#itr filing online 2023-24

Text

Our ITR Filing Plan Starting from for salaried person rs749 but now we offer only rs 499 , offer valid only 21 july 2024 so hurry up file your ITR with taxring Why choose taxring read Description Click here to choose the plan that suits you best! https://taxring.com/service/top-plan…

File your ITR with TaxRing and enjoy:

- Easy and quick filing process

- Expert assistance from our team of CAs

- Maximum refund guaranteed

- Filing for last 3 years' returns

- Tax planning and consultation

- Refund claims and follow-up

Don't wait, file your ITR now and avoid unnecessary penalties and fees!

whatsapp now - +91 9711296343

Visit us - https://taxring.com

#itr filing#taxring#income tax#taxation#itr#taxes#taxation services#itr filing last date#itr filing for fy 2023-24#income tax filing#income tax calculator#income tax department#income tax return#income tax notice#file itr#capital gain#file itr for salaried#file itr for business#itr filing online#return filing

2 notes

·

View notes

Video

youtube

How to determine residential status of an individual in Income Tax| Check before filing itr fy 2023-24

#youtube#how to file itr fy 2023-24#how to file itr1 fy 2023-24#itr1 fy 2023-24 offline#how to file online itr1 fy 2023-24#cadeveshthakur

0 notes

Video

youtube

3rd lecture - income tax act I income tax return file kaise banaye I IT...

#youtube#basic of income tax I income tax return filing 2023-24 I itr filing online 2023-24 kaise bhare I income tax return file kaise banaye itr 1

0 notes

Text

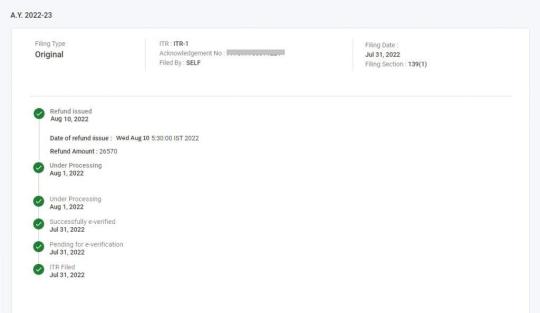

Income Tax Refund - How To Check Income Tax Refund Status For FY 2023-24 (AY 2024-25)?

Missed the ITR deadline? Don't worry! You can still file your Income Tax Return before December 31st, 2024, with a belated return. Need help? Contact us, Taxring experts, and we'll guide you through the process. Avoid penalties and file your belated return with ease. Reach out to us today!

What is an Income Tax Refund?

An income tax refund is a reimbursement from the government when you’ve overpaid your taxes during a financial year. This excess amount is returned to you after the tax authorities review your payments and liabilities.

For example, if a taxpayer pays Rs. 15,000 in taxes for the fiscal year 2023-2024 but has an actual tax burden of just Rs. 10,000, the Income Tax Department will reimburse Rs. 5,000 to the taxpayer. After filing and validating the income tax return, the department will start processing it. Once the return has been processed, the refund is typically credited to the taxpayer's bank account within four to five weeks.

How Does an Income Tax Refund Work?

1. Overpayment:Sometimes, taxpayers end up paying more tax than required through mechanisms such as: - Tax Deducted at Source (TDS)

- Advance Tax Payments

- Self-Assessment Tax

2. Filing Your Return: When you file your income tax return (ITR), you report your total income, deductions, and the taxes you've already paid.

3. Assessment:The tax authorities then assess your return to determine your actual tax liability. This includes reviewing your claims for deductions, exemptions, and tax credits.

4. Refund Calculation: If the tax authorities determine that your actual tax liability is lower than what you’ve already paid, the excess amount is calculated as your refund.

5. Receiving the Refund:Once your return is processed and approved, the excess amount is refunded to you. Note:To receive your income tax refund, you must complete the e-filing of your return. Ensure that all details are accurately filled out to avoid delays in processing.

If you've paid more taxes than you owe, you can request a refund for the excess amount. To track your refund status, simply use the Income Tax Department's online facility.

Here’s how:

1. Check Your Refund Status: Enter your PAN (Permanent Account Number) and the Assessment Year on the official portal to see the progress of your refund.

2. Refund Timeline: Refunds are usually processed within 4-5 weeks after e-verifying your return.

3. If Delayed:

- Review Your Return: Log in to the e-filing portal, go to "e-File" > "Income Tax Returns" > View Filed Returns to check for discrepancies.

- Check Your Email:Look for notifications from the Income Tax Department regarding your refund status.

- Track Your Refund:Use the online tools provided to monitor your refund progress.

How to Claim Your Income Tax Refund

1. File Your Income Tax Return:Submit your return with details of your income, deductions, and taxes paid.

2. Refund Calculation:The refund amount you’re eligible for will be automatically calculated and shown in your return.

Follow these steps to ensure you receive the refund you're due!

To receive an income tax refund, you must complete the e-filing process. Make sure you e-file this year to receive your tax refund sooner.

How to Easily Calculate Your Income Tax Refund

If you’ve paid more tax than you actually owe, you can get the extra amount back as a refund. Here’s a simple way to figure it out:

Refund Calculation:

Refund = Taxes Paid – Tax Liability

Steps to Calculate Your Refund:

1. Add Up Your Taxes Paid: This includes Advance Tax, TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and Self-Assessment Tax.

2. Find Your Tax Liability:This is the total tax you actually owe for the year.

3. Subtract Your Tax Liability from Taxes Paid:This will give you the amount of your refund.

Example:

Let’s say Mr. Gupta paid ₹3,00,000 as advance tax. At the end of the year, he finds out his total tax liability is only ₹2,00,000. Here’s how to calculate his refund:

₹3,00,000 (Taxes Paid) - ₹2,00,000 (Tax Liability) = ₹1,00,000 (Refund)

What To Do Next:

File your Income Tax Return (ITR). The tax department will check your details, and if everything is correct, they’ll send the ₹1,00,000 refund to your bank account.

It’s that simple! Get started and claim your refund today!

How can I Check My Income tax Refund Status for 2024-25?

1. Use the Income Tax Portal.

Step 1: Access the income tax portal and sign in to your account.

Step 2: Click on 'e-File', choose 'Income Tax Returns' and then select ‘View Filed Returns’

Step 3: You can see the status of your current and past income tax returns.

Step 4: Click on 'View details,' and you'll see the status of your income tax refund, as shown in the picture below.

2. Through NSDL Portal

Step 1: Visit the NSDL Portal

Step 2: Enter your PAN details, select the Assessment Year from the drop-down option for which tax refund is awaited and enter the Captcha Code

Step 3: Click ‘Proceed’ under the ‘Taxpayer Refund (PAN)’ option

You will be directed to a page that displays the ‘Refund Status’.

3. Through TRACES

Step 1: Log in to the income tax portal

Step 2: Click on ‘e-File’, select ‘Income Tax Returns’ and hit ‘View Form 26AS’

Step 3: You will be directed to the TDS Reconciliation Analysis and Correction Enabling System (TRACES) page, and Click on ‘View Tax Credit (Form 26AS/Annual tax statement) at the bottom of the page

Step 4: Select the Assessment Year from the drop-down menu, and select view as ‘text’

You are directed to a page that displays the details of the paid refund

Related Articles:

Old Vs New Tax regime

How to file ITR after the deadline

What are the reasons for Refund Failure?

Income tax Audit under section 44AB

What is a Belated Return & How to file a Belated Return ?

0 notes

Text

What is ITR-2 form: How to file ITR-2 FY 2022-23 (AY 2023-24) - Tax Craft Hub

The ITR-2 form is an Income Tax Return form used by individuals and Hindu Undivided Families (HUFs) in India who do not have income from business or profession, but have income from salary/pension, house property, capital gains, foreign assets/income, and other sources. To file ITR-2 for FY 2022-23, gather necessary documents such as PAN card, Aadhaar card, bank details, Form 16, Form 26AS, and investment proofs. You can file online via the Income Tax e-Filing portal or offline by downloading the form utility, filling it, generating an XML file, and uploading it. After filling in personal, income, tax, and deduction details, validate the form, compute the tax, and submit it. Finally, verify the return electronically or by sending a signed ITR-V to the CPC Bangalore within 120 days.

For More Information About What is ITR-2 Form

0 notes

Text

ITR filing 2024: Approved banks for tax payments, refunds, and additional

ITR filing 2024: The last date to file the income tax return (ITR) is July 31, 2024 for financial year 2023-24 (assessment year 2024-25).

You will have to pay the difference if your taxable income is greater than the TDS (tax deducted at source) that you paid for the year. Any of the 28 banks that have been approved by the Income Tax Department can be utilized for doing this online. Axis Bank,…

0 notes

Video

youtube

#lallulal #lallulalnews @lallulalnews ITR फाइल करने से पहले फॉर्म-16 में ये चीजें चेक करना न भूलें, देखें पूरी डिटेल्स में #itr20024 #itr #itrfilling #incometax #incometaxreturn #incometaxnotices #incometaxrevisionbcom #incometaxact #incometaxefiling #incometaxindiaefiling income tax return,income tax,how to file income tax return,income tax return filing 2023-24,income tax returns,income tax return filing,income tax return filing 2024-25,income tax return kaise bhare,income tax slab,income tax return kya hai,what is income tax return,why to file income tax return,income tax return filing 2024,how to file income tax return 2020,tax,benefits of filing income tax return,how to file income tax return 2024-25 Lallu Lal (लल्लू लाल)- हे भैया सच्ची खबर तो लल्लू लाल ही देंगे..भारत के हर कोने से चुनी गई खबरों का संग्रह। भारत के राजनैतिक, सामाजिक और आर्थिक मुद्दों पर गहराई से जानकारी देना हमारा लक्ष्य है। हम यहाँ पर हर विषय को गहराई से देखते हैं, ताकि भारत के करोड़ों Online User के पास सही खबर मिले। चीजें चेक करना न भूलें, देखें पूरी...

0 notes

Text

Your Path to Financial Clarity: A Simple Guide to Income Tax Return Filing

It can be a difficult task to file Income Tax Return but it is an important aspect of financial responsibility. Online ITR Filing offers a number of benefits. If you understand about the Income Tax Return Filing properly then this annual task will become smooth for you. Here, in this article we will jump into the deep ocean of ITR Filing and explain you everything.

Importance of Income Tax Return Filing

Legal Compliance

Proof of Income

Avoid Penalties

Claim Refunds

Carry Forward Losses

Process of Income Tax Refund Filing

Step 1: Gather Necessary Documents: First of all you have to gather all the essential financial documents including audited financial statements, bank statements, receipts related to TDS, and all the other supporting documents related to your income and expenditure.

Step 2: Select the Correct ITR: Then, you have to select the appropriate ITR Form as per your income sources.

Step 3: Compute Your Tax Liability: After that, you have to calculate your total income including all the applicable exemptions and deductions. And then compute your tax liability.

Step 4: Prepare and Validate Your ITR: Then you have to file your ITR online via e-filing portal of Income Tax Department. Also validate your form to make sure that all the mandatory fields have been filled accurately.

Step 5: Upload and Submit: After that you have to upload your respective ITR along with all the required documents. At last submit your ITR electronically.

Step 6: Verification: After the successful submission, E- Verification of ITR is the most crucial & important step. You have the option to e — verify the ITR via Aadhaar OTP, Net banking, EVC i.e. Electronic Verification Code or by sending a physical copy of ITR to CPC Bengaluru. You can also verify your ITR by using DSC i.e. Digital Signature Certificate.

Step 7: Acknowledgement: At last after the completion of the verification step, you will get an acknowledgement receipt from the Income Tax Department. You should keep this receipt safely for your future reference.

Deadline of Income Tax Return Filing

The Income Tax Return Last Date for FY 2023–24 will be 31st July 2024. However, for the taxpayers who have been required to conduct an income tax audit and have business income, ITR Filing last date will be 31st October 2024. This date will remain as it is until government has extended it.

Conclusion

Income Tax Return Filing can become more manageable as well as very beneficial for you if you understand its importance and ITR Filing process. You can stay compliant, claim your refunds, and also enjoy the financial clarity that you get only with accurate ITR Filing.

Learn More

#File Income Tax Return#income tax return filing#itr filing#itr filing last date#file itr online#income tax return last date#itr filing online#online itr filing#ca near me for itr filing#itr filing consultants

0 notes

Text

youtube

#how to file income tax return fy 2023 24#how to file itr1 online#how to file itr1#how to file itr#how to file itr1 online with form16#how to file itr1 ay 2024 25#how to file itr 1#how to file itr1 ay 2024-25#Youtube

0 notes

Video

youtube

ITR (Income Tax Return) Online Filing.

How Salaried Taxpayers can file ITR (Income Tax Return) Online for F.Y. 2023-24?

0 notes

Text

Income Tax Return Filing for AY 2024-25

Income Tax Return Filing for AY 2024-25 has been started. The last date to file Income Tax Return (ITR) for FY 2023-24 (AY 2024-25) without a late fee is 31st July 2024.

#IncomeTax#TaxFiling#TaxSeason#ITR#ITRfiling#TaxReturn#TaxPayer#TaxCompliance#FinancialYear#TaxDeductions#TaxRefund#TaxPlanning#TaxBenefits#TaxSavings#Taxation#TaxDeadline

0 notes

Text

E-filing your Income Tax Return (ITR) for FY 2023-24 (AY 2024-25) has become easier than ever! This comprehensive guide will walk you through the step-by-step process of filing your ITR online. Learn about the benefits of filing on time, understand the required documents, and confidently navigate the Income Tax Department portal.

1 note

·

View note

Text

Who has to File an Income Tax Return Mandatorily in Delhi?

In the bustling metropolis of Delhi, navigating the maze of income tax regulations can be daunting. Understanding who is obligated to file an income tax return is crucial for every resident. Let's delve into the criteria that make income tax return filing mandatory in Delhi and explore key considerations to streamline the process effectively.

Criteria for Mandatory Income Tax Return Filing in Delhi

Resident Status: Individuals residing in Delhi, whether citizens or non-citizens, are required to file an income tax return if their total income exceeds the prescribed threshold set by the Income Tax Department.

Income Thresholds: The income thresholds vary depending on the age and residential status of the individual. For instance, for the assessment year 2023-24, individuals below 60 years of age with an income exceeding ₹2.5 lakhs are required to file returns. For senior citizens aged 60 to 80, the threshold is ₹3 lakhs, and for super senior citizens above 80 years, it stands at ₹5 lakhs.

Understanding Income Thresholds and Eligibility

Age-based Thresholds: The income tax slabs and thresholds are categorized based on age to provide relief to different segments of taxpayers. It's essential to ascertain the correct slab applicable to your age group to determine your tax filing obligations accurately.

Types of Income: Apart from salary income, various sources such as rental income, interest income, capital gains, and income from business or profession contribute to the total income. Individuals must consider all sources of income to assess whether they meet the mandatory filing criteria.

Implications of Residential Status on Tax Filing Obligations

Resident vs. Non-Resident: The residential status of an individual greatly impacts their tax liabilities. Residents are taxed on their global income, including income earned abroad, whereas non-residents are taxed only on income earned in India. Understanding your residential status is crucial for determining your tax filing obligations accurately.

Double Taxation Avoidance: Individuals who qualify as residents in more than one country may be subjected to double taxation. It's imperative to leverage double taxation avoidance agreements, if applicable, to prevent paying taxes on the same income in multiple jurisdictions.

Importance of Aadhaar Linking and PAN Verification

Aadhaar Linking: Linking Aadhaar with PAN is mandatory for filing income tax returns. It streamlines the verification process and helps in curbing tax evasion by ensuring transparency and authenticity in financial transactions.

PAN Verification: Verifying PAN details ensures that the information provided in the tax return is accurate and matches the records with the Income Tax Department. Any discrepancies in PAN Registration details can lead to delays or rejections in the filing process.

Streamlining the Process With Taxgoal: Online ITR Filing in Delhi

Simplified Online Filing: Taxgoal provides a user-friendly platform for individuals to file their income tax returns seamlessly. With step-by-step guidance and intuitive interfaces, taxpayers can navigate through the filing process effortlessly.

Expert Assistance: Taxgoal offers expert assistance to address queries and provide personalized tax advice. Whether you're a salaried individual, a freelancer, or a business owner, Taxgoal caters to diverse tax filing needs with precision and reliability.

Conclusion

Navigating the intricacies of regulations For Income Tax Return Filing in Delhi requires a clear understanding of the criteria for mandatory filing and compliance with verification procedures. By leveraging technology-driven solutions like Taxgoal, taxpayers can streamline the filing process and ensure adherence to regulatory requirements, thus fostering a culture of tax compliance and transparency.

Final Words

As Delhi continues to evolve as a dynamic economic hub, staying abreast of tax regulations is paramount for individuals to fulfill their civic responsibilities and contribute to the nation's growth story. With the right tools and knowledge at their disposal, taxpayers can navigate the tax landscape with confidence and efficiency.

#Taxgoal#IncomeTax#TaxFiling#DelhiTax#TaxRegulations#Aadhaar#PANVerification#TaxCompliance#ResidentialStatus#TaxThresholds#OnlineFiling#DoubleTaxation#TaxationLaws#FinancialCompliance#TaxAdvice

0 notes

Text

Filing Income Tax Returns in India: A Comprehensive Guide with Ensurekar

Introduction

Filing your income tax return (ITR) in India can seem daunting, but with the right information and guidance, it can be a smooth and efficient process. This guide provides a comprehensive overview of e-filing income tax returns in India, including registration, types of returns, filing procedures, and crucial details for the Assessment Year (AY) 2023-24.

What is eFiling Income Tax Return?

The Income Tax Department of India offers a convenient online platform for electronically filing your ITR. This e-filing portal eliminates the need for physical visits to tax offices and streamlines the entire process.

Why File Your ITR?

Individuals falling under specific tax slabs are mandated to file their returns. Here are some reasons why filing your ITR is important:

Fulfilling Tax Obligations: It ensures compliance with tax regulations and avoids potential penalties for non-filing.

Claiming Refunds: If you've paid excess taxes through TDS (Tax Deducted at Source), filing your ITR is necessary to claim a refund.

Loan and Visa Applications: Many financial institutions and embassies require a clean tax filing history for loan approvals and visa processing.

Carrying Forward Losses: If you've incurred losses under a specific income head, filing your return allows you to carry them forward and offset future income.

Building a Credit History: A consistent record of timely ITR filing can positively impact your creditworthiness.

Types of eFiling Income Tax Returns

There are two main ways to file your ITR electronically:

Self-e-Filing: This involves filing your return directly through the Income Tax Department's e-filing portal. You'll need to fill out the ITR form with all necessary information, attach required documents, and submit it online.

Assisted ITR Filing: You can opt for assistance from authorized professionals like tax consultants, chartered accountants, or online tax-filing platforms. These intermediaries will handle the entire filing process, from collecting information to submitting your return online.

Benefits of eFiling Income Tax Return (ITR):

Convenience: Eliminates the need for physical visits and saves time and effort.

Security: The online process protects sensitive information with secure protocols.

Timely Processing: E-filing leads to faster processing and quicker refunds compared to paper returns.

Accuracy: The online platform helps with accurate tax calculations and reduces the chances of errors.

Environmentally Friendly: E-filing reduces paper usage and contributes to a greener environment.

How to File an eFiling Income Tax Return

Step 1: Registration

New users need to register on the Income Tax Department's e-filing portal using their PAN card details.

Step 2: Gather Documents

Collect all relevant documents like PAN card, Aadhaar card, Form 16 (salary certificate), TDS certificates, bank statements, investment proofs, and any other income or deduction-related documents.

Step 3: Choose the Right ITR Form

The appropriate ITR form depends on your income sources and category. Common forms include ITR-1 (for income up to ₹50 lakhs) and ITR-2 (for income with capital gains or foreign assets). For AY 2023-24, ensure you use the most recent versions of the forms.

Step 4: Fill and Verify the ITR Form

Fill out the chosen ITR form with accurate details about your income, deductions, and exemptions. Carefully review the entries to avoid errors. You can verify the return electronically using Aadhaar OTP or EVC (Electronic Verification Code), or by sending a signed physical copy of ITR-V to the Centralized Processing Center (CPC) within 120 days of filing.

Step 5: File the Return Online

Log in to the e-filing portal, navigate to the 'e-File' section and select 'Income Tax Return.' Upload the prepared ITR form or XML file and submit it.

Step 6: Keep Records for Reference

Maintain copies of the filed return, acknowledgment receipt, and supporting documents for future reference.

How Ensurekar Can Help

At Ensurekar, we understand the complexities of tax filing. We offer a comprehensive range of services to ensure a smooth and efficient ITR filing experience:

Expert Guidance: Our experienced tax professionals can guide you through the entire process, from choosing the right ITR form to maximizing deductions and claiming refunds.

Accurate Calculations: We ensure accurate tax calculations to minimize any tax liabilities or penalties.

Timely Filing: We help you meet all deadlines and avoid late filing penalties.

Stress-Free Experience: We take the stress out of tax filing, allowing you to focus on other important matters.

Additional Information:

Penalty for Late Filing of ITR: Filing your ITR after the due date can attract penalties and interest charges on the tax payable.

Steps to File ITR without Form 16: If you don't have Form 16, you can still file your ITR by gathering income proofs from various sources, calculating your TDS using Form 26AS, and claiming eligible deductions.

Conclusion:

Filing your income tax return is a crucial responsibility. By leveraging the benefits of e-filing and potentially seeking professional assistance from Ensurekar, you can ensure a smooth, accurate, and timely filing process.

0 notes

Text

Simplifying Your Tax Season: Finding Income Tax Filing Services Near You

Introduction:

As tax season approaches, the task of filing your income tax returns might seem daunting. Whether you're a seasoned taxpayer or a first-timer, having a reliable and convenient income tax filing service near you can make the process smoother. In this blog post, we'll explore the importance of timely tax filing, the benefits of using professional services, and how to find the right income tax filing assistance in your local area.

1. The Importance of Timely Income Tax Filing:

Filing your income tax returns on time is crucial to avoid penalties and legal consequences. Many individuals delay the process due to its complexity or lack of understanding, but with the right assistance, you can ensure compliance with tax regulations and enjoy peace of mind.

2. Benefits of Using Professional Income Tax Filing Services:

a. Expertise: Professional tax preparers are well-versed in tax laws and regulations. Their expertise can help you navigate the complexities of the tax code, ensuring accurate and efficient filing.

b. Time Savings: Filing taxes can be time-consuming, especially if you have a complex financial situation. Professional services can save you time and effort, allowing you to focus on other important aspects of your life.

c. Maximizing Deductions: Tax professionals are adept at identifying eligible deductions and credits, potentially saving you money. They can help you optimize your return and ensure you're not missing out on any available benefits.

d. Peace of Mind: With a qualified tax professional handling your filing, you can have peace of mind knowing that your returns are accurate and in compliance with tax laws.

3. How to Find Income Tax Filing Services Near You:

a. Local Tax Firms: Research local tax firms or accounting offices in your area. Many firms offer income tax filing services and can provide personalized assistance.

b. Online Platforms: Explore online platforms that connect you with tax professionals in your locality. These platforms often allow you to read reviews and compare services before making a decision.

c. Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can offer valuable insights into the reliability and efficiency of local tax filing services.

d. Community Centers and Nonprofits: Some community centers and nonprofit organizations offer free or low-cost tax preparation services. Check with local community resources to see if such programs are available in your area.

Conclusion:

Filing your income tax returns doesn't have to be a stressful experience. By utilizing professional income tax filing services near you, you can simplify the process, ensure accuracy, and potentially maximize your returns. Take the proactive step of finding reliable assistance, and make this tax season a smoother and more rewarding experience.

Confused? Talk to our experts. Explore our guides and tools for a smooth filing experience:

- Income Tax e-Filing for FY 2022-23

- Income Tax Slabs for FY 2023-24

- Income Tax Calculator

- Section 80 Deductions

- Old vs New Tax Regime

- Check Aadhar PAN Card Link Status

- ITR Filing Last Date for FY 2022-23

- Capital Gains Tax in India

Have questions? Check out our FAQs or reach out to us. Let's make this tax season stress-free and rewarding for you! 💰📅

0 notes

Text

Salaried Individuals must wait until June 15 to file ITR

Salaried Income Tax Returns: As of April 1, the online income tax return (ITR) filing process for the financial year 2023–24 (assessment year 2024–25) is now available due to the e-filing income tax portal. In addition, utilities for the ITR forms that are utilized the most frequently have also been made available. The Income Tax Department has activated all the necessary utilities and enabled…

View On WordPress

0 notes