#kisan vikas patra yojana

Text

किसान विकास पत्र योजना।Kisan Vikas Patra Yojana

किसान विकास पत्र योजना

किसान विकास पत्र योजना पोस्ट ऑफिस द्वारा पेश की जाने वाली जोखिम मुक्त योजना है इस योजना में आप बिना किसी रिस्क के पैसा निवेश कर सकते हैं।

अगर आप पोस्ट ऑफिस की योजना में पैसे निवेश करके अच्छी कमाई करना चाहते हैं तो आप डाकघर की किसान विकास पत्र योजना के तहत निवेश करके डबल फायदा उठा सकते हैं इसके तहत आपको इस स्कीम में 10 साल के लिए पैसा निवेश करना होगा इसे आप 1000 के निवेश के…

View On WordPress

0 notes

Text

किसान विकास पत्र योजना 2022: Kisan Vikas Patra, ब्याज दर, कैलकुलेटर, टैक्स बेनिफिट्स

किसान विकास पत्र योजना 2022: Kisan Vikas Patra, ब्याज दर, कैलकुलेटर, टैक्स बेनिफिट्स

Kisan Vikas Patra | किसान विकास पत्र योजना 2022 | पोस्ट ऑफिस स्कीम | इन्वेस्टमेंट स्कीम | Post Office Government Scheme | ब्याज दर, कैलकुलेटर, टैक्स बेनिफिट्स | KVS, पोस्ट ऑफिस नई योजना, इन्वेस्टमेंट योजना, Kisan Vikas Patra Yojana

Kisan Vikas Patra एक ऐसी स्कीम है, जो 124 महीने में पैसा डबल कर के देती है। ये योजना पोस्ट ऑफिस द्वारा चलाई गई योजना है जिसे हम KVP-kisan Vikas Patra योजना कहते है।…

View On WordPress

0 notes

Text

Financial Planning –Ways To Create A Successful Plan

Everyone desires to be able to retire comfortably, but life is full of competing demands, some of which are planned and others that are not. The majority of our significant life events are planned, including things like getting married, getting a house, having kids, paying for their school and weddings, and saving enough money for a happy retirement.

Financial planning is, to put it simply, a methodical strategy to achieving one's life goals. Your financial plan serves as a road map for your life. In essence, it gives you more control over your income, expenses, and investments, which helps you manage your money and reach your goals.

For instance, if you wish to spend a large sum of Rs. 10 lakh for your child's college education, you must reach this goal by the time the child turns 18. Planning your finances becomes essential in this situation.

Read:How to Save Money from Salary? 15 Smart Tips

How to Save Money For The Future? 10 Ways to Save Money For The Future

The Significance of Financial Planning

The biggest challenge a middle-class family in India faces is financial planning.Why is financial planning necessary? Let’s learn about the significance of financial planning.

• To build wealth;

• To build a retirement fund;

• To pay for your child's education;

• To save taxes;

• To tackle inflation;

• To establish a reserve fund;

• To effectively manage your money

How To Create A Successful Financial Plan?

Analyze Your Current Financial Situation

To begin financial planning, you must first evaluate your existing finances, including your income, expenses, debt, savings, and assets.

Read: Best Apps For Saving Money- 10 Best Money Saving Apps

Money manager apps: 5 best money management apps in India

Make Investment Plans

As soon as you start saving, think about investing it for greater returns. Your goals will be attained more quickly as a result. You have a wide range of investment options available to you. However, be sure that your investing portfolio contains a variety of different asset classes and investment kinds, including both high-risk and low-risk options. This diversification will reduce the chances of losing money due to market fluctuations. For instance, you might invest in SIPs, mutual funds, or government programmes like the Atal Pension Yojana, Kisan Vikas Patra, and National Savings Certificates. Chit funds are another option for investing your money. Chit fund is a tool for both saving and borrowing.

Read:What are Top 12 Alternative Investment Options in India for 2022

The Best Saving Plans & Schemes in India

Choose the Right Plan

Your goals, age, risk, and investment amount should all be taken into consideration when choosing an investment strategy. You can also hire a financial planner to help you. A financial planner is an expert who can assist you in better planning your finances and achieving your financial goals. Insurance, estate planning, retirement planning, and tax planning are other areas they can assist you with.

Read:Where To Invest Money To Get Good Returns In India?

8 Financial Advice From Some Of The Richest People In The World

Monitoring Your Financial Plan Regularly

Once you've made an investment, the process of financial planning is not over. You must also monitor the performance of the funds.You may need to replace them with funds that perform better if they fail.As you get older, your aspirations and goals alter. For example, your financial priorities may change after your marriage or after the birth of your child.

0 notes

Text

Get your money doubled with these POST OFFICE schemes; Check interest rate, return calculator, maturity time

Get your money doubled with these POST OFFICE schemes; Check interest rate, return calculator, maturity time

Post Office Investment Scheme Return Calculator: If you don’t want to take any risk with your money, you can put your money into these schemes including National Savings Certificate (NSC), Sukanya Samriddhi Yojana, Senior Citizen Saving Scheme (SCSS), Kisan Vikas Patra (KVP) and Senior Citizens Savings Scheme among others.

source…

View On WordPress

0 notes

Photo

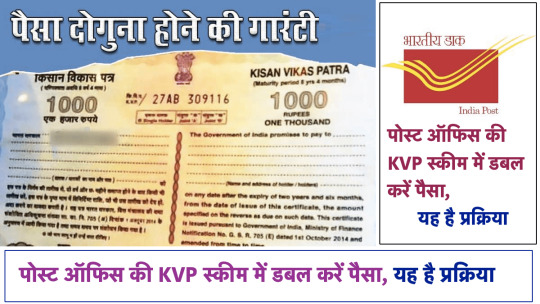

(via Kisan Vikas Patra Yojana 2020 - Online Apply KVP, Calculator, Tax Benefits)

3 notes

·

View notes

Text

Post Office Kisan Vikas Patra: मोदी सरकार की नई योजना में 5 लाख बन जाएंगे सीधे 10 लाख, कुछ ही महीनों में दोगुना हो जाएगा आपका पैसा

Post Office Kisan Vikas Patra: मोदी सरकार की नई योजना में 5 लाख बन जाएंगे सीधे 10 लाख, कुछ ही महीनों में दोगुना हो जाएगा आपका पैसा

Post Office Kisan Vikas Patra : डाकघर किसान विकास पत्र: डाकघर की योजनाएं निश्चित रूप से एक दीर्घकालिक निवेश हैं, लेकिन इसमें कोई जोखिम कारक नहीं है क्योंकि इसमें सरकारी गारंटी उपलब्ध है। ये योजनाएं उन लोगों के लिए हैं जो पारंपरिक निवेश पसंद करते हैं और लंबी अवधि का नजरिया रखते हैं।

Post Office Kisan Vikas Patra

डाकघर किसान विकास पत्र: डाकघर योजनाएं उनके लिए हैं जो पारंपरिक निवेश पसंद करते हैं…

View On WordPress

#how to invest in kisan vikas patra#Kisan Vikas Patra#kisan vikas patra in hindi#kisan vikas patra interest rate#kisan vikas patra kya hai#kisan vikas patra post office#kisan vikas patra post office scheme#kisan vikas patra post office scheme 2022#kisan vikas patra scheme#kisan vikas patra tax benefit#kisan vikas patra yojana#post office kisan vikas patra#Post Office Kisan Vikas Patra Scheme#Post Office KVP Scheme#post office scheme kisan vikas patra

0 notes

Text

Kisan Vikas Patra | All info in hindi on Gyanibaba.net

It is obvious from the name of Kisan Vikas Patra that it is to support ranchers, however as a general rule it is an administration conspire, in which ranchers and any individual can contribute. Companions, in this article today we will see what is Kisan Vikas Patra Yojana, what is the on the web and disconnected course of applying it, what are the advantages of this plan ds, what is its loan cost, and what is kisan vikas patra number cruncher? So companions, remain tuned till the finish of this article.

0 notes

Photo

#NationalFarmersDay #KisanDiwas #किसान_दिवस #ThankYou #Farmers #kisan #wednesdaythought #WednesdayMotivation #JaiJagannath

#nationalfarmersday#national farmers day#kisandiwas#kisan diwas#किसान_दिवस#thankyou#thank you#farmers#farmers news#kisan#kisan vikas patra#pm kisan#kisan suryodaya yojana#wednesdaythought#wednesdaythoughts#wednesdaymotivation#jaijagannath

1 note

·

View note

Text

Small Saving Schemes: A setback for those investing in PPF, Sukanya Samriddhi Yojana

Small Saving Schemes: A setback for those investing in PPF, Sukanya Samriddhi Yojana

Small Saving Schemes News: Investors in small government savings schemes have suffered a major setback. Despite the increase in the repo rate by the RBI and the increase in the yield of government bonds, the government decided not to increase the interest rates on savings schemes like NSC, PPF and Sukanya Samriddhi Yojna in the month of July to September. has done. The Department of Economic…

View On WordPress

#Government Saving Schemes#Kisan Vikas Patra#Ministry of Finance#NSC#Post Office Deposit Scheme#PPF#RBI#small saving schemes#small savings scheme#Sukanya samriddhi yojana

0 notes

Text

PPF, सुकन्या समृद्धि और NSC जैसी स्कीम्स के निवेशकों के लिए अच्छी खबर, 30 जून को सरकार देगी बड़ी खुशखबरी!

PPF, सुकन्या समृद्धि और NSC जैसी स्कीम्स के निवेशकों के लिए अच्छी खबर, 30 जून को सरकार देगी बड़ी खुशखबरी!

Photo:INDIA TV

Small Saving

Highlights

छोटी बचत पर वित्त मंत्रालय तय करता है ब्याज दर

पिछले दो साल के छोटी बचत पर ब्याज दरों में कोई बदलाव नहीं हुआ

सरकार अब महंगाई देखते हुए ब्याज दरों में बढ़ोतरी कर सकती है

PPF, सुकन्या समृद्धि और NSC समेत तमाम स्मॉल सेविंग स्कीम्स में निवेश करने वालों निवेशकों को जल्द अच्छी खबर मिल सकती है। करीब दो साल बाद सरकार 30 जून को स्मॉल सेविंग स्कीम्स पर ब्याज दरों…

View On WordPress

#Government Saving Schemes#interest rate hike#Kisan Vikas Patra#ministry of finance#Modi Government likely to change Small savings scheme interest rate#National Saving certificate interest rate#NSC#Post Office Deposit Schemes#post office inter#PPF#PPF Interest rate#rbi#small savings scheme#Small savings Scheme interest rate#sukanya samriddhi yojana#छोटी बचत योजना#छोटी बचत योजनाओं का ब्याज#पीपीएफ#पोस्टल डिपॉजिट स्कीम्स#रेपो रेट#लघु बचत योजना#सुकन्या समृद्धि योजना#स्मॉल सेविंग्स स्कीम

0 notes

Text

Post Office Scheme: This super hit scheme will make you rich, money will be double in few months

Post Office Scheme: There are many options available to you if you want to invest money. Since some investments are high risk, they give good returns. On the other hand, some investments have absolutely zero risk and good returns. Now if you are looking for an option that gives a good return on zero risk then you can invest in Post Office Saving Scheme Kisan Vikas Patra.

Let us tell you that there is a government guarantee on the Kisan Vikas Patra scheme, so this scheme is quite safe in this respect. Also, the returns are good. Let us know about this plan.

What is Kisan Vikas Patra (KVP)?

The duration of Kisan Vikas Patra Yojana is 10 years and 4 months. If you invest in this scheme from 1st April 2022 to 30th June 2022 then the lumpsum amount deposited by you doubles in 10 years 4 months. In this scheme, a compound interest of 6.9% is given annually.

You can invest as much as you want:

You can buy Kisan Vikas Patra Certificate with an investment of as low as Rs 1,000, there is no investment limit. That is, you can put as much money into it as you wish.

This scheme, which was previously only available to farmers, began in 1988. But now everyone can open it. Let us inform you that if you make an investment of more than Rs 50,000, you will be required to present a PAN card.

Read More: Post Office Scheme: This super hit scheme will make you rich, money will be double in few months

0 notes

Text

Sukanya Samriddhi Yojana और PPF 2022 में निवेश की बल्ले -बल्ले हो गई, ब्याज दर इतना बढेगा,यहाँ चेक करे नए दर

Sukanya Samriddhi Yojana और PPF 2022 में निवेश की बल्ले -बल्ले हो गई, ब्याज दर इतना बढेगा,यहाँ चेक करे नए दर

Sukanya Samriddhi Yojana : Government Saving Schemes: अगर आपने भी सुकन्या समृद्धि योजना ( Sukanya Samridhi Yojana), एनएससी (NSC), पीपीएफ(PPF) जैसी बचत योजना में निवेश किया है तो आपके लिए जरुरी खबर है.

अब आपको इन स्कीमों पर जबरदस्त रिटर्न मिलने वाला है. दरअसल, 1 जुलाई से केंद्र सरकार अपनी पीपीएफ और सुकन्या समृद्धि जैसी बचत योजना पर ब्याज दरों में जबरदस्त बढ़ोतरी का ऐलान कर सकती है.

Sukanya…

View On WordPress

#4 श्रेष्ठ बचत योजनाएं कौन सी हैं?#benefits of kisan vikas patra#best saving scheme for senior citizen#government schemes#government schemes 2022#government small savings schemes#how to invest in kisan vikas patra#investment senior citizen#Kisan Vikas Patra#kisan vikas patra calculator#kisan vikas patra in hindi#kisan vikas patra in tamil#kisan vikas patra interest rate#kisan vikas patra kya hai#kisan vikas patra post office#kisan vikas patra post office scheme#kisan vikas patra scheme#kisan vikas patra yojana#old age saving scheme#post office kisan vikas patra#post office kisan vikas patra scheme#post office saving scheme#post office saving scheme in tamil#post office saving schemes#post office saving schemes in tamil#post office savings scheme in tamil#saving scheme#saving schemes#saving schemes by government#saving schemes in tamil

0 notes

Text

Kisan Vikas Patra Scheme 2021: Kisan Vikas Patra, Interest Rate, Tax Benefits

Kisan Vikas Patra Scheme 2021: Kisan Vikas Patra, Interest Rate, Tax Benefits

Kisan Vikas Patra: You all know that the government keeps on launching various schemes to promote the habit of saving towards the citizens of the country. One such scheme is the Kisan Vikas Patra Yojana. To take advantage of this scheme, gender term investment has to be made. This scheme has been started for those people who do not want to take risks. Today we are going to provide you all the…

View On WordPress

#kisan vikas patra#kisan vikas patra calculator#Kisan Vikas Patra interest rate#kisan vikas patra scheme

0 notes

Link

0 notes

Text

Check Latest Post Office Small Savings Scheme Interest Rates Here

Check Latest Post Office Small Savings Scheme Interest Rates Here

[ad_1]

<!-- -->

India Post, through its vast network of post offices across the country, offers a whole host of government’s small savings scheme like Senior Citizen Savings Scheme, Monthly Income Account, Public Provident Fund (PPF) Scheme, Kisan Vikas Patra and Sukanya Samriddhi Yojana (SSY) Account Scheme among other saving schemes. The government keeps changing the interest rate on small…

View On WordPress

#Kisan vikas patra#PPF interest rates#Public Provident Fund#Small savings scheme interest rate#Small savings schemes#Sukanya Samriddhi

0 notes

Text

Check Latest Post Office Small Savings Scheme Interest Rates Here

Check Latest Post Office Small Savings Scheme Interest Rates Here

[ad_1]

<!-- -->

India Post, through its vast network of post offices across the country, offers a whole host of government’s small savings scheme like Senior Citizen Savings Scheme, Monthly Income Account, Public Provident Fund (PPF) Scheme, Kisan Vikas Patra and Sukanya Samriddhi Yojana (SSY) Account Scheme among other saving schemes. The government keeps changing the interest rate on small…

View On WordPress

0 notes