#including the history of the blockchain

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

264 notes

·

View notes

Text

The Collective Intelligence Institute

History is written by the winners, which is why Luddite is a slur meaning “technophobe” and not a badge of honor meaning, “Person who goes beyond asking what technology does, to asking who it does it for and who it does it to.”

https://locusmag.com/2022/01/cory-doctorow-science-fiction-is-a-luddite-literature/

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/02/07/full-stack-luddites/#subsidiarity

Luddites weren’t anti-machine activists, they were pro-worker advocates, who believed that the spoils of automation shouldn’t automatically be allocated to the bosses who skimmed the profits from their labor and spent them on machines that put them out of a job. There is no empirical right answer about who should benefit from automation, only social contestation, which includes all the things that desperate people whose access to food, shelter and comfort are threatened might do, such as smashing looms and torching factories.

The question of who should benefit from automation is always urgent, and it’s also always up for grabs. Automation can deepen and reinforce unfair arrangements, or it can upend them. No one came off a mountain with two stone tablets reading “Thy machines shall condemn labor to the scrapheap of the history while capital amasses more wealth and power.” We get to choose.

Capital’s greatest weapon in this battle is inevitabilism, sometimes called “capitalist realism,” summed up with Frederic Jameson’s famous quote “It’s easier to imagine the end of the world than the end of capitalism” (often misattributed to Žižek). A simpler formulation can be found in the doctrine of Margaret Thatcher: “There Is No Alternative,” or even Dante’s “Abandon hope all ye who enter here.”

Hope — alternatives — lies in reviving our structural imagination, thinking through other ways of managing our collective future. Last May, Wired published a brilliant article that did just that, by Divya Siddarth, Danielle Allen and E. Glen Weyl:

https://www.wired.com/story/web3-blockchain-decentralization-governance/

That article, “The Web3 Decentralization Debate Is Focused on the Wrong Question,” set forth a taxonomy of decentralization, exploring ways that power could be distributed, checked, and shared. It went beyond blockchains and hyperspeculative, Ponzi-prone “mechanism design,” prompting me to subtitle my analysis “Not all who decentralize are bros”:

https://pluralistic.net/2022/05/12/crypto-means-cryptography/#p2p-rides-again

That article was just one installment in a long, ongoing project by the authors. Now, Siddarth has teamed up with Saffron Huang to launch the Collective Intelligence project, “an incubator for new governance models for transformative technology.”

https://cip.org/whitepaper

The Collective Intelligence Project’s research focus is “collective intelligence capabilities: decision-making technologies, processes, and institutions that expand a group’s capacity to construct and cooperate towards shared goals.” That is, asking more than how automation works, but who it should work for.

Collective Intelligence institutions include “markets…nation-state democracy…global governance institutions and transnational corporations, standards-setting organizations and judicial courts, the decision structures of universities, startups, and nonprofits.” All of these institutions let two or more people collaborate, which is to say, it lets us do superhuman things — things that transcend the limitations of the lone individual.

Our institutions are failing us. Confidence in democracy is in decline, and democratic states have failed to coordinate to solve urgent crises, like the climate emergency. Markets are also failing us, “flatten[ing] complex values in favor of over-optimizing for cost, profit, or share price.”

Neither traditional voting systems nor speculative markets are up to the task of steering our emerging, transformative technologies — neither machine learning, nor bioengineering, nor labor automation. Hence the mission of CIP: “Humans created our current CI systems to help achieve collective goals. We can remake them.”

The plan to do this is in two phases:

Value elicitation: “ways to develop scalable processes for surfacing and combining group beliefs, goals, values, and preferences.” Think of tools like Pol.is, which Taiwan uses to identify ideas that have the broadest consensus, not just the most active engagement.

Remake technology institutions: “technology development beyond the existing options of non-profit, VC-funded startup, or academic project.” Practically, that’s developing tools and models for “decentralized governance and metagovernance, internet standards-setting,” and consortia.

The founders pose this as a solution to “The Transformative Technology Trilemma” — that is, the supposed need to trade off between participation, progress and safety.

This trilemma usually yields one of three unsatisfactory outcomes:

Capitalist Acceleration: “Sacrificing safety for progress while maintaining basic participation.” Think of private-sector geoengineering, CRISPR experimentation, or deployment of machine learning tools. AKA “bro shit.”

Authoritarian Technocracy: “Sacrificing participation for progress while maintaining basic safety.” Think of the vulnerable world hypothesis weirdos who advocate for universal, total surveillance to prevent “runaway AI,” or, of course, the Chinese technocratic system.

Shared Stagnation: “Sacrificing progress for participation while maintaining basic safety.” A drive for local control above transnational coordination, unwarranted skepticism of useful technologies (AKA “What the Luddites are unfairly accused of”).

The Institute’s goal is to chart a fourth path, which seeks out the best parts of all three outcomes, while leaving behind their flaws. This includes deliberative democracy tools like sortition and assemblies, backed by transparent machine learning tools that help surface broadly held views from within a community, not just the views held by the loudest participants.

This dovetails into creating new tech development institutions to replace the default, venture-backed startup for “societally-consequential, infrastructural projects,” including public benefit companies, focused research organizations, perpetual purpose trusts, co-ops, etc.

It’s a view I find compelling, personally, enough so that I have joined the organization as a volunteer advisor.

This vision resembles the watershed groups in Ruthanna Emrys’s spectacular “Half-Built Garden,” which was one of the most inspiring novels I read last year (a far better source of stfnal inspo than the technocratic fantasies of the “Golden Age”):

https://pluralistic.net/2022/07/26/aislands/#dead-ringers

And it revives the long-dormant, utterly necessary spirit of the Luddites, which you can learn a lot more about in Brian Merchant’s forthcoming, magesterial “Blood In the Machine: The Origins of the Rebellion Against Big Tech”:

https://www.littlebrown.com/titles/brian-merchant/blood-in-the-machine/9780316487740/

This week (Feb 8–17), I’ll be in Australia, touring my book Chokepoint Capitalism with my co-author, Rebecca Giblin. We’ll be in Brisbane tomorrow (Feb 8), and then we’re doing a remote event for NZ on Feb 9. Next are Melbourne, Sydney and Canberra. I hope to see you!

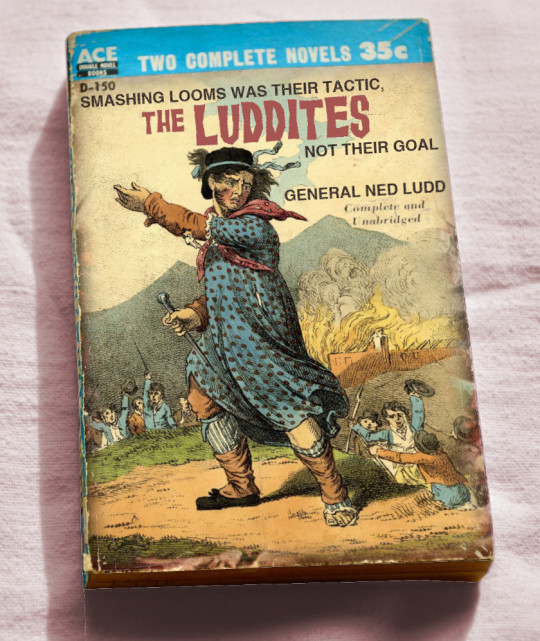

[Image ID: An old Ace Double paperback. The cover illustration has been replaced with an 18th century illustration depicting a giant Ned Ludd leading an army of Luddites who have just torched a factory. The cover text reads: 'The Luddites. Smashing looms was their tactic, not their goal.']

#pluralistic#ai#artificial intelligence#b-corps#collective intelligence#full-stack luddism#full-stack luddites#governance#luddism#ml#sortition#subsidiarity

621 notes

·

View notes

Text

The International Monetary Fund (IMF) published a report recently that warns about the very serious privacy risks associated with central bank digital currencies (CBDCs).

According to the paper, entitled "Central Bank Digital Currency Data Use and Privacy Protection," any central bank can use its CBDC system to collect all sorts of private information about users. It could then turn that private information over to the authorities for mass surveillance and possibly persecution reasons.

"CBDC data allows for commercial exploitation while also raising the possibility of state surveillance," the IMF warns.

The way CBDCs work is that every time a transaction is made, all sorts of private information is transferred and uploaded into the blockchain as proof. That information is then open game for government authorities and anyone else to exploit it for ulterior purposes.

"Central bank digital currency (CBDC), as a digital form of central bank money, may allow for a 'digital trail' – data – to be collected and stored," the paper explains.

"In contrast to cash, CBDC could be designed to potentially include a wealth of personal data, encapsulating transaction histories, user demographics, and behavioral patterns. Personal data could establish a link between counterparty identities and transactions."

The paper goes on to explain that there is economic value in CBDCs due to the data trail it creates. Data is considered an "infrastructural resource that can be used by an unlimited number of users and for an unlimited number of purposes as an input to produce goods and services."

"CBDC data could potentially be harvested by financial institutions that, in turn, could help develop data-driven businesses," the paper continues.

6 notes

·

View notes

Text

It’s a cartel in the classic economic and business sense—OPEC, not Sinaloa—a small group of connected actors working together to dominate a market that they only recently helped create. For crypto, where money is fake, value is purely hype-based, and new tokens can be spun out of nothing, it makes perfect sense. It’s a small industry, notionally worth $3 trillion at its peak in November 2021 but now hovering around $1 trillion. Many leading crypto luminaries know each other, interact on social media, trade with each other, and hobnob at small private gatherings like the Satoshi Roundtable, an annual invite-only meeting of select crypto insiders. Last spring, I confirmed via some attendees that Jean-Louis van der Velde, Tether’s elusive Hong Kong-based CEO, was at the invite-only FTX conference in the Bahamas, alongside luminaries like Bill Clinton and Tony Blair. In a public Twitter exchange, Bankman-Fried—whose Alameda hedge fund allegedly bought at least $36 billion worth of Tether in just a few years—said he didn’t know if van der Velde was there. I didn’t believe him.

Many crypto power players have histories with poker, online gambling, offshore finance, and/or other gray-market economies. A lot of them do business via so-called OTC, or over the counter, trades: person-to-person exchanges that might not leave a trace on the blockchain, crypto’s supposedly transparent public ledger. Over time, the industry, including its black-market participants, has developed its own protocols, social codes, and, as interests aligned, what amounted to an omerta. What was good for one member was often good for the rest.

40 notes

·

View notes

Text

A Comprehensive Guide to Solana : How to Buy Meme Tokens & Using Solana Meme Coin Maker

Introduction

In the dynamic world of cryptocurrency, Solana has emerged as a powerhouse blockchain platform known for its high speed, low fees, and scalability. Whether you’re a seasoned investor or new to the crypto scene, understanding Solana’s ecosystem can open up numerous opportunities. This guide will explore how to buy Solana, delve into the world of meme tokens on Solana, and introduce you to our platform, SolanaLauncher, a cutting-edge tool for creating your own Solana meme coins.

What is Solana?

Solana is a high-performance blockchain that supports decentralized applications and cryptocurrencies. Launched in 2020, Solana aims to provide fast, secure, and scalable blockchain solutions. Unlike many other blockchains, Solana can process thousands of transactions per second (TPS), thanks to its unique Proof of History (PoH) consensus mechanism.

Solana: How to Buy

Setting Up a Wallet

Before you can buy Solana (SOL), you need a digital wallet to store your tokens. Some popular Solana-compatible wallets include:

Phantom: A user-friendly wallet with excellent integration for Solana dApps.

Sollet: An open-source wallet that offers advanced features for developers.

Solflare: A secure wallet with staking capabilities.

Purchasing Solana

Once you have a wallet set up, you can buy Solana from major cryptocurrency exchanges. Here’s a step-by-step guide:

Choose an Exchange: Select a reputable exchange like Binance, Coinbase, or FTX.

Create an Account: Sign up and complete the necessary KYC (Know Your Customer) verification.

Deposit Funds: Deposit fiat currency (like USD) or other cryptocurrencies (like Bitcoin or Ethereum) into your exchange account.

Buy Solana: Navigate to the trading section, search for Solana (SOL), and place a buy order. You can choose a market order for immediate purchase or a limit order to buy at a specific price.

Transfer to Wallet: Once you have purchased SOL, transfer it to your Solana-compatible wallet for security.

Exploring Meme Tokens on Solana

What are Meme Tokens?

Meme tokens are a type of cryptocurrency inspired by internet memes and cultural trends. Unlike traditional cryptocurrencies, meme tokens often derive their value from social media buzz and community engagement. They can be highly volatile but offer unique opportunities for investors who can identify viral trends early.

Popular Meme Tokens on Solana

Solana’s high-speed and low-fee environment makes it an ideal platform for meme tokens. Some popular meme tokens on Solana include:

SAMO (Samoyedcoin): Inspired by the Samoyed dog breed, SAMO has garnered a strong community following.

COPE: A meme token that aims to provide users with a sense of community and belonging, COPE has seen significant engagement.

Creating Your Own Meme Token with Solana Meme Coin Maker

Why Create a Meme Token?

Creating your own meme token allows you to capitalize on viral trends, engage with a community, and even raise funds for projects. Meme tokens can serve various purposes, from entertainment and community building to innovative financial instruments.

Introducing SolanaLauncher

Our platform, SolanaLauncher, simplifies the process of creating meme tokens on Solana. With SolanaLauncher, you can generate your own meme tokens in less than three seconds without any coding knowledge. Here’s how you can get started:

Sign Up: Create an account on SolanaLauncher and log in to access the token creation tool.

Fill in Token Details: Enter the required details, such as token name, symbol, and total supply.

Generate Token: Click on “Create Token” and your meme token will be generated on the Solana blockchain instantly.

Benefits of Using SolanaLauncher

Ease of Use: SolanaLauncher is designed for users of all technical levels. You don’t need any programming skills to create your own token.

Speed: Create and deploy your token in less than three seconds, thanks to Solana’s high-speed network.

24/7 Support: Our dedicated support team is available around the clock to assist you with any questions or issues.

How to Promote Your Meme Token

Build a Community

Community engagement is crucial for the success of any meme token. Use social media platforms like Twitter, Reddit, and Discord to build and interact with your community. Regular updates, engaging content, and interactive events can help foster a loyal following.

Leverage Influencers

Collaborating with influencers in the crypto space can help boost the visibility of your meme token. Influencers can provide endorsements, share your content, and help drive community engagement.

Provide Utility

While meme tokens often start as fun projects, adding utility can enhance their value and longevity. Consider integrating your token with decentralized applications, offering staking rewards, or creating exclusive content or services for token holders.

Investing in Solana Meme Coins

Research and Due Diligence

Before investing in any meme token, conduct thorough research. Understand the project’s goals, the team behind it, and the strength of its community. Be wary of projects that lack transparency or seem too good to be true.

Diversify Your Portfolio

Diversification is key to managing risk in the volatile world of meme tokens. Spread your investments across multiple tokens and other types of cryptocurrencies to mitigate potential losses.

Stay Informed

The cryptocurrency market is highly dynamic. Stay informed about market trends, news, and developments in the Solana ecosystem. Following key influencers and joining relevant communities can provide valuable insights.

Conclusion

Solana offers a robust platform for buying, trading, and creating meme tokens, thanks to its high-speed transactions, low fees, and scalability. Whether you’re looking to invest in popular meme tokens or create your own, Solana provides the tools and infrastructure to succeed.

With SolanaLauncher, generating your own meme token has never been easier. In just a few clicks, you can turn your idea into a reality and engage with a global community. By leveraging Solana’s strengths and following best practices for investment and promotion, you can capitalize on the exciting opportunities in the meme token space.

Start your journey today with Solana and SolanaLauncher, and be part of the next wave of innovation in the cryptocurrency world. Whether you’re an investor, developer, or enthusiast, Solana’s vibrant ecosystem offers endless possibilities. Don’t miss out on the chance to be part of this revolutionary platform.

3 notes

·

View notes

Text

First Time Investing in Crypto: Tips for New Traders on the Digital Coin Market

This has changed the financial landscape for good; it is the first time in history that investors have a share of this type since cryptocurrency entered the market. But then again, getting into the crypto market to begin with can be incredibly intimidating for a novice. This includes some key tips that you must know for making trade-offs more intelligent and how to invest in cryptocurrencies.

1. Understand the Basics

Understand the basic principles of what Cryptocurrency is, how it works before you invest. If you're unfamiliar, cryptocurrencies are basically decentralized systems, operating with a peer-to-peer framework, that let users do all sorts of things like get rewards for paying on time or using an app. Because they are not organically produced like typical tender, these financial tools are meant to be circulated in a decentralized way via blockchain networks. Educate yourself onwards like blockchain, altcoins, wallets and exchanges.

2. Do Your Research

The value of cryptocurrencies is influenced by a number of factors, and this makes it an extremely volatile market. Learn about various cryptocurrencies and how they are used. Tools like CoinMarketCap and CoinGecko show trends, rankings other handy information regarding ranging and past data. Follow us on Twitter for more news and updates on the Bitcoin space.

3. Diversify Your Portfolio

Investors apply diversification in their investment strategies. Diversify by investing in multiple cryptocurrencies I mean, everyone knows Bitcoin and Ethereum — why not looking a little bit further down the line at some promising altcoins with real fundamentals. A healthy mix of investments can ensure you have a little exposure to any type of gain or loss that may arise.

4. Only Invest What You Can Afford to Lose

The world of crypto is such that even the prices can and do tend to rise or crash in a jiffy, thanks to high volatility. Gamble only with money you can afford to lose without impacting your finances. Never borrow to invest in crypto or use your emergency savings for crypto investing. This approach ensures that you still are able to stay financially safe in case there's a downtrend.

5. Choose a Reliable Exchange

It is important to be sure that you deal with reliable cryptocurrency exchanges for safe trading. Search for exchanges with strong security protocols, a simple UI, and broad coin support. Some of the most trusted exchanges that people have been using include Binance, Coinbase and Kraken. Are they regulated and insured for digital assets.

6. Secure Your Investments

In the world of crypto, security is vital. Keep your cryptocurrencies on hardware wallets or in cold storage solutions; simply turn on 2FA in your exchange accounts and do not publish or disclose the private keys. Keep your software up to date and watch out for phishing attacks and malware.

7. Stay Informed and Adapt

As we know the crypto market is alive and never takes a nap. Learn from the market, regulatory and tech changes. Engage in some of the crypto community forums on platforms like Reddit, Twitter and Telegram to get the benefits of inside knowledge from other investors. Change your investment plan based on new informational and market circumstances

8. Have a Long-Term Perspective

Although there is money in short-term trading, it often requires quite a bit of time and skill to excel what you do. Long term investment strategy If you are beginner, Long term is the best way for you to invest your money from beginning. Look at the long term growth potential of cryptocurrencies instead of trying to make a quick buck. I read many books and listend to a lot of podcasts about the stock market, nearly all these sources agreed that patience and discipline was key to becoming a successful long-term investor.

9. Seek Professional Advice

If you are uncertain about the investments, you can get help from financial advisors or even some crypto experts. They can offer some personalized advice, depending on your financial goals and comfort with risk. Expert help will make it easier for you to manage the particularly volatile world of crypto.

Conclusion

Investing in cryptocurrency can also be a lucrative endeavor as long the trader is well-versed when it comes to his or her craft. These basic principles, combined with extensive research, establishing a diversified portfolio, and security first will put you in good stead on your crypto investment journey. The key is to stay informed, adapt and think long-term in order for you to succeed.

#crypto#cryptocurrency#cryptocurreny trading#cryptocommunity#investing#economy#investment#bitcoin#ethereum#blockchain#personal finance#finance

2 notes

·

View notes

Text

BTC Nashville Conference 2024: A Gathering of Minds and Innovation

The BTC Nashville Conference 2024 kicks off today, bringing together some of the brightest minds and most influential figures in the cryptocurrency world. This event, set to run from July 25th to July 27th, promises to be a pivotal moment for the crypto community, offering insights, discussions, and networking opportunities that could shape the future of digital currencies.

Keynote Speakers

This year's conference features a lineup of notable speakers, including former President Donald Trump. Trump's speech is highly anticipated, especially given the recent speculation about his interest in Bitcoin as a US Treasury reserve asset. His stance on Bitcoin could potentially influence market dynamics and government policies.

Major Topics

The conference will cover a wide range of topics crucial to the future of Bitcoin and the broader crypto ecosystem. Key discussions will include:

Bitcoin Adoption and Regulation: Experts will delve into the challenges and opportunities in increasing Bitcoin adoption worldwide and the regulatory landscape shaping this process.

The Future of Digital Currencies: Speakers will explore the potential paths for digital currencies, examining trends, innovations, and market predictions.

Technological Advancements in Blockchain: Attendees will learn about the latest developments in blockchain technology and how these innovations can enhance security, scalability, and efficiency.

The Role of Bitcoin in the Global Economy: Discussions will focus on Bitcoin's impact on global markets, its potential as a hedge against inflation, and its role in the future financial system.

Significant Events

One of the most exciting aspects of the BTC Nashville Conference is the potential for major announcements. Recently, there has been significant buzz around the $1 billion inflows to the Ethereum ETF. This development could have far-reaching implications for the crypto market, influencing investor sentiment and market dynamics.

Bullish Outlook for Crypto

Moving forward, the outcomes of the BTC Nashville Conference could be highly bullish for the crypto market. Positive remarks from influential figures like Trump, coupled with significant announcements and advancements discussed at the conference, could drive increased confidence and investment in cryptocurrencies. The potential regulatory clarity and innovative breakthroughs highlighted at the event are likely to contribute to a more robust and dynamic crypto ecosystem.

Networking and Innovation

Beyond the scheduled talks and panels, the conference offers invaluable networking opportunities. Attendees will have the chance to connect with industry leaders, innovators, and fellow enthusiasts. These interactions can lead to collaborations, partnerships, and new ventures that drive the crypto space forward.

Conclusion

The BTC Nashville Conference 2024 is more than just a series of talks; it's a convergence of ideas and visions that could define the future of cryptocurrency. As we look forward to the insights and announcements from this event, it's clear that the conversations here will resonate far beyond the conference halls.

Stay tuned for updates and insights from the BTC Nashville Conference as we continue to explore the evolving landscape of digital currencies and their impact on our world.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#BTCNashville2024#BitcoinConference#CryptoEvent#BlockchainInnovation#Bitcoin#Cryptocurrency#DigitalCurrency#CryptoNews#Blockchain#CryptoCommunity#FinancialFreedom#CryptoAdoption#FutureOfFinance#BitcoinTechnology#CryptoBullish#financial empowerment#financial experts#unplugged financial#financial education#finance#globaleconomy

3 notes

·

View notes

Text

Transforming the Health Landscape: The Global Blockchain in Healthcare Market

The integration of blockchain technology into the healthcare sector is revolutionizing the way medical data is managed, shared, and secured. As the demand for transparent, efficient, and secure healthcare services grows, blockchain offers promising solutions to longstanding challenges.

Understanding Blockchain in Healthcare

Blockchain Technology is a decentralized digital ledger that records transactions across multiple computers in a way that ensures the security and transparency of data. In healthcare, blockchain can be used to manage patient records, track pharmaceuticals, ensure the integrity of clinical trials, and streamline administrative processes. The immutable nature of blockchain helps in preventing data breaches, ensuring data accuracy, and enhancing patient privacy.

According to BIS Research, the Global Blockchain in Healthcare Market was estimated to grow to a value of $5.61 billion by 2025, and still the market is showing a steep growth till 2030 witnessing a double-digit CAGR growth rate throughout the forecast period.

Key Market Dynamics

Several factors are driving the growth of the global blockchain in healthcare market:

Data Security and Privacy:

Need for robust data security and privacy solutions.

Healthcare data breaches are a growing concern.

Blockchain's secure, immutable nature protects sensitive patient information.

Interoperability and Data Sharing:

Facilitates seamless data sharing between healthcare providers and systems.

Overcomes current interoperability issues.

Leads to better patient outcomes by providing a comprehensive view of health history.

Supply Chain Transparency:

Tracks the entire lifecycle of drugs in the pharmaceutical industry.

Ensures the authenticity of medications.

Helps combat counterfeit drugs.

Efficient Administrative Processes:

Streamlines various administrative processes, such as billing and claims management.

Reduces fraud and administrative costs.

Support from Regulatory Bodies:

Increasing support from regulatory bodies and governments.

Initiatives by FDA and EMA to explore blockchain for drug traceability and clinical trials boost market growth.

Request for an updated Research Report on Global Blockchain in Healthcare Market Research.

Global Blockchain in Healthcare Industry Segmentation

Segmentation by Application:

Data Exchange and Interoperability

Supply Chain Management

Claims Adjudication and Billing Management

Clinical Trials and Research

Others

Segmentation by End-User:

Healthcare Providers

Pharmaceutical Companies

Payers

Others

Segmentation by Region:

North America

Europe

Asia-Pacific

Latin America and Middle East & Africa

Future Market Prospects

The future of the global blockchain in healthcare market looks promising, with several trends likely to shape its trajectory:

Integration with AI and IoT: The integration of blockchain with artificial intelligence (AI) and the Internet of Things (IoT) will enhance data analytics, predictive healthcare, and real-time monitoring.

Expansion of Use Cases: New use cases for blockchain in digital healthcare will emerge, including patient-centered care models, personalized medicine, and enhanced telemedicine services.

Focus on Patient-Centric Solutions: Blockchain will enable more patient-centric healthcare solutions, empowering patients with greater control over their health data and enhancing patient engagement.

Development of Regulatory Frameworks: The establishment of clear regulatory frameworks and industry standards will facilitate the widespread adoption of blockchain in healthcare.

Conclusion

The Global Blockchain in Healthcare Industry is poised for significant growth, driven by the need for enhanced data security, interoperability, supply chain transparency, and efficient administrative processes. By addressing challenges related to regulatory compliance, implementation costs, standardization, and scalability, and leveraging opportunities in technological advancements, investments, partnerships, and government initiatives, the potential of blockchain in healthcare can be fully realized. This technology promises to revolutionize healthcare delivery, enhancing efficiency, transparency, and patient outcomes, and setting new standards for the future of digital health.

#Blockchain in Healthcare Market#Blockchain in Healthcare Industry#Blockchain in Healthcare Market Report#Blockchain in Healthcare Market Research#Blockchain in Healthcare Market Forecast#Blockchain in Healthcare Market Analysis#Blockchain in Healthcare Market Growth#BIS Research#Healthcare

2 notes

·

View notes

Text

What is Blockchain Technology & How Does Blockchain Work?

Introduction

Gratix Technologies has emerged as one of the most revolutionary and transformative innovations of the 21st century. This decentralized and transparent Blockchain Development Company has the potential to revolutionize various industries, from finance to supply chain management and beyond. Understanding the basics of Custom Blockchain Development Company and how it works is essential for grasping the immense opportunities it presents.

What is Blockchain Development Company

Blockchain Development Company is more than just a buzzword thrown around in tech circles. Simply put, blockchain is a ground-breaking technology that makes digital transactions safe and transparent. Well, think of Custom Blockchain Development Company as a digital ledger that records and stores transactional data in a transparent and secure manner. Instead of relying on a single authority, like a bank or government, blockchain uses a decentralized network of computers to validate and verify transactions.

Brief History of Custom Blockchain Development Company

The Custom Blockchain Development Company was founded in the early 1990s, but it didn't become well-known until the emergence of cryptocurrencies like Bitcoin. The notion of a decentralized digital ledger was initially presented by Scott Stornetta and Stuart Haber. Since then, Blockchain Development Company has advanced beyond cryptocurrency and found uses in a range of sectors, including voting systems, supply chain management, healthcare, and banking.

Cryptography and Security

One of the key features of blockchain is its robust security. Custom Blockchain Development Company relies on advanced cryptographic algorithms to secure transactions and protect the integrity of the data stored within it. By using cryptographic hashing, digital signatures, and asymmetric encryption, blockchain ensures that transactions are tamper-proof and verifiable. This level of security makes blockchain ideal for applications that require a high degree of trust and immutability.

The Inner Workings of Blockchain Development Company

Blockchain Development Company data is structured into blocks, each containing a set of transactions. These blocks are linked together in a chronological order, forming a chain of blocks hence the name of Custom Blockchain Development Company. Each block contains a unique identifier, a timestamp, a reference to the previous block, and the transactions it includes. This interconnected structure ensures the immutability of the data since any changes in one block would require altering all subsequent blocks, which is nearly impossible due to the decentralized nature of the network.

Transaction Validation and Verification

When a new transaction is initiated, it is broadcasted to the network and verified by multiple nodes through consensus mechanisms. Once validated, the transaction is added to a new block, which is then appended to the blockchain. This validation and verification process ensures that fraudulent or invalid transactions are rejected, maintaining the integrity and reliability of the blockchain.

Public vs. Private Blockchains

There are actually two main types of blockchain technology: private and public. Public Custom Blockchain Development Company, like Bitcoin and Ethereum, are open to anyone and allow for a decentralized network of participants. On the other hand, private blockchains restrict access to a select group of participants, offering more control and privacy. Both types have their advantages and use cases, and the choice depends on the specific requirements of the application.

Peer-to-Peer Networking

Custom Blockchain Development Company operates on a peer-to-peer network, where each participant has equal authority. This removes the need for intermediaries, such as banks or clearinghouses, thereby reducing costs and increasing the speed of transactions. Peer-to-peer networking also enhances security as there is no single point of failure or vulnerability. Participants in the network collaborate to maintain the Custom Blockchain Development Company security and validate transactions, creating a decentralized ecosystem that fosters trust and resilience.

Blockchain Applications and Use Cases

If you've ever had to deal with the headache of transferring money internationally or verifying your identity for a new bank account, you'll appreciate How Custom Blockchain Development Company can revolutionize the financial industry. Custom Blockchain Development Company provides a decentralized and transparent ledger system that can streamline transactions, reduce costs, and enhance security. From international remittances to smart contracts, the possibilities are endless for making our financial lives a little easier.

Supply Chain Management

Ever wondered where your new pair of sneakers came from? Custom Blockchain Development Company can trace every step of a product's journey, from raw materials to manufacturing to delivery. By recording each transaction on the Custom Blockchain Development Company supply chain management becomes more transparent, efficient, and trustworthy. No more worrying about counterfeit products or unethical sourcing - blockchain has got your back!

Enhanced Security and Trust

In a world where hacking and data breaches seem to happen on a daily basis, Custom Blockchain Development Company offers a beacon of hope. Its cryptographic algorithms and decentralized nature make it incredibly secure and resistant to tampering. Plus, with its transparent and immutable ledger, Custom Blockchain Development Company builds trust by providing a verifiable record of transactions. So you can say goodbye to those sleepless nights worrying about your data being compromised!

Improved Efficiency and Cost Savings

Who doesn't love a little efficiency and cost savings? With blockchain, intermediaries and third-party intermediaries can be eliminated, reducing the time and cost associated with transactions. Whether it's cross-border payments or supply chain management, Custom blockchain Development Company streamlined processes can save businesses a ton of money. And who doesn't want to see those savings reflected in their bottom line?

The Future of Blockchain: Trends and Innovations

As Custom Blockchain Development Company continues to evolve, one of the key trends we're seeing is the focus on interoperability and integration. Different blockchain platforms and networks are working towards the seamless transfer of data and assets, making it easier for businesses and individuals to connect and collaborate. Imagine a world where blockchain networks can communicate with each other like old friends, enabling new possibilities and unlocking even more potential.

Conclusion

Custom Blockchain Development Company has the potential to transform industries, enhance security, and streamline processes. From financial services to supply chain management to healthcare, the applications are vast and exciting. However, challenges such as scalability and regulatory concerns need to be addressed for widespread adoption. With trends like interoperability and integration, as well as the integration of Blockchain Development Company with IoT and government systems, the future looks bright for blockchain technology. So strap on your digital seatbelt and get ready for the blockchain revolution!

#blockchain development company#smart contracts in blockchain#custom blockchain development company#WEB#websites

3 notes

·

View notes

Text

Smart contracts: Transformative applications of blockchain technology

Smart contracts are a key application of blockchain technology that utilizes programming code to automatically execute, control, and record contract terms without relying on traditional intermediaries. This technology is gradually transforming our understanding of contracts and transactions, bringing unprecedented efficiency and transparency to a wide range of industries. This article will delve into the benefits, application scenarios, and challenges of smart contracts.

Advantages of smart contracts

Automation: Once a smart contract is written and deployed on the blockchain, it can be automatically executed when preset conditions are met. This automation not only increases efficiency, but also reduces human error and latency.

Lower costs: Execution of smart contracts does not rely on third-party intermediaries such as lawyers, banks and other financial institutions, thus significantly reducing the cost of transaction and contract execution. This disintermediation not only reduces costs, but also simplifies the process.

Increase transparency: the terms of all smart contracts are open and transparent, and all interested parties can view the status and activity of the contract in real time. This transparency builds trust and reduces information asymmetries and misunderstandings.

Security and immutability: Blockchain technology ensures that once a contract is deployed, its contents and records cannot be modified, improving the security of contract execution. All transactions are transparent and cannot be changed once recorded, reducing the risk of fraud and malicious behavior.

Reduce the risk of fraud: Due to the transparency and immutability of contracts, smart contracts greatly reduce the possibility of fraud. All parties can view the transaction history and contract execution, ensuring that everything is fair and transparent.

Improve efficiency and speed: The automatic execution features of smart contracts greatly improve the efficiency of processing transactions and contracts. While traditional contracts can take days, weeks or even months to execute, smart contracts can be completed in minutes, dramatically increasing the speed of business operations.

Facilitate new business models and services: Smart contracts make it possible to create complex business models and automated services that are difficult to achieve in traditional contract frameworks. They open the way for the development of innovative financial instruments, decentralized applications (DApps) and automated systems.

Application scenarios of smart contracts

Smart contracts can be used in a wide range of scenarios, including but not limited to:

Financial services, such as creating decentralized finance (DeFi) applications that automatically execute contracts for lending, insurance, payments, and more.

Supply chain management, monitoring the flow of goods and automatically releasing payments when goods meet a certain condition or location.

Digital identity, manage and verify digital identification, and simplify the online authentication process.

Voting system, creating a transparent and immutable voting system to ensure the fairness of the voting process.

Copyright and Intellectual Property, automatically manage and enforce copyright payments and distribution to protect the interests of creators.

The challenges and limitations of smart contracts

While smart contracts offer many advantages, they also face some challenges and limitations, including:

Code security: The security of smart contracts depends on how their code is written, and the presence of vulnerabilities can lead to serious security issues.

Legal status and compliance: The legal status of smart contracts is unclear and there may be legal and regulatory uncertainties in different jurisdictions.

Dependence on external data: Many smart contracts need to rely on external data sources to trigger execution conditions, and if external data is inaccurate, it can affect the outcome of contract execution.

Technical barriers and complexity of use: Writing and deploying smart contracts requires specialized programming skills and can be a high technical barrier for the average user.

peroration

Smart contracts, a key application of blockchain technology, are opening up new areas of automated trading and application development. They have the advantages of increased transaction efficiency, reduced costs, increased transparency and security, but they also face some challenges, especially in terms of code security, legal status and dependence on external data. As technology advances and regulations improve, smart contracts are expected to continue to play an important role in various industries, driving the development of the digital economy.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

3 notes

·

View notes

Text

Smart contracts: Transformative applications of blockchain technology

Smart contracts are a key application of blockchain technology that utilizes programming code to automatically execute, control, and record contract terms without relying on traditional intermediaries. This technology is gradually transforming our understanding of contracts and transactions, bringing unprecedented efficiency and transparency to a wide range of industries. This article will delve into the benefits, application scenarios, and challenges of smart contracts.

Advantages of smart contracts

Automation: Once a smart contract is written and deployed on the blockchain, it can be automatically executed when preset conditions are met. This automation not only increases efficiency, but also reduces human error and latency.

Lower costs: Execution of smart contracts does not rely on third-party intermediaries such as lawyers, banks and other financial institutions, thus significantly reducing the cost of transaction and contract execution. This disintermediation not only reduces costs, but also simplifies the process.

Increase transparency: the terms of all smart contracts are open and transparent, and all interested parties can view the status and activity of the contract in real time. This transparency builds trust and reduces information asymmetries and misunderstandings.

Security and immutability: Blockchain technology ensures that once a contract is deployed, its contents and records cannot be modified, improving the security of contract execution. All transactions are transparent and cannot be changed once recorded, reducing the risk of fraud and malicious behavior.

Reduce the risk of fraud: Due to the transparency and immutability of contracts, smart contracts greatly reduce the possibility of fraud. All parties can view the transaction history and contract execution, ensuring that everything is fair and transparent.

Improve efficiency and speed: The automatic execution features of smart contracts greatly improve the efficiency of processing transactions and contracts. While traditional contracts can take days, weeks or even months to execute, smart contracts can be completed in minutes, dramatically increasing the speed of business operations.

Facilitate new business models and services: Smart contracts make it possible to create complex business models and automated services that are difficult to achieve in traditional contract frameworks. They open the way for the development of innovative financial instruments, decentralized applications (DApps) and automated systems.

Application scenarios of smart contracts

Smart contracts can be used in a wide range of scenarios, including but not limited to:

Financial services, such as creating decentralized finance (DeFi) applications that automatically execute contracts for lending, insurance, payments, and more.

Supply chain management, monitoring the flow of goods and automatically releasing payments when goods meet a certain condition or location.

Digital identity, manage and verify digital identification, and simplify the online authentication process.

Voting system, creating a transparent and immutable voting system to ensure the fairness of the voting process.

Copyright and Intellectual Property, automatically manage and enforce copyright payments and distribution to protect the interests of creators.

The challenges and limitations of smart contracts

While smart contracts offer many advantages, they also face some challenges and limitations, including:

Code security: The security of smart contracts depends on how their code is written, and the presence of vulnerabilities can lead to serious security issues.

Legal status and compliance: The legal status of smart contracts is unclear and there may be legal and regulatory uncertainties in different jurisdictions.

Dependence on external data: Many smart contracts need to rely on external data sources to trigger execution conditions, and if external data is inaccurate, it can affect the outcome of contract execution.

Technical barriers and complexity of use: Writing and deploying smart contracts requires specialized programming skills and can be a high technical barrier for the average user.

peroration

Smart contracts, a key application of blockchain technology, are opening up new areas of automated trading and application development. They have the advantages of increased transaction efficiency, reduced costs, increased transparency and security, but they also face some challenges, especially in terms of code security, legal status and dependence on external data. As technology advances and regulations improve, smart contracts are expected to continue to play an important role in various industries, driving the development of the digital economy.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

3 notes

·

View notes

Text

Smart contracts: Transformative applications of blockchain technology

Smart contracts are a key application of blockchain technology that utilizes programming code to automatically execute, control, and record contract terms without relying on traditional intermediaries. This technology is gradually transforming our understanding of contracts and transactions, bringing unprecedented efficiency and transparency to a wide range of industries. This article will delve into the benefits, application scenarios, and challenges of smart contracts.

Advantages of smart contracts

Automation: Once a smart contract is written and deployed on the blockchain, it can be automatically executed when preset conditions are met. This automation not only increases efficiency, but also reduces human error and latency.

Lower costs: Execution of smart contracts does not rely on third-party intermediaries such as lawyers, banks and other financial institutions, thus significantly reducing the cost of transaction and contract execution. This disintermediation not only reduces costs, but also simplifies the process.

Increase transparency: the terms of all smart contracts are open and transparent, and all interested parties can view the status and activity of the contract in real time. This transparency builds trust and reduces information asymmetries and misunderstandings.

Security and immutability: Blockchain technology ensures that once a contract is deployed, its contents and records cannot be modified, improving the security of contract execution. All transactions are transparent and cannot be changed once recorded, reducing the risk of fraud and malicious behavior.

Reduce the risk of fraud: Due to the transparency and immutability of contracts, smart contracts greatly reduce the possibility of fraud. All parties can view the transaction history and contract execution, ensuring that everything is fair and transparent.

Improve efficiency and speed: The automatic execution features of smart contracts greatly improve the efficiency of processing transactions and contracts. While traditional contracts can take days, weeks or even months to execute, smart contracts can be completed in minutes, dramatically increasing the speed of business operations.

Facilitate new business models and services: Smart contracts make it possible to create complex business models and automated services that are difficult to achieve in traditional contract frameworks. They open the way for the development of innovative financial instruments, decentralized applications (DApps) and automated systems.

Application scenarios of smart contracts

Smart contracts can be used in a wide range of scenarios, including but not limited to:

Financial services, such as creating decentralized finance (DeFi) applications that automatically execute contracts for lending, insurance, payments, and more.

Supply chain management, monitoring the flow of goods and automatically releasing payments when goods meet a certain condition or location.

Digital identity, manage and verify digital identification, and simplify the online authentication process.

Voting system, creating a transparent and immutable voting system to ensure the fairness of the voting process.

Copyright and Intellectual Property, automatically manage and enforce copyright payments and distribution to protect the interests of creators.

The challenges and limitations of smart contracts

While smart contracts offer many advantages, they also face some challenges and limitations, including:

Code security: The security of smart contracts depends on how their code is written, and the presence of vulnerabilities can lead to serious security issues.

Legal status and compliance: The legal status of smart contracts is unclear and there may be legal and regulatory uncertainties in different jurisdictions.

Dependence on external data: Many smart contracts need to rely on external data sources to trigger execution conditions, and if external data is inaccurate, it can affect the outcome of contract execution.

Technical barriers and complexity of use: Writing and deploying smart contracts requires specialized programming skills and can be a high technical barrier for the average user.

peroration

Smart contracts, a key application of blockchain technology, are opening up new areas of automated trading and application development. They have the advantages of increased transaction efficiency, reduced costs, increased transparency and security, but they also face some challenges, especially in terms of code security, legal status and dependence on external data. As technology advances and regulations improve, smart contracts are expected to continue to play an important role in various industries, driving the development of the digital economy.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

4 notes

·

View notes

Text

I'd like to remind people that Web 2.0 != big social media sites. Web 2.0 includes social media, but there's a stage that's being missed.

Web 1.0 refers to the earliest stages of the Internet as we know it. Static pages without much capacity for end user interaction. This stage is reasonably well understood, and not the topic I want to discuss today.

Proto-Web 2.0 was basically just Web 1.0, but with comment sections. You know, the ancestor of Disquis. "User-generated content" as a supplement to static Web 1.0 stuff.

Then there were things like BBCode forums. These were little websites where communities with a common interest gather to talk about them. Websites built around "user-generated content" as a core feature. Some (including forums I spent a lot of time on in high school like Bay12 and GitP) are forums bolted to the side of "static" content like opinion pieces or indie video game projects; others are just forums.

(There's also stuff like wikis and 4chan which I think operate on roughly the same wavelength, but I don't have much experience with them. Aside from reading wikis, of course.)

Then there's the social media we all know and loathe today—centralized, algorithm-heavy, data-hungry, monolithic. They dominate the modern web for a whole host of economic reasons I don't really want to get into, and are what most people mean when they say Web 2.0.

And those people are wrong. Not just because they're using a word wrong; that's something I can usually tolerate, unless that word is "literally". They're wrong because they make criticisms of "Web 2.0" that only apply to the social media giants.

This is especially frustrating to me because of the Web 3.0 crowd. They talk about how their decentralized blockchain nonsense will solve all the problems of centralized social media platforms, because they do things that pre-social-media Web 2.0 managed to somehow pull off without the overhead of a public append-only database that requires you to burn a few gigajoules of electricity for each entry. Obfuscating the existence of decentralized online communities which didn't need to be bolted onto an NFT scam gives Web 3.0 grifters a scrap of legitimacy, which is far more than they deserve.

Also, BBCode forums are great and I think more people should use them...in part because I agree with many Web 2.0 haters' criticisms of big social media sites. Simplifying Internet history to "ARPAnet, Geocities, Facebook" ignores whole swathes of web history that should be remembered—both for their own sake and for ours.

#specifically not calling out any one example because I've seen several (not all of which are on Tumblr)#web 2.0#internet history#social media#internet

7 notes

·

View notes

Text

MetaTdex Obtains Groundbreaking License from DMCC: A Step Forward for the Mainstream Adoption and Legitimacy of Cryptocurrency

MetaTdex, a decentralized exchange based in Dubai, has made history by becoming the first decentralized exchange to obtain a license from the Dubai Multi Commodities Centre (DMCC). This achievement marks a significant milestone for the company, as it now has legal and regulatory backing to provide all encrypted digital asset exchange services in Dubai, including Bitcoin (BTC), Ether (ETH), USDT token and more.

The license (No. DMCC-870791) means that MetaTdex has obtained the authority to provide these services in a compliant and secure manner, ensuring that users can participate in Web 3.0 finance with confidence. This is a major step forward for the industry, as it promotes the mainstream adoption of cryptocurrency and blockchain technology.

MetaTdex established an operation center in Dubai in August 2022, and in just four months since moving into their new office, the company has already secured both a US MSB (Money Services Business) and Dubai DMCC license. This rapid progress is a testament to the hard work and dedication of the MetaTdex team, as well as the favorable regulatory environment in Dubai for cryptocurrency and blockchain technology.

Furthermore, MetaTdex is not content to rest on their laurels, and they are actively working on obtaining more licenses such as Dubai MTL (Metals and Minerals trading License), VARA (Virtual Asset Service Provider), DIFC (Dubai International Financial Centre), ADGM (Abu Dhabi Global Market). This indicates their goal to open up the connection between cryptocurrency and traditional stock markets, allowing users to gain more benefits in a compliant and secure Web 3.0 finance environment.

The development of the blockchain and cryptocurrency ecosystem in Dubai is something that is worth paying attention to. The DMCC license granted to MetaTdex is an indication that the government is committed to creating an environment that is favorable for blockchain technology and cryptocurrency. With a rapidly advancing regulatory environment, we can expect to see more companies following in MetaTdex’s footsteps and obtaining licenses to operate in Dubai.

In conclusion, the success of MetaTdex in obtaining a license from the DMCC is a significant achievement not only for the company but also for the entire blockchain and cryptocurrency industry. It is a clear signal that Dubai is open to innovative technologies and is working to create a favorable environment for their development. This is an encouraging development and it will be interesting to see how the ecosystem in Dubai continues to evolve in the coming years.

Join our Community to get the latest update on MetaTdex:

Main Group: https://t.me/MetaTdex_group

MetaTdex Twitter https://mobile.twitter.com/MetaTdex

Start your web3.0 journey with MetaTdex. www.metatdex.com

12 notes

·

View notes

Text

“The DeFi Game Changer on Solana: Unlocking Unprecedented Opportunities”

Introduction

In the dynamic world of decentralized finance (DeFi), new platforms and innovations are constantly reshaping the landscape. Among these, Solana has emerged as a game-changer, offering unparalleled speed, low costs, and robust scalability. This blog delves into how Solana is revolutionizing DeFi, why it stands out from other blockchain platforms, and what this means for investors, developers, and users.

What is Solana?

Solana is a high-performance blockchain designed to support decentralized applications and cryptocurrencies. Launched in 2020, it addresses some of the most significant challenges in blockchain technology, such as scalability, speed, and high transaction costs. Solana’s architecture allows it to process thousands of transactions per second (TPS) at a fraction of the cost of other platforms.

Why Solana is a DeFi Game Changer

1. High-Speed Transactions

One of Solana’s most remarkable features is its transaction speed. Solana can handle over 65,000 transactions per second (TPS), far exceeding the capabilities of many other blockchains, including Ethereum. This high throughput is achieved through its unique Proof of History (PoH) consensus mechanism, which timestamps transactions, allowing them to be processed quickly and efficiently.

2. Low Transaction Fees

Transaction fees on Solana are incredibly low, often less than a fraction of a cent. This affordability is crucial for DeFi applications, where high transaction volumes can lead to significant costs on other platforms. Low fees make Solana accessible to a broader range of users and developers, promoting more widespread adoption of DeFi solutions.

3. Scalability

Solana’s architecture is designed to scale without compromising performance. This scalability ensures that as the number of users and applications on the platform grows, Solana can handle the increased load without experiencing slowdowns or high fees. This feature is essential for DeFi projects that require reliable and consistent performance.

4. Robust Security

Security is a top priority for any blockchain platform, and Solana is no exception. It employs advanced cryptographic techniques to ensure that transactions are secure and tamper-proof. This high level of security is critical for DeFi applications, where the integrity of financial transactions is paramount.

Key Innovations Driving Solana’s Success in DeFi

Proof of History (PoH)

Solana’s Proof of History (PoH) is a novel consensus mechanism that timestamps transactions before they are processed. This method creates a historical record that proves that transactions have occurred in a specific sequence, enhancing the efficiency and speed of the network. PoH reduces the computational burden on validators, allowing Solana to achieve high throughput and low latency.

Tower BFT

Tower Byzantine Fault Tolerance (BFT) is Solana’s implementation of a consensus algorithm designed to maximize speed and security. Tower BFT leverages the synchronized clock provided by PoH to achieve consensus quickly and efficiently. This approach ensures that the network remains secure and resilient, even as it scales.

Sealevel

Sealevel is Solana’s parallel processing engine that enables the simultaneous execution of thousands of smart contracts. Unlike other blockchains, where smart contracts often face bottlenecks due to limited processing capacity, Sealevel ensures that Solana can handle multiple contracts concurrently. This capability is crucial for the development of complex DeFi applications that require high performance and reliability.

Gulf Stream

Gulf Stream is Solana’s mempool-less transaction forwarding protocol. It enables validators to forward transactions to the next set of validators before the current set of transactions is finalized. This feature reduces confirmation times, enhances the network’s efficiency, and supports high transaction throughput.

Solana’s DeFi Ecosystem

Leading DeFi Projects on Solana

Solana’s ecosystem is rapidly expanding, with numerous DeFi projects leveraging its unique features. Some of the leading DeFi projects on Solana include:

Serum: A decentralized exchange (DEX) that offers lightning-fast trading and low transaction fees. Serum is built on Solana and provides a fully on-chain order book, enabling users to trade assets efficiently and securely.

Raydium: An automated market maker (AMM) and liquidity provider built on Solana. Raydium integrates with Serum’s order book, allowing users to access deep liquidity and trade at competitive prices.

Saber: A cross-chain stablecoin exchange that facilitates seamless trading of stablecoins across different blockchains. Saber leverages Solana’s speed and low fees to provide an efficient and cost-effective stablecoin trading experience.

Mango Markets: A decentralized trading platform that combines the features of a DEX and a lending protocol. Mango Markets offers leverage trading, lending, and borrowing, all powered by Solana’s high-speed infrastructure.

The Future of DeFi on Solana

The future of DeFi on Solana looks incredibly promising, with several factors driving its continued growth and success:

Growing Developer Community: Solana’s developer-friendly environment and comprehensive resources attract a growing community of developers. This community is constantly innovating and creating new DeFi applications, contributing to the platform’s vibrant ecosystem.

Strategic Partnerships: Solana has established strategic partnerships with major players in the crypto and tech industries. These partnerships provide additional resources, support, and credibility, driving further adoption of Solana-based DeFi solutions.

Cross-Chain Interoperability: Solana is actively working on cross-chain interoperability, enabling seamless integration with other blockchain networks. This capability will enhance the utility of Solana-based DeFi applications and attract more users to the platform.

Institutional Adoption: As DeFi continues to gain mainstream acceptance, institutional investors are increasingly looking to platforms like Solana. Its high performance, low costs, and robust security make it an attractive option for institutional use cases.

How to Get Started with DeFi on Solana

Step-by-Step Guide

Set Up a Solana Wallet: To interact with DeFi applications on Solana, you’ll need a compatible wallet. Popular options include Phantom, Sollet, and Solflare. These wallets provide a user-friendly interface for managing your SOL tokens and interacting with DeFi protocols.

Purchase SOL Tokens: SOL is the native cryptocurrency of the Solana network. You’ll need SOL tokens to pay for transaction fees and interact with DeFi applications. You can purchase SOL on major cryptocurrency exchanges like Binance, Coinbase, and FTX.

Explore Solana DeFi Projects: Once you have SOL tokens in your wallet, you can start exploring the various DeFi projects on Solana. Visit platforms like Serum, Raydium, Saber, and Mango Markets to see what they offer and how you can benefit from their services.

Provide Liquidity: Many DeFi protocols on Solana offer opportunities to provide liquidity and earn rewards. By depositing your assets into liquidity pools, you can earn a share of the trading fees generated by the protocol.

Participate in Governance: Some Solana-based DeFi projects allow token holders to participate in governance decisions. By staking your tokens and voting on proposals, you can have a say in the future development and direction of the project.

Conclusion

Solana is undoubtedly a game-changer in the DeFi space, offering unparalleled speed, low costs, scalability, and security. Its innovative features and growing ecosystem make it an ideal platform for developers, investors, and users looking to leverage the benefits of decentralized finance. As the DeFi landscape continues to evolve, Solana is well-positioned to lead the charge, unlocking unprecedented opportunities for financial innovation and inclusion.

Whether you’re a developer looking to build the next big DeFi application or an investor seeking high-growth opportunities, Solana offers a compelling and exciting path forward. Dive into the world of Solana and discover how it’s transforming the future of decentralized finance.

#solana#defi#dogecoin#bitcoin#token creation#blockchain#crypto#investment#currency#token generator#defib#digitalcurrency#ethereum

3 notes

·

View notes

Text

Can blockchain clean up the gold industry in Brazil and across the globe?