#form 2290 for the 2022 is due

Photo

Tomorrow is the last date to report pro-rated form 2290 HVUT for December used heavy vehicles. E-file pro-rated form 2290 at Tax2290.com and get your schedule 1 copy now! More Visit at: https://blog.tax2290.com/tomorrow-is-the-last-date-to-e-file-pro-rated-form-2290-taxes-for-december-used-vehicles/

#Tax2290#Form 2290#Form 2290 Prorated Tax#Prorated Tax Deadline is Tomorrow#Form 2290 Partial Period Tax#Form 2290 pro-rated truck taxes#2290 prorated tax due date#December 2022 is due on January 31st 2023

0 notes

Photo

The new tax season, TY 2022-2023, has already started at the beginning of July 2022 as usual, and it is going to last till the end of June 2023. Truckers and trucking taxpayers must report their Highway Heavy Vehicle Use Tax (HVUT) for the whole tax period in advance around the beginning of the tax period. As per the IRS regulations, the last date to file and pay the form 2290 truck tax for this tax period, TY 2022-2023, is August 31, 2022. So, truckers should file their form 2290 tax returns to the IRS on or before the last date and get the IRS stamped schedule 1 copy to operate their trucking business on the public highways smoothly. Truckers and trucking taxpayers should remember that form 2290 HVUT due doesn’t fall on the due date of the vehicle’s registration. Form 2290 HVUT is absolutely necessary to register your new vehicle or renew your existing vehicle registration on its due date. So, tuckers should report form 2290 HVUT for every tax season before the deadlines, which is irrelevant to the heavy vehicle’s registration due date. @pay2290 @thinktradeinc @tax2290 @irs2290 @irs2290 @2290efile @2290tax @bigwheels2290 @trucktax2290 @trucktax2290

#2290 for 2022#heavy truck tax form 2290 for 2022#hvut form 2290 for 2022#tax 2290 for 2022 is due now#form 2290 for the 2022 is due#renew form 2290 online for 2022

0 notes

Quote

Timely E-File of HVUT Form 2290 Order To Avoid Penalties

Owners of heavy-duty vehicles weighing more than 55,000 pounds must file Form 2290 with the IRS to pay tax. For each tax year, the filing period begins on July 1st and concludes on June 30th. If a new vehicle is purchased between these dates, the truck owner must pay the tax within one month of the vehicle's first usage on the road.

Form 2290 due date and penalty for late filing

For the tax year 2022-23, the deadline to e-file Form 2290 is August 31st, 2022. To avoid penalties, truckers must be vigilant and file their taxes before the deadline. They can also use the e-filing option to pre-file their tax and pay it by August to save money on the tax and avoid late-payment fines and penalties.

Penalties for failure to file on time Form HVUT

If a truck owner fails to file his taxes on time, he will be subjected to fines that are disproportionately high for the trucking business. It is preferable to avoid highway tax noncompliance fines, which can be as high as 4.5 percent of the total tax payable for five months, calculated monthly.

Late filers will be subject to fines and penalties, as well as an extra monthly penalty of 0.5 percent of the total day, as well as 0.54 percent of the additional interest charges compounded monthly. The tax due of a vehicle owner, which was roughly $550, will climb to $700 for five months if the late fine penalties are calculated according to the percentages mentioned above. Along with such harsh fines, the state also suspends the registration of any vehicle that does not have proper documentation of HVUT tax payment.

If truck owners do not file their tax returns within 60 days of the extended due date or the due date, the minimum penalty for late filing is roughly $135 of the unpaid taxes. To prevent such penalties, it's critical to keep watchful and E-file the HVUT Form 2290 on time and well ahead of the deadlines.

Form 2290 e-filing with the IRS is simple and straightforward, and it can be completed in a matter of minutes. Truck2290 is an IRS-approved service provider that assists with the e-filing procedure in real time. Within a few minutes, individuals must create a free account and log in. They can then enter the truck's EIN and VIN, as well as the payment options. In less than 10 minutes after the IRS accepts the HVUT Forms, truck owners will receive a stamped Schedule-1 copy through email. As a result, e-filing Form 2290 is a wise choice that helps avoid late fees and undue stress.

#truck2290#form2290#form2290online#form 2290 online filing#fileform 2290#e file form 2290#2290 penalty#2290 online#2290 due date#2290 deadilne#form 2290 penalties#hvut form 2290#heavy vehicle use tax#2022#file form 2290 2022#pre file form 2290

0 notes

Text

MEET YOUR AUGUST 31ST FORM 2290 DEADLINE WITH ADVANCED FEATURES FROM EXPRESSTRUCKTAX

MEET YOUR AUGUST 31ST FORM 2290 DEADLINE WITH ADVANCED FEATURES FROM EXPRESSTRUCKTAX

The Form 2290 due date is fast approaching. File now at expresstrucktax.com to take advantage of the easy-to-use Form 2290 e-filing solution

ROCK HILL, SOUTH CAROLINA, UNITED STATES, August 19, 2022 /EINPresswire.com/ — August 31st is a very important deadline for drivers in the trucking industry. This is because that is the deadline to file Form 2290, an IRS tax form for the Heavy Vehicle Use…

View On WordPress

0 notes

Photo

August 31 is the due date for reporting the Federal Vehicle Use Tax Form 2290 with the IRS. You just have less than a day to get it done. #2290eFiling is the best way to report and pay the dues on time. @tax2290 #efiling2290 is Easy and Fast, Schedule 1 proof in just minutes.

The Heavy Vehicle Use Tax Form 2290 for the new tax year 2022 – 2023 is due now & renew it online to receive IRS stamped Schedule-1 proof in minutes. Electronic filing is fast & easy only at @Tax2290.com. The best way to report & pay the 2290 #TruckTaxes. #Form2290 #HeavyTruckTax

#2290 tax online#2290 tax e file#2290 tax online for 2022#2290 tax e filing#2290 tax electronic filing#2290 tax for 2022#2290 tax for 2290 tax year#2290 tax online for 2290 tax year#2290 tax for july 2022#2290 tax e filing for 2022#2290 truck tax#2290 heavy truck tax#2290 tax form efile#2290 truck tax efile#2290 heavy truck tax e file

0 notes

Text

Form 2290 Due date for the tax year 2022-2023

What is Form 2290?

IRS Form 2290 is a Heavy Vehicle Use Tax (HVUT), it should be filed if you run vehicles with a taxable gross weight of 55,000 pounds or more. And also you should file 2290 tax if your vehicle exceeds 5,000 miles or 7,500 miles (for agricultural vehicles) in a tax period.

When is the Form 2290 Due date?

Form 2290 due date for 2022-2023 tax year is August 31.

Failing to file HVUT will result in penalties and interest, which is assessed on a monthly basis.

Late filers not paying HVUT will also face an additional monthly penalty.

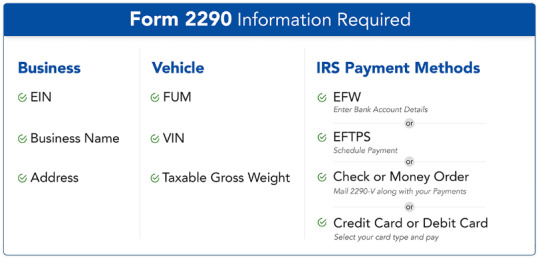

Information required to file Form 2290

Business Name, Address and Employer Identification Number (EIN).

Vehicle Identification Number (VIN), First Used Month (FUM), Taxable Gross Weight, Suspended vehicles (if any).

Review and transmit.

Benefits of filing Form 2290 with ExpressTruckTax

File Form 2290 with ExpressTruckTax, and avail several benefits such as,

Guaranteed Schedule 1 or money back

Free VIN Checker and VIN Correction

Bulk information upload

Copy last year’s return

0 notes

Photo

Form 2290 for Tax Year 2021 – 2022, Due Now Renew it at www.simpletrucktax.com for only $6.95. It’s time for your 2290 tax form renewal, the heavy highway vehicle use tax is required to be paid annually to the IRS for every truck that drives on the public.

0 notes

Text

e-File 2290 Form Online with the IRS

Every year, truckers, owner operators and trucking companies file form 2290 for using the American highways. Vehicles that weigh 55,000 pounds or more and have crossed 5,000 miles in a given tax period must file form 2290 and pay the Heavy Highway Vehicle Use Tax or the HVUT tax.

It is important to file your HVUT tax as you will receive an IRS watermarked Schedule 1 which acts as a proof of tax payment. Without the Schedule 1, users cannot update their vehicle registration and tags at the DMV.

When is the due date to e-file 2290 form?

There are mainly two scenarios that determine when you should start filing your form 2290 online. In the below section you can find the scenarios that determine the due date for filing your form 2290 online.

1.If you have been using your heavy vehicle continuously over the years:

In such scenarios, the due date for filing your form 2290 is August 31st of every year. The tax filing season begins on 1st of July 2021 and ends on the 30th of June 2022.

2.If you have recently purchased a truck or started using your truck recently. New trucks are registered every day in the US. If a truck is purchased in any month other than July, the user needs to file form 2290 and pay the HVUT tax within 30 days of the vehicle’s first use month. The

According Form 2290 IRS instructions, the due date for the newly used truck would be the last day of the month following the month of first use. For example, if you started using your heavy vehicle on the 1st of February then the due date will be on the 31st of March. Filing your form 2290 before the due date will ensure zero penalties for your truck.

0 notes

Photo

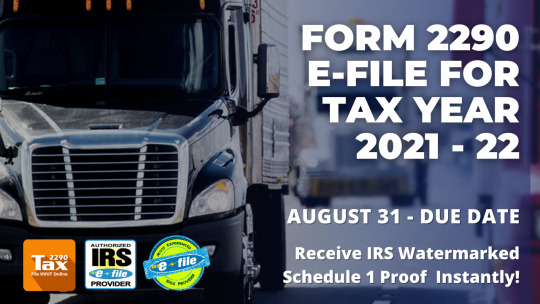

IRS Tax Form 2290 – Truck Tax Returns Due Date | Tax2290.com

Time to renew your heavy highway motor vehicle use tax using IRS Tax Form 2290 for the new tax filing period 2021 – 2022. E-filing is the fastest way to renew 2290 as you can receive Schedule-1 proof once IRS accepts your return.

@tax2290 it is easy and fast! Call us at 1-866-245-3918 or mail us at [email protected] for any suggestion and queries. Rest assured, our Tax Experts would never let you go wrong!

0 notes

Photo

Partial period form 2290 HVUT for the heavy vehicle’s first used on August is due on September 30, 2022. E-file at Tax2290.com and get your instant schedule 1 copy today! https://blog.tax2290.com/september-30-2022-is-the-last-date-to-report-your-partial-period-form-2290-hvut-for-the-vehicles-first-used-in-august-2022/

#Tax2290.com#Form 2290#Form 2290 Prorated Truck Tax#Form 2290 Partial Period Truck Tax#2290 prorated due on september 30 2022

0 notes

Photo

Form 2290 - HVUT Returns - Due Date - Tax Year 2021 - 22

When is Form 2290 Due? The Form 2290 #HVUT returns are due in July 2021 through June 2022, has to be reported and paid between July 1 and August 31. 2290eFiling is the best way to report and pay, to receive the IRS stamped Schedule 1 instantly.

#Pay 2290 online for 2021#pay 2290 taxes for 2021#pay 2290 electronically for 2021#pay 2290 taxes#pay 2290 tax due#pay 2290 truck tax for 2021

0 notes

Photo

IRS Tax Form 2290 - Due for 2021 - August 31 Deadline

When is Form 2290 Due? The Form 2290 #HVUT returns are due in July 2021 through June 2022, has to be reported and paid between July 1 and August 31. 2290eFiling is the best way to report and pay, to receive the IRS stamped Schedule 1 instantly.

#Truck tax form 2290 for 2021#hvut tax 2290 for 2021#tax 2290 electronic filing#form 2290 due date for 2021#August 31 due date for Tax 2290

0 notes

Photo

Hurry Up! Don't be late. eFile your form 2290 for the 2022 to 2023 Tax year. The Due Date of form 2290 is August 31st.File Now Today: https://www.truck2290.com/

0 notes

Photo

Report form 2290 HVUT truck taxes for the vehicle’s first used in September on a partial period basis within October 31, 2022. E-file form 2290 at Tax2290.com before the deadline! https://blog.tax2290.com/partial-period-form-2290-truck-tax-for-the-heavy-vehicles-first-used-in-september-2022-is-due-soon/

#Tax2290.com#Form 2290#Form 2290 Prorated Truck Tax#Pro-rated form 2290 taxes#Taxes on a partial period#Pay form 2290 truck taxes

0 notes

Link

#tax2290.com#partial period tax#Form 2290 partial period tax#prorated period tax#Form 2290 prorated period tax#partial period tax due date

0 notes

Text

IRS Form 2290 Due date for 2022 - 2023 is August 31

Form 2290 - An Overview

IRS Form 2290 should be filed if you run a vehicle with a combined gross weight of 55,000 pounds or more. Also you should file tax, If your vehicle exceeds 5,000 miles or 7,500 miles for agricultural purposes in a given tax period.

Due date for Form 2290

The due date to file Form 2290 for the year 2022 - 2023 is August 31, 2022.

Due date should be filed based on the First Used Month (FUM) of the vehicle.

If your FUM is July 1, then your due date is August 31.

If you fail to file Form 2290, you are liable for penalties and interest.

Steps to file Form 2290

Step 1:

Enter your Business Name, Address and Employer Identification Number (EIN)

Step 2:

Fill your Form 2290 by submitting your Vehicle Identification Number (VIN), Taxable Gross Weight, First Used Month (FUM), Suspended Vehicle (if any), Third party Designee detail, etc.

Review and Transmit your IRS Form 2290

Benefits of filing Form 2290 with ExpressTruckTax

Filing Form 2290 with ExpressTruckTax is Easy. Benefits include

Receive stamped Schedule 1 in minutes

Guaranteed Schedule 1 or your money back

Instant Error Check

Free VIN Checking and VIN Correction

Bulk Information Upload

Multi User Access

1 note

·

View note