#online w2 generator

Explore tagged Tumblr posts

Text

What to Look for in a Good 1099 Form Creator Tool

The first thing that you need to look for in a 1099 form creator is an easy-to-use interface. The tool should be simple and clear so that people of all age groups can easily fill it. Additionally, if they have an auto-fill option it is an added bonus. Some tools even provide step-by-step guidance to fill out the forms in the initial days.

#1099 Form Creator#Generate 1099 Misc Online#1099 Misc Generator#Online W2 Generator#Check Stub Maker Online#Direct Deposit Check Stub#Make Check Stubs#How To Make Check Stubs#Check Stub Maker#Online Payslip Generator#Salary Slip Generator#Free Payslip Generator Online#Salaried Pay Stub#Real Paycheck Stubs#Payroll Generator#Check Stubs#W2 Generator Calculator#Create W4 Form Online#Make W9 Online Free#8809 Form Creator#Generate 1099 C Form#SS 4 Form Maker#8995 Form Generator#Make 8995 Online Free#Online 1099-Div Form Generator#Generate 1099 OID Form Online#1099 INT Generator#Free 1099 G Form Generator#1040 Generator Free#Generate 1099 NEC Form Online

0 notes

Text

Simplify Tax Season: How an Online W2 Generator Can Save You Time and Stress

Tax season comes with urgency, and there is no doubt about it, and even endless work. Mainly here, employers, especially small businesses and even HR teams, generate a W2 form to help their employees with various purposes. This, in turn, can help people take certain steps in their requirements anytime they want to.

This is where the smarter way comes up which can be smarter, faster, and more efficient way to handle it—using an online W2 maker.

But what is W2 form and what importance does it hold? In this particular article, we will help you to know every detail of it and also how you can develop W2 form on your own without reaching your employer.

What is W2 form all about?

A W2 form is the document which is required that an employer must send to each employee and the IRS. It mainly reports to an employee's annual wages and also the amount of taxes withheld. Mainly these forms are crucial for both employees and also for the tax authorities and they must be accurate and timely.

In this manner, individuals can take advantage of it whenever they want to in their requirements.

How can W2 form help individuals?

Helps to save time

It has been found that the traditional W2 form involves payroll data, manually entering figures, formatting documents, and printing them. This consumes a few days to hours and this is where the online generator is required. This is where taking the facility of an online W2 form generator can help to automate the service in a few minutes.

Reducing errors

It has been found that manual entry can cause a risk of errors but with online tools, this is reduced and also helps in making the overall process of generating a W2 form easier. With an auto-calculation and pre-built template it becomes easier to get ahead of the requirement.

Quite affordable

There is no need to hire internal tax professionals or also invest in heavy software but with online W2 generator offers an affordable way to generate W2 form which is ideal for small businesses and freelancers.

Instant access and download service

Once you have generated the form, then it is also quite easier to download while being at home. There are different formats PayStubGenerators.com? available that can help you to download the form in the manner you want to.

IRS-Compliant Formats Being the best online generator, it is also seen that W2 forms are IRS-ready and meet the latest compliance standards, which can protect your business from potential penalties.

#generate paycheck stubs#generate w2 from paystub#w2 creator#w2 generator 2018#checkstubs generator#w2 maker 2018#paystubnow#check stub maker with overtime#online w2 generator#w-2 maker#w2 generator online#w2 form creator

1 note

·

View note

Text

Can a W2 Form Generator Integrate with Your Existing Payroll System?

Discover the seamless integration of modern technology with your payroll system through a W2 form generator. In this blog, we delve into the advantages of using a W2 form generator, exploring how it can effortlessly sync with your existing payroll processes to streamline operations, reduce manual errors, and save valuable time. Learn about the key features that enable smooth compatibility and the step-by-step guide to ensure a hassle-free setup. Whether you are a small business owner or a large corporation, understanding how a W2 form generator can enhance your payroll system is essential for efficient and accurate financial management.

0 notes

Text

Instant W2 Form Generator: Simplify Your Tax Filing Process

Experience seamless tax preparation with an Instant W2 Form Generator. Easily create accurate W2 forms for your employees, ensuring compliance and efficiency. Save time, reduce errors, and streamline your financial operations with this user-friendly tool designed for businesses of all sizes.

0 notes

Text

#Electronic paystubs delivering#Fedex w2 online#Colorado#USA#paycheck#paystub generator#eclectroni paystabs delevering#how to get my w2 from old job#fedex w2 online#pay stub to w2 converter free

0 notes

Text

Taxes 2024: glass's quick and gritty guide to free filing those bitches

By god I hate doing my taxes but what I hate more is paying money for someone to do them for me.

Here's the thing. If taking your W2s and property taxes to someone with the training and paying them $70 makes you feel better. Do it. BUT if you're stubborn and bitchy, you CAN do it yourself and if you're reading this post I'm going to make the assumption that your AGI is less than $79000 and therefore you qualify for free file. (and if you don't know what an AGI is then yes, you qualify).

It's honestly going to be okay. We will get through it together.

This guide is not going to be thorough, and while I will try to answer questions if you ask them, I'm not an expert: my knowledge comes from filing my own taxes for the fourth (fifth?) year in a row using the free file program and going through a number of life changes that I have to reflect on my taxes.

The post includes a link and screenshots. I will describe the bare minimum information of the images in Alt Text, but will not fully transcribe the full text as all the images will be from the IRS website which has accessibility options.

Here we go:

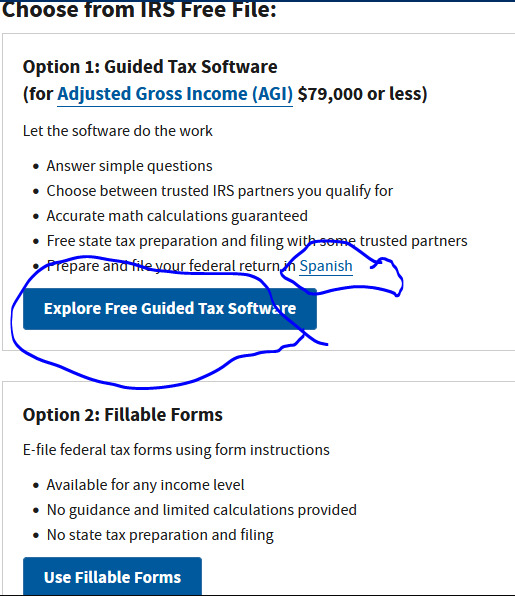

I want you to go to this page and then chose the first big blue button (unless you want it all in Spanish, then click on Spanish and I'll pray for you that it's all the same process)

If you are a brave, brave soul then take the fillable forms and be free, my children. I cannot help you there.

BUT if you chose the guided software options it's going to take you to these options

You may chose to browse options on your own. This does feel somewhat choose-your-own-adventure and I'm not your mother or your boss. HOWEVER. I implore you to take the guidance as far as you can. Chose the big blue button that says "Find Your Trusted Partner(s)" (very polycurious, if I may say).

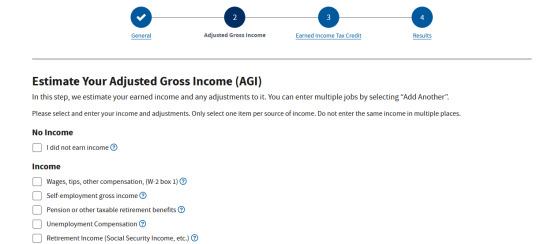

This survey is meant to be straightforward. There is a little blue questionmark that opens to explain the filing statuses very clearly and in detail. Chose the right status for you, then some other questions will show up. Answer the questions that come up (again, this general page should be info that is straightforward. most of us should be able to answer the general questions with just what's in our heads), then click next when the questions are done.

Now, you will need to know your income for this page, which probably mean you need your W2s or whatever other forms you might have that reflect/summarize your 2023 income. You don't need to get into extreme detail, you just need totals. Worked a couple of jobs and have W2s for all of them? Add "box 1" from each W2 together, select the first box under "Income" and type in your total in the fillable box that opens.

Further down this page is space for adjustments to your income, so stuff about student loans and health savings would be helpful, but again this survey isn't about the nitty gritty. Round numbers are fine.

Once you're done here, you'll click next and then it'll ask you about the Earned Income Tax Credit which is really just about if you have kids or not. Answer that question, click next and BOOM

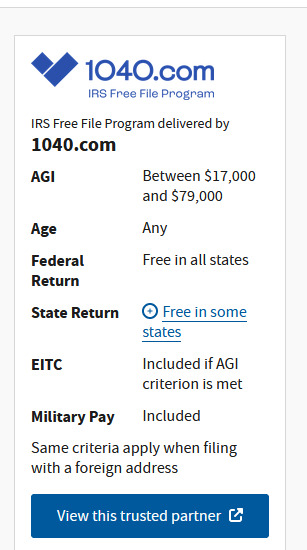

This is the only free file partner that I qualify for this year (again, life changes), but in previous years I have used HRBlock and Tax Slayer. All three sites have been guided similarly to this survey and as easy to use as can be possible given the US tax system.

Thus ends my guided portion, as going to 1040(.)com will show you a great deal of my personal info, but I will give you a few more notes:

Throughout the year, collect your tax forms/important papers in a safe, secure place that YOU WILL NOT FORGET. (preferably a safe or at least a heavy fireproof security box).

Once you get to the tax website you're going to use, you will need all those papers.

Start your filing early. I like to start when I get my W2s.

For one, you'll get everything done and then in April when someone, stressed and anxious, asks if you remember that taxes are due, you can smugly say you filed ages ago. For another, if you do run into significant issues, you have lots of time to resolve them.

Don't necessarily file super early. Sometimes congress does stuff that affects taxes as late as March. It's easier and less stressful to edit your pending forms than it is to file a correction.

When you have all the information in, look up the local and national news and see if there's anything going on regarding taxes. This year there's talk about extending the child tax credit. I haven't kept up with that because it doesn't apply to me, but it might be important to you. If there's nothing happening that might affect you, go ahead and file.

If you have a question, ask! Even the free file services have a help section

I lied, one last snip. This is from 1040. They have an FAQ section, and it's not just about the site itself. I have submitted questions to all three services I've used and all of them have answered me.

They won't hold your hand through every step, but if you have a specific question, they'll do their best to answer it.

You can also do a general internet search! "what this form?" and "do i need to include XYZ on my taxes" are all things i've found the answers for by searching them on duckduckgo

HRBlock has a huge amount of accessible information that I've used often.

I'll wrap here by just saying - if you get frustrated, save your work and walk away.

I called my employer's HR to ask something, waited a couple days then started an email to them, and realized the answer as I was writing the email.

The earlier you start, the more time you have to figure things out. You can do it. Good luck.

#US taxes#taxes#tax help#sorry it's all one block of text. I don't have the energy to make it less Like This

7 notes

·

View notes

Text

Glass Marble – The Timeless Classic of Marble Racing

Glass marble designs remain a cornerstone of marble racing, celebrated for their elegance and versatility. These iconic spheres, crafted from molten glass, have captivated players and collectors for generations. With their shimmering beauty and reliable performance, glass marbles continue to shine as a beloved choice in the dynamic world of marble sports.

What Is a Glass Marble?

A glass marble is a small, spherical object made from melted glass, cooled and shaped into a smooth, polished form. Known for their clarity and vibrant swirls of color, these marbles are both functional and decorative. Their consistent weight and sleek surface make them a go-to option for racing, offering a balance of speed and control on diverse tracks.

The Legacy of Glass Marbles in Play

Glass marbles trace their origins back centuries, evolving from handmade toys to staples in modern marble racing. Their enduring popularity stems from their craftsmanship and adaptability. For a closer look at their role in today’s sport, marblesport explores how glass marbles have stayed relevant, bridging nostalgia with contemporary competition.

Why Glass Marbles Remain Popular

The charm of glass marbles lies in their timeless appeal and performance. Their moderate weight suits a variety of racing conditions, from twisty obstacle courses to straight speedways. Beyond their utility, their stunning designs—featuring bubbles, streaks, or solid hues—make them collector’s items as much as racing tools. They offer a perfect mix of practicality and visual allure.

How to Race with Glass Marbles

Using glass marbles effectively involves understanding their strengths. They glide smoothly on most tracks, excelling where precision is key. Players can choose from different sizes or styles, like cat’s-eye or clear varieties, to match their strategy. Online tips and communities often highlight ways to polish or select glass marbles for optimal racing results, enhancing the fun.

The Future of Glass Marbles

As marble racing grows, glass marbles are holding strong, thanks to their classic appeal and ongoing innovation. Artisans continue to experiment with new colors and patterns, while their durability keeps them competitive. They’re more than just marbles—they’re a link to the past and a fixture in the sport’s future, inspiring both new racers and longtime fans.

In summary, glass marbles embody the essence of marble racing with their beauty, reliability, and rich history. They invite players to enjoy a sport that’s as much about skill as it is about appreciation. Whether you’re racing them or admiring their glow, glass marbles deliver an experience that’s both thrilling and enduring.

Tags: #glassmarble #marble_racing #classic_marbles #marblesport #timeless_racing Search Location: HQQ8+W2 Nhà Bè, Hồ Chí Minh, Việt Nam

0 notes

Text

W2 Reflection: Choosing a Business

I really enjoyed this week’s modules. The first thing we really learned about were business models and idea generation. I enjoyed reading the article about all the different business models. There are so many different models to choose from. It really came as a surprise to me, and I learned so much about how the different models functioned! It really got me thinking about what I wanted to do for my own business. That lesson was, in my opinion, a great start to the course because it sparked a lot of ideas for me. For example, I wasn’t too sure what sort of product/service to choose from, but now that I have a better idea on how things work, I believe I figured out what will work the best for me. I also like learning about demand and competition as well. There are so many variables that go into the demand and competition of products. It was interesting to test those variables out in Google Ads. It was a great way of seeing direct correlations between specific keywords. It will be a useful tool/resource when creating my online business.

0 notes

Text

Nurturing employee satisfaction in your online business is a multi-faceted endeavor. It requires consistent recognition of good performances, regular communication, and thoughtful gestures like using a W2 generator for streamlined tax compliance. Rewarding your team at the end of the year can be the icing on the cake, ensuring that your employees remain content and motivated in the virtual workspace.

0 notes

Text

Modernizing Payroll: The Benefits of Using a Pay Stub Generator with Logo

In today's fast-paced business environment, modernizing processes is essential for staying competitive and efficient. One area that has seen a significant transformation is payroll management, thanks to innovations like the integration of a Pay Stub Generator With Logo. This advancement is revolutionizing how companies manage their payroll systems while offering a range of benefits that extend beyond the mere paycheck.

Branding Beyond Borders

The inclusion of a company logo on pay stubs might seem like a small detail, but it has a substantial impact on brand identity. Each time an employee receives a paycheck stub with the company logo prominently displayed, it reinforces the brand's presence and creates a sense of unity. It's a powerful visual reminder that every payday is connected to the larger purpose and values of the company. This simple addition goes a long way in building a strong corporate identity that resonates with both employees and external stakeholders.

Professionalism in Every Pay Stub

Gone are the days of handwritten paychecks and basic text-based pay stubs. With the availability of advanced check stub makers and pay stub generators, companies can create professional-looking pay stubs online. These platforms allow businesses to add logos, customize fonts, and select color schemes that mirror the company's branding. This attention to detail contributes to an overall sense of professionalism and reliability, helping to foster trust between employers and employees.

Employee Engagement and Satisfaction

Creating pay stubs online using a generator with a logo is not just about delivering accurate financial information; it's also a way to engage and empower employees. A well-designed pay stub, complete with the company logo, shows that the organization values transparency and takes its communication seriously. This proactive approach can enhance employee satisfaction and increase loyalty. Moreover, when employees see their efforts reflected in a professional, branded pay stub, it can boost morale and foster a sense of belonging.

Efficiency and Accuracy

The process of manually creating pay stubs is not only time-consuming but also prone to errors. On the other hand, utilizing a check stub maker or pay stub generator streamlines the process, ensuring accuracy and consistency. Employees can access their pay stubs online, eliminating the need for physical distribution. This reduces the chances of lost or misplaced pay stubs and minimizes potential disputes regarding payment details. The automation provided by a pay stub generator enhances efficiency, freeing up valuable time for HR personnel to focus on more strategic tasks.

Compliance and Record-Keeping

Accurate record-keeping is critical for any business, especially when it comes to payroll. Pay stub generators often come equipped with features that ensure compliance with legal requirements. This includes the inclusion of essential information such as tax deductions, contributions to retirement funds, and other deductions. With the help of a pay stub generator, companies can effortlessly maintain detailed and accurate records that are essential for audits, employee queries, and tax reporting.

Check these :-

Fake W2 Generator

Free Pay Stub Template

Paystub for Self Employed

Accessibility and Convenience

In a digitally connected world, accessibility is key. With the ability to Create Pay Stub Online, both employers and employees can access necessary financial information at any time and from any location. This convenience is particularly advantageous for remote workers or employees who travel frequently. The inclusion of a logo on these online pay stubs ensures that the company's brand is carried with them wherever they go, strengthening the sense of belonging and alignment with the organization.

In conclusion, modernizing payroll by incorporating a pay stub generator with a logo offers a multitude of benefits that go beyond the financial transaction. From reinforcing branding and professionalism to enhancing employee engagement and satisfaction, the impact is far-reaching. With advanced tools like check stub makers and online pay stub generators, businesses can streamline processes, improve accuracy, and provide their employees with a polished, branded representation of their hard-earned income. As technology continues to evolve, leveraging these tools becomes an essential step toward a more efficient and engaging payroll management system.

0 notes

Text

Wel this is sad

I think someone almost scammed me out of my money, by trying to get me to buy my own product, through an email that said I made a sale. I'm starting think I'm going to need to watermark all my products regardless if I put writing over them that would be super hard to photohop out and still make the products look good.

Scammers are super annoying. Why prey off innocent people trying to make an honest living? If you have such iniative to prey on innocents, you should be creative and smart enough to come up with your own business ideas and become rich quick.

I've spent the last 3 years dealing with scammers at 1 of my w2 jobs, and got scammed once. And since then these scammers never change their script. And now that I'm trying a new way to make some money for the family, they are preying on the fact I'm new?

I'm too distrustful of emails to begin with, and inputting card information randomly into something I don't think I need to, to get my revenue deserved, especially when it doesn't show up on my sales dashboard almost 48 hours later.

So I went to the community forums to ask to be safe and also inform others of this scam, if it truely is a scam.

It might be sad, I'm extremely distrustful of humans in general as it can be hard to read people, especially with the internet and the phone. But I'm doing my best as a distrustful person, to trust people to have the good in them not to do this stuff.

I know I'm distrustful trusting person. I'm a conudrum, but it's instinct and the benefit of the doubt that has helped me keep going in this world. And as a new business person, I really, really, really want to trust people, I just gotta be safe with 100% pure online sales with no face to face contact.

I wish scamming wasn't a thing, and I wish it wasn't nearly as profitable as these know to be true when they get a naive person to give them what they want.

I may have been naive once, but I swear the dude that got me at work 3y ago pretending to be from corporate was a silver tongue, as he had me under some sort of spell until he started to get pushy about me depositing company money into an ATM.

Anyways, super sad I may not have sold one of my pieces after all.

Link to the product I thought I sold, but probably almost bought from myself, with money sent to the scammer.

0 notes

Text

W9 Maker Online - How Online Makers Simplify Tax Forms

PaystubUSA is a platform that offers various reliable tools like W9 Maker Online. This is what helps with the tax processing and makes sure them complete it in simple steps. With this reliable platform’s support, you can secure your details and it will be affordable for you.

#W9 Maker Online#Paycheck Now#Real Paycheck Stubs#Payroll Generator#Salaried Pay Stub#Online Payslip Generator#Free Payslip Generator Online#Salary Slip Generator#Paycheck Generator#Check Stubs#Check Stub Maker#How To Make Check Stubs#Make Check Stubs#Online Paycheck Generator#Direct Deposit Check Stub#Pay Stubs Generator#Make Pay Stub Online#Online W2 Generator#Generate 1099 Misc Online#1099 Misc Generator#W4 Generator Online#W4 Form Maker#Online W9 Generator#Make W9 Online Free#Generate W7 Online#Create W7 Form Online#Generate 1099 C Form Online#Make 8809 Online Free#Generate SS 4 Online#Make 8995 Forms

0 notes

Photo

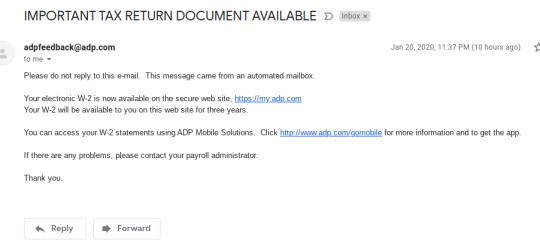

if you work for a company that does payroll through ADP, be aware that there is a phishing email going around that tells you your w-2 is ready

apparently the link leads to a convincing fake of ADP’s actual site and they use your info to steal your tax return (and then sell your info on the deep web, because theft wasn’t enough douchebaggery for them)

if you get this email, make sure you report it to ADP so they can sue the shit out of them

#psa#tax season#broke college student#scamalert#poor people problems#i got one this morning#online w2's tend to come with WAY more info than that^#super generic messages about important stuff is a big red flag

7 notes

·

View notes

Text

me: wants to buy used legend of spyro trilogy for the ps2

me: wants to buy devotional jewelry off etsy

me: wants to buy a new piece of furniture each month to slowly replace the hand-me-down, falling-a-part-junk

also me: has not yet finished my taxes.......

#why am i like this?#text#last year i did my taxes is fuckin february#though i didn't pay until the end bc i had to pay in over half of what i had saved up in my bank account bc no insurance#idk how to get my w2 for target since it's all online and i am no longer an employee#why did i wait so damn long ugh#personal#general related

12 notes

·

View notes

Text

Unlock Effortless Tax Filing: The Power of the Instant W2 Form Generator

In the fast-paced world of tax filing, where complexity often breeds frustration, an innovative solution has emerged – the Instant W2 Form Generator. Say goodbye to the headaches associated with traditional tax preparation, and embrace a streamlined, user-friendly experience that puts you in control.

The Need for Simplified Tax Filing

Tax season can be a daunting period for many individuals and businesses. The intricate nature of tax regulations, coupled with the time-consuming process of gathering and organizing financial information, often leads to stress and confusion. Recognizing the need for a more straightforward approach, the Instant W2 Form Generator aims to revolutionize the way we file our taxes.

Understanding the Instant W2 Form Generator

Features and Benefits

The Instant W2 Form Generator boasts a range of features designed to make tax filing a breeze. From automatic data entry to real-time error checking, users can experience unparalleled efficiency. The system ensures accurate calculations and provides instant access to W2 forms, empowering users to take control of their financial obligations.

How it Streamlines the Tax Filing Process

Navigating through the Instant W2 Form Generator is a user-friendly experience. With a simple interface and step-by-step guidance, even those unfamiliar with tax jargon can effortlessly complete their filing. This tool is not just about convenience; it's about empowering individuals and businesses to manage their taxes with confidence.

How to Access and Use the Instant W2 Form Generator

Getting started is as easy as a few clicks. The Instant W2 Form Generator's user-friendly interface ensures a seamless experience, guiding users through the process of entering their information accurately. This step-by-step approach eliminates the guesswork, making tax filing accessible to everyone.

Security Measures in Place

Concerned about the safety of your sensitive information? Rest assured. The Instant W2 Form Generator employs state-of-the-art encryption and data protection measures to safeguard your data. Your confidentiality is our top priority.

Cost-Effectiveness of Using the Instant W2 Form Generator

Comparing Costs to Traditional Tax Preparation Services

Traditional tax preparation services often come with hefty price tags. The Instant W2 Form Generator offers a cost-effective alternative without compromising on quality. Users can enjoy the same level of accuracy and professionalism without breaking the bank.

Highlighting Potential Savings for Users

Beyond the immediate cost savings, using the Instant W2 Form Generator can lead to long-term financial benefits. By optimizing the tax filing process, users can redirect their time and resources towards more productive endeavors.

Real-life Success Stories

Testimonials from Users

Don't just take our word for it. Hear from individuals and businesses that have experienced the power of the Instant W2 Form Generator. Their success stories speak volumes about the transformative impact this tool can have on your tax filing experience.

Demonstrating the Impact

From time savings to reduced stress, these real-life accounts highlight the tangible benefits of embracing modern technology for tax preparation.

Overcoming Common Misconceptions

Addressing Concerns about Online Tax Filing

Skepticism about online tax filing is common. In this section, we address common concerns and dispel myths surrounding the safety and accuracy of the Instant W2 Form Generator. It's time to embrace the future with confidence.

Providing Clarifications on Accuracy

The Instant W2 Form Generator is not just about speed; it's about accuracy. We delve into the technology behind the system, ensuring readers understand the meticulous checks and balances in place to guarantee precise results.

Industry Recognition and Awards

Acknowledging Accolades

The Instant W2 Form Generator has garnered recognition within the industry. Awards and accolades validate its effectiveness and showcase the trust placed in this innovative solution.

Establishing Credibility and Trust

When it comes to tax filing, credibility is crucial. The Instant W2 Form Generator's track record of excellence establishes it as a trusted companion in navigating the complexities of tax regulations.

Staying Updated with Tax Regulations

Adapting to Changing Tax Laws

Tax laws evolve, and so does the Instant W2 Form Generator. This section discusses the system's adaptability, ensuring users remain compliant with the latest regulations without the need for constant manual updates.

Ensuring Users are Always Compliant

By staying ahead of regulatory changes, the Instant W2 Form Generator ensures users are always on the right side of compliance. Say goodbye to last-minute scrambles to understand new laws – this tool has you covered.

The Future of Effortless Tax Filing

Predicting Advancements

As technology continues to advance, so does the future of tax preparation. In this section, we explore the potential advancements in tax preparation technology and how the Instant W2 Form Generator is positioned at the forefront of this evolution.

How the Instant W2 Form Generator Continues to Evolve

It's not just about meeting current needs; it's about anticipating future challenges. Discover how the Instant W2 Form Generator evolves to stay ahead of the curve, ensuring users always have access to the latest tools and features.

Exclusive Offer for Early Users

Limited-time Discounts or Special Features

As a gesture of appreciation, early users can enjoy exclusive offers, whether it be discounts on subscription plans or access to premium features. Seize the opportunity and unlock even greater value from the Instant W2 Form Generator.

Encouraging Users to Take Advantage of the Offer

Don't miss out – act now to enjoy the benefits of effortless tax filing at a fraction of the cost. This exclusive offer is a token of gratitude to those who embrace innovation early on.

User Support and Assistance

Highlighting Customer Service Availability

Questions or concerns? Our dedicated customer service team is here to assist. This section emphasizes the availability of reliable customer support, ensuring users never feel alone in their tax filing journey.

Addressing Queries Promptly

Fast, efficient, and friendly – that's our commitment to addressing user queries. Discover the peace of mind that comes with knowing help is just a click or call away.

Conclusion

In conclusion, the era of cumbersome tax filing is over. The Instant W2 Form Generator is not just a tool; it's a solution that empowers individuals and businesses to take control of their financial responsibilities with confidence. Say goodbye to stress and hello to the future of effortless tax filing.

0 notes

Text

Streamlining Payroll Processes: A Comprehensive Guide.

In today's dynamic business landscape, managing payroll efficiently is crucial for businesses of all sizes. From adhering to new hire reporting requirements to ensuring accurate distribution of W2 forms, there are numerous facets to consider. In this comprehensive guide, we'll delve into essential services and strategies to streamline payroll processes effectively.

Summary:

Effective payroll management entails navigating various regulatory requirements while ensuring timely and accurate payment to employees. This guide will explore key services such as new hire reporting, W2 distribution, electronic paystubs generation, and more. By leveraging these solutions, businesses can enhance efficiency, compliance, and employee satisfaction.

Click to Call: For assistance with optimizing your payroll processes and leveraging advanced solutions, contact Professional Automation Services today.

Conclusion:

Streamlining payroll processes is essential for businesses to maintain compliance and efficiency. By utilizing services such as new hire reporting, W2 distribution, and electronic paystub generation, organizations can simplify payroll management while ensuring accuracy and regulatory compliance.

Detail Points:

New Hire Reporting Requirements by State:

Understand the specific new hire reporting requirements mandated by each state.

Ensure timely submission of new hire information to comply with state regulations and avoid penalties.

Utilize automation tools to streamline the process and reduce manual errors.

W2 Self-Service and Distribution:

Implement self-service portals for employees to access and download their W2 forms.

Partner with reliable printing and mailing services to ensure accurate and timely distribution of W2 forms to employees.

Explore electronic options for W2 distribution to enhance convenience and reduce administrative burden.

Electronic Reporting for IRS and Social Security:

Leverage electronic reporting solutions to submit payroll information to the IRS and Social Security Administration seamlessly.

Ensure compliance with regulations governing electronic reporting and data security.

Automate the process to minimize errors and streamline reporting procedures.

Verify Social Security Numbers:

Employ tools or services to verify the accuracy of social security numbers provided by employees.

Verify social security numbers to ensure compliance with IRS regulations and prevent fraudulent activities.

Integrate social security number verification into the onboarding process for new hires.

Paycheck and Paystub Generation:

Utilize paycheck and paystub generators to automate the process of creating and distributing employee paystubs.

Ensure accuracy and compliance with wage and hour regulations when generating paystubs.

Offer electronic paystub delivery options to enhance convenience for employees and reduce paper waste.

Obtaining W2s from Previous Employers:

Provide employees with guidance on how to obtain W2 forms from previous employers.

Direct employees to contact their former employers or utilize online resources such as the IRS website.

Offer support and assistance to employees who encounter difficulties in obtaining W2 forms from previous employers.

Professional Automation Services:

Explore the services offered by professional automation providers to streamline payroll processes.

Consider outsourcing payroll tasks to experts in the field to ensure accuracy, compliance, and efficiency.

Evaluate the potential benefits of partnering with automation services to optimize payroll management.

By addressing these key points and implementing effective solutions, businesses can streamline payroll processes, reduce administrative burden, and ensure compliance with regulatory requirements.

#PayrollManagement#NewHireReporting#W2Distribution#ElectronicReporting#PaystubGeneration#Compliance#AutomationServices#IRSCompliance#SocialSecurityVerification#EmployeeBenefits#Efficiency#BusinessProcesses#RegulatoryCompliance#EmployeeSatisfaction#ProfessionalServices

0 notes