is the family background of Kosov himself: the former bank chairman’s parents were members of the Soviet Union’s intelligence elite and spied, among other places, in the United States. Kosov’s mother, Yelena Kosova, was officially the first female Soviet diplomat at the Soviet mission to the UN in New York—unofficially, she in fact helped steal US nuclear secrets.

Kosov’s father, Nikolay Kosov Sr., worked alongside her as a Soviet newspaper correspondent in New York, but he was in fact a spy too. Later, when the 1956 revolution was crushed, Kosov was part of a KGB task force sent to Hungary. KGB chief Ivan Serov directed agents to Budapest who, because of their previous Western contacts, could be involved in uncovering the alleged Western conspiracy behind the Hungarian revolution. Later, in the 1970s, Kosov Sr. became the KGB’s liaison officer in Budapest, so Kosov Jr. also spent his youth in Hungary.

Nikolay Kosov Jr. later became a diplomat himself in the 1980s at the Soviet Union’s embassy in London, where he worked—and became friends—with Andrey Kostin, who influenced him to switch to banking. As has previously reported, Kostin, a leading figure in the Russian financial elite, became chairman of Vneshekonombank and later VTB Bank (formerly Vneshtorgbank), while maintaining a close working relationship with the Kosov family. In 1998, for example, he took Nikolay Kosov as first vice-president of Vneshekonombank and then, as head of VTB, became the boss of Nikolay Kosov’s son, Pavel Kosov, who also became vice-president.

Pavel Kosov is not on any Western sanctions lists, but, as of October 2022, he is under sanctions by Ukraine’s National Security Council and its anti-corruption authority. Pavel Kosov is under sanctions because of his position as a state official—he is currently CEO of Russian state-owned agricultural lender Rosagroleasing. He was personally received and praised by Vladimir Putin in the Kremlin last June for the work of Rosagroleasing, including how they are helping to replace European imports.

Nikolay Kosov was exempt from Western sanctions until April 12, when the Treasury of the United States placed him on the sanctions list along with the IIB and two of its executives. This means that if the former bank chairman had any movable or real estate property in the US, he would no longer have access to it, nor would he be allowed to do business with US persons or entities.

Kosov was added to the US sanctions list despite the fact that he has not been officially a bank chairman since September last year. But it is not at all clear what his current role is, and internal emails show that he was still using his official bank email address at the end of last year.

Moreover, in the aforementioned document in which Kosov was asked to reply to the Dubai wealth adviser on whether he was a politically exposed person, he made contradictory statements about his own position. In one place, he referred to no longer holding a high position at the IIB, and in the next line he described himself as an active bank chairman.

In addition to Kosov, last Wednesday the IIB was separately placed on the US sanctions list. The decision was announced at a press conference by US Ambassador to Hungary David Pressman, who described the IIB as a tool for Moscow to increase its influence in Hungary and the region.

The day after the announcement, the Hungarian government announced that Hungary would also leave the bank—the last of the EU member states to do so. In response to this, the IIB announced on April 19 that it would leave Budapest and move its headquarters back to Russia, as its operations had become impossible.

2 notes

·

View notes

Text

Unlock Success: Affordable Accounting Services in Dubai by Nordholm

Dubai's bustling business environment offers a wealth of opportunities for entrepreneurs aiming to expand their ventures. At Nordholm Investments, our Accounting & Bookkeeping Services serve as a pivotal catalyst for business growth, providing Top-notch yet Affordable Accounting Services in Dubai. Our mission is centered on delivering customized solutions that precisely meet the unique requirements of investors eyeing the UAE market. We recognize the complexities involved in establishing a presence in a new location, and we're here to simplify the process.

Our comprehensive range of services includes:

Company Formation: We specialize in facilitating a seamless and hassle-free company setup process while ensuring adherence to local regulations.

Visa Procedures: Navigating the intricate visa requirements can be challenging. Our experts adeptly streamline this process, simplifying your entry into the UAE market.

Bank Account Setup: Efficient financial operations are crucial. We offer guidance and assistance in opening bank accounts, ensuring smooth transactions for your business.

HR and Payroll Services: Managing human resources and payroll necessitates meticulous attention. Our services guarantee seamless operations in these critical areas.

VAT Compliance and Accounting: we understand the significance of accurate accounting and VAT compliance. Our proficient team excels in managing these tasks with great attention to detail, allowing you to prioritize your core business operations.

We comprehend the pivotal role that Precise Accounting and Bookkeeping play in fostering sustainable business growth. Our team of seasoned professionals is committed to handling these critical aspects, empowering you to steer your business towards success.

We recognize the delicate balance necessary for a business to thrive. By amalgamating sustainability with security, we provide valuable insights and strategies that facilitate informed decision-making and unlock new opportunities.

Navigating the complexities of foreign countries, particularly in the United Arab Emirates, can be overwhelming. However, with Nordholm Investments by your side, investors can embark on stress-free business operations. Our understanding and enjoy in the region ensure a easy and worry-loose revel in, allowing you to cognizance on scaling your commercial enterprise goals.

Opting for our Affordable Accounting & Bookkeeping Services means choosing a dedicated partner invested in your business's success. Our Top-tier Accounting Services in Dubai are meticulously tailored to meet your needs, guaranteeing precise financial reporting and efficient operations while you concentrate on achieving your business objectives.

#DubaiBusiness#AccountingServices#NordholmInvestments#FinancialConsulting#VATCompliance#BookkeepingServices#CompanyFormation#PayrollManagement

5 notes

·

View notes

Text

In effect, Chinese state-owned conglomerate Cosco Shipping Holdings is building – virtually from scratch – a deep-water port in Peru. At the cost of US$ 3 billion, it will connect an industry and a logistics park in collaboration with a unit of the Swiss trading company Glencore.

At Chancay, 55 kilometers north of the capital Lima and the port of Callao the hum of heavy Chinese machinery and the thud of underground explosions drowning out the sound of waves are proof of the new port development underway in the Americas.

Signs in Spanish and Chinese announce construction milestones and upcoming public works. Thousands of workers move around the 1,100-hectare site, pouring concrete, driving construction equipment, and breaking rocks.

China Railway Group is building a 1.8 km tunnel from the port area so that trucks heading to the 800-hectare industrial and logistics park can bypass Chancay city center. Cosco operates in around 35 ports worldwide, but Chancay will be the conglomerate’s first outpost in South America.

“Cosco Shipping will cooperate with Peru to make the Port of Chancay into an important central port in Latin America,” President Xu Lirong said in 2019 when the company closed the deal to buy 60% of the Volcan unit project from Glencore for US$ 225 million.

“The Port of Chancay is an important initiative to implement China’s Silk Road initiative in Peru,” he added.[...]

Under Cosco’s plan, the new port will be able to handle the world’s largest container ships and process up to 1 million standard containers a year, with the first quays opening within a year.

“The port is planned to grow, and we have room to continue expanding for 50 years,” said Gonzalo Rios, the port’s deputy general manager. “There’s no other project like it, in size and construction technology today,” he said.

Peru’s main value to China as a trading partner is copper, a crucial input used in manufacturing and construction. However, while Chinese state-owned companies manage two of Peru’s biggest copper mines, their production is not expected to be shipped via Chancay. That’s because Cosco is prioritizing shipping infrastructure and agricultural commodities. Fishmeal is another major Chinese import from Peru.

Peru’s container trade with China lags well behind neighboring Chile. Chile received 643,958 twenty-foot equivalent units (TEU) of containers last year from China, while it shipped 331,047, according to S&P Global Market Intelligence’s Panjiva data service. For Peru, the numbers were, 397,046 TEU entered, and 133,239 exited.

The port of Callao, on the outskirts of Lima, today the main commercial port in Peru and the busiest container center in South America's western coast handled around 2.4 million TEU. The port unit of the Danish shipping company A.P. Moller-Maersk controls the north side of Callao. At the same time, Dubai terminal operator DP World manages the south, where it is investing US$ 350 million to expand capacity. [...]

“Some Chinese state investments have a different objective than classic commercial and financial success,” he added. “The objective is broader, strategic, and long-term.”

According to Omar Narrea, a management professor, Chancay would be a growth driver for Peru if the country is able to stimulate development in planned surrounding industrial parks that might take advantage of the new port and its location along the Pan American Highway.

28 Aug 22

28 notes

·

View notes