#kisan vikas patra interest rate

Text

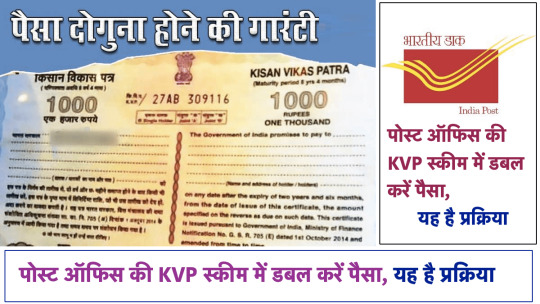

Post Office Kisan Vikas Patra: मोदी सरकार की नई योजना में 5 लाख बन जाएंगे सीधे 10 लाख, कुछ ही महीनों में दोगुना हो जाएगा आपका पैसा

Post Office Kisan Vikas Patra: मोदी सरकार की नई योजना में 5 लाख बन जाएंगे सीधे 10 लाख, कुछ ही महीनों में दोगुना हो जाएगा आपका पैसा

Post Office Kisan Vikas Patra : डाकघर किसान विकास पत्र: डाकघर की योजनाएं निश्चित रूप से एक दीर्घकालिक निवेश हैं, लेकिन इसमें कोई जोखिम कारक नहीं है क्योंकि इसमें सरकारी गारंटी उपलब्ध है। ये योजनाएं उन लोगों के लिए हैं जो पारंपरिक निवेश पसंद करते हैं और लंबी अवधि का नजरिया रखते हैं।

Post Office Kisan Vikas Patra

डाकघर किसान विकास पत्र: डाकघर योजनाएं उनके लिए हैं जो पारंपरिक निवेश पसंद करते हैं…

View On WordPress

#how to invest in kisan vikas patra#Kisan Vikas Patra#kisan vikas patra in hindi#kisan vikas patra interest rate#kisan vikas patra kya hai#kisan vikas patra post office#kisan vikas patra post office scheme#kisan vikas patra post office scheme 2022#kisan vikas patra scheme#kisan vikas patra tax benefit#kisan vikas patra yojana#post office kisan vikas patra#Post Office Kisan Vikas Patra Scheme#Post Office KVP Scheme#post office scheme kisan vikas patra

0 notes

Text

কিষাণ বিকাশ পত্র করুন আর টাকা 2 গুণ করুন নিশ্চিন্তে। Kisan Vikas Patra

#Kisan Vikas Patra#কিষাণ বিকাশ পত্র#KVP#kisan Vikas Patra interest rate#kisan Vikas Patra interest rate 2022

0 notes

Text

Post Office Savings Schemes: What Are The Latest PPF, Senior Citizen Saving Scheme, NSC, Sukanya Samriddhi & other interest rates? Check List

A Sukanya Samriddhi Yojana (SSY) account is exclusively designed for girl children and must be opened before they reach the age of 10. The initial deposit requirement is modest, starting at Rs 250, while the maximum allowable deposit in a financial year is capped at Rs 1,50,000. The SSY account offers an attractive interest rate of 8.2% per annum, which is calculated annually and compounded…

View On WordPress

#Kisan Vikas Patra Interest Rates#Monthly Income Account Interest Rates#National Savings Certificate Interest Rates#Post Office Savings Schemes Interest Rates#Public Provident Fund Interest Rates#Senior Citizen Savings Scheme Interest Rates#Small Savings Scheme Interest Rates#Sukanya Samriddhi Yojana Interest Rates

0 notes

Text

#Kisan Vikas Patra investment#secure savings schemes#government-backed savings#risk-averse investment options#guaranteed returns investment#best investment for risk-averse savers#safe investment options in India#KVP doubling period#Kisan Vikas Patra benefits#how to invest in Kisan Vikas Patra#KVP maturity period#Kisan Vikas Patra interest rates#secure investments with high returns#low-risk savings plans#Kisan Vikas Patra eligibility#financial security with KVP#long-term investment options#safe investment schemes in India#investment plans for conservative investors#advantages of Kisan Vikas Patra

0 notes

Text

Complete Guide on Kisan Vikas Patra 2024: Definition, Eligibility, Interest Rate

Discover all about Kisan Vikas Patra (KVP) on Registrationwala. Learn the definition, eligibility criteria, and current interest rates of KVP, a popular savings scheme in India. Find detailed insights into how KVP works, its benefits, and how to invest.

0 notes

Text

Kisan Vikas Patra Yojna 2023: check eligibility, interest rates, and more---Indian farmers 🚜🐄🌾👨🌾 info

Kisan Vikas Patra (KVP) is a certificate scheme launched by the Indian government in 1988. The scheme aims to encourage savings in the country for the secure future of the investors. This scheme doubles the one-time investment in a period of 9.5 years approximately. For example, if you deposit Rs 5,000, you will get Rs 10,000 post-maturity.

The scheme was initially launched for farmers, as it is…

View On WordPress

0 notes

Text

0 notes

Text

Senior citizens: Government hikes Senior #Citizen #savings Scheme (#scss), National Saving Certificate (#NSC), Post Office Monthly Income Scheme (#POMIS), Post Office Time Deposit (#potd) interest rates for the January–March quarter of FY 2022–23 - Lawyer2CA®️

Senior Citizen Savings Scheme (SCSS) has an interest rate of 8.0% per annum for the fourth quarter of FY 2022–23. Anyone over the age of 60 and who is over 55 but under 60, is eligible for this programme. An SCSS account can be opened with as minimum as Rs 1,000 and a maximum of Rs 15 Lakh. The account has a five-year maturity period that can be extended by an additional three years. A penalty equal to 1.5% of the deposit is imposed for early withdrawals made after one year. Section 80C of the Income Tax Act allows for the deduction of investments up to Rs 1.5 lakh. Additionally, the interest income is wholly taxable.

The Post Office Monthly Income Scheme (POMIS) interest rate has gone up from 6.7% to 7.1%. This account may be opened with a minimum deposit of Rs. 1,000 and a maximum deposit of Rs 4.5 Lakh (single account) and Rs 9 Lakh (joint account).

Post Office Time Deposit Account (POTD) can be opened for one, two, three, and five-years tenure. A minimum investment of Rs 1,000 is needed to open an account and there is no maximum investment amount. POTD now earns an interest rate of 6.6%, 6.8%, and 6.9% for periods of one year, two years, and three years, respectively. Under Section 80 C of the Income Tax Act of 1961, a senior citizen may be qualified for a tax deduction for a 5-year Post Office Time Deposit Account.

For the January-March quarter, the interest rate on National Savings Certificates (NSCs) is now, 7%. A minimum of Rs. 1,000 should be invested, in multiples of Rs. 100. There is no upper limit. The account will have 5 Years of maturity.

Kisan Vikas Patra's (#kvp) interest rate was hiked from 6.8% to 7%.

#Lawyer2CA #interestrates

https://economictimes.indiatimes.com/wealth/invest/senior-citizens-govt-hikes-senior-citizen-savings-scheme-nsc-post-office-time-deposit-interest-rates/post-office-time-deposit-account-potd/slideshow/96737707.cms

1 note

·

View note

Text

Earn over 9% interest on THESE FDs, Higher than PPF, Kisan Vikas Patra, Sukanya Samriddhi schemes! ! FD interest rate hike | Check latest interest rate of banks, savings account

Earn over 9% interest on THESE FDs, Higher than PPF, Kisan Vikas Patra, Sukanya Samriddhi schemes! ! FD interest rate hike | Check latest interest rate of banks, savings account

zeenews.india.com understands that your privacy is important to you and we are committed for being transparent about the technologies we use. This cookie policy explains how and why cookies and other similar technologies may be stored on and accessed from your device when you use or visit zeenews.india.com websites that posts a link to this Policy (collectively, “the sites”). This cookie policy…

View On WordPress

0 notes

Text

Get your money doubled with these POST OFFICE schemes; Check interest rate, return calculator, maturity time

Get your money doubled with these POST OFFICE schemes; Check interest rate, return calculator, maturity time

Post Office Investment Scheme Return Calculator: If you don’t want to take any risk with your money, you can put your money into these schemes including National Savings Certificate (NSC), Sukanya Samriddhi Yojana, Senior Citizen Saving Scheme (SCSS), Kisan Vikas Patra (KVP) and Senior Citizens Savings Scheme among others.

source…

View On WordPress

0 notes

Text

Sukanya Samriddhi Yojana और PPF 2022 में निवेश की बल्ले -बल्ले हो गई, ब्याज दर इतना बढेगा,यहाँ चेक करे नए दर

Sukanya Samriddhi Yojana और PPF 2022 में निवेश की बल्ले -बल्ले हो गई, ब्याज दर इतना बढेगा,यहाँ चेक करे नए दर

Sukanya Samriddhi Yojana : Government Saving Schemes: अगर आपने भी सुकन्या समृद्धि योजना ( Sukanya Samridhi Yojana), एनएससी (NSC), पीपीएफ(PPF) जैसी बचत योजना में निवेश किया है तो आपके लिए जरुरी खबर है.

अब आपको इन स्कीमों पर जबरदस्त रिटर्न मिलने वाला है. दरअसल, 1 जुलाई से केंद्र सरकार अपनी पीपीएफ और सुकन्या समृद्धि जैसी बचत योजना पर ब्याज दरों में जबरदस्त बढ़ोतरी का ऐलान कर सकती है.

Sukanya…

View On WordPress

#4 श्रेष्ठ बचत योजनाएं कौन सी हैं?#benefits of kisan vikas patra#best saving scheme for senior citizen#government schemes#government schemes 2022#government small savings schemes#how to invest in kisan vikas patra#investment senior citizen#Kisan Vikas Patra#kisan vikas patra calculator#kisan vikas patra in hindi#kisan vikas patra in tamil#kisan vikas patra interest rate#kisan vikas patra kya hai#kisan vikas patra post office#kisan vikas patra post office scheme#kisan vikas patra scheme#kisan vikas patra yojana#old age saving scheme#post office kisan vikas patra#post office kisan vikas patra scheme#post office saving scheme#post office saving scheme in tamil#post office saving schemes#post office saving schemes in tamil#post office savings scheme in tamil#saving scheme#saving schemes#saving schemes by government#saving schemes in tamil

0 notes

Text

Here are top 6 post office investment plans :

National Savings Certificate (NSC)**This is a low-risk with fixed income scheme offered by the government and is available with the post-offices across India. This post office saving scheme for boy child is loaded with best features and benefits to aptly suit your child’s needs. It facilitates a fixed income and definite returns to generate best revenues. This plan is currently available at 6.8% rate of interest per annum.

Features:

Minimum investment – Rs.1000

Maximum investment – no max. limit

Interest Rate – 6.8%

Lock in tenure – 5 years

Tax Benefits – Up to Rs.1.5 lakh (as per Section 80C of Income Tax)

Benefits

The plan offers fixed return on investment higher as compared to FDs.

Offer Tax benefits under section 80C.

Available at an initial investment of Rs 1,000, which is very less.

The Plan is available with a maturity period of 5 years.

No TDS allowed so the insured can obtain full value at maturity.

Ponmagan Podhuvaippu Nidhi Scheme

The department of post, Tamil Nadu introduced the Ponmagan Podhuvaippu Nidhi Scheme in the year 2015,especially meant for the male child. The account for this post office saving scheme for boy child can be opened through a parent/guardian for a minor boy below 10 years of age, while minor boys above 10 years can open the account on their own name. This special plan is limited to the residents of Tamil Nadu only, and can be availed by parents before their son attains 10 years of age.

Features:

Minimum investment – Rs.500

Maximum investment – 1.5 lakhs

Interest Rate – 9.70%

Maturity period – 15 years

Tax Benefits – available under Section 80C of Income Tax

Benefits

The plan offers ways to increase your income.

Offer Tax benefits under section 80C.

Nomination facility available.

Payments can be made in lump sum or in 12 small installments.

Parents can avail loan facility from fourth year of the account.

Post Office Monthly Income Scheme (POMIS)

Post office monthly income scheme or POMIS is a saving scheme for boy child where you can earn a fixed monthly interest by investing a certain amount. This scheme is easy to open in any post office across the country and is packed with features and benefits. For this scheme, the one key requirement is to have a post office savings account.

Features:

Minimum investment – Rs. 1000

Maximum investment – 4.5 lakhs

Interest Rate – 6.6%

Maturity period – 5 years

Tax Benefits – TDS is not applicable but sum invested is not covered under Section 80C

Benefits

The plan offers capital protection until the plan matures

This is a low risk plan and safe.

It offers affordable deposit amount facility.

The scheme offers guaranteed returns.

Multiple ownership is also available under this scheme.

Kisan Vikas Patra (KVP)

Kisan Vikas Patra or KVP is an apt plan that suits perfectly to the low income as well as the middle-class income families in India. This is a short-term post office saving scheme for boy child in India that permit parents to invest on a particular lump-sum money per year.

Features

Interest Rate – 6.9%

Minimum amount – Rs.1,00

Maximum amount – No Upper Limit

Maturity period – 10 years and 4 months

Lock-in period – 30 months

Benefits

The plan offers guaranteed returns with zero risks.

It helps accumulate savings for future your child.

Allow parents to get loans with low interest rates.

Nomination facility is available.

Post Office Recurring Deposit (RD)

This another good saving post office schemes for boy child in India. This is a recurring deposit plan that offer high rate of interest as compared to regular saving account in a bank. Under this scheme, parents can save a particular amount in the account every month for 5 years.

Features

Interest Rate – 5.8%

Minimum amount – Rs.100

Maximum amount – No Upper Limit

Maturity period – 5 years

Benefits

The plan offers limited restrictions.

Nomination facility is available.

Transfer of funds is available from RD to savings account.

Allow parents to save enough for their male child’s future.

Public Provident Fund (PPF)

Public Provident Fund or PPF is a post office scheme for male child in India that help parents to save on taxes as well. PPF is a long term plan of investment available at an attractive rate of interest and offers god returns on investment.

Features

Interest Rate – 7.1%

Minimum Amount – Rs.500

Maximum Amount – Rs 1.5 lakh

Tenure/Lock-in period – 15 years

Tax Benefit – available up to Rs.1.5 lakh under Section 80C

Benefits

The plan offers low risk.

Nomination facility is available.

Allow parents to take loans against the invested amount from 3rd of scheme.

Transfer of funds is available under this savings scheme.

Long term savings with attractive interest rate.

0 notes

Text

Centre raises rates on some small saving plans

Centre raises rates on some small saving plans

NEW DELHI: Amid rising inflation and higher fixed deposit rates, the finance ministry on Thursday announced an increase of up to 30 basis points in interest rates on certain small savings products for the next quarter, marking the first increase in nine quarters. While rates on public provident fund, the most popular small savings scheme, has been left unchanged, Kisan Vikas Patras and Senior…

View On WordPress

0 notes

Text

Small savings scheme interest rate: NSC, Kisan Vikas Patra, Mahila Samman Saving Certificate, PPF, SSY latest rates here | Mint

What are small savings scheme?

The government raised the interest rate on the five-year recurring deposit scheme for the December quarter and retained the rates for all other small savings schemes. The government reviews the rate every quarter

Small savings schemes are investment avenues offered and managed by the government that allow individuals to save and accumulate wealth. Currently, the…

View On WordPress

0 notes

Text

Centre raises rates on some small saving plans - Times of India

Centre raises rates on some small saving plans – Times of India

NEW DELHI: Amid rising inflation and higher fixed deposit rates, the finance ministry on Thursday announced an increase of up to 30 basis points in interest rates on certain small savings products for the next quarter, marking the first increase in nine quarters. While rates on public provident fund, the most popular small savings scheme, has been left unchanged, Kisan Vikas Patras and Senior…

View On WordPress

0 notes

Text

Govt hikes interest rate on small savings schemes for Q3 of FY23

The government has effected minor hikes of 0.1% to 0.3% in interest rates payable on five small savings instruments,including kisan vikas patra,Senior Citizen's Savings Scheme and time depositss for two and three years,for the quarter beggining 1 october,according to a statement...

With the correction, a three-year time store with mailing stations would procure 5.8 percent from the current 5.5 percent, an increment of 30 premise focuses for the second from last quarter of the ongoing monetary year.

Senior Resident Reserve funds plan will procure 20 premise directs more toward 7.6 percent from the current pace of 7.4 percent during the October-December period, a money service warning said.

As to Kisan Charge card, the public authority has amended both residency and loan fees.

In the mean time, there is no adjustment of loan fees of seven other assigned little reserve funds plans, including the Public Fortunate Asset (PPF) at 7.1%, Sukanya Samriddhi Record Plan at 7.6%, Public Investment funds Authentication (6.8%) as well as five-year repeating and time stores (5.8% and 6.7%, separately). Returns on investment funds stores and one-year time stores are likewise kept static at 4% and 5.5%The Reserve Bank since May has raised the benchmark lending rate by 140 basis points, prompting banks to raise interest rates on deposits as well.

0 notes