#generate w2 form

Explore tagged Tumblr posts

Text

The Ultimate Guide to Choosing the Right 1040 ES Form Creator

The IRS requires these payments using Form 1040-ES, which can be complex and time-consuming to prepare manually. A 1040 ES Form Creator automates much of this process by calculating your tax due, generating accurate forms, and tracking your payments.

#1040 ES Form Creator#Free Payslip Generator Online#Salary Slip Generator#Online Payslip Generator#Salaried Pay Stub#Payroll Generator#Real Paycheck Stubs#Paycheck Now#How To Make Check Stubs#Make Check Stubs#Check Stubs#Paystub Maker Online#Direct Deposit Check Stub#Pay Check Generator#Check Stub Maker Online#Checkstub Generator#Generate Paystub#Generate W2 Form#Create W2 Form Online#Make W2 Online Free#Generate 1099 Misc Online#Free 1099 Generator#Free W4 Generator#W4 Generator Calculator#Free W9 Generator#W9 Generator Calculator#W7 Maker Online#Free W7 Form Generator#Generate 1099 C Form Online#Online 1099-C Form Generator

0 notes

Text

Simplify Tax Season: How an Online W2 Generator Can Save You Time and Stress

Tax season comes with urgency, and there is no doubt about it, and even endless work. Mainly here, employers, especially small businesses and even HR teams, generate a W2 form to help their employees with various purposes. This, in turn, can help people take certain steps in their requirements anytime they want to.

This is where the smarter way comes up which can be smarter, faster, and more efficient way to handle it—using an online W2 maker.

But what is W2 form and what importance does it hold? In this particular article, we will help you to know every detail of it and also how you can develop W2 form on your own without reaching your employer.

What is W2 form all about?

A W2 form is the document which is required that an employer must send to each employee and the IRS. It mainly reports to an employee's annual wages and also the amount of taxes withheld. Mainly these forms are crucial for both employees and also for the tax authorities and they must be accurate and timely.

In this manner, individuals can take advantage of it whenever they want to in their requirements.

How can W2 form help individuals?

Helps to save time

It has been found that the traditional W2 form involves payroll data, manually entering figures, formatting documents, and printing them. This consumes a few days to hours and this is where the online generator is required. This is where taking the facility of an online W2 form generator can help to automate the service in a few minutes.

Reducing errors

It has been found that manual entry can cause a risk of errors but with online tools, this is reduced and also helps in making the overall process of generating a W2 form easier. With an auto-calculation and pre-built template it becomes easier to get ahead of the requirement.

Quite affordable

There is no need to hire internal tax professionals or also invest in heavy software but with online W2 generator offers an affordable way to generate W2 form which is ideal for small businesses and freelancers.

Instant access and download service

Once you have generated the form, then it is also quite easier to download while being at home. There are different formats PayStubGenerators.com? available that can help you to download the form in the manner you want to.

IRS-Compliant Formats Being the best online generator, it is also seen that W2 forms are IRS-ready and meet the latest compliance standards, which can protect your business from potential penalties.

#generate paycheck stubs#generate w2 from paystub#w2 creator#w2 generator 2018#checkstubs generator#w2 maker 2018#paystubnow#check stub maker with overtime#online w2 generator#w-2 maker#w2 generator online#w2 form creator

1 note

·

View note

Text

Can a W2 Form Generator Integrate with Your Existing Payroll System?

Discover the seamless integration of modern technology with your payroll system through a W2 form generator. In this blog, we delve into the advantages of using a W2 form generator, exploring how it can effortlessly sync with your existing payroll processes to streamline operations, reduce manual errors, and save valuable time. Learn about the key features that enable smooth compatibility and the step-by-step guide to ensure a hassle-free setup. Whether you are a small business owner or a large corporation, understanding how a W2 form generator can enhance your payroll system is essential for efficient and accurate financial management.

0 notes

Text

Instant W2 Form Generator: Simplify Your Tax Filing Process

Experience seamless tax preparation with an Instant W2 Form Generator. Easily create accurate W2 forms for your employees, ensuring compliance and efficiency. Save time, reduce errors, and streamline your financial operations with this user-friendly tool designed for businesses of all sizes.

0 notes

Text

Been thinking about how I'd rank each of the new pokemon introduced in each generation and I'm curious what the consensus is, so I'm running two polls.

Including Megas, Regional Variants, GMaxes, etc in the generation those new forms were introduced in, not the original Pokemon:

510 notes

·

View notes

Text

How much Darry and Soda would make modern day and if it would be enough to pay for at least the three of them: (note this may not be incredibly accurate and while yes I did do research while calculating this shit it wasn't super in depth! feel free to correct me on any and all mistakes you notice and feel free to also give your own opinions!! Much love!)

Starting with Darry's:

Before I get into number this is all assuming that Darry works exclusively the hours allotted to him while missing no work, he'd have a 5 day work week at 40 hours which is standard practice in the United States, except for his part time job which he'd be working 25/h a week (i talk about this more later just continue reading) also I'm not giving them any kind of insurance. Sorry! Lol!

Starting salary of a roofer in Oklahoma is $14/h with the average being around $15/h. Assuming this Darry will be getting around 30k a year. I'm going to be generous and say he works for a good company and has a strong union so I'll give him a end of year bonus as well ($200-$800)

His weekly pay would be around $550-$600

This would be taxed though! Using a taxing calculator (bc I'm not doing all that math babeee) He'd be payed around $500 a week.

Darry also canonically has a second job! Though it is never really talked about, not even mentioned whether it's part or full time. I'm just going to assume, generally, that it is probably a part time job that pays minimum wage. (I'm aware that there are many popular hc's as to what this job is I'm ignoring those lol) now I don't live in Oklahoma but I do have personal experience with working part time and it fucking sucks. They have you working only slightly less then a full time employee so they do not have to give you full benefits. It is an incredibly fucked up and exploitative practice.

Something to note is that Oklahoma allows part time employees to be payed half minimum wage the first 90 days of employment when under the age of 20. I do not think I will include this in the calculation because even though Darry would be 19 at the time of his parents death I think he would be 20 not long after and I do not care enough to look into this law to include it in my calculations! Just wanted to mention it because?? What the fuck Oklahoma?

Anyway, part time would have Darry working 25 hours a week for $7.25/h which would be around $180/week. After taxes he'd make $160/week getting him to $660 a week.

Finally, what everyone was waiting for.... doordash fucking driving baby. Considering he lives in a populated area I am going to be generous and say he manages to get around $20/h from doordash driving. Assuming he does this on the days he doesn't work part time (so the other 15 hours) he'd make a whopping 16k extra a year OMG!!

As for any money he'd earn from the state for guardianship of Pony and Soda: Idk! It's kind of confusing trying to figure out Oklahoma giving shit out for this because fostering and guardianship are two dif things and I'm almost certain Darry would have Guardianship over his siblings, not fostering them. So I'm just not including it: he may have received a check upon first becoming their guardian but since that is a one time thing I'm not going to include it in my final calculations (i know this is kinda contradictory for giving Darry a bonus for his roofing work but IDC IDC IDC IDC I AM NOT PUTTING THAT MUCH EFFORT INTO THIS (NOTE I FILLED OUT A MOCK W2 FORM TO GET A ROUGH ESTIMATE OF WHAT DARRY'S TAX RETURN WOULD BE BUT THAT DOESN'T MEAN I CARE))

All of the above considered: Darry is making $960 a week. Wow!

Now for Sodapop!

Soda I'm just going to copy paste what Darry's theoretical part time job would be because it's almost time for me to go to bed and I couldn't find any special rules for 16< year olds, so he'd be working 25 hours for $7.25 which after taxes is again $160

In total him an Darry combined are making a good healthy $1120 a week on average. Probably more if you consider Darry going insane with doordash/overtime! Overall a good $4480 a month

GREAT NOW TIME FOR EXPENSES!!

Expenses Include:

Mortgage payments

power bill

water bill

natural gas

car payments (maybe)

car insurance (maybe)

fuel

food

phone payments

internet bill

probably more I can't remember off the top of my head

OKAY NOW explaining the maybe's rq

You can just, not pay for car insurance. It's illegal, but when you're poor it's not like you can really care about the legality of certain things. Sometimes, it's eating vs car insurance, y'know? Especially because Darry is only 20, that shit is going to be expensive. And the car was def under his dad's name previously so he also def doesn't have any history. I'mma be generous though and say that he does have CREDIT history, which following my own car insurance premiums: my man is going to be paying like, $400 a month. and trust me, I'm being generous here. This is also for liability only. crazy right? With that considered, if I can not get Darry's salary to work with the rest of his expenses I'm saying he's driving without insurance. Hope you understand.

Now for the car itself, it might be payed off already might not. Again it's almost time for me to go to bed so I"m not willing to double check the book to see if car payments are ever mentioned. If they are I'll come back and fix this another time but for now. I'm not including it.

As for the gas for this theoretical truck? I'm going to put it from $250-$300 a month based off of what Reddit car owners said on how often they have to get gas for their own trucks. Great!

OKAY NOW FOR THE REAL EXPENSES! The average cost of utilities in Oklahoma, Tulsa specifically, is $270 a month for electricity, like $130 a month for natural gas, and for water $100 a month. Now you're probably saying, "Paya, isn't that a little high?" to which I'd say, they have 4 (presumably more) other boys coming around almost everyday. SO I feel it's fine to rate that shit on the higher side of things.

Before I forget: the mortgage payments!

This one is kinda fucked! I have no idea when the Curtis parents bought the house in canon. If it was after, or before Darry was born, etc. Because of this you can kinda just make hc's for this. The reason I say this is because obviously the housing market now is VERY different from the one in the 40s-60s which is when they'd have had to buy the house in cannon. In fact, I'm not even entirely sure they own the house in canon I'm just assuming right now! Like, if you're making a modern au: feel free to say that they're renting! Like who really cares about it? I'll even calculate it here for you so you have a frame of reference: Assuming the house is at least 2 bedrooms 1 bathroom it's gonna be around 1.5k a month. If you want to say they're paying a mortgage though, I'm going to assume based off the little data I could find of average home cost in 2004 (I'm assuming the house was bought around the time of Darry's birth) we're looking at somewhere between 150k-250k. I'm going to low ball it though because I think Oklahoma housing prices are generally cheaper and I'm going to assume they'd go for something affordable over something large. So I'll say 175k! Average interest on a home loan in 2004 was around 6%, with a 20% downpayment Darry will be paying 1k a month for the mortgage. Not that bad!

Phone bill is p cheap around 100$ feel like you may be able to play around with this. Like maybe they're paying for Johnny? Who knows not me I want to go to bed!

Food is like so fucking expensive now tbh. I pay $300 a month on grocery shopping a month for my household. Assuming Darry is purchasing food for himself, his brothers, and a little extra for the gang I'm going to put his grocery bill at around $500 a month. I think I'm lowkey low balling it, but I think he'd be a good bargain shopper. Btw, don't ask if he qualifies for food stamps! Because he doesn't!

internet bill is significantly cheaper going to be around $50 a month, as for services like live streaming and other things, we're gonna say it's all pirated. no one is paying for that shit when you can get it online for free! (Personal hc: Steve is a fucking amazing pirate and can get you literally anything you ask for.)

Final cost of living for my boys, not including school supplies, school/extra curriculars/or clothing: $2400 - $3350

Ending conclusion: If Darry works 80+ hours a week and Soda helps out with his part-time job they have more then enough to pay for almost all living expenses. Tell me where I fucked up! Thanks. Btw according to the shittily done w2 I did for Darry he'd get almost 2k in tax returns; i most def fucked something up but I'mma accept it despite that.

#the outsiders#darry curtis#sodapop curtis#ponyboy curtis#steve randle#two bit mathews#johnny depp#johnny cade#dallas winston

82 notes

·

View notes

Note

I love to hear your thoughts on W2 and W5. Also I love your Earth 3 fics. They’re so beautifully dark while still keeping the core characteristics of Dick and Tim. They have such a gothic romance vibe to it which I love. Gethsemane in Winter is definitely one of my top 3 fics from you.

Thank you for the ask!! <3

W2. Tell me about a fic you hope to post in 2025.

Optimally I'd like to start posting parts of the dicktim slowburn that I've been working on, but I'm a bit hesitant since it's pretty far from finished. But! The fic is pretty much a slowburn longfic spanning from A Lonely Place of Dying to my own take on what might happen post-RR #12 (the one where Tim gets kicked through a window). The fic mostly follows the general shape of canon, but I also reinterpret scenes from cannon and add some of my own in. The structure of the story is mildly non-linear, with a consistent present day scene used as a framing device that splits up separate arcs of flashback chapters. Since I really enjoy writing obsessive, codependent DickTim, the focus is on how a lot of trauma bonding led to these two having the very close relationship seen in canon, but I take it a bit farther since they're so extra about each other that I wanted to explore how the relationship might have tripped into more of a pre-dicktim focus in the flashbacks and a more romantic/sexual relationship in the present. Once they resolve their arguments about the RR conflict, of course.

W5. Tell me about a trope you’ve never written but want to try in 2025. I've always enjoyed the AU where someone is accidentally transformed into an animal and the other person has to take care of them. My beta reader and I brainstormed a version of that in which Dick is turned into a fluffy cat :3, so I might write that one out in fic form If not that, wingfic is fun and I haven't gotten a chance to write it yet :D Also, thank you so much!! When I first started in this fandom, there wasn't much Earth-3 dicktim content that had the vibe I was looking for, so I set out to write something I'd want to read. I'm really happy whenever other people also enjoy where it ended up! Also gothic romance vibe my beloved >:3 Gethsemane in Winter was so fun to write - I'm really glad you enjoy it!! I also really appreciate you letting me know that you enjoyed it! It means a lot to me <3 <3 <3 I never quite finished it, but I ended up writing a noir murder mystery style prequel to the series from the perspective of Detective Edward Nygma. He teams up with FBI agent Slade Wilson to track down the man only known as "Shrike," who is suspected to be behind a series of murders in which people had been left impaled on various spike-like objects. (Aka Dick's origin story in this verse. Tim also makes a couple of appearances since I'm basing some parts of this on A Lonely Place of Dying)

7 notes

·

View notes

Text

Taxes 2024: glass's quick and gritty guide to free filing those bitches

By god I hate doing my taxes but what I hate more is paying money for someone to do them for me.

Here's the thing. If taking your W2s and property taxes to someone with the training and paying them $70 makes you feel better. Do it. BUT if you're stubborn and bitchy, you CAN do it yourself and if you're reading this post I'm going to make the assumption that your AGI is less than $79000 and therefore you qualify for free file. (and if you don't know what an AGI is then yes, you qualify).

It's honestly going to be okay. We will get through it together.

This guide is not going to be thorough, and while I will try to answer questions if you ask them, I'm not an expert: my knowledge comes from filing my own taxes for the fourth (fifth?) year in a row using the free file program and going through a number of life changes that I have to reflect on my taxes.

The post includes a link and screenshots. I will describe the bare minimum information of the images in Alt Text, but will not fully transcribe the full text as all the images will be from the IRS website which has accessibility options.

Here we go:

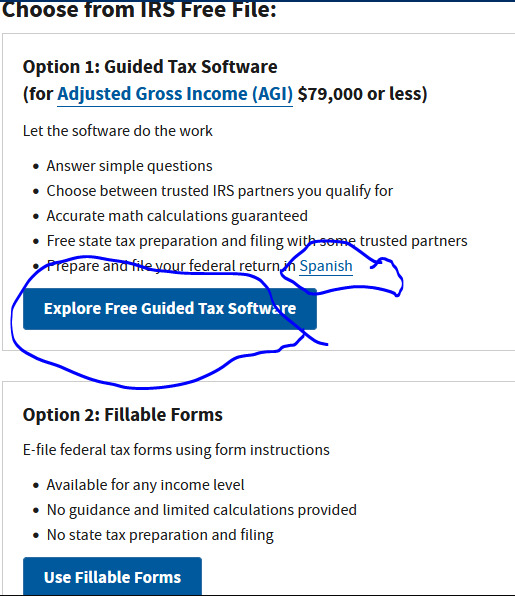

I want you to go to this page and then chose the first big blue button (unless you want it all in Spanish, then click on Spanish and I'll pray for you that it's all the same process)

If you are a brave, brave soul then take the fillable forms and be free, my children. I cannot help you there.

BUT if you chose the guided software options it's going to take you to these options

You may chose to browse options on your own. This does feel somewhat choose-your-own-adventure and I'm not your mother or your boss. HOWEVER. I implore you to take the guidance as far as you can. Chose the big blue button that says "Find Your Trusted Partner(s)" (very polycurious, if I may say).

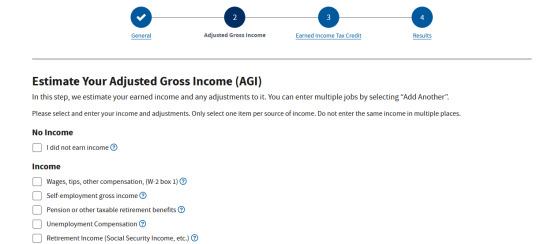

This survey is meant to be straightforward. There is a little blue questionmark that opens to explain the filing statuses very clearly and in detail. Chose the right status for you, then some other questions will show up. Answer the questions that come up (again, this general page should be info that is straightforward. most of us should be able to answer the general questions with just what's in our heads), then click next when the questions are done.

Now, you will need to know your income for this page, which probably mean you need your W2s or whatever other forms you might have that reflect/summarize your 2023 income. You don't need to get into extreme detail, you just need totals. Worked a couple of jobs and have W2s for all of them? Add "box 1" from each W2 together, select the first box under "Income" and type in your total in the fillable box that opens.

Further down this page is space for adjustments to your income, so stuff about student loans and health savings would be helpful, but again this survey isn't about the nitty gritty. Round numbers are fine.

Once you're done here, you'll click next and then it'll ask you about the Earned Income Tax Credit which is really just about if you have kids or not. Answer that question, click next and BOOM

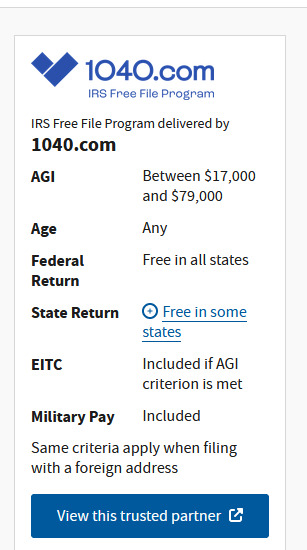

This is the only free file partner that I qualify for this year (again, life changes), but in previous years I have used HRBlock and Tax Slayer. All three sites have been guided similarly to this survey and as easy to use as can be possible given the US tax system.

Thus ends my guided portion, as going to 1040(.)com will show you a great deal of my personal info, but I will give you a few more notes:

Throughout the year, collect your tax forms/important papers in a safe, secure place that YOU WILL NOT FORGET. (preferably a safe or at least a heavy fireproof security box).

Once you get to the tax website you're going to use, you will need all those papers.

Start your filing early. I like to start when I get my W2s.

For one, you'll get everything done and then in April when someone, stressed and anxious, asks if you remember that taxes are due, you can smugly say you filed ages ago. For another, if you do run into significant issues, you have lots of time to resolve them.

Don't necessarily file super early. Sometimes congress does stuff that affects taxes as late as March. It's easier and less stressful to edit your pending forms than it is to file a correction.

When you have all the information in, look up the local and national news and see if there's anything going on regarding taxes. This year there's talk about extending the child tax credit. I haven't kept up with that because it doesn't apply to me, but it might be important to you. If there's nothing happening that might affect you, go ahead and file.

If you have a question, ask! Even the free file services have a help section

I lied, one last snip. This is from 1040. They have an FAQ section, and it's not just about the site itself. I have submitted questions to all three services I've used and all of them have answered me.

They won't hold your hand through every step, but if you have a specific question, they'll do their best to answer it.

You can also do a general internet search! "what this form?" and "do i need to include XYZ on my taxes" are all things i've found the answers for by searching them on duckduckgo

HRBlock has a huge amount of accessible information that I've used often.

I'll wrap here by just saying - if you get frustrated, save your work and walk away.

I called my employer's HR to ask something, waited a couple days then started an email to them, and realized the answer as I was writing the email.

The earlier you start, the more time you have to figure things out. You can do it. Good luck.

#US taxes#taxes#tax help#sorry it's all one block of text. I don't have the energy to make it less Like This

7 notes

·

View notes

Text

Online 1099 NEC Generator: Fast and Accurate Filing

Using an Online 1099 NEC Form Generator is the quickest and maximum correct manner to file your 1099 NEC bureaucracy. The technique is easy, reduces errors, and ensures well timed submission to the IRS. Whether you're submitting for one contractor or more than one, the 1099 NEC Generator allow you to stay organized.

#Online 1099 NEC Form Generator#Salary Slip Generator#Salaried Pay Stub#Real Paycheck Stubs#Payroll Generator#Paycheck Now#Free Payslip Generator Online#Online Payslip Generator#How To Make Check Stubs#Check Stub Maker#Check Stubs#Make Check Stubs#Direct Deposit Check Stub#Online Check Stub Maker#Pay Check Maker#Generate W2 Form#Make W2 Online Free#Generate 1099 Misc Online#Free W4 Form Generator#Online W9 Generator#Free W7 Form Generator#Online 1099-C Form Generator#Free Online 8809 Generator#Generate SS 4 Form#Generate 8995 Form#Create 941B Form Online#1099 OID Instructions#Generate 1099-Div Form Online#Generate 1099 INT Form#Online 1099 G Form

0 notes

Text

I think if there is something that I've learned this year having to deal with a lot of healthcare nonsense it's that many patients (myself included) need to learn our rights, and that there ARE options that we can take when we can't afford payment for drugs or care and when we get rejected by insurance for coverage for something. I wish to god we had a better healthcare system in this country; I do, but for now we have to live with the bullshit we have, and I think people would be served better by getting educated about their options and rights in the now to reduce harm in the now, while we fight for a better system. For now, here are some things that are of interest:

If you do not have health insurance at this time, you can get it through healthcare.gov. It doesn't matter where in the country you live, what your previous claims payment history is or what your current medical conditions are. You can pay for and get ANY plan that is offered on this site. This is defined through ACA Subtitle D, Part I.

When you look at the plans not signed in, they look SUPER expensive. They are not. Create an account and submit your tax information. Once your previous year's tax information is submitted, the site will tell you what your tax-credit reduction is for your monthly premiums. This is the amount of $ that the government will subsidize your premiums for. The less money you make, the more this amount will be. If your income was greater last year than it is this year, when you file your taxes you will get money back that you should have received in reductions on your premiums. If your income is greater, you owe. They give you the choice of how much of the credit to take in the now. If you choose not to use all of it, you get the unused amount back on your taxes.

If you have marketplace plan questions, call the healthcare dot gov help line (1-800-318-2596) and someone will help you. They will answer any questions you have, no matter how dumb they are. You can ask them simple stuff like "What is a premium?" and they helpfully explain it.

No insurance company can raise your premiums based on your claims payment history, your health conditions, your health history or any other form of "evidence of insurability". They cannot deny you a plan for any of these reasons or deny you renewal of a plan for them. You have rights, if your insurance is trying to do this, you can report them to the government. It is illegal for them to discriminate against YOU for any of these reasons. This is all defined either under ACA Subpart I: General Reform, sect 2702, sec 2703, and section 2705.

If you are over 65, you are eligible for medicare, and you should get it. If you have a serious disability, you can get medicare earlier. This will significantly reduce your healthcare costs. You have already paid into it if you have been paying taxes on a W2.

If you are poor, you may qualify for medicaid. If you are unemployed you probably qualify for medicaid. Eligibility requirements vary by state, but if you are below the federal poverty line and under 65, you are almost certainly eligible. Medicaid is low cost and covers most services. If you have children and are poor, you can get CHIP.

Certain services are considered "Essential Health Benefits" under the ACA and ALL plans are required to cover them. These EHBs include items and services in the following ten benefit categories: (1) ambulatory patient services; (2) emergency services; (3) hospitalization; (4) maternity and newborn care; (5) mental health and substance use disorder services including behavioral health treatment; (6) prescription drugs; (7) rehabilitative and habilitative services and devices; (8) laboratory services; (9) preventive and wellness services and chronic disease management; and (10) pediatric services, including oral and vision care. If you plan refuses to provide ANY coverage for items and services under these categories, that is illegal and you can report them.

If you visit a non-for-profit hospital for emergency services, and are uninsured or poor, they must provide you with financial assistance, whether that is FREE care or significantly reduced care. This applies even for insured patients who are visiting an emergency room that is not in their network. Talk to their billing department and ask about financial assistance and charity care.

Under the No-Surprises Act, a subsection of the CAA 2021, a provider of emergency services cannot balance bill you (bill you money after you have paid your deductible, copay, coinsurance and your insurance pays out their obligation to make up for costs on the visit from their providers being not in your network). This is something new I didn't know about until my current situation lol.

Certain forms of medical debt CANNOT be reported on your credit report. Additionally, if you apply for an FHA mortgage to purchase a home, the FHA does not consider medical debt when assessing mortgage eligibility. For more information about new rules regarding medical debt as related to creditworthiness here is the general bulletin.

If you are denied coverage for a medically necessary drug or service, you have the right to appeal this. Call your insurance company and ask for an explanation for the denial of coverage. Sometimes, your doctor can provide a letter of medical necessity for the service to get you coverage. The same drugs and services can be billed under different classifications, which may affect coverage. Read through your plans benefits booklet to find if the service you are being denied is covered under a different billing classification (usually called a CPT #). If this is the case, you can work with your provider to reclassify the billing of the drug or service to get coverage. Arm yourself with all the right vocabulary and information by reading through your plan's benefits booklet and by requesting an extended EOB (explanation of benefits) for the claim in question. Note that you cannot get extended EOBs for medication claims, but you can for services. You may also want to enlist your provider in your fight against charges as there is certain information that they can more easily access than you can and that they can do on your behalf.

Many drugs have manufacturer coupons that you can use to reduce your copay. These coupons can be applied WITH your insurance. If a pharmacy employee tells you otherwise, they don't know what the fuck they're talking about. Ask to speak with the head pharmacist about this. You can find many kinds of drug coupons through sites like goodrx or the manufacturer of your drug's website. Sometimes your doctor may also have coupons; ask them. If you have an especially competent pharmacist, they can also help you find coupons or discounts.

Anyhow, I hope someone finds this helpful. Learn your rights and your terminology so that you can get the care you need and deserve!

#healthcare#know your rights#insurance#health insurance#reference#resources#medical care#issues#ref#long post for ts

5 notes

·

View notes

Text

Wait I wanna ramble on the post about how sick 5th gen was, even discounting B+W2 since I didn't play them (whoops)

Day 1 we got introduced to a funky little bud named Victini

They're delightful! They were also part of the first event for 5th gen, so there was a phase where everyone and their grandma had one, and collecting them off the GTS was a blast :D

It's also a pokemon generation that really framed itself as a breath of fresh air for pokemon fans- because it added 156 new pokemon AND YOU WOULD ONLY RUN INTO THOSE POKEMON UNTIL YOU BEAT THE GAME.

Out of the 649 pokemon available in this generation, you would only get to catch the new ones until you finished, which made it feel like a truly "new" pokemon game and not just the next game where you find the same old pokes seconds into your adventure.

I'm sure for some that might be a downside, but as a person who played gen 5 at launch and skipped gen 4 because I was burnt out on the series, this decision revitalized like 300% of my interest because I could get my old faves Later, in the mean time EVERYTHING IS NEW!!!! WOOO!!!!

SEASONS! What a fun and gorgeous addition that was!!! I spent so long making sure I'd get all the different types of Deerling and Sawsbuck and storing them in my box since that's how you preserved it, but even not preserving it that is such a fun detail!!

There was that charming Dream World deal, which introduced us to new hidden abilities which made a ton of pokemon wildly more viable in combat while also opening up a whole new avenue of collecting (my favorite part of pokemon) in the form of collecting the event dream world abilities and collecting dream world females (DWFs) since DWFs could breed and had a chance to pass on the dream world ability- hidden abilities are so sick!!

Oh and the enemy this time around! Plasma think they are doing good but are really being controlled by a mega shitlord! AND THERE'S N!!!! N!!!! I LOVE N!!! HE'S SUCH A GOOD GUY! :D

Man, just looking through the pokedex again reveals so many pokemon I adore from 5th gen.

Zorua and Zoroark

Gigalith

Reuniclus!

YES REALLY, STUNFISK!!! :D

And I adore so many of the event pokes this time around, but like, Meloetta and Keldeo!! Love em!

and while this is hardly a "5th gen is SOOOOO good" point, I'd be remiss to bring up 5th gen and not shout out one of my favorite pokemon, who became a favorite kind of by accident.

Conkeldurr has like nothing at all special about him, but he became an integral part of my OG 5th gen team and while the initial purpose of doing so was to create an inside joke, I began "ironically" calling him one of my favorite pokemon and it VERY. QUICKLY. stopped being ironic and he's one of my favorite pokemon. (not "THE" fave though).

Look at em :) Silly construction guy, he's buff as heck and wiggles his concrete poles, love the guy :)

But man, 5th gen was just genuinely a fun game, I love how it split up pokemon you encountered, I loved playing it through, I loved collecting all 649 and then collecting WAY TOO MANY event pokemon from previous generations, I adored running my first and only trade shop on serebii during this time!!!

5th gen is such a fun time, one of my all time favorite pokemon experiences.

16K notes

·

View notes

Text

Unlock Effortless Tax Filing: The Power of the Instant W2 Form Generator

In the fast-paced world of tax filing, where complexity often breeds frustration, an innovative solution has emerged – the Instant W2 Form Generator. Say goodbye to the headaches associated with traditional tax preparation, and embrace a streamlined, user-friendly experience that puts you in control.

The Need for Simplified Tax Filing

Tax season can be a daunting period for many individuals and businesses. The intricate nature of tax regulations, coupled with the time-consuming process of gathering and organizing financial information, often leads to stress and confusion. Recognizing the need for a more straightforward approach, the Instant W2 Form Generator aims to revolutionize the way we file our taxes.

Understanding the Instant W2 Form Generator

Features and Benefits

The Instant W2 Form Generator boasts a range of features designed to make tax filing a breeze. From automatic data entry to real-time error checking, users can experience unparalleled efficiency. The system ensures accurate calculations and provides instant access to W2 forms, empowering users to take control of their financial obligations.

How it Streamlines the Tax Filing Process

Navigating through the Instant W2 Form Generator is a user-friendly experience. With a simple interface and step-by-step guidance, even those unfamiliar with tax jargon can effortlessly complete their filing. This tool is not just about convenience; it's about empowering individuals and businesses to manage their taxes with confidence.

How to Access and Use the Instant W2 Form Generator

Getting started is as easy as a few clicks. The Instant W2 Form Generator's user-friendly interface ensures a seamless experience, guiding users through the process of entering their information accurately. This step-by-step approach eliminates the guesswork, making tax filing accessible to everyone.

Security Measures in Place

Concerned about the safety of your sensitive information? Rest assured. The Instant W2 Form Generator employs state-of-the-art encryption and data protection measures to safeguard your data. Your confidentiality is our top priority.

Cost-Effectiveness of Using the Instant W2 Form Generator

Comparing Costs to Traditional Tax Preparation Services

Traditional tax preparation services often come with hefty price tags. The Instant W2 Form Generator offers a cost-effective alternative without compromising on quality. Users can enjoy the same level of accuracy and professionalism without breaking the bank.

Highlighting Potential Savings for Users

Beyond the immediate cost savings, using the Instant W2 Form Generator can lead to long-term financial benefits. By optimizing the tax filing process, users can redirect their time and resources towards more productive endeavors.

Real-life Success Stories

Testimonials from Users

Don't just take our word for it. Hear from individuals and businesses that have experienced the power of the Instant W2 Form Generator. Their success stories speak volumes about the transformative impact this tool can have on your tax filing experience.

Demonstrating the Impact

From time savings to reduced stress, these real-life accounts highlight the tangible benefits of embracing modern technology for tax preparation.

Overcoming Common Misconceptions

Addressing Concerns about Online Tax Filing

Skepticism about online tax filing is common. In this section, we address common concerns and dispel myths surrounding the safety and accuracy of the Instant W2 Form Generator. It's time to embrace the future with confidence.

Providing Clarifications on Accuracy

The Instant W2 Form Generator is not just about speed; it's about accuracy. We delve into the technology behind the system, ensuring readers understand the meticulous checks and balances in place to guarantee precise results.

Industry Recognition and Awards

Acknowledging Accolades

The Instant W2 Form Generator has garnered recognition within the industry. Awards and accolades validate its effectiveness and showcase the trust placed in this innovative solution.

Establishing Credibility and Trust

When it comes to tax filing, credibility is crucial. The Instant W2 Form Generator's track record of excellence establishes it as a trusted companion in navigating the complexities of tax regulations.

Staying Updated with Tax Regulations

Adapting to Changing Tax Laws

Tax laws evolve, and so does the Instant W2 Form Generator. This section discusses the system's adaptability, ensuring users remain compliant with the latest regulations without the need for constant manual updates.

Ensuring Users are Always Compliant

By staying ahead of regulatory changes, the Instant W2 Form Generator ensures users are always on the right side of compliance. Say goodbye to last-minute scrambles to understand new laws – this tool has you covered.

The Future of Effortless Tax Filing

Predicting Advancements

As technology continues to advance, so does the future of tax preparation. In this section, we explore the potential advancements in tax preparation technology and how the Instant W2 Form Generator is positioned at the forefront of this evolution.

How the Instant W2 Form Generator Continues to Evolve

It's not just about meeting current needs; it's about anticipating future challenges. Discover how the Instant W2 Form Generator evolves to stay ahead of the curve, ensuring users always have access to the latest tools and features.

Exclusive Offer for Early Users

Limited-time Discounts or Special Features

As a gesture of appreciation, early users can enjoy exclusive offers, whether it be discounts on subscription plans or access to premium features. Seize the opportunity and unlock even greater value from the Instant W2 Form Generator.

Encouraging Users to Take Advantage of the Offer

Don't miss out – act now to enjoy the benefits of effortless tax filing at a fraction of the cost. This exclusive offer is a token of gratitude to those who embrace innovation early on.

User Support and Assistance

Highlighting Customer Service Availability

Questions or concerns? Our dedicated customer service team is here to assist. This section emphasizes the availability of reliable customer support, ensuring users never feel alone in their tax filing journey.

Addressing Queries Promptly

Fast, efficient, and friendly – that's our commitment to addressing user queries. Discover the peace of mind that comes with knowing help is just a click or call away.

Conclusion

In conclusion, the era of cumbersome tax filing is over. The Instant W2 Form Generator is not just a tool; it's a solution that empowers individuals and businesses to take control of their financial responsibilities with confidence. Say goodbye to stress and hello to the future of effortless tax filing.

0 notes

Text

Been thinking about how I'd rank each of the new pokemon introduced in each generation and I'm curious what the consensus is, so I'm running two polls.

Including Megas, Regional Variants, GMaxes, etc in the generation those new forms were introduced in, not the original Pokemon:

274 notes

·

View notes

Text

Glass Marble – The Timeless Classic of Marble Racing

Glass marble designs remain a cornerstone of marble racing, celebrated for their elegance and versatility. These iconic spheres, crafted from molten glass, have captivated players and collectors for generations. With their shimmering beauty and reliable performance, glass marbles continue to shine as a beloved choice in the dynamic world of marble sports.

What Is a Glass Marble?

A glass marble is a small, spherical object made from melted glass, cooled and shaped into a smooth, polished form. Known for their clarity and vibrant swirls of color, these marbles are both functional and decorative. Their consistent weight and sleek surface make them a go-to option for racing, offering a balance of speed and control on diverse tracks.

The Legacy of Glass Marbles in Play

Glass marbles trace their origins back centuries, evolving from handmade toys to staples in modern marble racing. Their enduring popularity stems from their craftsmanship and adaptability. For a closer look at their role in today’s sport, marblesport explores how glass marbles have stayed relevant, bridging nostalgia with contemporary competition.

Why Glass Marbles Remain Popular

The charm of glass marbles lies in their timeless appeal and performance. Their moderate weight suits a variety of racing conditions, from twisty obstacle courses to straight speedways. Beyond their utility, their stunning designs—featuring bubbles, streaks, or solid hues—make them collector’s items as much as racing tools. They offer a perfect mix of practicality and visual allure.

How to Race with Glass Marbles

Using glass marbles effectively involves understanding their strengths. They glide smoothly on most tracks, excelling where precision is key. Players can choose from different sizes or styles, like cat’s-eye or clear varieties, to match their strategy. Online tips and communities often highlight ways to polish or select glass marbles for optimal racing results, enhancing the fun.

The Future of Glass Marbles

As marble racing grows, glass marbles are holding strong, thanks to their classic appeal and ongoing innovation. Artisans continue to experiment with new colors and patterns, while their durability keeps them competitive. They’re more than just marbles—they’re a link to the past and a fixture in the sport’s future, inspiring both new racers and longtime fans.

In summary, glass marbles embody the essence of marble racing with their beauty, reliability, and rich history. They invite players to enjoy a sport that’s as much about skill as it is about appreciation. Whether you’re racing them or admiring their glow, glass marbles deliver an experience that’s both thrilling and enduring.

Tags: #glassmarble #marble_racing #classic_marbles #marblesport #timeless_racing Search Location: HQQ8+W2 Nhà Bè, Hồ Chí Minh, Việt Nam

0 notes