#ftgratiot

Text

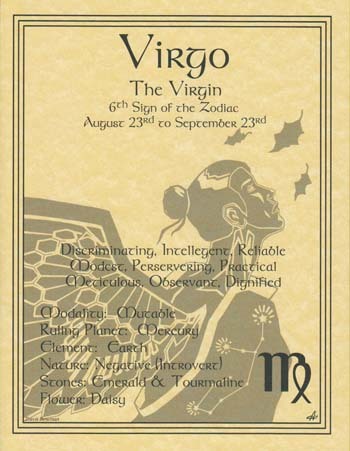

it's #Libra season at CrocoiteChaos.com!

.

.

.

#Fluorite #Sphere https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=23_120&products_id=35724

#PaloSanto #LapisLazuli #Bracelet https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=17_74&products_id=32830

#Tourmaline #Blackheart #FlowerOfLife https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=157_22&products_id=37838

#PeachMoonstone #Runes https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=23_123&products_id=33152

#RevivalOfTheRunes https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=133_143&products_id=35094

#LibraPoster https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=18&products_id=1921

#NewAge #Metaphysical #Witchcraft #Wiccan #Wicca #Witchy #Witch #Louisville #Detroit #PureMichigan #KYProud #KentuckyProud #FtGratiot #FortGratiot #LakeHuron #PortHuron #Brooks #Jeffersonville

4 notes

·

View notes

Text

Amazing Keller Williams Realty Fort Gratiot MI 48059 Homes Available For Purchase In Every Region

Well, there are no surprises here: Your primary step in the Keller Williams Realty Listings for property-buying procedure is to determine your budget, just as you 'd likely provide for any other significant monetary choice.

However where should you begin?

youtube

" As a basic rule of thumb, you need to be taking a look at home rates that are 2 to 3 times your annual earnings," says Tom Gilmour, a CFP ® at LearnVest Planning Services. "This assists guarantee that you're not handling a bigger mortgage commitment than you can afford."

Mentioning home mortgages, Gilmour suggests that payments normally not go beyond 28% of your month-to-month gross earnings-- but if you have other high expenses, such as private school tuition, it can be smart to pare down this percentage even more. If you're unsure what's sensible, consider looking for help from a financial professional, who can assist stroll you through an appropriate breakdown, based on your private situation.

How much is my home worth instantly?

You can discover what your house is worth by calling (855) 909-8898.

As soon as you have actually specified your spending plan, it's time to look at your money reserves. Gilmour recommends saving up a minimum of 20% for your down payment in order to avoid needing to purchase personal mortgage insurance coverage, plus another 3% for closing expenses.

You'll likewise want to make certain you have sufficient cost savings left over to help spend for any home improvements, decors or miscellaneous moving and maintenance costs that might pop up-- completely. Translation: You must not be utilizing your emergency fund to cover these expenses.

" Being a Keller Williams Realty propertyowner often features surprises, like a burst pipe in the middle of the night that requires to be repaired immediately," Gilmour says. "So you need to be financially ready for these surprises, which implies you should not diminish your emergency fund for expenses like furniture or remodeling."

Now that you have actually pin down your numbers, it's time to start looking for a mortgage loan provider with a credibility for good client service and prompt closings. You'll likely have a great deal of questions-- like the length of time the procedure will take and what the certifying standards are-- so select a lending institution that answers them all adequately.

Next, decide which mortgage makes the most sense for you. There are plenty of various options to consider. Although Gilmour encourages selecting one of the most typical two: a fixed-rate mortgage, in which your interest rate stays stable throughout of the loan, or an adjustable rate mortgage (ARM), in which your rate varies to show market modifications.

" [ARMs] can be an excellent choice-- but typically only if you plan to reside in your home no longer than the original set duration," Gilmour says. "Otherwise, if the interest rate rises, you might find yourself with a mortgage payment that's higher than you prepared and, depending on your budget plan, might not be sustainable."

When it comes to the length of your loan, Gilmour favors a 30-year term over 15-- even if you believe you can pay off your home much faster.

" Building equity in a Keller Williams Realty home can be a great way to grow your wealth, but it is very important that you do so in a manner that doesn't extend your finances too thin," he cautions. "Things can get truly awful when the real estate market decreases, so it may be a great concept to take out a 30-year mortgage however accelerate your monthly payments as if you had a 15-year mortgage. If you ever need to decrease your payment in the future, you'll still have that choice."

Next up on your order of business: Look for a pre-approval, the procedure in which a lender reviews your monetary information-- like your credit report, W2s and bank statements-- and dedicates to offering you a mortgage for a specified interest rate. It's a great idea to think about doing this now since it can show to a seller that you're a certified purchaser, and once a deal is made, the bank will simply need to evaluate the KW Realty house-- not the property and your financial resources.

However an advice: A bank may authorize you for a bigger loan than you've identified you can afford. So don't be seduced by their findings-- and stick to the number you arrived on in step one.

If the idea of not having the ability to afford your mortgage keeps you up during the night, this action is all about mitigating those worries by replicating the experience of being a Keller Williams Real Estate propertyowner-- before you buy.

Start by totaling up all of the monthly expenses related to a Fort Gratiot MI residence purchase, including your predicted mortgage payment, tax and insurance quotes, HOA fees and home maintenance expenses. And don't fret if you do not have concrete numbers-- the point is to see if you can manage a ballpark amount.

If the sum of the expenditures equals more than what you're spending for housing now, then deduct your lease from the total. The difference is what you should consider moving to your savings account for a few months to imitate what you 'd be paying to cover your month-to-month new-home costs.

If you can easily pull this off, then felt confident that you can most likely handle the common costs of being a Keller Williams Realty Fort Gratiot MI 48059 homeowner. However if you can't-- or you're making unpleasant compromises-- think about adjusting your home rate until all of these expenses are possible on your existing earnings.

It's the unusual fortunate person who discovers the best home within their budget plan, so before you go house hunting, brainstorm a list of what you definitely need to discover in a Keller Williams Realty house-- and which features are merely great bonus.

Examples of must-haves might consist of the variety of bed rooms and restrooms, distance to work and other places you frequent, and access to your preferred school districts. You might also have a strong choice on the amount of outside area a house offers, and whether it's move-in ready.

Things that should not be on your must-have list? The method a house is decorated, well-manicured landscaping, a swimming pool-- or anything else you can easily repair or install yourself.

Describe this list if you need help down the line making an unbiased decision between 2 or more houses-- along with to remind you of what's truly important, versus what could be tempting you to pay more than necessary.

Now for the fun part: house searching! Searching online resources like Trulia for available Fort Gratiot MI properties in your community is a good place to start, and can help confirm whether your budget and house must-haves are reasonable because of what's for sale. You can learn more information here on Youtube

This is also a prime-time show to choose whether you'll employ a realty agent, if you have not currently. While you're under no responsibility to do so, there are several prospective advantages to working with one. First off, an agent can provide access to more home choices than you'll likely find yourself, as well as established seeing appointments. Since home-buying can be a psychological process, an agent can likewise serve as a conciliator in between you and the seller.

To discover somebody, interview several purchasers' agents-- this suggests they solely represent you, and not the seller, too-- until you recognize somebody who understands your needs and makes you feel comfortable. As a last action, examine your state's real estate licensing board's website to ensure they're signed up, and do not have any problems or suspensions logged against them.

However whether you choose to work with an agent, you must strike the ground running now on viewing as numerous houses as possible.

Your loan provider will likely need the name of the company providing you with home insurance, which is why you ought to shop around for a quote while you're still house searching.

Standard insurance coverage usually covers fire, theft, storm damage and liability ought to someone get hurt on your property and sue you. However you can likewise add on riders for things like costly fashion jewelry, furnishings and home office devices, along with select to get extra flood insurance if your home is in a flood-prone area.

To find a supplier, you can search online, from firm to firm, or utilize an independent agent, who can offer several quotes to review simultaneously. It differs based on your area and, obviously, the value of your home, but you can approximate your expenses.

So you have actually fallen in love with a property that satisfies all of your needs and a few of your wants-- and it's within your price variety. Let's make a deal!

However here's where it can get tricky: You do not wish to low-ball your deal, and risk losing the Fort Gratiot MI residence to another buyer or insult the seller-- but you also don't wish to pay more than is required. So how do you land on the ideal number?

While there are no absolute rules, a few elements can assist notify your choice.

Initially, take a look at other home sales in the location. Is your house you desire priced fairly in comparison? Did other Keller Williams Realty Listings for residences cost less or more than the asking cost? If they sold for an amount that's comparable to your seller's sale price, that's an excellent indication you should be offering a number close to asking.

Next, think about for how long the Keller Williams Realty Fort Gratiot MI 48059 house has actually been on the marketplace, and how incentivized the Keller Williams Realty Fort Gratiot MI 48059 propertyowner is to sell. For example, if the seller is living in a shift home while waiting to offer, you may have a much better possibility of getting the seller to accept a discounted deal. However if he's delicately putting the Fort Gratiot MI house on the marketplace to see how much he can net, the seller may be more apt to wait on the ideal cost.

Lastly, what's the marketplace like in the neighborhood? Is it like New York City, where condominiums get taken up with all-cash deals, or are you in a Las Vegas-esque location, where empty Fort Gratiot MI residences are a common website? In the former scenario, it might be an excellent idea to start with a strong offer to beat out an army of other suitors, whereas you may have more leeway in a market like Vegas.

The seller accepted your offer-- congrats! However prior to you sign on the dotted line, you must ensure to review the contract thoroughly and comprehend each and every single stipulation.

Pay special attention to contingencies in the contract, which spell out situations when you can back out of the sale to help safeguard yourself in case something fails. For example, such scenarios can include if you find that the Keller Williams Realty home has severe physical defects or if your bank rescinds financing.

Speaking of defects, now is likewise the time when you'll get the Keller Williams Realty Listings for house inspected, which generally costs in between $200 and $500. If there are issues, such as a non-functioning fireplace or an old boiler, you might be able to request a cost decrease to help cover the cost of repairs. And if you find any offer breakers, such as an unsteady structure or serious mold, you have the choice of backing out now.

As soon as your inspector confirms that there are no huge flaws that might impact the Keller Williams Realty Fort Gratiot MI 48059 residence's worth, you'll send a mortgage application. Evaluation all closing expenses-- the ones you have actually hopefully conserved up 3% to spend for, which might include an attorney's cost, title insurance coverage and partial property taxes-- prior to you sign the agreement.

Who is Keller Williams?

Keller Williams is the world's largest real estate franchise by representative count, has more than 975 offices and 186,000 affiliates. The franchise business is likewise No. 1 in houses and sales volume in the United States.

Before the big day, you're entitled to a walk-through to confirm that nothing has actually altered because the examination. After that, make sure you have all the money required for the closing wired into the appropriate account.

Ask the settlement agent for copies of all the documentation you'll sign before closing, so you can thoroughly evaluate them at your leisure. You'll be putting your John Hancock on several products, including the HUD-1 settlement declaration, which details all of the expenses associated with the Keller Williams Realty Listings for property sale; the Last Truth-in-Lending Act declaration, which details the expense of the loan and the rates of interest; and your final mortgage documentation.

On closing day, bring your photo I.D., in addition to any documents you received throughout the Keller Williams Realty Listings for residence-buying process, including insurance coverage and home assessment certificates.

As soon as you've signed the documentation, you'll be handed the keys ... and you'll formally become a Keller Williams Realty Fort Gratiot MI 48059 houseowner!

Purchasing a house requires a great deal of effort and time, however these 10 steps can help make the Keller Real Estate house buying process workable and help you make the very best choices possible.

As quickly as you can, begin checking out Web sites, newspapers, and magazines that have property listings. Take down particular Keller Real Estate homes you are interested in and see how long they stay on the marketplace. Likewise, keep in mind any modifications in asking rates. This will give you a sense of the real estate patterns in specific areas.

Lenders usually recommend that people try to find Fort Gratiot MI properties that cost no greater than three to five times their annual home income if the Keller Williams Realty Fort Gratiot MI 48059 residence purchasers plan to make a 20% deposit and have a moderate amount of other debt.

However you should make this decision based upon your own monetary situation. Use our Affordability Calculator to see how much house you can pay for.

To assist you save for your deposit, attempt Discover Bank's AutoSavers Plan, that makes it simple to put aside loan each month.

Prior to you start trying to find a Keller Williams Realty INC property, you will need to know how much you can really spend. The very best way to do that is to get prequalified for a mortgage. To get prequalified, you simply require to supply some financial details to your mortgage lender, such as your earnings and the quantity of savings and financial investments you have. Your loan provider will examine this info and inform you just how much we can provide you. This will inform you the price series of the Keller Williams Realty Listings for homes you should be looking at. Later on, you can get preapproved for credit, which involves supplying your financial files (W-2 statements, paycheck stubs, checking account declarations, and so on) so your loan provider can verify your financial status and credit.

Property agents are essential partners when you're purchasing or selling a KW Realty home. Realty agents can offer you with valuable details on KW Realty homes and areas that isn't easily accessible to the public. Their knowledge of the Keller Real Estate property buying procedure, negotiating abilities, and familiarity with the location you want to live in can be very valuable. And most importantly, it doesn't cost you anything to utilize an agent-- they're compensated from the commission paid by the seller of your home.

Step 5: Purchase Your Home and Make a Deal

Start exploring Keller Williams Realty Listings for houses in your cost range. It might be handy to keep in mind (using this practical list) on all the Keller Williams Realty INC properties you visit. You will see a great deal of houses! It can be hard to keep in mind whatever about them, so you might want to take images or video to assist you remember each home.

What is the largest real estate company in the us?

Keller Williams Real Estate is an American innovation as well as global real estate franchise business with head office in Austin, Texas. It is the primary franchise in the USA by sales quantity, ranking number one in representatives and systems marketed in 2017.

Ensure to take a look at the little information of each house. For example:

Check the pipes by running the shower to see how strong the water pressure is and how long it takes to fume water

Try the electrical system by turning turn on and off

Open and close the doors and windows to see if they work effectively

It's likewise essential to examine the area and make a note of things such as:

Are the other Keller Williams Realty residences on the block well maintained?

Just how much traffic does the street get?

Is there enough street parking for your family and visitors?

Is it conveniently situated near places of interest to you: schools, shopping centers, dining establishments, parks, and public transportation?

Take as much time as you need to find the best home. Then deal with your property agent to negotiate a fair offer based upon the worth of comparable Keller Williams Realty Listings for houses in the very same neighborhood. As soon as you and the seller have actually reached agreement on a rate, the house will go into escrow, which is the time period it requires to complete all of the staying steps in the Fort Gratiot MI home buying process.

Usually, purchase offers are contingent on a Fort Gratiot MI property inspection of the property to look for signs of structural damage or things that might need fixing. Your real estate agent generally will assist you arrange to have this assessment performed within a few days of your offer being accepted by the seller. This contingency secures you by giving you an opportunity to renegotiate your deal or withdraw it without penalty if the examination reveals considerable product damage.

Both you and the seller will receive a report on the Fort Gratiot MI house inspector's findings. You can then choose if you want to ask the seller to repair anything on the property before closing the sale. Before the sale closes, you will have a walk-through of your home, which offers you the opportunity to validate that any agreed-upon repairs have been made.

Lenders have a wide range of competitively priced loan programs and a credibility for remarkable customer care. You will have lots of concerns when you are purchasing a Keller Real Estate home, and having one of our skilled, responsive mortgage lenders help you can make the procedure much easier.

Every home purchaser has their own priorities when selecting a mortgage. Some are interested in keeping their monthly payments as low as possible. Others are interested in making certain that their monthly payments never increase. And still others pick a loan based on the understanding they will be moving once again in simply a few years.

Lenders will schedule an appraiser to provide an independent estimate of the worth of your home you are purchasing. The appraiser is a member of a 3rd party company and is not directly connected with the lender. The appraisal will let all the parties included understand that you are paying a fair rate for the Keller Williams Real Estate residence.

As you can imagine, there is a great deal of paperwork involved in buying a house. Your lender will arrange for a title company to manage all of the documentation and make certain that the seller is the rightful owner of your house you are buying.

At closing, you will sign all of the paperwork needed to finish the purchase, including your loan files. It generally takes a couple of days for your loan to be funded after the documents is gone back to the lender. When the check is delivered to the seller, you are ready to move into your new home!

#Home#homes#house#houses#property#properties#realty#realestate#kellerwilliams#kw#kwrealty#michigan#mi#fortgratiot#gratiot#ftgratiot

0 notes

Text

CrocoiteChaos.com has all the #AutumnEquinox supplies!

.

.

.

#FeatherBurner https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=15_70&products_id=27353

#OnyxBowl https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=26&products_id=31734

#TurtleJournal https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=133_135&products_id=31801

#SacredEnergiesOfTheSunAndMoon https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=186&products_id=33245

#Angelite #Egg https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=157_22&products_id=28459

#Patchouli #Incense https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=15_67&products_id=3930

#Virgo #Poster https://www.crocoitechaos.com/index.php?main_page=product_info&cPath=18&products_id=1952

#NewAge #Metaphysical #Witchcraft #Wiccan #Wicca #Witchy #Crystals #Gemstones #Incense #LeatherJournal #Turtle #Virgin #Virgo #Sepember #Sixth #SixthHouse #Louisville #Detroit #AnnArbor #Lansing #Michigan #Kentucky #KYProud #KentuckyProud #PureMichigan #Jeffersonville #Brooks #Elizabethtown #FtGratiot #FortGratiot #PortHuron

2 notes

·

View notes