#how to open a forex trading account

Text

#Forex trading#online Forex trading platforms#top Forex trading companies#best Forex trading company#Forex trading apps beginners#how to open Forex trading account#FX Learn Pro review#Forex trading brokers comparison#free Forex trading demo account#Forex trading account setup#Forex trading platform reviews#Forex trading software#Forex market trading platforms#best online Forex brokers#Forex trading simulator#Forex trading account benefits#Forex market trading apps#virtual Forex trading platform#Forex trading company reviews#Forex trading tips beginners#Forex trading websites#Forex trading tutorial beginners#Forex trading platform comparison#Forex trading strategies#Forex trading demo#learn Forex trading online#best Forex trading platforms#top Forex trading apps#online Forex trading brokers#Forex trading software reviews

0 notes

Text

Everything You Need to Know About Options Trading

If You Think That All of This is Confusing to You. Here, We'll Explain All Details About an Open Options Trading Account. There Are 2 Types of Options, Call Option & Put Option. We Also Provide Info on Open Futures Trading Account, Critical Terms in Options Trading, Etc. Know more, Visit our blog!

#basics of trading options#Open Futures Trading Account#Lowest Brokerage Charges in India for Trading#Commodity Trading Account Opening Online#How to Open Equity Account#Trading Strategies#Best Broker in India for Share Market#Open Forex Account in India#Best Stock Advisory Service for India

0 notes

Text

Delving into the intricacies of trading, the blog provides a thorough examination of different trading strategies, spotlighting both day trading and swing trading. It further dissects crucial analysis methods, namely technical and fundamental analysis. The narrative underscores the critical role of aligning chosen strategies with individual goals and the guidance that Funded Traders Global can provide in this regard.

#ftg#Analyzing Your Trading Performance#Are there risks involved in trading with $100?#Basic Analysis Methods#Begin Trading with $100#Can I start trading right away with my $100 account?#Candlestick patterns#choosing a reliable forex broker#clear goals and risk tolerance#Creating a trading plan#Day Trading#Discuss the Possibility of Losing Your Initial $100#fundamental analysis#Highlight the Risks Associated with Forex Trading#How can I grow my $100 account?#How do I deal with emotions when trading with a small account?#How Forex Markets Work#Introduction to Different Trading Strategies#Is it really possible to start Forex trading with just $100?#Open a Live Trading Account#Psychology of Trading#Risks and Warnings with Trading with $100#Should I use leverage with a small account? Swing trading#technical analysis#Tips for Successful Trading#trading strategies#What Is Forex?#What role can Funded Traders Global play in my journey with a $100 account?#What's the best strategy for a small account?

1 note

·

View note

Text

0 notes

Text

To register your trading account

1. Open this link https://bit.ly/3zn3aEK

2. Fill in your email address

3. A registration link will be sent to your email which you need to open to complete your registration

4. Under the registration , you will be ask for Fiat, kindly select USD

5. You will be ask account type , kindly select Synthetic.

Notify us after successful registration

#deriv#how to open deriv account#best volatility index broker#best forex broker#deriv review#synthetic trading#volatility index#binary#forex#make money for free#forex autotrade#forex account managing

1 note

·

View note

Text

How To Get Started Investing In The Stock Market

Educate yourself: Before investing in the stock market, it's important to educate yourself about the basics of investing, including the different types of investments, the risks involved, and how to build a diversified portfolio. There are many resources available, including books, online courses, and investment blogs.

Determine your investment goals: It's important to have clear investment goals before investing in the stock market. Are you investing for retirement, a down payment on a house, or to generate passive income? Your investment goals will help determine the types of investments that are appropriate for you.

Open a brokerage account: To invest in the stock market, you'll need to open a brokerage account with a reputable brokerage firm. Some popular options include Fidelity, TD Ameritrade, and Charles Schwab. When choosing a brokerage firm, consider factors such as fees, investment options, and customer service.

Build a diversified portfolio: Diversification is key to successful investing. By investing in a mix of stocks, bonds, and other assets, you can reduce your risk and increase your chances of long-term success. Consider investing in a mix of large-cap and small-cap stocks, domestic and international investments, and bonds with varying maturities.

Start investing: Once you have a brokerage account and have determined your investment strategy, it's time to start investing. Consider starting with a small amount of money and gradually increasing your investments over time.

WAYS TO INVEST

There are several ways to invest in the stock market, including:

Individual Stocks: This involves buying shares of individual companies on the stock market. You can buy shares through a broker or an online trading platform.

Mutual Funds: Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks. This allows you to invest in a variety of companies with a single investment.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they trade like individual stocks on an exchange. This allows you to buy and sell ETFs throughout the trading day.

Index Funds: Index funds track the performance of a specific index, such as the S&P 500. This provides exposure to a broad range of companies and can be a good option for long-term investors.

TOOLS TO START INVESTING

Online Trading Platforms: Many brokers offer online trading platforms that allow you to buy and sell stocks and funds. These platforms typically provide research tools and stock charts to help you make informed investment decisions.

Robo-Advisors: Robo-advisors are digital platforms that use algorithms to create and manage investment portfolios for you. They can be a good option for beginner investors who want a hands-off approach.

Investment Apps: There are several investment apps available that allow you to buy and sell stocks and funds from your mobile device. These apps are often designed for beginner investors and offer low fees and user-friendly interfaces.

PLATFORMS

A few popular options:

Robinhood: Robinhood is a commission-free trading app that offers stocks, ETFs, and cryptocurrency trading. It’s designed for beginner investors and offers a user-friendly interface.

Acorns: Acorns is an investment app that automatically invests your spare change. It rounds up your purchases to the nearest dollar and invests the difference in a diversified portfolio of ETFs.

TD Ameritrade: TD Ameritrade is a popular trading platform that offers stocks, ETFs, mutual funds, options, futures, and forex trading. It offers a variety of trading tools and research resources.

ETRADE: ETRADE is a popular online broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of trading tools and resources, including a mobile app.

Fidelity: Fidelity is a full-service broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of investment tools and research resources, including a mobile app.

INVESTMENT STRATEGIES

Value Investing: Value investing involves buying stocks that are undervalued by the market and holding them for the long term. This approach requires patience and a thorough analysis of a company’s financial statements and growth potential.

Growth Investing: Growth investing involves buying stocks in companies that are expected to grow faster than the market average. This approach often involves investing in companies that are at the cutting edge of technology or have innovative business models.

Dividend Investing: Dividend investing involves buying stocks in companies that pay a dividend. This can provide a steady stream of income for investors and can be a good option for those looking for more conservative investments.

Passive Investing: Passive investing involves investing in a diversified portfolio of low-cost index funds or ETFs. This approach is designed to match the performance of the overall market and requires minimal effort on the part of the investor.

Real Estate Investing: Real estate investing involves buying and holding real estate assets for the purpose of generating income or appreciation. This can include investing in rental properties, real estate investment trusts (REITs), or crowdfunding platforms.

Options trading: is a type of trading strategy that involves buying and selling options contracts, which are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as stocks, at a specific price within a certain time frame. Options trading can be used to generate income, hedge against risk, or speculate on market movements.

Swing trading is a type of trading strategy that aims to capture short- to medium-term gains in a financial asset, such as stocks, currencies, or commodities. Swing traders typically hold their positions for a few days to several weeks, taking advantage of price swings or "swings" in the market. Swing traders use technical analysis to identify trends and patterns in the market, and they often employ a combination of charting tools and indicators to help them make trading decisions. They look for stocks or other assets that have a clear trend, either up or down, and then try to enter and exit positions at opportune times to capture profits.

TECHNICAL ANALYSIS TOOLS

There are many technical analysis resources available for traders to use in their analysis of financial markets. Here are some popular options:

TradingView: TradingView is a web-based charting and technical analysis platform that provides users with real-time data, customizable charts, and a variety of technical indicators and drawing tools.

StockCharts: StockCharts is another web-based platform that provides a wide range of technical analysis tools, including charting capabilities, technical indicators, and scanning tools to help traders identify potential trading opportunities.

Thinkorswim: Thinkorswim is a trading platform provided by TD Ameritrade that offers advanced charting and technical analysis tools, as well as a wide range of other features for traders, including paper trading, news and research, and risk management tools.

MetaTrader 4/5: MetaTrader is a popular trading platform used by many traders around the world. It provides a range of technical analysis tools, including customizable charts, indicators, and automated trading strategies.

Investing.com: Investing.com is a website that provides real-time quotes, charts, news, and analysis for a wide range of financial markets, including stocks, currencies, commodities, and cryptocurrencies.

Yahoo Finance: Yahoo Finance is a website that provides real-time stock quotes, news, and analysis, as well as customizable charts and a variety of other tools for traders and investors.

Finviz: is a popular web-based platform for traders and investors that provides a wide range of tools and information to help them analyze financial markets. The platform offers real-time quotes, customizable charts, news and analysis, and a variety of other features.

435 notes

·

View notes

Text

Buying and Selling Currency Pairs

Introduction

Are you intrigued by the world of Forex trading? Buying and selling currency pairs is a fundamental aspect of this exciting financial market. In this article, we'll dive deep into what currency pairs are, how they work, and how you can start trading them effectively.

Understanding Currency Pairs

Major, Minor, and Exotic Pairs

Currency pairs are the foundation of Forex trading. They are divided into three categories: major, minor, and exotic pairs. Major pairs include the most traded currencies, such as EUR/USD and USD/JPY. Minor pairs are less commonly traded, like EUR/GBP. Exotic pairs involve a major currency paired with a currency from an emerging economy, like USD/TRY.

Base and Quote Currency

In every currency pair, the first currency is the base currency, and the second is the quote currency. For example, in EUR/USD, EUR is the base currency, and USD is the quote currency. The value of the base currency is always 1, and the quote currency shows how much of it is needed to buy 1 unit of the base currency.

How Currency Pairs Work

The Concept of Exchange Rates

Exchange rates indicate how much one currency is worth in terms of another. For example, if the EUR/USD exchange rate is 1.10, it means 1 Euro can be exchanged for 1.10 US Dollars.

Bid and Ask Price

The bid price is the highest price a buyer is willing to pay for a currency pair, while the ask price is the lowest price a seller is willing to accept. The difference between these two prices is known as the spread, which is a key component of Forex trading costs.

The Forex Market

What is Forex?

The Foreign Exchange (Forex) market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. It operates 24 hours a day, five days a week, allowing traders from all over the globe to participate.

Trading Hours and Global Reach

Forex trading is divided into four main sessions: Sydney, Tokyo, London, and New York. This continuous cycle allows for seamless trading as one market closes and another opens, providing opportunities around the clock.

Getting Started with Forex Trading

Choosing a Broker

Selecting a reliable Forex broker is crucial. Look for one that is regulated by a reputable financial authority, offers competitive spreads, and provides a user-friendly trading platform.

Setting Up a Trading Account

Once you've chosen a broker, you'll need to open a trading account. This typically involves providing personal information, verifying your identity, and funding your account with an initial deposit.

CLICK THE LINK BELOW TO LEARN MORE IN DETAIL.

4 notes

·

View notes

Text

Forex Trading In Dubai Secrets Revealed!

In this video, we delve into the world of Forex trading in Dubai, exploring the strategies and tips to help you make money in the UAE. Whether you're a beginner or an experienced trader, this guide will provide valuable insights into the lucrative Forex market in Dubai. Watch now to learn how to navigate the trading landscape and maximize your profits in this thriving financial hub. .

Open NOW your trading account with ICM Capital - Dubai Branch

https://www.icm.com/lp/ar/landing_pages/2020/trade-with-global-multiregulated-broker

https://www.youtube.com/@londonforexorders1

#ForexTrading#Dubai#UAE#MakingMoney#ForexStrategies#FinancialHub#TradingTips#ForexTradingInDubai#الذهب#تحليل الذهب#تدا��ل الفوركس#الربح من الانترنت#تعلم التداول#سعر الذهب اليوم#EURUSD#GBPJPY#BTC#GBPUSD#ICT#XAUUSD

4 notes

·

View notes

Text

Tips for Business Owners on How to Invest in the Stock Market or Forex Online

Tips for Business Owners on How to Invest in the Stock Market or Forex Online

Business owners are often well-versed in managing their companies, but when it comes to investing in the stock market or forex online, they may find themselves in unfamiliar territory. However, these financial markets can offer an excellent opportunity to grow your wealth. This guide provides essential tips for business owners looking to venture into the world of online stock market and forex trading.

Educate Yourself

Before diving into online trading, educate yourself about the basics of both stock and forex markets. This includes understanding market terminology, different asset classes, risk management, and trading strategies. Several online resources, courses, and books can help you build a solid foundation of knowledge.

For business owners venturing into online stock investing, consider mastering the art through an online course that not only sharpens your skills but also provides a lucrative opportunity to share your knowledge. Start by selecting a reputable online learning platform, ensuring it covers fundamental concepts like market analysis, risk assessment, and investment strategies. Enroll in courses led by seasoned experts and successful investors to gain insights and practical tips.

Simultaneously, explore the prospect of offering your own online course. Leverage your business expertise to create a comprehensive curriculum tailored for beginners or those looking to enhance their investment skills. Utilize engaging content formats such as videos, quizzes, and interactive sessions. Establish your credibility by sharing your success stories and lessons learned.

Promote your course through social media, your business website, or relevant forums. Consider providing a free introductory module to attract potential learners. As your investment skills grow, so will your ability to guide others on this financial journey. Ultimately, investing in both your own education and sharing your knowledge through an online course can open new avenues for financial growth and business expansion.

Set Clear Investment Goals

Establish clear and realistic investment goals. Are you looking to generate short-term income, build long-term wealth, or diversify your investment portfolio? Having well-defined objectives will guide your investment decisions and risk tolerance.

Develop a Trading Plan

A trading plan is a roadmap that outlines your strategies, risk tolerance, and the assets you plan to invest in. It also includes entry and exit points for trades. Without a plan, you may be prone to impulsive decisions that can lead to significant losses.

Choose the Right Platform

Selecting the right online trading platform is crucial. Look for a platform that is user-friendly, secure, and provides access to a wide range of financial instruments. It should also offer robust research and analysis tools. Ensure the platform is regulated and reputable to protect your investments.

Diversify Your Portfolio

Diversification is a key principle of investing. Spreading your investments across different asset classes, such as stocks, bonds, and currencies, can help mitigate risks. Avoid putting all your capital into a single trade or asset.

Start with a Demo Account

If you're new to trading, consider starting with this INVESTING 101 online course with a demo account. Demo accounts allow you to practice trading with virtual money, helping you get a feel for the markets and your chosen platform without risking your capital.

Risk Management

Protect your investments by setting stop-loss orders. These are predefined price levels at which you're willing to exit a trade to limit potential losses. Additionally, only invest money you can afford to lose, and avoid using borrowed funds for trading.

Stay Informed

Stay updated with current events and economic news, as they can significantly impact the financial markets. Subscribing to financial news outlets and following relevant economic indicators can help you make informed decisions.

Technical and Fundamental Analysis

Learn and use both technical and fundamental analysis to make informed investment decisions. Technical analysis involves studying price charts and patterns, while fundamental analysis focuses on examining economic and company-specific factors that may affect asset prices.

Practice Patience

Rome wasn't built in a day, and the same goes for wealth accumulation through trading. Be patient and avoid chasing quick profits. Successful trading often involves a series of well-thought-out, disciplined decisions over time.

Embrace Continuous Learning

The financial markets are dynamic and ever-changing. As a business owner, it's crucial to keep learning and adapting to new market trends, strategies, and technologies. Joining trading forums or taking advanced courses can be beneficial.

Track and Analyze Your Trades

Maintain a trading journal to record your trades, including the reasons for entering and exiting each trade. Analyzing your trading history will help you identify patterns and improve your strategies.

Seek Professional Advice

Consider seeking advice from financial advisors or experts who can provide guidance based on your financial goals and risk tolerance. They can help tailor your investment strategies to your specific needs.

Tax Considerations

Understanding tax implications is vital. Depending on your location and trading activity, you may be subject to capital gains tax. Consult a tax professional to ensure compliance with tax regulations.

Avoid Emotional Trading

Emotions like fear and greed can lead to impulsive and irrational trading decisions. Stick to your trading plan, and if emotions start to cloud your judgment, take a step back and reevaluate.

Build a Financial Cushion

Maintain a financial cushion or emergency fund for personal and forex trading expenses. This will ensure that trading losses don't jeopardize your financial stability.

Review and Adjust Your Strategy

Regularly review your trading strategies and portfolio. If something isn't working or your goals change, be prepared to adjust your approach.

Stay Disciplined

Maintain discipline in your trading activities. Discipline helps you stick to your trading plan and avoid making hasty decisions based on emotions or short-term market fluctuations.

Network and Collaborate

Connect with other traders, both online and in-person, to exchange ideas and experiences. Collaborating with peers can provide valuable insights and support.

Monitor Market Hours

Stock and forex markets have specific trading hours. Be aware of these hours and ensure your trading activities align with them.

Conclusion

Investing in the stock market and forex online can be a rewarding way for business owners to grow their wealth. However, it's not without risks. By following these tips, you can make informed decisions, manage risks, and work towards achieving your investment goals. Remember that success in trading comes with time, practice, and continuous learning. Always approach online trading with caution, discipline, and a well-thought-out strategy.

2 notes

·

View notes

Text

Popular Forex Trading Strategies For Successful Traders

Identifying a successful Forex trading strategy is one of the most important aspects of currency trading. In general, there are numerous trading strategies designed by different types of traders to help you make profit in the market.

However, an individual trader needs to find the best Forex trading strategy that suits their trading style, as well as their risk tolerance. In the end, no one size fits all.

In order to make profit, traders should focus on eliminating the losing trades and achieving more winning ones. Any trading strategy that leads you towards this goal could prove to be the winning one.

How to Choose The Best Forex Trading Strategy

Before we proceed to discussing the most popular Forex trading strategies, it’s important that we understand the best methods of choosing a trading strategy. There are three main elements that should be taken into consideration in this process.

Time frame

Choosing a time frame that suits your trading style is very important. For a trader, there’s a huge difference between trading on a 15-min chart and a weekly chart. If you are leaning more towards becoming a scalper, a trader that aims to benefit from smaller market moves, then you should focus on the lower time frames e.g. from 1-min to 15-min charts.

On the other hand, swing traders are likely to use a 4-hour chart, as well as a daily chart, to generate profitable trading opportunities. Hence, before you choose your preferred trading strategy, make sure you answer the question: how long do I want to stay in a trade?

Varying time periods (long, medium, and short-term) correspond to different trading strategies.

Number of trading opportunities

When choosing your strategy, you should answer the question: how frequently do I want to open positions? If you are looking to open a higher number of positions then you should focus on a scalping trading strategy.

On the other hand, traders that tend to spend more time and resources on analyzing macroeconomic reports and fundamental factors are likely to spend less time in front of charts. Therefore, their preferred trading strategy is based on higher time frames and bigger positions.

Position size

Finding the proper trade size is of the utmost importance. Successful trading strategies require you to know your risk sentiment. Risking more than you can is very problematic as it can lead to bigger losses.

A popular advice in this regard is to set a risk limit at each trade. For instance, traders tend to set a 1% limit on their trades, meaning they won’t risk more than 1% of their account on a single trade.

For example, if your account is worth $30,000, you should risk up to $300 on a single trade if the risk limit is set at 1%. Depending on your risk sentiment, you can move this limit to 0.5% or 2%.

In general, the lower the number of trades you are looking to open the bigger the position size should be, and vice versa.

Three Successful Strategies

By now, you have identified a time frame, the desired position size on a single trade, and the approximate number of trades you are looking to open over a certain period of time. Below, we share three popular Forex trading strategies that have proven to be successful.

Scalping

Forex scalping is a popular trading strategy that is focused on smaller market movements. This strategy involves opening a large number of trades in a bid to bring small profits per each.

As a result, scalpers work to generate larger profits by generating a large number of smaller gains. This approach is completely opposite of holding a position for hours, days, or even weeks.

Scalping is very popular in Forex due to its liquidity and volatility. Investors are looking for markets where the price action is moving constantly to capitalize on fluctuations in small increments.

This type of trader tends to focus on profits that are around 5 pips per trade. However, they are hoping that a large number of trades is successful as profits are constant, stable and easy to achieve.

A clear downside to scalping is that you cannot afford to stay in the trade too long. Additionally, scalping requires a lot of time and attention, as you have to constantly analyze charts to find new trading opportunities.

Let’s now demonstrate how scalping works in practice. Below you see the EUR/USD 15-min chart. Our scalping trading strategy is based on the idea that we are looking to sell any attempt of the price action to move above the 200-period moving average (MA).

In about 3 hours, we generated four trading opportunities. Each time, the price action moved slightly above the 200-period moving average before rotating lower. A stop loss is located 5 pips above the moving average, while the price action never exceeded the MA by more than 3.5 pips.

Take profit is also 5 pips as we focus on achieving a large number of successful trades with smaller profits. Therefore, in total 20 pips were collected with a scalping trading strategy.

Day Trading

Day trading refers to the process of trading currencies in one trading day. Although applicable in all markets, day trading strategy is mostly used in Forex. This trading approach advises you to open and close all trades within a single day.

No position should stay open overnight to minimize the risk. Unlike scalpers, who are looking to stay in markets for a few minutes, day traders usually stay active over the day monitoring and managing opened trades. Day traders are mostly using 30-min and 1-hour time frames to generate trading ideas.

Many day traders tend to base their trading strategies on news. Scheduled events e.g. economic statistics, interest rates, GDPs, elections etc., tend to have a strong impact on the market.

In addition to the limit set on each position, day traders tend to set a daily risk limit. A common decision among traders is setting a 3% daily risk limit. This will protect your account and capital.

In the chart above, we see GBP/USD moving on an hourly chart. This trading strategy is based on finding the horizontal support and resistance lines on a chart. In this particular case, we are focused on resistance as the price is moving upward.

The price movement tags the horizontal resistance and immediately rotates lower. Our stop loss is located above the previous swing high to allow for a minor breach of the resistance line. Thus, a stop loss order is placed 25 pips above the entry point.

On the downside, we use the horizontal support to place a profit-taking order. Ultimately, the price action rotates lower to bring us around 65 pips in profits.

Position Trading

Position trading is a long-term strategy. Unlike scalping and day trading, this trading strategy is primarily focused on fundamental factors.

Minor market fluctuations are not considered in this strategy as they don’t affect the broader market picture.

Position traders are likely to monitor central bank monetary policies, political developments and other fundamental factors to identify cyclical trends. Successful position traders may open just a few trades over the entire year. However, profit targets in these trades are likely to be at least a couple of hundreds pips per each trade.

This trading strategy is reserved for more patient traders as their position may take weeks, months or even years to play out. You can observe the dollar index (DXY) reversing its trend direction on a weekly chart below.

A reversal is a result of the huge monetary stimulus provided by the US Federal Reserve and the Trump administration to help the troubled economy. As a result, the amount of active dollars increases, which decreases the value of the dollar. Position traders are likely to start selling the dollar on trillion-dollar stimulus packages.

Their target may depend on different factors: long-term technical indicators and the macroeconomic environment. Once they believe that the current bearish trend is nearing its end from a technical perspective, they will seek to exit the trade. In this example, we see the DXY rotating at the multi-year highs to trade more than 600 pips lower 4 months later (March - July).

2 notes

·

View notes

Text

Tyllionaire: An Insight into Trading and Forex

Tylor K. Moore, popularly known as Tyllionaire or “TY,” is a successful trader, entrepreneur, and author. His interest in the stock market and forex started early in life, and he was inspired by Jay Z's business acumen. In this article, we delve into some of his responses to interview questions to learn more about his approach to trading.

Inspiration for Trading According to TY, he became interested in the stock market early on in life. He was inspired by Jay Z's hustle to sell drugs on the corners. While he looked up to Jay Z for his business moves, he never wanted to sell drugs like him. TY believed there was a faster way to make money and that trading offered that opportunity. He started looking into stocks using newspapers and the internet while in high school. After a few years, he discovered forex and hasn't looked back since.

Motivation to Write a Book on Forex TY has written a book on forex, which he believes will solidify his name in something bigger than himself. He thinks it's dope that people can go to Barnes and Noble, say his name at the desk, and order a copy of his book. Having a book is like a business card for him, which he uses to introduce himself to new people.

Factors to Consider in Trading Stocks and Forex TY believes that the most important factor to consider in trading is risk to reward. He emphasizes that trading is not gambling but using money wisely to make more money. Every little risk involves losing something, be it time, energy, or money. Therefore, having a concrete trading plan is essential. TY advises traders to think of trading like a business and treat it as such.

Risk Management To manage risk, TY uses a simple approach. Suppose you have $1000 in a micro account, and you're trading forex. In that case, you're only supposed to risk a maximum of 3% per trade professionally. That's about $30 per trade, and you're looking to make $60 to $100 from that $30 risk. While this may not seem like a lot, it can help you double your forex account if done five or ten times.

Trading Style TY is a scalper, which means he's a hunter on the 5-minute chart. He wakes up around 3 am every morning, smokes a blunt, plays some call of duty to get his mind right, and starts trading. Usually, he catches the late London session so he can scalp GBPUSD until the NY session a few hours later. If US30 or NAS100 starts moving earlier on, then he'll catch it before the United States stock market opens. He advises traders to exit once they've hit a lick, saying that once the money stacks up, it's time to go.

Understanding the Market TY believes he has a great understanding of the ebbs and flows of the market. He advises people to learn how to read charts, and they'll find it just like driving a car; they'll never forget. He recommends a video on his YouTube channel called "Understanding Japanese Candlesticks," which he believes will help anyone learn to read charts.

Emotions and Trading TY believes that treating trading like an investment helps remove the emotional attachment to money. He advises traders to think of trading as money invested, which could work or not work. This way, when the emotion is removed, it's easier to trade on a day-to-day basis.

Advice for New Traders TY advises new traders to do what works for them. Every person has their unique experience, and they should study every profitable moment and try to duplicate the situation. He believes that trading is similar to basketball, where the

You can find TY on YouTube by typing in “TY” or “Tyllionaire” or also by googling his name Tyler K. Moore

5 notes

·

View notes

Text

#Forex trading#online Forex trading platforms#top Forex trading companies#best Forex trading company#Forex trading apps beginners#how to open Forex trading account#FX Learn Pro review#Forex trading brokers comparison#free Forex trading demo account#Forex trading account setup#Forex trading platform reviews#Forex trading software#Forex market trading platforms#best online Forex brokers#Forex trading simulator#Forex trading account benefits#Forex market trading apps#virtual Forex trading platform#Forex trading company reviews#Forex trading tips beginners#Forex trading websites#Forex trading tutorial beginners#Forex trading platform comparison#Forex trading strategies#Forex trading demo#learn Forex trading online#best Forex trading platforms#top Forex trading apps#online Forex trading brokers#Forex trading software reviews

0 notes

Text

Forex For Dummies: A Hobbyist’s Guide to Currency Trading

Hello there, fellow traders and aspiring enthusiasts! I’ve been navigating the fascinating world of Forex trading as a hobby for a good few years now. If you’re considering diving into this exhilarating pastime, you’ve come to the right place. This article will serve as your introduction to Forex trading, breaking down the key terms, concepts, and processes you’ll need to know.

Quick Plug: Hey, I’m Ingrid Olsen, dabbling in Forex trading whenever I get a chance. I’ve been using decodefx.com (by Decode Global) for my trades and seriously, it’s a game-changer. User-friendly, secure, and filled with useful features — it’s got everything you need for a smooth trading experience. Give it a go, and you’ll see what I mean!

The ABCs of Forex

Forex — short for foreign exchange — is all about trading one currency for another. It’s the world’s most liquid financial market, with daily trading volumes exceeding a staggering $5 trillion. What’s unique about Forex is that it’s decentralized — there’s no central exchange, and trades happen directly between two parties, round the clock, five days a week.

Let’s Talk Pairs

In the Forex market, currencies are traded in pairs, like EUR/USD (Euro/US Dollar). The first currency listed (EUR) is known as the ‘base’ currency, and the second one (USD) is the ‘quote’ or ‘counter’ currency. The value of a currency pair indicates how much of the quote currency it takes to buy one unit of the base currency. So, if EUR/USD is trading at 1.20, it means you need 1.20 US dollars to buy 1 Euro.

Interpreting Forex Quotes

When you see a Forex quote, you’ll notice two prices: the ‘bid’ and ‘ask’ price. The ‘bid’ is the price you can sell the base currency for, while the ‘ask’ is the price you can buy it. The difference between these two prices is the ‘spread’ — which is essentially your broker’s commission for the trade.

Going Long or Short

In Forex trading, you can ‘go long’ or ‘go short’. Going long means you’re buying the base currency because you believe it will increase in value against the quote currency. Conversely, going short means you’re selling the base currency as you think its value will decrease.

The Power of Leverage

One distinctive aspect of Forex trading is the use of ‘leverage’. Leverage is like a loan from your broker, allowing you to control a much larger amount than your actual investment. For instance, with 100:1 leverage, you can control $100,000 with just a $1,000 investment. But be careful — while leverage can amplify your gains, it can also magnify your losses.

The Art of Analysis

Successful Forex trading involves market analysis. This usually involves:

Fundamental Analysis: Examining economic data, political events, and social factors that could affect currency values. These can range from policy changes to economic reports and global events.

Technical Analysis: Using charts and statistical indicators to predict future price movements. Techniques might include analyzing trend lines, support and resistance levels, and using mathematical indicators.

Minimizing Risk

Forex trading, like any investment, carries risk. It’s crucial to manage this risk by setting stop-loss orders to limit potential losses, never risking more than a small percentage of your trading capital on a single trade, and keeping emotions out of trading decisions.

Finding a Broker

To start trading Forex, you’ll need to open an account with a Forex broker. Look for a regulated broker with a user-friendly platform, competitive spreads, good customer service, and hassle-free deposit and withdrawal options.

Final Thoughts

Forex trading can be a thrilling hobby, but it’s important to understand the basics before jumping in. Take the time to learn and practice (many brokers offer demo accounts), and don’t be afraid to ask for advice. Remember, the aim is not just to make profits, but also to enjoy the journey of becoming a savvy Forex trader. Happy trading!

Ingrid Olsen

3 notes

·

View notes

Text

How To Choose The Best CRM for Forex Brokers

Choosing the right CRM for Forex Brokers is essential for a successful trading business. A good CRM will help Forex Brokers to manage customer data, track sales and marketing activities, and improve customer service. It should be able to provide real-time data on customer behavior and trends in order to make informed decisions quickly. Additionally, it should have features like automated emails, lead scoring, contact management, and reporting capabilities that can help Forex Brokers maximize their profits. When selecting a CRM for Forex Brokers it is important to consider the features offered by different providers and determine which one best suits your needs.

The best forex CRM should have features that enable brokers to manage customer data efficiently, generate leads, automate customer service tasks, and provide real-time analytics about their business. With the right Forex CRM, brokers can streamline their operations and maximize profits. In this article, we will discuss some of the best Forex CRMs in the market today and how they can help you achieve success in your forex business.

Metatrader 5 CRM Software is a powerful tool designed to help businesses manage their customer relationships. It provides a comprehensive suite of features that enable businesses to easily manage customer accounts, track customer interactions, and create custom reports. With its intuitive interface and customizable features, Metatrader 5 CRM Software makes it easy for businesses to stay organized and keep track of their customers. With its powerful automation capabilities, Metatrader 5 CRM Software can help companies save time and money by streamlining customer service processes. By utilizing this software, businesses can ensure that their customers receive the best possible service and support.

Easy to Use Mobile Trading App

Mobile trading apps are becoming increasingly popular amongst investors and traders. They offer a convenient and easy way to trade stocks, commodities, currencies, and more from the comfort of your own home. With a mobile trading app, investors can easily access their accounts, monitor their investments in real-time, and make trades with just a few taps on their smartphone. These apps also provide users with detailed market analysis and research tools to help them make informed decisions about their investments. With the right mobile trading app, you can take control of your finances without ever having to leave your house.

Tradesoft is one of the best Forex Broker in forex trading platforms that offers its clients and traders with a wide range of services including Forex Training, Forex account opening like Demo and Live account, Mobile Trading App, and more. With their advanced mobile app, they provide an easy-to-use platform to enable traders to access the global markets at any time. The app is designed with the latest technology to ensure a secure trading experience and provide access to real-time data feeds from major exchanges around the world. With their sophisticated yet intuitive mobile trading app, traders can stay ahead of the market trends and make informed decisions on when to buy or sell.

2 notes

·

View notes

Text

Forex4Money Forex Registration Form for New Traders.

Forex4Money Forex registration form You must enter your first and last names, as well as your email address and password. You should also include your residential address as well as personal information such as your birth date and phone number after submitting. Then You will see three account types on the final page: mini, standard, and premium. Choose the account in which you want to trade and then a leverage ratio ranging from 1:1 to 1:400. and your registration is finished.

#forex registration form#how to register a forex trading company#open forex account#forex account india#best forex account

0 notes

Text

XM Broker Review 2023: A Comprehensive Analysis of Trading Fees and Services

XM Broker Review 2023

XM is a global forex and CFD broker regulated by Australia's ASIC, CySEC of Cyprus, and Belizean authority IFSC. XM has low stock CFD and withdrawal fees. Account opening is user-friendly and fast. You can use many educational tools, such as webinars and a demo account. On the other hand, XM has a limited product portfolio as it offers mainly CFDs and forex trading. Its forex and stock index CFD fees are average, and there is no investor protection for clients onboarded outside the EU.

XM is a regulated broker, it is overseen by top-tier financial regulators in multiple countries . XM is also covered by investor protection in selected jurisdictions.

XM Highlights

🗺️ Country of regulationCyprus, Australia, Belize, United Arab Emirates💰 Trading fees classAverage💰 Inactivity fee chargedYes💰 Withdrawal fee amount$0💰 Minimum deposit$5🕖 Time to open an account1 day💳 Deposit with bank cardAvailable👛 Depositing with electronic walletAvailable💱 Number of base currencies supported10🎮 Demo account providedYes🛍️ Products offeredForex, CFD, Real stocks for clients under Belize (IFSC)

Visit Broker74.89% of retail CFD accounts lose money

Fees

XM has low trading fees for CFDs and charges no withdrawal fee. On the other hand, forex and stock index fees are only average, and there is a fee for inactivity.

AssetsFee levelFee termsS&P 500 CFDLowThe fees are built into the spread, 0.4 points is the average spread cost during peak trading hours.Europe 50 CFDAverageThe fees are built into the spread, 2.5 points is the average spread cost during peak trading hours.EURUSDAverageWith Standard, Micro, and Ultra-Low accounts the fees are built into the spread. 1.7 pips is the Standard account's average spread cost during peak trading hours. With XM Zero accounts, there is a $3.5 commission per lot per trade and a small spread cost.Inactivity feeLow$15 one-off maintenance fee after one year of inactivity, followed by $5 per month fee if the account remains inactive

XM trading fees

XM trading fees are average. XM has many account types, which all differ in pricing. The Standard, Micro, and Ultra Low accounts charge higher spreads but there is no commission. The XM Zero account charges lower spreads, but there is a commission. The following calculations were made using the Standard account.

We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compared brokers by calculating all the fees of a typical trade for selected products.

We chose popular instruments within each asset class:

- Stock index CFDs: SPX and EUSTX50

- Stock CFDs: Apple and Vodafone

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

A typical trade means buying a leveraged position, holding it for one week and then selling. For volume, we chose a $2,000 position for stock index and stock CFDs, and $20,000 for forex transactions. The leverage we used was:

- 20:1 for stock index CFDs

- 5:1 for stock CFDs

- 30:1 for forex

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for XM fees.

CFD fees

XM has low stock CFD, while average stock index CFD fees.

XMFxProAdmirals (Admiral Markets)S&P 500 index CFD fee$2.5$1.1$1.4Europe 50 index CFD fee$3.1$1.2$1.4Apple CFD fee$6.7$9.4$5.3Vodafone CFD fee$2.3$14.7$14.2

Visit Broker74.89% of retail CFD accounts lose money

Account opening

XM accepts customers from all over the world. There are a few exceptions though; among others, you can't open an account from the USA, Canada, China, Japan, New Zealand or Israel.

What is the minimum deposit at XM?

The required XM minimum deposit is $5 for two XM Account types (Micro, Standard), which is very low, and $100 for the XM Zero account.

Account types

XM offers many account types, which differ in pricing, base currencies, minimum deposit and contract size.

MicroStandardXM ZeroShares AccountClient countryEEA

Australia

Other countriesEEA

Australia

Other countriesEAANon-EEA and non-Australian clientsPricingNo commission, but higher spreadNo commission, but higher spreadThere is a commission, but the spread is very lowMarket spread and commissionBase currenciesUSD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, SGD, ZARUSD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, SGD, ZARUSD, EUR, JPYUSDMinimum deposit$5$5$100$10,000Contract size1 Lot = 1,0001 Lot = 100,0001 Lot = 100,0001 share

Islamic or swap-free accounts are also available. With Islamic accounts, a flat commission is charged if you hold your leveraged position overnight instead of the percentage-based financing rates.

XM doesn't offer corporate accounts. If you sign up for a non-European entity, you will not be eligible for European client protection measures.

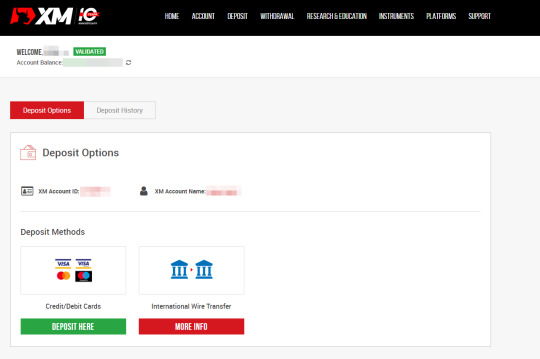

How to open your account

XM account opening is fully digital, fast and straightforward. You can fill out the online application form in 20 minutes. Our account was verified on the same day.

You can select many languages other than English:

ArabicBengaliChineseCzechDutchFilipinoFrenchGermanGreekHungarianIndonesianItalianKoreanMalayPolishPortugueseRussianSpanishSwedishThaiVietnamese

To open an account at XM, you have to go through these steps:

- Fill in your name, country of residence, email address and telephone number.

- Select the trading platform (MT4 or MT5) and account type.

- Add your personal information, such as your date of birth and address.

- Select the base currency and the size of the leverage.

- Provide your financial information and answer questions about your financial knowledge.

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Visit Broker74.89% of retail CFD accounts lose money

Deposit and withdrawal

Account base currencies

At XM, you can choose from 9 base currencies. The available base currencies are:

EURUSDGBPCHFJPYAUDSGDPLNHUFZAR

XMFxProAdmirals (Admiral Markets)Number of base currencies10811

Why does this matter? For two reasons. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee.

Deposit fees and options

XM charges no deposit fees. You can use bank transfers and credit/debit cards for depositing funds. Clients onboarded under IFSC can also deposit using the SticPay electronic wallet.

XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYes

A bank transfer can take several business days, while payment with a credit/debit card is instant.

You can only deposit money from accounts that are in your name.

XM review - Deposit and withdrawal - Deposit

XM withdrawal fees and options

XM charges no withdrawal fees. The only exception is bank (wire) transfers below $200, which incur a $15 fee.

XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYesWithdrawal fee$0$0$0

For credit/debit cards and electronic wallets (Skrill, Neteller), the withdrawal amount cannot exceed the amount you deposited using the same instrument. This means that you can only withdraw your trading profits via bank transfer.

How long does it take to withdraw money from XM? We tested debit card withdrawal and it took 2 business days.

You can only withdraw money to accounts that are in your name.

How do you withdraw money from XM?

- Log in to your account

- Go to 'Withdraw Funds'

- Select the withdrawal method

- Enter the withdrawal amount

Visit Broker74.89% of retail CFD accounts lose money

Web trading platform

Trading platformScoreAvailableWeb2.8starsYesMobile3.8starsYesDesktop3.4starsYes

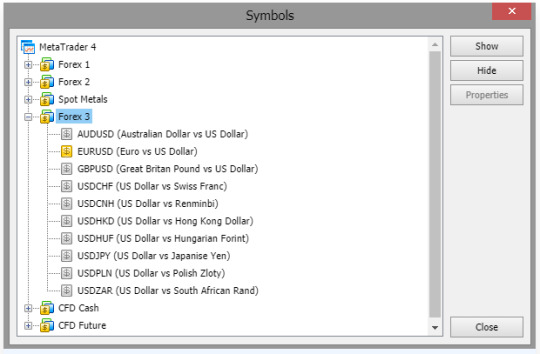

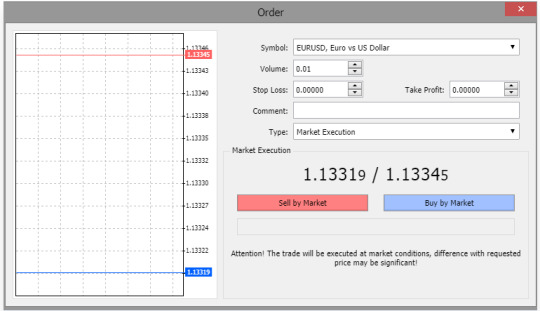

XM does not have its own trading platform; instead, it uses third-party platforms: MetaTrader 4 and MetaTrader 5. These platforms are very similar to each other in functionality and design. One major difference is that you can't trade stock CFDs on MetaTrader 4, only on MetaTrader 5.

We tested the MetaTrader 4 platform as it is more widely used.

MetaTrader 4 is available in an exceptionally large number of languages.

XM web trading platform languagesArabicBulgarianChineseCroatianCzechDanishDutchEnglishEstonianFinnishFrenchGermanGreekHebrewHindiHungarianIndonesianItalianJapaneseKoreanLatvianLithuanianMalayMongolianPersianPolishPortugueseRomanianRussianSerbianSlovakSlovenianSpanishSwedishTajikThaiTraditional ChineseTurkishUkrainianUzbekVietnamese

Look and feel

The XM web trading platform has great customizability. It is easy to change the size and the position of the tabs.

However, the platform feels outdated and some features are hard to find. For example, it took us a while to figure out how to add an asset to the watchlist.

Visit Broker74.89% of retail CFD accounts lose money

XM review - Web trading platform

Login and security

XM requires two-step authentication for the account login on the website where you can deposit and withdraw. The trading platform itself, however, doesn't have two-step authentication.

Search functions

The search functions are OK. You can find assets grouped into various categories. However, we missed the usual search function where you can type in the name of an asset manually.

XM review - Web trading platform - Search

Placing orders

You can use all the basic order types. However, you won't find more sophisticated order types such as 'one-cancels-the-other'. The following order types are available:

- Market

- Limit

- Stop

- Trailing Stop

Trailing Stop is available only in the MT4 desktop platform

To get a better understanding of these terms, read this overview of order types.

There are also order time limits you can use:

- Good 'til canceled (GTC)

- Good 'til time (GTT)

XM review - Web trading platform - Order panel

Alerts and notifications

You cannot set alerts and notifications on the XM web trading platform. This feature is available only on the desktop trading platform.

Portfolio and fee reports

XM has clear portfolio and fee reports. You can easily see your profit-loss balance and the commissions you paid. These reports can be found under the 'History' tab. We couldn't find a way to download them.

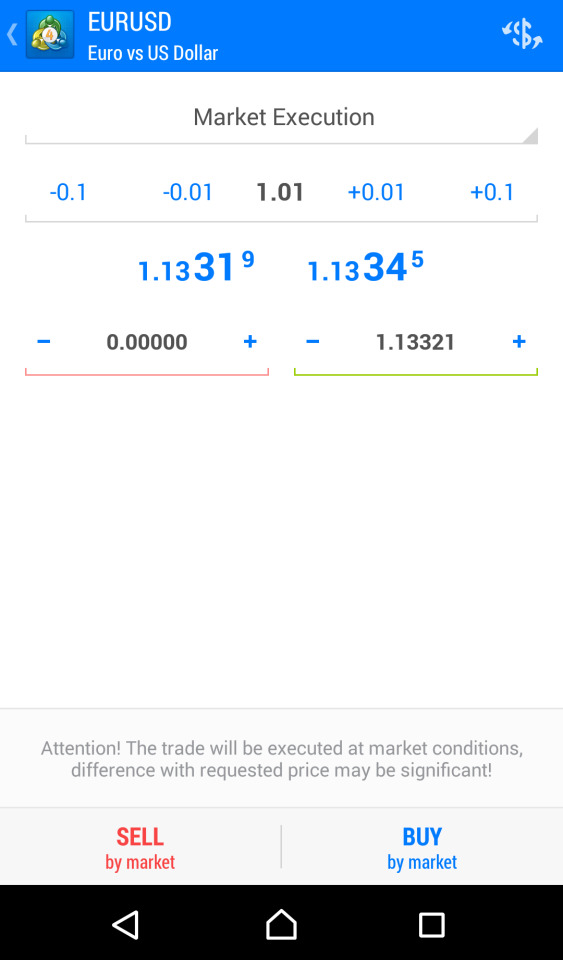

Mobile trading platform

XM offers MetaTrader 4 and MetaTrader 5 mobile trading platforms. Similarly to the web trading platform, we tested the MetaTrader 4 platform on Android.

Once you have downloaded the MT4 mobile trading platform, you should access the relevant XM server.

Just like on the web trading platform, you can choose from many languages on the mobile trading platform as well. Changing the language is a bit tricky on Android devices, as you can do it only if you switch the default language of your mobile.

XM mobile trading platform languagesArabicChinese (Simplified)Chinese (Traditional)CzechEnglishFrenchGermanGreekHindiIndonesianItalianJapaneseKoreanPolishPortuguesePortuguese (Brazil)RussianSpanishThaiTurkishUkrainianVietnamese

Look and feel

XM has a great mobile trading platform, we really liked its design and user-friendliness. It is easy to find all the features it provides.

XM review - Mobile trading platform

Login and security

XM requires only one-step login for the platform, but provides two-step account login to access deposit and withdrawal functions. A two-step login procedure for the trading platform would be safer.

You can't use fingerprint or Face ID authentication. Offering this feature would be more convenient.

Search functions

The search functions are good. You can search by typing the name of the product or by navigating the category folders.

XM review - Mobile trading platform - Search

Placing orders

You can use the same order types and order time limits as on the web trading platform.

XM review - Mobile trading platform - Order panel

Alerts and notifications

You can set alerts and notifications for your mobile, although only through the desktop trading platform. It would be much easier if you could set these notifications on the mobile trading platform as well.

Visit Broker74.89% of retail CFD accounts lose money

Desktop trading platform

For desktop trading too, you can use the MetaTrader 4 and 5 platforms; we tested MetaTrader 4.

It has the same design, is available in the same languages, offers the same order types, has the same search functions, and offers the same portfolio and fee reports as the web trading platform.

The desktop trading platform doesn't have two-step authentication; however, XM provides a two-step account login procedure on the website where you can deposit and withdraw funds.

The major difference is that you can set alerts and notifications on the desktop trading platform in the form of mobile push and email notifications. To set these, you have to add your email address and mobile MetaQuotes ID (you can find it in the MT4 app's settings). You can add them if you go to 'Tools' and then 'Options'.

Markets and products

XM is a CFD and forex broker with a great number of currency pairs available for trading. However, the CFD selection is lower compared to some XM alternatives.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XMFxProAdmirals (Admiral Markets)Currency pairs (#)557047Stock index CFDs (#)242943Stock CFDs (#)1,2611,7003,252ETF CFDs (#)--372Commodity CFDs (#)152528Bond CFDs (#)--2Cryptos (#)*-3042

Cryptos are available for customers onboarded under XM Global Limited entity.

You can't change the leverage levels of the products, which is a drawback. Changing the leverage manually is a very useful feature when you want to lower the risk of your trade. Be careful with forex and CFD trading, as the preset leverage levels may be high.

Real stocks and ETFs

XM provides real stocks for clients onboarded under XM's IFSC-regulated entity. You can trade stocks only using the Shares Account. It is a big addition compared to its competitors.

XMFxProAdmirals (Admiral Markets)Stock markets (#)3-11ETFs (#)--192

Visit Broker74.89% of retail CFD accounts lose money

Research

Trading ideas

XM provides trading ideas under the 'Trade Ideas' tab, where you can find various assets and their recent performances.

Read the full article

3 notes

·

View notes